Ear Health Market by Product (Ear Health Devices (Diagnostic Devices, Surgical Devices, Hearing Aids, Hearing Implants, CO2 Lasers), Ear Health Supplements, Ear Infection Drug Treatment), and Region - Global Forecast to 2026

[78 Pages Report] The global ear health market is projected to reach USD 1.9 billion by 2026 from USD 1.4 billion in 2021, at a CAGR of 6.3% during the forecast period. Growth in this market is largely driven by the growing geriatric population, high prevalence of ear diseases, rising incidence of noise-induced hearing loss, and shift in consumer preference towards plant-based supplements. Moreover, untapped emerging markets in developing countries are creating lucrative opportunities for the market players.

To know about the assumptions considered for the study, Request for Free Sample Report

Ear health Market Dynamics

Drivers: High prevalence of ear diseases

According to WHO estimates, globally, more than 466 million people have disabling hearing loss, and ear infections are the leading cause of it. Of this, around 432 million (93% of this population) are adults (242 million males and 190 million females) and 34 million (7% of this population) are children. Approximately one-third of the population aged over 65 years is impacted by disabling hearing loss. These trends are projected to drive the demand for otoscopes, as these instruments are widely used for diagnosing ear-related disorders. The U.S. Centers for Disease Control and Prevention (CDC) estimates that nearly 15% (over 50 million people) of Americans experience some form of tinnitus. The rising prevalence of ear diseases is expected to drive the adoption of ear health devices/drugs/supplements in the market.

Restraints: Adverse effects of ear health supplements

The supplements that claim to be effective on tinnitus and hearing impairment often do not work positively for every patient. These supplements are not proven to work and are filled with ingredients that often have little to no tinnitus-related research behind them. The ingredients themselves are not proprietary in any way. However, dietary supplement companies can claim that the specific ratio of included ingredients—their formula—is proprietary. The use of these supplements also causes side-effects in many patients. For instance, Gingko biloba, a traditional medicine used as an ingredient in a majority of ear health supplements, causes side effects such as nausea, vomiting, and headaches. It can also cause severe bleeding in people who take blood thinners or have blood-clotting disorders.

Opportunities: Emerging markets offer lucrative opportunities

Emerging economies such as India, South Korea, Malaysia, Vietnam, Saudi Arabia, and the UAE offer significant growth opportunities to major market players. This can be attributed to their low regulatory barriers, improvements in healthcare infrastructure, growing patient population, and rising healthcare expenditure. In addition, the regulatory policies in the Asia Pacific region are more adaptive and business-friendly than those in developed countries. This, along with the increasing competition in mature markets, has drawn key players in the ear health market to focus on emerging countries.

Challenges: Shortage of trained professionals

Currently, several countries are facing a shortage of skilled professionals who are capable of effectively performing ear surgery procedures, such as cochlear implantation. In 2012, there were 8,600 otolaryngologists in the US, and it is estimated that there will be a shortage of 2,500 otolaryngologists in the country by 2025 (Source: PubMed.gov). In 2020, in Canada, there were approximately 715 otorhinolaryngology surgeons, reflecting two surgeons per 100,000 people (Source: Journal of Medicine in the Tropics). Similarly, according to a survey of ENT services in Sub-Saharan Africa (2017 Survey), the total population of the 22 countries represented in the study (in sub-Saharan Africa) was 720,500,000 (75% of the population of Sub-Saharan Africa). The dearth of skilled ENT surgeons in these countries is expected to limit the number of surgical procedures performed, including cochlear implantation, despite the presence of a large target patient population base. This is a major challenge for the growth of the ear health market.

Ear health devices was the largest segment in the product of ear health market in 2020

Ear health devices accounted for the largest share of ear health market in 2020.

