High Potency APIs Market / HPAPI Market by Type (Innovative, Generic), Type of Synthesis (Synthetic, Biotech, Biosimilars, mAbs, Vaccines), Manufacturers (Captive, Merchant), Application (Oncology, Hormonal Imbalance, Glaucoma) & Region - Global Forecast to 2027

Market Growth Outlook Summary

The global high potency APIs market growth forecasted to transform from $24.5 billion in 2022 to $39.6 billion by 2027, driven by a CAGR of 10.1%. This growth is driven by increasing demand for oncology drugs, advancements in HPAPI manufacturing technologies, and the rising focus on precision medicine. Major players in the market include Pfizer, Roche, Sanofi, and Novartis, among others. Key market segments include innovative and generic HPAPIs, synthetic and biotech APIs, and therapeutic applications like oncology and hormonal imbalance. North America leads the market due to its strong oncology sector and prevalence of chronic diseases. Challenges include cross-contamination risks and the need for precise process designs, while CMOs and CDMOs present opportunities for manufacturers to outsource HPAPI production.

To know about the assumptions considered for the study, Request for Free Sample Report

High Potency APIs Market Dynamics

Drivers: Increasing demand for oncology drugs

The rising demand for oncology drugs is anticipated to create a wide scope of opportunities in the global HPAPI market. HPAPIs are extremely effective pharmacologically active ingredients, which offer significant efficiency in the action and efficiency even at low doses. The growing incidence and prevalence of cancer, there is a growth in demand for more potent cancer therapeutics, including HPAPIs. To cater to the growing demand, various pharmaceutical companies such as Pfizer, Sanofi, F. Hoffmann-La Roche, and others are increasingly making efforts toward building pipelines for novel cancer therapeutics.

Opportunities: Growing opportunities for CMOs and CDMOs

A comprehensive HPAPI manufacturing facility requires extensive planning, the use of risk management and assessment tools, and a mechanism to determine which compounds are suitable for manufacturing in each facility. The production of such compounds poses hazards and risks to workers and the environment. Pharmaceutical manufacturers also need to have the capacity for the safe production, storage, and transport of a growing range of potent compounds. This makes it evident that implementing a successful HPAPI manufacturing strategy requires significant time and investment. Hence, various sponsor companies prefer going to CMOs and CDMOs for assistance with the development, manufacturing, and distribution of HPAPIs and their formulated drug products, as many of these companies have the necessary equipment.

Challenges: Need for appropriate process designs

Process designs are one of the most vital requirements for HPAPI production operations. Most HPAPI and ADC drug payloads need to be produced in small clinical and commercial quantities. However, the production of gram scale GMP APIs and payloads is challenging. Maintaining containment control when using flexible and small equipment, including glass equipment, is a definite challenge and requires an approach that is tailored for each process and unit operation. It is also important to maintain appropriate process designs at the developmental scale to ensure that the process fits the equipment and capabilities of the facility upon scale-up. Furthermore, industry-wide, there is an ambiguity regarding the classification of HPAPIs. Different pharmaceutical companies often have proprietary systems, and the classification of new APIs is unknown due to a lack of data. These issues can be mitigated with appropriate process designs and containment controls, which most companies lack. All these factors collectively are likely to present a significant challenge for players in the HPAPI market.

Restraints: High risk of cross-contamination

The biggest risks associated with HPAPI manufacturing is cross-contamination (detrimental contamination of a product with a different product). Growing pressure on the pharmaceutical industry to control costs and to make biopharmaceuticals economical to the consumers are major factors compelling the industry to utilize effective and efficient multi-product and multi-purpose facilities to the greatest extent possible. Along with high potency, HPAPIs often exhibit high cytotoxicity, therefore efforts to prevent cross-contamination are essential to a safe manufacturing process which guarantees the wellbeing of employees, the environment, and the patient.

Global High Potency APIs Market Segmentation

The report divide the High Potency APIs market into type, type of synthesis, type of manufacturer, by therapeutic application and region. Based on type, the market is divided into generic HPAPI and innovative HPAPI. In 2021, the innovative segment will grow largest share in the market. Some Factors contributing to the market growth can be increasing investments in R&D to drive the market growth of this segment.

Based on type of synthesis, the High Potency APIs market is divided into biotech HPAPI and synthetic HPAPI segment. The synthetic HPAPI segment to command the largest share in 2021. Increasing number of new APIs, approvals and ease of production are driving the growth of synthetic segment.

Based on the type of manufacturer, the High Potency APIs market is segmented into merchant HPAPI manufacturers and captive HPAPI manufacturers. In 2021 the captive HPAPI manufacturers market to account for largest share of market. Factors such as companies in-house manufacturing facilities for economic benefits to drive the segment.

Based on therapeutic application, the High Potency APIs market is segmented into oncology, glaucoma, hormonal imbalance, and other therapeutic applications. The oncology segment to dominate the market during 2021. The growing prevalence of cancer and launch of new target therapies are the key factors for the growth in the segment.

