Door and Window Automation Market by Component (Operators, Sensors & Detectors (Infrared, Proximity, and Microwave), Access Control), Product (Industrial (Sectional, High-Speed, Roller Shutter), Pedestrian Doors (Sliding, Swing)) - Global Forecast to 2027

Updated on : Oct 25, 2024

The rising adoption of automatic doors and windows by elderly and disabled people as well as by hospital sector is driving the growth of the door and window automation industry. Moreover, integration of advanced technologies in automated solutions and growing focus of end-users on reducing heating and cooling costs is also expected to drive the growth of the market in the near future.

Door and Window Automation Market Size

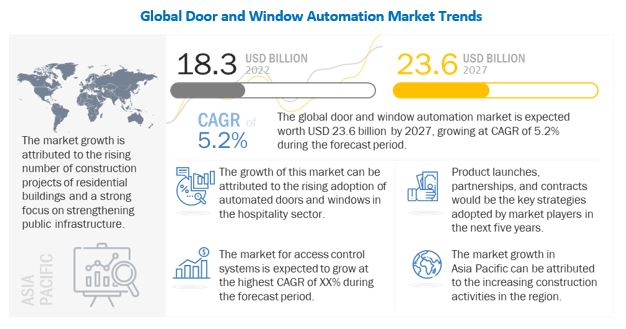

The global door and window automation market size is expected to grow from USD 18.3 billion in 2022 to USD 23.6 billion by 2027, growing at a CAGR of 5.2% during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

Door and Window Automation Market Dynamics

DRIVERS: Increasing use of automated doors and windows by elderly and disabled people

Many elderly and disabled people are unable to manually operate windows and doors due to the physical effort required. Automated doors and windows provide easy access to elderly people and persons with disabilities. The major role of automated doors is to control the flow of pedestrian traffic and provide accessibility to disabled and elderly people. Automatic doors are built-in with appropriate signage and designed after considering several parameters, including wheelchair access, door widths, clear vision panels, door entry equipment position, and height, to make them user-friendly and safe.

RESTRAINT: High installation and maintenance costs

Automated door and window systems require defined processes, systems, and a wide variety of sensors. Most of the automated doors are equipped with photoelectric sensors at the base of the track to provide safety for pedestrians. The cost of different components, including motors and actuators, access control systems, and control panels, associated with the automated door and window system is very high. Also, it requires highly skilled professionals to install such automated solutions. Thus, the integration and installation costs of the automatic door and window systems are high. The cost also increases depending on the complexity of components to be integrated to meet the requirements of a specific application.

OPPORTUNITIES: Rising demand for energy-efficient automated systems

Nowadays, companies are committed to providing world-class automated doors and windows for customers worldwide. Market players are focusing on providing high-performance and environment-friendly products. Manufacturing energy-efficient products has become one of the major priorities for many countries to reduce energy consumption. Governments of many countries, such as the US, Canada, and Mexico, have always promoted green environments. The US Green Building Council (USGBC) is a government body created to build green government buildings in the US to reduce greenhouse gas emissions, increase energy efficiency, conserve water, reduce waste, and increase the use of products and technologies that are environmentally friendly.

CHALLENGES: Risk of malfunctioning and requirement for significant amount of time to repair automated doors and windows

The smooth functioning of automated door and window systems is highly dependent on interconnectivity standards followed by the products, quality, and lifespan of various critical components, and networking technologies. The entire operation of the automated door and window system depends on the interoperability among all devices. These automatic doors might break down due to wear and tear or electronic malfunction. In other situations, the bottom track of the automatic door can be misaligned, or the spring could break. Also, multiple sensors deployed in automatic doors are subject to malfunction due to their high use. For every system component's efficient and reliable functioning, all segments need to operate smoothly and collectively. The malfunctioning or disconnection of any product creates several complications for the user in terms of high cost and technical complexities.

Operators were the most extensively used in automated doors and windows in 2021

Increased use of operators in commercial, retail, and industrial buildings to manage heavy pedestrian traffic effectively and efficiently is the major reason for the largest share of this segment. These operators are primarily used in swing and sliding doors. They can control the opening and closing of the door on their own; therefore, they are highly used in pedestrian doors. Operators also perform powerful and silent operations. The rising demand for safety and security due to high pedestrian traffic at hospitals and educational institutions, as well as the growing demand for effortless and easy access to buildings and facilities, is another reason for the significant growth of the market for operators.

Windows to hold significant growth rate during the forecast period

Automated windows with touch buttons are highly convenient and effective for use. Window automation is used for the purpose of convenience, natural ventilation, and smoke ventilation. Automated windows comprise different IO devices and smoke detectors, manual call points (break glass, rocker switches, or key switches), and fire alarm systems to make it a complete solution for residential and commercial buildings and are connected via a central hub. They provide ease of use and convenience, as well as maintain the desired temperature, which, in turn, helps reduce utility bills in commercial buildings, airports, auditoriums, and others. This in turn is expected to rise the adoption of automated windows during the forecast period.

Commercial building segment dominated the door and window automation market in 2021

The growth of the segment is attributed to the rising adoption of automatic doors and windows in offices, shopping malls, banks & financial institutions, and other commercial buildings. The installation of automatic doors and windows in commercial buildings provides the user an ease of access without compromising security. In commercial buildings, for example, retail shops and shopping malls, visitors always expect modern, clean, and functional buildings. Therefore, usually, building entrances set the scene by installing automated pedestrian doors, which are easy to use and simple to access for everyone, including children, disabled and elderly persons that require a high level of security.

