Exterior Insulation and Finish System (EIFS) Market by Type (PB, PM), Insulation Material (EPS, MW), End-use (Residential, Non-residential), Component (Adhesive, Insulation Board), Thickness (1-2 Inches, 3-6 Inches) & Region - Global Forecast to 2028

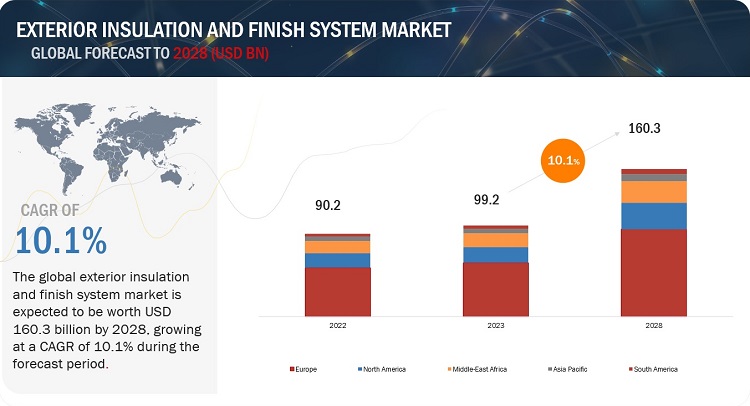

The market for exterior insulation and finish system is approximated to be USD 90.2 billion in 2022, and it is projected to reach USD 160.3 billion by 2028, at a CAGR of 10.1%.

Exterior insulation and finish system is basically a non-load bearing exterior wall treatment that utilizes rigid insulation boards on the wall sheathing, providing a plastic-like appearance. Primarily, exterior insulation and finish systems are used to reduce the amount of energy required to cool or heat a building by reducing the entry of hot air in summers and escape of heat during winters. These systems provide superb insulation and design flexibility and have been a popular choice for exterior building cladding for several decades. The exterior insulation and finish system market is segmented on the basis of type into polymer-based (PB) and polymer-modified (PM).

ATTRACTIVE OPPORTUNITIES IN THE EXTERIOR INSULATION AND FINISH SYSTEM MARKET

To know about the assumptions considered for the study, Request for Free Sample Report

Exterior insulation and finish system Market Dynamics

Driver: Growing investment in the construction industry will drive the market.

Infrastructure spending is a key driver of global and regional economies. It is expected that spending on capital projects and infrastructure will grow significantly in the next decade. The US, China, Japan, Germany, Australia, Canada, India, Indonesia, Brazil, and Spain are investing large amounts in the construction industry to achieve rapid and sustained economic growth. Considerable infrastructure investment is required for the modernization and commercialization of economic activities. Rapid urbanization in emerging markets, such as China, India, Brazil, Malaysia, and Indonesia, further boosts spending in vital infrastructure sectors, such as hospitality, healthcare, retail, and transportation. Increasing prosperity in these emerging markets is expected to drive the exterior insulation and finish system market.

Restraint: Availability of alternative green insulation material

Conventional materials such as stone wool, glass wool, and plastic foam, among others, are used in exterior insulation and finish systems. However, green insulation material known as hempcrete is proving to be increasingly popular among building professionals and engineers, especially in Europe. Hempcrete is a mixture of hemp fibers and cement-like binders that can be used for building thermal insulation. Hemp can be cultivated in both temperate and tropical climates and absorbs CO2 during its growth process, making it environment-friendly. Hempcrete provides resistance to heat and manages moisture in buildings. Thus, its availability acts as a restraint for the conventional insulation market.

Opportunities: Building-related energy-efficiency policies and regulations

In recent years, the EU, the US, and Asia Pacific countries have been very active in implementing policies that are influencing the overall energy consumption and resulting in a reduction of GHG emissions. These policies and initiatives are aimed at addressing climate change, improving energy efficiency, and reducing dependency on foreign energy sources. All these initiatives provide an opportunity for the global and exterior insulation and finish system market.

Challenges: Limited awareness among end users

There is a lack of awareness among consumers as well as building professionals about exterior insulation and finish systems. In some cases, buildings are not even insulated to code, that is, as per the location, weather conditions, and structure of the building; this is often due to lack of awareness on the part of some architects and building code officials. This has resulted in inadequate insulation in many commercial buildings. The lack of awareness about exterior insulation and finish system is a major challenge for the market.

