Ketones Market by Application (Supplements, Food & Beverages, Cosmetics & Personal Care Products), Supplement Type (Ketone Salts, Ketone Esters, Ketone Oils, Raspberry Ketones), Form (Solid, Liquid, Semi- Liquid) and Region - Global Forecast to 2029

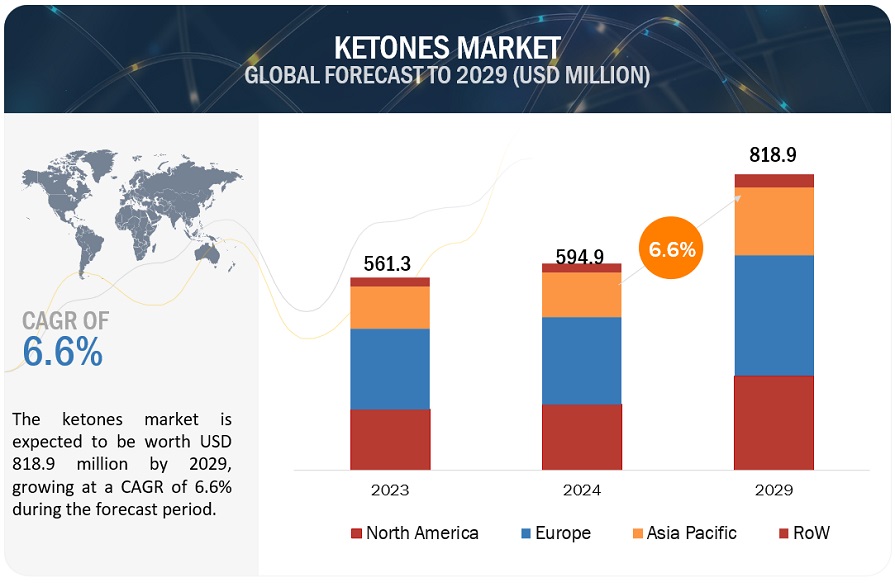

The global ketones market is witnessing significant growth, with an estimated value projected to reach USD 818.9 million by 2029 from the 2024 valuation of USD 594.9 million, indicating a substantial Compound Annual Growth Rate (CAGR) of 6.6%. The rising trend of consuming supplements due to increasing health concerns and consuming additional nutrients creates an opportunity for manufacturers to attract consumers by launching new ketone-based products. Ketone-based products find profitable opportunities in various industries. The demand for healthy food and drinks, such as low-fat and low-sugar, remains high, and consumers are getting more health-conscious, which is projected to drive the demand for ketones, globally.

The ketones market has been experiencing exponential growth in recent years with the evolving industry trends, reflecting a rapidly changing dynamic landscape like that witnessed in health and wellness. Following the major trend of ketogenic diets and shifts toward lifestyles that are oriented to be healthy, the demand for ketones as supplements is increasing. This growth is propelled by awareness of the potential benefits of ketones to support cognitive function, enhanced athletic performance, and weight management. As consumers continue to search for innovative solutions that augment their well-being the ketones market is experiencing a shift with changing consumer preferences and product offerings.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Increase in new product launches

With the increase in the presence of leading players such as Perfect Keto (US) and Keto Logic (US), the ketone market is projected to witness significant growth. Key players in the market are focusing on launching various new products in the market, buoyed by the spike in consumer demand. The ketone market is propelled by consistent innovation, which is highlighted in recent flavor launches in ketone supplements. For instance, Prüvit's launched the "Prickly Pear" flavor in September 2023. Though this product is met with various mixed reviews due to its unique tartness, reflects the industry's commitment to diversity. In 2018, 80% of the new product launches were witnessed in the North American region, which is dominated by the US, whereas Europe accounted for 10% of the product launches with 30 product launches, and the Asia Pacific region accounted for 6% with 19 new product launches. The increasing research and development and new product launches is propelling the growth of the ketones market.

Restraint: Side-effects and risks associated with the consumption of ketones

Ketone supplements are not advisable to be taken by children below the age of 18 and pregnant women, as they can hurt the metabolism process. In addition, the consumption of a higher dosage of ketone food products and supplements also results in issues, such as nausea, headache, and stomach pain. This acts as a major restraint among consumers for the adoption of supplements during the initial phases of ketone supplement consumption.