Asia Pacific is expected to be the leading region in the door and window automation market during the forecast period

Asia Pacific accounted for a share of more than 25% of the door and window automation market and is expected to witness the highest CAGR during the forecast period. The increased construction activities in various countries of Asia Pacific fuel the growth of the door and window automation market in the region. Further, the region is focused on constructing new residential buildings and strengthening public infrastructure. Additionally, strong economic growth, rising population, and rapid urbanization and industrialization are likely to create the need for a sophisticated infrastructure.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The door and window automation companies are as ASSA ABLOY (Sweden), Nabtesco Corporation (Japan), Allegion Plc (Ireland), and dormakaba Group (Switzerland).

Want to explore hidden markets that can drive new revenue in Door and Window Automation Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Door and Window Automation Market?

|

Report Metric |

Details |

| Estimated Market Size | USD 18.3 billion in 2022 |

|

Projected Market Size

|

USD 23.6 billion by 2027 |

| Growth Rate | CAGR of 5.2%. |

|

Market Size Available for Years |

2018–2027 |

|

Base Year |

2021 |

|

Forecast Period |

2022–2027 |

|

Units |

Value (USD Million/Billion) |

|

Segments Covered |

Control Systems, Component, Product, and End-user |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, and Rest of the World |

|

Companies Covered |

Major Players: ASSA ABLOY (Sweden), Boon Edam (Netherlands), Nabetsco Corporation (Japan), GEZE GmbH (Germany), dormakaba Group (Switzerland), Honeywell International Inc. (U.S.), Allegion Plc. (Ireland), among others - total 25 players have been covered |

This research report segments the door and window automation market based on control systems, component, product, end-user, and region.

By Control Systems:

- Fully Automatic

- Push and Go

- Power Assist

- Low Energy

By Component:

- Operators

- Sensors & Detectors

- Access Control Systems

- Motors & Actuators

- Control Panels

- Switches

- Others

By Product:

- Industrial Doors

- Pedestrian Doors

- Windows

By End-Users:

- Residential Building

- Airports

- Education Buildings

- Healthcare Facilities

- Hotels & Restaurants

- Industrial Production Units

- Public Transit Systems

- Commercial Buildings

- Entertainment Centers

- Others

By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Rest of the World (RoW)

Recent Developments

- In March 2022, ASSA ABLOY acquired JOTEC Service & Vertriebsges. mbh, a leading provider of industrial doors and related services in Germany. This acquisition is expected to reinforce ASSA to expand its portfolio of entrance automation systems.

- In March 2022, GEZE GmbH released the GC 342+ safety sensor for automatic swing doors based on laser technology to ensure the building's safety, hygiene, and comfort.

- In November 2021, dormakaba Group completed the acquisition of France-based Fermatic Group, a renowned provider of services for automatic doors and gates. The acquisition of Fermatic and its highly complementary portfolio will further strengthen the services business in France. This acquisition also offers cross-selling opportunities for entrance systems, electronic access, and data businesses.

Frequently Asked Questions (FAQs):

What is the total CAGR expected to be recorded for the door and window automation market during 2022-2027?

The global door and window automation market is expected to record a CAGR of 5.2% from 2022–2027.

What are the driving factors for the door and window automation market?

Increasing use of automated doors and windows by elderly and disabled people, rising adoption of automated doors and windows in hospitality sector, and thriving construction industry and growing number of infrastructure development projects worldwide.

Which are the significant players operating in the door and window automation market?

ASSA ABLOY (Sweden), Nabtesco Corporation (Japan), Allegion Plc (Ireland), and dormakaba Group (Switzerland) are some of the major companies operating in the door and window automation market.

Which region will lead the door and window automation market in the future?

Asia Pacific is expected to lead the door and window automation market during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 30)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 DOOR AND WINDOW AUTOMATION MARKET SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 DOOR AND WINDOW AUTOMATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 List of major secondary sources

2.1.2.2 Key data from secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Primary interviews with experts

2.1.3.2 Key data from primary sources

2.1.3.3 Key industry insights

2.1.3.4 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH (SUPPLY-SIDE): REVENUE GENERATED THROUGH SALES OF AUTOMATIC DOOR AND WINDOW PRODUCTS/SOLUTIONS/SERVICES

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market share by bottom-up analysis (demand side)

FIGURE 4 DOOR AND WINDOW AUTOMATION MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market share by top-down analysis (supply side)

FIGURE 5 DOOR AND WINDOW AUTOMATION MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 RISKS AND ASSOCIATED RESULTS

3 EXECUTIVE SUMMARY (Page No. - 44)

FIGURE 7 ACCESS CONTROL SYSTEMS SEGMENT TO DOMINATE DOOR AND WINDOW AUTOMATION MARKET IN 2022

FIGURE 8 MICROWAVE SENSORS TO DOMINATE SENSORS & DETECTORS SEGMENT IN 2022

FIGURE 9 WINDOWS SEGMENT TO EXHIBIT HIGHEST CAGR IN DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, DURING FORECAST PERIOD

FIGURE 10 HOTELS & RESTAURANTS SEGMENT TO REGISTER HIGHEST CAGR IN DOOR AND WINDOW AUTOMATION MARKET, BY END-USER, DURING FORECAST PERIOD

