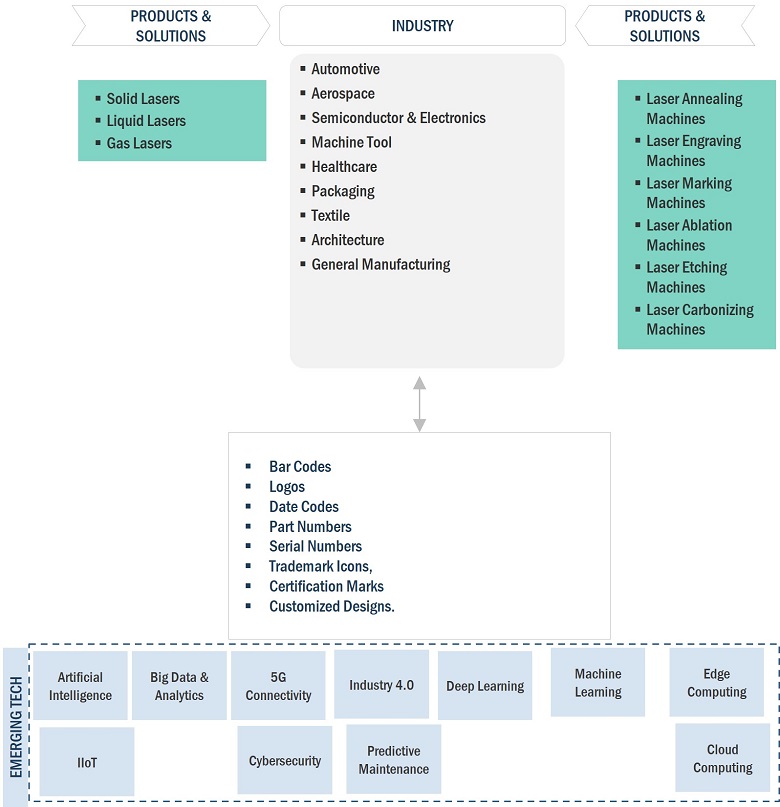

Laser Processing Market by Laser Type (Solid Lasers, Liquid Lasers, Gas Lasers), Configuration (Fixed Beam, Moving Beam, Hybrid), Application (Cutting, Welding, Drilling, Marking and Engraving), End-user Industry and Region - Global Forecast to 2029

