Immersion Cooling Market by Type (Single-Phase, Two-Phase), Application (High Performance Computing, Edge Computing, Cryptocurrency Mining), Cooling Fluid (Synthetic Oil, Mineral Oil), Component (Solutions, Services), and Region - Global Forecast to 2031

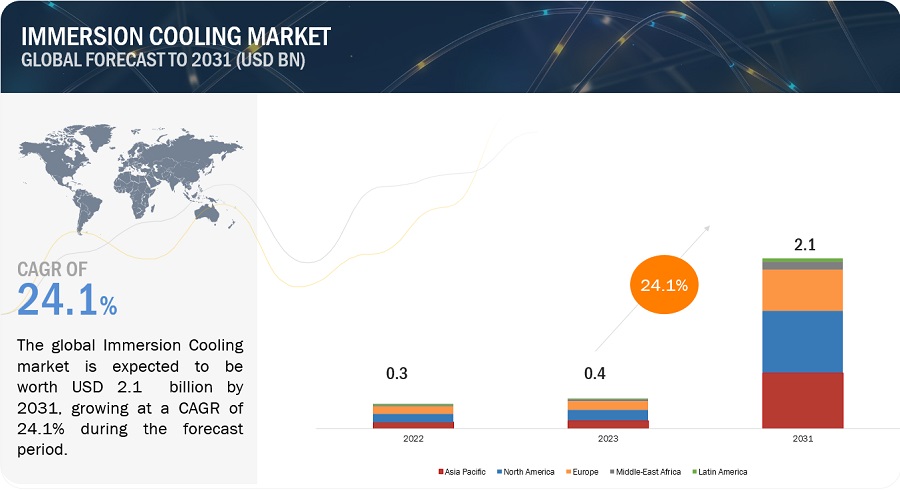

The immersion cooling market is projected to grow from USD 0.4 billion in 2023 to USD 2.1 billion by 2031, at a CAGR of 24.1% from 2023 to 2031. The major reason for the growth of the immersion cooling market is the demand for energy-efficient solutions. Immersion cooling solutions offer cost advantages, such as reduced operational expenditures and lower energy consumption, which make them an attractive option for data centers and other applications.

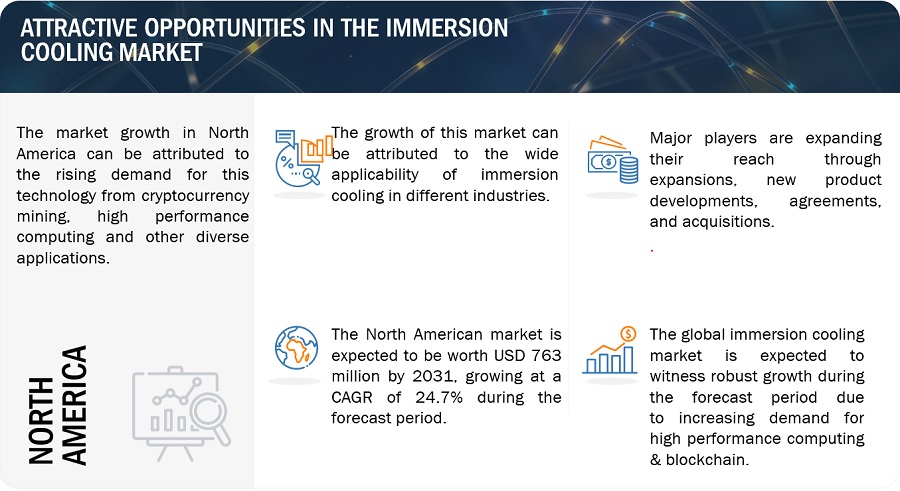

Attractive Opportunities in the Immersion Cooling Market

To know about the assumptions considered for the study, Request for Free Sample Report

Immersion Cooling Market Dynamics

Driver: Adoption of cryptocurrency mining & blockchain

The adoption of cryptocurrency mining and blockchain technologies is expected to drive the immersion cooling market's growth. Cryptocurrency mining, which involves solving complex algorithms and generating significant heat, can benefit from immersion cooling's ability to maintain optimal temperatures and reduce energy costs.. This has led to a renewed interest and investments in crypto mining, with immersion cooling offering advantages such as increased efficiency, hardware longevity, and improved mining power.

Restraint: Susceptible to leakage

Susceptibility to leakage is indeed a restraint of the immersion cooling market. While immersion cooling systems offer advantages such as reduced water usage and improved heat dissipation, they are not immune to leakage issues, which can affect their performance and reliability. This challenge is particularly notable in the case of fluorocarbon immersion coolants, which, despite being nonflammable and thermally stable, are still susceptible to leakage. The lack of knowledge on immersion cooling and fluid leakage issues is also estimated to hinder the market's growth.

Opportunity: Adoption of low-density data servers

The adoption of low-density data servers presents an opportunity for the immersion cooling market. As data center operators seek more compact and efficient cooling solutions, the use of low-density servers can complement the benefits of immersion cooling. By allowing for higher hardware density and reduced physical footprint in data centers, low-density servers align with the scalability and space-saving advantages offered by immersion cooling. This combination can lead to significant energy savings, reduced maintenance costs, and improved overall cost-effectiveness, making it an attractive proposition for data center operators looking to optimize their infrastructure. As the demand for data processing capabilities continues to rise, driven by technologies like IoT, AI, and blockchain, the synergy between low-density servers and immersion cooling is poised to play a key role in meeting the evolving needs of the data center industry.

Challenge: High investment in existing infrastructure

One of the challenges associated with immersion cooling technology is the high investment required for infrastructure and equipment. Immersion cooling systems require specialized equipment, such as tanks, pumps, and heat exchangers, which can be expensive to install and maintain. Additionally, installing immersion cooling systems may require significant modifications to existing data center infrastructure, which can further increase costs.

