Fungicides Market by Type (Chemical and Biological), Mode of Action (Contact and Systemic), Formulation (Liquid and Dry), Mode of Application (Foliar Spray, Seed Treatment, and Soil Treatment), Crop Type and Region - Global Forecast to 2029

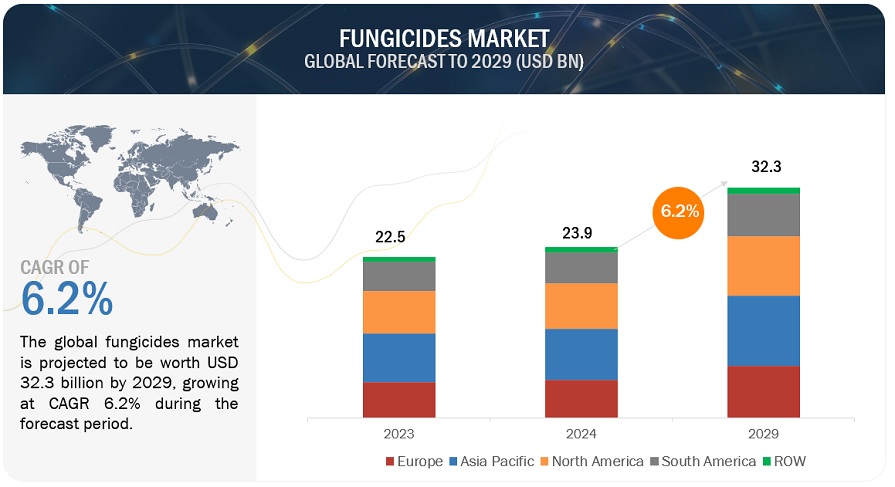

[328 Pages Report] According to MarketsandMarkets, the fungicides market is projected to reach USD 32.3 billion by 2029 from USD 23.9 billion by 2024, at a CAGR of 6.2% during the forecast period in terms of value. The global fungicides market is driven by the rapidly increasing demand for high farm yields to feed a growing global population needing effective crop-protection solutions. Intensification from climate change broadens the fit of fungal diseases, further driving fungicide demand. Formulations of fungicides coupled with advances in application technology enhance efficiency. Another factor contributing to the increase in the market is the growing awareness of sustainable agriculture and rising farming activities in developing countries. All these factors together boost the demand for innovative and proper broad-spectrum fungicide solutions across the globe.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Climate change increasing disease infestation in crops

With changing weather patterns and increased global temperatures, pests and diseases are more prone, leading to increased incidence rates of fungal diseases in crops. All these are conditions favoring increased ease of growth and spread of these fungi, thus eliciting vulnerability to a number of crop species across different regions. This puts farmers and those in agricultural production at a very high risk of failing crops, which affects productivity and profitability outright.

Fungicides are rapidly increasing, and it is imperative in modern-day crop protection strategies to counterbalance these harmful risks. High occurrences of attacks by fungal pathogens have sharply increased the use of effective fungicidal solutions that act mandatorily in crop health maintenance and yield stabilization.

Restraint : Restraints from stringent regulations in approval of new fungicide products

The fungicides market also remains under pressure from various regulatory frameworks enacted by various countries. The governments of most countries have been found to focus on environmental protection and public health, which restrains the growth of the fungicides market. Such strict regulations are in place whereby chemical fungicides are subjected to intense testing and approval processes before their utilization. This prolongs product launch time and increases the cost associated with the launch of new products. Regulation (EC) No 1107/2009 governs the marketing of Plant Protection Products (PPPs) within the European Union. Before their market availability or usage, PPPs must receive authorization in the respective EU country. This regulation establishes the guidelines and processes for PPP authorization. According to the timelines set up in Regulation (EC) No 1107/2009, the approval of active fungicide substances takes approximately 2.5 to 3.5 years. The time frame elapses from the date of admissibility to the date of publication of the regulation, which determines the approval or non-approval of the active substance.

Opportunity : Rising demand for biological fungicide

A major opportunity in the global fungicides market is the growing demand for bio-fungicides, resulting from increasing consumer awareness and regulatory pressures to adopt more sustainable ways of farming. With growing environmental concerns and organic farming initiatives, farmers and regulatory agencies are looking for substitutes for conventional chemical fungicides. Bio-fungicides, derived from natural sources, are an environmentally friendly solution and fit very well with the objectives of organic and sustainable agriculture. Therefore, these products reduce the environmental fingerprint of crop protection and help supply the rising market of health-oriented consumers who wish to consume foodstuffs produced using minimum synthesized inputs.

