Fraud Detection and Prevention Market Size, Share, Growth Analysis by Offering (Solutions (Fraud Analytics, Authentication, and GRC) and Services (Professional and Managed)), Fraud Type, Deployment Mode, Vertical and Region - Global Forecast to 2029

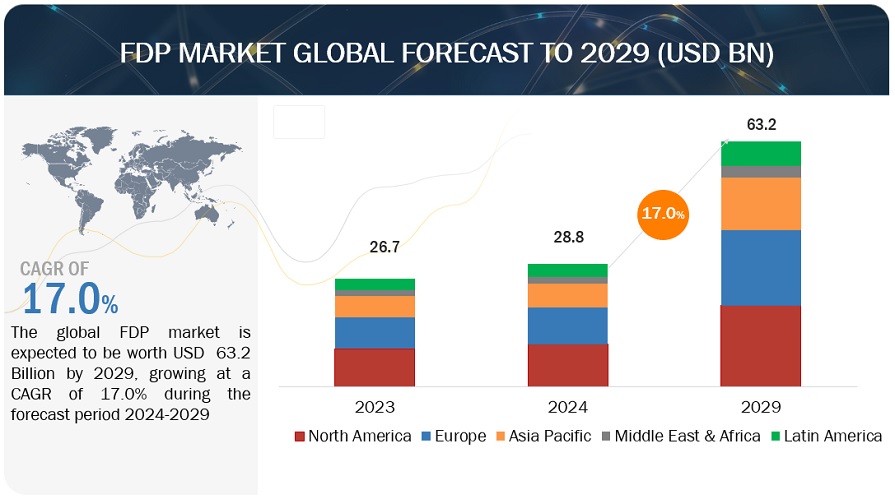

[516 Pages Report] The Fraud Detection And Prevention (FDP) Market size is projected to grow from USD 28.8 billion in 2024 to USD 63.2 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 17.0% during the forecast period. The key driver of fraud detection and prevention is the proliferation of mobile devices, and digital payment methods have created new opportunities for fraudsters to exploit vulnerabilities. Fraud detection solutions are constantly upgrading to adapt to the changing landscape of mobile and digital transactions, incorporating specialized capabilities for detecting mobile fraud patterns.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

FRAUD DETECTION AND PREVENTION MARKET DYNAMICS

Driver: Rise of synthetic identities

According to the McKinsey Institute, synthetic identity fraud is currently the fastest-growing form of financial crime in the US and is also experiencing an increase globally. Presently, it constitutes 85% of all fraud cases. This fraud involves perpetrators amalgamating genuine personal information with fabricated identifiers to craft new identities. They blend authentic data fragments with false details to establish entirely new personas. Organizations face significant challenges in combatting synthetic identity fraud since its essence lies in creating fictitious victims that lack real-life existence. Lenders face staggering exposure, with an estimated USD 3 billion in losses attributed to synthetic identity fraud across credit cards, auto loans, and unsecured loans. The surge in digital transactions and the accessibility of AI tools likely contribute to the escalation of fraud losses. AI is poised to facilitate synthetic identity theft, with platforms capable of swiftly generating synthetic customer data to link with existing Social Security Numbers. Furthermore, AI can streamline the credit application process online, as institutions often require minimal identity verification for digital presence establishment.

Although distinct from AI-generated fraud, which involves the creation of deepfakes or mimicking biometrics, synthetic identity theft is anticipated to evolve with AI assistance. Moving forward, organizations will intensify efforts to combat synthetic fraud by investing in solutions such as behavioral biometrics. These technologies scrutinize individuals' social media usage and credit activities over recent years to detect abnormal patterns, thereby impeding the proliferation of forged identities.

Restraint: False Positives

False positives present a challenge in fraud detection and prevention. Overly sensitive fraud detection systems may flag legitimate transactions as suspicious, leading to unnecessary delays, inconvenience for customers, and potential damage to customer relationships. Moreover, excessive false positives can strain resources and undermine the efficiency of fraud detection efforts. Mitigating false positives requires fine-tuning detection algorithms, incorporating contextual information into decision-making processes, and continuously refining detection strategies to balance accuracy and efficiency in identifying fraudulent activities. 69% of global buyers are reducing their spending, as reported by PwC, so it's imperative not to miss out on transactions. False positives are a direct path to customer attrition, with 25% of buyers who experience unjustified purchase rejections switching to a competitor. When a genuine customer is blocked, a genuine sale is blocked. The cost of false positives for online merchants is USD 443 billion annually. The cost of actual credit card fraud is estimated to cost online merchants USD 408 billion over the next decade. According to Forbes, one-third of shoppers in the US who encounter a false decline state said that they won't patronize the same merchant again. This figure increases to two-fifths in Europe.

