Insecticide Seed Treatment Market by Type (Chemical and Biological), Application Technique (Dressing, Coating, and Pelleting), Form (Liquid and Dry), Crop Type (Cereals & Oilseeds and Fruits & Vegetables), and Region - Global Forecast to 2022

[141 Pages Report] The insecticide seed treatment market was valued at USD 2.73 billion in 2016. It is projected to grow at a CAGR of 11.3% from 2017, to reach a projected value of USD 5.04 billion by 2022.

The years considered for the study are as follows:

- Base year: 2015

- Forecast period: 2016 to 2022

The objectives of the report are as follows:

- To define, segment, and measure the insecticide seed treatment market with respect to its type, application technique, form, crop type, and region

- To provide detailed information regarding the crucial factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze opportunities in the seed treatment insecticides market for stakeholders and study the details of the competitive landscape of the market

- To profile the key players and comprehensively analyze their market strategies and core competencies

Research Methodology:

- Major regions were identified, along with countries contributing the maximum share.

- Secondary research was conducted to obtain the value of the global insecticide seed treatment market for regions such as North America, Europe, Asia Pacific, South America, and RoW.

- Key players were identified through secondary sources such as the Bloomberg Businessweek, Factiva and companies’ annual reports while their market share in the respective regions was determined through both, primary and secondary research. The research methodology includes the study of annual and financial reports of top market players as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) for the global insecticide seed treatment market.

To know about the assumptions considered for the study, download the pdf brochure

The key players that have been profiled in this report include BASF SE (Germany), Syngenta AG (Switzerland), Bayer CropScience AG (Germany), Monsanto (US), Nufarm Limited (Australia), FMC Corporation (US), Novozymes A/S (Denmark), Platform Specialty Products Corporation (US), and Sumitomo Chemical Company Ltd. (Japan).

Target audience:

- Insecticide seed treatment manufacturers

- Insecticide seed treatment importers and exporters

- Insecticide seed treatment traders, distributors, and suppliers

- Government and research organizations

- Commercial research & development (R&D) institutions and financial institutions

Want to explore hidden markets that can drive new revenue in Insecticide Seed Treatment Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Insecticide Seed Treatment Market?

This research report categorizes the insecticide seed treatment market based on type, crop type, application technique, form, and region.

On the basis of type, the insecticide seed treatment market has been segmented as follows:

-

Chemical

- Neonicotinoids

- Pyrazoles

- Pyrethroids

- Others (organophosphates and carbamates)

- Biological

On the basis of crop type, the insecticide seed treatment market has been segmented as follows:

- Cereals & oilseeds

- Fruits & vegetables

- Others (turf & ornamentals, plantation crops, fiber crops, and silage & forage crops)

On the basis of application technique, the insecticide seed treatment market has been segmented as follows:

- Seed coating

- Seed dressing

- Seed pelleting

On the basis of form, the insecticide seed treatment market has been segmented as follows:

- Liquid

- Powder

On the basis of Region, the insecticide seed treatment market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakdown of the Rest of Europe insecticide seed treatment market into the Netherlands, Finland, Ireland, Russia, Greece, Austria, and Denmark

- Further breakdown of the Rest of Asia Pacific insecticide seed treatment market into Indonesia, Bangladesh, and Vietnam

- Further breakdown of the Rest of South America insecticide seed treatment market into Chile, Venezuela, and Peru

Company Information

- Detailed analyses and profiling of additional market players (up to five)

The insecticide seed treatment market is projected to grow at a CAGR of 11.3% from 2017, to reach a projected value of USD 5.04 billion by 2022. The increase in usage of seed treatment solutions on high-priced GM seeds, growth in the area under GM crops, increase in crop demand for biofuel and feed, and the use of insecticides as a low-cost crop protection solution are enhancing the market for insecticide seed treatment, globally. The growth in the insecticide seed treatment market is also driven by advanced farming technologies that ensure safe and reliable application of seed treatment formulas.

Based on type, the chemical segment dominated the market with the largest share in the global insecticide seed treatment market in 2016. The biological segment is projected to grow at a relatively higher CAGR from 2017 to 2022. The growth of the organic food market has led to the development of effective technologies for biological control, which in turn has led to the growth of the bioinsecticide seed treatment market.