Challenge: Development of fungicide resistance in fungi

The development of resistance in fungal strains due to the continuous and often repetitive use of some fungicides has emerged as one of the growing challenges in the worldwide fungicides market. With the rotation of these strains, they become much less sensitive to several applied fungicidal treatments on the market today, eroding product efficacy to the level of those previously obsolete products. This resistance, in turn, not only compromises crop protection efforts but also adds more pressure on agricultural producers to find alternative solutions.

FUNGICIDES MARKET ECOSYSTEM

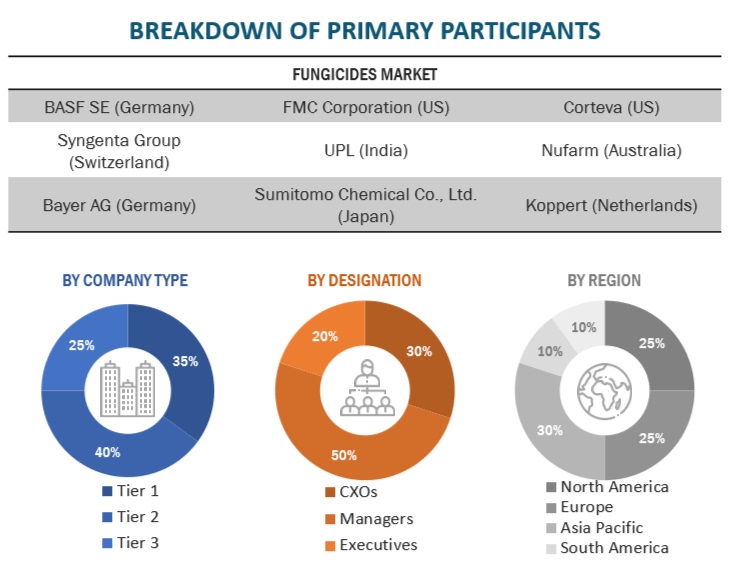

Key players within this market consist of reputable and financially robust fungicide manufacturers. These entities boast extensive industry tenure, offering diversified product portfolios, advanced technologies, and robust global sales and marketing networks. Prominent companies in this market include BASF SE (Germany), Bayer AG (Germany), Syngenta Group (Switzerland), UPL (India), Corteva (US), FMC Corporation (US), Nufarm (Australia), Sumitomo Chemical Co., Ltd. (Japan), NIPPON SODA CO, LTD. (Japan), Gowan Company (US), American Vanguard Corporation (US), Koppert (Netherlands), KUMIAI CHEMICAL INDUSTRY CO., LTD. (Japan), Albaugh LLC (US), and Sipcam Oxon Spa (Italy).

In crop type segment, cereals & grains segment to hold largest market share in global fungicides market

The cereals and grains segment hold the largest share in the fungicides market because they are critical to food security worldwide; their production must be done massively through agriculture. As staple crops, wheat, rice, and corn are extensively cultivated across varied climates and are therefore highly prone to attacks by a wide range of fungal diseases, most of which seriously affect yield and quality. The economic value of these crops and the large demand for companies to acquire them for further processing force farmers to invest heavily in efficient fungicide treatments to secure their yield. In addition, the large areas under cultivation of these cereal and grain crops multiply their requirement for uniform and continuous application, helping strengthen the dominant position of this segment in the market.

By formulation segment, liquid form segment to grow at highest rate during forecast period

The liquid form segment will grow at the highest growth rate in the fungicides market because it is easy to apply and provides uniform coverage. Liquid fungicides are easily mixed with water and other chemicals, which helps set proper dosing and distribution across crops—this, again, is very crucial when farming large acres of land. This versatility makes it possible for use with various application equipment, such as sprayers and irrigation systems, which makes them more effective in crop protection. Most of the liquid formulations also stick well to plant surfaces, offering protection from fungal infections for longer.