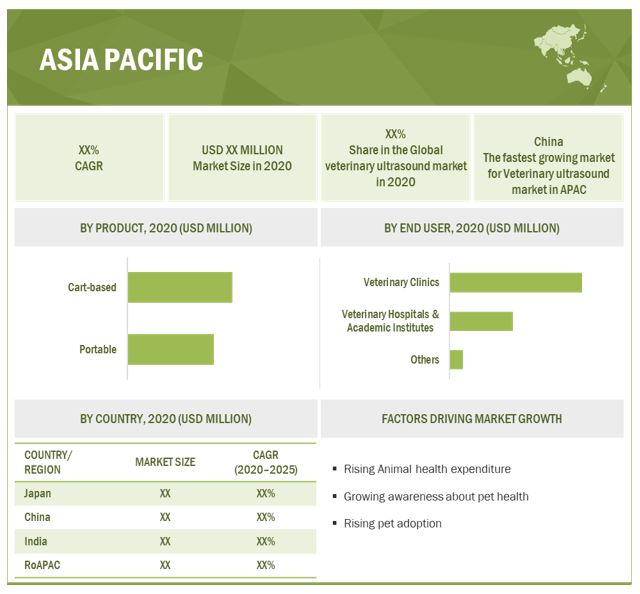

APAC to witness the highest growth rate during the forecast period.M

The Asia Pacific market is projected to grow at the highest CAGR during the forecast period. Market growth in the APAC region is mainly driven by the growing geriatric population, and high prevalence of ear diseases. Emerging markets offer significant and attractive growth opportunities for ear health market. The growth of ENT clinics & hospitals in these countries has increased the demand for ear health products.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The products and services market is dominated by a few globally established players such as include Sonova Holdings AG (Switzerland), Olympus Corp. (Japan), William Demant Holdings A/S (Denmark), Cochlear Limited (Australia), and Stryker Corporation (US).

Want to explore hidden markets that can drive new revenue in Ear Health Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Ear Health Market?

|

Report Metric |

Details |

|

Market size available for years |

2019–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Product, device type, and region. |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Companies covered |

Sonova Holdings AG (Switzerland), Olympus Corp. (Japan), William Demant Holdings A/S (Denmark), Cochlear Limited (Australia), Stryker Corporation (US), Johnson & Johnson (US), Novartis (Switzerland), Karl Storz GMBH & Co. KG (Germany), Medtronic Plc (Ireland), Oscar Remedies Pvt Ltd. (India), and InnerScope Hearing Technologies (US). |

The study categorizes the ear health market based on product, device type at global level.

Global Ear Health Market, by Product

- Ear health Market, By Product

- Ear Health devices

- Diagnostic Devices

- Surgical Devices

- Hearing Aids

- Hearing Implants

- CO2 Lasers

- Image-guided Surgery Systems

- Tinnitus and ear impairment care supplements

- Ear infection treatment medication

- Ear Health devices

Global Ear health Market, by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In 2021, Sonova Holding AG (Switzerland) acquired Sennheiser (Germany) for expanding its offerings and entering new growth markets.

- In 2021, Medtronic PLC (Ireland) acquired Intersect ENT (US) to expand Medtronic's portfolio of products used during ear, nose, and throat procedures.

- In 2021, InnerScope Hearing Technologies (US) acquired Atlazo Inc. (US) for developing next-generation hearing aids and hearable products by utilizing Atlazo’s patented Artificial Intelligence (AI) hardware platform.

- In 2020, Karl Storz GMBH & Co. KG (Germany) installed six OFFICE1 examination rooms specialized for ENT treatment at the IPS Central Hospital in Asunción, Paraguay.

Frequently asked questions

Which are the top industry players in the global ear health market?

The top market players in the global ear health market include Sonova Holdings AG (Switzerland), Olympus Corp. (Japan), William Demant Holdings A/S (Denmark), Cochlear Limited (Australia), and Stryker Corporation (US).

Which type of ear health products have been included in the ear health market report?

The key stakeholders to agricultural biologicals market would be

- Ear Health devices

- Tinnitus & ear impairment care supplements

- Ear infection treatment medication

Which geographical region is dominating in the global ear health market?

The global ear health market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. North America is the largest regional market for ear health products.

Which ear health product is the leading the ear health market?

The ear health devices segment accounted for the largest share of the ear health market in 2020..

