Empty Capsules Market By Type (Gelatin (Porcine, Bovine, Bonemeal), Non-Gelatin (HPMC, Starch)), Functionality (Immediate-Release, Sustained-Release, Delayed-Release), Therapeutic Application (Antibiotic, Dietary, Antacid, CVD) & Region - Global Forecast to 2029

Market Growth Outlook Summary

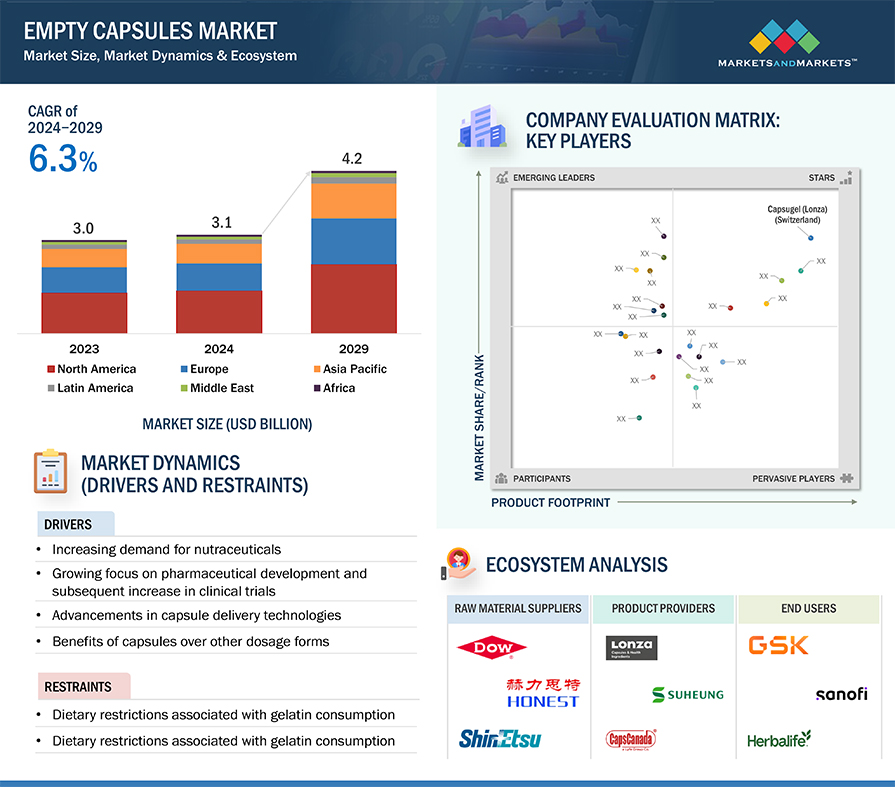

The global empty capsules market growth forecasted to transform from $3.1 billion in 2024 to $4.2 billion by 2029, driven by a CAGR of 6.3%. The growth of the market is driven by technological advancements such as entric coating to protect drugs or nutrients from stomach acids, controlled-release capsules for targeted and sustained drug delivery. Furthemore, demographic shift towards non-animal-derived ingredients and advantages of non-gelatin capsules over gelatin capsules such as superior stability is likely to give momentum to the growth of the non-gelatin empty capsules market. Rising investment in development of veg capsules and launch of novel veg capsules in the market by key market is futher likley to boost the market growth. For instance, in February 2023, Vivion, Inc., introduced new product range launch of empty gelatin, HPMC and pullulan capsules.

Empty Capsules Market Size, Dynamics & Ecosystem

To know about the assumptions considered for the study, Request for Free Sample Report

Global Empty Capsules Market Dynamics

DRIVER: Increasing demand for nutraceuticals

Mostly administered in capsules, nutraceuticals abound in fibre, antioxidants, heart-healthy components, vitamins, minerals, omega-3 fatty acids, calcium, and whole grains. Globally, growing health-conscious behaviours have driven demand for nutraceuticals as individuals give physical and mental well-being top priority via well-balanced diets and focused supplements top priority. Weighted towards a healthy gut, children, vision and sleep are the major focus trends. A study conducted in 318 Indian districts comprising more than 47,000 respondents showed that 71% of those surveyed consume nutraceuticals on a regular basis which reflects a major transition to health-conscious behavior. In addition, there is growing interest in CBD-based products as well as mental health among others, the sector is projected to hit USD 261.7 billion worth of nutraceutical components market by 2027 while plant-based substitutes.

