Exterior Wall Systems Market by Material Type (Ventilated, Non-Ventilated and Curtain Wall), Supporting Wall (Concrete, Wood and Masonry) End-use Industry (Commercial, Residential and Industrial), and Region - Global Forecast to 2026

Updated on : October 25, 2024

Exterior Wall Systems Market

Exterior Wall Systems Market was valued at USD 139.6 billion in 2021 and is projected to reach USD 199.3 billion by 2026, growing at 7.4% cagr from 2021 to 2026. The market is expected to witness significant growth in the future due to the increasing consumption of exterior wall systems in the residential, commercial and industrial sector as construction activities grow. Moreover, government spendings on infrastructure development have propelled the consumption of exterior wall systems.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global exterior wall systems market

In 2020, the exterior wall systems market was largely impacted by the COVID-19 pandemic with a substantial decline in its CAGR. Though a recovery is expected owing to the impact of the construction sector on the economy. Although the activity might continue, delays and halts are expected owing to supply chain disruptions, shortage of labours and materials. Construction workers may be unable to reach construction sites and will need to adhere to new on-site protocols that will reduce productivity. Some building-materials supply chains have also been interrupted, suspending production and distribution.

Exterior Wall Systems Market Dynamics

Driver: High demand of exterior wall systems from increase in industrial, commercial, and residential construction activities

The growth of the construction industry is the major driver of the exterior wall systems market. The construction industry's growth plays a significant role in determining the economic development of a country. The increase in the number of construction activities around the world will drive the exterior wall systems market. The rapid industrial growth has given rise to new commercial, non-commercial, and residential buildings. The construction of factories, manufacturing plants, stadiums, shopping centers, office buildings, hotels, public facilities (including government buildings), public transportation buildings, and other government projects has increased rapidly. This will have a direct impact on the need for sustainable decorative building construction solutions in these structures, due to which an increase in the demand for exterior wall systems is projected.

Restraint: Government regulations on carbon emissions

Environmental protection has been an important concern for many regions, along with possible serious legal implications, in recent years. The environmental pollution, from glass, aluminum, fiberglass, fiber cement, plasterboard, magnesium-oxide board, and PVC board manufacturers, and the chemical industry, has been a cause for concern. These industries provide raw materials for exterior wall systems. This has led to the adherence to stringent emission regulations by the stakeholders in the exterior wall systems market.

Opportunity: Rise in demand for green buildings

Green buildings are defined as structures that are environmentally responsible and resource-efficient throughout their lifecycle. These buildings provide various benefits, such as energy efficiency, sustainability, efficient use of resources, environment protection, and higher resale value. Properties of glass such as recyclability, ability to absorb radiations, and energy-saving make it an excellent option to be used as a green building material. The increase in demand for green will highly influence the growth of the exterior wall systems market. Green buildings are already trendy in the US and countries of Europe. They are penetrating Asia, the Middle East, and Latin America. Architects have also demanded high transparency of glass to allow more light in while maintaining heat resistance.

Challenge: Regular maintenance cost for optimum performance

Regular maintenance of many exterior wall systems, such as cladding, curtain wall, and aluminum composite panel, is required to maintain water tightness and increase longevity. Proper cleaning is also essential to remove the accumulation of dust and prevent any organic growth. It also helps in maintaining the appearance of the building. However, if it is broken or dented, it becomes challenging to repair the damaged part. Esthetic qualities of the cladding reduce. Hence, the cost and time associated with repairing could be a major challenge faced by the exterior wall systems.

Curtain Wall widely preferred type of exterior wall systems

Based on type, (for both pre installation or post installation) curtain wall is projected to be the largest segment in the exterior wall systems market. Curtain wall systems are made from a lightweight material, thereby reducing construction costs. The curtain wall façade does not carry any structural load from the building other than its own dead load weight. The primary purpose of a curtain wall system is to protect the building interior against the exterior natural phenomena such as sun exposure, temperature changes, earthquake, rain, and wind.

Significant increase in the demand for exterior wall systems from commercial sector

By End-use industry, the commercial sector is projected to be the largest segment in the exterior wall systems market. The growth of this segment is mainly attributed to the high demand for exterior wall systems due to increasing standardization in architecture, along with durability, safety, and greater aesthetic appeal of the facade systems. The biggest advantage of exterior wall systems is that it comes in various materials and styles, which makes it possible for people to choose a material which complements the whole building/house.

Glass panel most preferred material of exterior wall systems

By Material, glass panel is projected to be the largest segment in the exterior wall systems market. Construction glass has excellent weatherproof properties as well as features such as transparency, u-value, strength, greenhouse effect, workability, recyclable, solar heat gain co-efficiency, energy efficiency, and acoustic control which provide increased durability and outlook to the building’s facade structure. It provides various benefits such as luminosity, gives amplitude to space, gives better separation ideas, allows to combine different styles and transits a sense of modernity.

Concrete supporting wall most favored for exterior wall systems

Based on supporting wall, the concrete is projected to be the largest segment in the exterior wall systems market. The growth of this segment is mainly attributed to the high demand for exterior wall systems as concrete walls are load bearing walls. The high thermal mass of tightly sealed concrete walls, along with insulation, prevents drafting and creates an airtight, high-performing, energy-efficient home. Concrete walls do not rot or rust when exposed to moisture, resist termites unlike wood, do not dent, resist fire damage, and reduce the transmission of unwanted noise.

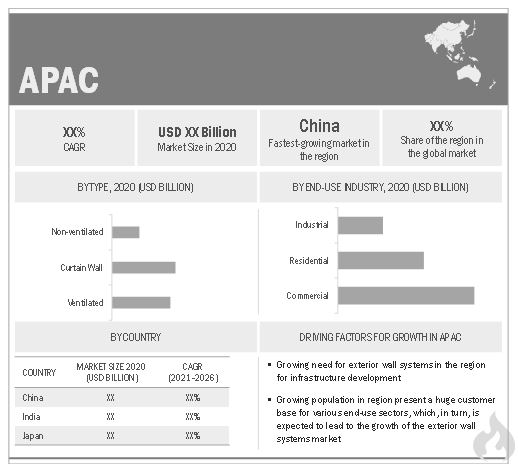

APAC region to lead the global exterior wall systems market by 2026

The APAC region accounted for the largest market share in 2020. The demand for exterior wall systems in APAC is mainly driven by China, India, and ASEAN countries, which are experiencing substantial growth in the construction industries. The growth of these industries is backed by the increasing public and private sector investments, increasing population, growing economy, and high disposable income.

Exterior Wall Systems Market Players

The exterior wall systems market is dominated by a few globally established players, such as Etex Group (Belgium), SCG (Thailand), Alcoa Corporation (US), 3A Composites(Switzerland), Avient Corporation (US), Louisiana-Pacific Corporation (US), Nichiha Corporation (Japan), CSR Limited (Australia), CRH (Ireland), Cornerstone Building Brands (US), amongst others.