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 12)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.2.2 MARKETS COVERED

FIGURE 1 EAR HEALTH MARKET

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

2 MARKET OVERVIEW (Page No. - 15)

2.1 INTRODUCTION

2.2 MARKET DYNAMICS

FIGURE 2 EAR HEALTH MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

2.2.1 DRIVERS

2.2.1.1 High prevalence of ear diseases

TABLE 1 GLOBAL NUMBER OF PEOPLE SUFFERING FROM HEARING LOSS IN 2020, BY AGE GROUP (10-YEAR RANGE)

2.2.1.2 Growth in the geriatric population

FIGURE 3 SHARE OF THE GLOBAL POPULATION AGED 65 AND ABOVE (2015–2019)

2.2.1.3 Rising incidence of noise-induced hearing loss

2.2.1.4 Shift in consumer preference toward plant-based supplements

2.2.2 RESTRAINTS

2.2.2.1 High cost of ear health devices and supplements

2.2.2.2 Adverse effects of ear health supplements

2.2.3 OPPORTUNITIES

2.2.3.1 Emerging markets offer lucrative opportunities

2.2.4 CHALLENGES

2.2.4.1 Shortage of trained professionals

2.2.4.2 Consumer skepticism associated with ear nutraceuticals

3 EAR HEALTH MARKET, BY PRODUCT (Page No. - 20)

3.1 INTRODUCTION

TABLE 2 GLOBAL EAR HEALTH MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

3.2 EAR HEALTH DEVICES

TABLE 3 GLOBAL EAR HEALTH DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 4 GLOBAL EAR HEALTH DEVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

3.2.1 DIAGNOSTIC DEVICES

TABLE 5 COMMON CAUSES OF HEARING LOSS AND DEAFNESS

TABLE 6 GLOBAL DIAGNOSTIC DEVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

3.2.2 SURGICAL DEVICES

TABLE 7 US: NUMBER OF OTOPLASTY PROCEDURES (2017-2020)

TABLE 8 GLOBAL SURGICAL DEVICES MARKET, BY REGION, 2019–2026 (USD MILLION)

3.2.3 HEARING AIDS

TABLE 9 GLOBAL HEARING AIDS MARKET, BY REGION, 2019–2026 (USD MILLION)

3.2.4 HEARING IMPLANTS

TABLE 10 GLOBAL HEARING IMPLANTS MARKET, BY REGION, 2019–2026 (USD MILLION)

3.2.5 CO2 LASERS

TABLE 11 GLOBAL CO2 LASERS MARKET, BY REGION, 2019–2026 (USD MILLION)

3.2.6 IMAGE-GUIDED SURGERY SYSTEMS

TABLE 12 GLOBAL IMAGE-GUIDED SURGERY SYSTEMS MARKET, BY REGION, 2019–2026 (USD MILLION)

3.3 TINNITUS AND EAR IMPAIRMENT CARE SUPPLEMENTS

TABLE 13 GLOBAL TINNITUS AND EAR IMPAIRMENT CARE SUPPLEMENTS MARKET, BY REGION, 2019–2026 (USD MILLION)

3.4 EAR INFECTION TREATMENT MEDICATION

TABLE 14 GLOBAL EAR INFECTION TREATMENT MEDICATION MARKET, BY REGION, 2019–2026 (USD MILLION)

4 EAR HEALTH MARKET, BY REGION (Page No. - 30)

4.1 INTRODUCTION

TABLE 15 GLOBAL EAR HEALTH MARKET, BY REGION, 2019–2026 (USD MILLION)

4.2 NORTH AMERICA

TABLE 16 NORTH AMERICA: EAR HEALTH MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 17 NORTH AMERICA: EAR HEALTH DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

4.3 EUROPE

TABLE 18 EUROPE: EAR HEALTH MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 19 EUROPE: EAR HEALTH DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

4.4 ASIA PACIFIC

TABLE 20 ASIA PACIFIC: EAR HEALTH MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 21 ASIA PACIFIC: EAR HEALTH DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

4.5 LATIN AMERICA

TABLE 22 NUMBER OF PEOPLE WITH DISABLING HEARING LOSS IN BRAZIL AND MEXICO, 2008 VS. 2018 (MILLION)

TABLE 23 LATIN AMERICA: EAR HEALTH MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 24 LATIN AMERICA: EAR HEALTH DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

4.6 MIDDLE EAST & AFRICA

TABLE 25 MIDDLE EAST & AFRICA: EAR HEALTH MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

TABLE 26 MIDDLE EAST & AFRICA: EAR HEALTH DEVICES MARKET, BY TYPE, 2019–2026 (USD MILLION)

