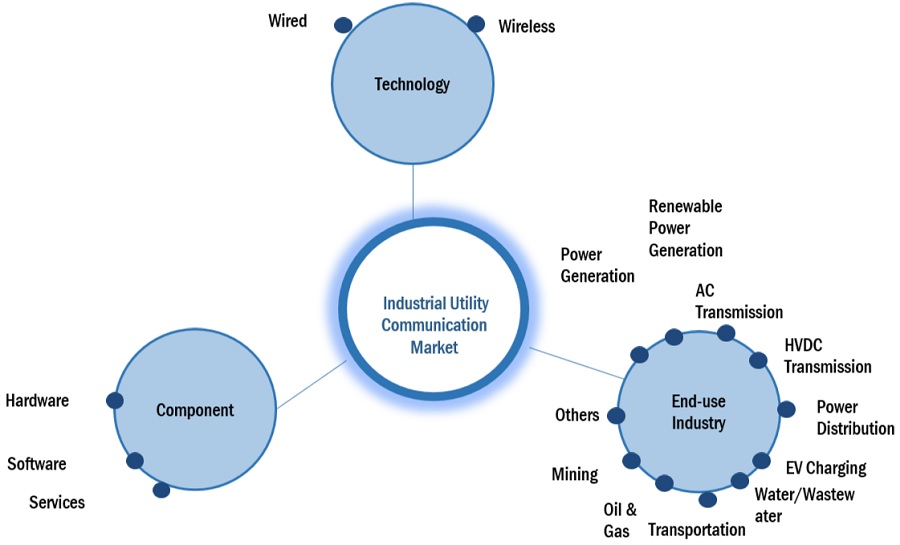

Industrial Utility Communication Market by Technology (Wired, Wireless), Component (Hardware, Software, Services), End-use Industry( Power Generation, AC Transmission, Oil & Gas, Transportation), and Region - Global Forecast to 2028

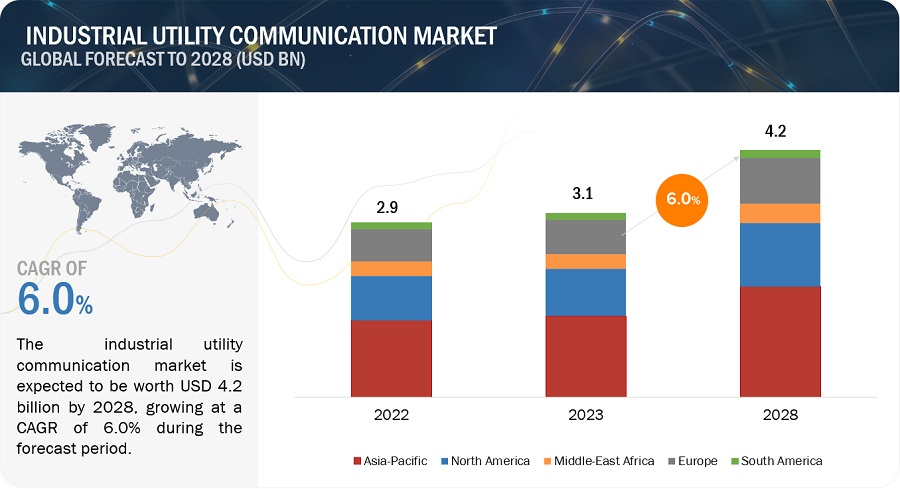

The industrial utility communication market is projected to reach USD 4.2 billion by 2028, at a CAGR of 6.0% from USD 3.1 billion in 2023. The market is mainly led by the significant usage of industrial utility communication in various end-use industries. The integration of advanced technologies like IoT, 5G, and AI into industrial processes, coupled with the demand for enhanced operational efficiency and real-time connectivity, is leading the growth of the industrial utility communication market. Additionally, the increasing need for reliable and secure communication networks across diverse industrial sectors such as power, oil and gas, and water utilities is driving the market forward.