The dressing segment dominated in terms of application technique in 2016. The seed dressing application technique is mostly used for insecticide seed treatment since it is a low-cost technique as compared to the others. It is hence, economical to use on low-cost cereals and grains, such as wheat and corn, which are the key crop types dominating the use of insecticides as seed treatment.

Based on form, the liquid formulations dominated the market in 2016. The powder seed treatment process involves dust, which leads to problems related to operator safety and poor plant hygiene. Thus, the use of dry powder formulations is expected to reduce gradually.

Based on crop type, in the insecticide seed treatment market, cereals & oilseeds accounted for the largest market share in 2016. The increase in demand from downstream markets in the food & beverage and feed industries has boosted the overall demand for insecticide seed treatment across the globe.

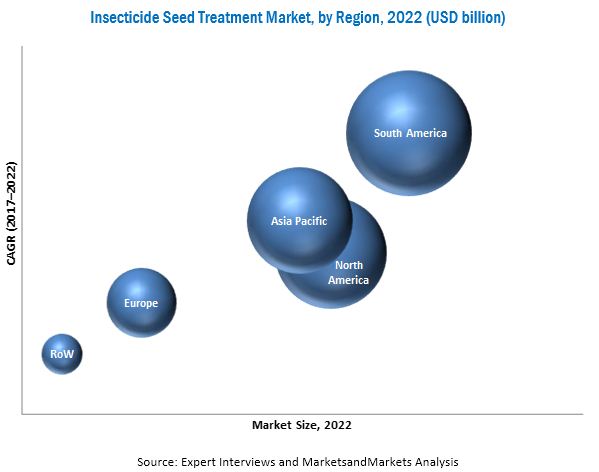

The South American region accounted for the largest market share in 2016; this is projected to grow at the highest CAGR during the forecast period. This is owing to the increased area under major seed treatment crops, such as corn and soybean. The demand for seed treatment products in the Asia Pacific region is expected to be primarily driven by countries such as China and India.

Multiple registrations of seed treatment products in different countries has been a matter of concern in insecticide seed treatment market since the assessment and understanding of requirements of different markets and then complying with them involves significant investment of time and money. The market for seed treatment consists of key players in the agricultural industry, such as BASF SE (Germany), Syngenta AG (Switzerland), Nufarm Limited (Australia), Bayer CropScience AG (Germany) and Platform Specialty Products Company (US). Bayer CropScience AG offers a variety of insecticides, herbicides, fungicides, plant growth regulators, and seeds. New product launches and expansion into different regions across the globe are the most preferred strategies adopted by key players to gain a larger share of the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

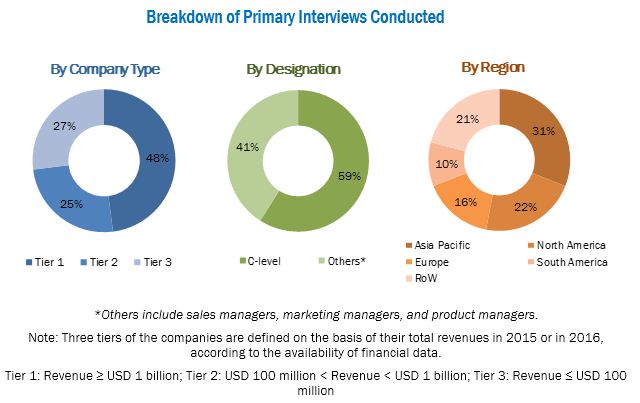

2.1.2.1 Breakdown of Primaries

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Opportunities in the Seed Treatment Insecticides Market

4.2 Seed Treatment Insecticides Market, By Form

4.3 South American Seed Treatment Insecticides Market, By Crop Type & Country

4.4 Seed Treatment Insecticides Market, By Type

4.5 Seed Treatment Insecticides Market: Market Share of Top Countries

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Macro Indicators

5.2.1 Increasing World Population and Food Requirement

5.2.2 Growing Incidence of Pest Infestation

5.2.3 Global Rise in the Export of Pesticides

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Effective Solution to Minimize Crop Loss

