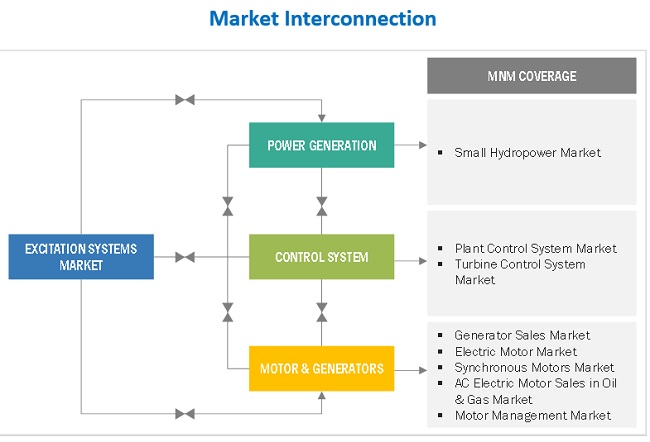

Excitation Systems Market by Type (Static and Brushless), Controller Type (Analog and Digital), Application (Synchronous Generators and Synchronous Motors), End User (Power Generation, Heavy Industries, and OEMs) and Region - Global Forecast to 2026

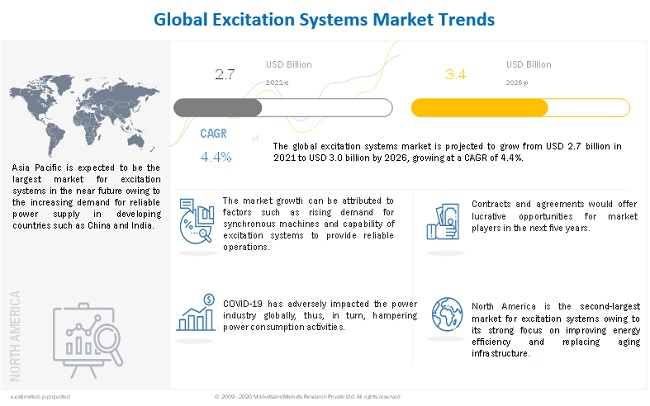

[213 Pages Report] The global excitation systems market in terms of revenue was estimated to be worth $2.7 billion in 2021 and is poised to reach $3.4 billion by 2026, growing at a CAGR of 4.4% from 2021 to 2026. Synchronous machines, which are used for fixed speed as well as variable speed applications, provide optimized energy use and reduce maintenance costs. Maintenance cost savings are much higher in case of brushless DC generators. Energy saving and power factor correction abilities are the key advantages offered by synchronous machines and have played a key role in their increasing popularity. The rising popularity of synchronous machines has, in turn, driven the growth of excitation systems.

To know about the assumptions considered for the study, Request for Free Sample Report

Excitation Systems Market Dynamics

Driver: Rise in demand for synchronous machines to provide reliable operation

A synchronous machine constitutes both synchronous motors as well as synchronous generators. Excitation systems are a key component in many power generating units used by plant owners and operators to achieve reliability of operations, stability, and fast transient response of their assets, according to grid requirements. Synchronous machines, along with excitation systems, ensure the stable and continuous power supply required for efficient plant operation. Thus, excitation systems ensure reliable long-term operation of synchronous machines as they influence operational readiness.

Restraint: Complex design leading to difficulty in maintenance of excitation systems

Generator excitation systems are known to be the most maintenance-intensive subsystems. Power plant reliability is greatly influenced by the maintenance activities carried out on various system equipment. Excitation systems, if not maintained properly, can be a major reason for unplanned outage hours of power plants. Hence, in order to prevent such outages, maintenance systems have to be revised adequately in order to ensure proper working of the systems. This is expected to hinder the growth of the excitation systems market.

Opportunities: Increasing investments in renewable energy, especially hydropower

Increasing concerns related to global warming, carbon emissions, and rising pollution have motivated countries to move toward clean energy sources. Governments are implementing strategies to tackle these environmental issues. According to the IEA, renewables will overtake coal to become the largest source of electricity generation worldwide in 2025. By that time, renewables are expected to supply one-third of the world’s electricity. Hydropower will continue to supply almost half of the global renewable electricity. It is the largest source of renewable electricity worldwide, followed by wind and solar PV. Thus, these investments create opportunities for the excitation systems market.

Challenges: Shortage of components/parts used in manufacturing excitation systems

The pandemic has slowed the growth of the power industry as more and more countries are resorting to lockdowns to prevent further spikes in the spread of the disease. The renewable energy industry, which until recently was growing at a rapid pace, has been witnessing slow growth during the past few months. This slowdown is mainly due to economic contractions, which have resulted in the reduction of power demand from various end-use industries. With the decrease in power demand, it is estimated that there would be very negligible investments from the utilities for replacing aging grid infrastructure and new renewable installations.

To know about the assumptions considered for the study, download the pdf brochure

Brushless is expected to grow at the fastest rate for excitation systems market, by type, during the forecast period

The market has been segmented, by type, into static and brushless. Brushless excitation systems segment is the fastest growing market of the excitation systems market in 2020. In brushless excitation systems, the field current is supplied to synchronous machines without using slip rings and carbon brushes. As these systems do not require carbon brushes, losses due to contact resistance are low, thus resulting in low maintenance as compared to static excitation systems.

The digital segment is projected to register a higher CAGR than the controller type segment during the forecast period

The report segments the excitation systems market by controller type into analog and digital. Digital control is estimated to be the fastest and the largest growing segment. Digital excitation systems provide a significant improvement in generator performance by improving transient as well as dynamic stability. Easy conversion of analog to digital controls is another key factor that is expected to foster the demand for digital control systems during the forecast period.

By application, synchronous generators are expected to be the most significant contributor to the excitation systems market during the forecast period

By application, the market has been segmented into synchronous generators and synchronous motors. Synchronous generators are expected to be the largest and fastest growing segment during the forecast period. The synchronous generator is designed for feeding turbo-generator excitation winding with automatically regulated DC in generator operation. The generator system includes various functional systems such as a power circuit, automatic regulators, and protection and control systems. Rising demand for generators in hydropower generation is expected to support the demand for excitation systems.