Opportunity: Increasing use of predictive analytics in FDP

The opportunity presented by predictive analytics lies in its capacity to empower organizations to foresee and preempt fraudulent activities before they materialize. By harnessing predictive analytics and machine learning algorithms, businesses can analyze vast datasets to identify patterns, trends, and anomalies indicative of potential fraud. This proactive approach enables organizations to implement preemptive measures, such as enhanced authentication protocols, transaction monitoring, and anomaly detection, to thwart fraudulent attempts before they inflict financial losses or reputational damage. Leveraging predictive analytics enhances the efficacy of fraud detection and prevention efforts and streamlines resource allocation by focusing on high-risk areas. Ultimately, organizations equipped with predictive analytics capabilities can stay one step ahead of fraudsters, fortifying their defenses and safeguarding their assets and stakeholders more effectively. Companies providing predictive analytics tools include SAP Analytics Cloud for healthcare, marketing, and manufacturing, Alteryx AI Platform for finance and supply chain, and Tableau for retail.

Challenge: Cross-Channel Fraud

Due to its multifaceted nature, cross-channel fraud poses a significant challenge to fraud detection and prevention efforts. Fraudsters adeptly exploit various channels, including online platforms, mobile apps, and in-person transactions, to perpetrate fraudulent activities. The interconnectedness of these channels complicates detection efforts, as fraudulent behaviors may manifest differently across different touchpoints, making it difficult to discern patterns and identify suspicious activities. Recent instances of cross-channel fraud include fraudulent money transfers to fictitious deposits or mule accounts, followed by cash withdrawals from ATMs. Often, innocent third parties unwittingly become accomplices in these fraudulent activities. In October 2021, QIIB, one of Qatar’s leading banks, recently selected IBM to deliver cross-channel fraud prevention to its customers. This supports QIIB’s aim to provide its customers with the ability to bank securely while offering an innovative and positive customer experience.

Fraud Detection and Prevention Market Ecosystem

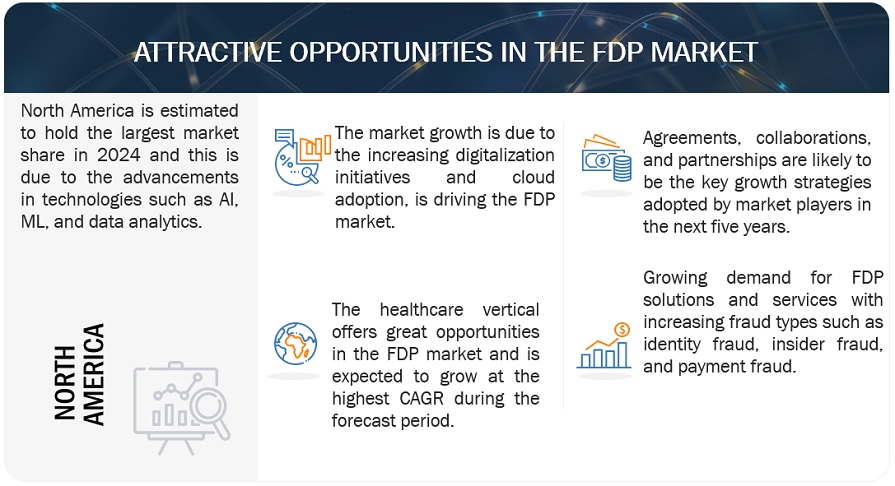

By vertical, Healthcare is expected to grow at the highest CAGR during the forecast period.

Fraud detection and prevention solutions are gaining traction within the healthcare vertical as organizations seek to combat fraudulent activities such as billing scams, identity theft, and prescription fraud. Leveraging advanced technologies such as machine learning and data analytics, these solutions enable healthcare providers to proactively identify irregularities in claims, patient records, and financial transactions. By implementing robust fraud detection measures, healthcare organizations can protect themselves from financial losses, uphold the integrity of patient data, and ensure compliance with regulatory requirements. As the healthcare industry becomes increasingly digitized, adopting such solutions is essential for safeguarding patient trust and maintaining the overall integrity of the healthcare system.

By organization size, the SME segment is expected to grow at the highest CAGR during the forecast period.

SMEs increasingly recognize the value of fraud detection and prevention solutions in navigating complex regulatory landscapes and mitigating operational risks. By implementing such solutions, SMEs can proactively mitigate risks associated with fraud, such as fraudulent transactions, identity theft, and internal malpractice. Moreover, as cyber threats continue to evolve, adopting robust fraud detection and prevention measures becomes imperative for SMEs to maintain trust among customers and stakeholders, fostering sustainable growth and resilience in today's dynamic business landscape.

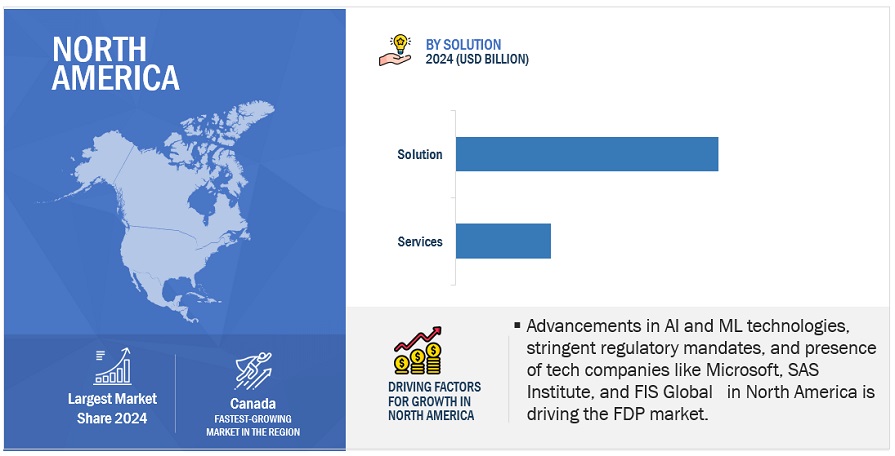

By region, North America accounts for the highest market size during the forecast period.

