Lithium-ion Battery Recycling Market by Source (Automotive, Non-Automotive), Battery Chemistry (LFP, NMC, LMO, NCA, LTO), Battery Component, Recycling Process (Hydrometallurgical, Pyrometallurgy, Physical/ Mechanical), and Region - Global Forecast to 2032

Lithium-ion Battery Recycling Market

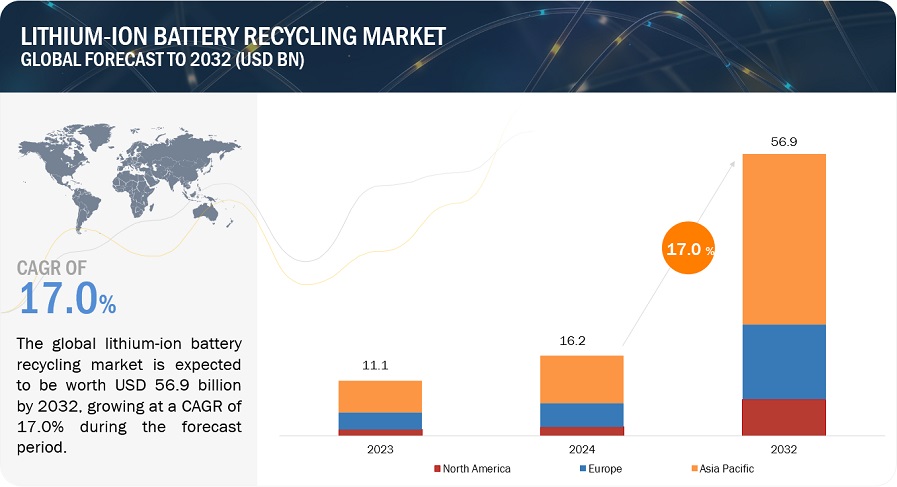

The global lithium-ion battery recycling market is valued at USD 16.2 billion in 2024 and is projected to reach USD 56.9 billion by 2032, growing at 17.0% cagr from 2024 to 2029.

The lithium-ion batteries are sourced from multiple sources including consumer electronics, industrial, marine, power, and other sources. After this, they are recycled to gain valuable metals like nickel and cobalt, back from these batteries. These batteries are then reused by battery manufacturers which strengthen the overall supply chain of batteries. Extraction of metals from lithium-ion batteries through different recycling process reduces dependence on mining for raw materials. The increased availability of metals also contributes towards overall price reduction for lithium-ion batteries. The rise in production of EVs and renewable energy storage systems is generating a substantial volume of end-of-life batteries, thereby fueling the market. Technological advancements in recycling are making the process more efficient and cost effective, thus improving their economics further compared to other methods like direct recovery. The rising awareness regarding sustainability is one of the key drivers of the li-ion battery recycling market.

Attractive Opportunities in the Lithium-Ion Battery Recycling Market

To know about the assumptions considered for the study, Request for Free Sample Report

Lithium-ion Battery Recycling Market Dynamics:

Driver: Increasing demand for electric vehicles

The market for recycled lithium-ion batteries is expected to grow due to the rise in the use of electric vehicles (EVs) and strict government regulations. The automobile industry is shifting toward the use of sustainable, clean fuels. There is a high reliance on oil in the transportation system, with around 70% used for vehicles. This heavy reliance is causing increasing concerns among environmentalists and economists. Increasing environmental awareness is leading to the adoption of electric vehicles. The widespread use of EVs is leading to the rise in the adoption of lithium-ion batteries, essential for an uninterrupted power supply, and this in turn would boost the market for lithium ion battery recycling market.

Restraints: Safety issues related to storage and transportation of spent batteries

Spent batteries hold a residual charge, which leads to the potential of unplanned discharge and may result in injury or damage to property and people. Unless properly labeled, all batteries should be treated as holding a charge and stored with care. Some batteries are small enough to be ingested or swallowed; thus, they should be stored safely out of the reach of children.

Large lithium-based batteries, such as those used for automotive applications, can be mistaken for lead-acid batteries if local battery manufacturers inappropriately label them. If not sorted correctly, these could pose a danger and must be separated from spent lead-acid batteries before storage. Due to these issues, state or national governments regulate the storage and transportation of spent batteries.

