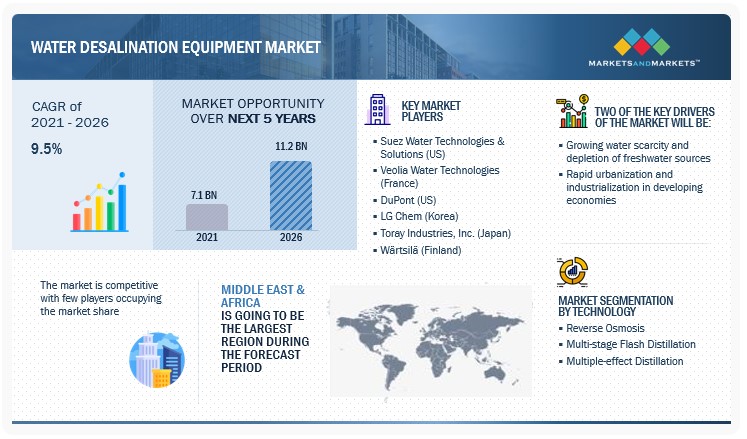

Water Desalination Equipment Market Technology (Reverse Osmosis, Multi-stage Flash Distillation, Multiple-effect Distillation) Application (Municipal, Industrial) Product (Membranes, Pumps, Evaporators), and Region-Global Forecast to 2026

The global water desalination equipment market in terms of revenue was estimated to worth $7.1 billion in 2021 and is poised to reach $11.2 billion by 2026, growing at a CAGR of 9.5 % from 2021 to 2026.

The water scarcity and depletion of freshwater sources across the globe and rapid urbanization and industrialization in developing economies are the major factors driving the growth of water desalination equipment market.

To know about the assumptions considered for the study, Request for Free Sample Report

Water desalination equipment Market Dynamics

Driver: Growing water scarcity and depletion of freshwater sources

Water covers 71% of the earth’s surface, out of which only 3% is fresh water available for drinking and agricultural purposes. Saving water is critical to ensure the long-term supply for consumption and other applications. Approximately 785 million people worldwide lack access to drinking water, and at least 2,000 million people use contaminated drinking water sources, as per UNICEF. According to the United Nations (UN), water consumption has been increasing at 1% annually since the 1980s, and a similar growth trend is expected until 2050, owing to factors such as rapid population growth, socio-economic development, and changing consumption patterns. By 2030, almost half of the world’s population is expected to face water scarcity. Of all freshwater resources, the majority (2.5%) is in the frozen state in the form of icecaps. The number of freshwater resources available directly for human consumption is just 1% of the total. The growing global population and depleting freshwater resources have increased the need for water desalination and, consequently, the demand for water desalination equipment.

Restraint: Scaling and fouling issues associated with RO membranes

A major concern of using RO membranes is the fouling that occurs on the surface of the membrane or its pores. Fouling occurs in both cellulose-based and thin-film composite membranes. There are four types of fouling, namely, biological, colloidal, scaling, and organic. The saturation of salts on the surface of the membrane is the prime reason for scaling in the desalination plants, and fouling reduces the flux and lifespan of the membrane. It can be controlled to some extent by using disinfectants, anti-scaling, and other pre-treatment’s, which add to the cost of operation. It persists and remains a key area for improvement in membrane quality.

Opportunities: Growing adoption of hybrid desalination technologies

Hybrid desalination consists of two or more processes that might include processes from thermal distillation, membrane separation, or both. The hybrid technology provides better water desalination results at a lower cost than a single technology process. It is a combination of thermal and membrane separation processes and provides advantages such as lower post-treatment costs and higher energy efficiencies in terms of consumption per m3 of the water desalinated. Another benefit of the hybrid desalination process is that it helps in reducing the operating and capital costs by delivering better economies of scale. The hybrid desalination process has an attractive long-term perspective as it offers a solution that has high levels of flexibility and operational reliability.

Challenges: Environmental issues pertaining to discharge of dense brine

Brine is generally defined as water with a salt concentration higher than 50 parts per thousand, though some brines can be saltier. As a result of the desalination process, dense brine stream is discharged into the environment, which adversely affects flora and fauna of the region, be it inland or sea. These discharges, when released into inland, increase the salinity of inland soil, affecting the surrounding fauna. The discharge of brine stream into the sea can cause significant damage to the marine ecosystem. Another challenge in the desalination process is related to the impingement of marine organisms that are larger than intake screens.