North America will lead the fraud detection and prevention market during the forecast period. The US and Canada are expected to contribute substantially to the North American market. The presence of key players such as Fiserv, Microsoft Corporation, SAS, and FIS Global makes it a leading region in the fraud detection and prevention market. The increasing implementation of cloud adoption, growing data breaches, and other cyber threats contribute to the region's fraud detection and prevention market growth.

Key Market Players

The key players in the fraud detection and prevention market are Fiserv (US), FIS Global (US), LexisNexis Risk Solutions (US), TransUnion (US), Experian (Ireland), NICE Actimize (US), ACI Worldwide (US), SAS Institute (US), RSA Security (US), SAP (Germany), FICO (US), Software AG (Germany), Microsoft (US), F5 (US), AWS (US), Bottomline Technologies (US), ClearSale (Brazil), Genpact (US), Securonix (US), Accertify (US), Feedzai (Portugal), Caseware (US), OneSpan (US), Signifyd (US), BioCatch (Israel), Friss (Netherlands), MaxMind (US), DataVisor (US), Cleafy (Italy), Gurucul (US), Riskified (Israel and US), Thomson Reuters (US), Sift (US), NoFraud (US), Featurespace (UK), HUMAN Security (US), XTN Cognitive Security (Italy), Equifax (US), Alloy (US), Castle (US), Enzoic (US), Kubient (US), SpyCloud (US), SEON (Hungary), Deduce (US), Incognia (US), Resistant AI (Czech Republic), Alfa Group (Italy) and Amani Technologies (UAE).

Want to explore hidden markets that can drive new revenue in Fraud Detection and Prevention Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Fraud Detection and Prevention Market?

|

Report Metrics |

Details |

|

Market size available for years |

|

|

Base year considered |

|

|

Forecast period |

|

|

Forecast units |

|

|

Segments Covered |

|

|

Geographies covered |

|

|

Companies covered |

|

The study categorizes the fraud detection and prevention market into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America.

By Fraud Type:

- Check Fraud

- Identity Fraud

- Insider Fraud

- Investment Fraud

- Payment Fraud

- Insurance Fraud

- Friendly Fraud

- Others

By Offering:

-

Solutions

-

Fraud Analytics

- Predictive Analytics

- Descriptive Analytics

- Prescriptive Analytics

- SNA

- Text Analytics

- Behavioral analytics

-

Authentication

- Single-factor Authentication (SFA)

- Multi-factor Authentication (MFA)

- GRC

-

Fraud Analytics

-

Services

-

Professional

- Risk Assessment

- Consulting and Training

- Implementation and Support

- Managed

-

Professional

By Deployment Mode:

- Cloud

- On-Premises

By Organization Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Vertical:

-

Banking, Financial Services, and Insurance (BFSI)

- Banking and Financial Institutes

- Insurance

- Retail & eCommerce

- Government

- Healthcare

- Manufacturing

- Travel & Transportation

- Real Estate

- Telecommunications

- Others

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Spain

- Italy

- Poland

- Ireland

- Czech Republic

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- AnZ

- Singapore

- Rest of Asia Pacific

-

Middle East and Africa

-

Middle East

-

GCC

- UAE

- KSA

- Rest of GCC

-

GCC

- South Africa

- Rest of the Middle East & Africa

-

Middle East

-

Latin America

- Brazil

- Mexico

- Colombia

- Rest of Latin America

Recent Developments

- In March 2024, FIS partnered with Stratyfy, an alumnus of the FIS Fintech Accelerator, to enhance its SecurLOCK card fraud management solution. This collaboration aims to significantly increase the accuracy of identifying and preventing fraudulent card transactions.

- In November 2023, LexisNexis Risk Solutions announced a new alliance with Agenium, a leader in disruptive platform technology, to integrate data and analytics into the life insurance application process, delivered through an innovative, no-code configurable platform.

- In September 2022, Fiserv acquired The LR2 Group, which operates as The City POS. The City POS provides payment processing and point-of-sale services. The City POS has been an important ISO partner of Fiserv for over a decade.

Frequently Asked Questions (FAQ):

What are the opportunities in the fraud detection and prevention market?

Fraud detection and prevention opportunities are expanding as technology advances and data analytics become more sophisticated. With the proliferation of digital transactions and online interactions, there's a growing need for innovative solutions to combat fraudulent activities across various industries. From machine learning algorithms that can identify suspicious patterns in financial transactions to biometric authentication methods for securing sensitive information, the landscape of fraud detection and prevention is ripe for innovation. Additionally, blockchain technology offers new possibilities for creating secure and transparent transaction networks.

What is the definition of the fraud detection and prevention market?

The process of finding fraudulent activity in a system and utilizing the resources to mitigate those risks is termed fraud detection. And utilizing automated tools and predictive analytics methods to discover the vulnerability is termed fraud prevention.

Which region is expected to show the highest market share in fraud detection and prevention?

