Healthcare Distribution Market by Type (Pharmaceutical (Brand-name, Generic, OTC, Vitamins), Medical Device, Biopharmaceutical (Vaccines, Monoclonal Antibodies)), End User (Retail Pharmacies, Hospital Pharmacies) & Region - Global Forecasts to 2024

Inquire Now to get the global numbers on Healthcare Distribution Market

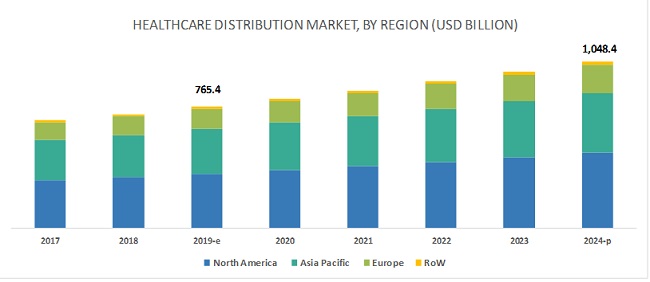

The healthcare distribution market is projected to reach USD 1,048.4 billion by 2024, at a CAGR of 6.5%. The growth of this market is primarily driven by the rising incidence of chronic diseases, growing importance of generics, rising adoption of track & trace solutions, and the growth of the medical device industry. In addition, emerging markets such as China and India, growth in the biosimilars market, increasing specialty drug dispensing, and increasing uptake of biopharmaceuticals are expected to offer potential growth opportunities to market players in the coming years. However, the increasing pricing pressure on market players is a major factor that is expected to impact market growth in the coming years.

The pharmaceutical product distribution services segment dominated the healthcare distribution market in 2018

On the basis of type, the healthcare distribution market is segmented into pharmaceutical product distribution services, medical device distribution services, and biopharmaceutical product distribution services. In 2018, the pharmaceutical product distribution services segment accounted for the largest share of the market majorly due to the increasing production of pharmaceutical formulations, rising pharmaceutical R&D expenditure, outsourcing of pharmaceutical manufacturing to Asian countries, and the establishment of new manufacturing facilitates by global pharmaceutical giants in newer geographies.

Retail pharmacies to account for the largest share of the healthcare distribution market, by end user, in 2018

On the basis of end user, the healthcare distribution market is segmented into retail pharmacies, hospital pharmacies, and other end users. The retail pharmacies segment accounted for the largest share of the market in 2018. These pharmacies deal with a large volume of prescriptions on a daily basis. Moreover, in the US and other developed countries, the implementation of programs to ensure affordable healthcare for citizens has significantly increased the volume of prescriptions in retail pharmacies.

APAC market to grow at the highest CAGR during the forecast period

North America dominated the healthcare distribution market in 2018. However, the APAC market is estimated to grow at the highest CAGR during the forecast period owing to the growing regulatory requirements in the healthcare industries of several APAC countries to maintain compliance with good manufacturing and distribution practices and the rising number of pharmaceutical and biotechnology companies in this region. China and India are the fastest-growing markets in this region majorly due to the expanding pharmaceutical industries in these countries and the implementation of stringent regulations to enhance the quality and reliability of pharmaceutical drugs.

Key Market Players

The prominent players operating in the healthcare distribution market are McKesson Corporation (US), AmerisourceBergen Corporation (US), Cardinal Health, Inc. (US), Owens & Minor, Inc. (US), Morris and Dickson Co., LLC (US), KeySource Medical, Inc. (US), Rochester Drug Cooperative, Inc. (US), Henry Schein Inc. (US), Smith Drug Company (US), FFF Enterprises (US), Patterson Companies Inc. (US), Mutual Drug (US), Shanghai Pharmaceutical Group Co., Ltd. (China), Medline Industries (US), PHOENIX Group (Germany), and CuraScript SD (US).

McKesson is a global leader in healthcare distribution and has been operating in the market for about 159 years. Through its Distribution Solutions segment, McKesson distributes 1/3rd of prescription medicines in North America and more than 275,000 SKUs of branded & private label medical-surgical supplies. McKesson focuses on partnering with payers, hospitals, pharmacies, pharmaceutical companies, and other organizations. In this market, the company focuses on inorganic growth strategies, such as agreements, to complement its business. In May 2019, the company renewed its distribution agreement with CVS Health through 2023. The company also focuses on innovation in existing products and solutions as a key strategy to strengthen its market position.