Opportunity: Rising adoption of lithium-ion batteries due to declining prices

The declining costs of lithium ion batteries can act as opportunities of growth in the lithium ion battery recycling market.According to a recent industry survey by BloombergNEF, the average cost of a lithium-ion battery pack was reduced to USD 137 per kWh in 2020 compared to the earlier USD 181 per kWh. Due to developments in battery technology over the last decade, battery pack prices have declined 88% since 2010. BloombergNEF projects that battery pack prices are expected to reduce to USD 58 per kWh by 2030 and to USD 44 per kWh by 2035. Tesla Motors Inc. (US) has undertaken developments such as the inception of the Gigafactory-1, which includes the increased production of lithium-ion batteries in 2018 compared to 2013. This is expected to help reduce the prices of lithium-ion batteries.

Challenge: High recycling costs

The lithium-ion battery recycling market is a growing market that is mainly fueled by the increase in the usage of lithium-ion batteries in both, automotive as well as non-automotive sectors. However, this markets’ growth may be hindered by the challenge posed by the high recycling costs of lithium-ion batteries. According to the Centre for Energy Economics (CEE), the lithium recovery rate is only 1–3% globally from all applications. Technologies for lithium extraction from lithium-based batteries are being developed by companies such as Toxco (US) and Umicore (Belgium). However, the high cost of recycling, the unavailability of proper storage systems for collecting spent batteries, and the absence of recycling technologies are some of the challenges for the market players.

Lithium-Ion Battery Recycling Market: Ecosystem

Prominent companies in this market include well-established, and financially stable recyclers of lithium-ion battery recycling market. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Umicore (Belgium), Cirba Solutions (US), Glencore (Switzerland), Contemporary Amperex Technology Co., Ltd. (China), and RecycLiCo Battery Materials Inc. (Canada).

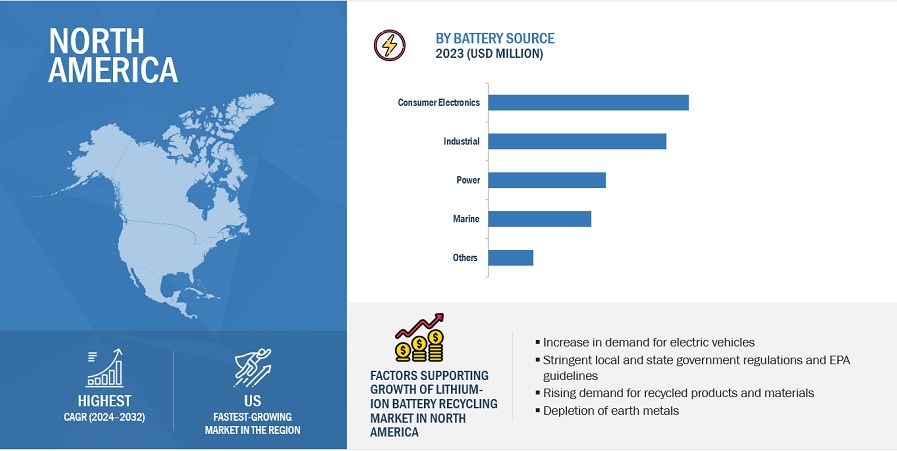

"Consumer electronics segment, by source, is estimated to account for the highest CAGR during the forecast period."

There is a rise in the need for consumer electronics like smartphones, laptops and tablets that use lithium-ion batteries, around the world. As the demand for consumer electronics increases, a large number of used lithium-ion batteries will soon be left useless because their life spans have come to an end. Since both producers and consumers are now realizing how disastrous wrong disposal of these batteries could be on the environment, increased waste offers them an opportunity to recycle them. Moreover, these batteries contain crucial metals like cobalt and lithium, that thus enhances the chances of investment in this market and also makes the consumer electronics segment the leading source of lithium-ion batteries that are to be recycled.

"Lithium Nickel Cobalt Aluminum Oxide (NCA), by battery chemistry, is estimated to account for the highest CAGR during the forecast period."

The CAGR for lithium-ion battery recycling market will arguably be highest in lithium nickel cobalt aluminum oxide (NCA), mainly due its rising usage in performance demanding applications such as electric vehicles (EVs) and energy storage systems. The high energy density of NCA batteries makes them valuable for longer supply periods thus their popularity increases as more people look for long-lasting, efficient batteries. In addition to that, greater emphasis on sustainability and circular economy is prompting investment into technologies capable of recovering valuable materials from NCA batteries through recycling. These metals include nickel, cobalt and lithium which are essential metals as well as help reduce environmental concerns arising from disposal restrictions on these items when these batteries are at end-of-life stage. As a result, NCA has the potential to spur growth in the lithium-ion battery recycling market over time due to increased regulatory pressures and a transition towards green consumerism.

