eClinical Solutions Market by Product (CDMS, EDC, CTMS, eCOA, RTSM, eTMF, Safety), Deployment (On premise, Cloud), Application (Collection, Operations, Analytics), Trial Phase, End user (Pharma, Biotech, Med Devices), & Region - Global Forecast to 2029

Updated on : September 24, 2024

Overview of the eClinical Solutions Market

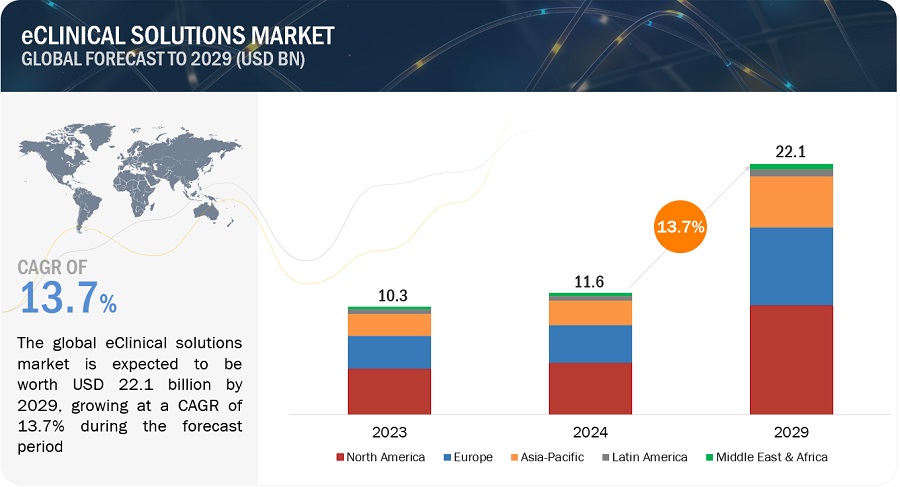

eClinical Solutions market forecasted to transform from USD 11.6 billion in 2024 to USD 22.1 billion in 2029, driven by a CAGR of 13.7%. eClinical solutions outperform traditional ways of clinical trials in terms of clinical trial efficiency, site performance, reduced research effort, and cost efficiency; this has significantly contributed to market growth. The operational advantages of eClinical solutions are also driving this market among contract research organizations (CROS), researchers, and pharmaceutical/biotech companies in this sector. Additionally, regulatory authorities standardize clinical data, and eClinical solutions like electronic data capture (EDC) and clinical data management systems (CDMS) include regulatory data compliance. This fuels the market for eClinical solutions that ensure data compliance.

eClinical Solutions Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Eclinical Solutions Market Overview

eClinical solutions Market Dynamics

Driver: An increase in the use of novel software solutions in clinical research.

Throughout any clinical study, the majority of researchers are shown to be facing huge operational challenges surrounding patient recruitment and retention. In most cases, clinical trials are of longer duration, and it costs more to research because there has been no real-time access to research data and manual compilation of data for protocol matrices. This might affect all phases, but most of all, research design, data collection, data management, and reporting regulations, and the analysis of data, and it might delay the market entry of successful candidates of drugs. Example: In November 2022, Medidata released Rave Companion, the first scalable answer for automating Rave EDC data capture. Clinical trial sites and data managers avoid several potential errors due to Rave Companion's modernization of the EDC user experience.

It takes ~13 years and an overall investment of up to USD 1.3 billion (~USD 146 million annually) to commercialize a successful drug candidate; this includes initial drug screening, product synthesis, preclinical and clinical studies, and regulatory filing & approvals. (Source: London School of Hygiene and Tropical Medicine). Therefore, researchers are favoring cutting-edge eclinical solutions over traditional approaches since they provide better clinical trial efficiency, boost site performance, and streamline research workload. These software solutions enable pharmaceutical corporations and independent researchers to assess the operating characteristics of different software design options, model, forecast, and track clinical trial enrolment, and detect procedural bottlenecks associated with clinical trials. The procedural and operational benefits provided by eClinical systems are driving significant growth in their adoption by CROS, independent researchers, and pharmaceutical, medical device, and biotechnology corporations for clinical research programs.

Restraint: High implementation costs associated with clinical solutions.

eClinical systems enable researchers to efficiently organise, standardise, and manage clinical research data and information across the research lifecycle. Several integrated eClinical solutions (such as CTMS and CDMS) offer clinical researchers comprehensive solutions for all clinical trial operations. However, many software solutions are expensive and come with a fee. The installation and maintenance of clinical solutions cost around USD 2 million, with additional fees for technical support for cloud-based systems. The significant costs associated with advanced clinical software solutions are expected to be borne by low-income and small end-customers, such as pharmaceutical and biotechnology businesses, independent researchers, and CROs.

Opportunity: Growing number of clinical trials in developing nations.

The life science industry is witnessing a global increase in the number of clinical trials conducted each year. An increasing number of industry and government sponsors across developed countries are outsourcing their clinical trial processes to developing countries owing to procedural affordability and efficiency, lower operational costs, availability of a large population base, faster patient recruitment, limited regulatory barriers, effective compliance with regulatory guidelines, and stronger intellectual property protections. Asian countries are developing as significant outsourcing destinations for clinical trials, owing to their vast and genetically diverse populations, high illness prevalence, and low-cost outsourced services. Many clinical studies are outsourced to CROS companies in China and India.

The growing number of pharmaceutical companies in developing Asian countries such as China, India, Taiwan, and Korea have also created growth opportunities for the eclinical solutions market in this region. China is the key emerging market for the establishment of pharma and biopharmaceutical companies. Funding support from governments, private entities, and other non-profit organizations in the country is also expected to drive market growth in China for the next decade. India is also one of the top five locations for clinical trial sites, with numerous large-scale global research being undertaken there. The expanding number of clinical trials in emerging nations is expected to create significant market opportunities for well-known and new software businesses to strengthen and improve their market positions in the worldwide clinical solutions industry.

Challenge: Concerns pertaining to patient privacy.