FIGURE 11 DOOR AND WINDOW AUTOMATION MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 49)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR DOOR AND WINDOW AUTOMATION MARKET PLAYERS

FIGURE 12 GROWING CONSTRUCTION ACTIVITIES IN VARIOUS COUNTRIES OF ASIA PACIFIC TO DRIVE MARKET GROWTH

4.2 DOOR AND WINDOW AUTOMATION MARKET, BY COMPONENT

FIGURE 13 ACCESS CONTROL SYSTEMS TO DOMINATE DOOR AND WINDOW AUTOMATION MARKET IN 2022

4.3 DOOR AND WINDOW AUTOMATION MARKET, BY SENSOR AND DETECTOR TYPE

FIGURE 14 INFRARED SENSORS TO REGISTER HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

4.4 DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT

FIGURE 15 PEDESTRIAN DOORS TO LEAD DOOR AND WINDOW AUTOMATION MARKET IN 2022

4.5 DOOR AND WINDOW AUTOMATION MARKET, BY END-USER

FIGURE 16 COMMERCIAL BUILDINGS TO CAPTURE MAJORITY OF MARKET SHARE IN 2022

4.6 DOOR AND WINDOW AUTOMATION MARKET, BY REGION

FIGURE 17 NORTH AMERICA TO HOLD LARGEST SHARE OF DOOR AND WINDOW AUTOMATION MARKET IN 2027

5 MARKET OVERVIEW (Page No. - 52)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 GLOBAL DOOR AND WINDOW AUTOMATION MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing use of automated doors and windows by elderly and disabled people

5.2.1.2 Rising adoption of automated doors and windows in hospitality sector

5.2.1.3 Thriving construction industry and growing number of infrastructure development projects worldwide

FIGURE 19 IMPACT OF DRIVERS ON DOOR AND WINDOW AUTOMATION MARKET

5.2.2 RESTRAINTS

5.2.2.1 High installation and maintenance costs

5.2.2.2 Need to follow stringent codes and safety standards

FIGURE 20 IMPACT OF RESTRAINTS ON DOOR AND WINDOW AUTOMATION MARKET

5.2.3 OPPORTUNITIES

5.2.3.1 Rising demand for energy-efficient automated systems

5.2.3.2 Integration of advanced technologies in automated solutions

5.2.3.3 Increasing inclination of owners toward home automation

5.2.3.4 Growing focus of end users on reducing heating and cooling costs

FIGURE 21 IMPACT OF OPPORTUNITIES ON DOOR AND WINDOW AUTOMATION MARKET

5.2.4 CHALLENGES

5.2.4.1 Risk of malfunctioning and requirement for significant amount of time to repair automated doors and windows

FIGURE 22 IMPACT OF CHALLENGES ON DOOR AND WINDOW AUTOMATION MARKET

5.3 SUPPLY/VALUE CHAIN ANALYSIS

FIGURE 23 DOOR AND WINDOW AUTOMATION MARKET: SUPPLY/VALUE CHAIN ANALYSIS

5.4 ECOSYSTEM

FIGURE 24 GLOBAL DOOR AND WINDOW AUTOMATION MARKET: ECOSYSTEM

TABLE 2 COMPANIES AND THEIR ROLES IN DOOR AND WINDOW AUTOMATION ECOSYSTEM

5.5 PRICING ANALYSIS

5.5.1 AVERAGE SELLING PRICE OF AUTOMATED DOORS OFFERED BY KEY PLAYERS, BY PRODUCT TYPE

FIGURE 25 AVERAGE SELLING PRICE OF AUTOMATED DOORS OFFERED BY KEY PLAYERS, BY PRODUCT TYPE

TABLE 3 AVERAGE SELLING PRICE OF DIFFERENT DOOR TYPES OFFERED BY KEY PLAYERS (USD)

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 26 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

5.7 TECHNOLOGY ANALYSIS

5.7.1 INTERNET OF THINGS (IOT)

5.7.2 CLOUD COMPUTING

FIGURE 27 UTILIZATION OF IOT PLATFORMS BY DOOR AND WINDOW AUTOMATION USERS

5.7.3 SMART LOCKS

5.8 PORTER’S FIVE FORCES ANALYSIS

TABLE 4 DOOR AND WINDOW AUTOMATION MARKET: PORTER’S FIVE FORCES ANALYSIS

5.8.1 BARGAINING POWER OF SUPPLIERS

5.8.2 BARGAINING POWER OF BUYERS

5.8.3 THREAT OF SUBSTITUTES

5.8.4 THREAT OF NEW ENTRANTS

5.8.5 INTENSITY OF COMPETITIVE RIVALRY

5.9 KEY STAKEHOLDERS AND BUYING CRITERIA

5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 28 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USERS

TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USERS (%)

FIGURE 29 KEY BUYING CRITERIA FOR TOP THREE END-USERS

TABLE 6 KEY BUYING CRITERIA OF TOP THREE END-USERS

5.10 CASE STUDY

5.10.1 ROYAL BOOM EDAM INTERNATIONAL B.V. PROVIDES GLASS REVOLVING DOORS, SLIMLINE OPTICAL TURNSTILES, AND SWING ACCESS GATE TO IMB BANK AUSTRALIA

