Digital Pathology Market by Product (Scanner, Software, Storage System), Type (Human, Veterinary), Application (Teleconsultation, Training, Disease Diagnosis, Drug Discovery), End User (Pharma & Biotech, Academia, Hospitals) - Global Forecast to 2029

Market Growth Outlook Summary

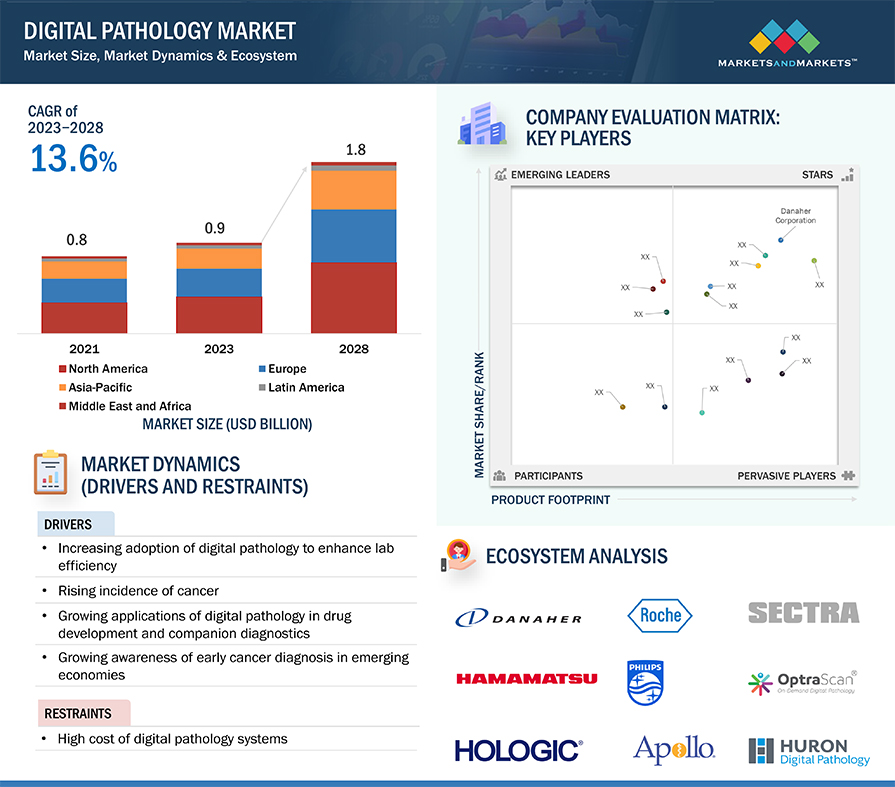

The global digital pathology market growth forecasted to transform from USD 1.1 billion in 2024 to USD 2.0 billion by 2029, driven by a CAGR of 13.1%. The market growth is driven by several key factors such as streamlined diagnostic processes, enhanced collaboration and remote access, advanced image analysis and AI integration, rising incidence of cancer, shortage of skilled pathologist practitioners, and growing application of digital pathology in drug development. However, high capital investment and lack of healthcare IT infrastructure limits the growth of the market.

Digital Pathology Market Size, Dynamics & Ecosystem

To know about the assumptions considered for the study, Request for Free Sample Report

Digital pathology Market Dynamics

Driver: Advancements in Technology

Technological advancements like whole-slide imaging (WSI), image analysis software, and artificial intelligence (AI) have revolutionized digital pathology. These innovations have significantly enhanced diagnostic precision, operational efficiency, and automated workflow processes, thereby increasing the appeal of digital pathology among healthcare providers.

Digital pathology enables telepathology, where pathologists can review slides remotely. This capability is crucial for areas with limited access to pathology expertise, leading to improved patient care outcomes through faster diagnosis and treatment.

Restraint: Workflow Integration

Integrating digital pathology systems into existing laboratory workflows can be complex. It may require changes in processes and training for pathologists and laboratory technicians. Ensuring seamless integration with existing laboratory information systems (LIS) and electronic health records (EHR) is crucial but challenging.

Opportunity: AI and Machine learning applications

Artificial intelligence (AI) and machine learning (ML) are becoming integral to digital pathology, aiding pathologists in identifying abnormalities, measuring biomarkers, and forecasting outcomes through image analysis. These AI tools hold promise in boosting diagnostic precision, minimizing mistakes, and refining treatment strategies, ultimately leading to better patient results. Over the past two decades, global scientific publications on AI have surged more than sixfold, exceeding 60,000 annually. Reflecting this interest, at least 26 governments have developed national AI strategies in recent years. These technologies have the potential to enhance diagnostic accuracy, streamline workflow efficiency, and improve patient outcomes.

