Security Solutions Market by Systems (Video Surveillance, Access Control, Thermal Imaging, Fire Protection, Entrance Control, Intruder Alarm), Services (Security Systems Integration, Remote Monitoring, VSaaS, ACaaS), Vertical - Global Forecast to 2029

Updated on : October 23, 2024

Security Solutions Market Size

[270 Pages Report] The global security solutions market size is expected to be valued at USD 354.7 billion in 2024 and is projected to reach USD 502.1 billion by 2029; growing at a CAGR of 7.2% from 2024 to 2029. The security solutions market is propelled by a convergence of factors, including heightened global security threats, increasing awareness of the need for robust protective measures, and rapid technological advancements such as artificial intelligence and IoT. The integration of advanced technologies, such as biometrics, video analytics, and cloud-based solutions, enhances the capabilities of security systems, providing a multifaceted approach to threat detection and mitigation.

Security Solutions Market and Statistics Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Security solutions market dynamics

Driver: Increasing concerns regarding public safety and infrastructure protection

Growing concerns regarding public safety and infrastructure protection are significant drivers for the security solutions market. Heightened awareness of potential threats to public spaces, critical infrastructure, and large-scale events has prompted increased investments in advanced security technologies. Organizations and governments seek comprehensive solutions, including video surveillance, access control, and threat detection systems, to mitigate risks, enhance emergency response capabilities, and safeguard public and private assets.

Restraint: Concerns over privacy and data protection regulations

Concerns over privacy and stringent data protection regulations act as a restraint for the security solutions market. As individuals and organizations become more conscious of privacy issues, there is a delicate balance that security solutions must strike between providing robust protection and respecting privacy rights. Compliance with regulations, such as GDPR and similar laws, imposes surveillance and data management practices challenges.

Opportunity: Increasing demand for remote monitoring and surveillance solutions

The increasing demand for remote monitoring and surveillance solutions presents a significant opportunity for the security solutions industry . With the rise of remote work, global connectivity, and the need for real-time tracking, businesses and individuals seek comprehensive security systems that enable remote access and surveillance. Advanced technologies, including cloud-based solutions, IoT integration, and high-definition cameras, facilitate effective remote monitoring.

Challenge: Risk of rapid technological changes and obsolescence

The risk of rapid technological changes and obsolescence poses a significant challenge for the security solutions market. The fast-paced evolution of technology introduces the risk that solutions implemented today may become outdated or incompatible with emerging technologies in the near future. This challenge requires continuous adaptation and innovation within the security industry to keep pace with evolving threats and technological advancements. Organizations investing in security solutions face the dilemma of selecting technologies that will remain relevant over the long term, mitigating the risk of premature obsolescence and ensuring sustained effectiveness in addressing dynamic security challenges.

Security Solutions Market Ecosystem

The security solutions market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the market include Johnson Controls from Ireland, Honeywell International Inc. from the US, Robert Bosch GmbH from Germany, ADT from the US, and Hangzhou Hikvision Digital Technology Co., Ltd. from China.

Security Solutions Market Segmentation

Security Solutions Market Share & Trends

Based on the system, video surveillance systems for the security solutions market to hold the highest market share during the forecast period

The security solutions market for video surveillance systems commands a significant share due to the critical role video surveillance plays in addressing security concerns. Video surveillance offers real-time monitoring, threat detection, and forensic analysis, making it a cornerstone of comprehensive security strategies. The proliferation of security cameras, coupled with advancements in technology such as high-definition imaging, analytics, and artificial intelligence, has elevated the capabilities of video surveillance systems. Industries across various sectors, including retail, transportation, critical infrastructure, and smart cities, rely on video surveillance for crime prevention, safety enforcement, and operational insights.

Based on services, the security solutions market for system security integration to hold the highest market share during the forecast period

The security solutions market for security system integration services commands a significant share due to the growing complexity of security needs across various industries. Organizations recognize the importance of a holistic and integrated approach to security, involving the seamless coordination of different security components such as access control, video surveillance, and intrusion detection systems. Security system integration services provide tailored solutions that unify diverse security technologies, creating a comprehensive and interoperable security infrastructure.

Based on vertical, the security solutions for commercial to hold the highest market share during the forecast period

The security solutions market for the commercial vertical holds a substantial market share due to the heightened emphasis on security in the business environment. Businesses, from small enterprises to large corporations, prioritize implementing comprehensive security measures to safeguard assets, personnel, and sensitive information. The commercial sector faces diverse security challenges, including physical and cyber threats, theft prevention, and access control. The demand for integrated security solutions, such as access control systems, video surveillance, and intrusion detection, is propelled by regulatory compliance, risk management considerations, and the need to ensure business continuity.