5.10.2 ERREKA PROVIDES AUTOMATIC SWING DOOR TO PROPRIETORS OF VILLAGE HALL IN EXETER

5.10.3 GEZE GMBH OFFERS AUTOMATIC DOORS TO EXPERIMENTA - DAS SCIENCE CENTER (HEILBRONN)

5.10.4 ERREKA PROVIDES AUTOMATIC SWING DOOR OPENER TO MALVERN PANALYTICAL

5.10.5 GEZE GMBH PROVIDES AUTOMATED WINDOWS FOR VENTILATION IN PRAEDINIUS GRAMMAR SCHOOL IN GRONINGEN

5.11 TRADE ANALYSIS

FIGURE 30 IMPORT DATA FOR HS CODE 830260, BY KEY COUNTRY, 2017–2021 (USD MILLION)

FIGURE 31 EXPORT DATA FOR HS CODE 830260, BY KEY COUNTRY, 2017–2021 (USD MILLION)

5.12 PATENT ANALYSIS

FIGURE 32 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS

FIGURE 33 PATENT ANALYSIS RELATED TO DOOR AND WINDOW AUTOMATION MARKET, 2012–2021

5.12.1 LIST OF MAJOR PATENTS

5.13 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 7 DOOR AND WINDOW AUTOMATION MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 TARIFF AND REGULATORY LANDSCAPE

5.14.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 9 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 10 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 11 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.14.2 SAFETY STANDARDS

6 CONTROL SYSTEMS IN FULLY AUTOMATED DOORS AND WINDOWS (Page No. - 78)

6.1 INTRODUCTION

FIGURE 34 CONTROL SYSTEMS IN AUTOMATIC DOORS AND WINDOWS

6.2 FULLY AUTOMATIC

6.3 PUSH AND GO

6.4 POWER ASSIST

6.5 LOW ENERGY

7 DOOR AND WINDOW AUTOMATION MARKET, BY COMPONENT (Page No. - 80)

7.1 INTRODUCTION

FIGURE 36 ACCESS CONTROL SYSTEMS TO DOMINATE DOOR AND WINDOW AUTOMATION MARKET THROUGHOUT FORECAST PERIOD

TABLE 12 DOOR AND WINDOW AUTOMATION MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 13 DOOR AND WINDOW AUTOMATION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

7.2 OPERATORS

7.2.1 DRIVE OPENING AND CLOSING FUNCTIONS ON RECEIVING SIGNALS

TABLE 14 OPERATORS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 15 OPERATORS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

7.3 SENSORS & DETECTORS

7.3.1 DETECT MOTION, PRESSURE, AND CHANGES IN RESISTANCE FORCE

7.3.2 INFRARED SENSORS

7.3.2.1 Detect obstructions and perform opening and closing functions accordingly

7.3.3 PROXIMITY SENSORS

7.3.3.1 Useful in non-contact detection of objects near automated doors or windows

7.3.4 MICROWAVE SENSORS

7.3.4.1 Uni-directional detection technology useful for sliding and swing doors

TABLE 16 SENSORS & DETECTORS: DOOR AND WINDOW AUTOMATION MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 17 SENSORS & DETECTORS: DOOR AND WINDOW AUTOMATION MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 18 SENSORS & DETECTORS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 19 SENSORS & DETECTORS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

7.4 ACCESS CONTROL SYSTEMS

7.4.1 COMBINED WITH AUTOMATED DOORS FOR IMPROVED SAFETY AND SECURITY

TABLE 20 ACCESS CONTROL SYSTEMS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 21 ACCESS CONTROL SYSTEMS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

7.5 MOTORS & ACTUATORS

7.5.1 CONTROL AND SAFEGUARD AUTOMATIC DOORS AND WINDOWS

TABLE 22 MOTORS & ACTUATORS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 23 MOTORS & ACTUATORS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

7.6 CONTROL PANELS

7.6.1 USEFUL IN EMERGENCY SITUATIONS

TABLE 24 CONTROL PANELS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 25 CONTROL PANELS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

7.7 SWITCHES

7.7.1 ACTIVATE OR DEACTIVATE COMPONENT SYSTEMS IN AUTOMATED DOORS AND WINDOWS

TABLE 26 SWITCHES: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 27 SWITCHES: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

7.8 OTHERS

TABLE 28 OTHER COMPONENTS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 29 OTHER COMPONENTS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

8 DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT (Page No. - 92)

8.1 INTRODUCTION

FIGURE 38 PEDESTRIAN DOORS TO DOMINATE MARKET IN 2022

TABLE 30 DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 31 DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

8.2 INDUSTRIAL DOORS

8.2.1 INSTALLED IN PRODUCTION PLANTS AS SAFETY MEASURE

8.2.2 SECTIONAL DOORS

8.2.2.1 Suitable for industrial premises with limited space

8.2.3 HIGH-SPEED DOORS

8.2.3.1 Designed for industrial areas that require temperature control, hygiene, and fast access

8.2.4 ROLLER SHUTTER DOORS

8.2.4.1 Withstand adverse weather conditions and offer high safety and security

8.2.5 OTHERS

TABLE 32 INDUSTRIAL DOORS: DOOR AND WINDOW AUTOMATION MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 33 INDUSTRIAL DOORS: DOOR AND WINDOW AUTOMATION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 34 INDUSTRIAL DOORS: DOOR AND WINDOW AUTOMATION MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 35 INDUSTRIAL DOORS: DOOR AND WINDOW AUTOMATION MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 36 INDUSTRIAL DOORS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 37 INDUSTRIAL DOORS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 PEDESTRIAN DOORS

