Electric Vehicles Battery Recycling Market by Source (Passenger Vehicles, Commercial Vehicles, E-Bikes), Chemistry (Li-NMC, LFP, LMO, LTO, NCA), Process (Hydrometallurgical, Pyrometallurgy, Physical/ Mechanical), and Region - Global Forecast to 2031

Updated on : April 01, 2024

Electric Vehicles Battery Recycling Market

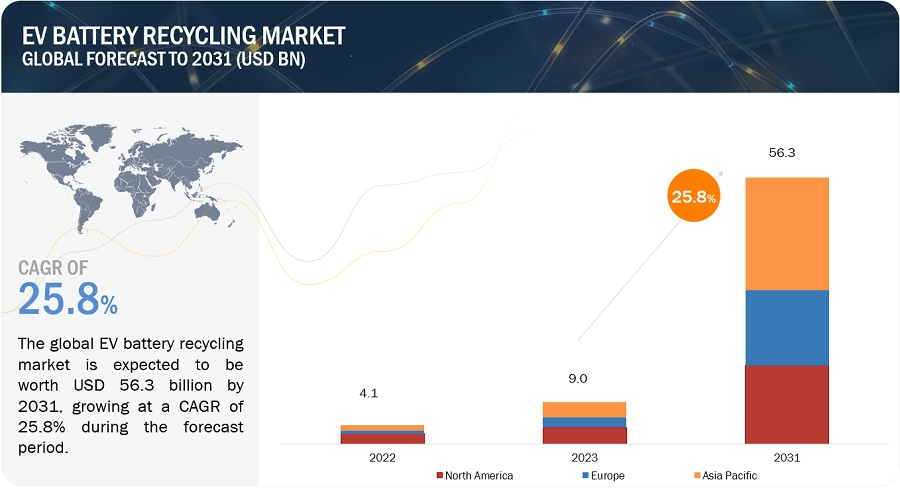

The electric vehicles battery recycling market was valued at USD 9.0 billion in 2023 and is projected to reach USD 56.3 billion by 2031, growing at 25.8% cagr from 2023 to 2031. Use of EV vehicles in Automotive sectors and advancement in lithium-ion battery are driving the growth in EV Battery Recycling market. The recycling of EV batteries is crucial to reduce waste, save valuable resources, and protect the environment. Automotive manufacturers are collaborating with recycling companies to recycle EV Batteries.

Attractive Opportunities in the EV Battery Recycling Market

To know about the assumptions considered for the study, Request for Free Sample Report