Data integration points to the increased problem of patient privacy, with the escalating number of databases amongst research institutions, CROS, partners, and software companies, the risks of data breach augment. The 2009 Health Information Technology for Economic and Clinical Health Act (HITECH Act) states that covered entities must protect individual health records and other identifiable health information by acquiring appropriate safeguards to protect privacy As such, applying the electronics tools to the patient databases raises concerns on the privacy of the patient record, thus creating another key challenge for pharmaceutical enterprises in to complying with privacy policies while using eClinical software solutions.

eClinical Solutions Market Ecosystem

This section highlights the market's key participants, which include network connection and hardware providers (telecommunications firms), infrastructure service providers (computer tools and electronics makers), and software and service providers. It also contains an overview of firms that provide solutions in the eClinical industry, including recent corporate advancements and MarketsandMarkets' assessment of these suppliers. Additionally, it underscores each company's distinctive features and expertise within the market.

The electronic clinical outcome assessment solutions segment is expected to register highest growth rate during the forecast period in the eClinical solutions industry, by product.

The electronic clinical outcome assessment solutions register the highest growth rate during the forecast period in the eClinical solutions market. This highest growth can be attributed to factors such as eCOA solutions enhancing data accuracy and reliability by reducing manual data entry errors and providing real-time data capture, which is crucial for clinical trials; these solutions improve patient engagement and compliance through user-friendly interfaces and mobile accessibility, allowing patients to conveniently report outcomes. Additionally, regulatory bodies are increasingly endorsing electronic data collection methods, driving the adoption of eCOA solutions to ensure compliance with evolving standards.

Web-Hosted & Cloud-Based model segment accounted for the largest market share by the deployment model of eClinical solutions industry.

In 2023 the web-hosted and cloud-based model was the largest segment in the eClinical solutions market by deployment model. This is due to factors like easy integration with existing infrastructure without significant capital expenditure; flexibility and accessibility so researchers, clinicians and other stakeholders can access data and applications from anywhere and hence more collaboration and efficiency. Web-hosted and cloud-based systems have advanced security features and automatic updates, which make them compliant with the latest regulations and are protected against data breaches, which increases their share in the eClinical solutions market.

North America accounted for largest market share of the eClinical solutions industry in 2023.

In 2023, North America held the largest share of the eClinical Solutions market. The region's high digital literacy and technological innovation, as demonstrated by companies such as Medidata Solutions, drive the broad use of eClinical solutions. The availability of regulatory frameworks, such as the FDA's 21 CFR Part 11, promotes compliance while increasing demand for sophisticated data management and clinical trial solutions. Further, Asia Pacific to have the highest growth rate during the forecast period in the eClinical solutions market. This is driven by factors such as the rapidly expanding healthcare sector, increasing government support for clinical research, and a growing number of clinical trials being conducted in the region.

To know about the assumptions considered for the study, download the pdf brochure

The eClinical solutions market key established players include Medidata (A Dassault Systèmes Company) (France), Veeva Systems (US), IQVIA Inc. (US), ICON plc (Ireland), Oracle (US) among others.

Scope of the eClinical Solutions Industry:

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$11.6 billion |

|

Projected Revenue by 2030 |

$22.1 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 13.7% |

|

Market Driver |

An increase in the use of novel software solutions in clinical research. |

|

Market Opportunity |

Growing number of clinical trials in developing nations. |

The study categorizes eClinical solutions market to forecast revenue and analyze trends in each of the following submarkets:

By Segment

-

Product

- Electronic Data Capture & Clinical Data Management Solutions

- Clinical Trial Management Solutions

- Clinical Analytics Platforms

- Randomization & Trial Supply Management

- Electronic Clinical Outcome Assessment Solutions

- Electronic Trial Master File Solutions

- Electronic Consent Solutions

- Regulatory Information Management Solutions

- Clinical Data Integration Platforms

- Safety Solutions

- Other eClinical Solutions

-

Deployment Model

- Web-Based & Cloud-Based Model

- On-Premise Model

-

Application

- Data Collection

- Document Management & Storage

- Supply Management

- Data Analytics

- Regulatory Information Management

- Other Applications

-

Clinical Trial Phase

- Phase I

- Phase II

- Phase III

- Phase IV

-

End User

- Pharmaceutical & Biopharmaceutical Companies

- Contract Research Organizations

- Consulting Service Companies

- Medical Device Manufacturers

- Hospitals & Healthcare Providers

- Academic Research Institutes

- Government Organizations

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- RoE

-

Asia Pacific

- Japan

- China

- India

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLATAM

-

Middle East & Africa

- GCC

- RoMEA

Recent Developments of eClinical Solutions Industry:

- In February 2023, Medidata, Dassault Systèmes (US) launched a Clinical Data Studio a software to modernize the data experience to clinical trials using AI.

- In October 2023, Mednet (US) developed its latest eConsent software which provides a simple and cost-effective method for collecting and storing participant consent. The requirements of decentralized, virtual, and hybrid clinical trials are met by this feature.

- In August 2022, Clario (US) launched eCOA digital solutions, Clario Translation Workbench, this will help to reduce translation time by 20–30%, which will speed up eCOA studies and increase patient access to clinical trials.

- In November 2022, Medidata, Dassault Systèmes (US) introduced Rave Companion, the first scalable solution, to automate the entry of EHR data into Rave EDC. Several potential errors are avoided by clinical trial sites and data managers owing to Rave Companion's modernization of the EDC user experience.

Frequently Asked Questions (FAQ):

Which are the top industry players in the global eClinical solutions market?

The top market players in the global eClinical solutions market include Medidata (A Dassault Systèmes Company) (France), Veeva Systems (US), IQVIA Inc. (US), ICON plc (Ireland), Oracle (US), Signant Health (US), Clario (US), eClinical Solutions (US), Clinion (US), MaxisIT (US), 4G Clinical (US), Fountayn (US), Saama (US), Mednet (US), Advarra (US), Caidya (US), OpenClinica (US), EvidentIQ (Germany), Research Manager (Netherlands), Anju Software, Inc. (US), Medrio (US), Castor (US), RealTime Software Solutions, LLC (US), Y-Prime, LLC (US), and Vial (US).

Which geographical region is dominating in the global eClinical solutions market?