8.3.1 ACCOUNTED FOR LARGEST MARKET SHARE IN 2021

8.3.2 SLIDING DOORS

8.3.2.1 Are highly robust, reliable, and compatible with BMS

8.3.3 SWING DOORS

8.3.3.1 Provide privacy, safety, and convenience

8.3.4 OTHERS

TABLE 38 PEDESTRIAN DOORS: DOOR AND WINDOW AUTOMATION MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 39 PEDESTRIAN DOORS: DOOR AND WINDOW AUTOMATION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 40 PEDESTRIAN DOORS: DOOR AND WINDOW AUTOMATION MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 41 PEDESTRIAN DOORS: DOOR AND WINDOW AUTOMATION MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 42 PEDESTRIAN DOORS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 43 PEDESTRIAN DOORS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 WINDOWS

8.4.1 HOTELS AND RESTAURANTS TO FUEL DEMAND FOR AUTOMATED WINDOWS

TABLE 44 WINDOWS: DOOR AND WINDOW AUTOMATION MARKET, BY COMPONENT, 2018–2021 (USD MILLION)

TABLE 45 WINDOWS: DOOR AND WINDOW AUTOMATION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 46 WINDOWS: DOOR AND WINDOW AUTOMATION MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 47 WINDOWS: DOOR AND WINDOW AUTOMATION MARKET, BY END-USER, 2022–2027 (USD MILLION)

TABLE 48 WINDOWS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 49 WINDOWS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

9 DOOR AND WINDOW AUTOMATION MARKET, BY END-USER (Page No. - 106)

9.1 INTRODUCTION

FIGURE 40 COMMERCIAL BUILDINGS TO CAPTURE LARGEST SHARE OF DOOR AND WINDOW AUTOMATION MARKET IN 2022

TABLE 50 DOOR AND WINDOW AUTOMATION MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 51 DOOR AND WINDOW AUTOMATION MARKET, BY END-USER, 2022–2027 (USD MILLION)

9.2 RESIDENTIAL BUILDINGS

9.2.1 PREFER ACCESS CONTROL SYSTEM-INTEGRATED AUTOMATED DOORS

TABLE 52 RESIDENTIAL BUILDINGS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 53 RESIDENTIAL BUILDINGS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 54 RESIDENTIAL BUILDINGS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 55 RESIDENTIAL BUILDINGS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 AIRPORTS

9.3.1 DEPLOY PEDESTRIAN DOORS TO CONTROL HIGH-VOLUME TRAFFIC

TABLE 56 AIRPORTS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 57 AIRPORTS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 58 AIRPORTS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 59 AIRPORTS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 EDUCATIONAL BUILDINGS

9.4.1 INSTALL AUTOMATED DOORS FOR FREE MOVEMENT OF HIGH FOOT TRAFFIC

TABLE 60 EDUCATIONAL BUILDINGS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 61 EDUCATIONAL BUILDINGS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 62 EDUCATIONAL BUILDINGS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 63 EDUCATIONAL BUILDINGS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 HEALTHCARE FACILITIES

9.5.1 UTILIZE AUTOMATED DOORS TO PROVIDE GREATER MOBILITY TO PATIENTS AND STAFF

TABLE 64 HEALTHCARE FACILITIES: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 65 HEALTHCARE FACILITIES: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 66 HEALTHCARE FACILITIES: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 67 HEALTHCARE FACILITIES: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 HOTELS & RESTAURANTS

9.6.1 DEPLOY SLIDING AND REVOLVING DOORS FOR SMOOTH FLOW OF PEDESTRIAN TRAFFIC

TABLE 68 HOTELS & RESTAURANTS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 69 HOTELS & RESTAURANTS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 70 HOTELS & RESTAURANTS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 71 HOTELS & RESTAURANTS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 INDUSTRIAL PRODUCTION UNITS

9.7.1 UTILIZE HIGH-SPEED DOORS TO ACHIEVE ENVIRONMENTAL CONTROL

TABLE 72 INDUSTRIAL PRODUCTION UNITS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 73 INDUSTRIAL PRODUCTION UNITS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 74 INDUSTRIAL PRODUCTION UNITS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 75 INDUSTRIAL PRODUCTION UNITS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 PUBLIC TRANSIT SYSTEMS

9.8.1 METROS AND SUBWAYS DEPLOYED WITH AUTOMATED DOORS FOR SAFE TRANSIT

TABLE 76 PUBLIC TRANSIT SYSTEMS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 77 PUBLIC TRANSIT SYSTEMS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 78 PUBLIC TRANSIT SYSTEMS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 79 PUBLIC TRANSIT SYSTEMS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 COMMERCIAL BUILDINGS

9.9.1 HELD LARGEST MARKET SHARE IN 2021

TABLE 80 COMMERCIAL BUILDINGS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 81 COMMERCIAL BUILDINGS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 82 COMMERCIAL BUILDINGS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 83 COMMERCIAL BUILDINGS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

9.10 ENTERTAINMENT CENTERS

9.10.1 UTILIZE AUTOMATED DOORS TO MANAGE HUGE CROWDS AT STADIUMS AND AUDITORIUMS

TABLE 84 ENTERTAINMENT CENTERS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 85 ENTERTAINMENT CENTERS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 86 ENTERTAINMENT CENTERS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 87 ENTERTAINMENT CENTERS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