EV Battery Recycling Market Dynamics

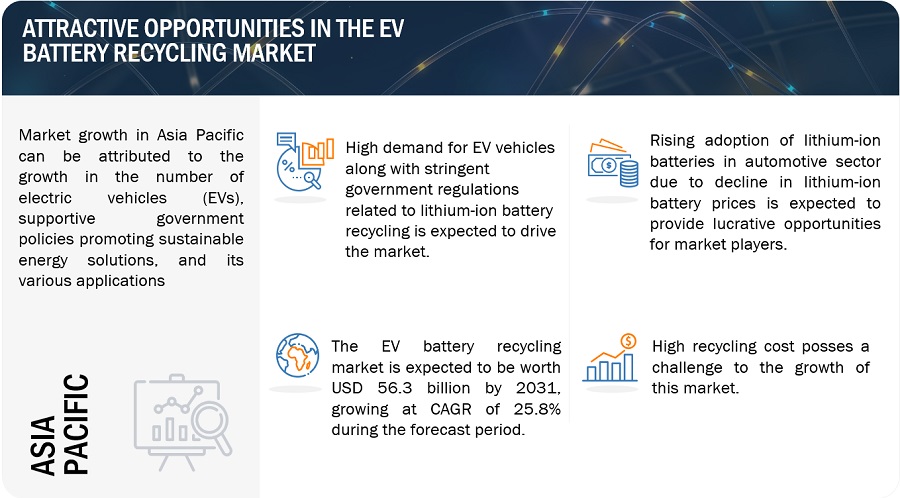

Driver: Increase in demand for recycled products and materials

The increasing interest in utilizing recycled materials and batteries is anticipated to promote research and development in the recycling of both batteries and materials. The upward path in material costs, coupled with a growing demand for eco-friendly or recycled products, is projected to create various sectors for growth within the battery recycling market. The mounting interest in recycled products and materials serves as a significant change, expected to have a substantial impact on the electric vehicle battery recycling market. This heightened demand is driven by a worldwide movement toward sustainable practices, a heightened environmental consciousness, and a growing awareness of the limited availability of natural resources.

Restraints: Safety issues related to storage and transportation of spent batteries

Spent batteries has hazardous chemicals, including acids and heavy metals such as mercury. In July 2007, a fire sparked by a lithium-based battery led to the ignition of over 132,000 liters of chemicals, resulting in the closure of two major highways in the UK. These batteries retain some charge after use, posing a risk of unexpected discharges that can harm people or property. It's crucial to handle all batteries cautiously, assuming they still have a charge unless properly labeled, and store them carefully, especially small batteries that could be swallowed by children. Larger lithium-based batteries, commonly found in cars, may be incorrectly identified as lead-acid batteries if not labeled accurately by local manufacturers. To prevent hazards, these batteries must be separated from used lead-acid batteries before storage. Concerns about the potential dangers associated with used batteries have led to regulations by state or national governments governing their storage and transportation.

Opportunity: Rising adoption of lithium-ion batteries due to decline in prices

Expensive lithium-ion batteries have held back market growth since the 1990s. These batteries have various parts, and some are subsidized. The main part, called the cell, makes up about half the cost, with the rest going to electronics, assembly, and packaging. Recent promises from battery and car companies suggest a significant price drop. A Bloomberg NEF survey shows the average battery pack cost went down to USD 137 per kWh in 2020, dropping 88% since 2010. Predictions say prices might go as low as USD 58 per kWh by 2030 and USD 44 per kWh by 2035. Tesla's Gigafactory-1 is one effort to increase battery production and lower prices. With advancements like large-scale manufacturing and better technology, lithium-ion battery prices are expected to decrease. This decline is likely to boost the renewable energy and grid storage markets, favoring lithium-ion batteries and increasing their market share. As a result, there could be a growing demand for recycling used automotive lithium-based batteries.

Challenge: High recycling cost and dearth of technologies

The Centre for Energy Economics (CEE) reports that globally, only 1-3% of lithium is recovered from all applications. Companies like Toxco (US) and Umicore (Belgium) are working on technologies to extract lithium from batteries. However, challenges for the industry include the high recycling costs, lack of proper storage for used batteries, and a shortage of recycling technologies. Recycling lithium-ion batteries is costly, and traditional methods can be energy-intensive. This makes recycling economically challenging compared to extracting materials from raw sources. Additionally, the diverse chemistries of lithium-ion batteries, varying among manufacturers, make it difficult to develop universal and cost-effective recycling processes. The need for customized recycling solutions adds complication and cost to the process, negatively impacting the market for electric vehicle battery recycling.

EV Battery Recycling Market Ecosystem

Prominent companies in this market include well-established, and financially stable manufacturers of EV battery recycling market. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include).

"Lithium Iron Phosphate, by battery chemistry, is estimated to account for the highest CAGR during the forecast period."

The rising popularity of lithium iron phosphate (LFP) electric vehicle (EV) batteries can be attributed to several compelling factors. LFP batteries excel in safety, boasting a reduced risk of overheating and fire as compared to other lithium-ion batteries. LFP batteries are environmentally sustainable, being non-toxic and recyclable, making them an eco-friendly choice. With a wide operating temperature range, they prove versatile for various applications, including those facing extreme temperatures. Cost-effectiveness is another advantage, as iron and phosphorus, the key components, are readily available and affordable globally.