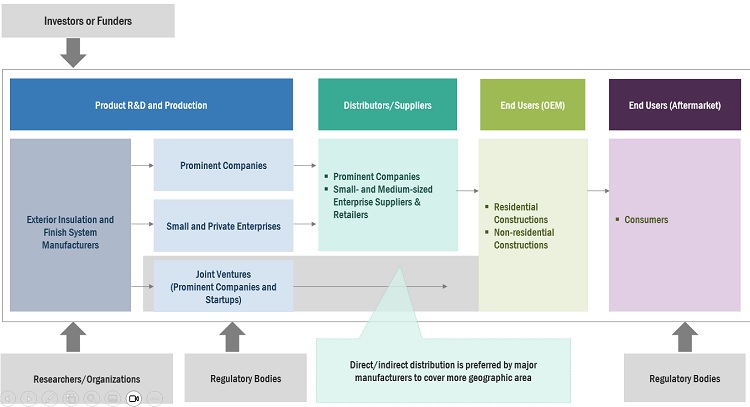

Exterior Insulation and Finish System (EIFS) Market ECOSYSTEM DIAGRAM

By Type, the Polymer-based segment accounted for the highest CAGR during the forecast period

The polymer-based segment led the market for exterior insulation and finish system, with a highest share of the overall market, in terms of value, in 2022, and is expected to grow at the highest CAGR from 2023 to 2028. The demand for exterior insulation in recent years has been increasing due to their properties, such as easy installation, the low cost, and resistance to heat and moisture of polymer-based insulation.

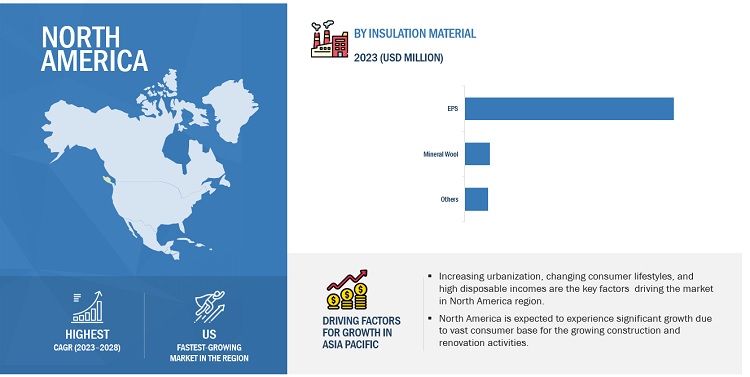

By Insulation Material, the EPS segment accounted for the largest share during the forecast period

The EPS segment accounted for highest share of the overall market in 2022, in terms of value. This can be attributed to the efficient cost, durability, water-resistance, high thermal insulation, low maintenance, and reliability of EPS. Exterior insulation and finish systems with EPS insulation material are the most widely used in North America and Europe.

By End Use Industry, the non-residential segment accounted for the largest share during the forecast period

The non-residential segment led the market for exterior insulation and finish system, with a highest share of the overall market, in terms of value, in 2022. Rising government concerns and increased spending on commercial & institutional construction have also fueled the demand for exterior insulation and finish systems in the non-residential segment. The housing renovation & remodeling activities, increasing green building norms, and focus on energy-efficient buildings in developed countries are the key factors propelling the growth of the exterior insulation and finish system market in the non-residential industry.

By Component, the exterior insulation and finish system comprised of adhesives, insulation boards, base coats, reinforcements (glass fiber mesh), and finish coats (renders and paints)

Exterior insulation and finish systems (EIFS) can be used to improve the energy efficiency of both new as well as existing buildings. A comprehensive range of these systems is available to meet the various demands of building structure and architecture. External insulation and finish systems or external thermal insulation composite systems (ETICS) are a set of construction elements consisting of certain (specified) prefabricated components applied directly to the facade.

By Thickness, the exterior insulation and finish system is available with 1-2 Inches, 3-6 Inches, and more than 6 inches

Exterior wall insulation has drawn a lot of attention in recent years due to both the high cost of energy as well as the impact that energy consumption has on the environment. The thickness of insulation plays an important role in determining how efficient the insulation is. When insulation of the right thickness is used, significant energy reduction can be achieved.

To know about the assumptions considered for the study, download the pdf brochure

Key Exterior Insulation and Finish System (EIFS) Market Players

Exterior insulation and finish system comprises major manufacturers such as Wacker Chemie AG (Germany), BASF SE (Germany), Saint-Gobain (France), Owen Corning (US), Sto SE & Co KGaA (US), Dryvit Systems Inc. (US), Terraco Group (UK), Omega Products International (US), Master Wall, Inc. (US), Parex USA, Inc. (US), Rmax (US), Durabond Products Limited (Canada), Adex Systems (Canada), and were the leading players in the exterior insulation and finish system market. Expansions, acquisitions, joint ventures, and Durock Alfacinf International (Canada). New product developments are some of the major strategies adopted by these key players to enhance their positions in the exterior insulation and finish system market.

Want to explore hidden markets that can drive new revenue in Exterior Insulation and Finish System (EIFS) Market?