Security Solutions Market Regional Analysis

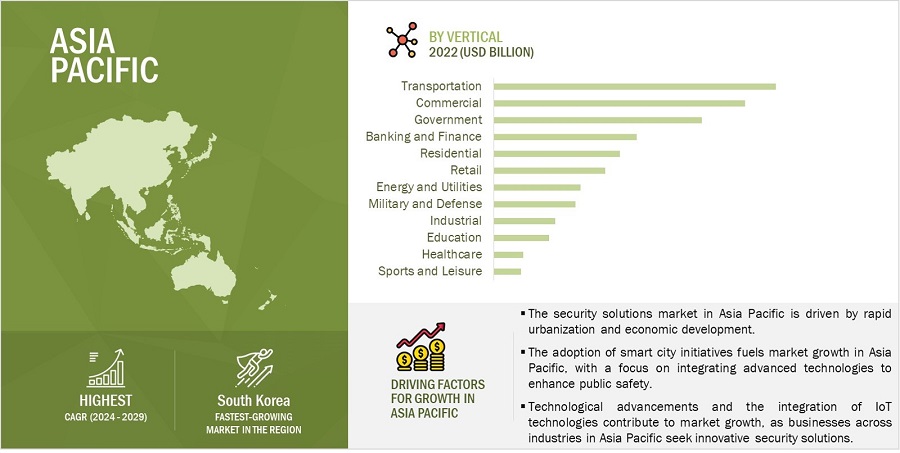

Security solutions market in Asia Pacific to hold the highest market share during the forecast period

The security solutions market in the Asia Pacific holds a significant market share due to the region's dynamic economic growth, rapid urbanization, and increasing awareness of security challenges. Governments and businesses in Asia Pacific are investing in advanced security technologies to address diverse threats, including cyberattacks and physical intrusions. The adoption of smart city initiatives, critical infrastructure projects, and the escalating demand for comprehensive security measures across various industries contribute to the flourishing market in Asia Pacific. The unique combination of economic development, technological adoption, and evolving security needs positions the region as a critical driver of market share in the global security solutions landscape.

Security Solutions Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Security Solutions Companies - Key Market Players:

The security solutions companies is dominated by players such as

- Johnson Controls (Ireland),

- Honeywell International Inc. (US),

- ADT (US),

- Hikvision Digital Technology Co., Ltd. (China),

- Robert Bosch GmbH (Germany), and others.

Security Solutions Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 354.7 billion in 2024 |

| Projected Market Size | USD 502.1 billion by 2029 |

| Growth Rate | CAGR of 7.2% |

|

Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

|

|

Geographies covered |

|

|

Companies covered |

The major market players include Johnson Controls (Ireland), Honeywell International Inc. (US), Robert Bosch GmbH (Germany), ADT (US), Hangzhou Hikvision Digital Technology Co., Ltd. (China), Zhejiang Dahua Technology Co., Ltd. (China), Axis Communications AB (Sweden), SECOM Co., Ltd. (Japan), Siemens (Germany), Assa Abloy (Sweden). (Total 25 players are profiled) |

Security Solutions Market Highlights

The study categorizes the security solutions market based on the following segments:

|

Segment |

Subsegment |

|

By System |

|

|

By Services |

|

|

By Vertical |

|

|

By region |

|

Recent Developments in Security Solutions Industry

- In December 2023, Hikvision announced the launch of a 4-wire HD analog intercom solution. This cutting-edge solution enhances security and convenience for villa, apartment owners, and visitors.

- In December 2023, Dahua announced the launch of its state-of-the-art video access controller. This cutting-edge device aims to redefine residential access control systems by incorporating advanced security technology and intuitive, user-friendly features, ensuring a new level of security for residential environments.

- In November 2023, Johnson Controls announced a digital assessment tool for K-12 school districts to evaluate the physical security of their campuses, identify vulnerabilities and threats, and take appropriate action. With simplified access to data-driven insights, administrators can make more informed decisions to keep their students and teachers safe from a widening range of threats.

- In November 2023, Axis Communications announced a new series of next-generation bullet cameras: AXIS Q18 Series. These cameras detect and classify moving objects using AXIS Object Analytics.

- In November 2023, Robert Bosch launched the FLEXIDOME micro 3100i cameras. The FLEXIDOME micro 3100i cameras ensure reliable detection in and around buildings. They offer excellent value with edge-based AI and good image quality.