North America is expected to account for the largest market share during the forecast period.

Which are the key drivers supporting the market growth for IT operations analytics market?

Major vendors in the fraud detection and prevention market include Fiserv (US), FIS Global (US), Lexisnexis Risk Solutions (US), TransUnion (US), Experian (Ireland), NICE Actimize (US), ACI Worldwide (US), SAS Institute (US), RSA Security (US), SAP (Germany), FICO (US), Software AG (Germany), Microsoft (US), F5 (US), AWS (US), Bottomline Technologies (US), ClearSale (Brazil), Genpact (US), Securonix (US), Accertify (US), Feedzai (Portugal), Caseware (US), OneSpan (US), Signifyd (US), BioCatch (Israel), Friss (Netherlands), MaxMind (US), DataVisor (US), Cleafy (Italy), Gurucul (US), Riskified (Israel and US), Thomson Reuters (US), Sift (US), NoFraud (US), Featurespace (UK), HUMAN Security (US), XTN Cognitive Security (Italy), Equifax (US), Alloy (US), Castle (US), Enzoic (US), Kubient (US), SpyCloud (US), SEON (Hungary), Deduce (US), Incognia (US), Resistant AI (Czech Republic), Alfa Group (Italy), and Amani Technologies (UAE).

What is the current size of the fraud detection and prevention market?

The fraud detection and prevention market size is projected to grow from USD 28.8 billion in 2024 to USD 63.2 billion by 2029 at a Compound Annual Growth Rate (CAGR) of 17.0% during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased use of digital technologies and IoT- Increased revenue losses and chargebacks due to fraud- Increased adoption of fraud analytics and risk-based authentication solutions to combat fraudRESTRAINTS- Rise in fraud complexity- Budgetary issues in developing in-house fraud detection solution- Lack of infrastructure to support AI and MLOPPORTUNITIES- Increased adoption of advanced technologies- Adoption of batch, streaming, and predictive analytics for real-time fraud detection- Growing need to protect SMEs from fraudCHALLENGES- Lack of trained professionals to analyze fraud attacks- Lack of awareness related to digital fraud in organizations

-

5.3 ECOSYSTEMECOSYSTEM/MARKET MAP

- 5.4 FRAUD DETECTION AND PREVENTION FRAMEWORK

-

5.5 TECHNOLOGY ANALYSISFRAUD DETECTION AND ARTIFICIAL INTELLIGENCEFRAUD DETECTION AND DATA ANALYTICSFRAUD DETECTION AND INTERNET OF THINGSFRAUD DETECTION AND REAL-TIME AUTHENTICATION

-

5.6 TARIFF AND REGULATORY LANDSCAPEINTRODUCTIONPAYMENT SERVICE DIRECTIVE/STRONG CUSTOMER AUTHENTICATION COMPLIANCEPAYMENT CARD INDUSTRY DATA SECURITY STANDARDINFORMATION TECHNOLOGY (IT) ACT, 2000GENERAL DATA PROTECTION REGULATION COMPLIANCEANTI-MONEY LAUNDERING/COMBATING FINANCING OF TERRORISM COMPLIANCEBANK SECRECY ACTPERSONAL INFORMATION PROTECTION AND ELECTRONIC DOCUMENTS ACTREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.7 PATENT ANALYSIS

-

5.8 HISTORY OF FRAUD DETECTION AND PREVENTION1990S2000–20102010–20202020–2030

-

5.9 VALUE CHAIN ANALYSISFRAUD DETECTION AND PREVENTION SOLUTIONS AND SERVICES PROVIDERSREGULATORY AUTHORITIES, INCLUDING GOVERNMENT OR INDUSTRY ASSOCIATIONSSOLUTION DESIGNERS AND DEVELOPERS/CONSULTANTSSYSTEM INTEGRATORSRESELLERSEND USERS

- 5.10 PRICING ANALYSIS

-

5.11 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.12 USE CASESUSE CASE 1: SIGNIFYD HELPED BHFO MANAGE FRAUD AND ELIMINATE UNNECESSARY CUSTOMER FRICTIONUSE CASE 2: KOUNT HELPED GETTY IMAGES REDUCE CHARGEBACKS AND STAY AHEAD OF FRAUDUSE CASE 3: ACCERTIFY HELPED GUITAR CENTER DOUBLE FRAUD SAVINGS AND REDUCE FRAUD LOSSES BY 62%USE CASE 4: RISKIFIED HELPED WAYFAIR REDUCE FRAUD COST BY 60%

- 5.13 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESS

- 5.15 KEY CONFERENCES AND EVENTS IN 2023–2024

-

6.1 INTRODUCTIONFRAUD TYPES: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

-

6.2 CHECK FRAUDRISING CHECK FRAUD DUE TO TECHNOLOGICAL ADVANCEMENTS AND ECONOMIC CONDITIONS TO DRIVE MARKET

-

6.3 IDENTITY FRAUDRISING CONSUMER PENETRATION IN DIGITAL PLATFORMS FOR BANKING AND OFFICIAL PURPOSES TO PROPEL MARKET

-

6.4 INSIDER FRAUDDIGITAL ACCESS TO CRITICAL BUSINESS INFORMATION TO EMPLOYEES ACCELERATING INSIDER FRAUD TO DRIVE MARKET

-

6.5 INVESTMENT FRAUDRISING ILLEGAL SALE OF FINANCIAL INSTRUMENTS DUE TO INCREASING ADOPTION OF BLOCKCHAIN AND CRYPTOCURRENCIES TO BOOST MARKET