By type segment, biological fungicide segment to grow at highest CAGR during forecast period

The biological fungicides segment will likely witness the highest CAGR growth during the forecast period. This is due to the global rising trend in sustainable and eco-friendly farming methods. With rising pressure from consumers and regulatory agencies to reduce dependence on chemical inputs, farmers are turning to biological fungicides obtained from natural organisms like bacteria, fungi, and plant extracts. The products offer an effective, environment-friendly substitute that furthers organic agriculture and the principles of integrated pest management. Moreover, biological fungicides are generally low in toxicity, reducing their impact on non-target organisms and the environment, therefore fighting another growing concern—the presence of chemical residues in food.

In mode of action segment, contact fungicides subsegment to grow at highest rate during forecast period

The contact fungicides segment is expected to witness the highest CAGR in the fungicides market during the forecast period. This is because contact fungicides have immediate action, effectively control a broad spectrum of fungal diseases and provide immediate control over diseases. Contact fungicides kill fungi upon direct contact by creating a protective barrier on the surface of the plant tissues. This faster action is, therefore, quite beneficial in the control of outbreaks of fungal diseases, mostly where weather suddenly changes to favor the growth of fungi. Other than that, contact fungicides are less likely to induce resistance in fungi because they do not penetrate plant tissues.

Asia Pacific to dominate fungicides market during forecast period

Asia Pacific dominates the fungicides market due to the region's extensive agricultural activities, rapid population growth, and increasing demand for food security. Countries such as China, India, and Japan are major agricultural producers, cultivating crops essential to domestic consumption and global food supply chains. The diverse climatic conditions in this region make crops particularly susceptible to various fungal diseases, driving the demand for effective fungicide solutions. Additionally, the rising awareness among farmers about the benefits of using fungicides to enhance crop yields and quality, coupled with supportive government policies aimed at improving agricultural productivity, further propels market growth in the Asia Pacific. As the region continues modernizing its farming practices and expanding its agricultural output, its dominance in the fungicides market is expected to strengthen.

Key market players

The key players in this market include BASF SE (Germany), Bayer AG (Germany), Syngenta Group (Switzerland), UPL (India), Corteva (US), FMC Corporation (US), Nufarm (Australia), Sumitomo Chemical Co., Ltd. (Japan), NIPPON SODA CO, LTD. (Japan), Gowan Company (US), American Vanguard Corporation (US), Koppert (Netherlands), KUMIAI CHEMICAL INDUSTRY CO., LTD. (Japan), Albaugh LLC (US), and Sipcam Oxon Spa (Italy). These market participants emphasize expanding their footprint via agreements and partnerships. They maintain a robust presence in North America, Asia Pacific, South America, RoW, and Europe, and they are supported by manufacturing facilities and well-established distribution networks spanning these regions.

Want to explore hidden markets that can drive new revenue in Fungicides Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Fungicides Market?

|

Report Metric |

Details |

|

Market size available for years |

2024–2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2029 |

|

Forecast units |

Value (USD Million) and Volume (Kilotons) |

|

Segments covered |

By Type, Crop Type, Mode of Application, Mode of Action, Formulation, and Region |

|

Geographies covered |

North America, Europe, South America, Asia Pacific, and RoW |

|

Companies covered |

|

This research report categorizes the fungicides market based on type, crop type, mode of application, mode of action, formulation, and region.

Target Audience

- Fungicides traders, retailers, and distributors

- Fungicides manufacturers & suppliers

- Related government authorities, commercial research & development (R&D) institutions.

- Regulatory bodies, including government agencies and NGOs.

- Commercial research & development (R&D) institutions and financial institutions.

- Government and research organizations.

- Venture capitalists and investors.

- Technology providers to Fungicides companies.

- Associations and industry bodies.

Fungicides Market:

By Type

- Chemical Fungicides

- Biological Fungicides

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Other Crop Types

By Mode of Application

- Foliar Spray

- Soil Treatment

- Seed Treatment

- Other Modes of Application

By Mode of Action

- Contact

- Systemic

By Formulation

- Liquid

- Dry

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent developments

- In June 2024, BASF SE launched its new rice fungicide, Cevya (400g/L mefentrifluconazole), in China that features the active ingredient Revysol (mefentrifluconazole) for effective prevention and control of rice false smut.