RESTRAINT: Dietary restrictions and issues with gelatin

Originally utilised extensively in the pharmaceutical and nutraceutical sectors, gelatin is the original and most often used component for making capsules. It is not fit for those with religious or dietary restrictions against animal products since it comes from the collagen of animal by-products including bones, skins, and hooves. The demand for vegetarian capsules—which are also more suitable for religious reasons—classified as Kosher and Halal—has grown along with the rise in vegetarian and vegan diets. Unlike gelatin capsules, which are only suitable for powdered drugs or supplements, vegetarian capsules satisfy a wider client base and are compatible with other substances. These elements are controlling the expansion of the capsule market based on gelatin.

OPPORTUNITY: Expansion of capsule production in emerging economies

The normally robust pharmaceuticals sector is finding challenges from a shrinking medicine pipeline, government pressure to cut costs, and strict regulations on new products. Low-cost manufacturing, attractive tax rates, and relaxed regulations help this situation inspire empty capsule manufacturers to move their operations to high growth developing areas. Big companies are raising their capacity in these regions to meet the increased demand for empty capsules and boost pharmaceutical output. For example, a major South Korean company opened a plant in Vietnam in May 2022, therefore significantly increasing its annual capsule production. Likewise, in February 2021 a European corporation started to be more visible in South Asia. Many pharmaceutical businesses are adopting contract manufacturing—focusing on core activities while outsourcing production—to offset profit margin constraints from cost-cutting and legislative changes, hence generating predicted demand for empty capsules.

CHALLENGES: Increasing prices and low availability of raw materials

Because of the differences between the demand and supply growth rates of gelatin, changing gelatin prices are having a major effect on the empty capsules market. While the demand for collagen, which mostly consumes gelatin, is forecast to spike at a strong CAGR of 8.25%, the gelatin market is expected to increase modestly in the United States at a CAGR of 3.3%. This higher demand for collagen strains gelatin supply for various applications, including empty capsule manufacture. Further aggravating the scenario are supply limitations including limited availability of raw materials including hides, bones, and pigskin and decreasing cattle slaughter levels. These elements build a major obstacle to the expansion of the empty capsule industry.

Global Empty Capsules Market Ecosystem Analysis

Raw material suppliers offer gelatin and HPMC in the empty capsules market; product manufacturers create the capsules following strict quality and regulatory standards. These capsules find use in end consumers in the pharmaceutical, nutraceutical, cosmetic, and research domains. Regulatory authorities guarantee public health by means of safety and quality compliance. These players taken together help several sectors by enabling the effective manufacture, transportation, and use of empty capsules, therefore promoting world healthcare and research.

Empty Capsules Market Segmentation & Geographical Spread

To know about the assumptions considered for the study, download the pdf brochure

Gelatin segment held a dominant share in the type of segment in the empty capsules market

Based on the type, the empty capsules market has been segmented into gelatin and non-gelatin capsules. The gelatin capsules segment is further categorized as porcine gelatin, bovine-derived gelatin, bone meal, and other gelatin sources. The non-gelatin capsules segment is further categorized as hydroxypropyl methylcellulose (HPMC) capsules, and pullulan & starch capsules. In 2023, gelatin capsules segment accounted for the largest share of the empty capsules market.

Gelatin capsules segment dominated the market due to the compatibility with a wide range of active ingredients, and cost-effectiveness. Non-gelatin capsules are likely to grow at significant CAGR during the forecast period owing to launch of new products in the market and rise in adoption of veg capsules among patient populations across the globe.