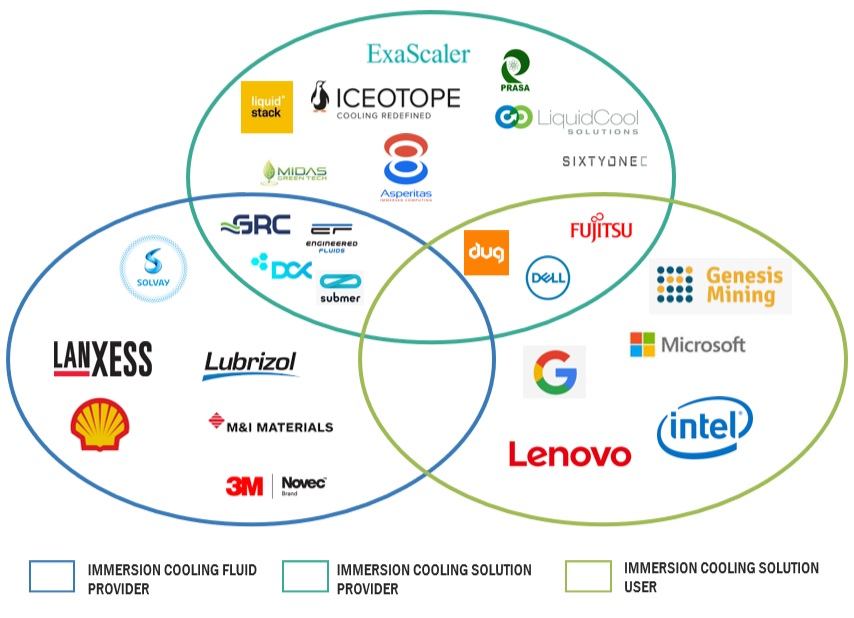

Immersion Cooling: Ecosystem

Based on the type, the Single phase is projected to grow at the highest CAGR during the forecast period.

Single-phase is anticipated to grow at the highest CAGR based on the type. The growth of the single-phase immersion cooling market can be attributed to its simplicity, efficiency in heat dissipation, energy-saving capabilities, and scalability. As the demand for high-performance computing continues to rise across various sectors, the advantages of single-phase immersion cooling make it a compelling choice for organizations seeking effective and sustainable cooling solutions for their increasingly powerful and densely packed computing systems.

Based on Application, the Artificial Intelligence segment is projected to grow at the highest CAGR during the forecast period.

The increasing demand for high-performance computing (HPC) in AI applications is a key driver. AI models, such as intense learning models, are becoming more complex and computationally intensive, leading to higher power densities and increased heat generation. Immersion cooling provides an efficient solution for managing the heat produced by powerful GPUs and TPUs used in AI model training, allowing optimal performance without the risk of thermal throttling.

Based on cooling fluids, the synthetic fuels segment is projected to grow at the highest CAGR during the forecast period.

The versatility of synthetic fluids in immersion cooling systems is another factor fueling market expansion. These fluids can be customized to suit different cooling requirements and hardware configurations, providing a flexible and adaptable solution for various industries. As technology advances, developing synthetic fluids with improved properties, such as higher thermal conductivity and excellent stability, further enhances their applicability in diverse immersion cooling settings.

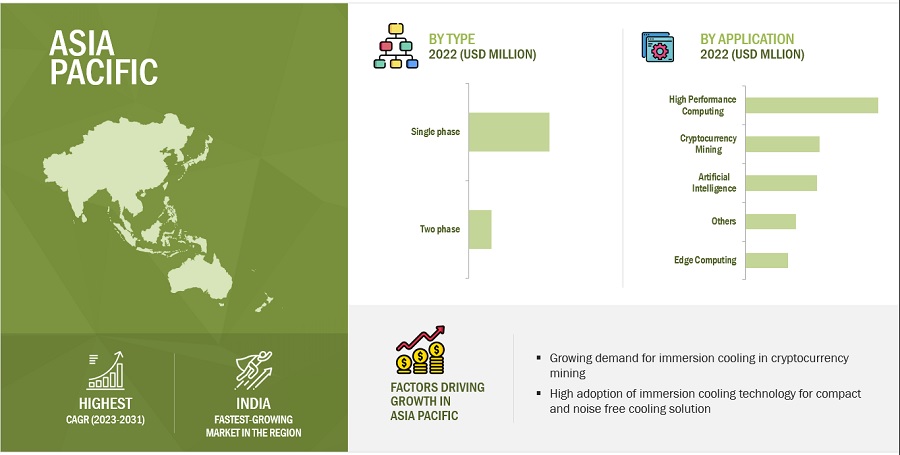

Asia Pacific is projected to grow at the highest CAGR during the forecast period.

The rapid expansion of data center infrastructure in APAC is a significant driver for the growth of immersion cooling. As businesses and governments in the region invest heavily in digital transformation, cloud services, and AI-driven applications, the demand for efficient cooling solutions that can handle the heat generated by advanced computing systems is on the rise. Immersion cooling, with its ability to provide adequate heat dissipation and energy efficiency, is well-suited to meet the evolving needs of data centers in APAC.

Source: Expert Interviews, Secondary Research, Whitepapers, Journals, Magazines, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Some of the key players in the market include LiquidStack (Netherlands), Fujitsu (Japan), Green Revolution Cooling Inc (US), Submer (Spain), Asperitas (Netherlands), Midas Green Technologies (US), Iceotope Technologies Ltd (US), LiquidCool Solutions (US), and DUG Technology (Australia).

Read More: Immersion Cooling Companies

Want to explore hidden markets that can drive new revenue in Immersion Cooling Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Immersion Cooling Market?

|

Report Metric |

Details |

|

Market Size Available for Years |

2017–2031 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Units |

Value (USD Million and USD Billion) |

|

Segments Covered |

Type, Cooling Fluid, Application, and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East, South America, and Africa |

|

Companies Covered |

The major market players include LiquidStack (Netherlands), Fujitsu (Japan), Green Revolution Cooling Inc (US), Submer (Spain), Asperitas (Netherlands), Midas Green Technologies (US), Iceotope Technologies Ltd (US), LiquidCool Solutions (US), DUG Technology (Australia), DCX - The Liquid Cooling Company (Poland), Engineered Fluids (US), TIEMMERS (Netherlands), TMGcore, Inc. (US), GIGA-BYTE Technology Co., Ltd. and so on. |

This research report categorizes the immersion cooling market based on type, cooling fluid, application, and region.

