Digital Health Market by Revenue Model (Subscription, Pay per service, Free apps), Technology (Wearables, mHealth, Tele-healthcare, RPM, LTC monitoring, Population Health management, DTx), EHR, Healthcare Analytics, ePrescribing & Region - Global Forecast to 2028

Market Growth Outlook Summary

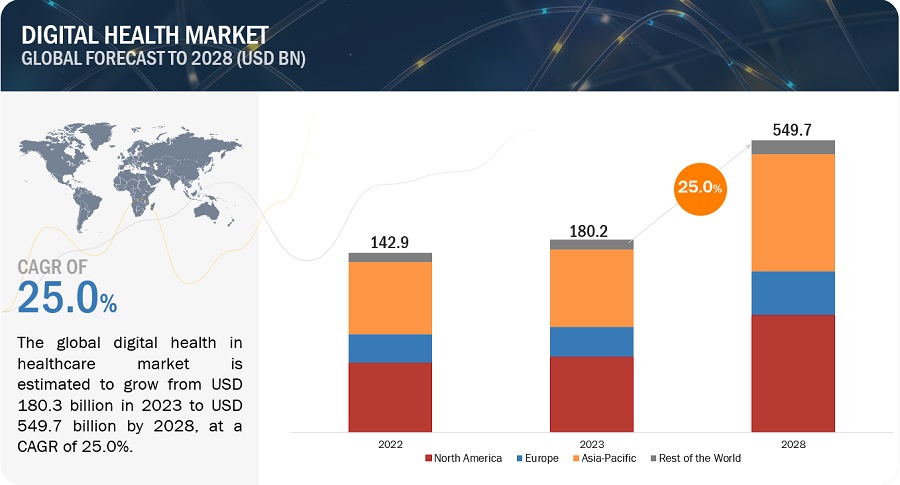

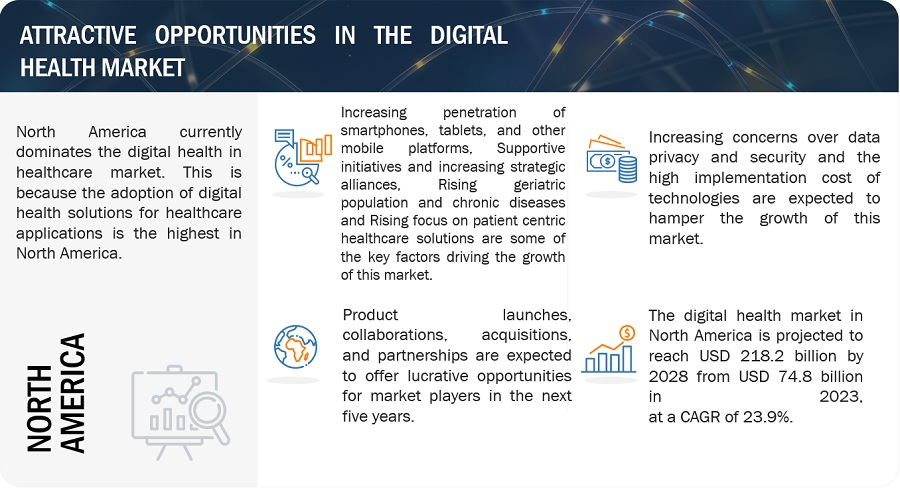

The global digital health market growth forecasted to transform from USD 180.2 billion in 2023 to USD 549.7 billion by 2028, driven by a CAGR of 25.0%. Increasing penetration of smartphones, tablets, and other mobile platforms, Supportive initiatives and increasing strategic alliances, Rising geriatric population and chronic diseases and Rising focus on patient centric healthcare solutions are some of the key factors driving the growth of this market. However, High cost of deployment of digital health solutions for small and medium-sized hospitals in emerging countrie; and Interoperability issues in the digital health market are some of the factors expected to restrain the growth of this market in the coming years.

Digital Health Market Trend

To know about the assumptions considered for the study, Request for Free Sample Report

Digital Health Market Opportunities

Digital Health Market Dynamics

Driver: Increasing penetration of smartphones, tablets, and other mobile platforms

The adoption of smartphones, tablet PCs, and Personal Digital Assistants (PDAs) has increased significantly in the past few years. These devices are the primary internet connectivity source in developed regions, such as North America and Europe. The adoption of these devices is also on the rise in emerging regions due to the introduction of low-cost devices and the continued expansion of high-speed mobile networks. The high penetration of smartphones, tablets, and other mobile platforms has become a significant driver for the digital health market. With the widespread availability of these devices, individuals now have convenient access to a plethora of health and wellness apps, telemedicine services, and wearable health tech. This technological convergence empowers people to monitor their health, access medical consultations remotely, and gather real-time health data, ultimately fostering a more proactive approach to healthcare.

Restraint: High cost of deployment of digital health solutions

The cost of various digital health solutions is considerably high, making it difficult for especially for small and medium-sized healthcare organizations to implement them. The primary reasons for this situation stem from challenges associated with deploying multiple networks within healthcare facilities, limited wireless connectivity alternatives, and the necessity of implementing additional security measures to prevent data breaches. Furthermore, ongoing support and maintenance services, such as software adjustments and upgrades to accommodate evolving user needs, contribute significantly to the overall cost of ownership. Additionally, post-sales custom interface development for device integration demands further verification and validation to ensure the accuracy and comprehensiveness of solutions, further inflating the total cost of ownership for healthcare providers. These supplementary expenses are often beyond the means of smaller hospitals and healthcare organizations.