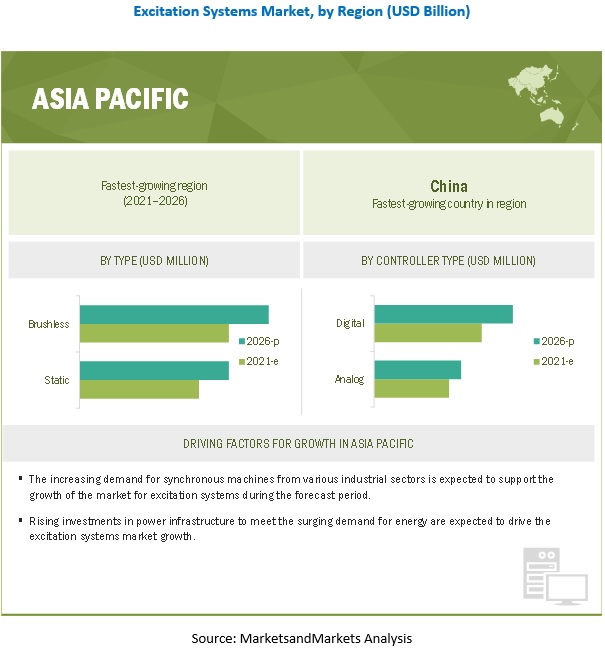

Asia Pacific is expected to be the largest market during the forecast period.

In this report, the excitation systems market has been analyzed with respect to six regions, namely, North America, Europe, Asia Pacific, South America, the Middle East, and Africa. Asia Pacific is expected to be the largest and fastest-growing market for excitation systems during the forecast period. Also, rapidly growing renewable energy based capacity additions are expected to support the demand for excitation systems for synchronous machines in the coming years.

Key Market Players

Some of the major players in the excitation systems market are ABB (Switzerland), Siemens Energy(Germany), General Electric (US), ANDRITZ Group (Austria), and Emerson (US).

Want to explore hidden markets that can drive new revenue in Excitation Systems Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Excitation Systems Market?

|

Report Metric |

Details |

|

Market Size available for years |

2016–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2020–2026 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Controller Type, Application, End User and region |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East, Africa, and South America |

|

Companies covered |

ABB (Switzerland), Siemens Energy (Germany),General Electric (US), ANDRITZ Group (Austria), Voith Group (Germany), Nidec Corporation (Japan), KONCAR Group(Croatia), Emerson (US), Melrose Industries PLC (UK), Mitsubishi Electric Corporation (Japan), WEG (Brazil), Tenel, S.R.O. (Czech Republic), Basler Electric (US), Automation Electronics India (India), Amtech Power Ltd. (India), Reivax (Brazil), Veo Oy (Finland), L & S Electric (US), PLUTON Group (Ukraine), NR Electric Co., Ltd, Birr Machines (Aargau), SVEA Power (Sweden) , Excitation & Engineering Services Ltd (UK) , Nelumbo Icona Controls Pvt. Ltd (India), F&S PROZESSAUTOMATION GmbH (Germany) |

This research report categorizes the excitation systems market-based type, controller type, application, end user and region.

Based on component, the market has been segmented as follows:

By Type

- Static

- Brushless

By Controller Type

- Analog

- Digital

By Application

- Synchronous Generators

- Synchronous Motors

By End User

-

Power Generation Industry

- Hydroelectric Power Plants

- Thermal Power Plants

-

Heavy Industries

- Marine

- Others

- OEMs

By Region

- North America

- Asia Pacific

- Europe

- Middle East

- Africa

- South America

Recent Developments

- In November 2020, Emerson was awarded a contract from Oklahoma Gas and Electric (OG&E) for the OG&E Redbud combined-cycle plant to upgrade and unify nine disparate control systems across four units. By installing Emerson’s Ovation technology at its Redbud combined-cycle power plant, Oklahoma Gas and Electric (OG&E) has realized numerous benefits, including the ability to cold start each unit 25 to 35 minutes faster, enabling the utility to more quickly generate megawatts while also reducing fuel costs.

- In November 2020, ABB won a contract to provide excitation systems and speed regulation for four generator units at the Governador José Richa hydropower plant on the Iguazu River. The solution helped Copel (Companhia Paranaense de Energia) to enhance the visibility of its operational data using predictive diagnostics.

- In May 2020, ANDRITZ signed a contract with Companhia Hidrelétrica do São Francisco (CHESF) to perform complete modernization and digitalization of the Sobradinho hydropower plant located on the São Francisco river, Brazil. The scope of supply comprises medium & low voltage cubicles, automation & control systems, spillway & water intake, conditioning monitoring system, HIPASE technology for synchronization, excitation, turbine governor and protection, repair service, transformers, cooling, and ventilation systems.

- In March 2020, Nidec Leroy-Somer launched TAL 0473. The TAL 0473 delivers a nominal power between 400 and 660 kVA at 50 Hz (from 495 to 825 kVA at 60 Hz). The alternator features a SHUNT excitation system and an R150 regulator as standard.

- In November 2019, Reivax (Canada) and General Electric (US) signed a contract with Seattle City Light (US) to supply static excitation systems for boundary dam power stations.

Frequently Asked Questions (FAQ):

What is the current size of the excitation systems market?

The current market size of global excitation systems market is 2.5 billion in 2020.

What is the major drivers for excitation systems market?

Energy saving & power factor correction abilities increase in demand for uninterrupted and reliable power supply in several industries are the key advantages offered by synchronous machines are some of the major drivers driving the market of excitation systems .

Which is the fastest growing region during the forecasted period in excitation systems market?

Asia Pacific is the fastest growing region during the forecasted period owing to increasing power consumption, growing renewable energy-based capacity additions are expected to support the demand for excitation systems for synchronous machines

Which is the fastest growing segment, by end use during the forecasted period in excitation systems market?

The OEMs , by end user is the fastest growing segment during the forecasted period due to increase demand of synchronous machine. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 EXCITATION SYSTEMS MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

1.2.2 MARKET, BY END USER: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONAL SCOPE

1.4 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 34)

2.1 RESEARCH DATA

FIGURE 1 EXCITATION SYSTEMS MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