Based on application, the immersion cooling market has been segmented into:

- High-performance Computing

- Artificial Intelligence

- Edge Computing

- Cryptocurrency Mining

- Others (Cloud Computing, Enterprise Computing)

Based on type, the immersion cooling market has been segmented into:

- Single-Phase Immersion Cooling

- Two-Phase Immersion Cooling

Based on the cooling fluid, the immersion cooling market has been segmented into:

- Mineral Oil

- Synthetic Fluids

- Fluorocarbon-based Fluids

- Other (Vegetable Oil, Bio-Oil, Silicone Oil, Deionized Water)

Based on the components, the immersion cooling market has been segmented into:

- Solutions

- Services

Based on the region, the immersion cooling market has been segmented into:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In October 2023, GRC (Green Revolution Cooling) Inc., the leader in single-phase immersion cooling for data centers, announced the launch of a new data center solution, Next-Gen Immersion Cooled Data Centers in Middle East & Africa, with the collaboration of Dell Technologies, and DCV Industries.

- In October 2023, Submer and Intel collaborated to enhance single-phase immersion technology through a Forced Convection Heat Sink (FCHS) package. It reduces the quantity and cost of components required for comprehensive heat capture and the dissipation of chips with Thermal Design Power (TDP) exceeding 1000W.

- In May 2020, Asperitas partnered with European data center owner/operator, Maincubes. The two companies planned to offer immersion cooling solutions in dedicated immersion cooling colocation suites in the Maincubes Amsterdam AMS01 data center. AMS01 is also home to the European Open Compute Project (OCP) Experience Center, while Asperitas is a leading OCP standards contributor in immersion cooling.

Frequently Asked Questions (FAQ):

What is Immersion Cooling?

Immersion cooling technology, also known as direct liquid cooling, is used to cool electrical and electronic components, including complete servers and storage devices, by submerging them in a thermally conductive but electrically insulating liquid coolant.

What is the current size of the global immersion cooling market?

The global immersion cooling market is estimated to be USD 373 million in 2023 and projected to reach USD 2,098 million by 2031, at a CAGR of 24.1%.

Who are the winners in the global immersion cooling market?

Companies such as LiquidStack (Netherlands), Fujitsu (Japan), Green Revolution Cooling Inc (US), Submer (Spain), Asperitas (Netherlands), and Midas Green Technologies (US) are the leading players. These players have adopted the strategies of expansions, agreements, mergers & acquisitions, partnerships, new product launches, joint ventures, investments & contracts, collaborations, and new technology & new process developments to increase their presence in the global market.

What are the key regions in the global immersion cooling market?

In terms of region, the highest share was observed to be in North America. This is primarily due to growing demand for the application in cryptocurrency mining.

What is the major type of Immersion Cooling technology used in the global market?

The single-phase immersion cooling market has witnessed notable growth due to several factors that make it an attractive solution for cooling high-performance computing systems. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

5.1 INTRODUCTIONDRIVERS- Adoption in cryptocurrency mining & blockchain- Growing density of servers- Growing need for eco-friendly data center cooling solutions- Rising need for cost-effective cooling solutions- Increasing demand for compact and noise-free solutionsRESTRAINTS- Susceptibility to leakage- Dominance of air cooling technologyOPPORTUNITIES- Adoption in low-density data centers- Emergence of AI, high-performance electronics, telecom, and other technologies- Development of cooling solutions for deployment in harsh environments- High-density cooling requirementsCHALLENGES- High investments in existing infrastructure- Retrofitting immersion cooling solutions in large and medium-scale data centers

-

5.2 PORTER'S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

-

5.4 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPEAVERAGE SELLING PRICE TREND, BY REGION

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM/MARKET MAP

-

5.7 TECHNOLOGY ANALYSISSINGLE-PHASE- IT chassis- Tub/Open bathTWO-PHASE- Tub/Open bathHYBRID

-

5.8 PATENTS ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTS

-

5.9 TRADE DATAIMPORT SCENARIOEXPORT SCENARIO

- 5.10 KEY CONFERENCES & EVENTS

-

5.11 TARIFF & REGULATORY LANDSCAPEOPEN COMPUTE PROJECT (OCP) - QUALITY & SAFETY REQUIREMENTS FOR IMMERSION COOLING TECHNOLOGYOPEN COMPUTE PROJECT (OCP) - DIELECTRIC COOLING FLUID REQUIREMENTS FOR DATA CENTER APPLICATIONSIMMERSION COOLING TECHNOLOGY - COUNTRY/REGIONAL REGULATIONS- US- Europe- China- Japan- IndiaREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.12 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS- Buying criteria for cryptocurrency miningBUYING CRITERIA

-

5.13 MARKETING CHANNELS USED BY IMMERSION COOLING SOLUTION PROVIDERS: COMPARATIVE ANALYSISB2B MARKETING CHANNELS - COMPARATIVE ANALYSIS

-

5.14 PARTNERS OF IMMERSION COOLING COMPANIESPARTNERSHIPS

- 5.15 TOTAL COST OF OWNERSHIP

-

5.16 CASE STUDY ANALYSISASPERITAS AND ITRENEW PARTNER TO BRING SUSTAINABLE, PLUG-AND-PLAY DATA CENTER SOLUTION FULL CIRCLEDUG REDUCED ENERGY SPENDING IN DATA CENTER BY ADOPTING GRC'S IMMERSION COOLING TECHNOLOGYMICROSOFT CHOSE IMMERSION COOLING TECHNOLOGY BY LIQUIDSTACK FOR ITS CLOUD SERVERSBITFURY GROUP ENHANCES DATA CENTER COOLING EFFICIENCY USING 3M'S ENGINEERED FLUIDSMACQUARIE TELECOM GROUP TO DEPLOY SUBMER'S IMMERSION COOLING SOLUTIONS AT ITS DATA CENTERSNTT DATA CORPORATION TO ADOPT LIQUIDSTACK'S TWO-PHASE IMMERSION COOLING SOLUTIONS AT ITS DATA CENTERS