Challenge: Privacy and security concerns

Privacy and security concerns are paramount in the digital health market and exert a substantial impact. The crux of the issue lies in the extensive data collection inherent to digital health products, encompassing personal health information (PHI) which includes individually identifiable information related to an individual's health status, created, collected, transmitted, or maintained by HIPAA-covered entities for healthcare provision, payment, or operational purposes. Medical information is highly sought after on the black market. Criminals exploit this valuable commodity to submit fraudulent insurance claims and illicitly acquire medical equipment, resulting in a worrisome increase in compromised healthcare records.

Opportunity: Increasing advancements and adoption in digital health

The advancement of technology in healthcare has catalyzed a transformative shift in the digital health market. These innovations are revolutionizing healthcare by saving time, improving accuracy, and integrating technologies in novel ways. The Internet of Medical Things (IoMT) has emerged as a key development, facilitating telemedicine, smart sensors, and enhanced patient-doctor communication. The COVID-19 pandemic has accelerated the adoption of telehealth services, emphasizing the role of technology in virtual healthcare.

Digital Health Market Ecosystem Analysis

Tele-healthcare segment accounted for the largest share of the global digital health market.

Based on technology, the market is segmented into mHealth, Tele-healthcare, Digital Therapeutics and Health Management Solutions. Tele healthcare segment accounted for the largest share of the market in 2022. Some of the key factors responsible for the large share of this segment include increased demand for telehealth during the COVID-19 pandemic, improved consumer and provider attitudes towards virtual care, growing need for remote care, government support and policies, and investment and innovation. Additionally, telehealth also offers a cost-effective, quick, and accurate way to access healthcare services, making it an essential modality for future care needs.

Software segment expected to hold the largest share of digital health market.

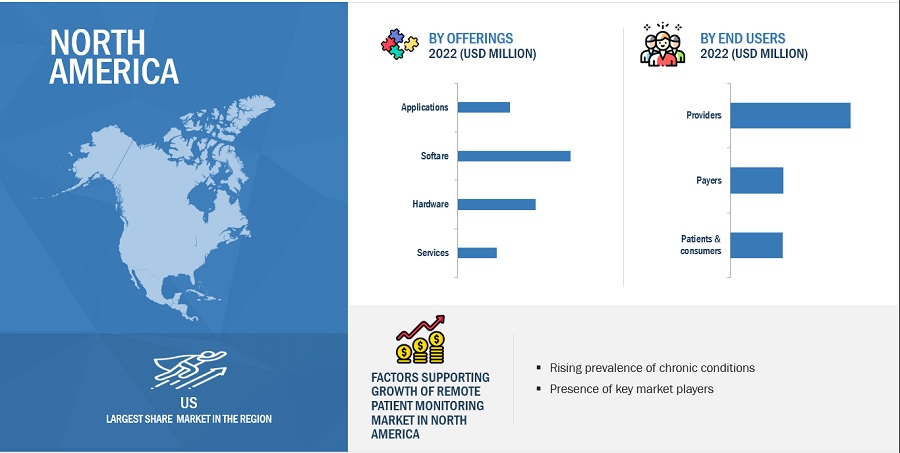

Based on offering, the market is segmented into software, hardware and services. The software segment expected to account for the largest market share of the global Digital Health market in 2022. Software is the most dominant segment in digital health due to its flexibility, cost-effectiveness, ease of use, and innovation, allowing for easy updates, lower costs, and improved healthcare delivery.

The patients & consumers segment of the digital health market is expected to grow at the highest CAGR during the forecast period

On the basis of end-user, the market is segmented into healthcare providers, payers, Patients & Consumers. The patients & consumers segment is expected to be the fastest-growing end user segment in this market. The high growth of this segment is attributed to increasing awareness of self-health management, proliferation of smartphones and mHealth devices that has made health tracking and monitoring more accessible and convenient.

North america accounted for the largest share of the global digital health market.

The market is segmented into four key regions—North America, Europe, APAC, and the Rest of the World (RoW). North America, being the early adopter of advanced technologies, has captured the largest share of the Digital Health market in 2022, followed by Europe and APAC. It is also projected to register the highest CAGR. North America is the fastest-growing regional segment for digital health due to its technological development, expansion in the healthcare industry, favorable regulatory environment, and the presence of key players and innovation hubs.

Digital Health Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Prominent players in the digital health market include Koninklijke Philips N.V. (Netherlands), Medtronic (Ireland), GE HealthCare (US), Abbott (US), OMRON Corporation (Japan), Fitbit, Inc. (A Google Company) (US), Johnson & Johnson Private Limited (US), Siemens Healthineers AG (Germany), Masimo (US), Apple, Inc. (US), Merative (US), AT &T, Inc. (US), Veradigm LLC (US), Noom, Inc. (US), Teladoc Health, Inc. (US), Omada Health Inc. (US), Dexcom, Inc. (US), Biotricity (US), iHealth Labs Inc (US), my mhealth Limited (UK), athenahealth (US), eClinicalWorks (US), AirStrip Technologies, Inc (US), AdvancedMD, Inc. (US), and Qardio, Inc. (US).