- In July 2023, Honeywell launched the Morley-IAS Max fire detection and alarm system. The system offers end users a technically advanced range of functions that is easy to install, commission, and maintain.

- In January 2023, ADT introduced the ADT+ app. By using ADT+ app, customers can easily access and control their ADT devices, including a access control system, entrance control system , and intruder alarm systems, and compatible Google products.

Frequently Asked Questions(FAQs):

What are the major driving factors and opportunities in the security solutions market?

Some of the major driving factors for the growth of this market include Increasing concerns regarding public safety and infrastructure protection, Technological advancements in surveillance and access control systems, Rising incidence of theft, vandalism, and unauthorized access, and Expansion of smart infrastructure and smart city projects globally. Moreover, increasing demand for remote monitoring and surveillance solutions, growing adoption of cloud-based security solutions, and Expanding retail and commercial sector security requirements are some of the critical opportunities for the security solutions market.

Which region is expected to hold the highest market share?

The security solutions market share in Asia Pacific is substantial due to several contributing factors. The region is undergoing rapid economic development and urbanization, increasing the need for advanced security measures to protect critical infrastructure, businesses, and growing urban populations. The adoption of smart city initiatives across various countries in the Asia Pacific further propels market growth, with a focus on integrating advanced technologies for enhanced public safety and overall urban security. As geopolitical dynamics evolve and technology adoption accelerates, Asia Pacific remains a focal point for the security solutions market, leading to a larger market share than other regions.

Who are the leading players in the global security solutions market?

Companies such as Johnson Controls (Ireland), Honeywell International Inc. (US), Robert Bosch GmbH (Germany), ADT (US), and Hangzhou Hikvision Digital Technology Co., Ltd. (China) are the leading players in the market.

What are some of the technological advancements in the market?

Key advancements include the integration of artificial intelligence and machine learning for predictive analytics, enabling proactive threat detection. Additionally, adopting biometrics, advanced video analytics, and IoT-driven solutions has revolutionized access control and surveillance, providing more sophisticated and accurate security protocols. Cloud-based architectures facilitate remote monitoring and management, while the deployment of automation and robotics further augments the efficiency of security systems. These technological strides address current security challenges and position the industry to adapt swiftly to emerging threats, reflecting a dynamic landscape driven by continuous innovation.

What is the impact of the global recession on the market?

The security solutions industry is expected to be adversely impacted by the recession and rising inflation in 2024. The growth primarily depends on producing and selling a broad range of semiconductor devices, including image sensors, controllers, readers, processors, and memory and storage, which are primary components of security solutions systems. With the increased inflation, interest rates, and unemployment, demand for security solutions among consumers and enterprises is bound to be less, which, in turn, will affect production and investments across the globe. Due to the recession, verticals such as residential, commercial, retail, banking, industrial, military and defense, and transportation, which use security solutions, would have low CAPEX spending for security solutions-based development.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