Another major issue is that certain clinical trials have shown negative results, which have led consumers to doubt the actual credentials of companies that provide BHB ketone supplements. In a recent study, in 2019, it was discovered that after giving a ketones-based drink to 11 elite cyclists in Australia, the athletes performed worse, had slower times, and all of them reported upset stomachs, which contradicted the intended benefits of these products. These side effects associated with the consumption of ketone-based products is anticipated to hamper the growth of the market.

Opportunity: Increasing use of ketones to create growth opportunities for manufacturers in the beverage industry

Ketone supplements are increasingly being used in the powdered form. However, with the increasing demand for functional drinks, such as protein and other health-related drinks, the demand for keto-based drinks is also on the rise. Sports-based ketone supplements are increasingly being consumed by individuals without being on a keto-based diet. With the results showing a positive impact on the health of individuals, such as the increase in endurance levels, the demand for ketone-based drinks remains high. Key players in the ketones market are competing with research and development and the launch of new products to strengthen their position in the market. The term "drinkable ketones" refers to beverages or supplements that contain externally produced exogenous ketones. In January 2022, Health Via Modern Nutrition, a nutrition company based in the United States, launched Ketone-IQ. Which is considered as next major development in drinkable ketones, Ketone-IQ is developed to maximize metabolic states and provide advantages such as sustained energy, improved endurance and mental health, and control of appetite. The target audience includes a wide range of audiences such as military personnel, high-performing athletes, and health-conscious individuals. The enhanced demand for ketone-based drinks poses as a major opportunity for the growth of the market.

Challenges: High R&D cost and technical difficulties in the manufacturing process

The production of ketone-based food and supplements requires high investment in R&D to test the accurate mixture of ingredients that are to be used in the manufacture of products such as ketone salts and ketone esters. The manufacturing process of ketone esters is a difficult process, as the BHB is bound to precursors such as glycerol through an ester bond, which is an extremely volatile process and requires high skill levels. The binding of a BHB to a mineral such as sodium, calcium, or magnesium also requires a lot of research to get the proper formulation. The majority of the cost related to the manufacturing of products is utilized during the testing and clinical trial phases of the product. Marketing and distribution costs also remain high, as more companies are focusing on expanding their distribution network by partnering with various e-commerce platforms.

Ketones Market Ecosystem

In the type segment, the market for ketone esters is projected to grow at the highest CAGR during the forecast period.

Ketone esters are salt-free liquids that contain BHB, which is bound to precursors, such as glycerol, via an ester bond. The D-BHB monoester in HVMN Ketone increases blood ketones to exceptional levels of 3–6 mM within 30 minutes of consumption, which results in a faster ketosis process. As these esters are salt-free, they do not impact water retention and have side effects, such as high salt content. Ketone esters are mostly used in the testing phase and have shown a positive impact, which includes increased endurance, enhanced recovery, and cognitive benefits. In February 2022, polyether ether ketone (PEEK) occupied a leading position in innovative materials, due to rapid developments in the manufacturing of additives and material science. Over the years, PEEK emerged as a highly developed engineering thermoplastic, which is commended for its exceptional combination of high-temperature performance, mechanical strength, and chemical resistance. PEEK's application also extends to biomedical realms, where 3D-printed composite materials provide tailored solutions for orthopedic implants and prosthetics, highlighting the material's potential for groundbreaking developments in customized healthcare and further augmenting the growth of the market

In the application segment, food and beverages are anticipated to record the highest CAGR during the forecast period.

In food & beverage applications, ketone molecule is used to prepare ketone beverages, such as ketone drinks. Ketone boosts or supercharges the body, unlike any other source. In recent times, there has been an increasing trend among sports players and younger populations to consume energy drinks or caffeine-containing products that boost their energy and improve performance. These drinks and energy shots are gaining traction across the globe, since the younger population is perceiving their positive effects in concentration, stamina, and endurance, and ignoring the high caffeine effect, such as high dehydration due to the diuretic property, which affects their endurance. The rising awareness regarding the side effects of caffeine on the body is a major factor that is projected to increase the share of the ketone-infused food and beverages market in the future. As ketones are accustomed to the body, their consumption will not adversely affect the body. Due to these factors, they are gaining popularity in the energy drinks market.