Challenge: Cost of Implementation

Moving from traditional microscopy to digital pathology requires substantial initial investments. These encompass acquiring digital slide scanners, setting up storage systems for vast image files, and establishing IT infrastructure capable of managing and processing digital pathology data. These expenses may pose challenges, particularly for smaller laboratories or healthcare facilities with limited financial resources.

Digital Pathology Market Ecosystem

The digital pathology market’s ecosystem comprises entities responsible for delivering digital pathology solutions to end users via various deployment models. The demand continues to grow and expand as enterprises implement digital pathology software to reduce costs and optimize the workload performance of their health systems. Solution and service providers continue to enhance and mature their offerings to increase the value addition.

Solution providers in the digital pathology market develop high-end digital pathology solutions based on the customer’s requirements.

Digital Pathology Market Segmentation & Geographical Spread

To know about the assumptions considered for the study, download the pdf brochure

By product, software segment is the fastest growing in the digital pathology industry in 2023.

By product, the digital pathology market is segmented into scanners, software, and systems segments. The software segment registers the highest CAGR during the forecast period. The software segment in the digital pathology market is growing rapidly due to several factors. Advancements in AI and machine learning are enhancing the analysis of pathology data, improving diagnostic accuracy and efficiency. AI-powered software helps pathologists detect patterns and anomalies in digital images that may be overlooked otherwise. Additionally, software solutions are crucial for integrating digital pathology systems with existing healthcare IT infrastructure, such as EHR and LIS, streamlining workflows and improving data accessibility.

By type, the human pathology segment of the digital pathology industry registers the highest growth rate during the forecast period.

Based on type, the digital pathology market is segmented into human pathology and veterinary pathology. Human pathology registers a high growth rate during forecast period due to the rising prevalence of chronic diseases such as cancer. Digital pathology has significant potential in human specimen slide analysis. It also improves productivity and efficiency for healthcare providers and reduces manual errors. Owing to this, companies are adopting organic strategies. For instance, In March 2024, Koninklijke Philips N.V (Netherlands) and Amazon Web Services (AWS) announced an expanded collaboration with AWS to address the growing need for secure, scalable digital pathology solutions in the cloud. This collaboration will help to accelerate workflow efficacy and will help in enabling seamless integration with existing healthcare system to deliver holistic patient care.

The drug discovery segment accounted for the largest share of the global digital pathology industry in 2023.

Based on application, the digital pathology market is segmented into drug discovery, disease diagnosis, training and education segment. The drug discovery segment accounted for the largest share of the application segment in 2023. This is due to the accuracy of the drug development process; digital pathology allows researchers to analyze vast datasets quickly and accurately. Moreover, AI helps in structure-based drug discovery by predicting the 3D protein structure because the design is in line with the chemical environment of the target protein site, thus helping to predict the effect of a compound on the target along with safety considerations before their synthesis or production. Additionally, this approach transforms global pharmaceutical research by enabling data sharing to integrate dispersed pharmaceutical pathology laboratories worldwide. This, in turn, provides pathologists with instant access to relevant pathology data globally. Growing life science R&D, rising government funding for research, and increasing digital pathology applications in life science and nanotechnology research are driving the growth of this segment.

Pharmaceutical and biotechnology companies are largest end users of the digital pathology industry.

Based on end users, the Digital Pathology market is segmented into pharmaceutical and biotechnology companies, hospital and reference laboratories, and academic and research institutes. Pharmaceutical and biotechnology companies dominate the digital pathology market due to their extensive research and development needs. They use advanced technologies to streamline drug discovery and testing. Digital pathology provides high-resolution imaging, efficient data management, and precise analysis, which enhances their ability to study diseases, identify biomarkers, and evaluate drug efficacy. It accelerates preclinical and clinical trials with faster, more accurate diagnostics. Additionally, the seamless sharing of digital slides and data across global teams boosts collaborative research, driving innovation and productivity. These companies' significant investments in cutting-edge technologies optimize research outcomes and maintain their competitive edge.

North America dominates the global digital pathology market.

The digital pathology market is segmented into five major regional segments, namely, North America, Europe, Asia Pacific, Latin America, and Middle East and Africa. In 2023, North America accounted for the largest share of the Digital Pathology market. This is due to its advanced healthcare infrastructure and significant investment in healthcare technologies, Additionally, North America, particularly US, has a high prevalence of cancer, driving the demand for efficient and accurate diagnostic tools.