- 6.1 INTRODUCTION

-

6.2 SINGLE-PHASE IMMERSION COOLINGOFFERS EFFICIENT COOLING AND LOW MAINTENANCE

-

6.3 TWO-PHASE IMMERSION COOLINGFLUID LOSS REMAINS PRIMARY CONCERN IN TWO-PHASE IMMERSION COOLING SYSTEMS

- 7.1 INTRODUCTION

-

7.2 HIGH-PERFORMANCE COMPUTINGNEED FOR HIGH-EFFICIENCY COOLING TO DRIVE MARKET

-

7.3 EDGE COMPUTINGEDGE COMPUTING GAINING TRACTION IN OIL & GAS, DEFENSE, AND TELECOM INDUSTRIES

-

7.4 ARTIFICIAL INTELLIGENCEDIGITAL TRANSFORMATION OF COMPANIES EXPECTED TO DRIVE MARKET IN AI APPLICATION SEGMENT

-

7.5 CRYPTOCURRENCY MININGIMMERSION COOLING MARKET TO WITNESS HIGHEST GROWTH IN CRYPTOCURRENCY MINING APPLICATION

- 7.6 OTHERS

- 8.1 INTRODUCTION

-

8.2 SOLUTIONSGROWING DEMAND FOR HIGH-DENSITY SERVER COOLING TO DRIVE MARKET

-

8.3 SERVICESASIA PACIFIC TO WITNESS HIGHEST GROWTH IN SERVICES SEGMENT

- 9.1 INTRODUCTION

-

9.2 MINERAL OILASIA PACIFIC TO BE FASTEST-GROWING MARKET FOR MINERAL OIL SEGMENT

-

9.3 FLUOROCARBON-BASED FLUIDSFLUOROCARBON-BASED FLUIDS INCREASINGLY USED IN HIGH-PERFORMANCE LIQUID COOLING APPLICATIONS

-

9.4 SYNTHETIC FLUIDSLOW CORROSION & LOW FLAMMABILITY FUELING DEMAND

- 9.5 OTHERS

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICCHINA- Rise in number of data centers to drive marketINDIA- Surging demand from data centers to boost marketJAPAN- Redesigning of existing data center facilities to drive marketSOUTH KOREA- Advancements in AI and cryptocurrency mining to drive marketTHAILAND- Expansion of digital hardware infrastructure to fuel marketMALAYSIA- Rapid cloud service adoption to fuel marketREST OF ASIA PACIFIC

-

10.3 EUROPEGERMANY- Attractive investments and growth of data centers to boost marketFRANCE- Rising demand for immersion cooling from cloud providers to drive marketNETHERLANDS- Use of green energy for data centers to propel marketUK- New eco-design requirements set by European parliament for servers and data centers to drive marketRUSSIA- Growing demand for computing resources and data storage systems to drive marketSPAIN- Innovations in cloud computing to boost demand for data center solutionsREST OF EUROPE

-

10.4 NORTH AMERICAUS- Surging demand from cryptocurrency providers to drive marketCANADA- Increasing digitalization and massive data generation to drive marketMEXICO- Big data and automation technologies to drive market

- 10.5 MIDDLE EAST & AFRICA

- 10.6 SOUTH AMERICA

- 11.1 INTRODUCTION

-

11.2 STRATEGIES ADOPTED BY KEY MARKET PLAYERSSTRATEGIES ADOPTED BY KEY IMMERSION COOLING TECHNOLOGY PROVIDERS

-

11.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERS

-

11.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINTCOMPANY PRODUCT TYPE FOOTPRINTCOMPANY APPLICATION FOOTPRINTCOMPANY REGION FOOTPRINTCOMPANY OVERALL FOOTPRINT

-

11.5 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

- 11.6 COMPETITIVE SCENARIO AND TRENDS

-

12.1 KEY COMPANIESGREEN REVOLUTION COOLING INC.- Business overview- Products offered- Recent developments- MnM viewSUBMER- Business overview- Products offered- Recent developments- MnM viewASPERITAS- Business overview- Products offered- Recent developments- MnM viewLIQUIDSTACK- Business overview- Products offered- Recent developments- MnM viewMIDAS IMMERSION COOLING- Business overview- Products offered- Recent developments- MnM viewFUJITSU- Business overview- Products offered- Recent developmentsICEOTOPE TECHNOLOGIES LIMITED- Business overview- Products offered- Recent developmentsLIQUIDCOOL SOLUTIONS- Business overview- Products offered- Recent developmentsDUG TECHNOLOGY- Business overview- Products offered- Recent developmentsDCX- THE LIQUID COOLING COMPANY- Business overview- Products offered- Recent developmentsBITFURY GROUP LIMITED- Business overview- Products offered3M- Business overview- Products offeredENGINEERED FLUIDS- Business overview- Products offeredTEIMMERS- Business overview- Products offeredTMGCORE, INC.- Business overview- Products offered- Recent developmentsGIGA-BYTE TECHNOLOGY CO., LTD.- Business overview- Products offeredWIWYNN- Business overview- Products offeredHYPERTEC- Business overview- Products offeredPEZY COMPUTING- Business overview- Products offeredPRASA- Business overview- Products offered2CRSI GROUP- Business overview- Products offeredKAORI HEAT TREATMENT CO., LTD.- Business overview- Products offeredTAS- Business overview- Products offeredDELTA POWER SOLUTIONS- Business overview- Products offeredBOYD- Business overview- Products offeredRSI K.K.- Business overview- Products offered

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 IMMERSION COOLING INTERCONNECTED MARKETSDATA CENTER LIQUID COOLING MARKET- Market definition- Market overview- Data center liquid cooling market, by type of cooling