The dietary supplements segment is expected to register the fastest growth during the forecast period.

Based on the therapeutic application of empty capsules, the market has been segmented into antibiotic & antibacterial drugs, dietary supplements, antacid & antiflatulent preparations, antianemic preparations, anti-inflammatory drugs, cardiovascular therapy drugs, cough & cold drugs, other therapeutic applications. In 2023, antibiotic & antibacterial drugs segment accounted for the largest share. Over the projected period, the segment on dietary supplements is likely to have the greatest CAGR. The growing consumer attention on health and wellbeing, which results in more demand for dietary supplements, drives the empty capsule market in dietary supplements. Furthermore, new capsule formulations including vegetarian and vegan choices appeal to a larger audience and help to increase market growth.

North America accounted for the largest share in empty capsules market in 2023

Geologically, the empty capsules market is broken out into North America, Europe, Asia Pacific, Latin America, the Middle East, and Africa. First in share was North America, then Europe. Empty capsules in North America are driven by the increased need for dietary supplements and medications, developments in capsule production techniques, and customer inclination for quick and easy dose forms. Moreover, a great focus on preventive health drives regional market growth.

Key Market Players

Key players in the global empty capsules market include Capsugel (Lonza) (Switzerland), ACG (India), QUALICAPS (Roquette Frères) (France), SUHEUNG (South Korea), Shanxi Guangsheng Capsule Limited (China), CapsCanada (Lyfe Group) (US), HealthCaps India (India), Nectar Lifesciences Ltd. (India), Sunil Healthcare Limited (India), Farmacapsulas (Colombia), NATURAL CAPSULES LIMITED (India), Erawat Pharma Limited (India), Qingdao Yiqing Biotechnology Co., Ltd. (Baotou Dongbao Bio-Tech Co., Ltd.) (China), Fortcaps ( Kumar Organic Products Limited) (India), Comed Chemicals Limited (India), Roxlor (US), Medisca Inc. (US), Zhejiang Yuexi Capsule Co. (China), ZHEJIANG HUILI CAPSULES CO., LTD (China), Shaoxing Zhongya Capsule Co., Ltd. (China), Shing Lih Fang Enterprise Co., Ltd. (Taiwan), Chemcaps Limited (India), SNAIL PHARMA INDUSTRY (China), SavoiurCaps (India), Shanxi JC Biological Technology CO. (China), Shaoxing Kangke Capsule Co., Ltd. (China), Lefancaps (Canada), BIO-CAPS INDIA LTD. (India), BioCaps Enterprise (US), Bright Pharma Caps (US), and SHREE PHARMA CAPS (India).

Scope of the In Vitro Toxicology Testing Industry:

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$3.1 billion |

|

Estimated Value by 2029 |

$4.2 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 6.3% |

|

Market Driver |

Increasing demand for nutraceuticals |

|

Market Opportunity |

Expansion of capsule production in emerging economies |

This report categorizes the global empty capsules market to forecast revenue and analyze trends in each of the following submarkets:

By Type

-

Gelatin Capsules (Value (USD Million) & Volume (Billion Units))

- Porcine Gelatin

- Bovine-derived Gelatin

- Bone Meal Gelatin

- Other Gelatin Sources

-

Non-gelatin Capsules (Value (USD Million) & Volume (Billion Units)

- Hydroxypropyl Methylcellulose (HPMC)

- Pullulan & Starch

By Functionality

- Immediate-release Capsules

- Sustained-release Capsules

- Delayed-release Capsules

By Therapeutic Application

- Antibiotic & antibacterial drugs

- Dietary supplements

- Antacid & antiflatulent preparations

- Antianemic preparations

- Anti-inflammatory drugs

- Cardiovascular therapy drugs

- Cough & cold drugs

- Other therapeutic applications

By End User

- Pharmaceutical Industry

- Nutraceutical Industry

- Cosmetic Industry

- Research Laboratories

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- RoE

-

Asia Pacific

- China

- Japan

- India

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLATAM

- Middle East & Africa

Recent Developments

- In October 2023 Roquette purchased pharmaceutical instruments to improve worldwide presence and Qualicaps, a producer of hard capsules. Thus, it not only provided oral dosage solutions all around but also enhanced ground-up versions of them. By combining two companies like Roquette and Qualicaps then the new company will be able to advance technically along with improving services in order to provide customers an extensive range from generic capsules or full binders including others such fillers used in this field for years past decades present day but not future times yet.