2.3 SCOPE

2.4 IMPACT OF COVID-19 ON POWER INDUSTRY

2.5 MARKET SIZE ESTIMATION

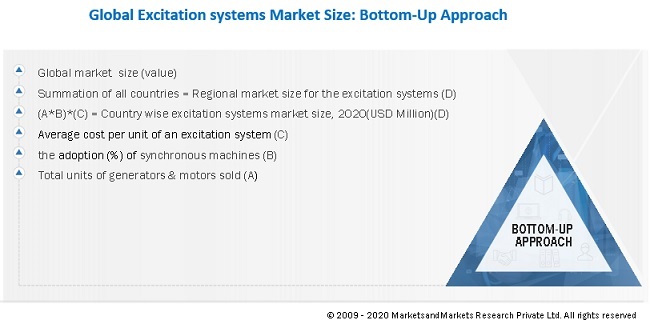

2.5.1 BOTTOM-UP APPROACH

FIGURE 3 EXCITATION SYSTEMS MARKET: INDUSTRY-REGION/COUNTRY-WISE ANALYSIS

2.5.2 TOP-DOWN APPROACH

FIGURE 4 MARKET: TOP-DOWN APPROACH

2.6 DEMAND-SIDE METRICS

FIGURE 5 MAIN METRICS CONSIDERED WHILE CONSTRUCTING AND ASSESSING DEMAND FOR EXCITATION SYSTEMS

2.6.1 CALCULATION FOR DEMAND SIDE

2.6.2 ASSUMPTIONS FOR DEMAND SIDE

2.7 SUPPLY-SIDE ANALYSIS

FIGURE 6 KEY STEPS CONSIDERED FOR ASSESSING SUPPLY OF EXCITATION SYSTEMS

FIGURE 7 MARKET: SUPPLY-SIDE ANALYSIS, 2019

2.7.1 CALCULATIONS FOR SUPPLY SIDE

2.7.2 ASSUMPTIONS FOR SUPPLY SIDE

2.7.2.1 Key primary insights for supply side

2.8 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 45)

TABLE 1 EXCITATION SYSTEMS MARKET SNAPSHOT

FIGURE 8 ASIA PACIFIC DOMINATED EXCITATION SYSTEMS IN 2020

FIGURE 9 BRUSHLESS EXCITATION SYSTEMS TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 10 DIGITAL EXCITATION SYSTEMS TO HOLD COMMANDING POSITION DURING FORECAST PERIOD

FIGURE 11 SYNCHRONOUS GENERATORS TO LEAD EXCITATION SYSTEMS MARKET FROM 2021 TO 2026

FIGURE 12 ORIGINAL EQUIPMENT MANUFACTURERS TO COMMAND EXCITATION SYSTEM MARKET DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE OPPORTUNITIES IN EXCITATION SYSTEMS MARKET, 2021–2026

FIGURE 13 RISING DEMAND FOR SYNCHRONOUS MACHINES TO DRIVE EXCITATION SYSTEM MARKET GROWTH

4.2 EXCITATION SYSTEMS MARKET, BY TYPE

FIGURE 14 BRUSHLESS EXCITATION SYSTEMS HELD LARGER MARKET SHARE IN 2020

4.3 MARKET, BY CONTROLLER TYPE

FIGURE 15 DIGITAL EXCITATION SYSTEMS CAPTURED LARGER MARKET SHARE THAN ANALOG EXCITATION SYSTEMS IN 2020

4.4 MARKET, BY END USER

FIGURE 16 ORIGINAL EQUIPMENT MANUFACTURERS (OEMS) HELD LARGEST MARKET SHARE IN 2020

4.5 MARKET, BY REGION

FIGURE 17 MARKET IN ASIA PACIFIC TO GROW AT FASTEST RATE DURING FORECAST PERIOD

4.6 MARKET IN ASIA PACIFIC, BY APPLICATION & COUNTRY

FIGURE 18 SYNCHRONOUS GENERATORS AND CHINA DOMINATED EXCITATION SYSTEMS MARKET IN ASIA PACIFIC IN 2020

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 19 COVID-19 GLOBAL PROPAGATION

FIGURE 20 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 ROAD TO RECOVERY

FIGURE 21 RECOVERY ROAD FOR 2020 & 2021

5.4 COVID-19 ECONOMIC ASSESSMENT

FIGURE 22 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.5 MARKET DYNAMICS

FIGURE 23 EXCITATION SYSTEMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.5.1 DRIVERS

5.5.1.1 Increase in demand for uninterrupted and reliable power supply in several industries

FIGURE 24 ELECTRICITY DEMAND, BY SECTOR: STATED POLICIES SCENARIO, 2018–2040

5.5.1.2 Rise in demand for synchronous machines by industrial users to ensure uninterrupted power supply for efficient production

5.5.1.3 Advantages of synchronous machines, for example, energy conservation and ability to improve system power factor

5.5.2 RESTRAINTS

5.5.2.1 Complex design leading to difficulty in maintenance of excitation systems

5.5.3 OPPORTUNITIES

5.5.3.1 Increasing investments in renewable energy projects, especially in hydropower sector

FIGURE 25 RENEWABLE POWER INVESTMENTS, 2012–2020

5.5.3.2 Growing adoption of high-voltage direct-current (HVDC) technology in synchronous machines

5.5.4 CHALLENGES

5.5.4.1 Shortage of components/parts used in manufacturing excitation systems

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESS

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN EXCITATION SYSTEM MARKET

FIGURE 26 REVENUE SHIFT FOR MARKET PLAYERS

5.7 SUPPLY CHAIN ANALYSIS

FIGURE 27 EXCITATION SYSTEMS: SUPPLY CHAIN

TABLE 2 SUPPLY CHAIN PARTICIPANTS IN MARKET

5.7.1 RAW MATERIAL PROVIDERS/SUPPLIERS

5.7.2 COMPONENT MANUFACTURERS

5.7.3 EXCITATION SYSTEM MANUFACTURERS/ASSEMBLERS

5.7.4 END USERS

5.8 EXCITATION SYSTEMS MARKET MAP

FIGURE 28 EXCITATION SYSTEMS: MARKET MAP

5.9 AVERAGE PRICING OF EXCITATION SYSTEMS

5.10 TRADE DATA STATISTICS

TABLE 3 REGION-WISE IMPORT DATA, 2018–2019 (USD MILLION)

TABLE 4 REGION-WISE EXPORT DATA, 2018–2019 (USD MILLION)

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 29 EXCITATION SYSTEMS MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 5 MARKET: PORTER’S FIVE FORCES

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF RIVALRY

5.12 TECHNOLOGY ANALYSIS

5.12.1 TECHNOLOGY TRENDS FOR EXCITATION SYSTEMS

5.13 EXCITATION SYSTEMS: CODES AND REGULATIONS

5.14 EXCITATION SYSTEMS: PATENT ANALYSIS

5.14.1 INNOVATIONS & PATENT REGISTRATION

TABLE 6 IMPORTANT INNOVATION & PATENT REGISTRATION, 2016–2020

5.15 CASE STUDY ANALYSIS

5.15.1 EXCITATION SYSTEMS FOR HYDROPOWER PLANT

5.15.1.1 Reivax introduced static excitation systems for 826-MVA project

6 EXCITATION SYSTEMS MARKET, BY TYPE (Page No. - 71)

6.1 INTRODUCTION

FIGURE 30 BRUSHLESS EXCITATION SYSTEMS LED MARKET IN 2020

TABLE 7 EXCITATION SYSTEMS MARKET, BY TYPE, 2016–2019 (USD BILLION)