Exterior Wall Systems Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Billion) and Volume (Million Square Meter) |

|

Segments covered |

Type, End-use Industry, Supporting Wall, Material and Region |

|

Geographies covered |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies covered |

Etex Group (Belgium), SCG (Thailand), Alcoa Corporation (US), 3A Composites(Switzerland), Avient Corporation (US), Louisiana-Pacific Corporation (US), Nichiha Corporation (Japan), CSR Limited (Australia), CRH (Ireland), Cornerstone Building Brands (US) |

This research report categorizes the exterior wall systems market based on type, end-use industry, and region.

Exterior Wall Systems Market on the basis of type

- Ventilated (Pre Installation and Post Installation)

- Non-Ventilated (Pre Installation and Post Installation)

- Curtain Wall (Pre Installation and Post Installation)

Exterior Wall Systems Market on the basis of end-use industry

- Commercial

- Industrial

- Residential

Exterior Wall Systems Market on the basis of material

- Glass Panel

- Ceramic Tile

- Vinyl

- Metal Panel

- Brick & Stone

- Fiber Cement

- Gypsum/Plasterboard

- EIFS

- Wood

- Fiberglass Panel

- HPL

- GRC

- Others include magnesium oxide boards and cement board

Exterior Wall Systems Market on the basis of supporting wall

- Concrete

- Masonry

- Wood

Exterior Wall Systems Market on the basis of region

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Recent Developments

- In November 2020, Etex-Arauco an E2E joint venture signed an agreement to acquire a majority stake in Tecverde. Techverd works in innovative wood-frame construction systems allow for nearly a full building to be fabricated. This will enable E2E to break new ground in the construction industry of Brazil.

- In September 2020, Alcoa announced the expansion of its SustanaTM line of products with the introduction of EcoSourceTM, the industry’s first low-carbon, smelter-grade alumina brand. This expansion aims to decrease the use of carbon and move towards sustainable and eco friendly products.

- In August 2020, SCG entered into a joint-venture agreement with SHO-BOND & MIT Infrastructure Maintenance Corporation (“SB&M”) to engage in Lifetime Solution for building and infrastructures in Thailand, catering to the growing trends in the repair and maintenance market in Thailand and across ASEAN.

- In January 2019, Etex’s two new divisions, Etex Residential Roofing (clay, concrete tiles and components for residential applications in Europe and South Africa) and Etex Exteriors (all fibre cement activities for architectural, residential and agricultural segments), become operational.

- In September 2018, 3A Composites acquired the european acrylic sheet business from Lucite International.

Upcoming Changes in the Exterior Wall Systems Market Report

|

CHANGE |

DESCRIPTION |

|

Scope of the Market |

|

|

COVID-19 Impact |

|

|

Market Overview |

|

|

Competitive Landscape |

|

|

Company Profiles |

|

|

New & Improved Representation of Financial Information |

|

|

Recent Market Developments |

|

|

Latest Product Portfolio |

|

Frequently Asked Questions (FAQ):

What is the current size of global exterior wall systems market?

The global exterior wall systems market size is projected to grow from USD 139.6 billion in 2021 to USD 199.3 billion by 2026, at a CAGR of 7.4% from 2021 to 2026.

How is the exterior wall systems market aligned?

The exterior wall systems market is highly fragmented, and have number of manufacturer operating at the regional, and domestic level. The market will continue to be fragmented and this fragmentation will increase over the forecast period.

Who are the key players in the global exterior wall systems market?

The key players operating in the exterior wall systems market are Etex Group (Belgium), SCG (Thailand), Alcoa Corporation (US), 3A Composites(Switzerland), Avient Corporation (US), Louisiana-Pacific Corporation (US), Nichiha Corporation (Japan), CSR Limited (Australia), CRH (Ireland), Cornerstone Building Brands (US), amongst others.

What are the latest ongoing trends in the exterior wall systems market?

The latest ongoing trends in the exterior wall systems market are use of green and sustainable products to make eco friendly homes. Structural insulated panels and insulated concrete blocks are among the green trends for constructing exterior walls for home. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 47)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSION AND EXCLUSION

TABLE 1 INCLUSION AND EXCLUSION

1.4 MARKET SCOPE

FIGURE 1 EXTERIOR WALL SYSTEMS MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

FIGURE 2 EXTERIOR WALL SYSTEMS MARKET, BY REGION

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 53)

2.1 RESEARCH DATA

FIGURE 3 EXTERIOR WALL SYSTEMS MARKET: RESEARCH DESIGN

2.2 MARKET SIZE ESTIMATION

FIGURE 4 BOTTOM-UP APPROACH

FIGURE 5 TOP-DOWN APPROACH

FIGURE 6 SUPPLY-SIDE ANALYSIS

2.3 DATA TRIANGULATION

FIGURE 7 EXTERIOR WALL SYSTEMS MARKET: DATA TRIANGULATION

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

FIGURE 8 KEY MARKET INSIGHTS

FIGURE 9 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 60)

FIGURE 10 CURTAIN WALL (PRE-INSTALLATION) TO DOMINATE EXTERIOR WALL SYSTEMS MARKET BY 2026

FIGURE 11 CURTAIN WALL (POST-INSTALLATION) TO DOMINATE EXTERIOR WALL SYSTEMS MARKET BY 2026

FIGURE 12 GLASS PANEL TO DOMINATE EXTERIOR WALL SYSTEMS MARKET BY 2026

FIGURE 13 WOOD TO DOMINATE EXTERIOR WALL SYSTEMS MARKET BY 2026

FIGURE 14 COMMERCIAL TO BE LARGEST SEGMENT IN EXTERIOR WALL SYSTEMS MARKET DURING FORECAST PERIOD

FIGURE 15 APAC LED EXTERIOR WALL SYSTEMS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 65)

4.1 EMERGING ECONOMIES TO WITNESS A RELATIVELY HIGHER DEMAND FOR EXTERIOR WALL SYSTEMS

FIGURE 16 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES IN EXTERIOR WALL SYSTEMS MARKET DURING FORECAST PERIOD

4.2 APAC: EXTERIOR WALL SYSTEMS MARKET, BY END-USE INDUSTRY AND COUNTRY

FIGURE 17 CHINA WAS LARGEST MARKET FOR EXTERIOR WALL SYSTEMS IN APAC IN 2020

4.3 EXTERIOR WALL SYSTEMS MARKET, BY PRE-INSTALLATION TYPE

FIGURE 18 CURTAIN WALL TO LEAD EXTERIOR WALL SYSTEMS MARKET DURING FORECAST PERIOD

4.4 EXTERIOR WALL SYSTEMS MARKET, BY POST-INSTALLATION TYPE

FIGURE 19 CURTAIN WALL TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4.5 EXTERIOR WALL SYSTEMS MARKET, BY END-USE INDUSTRY