"E-Bikes, by source , is estimated to account for the highest CAGR during the forecast period."

E-Bikes by source contributes to have highest CAGR during the forecast period as electric vehicle (EV) batteries in e-bikes is driven by several key advantages. EV batteries, particularly lithium-ion and lithium-iron-phosphate (LFP) types, offer higher energy density, ensuring longer range and improved e-bike performance. Safety is enhanced, with lithium-ion batteries being less susceptible to thermal runaway and oxygen release in case of fire compared to lead-acid batteries

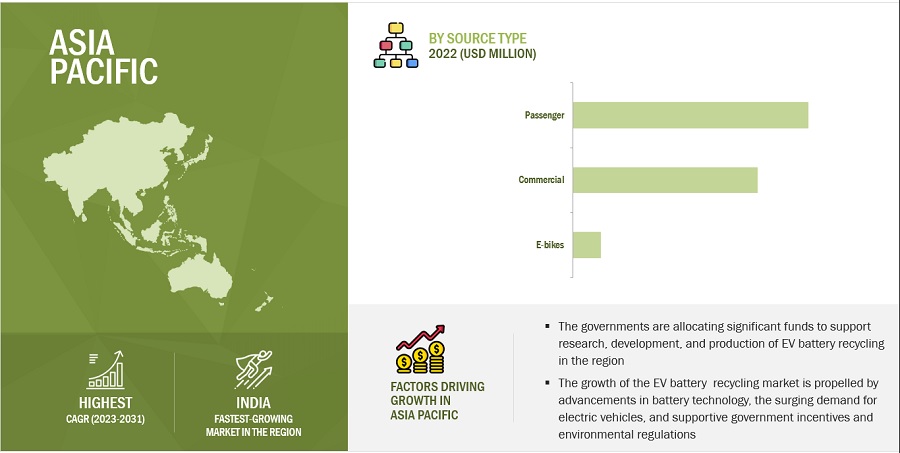

"Asia Pacific is estimated to account for the highest CAGR during the forecast period."

The demand for EV batteries in Asia Pacific is significant, driven by the increasing adoption of EVs in emerging economies. Growing investments by leading automotive OEMs to set up battery manufacturing and recycling facilities in the region, and rising government initiatives to support EV battery manufacturing, and EV battery recycling are some of the factors driving the growth of the EV battery recycling market in the Asia-Pacific region.

Source: Secondary Research, Expert Interviews, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, download the pdf brochure

EV Battery Recycling Market Players

Major companies in the EV Battery Recycling Market include Contemporary Amperex Technology Co., Limited. (China), Glencore (Switzerland), GEM Co., Ltd. (China), ERAMET (France), Li-Cycle Corp (Canada), Umicore (Belgium) among others. A total of 23 major players have been covered. These players have adopted product launches, agreements, joint ventures, investments, acquisitions, mergers, and expansions as the major strategies to consolidate their position in the market.

Read More: Electric Vehicles Battery Recycling Companies

EV Battery Recycling Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 4.1 Billion |

|

Revenue Forecast in 2031 |

USD 56.3 Billion |

|

CAGR |

25.8% |

|

Market Size Available for Years |

2017–2031 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2031 |

|

Forecast Units |

Value (USD Billion/Million) and Volume (Units) |

|

Segments Covered |

Battery Chemistry , Sources,Process and Region. |

|

Geographies Covered |

Asia Pacific, Europe, and North America |

|

Companies Covered |

The major market players include Contemporary Amperex Technology Co., Limited. (China), Glencore (Switzerland), GEM Co., Ltd. (China), ERAMET (France), Li-Cycle Corp (Canada), Umicore (Belgium) ,Accurec-Recycling GMBH (Germany), Fortum (Finland) ,Cirba solutions (US) ,Neometals Ltd.(Australia),Redwood Materials Inc. (US),Ecobat (US),Stena Recycling (Sweden) ,TES (Singapore),Ace Green Recycling, Inc. (USA), ,Shenzhen Highpower Technology Co., Ltd (China) and others. |

This research report categorizes the EV battery recycling market market based on Battery Chemistry , Sources,Process and Region.