TABLE 8 MARKET, BY TYPE, 2020–2026 (USD BILLION)

6.2 STATIC

6.2.1 INCREASED NEED FOR HIGH-PERFORMANCE AND FAST-RESPONSE EXCITATION SYSTEMS

TABLE 9 STATIC MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 10 STATIC MARKET, BY REGION, 2020–2025 (USD MILLION)

6.3 BRUSHLESS

6.3.1 LOW MAINTENANCE AND HIGH RELIABILITY OF BRUSHLESS EXCITATION SYSTEMS

TABLE 11 BRUSHLESS EXCITATION SYSTEM MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 12 BRUSHLESS MARKET, BY REGION, 2020–2025 (USD MILLION)

7 EXCITATION SYSTEMS MARKET, BY CONTROLLER TYPE (Page No. - 75)

7.1 INTRODUCTION

FIGURE 31 DIGITAL CONTROL SYSTEMS DOMINATED MARKET IN 2020

TABLE 13 EXCITATION SYSTEMS MARKET, BY CONTROLLER TYPE, 2016–2019 (USD BILLION)

TABLE 14MARKET, BY CONTROLLER TYPE, 2020–2026 (USD BILLION)

7.2 ANALOG

7.2.1 RELIABILITY OF ANALOG EXCITATION SYSTEMS TO MODERATELY DRIVE MARKET GROWTH IN COMING YEARS

TABLE 15 ANALOG MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 16 ANALOG MARKET, BY REGION, 2020–2026 (USD MILLION)

7.3 DIGITAL

7.3.1 REPLACEMENT OF ANALOG EXCITATION SYSTEMS WITH DIGITAL EXCITATION SYSTEMS TO FUEL MARKET GROWTH

TABLE 17 DIGITAL MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 18 DIGITAL MARKET, BY REGION, 2020–2026 (USD MILLION)

8 EXCITATION SYSTEMS MARKET, BY APPLICATION (Page No. - 80)

8.1 INTRODUCTION

FIGURE 32 SYNCHRONOUS GENERATORS DOMINATED MARKET, BY APPLICATION, IN 2020

TABLE 19 EXCITATION SYSTEMS MARKET, BY APPLICATION, 2016–2019 (USD BILLION)

TABLE 20 MARKET, BY APPLICATION, 2020–2026 (USD BILLION)

8.2 SYNCHRONOUS GENERATORS

8.2.1 INCREASING FOCUS ON IMPROVING STABILITY OF POWER SYSTEMS

TABLE 21 MARKET FOR SYNCHRONOUS GENERATORS, BY REGION, 2016–2019 (USD MILLION)

TABLE 22 MARKET FOR SYNCHRONOUS GENERATORS, BY REGION, 2020–2026 (USD MILLION)

8.3 SYNCHRONOUS MOTORS

8.3.1 SURGING DEMAND FOR SYNCHRONOUS MOTORS BY HEAVY INDUSTRIES

TABLE 23 MARKET FOR SYNCHRONOUS MOTORS, BY REGION, 2016–2019 (USD MILLION)

TABLE 24 MARKET FOR SYNCHRONOUS MOTORS, BY REGION, 2020–2026 (USD MILLION)

9 EXCITATION SYSTEMS MARKET, BY END USER (Page No. - 85)

9.1 INTRODUCTION

FIGURE 33 ORIGINAL EQUIPMENT MANUFACTURERS COMMANDED MARKET IN 2020

TABLE 25 MARKET, BY END USER, 2019–2026 (USD BILLION)

9.2 POWER GENERATION INDUSTRY

TABLE 26 EXCITATION SYSTEMS MARKET FOR POWER GENERATION INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

TABLE 27 MARKET FOR POWER GENERATION INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

9.2.1 HYDROELECTRIC POWER PLANTS

9.2.1.1 Increased focus on expanding hydropower installed capacity propelled market growth

TABLE 28 MARKET FOR HYDROELECTRIC POWER PLANTS, BY REGION, 2019–2026 (USD MILLION)

9.2.2 THERMAL POWER PLANTS

9.2.2.1 Urgent need to upgrade aging electric infrastructure drives market growth

TABLE 29 MARKET FOR THERMAL POWER PLANTS, BY REGION, 2019–2026 (USD MILLION)

9.3 HEAVY INDUSTRIES

TABLE 30 EXCITATION SYSTEMS MARKET FOR HEAVY INDUSTRIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 31 MARKET FOR HEAVY INDUSTRIES, BY TYPE, 2019–2026 (USD MILLION)

9.3.1 MARINE

9.3.1.1 Growing number of commercial vessels for maritime freight transport to spur demand for excitation systems

TABLE 32 MARKET FOR MARINE INDUSTRY, BY REGION, 2019–2026 (USD MILLION)

9.3.2 OTHERS

TABLE 33 MARKET FOR OTHER HEAVY INDUSTRIES, BY REGION, 2019–2026 (USD MILLION)

9.4 ORIGINAL EQUIPMENT MANUFACTURERS

9.4.1 SURGING DEMAND FOR SYNCHRONOUS MACHINES TO PROMOTE MARKET GROWTH

TABLE 34 MARKET FOR OEMS, BY REGION, 2019–2026 (USD MILLION)

10 GEOGRAPHIC ANALYSIS (Page No. - 94)

10.1 INTRODUCTION

FIGURE 34 EXCITATION SYSTEMS MARKET, BY REGION, 2020

FIGURE 35 REGIONAL SNAPSHOT: ASIA PACIFIC TO REGISTER HIGHEST CAGR IN EXCITATION SYSTEM MARKET DURING FORECAST PERIOD

TABLE 35 MARKET, BY REGION, 2016–2019 (USD MILLION)

TABLE 36 MARKET, BY REGION, 2020–2026 (USD MILLION)

10.2 ASIA PACIFIC

10.2.1 IMPACT OF COVID-19 ON MARKET IN ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: MARKET SNAPSHOT

10.2.2 BY TYPE

TABLE 37 EXCITATION SYSTEMS MARKET IN ASIA PACIFIC, BY TYPE, 2016–2019 (USD MILLION)