By Region, the global High Potency APIs market is segmented into North America, Europe, Asia, and the rest of World (RoW). North America is expected to dominate the market in 2021. Factors such as growing oncology sector, prevlance and incidence of chronic diseases and lifestyle diseases to drive the market segment in North America.

To know about the assumptions considered for the study, download the pdf brochure

The major players in the HPAPI market include Pfizer, Inc. (US), F. Hoffmann-La Roche (Switzerland), Sanofi (France), Bristol-Myers Squibb Company (US), Bayer AG (Germany), Novartis International AG (Switzerland), Boehringer Ingelheim International GmbH. (Germany), Teva Pharmaceutical Industries Ltd. (Israel), Eli Lilly and Company (US), Merck & Co., Inc. (US), AbbVie (US), and Viatris Inc. (US).

High Potency APIs Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2022–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Values (USD Million) |

|

Segments covered |

Type, Type of Synthesis, Type of manufacturers, Therapeutic application, and Region |

|

Geographies covered |

North America (US & Canada), Europe (UK, Germany, France, Italy, Spain and RoE) Asia (China, Japan, India, RoA), and RoW |

|

Companies covered |

Pfizer, Inc. (US), F. Hoffmann-La Roche (Switzerland), Sanofi (France), Bristol-Myers Squibb Company (US), Bayer AG (Germany), Novartis International AG (Switzerland), Boehringer Ingelheim International GmbH. (Germany), Teva Pharmaceutical Industries Ltd. (Israel), Eli Lilly and Company (US), Merck & Co., Inc. (US), AbbVie (US), and Viatris Inc. (US). |

This report categorizes the High Potency APIs Market into the following segments and sub-segments:

By Type

- Innovative API Market

- Generic API Market

By Type of Synthesis

- Synthetic API Market

- Biotech API Market

By Type of Manufacturers

- Captive API Market

- Merchant API Market

By Therapeutic Application

- Oncology

- Hormonal Imbalance

- Glaucoma

- Other therapeutic applications

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- ROE

-

Asia

- Japan

- China

- India

- ROA

- Rest of the World (RoW)

Recent Developments:

- In 2022, Pfizer acquired Arena Pharmaceuticals. The deal will benefit in bringing the pipeline of Arena Pharmaceuticals to the company’s Inflammation and Immunology Therapeutic Area, helping in the further developments to change the lives of those with immuno-inflammatory diseases.

- In 2021, Sandoz, a Novartis division, had successfully completed the acquisition of GSK’s Cephalosporin Antibiotics business. Through this transaction, Sandoz had acquired the rights to three established brands (Zinnat, Zinacef, and Fortum) in more than 100 markets, further reinforcing its leading global position in antibiotics.

- In 2020, La Roche collaborated with Atea Pharmaceuticals to develop a potential oral treatment for the COVID-19 patients.

Frequently Asked Questions (FAQ):

What is the projected market value of the global high potency APIs market?

The global market of high potency APIs is projected to reach USD 39.6 billion.

What is the estimated growth rate (CAGR) of the global high potency APIs market for the next five years?

The global high potency APIs market has an estimated annual growth rate of 10.1% and had a revenue size of approximately $24.5 billion in 2022.

What are the major revenue pockets in the high potency APIs market currently?

By Region, the global High Potency APIs market is segmented into North America, Europe, Asia, and the rest of World (RoW). North America is expected to dominate the market in 2021. Factors such as growing oncology sector, prevlance and incidence of chronic diseases and lifestyle diseases to drive the market segment in North America.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 HPAPI MARKET: GEOGRAPHIC SCOPE

1.3.2 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 SUMMARY OF CHANGES

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

FIGURE 2 RESEARCH DESIGN

2.1 SECONDARY DATA

2.1.1 SECONDARY SOURCES

2.2 PRIMARY DATA

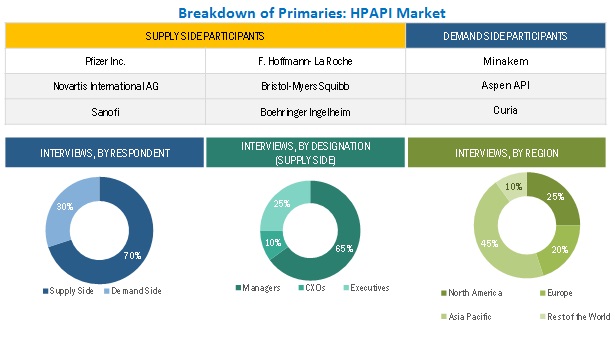

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: HPAPI MARKET

2.2.1 KEY DATA FROM PRIMARY SOURCES

2.2.2 PRIMARY INSIGHTS

2.3 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

2.4 MARKET GROWTH RATE PROJECTIONS

FIGURE 6 HPAPI MARKET: CAGR PROJECTIONS

2.5 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.6 RESEARCH ASSUMPTIONS

2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 8 HPAPI MARKET, BY TYPE, 2021 VS. 2027