FIGURE 20 COMMERCIAL TO BE THE LARGEST END-USE INDUSTRY FOR EXTERIOR WALL SYSTEMS MARKET BY 2026

4.6 EXTERIOR WALL SYSTEMS MARKET, BY MATERIAL

FIGURE 21 GLASS PANEL TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

4.7 EXTERIOR WALL SYSTEMS MARKET, BY SUPPORTING WALL

FIGURE 22 WOOD TO REGISTER HIGHEST CAGR IN EXTERIOR WALL SYSTEMS MARKET DURING FORECAST PERIOD

4.8 EXTERIOR WALL SYSTEMS MARKET, BY COUNTRY

FIGURE 23 CHINA TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 69)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 EXTERIOR WALL SYSTEMS MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increase in industrial, commercial, and residential construction activities

5.2.1.2 Rise in preference for dry construction techniques over wet construction methods

5.2.1.3 Increase in demand for protective wall systems enhancing esthetic appeal of a building

5.2.2 RESTRAINTS

5.2.2.1 Government regulations on carbon emissions

5.2.2.2 High production cost & capital investment

5.2.2.3 Price volatility of raw materials

FIGURE 25 ALUMINUM PRICE (USD/PER METRIC TONNE)

5.2.3 OPPORTUNITIES

5.2.3.1 Rise in demand for green buildings

5.2.3.2 Growth in investment in infrastructural projects in developing economies

5.2.4 CHALLENGES

5.2.4.1 Production and installation requirements of a complex structural glazing

5.2.4.2 Regular maintenance cost for optimum performance

5.3 RANGE SCENARIO FOR EXTERIOR WALL SYSTEMS MARKET

FIGURE 26 RANGE SCENARIO FOR EXTERIOR WALL SYSTEMS MARKET

5.3.1 OPTIMISTIC SCENARIO

5.3.2 PESSIMISTIC SCENARIO

5.3.3 REALISTIC SCENARIO

5.4 YC-YCC DRIVERS

FIGURE 27 YC-YCC DRIVERS

5.5 MARKET MAPPING/ ECOSYSTEM MAP

FIGURE 28 ECOSYSTEM MAP

5.6 PATENT ANALYSIS

5.6.1 INTRODUCTION

5.6.2 METHODOLOGY

5.6.3 DOCUMENT TYPE

TABLE 2 TOTAL NUMBER OF PATENTS FOR EXTERIOR WALL SYSTEMS

FIGURE 29 EXTERIOR WALL SYSTEMS MARKET: GRANTED PATENT, LIMITED PATENT, AND PATENT APPLICATION

FIGURE 30 PUBLICATION TRENDS - LAST 10 YEARS

5.6.4 INSIGHT

FIGURE 31 JURISDICTION ANALYSIS

5.6.5 TOP COMPANIES/ APPLICANTS

FIGURE 32 TOP APPLICANTS OF EXTERIOR WALL SYSTEMS

TABLE 3 LIST OF PATENTS BY SUZHOU KELIDA BUILDING & DECORATION CO LTD.

TABLE 4 LIST OF PATENTS BY JANGHO GROUP CO LTD

TABLE 5 LIST OF PATENTS BY GOLDEN CURTAIN WALL GROUP CO LTD.

TABLE 6 LIST OF TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

5.6.6 DISCLAIMER

5.7 TECHNOLOGY ANALYSIS

5.8 REGULATORY ANALYSIS

TABLE 7 FEW STANDARDS & TESTS FOR EXTERIOR WALL SYSTEMS

TABLE 8 FEW FIRE REGULATIONS FOR EXTERIOR WALL SYSTEMS

5.9 PRICING ANALYSIS

TABLE 9 MATERIAL PRICE (USD PER SQUARE METER)

5.1 TRADE ANALYSIS

TABLE 10 GLASS & GLASSWARE IMPORTS (BY COUNTRY), IN 2020

TABLE 11 GLASS & GLASSWARE EXPORTS (BY COUNTRY), IN 2020

TABLE 12 CERAMIC PRODUCTS IMPORTS (BY COUNTRY), IN 2020

TABLE 13 CERAMIC PRODUCTS EXPORTS (BY COUNTRY), IN 2020

TABLE 14 PLYWOOD, VENEERED PANEL AND SIMILAR LAMINATED WOOD, IMPORTS (BY COUNTRY), IN 2020

TABLE 15 PLYWOOD, VENEERED PANEL AND SIMILAR LAMINATED WOOD, EXPORTS (BY COUNTRY), IN 2020

TABLE 16 ALUMINUM & ARTICLES THEREOF, IMPORTS (BY COUNTRY), IN 2020

TABLE 17 ALUMINUM & ARTICLES THEREOF, EXPORTS (BY COUNTRY), IN 2020

5.11 CASE STUDY ANALYSIS

TABLE 18 EXTERIOR WALL SYSTEM FOR HOBSONVILLE POINT

TABLE 19 EXTERIOR WALL SYSTEM FOR CERTAINTEED CORPORATION

TABLE 20 EXTERIOR WALL SYSTEM FOR PARK TOWER AT TRANSBAY

6 INDUSTRY TRENDS (Page No. - 92)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 33 EXTERIOR WALL SYSTEMS MARKET: SUPPLY CHAIN

TABLE 21 EXTERIOR WALL SYSTEMS MARKET: ECOSYSTEM

6.2.1 PROMINENT COMPANIES

6.2.2 SMALL & MEDIUM ENTERPRISES

6.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 34 PORTER’S FIVE FORCES ANALYSIS

TABLE 22 EXTERIOR WALL SYSTEMS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.3.1 THREAT OF NEW ENTRANTS

6.3.2 THREAT OF SUBSTITUTES

6.3.3 BARGAINING POWER OF SUPPLIERS

6.3.4 BARGAINING POWER OF BUYERS

6.3.5 INTENSITY OF COMPETITIVE RIVALRY

7 COVID-19 IMPACT ON THE EXTERIOR WALL SYSTEMS MARKET (Page No. - 98)

7.1 INTRODUCTION

7.2 IMPACT OF COVID-19 ON THE EXTERIOR WALL SYSTEMS MARKET

8 EXTERIOR WALL SYSTEMS MARKET, BY MATERIAL (Page No. - 100)

8.1 INTRODUCTION

FIGURE 35 GLASS PANEL TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 23 EXTERIOR WALL SYSTEMS MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 24 MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQAURE METER)