- In August 2023, Bayer AG invested USD 231.3 million to construct a new R&D facility at its Monheim site. This investment marked Germany's largest single financial commitment towards crop protection in the last four decades. The R&D facility was designed to accommodate approximately 200 employees. By implementing advanced safety measures, including early safety screens and Artificial Intelligence (AI), Bayer aimed to develop the next generation of safe and sustainable crop protection products. This will help develop new fungicide products.

- In March 2023, Corteva acquired Stoller, one of the largest independent companies in the biologicals sector, headquartered in Houston, Texas. This acquisition will strengthen Corteva’s dedication to offering farmers environmentally friendly, sustainable solutions that align with advancing farming practices and demonstrate proven effectiveness.

Frequently Asked Questions (FAQ):

Which are major companies in fungicides market? What are their major strategies to strengthen their market presence?

The key players in this include BASF SE (Germany), Bayer AG (Germany), Syngenta Group (Switzerland), UPL (India), Corteva (US), FMC Corporation (US), Nufarm (Australia), Sumitomo Chemical Co., Ltd. (Japan), NIPPON SODA CO, LTD. (Japan), Gowan Company (US), American Vanguard Corporation (US), Koppert (Netherlands), KUMIAI CHEMICAL INDUSTRY CO., LTD. (Japan), Albaugh LLC (US), and Sipcam Oxon Spa (Italy). These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, and Europe. They also have manufacturing facilities and strong distribution networks across these regions.

What are drivers and opportunities for fungicides market?

The growth drivers for the fungicides market include rising global food demands, climate variability increasing the risk of fungal diseases, and improvements in formulation and application technologies. In addition, the agricultural sectors of the emerging markets are expanding. This has introduced more fungicide uses. Other opportunities in the market include trends in biological fungicides, which are driven by a concern for sustainability; new formulations of fungicides that help address resistance issues; and fungicide integration into integrated pest management strategies. In addition, there are ever-growing opportunities for fungicides with advanced solutions to enhance application efficiency and effectiveness through emerging precision agriculture technologies.

Which region is expected to hold largest market share?

Asia Pacific region is expected to hold the largest share in the global fungicides market, driven by the rapid economic development and modernization of agriculture within the region. Growing investments in agriculture, associated infrastructure, and innovation give better access to new crop protection solutions, including fungicides, to farmers. Besides, the extensive and diversified agricultural practices raise the demand for fungicides to control several fungal diseases efficiently. Furthermore, the growth of large-scale commercial farming and increasing concentration toward achieving improved productivity and efficiency in agriculture are driving forces toward high market share in the Asia Pacific region for the global fungicides market.

What are key technology trends prevailing in fungicides market?

New trends in technologies for fungicides include the development of novel formulation and precision application technologies. The application of fungicides becomes more accurate and effective in targeting specific areas of infection by avoiding wastage through precision agriculture technologies such as drones and remote sensing. Besides, controlled-release and nano-encapsulation formulation innovations can increase fungicides' efficacy and residual life by improving adhesion to plant surfaces and enhancing targeted delivery. These developments contribute to boosting the potency of fungicides and are in line with sustainable agriculture since they reduce the environmental impact and maximize the use of resources.

What is total CAGR expected to be recorded for fungicides market during forecast period?

The CAGR is expected to record as of 6.2% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

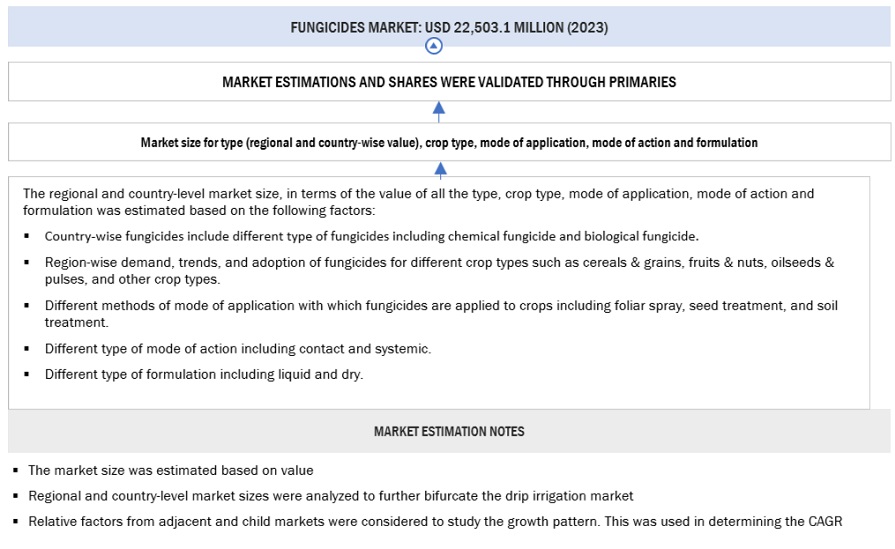

The study involved four major activities in estimating the current size of the fungicides market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the fungicides market.