-

6.6 PAYMENT FRAUDGROWING USE OF CREDIT AND DEBIT CARDS AND DIGITALIZATION OF MONETARY TRANSACTIONS TO DRIVE MARKET

-

6.7 INSURANCE FRAUDGROWING DEMAND FOR ANALYTICS AND COMPLIANCE SOLUTIONS TO SAFEGUARD POLICYHOLDERS TO DRIVE MARKET

-

6.8 FRIENDLY FRAUDIMPROVING CUSTOMER COMMUNICATION AND OPTIMIZING FRAUD DETECTION SYSTEMS TO COMBAT FRIENDLY FRAUD TO PROPEL MARKET

- 6.9 OTHER FRAUDS

-

7.1 INTRODUCTIONOFFERINGS: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

-

7.2 SOLUTIONSSOLUTIONS: FRAUD DETECTION AND PREVENTION MARKET DRIVERSFRAUD ANALYTICS- Surge to analyze enterprises’ systems and databases to identify vulnerabilities to prevent fraud to drive market- Predictive analytics- Descriptive analytics- Prescriptive analytics- SNA- Text analytics- Behavioral analyticsAUTHENTICATION- Need to maintain authenticity of transactions by blocking unauthorized access and identifying false input to boost market- SFA- Multi-factor authentication- RBAGOVERNANCE, RISK, AND COMPLIANCE- Growing need to detect identity fraud, payment fraud, and anti-money laundering scams to drive market

-

7.3 SERVICESSERVICES: FRAUD DETECTION AND PREVENTION MARKET DRIVERSPROFESSIONAL SERVICES- Surging deployment of specialized services to identify, prevent, and mitigate fraud risks by organizations to boost market- Risk assessment- Consulting services- Training and education- ImplementationMANAGED SERVICES- Need to monitor, investigate, assess risk management, and create strategies to prevent fraud to propel market

-

8.1 INTRODUCTIONDEPLOYMENT MODES: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

-

8.2 CLOUDDEMAND FOR CLOUD FROM SMES DUE TO ITS COST-EFFECTIVENESS AND EASE OF SECURING APPLICATIONS TO BOOST DEMAND

-

8.3 ON-PREMISESNEED TO PROVIDE FULL CONTROL OVER PLATFORMS, SYSTEMS, AND DATA TO ORGANIZATIONS TO PROPEL GROWTH

-

9.1 INTRODUCTIONORGANIZATION SIZE: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

-

9.2 SMALL AND MEDIUM-SIZED ENTERPRISESRISING NEED TO PROTECT APPLICATIONS FROM VULNERABILITIES AND ATTACKS AND ENHANCE SECURITY SYSTEM IN SMES TO DRIVE MARKET

-

9.3 LARGE ENTERPRISESREQUIREMENT FROM LARGE ENTERPRISES TO SECURE NETWORKS AND SYSTEMS TO BOOST DEMAND FOR FRAUD DETECTION SOLUTIONS

-

10.1 INTRODUCTIONVERTICALS: FRAUD DETECTION AND PREVENTION MARKET DRIVERS

-

10.2 BANKING, FINANCIAL SERVICES, AND INSURANCEBANKING AND FINANCIAL INSTITUTES- Need to prevent card skimming, SMS phishing, viruses, cyberstalking, trojans, and identity theft to drive marketINSURANCE- Increased digitalization of insurance driving organized criminal fraud and insurance fraud to boost market

-

10.3 RETAIL AND ECOMMERCELARGE NUMBER OF MONETARY TRANSACTIONS THROUGH DIGITAL CHANNELS AND FRAUDULENT TRANSITIONS TO BOOST MARKET

-

10.4 GOVERNMENTDEPLOYMENT OF DIGITAL APPLICATIONS TO HANDLE CRITICAL DATA BY GOVERNMENT INSTITUTES TO DRIVE MARKET

-

10.5 HEALTHCARENEED TO SECURE PRIVATE AND HIGHLY CONFIDENTIAL HEALTHCARE DATA AND PRESERVE TRUST AMONG PATIENTS TO PROPEL MARKET

-

10.6 MANUFACTURINGEXPOSURE OF MANUFACTURING ENTERPRISES TO CYBER THREATS DUE TO INCREASING DIGITAL TRANSFORMATION TO DRIVE MARKET

-

10.7 TRAVEL AND TRANSPORTATIONSURGE TO PREVENT FRAUDSTERS FROM TARGETING LOYALTY ACCOUNTS AND STORE VALUE FROM MISUSING TRAVEL DATA TO BOOST MARKET

-

10.8 REAL ESTATEGROWING PROPERTY FLIPPING FRAUD, MORTGAGE FRAUD, FORECLOSURE FRAUD, AND RENTAL FRAUD TO DRIVE MARKET

-

10.9 TELECOMMUNICATIONSRISING ONLINE FRAUDS, FAKE IDENTITIES, FRAUDULENT CALLS, IDENTITY THEFTS, AND CALLING CARD FRAUD TO DRIVE MARKET