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Industrial Utility Communication Market

Market Dynamics

Driver: Growing Adoption of Smart Grid Technologies

A significant part of the industrial utility communication market is dedicated to enabling smart grid technologies. Smart grids use advanced communication systems to monitor, control, and optimize the generation, distribution, and consumption of energy. These systems improve grid reliability, reduce energy losses, and support the integration of renewable energy sources. Utilities are increasingly investing in modernizing their infrastructure, including the implementation of smart grids. Smart grid technologies are being deployed by utility companies around the world to improve the efficiency and reliability of their power grids. Utility communication systems are essential for the successful deployment of smart grid technologies. In a December 2019 study focusing on the implementation of smart meters in the European Union (EU), some key findings were revealed, it is projected that approximately 225 million smart meters for electricity and 51 million for gas will be deployed across the EU by the year 2024. This ambitious rollout represents a potential investment totaling €47 billion(52.63 billion USD). By 2024, it is anticipated that nearly 77% of European consumers will have a smart meter for electricity, marking a significant increase in adoption. The Biden-Harris Administration has unveiled a historic $3.5 billion investment in America's electric grid. This significant funding aims to bolster the electric grid infrastructure, enhance utility communication systems, promote the integration of clean energy sources, reduce operational costs, and create job opportunities within the utility sector.

Restraint: High Cost of Deployment and Maintainence

The high cost associated with the deployment and maintenance of industrial utility communication systems presents a significant challenge within the utility industry, particularly for smaller utility companies. These systems, which are instrumental in optimizing the operation of utility infrastructure, often require substantial initial investments and ongoing maintenance expenditures, which can be a barrier to entry and expansion for smaller players in the field.

The deployment of industrial utility communication systems involves various components, including the installation of advanced metering infrastructure, communication networks, and monitoring equipment. These upfront costs can be substantial, encompassing the purchase of hardware, software, and the necessary infrastructure for data transmission and processing. Smaller utility companies may find it financially burdensome to make these initial investments, potentially limiting their ability to embrace modernization and efficiency-enhancing technologies. Moreover, the maintenance of industrial utility communication systems is an ongoing expense that can strain the budgets of smaller utility companies.

Opportunity: Rise in Number of Upcoming Smart City Projects in Developing Regions

Developing regions are making substantial investments in the development of smart city projects, a key component of which is the widespread deployment of utility communication systems. These systems play a critical role in supporting the efficient operation of smart grids, intelligent water management, and advanced waste management applications within these urban initiatives. In the context of smart grids, utility communication systems facilitate real-time monitoring and control of energy distribution, allowing for optimal resource management, reduced energy waste, and enhanced grid resilience.

According to data from the World Bank, the global urban population currently stands at 56%, accounting for approximately 4.4 billion individuals. Projections indicate that this figure is set to double by 2050, with 7 out of 10 people expected to reside in urban areas. In alignment with these demographic shifts, the World Economic Forum (WEF) foresees a migration of 2.5 billion people to urban centers, with a significant 90% of this urbanization trend concentrated in the regions of Asia and Africa. In this context, industrial utility communication systems become increasingly pivotal. These systems help facilitate uninterrupted connectivity and the seamless exchange of data across critical functions such as power distribution, monitoring water quality, and optimizing waste management processes.

Challenge: Security Concerns And Cybersecurity Threats

Utility communication systems are susceptible to cybersecurity threats, which can have far-reaching implications for public safety, national security, and economic stability. These threats are compounded by the expanding attack surface resulting from the integration of intelligent distribution systems, sensors, and IoT devices into utility infrastructure, providing cybercriminals with additional entry points. The energy sector, in particular, faces significant vulnerability to cyberattacks, making it imperative to adopt a structured approach that combines communication, organizational, and process frameworks with technical enhancements to mitigate risks. Power utilities encounter challenges in finding tailored cybersecurity solutions due to their specialized activities and the increasing digitalization of their operations, which feature complex IT and OT systems capable of remote control.

To counter these cybersecurity threats, utilities should adopt a proactive and preemptive stance in addressing the evolving threat landscape. It's crucial to establish a well-defined, prioritized, and meticulously planned cybersecurity program.

MARKET ECOSYSTEM

The market ecosystem for industrial utility communication is composed of a diverse array of entities and stakeholders that collectively contribute to the development, implementation, and advancement of industrial utility communication materials. At the core of this ecosystem are communication device manufacturers who focus on research, development, and manufacturing of industrial utility communication. They continuously innovate and produce novel communication solutions to meet the evolving demands of the market.

General Electric (US), Siemens (Germany), Schneider Electric (France), Hitachi Energy Ltd. (Switzerland), FUJITSU (Japan), Motorola Solutions, Inc. (US), Telefonaktiebolaget LM Ericsson (Sweden), Nokia (Finland), Itron Inc. (US), Cisco Systems, Inc. (US), Emerson Electric Co. (US) etc.

Industrial utility communication market: ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

"In Hardware, Wireless-Private Cellular is the largest sub-segment amongst the component segment in the industrial utility communication market in 2023, in terms of value."