5.3.1.2 Additional Advantages of Seed Treatment Insecticides

5.3.1.3 Increase in Area Under GM Crops

5.3.1.4 Increase in Demand for Biofuel and Feed

5.3.2 Restraints

5.3.2.1 Stringent Government Regulations

5.3.2.2 Depressed Commodity Prices and Lower Farm Incomes

5.3.2.3 Structural Weakness of the Seed Treatment Industry in Asia-Pacific and African Economies

5.3.3 Opportunities

5.3.3.1 Issues Associated With GE Crop Varieties

5.3.3.2 Technological Advancements in Seed Treatment

5.3.4 Challenges

5.3.4.1 Existing Ban on Neonicotinoids

5.3.4.2 Lack of Seed Treatment Awareness at Farmer Level

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Supply Chain Analysis

7 Seed Treatment Insecticides Market, By Type (Page No. - 44)

7.1 Introduction

7.2 Synthetic Chemical

7.2.1 Neonicotinoids

7.2.2 Pyrazoles

7.2.3 Pyrethroids

7.2.4 Others

7.3 Biological

8 Seed Treatment Insecticides Market, By Application Technique (Page No. - 48)

8.1 Introduction

8.2 Seed Dressing

8.3 Seed Coating

8.4 Seed Pelleting

9 Seed Treatment Insecticides Market, By Form (Page No. - 52)

9.1 Introduction

9.2 Liquid

9.3 Powder

10 Seed Treatment Insecticides Market, By Crop Type (Page No. - 56)

10.1 Introduction

10.2 Cereals & Oilseeds

10.2.1 Corn

10.2.2 Wheat

10.2.3 Rice

10.2.4 Soybean

10.2.5 Other Cereals & Oilseeds

10.3 Fruits & Vegetables

10.4 Other Crop Types

11 Seed Treatment Insecticides Market, By Region (Page No. - 62)

11.1 Introduction

11.2 North America

11.2.1 U.S.

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 France

11.3.2 Germany

11.3.3 Russia

11.3.4 Rest of Europe

11.4 Asia-Pacific

11.4.1 China

11.4.2 India

11.4.3 Japan

11.4.4 Australia

11.4.5 Rest of Asia-Pacific

11.5 South America

11.5.1 Brazil

11.5.2 Argentina

11.5.3 Rest of South America

11.6 Rest of the World (RoW)

11.6.1 South Africa

11.6.2 Turkey

11.6.3 Others in RoW

12 Competitive Landscape (Page No. - 95)

12.1 Introduction

12.2 Vendor Dive Analysis

12.2.1 Vanguards

12.2.2 Innovators

12.2.3 Dynamic

12.2.4 Emerging

12.3 Competitive Benchmarking

12.3.1 Product Offerings

12.3.2 Business Strategy

*Top 23 Companies Analyzed for This Study are – BASF SE (Germany), Syngenta AG (Switzerland), Bayer Cropscience AG (Germany), Monsanto Company (U.S.), Nufarm Limited (Australia), Platform Specialty Products Corporation (U.S.), Sumitomo Corporation (Japan), E.I. Du Pont De Nemours and Company (U.S.), FMC Corporation (U.S.), Incotec Group Bv (Netherlands), Certis Europe LLC (U.S.), Adama Agricultural Solutions Ltd. (Israel), Novozymes A/S (Denmark), Upl Limited (India), Rallis India Limited (India), Tagros Chemicals India Ltd., (India), Germains Seed Technology (U.K.), Wilbur-Ellis Holdings, Inc (U.S.), Helena Chemical Company (U.S.), Loveland Products, Inc (U.S.), Rotam (China), Winfield Solutions, LLC. (U.S.), Auswest Seeds (Australia)

12.4 Market Share Analysis

13 Company Profiles (Page No. - 101)

(Business Overview, Company Scorecard, Product Offering, Business Strategy & Recent Developments)*

13.1 Bayer Cropscience AG

13.2 BASF SE

13.3 Syngenta AG

13.4 E. I. Du Pont De Nemours and Company

13.5 Nufarm Limited

13.6 Monsanto Company

13.7 FMC Corporation

13.8 Novozymes A/S

13.9 Platform Specialty Products Corporation

13.10 Sumitomo Chemical Company Ltd

13.11 Adama Agricultural Solutions Ltd

*Details on Business Overview, Company Scorecard, Product Offering, Business Strategy & Recent Developments Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 135)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Introducing RT: Real-Time Market Intelligence