Based on battery chemistry Type, the EV battery recycling market market has been segmented as follows:

- Lithium nickel manganese cobalt

- Lithium iron phosphate

- Lithium titanate oxide

- Lithium manganese oxide

- Lithium nickel cobalt aluminum oxide

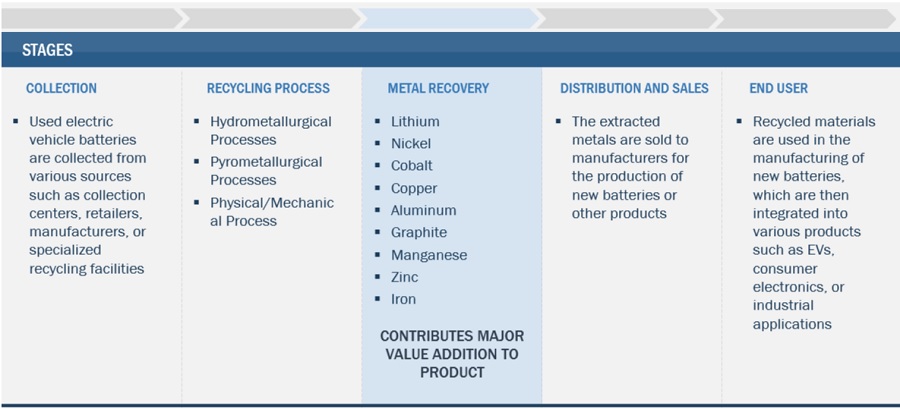

Based on Process, the EV battery recycling market market has been segmented as follows:

- Hydrometallurgical process

- Pyrometallurgy process

- Physical/mechanical process

Based on Sources, the EV battery recycling market market has been segmented as follows:

- Commercial

- Passenger

- E-bikes

Based on region, the EV battery recycling market market has been segmented as follows:

- Asia Pacific

- Europe

- North America

Recent Developments

- In Sep-2022 Umicore and PowerCo had announced the founding of a joint venture for precursor and cathode material production in Europe. From 2025 onwards, the joint venture will supply PowerCo's European battery cell factories with key materials. It also aims to include elements of refining and battery recycling based on Umicore's technology.

- In March 2022, Neometals and Mercedes-Benz confirmed their plans for a battery recycling joint venture. Through the JV, the companies intend to build a 2,500-ton-per-year lithium-ion battery recycling plant in Germany.

- In November 2022, Li-Cycle Corp. has announced a strategic partnership with Vines Energy Solutions, a battery & cell pack manufacturer and a member company of Vingroup. Through this partnership, Li-Cycle provided its recycling solutions to Vines Energy Solutions

Frequently Asked Questions (FAQ):

What is the key driver for the ev battery recycling market?

Growing adoption of EVs and plug-in vehicles as a driving force for the EV battery recycling market

Which region is expected to register the highest CAGR in the EV Battery Recycling Market during the forecast period?

The EV Battery Recycling Market in Asia Pacific is estimated to register the highest CAGR during the forecast period.

What is the major source of EV battery ?

The passenger segment holds a prominent position in the EV battery recycling market due to the widespread use of passenger cars and the increasing adoption of electric vehicles (EVs). As the demand for electric passenger cars continues to rise, the number of spent EV batteries from this segment also increases, driving the need for effective recycling solutions.

Who are the major players of the EV battery recycling market?

The key players operating in the market include Glencore (Switzerland), GEM Co., Ltd. (China), ERAMET (France), Li-Cycle Corp (Canada), Umicore (Belgium).

What is the total CAGR expected to record for the EV Battery Recycling Marketduring 2023-2031?