Wireless private cellular technology in the hardware segment holds the largest market share in industrial utility communication due to its ability to offer dedicated and secure networks, enabling reliable and real-time data transmission within industrial settings. This technology provides robust connectivity, flexibility, and scalability, catering to the specific needs of various industries for seamless communication across large areas or within challenging environments like manufacturing plants and other utilities.

“Power Generation accounted for the largest end-use industry share of the industrial utility communication market in 2023” in terms of value.

In the industrial utility communication sector, power generation commands a significant market share, driven by its essential reliance on sophisticated communication systems. These technologies play a pivotal role in overseeing power generation, distribution, and transmission networks, ensuring seamless operations. With real-time data monitoring and predictive maintenance capabilities, these systems optimize power processes, enabling uninterrupted electricity supply and enhanced operational efficiency. The demand for robust communication networks to maintain grid stability and ensure swift response to operational issues cements power generation's substantial foothold in this sector.

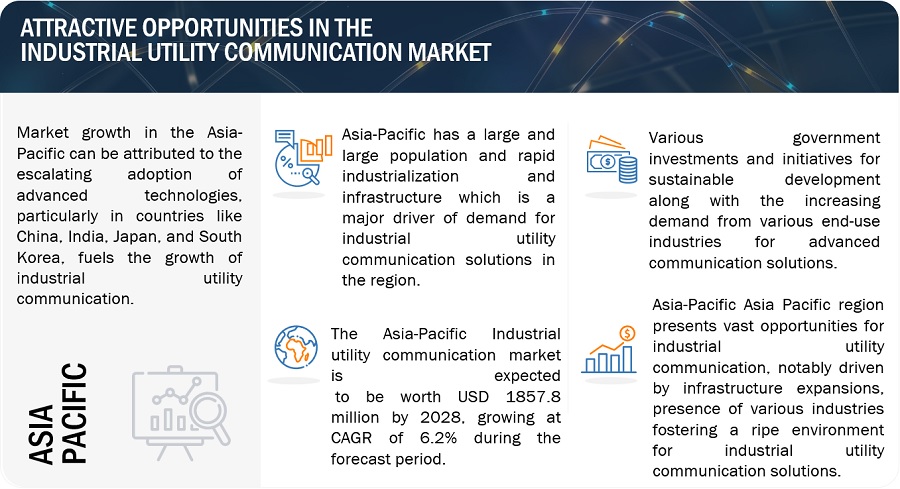

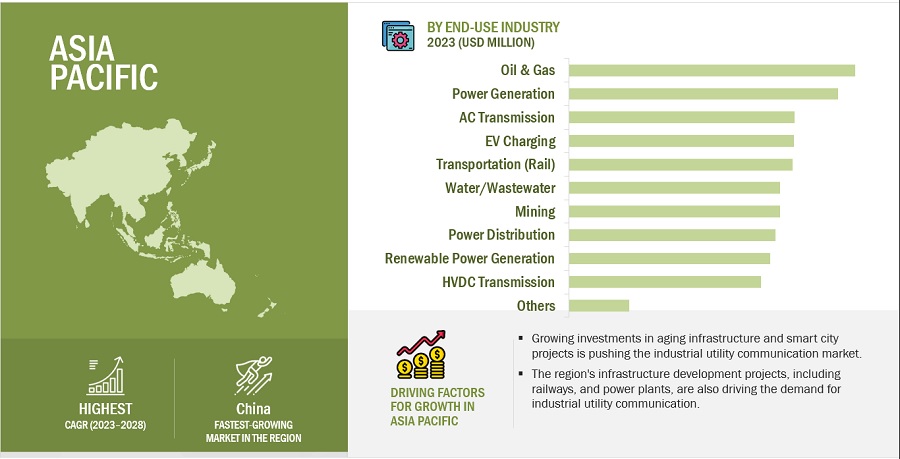

"Asia pacific is the fastest growing market for industrial utility communication Market from 2023-2028, in terms of value."

Asia Pacific is the fastest and the largest growing market for industrial utility communication globally due to its rapid industrialization and growing investments in smart infrastructure. Moreover, government initiatives and favorable policies aimed at advancing digital transformation significantly propel market expansion. Investments in smart city endeavors, energy management systems, and the establishment of strong communication networks in utilities act as primary drivers for adopting industrial utility communication technologies. Additionally, the region's expansive population and increasing urbanization drive the demand for streamlined utility services, compelling utilities to invest in advanced communication tech for optimal resource management and distribution.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market are General Electric (US), Siemens (Germany), Schneider Electric (France), Hitachi Energy Ltd. (Switzerland), FUJITSU (Japan), Motorola Solutions, Inc. (US), Telefonaktiebolaget LM Ericsson (Sweden), Nokia (Finland), Itron Inc. (US), Cisco Systems, Inc. (US), Emerson Electric Co. (US) etc. Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of industrial utility communication have opted for new product launches and partnerships to sustain their market position.