8.2 GLASS PANEL

8.2.1 OFFERS LUMINOSITY AND ACOUSTIC CONTROL TO BUILDINGS

8.3 CERAMIC TILES

8.3.1 MOST COMMONLY USED TYPE OF WALL CLADDING

8.4 VINYL

8.4.1 LOWEST COST OPTION FOR EXTERNAL WALL SYSTEMS

8.5 METAL PANEL

8.5.1 HIGHER DEMAND DUE TO LOW MAINTENANCE AND HIGH RELIABILITY

8.6 BRICK & STONE

8.6.1 PROVIDES STRONG PROTECTION AND GIVES ANTIQUE LOOK

8.7 FIBER CEMENT

8.7.1 INCREASING DEMAND DUE TO CREATIVE LIBERTY WITH STRONG PROTECTION

8.8 GYPSUM/PLASTERBOARDS

8.8.1 GYPSUM PLASTERBOARD VERSATILE AND RECYCLABLE

8.9 EXTERIOR INSULATION AND FINISH SYSTEM (EIFS)

8.9.1 OFFERS MAXIMUM ENERGY SAVINGS AND REDUCTION IN THERMAL LOADS

8.10 WOOD

8.10.1 HIGH DEMAND FOR WOOD PANELS IN RESIDENTIAL BUILDING

8.11 FIBERGLASS PANELS

8.11.1 SCRATCH-RESISTANT MATERIAL AND PREFERRED FOR DEEP CLEANING ENVIRONMENT

8.12 HPL (HIGH-PRESSURE LAMINATE)

8.12.1 PROVIDES DURABILITY AND BEARS THE WEIGHT OF HIGH-PRESSURE OBJECTS

8.13 GRC (GLASS-REINFORCED CONCRETE)

8.13.1 OFFERS HIGH COMPRESSIVE, FLEXURAL, AND TENSILE STRENGTH

8.14 OTHERS

8.14.1 CONTRIBUTES VARIOUS PROPERTIES TO WALL CLADDING

9 EXTERIOR WALL SYSTEMS MARKET, BY TYPE (Page No. - 108)

9.1 INTRODUCTION

FIGURE 36 CURTAIN WALL SEGMENT FOR PRE INSTALLATION TYPE TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 25 EXTERIOR WALL SYSTEMS MARKET SIZE, BY PRE INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 26 MARKET SIZE, BY PRE INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

FIGURE 37 CURTAIN WALL SEGMENT FOR POST INSTALLATION TYPE TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 27 EXTERIOR WALL SYSTEMS MARKET SIZE, BY POST INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 28 MARKET SIZE, BY POST INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

9.2 VENTILATED

9.2.1 VENTILATED SYSTEMS PROVIDE EXCELLENT THERMAL PERFORMANCE

9.3 NON-VENTILATED

9.3.1 NON-VENTILATED FAÇADE SYSTEMS ARE VAPOR-TIGHT SYSTEMS

9.4 CURTAIN WALL

9.4.1 CURTAIN WALL SYSTEMS USE LIGHTWEIGHT MATERIALS

10 EXTERIOR WALL SYSTEMS MARKET, BY SUPPORTING WALL (Page No. - 133)

10.1 INTRODUCTION

FIGURE 38 WOOD SEGMENT TO EXHIBIT HIGHEST GROWTH RATE DURING FORECAST PERIOD

TABLE 29 MARKET SIZE, BY SUPPORTING WAL, 2019–2026 (USD BILLION)

TABLE 30 MARKET SIZE, BY SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

10.2 CONCRETE

10.2.1 MOST USED MATERIAL IN CONSTRUCTION MARKET

TABLE 31 MARKET SIZE, BY CONCRETE SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 32 MARKET SIZE, BY CONCRETE SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

10.3 MASONRY

10.3.1 RENDERS FLEXIBILITY AND LASTINGNESS TO STRUCTURE

TABLE 33 MARKET SIZE, BY MASONRY SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 34 MARKET SIZE, BY MASONRY SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

10.4 WOOD

10.4.1 OFFERS WARM LOOK AND NATURAL INSULATION

TABLE 35 MARKET SIZE, BY WOOD SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 36 MARKET SIZE, BY WOOD SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

11 EXTERIOR WALL SYSTEMS MARKET, BY END USE (Page No. - 119)

11.1 INTRODUCTION

FIGURE 39 COMMERCIAL SEGMENT TO EXHIBIT HIGHER GROWTH RATE DURING FORECAST PERIOD

TABLE 37 MARKET SIZE, BY END USE,2019–2026 (USD BILLION)

TABLE 38 MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

11.2 COMMERCIAL

11.2.1 COMMERCIAL SEGMENT TO DOMINATE MARKET BY 2026

11.3 RESIDENTIAL

11.3.1 REQUIREMENT OF GREAT ESTHETIC APPEAL ATTAINED

11.4 INDUSTRIAL

11.4.1 OFFERS FIRE PROTECTION TO INDUSTRIAL AREAS

12 EXTERIOR WALL SYSTEMS MARKET, BY REGION (Page No. - 123)

12.1 INTRODUCTION

FIGURE 40 REGIONAL SNAPSHOT: CHINA TO BE FASTEST-GROWING MARKET FROM 2021 TO 2026

TABLE 39 MARKET SIZE, BY REGION, 2019–2026 (USD BILLION)

TABLE 40 MARKET SIZE, BY REGION, 2019–2026 (MILLION SQUARE METER)

TABLE 41 MARKET SIZE, BY MATERIAL,2019–2026 (USD BILLION)

TABLE 42 MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 43 MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 44 MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 45 MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 46 MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 47 MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 48 MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 49 MARKET SIZE, BY SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 50 MARKET SIZE, BY SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 51 MARKET SIZE, BY CONCRETE SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 52 MARKET SIZE, BY CONCRETE SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 53 MARKET SIZE, BY MASONRY SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 54 MARKET SIZE, BY MASONRY SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 55 MARKET SIZE, BY WOOD SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 56 MARKET SIZE, BY WOOD SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

12.2 APAC

FIGURE 41 APAC: EXTERIOR WALL SYSTEMS MARKET SNAPSHOT

TABLE 57 APAC: MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 58 APAC: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METERS)

TABLE 59 APAC: MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 60 APAC: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 61 APAC: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 62 APAC: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 63 APAC: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 64 APAC: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 65 APAC: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 66 APAC: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 67 APAC: MARKET SIZE, BY SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 68 APAC: MARKET SIZE, BY SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 69 APAC: MARKET SIZE, BY CONCRETE SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 70 APAC: MARKET SIZE, BY CONCRETE SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 71 APAC: MARKET SIZE, BY MASONRY SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 72 APAC: MARKET SIZE, BY MASONRY SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 73 APAC: MARKET SIZE, BY WOOD SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 74 APAC: MARKET SIZE, BY WOOD SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

12.2.1 CHINA

12.2.1.1 China to be the fastest-growing market for exterior wall systems

TABLE 75 CHINA: MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 76 CHINA: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 77 CHINA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 78 CHINA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 79 CHINA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 80 CHINA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 81 CHINA: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 82 CHINA: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.2.2 JAPAN

12.2.2.1 Growth in infrastructure to offer opportunities for exterior wall systems

TABLE 83 JAPAN: MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 84 JAPAN: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 85 JAPAN: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 86 JAPAN: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 87 JAPAN: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 88 JAPAN: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 89 JAPAN: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 90 JAPAN: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.2.3 INDIA