TABLE 38 MARKET IN ASIA PACIFIC, BY TYPE, 2020–2026 (USD MILLION)

10.2.3 BY CONTROLLER TYPE

TABLE 39 MARKET IN ASIA PACIFIC, BY CONTROLLER TYPE, 2016–2019 (USD MILLION)

TABLE 40 MARKET IN ASIA PACIFIC, BY CONTROLLER TYPE, 2020–2026 (USD MILLION)

10.2.4 BY APPLICATION

TABLE 41 MARKET IN ASIA PACIFIC, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 42 MARKET IN ASIA PACIFIC, BY APPLICATION, 2020–2026 (USD MILLION)

10.2.5 BY END USER

TABLE 43 MARKET IN ASIA PACIFIC, BY END USER, 2019–2026 (USD MILLION)

10.2.5.1 By power generation industry

TABLE 44 EXCITATION SYSTEM MARKET IN ASIA PACIFIC FOR POWER GENERATION INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.2.5.2 By heavy industries

TABLE 45 MARKET IN ASIA PACIFIC FOR HEAVY INDUSTRIES, BY TYPE, 2019–2026 (USD MILLION)

10.2.6 BY COUNTRY

TABLE 46 EXCITATION SYSTEMS MARKET IN ASIA PACIFIC, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 47 MARKET IN ASIA PACIFIC, BY COUNTRY, 2020–2026 (USD MILLION)

10.2.6.1 China

10.2.6.1.1 Government reforms and policies to speed up clean energy transformation

TABLE 48 MARKET IN CHINA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 49 MARKET IN CHINA, BY TYPE, 2020–2026 (USD MILLION)

10.2.6.2 India

10.2.6.2.1 Government investments in hydropower plants

TABLE 50 MARKET IN INDIA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 51 MARKET IN INDIA, BY TYPE, 2020–2026 (USD MILLION)

10.2.6.3 Japan

10.2.6.3.1 High demand for synchronous machines in marine industry

TABLE 52 MARKET IN JAPAN, BY TYPE, 2016–2019 (USD MILLION)

TABLE 53 MARKET IN JAPAN, BY TYPE, 2020–2026 (USD MILLION)

10.2.6.4 South Korea

10.2.6.4.1 Increased requirement for high-efficiency equipment to reduce carbon emissions

TABLE 54 EXCITATION SYSTEMS MARKET IN SOUTH KOREA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 55 MARKET IN SOUTH KOREA, BY TYPE, 2020–2026 (USD MILLION)

10.2.6.5 Australia

10.2.6.5.1 Massive investment in mining industry

TABLE 56 MARKET IN AUSTRALIA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 57 MARKET IN AUSTRALIA, BY TYPE, 2020–2026 (USD MILLION)

10.2.6.6 Rest of Asia Pacific

TABLE 58 MARKET IN REST OF ASIA PACIFIC, BY TYPE, 2016–2019 (USD MILLION)

TABLE 59 MARKET IN REST OF ASIA PACIFIC, BY TYPE, 2020–2026 (USD MILLION)

10.3 NORTH AMERICA

10.3.1 IMPACT OF COVID-19 ON MARKET IN NORTH AMERICA

FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

10.3.2 BY TYPE

TABLE 60 EXCITATION SYSTEMS MARKET IN NORTH AMERICA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 61 MARKET IN NORTH AMERICA, BY TYPE, 2020–2026 (USD MILLION)

10.3.3 BY CONTROLLER TYPE

TABLE 62 MARKET IN NORTH AMERICA, BY CONTROLLER TYPE, 2016–2019 (USD MILLION)

TABLE 63 MARKET IN NORTH AMERICA, BY CONTROLLER TYPE, 2020–2026 (USD MILLION)

10.3.4 BY APPLICATION

TABLE 64 MARKET IN NORTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 65 MARKET IN NORTH AMERICA, BY APPLICATION, 2020–2026 (USD MILLION)

10.3.5 BY END USER

TABLE 66 MARKET IN NORTH AMERICA, BY END USER, 2019–2026 (USD MILLION)

10.3.5.1 By power generation industry

TABLE 67 MARKET IN NORTH AMERICA FOR POWER GENERATION INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.3.5.2 BY heavy industries

TABLE 68 MARKET IN NORTH AMERICA FOR HEAVY INDUSTRIES, BY TYPE,2019–2026 (USD MILLION)

10.3.6 BY COUNTRY

TABLE 69 EXCITATION SYSTEMS MARKET IN NORTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 70 MARKET IN NORTH AMERICA, BY COUNTRY, 2020–2026 (USD MILLION)

10.3.6.1 US

10.3.6.1.1 Increasing investment in building and refurbishing hydroelectric generation stations boosts market growth

TABLE 71 MARKET IN US, BY TYPE, 2016–2019 (USD MILLION)

TABLE 72 MARKET IN US, BY TYPE, 2020–2026 (USD MILLION)

10.3.6.2 Canada

10.3.6.2.1 Surging demand for synchronous machines in oil & gas to propel market growth

TABLE 73 MARKET IN CANADA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 74 MARKET IN CANADA, BY TYPE, 2020–2026 (USD MILLION)

10.3.6.3 Mexico

10.3.6.3.1 Booming industrial sector to boost demand for excitation systems

TABLE 75 MARKET IN MEXICO, BY TYPE, 2016–2019 (USD MILLION)

TABLE 76 MARKET IN MEXICO, BY TYPE, 2020–2026 (USD MILLION)

10.4 EUROPE

10.4.1 IMPACT OF COVID-19 ON MARKET IN EUROPE

10.4.2 BY TYPE

TABLE 77 EXCITATION SYSTEMS MARKET IN EUROPE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 78 MARKET IN EUROPE, BY TYPE, 2020–2026 (USD MILLION)

10.4.3 BY CONTROLLER TYPE

TABLE 79 MARKET IN EUROPE, BY CONTROLLER TYPE, 2016–2019 (USD MILLION)

TABLE 80 MARKET IN EUROPE, BY CONTROLLER TYPE, 2020–2026 (USD MILLION)

10.4.4 BY APPLICATION

TABLE 81 MARKET IN EUROPE, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 82 MARKET IN EUROPE, BY APPLICATION, 2020–2026 (USD MILLION)

10.4.5 BY END USER

TABLE 83 MARKET IN EUROPE, BY END USER, 2019–2026 (USD MILLION)

10.4.5.1 By power generation industry

TABLE 84 MARKET IN EUROPE FOR POWER GENERATION INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.4.5.2 By heavy industries