Want to explore hidden markets that can drive new revenue in Healthcare Distribution Market?

Scope of the Report:

Want to explore hidden markets that can drive new revenue in Healthcare Distribution Market?

|

Report Metric |

Details |

|

Market size available for years |

2017–2024 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2024 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, End User, and Region |

|

Geographies covered |

North America, Europe, the Asia Pacific, and the Rest of the World |

|

Companies covered |

McKesson Corporation (US), AmerisourceBergen Corporation (US), Cardinal Health, Inc. (US), Owens & Minor, Inc. (US), Morris and Dickson Co., LLC (US), KeySource Medical, Inc. (US), Rochester Drug Cooperative, Inc. (US), Henry Schein Inc. (US), Smith Drug Company (US), FFF Enterprises (US), Patterson Companies Inc. (US), Mutual Drug (US), Shanghai Pharmaceutical Group Co., Ltd. (China), Medline Industries (US), PHOENIX Group (Germany), and CuraScript SD (US). |

This research report categorizes the market into the following segments and subsegments:

Healthcare Distribution Market, by Type

-

Pharmaceutical Product Distribution Services

- OTC Drugs/Vitamins

- Generic Drugs

- Brand-name/Innovator Drugs

-

Biopharmaceutical Product Distribution Services

- Monoclonal Antibodies

- Vaccines

- Recombinant Proteins

- Blood and Blood Products

- Other Products (cellular & gene therapy products, stem cell products, and tissue & tissue products)

- Medical Device Distribution Services

Healthcare Distribution Market, by End User

- Retail Pharmacies

- Hospital Pharmacies

- Other End Users (clinical laboratories, physician offices, home care settings, online pharmacies, and long-term care facilities)

Healthcare Distribution Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Rest of Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In April 2019, Cardinal Health collaborated with PANTHERx Specialty Pharmacy (US) to strengthen its cell and gene therapy offerings with a coordinated suite of specialty distribution, third-party logistics (3PL) services, and specialty pharmacy dispensing services.

- In April 2019, McKesson collaborated with Google Cloud (US) to develop new modernized applications and solutions for product manufacturing, specialty pharmaceutical distribution, and retail operations for pharmacies.

- In January 2018, AmerisourceBergen (US) acquired H. D. Smith (US) to enhance and expand AmerisourceBergen’s strategic scale and strengthen the company’s support to community pharmacies

Critical questions answered in the report:

- What are the key players operating in the market and how intense is the competition?

- Emerging countries have immense opportunities for the growth of the healthcare distribution market. Will this scenario continue in the coming years?

- What are the reasons contributing to the growth of the pharmaceutical product distribution market?

- What are the challenges hindering the adoption of healthcare distribution?

- What are the growth strategies being implemented by major market players?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Healthcare Distribution Services: Market Overview

4.2 North America: Healthcare Distribution Services Market, By Type (2018)

4.3 Europe: Healthcare Distribution Services Market, By End User (2018)

4.4 Healthcare Distribution Services Market: Geographic Growth Opportunities

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Incidence and Large Economic Burden of Chronic Diseases