14.4 Available Customizations

14.5 Related Reports

14.6 Author Details

List of Tables (73 Tables)

Table 1 Global Protein Production, Until 2050 (Million Metric Tons)

Table 2 Seed Treatment Insecticides Market Size, By Type, 2015-2022 (USD Million)

Table 3 Synthetic Chemical Seed Treatment Insecticides Market Size, By Region, 2015-2022 (USD Million)

Table 4 Synthetic Chemical Seed Treatment Insecticides Market Size, By Subtype, 2015-2022 (USD Million)

Table 5 Biological Seed Treatment Insecticides Market Size, By Region, 2015-2022 (USD Million)

Table 6 Seed Treatment Insecticides Market Size, By Application Technique, 2015–2022 (USD Million)

Table 7 Seed Dressing Insecticides Market Size, By Region, 2015–2022 (USD Million)

Table 8 Seed Coating Insecticides Market Size, By Region, 2015–2022 (USD Million)

Table 9 Seed Pelleting Insecticides Market Size, By Region, 2015–2022 (USD Million)

Table 10 Seed Treatment Insecticides Market Size, By Form, 2015–2022 (USD Million)

Table 11 Liquid Seed Treatment Insecticides Market Size, By Region, 2015–2022 (USD Million)

Table 12 Powder Seed Treatment Insecticides Market Size, By Region, 2015–2022 (USD Million)

Table 13 Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 14 Cereals & Oilseeds Market Size, By Region, 2015–2022 (USD Million)

Table 15 Cereals & Oilseeds Market Size, By Crop, 2015–2022 (USD Million)

Table 16 Fruits & Vegetables Market Size, By Region, 2015–2022 (USD Million)

Table 17 Other Crop Types Market Size, By Region, 2015–2022 (USD Million)

Table 18 Seed Treatment Insecticides Market Size, By Region, 2015–2022 (USD Million)

Table 19 North America: Seed Treatment Insecticides Market Size, By Country, 2015–2022 (USD Million)

Table 20 North America: Seed Treatment Insecticides Market Size, By Type, 2015–2022 (USD Million)

Table 21 North America: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 22 North America: Seed Treatment Insecticides Market Size, By Application Technique, 2015–2022 (USD Million)

Table 23 North America: Seed Treatment Insecticides Market Size, By Form, 2015–2022 (USD Million)

Table 24 U.S.: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 25 Canada: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 26 Mexico: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 27 Europe: Seed Treatment Insecticides Market Size, By Country, 2015–2022 (USD Million)

Table 28 Europe: Seed Treatment Insecticides Market Size, By Type, 2015–2022 (USD Million)

Table 29 Europe: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 30 Europe: Seed Treatment Insecticides Market Size, By Application Technique, 2015–2022 (USD Million)

Table 31 Europe: Seed Treatment Insecticides Market Size, By Form, 2015–2022 (USD Million)

Table 32 France: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 33 Germany: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 34 Russia: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 35 Rest of Europe: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 36 Key Crops Cultivated, By Country/Region

Table 37 Asia-Pacific: Seed Treatment Insecticides Market Size, By Country, 2015–2022 (USD Million)

Table 38 Asia-Pacific: Seed Treatment Insecticides Market Size, By Type, 2015–2022 (USD Million)

Table 39 Asia-Pacific: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 40 Asia-Pacific: Seed Treatment Insecticides Market Size, By Application Technique, 2015–2022 (USD Million)

Table 41 Asia-Pacific: Seed Treatment Insecticides Market Size, By Form, 2015–2022 (USD Million)

Table 42 China: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 43 India: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 44 Japan: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 45 Australia: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 46 Rest of Asia-Pacific: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 47 South America: Seed Treatment Insecticides Market Size, By Country, 2015–2022 (USD Million)

Table 48 South America: Seed Treatment Insecticides Market Size, By Type, 2015–2022 (USD Million)

Table 49 South America: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 50 South America: Seed Treatment Insecticides Market Size, By Application Technique, 2015–2022 (USD Million)

Table 51 South America: Seed Treatment Insecticides Market Size, By Form, 2015–2022 (USD Million)

Table 52 Brazil: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 53 Argentina: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 54 Rest of South America: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 55 RoW: Seed Treatment Insecticides Market Size, By Country, 2015–2022 (USD Million)