Digital Health Market Report Scope

|

Report Metric |

Details |

|

Market Size in 2023 |

USD 180.2 billion |

|

Forecasted Size by 2028 |

USD 549.7 billion |

|

Market Growth Rate |

Poised to Grow at a CAGR of 25.0% |

|

Market Driver |

Increasing penetration of smartphones, tablets, and other mobile platforms |

|

Market Opportunity |

Increasing advancements and adoption in digital health |

The study categorizes the digital health market to forecast revenue and analyze trends in each of the following submarkets:

By Offering

-

Software

- Subscription Based

- Annual Licensing

-

Services

- Subscription Based

- Pay-Per-Service (Value-based)

-

Application (Apps)

- Subscription based

- One-time Purchase

- Value-Based

- Hardware

By Technology

- mHealth

-

mHealth Devices

- Vital Signs Monitors

- Peakflow Meters

- Fetal Monitors

- Sleep Apnea Monitors

- Neurological Monitors

- Others

-

mHealth Apps

- Fitness Apps

- Medical Apps

-

Telecare

- Activity Monitoring

- Remote Medication Management

-

Telehealth

- LTC Monitoring

- Video Consultation

- Digital Therapeutics

- Preventive Therapeutics

- Treatment Therapeutics

- Healthcare Management Systems

- EHR

- Healthcare Analytics

- E-prescribing

By Application

- Chronic Disease Management

- Behavioural Health

- Health & Fitness

- Other Applications

By End User

- Provider

- Hospitals & Clinics

- Long term care facilities & Assisted Living

- Payers

- Public

- Private

- Patients & Consumers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- MEA

Recent Developments of Digital Health Market

- In May 2023 Medtronic (Ireland) acquired EOFlow Co. Ltd. (South Korea) to expand its ability to treat patients with diabetes.

- In March 2023, GE HealthCare (US) partnered with Advantus Health Partners (US) to sign a multi-year contract to expand access to Healthcare Technology Management Services.

- In April 2023, Abbott (US) acquired Cardiovascular Systems, Inc. (CSI) (US) to gain a complementary treatment option for vascular illness. The highly advanced atherectomy technology from CSI prepares vessels for angioplasty or stenting to restore blood flow.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global digital health market between 2023 and 2028?

The global digital health market is projected to grow from USD 180.2 billion in 2023 to USD 549.7 billion by 2028, demonstrating a robust CAGR of 25.0%.

What are the key factors driving the digital health market?

Key factors driving the digital health market include the increasing penetration of smartphones, rising healthcare costs, advancements in digital infrastructure, and the growing demand for cost-effective remote healthcare solutions.

What challenges does the digital health market face?

The digital health market faces challenges such as high deployment costs of solutions, limited access to technology in underserved areas, and privacy and security concerns regarding personal health information.

Which segments are leading the digital health market?

The telehealth segment accounted for the largest share of the digital health market in 2022, driven by increased demand for remote care during the COVID-19 pandemic and improved attitudes toward virtual healthcare.

What opportunities exist in the digital health market?

Opportunities in the digital health market arise from advancements in technology, such as the Internet of Medical Things (IoMT), which enhances telemedicine, smart sensors, and patient-doctor communication.

How is the geriatric population affecting the digital health market?

The aging population drives demand for digital health solutions that facilitate remote monitoring and management of chronic diseases, enhancing healthcare accessibility and efficiency.

What role do healthcare providers play in the digital health market?

Healthcare providers are critical to the digital health market, adopting solutions to improve patient care delivery, enhance operational efficiency, and respond to the growing demand for remote healthcare services.

What advancements in technology are impacting the digital health market?

Advancements such as telehealth, mHealth, and digital therapeutics are significantly influencing the digital health market by enhancing healthcare access, patient engagement, and disease management.

How do privacy and security concerns affect the digital health market?

Privacy and security concerns regarding data breaches and unauthorized access to personal health information are significant challenges that can hinder the growth of the digital health market.

What are some recent developments in the digital health market?

Recent developments include acquisitions and partnerships among major players, such as Medtronic acquiring EOFlow and GE HealthCare partnering with Advantus Health Partners to enhance healthcare technology management.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing penetration of smartphones, tablets, and other mobile platforms- Supportive initiatives and increasing strategic alliances- Rising geriatric population and subsequent increase in prevalence of chronic diseases- Rising focus on patient-centric healthcare solutionsRESTRAINTS- High cost of deployment of digital health solutions for small and medium-sized hospitals in emerging countries- Interoperability issuesOPPORTUNITIES- Shift toward intelligent health ecosystem to deliver personalized health experiences- Digital health solutions for universal healthcare access- Improving regulatory support and reimbursements- Advancements in digital healthCHALLENGES- Healthcare gap in emerging economies- Privacy and security concerns

-

5.3 INDUSTRY TRENDSEMERGENCE OF VALUE-BASED STRATEGY FOR CONTINUOUS CARECONSUMER EMPOWERMENTTECHNOLOGICALLY ENABLED PRIMARY CARE SERVICESRISING AWARENESS OF DIGITAL THERAPEUTICS TO TREAT HUMAN DISEASESPENETRATION OF PAID MEDICAL APPS