- 10.10 OTHER VERTICALS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPEUS- Technological advancements, increasing use of online banking portals, and evolving fraud trends to drive marketCANADA- Increased fraudulent activities and cybercrimes giving rise to government initiatives to propel market

-

11.3 EUROPEEUROPE: FRAUD DETECTION AND PREVENTION MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPEUK- Increased losses due to fraud-related crimes and government initiatives to curb them to boost marketGERMANY- Rising identity theft and stolen personal information, phishing scams, and financial crimes to drive marketFRANCE- Stringent regulations to prevent financial crimes, money laundering, and terrorism to fuel marketSPAIN- Vulnerability to fraud for being hub for business and economic activities to drive marketITALY- Continued investment in technology and awareness regarding cybersecurity to drive marketPOLAND- Government initiatives and measures to combat fraud and investment in advanced technology to boost marketIRELAND- Increasing financial losses caused by fraud and other cybercrimes and concerns from financial institutions to boost marketCZECH REPUBLIC- Rising fraud, embezzlement, and money laundering in finance, insurance, and real estate sectors to drive marketREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPECHINA- Growing threat of online scammers and rising telecom and internet fraud to boost marketJAPAN- Growing risk of fraud due to rapid digitalization of advanced economy and partnerships with overseas FDP vendors to boost marketAUSTRALIA AND NEW ZEALAND- Surge in fraud-related attacks and regulatory requirements to improve data security and customer privacy to fuel marketINDIA- Increased internet penetration, improved telecom services, and government initiatives to drive marketSINGAPORE- Technological advancement, global connectivity, sophistication of cybercriminals, and human vulnerabilities to drive marketREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY LANDSCAPEUAE- Increasing prevalence of fraudulent activities and high-intensity fraud-combatting regulations adopted by government to drive marketKSA- Guidelines adopted by Saudi Arabian Monetary Authority (SAMA) to prevent and detect fraud to boost marketSOUTH AFRICA- Growing digitalization and internet usage leading to increased frauds and cybercrimes to drive marketREST OF MIDDLE EAST & AFRICA

-

11.6 LATIN AMERICALATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Increased digital transactions, rising eCommerce platforms, and need for innovative solutions to combat fraud to drive marketMEXICO- Increased fraud and financial crimes, need for cybersecurity solutions, and growing fintech industry to drive marketCOLOMBIA- Increased financial crimes and additional investment in advanced technologies to drive marketREST OF LATIN AMERICA

- 12.1 OVERVIEW

- 12.2 HISTORICAL REVENUE ANALYSIS

- 12.3 VALUATION AND FINANCIAL METRICS OF KEY FRAUD DETECTION AND PREVENTION VENDORS

- 12.4 FRAUD DETECTION AND PREVENTION MARKET: RANKING OF KEY PLAYERS

- 12.5 MARKET SHARE ANALYSIS

-

12.6 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 12.7 COMPETITIVE BENCHMARKING

-

12.8 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING FOR STARTUPS/SMES

-

12.9 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHES & ENHANCEMENTSDEALS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSFISERV- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFIS GLOBAL- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLEXISNEXIS RISK SOLUTIONS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBAE SYSTEMS- Business overview- Products/Solutions/Services offered- MnM viewTRANSUNION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewEXPERIAN- Business overview- Products/Solutions/Services offered- Recent developmentsNICE ACTIMIZE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewACI WORLDWIDE- Business overview- Products/Solutions/Services offered- Recent developmentsSAS INSTITUTE- Business overview- Products/Solutions/Services offeredRSA SECURITY- Business overview- Products/Solutions/Services offered- Recent developmentsSAP- Business overview- Products/Solutions/Services offeredFICO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSOFTWARE AG- Business overview- Products/Solutions/Services offeredMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developmentsNEUSTAR- Business overview- Products/Solutions/Services offered- Recent developmentsF5- Business overview- Products/Solutions/Services offered- Recent developmentsINGENICO- Business overview- Products/Solutions/Services offeredAWS- Business overview- Products/Solutions/Services offered- Recent developmentsBOTTOMLINE TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developmentsCLEARSALE- Business overview- Products/Solutions/Services offered- Recent developmentsGENPACT- Business overview- Products/Solutions/Services offered

-

13.3 OTHER KEY PLAYERSKOUNTSECURONIXACCERTIFYFEEDZAICASEWAREPERIMETER XONESPANSIGNIFYDBIOCATCHFRISSMAXMINDDATAVISORCLEAFYGURUCULPONDERA SOLUTIONSRISKIFIEDALLOYCASTLESIFTNOFRAUDFEATURESPACEENZOICMERLON AIKUBIENTSPYCLOUDSEONNETHONETRUSTCHECKRDEDUCEINCOGNIARESISTANT AI