TABLE 85 MARKET IN EUROPE FOR HEAVY INDUSTRIES, BY TYPE, 2019–2026 (USD MILLION)

10.4.6 BY COUNTRY

TABLE 86 EXCITATION SYSTEMS MARKET IN EUROPE, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 87 MARKET IN EUROPE, BY COUNTRY, 2020–2026 (USD MILLION)

10.4.6.1 Russia

10.4.6.1.1 Substantial investments in T&D sector

TABLE 88 MARKET IN RUSSIA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 89 EXCITATION SYSTEMS MARKET IN RUSSIA, BY TYPE, 2020–2026 (USD MILLION)

10.4.6.2 Germany

10.4.6.2.1 Strong focus on development of manufacturing sector

TABLE 90 MARKET IN GERMANY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 91 MARKET IN GERMANY, BY TYPE, 2020–2026 (USD MILLION)

10.4.6.3 UK

10.4.6.3.1 Government initiative to improve maritime trade

TABLE 92 MARKET IN UK, BY TYPE, 2016–2019 (USD MILLION)

TABLE 93 MARKET IN UK, BY TYPE, 2020–2026 (USD MILLION)

10.4.6.4 Italy

10.4.6.4.1 Thriving industrial sector in Italy

TABLE 94 MARKET IN ITALY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 95 MARKET IN ITALY, BY TYPE, 2020–2026 (USD MILLION)

10.4.6.5 Norway

10.4.6.5.1 High dependence on hydroelectric power plants

TABLE 96 MARKET IN NORWAY, BY TYPE, 2016–2019 (USD MILLION)

TABLE 97 MARKET IN NORWAY, BY TYPE, 2020–2026 (USD MILLION)

10.4.6.6 Rest of Europe

TABLE 98 MARKET IN REST OF EUROPE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 99 MARKET IN REST OF EUROPE, BY TYPE, 2020–2026 (USD MILLION)

10.5 SOUTH AMERICA

10.5.1 IMPACT OF COVID-19 ON MARKET IN SOUTH AMERICA

10.5.2 BY TYPE

TABLE 100 EXCITATION SYSTEMS MARKET IN SOUTH AMERICA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 101 MARKET IN SOUTH AMERICA, BY TYPE, 2020–2026 (USD MILLION)

10.5.3 BY CONTROLLER TYPE

TABLE 102 MARKET IN SOUTH AMERICA, BY CONTROLLER TYPE, 2016–2019 (USD MILLION)

TABLE 103 MARKET IN SOUTH AMERICA, BY CONTROLLER TYPE, 2020–2026 (USD MILLION)

10.5.4 BY APPLICATION

TABLE 104 MARKET IN SOUTH AMERICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 105 MARKET IN SOUTH AMERICA, BY APPLICATION, 2020–2026 (USD MILLION)

10.5.5 BY END USER

TABLE 106 MARKET IN SOUTH AMERICA, BY END USER, 2019–2026 (USD MILLION)

10.5.5.1 By power generation industry

TABLE 107 MARKET IN SOUTH AMERICA FOR POWER GENERATION INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.5.5.2 BY heavy industries

TABLE 108 MARKET IN SOUTH AMERICA FOR HEAVY INDUSTRIES, BY TYPE, 2019–2026 (USD MILLION)

10.5.6 BY COUNTRY

TABLE 109 EXCITATION SYSTEMS MARKET IN SOUTH AMERICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 110 MARKET IN SOUTH AMERICA, BY COUNTRY, 2020–2026 (USD MILLION)

10.5.6.1 Brazil

10.5.6.1.1 Increasing investments in oil & gas and hydropower projects to fuel demand for excitation systems

TABLE 111 MARKET IN BRAZIL, BY TYPE, 2016–2019 (USD MILLION)

TABLE 112 MARKET IN BRAZIL, BY TYPE, 2020–2026 (USD MILLION)

10.5.6.2 Argentina

10.5.6.2.1 Growing dependence on thermal power and surging naval budgets to support excitation systems market growth

TABLE 113 MARKET IN ARGENTINA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 114 MARKET IN ARGENTINA, BY TYPE, 2020–2026 (USD MILLION)

10.5.6.3 Rest of South America

TABLE 115 MARKET IN REST OF SOUTH AMERICA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 116 MARKET IN REST OF SOUTH AMERICA, BY TYPE, 2020–2026 (USD MILLION)

10.6 MIDDLE EAST

10.6.1 IMPACT OF COVID-19 ON MARKET IN MIDDLE EAST

10.6.2 BY TYPE

TABLE 117 EXCITATION SYSTEMS MARKET IN MIDDLE EAST, BY TYPE, 2016–2019 (USD MILLION)

TABLE 118 MARKET IN MIDDLE EAST, BY TYPE, 2020–2026 (USD MILLION)

10.6.3 BY CONTROLLER TYPE

TABLE 119 MARKET IN MIDDLE EAST, BY CONTROLLER TYPE, 2016–2019 (USD MILLION)

TABLE 120 MARKET IN MIDDLE EAST, BY CONTROLLER TYPE, 2020–2026 (USD MILLION)

10.6.4 BY APPLICATION

TABLE 121 MARKET IN MIDDLE EAST, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 122 MARKET IN MIDDLE EAST, BY APPLICATION, 2020–2026 (USD MILLION)

10.6.5 BY END USER

TABLE 123 MARKET IN MIDDLE EAST, BY END USER, 2019–2026 (USD MILLION)

10.6.5.1 By power generation industry

TABLE 124 MARKET IN MIDDLE EAST FOR POWER GENERATION INDUSTRY, BY TYPE, 2019–2026 (USD MILLION)

10.6.5.2 BY heavy industries

TABLE 125 MARKET IN MIDDLE EAST FOR HEAVY INDUSTRIES, BY TYPE, 2019–2026 (USD MILLION)

10.6.6 BY COUNTRY

TABLE 126 EXCITATION SYSTEMS MARKET IN MIDDLE EAST, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 127 MARKET IN MIDDLE EAST, BY COUNTRY, 2020–2026 (USD MILLION)

10.6.6.1 Saudi Arabia

10.6.6.1.1 Government initiatives to meet rising demand for energy to foster market growth

TABLE 128 MARKET IN SAUDI ARABIA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 129 MARKET IN SAUDI ARABIA, BY TYPE, 2020–2026 (USD MILLION)

10.6.6.2 Oman

10.6.6.2.1 Thriving oil & gas sector to encourage demand for excitation systems

TABLE 130 MARKET IN OMAN, BY TYPE, 2016–2019 (USD MILLION)