-

5.4 TECHNOLOGY ANALYSISHEALTHCARE ANALYTICSCLOUD HEALTHCAREPATIENT ENGAGEMENTHOME HEALTHCAREDIGITAL BIOMARKERS

-

5.5 PRICING ANALYSISAVERAGE SELLING PRICE OF MEDICAL DEVICES IN DIGITAL HEALTH MARKET

-

5.6 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTES

-

5.7 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

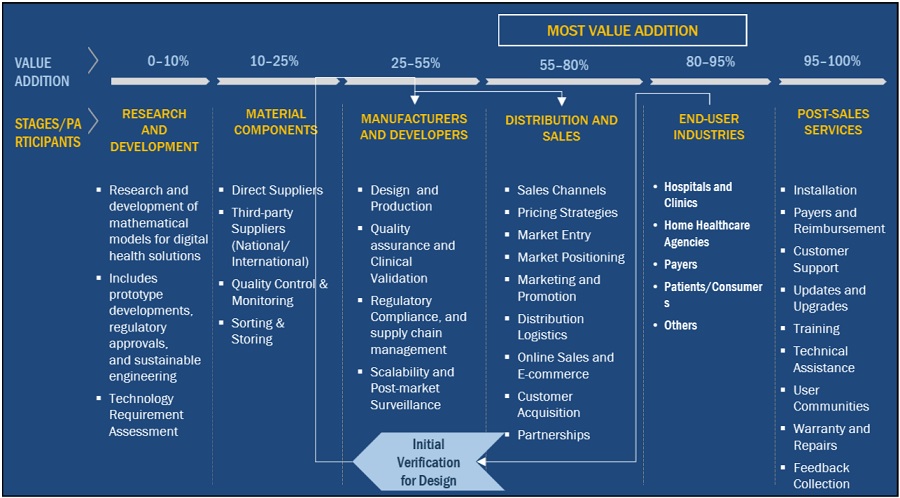

5.8 VALUE CHAIN ANALYSISRESEARCH AND PRODUCT DEVELOPMENTMATERIAL COMPONENTSMANUFACTURERS AND DEVELOPERSDISTRIBUTION AND SALESEND-USER INDUSTRIESPOST-SALE SERVICES

-

5.9 ECOSYSTEM/MARKET MAP

- 5.10 REVENUE SHIFT AND NEW REVENUE POCKETS FOR DIGITAL HEALTH MARKET

-

5.11 CASE STUDY ANALYSISCASE STUDY 1: CLÍNICAS DEL AZÚCAR (CDA)CASE STUDY 2: NOVA HOSPITAL & ENOVACOMCASE STUDY 3: APPLE & NHS TEAMS

-

5.12 PATENT ANALYSIS

- 5.13 ADJACENT MARKET ANALYSIS

-

5.14 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.15 KEY CONFERENCES AND EVENTS IN 2023–2024

-

5.16 UNMET NEEDS IN DIGITAL HEALTH MARKETEND-USER EXPECTATIONS

- 6.1 INTRODUCTION

-

6.2 HARDWAREINCREASING DEMAND FOR DATA PROCESSING AND STORAGE TO DRIVE MARKET

-

6.3 SOFTWAREANNUAL LICENSING- Pricing model where users pay recurring fees on yearly basisSUBSCRIPTION-BASED- Provides flexibility to scale usage as needed

-

6.4 SERVICESSUBSCRIPTION-BASED- Offer ongoing access to healthcare solutions and supportPAY-PER-USE (VALUE-BASED)- Users pay for individual healthcare services

-

6.5 APPLICATIONSONE-TIME PURCHASE- Model popular for fitness trackersSUBSCRIPTION-BASED- Require users to pay recurring feesPAY-PER-USE (VALUE-BASED)- Allow users to pay for specific services

- 7.1 INTRODUCTION

-

7.2 TELEHEALTHCARETELECARE/RPM- Activity monitoring- Remote medication managementTELEHEALTH- LTC monitoring- Video consultation

-

7.3 MHEALTHWEARABLES- Vital signs monitors- Peak flow meters- Fetal monitors- Sleep apnea monitors- Neurological monitors- Other wearablesMHEALTH APPS- Medical apps- Fitness apps

-

7.4 DIGITAL THERAPEUTICSPREVENTIVE APPLICATIONS- Rising awareness of self-health management to drive marketTREATMENT APPLICATIONS- Rising prevalence of chronic diseases to drive market

-

7.5 HEALTH MANAGEMENT SOLUTIONSELECTRONIC HEALTH RECORDS- Increased adoption of EHRs in emerging countries to drive marketHEALTHCARE ANALYTICS- Support for fact-based diagnostics and therapeutic decision-making to ensure demandEPRESCRIBING- Integrated ePrescribing solutions offer significant benefits over standalone systems

- 8.1 INTRODUCTION

-

8.2 CHRONIC DISEASE MANAGEMENTCHRONIC DISEASE MANAGEMENT SEGMENT TO DOMINATE DIGITAL HEALTH MARKET

-

8.3 BEHAVIORAL HEALTHRISING AWARENESS OF MENTAL HEALTH TO DRIVE GROWTH

-

8.4 HEALTH & FITNESSHEALTH & FITNESS SEGMENT TO WITNESS HIGH GROWTH DURING FORECAST PERIOD

- 8.5 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 PROVIDERSHOSPITALS & CLINICS- Need to reduce healthcare costs to drive marketLONG-TERM CARE CENTERS & ASSISTED LIVING CENTERS- Increasing geriatric population to support market growth