The global eClinical solutions market is segmented into North America, Europe, Asia Pacific, Latin America, the Middle East and Africa. North America holds the largest share during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing focus on cost-effective processes- Favorable government support and funding- Need for data standardization- Increasing R&D expenditure on drug developmentRESTRAINTS- High implementation costs- Lack of skilled professionals- Limited awareness among researchersOPPORTUNITIES- Increasing number of clinical trials- Outsourcing of clinical trials- Gradual shift toward real-time data analysisCHALLENGES- Limited adoption in developing and underdeveloped countries- Software reliability issues- Patient privacy concerns

-

5.3 ECOSYSTEM ANALYSISHEALTHCARE PROVIDERSCLOUD PROVIDERSGOVERNMENT AGENCIES AND REGULATORY BODIESECLINICAL SOLUTION COMPANIES

-

5.4 CASE STUDY ANALYSISENHANCED PATIENT RECORDS USING MEDIDATA ECOA APPIMPROVED ALZHEIMER’S TREATMENT WITH LEQEMB THERAPYEFFICIENT CLINICAL TRIAL UTILIZING SCALE MANAGEMENT EXPERTISE

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 PORTER'S FIVE FORCES ANALYSISBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSINTENSITY OF COMPETITIVE RIVALRY

-

5.7 REGULATORY LANDSCAPEREGULATORY ANALYSIS- North America- Europe- Asia Pacific- Latin America- Middle East & AfricaREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.8 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR ECLINICAL SOLUTIONSJURISDICTION AND TOP APPLICANT ANALYSIS

-

5.9 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- AI-enabled and integrated platforms- Clinical data integrationCOMPLEMENTARY TECHNOLOGIES- Cloud computing- Analytical toolsADJACENT TECHNOLOGIES- Electronic health records- Real-world data- Bioinformatics

-

5.10 INDUSTRY TRENDSDECENTRALIZED CLINICAL TRIALSTELEMEDICINEBIG DATA

-

5.11 PRICING ANALYSISINDICATIVE PRICING ANALYSIS, BY DEPLOYMENT MODELAVERAGE SELLING PRICE TREND, BY REGION

- 5.12 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIABUYING CRITERIA

- 5.14 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.15 END-USER ANALYSISUNMET NEEDSEND-USER EXPECTATIONS

- 5.16 INVESTMENT AND FUNDING SCENARIO

-

5.17 IMPACT OF AI/GEN AI ON ECLINICAL SOLUTIONS MARKETKEY USE CASESIMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS- Case study- Clinical trial management system market- Clinical trial market- Electronic clinical outcome assessment solution marketUSER READINESS AND IMPACT ASSESSMENT- User readiness- Impact assessment

- 6.1 INTRODUCTION

-

6.2 ELECTRONIC DATA CAPTURE & CLINICAL DATA MANAGEMENT SOLUTIONSRISING NEED TO REDUCE TIME AND COSTS IN CLINICAL TRIALS TO ENCOURAGE GROWTH

-

6.3 CLINICAL TRIAL MANAGEMENT SOLUTIONSRISING DEMAND FOR SITE & DATA COLLECTION SOLUTIONS TO FACILITATE GROWTH

-

6.4 CLINICAL ANALYTICS PLATFORMSGROWING ADOPTION OF ELECTRONIC MEDICAL RECORDS TO BOOST MARKET

-

6.5 RANDOMIZATION & TRIAL SUPPLY MANAGEMENT SOLUTIONSGROWING TREND OF GLOBALIZATION TO FUEL MARKET

-

6.6 ELECTRONIC CLINICAL OUTCOME ASSESSMENT SOLUTIONSINCREASING ADOPTION OF EDIARIES TO AID GROWTH

-

6.7 ELECTRONIC TRIAL MASTER FILE SOLUTIONSIMPROVED INFORMATION SEARCH AND RETRIEVAL TO FUEL MARKET

-

6.8 ELECTRONIC CONSENT SOLUTIONSGROWING INCLINATION TOWARD DIGITIZATION TO PROMOTE GROWTH

-

6.9 REGULATORY INFORMATION MANAGEMENT SOLUTIONSENHANCED REGULATORY SUBMISSION PROCESS TO AUGMENT GROWTH

-

6.10 CLINICAL DATA INTEGRATION PLATFORMSGROWING VOLUME OF CLINICAL DATA AND IMPROVED CLOUD TECHNOLOGY TO PROPEL MARKET

-

6.11 SAFETY SOLUTIONSGROWING ADOPTION OF ECLINICAL SOFTWARE TO SUPPORT MARKET GROWTH

- 6.12 OTHER SOLUTIONS

- 7.1 INTRODUCTION

-

7.2 WEB-HOSTED & CLOUD-BASED MODELSGROWING DEMAND FOR CLOUD-BASED SOLUTIONS TO AUGMENT GROWTH

-

7.3 ON-PREMISE MODELSMINIMIZED DATA BREACHES AND EXTERNAL ATTACK RISKS TO SUPPORT MARKET

- 8.1 INTRODUCTION

-

8.2 DATA COLLECTIONIMPROVED TRIAL EFFICIENCY TO DRIVE MARKET

-

8.3 DOCUMENT MANAGEMENT & STORAGERISING INCLINATION TOWARD STREAMLINED DOCUMENT WORKFLOWS TO FUEL MARKET

-

8.4 SUPPLY MANAGEMENTNEED TO ADDRESS COMPLEXITIES IN MANAGING CLINICAL TRIAL SUPPLIES TO BOOST MARKET

-

8.5 DATA ANALYTICSINCREASING NEED FOR OPTIMIZED TRIAL DESIGNS TO AID GROWTH

-

8.6 CLINICAL TRIAL OPERATIONSGROWING FOCUS ON ENHANCED DRUG DEVELOPMENT TO PROPEL MARKET

-

8.7 REGULATORY INFORMATION MANAGEMENTEVOLVING GLOBAL REGULATORY STANDARDS TO STIMULATE GROWTH

- 8.8 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 PHASE IINCREASING DEMAND FOR ACCURATE CLINICAL DATA MANAGEMENT TO ACCELERATE GROWTH

-

9.3 PHASE IIPUSH TOWARD FASTER DRUG DEVELOPMENT TO FACILITATE GROWTH

-

9.4 PHASE IIIINVOLVEMENT OF LARGE PATIENT POPULATION TO ENCOURAGE SEGMENT GROWTH

-

9.5 PHASE IVGROWING EMPHASIS ON SAFE DRUGS TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIESINCREASING R&D EXPENDITURE TO DRIVE MARKET