- Capugel Enprotect presented the first coating-free capsule for intestinal (enteric) medicine delivery in November 2022. Aiming at small chemicals, peptides, proteins, and RNA-based treatments, this novel delivery technology seeks to It also looks at making live biotherapeutic objects feasible.

- ACG made an agreement with the Government of Maharashtra (India) in December 2021 to construct the largest capsule manufacturing unit in Asia at Aurangabad. This facility will output 40 billion capsules per year, which will be utilized by local as well as global nutraceutical and pharmaceutical firms.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global empty capsules market between 2024 and 2029?

The global empty capsules market is expected to grow from USD 3.1 billion in 2024 to USD 4.2 billion by 2029, at a CAGR of 6.3%, driven by the rising demand for non-gelatin capsules, increasing nutraceutical consumption, and technological advancements in capsule delivery systems.

What are the key factors driving the empty capsules market?

The major drivers for the empty capsules market include increasing demand for nutraceuticals, the shift towards non-animal-derived ingredients, and rising investments in developing new veg capsule formulations. Technological advancements like controlled-release capsules and expansion into emerging economies are also key contributors to market growth.

What are the major challenges faced by the empty capsules market?

The primary challenges include the rising prices and limited availability of gelatin raw materials, along with the impact of dietary restrictions on gelatin capsules. Supply chain disruptions and fluctuating raw material costs are also key issues hindering market growth.

Which regions are expected to show growth in the empty capsules market?

North America and Europe are the dominant regions in the empty capsules market, driven by increasing nutraceutical consumption and advancements in capsule production. However, emerging economies in Asia Pacific, Latin America, and Africa are projected to provide significant growth opportunities due to the expanding pharmaceutical and nutraceutical sectors in these regions.

What are the different types of capsules available in the empty capsules market?

The empty capsules market is segmented into gelatin and non-gelatin capsules. Gelatin capsules are further categorized into porcine, bovine, and bone meal sources, while non-gelatin capsules include hydroxypropyl methylcellulose (HPMC), pullulan, and starch-based capsules.

What are the opportunities for growth in the empty capsules market?

Opportunities for growth include the expansion of capsule manufacturing in emerging economies, increased adoption of veg capsules among health-conscious consumers, and innovations in capsule delivery systems such as controlled-release and enteric-coated capsules. Growing demand for plant-based alternatives also presents a significant opportunity.

What are the recent developments in the empty capsules market?

Recent developments include the introduction of new product ranges, such as Vivion Inc.'s empty gelatin, HPMC, and pullulan capsules in 2023. Companies are focusing on launching novel veg capsules to meet the growing demand for non-gelatin-based products.

Which therapeutic applications dominate the empty capsules market?

In 2023, antibiotic and antibacterial drugs were the leading therapeutic applications in the empty capsules market. However, the dietary supplements segment is expected to grow at the fastest rate, driven by rising consumer interest in health and wellness.

How does the growing demand for nutraceuticals impact the empty capsules market?

The growing demand for nutraceuticals, especially those administered in capsule form, is a major driver for the empty capsules market. Consumers are increasingly prioritizing health-conscious behaviors, which is boosting the need for dietary supplements, vitamins, and plant-based capsules.

Who are the key players in the empty capsules market?