-

9.3 PAYERSPUBLIC- Focus on developing outcome-based payment models to drive demand for digital health solutionsPRIVATE- Increase in operational efficiency to boost demand for digital health among private payers

-

9.4 PATIENTS & CONSUMERSINCREASING AWARENESS OF SELF-HEALTH MANAGEMENT TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICAUS- High adoption rate of connected medical devices to drive marketCANADA- Federal investments in health-related technologies to boost market

-

10.3 EUROPEGERMANY- Government initiatives to support market growthUK- High penetration of wearables to drive marketFRANCE- Government support for e-Health to propel marketREST OF EUROPE

-

10.4 ASIA PACIFICCHINA- High burden of chronic diseases to support market growthJAPAN- Large geriatric population to propel marketINDIA- Growing adoption of telemedicine to drive marketREST OF ASIA PACIFIC

-

10.5 LATIN AMERICAGOVERNMENT SUPPORT FOR ADOPTION OF CONNECTED MEDICAL DEVICES TO PROPEL MARKET

-

10.6 MIDDLE EAST & AFRICAINCREASING DEMAND FOR QUALITY HEALTHCARE TO DRIVE MARKET

- 11.1 INTRODUCTION

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 11.4 MARKET RANKING ANALYSIS

-

11.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.6 COMPANY FOOTPRINT

-

11.7 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESDYNAMIC COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.8 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSKONINKLIJKE PHILIPS N.V.- Business overview- Products & services offered- Recent developments- MnM viewMEDTRONIC- Business overview- Products & services offered- Recent developments- MnM viewGE HEALTHCARE- Business overview- Products & services offered- Recent developments- MnM viewABBOTT- Business overview- Products & services offered- Recent developments- MnM viewOMRON CORPORATION- Business overview- Products & services offered- Recent developments- MnM viewFITBIT, INC.- Business overview- Products & services offered- Recent developmentsJOHNSON & JOHNSON PRIVATE LIMITED- Business overview- Products & services offered- Recent developmentsSIEMENS HEALTHINEERS AG- Business overview- Products & services offered- Recent developmentsMASIMO- Business overview- Products & services offered- Recent developmentsAPPLE, INC.- Business overview- Products & services offered- Recent developmentsMERATIVE- Business overview- Products & services offered- Recent developmentsAT&T, INC.- Business overview- Products & services offered- Recent developmentsVERADIGM LLC- Business overview- Products & services offered- Recent developmentsNOOM, INC.- Business overview- Products & services offered- Recent developmentsTELADOC HEALTH, INC.- Business overview- Products & services offered- Recent developmentsOMADA HEALTH INC.- Business overview- Products & services offered- Recent developmentsDEXCOM, INC.- Business overview- Products & services offered- Recent developmentsBIOTRICITY- Business overview- Products & services offered- Recent developments

-

12.2 OTHER PLAYERSIHEALTH LABS INC.MY MHEALTH LIMITEDATHENAHEALTH, INC.ECLINICALWORKSAIRSTRIP TECHNOLOGIES, INC.ADVANCEDMD, INC.QARDIO, INC.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 RISK ASSESSMENT ANALYSIS

- TABLE 2 MARKET DYNAMICS: IMPACT ANALYSIS

- TABLE 3 REMOTE PATIENT MONITORING (RPM) BILLING AND REIMBURSEMENT CPT CODES

- TABLE 4 DIGITAL HEALTH MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 DIGITAL HEALTH MARKET: REGULATORY STANDARDS