-

10.3 CONTRACT RESEARCH ORGANIZATIONSGROWING OUTSOURCING OF CLINICAL TRIALS TO FUEL MARKET

-

10.4 CONSULTING SERVICE COMPANIESINCREASING COMPLEXITIES AND COSTS OF CLINICAL DATA MANAGEMENT TO PROPEL MARKET

-

10.5 MEDICAL DEVICE MANUFACTURERSRISING DEVELOPMENT OF NEW MEDICAL DEVICES TO BOOST MARKET

-

10.6 HOSPITALS & HEALTHCARE PROVIDERSGROWING COLLABORATIONS BETWEEN HOSPITALS AND ECLINICAL SOLUTION PROVIDERS TO STIMULATE MARKET

-

10.7 ACADEMIC & RESEARCH INSTITUTESFAVORABLE GOVERNMENT SUPPORT FOR CLINICAL RESEARCH TO EXPEDITE GROWTH

-

10.8 GOVERNMENT ORGANIZATIONSINCREASED ADOPTION BY HEALTH DEPARTMENTS AND REGULATORY BODIES TO SPEED UP GROWTH

- 10.9 OTHER END USERS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAMACROECONOMIC OUTLOOK FOR NORTH AMERICAUS- Rising government funding for pharmaceutical R&D to drive marketCANADA- Advanced facilities and shorter approval times for drug candidates to fuel market

-

11.3 EUROPEMACROECONOMIC OUTLOOK FOR EUROPEGERMANY- High number of sponsored clinical trials to augment growthUK- Increased investments by pharmaceutical companies to boost marketFRANCE- Booming generics market to aid growthITALY- Favorable drug approval scenario to support market growthSPAIN- Robust network of research centers, universities, and hospitals to encourage growthREST OF EUROPE

-

11.4 ASIA PACIFICMACROECONOMIC OUTLOOK FOR ASIA PACIFICCHINA- Low manufacturing costs and huge demand for medicines to expedite growthINDIA- Growing foreign direct investments to facilitate market growthJAPAN- Drug discovery and development initiatives to promote growthREST OF ASIA PACIFIC

-

11.5 LATIN AMERICAMACROECONOMIC OUTLOOK FOR LATIN AMERICABRAZIL- Higher adoption of advanced digital technologies to stimulate growthMEXICO- Government initiatives to enhance digital infrastructure of healthcare to propel marketREST OF LATIN AMERICA

-

11.6 MIDDLE EAST & AFRICAMACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICAGCC COUNTRIES- Growing modernization initiatives in healthcare sector to support market growthREST OF MIDDLE EAST & AFRICA

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS, 2019–2023

- 12.4 MARKET SHARE ANALYSIS, 2023

-

12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023- Company footprint- Product footprint- Application footprint- End-user footprint- Region footprint

-

12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023

-

12.7 COMPANY EVALUATION AND FINANCIAL METRICS

- 12.8 BRAND/PRODUCT COMPARISON

-

12.9 COMPETITIVE SCENARIOPRODUCT LAUNCHES AND ENHANCEMENTSDEALSEXPANSIONSOTHER DEVELOPMENTS

-

13.1 KEY PLAYERSMEDIDATA (A DASSAULT SYSTÈMES COMPANY)- Business overview- Products offered- Recent developments- MnM viewVEEVA SYSTEMS- Business overview- Products offered- Recent developments- MnM viewIQVIA INC.- Business overview- Products offered- Recent developments- MnM viewICON PLC- Business overview- Products offered- Recent developmentsORACLE- Business overview- Products offered- Recent developmentsSIGNANT HEALTH- Business overview- Products offered- Recent developmentsCLARIO- Business overview- Products offered- Recent developmentsECLINICAL SOLUTIONS- Business overview- Products offered- Recent developmentsCLINION- Business overview- Products offered- Recent developmentsMAXISIT- Business overview- Products offered4G CLINICAL- Business overview- Products offered- Recent developmentsFOUNTAYN- Business overview- Products offeredSAAMA- Business overview- Products offered- Recent developmentsMEDNET- Business overview- Products offered- Recent developmentsADVARRA- Business overview- Products offered- Recent developmentsCAIDYA- Business overview- Products offered- Recent developmentsOPENCLINICA, LLC- Business overview- Products offered- Recent developmentsEVIDENTIQ- Business overview- Products offered- Recent developments

-

13.2 OTHER PLAYERSRESEARCH MANAGERANJU SOFTWARE INC.MEDRIOCASTORREALTIME SOFTWARE SOLUTIONS, LLCYPRIME, LLC.VIAL

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 ECLINICAL SOLUTIONS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 3 ECLINICAL SOLUTIONS MARKET: PORTER’S FIVE FORCES

- TABLE 4 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 INNOVATIONS AND PATENT REGISTRATIONS, 2022–2023

- TABLE 9 INDICATIVE PRICING ANALYSIS OF ECLINICAL SOLUTIONS, BY DEPLOYMENT MODEL

- TABLE 10 ECLINICAL SOLUTIONS MARKET: KEY CONFERENCES AND EVENTS, 2024–2025

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TOP 3 END USERS (%)