5.2.1.2 Favorable R&D Investment Scenario and Subsequent Increase in Drug Launches

5.2.1.3 Growth of Track & Trace Solutions

5.2.1.4 Growing Importance of Generics

5.2.1.5 Growth of the Medical Devices Industry

5.2.2 Opportunities

5.2.2.1 Growth in the Biosimilars Market

5.2.2.2 Emerging Markets

5.2.2.3 Increasing Specialty Drug Dispensing

5.2.2.4 Increasing Uptake of Biopharmaceuticals

5.2.3 Challenges

5.2.3.1 Pricing Pressures

6 Healthcare Distribution Services Market, By Type (Page No. - 43)

6.1 Introduction

6.2 Pharmaceutical Product Distribution Services

6.2.1 Over-The-Counter Drugs/Vitamins

6.2.1.1 Sales of OTC Drugs have Risen Due to Innovations, Promotion of Self-Medication, and Increased Access

6.2.2 Brand-Name/Innovator Drugs

6.2.2.1 Rising Demand for Prescription Drugs to Support the Growth of This Market Segment

6.2.3 Generic Drugs

6.2.3.1 Government Initiatives for Promoting the Usage of Generics to Support the Growth of This Market Segment

6.3 Medical Device Distribution Services

6.4 Biopharmaceutical Product Distribution Services

6.4.1 Monoclonal Antibodies

6.4.1.1 Increasing Incidence of Cancer to Support the Growth of This Market Segment

6.4.2 Vaccines

6.4.2.1 Growing Prevalence of Infectious Diseases has Boosted Vaccine Development

6.4.3 Recombinant Proteins

6.4.3.1 Growing Applications of Recombinant Proteins in Biopharmaceuticals to Drive the Growth of This Market Segment

6.4.4 Blood and Blood Products

6.4.4.1 Increasing Number of Blood Donations and Blood Transfusions to Support the Growth of This Market Segment

6.4.5 Other Products

7 Healthcare Distribution Services Market, By End User (Page No. - 58)

7.1 Introduction

7.2 Retail Pharmacies

7.2.1 Large Volume of Prescriptions to Increase the Demand for Healthcare Distribution Services

7.3 Hospital Pharmacies

7.3.1 Significant Number of Inpatient Visits and Requirement of Large Volume of Drugs By Hospitals to Drive the Healthcare Distribution Services Market for Hospital Pharmacies

7.4 Other End Users

8 Healthcare Distribution Services Market, By Region (Page No. - 64)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.1.1 US Dominates the North American Healthcare Distribution Services Market

8.2.2 Canada

8.2.2.1 Rising Prevalence of Chronic Diseases and Increasing Market for Specialty Drugs Will Drive Market Growth in Canada

8.3 Europe

8.3.1 Germany

8.3.1.1 Germany Accounted for the Largest Share of the European Healthcare Distribution Services Market in 2018

8.3.2 France

8.3.2.1 Presence of Leading Pharmaceutical Companies in the Country Will Drive Market Growth in France

8.3.3 UK

8.3.3.1 Growth in the Pharmaceuticals Market and Increase in Research Activity Will Drive Market Growth in the UK

8.3.4 Rest of Europe

8.4 Asia Pacific

8.4.1 China and India are the Fastest-Growing Markets in the APAC

8.5 Rest of the World

9 Competitive Landscape (Page No. - 98)

9.1 Introduction

9.2 Healthcare Distribution Services Market Share Analysis (2018)

9.3 Competitive Scenario

10 Company Profiles (Page No. - 102)

10.1 McKesson Corporation

10.1.1 Business Overview

10.1.2 Solutions Offered

10.1.3 Recent Developments

10.1.4 MnM View

10.2 Cardinal Health, Inc.

10.2.1 Business Overview

10.2.2 Services Offered

10.2.3 Recent Developments

10.2.4 MnM View

10.3 AmerisourceBergen Corporation

10.3.1 Business Overview

10.3.2 Services Offered

10.3.3 Recent Developments

10.3.4 MnM View

10.4 Owens & Minor, Inc.

10.4.1 Business Overview

10.4.2 Services Offered

10.4.3 Recent Developments

10.4.4 MnM View

10.5 Morris & Dickson Co. L.L.C.

10.5.1 Business Overview

10.5.2 Services Offered

10.5.3 Recent Developments

10.6 Curascript Specialty Distribution

10.6.1 Business Overview

10.6.2 Services Offered

10.6.3 Recent Developments

10.7 FFF Enterprises, Inc.

10.7.1 Business Overview

10.7.2 Services Offered

10.7.3 Recent Developments

10.8 Medline Industries

10.8.1 Business Overview

10.8.2 Services Offered

10.8.3 Recent Developments

10.9 Attain Med, Inc.

10.9.1 Business Overview

10.9.2 Recent Developments

10.10 Dakota Drug

10.10.1 Business Overview

10.10.2 Recent Developments

11 Appendix (Page No. - 126)

11.1 Discussion Guide: Healthcare Distribution Services Market

11.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (67 Tables)

Table 1 Serialization & Aggregation Regulations, By Country/Region

Table 2 Healthcare Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 3 Pharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 4 Pharmaceutical Product Distribution Services Market, By Country, 2017–2024 (USD Billion)

Table 5 Pharmaceutical Product Distribution Services Market for OTC Drugs/Vitamins, By Country, 2017–2024 (USD Billion)

Table 6 Pharmaceutical Product Distribution Services Market for Brand-Name/Innovator Drugs, By Country, 2017–2024 (USD Billion)