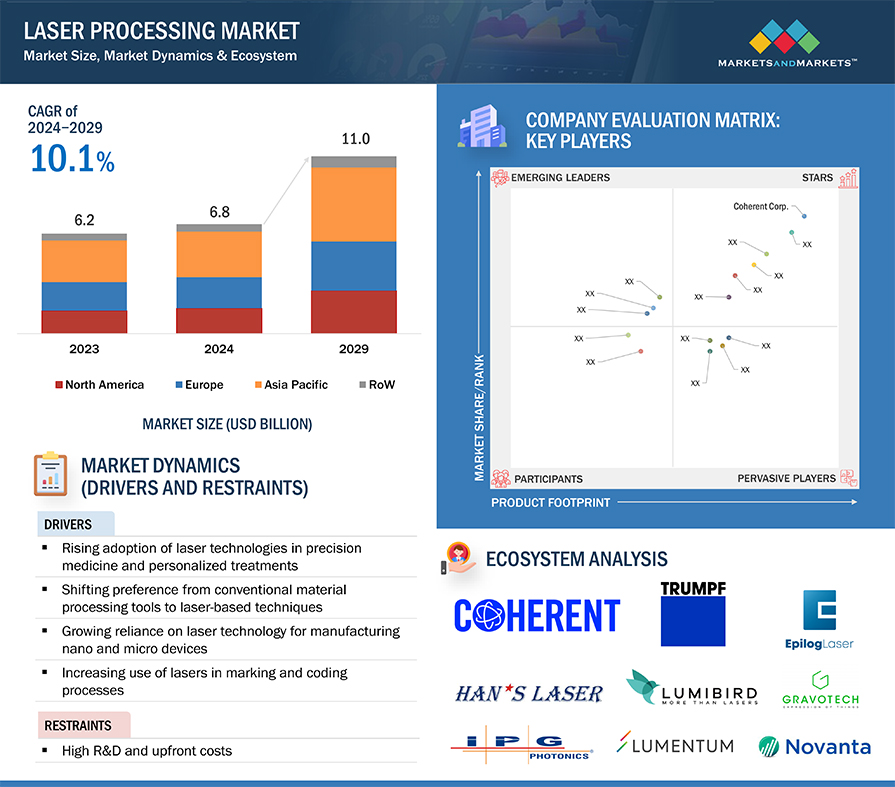

[262 Pages Report] The global laser processing market size is estimated to be valued at USD 6.8 billion in 2024 and is anticipated to reach USD 11.0 billion by 2029, at a CAGR of 10.1% during the forecast period. The market growth is ascribed to emerging trends in laser processing, surging demand for laser processing in medical applications, advancement of laser-based techniques compared with conventional material processing methods, and significant transition towards nanodevices and microdevices production.

Laser Processing Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Laser Processing Market Trends

Driver: Advancement of laser-based techniques compared with conventional material processing methods

Laser-based techniques are superior to conventional material processing methods in terms of precision, efficiency, and versatility. Unlike traditional methods that rely on mechanical tools, lasers can focus on extremely fine details with pinpoint accuracy. This precision minimizes material waste and allows for intricate and complex designs. Moreover, laser technology is non-contact, reducing wear and tear on tools and eliminating the need for direct physical contact with the material. Laser processing is often faster, leading to higher production rates and increased efficiency. Additionally, the heat-affected zone in laser processing is minimal, reducing the risk of thermal damage to the material. This is particularly beneficial for delicate materials or applications where precision is paramount. Lasers are used for cutting, drilling, marking, engraving, welding, etching, and micro-machining. They offer a significantly higher level of accuracy and speed than traditional tools, such as saw machines, drill bits, chemicals, or electricity. For instance, they can achieve extremely high levels of precision, allowing for intricate and detailed material processing, which is particularly beneficial in applications such as engraving, cutting, and micro-machining. In the manufacturing vertical, laser systems are rapidly replacing traditional tools. Laser processing is also used in the creation of sculptures, as well as in the modeling, prototyping, and design of trophies, gift articles, and false walls. Previously, these processes required skilled workers and a significant amount of time to complete a single artwork or product. However, laser processing has made these processes more convenient, precise, and productive, while also reducing the need for skilled workers and lowering the cost of the artwork or product.

Restraint: Lack of trained workforce

The lack of trained personnel is another factor that is restraining the growth of the laser processing market. The laser processing market faces a significant hindrances due to the lack of a trained workforce. The specialized nature of laser systems necessitates skilled professionals who possess expertise in operating, maintaining, and optimizing these advanced technologies. Skilled labor is essential for operating and maintaining laser systems, adding expenses related to hiring and training qualified professionals. However, there is a shortage of individuals with the necessary training and qualifications to effectively manage laser-based processes in various industries. This deficiency in skilled personnel can impede the seamless integration and utilization of laser technology, limiting its potential impact on manufacturing, healthcare, research, and other sectors. For instance, the operation of an excimer laser requires the presence of at least one trained personnel to ensure that the operator is aware of the protocols to be followed during the use of laser systems. The lack of trained staff could damage the materials involved in laser processing and lead to high time consumption.

Opportunity: Growing adoption of laser processing in surface treatment and engraving

Laser processing is widely utilized for surface treatment and engraving across various industries, or verticals, due to its precision, versatility, and efficiency. In the automotive sector, laser surface treatment techniques are employed to prepare surfaces for painting, improve adhesion, and enhance functional properties like corrosion resistance and wear resistance. Laser engraving is used for part identification, branding, and customization, providing permanent and high-contrast markings on components such as engine parts, chassis components, and interior trim. In the electronics industry, laser surface treatment is applied for microstructuring and texturing of substrates, improving adhesion and electrical properties in devices such as circuit boards and semiconductor components. Laser engraving is also utilized for marking and cutting precision components like microchips and electronic housings. In the medical field, laser surface treatment techniques are employed to modify the surface properties of implants, enabling better integration with the human body and reducing the risk of rejection. Laser engraving is used for marking medical devices and instruments with essential information for traceability and compliance. In the consumer goods sector, laser surface treatment enhances the aesthetic appeal and functionality of products like appliances, jewelry, and packaging materials, while laser engraving provides customizable designs and branding options. Overall, laser processing in surface treatment and engraving serves a wide range of verticals, contributing to improved product quality, functionality, and customization across diverse industries.