- TABLE 10 DIGITAL HEALTH MARKET: ECOSYSTEM

- TABLE 11 KEY PATENTS IN DIGITAL HEALTH MARKET

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 13 KEY BUYING CRITERIA FOR DIGITAL MARKET OFFERINGS

- TABLE 14 DIGITAL HEALTH MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 15 UNMET NEEDS IN DIGITAL HEALTH MARKET

- TABLE 16 END-USER EXPECTATIONS IN DIGITAL HEALTH MARKET

- TABLE 17 DIGITAL HEALTH MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 18 DIGITAL HEALTH HARDWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 19 DIGITAL HEALTH SOFTWARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 20 DIGITAL HEALTH SOFTWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 ANNUAL LICENSING SOFTWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 SUBSCRIPTION-BASED SOFTWARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 23 DIGITAL HEALTH SERVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 24 DIGITAL HEALTH SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 SUBSCRIPTION-BASED SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 PAY-PER-USE SERVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 27 DIGITAL HEALTH APPLICATIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 28 DIGITAL HEALTH APPLICATIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 ONE-TIME PURCHASE APPLICATIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 SUBSCRIPTION-BASED APPLICATIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 PAY-PER-USE APPLICATIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 32 DIGITAL HEALTH MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 33 TELEHEALTHCARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 34 TELEHEALTHCARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 TELECARE MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 36 TELECARE MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 37 ACTIVITY MONITORING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 REMOTE MEDICATION MANAGEMENT MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 TELEHEALTH MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 40 TELEHEALTH MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 41 LTC MONITORING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 VIDEO CONSULTATION MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 MHEALTH MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 44 MHEALTH MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 45 MHEALTH DEVICES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 46 MHEALTH DEVICES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 VITAL SIGNS MONITORS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 PEAK FLOW METERS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 49 FETAL MONITORS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 SLEEP APNEA MONITORS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 NEUROLOGICAL MONITORS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 OTHER WEARABLES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 53 MHEALTH APPS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 54 MHEALTH APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 MEDICAL APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 FITNESS APPS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 57 DIGITAL THERAPEUTICS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 58 DIGITAL THERAPEUTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 PREVENTIVE APPLICATIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 TREATMENT APPLICATIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 61 HEALTH MANAGEMENT SOLUTIONS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 62 HEALTH MANAGEMENT SOLUTIONS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 ELECTRONIC HEALTH RECORDS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 HEALTHCARE ANALYTICS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 EPRESCRIBING MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 66 DIGITAL HEALTH MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 67 DIGITAL HEALTH MARKET FOR CHRONIC DISEASE MANAGEMENT, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 68 DIGITAL HEALTH MARKET FOR BEHAVIORAL HEALTH, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 DIGITAL HEALTH MARKET FOR HEALTH & FITNESS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 70 DIGITAL HEALTH MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 71 DIGITAL HEALTH MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 72 DIGITAL HEALTH MARKET FOR PROVIDERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 73 DIGITAL HEALTH MARKET FOR PROVIDERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 DIGITAL HEALTH MARKET FOR HOSPITALS & CLINICS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 75 DIGITAL HEALTH MARKET FOR LONG-TERM CARE CENTERS & ASSISTED LIVING CENTERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 76 DIGITAL HEALTH MARKET FOR PAYERS, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 77 DIGITAL HEALTH MARKET FOR PAYERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 78 DIGITAL HEALTH MARKET FOR PUBLIC PAYERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 79 DIGITAL HEALTH MARKET FOR PRIVATE PAYERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 DIGITAL HEALTH MARKET FOR PATIENTS & CONSUMERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 DIGITAL HEALTH MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: DIGITAL HEALTH MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: DIGITAL HEALTH MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: DIGITAL HEALTH MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: DIGITAL HEALTH MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: DIGITAL HEALTH MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 87 US: DIGITAL HEALTH MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 88 US: DIGITAL HEALTH MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 89 US: DIGITAL HEALTH MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 90 US: DIGITAL HEALTH MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 91 CANADA: DIGITAL HEALTH MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 92 CANADA: DIGITAL HEALTH MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 93 CANADA: DIGITAL HEALTH MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 94 CANADA: DIGITAL HEALTH MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 95 EUROPE: DIGITAL HEALTH MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 96 EUROPE: DIGITAL HEALTH MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 97 EUROPE: DIGITAL HEALTH MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 98 EUROPE: DIGITAL HEALTH MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 99 EUROPE: DIGITAL HEALTH MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 100 GERMANY: DIGITAL HEALTH MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 101 GERMANY: DIGITAL HEALTH MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 102 GERMANY: DIGITAL HEALTH MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 103 GERMANY: DIGITAL HEALTH MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 104 UK: DIGITAL HEALTH MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 105 UK: DIGITAL HEALTH MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 106 UK: DIGITAL HEALTH MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 107 UK: DIGITAL HEALTH MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 108 FRANCE: DIGITAL HEALTH MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 109 FRANCE: DIGITAL HEALTH MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 110 FRANCE: DIGITAL HEALTH MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 111 FRANCE: DIGITAL HEALTH MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 112 REST OF EUROPE: DIGITAL HEALTH MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 113 REST OF EUROPE: DIGITAL HEALTH MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 114 REST OF EUROPE: DIGITAL HEALTH MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 115 REST OF EUROPE: DIGITAL HEALTH MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: DIGITAL HEALTH MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 117 ASIA PACIFIC: DIGITAL HEALTH MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 118 ASIA PACIFIC: DIGITAL HEALTH MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 119 ASIA PACIFIC: DIGITAL HEALTH MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 120 ASIA PACIFIC: DIGITAL HEALTH MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 121 CHINA: DIGITAL HEALTH MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 122 CHINA: DIGITAL HEALTH MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 123 CHINA: DIGITAL HEALTH MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 124 CHINA: DIGITAL HEALTH MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 125 JAPAN: DIGITAL HEALTH MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 126 JAPAN: DIGITAL HEALTH MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 127 JAPAN: DIGITAL HEALTH MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 128 JAPAN: DIGITAL HEALTH MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 129 INDIA: DIGITAL HEALTH MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 130 INDIA: DIGITAL HEALTH MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 131 INDIA: DIGITAL HEALTH MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 132 INDIA: DIGITAL HEALTH MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: DIGITAL HEALTH MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: DIGITAL HEALTH MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 135 REST OF ASIA PACIFIC: DIGITAL HEALTH MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: DIGITAL HEALTH MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 137 LATIN AMERICA: DIGITAL HEALTH MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 138 LATIN AMERICA: DIGITAL HEALTH MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 139 LATIN AMERICA: DIGITAL HEALTH MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 140 LATIN AMERICA: DIGITAL HEALTH MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 141 MIDDLE EAST & AFRICA: DIGITAL HEALTH MARKET, BY OFFERING, 2021–2028 (USD MILLION)

- TABLE 142 MIDDLE EAST & AFRICA: DIGITAL HEALTH MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 143 MIDDLE EAST & AFRICA: DIGITAL HEALTH MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 144 MIDDLE EAST & AFRICA: DIGITAL HEALTH MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 145 COMPANY FOOTPRINT