Table 56 RoW: Seed Treatment Insecticides Market Size, By Type, 2015–2022 (USD Million)

Table 57 RoW: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 58 RoW: Seed Treatment Insecticides Market Size, By Application Technique, 2015–2022 (USD Million)

Table 59 RoW: Seed Treatment Insecticides Market Size, By Form, 2015–2022 (USD Million)

Table 60 South Africa: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 61 Turkey: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 62 Others in RoW: Seed Treatment Insecticides Market Size, By Crop Type, 2015–2022 (USD Million)

Table 63 Bayer Cropscience AG: Products Offered

Table 64 BASF SE: Products Offered

Table 65 Syngenta AG: Products Offered

Table 66 E. I. Du Pont De Nemours and Company: Products Offered

Table 67 Nufarm Limited: Products Offered

Table 68 Monsanto Company: Products Offered

Table 69 FMC Corporation: Products Offered

Table 70 Novozymes A/S Company: Products Offered

Table 71 Platform Specialty Products Corporation: Products Offered

Table 72 Sumitomo Chemical Company Ltd: Products Offered

Table 73 Adama Agricultural Solutions Ltd: Products Offered

List of Figures (42 Figures)

Figure 1 Seed Treatment Insecticides Market Segmentation

Figure 2 Seed Treatment Insecticides Market: Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation & Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Cereals & Oilseeds Segment Projected to Be the Fastest-Growing Crop Type During the Forecast Period

Figure 8 Seed Dressing: Most Attractive Application Technique Segment for Investment, 2016

Figure 9 Synthetic Chemical Seed Treatment Insecticides are Projected to Account for A Relatively Larger Share Through 2022

Figure 10 Liquid Form of Seed Treatment Insecticides to Be More Widely Used During the Forecast Period

Figure 11 South America is Projected to Register the Highest Growth Rate During the Forecast Period

Figure 12 High Cost of GM Seeds is Driving the Seed Treatment Insecticides Market

Figure 13 Liquid Segment to Dominate During the Forecast Period

Figure 14 Cereals & Oilseeds Segment Accounted for the Largest Share in the South American Seed Treatment Insecticides Market, 2016

Figure 15 Synthetic Chemical Segment Estimated to Dominate the Market in 2017

Figure 16 Brazil Dominated the Seed Treatment Insecticides Market in 2016

Figure 17 Global Population Projected to Reach ~9.5 Billion By 2050

Figure 18 Decrease in Per Capita Arable Land

Figure 19 Export Value of Pesticides, 2004–2014 (USD Million)

Figure 20 Seed Treatment Insecticides Market: Drivers, Restraints, Opportunities, and Challenges

Figure 21 Increase in Global Area Under GM Crops, 1996–2016 (Million Hectares)

Figure 22 Bioethanol to Dominate the Biofuels Market

Figure 23 U.S. Commodity Price for Crop Production and Net Farm Income, 2010–2017 (USD Billion)

Figure 24 Value Chain Analysis: Significant Value Added During R&D and Production Phases

Figure 25 Supply Chain: Research & Development Plays A Key Role in the Seed Treatment Insecticides Market

Figure 26 North America: Seed Treatment Insecticides Market: Snapshot

Figure 27 Europe: Seed Treatment Insecticides Market Snapshot

Figure 28 Asia-Pacific: Seed Treatment Insecticides Market Snapshot

Figure 29 South American Seed Treatment Insecticides Market Snapshot

Figure 30 Dive Chart

Figure 31 Market Share Analysis, By Key Player, 2016

Figure 32 Bayer Cropscience AG: Company Snapshot

Figure 33 BASF SE: Company Snapshot

Figure 34 Syngenta AG: Company Snapshot

Figure 35 E. I. Du Pont De Nemours and Company: Company Snapshot

Figure 36 Nufarm Limited: Company Snapshot

Figure 37 Monsanto Company: Company Snapshot

Figure 38 FMC Corporation: Company Snapshot

Figure 39 Novozymes A/S: Company Snapshot

Figure 40 Platform Specialty Products Corporation: Company Snapshot

Figure 41 Sumitomo Chemical Company Ltd: Company Snapshot

Figure 42 Adama Agricultural Solutions Ltd: Company Snapshot

Growth opportunities and latent adjacency in Insecticide Seed Treatment Market