9.11 OTHERS

TABLE 88 OTHERS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 89 OTHERS: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 90 OTHERS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 91 OTHERS: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

10 DOOR AND WINDOW AUTOMATION MARKET, BY REGION (Page No. - 127)

10.1 INTRODUCTION

FIGURE 41 DOOR AND WINDOW AUTOMATION MARKET, BY REGION

FIGURE 42 GEOGRAPHIC SNAPSHOT FOR DOOR AND WINDOW AUTOMATION MARKET, 2022–2027

TABLE 92 DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 93 DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 43 NORTH AMERICA: DOOR AND WINDOW AUTOMATION MARKET SNAPSHOT

FIGURE 44 US TO ACCOUNT FOR LARGEST SHARE OF NORTH AMERICAN DOOR AND WINDOW AUTOMATION MARKET IN 2022

TABLE 94 NORTH AMERICA: DOOR AND WINDOW AUTOMATION MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 95 NORTH AMERICA: DOOR AND WINDOW AUTOMATION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 96 NORTH AMERICA: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 97 NORTH AMERICA: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 98 NORTH AMERICA: DOOR AND WINDOW AUTOMATION MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 99 NORTH AMERICA: DOOR AND WINDOW AUTOMATION MARKET, BY END-USER, 2022–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Dominated North American market in 2021

10.2.2 CANADA

10.2.2.1 Records high installation of automated solutions in commercial buildings and healthcare facilities

10.2.3 MEXICO

10.2.3.1 Witnesses increasing investment in infrastructure development

10.3 EUROPE

FIGURE 45 EUROPE: DOOR AND WINDOW AUTOMATION MARKET SNAPSHOT

FIGURE 46 GERMANY TO ACCOUNT FOR LARGEST SHARE OF EUROPEAN DOOR AND WINDOW AUTOMATION MARKET IN 2027

TABLE 100 EUROPE: DOOR AND WINDOW AUTOMATION MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 101 EUROPE: DOOR AND WINDOW AUTOMATION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 102 EUROPE: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 103 EUROPE: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 104 EUROPE: DOOR AND WINDOW AUTOMATION MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 105 EUROPE: DOOR AND WINDOW AUTOMATION MARKET, BY END-USER, 2022–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Early adopter of advanced automated products for safety and security

10.3.2 UK

10.3.2.1 Keen on deploying energy-efficient products in commercial and residential buildings

10.3.3 FRANCE

10.3.3.1 Witnesses strong demand for automated doors from tourism and construction industries

10.3.4 ITALY

10.3.4.1 Thriving tourism industry likely to support market growth

10.3.5 SPAIN

10.3.5.1 Growing number of hotels and restaurants to fuel market growth

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

FIGURE 47 ASIA PACIFIC: DOOR AND WINDOW AUTOMATION MARKET SNAPSHOT

FIGURE 48 INDIA TO RECORD HIGHEST CAGR IN DOOR AND WINDOW AUTOMATION MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

TABLE 106 ASIA PACIFIC: DOOR AND WINDOW AUTOMATION MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 107 ASIA PACIFIC: DOOR AND WINDOW AUTOMATION MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

TABLE 108 ASIA PACIFIC: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 109 ASIA PACIFIC: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 110 ASIA PACIFIC: DOOR AND WINDOW AUTOMATION MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 111 ASIA PACIFIC: DOOR AND WINDOW AUTOMATION MARKET, BY END-USER, 2022–2027 (USD MILLION)

10.4.1 CHINA

10.4.1.1 High infrastructure development spending supports market growth

10.4.2 JAPAN

10.4.2.1 Captured largest market share in 2021

10.4.3 INDIA

10.4.3.1 Likely to witness high demand automated systems for office buildings and hotels

10.4.4 SOUTH KOREA

10.4.4.1 Hotel industry expected to propel market growth

10.4.5 REST OF ASIA PACIFIC

10.5 REST OF THE WORLD (ROW)

FIGURE 49 MIDDLE EAST & AFRICA TO DOMINATE DOOR AND WINDOW AUTOMATION MARKET IN ROW IN 2022

TABLE 112 ROW: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 113 ROW: DOOR AND WINDOW AUTOMATION MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 114 ROW: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2018–2021 (USD MILLION)

TABLE 115 ROW: DOOR AND WINDOW AUTOMATION MARKET, BY PRODUCT, 2022–2027 (USD MILLION)

TABLE 116 ROW: DOOR AND WINDOW AUTOMATION MARKET, BY END-USER, 2018–2021 (USD MILLION)

TABLE 117 ROW: DOOR AND WINDOW AUTOMATION MARKET, BY END-USER, 2022–2027 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Infrastructure development projects to boost market growth

10.5.2 MIDDLE EAST & AFRICA

10.5.2.1 Thriving hospitality sector to accelerate market growth

11 COMPETITIVE LANDSCAPE (Page No. - 151)

11.1 INTRODUCTION

TABLE 118 KEY DEVELOPMENTS IN DOOR AND WINDOW AUTOMATION MARKET (2019–2022)

11.2 REVENUE ANALYSIS OF TOP COMPANIES

FIGURE 50 DOOR AND WINDOW AUTOMATION MARKET: REVENUE ANALYSIS, 2019–2021

11.3 MARKET SHARE ANALYSIS OF TOP PLAYERS, 2021

TABLE 119 DOOR AND WINDOW AUTOMATION MARKET: DEGREE OF COMPETITION

11.4 COMPANY EVALUATION QUADRANT, 2021

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 51 DOOR AND WINDOW AUTOMATION MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