Scope of the Report:

Want to explore hidden markets that can drive new revenue in Exterior Insulation and Finish System (EIFS) Market?

|

Report Metric |

Details |

|

Years Considered |

2021–2028 |

|

Base year |

2022 |

|

Forecast period |

2023–2028 |

|

Unit considered |

Value (USD Billion), and Volume (Million Square Feet) |

|

Segments |

Type, Insulation material, End-use industry, Component, Thickness, and Region |

|

Regions |

Europe, North America, Middle East & Africa, Asia Pacific, and South America |

|

Companies |

The major players are BASF SE (Germany), Saint-Gobain (France), Wacker Chemie AG (Germany), Sto SE & Co. KGaA (Germany), Owens Corning (United States), and others are covered in the Exterior insulation and finish system market. |

This research report categorizes the global Exterior insulation and finish system market on the basis of Type, Insulation material, End-use industry, Component, thickness, and Region.

Exterior insulation and finish system Market, By Type

- Polymer-based (PB)

- Polymer-modified (PM)

Exterior insulation and finish system Market, By Insulation material

- EPS

- MW

- Others

Exterior insulation and finish system Market, By End-use industry

- Non-residential

- Residential

Exterior insulation and finish system Market, By Component

- Adhesives

- Insulation boards

- Base coats

- Reinforcement mesh

- Finish coats

Exterior insulation and finish system Market, By Thickness

- 1-2 inches

- 3-6 inches

- More than 6 inches

Exterior insulation and finish system Market, By Region

- Europe

- North America

- Middle East & Africa

- Asia Pacific (APAC)

- South America

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In February 2023, The Sto SE & Co. KGaA launched StoGuard Conformable Membrane, a self-adhering membrane utilized in StoGuard air and water-resistant barrier systems. The novel membrane can be used to seal penetrations, rough apertures, substrate transitions, sheathing joints, dynamic joints, and substrate transitions.

- In March 2023, Wacker Chemie AG exhibited three new polymeric binders at the European Coatings Show in Nuremberg, Germany; the binders are intended for use in the creation of tile adhesives and mortars for external insulation and finish systems (EIFS). The VINNAPAS 4419 E, VINNAPAS 8819 E, and VINNAPAS 4449 E generate an unusually creamy consistency when added to dry-mix mortars, making the finished product simpler for customers to process. They also enhance wetting ability, and slip resistance.

- In June 2022, The BASF SE Neopor team launched Neopor BMB at the American Institute of Architects (AIA) Conference on Architecture in Chicago, IL. The low-carbon, EPS rigid foam insulation product offers added sustainability benefits in addition to traditional Neopor features. Neopor BMB's manufacture results in 60% lesser CO2 emissions than regular foam plastic insulation, and the material's carbon footprint is 90% lower than that of traditional Neopor.

- In January 2022, Owens Corning acquired Natural Polymers, LLC, a Cortland, Illinois-based producer of spray polyurethane foam insulation for building and construction applications. The tested technology from Natural will help the company offer clients a diverse selection of insulating products and long-term, sustainable solutions.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the Exterior insulation and finish system Market?

The major drivers influencing the growth of the Exterior insulation and finish system market are the growing investments in construction industry and stringent regulations to reduce greenhouse gas emissions.

What are the major challenges in the exterior insulation and finish system Market?

The major challenge in the exterior insulation and finish system market are the limited awareness among end users and the lack of skilled workers.

What are the restraining factors in the exterior insulation and finish system Market?

The major restraining factor faced by the exterior insulation and finish system market is the availability of alternative green insulation material and Fluctuating raw material prices.

What is the key opportunity in the Exterior insulation and finish system Market?

Building-related energy-efficiency policies and regulations are the key opportunity for the Exterior insulation and finish system market.

What are the different insulation materials used in the Exterior insulation and finish system?

EPS, MW, XPS, WW etc. are some of the insulation materials used in EIFS.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing investments in construction industry- Stringent regulations to reduce greenhouse gas emissions- Need to reduce energy consumption and focus on green buildings- Introduction of rebates and tax creditsRESTRAINTS- Health risks resulting from use of toxic chemicals as raw materials- Availability of alternative green insulation material- Fluctuating raw material pricesOPPORTUNITIES- Building-related energy-efficiency policies and regulationsCHALLENGES- Limited awareness among end users- Lack of skilled workers

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

-

6.3 TRENDS AND DISRUPTIONS IMPACTING MARKET GROWTHREVENUE SHIFT AND NEW REVENUE POCKETS FOR EXTERIOR INSULATION AND FINISH SYSTEM MANUFACTURERS

-

6.4 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.5 PATENT ANALYSISINTRODUCTIONMETHODOLOGY

-

6.6 REGULATORY ANALYSISINTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO)AMERICAN NATIONAL STANDARDS INSTITUTENATIONAL FIRE PROTECTION ASSOCIATION