-

13.4 COLD PLATE LIQUID COOLINGHIGH-DENSITY DATA CENTER INSTALLATION TO DRIVE DEMAND

-

13.5 IMMERSED LIQUID COOLINGLOW CARBON FOOTPRINT THROUGH IMMERSION LIQUID COOLING TO DRIVE SEGMENT

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 IMMERSION COOLING MARKET, BY TYPE: INCLUSIONS AND EXCLUSIONS

- TABLE 2 IMMERSION COOLING MARKET, BY COOLING FLUID: INCLUSIONS AND EXCLUSIONS

- TABLE 3 IMMERSION COOLING MARKET, BY COMPONENT: INCLUSIONS AND EXCLUSIONS

- TABLE 4 IMMERSION COOLING MARKET, BY APPLICATION: INCLUSIONS AND EXCLUSIONS

- TABLE 5 IMMERSION COOLING MARKET, BY REGION: INCLUSIONS AND EXCLUSIONS

- TABLE 6 FACTOR ANALYSIS

- TABLE 7 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 8 CARBON FOOTPRINT OF AIR-COOLING VERSUS IMMERSION-COOLING FOR DATA CENTERS

- TABLE 9 AIR-COOLING VERSUS IMMERSION-COOLING FOR DATA CENTERS

- TABLE 10 COMPARATIVE NOISE LEVEL

- TABLE 11 WATER CONSUMPTION IN AIR-COOLING VERSUS IMMERSION-COOLING FOR DATA CENTERS

- TABLE 12 IMMERSION COOLING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 13 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE (USD/L)

- TABLE 14 AVERAGE SELLING PRICE TREND OF IMMERSION COOLING FLUIDS, BY REGION (USD/L)

- TABLE 15 IMMERSION COOLING MARKET: ROLE IN ECOSYSTEM

- TABLE 16 LIST OF PATENTS PERTAINING TO IMMERSION COOLING MARKET, 2017–2021

- TABLE 17 TOP 10 PATENT OWNERS IN LAST 10 YEARS

- TABLE 18 IMMERSION COOLING MARKET: CONFERENCES & EVENTS (2022 & 2023)

- TABLE 19 DIELECTRIC COOLING FLUID SPECIFICATIONS

- TABLE 20 DIELECTRIC COOLING FLUID MINIMUM REQUIREMENTS

- TABLE 21 HYDROCARBON FLUIDS QUALITY MANAGEMENT TABLE

- TABLE 22 FLUOROCARBON FLUIDS QUALITY MANAGEMENT TABLE

- TABLE 23 APPROACHES IN INDIAN CONTEXT

- TABLE 24 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 25 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 26 KEY BUYING CRITERIA

- TABLE 27 DETAILS OF DIFFERENT DISTRIBUTION CHANNELS

- TABLE 28 LIST OF PARTNER COMPANIES OF MAJOR IMMERSION COOLING SOLUTION PROVIDERS

- TABLE 29 AVERAGE PRICE OF COOLING FLUID (USD/LITER)

- TABLE 30 IMMERSION COOLING MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 31 IMMERSION COOLING MARKET, BY TYPE, 2023–2031 (USD MILLION)

- TABLE 32 SINGLE-PHASE IMMERSION COOLING MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 33 SINGLE-PHASE IMMERSION COOLING MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 34 TWO-PHASE IMMERSION COOLING MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 35 TWO-PHASE IMMERSION COOLING MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 36 IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 37 IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 38 IMMERSION COOLING MARKET IN HIGH-PERFORMANCE COMPUTING, BY REGION, 2017–2022 (USD MILLION)

- TABLE 39 IMMERSION COOLING MARKET IN HIGH-PERFORMANCE COMPUTING, BY REGION, 2023–2031 (USD MILLION)

- TABLE 40 IMMERSION COOLING MARKET IN EDGE COMPUTING, BY REGION, 2017–2022 (USD MILLION)

- TABLE 41 IMMERSION COOLING MARKET IN EDGE COMPUTING, BY REGION, 2023–2031 (USD MILLION)

- TABLE 42 IMMERSION COOLING MARKET IN ARTIFICIAL INTELLIGENCE, BY REGION, 2017–2022 (USD MILLION)

- TABLE 43 IMMERSION COOLING MARKET IN ARTIFICIAL INTELLIGENCE, BY REGION, 2023–2031 (USD MILLION)

- TABLE 44 IMMERSION COOLING MARKET IN CRYPTOCURRENCY MINING, BY REGION, 2017–2022 (USD MILLION)

- TABLE 45 IMMERSION COOLING MARKET IN CRYPTOCURRENCY MINING, BY REGION, 2023–2031 (USD MILLION)

- TABLE 46 IMMERSION COOLING MARKET IN OTHER APPLICATIONS, BY REGION, 2017–2022 (USD MILLION)

- TABLE 47 IMMERSION COOLING MARKET IN OTHER APPLICATIONS, BY REGION, 2023–2031 (USD MILLION)

- TABLE 48 IMMERSION COOLING MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 49 IMMERSION COOLING MARKET, BY COMPONENT, 2023–2031 (USD MILLION)

- TABLE 50 SOLUTIONS: IMMERSION COOLING MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 51 SOLUTIONS: IMMERSION COOLING MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 52 SERVICES: IMMERSION COOLING MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 53 SERVICES: IMMERSION COOLING MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 54 IMMERSION COOLING MARKET, BY COOLING FLUID, 2017–2022 (USD MILLION)

- TABLE 55 IMMERSION COOLING MARKET, BY COOLING FLUID, 2023–2031 (USD MILLION)

- TABLE 56 MINERAL OIL: IMMERSION COOLING MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 57 MINERAL OIL: IMMERSION COOLING MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 58 FLUOROCARBON-BASED FLUIDS: IMMERSION COOLING MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 59 FLUOROCARBON-BASED FLUIDS: IMMERSION COOLING MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 60 SYNTHETIC FLUIDS: IMMERSION COOLING MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 61 SYNTHETIC FLUIDS: IMMERSION COOLING MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 62 OTHER FLUIDS: IMMERSION COOLING MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 63 OTHER FLUIDS: IMMERSION COOLING MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 64 IMMERSION COOLING MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 65 IMMERSION COOLING MARKET, BY REGION, 2023–2031 (USD MILLION)