11.5 SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION QUADRANT, 2021

11.5.1 PROGRESSIVE COMPANIES

11.5.2 RESPONSIVE COMPANIES

11.5.3 DYNAMIC COMPANIES

11.5.4 STARTING BLOCKS

FIGURE 52 DOOR AND WINDOW AUTOMATION MARKET (GLOBAL): SME EVALUATION QUADRANT, 2021

11.6 DOOR AND WINDOW AUTOMATION MARKET: COMPANY FOOTPRINT

TABLE 120 COMPANY PRODUCT FOOTPRINT

TABLE 121 COMPANY END-USER FOOTPRINT

TABLE 122 COMPANY REGION FOOTPRINT

TABLE 123 COMPANY FOOTPRINT

11.7 COMPETITIVE BENCHMARKING

TABLE 124 DOOR AND WINDOW AUTOMATION MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 125 DOOR AND WINDOW AUTOMATION MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

11.8 COMPETITIVE SCENARIOS AND TRENDS

11.8.1 PRODUCT LAUNCHES

TABLE 126 DOOR AND WINDOW AUTOMATION MARKET: PRODUCT LAUNCHES, MARCH 2022–APRIL 2022

11.8.2 DEALS

TABLE 127 DOOR AND WINDOW AUTOMATION MARKET: DEALS, NOVEMBER 2019–JULY 2022

12 COMPANY PROFILES (Page No. - 166)

12.1 KEY PLAYERS

(Business overview, Products/Solutions/Services offered, Business overview, Products/Solutions/Services offered, Recent developments, Deals, MnM view, Key strengths/Right to win, Strategic choices made, and Weaknesses/Competitive threats)*

12.1.1 ABB

TABLE 128 ABB: BUSINESS OVERVIEW

FIGURE 53 ABB: COMPANY SNAPSHOT

TABLE 129 ABB: PRODUCT/SOLUTION/SERVICE OFFERINGS

12.1.2 ALLEGION PLC

TABLE 130 ALLEGION PLC: BUSINESS OVERVIEW

FIGURE 54 ALLEGION PLC: COMPANY SNAPSHOT

TABLE 131 ALLEGION PLC: PRODUCT/SOLUTION/SERVICE OFFERINGS

12.1.3 ASSA ABLOY

TABLE 132 ASSA ABLOY: BUSINESS OVERVIEW

FIGURE 55 ASSA ABLOY: COMPANY SNAPSHOT

TABLE 133 ABBA ABLOY: PRODUCT/SOLUTION/SERVICE OFFERINGS

12.1.4 CAME

TABLE 134 CAME: BUSINESS OVERVIEW

TABLE 135 CAME: PRODUCT/SOLUTION/SOFTWARE OFFERINGS

12.1.5 DORMAKABA GROUP

TABLE 136 DORMAKABA GROUP: BUSINESS OVERVIEW

FIGURE 56 DORMAKABA GROUP: COMPANY SNAPSHOT

TABLE 137 DORMAKABA GROUP: PRODUCT/SOLUTION/SERVICE OFFERINGS

12.1.6 ERREKA

TABLE 138 ERREKA: BUSINESS OVERVIEW

TABLE 139 ERREKA: PRODUCT/SOLUTION/SERVICE OFFERINGS

12.1.7 GEZE GMBH

TABLE 140 GEZE GMBH: BUSINESS OVERVIEW

TABLE 141 GEZE GMBH: PRODUCT/SOLUTION/SERVICE OFFERINGS

12.1.8 GIRA GIERSIEPEN GMBH & CO. KG

TABLE 142 GIRA GIERSIEPEN GMBH & CO. KG: BUSINESS OVERVIEW

TABLE 143 GIRA GIERSIEPEN GMBH & CO. KG: PRODUCT/SOLUTION/SERVICE OFFERINGS

12.1.9 HONEYWELL INTERNATIONAL INC.

TABLE 144 HONEYWELL INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 57 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

TABLE 145 HONEYWELL INTERNATIONAL INC.: PRODUCT/SOLUTION/SERVICE OFFERINGS

12.1.10 HORMANN

TABLE 146 HÖRMANN: BUSINESS OVERVIEW

TABLE 147 HÖRMANN: PRODUCT/SOLUTION/SERVICE OFFERINGS

12.1.11 INSTEON

TABLE 148 INSTEON: BUSINESS OVERVIEW

TABLE 149 INSTEON: PRODUCT/SOLUTION/SERVICE OFFERINGS

12.1.12 NABTESCO CORPORATION

TABLE 150 NABTESCO CORPORATION: BUSINESS OVERVIEW

FIGURE 58 NABTESCO CORPORATION: COMPANY SNAPSHOT

TABLE 151 NABTESCO CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.1.13 ROYAL BOON EDAM INTERNATIONAL B.V.