- 6.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.8 PRICING ANALYSISAVERAGE SELLING PRICE, BY REGIONAVERAGE SELLING PRICE, BY INSULATION MATERIAL

-

6.9 TECHNOLOGY ANALYSISDRAINABLE EIFSSYNTHETIC COATINGSCUSTOMIZABLE REINFORCING MESH

-

6.10 ECOSYSTEM ANALYSIS

- 6.11 CASE STUDY ANALYSIS

- 6.12 KEY CONFERENCES & EVENTS, 2023

-

6.13 MACROECONOMIC INDICATORSINTRODUCTIONTRENDS AND GDP FORECAST

-

6.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

- 7.2 POLYMER-BASED (PB)

- 7.3 POLYMER-MODIFIED (PM)

- 8.1 INTRODUCTION

- 8.2 EXPANDED POLYSTYRENE (EPS)

- 8.3 MINERAL WOOL (MW)

- 8.4 OTHERS

- 9.1 INTRODUCTION

- 9.2 ADHESIVE

- 9.3 INSULATION BOARD

- 9.4 BASE COAT

- 9.5 REINFORCEMENT

- 9.6 FINISH COAT

- 10.1 INTRODUCTION

- 10.2 1–2 INCHES

- 10.3 3–6 INCHES

- 10.4 MORE THAN 6 INCHES

- 11.1 INTRODUCTION

- 11.2 RESIDENTIAL

-

11.3 NON-RESIDENTIALCOMMERCIAL BUILDINGSINDUSTRIAL BUILDINGSOTHER NON-RESIDENTIAL BUILDINGS

- 12.1 INTRODUCTION

-

12.2 EUROPERECESSION IMPACTGERMANY- Booming construction industry to drive marketUK- New construction projects to drive demandFRANCE- Growth in construction industry to propel demandITALY- Need to reduce energy consumption to drive marketSPAIN- Increasing LEED green building initiatives to boost marketPOLAND- Rising demand for commercial spaces to drive marketREST OF EUROPE

-

12.3 NORTH AMERICARECESSION IMPACTUS- Significant presence of EIFS manufacturers to drive marketCANADA- Increasing residential and non-residential construction activities to drive demandMEXICO- Rising infrastructure investment to drive market growth

-

12.4 MIDDLE EAST & AFRICARECESSION IMPACTTURKEY- Investments in building & construction industry to drive marketUAE- Efforts to encourage energy efficiency to drive demandSAUDI ARABIA- Increasing infrastructural projects to propel marketSOUTH AFRICA- Need to adhere to national building standards to boost marketREST OF MIDDLE EAST & AFRICA

-

12.5 ASIA PACIFICRECESSION IMPACTCHINA- Availability of cheap raw material and labor to drive market growthJAPAN- Mega construction projects to fuel marketAUSTRALIA- Growth in construction industry to boost marketINDIA- Increasing urbanization to drive demandSOUTH KOREA- Rise in construction permits to support market growthREST OF ASIA PACIFIC

-

12.6 SOUTH AMERICARECESSION IMPACTBRAZIL- Growing demand for energy-efficient facade systems to boost marketARGENTINA- Increasing government expenditure on construction projects to propel marketREST OF SOUTH AMERICA

- 13.1 OVERVIEW

- 13.2 MARKET SHARE ANALYSIS

- 13.3 REVENUE ANALYSIS OF TOP PLAYERS

-

13.4 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPARTICIPANTSPERVASIVE COMPANIES

- 13.5 COMPETITIVE BENCHMARKING

-

13.6 COMPETITIVE LEADERSHIP MAPPING (START-UPS/SMES)SME MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 13.7 COMPETITIVE BENCHMARKING OF OVERALL MARKET

-

13.8 COMPETITIVE SCENARIODEALSPRODUCT LAUNCHESOTHER DEVELOPMENTS

-

14.1 KEY PLAYERSBASF SE- Business overview- Products/solutions/services offered- Recent developments- MnM viewSAINT-GOBAIN- Business overview- Products/solutions/services offered- Recent developments- MnM viewWACKER CHEMIE AG- Business overview- Products/solutions/services offered- Recent developments- MnM viewSTO SE & CO. KGAA- Business overview- Products/solutions/services offered- Recent developments- MnM viewOWENS CORNING- Business overview- Products/solutions/services offered- Recent developments- MnM viewSFS GROUP AG- Business overview- Products/solutions/services offered- MnM viewDRYVIT SYSTEMS, INC.- Business overview- Products/solutions/services offered- MnM viewMASTER WALL, INC.- Business overview- Products/solutions/services offered- Recent developments- MnM viewPAREX USA, INC.- Business overview- Products/solutions/services offered- MnM viewSIKA CORPORATION- Business overview- Products/solutions/services offered- MnM viewROCKWOOL INTERNATIONAL A/S- Business overview- Products/solutions/services offered