12.2.3.1 Government policies for infrastructure development to increase demand for exterior wall systems

TABLE 91 INDIA: MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 92 INDIA: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 93 INDIA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 94 INDIA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 95 INDIA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 96 INDIA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 97 INDIA: MARKET SIZE, BY END USE,2019–2026 (USD BILLION)

TABLE 98 INDIA: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.2.4 SOUTH KOREA

12.2.4.1 Government spending on infrastructure to drive demand for exterior wall systems

TABLE 99 SOUTH KOREA: MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 100 SOUTH KOREA: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 101 SOUTH KOREA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 102 SOUTH KOREA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 103 SOUTH KOREA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 104 SOUTH KOREA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 105 SOUTH KOREA: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 106 SOUTH KOREA: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.2.5 AUSTRALIA

12.2.5.1 Increased demand for infrastructure due to population growth to accelerate use of exterior wall systems

TABLE 107 AUSTRALIA: MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 108 AUSTRALIA: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 109 AUSTRALIA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 110 AUSTRALIA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 111 AUSTRALIA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 112 AUSTRALIA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 113 AUSTRALIA: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 114 AUSTRALIA: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.2.6 REST OF APAC

TABLE 115 REST OF APAC: MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 116 REST OF APAC: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 117 REST OF APAC: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 118 REST OF APAC: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 119 REST OF APAC: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 120 REST OF APAC: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 121 REST OF APAC: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 122 REST OF APAC: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.3 NORTH AMERICA

FIGURE 42 NORTH AMERICA: MARKET SNAPSHOT

TABLE 123 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 124 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METERS)

TABLE 125 NORTH AMERICA: MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 126 NORTH AMERICA: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 127 NORTH AMERICA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 128 NORTH AMERICA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 129 NORTH AMERICA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 130 NORTH AMERICA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 131 NORTH AMERICA: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 132 NORTH AMERICA: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 133 NORTH AMERICA: MARKET SIZE, BY SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 134 NORTH AMERICA: MARKET SIZE, BY SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 135 NORTH AMERICA: MARKET SIZE, BY CONCRETE SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 136 NORTH AMERICA: MARKET SIZE, BY CONCRETE SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 137 NORTH AMERICA: MARKET SIZE, BY MASONRY SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 138 NORTH AMERICA: MARKET SIZE, BY MASONRY SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 139 NORTH AMERICA: MARKET SIZE, BY WOOD SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 140 NORTH AMERICA: MARKET SIZE, BY WOOD SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

12.3.1 US

12.3.1.1 US to dominate exterior wall systems market in North America

TABLE 141 US: MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 142 US: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 143 US: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 144 US: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 145 US: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 146 US: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 147 US: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 148 US: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.3.2 CANADA

12.3.2.1 Investment in infrastructure projects to drive the market for exterior wall systems

TABLE 149 CANADA: MARKET SIZE, BY MATERIAL,2019–2026 (USD MILLION)

TABLE 150 CANADA: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 151 CANADA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 152 CANADA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 153 CANADA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 154 CANADA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 155 CANADA: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 156 CANADA: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.3.3 MEXICO

12.3.3.1 Significant opportunities for exterior wall systems for biopharmaceutical products

TABLE 157 MEXICO: MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 158 MEXICO: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 159 MEXICO: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 160 MEXICO: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 161 MEXICO: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 162 MEXICO: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 163 MEXICO: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 164 MEXICO: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.4 EUROPE

FIGURE 43 EUROPE: MARKET SNAPSHOT

TABLE 165 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 166 EUROPE: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METERS)

TABLE 167 EUROPE: MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 168 EUROPE: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 169 EUROPE: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 170 EUROPE: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 171 EUROPE: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 172 EUROPE: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 173 EUROPE: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 174 EUROPE: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 175 EUROPE: MARKET SIZE, BY SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 176 EUROPE: MARKET SIZE, BY SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 177 EUROPE: MARKET SIZE, BY CONCRETE SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 178 EUROPE: MARKET SIZE, BY CONCRETE SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 179 EUROPE: MARKET SIZE, BY MASONRY SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 180 EUROPE: MARKET SIZE, BY MASONRY SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 181 EUROPE: MARKET SIZE, BY WOOD SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 182 EUROPE: MARKET SIZE, BY WOOD SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

12.4.1 GERMANY

12.4.1.1 Germany to lead the market for exterior wall systems in Europe

TABLE 183 GERMANY: MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 184 GERMANY: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 185 GERMANY: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 186 GERMANY: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 187 GERMANY: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 188 GERMANY: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 189 GERMANY: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 190 GERMANY: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.4.2 UK

12.4.2.1 Public spending in infrastructure to offer opportunities for exterior wall systems market

TABLE 191 UK: EXTERIOR WALL SYSTEMS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 192 UK: EXTERIOR WALL SYSTEMS MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 193 UK: EXTERIOR WALL SYSTEMS MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 194 UK: EXTERIOR WALL SYSTEMS MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 195 UK: EXTERIOR WALL SYSTEMS MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 196 UK: EXTERIOR WALL SYSTEMS MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 197 UK: EXTERIOR WALL SYSTEMS MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 198 UK: EXTERIOR WALL SYSTEMS MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.4.3 FRANCE

12.4.3.1 Rise in demand for exterior wall systems with increased spending on infrastructure

TABLE 199 FRANCE: EXTERIORWALL SYSTEMS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 200 FRANCE: EXTERIOR WALL SYSTEMS MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 201 FRANCE: EXTERIOR WALL SYSTEMS MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 202 FRANCE: EXTERIOR WALL SYSTEMS MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 203 FRANCE: EXTERIOR WALL SYSTEMS MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 204 FRANCE: EXTERIOR WALL SYSTEMS MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 205 FRANCE: EXTERIOR WALL SYSTEMS MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 206 FRANCE: EXTERIOR WALL SYSTEMS MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.4.4 RUSSIA

12.4.4.1 Large investments by government on infrastructure projects

TABLE 207 RUSSIA: EXTERIOR WALL SYSTEMS MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 208 RUSSIA: EXTERIOR WALL SYSTEMS MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 209 RUSSIA: EXTERIOR WALL SYSTEMS MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 210 RUSSIA: EXTERIOR WALL SYSTEMS MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 211 RUSSIA: EXTERIOR WALL SYSTEMS MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 212 RUSSIA: EXTERIOR WALL SYSTEMS MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 213 RUSSIA: EXTERIOR WALL SYSTEMS MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 214 RUSSIA: EXTERIOR WALL SYSTEMS MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.4.5 ITALY

12.4.5.1 Demand for exterior wall systems reduces due to pandemic

TABLE 215 ITALY: EXTERIOR WALL SYSTEMS MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 216 ITALY: EXTERIOR WALL SYSTEMS MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 217 ITALY: EXTERIOR WALL SYSTEMS MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 218 ITALY: EXTERIOR WALL SYSTEMS MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 219 ITALY: EXTERIOR WALL SYSTEMS MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 220 ITALY: EXTERIOR WALL SYSTEMS MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 221 ITALY: EXTERIOR WALL SYSTEMS MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 222 ITALY: EXTERIOR WALL SYSTEMS MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.4.6 SPAIN