- TABLE 146 OFFERING FOOTPRINT

- TABLE 147 TECHNOLOGY FOOTPRINT

- TABLE 148 REGION FOOTPRINT

- TABLE 149 STARTUP/SME FOOTPRINT ANALYSIS

- TABLE 150 OFFERING FOOTPRINT

- TABLE 151 TECHNOLOGY FOOTPRINT

- TABLE 152 REGION FOOTPRINT

- TABLE 153 DIGITAL HEALTH MARKET: PRODUCT LAUNCHES, 2020–2023

- TABLE 154 DIGITAL HEALTH MARKET: DEALS, 2020–2023

- TABLE 155 DIGITAL HEALTH MARKET: OTHER DEVELOPMENTS, 2020–2023

- TABLE 156 KONINKLIJKE PHILIPS N.V.: BUSINESS OVERVIEW

- TABLE 157 MEDTRONIC: BUSINESS OVERVIEW

- TABLE 158 GE HEALTHCARE: BUSINESS OVERVIEW

- TABLE 159 ABBOTT: BUSINESS OVERVIEW

- TABLE 160 OMRON CORPORATION: BUSINESS OVERVIEW

- TABLE 161 GOOGLE: BUSINESS OVERVIEW

- TABLE 162 JOHNSON & JOHNSON PRIVATE LIMITED: BUSINESS OVERVIEW

- TABLE 163 SIEMENS HEALTHINEERS AG: BUSINESS OVERVIEW

- TABLE 164 MASIMO: BUSINESS OVERVIEW

- TABLE 165 APPLE, INC.: BUSINESS OVERVIEW

- TABLE 166 MERATIVE: COMPANY OVERVIEW

- TABLE 167 AT&T, INC.: BUSINESS OVERVIEW

- TABLE 168 VERADIGM LLC: BUSINESS OVERVIEW

- TABLE 169 NOOM, INC.: BUSINESS OVERVIEW

- TABLE 170 TELADOC HEALTH, INC.: BUSINESS OVERVIEW

- TABLE 171 OMADA HEALTH INC.: BUSINESS OVERVIEW

- TABLE 172 DEXCOM, INC.: BUSINESS OVERVIEW

- TABLE 173 BIOTRICITY: BUSINESS OVERVIEW

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 PRIMARY SOURCES

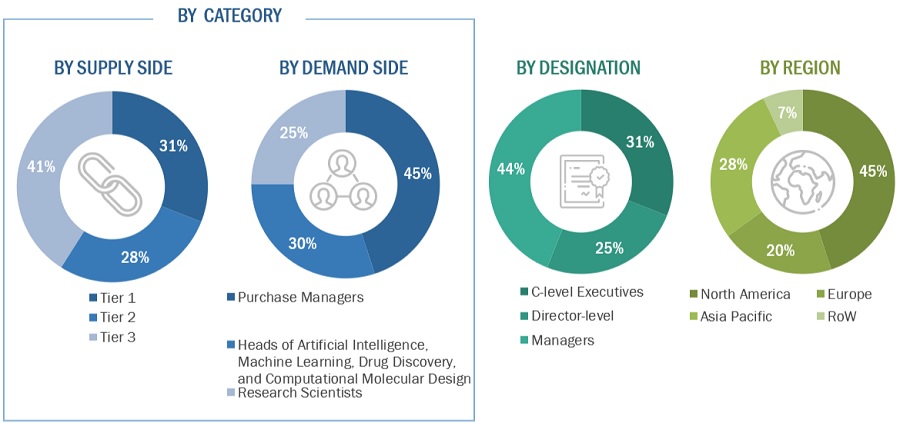

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MARKET SIZE ESTIMATION: DIGITAL HEALTH MARKET

- FIGURE 5 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 6 TOP-DOWN APPROACH

- FIGURE 7 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2023–2028)

- FIGURE 8 DIGITAL HEALTH MARKET: CAGR PROJECTIONS

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 DIGITAL HEALTH MARKET, BY OFFERING, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 DIGITAL HEALTH MARKET, BY TECHNOLOGY, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 DIGITAL HEALTH MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 DIGITAL HEALTH MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 14 GEOGRAPHICAL SNAPSHOT OF DIGITAL HEALTH MARKET

- FIGURE 15 RISING FOCUS ON PATIENT-CENTRIC HEALTHCARE SOLUTIONS TO DRIVE MARKET

- FIGURE 16 TELEHEALTHCARE ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2022

- FIGURE 17 MARKET IN CHINA TO REGISTER HIGHEST GROWTH

- FIGURE 18 MIDDLE EAST & AFRICA TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 19 EMERGING MARKETS TO REGISTER HIGHER GROWTH BETWEEN 2023 & 2028

- FIGURE 20 DIGITAL HEALTH MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 21 SMARTPHONE USERS WORLDWIDE, 2016–2027 (BILLION)

- FIGURE 22 NUMBER OF PARTNERSHIPS WORLDWIDE, JANUARY–SEPTEMBER 2022

- FIGURE 23 GERIATRIC POPULATION, BY REGION, 2010–2030 (% OF TOTAL POPULATION)