"North America region is estimated to account for the highest CAGR during the forecast period."

North America seems poised to dominate this segment of the lithium-ion battery recycling market with predicted highest compound annual growth rate (CAGR) over the next few years due to escalated acceptance rates for electric automobiles and enhanced technologies involved in recycling. Against this backdrop lies escalating production of lithium-ion powered consumer electronics whose end-of life disposal has been a major concern particularly in large quantities thereby generating excessive battery waste streams from households among others. This has propelled investments into recycling facilities and technologies since sustainable development and circular economy are strongly embraced in this area.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Lithium-ion Battery Recycling Market Players

Umicore (Belgium), Glencore (Switzerland), Cirba Solutions (US), Contemporary Amperex Technology Co., Ltd. (China), and RecycLiCo Battery Materials Inc. (Canada) among others. A total of 27 major players have been covered. These players have adopted product launches, joint ventures, agreements, investments, acquisitions, mergers, and expansions as the major strategies to consolidate their position in the market.

Lithium-ion Battery Recycling Market Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2022 |

|

Base Year Considered |

2023 |

|

Forecast Period |

2024–2032 |

|

Forecast Units |

Value (USD Billion) and Volume (Units) |

|

Segments Covered |

Battery Chemistry, Source, Recycling Process, Battery Component, and Region |

|

Geographies Covered |

Asia Pacific, Europe, and North America |

|

Companies Covered |

The major market players include Glencore (Switzerland), Umicore (Belgium), Cirba Solutions (US), Contemporary Amperex Technology Co., Ltd. (China), RecycLiCo Battery Materials Inc. (Canada), Accurec Recycling GmbH (Germany), American Battery Technology Company (US), Ecobat (US), Fortum (Finland), Gem Co., Ltd (China), Aqua Metals, Inc. (US), Li-Cycle Corp (Canada), Neometals Ltd (Australia), Redwood Materials Inc (US), Stena Recycling (Sweden), SK Tes (Singapore), Velio (France) and others. |

This research report categorizes the Lithium-ion battery recycling market based on Source, Battery Chemistry, Recycling Process, Battery Component, and Region.

Based on Source, the Lithium-ion battery recycling market has been segmented as follows:

- Automotive

- Non-Automotive

Based on Battery Chemistry, the Lithium-ion battery recycling market has been segmented as follows:

- Lithium-Nickel Manganese Cobalt (Li-NMC)

- Lithium-Ion Phosphate (LFP)

- Lithium-Manganese Oxide (LMO)

- Lithium-Titanate Oxide (LTO)

- Lithium-Nickel Cobalt Aluminum Oxide (NCA)

Based on Recycling Process, the Lithium-ion battery recycling market has been segmented as follows:

- Hydrometallurgical Process

- Pyrometallurgy Process

- Physical/ Mechanical Process

Based on Battery Component, the Lithium-ion battery recycling market has been segmented as follows:

- Active Material

- Non-Active Material

Based on region, the Lithium-ion battery recycling market has been segmented as follows:

- Asia Pacific

- Europe

- North America

Recent Developments

- In February 2024, Cirba Solutions and EcoPro signed an MoU to improve lithium-ion battery recycling. This collaboration is crucial due to the increasing demand for battery materials and the focus on clean energy production in the US.

- In April 2022, Umicore signed a long-term strategic supply agreement with Automotive Cells Company (ACC) for battery recycling services. At the end of the Umicore recycling process, the recovered metals are delivered to the ACC pilot plant in Nersac, France, in battery-grade quality, allowing them to be re-circulated into producing new Li-ion batteries.

- In August 2021, Glencore entered a long-term strategic partnership with Britishvolt, a pioneer in electric vehicle battery technology and production in the UK. Through this partnership, Glencore supplies Britishvolt with cobalt. This partnership enhanced Glencore's position in the lithium-ion battery recycling market through its product portfolio.

Frequently Asked Questions (FAQ):

What is the key driver for the lithium-ion battery recycling market?

Growing adoption of EVs and plug-in vehicles as a driving force for the lithium-ion battery recycling market

Which region is expected to register the highest CAGR in the lithium-ion battery recycling market during the forecast period?

The lithium-ion battery recycling market in North America is estimated to register the highest CAGR during the forecast period.

What is the major end-use of lithium-ion battery recycling?

The automotive segment is the major end-use of lithium-ion battery recycling market.