12.4.6.1 Construction activities to accelerate demand for exterior wall systems

TABLE 223 SPAIN: EXTERIOR WALL SYSTEMS MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 224 SPAIN: EXTERIOR WALL SYSTEMS MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 225 SPAIN: EXTERIOR WALL SYSTEMS MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 226 SPAIN: EXTERIOR WALL SYSTEMS MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 227 SPAIN: EXTERIOR WALL SYSTEMS MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 228 SPAIN: EXTERIOR WALL SYSTEMS MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 229 SPAIN: EXTERIOR WALL SYSTEMS MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 230 SPAIN: EXTERIOR WALL SYSTEMS MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.4.7 REST OF EUROPE

TABLE 231 REST OF EUROPE: MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 232 REST OF EUROPE: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 233 REST OF EUROPE: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 234 REST OF EUROPE: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 235 REST OF EUROPE: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 236 REST OF EUROPE: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 237 REST OF EUROPE: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 238 REST OF EUROPE: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.5 SOUTH AMERICA

TABLE 239 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 240 SOUTH AMERICA: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METERS)

TABLE 241 SOUTH AMERICA: MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 242 SOUTH AMERICA: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 243 SOUTH AMERICA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 244 SOUTH AMERICA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 245 SOUTH AMERICA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 246 SOUTH AMERICA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 247 SOUTH AMERICA: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 248 SOUTH AMERICA: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 249 SOUTH AMERICA: MARKET SIZE, BY SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 250 SOUTH AMERICA: MARKET SIZE, BY SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 251 SOUTH AMERICA: MARKET SIZE, BY CONCRETE SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 252 SOUTH AMERICA: MARKET SIZE, BY CONCRETE SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 253 SOUTH AMERICA: MARKET SIZE, BY MASONRY SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 254 SOUTH AMERICA: MARKET SIZE, BY MASONRY SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 255 SOUTH AMERICA: MARKET SIZE, BY WOOD SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 256 SOUTH AMERICA: MARKET SIZE, BY WOOD SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

12.5.1 BRAZIL

12.5.1.1 Brazil to dominate exterior wall systems market in South America

TABLE 257 BRAZIL: MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 258 BRAZIL: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 259 BRAZIL: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 260 BRAZIL: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 261 BRAZIL: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 262 BRAZIL: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 263 BRAZIL: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 264 BRAZIL: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.5.2 ARGENTINA

12.5.2.1 Increasing demand for exterior wall systems for industrial applications

TABLE 265 ARGENTINA: MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 266 ARGENTINA: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 267 ARGENTINA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 268 ARGENTINA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 269 ARGENTINA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 270 ARGENTINA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 271 ARGENTINA: MARKET SIZE, BY END USE, 2019–2026 (USD MILLION)

TABLE 272 ARGENTINA: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 273 REST OF SOUTH AMERICA: MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 274 REST OF SOUTH AMERICA: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 275 REST OF SOUTH AMERICA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD MILLION)

TABLE 276 REST OF SOUTH AMERICA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 277 REST OF SOUTH AMERICA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD MLLION)

TABLE 278 REST OF SOUTH AMERICA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 279 REST OF SOUTH AMERICA: MARKET SIZE, BY END USE, 2019–2026 (USD MMLLION)

TABLE 280 REST OF SOUTH AMERICA: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.6 MIDDLE EAST & AFRICA

TABLE 281 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2026 (USD BILLION)

TABLE 282 MIDDLE EAST & AFRICA: MARKET SIZE, BY COUNTRY, 2019–2026 (MILLION SQUARE METERS)

TABLE 283 MIDDLE EAST & AFRICA: MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 284 MIDDLE EAST & AFRICA: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 285 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 286 MIDDLE EAST & AFRICA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 287 MIDDLE EAST & AFRICA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 288 MIDDLE EAST & AFRICA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 289 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 290 MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

TABLE 291 MIDDLE EAST & AFRICA: MARKET SIZE, BY SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 292 MIDDLE EAST & AFRICA: MARKET SIZE, BY SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 293 MIDDLE EAST & AFRICA: MARKET SIZE, BY CONCRETE SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 294 MIDDLE EAST & AFRICA: MARKET SIZE, BY CONCRETE SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 295 MIDDLE EAST & AFRICA: MARKET SIZE, BY MASONRY SUPPORTING WALL, 2019–2026 (USD MILLION)

TABLE 296 MIDDLE EAST & AFRICA: MARKET SIZE, BY MASONRY SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

TABLE 297 MIDDLE EAST & AFRICA: MARKET SIZE, BY WOOD SUPPORTING WALL, 2019–2026 (USD BILLION)

TABLE 298 MIDDLE EAST & AFRICA: MARKET SIZE, BY WOOD SUPPORTING WALL, 2019–2026 (MILLION SQUARE METER)

12.6.1 UAE

12.6.1.1 Huge government spending in infrastructure to drive the demand for exterior wall systems

TABLE 299 UAE: MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 300 UAE: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 301 UAE: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 302 UAE: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 303 UAE: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 304 UAE: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 305 UAE: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 306 UAE: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.6.2 SAUDI ARABIA

12.6.2.1 Huge construction projects to accelerate market for exterior wall systems

TABLE 307 SAUDI ARABIA: MARKET SIZE, BY MATERIAL, 2019–2026 (USD BILLION)

TABLE 308 SAUDI ARABIA: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 309 SAUDI ARABIA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 310 SAUDI ARABIA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 311 SAUDI ARABIA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 312 SAUDI ARABIA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 313 SAUDI ARABIA: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 314 SAUDI ARABIA: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.6.3 TURKEY

12.6.3.1 Geopolitical position of turkey makes it favorable for investments

TABLE 315 TURKEY: MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 316 TURKEY: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 317 TURKEY: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 318 TURKEY: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 319 TURKEY: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 320 TURKEY: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 321 TURKEY: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 322 TURKEY: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.6.4 SOUTH AFRICA

12.6.4.1 Ongoing mega projects to drive exterior wall systems market

TABLE 323 SOUTH AFRICA: MARKET SIZE, BY MATERIAL, 2019–2026 (USD MLLION)

TABLE 324 SOUTH AFRICA: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 325 SOUTH AFRICA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 326 SOUTH AFRICA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 327 SOUTH AFRICA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 328 SOUTH AFRICA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 329 SOUTH AFRICA: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 330 SOUTH AFRICA: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

12.6.5 REST OF MIDDLE EAST & AFRICA

TABLE 331 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY MATERIAL, 2019–2026 (USD MILLION)

TABLE 332 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY MATERIAL, 2019–2026 (MILLION SQUARE METER)