FIGURE 9 HIGH POTENCY APIS MARKET, BY TYPE OF MANUFACTURER, 2021 VS. 2027

FIGURE 10 GLOBAL MARKET, BY TYPE OF SYNTHESIS, 2021 VS. 2027

FIGURE 11 GLOBAL MARKET, BY THERAPEUTIC APPLICATION, 2021 VS. 2027

FIGURE 12 GEOGRAPHIC SNAPSHOT OF GLOBAL HIGH POTENCY APIS MARKET (2022–2027)

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 HIGH POTENCY APIS MARKET OVERVIEW

FIGURE 13 INCREASING DEMAND FOR ONCOLOGY DRUGS AND ANTIBODY-DRUG CONJUGATES TO DRIVE MARKET GROWTH

4.2 HPAPI MARKET, BY TYPE, (2021 VS. 2027)

FIGURE 14 INNOVATIVE HPAPIS TO DOMINATE THE HIGH POTENCY APIS MARKET IN 2027

4.3 HIGH POTENCY APIS MARKET, BY TYPE OF SYNTHESIS, (2021 VS. 2027)

FIGURE 15 SYNTHETIC HPAPIS TO DOMINATE MARKET SHARE IN 2021

4.4 HIGH POTENCY APIS MARKET BY THERAPEUTIC AREA (2021–2027)

FIGURE 16 ONCOLOGY SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.5 GEOGRAPHICAL SNAPSHOT OF GLOBAL MARKET

FIGURE 17 CHINA & INDIA TO REGISTER HIGH GROWTH RATES DURING 2022–2027

5 MARKET OVERVIEW (Page No. - 53)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 HPAPI MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Increasing demand for oncology drugs

TABLE 1 PIPELINE OF ONCOLOGY DRUGS (2021)

5.2.1.2 Growing demand for antibody-drug conjugates

5.2.1.3 Increasing focus of leading pharmaceutical companies on HPAPIs

5.2.1.4 Advancements in HPAPI manufacturing technologies

5.2.1.5 Growing focus on precision medicine

5.2.2 RESTRAINTS

5.2.2.1 Increasing requirement of large investments for employee safety

5.2.2.2 Discrepancies in HPAPI banding systems

5.2.2.3 Rising number of uncertainties associated with products

5.2.2.4 High risk of cross-contamination

5.2.3 OPPORTUNITIES

5.2.3.1 Growing opportunities for CMOs and CDMOs

5.2.3.2 Increasing opportunities for companies in emerging markets

5.2.4 CHALLENGES

5.2.4.1 Need for appropriate process designs

5.2.4.2 Constant evolution of industry standards and technologies

5.3 IMPACT OF COVID-19 ON HPAPI MARKET

5.4 TARIFF AND REGULATORY LANDSCAPE

5.4.1 HANDLING HPAPI

5.4.2 THIRD PARTY CERTIFICATION

5.4.3 CONTAINMENT STRATEGIES

5.4.4 CHALLENGES

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 2 HIGH POTENCY APIS MARKET: PORTER’S FIVE FORCES ANALYSIS

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF SUPPLIERS

5.5.4 BARGAINING POWER OF BUYERS

5.5.5 DEGREE OF COMPETITION

5.6 TECHNOLOGY ANALYSIS

5.6.1 HANDLING POTENT COMPOUNDS

5.6.2 CONTROLS

5.6.3 SAFETY ASSESSMENT AND STANDARD OPERATING PROCEDURES

5.6.4 DEDICATED EQUIPMENT AND SYSTEMS

5.6.5 EXPERTISE AND TRAINING

5.6.6 COMBUSTIBLE DUST HANDLING

5.6.7 SUITABLE PERSONAL PROTECTIVE EQUIPMENT

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 19 HPAPI MARKET: SUPPLY CHAIN ANALYSIS

5.8 PRICING ANALYSIS

TABLE 3 SELLING PRICE OF HPAPI PRODUCTS BY TOP PLAYERS

5.9 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 4 HIGH POTENCY APIS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

5.10.1 KEY STAKEHOLDERS IN THE BUYING PROCESS

FIGURE 20 INFLUENCE OF STAKEHOLDERS IN THE BUYING PROCESS OF HPAPI

5.10.2 BUYING CRITERIA FOR HPAPI

FIGURE 21 KEY BUYING CRITERIA FOR END USERS

6 HPAPI CLASSIFICATION AND OVERVIEW (Page No. - 69)

6.1 INTRODUCTION

6.2 HPAPI INGREDIENTS CLASSIFICATION AS PER SAFEBRIDGE CONSULTANTS

TABLE 5 CATEGORIES OF HPAPIS

TABLE 6 POTENCY CLASSIFICATION SYSTEM

7 HPAPI MARKET, BY TYPE (Page No. - 72)

7.1 INTRODUCTION

FIGURE 22 INNOVATIVE HPAPIS SEGMENT TO DOMINATE GLOBAL MARKET

TABLE 7 HIGH POTENCY APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

7.2 INNOVATIVE HPAPIS

TABLE 8 INNOVATIVE HPAPIS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 9 NORTH AMERICA: INNOVATIVE HPAPIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 10 EUROPE: INNOVATIVE HPAPIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 11 ASIA: INNOVATIVE HPAPIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 GENERIC HPAPIS