Key players in the global empty capsules market include Capsugel (Lonza), ACG, QUALICAPS, SUHEUNG, Shanxi Guangsheng Capsule Limited, CapsCanada, HealthCaps India, and Vivion Inc., among others. These companies are investing in innovations and expanding their production capacities to meet the growing market demand.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

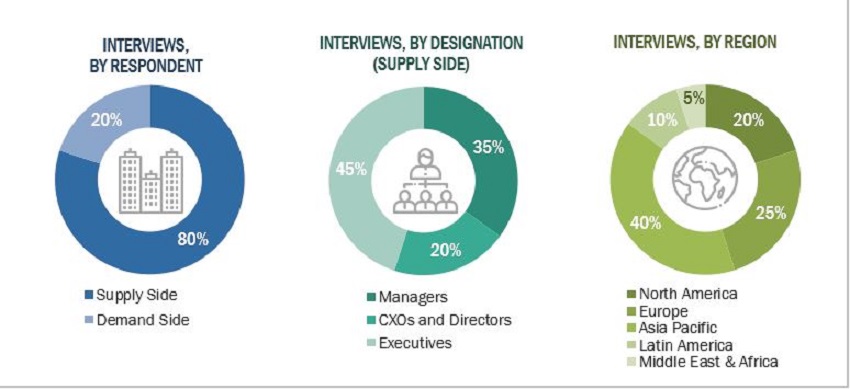

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global empty capsules market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the empty capsules market. The secondary sources used for this study include European Federation of Pharmaceutical Industries and Associations (EFPIA), United States Food and Drug Administration (US FDA), Central Drugs Standard Control Organisation (CDSCO), Drugs Technical Advisory Board (DTAB), Pharmaceutical Research and Manufacturers of America (PhRMA), Indian Pharmaceutical Association (IPA), National Institutes of Health (NIH), Molecular Diversity Preservation International (MDPI), World Health Organization (WHO). Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements), business magazines and research journals, press releases, and trade, business, and professional associations. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global empty capsules market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (personnel from pharmaceutical companies, nutraceutical companies and reference laboratories) and supply side (C-level and D-level executives, product managers, and marketing and sales managers of key manufacturers, distributors, and channel partners, among others, from Tier 1 and Tier 2 companies engaged in offering products) across five major regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Approximately 80% of primary interviews were conducted with supply-side representatives, while demand-side participants accounted for the remaining share. This preliminary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the empty capsules market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

Bottom-up Approach

- The key players in the industry and market have been identified through extensive secondary research.

- The revenues generated from the empty capsules business of leading players have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Top-down Approach

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments.

Data Triangulation

To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

A capsule is a form of solid oral dosage, which consists of a container, usually made of gelatin or HPMC material and filled with a medicinal substance. Empty capsules are hard shells of various shapes and have a capacity of usually a single dose of the active ingredient. Empty capsules contain dry, powdered ingredients or miniature pellets. These are made in two halves—a smaller-diameter “body” that is filled and then sealed using a larger-diameter “cap.”.

The scope of this report includes products gelatin and non-gelatin empty capsules which are utilized by various industries such as pharmaceutical, nutraceutical, and cosmetic for various type of applications including medicine, dietary supplements and cosmetics.

Stakeholders

- Empty capsules manufacturers, vendors, and distributors

- Pharmaceutical companies

- Nutraceutical companies

- Cosmeceutical companies

- Research laboratories

- Life Science Companies

- Venture Capitalists and Investors

- Government Organizations

- Private Research Firms

Report Objectives

- To define, describe, and forecast the empty capsules market based on type, functionality, therapeutic application, end user, and region.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges).

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall empty capsules market.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the size of the market segments with respect to six main regions, namely, North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa.

- To profile the key players in the empty capsules market and comprehensively analyze their product portfolios, market positions, and core competencies.

- To track and analyze competitive developments such as acquisitions, product launches, expansions, agreements, partnerships, and collaborations in the empty capsules market.

- To benchmark players within the empty capsules market using the ‘Company Evaluation Matrix' framework, which analyzes market players based on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakdown of the Rest of Europe empty capsules market, by country

- Further breakdown of the Rest of Asia Pacific empty capsules market, by country

- Further breakdown of the Rest of Latin America empty capsules market, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Empty Capsules Market