Table 7 Pharmaceutical Product Distribution Services Market for Generic Drugs, By Country, 2017–2024 (USD Billion)

Table 8 Medical Device Distribution Services Market, By Country, 2017–2024 (USD Billion)

Table 9 Biopharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 10 Biopharmaceutical Product Distribution Services Market, By Country, 2017–2024 (USD Billion)

Table 11 Biopharmaceutical Product Distribution Services Market for Monoclonal Antibodies, By Country, 2017–2024 (USD Billion)

Table 12 Biopharmaceutical Product Distribution Services Market for Vaccines, By Country, 2017–2024 (USD Billion)

Table 13 Biopharmaceutical Product Distribution Services Market for Recombinant Proteins, By Country, 2017–2024 (USD Billion)

Table 14 Biopharmaceutical Product Distribution Services Market for Blood and Blood Products, By Country, 2017–2024 (USD Billion)

Table 15 Biopharmaceutical Product Distribution Services Market for Other Products, By Country, 2017–2024 (USD Billion)

Table 16 Healthcare Distribution Services Market, By End User, 2017–2024 (USD Billion)

Table 17 Healthcare Distribution Services Market for Retail Pharmacies, By Country, 2017–2024 (USD Billion)

Table 18 Healthcare Distribution Services Market for Hospital Pharmacies, By Country, 2017–2024 (USD Billion)

Table 19 Healthcare Distribution Services Market for Other End Users, By Country, 2017–2024 (USD Billion)

Table 20 Healthcare Distribution Services Market, By Region, 2017–2024 (USD Billion)

Table 21 North America: Healthcare Distribution Market, By Country, 2017–2024 (USD Billion)

Table 22 North America: Healthcare Distribution Market, By End User, 2017–2024 (USD Billion)

Table 23 North America: Healthcare Distribution Market, By Type, 2017–2024 (USD Billion)

Table 24 North America: Pharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 25 North America: Biopharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 26 US: Pharmaceutical Imports and Exports (2015)

Table 27 US: Healthcare Distribution Market, By End User, 2017–2024 (USD Billion)

Table 28 US: Healthcare Distribution Market, By Type, 2017–2024 (USD Billion)

Table 29 US: Pharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 30 US: Biopharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 31 Canada: Healthcare Distribution Market, By End User, 2017–2024 (USD Billion)

Table 32 Canada: Healthcare Distribution Market, By Type, 2017–2024 (USD Billion)

Table 33 Canada: Pharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 34 Canada: Biopharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 35 Europe: Healthcare Distribution Market, By Country, 2017–2024 (USD Billion)

Table 36 Europe: Healthcare Distribution Market, By End User, 2017–2024 (USD Billion)

Table 37 Europe: Healthcare Distribution Market, By Type, 2017–2024 (USD Billion)

Table 38 Europe: Pharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 39 Europe: Biopharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 40 Germany: Healthcare Distribution Market, By End User, 2017–2024 (USD Billion)

Table 41 Germany: Healthcare Distribution Market, By Type, 2017–2024 (USD Billion)

Table 42 Germany: Pharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 43 Germany: Biopharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 44 France: Healthcare Distribution Market, By End User, 2017–2024 (USD Billion)

Table 45 France: Healthcare Distribution Market, By Type, 2017–2024 (USD Billion)

Table 46 France: Pharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 47 France: Biopharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 48 UK: Healthcare Distribution Market, By End User, 2017–2024 (USD Billion)

Table 49 UK: Healthcare Distribution Market, By Type, 2017–2024 (USD Billion)

Table 50 UK: Pharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 51 UK: Biopharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 52 RoE: Healthcare Distribution Market, By End User, 2017–2024 (USD Billion)

Table 53 RoE: Healthcare Distribution Market, By Type, 2017–2024 (USD Billion)

Table 54 RoE: Pharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 55 RoE: Biopharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 56 Asia Pacific: Healthcare Distribution Market, By End User, 2017–2024 (USD Billion)

Table 57 Asia Pacific: Healthcare Distribution Market, By Type, 2017–2024 (USD Billion)

Table 58 Asia Pacific: Pharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 59 Asia Pacific: Biopharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 60 RoW: Healthcare Distribution Market, By End User, 2017–2024 (USD Billion)

Table 61 RoW: Healthcare Distribution Market, By Type, 2017–2024 (USD Billion)