-

14.2 ADDITIONAL PLAYERSDURABOND PRODUCTS LTDDUROCK ALFACING INTERNATIONAL LIMITEDTERRACO GROUPOMEGA PRODUCTS INTERNATIONALADEX SYSTEMSMASTER BUILDERS SOLUTIONSATLAS EPSDUPONT DE NEMOURS, INC.ENERGEX WALL SYSTEMSCABOT GYPSUMKINGSPAN GROUP PLCDOWTHE RAYMOND GROUPIPA SYSTEMS, INC.

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

-

15.3 INSULATION PRODUCTS MARKETMARKET DEFINITIONMARKET OVERVIEW

- 15.4 INSULATION PRODUCTS MARKET, BY INSULATION TYPE

- 15.5 INSULATION PRODUCTS MARKET, BY MATERIAL TYPE

- 15.6 INSULATION PRODUCTS MARKET, BY END-USE INDUSTRY

- 15.7 INSULATION PRODUCTS MARKET, BY REGION

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS

- TABLE 1 EXTERIOR INSULATION AND FINISH SYSTEM MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 INDUSTRY (INCLUDING CONSTRUCTION) VALUE ADDED (USD MILLION), 2021

- TABLE 3 REGION-WISE REGULATIONS TO REDUCE GHG EMISSIONS

- TABLE 4 PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 AVERAGE SELLING PRICE, BY INSULATION MATERIAL (USD/SQUARE FOOT)

- TABLE 7 KEY CONFERENCES & EVENTS, 2023

- TABLE 8 WORLDWIDE GDP GROWTH PROJECTION

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF EXTERIOR INSULATION AND FINISH SYSTEMS

- TABLE 10 KEY BUYING CRITERIA FOR EIFS INDUSTRY

- TABLE 11 EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 12 EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 13 TEMPERATURE RANGE FOR DIFFERENT MATERIALS

- TABLE 14 R-VALUE OF DIFFERENT MATERIALS

- TABLE 15 EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 16 EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 17 R-VALUE FOR EPS OF VARYING THICKNESS FOR A STANDARD OR DRAINAGE EIFS

- TABLE 18 EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 19 EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 20 EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 21 EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY REGION, 2021–2028 (MILLION SQUARE FEET)