The market is expected to record a CAGR of 25.8 % from 2023-2031. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current size of the EV battery recycling market market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the EV battery recycling market value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study include annual reports, press releases, and investor presentations of companies; white papers; certified publications; and articles by recognized authors; gold- and silver-standard websites; EV battery recycling market manufacturing companies, regulatory bodies, trade directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It has also been used to obtain information about key developments from a market-oriented perspective.

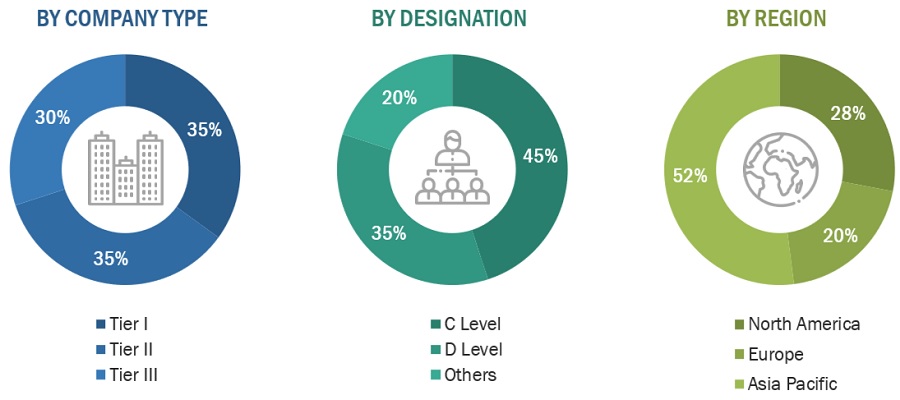

Primary Research

The EV battery recycling market market comprises several stakeholders, such as such as raw material suppliers, technology support providers, EV battery recycling market manufacturers, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the EV battery recycling market market . Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the total size of the EV battery recycling market market. These approaches have also been used extensively to estimate the size of various dependent subsegments of the market. The research methodology used to estimate the market size included the following:

The following segments provide details about the overall market size estimation process employed in this study

- The key players in the market were identified through secondary research.

- The market shares in the respective regions were identified through primary and secondary research.

- The value chain and market size of the EV battery recycling market market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of annual and financial reports of the top market players and interviews with industry experts, such as CEOs, VPs, directors, sales managers, and marketing executives, for key insights, both quantitative and qualitative.

Global EV battery recycling market market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global EV Battery Recycling Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the oil & gas sector.

Market Definition

The recycling of electric vehicle (EV) batteries involves recovering and repurposing materials from used lithium-ion batteries to reduce environmental impact and handle waste responsibly. This includes collecting, sorting, and dismantling batteries, followed by shredding to separate components. Chemical and mechanical methods are then utilized to extract valuable materials such as lithium, cobalt, and nickel. These recovered materials can be reintegrated into the production of new batteries, promoting resource conservation and lessening the need for raw materials. Additionally, effective recycling contributes to responsible disposal of hazardous waste, fostering a sustainable and circular approach within the electric vehicle industry.

Key Stakeholders

- Raw material manufacturers

- Technology support providers

- Manufacturers of EV battery recycling market

- Traders, distributors, and suppliers

- Regulatory Bodies and Government Agencies

- Research & Development (R&D) Institutions

- End-use Industries

- Consulting Firms, Trade Associations, and Industry Bodies

- Investment Banks and Private Equity Firms

Report Objectives

- To analyze and forecast the market size of EV battery recycling market market in terms of value and volume

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global EV battery recycling market on the basis of battery chemistry , sources,process and region.

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To forecast the size of various market segments based on four major regions: North America, Europe, Asia Pacific along with their respective key countries

- To track and analyze the competitive developments, such as acquisitions, partnerships, collaborations, agreements and expansions in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the EV battery recycling market market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Growth opportunities and latent adjacency in Electric Vehicles Battery Recycling Market