- TABLE 66 ASIA PACIFIC: IMMERSION COOLING MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 67 ASIA PACIFIC: IMMERSION COOLING MARKET, BY COUNTRY, 2023–2031 (USD MILLION)

- TABLE 68 ASIA PACIFIC: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 69 ASIA PACIFIC: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 70 ASIA PACIFIC: IMMERSION COOLING MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 71 ASIA PACIFIC: IMMERSION COOLING MARKET, BY TYPE, 2023–2031 (USD MILLION)

- TABLE 72 ASIA PACIFIC: IMMERSION COOLING MARKET, BY COOLING FLUID, 2017–2022 (USD MILLION)

- TABLE 73 ASIA PACIFIC: IMMERSION COOLING MARKET, BY COOLING FLUID, 2023–2031 (USD MILLION)

- TABLE 74 ASIA PACIFIC: IMMERSION COOLING MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 75 ASIA PACIFIC: IMMERSION COOLING MARKET, BY COMPONENT, 2023–2031 (USD MILLION)

- TABLE 76 CHINA: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 77 CHINA: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 78 INDIA: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 79 INDIA: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 80 JAPAN: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 81 JAPAN: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 82 SOUTH KOREA: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 83 SOUTH KOREA: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 84 THAILAND: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 85 THAILAND: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 86 MALAYSIA: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 87 MALAYSIA: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 88 REST OF ASIA PACIFIC: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 89 REST OF ASIA PACIFIC: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 90 EUROPE: IMMERSION COOLING MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 91 EUROPE: IMMERSION COOLING MARKET, BY COUNTRY, 2023–2031 (USD MILLION)

- TABLE 92 EUROPE: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 93 EUROPE: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 94 EUROPE: IMMERSION COOLING MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 95 EUROPE: IMMERSION COOLING MARKET, BY TYPE, 2023–2031 (USD MILLION)

- TABLE 96 EUROPE: IMMERSION COOLING MARKET, BY COOLING FLUID, 2017–2022 (USD MILLION)

- TABLE 97 EUROPE: IMMERSION COOLING MARKET, BY COOLING FLUID, 2023–2031 (USD MILLION)

- TABLE 98 EUROPE: IMMERSION COOLING MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 99 EUROPE: IMMERSION COOLING MARKET, BY COMPONENT, 2023–2031 (USD MILLION)

- TABLE 100 GERMANY: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 101 GERMANY: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 102 FRANCE: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 103 FRANCE: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 104 NETHERLANDS: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 105 NETHERLANDS: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 106 UK: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 107 UK: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 108 RUSSIA: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 109 RUSSIA: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 110 SPAIN: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 111 SPAIN: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 112 REST OF EUROPE: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 113 REST OF EUROPE: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 114 NORTH AMERICA: IMMERSION COOLING MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 115 NORTH AMERICA: IMMERSION COOLING MARKET, BY COUNTRY, 2023–2031 (USD MILLION)

- TABLE 116 NORTH AMERICA: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 117 NORTH AMERICA: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 118 NORTH AMERICA: IMMERSION COOLING MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 119 NORTH AMERICA: IMMERSION COOLING MARKET, BY TYPE, 2023–2031 (USD MILLION)

- TABLE 120 NORTH AMERICA: IMMERSION COOLING MARKET, BY COOLING FLUID, 2017–2022 (USD MILLION)

- TABLE 121 NORTH AMERICA: IMMERSION COOLING MARKET, BY COOLING FLUID, 2023–2031 (USD MILLION)

- TABLE 122 NORTH AMERICA: IMMERSION COOLING MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 123 NORTH AMERICA: IMMERSION COOLING MARKET, BY COMPONENT, 2023–2031 (USD MILLION)

- TABLE 124 US: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 125 US: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 126 CANADA: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 127 CANADA: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 128 MEXICO: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 129 MEXICO: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: IMMERSION COOLING MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: IMMERSION COOLING MARKET, BY TYPE, 2023–2031 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: IMMERSION COOLING MARKET, BY COOLING FLUID, 2017–2022 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: IMMERSION COOLING MARKET, BY COOLING FLUID, 2023–2031 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: IMMERSION COOLING MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: IMMERSION COOLING MARKET, BY COMPONENT, 2023–2031 (USD MILLION)

- TABLE 138 SOUTH AMERICA: IMMERSION COOLING MARKET, BY APPLICATION, 2017–2022 (USD MILLION)

- TABLE 139 SOUTH AMERICA: IMMERSION COOLING MARKET, BY APPLICATION, 2023–2031 (USD MILLION)

- TABLE 140 SOUTH AMERICA: IMMERSION COOLING MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 141 SOUTH AMERICA: IMMERSION COOLING MARKET, BY TYPE, 2023–2031 (USD MILLION)

- TABLE 142 SOUTH AMERICA: IMMERSION COOLING MARKET, BY COOLING FLUID, 2017–2022 (USD MILLION)

- TABLE 143 SOUTH AMERICA: IMMERSION COOLING MARKET, BY COOLING FLUID, 2023–2031 (USD MILLION)

- TABLE 144 SOUTH AMERICA: IMMERSION COOLING MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 145 SOUTH AMERICA: IMMERSION COOLING MARKET, BY COMPONENT, 2023–2031 (USD MILLION)

- TABLE 146 IMMERSION COOLING MARKET: DEGREE OF COMPETITION

- TABLE 147 IMMERSION COOLING MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 148 IMMERSION COOLING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 149 IMMERSION COOLING MARKET: PRODUCT LAUNCHES, 2018–2022