- TABLE 22 EUROPE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 EUROPE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 24 EUROPE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 25 EUROPE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 26 EUROPE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 27 EUROPE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 28 EUROPE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 29 EUROPE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 30 GERMANY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 31 GERMANY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 32 GERMANY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 33 GERMANY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 34 GERMANY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 35 GERMANY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 36 UK: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 37 UK: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 38 UK: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 39 UK: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 40 UK: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 41 UK: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 42 FRANCE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 43 FRANCE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 44 FRANCE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 45 FRANCE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 46 FRANCE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 47 FRANCE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 48 ITALY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 49 ITALY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 50 ITALY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 51 ITALY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 52 ITALY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 53 ITALY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 54 SPAIN: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 55 SPAIN: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 56 SPAIN: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 57 SPAIN: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 58 SPAIN: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 59 SPAIN: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 60 POLAND: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 61 POLAND: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 62 POLAND: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 63 POLAND: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 64 POLAND: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 65 POLAND: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 66 REST OF EUROPE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 67 REST OF EUROPE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 68 REST OF EUROPE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 69 REST OF EUROPE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 70 REST OF EUROPE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 71 REST OF EUROPE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 72 NORTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 74 NORTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 76 NORTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 77 NORTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 78 NORTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 80 US: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 81 US: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 82 US: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 83 US: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 84 US: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 85 US: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 86 CANADA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 87 CANADA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 88 CANADA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 89 CANADA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 90 CANADA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 91 CANADA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 92 MEXICO: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 93 MEXICO: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 94 MEXICO: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 95 MEXICO: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 96 MEXICO: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 97 MEXICO: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 98 MIDDLE EAST & AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 99 MIDDLE EAST & AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 100 MIDDLE EAST & AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 101 MIDDLE EAST & AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 102 MIDDLE EAST & AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 103 MIDDLE EAST & AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 104 MIDDLE EAST & AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 105 MIDDLE EAST & AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 106 TURKEY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 107 TURKEY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 108 TURKEY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 109 TURKEY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 110 TURKEY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 111 TURKEY: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 112 UAE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 113 UAE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 114 UAE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 115 UAE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 116 UAE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 117 UAE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 118 SAUDI ARABIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 119 SAUDI ARABIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 120 SAUDI ARABIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 121 SAUDI ARABIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 122 SAUDI ARABIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 123 SAUDI ARABIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 124 SOUTH AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 SOUTH AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 126 SOUTH AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 127 SOUTH AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 128 SOUTH AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 129 SOUTH AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 130 REST OF MIDDLE EAST & AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 131 REST OF MIDDLE EAST & AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 132 REST OF MIDDLE EAST & AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 133 REST OF MIDDLE EAST & AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 134 REST OF MIDDLE EAST & AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 135 REST OF MIDDLE EAST & AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 136 ASIA PACIFIC: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 138 ASIA PACIFIC: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 139 ASIA PACIFIC: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 140 ASIA PACIFIC: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 141 ASIA PACIFIC: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 142 ASIA PACIFIC: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 143 ASIA PACIFIC: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 144 CHINA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 145 CHINA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 146 CHINA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 147 CHINA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 148 CHINA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 149 CHINA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 150 JAPAN: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 151 JAPAN: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 152 JAPAN: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 153 JAPAN: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 154 JAPAN: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 155 JAPAN: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 156 AUSTRALIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 157 AUSTRALIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 158 AUSTRALIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 159 AUSTRALIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 160 AUSTRALIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 161 AUSTRALIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 162 INDIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 163 INDIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 164 INDIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 165 INDIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 166 INDIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 167 INDIA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 168 SOUTH KOREA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 169 SOUTH KOREA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 170 SOUTH KOREA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 171 SOUTH KOREA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 172 SOUTH KOREA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 173 SOUTH KOREA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 174 REST OF ASIA PACIFIC: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 176 REST OF ASIA PACIFIC: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 177 REST OF ASIA PACIFIC: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 178 REST OF ASIA PACIFIC: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 179 REST OF ASIA PACIFIC: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 180 SOUTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 181 SOUTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY COUNTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 182 SOUTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 183 SOUTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 184 SOUTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 185 SOUTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 186 SOUTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 187 SOUTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 188 BRAZIL: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 189 BRAZIL: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 190 BRAZIL: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 191 BRAZIL: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 192 BRAZIL: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 193 BRAZIL: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 194 ARGENTINA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 195 ARGENTINA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 196 ARGENTINA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 197 ARGENTINA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 198 ARGENTINA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 199 ARGENTINA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 200 REST OF SOUTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 201 REST OF SOUTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY TYPE, 2021–2028 (MILLION SQUARE FEET)

- TABLE 202 REST OF SOUTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (USD MILLION)

- TABLE 203 REST OF SOUTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY INSULATION MATERIAL, 2021–2028 (MILLION SQUARE FEET)

- TABLE 204 REST OF SOUTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 205 REST OF SOUTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY END-USE INDUSTRY, 2021–2028 (MILLION SQUARE FEET)

- TABLE 206 EXTERIOR INSULATION AND FINISH SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 207 EXTERIOR INSULATION AND FINISH SYSTEM MARKET: KEY PLAYERS