TABLE 12 GENERIC HPAPIS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 13 NORTH AMERICA: GENERIC HPAPIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 14 EUROPE: GENERIC HPAPIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 15 ASIA: GENERIC HPAPIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8 HPAPI MARKET, BY TYPE OF SYNTHESIS (Page No. - 79)

8.1 INTRODUCTION

FIGURE 23 SYNTHETIC SEGMENT TO DOMINATE MARKET IN 2021

TABLE 16 HIGH POTENCY APIS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

8.2 SYNTHETIC APIS

TABLE 17 SYNTHETIC APIS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 18 NORTH AMERICA: SYNTHETIC APIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 19 EUROPE: SYNTHETIC APIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 20 ASIA: SYNTHETIC APIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.1 SYNTHETIC APIS MARKET, BY TYPE

TABLE 21 SYNTHETIC APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 22 INNOVATIVE SYNTHETIC APIS

TABLE 23 INNOVATIVE SYNTHETIC APIS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 24 NORTH AMERICA: INNOVATIVE SYNTHETIC APIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 25 EUROPE: INNOVATIVE SYNTHETIC APIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 26 ASIA: INNOVATIVE SYNTHETIC APIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.2.2 GENERIC SYNTHETIC APIS

TABLE 27 GENERIC SYNTHETIC APIS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 28 NORTH AMERICA: GENERIC SYNTHETIC APIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 29 EUROPE: GENERIC SYNTHETIC APIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 30 ASIA: GENERIC SYNTHETIC APIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 BIOTECH APIS

TABLE 31 BIOTECH APIS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 32 NORTH AMERICA: BIOTECH APIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 33 EUROPE: BIOTECH APIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 34 ASIA: BIOTECH APIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.3.1 BIOTECH APIS MARKET, BY TYPE

TABLE 35 BIOTECH APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

8.3.2 INNOVATIVE BIOTECH APIS

TABLE 36 INNOVATIVE BIOTECH APIS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 37 NORTH AMERICA: INNOVATIVE BIOTECH APIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 38 EUROPE: INNOVATIVE BIOTECH APIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 39 ASIA: INNOVATIVE BIOTECH APIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.3.3 BIOSIMILARS

TABLE 40 BIOSIMILARS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 41 NORTH AMERICA: BIOSIMILARS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 42 EUROPE: BIOSIMILARS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 43 ASIA: BIOSIMILARS INGREDIENTS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.3.4 BIOTECH APIS MARKET, BY PRODUCT

TABLE 44 BIOTECH APIS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

8.3.5 MONOCLONAL ANTIBODIES

TABLE 45 MONOCLONAL ANTIBODIES MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3.6 VACCINES

TABLE 46 VACCINES MARKET, BY REGION, 2020–2027 (USD MILLION)

8.3.7 RECOMBINANT PROTEINS

TABLE 47 RECOMBINANT PROTEINS MARKET, BY REGION, 2020–2027 (USD MILLION)

9 HPAPI MARKET, BY TYPE OF MANUFACTURER (Page No. - 99)

9.1 INTRODUCTION

FIGURE 24 CAPTIVE HPAPI MANUFACTURERS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2021

TABLE 48 HIGH POTENCY APISMARKET, BY TYPE OF MANUFACTURER, 2020–2027 (USD MILLION)

9.2 CAPTIVE API MANUFACTURERS

TABLE 49 CAPTIVE API MANUFACTURERS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 50 NORTH AMERICA: CAPTIVE API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 51 EUROPE: CAPTIVE API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 52 ASIA: CAPTIVE API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.3 MERCHANT API MANUFACTURERS

TABLE 53 MERCHANT API MANUFACTURERS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: MERCHANT API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 55 EUROPE: MERCHANT API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 56 ASIA: MERCHANT API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.1 MERCHANT API MANUFACTURERS MARKET BY TYPE

TABLE 57 MERCHANT API MANUFACTURERS MARKET BY TYPE, 2020–2027, (USD MILLION)

9.3.2 INNOVATIVE MERCHANT API MANUFACTURERS

TABLE 58 INNOVATIVE MERCHANT API MANUFACTURERS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 59 NORTH AMERICA: INNOVATIVE MERCHANT API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 60 EUROPE: INNOVATIVE MERCHANT API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 61 ASIA: INNOVATIVE MERCHANT API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.3 GENERIC MERCHANT API MANUFACTURERS

TABLE 62 GENERIC MERCHANT API MANUFACTURERS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 63 NORTH AMERICA: GENERIC MERCHANT API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 64 EUROPE: GENERIC MERCHANT API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 65 ASIA: GENERIC MERCHANT API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.4 MERCHANT API MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS

TABLE 66 MERCHANT API MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 , (USD MILLION)