TABLE 131 MARKET IN OMAN, BY TYPE, 2020–2026 (USD MILLION)

10.6.6.3 Qatar

10.6.6.3.1 Huge investment in heavy industries to fuel market growth

TABLE 132 MARKET IN QATAR, BY TYPE, 2016–2019 (USD MILLION)

TABLE 133 MARKET IN QATAR, BY TYPE, 2020–2026 (USD MILLION)

10.6.6.4 UAE

10.6.6.4.1 Government initiatives toward digitalization for energy conservation to accelerate demand for excitation systems

TABLE 134 MARKET IN UAE, BY TYPE, 2016–2019 (USD MILLION)

TABLE 135 MARKET IN UAE, BY TYPE, 2020–2026 (USD MILLION)

10.6.6.5 Rest of Middle East

TABLE 136 MARKET IN REST OF MIDDLE EAST, BY TYPE, 2016–2019 (USD MILLION)

TABLE 137 MARKET IN REST OF MIDDLE EAST, BY TYPE, 2020–2026 (USD MILLION)

10.7 AFRICA

10.7.1 IMPACT OF COVID-19 ON MARKET IN AFRICA

10.7.2 BY TYPE

TABLE 138 EXCITATION SYSTEMS MARKET IN AFRICA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 139 MARKET IN AFRICA, BY TYPE, 2020–2026 (USD MILLION)

10.7.3 BY CONTROLLER TYPE

TABLE 140 MARKET IN AFRICA, BY CONTROLLER TYPE, 2016–2019 (USD MILLION)

TABLE 141 MARKET IN AFRICA, BY CONTROLLER TYPE, 2020–2026 (USD MILLION)

10.7.4 BY APPLICATION

TABLE 142 MARKET IN AFRICA, BY APPLICATION, 2016–2019 (USD MILLION)

TABLE 143 MARKET IN AFRICA, BY APPLICATION, 2020–2026 (USD MILLION)

10.7.5 BY END USER

TABLE 144 MARKET IN AFRICA, BY END USER, 2019–2026 (USD MILLION)

10.7.5.1 By power generation industry

TABLE 145 MARKET IN AFRICA FOR POWER GENERATION INDUSTRY, BY TYPE, 2020–2026 (USD MILLION)

10.7.5.2 By heavy industries

TABLE 146 MARKET IN AFRICA FOR HEAVY INDUSTRIES, BY TYPE, 2019–2026 (USD MILLION)

10.7.6 BY COUNTRY

TABLE 147 EXCITATION SYSTEMS MARKET IN AFRICA, BY COUNTRY, 2016–2019 (USD MILLION)

TABLE 148 MARKET IN AFRICA, BY COUNTRY, 2020–2026 (USD MILLION)

10.7.6.1 Egypt

10.7.6.1.1 Significant investment in oil & gas and intense need to meet increasing power demand

TABLE 149 MARKET IN EGYPT, BY TYPE, 2016–2019 (USD MILLION)

TABLE 150 MARKET IN EGYPT, BY TYPE, 2020–2026 (USD MILLION)

10.7.6.2 South Africa

10.7.6.2.1 Urgent need to upgrade power infrastructure to prevent power outages

TABLE 151 MARKET IN SOUTH AFRICA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 152 MARKET IN SOUTH AFRICA, BY TYPE, 2020–2026 (USD MILLION)

10.7.6.3 Nigeria

10.7.6.3.1 Supportive hydro power policies of government

TABLE 153 MARKET IN NIGERIA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 154 MARKET IN NIGERIA, BY TYPE, 2020–2026 (USD MILLION)

10.7.6.4 Algeria

10.7.6.4.1 Increased power demand in country

TABLE 155 MARKET IN ALGERIA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 156 MARKET IN ALGERIA, BY TYPE, 2020–2026 (USD MILLION)

10.7.6.5 Rest of Africa

TABLE 157 MARKET IN REST OF AFRICA, BY TYPE, 2016–2019 (USD MILLION)

TABLE 158 MARKET IN REST OF AFRICA, BY TYPE, 2020–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 151)

11.1 KEY PLAYERS’ STRATEGIES

FIGURE 38 OVERVIEW OF KEY STRATEGIES ADOPTED BY TOP PLAYERS, 2018–2020

11.2 SHARE ANALYSIS OF TOP 5 PLAYERS

TABLE 159 EXCITATION SYSTEMS MARKET: DEGREE OF COMPETITION

FIGURE 39 EXCITATION SYSTEM MARKET SHARE ANALYSIS, 2019

11.3 MARKET EVALUATION FRAMEWORK

TABLE 160 MARKET EVALUATION FRAMEWORK, 2018–2020

11.4 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

FIGURE 40 TOP 5 PLAYERS DOMINATED MARKET IN LAST 5 YEARS

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STAR

11.5.2 EMERGING LEADER

11.5.3 PERVASIVE

11.5.4 PARTICIPANT

FIGURE 41 COMPETITIVE LEADERSHIP MAPPING: MARKET, 2019

TABLE 161 COMPANY APPLICATION FOOTPRINT

TABLE 162 COMPANY END USER FOOTPRINT

TABLE 163 COMPANY REGION FOOTPRINT

11.6 COMPETITIVE SCENARIO

TABLE 164 EXCITATION SYSTEMS MARKET: PRODUCT LAUNCHES AND DEVELOPMENTS, JANUARY 2018–DECEMBER 2020

TABLE 165 MARKET: DEALS, JANUARY 2018–DECEMBER 2020

12 COMPANY PROFILES (Page No. - 162)

12.1 MAJOR PLAYERS

12.1.1 ABB

(Business and financial overview, Products offered, Recent developments, MnM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats)*