Challenge: Environmental challenges related to the utilization of rare earth elements

The use of rare earth elements (REEs) in laser processing raises environmental concerns due to the potential negative impacts associated with their extraction, processing, and disposal. Rare earth elements, such as neodymium and dysprosium, are essential components in the production of certain types of lasers, particularly in solid-state lasers used in various applications. Mining and processing of REEs are often associated with environmental degradation, habitat disruption, and the release of hazardous substances into ecosystems. Additionally, the extraction and separation processes can lead to soil and water contamination, posing risks to both human health and wildlife. The refining processes use toxic acids, which, if mishandled, may result in severe environmental damage. Also, the use of rare-earth metals poses the risk of supply disruptions in the short term, and supply challenges for these metals may affect the deployment of clean energy technology in the years to come. Furthermore, rare earth mining has been linked to social and human rights issues, as it is concentrated in a few countries with lax environmental regulations.

Laser Processing Market Ecosystem

Laser Processing Market Segmentation

The fibre lasers segment accounted for the largest share of the laser processing market in 2023.

Laser processing involves using lasers for various applications, such as cutting, welding, drilling, marking, engraving, and scribing. The lasers used to carry out these operations include solid, gas, liquid, and other laser types. Solid-state lasers, particularly fiber lasers have become significant players in the laser processing market, holding a substantial market share. Recognized for their high power, energy density, and enhanced reliability, these lasers are extensively applied in cutting, welding, and engraving across diverse materials. Their compact design, efficiency, and adaptability make them suitable for seamless integration into manufacturing processes. Advancements in fiber laser technology, coupled with their versatility in material processing and applications in additive manufacturing and microprocessing, contribute to their prominence.

The hybrid configuration segment is to hold the largest market share during the forecast period.

Laser processing requires either of the three types of laser configurations: fixed beam, moving beam, and hybrid configuration. Hybrid configuration in laser processing refers to a setup that combines laser technology with other complementary manufacturing methods, such as milling, drilling, or waterjet cutting, to leverage the strengths of each technique for improved processing efficiency and flexibility. A hybrid system is more efficient than the moving beam system as it provides a constant beam delivery path length and allows a comparatively simpler beam delivery system.

Marking and Engraving application will grow at the highest CAGR during the forecast period.

The market has been segmented by applications, cutting, drilling, welding, marking & engraving, microprocessing, advanced processing, and others. Marking & engraving are the major application areas of lasers at present because this process is maintenance-free, flexible, and precise in nature, which further creates additional market opportunities for lasers. The electronics/semiconductor, medical, aerospace, automotive, consumer products, gifts & trophies, and food & beverage end-user industries generally use lasers for marking & engraving applications.

Asia Pacific region to hold the largest market share during the forecast period.

The Asia Pacific region is segmented into China, Japan, South Korea, India, and the Rest of Asia Pacific, representing the largest market for laser processing. Both Japan and India stand out as the world's fastest-growing economies. APAC has been ahead in terms of the adoption of laser processing solutions as compared to other regions. High population density, increasing R&D investments in technology, and growing manufacturing and electronics sectors are expected to drive the growth of the laser processing market in the region. Additionally, the presence of key industry players and the region's status as a manufacturing hub facilitate the production and distribution of laser processing products.

Laser Processing Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major companies in the laser processing companies are Coherent Corp. (US), TRUMPF (Germany), Han’s Laser Technology Industry Group Co., Ltd (China), IPG Photonics Corporation (US), JENOPTIK AG (Germany) and others. These companies have used both organic and inorganic growth strategies, such as product launches, acquisitions, and partnerships to strengthen their position in the laser processing market.