- 14.1 LIMITATIONS

- 14.2 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET

- 14.3 ANTI-MONEY LAUNDERING MARKET

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2017–2021

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 FRAUD DETECTION AND PREVENTION MARKET: ASSUMPTIONS

- TABLE 4 FRAUD DETECTION AND PREVENTION MARKET: LIMITATIONS

- TABLE 5 FRAUD DETECTION AND PREVENTION MARKET: ECOSYSTEM

- TABLE 6 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 PRICING ANALYSIS

- TABLE 8 IMPACT OF PORTER'S FIVE FORCES ON FRAUD DETECTION AND PREVENTION MARKET

- TABLE 9 INFLUENCE OF KEY STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 10 FRAUD DETECTION AND PREVENTION MARKET: LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 11 FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 12 FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 13 CHECK FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 14 CHECK FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 15 IDENTITY FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 16 IDENTITY FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 17 INSIDER FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 18 INSIDER FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 19 INVESTMENT FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 20 INVESTMENT FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 21 PAYMENT FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 22 PAYMENT FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 INSURANCE FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 24 INSURANCE FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 FRIENDLY FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 26 FRIENDLY FRAUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 27 FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 28 FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 29 SOLUTIONS: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 30 SOLUTIONS: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 SOLUTIONS: FRAUD DETECTION AND PREVENTION MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 32 SOLUTIONS: FRAUD DETECTION AND PREVENTION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 33 FRAUD ANALYTICS: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 34 FRAUD ANALYTICS: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 AUTHENTICATION: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 36 AUTHENTICATION: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 GOVERNANCE, RISK, AND COMPLIANCE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 38 GOVERNANCE, RISK, AND COMPLIANCE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 39 SERVICES: FRAUD DETECTION AND PREVENTION MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 40 SERVICES: FRAUD DETECTION AND PREVENTION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 41 SERVICES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 42 SERVICES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 PROFESSIONAL SERVICES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 44 PROFESSIONAL SERVICES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 MANAGED SERVICES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 46 MANAGED SERVICES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 48 FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 49 CLOUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 50 CLOUD: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 ON-PREMISES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 52 ON-PREMISES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 54 FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 55 SMALL AND MEDIUM-SIZED ENTERPRISES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 56 SMALL AND MEDIUM-SIZED ENTERPRISES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 57 LARGE ENTERPRISES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 58 LARGE ENTERPRISES: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 60 FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 61 BANKING, FINANCIAL SERVICES, AND INSURANCE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 62 BANKING, FINANCIAL SERVICES, AND INSURANCE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 BANKING, FINANCIAL SERVICES, AND INSURANCE: FRAUD DETECTION AND PREVENTION MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 64 BANKING, FINANCIAL SERVICES, AND INSURANCE: FRAUD DETECTION AND PREVENTION MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 65 RETAIL AND ECOMMERCE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 66 RETAIL AND ECOMMERCE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 GOVERNMENT: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 68 GOVERNMENT: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 69 HEALTHCARE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 70 HEALTHCARE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 MANUFACTURING: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 72 MANUFACTURING: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 TRAVEL AND TRANSPORTATION: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 74 TRAVEL AND TRANSPORTATION: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 75 REAL ESTATE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 76 REAL ESTATE: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 TELECOMMUNICATIONS: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 78 TELECOMMUNICATIONS: FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 79 FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 80 FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 92 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 93 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 95 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 96 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 97 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 98 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 99 US: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 100 US: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 101 US: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 102 US: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 103 US: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 104 US: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 105 US: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 106 US: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 107 US: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 108 US: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 109 US: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 110 US: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 111 US: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 112 US: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 113 US: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 114 US: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 115 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 116 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 117 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 118 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 119 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 120 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 121 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 122 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 123 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 124 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 125 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 126 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 127 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 128 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 129 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 130 CANADA: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 131 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 132 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 133 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 134 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 135 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 136 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 137 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 138 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 139 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 140 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 141 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 142 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 143 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 144 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 145 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 146 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 147 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 148 EUROPE: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 149 UK: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 150 UK: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 151 UK: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 152 UK: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 153 UK: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 154 UK: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 155 UK: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 156 UK: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 157 UK: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 158 UK: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 159 UK: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 160 UK: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 161 UK: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 162 UK: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 163 UK: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 164 UK: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 165 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 166 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 167 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 168 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 169 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 170 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 171 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 172 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 173 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 174 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 175 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 176 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 177 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 178 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 179 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 180 GERMANY: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 181 FRANCE: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 182 FRANCE: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 183 FRANCE: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 184 FRANCE: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 185 FRANCE: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 186 FRANCE: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 187 FRANCE: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 188 FRANCE: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 189 FRANCE: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 190 FRANCE: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 191 FRANCE: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 192 FRANCE: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 193 FRANCE: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 194 FRANCE: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 195 FRANCE: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 196 FRANCE: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 197 SPAIN: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 198 SPAIN: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 199 SPAIN: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 200 SPAIN: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 201 SPAIN: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 202 SPAIN: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 203 SPAIN: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 204 SPAIN: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 205 SPAIN: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 206 SPAIN: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 207 SPAIN: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 208 SPAIN: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 209 SPAIN: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 210 SPAIN: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 211 SPAIN: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 212 SPAIN: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 213 ITALY: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 214 ITALY: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 215 ITALY: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 216 ITALY: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 217 ITALY: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 218 ITALY: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 219 ITALY: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 220 ITALY: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 221 ITALY: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 222 ITALY: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 223 ITALY: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 224 ITALY: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 225 ITALY: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 226 ITALY: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 227 ITALY: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 228 ITALY: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 229 POLAND: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 230 POLAND: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 231 POLAND: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 232 POLAND: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 233 POLAND: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 234 POLAND: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 235 POLAND: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 236 POLAND: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 237 POLAND: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 238 POLAND: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 239 POLAND: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 240 POLAND: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 241 POLAND: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 242 POLAND: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 243 POLAND: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 244 POLAND: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 245 IRELAND: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 246 IRELAND: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 247 IRELAND: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 248 