Who are the major players of the lithium-ion battery recycling market?

The key players operating in the market include Umicore (Belgium), Glencore (Switzerland), Cirba Solutions (US), Contemporary Amperex Technology Co., Ltd. (China), and RecycLiCo Battery Materials Inc. (Canada).

What is the total CAGR expected to record for the lithium-ion battery recycling market during 2024-2032?

The market is expected to record a CAGR of 17.0% from 2024-2032. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

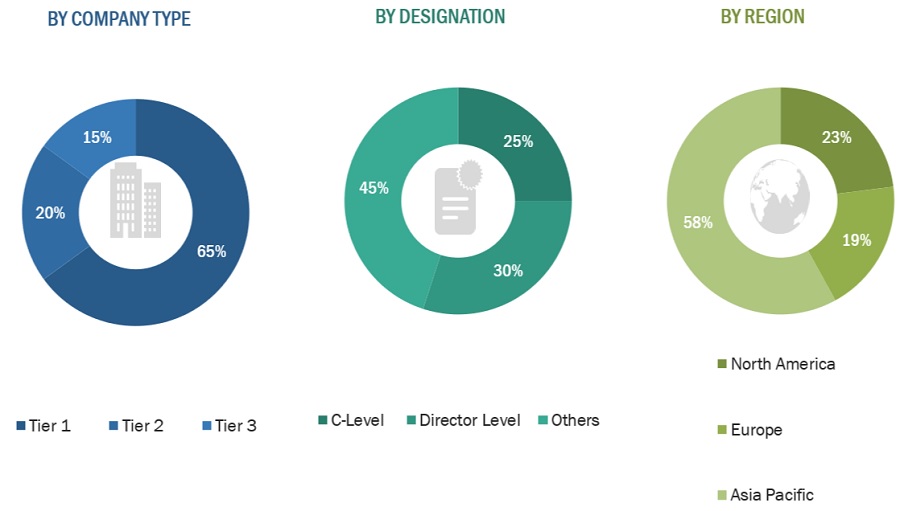

The study involved four major activities in estimating the current size of the Lithium-ion battery recycling market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the lithium-ion battery recycling value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors; gold- and silver-standard websites; lithium-ion battery recycling manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

Primary Research

The Lithium-ion battery recycling market comprises several stakeholders, such as such as raw material suppliers, technology support providers, lithium-ion battery recyclers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Lithium-ion battery recycling market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

>Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the Lithium-ion battery recycling market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the Lithium-ion battery recycling market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global Lithium-ion battery recycling market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Lithium-ion battery recycling market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas sector.

Market Definition

Lithium-ion battery recycling refers to the reuse and reprocessing of spent lithium-ion batteries to reduce their disposal as municipal solid waste or material waste. Lithium-ion batteries contain several toxic chemicals & heavy metals and disposing of them as trash has raised environmental and health concerns due to water pollution and soil contamination. Lithium-ion battery recycling is important not only for the recovery of valuable materials and metals but also for efficient waste management. Various types of lithium-ion batteries are available in the market, including lithium-titanate oxide (LTO), lithium-manganese oxide (LMO), lithium-iron phosphate (LFP), lithium-nickel cobalt aluminum oxide (NCA), and lithium-nickel manganese cobalt (Li-NMC). These batteries are majorly used in the automotive and non-automotive industries such as marine, power, industrial, and others. Li-ion batteries provide the required amount of power at a low cost and help reduce the weight and size of products, which are the major factors leading to the market growth. The rising demand for Li-ion batteries in electric vehicles is expected to lead to the growth of the lithium-ion battery recycling market during the forecast period.

Key Stakeholders

- Raw material manufacturers

- Technology support providers

- Recyclers of Lithium-ion battery

- Traders, distributors, and suppliers

- Regulatory Bodies and Government Agencies

- Research & Development (R&D) Institutions

- End-use Industries

- Consulting Firms, Trade Associations, and Industry Bodies

- Investment Banks and Private Equity Firms

Report Objectives

- To analyze and forecast the market size of Lithium-ion battery recycling market in terms of value

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global Lithium-ion battery recycling market on the basis of battery chemistry, source, recycling process, battery component, and region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast the size of various market segments based on four major regions: North America, Europe, and Asia Pacific, along with their respective key countries

- To track and analyze the competitive developments, such as acquisitions, partnerships, collaborations, agreements and expansions in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the Lithium-ion battery recycling market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Lithium-ion Battery Recycling Market