- TABLE 208 DEALS, 2020–2023

- TABLE 209 PRODUCT LAUNCHES, 2020–2023

- TABLE 210 OTHER DEVELOPMENTS, 2020–2023

- TABLE 211 BASF SE: BUSINESS OVERVIEW

- TABLE 212 BASF SE: PRODUCT LAUNCHES

- TABLE 213 SAINT-GOBAIN: BUSINESS OVERVIEW

- TABLE 214 SAINT-GOBAIN: DEALS

- TABLE 215 WACKER CHEMIE AG: BUSINESS OVERVIEW

- TABLE 216 WACKER CHEMIE AG: PRODUCT LAUNCHES

- TABLE 217 WACKER CHEMIE AG: OTHERS

- TABLE 218 STO SE & CO. KGAA: BUSINESS OVERVIEW

- TABLE 219 STO SE & CO. KGAA: PRODUCT LAUNCHES

- TABLE 220 OWENS CORNING: BUSINESS OVERVIEW

- TABLE 221 OWENS CORNING: PRODUCT LAUNCHES

- TABLE 222 OWENS CORNING: DEALS

- TABLE 223 SFS GROUP AG: BUSINESS OVERVIEW

- TABLE 224 DRYVIT SYSTEMS, INC.: BUSINESS OVERVIEW

- TABLE 225 MASTER WALL, INC.: BUSINESS OVERVIEW

- TABLE 226 MASTER WALL, INC.: PRODUCT LAUNCHES

- TABLE 227 PAREX USA, INC.: BUSINESS OVERVIEW

- TABLE 228 SIKA CORPORATION: BUSINESS OVERVIEW

- TABLE 229 ROCKWOOL INTERNATIONAL A/S : BUSINESS OVERVIEW

- TABLE 230 DURABOND PRODUCTS LTD: COMPANY OVERVIEW

- TABLE 231 DUROCK ALFACING INTERNATIONAL LIMITED: COMPANY OVERVIEW

- TABLE 232 TERRACO GROUP: COMPANY OVERVIEW

- TABLE 233 OMEGA PRODUCTS INTERNATIONAL: COMPANY OVERVIEW

- TABLE 234 ADEX SYSTEMS: COMPANY OVERVIEW

- TABLE 235 MASTER BUILDERS SOLUTIONS: COMPANY OVERVIEW

- TABLE 236 ATLAS EPS: COMPANY OVERVIEW

- TABLE 237 DUPONT DE NEMOURS, INC.: COMPANY OVERVIEW

- TABLE 238 ENERGEX WALL SYSTEMS: COMPANY OVERVIEW

- TABLE 239 CABOT GYPSUM: COMPANY OVERVIEW

- TABLE 240 KINGSPAN GROUP PLC: COMPANY OVERVIEW

- TABLE 241 DOW: COMPANY OVERVIEW

- TABLE 242 THE RAYMOND GROUP: COMPANY OVERVIEW

- TABLE 243 IPA SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 244 INSULATION PRODUCTS MARKET SIZE, BY INSULATION TYPE, 2020–2026 (USD MILLION)

- TABLE 245 INSULATION PRODUCTS MARKET SIZE, BY MATERIAL TYPE, 2020–2026 (USD MILLION)

- TABLE 246 INSULATION PRODUCTS MARKET SIZE, BY END-USE INDUSTRY, 2020–2026 (USD MILLION)

- TABLE 247 INSULATION PRODUCTS MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

- FIGURE 1 EXTERIOR INSULATION AND FINISH SYSTEM MARKET SEGMENTATION

- FIGURE 2 EXTERIOR INSULATION AND FINISH SYSTEM MARKET, BY REGION

- FIGURE 3 EXTERIOR INSULATION AND FINISH SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 4 EXTERIOR INSULATION AND FINISH SYSTEM MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 EXTERIOR INSULATION AND FINISH SYSTEM MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 EXTERIOR INSULATION AND FINISH SYSTEM MARKET SIZE ESTIMATION (SUPPLY-SIDE)

- FIGURE 7 VOLUME APPROACH

- FIGURE 8 EXTERIOR INSULATION AND FINISH SYSTEM MARKET: DATA TRIANGULATION

- FIGURE 9 STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 10 POLYMER-BASED SEGMENT ACCOUNTED FOR LARGER MARKET SHARE

- FIGURE 11 EPS INSULATION MATERIAL SEGMENT TO HOLD LARGEST MARKET SIZE

- FIGURE 12 NON-RESIDENTIAL SEGMENT TO LEAD EXTERIOR INSULATION AND FINISH SYSTEM MARKET

- FIGURE 13 EUROPE LED EXTERIOR INSULATION AND FINISH SYSTEM MARKET IN 2022

- FIGURE 14 FOCUS ON ENERGY-EFFICIENT AND GREEN BUILDINGS TO DRIVE MARKET GROWTH

- FIGURE 15 EUROPE AND POLYMER-BASED SEGMENT DOMINATED EXTERIOR INSULATION AND FINISH SYSTEM MARKET IN 2022

- FIGURE 16 P0LAND PROJECTED TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 EXTERIOR INSULATION AND FINISH SYSTEM MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 INCREASING CONSTRUCTION OF GREEN BUILDINGS IN US

- FIGURE 19 VALUE CHAIN

- FIGURE 20 REVENUE SHIFT FOR EXTERIOR INSULATION AND FINISH SYSTEM MANUFACTURERS

- FIGURE 21 EXTERIOR INSULATION AND FINISH SYSTEM MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 22 GRANTED PATENTS ACCOUNTED FOR 39% OF TOTAL COUNT IN LAST FIVE YEARS

- FIGURE 23 PUBLICATION TRENDS - LAST FIVE YEARS

- FIGURE 24 JURISDICTION ANALYSIS

- FIGURE 25 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 26 AVERAGE SELLING PRICE, BY REGION (USD/SQUARE FEET)

- FIGURE 27 ECOSYSTEM OF EXTERIOR INSULATION AND FINISH SYSTEM MARKET

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 29 KEY BUYING CRITERIA OF EIFS INDUSTRY

- FIGURE 30 EXTERIOR INSULATION AND FINISH SYSTEM MARKET SIZE, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 31 EXTERIOR INSULATION AND FINISH SYSTEM MARKET SIZE, BY INSULATION MATERIAL, 2023 VS. 2028 (USD MILLION)

- FIGURE 32 EXTERIOR INSULATION AND FINISH SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2023 VS. 2028 (USD MILLION)