TABLE 166 ABB: BUSINESS OVERVIEW

FIGURE 42 ABB: COMPANY SNAPSHOT

12.1.2 GENERAL ELECTRIC

TABLE 167 GENERAL ELECTRIC: BUSINESS OVERVIEW

FIGURE 43 GENERAL ELECTRIC: COMPANY SNAPSHOT

12.1.3 SIEMENS ENERGY

TABLE 168 SIEMENS ENERGY: BUSINESS OVERVIEW

FIGURE 44 SIEMENS ENERGY: COMPANY SNAPSHOT

12.1.4 EMERSON

TABLE 169 EMERSON: BUSINESS OVERVIEW

FIGURE 45 EMERSON: COMPANY SNAPSHOT

12.1.5 ANDRITZ GROUP

TABLE 170 ANDRITZ GROUP: BUSINESS OVERVIEW

FIGURE 46 ANDRITZ GROUP: COMPANY SNAPSHOT

12.1.6 NIDEC CORPORATION

TABLE 171 NIDEC CORPORATION: BUSINESS OVERVIEW

FIGURE 47 NIDEC CORPORATION: COMPANY SNAPSHOT

12.1.7 MELROSE INDUSTRIES PLC

TABLE 172 MELROSE INDUSTRIES PLC: BUSINESS OVERVIEW

FIGURE 48 MELROSE INDUSTRIES PLC: COMPANY SNAPSHOT

12.1.8 VOITH GROUP

TABLE 173 VOITH GROUP: BUSINESS OVERVIEW

FIGURE 49 VOITH GROUP: COMPANY SNAPSHOT

12.1.9 KONCAR GROUP

TABLE 174 KONCAR GROUP: BUSINESS OVERVIEW

FIGURE 50 KONCAR GROUP: COMPANY SNAPSHOT

12.1.10 MITSUBISHI ELECTRIC CORPORATION

TABLE 175 MITSUBISHI ELECTRIC CORPORATION: BUSINESS OVERVIEW

FIGURE 51 MITSUBISHI ELECTRIC CORPORATION: COMPANY SNAPSHOT

12.1.11 WEG

TABLE 176 WEG: BUSINESS OVERVIEW

FIGURE 52 WEG: COMPANY SNAPSHOT

12.1.12 BASLER ELECTRIC

12.1.13 AMTECH POWER

12.1.14 VEO OY

12.1.15 TENEL, S.R.O.

TABLE 177 TENEL, S.R.O.: BUSINESS OVERVIEW,2020

12.2 OTHER PLAYERS

12.2.1 REIVAX

12.2.2 BIRR MACHINES AG

12.2.3 EXCITATION & ENGINEERING SERVICES LTD.

12.2.4 NELUMBO ICONA CONTROLS PVT. LTD.

12.2.5 SVEA POWER

*Details on Business and financial overview, Products offered, Recent developments, MnM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 206)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

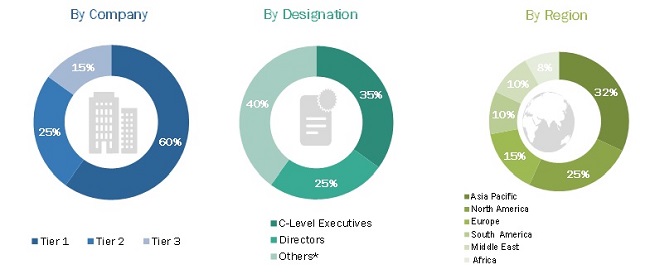

This study involved four major activities in estimating the current size of the excitation systemsmarket. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were used to estimate the total market size. After that, the market breakdown and data triangulation were done to estimate the market size of the segments and sub-segments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of the global excitation systems market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The excitation systems market comprises several stakeholders, such as end-product manufacturers, service providers, and end-users in the supply chain. The demand-side of this market is characterized by its end-users, such as upstream/oilfield operators, and others. The supply-side is characterized by excitation systems service providers, tool providers, integrators, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global excitation systems market and its dependent submarkets. These methods were also used extensively to estimate the size of various sub-segments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas upstream sector.

Report Objectives

- To define, describe, segment, and forecast the excitation systems market size, by type, controller type, application, end user, and region, in terms of value

- To provide detailed information regarding major factors, namely, drivers, restraints, opportunities, and challenges that influence market growth

- To strategically analyze the market with respect to individual growth trends, future expansions, and contribution of each segment to the market

- To provide a detailed analysis of the impact of the COVID-19 pandemic on the market and an estimation of the market size

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the growth of the excitation systems market with respect to key regions—Asia Pacific, Europe, North America, South America, the Middle East, and Africa

- To provide detailed information regarding Porter’s five forces analysis, supply chain analysis, product pricing trade analysis, revenue shift trend pertaining to the market

- To strategically profile the key players and comprehensively analyze their market rankings and core competencies*

- To analyze competitive developments in the market, such as contracts and agreements, product developments, mergers and acquisitions, investments, and expansions.

Synchronous Machine & Its impact on Excitation Systems Market

Synchronous machines are commonly used as generators in power systems. The excitation system of a synchronous machine is in charge of controlling its output voltage and maintaining stability during changes in load and other operating conditions. The sequence of the excitation system, particularly the type of control and regulation used, can have a significant impact on the synchronous machine's operation and performance. There is a market in the power industry for excitation systems that provide improved performance and control for synchronous machines. The need for improved power system stability, efficiency, and reliability drives demand for these systems. Excitation systems that can provide quick and precise voltage regulation are especially useful in power systems that use a high proportion of renewable energy sources, where voltage fluctuations can be more frequent and pronounced.

This market is closely related to the sequence of excitation systems because it determines the level of performance and functionality that the system can provide. For example, advanced control algorithms, digital signal processing, and other technologies may be used in modern excitation systems to provide fast and accurate voltage regulation, which can improve the efficiency and stability of synchronous machines. These advanced features can also raise the excitation system's cost, making it more expensive than simpler, less advanced systems.

Synchronous Machine can have a significant impact on the Excitation Systems Market in several ways. Here are a few examples:

- Increased Efficiency: With the increasing demand for energy efficiency, synchronous machines with improved designs are being developed.

- Improved Stability: Synchronous machines require stable voltage to maintain their output. The excitation system plays a crucial role in achieving this stability.

- Higher Reliability: The reliability of synchronous machines is crucial in power systems, as a failure can lead to widespread power outages.

- Integration with Smart Grid: Synchronous machines are increasingly being integrated into smart grids, which require advanced control systems.

The top players in the Synchronous Machine market General Electric Company, Siemens AG, ABB Ltd, Toshiba Corporation, WEG S.A

Some of the key industries that are going to get impacted because of the growth of Synchronous Machine are,

- Renewable Energy Integration: Synchronous machines can provide the necessary stability and control required for integrating intermittent sources such as wind and solar power into the grid.

- Electric Vehicles: Synchronous machines are being explored as a means of powering electric vehicles.

- Energy Storage: Synchronous machines are being explored as a means of storing energy in grid-scale applications.

- High-Speed Rail: Synchronous machines are being explored as a means of powering high-speed rail systems.

- Aerospace: Synchronous machines are being investigated for potential use in aerospace applications, where their high power density and efficiency make them a viable alternative to other power generation technologies.

Speak to our Analyst today to know more about Synchronous Machine Market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Excitation Systems Market