- TABLE 150 IMMERSION COOLING MARKET: DEALS, 2018–2022

- TABLE 151 IMMERSION COOLING MARKET: OTHERS, 2018–2022

- TABLE 152 GREEN REVOLUTION COOLING INC.: COMPANY OVERVIEW

- TABLE 153 SUBMER: COMPANY OVERVIEW

- TABLE 154 ASPERITAS: COMPANY OVERVIEW

- TABLE 155 LIQUIDSTACK: COMPANY OVERVIEW

- TABLE 156 MIDAS IMMERSION COOLING: COMPANY OVERVIEW

- TABLE 157 FUJITSU: COMPANY OVERVIEW

- TABLE 158 ICEOTOPE TECHNOLOGIES LIMITED: COMPANY OVERVIEW

- TABLE 159 LIQUIDCOOL SOLUTIONS: COMPANY OVERVIEW

- TABLE 160 DUG TECHNOLOGY: COMPANY OVERVIEW

- TABLE 161 DCX -THE LIQUID COOLING COMPANY: COMPANY OVERVIEW

- TABLE 162 BITFURY GROUP LIMITED: COMPANY OVERVIEW

- TABLE 163 3M: COMPANY OVERVIEW

- TABLE 164 ENGINEERED FLUIDS: COMPANY OVERVIEW

- TABLE 165 TEIMMERS: COMPANY OVERVIEW

- TABLE 166 TMGCORE, INC.: COMPANY OVERVIEW

- TABLE 167 GIGA-BYTE TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 168 WIWYNN: COMPANY OVERVIEW

- TABLE 169 HYPERTEC: COMPANY OVERVIEW

- TABLE 170 PEZY COMPUTING: COMPANY OVERVIEW

- TABLE 171 PRASA: COMPANY OVERVIEW

- TABLE 172 2CRSI GROUP: COMPANY OVERVIEW

- TABLE 173 KAORI HEAT TREATMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 174 TAS: COMPANY OVERVIEW

- TABLE 175 DELTA POWER SOLUTIONS: COMPANY OVERVIEW

- TABLE 176 BOYD: COMPANY OVERVIEW

- TABLE 177 RSI K.K.: COMPANY OVERVIEW

- TABLE 178 DATA CENTER LIQUID COOLING MARKET, BY TYPE OF COOLING, 2017–2022 (USD MILLION)

- TABLE 179 DATA CENTER LIQUID COOLING MARKET, BY TYPE OF COOLING, 2023–2028 (USD MILLION)

- FIGURE 1 IMMERSION COOLING MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2—BOTTOM-UP (DEMAND SIDE)

- FIGURE 6 IMMERSION COOLING MARKET: DATA TRIANGULATION

- FIGURE 7 HIGH-PERFORMANCE COMPUTING TO ACCOUNT FOR LARGEST SHARE OF IMMERSION COOLING MARKET

- FIGURE 8 SYNTHETIC FLUIDS SEGMENT TO DOMINATE IMMERSION COOLING MARKET DURING FORECAST PERIOD

- FIGURE 9 SINGLE-PHASE IMMERSION COOLING SEGMENT TO LEAD IMMERSION COOLING MARKET

- FIGURE 10 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER SHARE OF OVERALL IMMERSION COOLING MARKET

- FIGURE 11 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE OF IMMERSION COOLING MARKET

- FIGURE 12 ADOPTION IN CRYPTOCURRENCY MINING AND GROWING SERVER DENSITY DRIVING GROWTH

- FIGURE 13 ASIA PACIFIC IMMERSION COOLING MARKET PROJECTED TO WITNESS HIGHEST CAGR FROM 2023 TO 2031

- FIGURE 14 CRYPTOCURRENCY MINING ACCOUNTED FOR LARGEST SHARE OF NORTH AMERICA IMMERSION COOLING MARKET

- FIGURE 15 IMMERSION COOLING MARKET IN CHINA PROJECTED TO WITNESS HIGHEST CAGR FROM 2023 TO 2031

- FIGURE 16 IMMERSION COOLING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 17 AVERAGE SERVER RACK DENSITY, 2016–2020

- FIGURE 18 IMMERSION COOLING MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 19 REVENUE SHIFTS AND NEW REVENUE POCKETS IN IMMERSION COOLING MARKET

- FIGURE 20 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- FIGURE 21 AVERAGE SELLING PRICE OF IMMERSION COOLING FLUIDS, BY REGION

- FIGURE 22 IMMERSION COOLING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 23 IMMERSION COOLING MARKET: ECOSYSTEM MAPPING

- FIGURE 24 TYPES OF IMMERSION COOLING SOLUTIONS

- FIGURE 25 NUMBER OF GRANTED PATENTS, PATENT APPLICATIONS, AND LIMITED PATENTS

- FIGURE 26 PATENT PUBLICATION TRENDS (2011–2022)

- FIGURE 27 TOP JURISDICTIONS FOR IMMERSION COOLING SOLUTION PATENTS

- FIGURE 28 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 29 IMMERSION COOLING FLUIDS IMPORT, BY KEY COUNTRIES, 2018–2022 (USD BILLION)

- FIGURE 30 IMMERSION COOLING FLUIDS EXPORT, BY KEY COUNTRIES, 2018–2022 (USD BILLION)

- FIGURE 31 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 32 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 33 IMMERSION COOLING MARKET, BY TYPE, 2023 & 2031 (USD MILLION)

- FIGURE 34 IMMERSION COOLING MARKET, BY APPLICATION, 2023 & 2031 (USD MILLION)

- FIGURE 35 IMMERSION COOLING MARKET, BY COMPONENT, 2023 & 2031 (USD MILLION)

- FIGURE 36 IMMERSION COOLING MARKET, BY COOLING FLUID, 2023 & 2031 (USD MILLION)

- FIGURE 37 IMMERSION COOLING MARKET IN CHINA TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 ASIA PACIFIC: IMMERSION COOLING MARKET SNAPSHOT

- FIGURE 39 EUROPE: IMMERSION COOLING MARKET SNAPSHOT

- FIGURE 40 NORTH AMERICA: IMMERSION COOLING MARKET SNAPSHOT

- FIGURE 41 RANKING OF TOP FIVE PLAYERS IN IMMERSION COOLING MARKET, 2022

- FIGURE 42 LEADING PLAYERS ACCOUNTED FOR 60% TO 70% OF GLOBAL MARKET IN 2022

- FIGURE 43 IMMERSION COOLING MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 44 IMMERSION COOLING MARKET: COMPANY PRODUCT FOOTPRINT