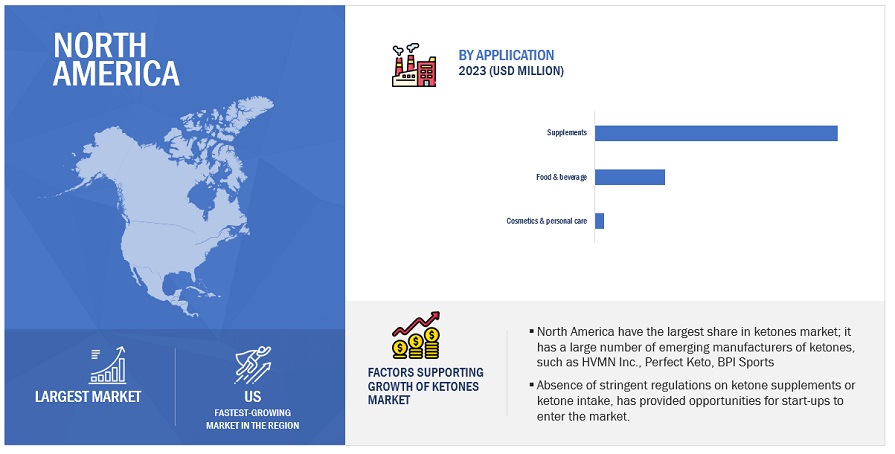

The ketones market in the North American region is accounting for the major share during the study period

Due to the change in lifestyles, rising geriatric population, and the growth in disposable income among people, the demand for ketone supplements is growing. The North American region accounted for the largest share of the ketone supplement market. Due to the increased awareness related to health trends, the popularity of ketones remains high in the region. The increase in the elderly population has led people to spend more on nutritional food, which, in turn, is projected to create profitable growth opportunities for this market. Ketone supplements possess other functions, such as improving brain and memory, weight loss, and liver health. These functionalities have encouraged consumers to adopt ketone supplements in higher amounts, particularly ketone sales. Moreover, with the rising trend of consuming functional food, there has been an increase in the availability of ketones across restaurants and food outlets, which has further driven the growth opportunities for ketones. Moreover, the absence of stringent rules and regulations regarding ketone consumption, unlike caffeine, protein, and other macro and micronutrients, further encourages companies to enter this growing market.

Key Market Players

Key players in this market include Perfect Keto Group (US), H.V.M.N. INC. (US), KetoLogic (US), Pruvit Ventures, Inc. (US), and KetoneAid (US). Companies are focusing on expanding their production facilities, entering into partnerships as well as agreements, and launching new products to grow their business and, in turn, their market share.

Want to explore hidden markets that can drive new revenue in Ketones Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Ketones Market?

|

Report Metric |

Details |

|

Market size estimation |

2024–2029 |

|

Base year considered |

2023 |

|

Forecast period considered |

2024–2029 |

|

Units considered |

Value (USD Million), Volume (Kilo Ton) |

|

Segments Covered |

Type, Form, Application, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

|

Target Audience

- Ketones manufacturers, formulators, and blenders

- Technological and raw material providers to ketone manufacturers

- Commercial research & development (R&D) organizations and financial institutions

- Government departments and regulatory bodies such as the US Food and Drug Administration (FDA), European Food Safety Authority (EFSA) and Canadian Food Inspection Agency (CFIA) among others.

Ketones Market:

By Type

- Ketone Salts

- Ketone Esters

- Ketone Oils

- Raspberry Ketones

By Form

- Solid

- Liquid & Semi-liquid

By Application

- Supplements

- Food & Beverages

- Cosmetics & Personal Care

By Region:

- North America

- Europe

- Asia Pacific

- Rest of the World (RoW)

Recent Developments

- In June 2024, one of the major in the health and nutrition space named Intelligent Brands divested the nutraceuticals division Pruvit in a USD 107 Million Deal. Lacore and Harding, through their investment firm Adventures Capital, have now gained control of Pruvit.