TABLE 152 ROYAL BOON EDAM INTERNATIONAL B.V.: BUSINESS OVERVIEW

TABLE 153 ROYAL BOON EDAM INTERNATIONAL B.V.: PRODUCT/SOLUTION/SERVICE OFFERINGS

12.1.14 SCHNEIDER ELECTRIC

TABLE 154 SCHNEIDER ELECTRIC: BUSINESS OVERVIEW

FIGURE 59 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

TABLE 155 SCHNEIDER ELECTRIC: PRODUCT/SOLUTION/SERVICE OFFERINGS

12.1.15 SIEMENS AG

TABLE 156 SIEMENS AG: BUSINESS OVERVIEW

FIGURE 60 SIEMENS AG: COMPANY SNAPSHOT

TABLE 157 SIEMENS AG: PRODUCT/SOLUTION/SERVICE OFFERINGS

12.2 OTHER PLAYERS

12.2.1 AUTOMATED DOOR SYSTEMS

12.2.2 DEUTSCHTEC

12.2.3 EBSA

12.2.4 JLC GROUP

12.2.5 KBB AUTOMATIC DOOR GROUP

12.2.6 KINTROL PTY LTD

12.2.7 MANUSA

12.2.8 MAVIFLEX

12.2.9 MAXWELL AUTOMATIC DOORS INDIA PVT. LTD.

12.2.10 PONZI SRL

*Details on Business overview, Products/Solutions/Services offered, Business overview, Products/Solutions/Services offered, Recent developments, Deals, MnM view, Key strengths/Right to win, Strategic choices made, and Weaknesses/Competitive threats might not be captured in case of unlisted companies.

13 ADJACENT AND RELATED MARKETS (Page No. - 203)

13.1 INTRODUCTION

13.2 LIMITATIONS

13.3 SMART HOME MARKET, BY SALES CHANNEL

13.3.1 INTRODUCTION

TABLE 158 SMART HOME MARKET, BY SALES CHANNEL, 2017–2020 (USD BILLION)

TABLE 159 SMART HOME MARKET, BY SALES CHANNEL, 2021–2026 (USD BILLION)

13.3.2 DIRECT SALES CHANNELS

13.3.2.1 Opted by players with limited sales and distribution networks

TABLE 160 DIRECT SALES CHANNELS: SMART HOME MARKET, BY REGION, 2017–2020 (USD BILLION)

TABLE 161 DIRECT SALES CHANNELS: SMART HOME MARKET, BY REGION, 2021–2026 (USD BILLION)

13.3.3 INDIRECT SALES CHANNELS

13.3.3.1 Increasingly adopted after COVID-19 outbreak

TABLE 162 INDIRECT SALES CHANNELS: SMART HOME MARKET, BY REGION, 2017–2020 (USD BILLION)

TABLE 163 INDIRECT SALES CHANNELS: SMART HOME MARKET, BY REGION, 2021–2026 (USD BILLION)

14 APPENDIX (Page No. - 208)

14.1 INSIGHTS FROM INDUSTRY EXPERTS

14.2 DISCUSSION GUIDE

14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 CUSTOMIZATION OPTIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

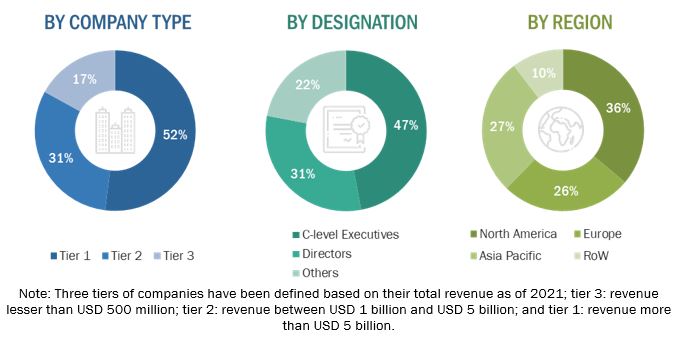

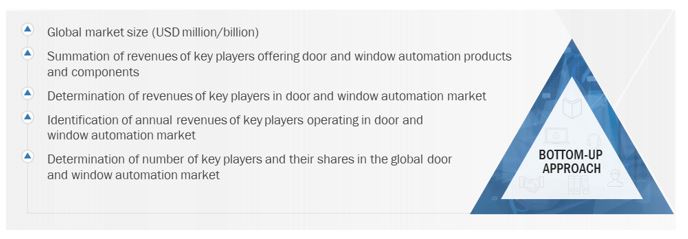

The study involved four major activities in estimating the current size of the door and window automation market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. To validate these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred for identifying and collecting information important for the door and window automation market study. Secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, and certified publications; articles from recognized authors; directories; and databases.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts, such as CEOs, VPs, marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the door and window automation market. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used to estimate and validate the size of the overall door and window automation market based on segments. The research methodology used to estimate the market size has been given below:

- Key players operating in the door and window automation market have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined by using secondary sources and verified through primary sources.

Global door and window automation market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall door and window automation market size-using the estimation processes explained above-the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends in both the demand and supply sides of the door and window automation market.

Report Objectives:

- To describe and forecast the door and window automation market, in terms of value, based on component, product, and end-user.

- To forecast the market size, in terms of value, for four main regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a comprehensive overview of the value chain of the door and window automation ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market.

- To strategically profile key players and comprehensively analyze their market position in terms of ranking and core competencies2 and provide a detailed competitive landscape of the market.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the door and window automation.

- To analyze competitive strategies, such as product launches, partnership, agreement, and acquisitions, adopted by key market players in the door and window automation market.

Available Customizations

Based on the given market data, MarketsandMarkets offers customizations in the reports according to the client’s specific requirements. The available customization options are as follows:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Door and Window Automation Market

We are a manufacturer specifically of window automation devices and I would like to know before buying this report whether the data specifically separates windows and doors or whether they are both combined for the figures.