Table 62 RoW: Pharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 63 RoW: Biopharmaceutical Product Distribution Services Market, By Type, 2017–2024 (USD Billion)

Table 64 Solution and Service Launches, 2016–2019

Table 65 Agreements, Collaborations, and Contracts, 2016–2019

Table 66 Acquisitions, 2016–2019

Table 67 Expansions, 2016–2019

List of Figures (28 Figures)

Figure 1 Healthcare Distribution Services Market Segmentation

Figure 2 Healthcare Distribution Services Market: Research Methodology

Figure 3 Research Design

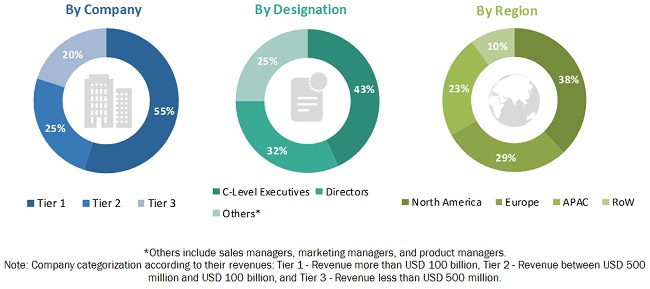

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Data Triangulation Methodology

Figure 6 Healthcare Distribution Services Market Share, By Type, 2018

Figure 7 Pharmaceutical Product Distribution Services Market Share, By Type, 2018

Figure 8 Biopharmaceutical Product Distribution Services Market Share, By Type, 2018

Figure 9 Healthcare Distribution Services Market Share, By End User, 2018

Figure 10 Geographical Snapshot of the Healthcare Distribution Services Market

Figure 11 Rising Incidence of Chronic Diseases and Availability of R&D Investments are the Key Factors Driving Market Growth

Figure 12 Pharmaceutical Product Distribution Services Segment Dominated the North American Healthcare Distribution Services Market in 2018

Figure 13 Retail Pharmacies Accounted for the Largest Share of the European Healthcare Distribution Services Market in 2018

Figure 14 Asia Pacific Market to Register the Highest Growth During the Forecast Period

Figure 15 Medical Devices Market, 2016–2020 (USD Billion)

Figure 16 Healthcare Distribution Services Market, By Type, 2019 vs 2024 (USD Billion)

Figure 17 Healthcare Distribution Services Market, By End User, 2019 vs 2024 (USD Billion)

Figure 18 Healthcare Distribution Services Market: Geographic Snapshot

Figure 19 North America: Healthcare Distribution Services Market Snapshot

Figure 20 Europe: Healthcare Distribution Services Market Snapshot

Figure 21 Y-O-Y Growth in the German Pharmaceutical Industry, 2011–2015

Figure 22 Asia Pacific: Market Snapshot

Figure 23 RoW: Market Snapshot

Figure 24 Market Share Analysis, By Key Player, 2018

Figure 25 McKesson Corporation: Company Snapshot (2018)

Figure 26 Cardinal Health: Company Snapshot (2018)

Figure 27 AmerisourceBergen Corporation: Company Snapshot (2017)

Figure 28 Owens & Minor: Company Snapshot (2017)

This study involved the extensive use of both primary and secondary sources to study various factors affecting the industry and identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the healthcare distribution market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the healthcare distribution market. The primary sources from the demand side include industry experts from hospital pharmacies, retail pharmacies, wholesalers, long-term care facilities, physician offices, clinical laboratories, specialty pharmacies, and mail-order pharmacies. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by type, end user, and region).

Data Triangulation

After arriving at the market size, the healthcare distribution market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments.

Objectives of the Study

- To define, describe, segment, and forecast the global healthcare distribution market by type, end user, and region.

- To provide detailed information about the factors influencing market growth (such as drivers, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the healthcare distribution market in four major regions—North America, Europe, the Asia Pacific, and the Rest of the World— along with the respective key countries in these regions

- To profile the key players operating in the global healthcare distribution market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments such as agreements, collaborations, partnerships, mergers, and contracts; acquisitions; expansions; and solution and service launches of the leading players operating in the healthcare distribution market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- A further breakdown of the Asia Pacific healthcare distribution market into China, Japan, India, and other Asia Pacific countries

- Detailed analysis and profiling of additional market players (up to 3)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Healthcare Distribution Market