TABLE 333 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 334 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY PRE-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 335 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (USD BILLION)

TABLE 336 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY POST-INSTALLATION TYPE, 2019–2026 (MILLION SQUARE METER)

TABLE 337 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2019–2026 (USD BILLION)

TABLE 338 REST OF MIDDLE EAST & AFRICA: MARKET SIZE, BY END USE, 2019–2026 (MILLION SQUARE METER)

13 COMPETITIVE LANDSCAPE (Page No. - 244)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

FIGURE 44 COMPANIES ADOPTED EXPANSION AS KEY GROWTH STRATEGY DURING 2016–202O

13.3 MARKET RANKING

FIGURE 45 MARKET RANKING OF KEY PLAYERS, 2020

13.3.1 ETEX GROUP

13.3.2 SCG

13.3.3 ALCOA CORPORATION

13.3.4 3A COMPOSITES

13.3.5 AVIENT CORPORATION

13.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 46 REVENUE ANALYSIS FOR KEY COMPANIES IN EXTERIOR WALL SYSTEMS MARKET

13.5 MARKET SHARE ANALYSIS

TABLE 339 EXTERIOR WALL SYSTEMS MARKET: MARKET SHARES OF KEY PLAYERS

FIGURE 47 SHARE OF LEADING COMPANIES IN EXTERIOR WALL SYSTEMS MARKET

13.6 COMPANY EVALUATION QUADRANT

FIGURE 48 EXTERIOR WALL SYSTEMS MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

13.6.1 STAR

13.6.2 PERVASIVE

13.6.3 EMERGING LEADER

13.6.4 PARTICIPANT

13.7 COMPETITIVE BENCHMARKING

13.7.1 STRENGTH OF PRODUCT PORTFOLIO

13.7.2 BUISNESS STRATEGY EXCELLENCE

TABLE 340 COMPANY END USE FOOTPRINT

TABLE 341 COMPANY REGION FOOTPRINT

FIGURE 49 COMPANY MATERIAL FOOTPRINT

13.8 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES)

13.8.1 PROGRESSIVE COMPANIES

13.8.2 RESPONSIVE COMPANIES

13.8.3 STARTING BLOCKS

13.8.4 DYNAMIC COMPANIES

FIGURE 50 COMPETITIVE LEADERSHIP MAPPING OF SMES (SMALL AND MEDIUM-SIZED ENTERPRISES), 2020

13.9 COMPETITIVE SCENARIO AND TRENDS

13.9.1 DEALS

TABLE 342 EXTERIOR WALL SYSTEMS MARKET: DEALS, JANUARY 2016- NOVEMBER 2020

13.9.2 OTHERS

TABLE 343 EXTERIOR WALL SYSTEMS MARKET: OTHERS, JANUARY 2016-NOVEMBER 2020

14 COMPANY PROFILES (Page No. - 261)

14.1 KEY COMPANIES

(Business overview, Products and Solutions, Recent developments, MNM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats)*