- TABLE 12 KEY BUYING CRITERIA FOR TOP 3 END USERS

- TABLE 13 UNMET NEEDS IN ECLINICAL SOLUTIONS MARKET

- TABLE 14 END-USER EXPECTATIONS IN ECLINICAL SOLUTIONS MARKET

- TABLE 15 ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 16 ECLINICAL SOLUTIONS MARKET FOR ELECTRONIC DATA CAPTURE & CLINICAL DATA MANAGEMENT SOLUTIONS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 17 ECLINICAL SOLUTIONS MARKET FOR CLINICAL TRIAL MANAGEMENT SOLUTIONS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 18 ECLINICAL SOLUTIONS MARKET FOR CLINICAL ANALYTICS PLATFORMS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 19 ECLINICAL SOLUTIONS MARKET FOR RANDOMIZATION & TRIAL SUPPLY MANAGEMENT SOLUTIONS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 20 ECLINICAL SOLUTIONS MARKET FOR ELECTRONIC CLINICAL OUTCOME ASSESSMENT SOLUTIONS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 21 ECLINICAL SOLUTIONS MARKET FOR ELECTRONIC TRIAL MASTER FILE SOLUTIONS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 22 ECLINICAL SOLUTIONS MARKET FOR ELECTRONIC CONSENT SOLUTIONS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 23 ECLINICAL SOLUTIONS MARKET FOR REGULATORY INFORMATION MANAGEMENT SOLUTIONS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 24 ECLINICAL SOLUTIONS MARKET FOR CLINICAL DATA INTEGRATION PLATFORMS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 25 ECLINICAL SOLUTIONS MARKET FOR SAFETY SOLUTIONS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 26 ECLINICAL SOLUTIONS MARKET FOR OTHER SOLUTIONS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 27 ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 28 ECLINICAL SOLUTIONS MARKET FOR WEB-HOSTED & CLOUD-BASED MODELS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 29 ECLINICAL SOLUTIONS MARKET FOR ON-PREMISE MODELS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 30 ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 31 ECLINICAL SOLUTIONS MARKET FOR DATA COLLECTION, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 32 ECLINICAL SOLUTIONS MARKET FOR DOCUMENT MANAGEMENT & STORAGE, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 33 ECLINICAL SOLUTIONS MARKET FOR SUPPLY MANAGEMENT, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 34 ECLINICAL SOLUTIONS MARKET FOR DATA ANALYTICS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 35 ECLINICAL SOLUTIONS MARKET FOR CLINICAL TRIAL OPERATIONS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 36 ECLINICAL SOLUTIONS MARKET FOR REGULATORY INFORMATION MANAGEMENT, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 37 ECLINICAL SOLUTIONS MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 38 ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 39 ECLINICAL SOLUTIONS MARKET FOR PHASE I, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 40 ECLINICAL SOLUTIONS MARKET FOR PHASE II, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 41 ECLINICAL SOLUTIONS MARKET FOR PHASE III, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 42 ECLINICAL SOLUTIONS MARKET FOR PHASE IV, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 43 ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 44 ECLINICAL SOLUTIONS MARKET FOR PHARMACEUTICAL & BIOPHARMACEUTICAL COMPANIES, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 45 ECLINICAL SOLUTIONS MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 46 ECLINICAL SOLUTIONS MARKET FOR CONSULTING SERVICE COMPANIES, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 47 ECLINICAL SOLUTIONS MARKET FOR MEDICAL DEVICE MANUFACTURERS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 48 ECLINICAL SOLUTIONS MARKET FOR HOSPITALS & HEALTHCARE PROVIDERS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 49 ECLINICAL SOLUTIONS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 50 ECLINICAL SOLUTIONS MARKET FOR GOVERNMENT ORGANIZATIONS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 51 ECLINICAL SOLUTIONS MARKET FOR OTHER END USERS, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 52 ECLINICAL SOLUTIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

- TABLE 53 NORTH AMERICA: ECLINICAL SOLUTIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 54 NORTH AMERICA: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 55 NORTH AMERICA: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 56 NORTH AMERICA: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 57 NORTH AMERICA: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 58 NORTH AMERICA: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 59 US: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 60 US: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 61 US: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 62 US: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 63 US: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 64 CANADA: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 65 CANADA: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 66 CANADA: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 67 CANADA: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 68 CANADA: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 69 EUROPE: ECLINICAL SOLUTIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 70 EUROPE: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 71 EUROPE: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 72 EUROPE: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 73 EUROPE: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 74 EUROPE: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 75 GERMANY: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 76 GERMANY: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 77 GERMANY: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 78 GERMANY: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 79 GERMANY: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 80 UK: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 81 UK: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 82 UK: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 83 UK: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 84 UK: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 85 FRANCE: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 86 FRANCE: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 87 FRANCE: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 88 FRANCE: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 89 FRANCE: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 90 ITALY: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 91 ITALY: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 92 ITALY: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 93 ITALY: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 94 ITALY: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 95 SPAIN: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 96 SPAIN: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 97 SPAIN: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 98 SPAIN: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 99 SPAIN: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 100 REST OF EUROPE: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 101 REST OF EUROPE: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 102 REST OF EUROPE: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 103 REST OF EUROPE: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 104 REST OF EUROPE: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 105 ASIA PACIFIC: ECLINICAL SOLUTIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 106 ASIA PACIFIC: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 107 ASIA PACIFIC: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 108 ASIA PACIFIC: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 109 ASIA PACIFIC: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 110 ASIA PACIFIC: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 111 CHINA: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 112 CHINA: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 113 CHINA: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 114 CHINA: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 115 CHINA: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 116 INDIA: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 117 INDIA: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 118 INDIA: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 119 INDIA: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 120 INDIA: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 121 JAPAN: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 122 JAPAN: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 123 JAPAN: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 124 JAPAN: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 125 JAPAN: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 126 REST OF ASIA PACIFIC: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 127 REST OF ASIA PACIFIC: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 130 REST OF ASIA PACIFIC: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 131 LATIN AMERICA: ECLINICAL SOLUTIONS MARKET, BY COUNTRY, 2022–2029 (USD MILLION)

- TABLE 132 LATIN AMERICA: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 133 LATIN AMERICA: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 134 LATIN AMERICA: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 135 LATIN AMERICA: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 136 LATIN AMERICA: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 137 BRAZIL: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 138 BRAZIL: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 139 BRAZIL: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 140 BRAZIL: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 141 BRAZIL: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 142 MEXICO: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 143 MEXICO: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 144 MEXICO: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 145 MEXICO: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 146 MEXICO: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 147 REST OF LATIN AMERICA: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 148 REST OF LATIN AMERICA: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 149 REST OF LATIN AMERICA: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 150 REST OF LATIN AMERICA: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 151 REST OF LATIN AMERICA: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 152 MIDDLE EAST & AFRICA: ECLINICAL SOLUTIONS MARKET, BY REGION, 2022–2029 (USD MILLION)

- TABLE 153 MIDDLE EAST & AFRICA: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 154 MIDDLE EAST & AFRICA: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 155 MIDDLE EAST & AFRICA: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 156 MIDDLE EAST & AFRICA: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 157 MIDDLE EAST & AFRICA: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 158 GCC COUNTRIES: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 159 GCC COUNTRIES: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 160 GCC COUNTRIES: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 161 GCC COUNTRIES: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 162 GCC COUNTRIES: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 163 REST OF MIDDLE EAST & AFRICA: ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2022–2029 (USD MILLION)