Prominent players in digital pathology market include Fujifilm Holdings Corporation (Japan), Danaher Corporation (US), Koninklijke Philips N.V. (Netherlands), Mikroscan Technologies, Inc. (US), PathAI (US), Hamamatsu Photonics K.K. (Japan), F. Hoffmann-La Roche Ltd. (Switzerland), 3DHISTECH (Hungary), Apollo Enterprise Imaging (US), XIFIN, Inc. (US), Proscia Inc. (US), KONFOONG BIOTECH INTERNATIONAL CO., LTD. (China), Glencoe Software, Inc. (US), Aiforia (Finland), Paige AI, Inc. (US), Huron Digital Pathology (Canada), Hologic, Inc. (US), Corista (US), Indica Labs Inc. (US), Objective Pathology Services Limited (Canada), Sectra AB (Sweden), OptraSCAN (US), Akoya Biosciences, Inc. (US), Motic Digital Pathology (US), and Kanteron Systems (Spain).

Digital Pathology Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2024 |

$1.1 billion |

|

Projected Revenue by 2029 |

$2.0 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 13.1% |

|

Market Driver |

Advancements in Technology |

|

Market Opportunity |

AI and Machine learning applications |

The study categorizes the digital pathology market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Scanners

- Brightfield Scanners

- Other Scanners

-

Software, By Type

- Integrated Software

-

Standalone Software

- Information Management Software

- Image Analysis Software

-

Software, By Deployment Mode

- On-Premises

- Cloud-Based

- Storage Systems

By Type

- Human Pathology

- Veterinary Pathology

By Application

- Drug Discovery

- Disease Diagnosis

- Training & Education

By End User

- Pharmaceutical & Biotechnology Companies

- Hospitals & Reference Laboratories

- Academic & Research Institutes

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Spain

- Italy

- Sweden

- Denmark

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Rest of APAC (RoAPAC)

-

Latin America

- Brazil

- Mexico

- Rest of Latin America (RoLATAM)

-

Middle East & Africa

- GCC Countries

- Rest of Middle East & Africa (RoMEA)

Recent Developments of Digital Pathology Market

- In March 2024, Koninklijke Philips N.V. (Netherlands) announced an expanded collaboration with AWS to address the growing need for secure, scalable digital pathology solutions in the cloud. This collaboration will help to accelerate workflow efficacy and will help in enabling seamless integration with existing healthcare systems to deliver holistic patient care.

- In February 2024, Roche announced its collaboration with Path AI to develop AI-enabled digital pathology algorithms in the companion diagnostics space. This collaboration will allow Roche to accelerate its ability to meet the demand from biopharma companies looking to develop AI-enabled companion diagnostics and provide end-to-end solutions.

- In March 2022, Roche Diagnostics partnered with SRL Diagnostics. Under this partnership, SRL Diagnostics planned to transform its lab at Fortis Memorial Research Institute with Roche Diagnostics.

- In March 2023, Agilent Technologies announced its partnership with Hamamatsu Photonics K.K. to incorporate NanoZoomer range, including the S360MD Slide Scanner System, into its end-to-end digital pathology solution.

- In June 2021, Danaher Corporation enhanced the integration of digital pathology into diagnostic pathways with DICOM imaging. The company announced that its Next Generation Aperio GT 450 DX Scanner now includes support for DICOM imaging.

Frequently Asked Questions (FAQ):

What is the growth outlook of the global digital pathology market between 2024 and 2029?

The global digital pathology market is projected to grow from USD 1.1 billion in 2024 to USD 2.0 billion by 2029, demonstrating a robust CAGR of 13.1%.

What factors are driving the growth of the digital pathology market?

The growth of the digital pathology market is primarily driven by advancements in AI and machine learning, rising demand for telepathology, and increasing government funding for healthcare digitalization.

What are the main challenges faced by the digital pathology market?

The digital pathology market faces challenges such as high implementation costs, the complexity of integrating digital systems into existing workflows, and a shortage of skilled pathologists.

How does AI influence the digital pathology market?

AI and machine learning applications enhance diagnostic accuracy in digital pathology by analyzing complex data, identifying abnormalities, and providing predictive analytics, which significantly improve patient outcomes.

Which region holds the largest share in the digital pathology market?

North America holds the largest share of the digital pathology market, driven by its advanced healthcare infrastructure and significant investment in digital health technologies, including AI and cloud-based solutions.

What role does telepathology play in the digital pathology market?

Telepathology enables remote slide analysis, allowing pathologists to consult and collaborate from different locations, making it crucial for areas with limited pathology expertise and contributing to faster diagnosis.

What is the role of AI in drug discovery within the digital pathology market?

AI aids in drug discovery by analyzing large datasets, predicting protein structures, and accelerating the evaluation of drug efficacy, making it a crucial component of pharmaceutical research in digital pathology.

What are the key segments of the digital pathology market by product?