- FIGURE 33 US TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICAN MARKET TO RECORD FASTEST -GROWTH DURING FORECAST PERIOD

- FIGURE 35 EUROPE: EXTERIOR INSULATION AND FINISH SYSTEM MARKET SNAPSHOT

- FIGURE 36 NORTH AMERICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET SNAPSHOT

- FIGURE 37 MIDDLE EAST & AFRICA: EXTERIOR INSULATION AND FINISH SYSTEM MARKET SNAPSHOT

- FIGURE 38 ASIA PACIFIC: EXTERIOR INSULATION AND FINISH SYSTEM MARKET SNAPSHOT

- FIGURE 39 DEALS AND PRODUCT LAUNCHES WERE KEY GROWTH STRATEGIES BETWEEN 2020 AND 2023

- FIGURE 40 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

- FIGURE 41 FOUR-YEAR REVENUE ANALYSIS OF KEY COMPANIES

- FIGURE 42 COMPETITIVE LEADERSHIP MAPPING: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, 2022

- FIGURE 43 SME MATRIX: EXTERIOR INSULATION AND FINISH SYSTEM MARKET, 2021

- FIGURE 44 BASF SE: COMPANY SNAPSHOT

- FIGURE 45 SAINT-GOBAIN: COMPANY SNAPSHOT

- FIGURE 46 WACKER CHEMIE AG: COMPANY SNAPSHOT

- FIGURE 47 STO SE & CO. KGAA: COMPANY SNAPSHOT

- FIGURE 48 OWENS CORNING: COMPANY SNAPSHOT

- FIGURE 49 SFS GROUP AG: COMPANY SNAPSHOT

- FIGURE 50 ROCKWOOL INTERNATIONAL A/S: COMPANY SNAPSHOT

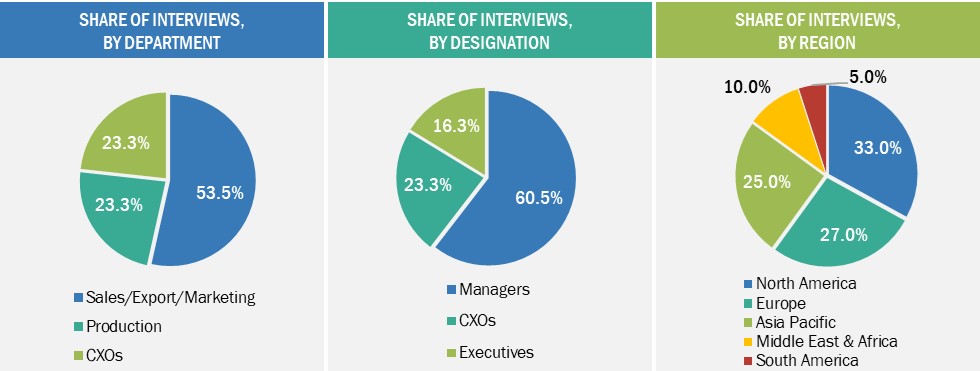

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the exterior insulation and finish system market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies, white papers, and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The Exterior insulation and finish system market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the Exterior insulation and finish system market. Primary sources from the supply side include associations and institutions involved in the exterior insulation and finish system industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents—

Notes: Other designations include product, sales, and marketing managers. Tiers of the companies are classified based on their annual revenues as of 2021, Tier 1 = >USD 5 Billion, Tier 2 = USD 1 Billion to USD 5 Billion, and Tier 3=

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global Exterior insulation and finish system market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage share split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players, along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach and Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Market Definition

The Exterior insulation and finish system market refers to the industry that produces and supplies exterior insulation and finish system. Exterior insulation and finish system material refers to a type of cladding that provides an insulated finished surface for exterior walls. It is used to create an energy-efficient, fire-resistant, low-maintenance, and esthetic outer surface and can be applied in numerous layers over outer sheathing.

Key Stakeholders

- Raw Material Suppliers

- Exterior insulation and finish system Manufacturers

- Exterior insulation and finish system importers and exporters

- Builders and contractors

- Commercial R&D institutions

- Architects and contractors

- Associations and industry bodies

- Regulatory bodies

Report Objectives

- To define, describe, and forecast the global exterior insulation and finish system market in terms of value and volume.

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on type, insulation material, region, and end-use industry.

- To forecast the market size, in terms of value and volume, with respect to five main regions: Europe, North America, Middle East & Africa, Asia Pacific, and South America.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape

- To strategically profile key players in the market

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions

- To strategically profile the leading players and comprehensively analyze their key developments in the market

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the Asia Pacific Exterior insulation and finish system market

- Further breakdown of the Rest of Europe's Exterior insulation and finish system market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Exterior Insulation and Finish System (EIFS) Market