Want to explore hidden markets that can drive new revenue in Industrial Utility Communication Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Industrial Utility Communication Market?

|

Report Metric |

Details |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Billion/Million) |

|

Segments |

By Technology, By Component, End-use Industry and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

General Electric (US), Siemens (Germany), Schneider Electric (France), Hitachi Energy Ltd. (Switzerland), FUJITSU (Japan), Motorola Solutions, Inc. (US), Telefonaktiebolaget LM Ericsson (Sweden), Nokia (Finland), Itron Inc. (US), Cisco Systems, Inc. (US), Emerson Electric Co. (US) |

Segmentation

This report categorizes the global Industrial utility communication market based on by technology, by component, end-use industry and region.

On the basis of technology the market has been segmented as follows:

- Wired

- Wireless

On the basis of component, the market has been segmented as follows:

- Hardware

- Software

- Services

On the basis of end-use industry, the market has been segmented as follows:

- Power Generation

- Renewable Power Generation

- AC Transmission

- HVDC Transmission

- Power Distribution

- EV- Charging

- Water/Wastewater

- Oil & Gas

- Mining

- Transportation

- Others

On the basis of region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In 2023, Siemens introduced an in-house developed private infrastructure tailored for the 5G mobile communications standard. This solution empowers industrial firms to establish their localized 5G networks, optimizing support for automation applications.

- In 2023, Motorola Solutions has launched the MOTOTRBO™ R2 radio in Latin America, aiming to maintain connectivity for frontline workers in diverse sectors such as airports, manufacturing, agriculture, private security, and retail.

- In 2023, M1, a prominent operator in Southeast Asia, has chosen Ericsson as its partner to revamp its 4G/5G mobile transport network. This transformation involves implementing Ericsson Router 6676, known for its high performance.

- In 2023, Nokia collaborates with DXC Technology to introduce the DXC Signal Private LTE and 5G Solution, tailored for significant market sectors like manufacturing, energy, healthcare, supply chain and logistics, transportation, and education.

- In 2022, Schneider Electric and Claroty have unveiled 'Cybersecurity Solutions for Buildings,' aimed at mitigating cyber and asset risks in smart buildings. This collaborative solution combines Claroty's renowned cybersecurity technology, designed for cyber-physical systems across various sectors, with Schneider Electric's industry proficiency. Together, they aim to identify all assets within facilities, offer exceptional risk and vulnerability management capabilities, and ensure ongoing threat monitoring for safeguarding enterprise investments.

- In 2022, Hitachi Energy unveiled its latest TRO600 series wireless routers equipped with 5G capabilities. These routers are specifically designed to assist industrial and utility clients in attaining exceptional reliability and resilience for their mission-critical operations.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the industrial utility communication market?

This study's forecast period for the industrial utility communication market is 2023-2028. The market is expected to grow at a CAGR of 6.0% in terms of value, during the forecast period.

Who are the major key players in the industrial utility communication market?

General Electric (US), Siemens (Germany), Schneider Electric (France), Hitachi Energy Ltd. (Switzerland), FUJITSU (Japan), Motorola Solutions, Inc. (US), Telefonaktiebolaget LM Ericsson (Sweden), Nokia (Finland), Itron Inc. (US), Cisco Systems, Inc. (US), Emerson Electric Co. (US) etc. are the leading manufacturers and service provider of industrial utility communication market.

What are the emerging trends in the Industrial utility communication market?

Rapid advancements in IoT and 5G technologies are reshaping industrial utility communication, and are some emerging trends, they foster enhanced connectivity and real-time data analytics. The integration of AI and machine learning further drives predictive maintenance and operational efficiency in this sector.

What are the drivers and opportunities for the industrial utility communication market?

Growing adoption of smart grid technologies and growing demand for automation and wireless communication systems are some drivers for industrial utility communication market. The rise in number of smart city projects in developing nations along with aging utility infrastructure provide significant opportunities for industrial utility communication solutions.

What are the restraining factors in the industrial utility communication market?