9.3.5 SYNTHETIC API MANUFACTURERS

TABLE 67 SYNTHETIC API MANUFACTURERS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: SYNTHETIC API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 69 EUROPE: SYNTHETIC API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 70 ASIA: SYNTHETIC API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.3.6 BIOTECH API MANUFACTURERS

TABLE 71 BIOTECH API MANUFACTURERS MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 72 NORTH AMERICA: BIOTECH API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 73 EUROPE: BIOTECH API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 74 ASIA: BIOTECH API MANUFACTURERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10 HPAPI MARKET, BY THERAPEUTIC APPLICATION (Page No. - 116)

10.1 INTRODUCTION

FIGURE 25 ONCOLOGY SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

TABLE 75 HPAPI MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

10.2 ONCOLOGY

TABLE 76 HIGH POTENCY APIS MARKET FOR ONCOLOGY, BY REGION, 2020–2027 (USD MILLION)

TABLE 77 NORTH AMERICA: HIGH POTENCY APIS MARKET FOR ONCOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 78 EUROPE: HIGH POTENCY APIS MARKET FOR ONCOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 79 ASIA: MARKET FOR ONCOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

10.3 HORMONAL IMBALANCE

TABLE 80 HIGH POTENCY APIS MARKET FOR HORMONAL IMBALANCE, BY REGION, 2020–2027 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET FOR HORMONAL IMBALANCE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 82 EUROPE: HIGH POTENCY APIS MARKET FOR HORMONAL IMBALANCE, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 83 ASIA: HIGH POTENCY APIS MARKET FOR HORMONAL IMBALANCE, BY COUNTRY, 2020–2027 (USD MILLION)

10.4 GLAUCOMA

TABLE 84 HPAPI MARKET FOR GLAUCOMA, BY REGION, 2020–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET FOR GLAUCOMA, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 86 EUROPE: HIGH POTENCY APIS MARKET FOR GLAUCOMA, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 87 ASIA: HIGH POTENCY APIS MARKET FOR GLAUCOMA, BY COUNTRY, 2020–2027 (USD MILLION)

10.5 OTHER THERAPEUTIC APPLICATIONS

TABLE 88 HIGH POTENCY APIS MARKET FOR OTHER THERAPEUTIC APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 89 NORTH AMERICA: HIGH POTENCY APIS MARKET FOR OTHER THERAPEUTIC APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 90 EUROPE: HIGH POTENCY APIS MARKET FOR OTHER THERAPEUTIC APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 91 ASIA: HIGH POTENCY APIS MARKET FOR OTHER THERAPEUTIC APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

11 HPAPI MARKET, BY REGION (Page No. - 128)

11.1 INTRODUCTION

TABLE 92 HPAPI MARKET, BY REGION, 2020–2027 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 26 NORTH AMERICA: HPAPI MARKET SNAPSHOT

TABLE 93 NORTH AMERICA: HIGH POTENCY APIS MARKETMARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 94 NORTH AMERICA: HIGH POTENCY APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 95 NORTH AMERICA: HIGH POTENCY APIS MARKET, BY TYPE OF MANUFACTURER, 2020–2027 (USD MILLION)

TABLE 96 NORTH AMERICA: MERCHANT APIS MANUFACTURERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 NORTH AMERICA: MERCHANT APIS MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: HIGH POTENCY APIS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 99 NORTH AMERICA: SYNTHETIC APIS INGREDIENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 100 NORTH AMERICA: BIOTECH APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 101 NORTH AMERICA: BIOTECH HPAPI MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 102 NORTH AMERICA: HIGH POTENCY APISM ARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

11.2.1 US

11.2.1.1 Increasing Investments in cancer research to drive market growth

TABLE 103 US: HPAPI MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 104 US: HIGH POTENCY APIS MARKET, BY TYPE OF MANUFACTURER, 2020–2027 (USD MILLION)

TABLE 105 US: MERCHANT API MANUFACTURERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 106 US: MERCHANT HPAPI MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 107 US: MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 108 US: SYNTHETIC APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 109 US: BIOTECH APIS MARKET, BY TYPE, 2020–2027 (USD MILLION

TABLE 110 US: BIOTECH APIS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 111 US: HIGH POTENCY APIS, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

11.2.2 CANADA

11.2.2.1 The rising prevalence of cancer to drive market growth

TABLE 112 CANADA: HPAPI MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 113 CANADA: HIGH POTENCY APIS MARKET, BY TYPE OF MANUFACTURER, 2020–2027 (USD MILLION)

TABLE 114 CANADA: MERCHANT API MANUFACTURERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 115 CANADA: MERCHANT API MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 116 CANADA: HIGH POTENCY APIS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 117 CANADA: SYNTHETIC APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 118 CANADA: BIOTECH APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 119 CANADA: BIOTECH APIS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 120 CANADA: HPAPI MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

11.3 EUROPE

FIGURE 27 EUROPE: HPAPI MARKET SNAPSHOT

TABLE 121 EUROPE: HIGH POTENCY APIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 122 EUROPE: HIGH POTENCY APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 123 EUROPE: HIGH POTENCY APIS MARKET, BY TYPE OF MANUFACTURER, 2020–2027 (USD MILLION)