- TABLE 164 REST OF MIDDLE EAST & AFRICA: ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2022–2029 (USD MILLION)

- TABLE 165 REST OF MIDDLE EAST & AFRICA: ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2022–2029 (USD MILLION)

- TABLE 166 REST OF MIDDLE EAST & AFRICA: ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2022–2029 (USD MILLION)

- TABLE 167 REST OF MIDDLE EAST & AFRICA: ECLINICAL SOLUTIONS MARKET, BY END USER, 2022–2029 (USD MILLION)

- TABLE 168 ECLINICAL SOLUTIONS MARKET: DEGREE OF COMPETITION

- TABLE 169 ECLINICAL SOLUTIONS MARKET: PRODUCT FOOTPRINT

- TABLE 170 ECLINICAL SOLUTIONS MARKET: APPLICATION FOOTPRINT

- TABLE 171 ECLINICAL SOLUTIONS MARKET: END-USER FOOTPRINT

- TABLE 172 ECLINICAL SOLUTIONS MARKET: REGION FOOTPRINT

- TABLE 173 ECLINICAL SOLUTIONS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 174 ECLINICAL SOLUTIONS MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 175 ECLINICAL SOLUTIONS MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021–JUNE 2024

- TABLE 176 ECLINICAL SOLUTIONS MARKET: DEALS, JANUARY 2021– JUNE 2024

- TABLE 177 ECLINICAL SOLUTIONS MARKET: EXPANSIONS, JANUARY 2021– JUNE 2024

- TABLE 178 ECLINICAL SOLUTIONS MARKET: OTHER DEVELOPMENTS, JANUARY 2021– JUNE 2024

- TABLE 179 MEDIDATA (A DASSAULT SYSTÈMES COMPANY): COMPANY OVERVIEW

- TABLE 180 MEDIDATA (A DASSAULT SYSTÈMES COMPANY): PRODUCTS OFFERED

- TABLE 181 MEDIDATA (A DASSAULT SYSTÈMES COMPANY): PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021− JUNE 2024

- TABLE 182 MEDIDATA (A DASSAULT SYSTÈMES COMPANY): DEALS, JANUARY 2021− JUNE 2024

- TABLE 183 VEEVA SYSTEMS: COMPANY OVERVIEW

- TABLE 184 VEEVA SYSTEMS: PRODUCTS OFFERED

- TABLE 185 VEEVA SYSTEMS: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021− JUNE 2024

- TABLE 186 VEEVA SYSTEMS: DEALS, JANUARY 2021− JUNE 2024

- TABLE 187 IQVIA INC.: COMPANY OVERVIEW

- TABLE 188 IQVIA INC.: PRODUCTS OFFERED

- TABLE 189 IQVIA INC.: DEALS, JANUARY 2021−JUNE 2024

- TABLE 190 ICON PLC: COMPANY OVERVIEW

- TABLE 191 ICON PLC: PRODUCTS OFFERED

- TABLE 192 ICON PLC: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021− JUNE 2024

- TABLE 193 ICON PLC: DEALS, JANUARY 2021− JUNE 2024

- TABLE 194 ORACLE: COMPANY OVERVIEW

- TABLE 195 ORACLE: PRODUCTS OFFERED

- TABLE 196 ORACLE: DEALS, JANUARY 2021−JUNE 2024

- TABLE 197 SIGNANT HEALTH: COMPANY OVERVIEW

- TABLE 198 SIGNANT HEALTH: PRODUCTS OFFERED

- TABLE 199 SIGNANT HEALTH: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021− JUNE 2024

- TABLE 200 SIGNANT HEALTH: DEALS, JANUARY 2021− JUNE 2024

- TABLE 201 CLARIO: COMPANY OVERVIEW

- TABLE 202 CLARIO: PRODUCTS OFFERED

- TABLE 203 CLARIO: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021− JUNE 2024

- TABLE 204 CLARIO: DEALS, JANUARY 2021− JUNE 2024

- TABLE 205 CLARIO: OTHER DEVELOPMENTS, JANUARY 2021– JUNE 2024

- TABLE 206 ECLINICAL SOLUTIONS: COMPANY OVERVIEW

- TABLE 207 ECLINICAL SOLUTIONS: PRODUCTS OFFERED

- TABLE 208 ECLINICAL SOLUTIONS: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021− JUNE 2024

- TABLE 209 ECLINICAL SOLUTIONS: DEALS, JANUARY 2021− JUNE 2024

- TABLE 210 CLINION: COMPANY OVERVIEW

- TABLE 211 CLINION: PRODUCTS OFFERED

- TABLE 212 CLINION: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021− JUNE 2024

- TABLE 213 CLINION: DEALS, JANUARY 2021− JUNE 2024

- TABLE 214 MAXISIT: COMPANY OVERVIEW

- TABLE 215 MAXISIT: PRODUCTS OFFERED

- TABLE 216 4G CLINICAL: COMPANY OVERVIEW

- TABLE 217 4G CLINICAL: PRODUCTS OFFERED

- TABLE 218 4G CLINICAL: DEALS, JANUARY 2021− JUNE 2024

- TABLE 219 FOUNTAYN: COMPANY OVERVIEW

- TABLE 220 FOUNTAYN: PRODUCTS OFFERED

- TABLE 221 SAAMA: COMPANY OVERVIEW

- TABLE 222 SAAMA: PRODUCTS OFFERED

- TABLE 223 SAAMA: DEALS, JANUARY 2021− JUNE 2024

- TABLE 224 MEDNET: COMPANY OVERVIEW

- TABLE 225 MEDNET: PRODUCTS OFFERED

- TABLE 226 MEDNET: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021− JUNE 2024

- TABLE 227 MEDNET: DEALS, JANUARY 2021− JUNE 2024

- TABLE 228 ADVARRA: COMPANY OVERVIEW

- TABLE 229 ADVARRA: PRODUCTS OFFERED

- TABLE 230 ADVARRA: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021− JUNE 2024