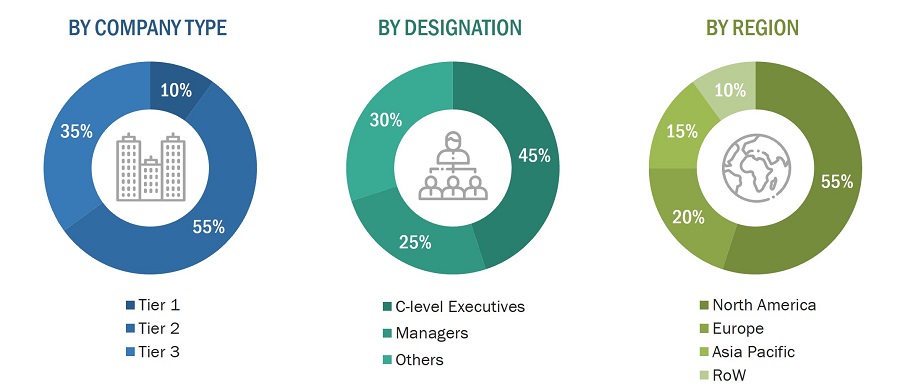

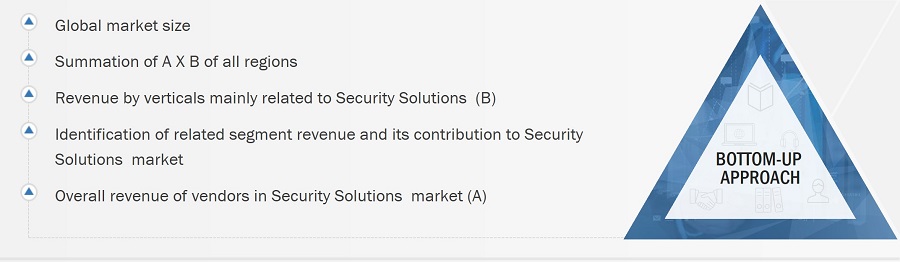

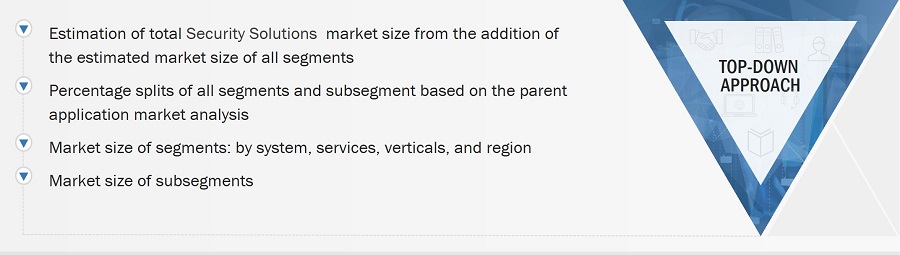

The study involved four major activities in estimating the current size of the security solutions market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE |

WEB LINK |

|

Federal Communications Commission (FCC) |

|

|

National Institute of Standards and Technology (NIST) |

|

|

Ministry of Electronics and Information Technology (MeitY) |

|

|

Ministry of Industry and Information Technology (MIIT) |

|

|

Ministry of Internal Affairs and Communications (MIC) |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the security solutions market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the security solutions market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the security solutions market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying various verticals using or expected to implement security solutions

- Analyzing each verticals, along with the major related companies and security solutions providers

- Estimating the security solutions market for verticals

- Understanding the demand generated by companies operating across different verticals

- Tracking the ongoing and upcoming implementation of projects based on security solutions technology by vertical and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with the key opinion leaders to understand the type of security solutions products designed and developed vertically. This information would help analyze the breakdown of the scope of work carried out by each major company in the security solutions market

- Arriving at the market estimates by analyzing security solutions companies as per their countries, and subsequently combining this information to arrive at the market estimates by region

- Verifying and cross-checking the estimates at every level through discussions with the key opinion leaders, including CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

To calculate the market size of specific segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The top-down approach was implemented for the data extracted from the secondary research to validate the market size obtained.

The market share of each company was estimated to verify the revenue shares used earlier in the top-down approach. The overall parent market size and individual market sizes were determined and confirmed in this study by the data triangulation method and the validation of data through primaries. The data triangulation method used in this study is explained in the next section.

- Focusing on top-line investments and expenditures being made in the ecosystems of various verticals.

- Building and developing the information related to the market revenue generated by key security solutions manufacturers

- Conducting multiple on-field discussions with the key opinion leaders involved in the development of security solutions products in various verticals

- Estimating geographic splits using secondary sources based on various factors, such as the number of players in a specific country and region, the offering of security solutions, and the level of solutions offered in verticals

- Impact of the recession on the steps mentioned above has also been considered.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the overall market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, the data triangulation procedure has been employed wherever applicable. The data has been triangulated by studying various factors and trends from both demand and supply sides. Along with this, the market size has been validated using top-down and bottom-up approaches.

Market Definition

Security solutions encompass a comprehensive set of measures, technologies, and practices designed to protect physical assets, facilities, and individuals from unauthorized access, theft, vandalism, and other potential threats. These solutions often include a combination of hardware and software components such as access control systems, surveillance cameras, perimeter barriers (e.g., fences, gates), alarm systems, biometric identification systems, and visitor management systems. The primary goal is to create a secure environment that deters intrusions, monitors activities and responds promptly to security incidents. By deploying tailored physical security solutions, organizations can safeguard their premises, assets, and personnel, thereby mitigating risks, ensuring safety compliance, and maintaining operational continuity.

Key Stakeholders

- Security System Providers

- End-User Organizations

- System Integrators

- Consultants and Advisory Firms

- Regulatory Bodies and Compliance Agencies

- Technology Vendors

- Security Service Providers

- Distributors and Resellers

- Industry Associations and Organizations

- Investors and Financial Institutions

Report Objectives

- To define, describe, and forecast the security solutions market based on system, services, vertical, and region.

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments such as collaborations, agreements, partnerships, product developments, and research & development (R&D) in the market

- To analyze the impact of the recession on the security solutions market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the security solutions market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the security solutions market.

Growth opportunities and latent adjacency in Security Solutions Market