14.1.1 ETEX GROUP

TABLE 344 ETEX GROUP: BUSINESS OVERVIEW

FIGURE 51 ETEX GROUP: COMPANY SNAPSHOT

TABLE 345 ETEX GROUP: PRODUCT OFFERED

TABLE 346 ETEX GROUP: DEALS

14.1.2 SCG

TABLE 347 SCG: BUSINESS OVERVIEW

FIGURE 52 SCG: COMPANY SNAPSHOT

TABLE 348 SCG: PRODUCT OFFERED

TABLE 349 SCG: DEALS

14.1.3 ALCOA CORPORATION

TABLE 350 ALCOA CORPORATION: BUSINESS OVERVIEW

FIGURE 53 ALCOA CORPORATION: COMPANY SNAPSHOT

TABLE 351 ALCOA CORPORATION: PRODUCT OFFERED

TABLE 352 ALCOA CORPORATION: DEALS

14.1.4 3A COMPOSITES

TABLE 353 3A COMPOSITES: BUSINESS OVERVIEW

FIGURE 54 3A COMPOSITES: COMPANY SNAPSHOT

TABLE 354 3A COMPOSITES: PRODUCT OFFERED

TABLE 355 3A COMPOSITES: DEALS

14.1.5 AVIENT CORPORATION

TABLE 356 AVIENT CORPORATION: BUSINESS OVERVIEW

FIGURE 55 AVIENT CORPORATION: COMPANY SNAPSHOT

TABLE 357 AVIENT CORPORATION: PRODUCT OFFERED

TABLE 358 AVIENT CORPORATION: DEALS

14.1.6 LOUISIANA-PACIFIC CORPORATION

TABLE 359 LOUISIANA-PACIFIC CORPORATION: BUSINESS OVERVIEW

FIGURE 56 LOUISIANA-PACIFIC CORPORATION: COMPANY SNAPSHOT

TABLE 360 LOUISIANA-PACIFIC CORPORATION: PRODUCT OFFERED

14.1.7 NICHIHA CORPORATION

TABLE 361 NICHIHA CORPORATION: BUSINESS OVERVIEW

FIGURE 57 NICHIHA CORPORATION: COMPANY SNAPSHOT

TABLE 362 NICHIHA CORPORATION: PRODUCT OFFERED

TABLE 363 NICHIHA CORPORATION: DEALS

14.1.8 CSR LIMITED

TABLE 364 CSR LIMITED: BUSINESS OVERVIEW

FIGURE 58 CSR LIMITED: COMPANY SNAPSHOT

TABLE 365 CSR LIMITED: PRODUCT OFFERED

14.1.9 CRH

TABLE 366 CRH: BUSINESS OVERVIEW

FIGURE 59 CRH: COMPANY SNAPSHOT

TABLE 367 CRH: PRODUCT OFFERED

14.1.10 CORNERSTONE BUILDING BRANDS

TABLE 368 CORNERSTONE BUILDING BRANDS: BUSINESS OVERVIEW

FIGURE 60 CORNERSTONE BUILDING BRANDS: COMPANY SNAPSHOT

TABLE 369 CORNERSTONE BUILDING BRANDS: PRODUCTS OFFERED

TABLE 370 CORNERSTONE BUILDING BRANDS: DEALS

14.2 OTHER PLAYERS

14.2.1 KRONOSPAN LIMITED

TABLE 371 KRONOSPAN LIMITED: COMPANY OVERVIEW

14.2.2 SHERA

TABLE 372 SHERA: COMPANY OVERVIEW

14.2.3 DRYVIT SYSTEMS INC.

TABLE 373 DRYVIT SYSTEMS INC.: COMPANY OVERVIEW

14.2.4 STADUR PRODUKTIONS GMBH & CO.KG

TABLE 374 STADUR PRODUKTIONS GMBH & CO.KG: COMPANY OVERVIEW

14.2.5 TRUSUS

TABLE 375 TRUSUS: COMPANY OVERVIEW

14.2.6 ELEMENTIA

TABLE 376 ELEMENTIA: COMPANY OVERVIEW

14.2.7 TORAY INDUSTRIES

TABLE 377 TORAY INDUSTRIES: COMPANY OVERVIEW

14.2.8 BORAL LIMITED

TABLE 378 BORAL LIMITED:COMPANY OVERVIEW

14.2.9 ARCELORMITTAL

TABLE 379 ARCELORMITTAL: COMPANY OVERVIEW

14.2.10 NUCOR

TABLE 380 NUCOR: COMPANY OVERVIEW

14.2.11 UNIVERSAL CEMENT CORPORATION

TABLE 381 UNIVERSAL CEMENT CORPORATION: COMPANY OVERVIEW

14.2.12 VINH TUONG INDUSTRIAL CORPORATION

TABLE 382 VINH TUONG INDUSTRIAL CORPORATION: COMPANY OVERVIEW

14.2.13 TERRACO GROUP

TABLE 383 TERRACO GROUP: COMPANY OVERVIEW

14.2.14 METECENO GROUP

TABLE 384 METECENO GROUP: COMPANY OVERVIEW

14.2.15 RIEDER GROUP

TABLE 385 RIEDER GROUP: COMPANY OVERVIEW

*Details on Business overview, Products and Solutions, Recent developments, MNM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 ADJACENT MARKETS (Page No. - 300)

15.1 CLADDING SYSTEMS MARKET

TABLE 386 CLADDING SYSTEMS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 387 CLADDING SYSTEMS MARKET SIZE, BY REGION, 2016–2023 (MILLION SQ. MT.)

TABLE 388 CLADDING SYSTEMS MARKET SIZE, BY MATERIAL, 2016–2023 (USD MILLION)

TABLE 389 CLADDING SYSTEMS MARKET SIZE, BY MATERIAL, 2016–2023 (MILLION SQ. MT.)

TABLE 390 CLADDING SYSTEMS MARKET SIZE, BY USE, 2016–2023 (USD MILLION)

TABLE 391 CLADDING SYSTEMS MARKET SIZE, BY USE, 2016–2023 (MILLION SQ. MT.)

TABLE 392 CLADDING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2023 (USD MILLION)

TABLE 393 CLADDING SYSTEMS MARKET SIZE, BY APPLICATION, 2016–2023 (MILLION SQ. MT.)

15.2 EXTERIOR INSULATION AND FINISH SYSTEM (EIFS) MARKET

TABLE 394 EIFS MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 395 EIFS MARKET SIZE, BY REGION, 2016–2023 (MILLION SQUARE FEET)

TABLE 396 EIFS MARKET SIZE, BY TYPE, 2016–2023 (USD MILLION)

TABLE 397 EIFS MARKET SIZE, BY TYPE, 2016–2023 (MILLION SQUARE FEET)

TABLE 398 EIFS MARKET SIZE, BY INSULATION MATERIAL, 2016–2023 (USD MILLION)

TABLE 399 EIFS MARKET SIZE, BY INSULATION MATERIAL, 2016–2023 (MILLION SQUARE FEET)

TABLE 400 EIFS MARKET SIZE, BY END-USE INDUSTRY, 2016–2023 (USD MILLION)

TABLE 401 EIFS MARKET SIZE, BY END-USE INDUSTRY, 2016–2023 (MILLION SQUARE FEET)

15.3 GLASS CURTAIN WALL MARKET

TABLE 402 GLASS CURTAIN WALL MARKET SIZE, BY REGION, 2016–2023 (USD MILLION)

TABLE 403 GLASS CURTAIN WALL MARKET SIZE, BY REGION, 2016–2023 (THOUSAND SQUARE METER)

TABLE 404 GLASS CURTAIN WALL MARKET, BY SYSTEM, 2016–2023 (USD MILLION)

TABLE 405 GLASS CURTAIN WALL MARKET, BY SYSTEM, 2016–2023 (THOUSAND SQUARE METER)

TABLE 406 GLASS CURTAIN WALL MARKET, BY END USE, 2016–2023 (USD MILLION)

TABLE 407 GLASS CURTAIN WALL MARKET, BY END USE, 2016–2023 (THOUSAND SQUARE METER)

15.4 SIDING MARKET

TABLE 408 SIDING MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

TABLE 409 SIDING MARKET SIZE, BY REGION, 2017–2024 (MILLION SQUARE FEET)

TABLE 410 SIDING MARKET SIZE, BY MATERIAL, 2017–2024 (USD MILLION)

TABLE 411 SIDING MARKET SIZE, BY MATERIAL, 2017–2024 (MILLION SQUARE FEET)

TABLE 412 SIDING MARKET SIZE, BY END USE INDUSTRY, 2017–2024 (USD MILLION)

TABLE 413 SIDING MARKET SIZE, BY END USE INDUSTRY, 2017–2024 (MILLION SQUARE FEET)

16 APPENDIX (Page No. - 311)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

The study involved four major activities for estimating the current global size of the exterior wall systems market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions and sizes with the industry experts across the value chain of precast concrete through primary research. The supply-side approach was employed to estimate the overall size of the exterior wall systems market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the exterior wall systems market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

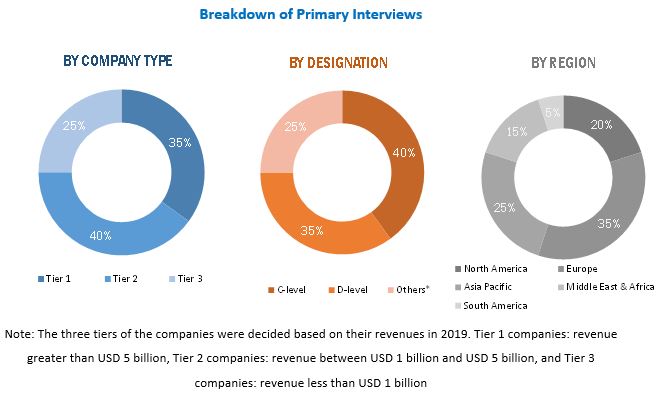

Primary Research

Various primary sources from both the supply and demand sides of the exterior wall systems market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the exterior wall systems industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

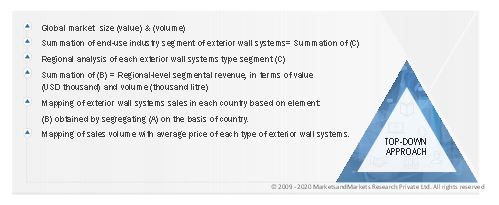

Market Size Estimation

The top-down approach was used to estimate and validate the global size of the exterior wall systems market. These approaches were also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the exterior wall systems market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the exterior wall systems market in terms of value and volume based on type, material,supporting wall, end-use industry, and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, APAC, Middle East & Africa, and South America

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as investments & expansions, partnerships & collaborations, new product developments, and merger & acquisitions, in the exterior wall systems market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the exterior wall systems report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the exterior wall systems market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Exterior Wall Systems Market