- In June 2023, Advanced Biotech launched a facility in Oneonta, New York, specially crafted to maximize energy efficiency. The facility consists of a 65,000 sq. foot warehouse, and 10,000 sq. feet of refrigeration, along with additional capabilities for spray drying and specialty chemical manufacturing. This production facility will allow the company to enhance the production of ketone-based products like Raspberry Ketone Natural, Methyl Ketone Mix 2hn Natural, Methyl Ketones Mix (Non-Dairy) Natural, and many more.

- In April 2023, Health Via Modern Nutrition launched Ketone-IQ in all 389 Sprouts Farmers Market grocery store locations in the US. Ketone IQ is designed to health wellness demands of consumers and is available in all the major grocery stores in the functional wellness shot category in grocery stores. It is highly popular because of the affordability of the product, and the company will benefit from these grocery stores.

Frequently Asked Questions (FAQ):

What is the intensity of competition in the ketones market? Which are the major companies in the ketones market?

The ketones market can be classified as consolidated, with the majority of the market share acquired by the top 5 key players globally. These key players constantly take strategic measures to diversify their product portfolio and strengthen their geographical presence. Small startups are also entering the market, but they have a very limited geographical presence and have a very low share in the overall ketones market. Key players in this market include Perfect Keto Group (US), H.V.M.N. INC. (US), KetoLogic (US), Pruvit Ventures, Inc. (US), and KetoneAid (US),

What are the drivers for the ketones market?

Some of the major factors driving the demand for exogenous ketone supplements include health benefits such as muscle gain, weight loss, and improved athletic performance. It also helps in reducing keto-flu among early adopters of the ketogenic diet. With many new companies entering the market and clinical results showing a positive impact of keto supplements, the market is projected to witness high growth in the coming years.

Which region is projected to record the highest CAGR in the ketones market during the forecast period?

The Asia Pacific market is projected to grow at the highest CAGR of 7.4% during the forecast period attributed to the increasing consumption of processed food products and growth in the fast-food industry, which has led to an unhealthy & desk-bound lifestyle. Due to these factors, consumers are gaining weight leading to an increase in health concerns among consumers and a growing preference among consumers for supplements to maintain fitness without any need for dietary meals.

What kind of information is provided in the company profile section?

As the consumption of ketones becomes more prevalent, the risk of the flu, a set of symptoms associated with the initial stages of a ketogenic diet, necessitates precise ketone level monitoring. To address this need, innovative technologies are emerging in the ketones market. For instance, Continuous ketone monitoring involves implantable or wearable sensors that continuously track ketone levels in the bloodstream or interstitial fluid, akin to continuous glucose monitoring (CGM) for diabetics. CKM eliminates the need for frequent blood tests, providing real-time data. Early prototypes, like the Ever sense EXC4 sensor, have shown promising results in clinical trials, offering continuous ketone monitoring for up to 14 days.

What is the expected total CAGR for the ketones market from 2024 to 2029?

The CAGR is expected to be 6.6% from 2024 to 2029. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