TABLE 124 EUROPE: MERCHANT API MANUFACTURERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 125 EUROPE: MERCHANT API MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 126 EUROPE: HPAPI MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 127 EUROPE: SYNTHETIC APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 128 EUROPE: BIOTECH APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 129 EUROPE: BIOTECH APIS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 130 EUROPE: HIGH POTENCY APIS MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 The strong focus on biotech and medical research to drive market growth

TABLE 131 GERMANY: HPAPI MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 132 GERMANY: HIGH POTENCY APIS MARKET, BY TYPE OF MANUFACTURER, 2020–2027 (USD MILLION)

TABLE 133 GERMANY: MERCHANT API MANUFACTURERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 134 GERMANY: MERCHANT API MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 135 GERMANY: HIGH POTENCY APIS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 136 GERMANY: SYNTHETIC APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 137 GERMANY: BIOTECH APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 138 GERMANY: BIOTECH APIS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 139 GERMANY: HPAPI MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

11.3.2 FRANCE

11.3.2.1 The presence of many pharmaceutical companies coupled with the growing demand for novel cancer therapies to drive market growth

TABLE 140 FRANCE: HPAPI MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 141 FRANCE: HIGH POTENCY APIS MARKET, BY TYPE OF MANUFACTURER, 2020–2027 (USD MILLION)

TABLE 142 FRANCE: MERCHANT API MANUFACTURERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 143 FRANCE: MERCHANT HPAPI MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 144 FRANCE: HIGH POTENCY APIS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 145 FRANCE: SYNTHETIC APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 146 FRANCE: BIOTECH APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 147 FRANCE: BIOTECH APIS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 148 FRANCE: HPAPI MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

11.3.3 UK

11.3.3.1 Increasing in the demand for cancer therapies to drive market growth

TABLE 149 UK: HPAPI MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 150 UK: HIGH POTENCY APIS MARKET, BY TYPE OF MANUFACTURER, 2020–2027 (USD MILLION)

TABLE 151 UK: MERCHANT HPAPI MANUFACTURERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 152 UK: MERCHANT HPAPI MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 153 UK: HIGH POTENCY APIS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 154 UK: SYNTHETIC APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 155 UK: BIOTECH APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 156 UK: BIOTECH APIS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 157 UK: HPAPI MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

11.3.4 ITALY

11.3.4.1 Robust generic API production capacities to drive the market growth

TABLE 158 ITALY: HPAPI MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 159 ITALY: HIGH POTENCY APIS MARKET, BY TYPE OF MANUFACTURER, 2020–2027 (USD MILLION)

TABLE 160 ITALY: MERCHANT API MANUFACTURERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 161 ITALY: MERCHANT API MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 162 ITALY: HIGH POTENCY APIS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 163 ITALY: SYNTHETIC APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 164 ITALY: BIOTECH APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 165 ITALY: BIOTECH APIS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 166 ITALY: HPAPI MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

11.3.5 SPAIN

11.3.5.1 Developments in the ADC segment to drive market growth

TABLE 167 SPAIN: HPAPI MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 168 SPAIN: HIGH POTENCY APIS MARKET, BY TYPE OF MANUFACTURER, 2020–2027 (USD MILLION)

TABLE 169 SPAIN: MERCHANT API MANUFACTURERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 170 SPAIN: MERCHANT MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 171 SPAIN: HIGH POTENCY APIS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 172 SPAIN: SYNTHETIC APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 173 SPAIN: BIOTECH APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 174 SPAIN: BIOTECH APIS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 175 SPAIN: HPAPI MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 176 REST OF EUROPE: HPAPI MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 177 REST OF EUROPE: HIGH POTENCY APIS ARKET, BY TYPE OF MANUFACTURER, 2020–2027 (USD MILLION)

TABLE 178 REST OF EUROPE: MERCHANT API MANUFACTURERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 179 REST OF EUROPE: MERCHANT MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 180 REST OF EUROPE: HIGH POTENCY APIS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 181 REST OF EUROPE: SYNTHETIC APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 182 REST OF EUROPE: BIOTECH APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 183 REST OF EUROPE: BIOTECH APIS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 184 REST OF EUROPE: HPAPI MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

11.4 ASIA

FIGURE 28 ASIA: HPAPI MARKET SNAPSHOT

TABLE 185 ASIA: HIGH POTENCY APIS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 186 ASIA: HIGH POTENCY APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 187 ASIA: HIGH POTENCY APIS MARKET, BY TYPE OF MANUFACTURER, 2020–2027 (USD MILLION)

TABLE 188 ASIA: MERCHANT API MANUFACTURERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 189 ASIA: MERCHANT API MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 190 ASIA: HPAPI MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 191 ASIA: SYNTHETIC APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 192 ASIA: BIOTECH APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 193 ASIA: BIOTECH APIS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 194 ASIA: HPAPI MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