The digital pathology market is segmented by product into scanners, software, and storage systems, with the software segment expected to grow at the highest CAGR due to advancements in AI-powered analysis.

What are the recent developments in the digital pathology market?

Recent developments include collaborations such as Roche's partnership with PathAI for AI-enabled diagnostics and Philips' expanded collaboration with AWS for cloud-based pathology solutions.

Why are pharmaceutical and biotechnology companies significant end-users of digital pathology?

Pharmaceutical and biotechnology companies are key end-users due to their need for high-resolution imaging and precise analysis, which supports drug discovery and clinical trials, leading to faster, more accurate research outcomes.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved five major activities to estimate the current size of the Digital Pathology market. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard & silver-standard websites, regulatory bodies, and databases (such as D&B Hoovers, Bloomberg Business, and Factiva) were referred to in order to identify and collect information for the study of Digital Pathology Market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

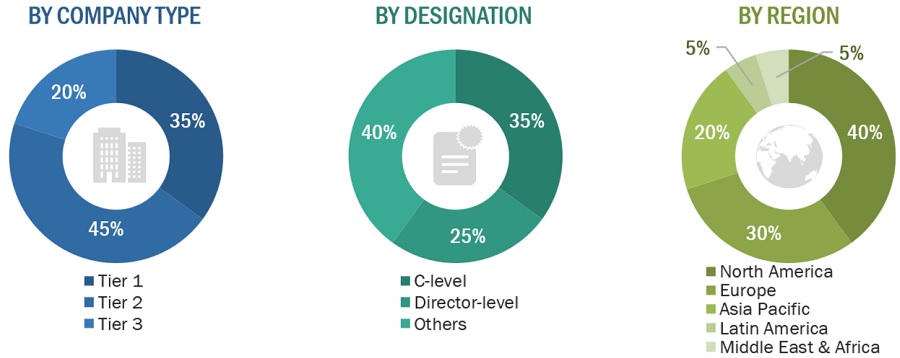

Extensive primary research was conducted after acquiring basic knowledge about the global Digital Pathology market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (Hospital directors, Hospital Vice Presidents, Department heads, and Critical care specialists ) and supply side (such as C-level and D-level executives, technology experts, product managers, marketing and sales managers, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East, and Africa. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews

The following is a breakdown of the primary respondents:

Breakdown of Primary Participants:

Note 1: Others include sales managers, marketing managers, and product managers.

Note 2: Tiers of companies are defined on the basis of their total revenues in 2023. Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Digital Pathology market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Digital Pathology Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Digital Pathology Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the Digital Pathology Market.

Market Definition:

Digital pathology refers to the use of digital technology to capture, manage, share, and analyze pathology information, typically in the form of high-resolution digital images derived from glass slides. This technology allows pathologists to view, interpret, and manage pathology data more efficiently and accurately.

Key Stakeholders:

- Healthcare institutions/providers (hospitals, medical groups, physician practices, diagnostic centers, pharmacies, ambulatory centers, and outpatient clinics)

- Digital Pathology organizations

- Senior Management

- Finance/Procurement Department

- R&D Department

- Healthcare data aggregators

- Venture capitalists

- Government agencies

- Healthcare startups, consultants, and regulators

- Academic medical institutes

Report Objectives

- To define, describe, and forecast the global Digital Pathology market based on product, type, application, end user, and region.

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micro-markets with respect to individual growth trends, prospects, and contributions to the overall Digital Pathology market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To strategically analyze the market structure profile the key players of the Digital Pathology market and comprehensively analyze their core competencies.

- To forecast the size of the market segments with respect to five regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

- To track and analyze competitive developments such as product launches and enhancements and investments, partnerships, collaborations, acquisitions, expansions, agreements, sales contracts, and alliances in the Digital Pathology market during the forecast period.

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolios of the top companies

- Further breakdown of the Rest of the Asia Pacific digital pathology market into South Korea, Australia, New Zealand, and other countries

- Further breakdown of the Rest of Europe digital pathology market into Italy, Spain, Belgium, Russia, the Netherlands, Switzerland, and other countries

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Pathology Market

Keen to Know about Digital Pathology Market Size, Share and Trend Analysis Report by Product (ArtificiaI Intelligence, Scanner, Software, Storage), Type (Human, Veterinary), Application (Teleconsultation, Training, Disease Diagnosis, Drug Discovery), and Pharma, Diagnostic Labs, Hospitals as well as Academia, Hospitals - Global Forecast to 2031

Looking to gain more insights on the global Industrial Digital Pathology Market

What are the growth opportunities in Digital Pathology Market?

What are the growth opportunities in Digital Pathology Market?

Can you enlighten us on geographical growth analysis in Digital Pathology Market?