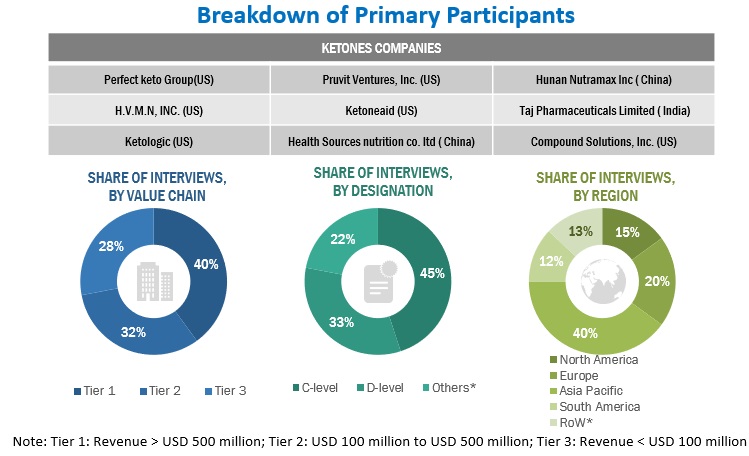

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the Ketones market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Agricultural Organization (FAO), United States Department of Agriculture (USDA), U.S. Food and Drug Administration (FDA) U.S. Food and Drug Administration (FDA), European Food Safety Authority (EFSA), World Health Organization (WHO), Consumer Healthcare Products Association (CHPA), European Federation of Associations of Health Product Manufacturers (EHPM), Canadian Health Food Association (CHFA), and Health Food Manufacturers' Association (HFMA), associations were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases.

Primary Research

The Ketones market encompasses various stakeholders involved in the supply chain, raw material manufacturers, raw material suppliers, regulatory organizations, and research institutions. To gather comprehensive information, primary sources from both the supply and demand sides were engaged. Primary interviewees from the supply side consisted of manufacturers, distributors, importers, and technology providers involved in the production and distribution of Ketones. On the demand side, key opinion leaders, executives, and CEOs of companies in the Ketones market were approached through questionnaires, emails, and telephonic interviews. This approach ensured a comprehensive and well-rounded understanding of the Ketones market from various perspectives.

To know about the assumptions considered for the study, download the pdf brochure

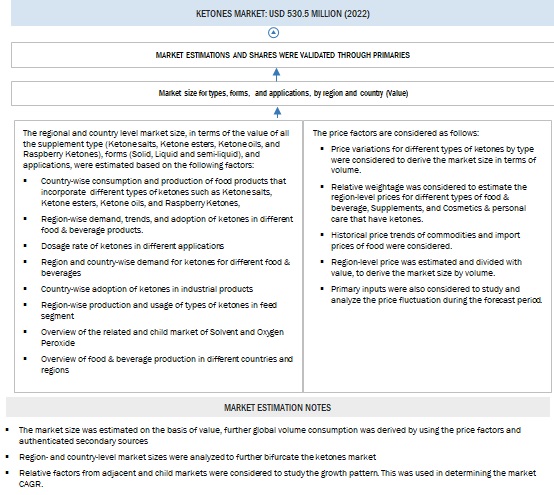

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the marketand various dependent submarkets. The research methodology used to estimate the market size includes extensive secondary research of key players, reports, reviews, and newsletters of top market players, along with extensive interviews from leaders, such as CEOs, directors, and marketing executives.

Global Ketones Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Ketones Market Size: Top-Down Approach

Market Definition

Ketones are organic compounds that are characterized by the presence of the carbonyl group, in which carbon atom is covalently bonded to an oxygen atom and are also known as ketone bodies. Ketones are the by-products of the human body that break down fats for energy. They are chemicals that are usually produced in the liver, particularly due to insufficient stored glucose or sugar to turn into energy. Three types of ketones are burned in the body during ketosis, namely, acetoacetate, beta-hydroxybutyric acid, and acetone.

Data Triangulation

The data triangulation and market breakdown procedures explained above were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Key Stakeholders

- Food & beverage suppliers and manufacturers

- Food & beverage importers and exporters

- Food & beverage traders and distributors

- Government and research organizations

- Associations and industry bodies

- World Health Organization (WHO)

- Food and Drug Administration (FDA)

- Institute of Food and Agricultural Sciences (IFAS)

- Global Food & Beverage Association (GFBA)

- The National Food Safety and Quality Service (SENASA)

- Food Safety and Standards Authority of India (FSSAI)

- US Department of Agriculture (USDA)

- Food Standards Australia New Zealand (FSANZ)

- Institute of Food Technologists

- Food and Agriculture Organization (FAO)

- EC EUROPA

Report Objectives

- To define, segment, and project the global market for Ketones based on type, form, application, and region.

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets for individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders.

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies.

- To analyze competitive developments in the Ketones market, including joint ventures, mergers & acquisitions, new product developments, and research & development activities

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of the European Ketones market, by key country

- Further breakdown of the Rest of the Asia Pacific Ketones market, by key country

- Further breakdown of the Rest of South America Ketones market, by key country

Company Information

- Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Ketones Market