11.4.1 JAPAN

11.4.1.1 Investments in the development of ADC products to drive market growth

TABLE 195 JAPAN: HPAPI MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 196 JAPAN: HIGH POTENCY APIS MARKET, BY TYPE OF MANUFACTURER, 2020–2027 (USD MILLION)

TABLE 197 JAPAN: MERCHANT API MANUFACTURERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 198 JAPAN: MERCHANT HPAPI MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 199 JAPAN: HIGH POTENCY APIS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 200 JAPAN: SYNTHETIC APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 201 JAPAN: BIOTECH APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 202 JAPAN: BIOTECH APIS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 203 JAPAN: HPAPI MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

11.4.2 CHINA

11.4.2.1 Low labor costs, presence of well-equipped manufacturing plants to drive market growth

TABLE 204 CHINA: HPAPI MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 205 CHINA: HIGH POTENCY APIS MARKET, BY TYPE OF MANUFACTURER, 2020–2027 (USD MILLION)

TABLE 206 CHINA: MERCHANT API MANUFACTURERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 207 CHINA: MERCHANT API MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 208 CHINA: HIGH POTENCY APIS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 209 CHINA: SYNTHETIC APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 210 CHINA: BIOTECH APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 211 CHINA: BIOTECH APIS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 212 CHINA: HPAPI MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

11.4.3 INDIA

11.4.3.1 Increasing Investments in Oncology to drive market growth

TABLE 213 INDIA: HPAPI MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 214 INDIA: HIGH POTENCY APIS MARKET, BY TYPE OF MANUFACTURER, 2020–2027 (USD MILLION)

TABLE 215 INDIA: MERCHANT API MANUFACTURERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 216 INDIA: MERCHANT API MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 217 INDIA: HIGH POTENCY APIS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 218 INDIA: SYNTHETIC APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 219 INDIA: BIOTECH APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 220 INDIA: BIOTECH APIS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 221 INDIA: HPAPI MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

11.4.4 REST OF ASIA

TABLE 222 REST OF ASIA: HPAPI MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 223 REST OF ASIA: HIGH POTENCY APIS MARKET, BY TYPE OF MANUFACTURER, 2020–2027 (USD MILLION)

TABLE 224 REST OF ASIA: MERCHANT API MANUFACTURERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 225 REST OF ASIA: MERCHANT API MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 226 REST OF ASIA: HIGH POTENCY APIS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 227 REST OF ASIA: SYNTHETIC APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 228 REST OF ASIA: BIOTECH APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 229 REST OF ASIA: BIOTECH APIS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 230 REST OF ASIA: HPAPI MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

11.5 REST OF THE WORLD

FIGURE 29 REST OF THE WORLD: HPAPI MARKET SNAPSHOT

TABLE 231 ROW: HPAPI MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 232 ROW: HIGH POTENCY APIS MARKET, BY TYPE OF MANUFACTURER, 2020–2027 (USD MILLION)

TABLE 233 ROW: MERCHANT API MANUFACTURERS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 234 ROW: MERCHANT API MANUFACTURERS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 235 ROW: HIGH POTENCY APIS MARKET, BY TYPE OF SYNTHESIS, 2020–2027 (USD MILLION)

TABLE 236 ROW: SYNTHETIC APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 237 ROW: BIOTECH APIS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 238 ROW: BIOTECH APIS MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 239 ROW: HPAPI MARKET, BY THERAPEUTIC APPLICATION, 2020–2027 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 210)

12.1 OVERVIEW

12.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN

FIGURE 30 KEY DEVELOPMENTS IN HPAPI MARKET, 2019–2022

12.3 MARKET SHARE ANALYSIS

FIGURE 31 HIGH POTENCY APIS MARKET: MARKET SHARE ANALYSIS, BY KEY PLAYER, 2021

TABLE 240 HPAPI MARKET: DEGREE OF COMPETITION

12.4 REVENUE SHARE ANALYSIS OF THE TOP PLAYERS OF THE GLOBAL HIGH POTENCY APIS MAKRET

FIGURE 32 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN GLOBAL HIGH POTENCY APIS MARKET, 2019–2021

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

FIGURE 33 HPAPI MARKET: COMPANY EVALUATION QUADRANT

12.6 FOOTPRINT OF COMPANIES

TABLE 241 PORTFOLIO ANALYSIS BY TYPE OF SYNTHESIS: HIGH POTENCY APIS MARKET (2021)

TABLE 242 PORTFOLIO ANALYSIS BY TYPE OF MANUFACTURER: HPAPI MARKET (2021)

TABLE 243 PORTFOLIO ANALYSIS BY TYPE OF THERAPEUTIC APPLICATIONS: HIGH POTENCY APIS MARKET (2021)

12.7 REGIONAL FOOTPRINT

TABLE 244 REGIONAL FOOTPRINT OF COMPANIES: HPAPI MARKET (2021)