Want to explore hidden markets that can drive new revenue in Laser Processing Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Laser Processing Market?

|

Report Metric |

Details |

|

Years Considered |

2020–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD million/billion) |

|

Segments Covered |

Laser Type, Configuration, Application, Industry and Region |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

Coherent Corp. (US), TRUMPF (Germany), Han’s Laser Technology Industry Group Co., Ltd (China), IPG Photonics Corporation (US), Jenoptik AG (Germany), Lumentum Operation LLC (US), A total of 25 players are covered. |

Laser Processing Market Highlights

In this report, the overall laser processing market has been segmented based on Laser Type, Configuration, Application, Industry and Region.

|

Segment |

Subsegment |

|

By Laser Type |

|

|

By Discrete Industry |

|

|

By Application |

|

|

By Industry |

|

|

By Region |

|

Recent Developments

- In January 2024, Coherent introduced the OBIS 640 XT, a red laser module that matches the high output power, low noise, beam quality, and compact size of its existing portfolio of blue and green laser modules, which as a complete set enable high-performance SRM systems.

- In January 2024, Novanta Inc. completed the acquisition of Motion Solutions. This acquisition creates the potential to develop new and unique intelligent subsystems using our combined technology offerings.

- In November 2023, IPG Photonics collaborated with Miller Electronics Mfg. LLC for their commitment for innovation with quality and reliability The alliance will advance laser technologies for the handheld welding market and reshape the landscape of welding tools to provide welders with powerful, efficient, and precise solutions that meet the demands of modern welding applications. This collaboration will deliver dependable solutions that welders can rely on for their critical tasks.

Frequently Asked Questions (FAQs):

What will be the global laser processing market size in 2024?

The laser processing market is expected to be valued at USD 6.8 billion in 2024.

Who are the global laser processing market winners?

Companies such as are Coherent Corp., TRUMPF, Han’s Laser Technology Industry Group Co., Ltd, IPG Photonics Corporation, Jenoptik AG fall under the winners’ category.

Which region is expected to hold the highest global laser processing market share?

Asia Pacific will dominate the global laser processing market in 2024.

What are the major drivers of the laser processing market?

Surging demand for laser processing in medical applications, Advancement of laser-based techniques compared with conventional material processing methods, Significant transition towards nanodevices and microdevices production, Rising demand for authentic and top notch products.

What are the major strategies adopted by laser processing companies?

The companies have adopted product launches, acquisitions, expansions, and contracts to strengthen their position in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

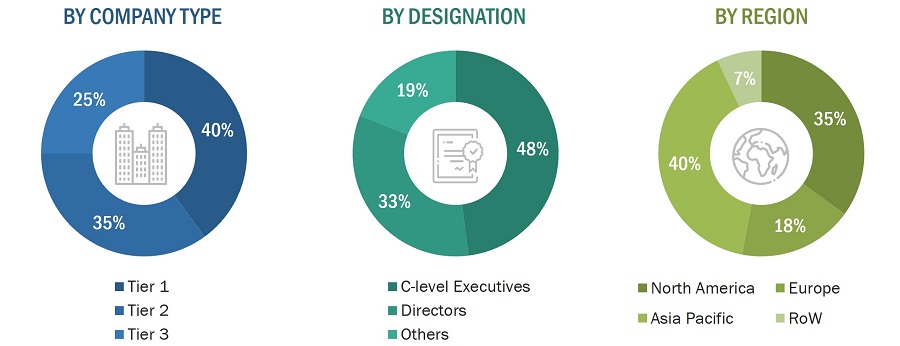

The study involves four major activities that estimate the size of the laser processing market. Exhaustive secondary research was conducted to collect information related to the market. Following this was validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the laser processing market. Subsequently, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data were collected and analyzed to estimate the overall market size, further validated by primary research. The relevant data is collected from various secondary sources, it is analyzed to extract insights and information relevant to the market research objectives. This analysis has involved summarizing the data, identifying trends, and drawing conclusions based on the available information.

Primary Research

In the primary research process, numerous sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. The primary sources from the supply side included various industry experts such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from wireless charging providers, (Coherent Corp., TRUMPF, Han’s Laser Technology Industry Group Co., Ltd, IPG Photonics Corporation, Jenoptik AG) research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Approximately 25% of the primary interviews were conducted with the demand side and 75% with the supply side. These data were collected mainly through questionnaires, emails, and telephonic interviews, accounting for 80% of the primary interviews.