The high cost of deployment and maintenance and lack of standard and interoperability serve as restraint to the widespread adoption and implementation of industrial utility communication. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

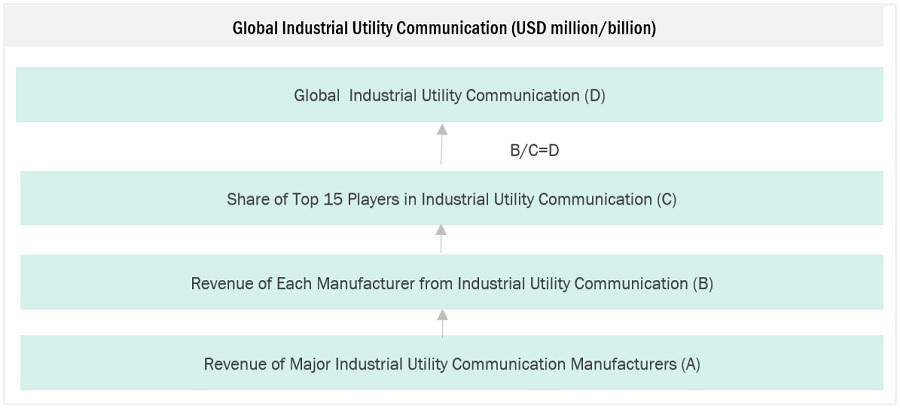

The study involved four major activities in estimating the market size of the industrial utility communication market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The industrial utility communication market comprises several stakeholders in the value chain, which include input suppliers, equipment manufacturers, technology providers, service providers, distribution and logistics, and end users. Various primary sources from the supply and demand sides of the industrial utility communication market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the industrial utility communication industry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of industrial utility communication the outlook of their business, which will affect the overall market.

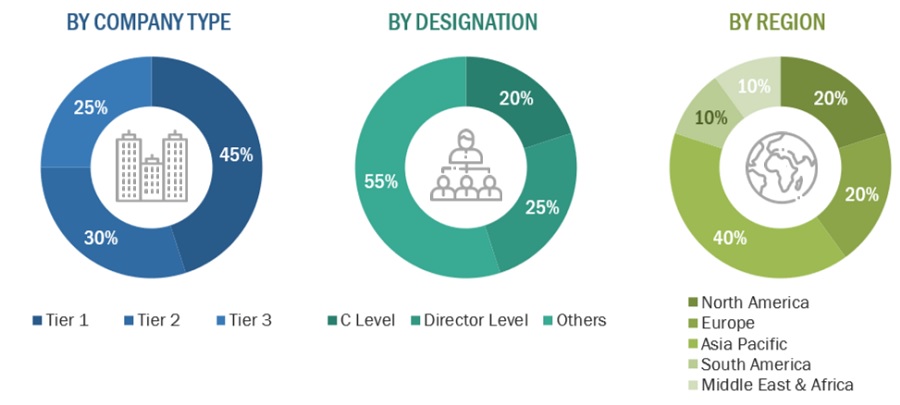

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company name |

Designation |

|

Schneider Electric |

Head of Partnerships for Digital Grid |

|

Siemens |

Head of Industrial Engineering and Planning |

|

General Electric |

R&D Manager |

|

Nokia |

Marketing Manager |

|

Hitachi Energy Ltd. |

Product & Sales Manager |

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the industrial utility communication market.

- The key players in the industry have been identified through extensive secondary research.

- The industry's supply chain has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Industrial Utility Communication Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Industrial Utility Communication Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The global industrial utility communication market is a thriving industry fueled by the escalating demand for communication products across various end use industries. This market focuses on establishing robust, reliable, and efficient communication infrastructures that facilitate seamless data transmission, control, and monitoring within industrial environments. The market features a multitude of regional and global players, each offering a diverse range of industrial utility communication products. Geographically, the Asia-Pacific region dominates the global industrial utility communication market, followed by North America and Europe. Asia-Pacific is the largest regional market, fueled by the rapid industrialization and urbanization in the region. China and India are the major contributors to the growth of the industrial utility communication market in Asia-Pacific. Europe holds the second-largest market share, with a strong presence of global and regional players. North America is a mature market but is witnessing steady growth due to government investments and rising demand for advanced communication technologies.

Key Stakeholders

- Raw material suppliers.

- Industrial utility communication manufacturers, software suppliers.

- Service Providers & Grid Operators.

- End-use industry participants.

- Government and research organizations.

- Associations and industrial bodies.

- Research & development (R&D) institutions.

- Environmental support agencies.

Report Objectives

- To define, describe, and forecast the size of the Industrial utility communication market, in terms of value.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on by technology, by component, end-use industry and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Industrial Utility Communication Market