- FIGURE 24 HEALTHCARE BREACHES REPORTED TO US DEPARTMENT OF HEALTH AND HUMAN SERVICES IN 2021

- FIGURE 25 DIGITAL HEALTH MARKET: VALUE CHAIN ANALYSIS

- FIGURE 26 DIGITAL HEALTH MARKET: ECOSYSTEM

- FIGURE 27 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

- FIGURE 28 NUMBER OF PATENTS PUBLISHED, JANUARY 2013–OCTOBER 2023

- FIGURE 29 TOP PATENT OWNERS IN DIGITAL HEALTH MARKET, JANUARY 2013–OCTOBER 2023

- FIGURE 30 POPULATION HEALTH MANAGEMENT MARKET OVERVIEW

- FIGURE 31 METAVERSE IN HEALTHCARE MARKET OVERVIEW

- FIGURE 32 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 33 KEY BUYING CRITERIA FOR DIGITAL HEALTH OFFERINGS

- FIGURE 34 NORTH AMERICA: DIGITAL HEALTH MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: DIGITAL HEALTH MARKET SNAPSHOT

- FIGURE 36 KEY DEVELOPMENTS OF MAJOR PLAYERS BETWEEN JANUARY 2020 AND SEPTEMBER 2023

- FIGURE 37 REVENUE ANALYSIS OF KEY PLAYERS IN DIGITAL HEALTH MARKET, 2018–2022 (USD BILLION)

- FIGURE 38 DIGITAL HEALTH MARKET RANKING ANALYSIS OF KEY PLAYERS (2022)

- FIGURE 39 DIGITAL HEALTH MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 40 DIGITAL HEALTH MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 41 KONINKLIJKE PHILIPS N.V.: COMPANY SNAPSHOT (2022)

- FIGURE 42 MEDTRONIC: COMPANY SNAPSHOT (2022)

- FIGURE 43 GE HEALTHCARE: COMPANY SNAPSHOT (2022)

- FIGURE 44 ABBOTT: COMPANY SNAPSHOT (2022)

- FIGURE 45 OMRON CORPORATION: COMPANY SNAPSHOT (2022)

- FIGURE 46 GOOGLE: COMPANY SNAPSHOT (2022)

- FIGURE 47 JOHNSON & JOHNSON PRIVATE LIMITED: COMPANY SNAPSHOT (2022)

- FIGURE 48 SIEMENS HEALTHINEERS AG: COMPANY SNAPSHOT (2022)

- FIGURE 49 MASIMO: COMPANY SNAPSHOT (2022)

- FIGURE 50 APPLE, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 51 AT&T, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 52 VERADIGM LLC: COMPANY SNAPSHOT (2021)

- FIGURE 53 TELADOC HEALTH, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 54 DEXCOM, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 55 BIOTRICITY: COMPANY SNAPSHOT (2022)

This market research study involved the extensive use of secondary sources, directories, and databases to identify and collect information useful for this technical, market-oriented, and financial study of the Digital Health market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and to assess market prospects. The size of the Digital Health market was estimated through various secondary research approaches and triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as WHO, AAAI, EurAI, GCAAI. Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements); business magazines and research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global Digital Health market, which was validated through primary research.

Primary Research

Extensive primary research was conducted after acquiring basic knowledge about the global Digital Health market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (Healthcare Providers – Doctors, Clinicians, ) and supply-side (such as C-level and D-level executives, technology experts, product managers, marketing and sales managers, distributors, and channel partners, among others) across five major regions—North America, Europe, the Asia Pacific, Latin America, Middle East and the Africa. Approximately 70% and 30% of primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

Note 1: Tiers are defined based on the total revenues of companies. As of 2021, Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

Both top-down and bottom-up approaches were used to estimate and validate the total size of the global Digital Health market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The revenue generated from the sale of Digital Health products by leading players has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global digital health market size: top down approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global digital health market size: bottom up approach

Data Triangulation

After arriving at the overall market size, from the market size estimation process explained above, the Digital Health market was split into segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the remote patient monitoring market

Market Definition

The digital health market refers to the use of digital technologies, information, and communication systems to improve and enhance healthcare delivery, patient care, and overall health outcomes. It encompasses a wide range of products and services that leverage technology to address various healthcare needs and challenges.

Key Stakeholders:

- Healthcare providers

- Patients

- Wireless device manufacturers

- Healthcare technology suppliers

- Health IT Companies

- Pharmaceutical Companies

- Telecommunication Companies

- Application developers and app stores

- Medical Device Manufacturers

- Government and Regulatory Bodies

- Healthcare Payers

- Internet identity management, privacy, and security companies

- Sensor, presence, location, and detection solution providers

- Data management and predictive analysis companies

- Health Data Analytics Providers

- Research institutions

Report Objectives

- To define, describe, and forecast the global Digital Health market based on offering, application, technology, end user, and region

- To provide detailed information regarding the major factors (such as drivers, restraints, opportunities, and challenges) influencing the market growth

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall Digital Health market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To strategically analyze the market structure and profile the key players of the Digital Health market and comprehensively analyze their core competencies

- To forecast the size of the market segments with respect to four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (Latin America and the Middle East & Africa)

- To track and analyze competitive developments such as product launches, acquisitions, partnerships, agreements, and collaborations in the Digital Health market during the forecast period

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company information

- Detailed analysis and profiling of additional market players (up to 10)

Growth opportunities and latent adjacency in Digital Health Market