- FIGURE 45 IMMERSION COOLING MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 46 FUJITSU: COMPANY SNAPSHOT

- FIGURE 47 DUG TECHNOLOGY: COMPANY SNAPSHOT

- FIGURE 48 GIGA-BYTE TECHNOLOGY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 49 WIWYNN: COMPANY SNAPSHOT

- FIGURE 50 DELTA POWER SOLUTIONS: COMPANY SNAPSHOT

The study involved four major activities in estimating the current Immersion Cooling market size—exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and measures with industry experts across the value chain of immersion cooling technology through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on the revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, notifications by regulatory bodies, trade directories, and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

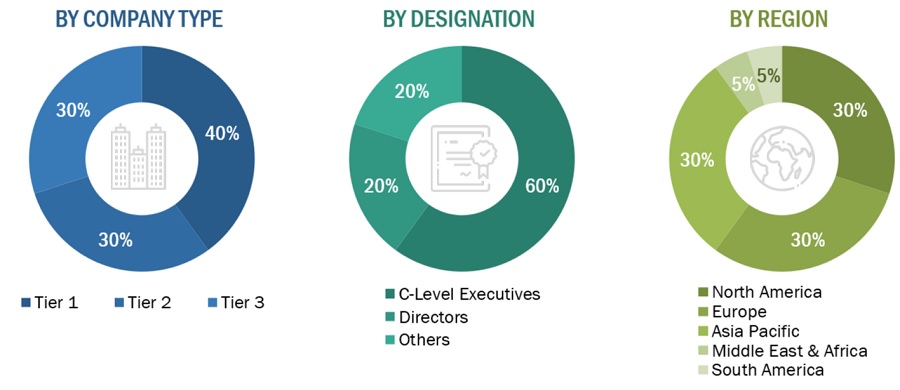

The immersion cooling market comprises several stakeholders in the supply chain, such as immersion cooling fluid providers, technology manufacturers, data centers manufacurures, traders, associations, and regulatory organizations. The demand side of this market is characterized by the development of high performance computing, edge computing, artificial intelligence, cryptocurrency mining, and other applications industries. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

Note: “Others” includes sales, marketing, and product managers

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

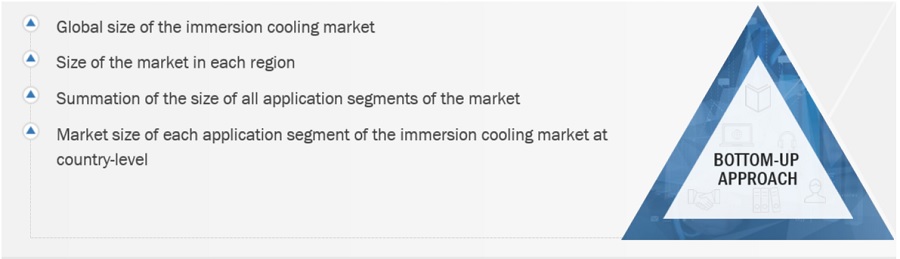

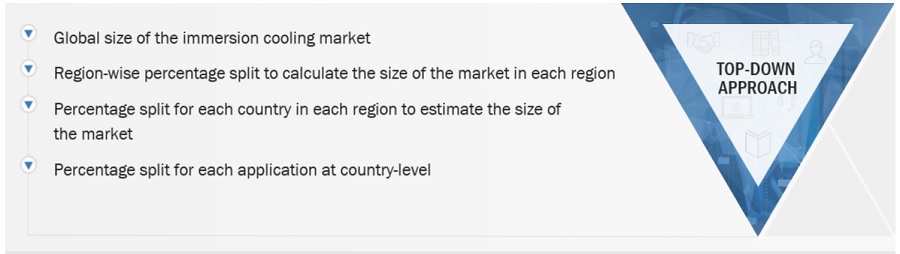

The top-down and bottom-up approaches were used to estimate and validate the total size of the immersion cooling market. These methods were also used extensively to determine the market size of various segments. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the immersion cooling market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Immersion Cooling Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Immersion Cooling Market Size: Top-Down Approach

Data Triangulation

The market was split into several segments and sub-segments after arriving at the overall market size using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The market size was calculated globally by summing up the country-level and regional-level data.

Market Definition

The global immersion cooling market refers to the industry involved in providing advanced cooling solutions for electronic components, particularly in data centers and high-performance computing environments. In immersion cooling, electronic hardware is submerged in dielectric fluids, which efficiently absorb and dissipate heat generated during operation. This innovative cooling method is gaining traction worldwide due to its ability to enhance energy efficiency, reduce operational costs, and optimize overall system performance. As the demand for high-density computing continues to rise, the global immersion cooling market plays a crucial role in addressing the challenges associated with heat dissipation and supporting the evolution of more sustainable and efficient data center infrastructure on a global scale.

Key Stakeholder

- Data center Manufacturers

- Crypto Miners.

- Manufacturers of immersion cooling fluids.

- Associations and Industrial Bodies such as The American National Standards Institute (ANSI), The American Society of Heating, Refrigerating, and Air-Conditioning Engineers (ASHRAE), The National Electrical Manufacturers Association (NEMA), The Telecommunication Industry Association (TIA), The Canadian Standards Association Group (CSA Group), and Others

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives:

- To define, describe, and forecast the size of the global immersion cooling market in terms of value

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of the immersion cooling market

- To analyze and forecast the size of various segments (type, application and cooling fluid) of the immersion cooling market based on five major regions—North America, Europe, Asia Pacific, South America, Middle East, and Africa—along with key countries in each of these regions

- To analyze recent developments and competitive strategies, such as expansions, new product developments, collaborations, and acquisitions, to draw the competitive landscape of the market

- To strategically profile the key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the Middle East & African, and South American immersion cooling markets

- Product matrix, which gives a detailed comparison of the product portfolio of each company

- Detailed analysis and profiles of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Immersion Cooling Market