IRELAND: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 249 IRELAND: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 250 IRELAND: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 251 IRELAND: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 252 IRELAND: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 253 IRELAND: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 254 IRELAND: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 255 IRELAND: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 256 IRELAND: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 257 IRELAND: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 258 IRELAND: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 259 IRELAND: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 260 IRELAND: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 261 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 262 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 263 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 264 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 265 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 266 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 267 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 268 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 269 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 270 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 271 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 272 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 273 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 274 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 275 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 276 CZECH REPUBLIC: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 277 REST OF EUROPE: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 278 REST OF EUROPE: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 279 REST OF EUROPE: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 280 REST OF EUROPE: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 281 REST OF EUROPE: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 282 REST OF EUROPE: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 283 REST OF EUROPE: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 284 REST OF EUROPE: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 285 REST OF EUROPE: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 286 REST OF EUROPE: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 287 REST OF EUROPE: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 288 REST OF EUROPE: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 289 REST OF EUROPE: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 290 REST OF EUROPE: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 291 REST OF EUROPE: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 292 REST OF EUROPE: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 293 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 294 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 295 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 296 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 297 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 298 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 299 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 300 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 301 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 302 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 303 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 304 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 305 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 306 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 307 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 308 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 309 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 310 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 311 CHINA: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 312 CHINA: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 313 CHINA: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 314 CHINA: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 315 CHINA: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 316 CHINA: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 317 CHINA: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 318 CHINA: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 319 CHINA: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 320 CHINA: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 321 CHINA: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 322 CHINA: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 323 CHINA: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 324 CHINA: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 325 CHINA: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 326 CHINA: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 327 JAPAN: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 328 JAPAN: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 329 JAPAN: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 330 JAPAN: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 331 JAPAN: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 332 JAPAN: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 333 JAPAN: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 334 JAPAN: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 335 JAPAN: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 336 JAPAN: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 337 JAPAN: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 338 JAPAN: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 339 JAPAN: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 340 JAPAN: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 341 JAPAN: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 342 JAPAN: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 343 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 344 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 345 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 346 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 347 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 348 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 349 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 350 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 351 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 352 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 353 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 354 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 355 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 356 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 357 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 358 AUSTRALIA AND NEW ZEALAND: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 359 INDIA: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 360 INDIA: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 361 INDIA: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 362 INDIA: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 363 INDIA: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 364 INDIA: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 365 INDIA: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 366 INDIA: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 367 INDIA: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 368 INDIA: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 369 INDIA: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 370 INDIA: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 371 INDIA: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 372 INDIA: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 373 INDIA: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 374 INDIA: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 375 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 376 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 377 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 378 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 379 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 380 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 381 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 382 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 383 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 384 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 385 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 386 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 387 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 388 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 389 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 390 SINGAPORE: FRAUD DETECTION AND PREVENTION MARKET, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 391 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 392 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 393 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 394 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 395 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 396 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 397 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 398 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 399 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 400 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 401 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 402 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 403 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 404 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 405 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 406 REST OF ASIA PACIFIC: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 407 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 408 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 409 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 410 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 411 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 412 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 413 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 414 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 415 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 416 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 417 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 418 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 419 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 420 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 421 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 422 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 423 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 424 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 425 UAE: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 426 UAE: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 427 UAE: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 428 UAE: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 429 UAE: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 430 UAE: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 431 UAE: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 432 UAE: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 433 UAE: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 434 UAE: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 435 UAE: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 436 UAE: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 437 UAE: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 438 UAE: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 439 UAE: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 440 UAE: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 441 KSA: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 442 KSA: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 443 KSA: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 444 KSA: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 445 KSA: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 446 KSA: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 447 KSA: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 448 KSA: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 449 KSA: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 450 KSA: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 451 KSA: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 452 KSA: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 453 KSA: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 454 KSA: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 455 KSA: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 456 KSA: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 457 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 458 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 459 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 460 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 461 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 462 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 463 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 464 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 465 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 466 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 467 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 468 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 469 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 470 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 471 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 472 SOUTH AFRICA: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 473 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 474 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 475 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 476 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 477 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2017–2022 (USD MILLION)

- TABLE 478 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 479 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 480 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 481 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 482 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 483 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 484 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 485 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 486 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 487 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2017–2022 (USD MILLION)

- TABLE 488 REST OF MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION, BY BFSI TYPE, 2023–2028 (USD MILLION)

- TABLE 489 LATIN AMERICA: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 490 LATIN AMERICA: FRAUD DETECTION AND PREVENTION, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 491 LATIN AMERICA: FRAUD DETECTION AND PREVENTION, BY SOLUTION, 2017–2022 (USD MILLION)