12.8 COMPETITIVE SCENARIO

TABLE 245 PRODUCT LAUNCHES

TABLE 246 DEALS

13 COMPANY PROFILES (Page No. - 220)

13.1 MAJOR PLAYERS

(Business overview, Products offered, Recent Developments, MNM view)*

13.1.1 PFIZER INC.

TABLE 247 PFIZER INC.: BUSINESS OVERVIEW

FIGURE 34 PFIZER INC.: COMPANY SNAPSHOT (2021)

13.1.2 NOVARTIS INTERNATIONAL AG

TABLE 248 NOVARTIS INTERNATIONAL AG: BUSINESS OVERVIEW

FIGURE 35 NOVARTIS INTERNATIONAL AG: COMPANY SNAPSHOT (2021)

13.1.3 SANOFI

TABLE 249 SANOFI: BUSINESS OVERVIEW

FIGURE 36 SANOFI: COMPANY SNAPSHOT (2021)

13.1.4 F. HOFFMANN-LA ROCHE

TABLE 250 F. HOFFMANN-LA ROCHE: BUSINESS OVERVIEW

FIGURE 37 F. HOFFMANN-LA ROCHE: COMPANY SNAPSHOT (2021)

13.1.5 BRISTOL-MYERS SQUIBB COMPANY

TABLE 251 BRISTOL-MYERS SQUIBB COMPANY: BUSINESS OVERVIEW

FIGURE 38 BRISTOL-MYERS SQUIBB COMPANY: COMPANY SNAPSHOT (2021)

13.1.6 BOEHRINGER-INGELHEIM

TABLE 252 BOEHRINGER-INGELHEIM: BUSINESS OVERVIEW

FIGURE 39 BOEHRINGER-INGELHEIM: COMPANY SNAPSHOT (2021)

13.1.7 TEVA PHARMACEUTICAL INDUSTRY LTD.

TABLE 253 TEVA PHARMACEUTICAL INDUSTRY LTD.: BUSINESS OVERVIEW

FIGURE 40 TEVA PHARMACEUTICAL INDUSTRY LTD.: COMPANY SNAPSHOT (2021)

13.1.8 ELI LILY AND COMPANY

TABLE 254 ELI LILY AND COMPANY: BUSINESS OVERVIEW

FIGURE 41 ELI LILY AND COMPANY: COMPANY SNAPSHOT (2021)

13.1.9 MERCK & CO., INC.

TABLE 255 MERCK & CO., INC.: BUSINESS OVERVIEW

FIGURE 42 MERCK & CO., INC.: COMPANY SNAPSHOT (2021)

13.1.10 ABBVIE INC.

TABLE 256 ABBVIE INC.: BUSINESS OVERVIEW

FIGURE 43 ABBVIE INC.: COMPANY SNAPSHOT (2021)

13.1.11 VIATRIS INC.

TABLE 257 VIATRIS INC.: BUSINESS OVERVIEW

FIGURE 44 VIATRIS INC.: COMPANY SNAPSHOT (2021)

13.1.12 BAYER

TABLE 258 BAYER AG: BUSINESS OVERVIEW

FIGURE 45 BAYER AG: COMPANY SNAPSHOT (2021)

*Details on Business overview, Products offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 276)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources; directories; databases such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; company house documents; and SEC filings of companies. Secondary research was mainly used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the HPAPI market.

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary research was also used to obtain key information about the market classification and segmentation according to industry trends, regional markets, and developments.

Secondary Data

In the secondary research process, various sources were referred to identify and collect useful information for the study. These sources included annual reports, press releases, investor presentations of companies, white papers, certified publications, articles from recognized authors, gold standard and silver standard websites, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s value chain, market classification, and segmentation according to the industry trends to the bottom-most level, geographical markets, and key developments from both market and technology oriented perspectives.

Primary Sources

Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the HPAPI market. Primary sources from the demand side included purchasing officers in pharmaceutical and biotechnology companies.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

High Potency APIs Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the sizes of the market and various other dependent submarkets. The research methodology used to estimate the market size includes the following details:

- The key players in the market were identified through secondary research, and their market contributions were determined through primary and secondary research.

- This entire procedure included the study of the annual and financial reports of the top market players and extensive interviews for the key insights from industry leaders.

- All percentage shares, splits, and breakdowns were determined by secondary sources and verified through primary sources.

- All possible parameters affecting the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to reach the final quantitative and qualitative data.

- The data mentioned above is consolidated and added with detailed inputs and analyses from MarketsandMarkets and presented in this report.

Data Triangulation

After arriving at the overall market size, the total market was split into several segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all the segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market was validated using both top-down and bottom-up approaches.

Report Objective

- To define, describe, and forecast the global high potency active pharmaceutical ingredients (HPAPI) market based on type, the type of manufacturer, the type of synthesis, therapeutic application, and region

- To provide detailed information about factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to the individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments of North America, Europe, Asia, and the Rest of the World

- To profile key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as agreements, partnerships, collaborations, and alliances; acquisitions; and R&D activities in the global HPAPI market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs.

The following customization options are available for the report:

- Additional Company Profiling

- Company profiles for 5 additional companies.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in High Potency APIs Market