In the secondary research process, various sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles from recognized authors, gold & silver standard websites, directories, and databases were referred to identify and collect information. This research study involved the extensive use of secondary sources—directories and databases such as Bloomberg Businessweek and Factiva—to identify and collect information useful for a technical, market-oriented, and commercial study of the fungicides market.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives.

Primary Research

Extensive primary research was conducted after obtaining information regarding the fungicides market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, research, and development teams, and related key executives from distributors and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, crop type, mode of application, mode of action, formulation, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

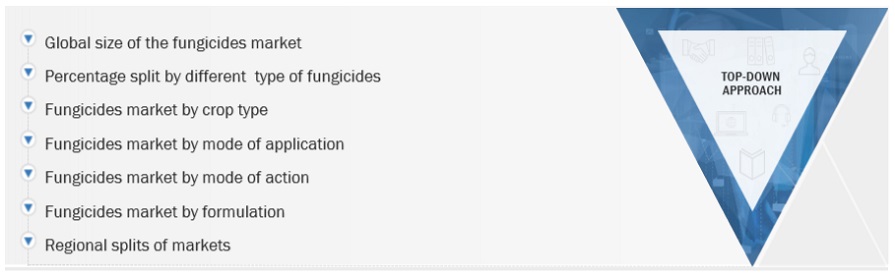

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the fungicides market. These approaches were also used extensively to estimate the size of various dependent submarkets. The research methodology used to estimate the market size includes the following:

- Key players were identified through extensive secondary research.

- The industry’s value chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The following figure provides an illustrative representation of the complete market size estimation process implemented in this research study for an overall estimation of the fungicides market in a consolidated format.

The following sections (bottom-up & top-down) depict the overall market size estimation process employed for the purpose of this study.

Global Fungicides Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Fungicides Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to estimate the overall fungicides market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Fungicide is a type of pesticide that is used to destroy or prevent the growth of fungi and their spores. They are applied to crops to protect them from fungi, such as rust, mildew, mold, and blight. They function in different ways, though most damage fungal cell membranes or interfere with energy production within fungal cells.

Key Stakeholders

- Fungicide manufacturers, formulators, and blenders

- Pesticides traders, suppliers, distributors, importers, and exporters

- Raw material suppliers and technology providers to manufacturers

- Agricultural co-operative societies

- Fungicide associations and industry bodies:

- Food and Agriculture Organization (FAO)

- European Crop Protection Agency (ECPA)

- Pesticides Manufacturers and Formulators Association (PMFAI)

- China Crop Protection Industry Association (CCPIA)

- Government agricultural departments and regulatory bodies:

- US Environmental Protection Agency (EPA)

- Canadian Food Inspection Agency (CFIA)

- US Department of Agriculture (USDA)

- European Chemical Agency (ECHA)

- European Food Safety Authority (EFSA)

Report Objectives

MARKET INTELLIGENCE

- Determining and projecting the size of the fungicides market with respect to type, crop type, mode of application, mode of action, formulation, and region.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments

- Providing detailed information about the key factors influencing the market growth (drivers, restraints, opportunities, and industry-specific challenges)

- Providing the regulatory framework and market entry process related to the fungicides market

- Analyzing the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

COMPETITIVE INTELLIGENCE

- Identifying and profiling the key players in the fungicides market

- Providing a comparative analysis of market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the country

- Providing insights on key product innovations and investments in the fungicides market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

PRODUCT ANALYSIS

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

GEOGRAPHIC ANALYSIS

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of Europe into Belgium, Poland, and Portugal.

- Further breakdown of the Rest of Asia Pacific into Malaysia, South Korea, and Vietnam.

- Further breakdown of the Rest of South America into Peru, Colombia, and Paraguay.

COMPANY INFORMATION

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Fungicides Market