5 COMPETITIVE LANDSCAPE (Page No. - 38)

5.1 OVERVIEW

FIGURE 4 KEY DEVELOPMENTS IN THE EAR HEALTH MARKET, JANUARY 2018–NOVEMBER 2021

5.2 RANKING OF KEY PLAYERS IN THE EAR HEALTH MARKET

FIGURE 5 EAR HEALTH MARKET: MARKET RANK OF KEY PLAYERS

6 COMPANY PROFILES (Page No. - 40)

6.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

6.1.1 SONOVA HOLDING AG

FIGURE 6 SONOVA HOLDING AG: COMPANY SNAPSHOT

TABLE 27 SONOVA HOLDING AG: BUSINESS OVERVIEW

6.1.2 OLYMPUS CORPORATION

FIGURE 7 OLYMPUS CORPORATION: COMPANY SNAPSHOT

TABLE 28 OLYMPUS CORPORATION: BUSINESS OVERVIEW

6.1.3 WILLIAM DEMANT HOLDING A/S

FIGURE 8 WILLIAM DEMANT HOLDING A/S: COMPANY SNAPSHOT

TABLE 29 WILLIAM DEMANT HOLDING A/S: BUSINESS OVERVIEW

6.1.4 STRYKER CORPORATION

FIGURE 9 STRYKER CORPORATION: COMPANY SNAPSHOT

TABLE 30 STRYKER CORPORATION: BUSINESS OVERVIEW

6.1.5 COCHLEAR LIMITED

FIGURE 10 COCHLEAR LIMITED: COMPANY SNAPSHOT

TABLE 31 COCHLEAR LIMITED: BUSINESS OVERVIEW

6.1.6 JOHNSON & JOHNSON

FIGURE 11 JOHNSON & JOHNSON: COMPANY SNAPSHOT

TABLE 32 JOHNSON & JOHNSON: BUSINESS OVERVIEW

6.1.7 NOVARTIS

FIGURE 12 NOVARTIS: COMPANY SNAPSHOT

TABLE 33 NOVARTIS: BUSINESS OVERVIEW

6.1.8 KARL STORZ GMBH & CO. KG

TABLE 34 KARL STORZ GMBH & CO. KG: BUSINESS OVERVIEW

6.1.9 MEDTRONIC PLC

FIGURE 13 MEDTRONIC PLC: COMPANY SNAPSHOT

TABLE 35 MEDTRONIC PLC: BUSINESS OVERVIEW

6.1.10 OSCAR REMEDIES PVT. LTD.

TABLE 36 OSCAR REMEDIES: BUSINESS OVERVIEW

6.1.11 INNERSCOPE HEARING TECHNOLOGIES, INC.

TABLE 37 INNERSCOPE HEARING TECHNOLOGIES, INC.: BUSINESS OVERVIEW

6.1.12 ARCHES NATURAL PRODUCTS, INC.

TABLE 38 ARCHES NATURAL PRODUCTS, INC.: BUSINESS OVERVIEW

6.1.13 PHYTAGE LABS

TABLE 39 PHYTAGE LABS: BUSINESS OVERVIEW

6.1.14 THE RELIEF PRODUCTS, INC.

TABLE 40 THE RELIEF PRODUCTS, INC.: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of comprehensive secondary sources; directories and databases such as D&B, Bloomberg Business, and Factiva; and white papers, annual reports, and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the global ear health market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the ear health market. The primary sources from the demand side include otolaryngologists, research professionals, academic leaders.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (segmental analysis of major segments) and top-down approach (assessment of utilization/adoption/penetration trends, by product, device type, and region).

Data Triangulation

After arriving at the market size, the total Ear health market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Report Objectives

- To define, describe, and forecast the ear health market by product and region

- To provide detailed information about the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To forecast the size of the ear health market in North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players and comprehensively analyze their core competencies in the ear health market

- To track and analyze competitive developments such as partnerships, agreements, collaborations, mergers & acquisitions, and product launches in the ear health market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Asia Pacific Ear health Market into Australia, New Zealand and others

- Further breakdown of the Rest of Europe Ear health Market into The Netherlands, Belgium, Switzerland and others

- Further breakdown of the Latin America Ear health Market into Argentina, Colombia, Chile, and others

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Ear Health Market