- TABLE 231 ADVARRA: DEALS, JANUARY 2021− JUNE 2024

- TABLE 232 CAIDYA: COMPANY OVERVIEW

- TABLE 233 CAIDYA: PRODUCTS OFFERED

- TABLE 234 CAIDYA: DEALS, JANUARY 2021− JUNE 2024

- TABLE 235 CAIDYA: EXPANSIONS, JANUARY 2021− JUNE 2024

- TABLE 236 OPENCLINICA, LLC: COMPANY OVERVIEW

- TABLE 237 OPENCLINICA, LLC: PRODUCTS OFFERED

- TABLE 238 OPENCLINICA, LLC: DEALS, JANUARY 2021− JUNE 2024

- TABLE 239 EVIDENTIQ: COMPANY OVERVIEW

- TABLE 240 EVIDENTIQ: PRODUCTS OFFERED

- TABLE 241 EVIDENTIQ: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2021− JUNE 2024

- TABLE 242 EVIDENTIQ: DEALS, JANUARY 2021− JUNE 2024

- TABLE 243 RESEARCH MANAGER: COMPANY REVIEW

- TABLE 244 ANJU SOFTWARE INC.: COMPANY REVIEW

- TABLE 245 MEDRIO: COMPANY OVERVIEW

- TABLE 246 CASTOR: COMPANY OVERVIEW

- TABLE 247 REALTIME SOFTWARE SOLUTIONS, LLC: COMPANY OVERVIEW

- TABLE 248 YPRIME, LLC.: COMPANY OVERVIEW

- TABLE 249 VIAL: COMPANY OVERVIEW

- FIGURE 1 ECLINICAL SOLUTIONS MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 PRIMARY SOURCES

- FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 IMPACT ANALYSIS OF MARKET DYNAMICS, 2024–2029

- FIGURE 8 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 9 DATA TRIANGULATION

- FIGURE 10 ECLINICAL SOLUTIONS MARKET, BY PRODUCT, 2024 VS. 2029 (USD MILLION)

- FIGURE 11 ECLINICAL SOLUTIONS MARKET, BY DEPLOYMENT MODEL, 2024 VS. 2029 (USD MILLION)

- FIGURE 12 ECLINICAL SOLUTIONS MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 13 ECLINICAL SOLUTIONS MARKET, BY CLINICAL TRIAL PHASE, 2024 VS. 2029 (USD MILLION)

- FIGURE 14 ECLINICAL SOLUTIONS MARKET, BY END USER, 2024 VS. 2029 (USD MILLION)

- FIGURE 15 ECLINICAL SOLUTIONS MARKET, BY REGION, 2024–2029 (USD MILLION)

- FIGURE 16 INCREASING ADOPTION OF ECLINICAL SOLUTIONS AND RISING R&D EXPENDITURE FOR DRUG DEVELOPMENT TO DRIVE MARKET

- FIGURE 17 CHINA TO DOMINATE ASIA PACIFIC MARKET IN 2024

- FIGURE 18 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 19 NORTH AMERICA TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 20 EMERGING ECONOMIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 21 ECLINICAL SOLUTIONS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 22 ECLINICAL SOLUTIONS MARKET: ECOSYSTEM ANALYSIS

- FIGURE 23 ECLINICAL SOLUTIONS MARKET: VALUE CHAIN ANALYSIS

- FIGURE 24 PORTER’S FIVE FORCES ANALYSIS

- FIGURE 25 PATENT PUBLICATION TRENDS IN ECLINICAL SOLUTIONS MARKET, 2015–2024

- FIGURE 26 PATENT ANALYSIS, JANUARY 2015–JUNE 2024

- FIGURE 27 INDICATIVE PRICING ANALYSIS FOR FIRST YEAR, BY DEPLOYMENT MODEL

- FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY TOP 3 END USERS

- FIGURE 29 KEY BUYING CRITERIA FOR TOP 3 END USERS

- FIGURE 30 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 31 INVESTMENT AND FUNDING SCENARIO

- FIGURE 32 MARKET POTENTIAL OF AI/GENERATIVE AI ON ECLINICAL SOLUTIONS

- FIGURE 33 IMPACT OF AI/GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEMS

- FIGURE 34 NORTH AMERICA: ECLINICAL SOLUTIONS MARKET SNAPSHOT

- FIGURE 35 DISTRIBUTION OF R&D COMPANIES, BY COUNTRY, 2021 VS. 2022

- FIGURE 36 ASIA PACIFIC: ECLINICAL SOLUTIONS MARKET SNAPSHOT

- FIGURE 37 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN ECLINICAL SOLUTIONS MARKET

- FIGURE 38 REVENUE ANALYSIS OF KEY PLAYERS IN ECLINICAL SOLUTIONS MARKET, 2019–2023 (USD BILLION)

- FIGURE 39 ECLINICAL SOLUTIONS MARKET SHARE ANALYSIS, 2023

- FIGURE 40 RANKING OF KEY PLAYERS IN ECLINICAL SOLUTIONS MARKET, 2023

- FIGURE 41 ECLINICAL SOLUTIONS MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 42 ECLINICAL SOLUTIONS MARKET: COMPANY FOOTPRINT

- FIGURE 43 ECLINICAL SOLUTIONS MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 44 EV/EBITDA OF KEY VENDORS

- FIGURE 45 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF COMPUTER VISION SOLUTION VENDORS

- FIGURE 46 ECLINICAL SOLUTIONS MARKET: BRAND/PRODUCT COMPARISON

- FIGURE 47 MEDIDATA (A DASSAULT SYSTÈMES COMPANY): COMPANY SNAPSHOT (2023)

- FIGURE 48 VEEVA SYSTEMS: COMPANY SNAPSHOT (2023)

- FIGURE 49 IQVIA INC.: COMPANY SNAPSHOT (2023)

- FIGURE 50 ICON PLC: COMPANY SNAPSHOT (2023)

- FIGURE 51 ORACLE: COMPANY SNAPSHOT (2023)

This research study involved the extensive use of both primary and secondary sources. It involved the analysis of various factors affecting the industry to identify the segmentation types, industry trends, key players, the competitive landscape of market players, and key market dynamics such as drivers, opportunities, challenges, restraints, and key player strategies.

Secondary Research

This research study extensively utilized secondary sources, including directories, databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva, as well as white papers, annual reports, and companies' house documents. The aim of the secondary research was to gather and analyze information for a comprehensive and commercially focused study of the eClinical solutions market, encompassing technical aspects and market dynamics. It also facilitated the identification of key players, market classification, industry trends, geographical markets, and significant market-related developments. Additionally, a database of prominent industry leaders was compiled through secondary research.