To know about the assumptions considered for the study, download the pdf brochure

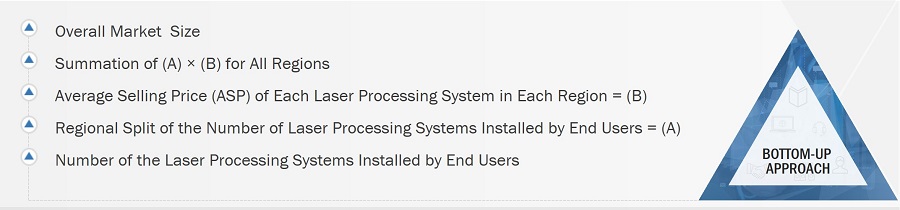

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the wireless charging market and other dependent submarkets listed in this report.

- The key players in the industry and markets were identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After estimating the overall market size, the total market was split into several segments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and gauge exact statistics for all segments. The data were triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both top-down and bottom-up approaches.

Market Definition

Laser (light amplification by stimulated emission of radiation) is a device that is capable of emitting light through a process of optical amplification based on the stimulated emission of electromagnetic radiation. Laser processing involves the use of lasers to cut, weld, or grind materials across various end-user industries. It works by directing a high-power laser output, usually through optics. Lasers are now being used across a wide range of end-user industries, such as automobile, aerospace, microelectronics, medical & life sciences, architecture, and machine tools.

Stakeholders

- Microelectronics manufacturers

- Aerospace companies

- Medical & life sciences companies

- Automotive companies

- Architecture firms

- Machine tool manufacturers

- Lasers and systems manufacturers

- Laser processing solution providers

- Engineering and manufacturing companies

- Technology providers

The main objectives of this study are as follows:

- To define, describe, and estimate the size of the global laser processing market, in terms of value, segmented based on laser type, configuration, application, industry, and region

- To forecast the market size for various segments with respect to four main regions—North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To profile the key market players, and comprehensively analyze their market share and core competencies

- To analyze competitive developments, such as partnerships, expansions, acquisitions, product launches, and research & development (R&D) activities, in the laser processing market

- To provide the leadership mapping based on company product footprint and market share

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of different market players (up to five)

Growth opportunities and latent adjacency in Laser Processing Market

How dot peen marking affect adoption of laser for marketing and engraving application?

Dear Sir/Madam, I am working on a project involving femtosecond pulsed lasers for my master's thesis. The project focuses on laser microprocessing of silicon. Thus I would be really interested by having any information on the laser microprocessing market of silicon or the market of silicon in general. Unfortunately we don't have enough funding now to purchase your book without being sure we can find what we are looking for. This is why I am requesting a free sample report.

Dear Market research Team, Before buying I would like to have a summary of the study.

Hi, I am interested in evaluate the US laser processing market and their applications that best fit the using of small-medium Fiber laser machines, which have an high precision and can work for small/medium metal pieces.

Currently selling Nitrogen Gas generators throughout Eastern Europe and CIS and would be interested in what this report has to say, in relation to Laser Cutting.

Interested in each of the applications by the market size of Laser Diode, DPSSL, and Fiber Laser. We especially would like to make sure the application.

Will increase in adoption of fiber laser will affect demand of CO2 laser?

I am a polish student and involved in some project about ultrafast lasers. I have found that they are commonly used in micromachining so I am also really interested in this market. Can you share the summary for this market study?

I am specially interested in fiber laser latest developments. And market opportunity for high power cutting machine in South Asia and Middle East regions.

Trying to understand the market for ultra-short pulse lasers for the processing of ultra-hard materials .

Hard to tell what your definition of "Laser Processing Market" is - seems like this includes more than just annual system sales. Can you please define it a bit further - what the study covers in this $17.4 billion market by 2020?

I need to know which companies you have considered for the study, are these companies produces laser machines or the user of the machines?

Interested in laser marking and engraving applications as it relates to tooling and tube identification specifically in aerospace and automotive industry segments.

Can you provide the qualitative and quantitative data for laser marking and engraving applications particularly for growth in the fiber and decline in CO2 and other solid state lasers?

I'm one of the co-founders in a startup focused on distributed manufacturing. I've been struggling to find a decent total addressable market number, and I'm pretty sure you guys have some of the data I need in your report. We don't have the funds to buy the full report. I'm wondering if you would be willing to sell part of the data so I can build a market case for investors. We are focused specifically on the laser fabrication market for metals and non-metals. For the time being out customers are mainly prototyping parts. I appreciate any help or advice you can offer.