Primary Research

In the primary research process, various supply-side and demand-side sources were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side included industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, engineers, and related key executives from various companies and organizations operating in the eClinical solutions market. Primary sources from the demand side included personnel from pharmaceutical & biotechnology companies, government organizations, research institutes and hospitals (small, medium-sized, and large hospitals).

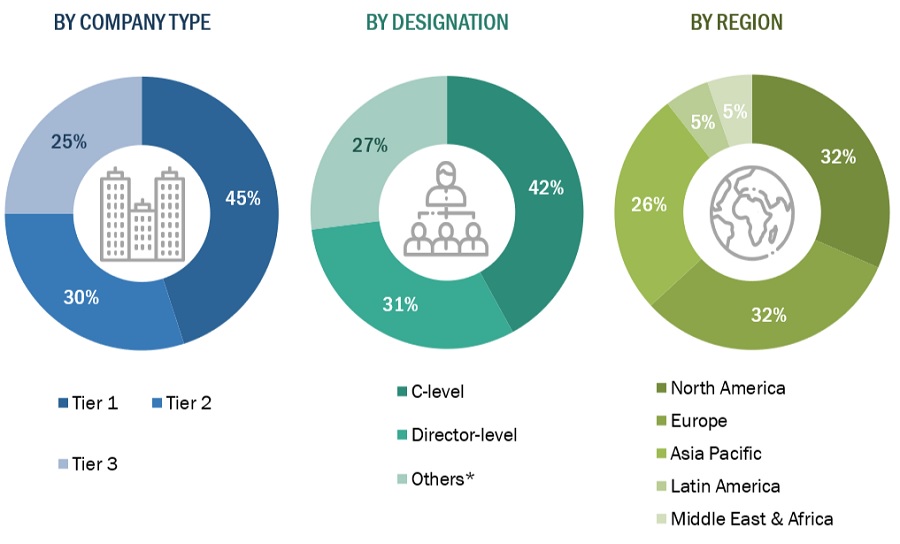

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2022: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

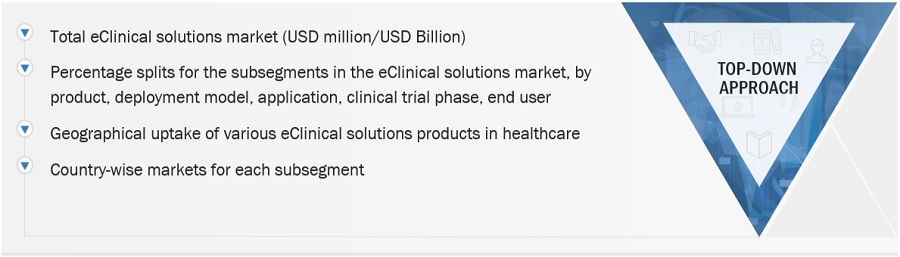

The total size of the eClinical solutions market was determined after data triangulation through the two approaches mentioned below. After the completion of each approach, the weighted average of these approaches was taken based on the level of assumptions used in each approach.

Global eClinical Solutions Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

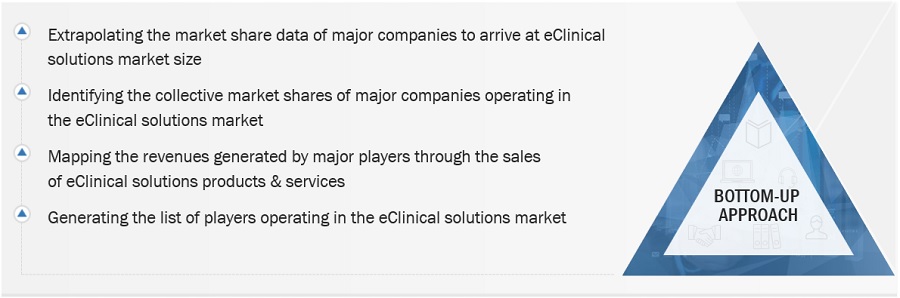

Global eClinical Solutions Market Size: Bottom-Up Approach

Data Triangulation

The size of the eClinical solutions market was estimated through segmental extrapolation using the bottom-up approach. The methodology used is as given below: -

- Revenues for individual companies were gathered from public sources and databases.

- Shares of leading players in the eClinical solutions market were gathered from secondary sources to the extent available. In certain cases, shares of eClinical solutions businesses have been ascertained after a detailed analysis of various parameters including product portfolios, market positioning, selling price, and geographic reach & strength.

- Individual shares or revenue estimates were validated through interviews with experts.

- The total revenue in the eClinical solutions market was determined by extrapolating the market share data of major companies.

Market Definition

eclinical solutions are the software/platform that changes the paper-based clinical research model into an electronic form. Such technologies help the researcher in facilitating the process of data collection, its transmission, and surveillance of the clinical trial process and provide enhanced options for better planning and execution of a clinical trial. eClinical technologies fast-track the study by reducing the risk and maximizing resources.

Key Stakeholders

- Healthcare IT Service Providers

- eClinical Solution Vendors

- Clinical Research Organizations

- Pharmaceutical/Biopharmaceutical Companies

- Research and Development (R&D) Companies

- Business Research and Consulting Service Providers

- Medical Research Laboratories

- Government agencies

- Healthcare startups, consultants, and regulators

- Academic Medical Centers/Universities/Hospitals

Objectives of the Study

- To define, describe, and forecast the eClinical solutions market based on product, deployment model, application, clinical trial phase, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall eClinical solutions market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, the Asia Pacific, Latin America, the Middle East & Africa.

- To profile the key players and analyze their market shares and core competencies2

- To track and analyze competitive developments such as product launches & approvals, partnerships, agreements, and collaborations in the overall eClinical solutions market

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific eClinical solutions market into Australia, Taiwan, New Zealand, Thailand, Singapore, Malaysia, and other countries

- Further breakdown of the Rest of Europe eClinical solutions market into Russia, Austria, Finland, Sweden, Turkey, Norway, Poland, Portugal, Romania, Denmark, and other countries

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in eClinical Solutions Market

Looking to gain more insights on the global eClinical Solutions Market

What are the growth opportunities in eClinical Solutions Market?

Can you enlighten us on geographical growth analysis in eClinical Solutions Market?