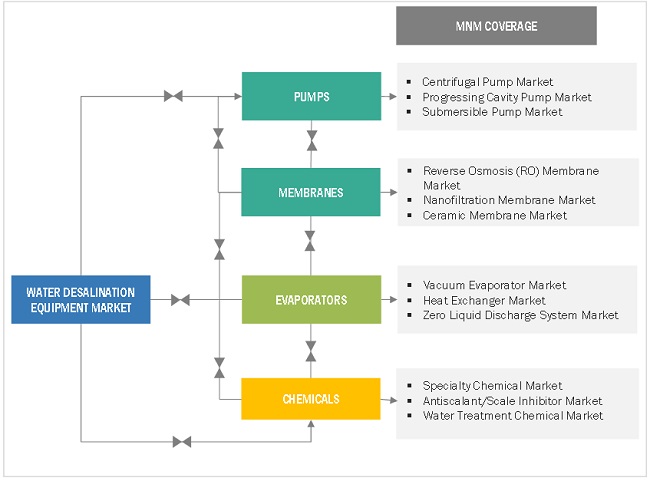

Market Interconnection

During the forecast period, the reverse osmosis segment is found to hold the major share of the water desalination equipment market, by technology

By technology, the water desalination equipment market is segmented into reverse osmosis (RO), multi-stage flash distillation (MSF), multiple-effect distillation (MED), and others. Owing to its properties such as low installation cost, easy processing, ability to treat all types of feed water, and minimal use of chemicals, the demand for reverse osmosis technology is expected to grow at a healthy rate, thus enabling the segment to occupy the largest share of the market. In addition, the segment is also expected to be the fastest growing, during the forecast period.

By application, the municipal segment is expected to be the largest contributor to the water desalination equipment market, during the forecast period

The water desalination equipment market, by application, is segmented into municipal, industrial, and others. The primary factor that leads to the high market share of the municipal segment can be attributed to the constant growth in population and migration of people from rural to urban areas.

The membranes segment is expected to be the fastest-growing market, by product, during the forecast period

The water desalination equipment market, by product, is segmented into membranes, pumps, evaporators, and others, which includes pressure vessels, energy recovery devices, and chemicals. The high growth rate of the membranes segment can be attributed to the characteristic of the membranes to have high permeability to water and impermeability to dissolved salts and particulate matter, which has made them ideal for use in municipal applications.

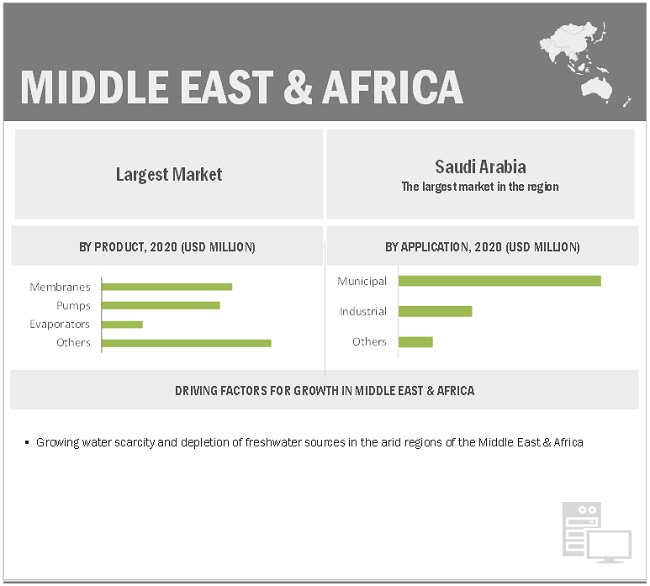

Middle East & Africa is expected to dominate the global water desalination equipment market

The Middle East & Africa region is estimated to be the largest market for the water desalination equipment, followed by APAC. The high market share of the Middle East & Africa region is primarily due to the presence of minimal levels of consumable water, water scarcity, coupled with the high rate of consumable water quality degeneration.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

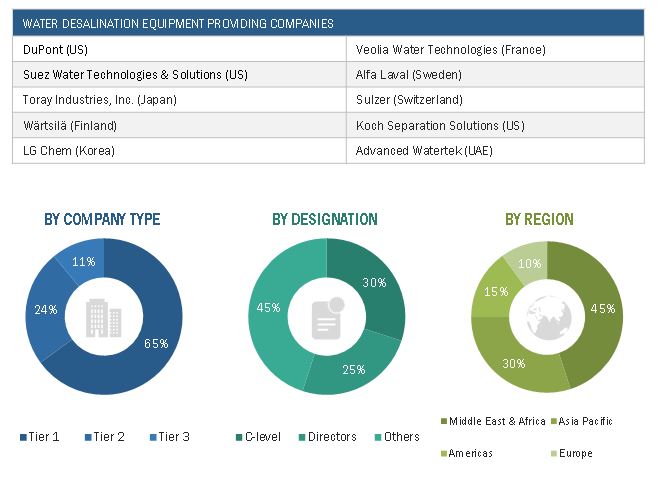

The major players in the water desalination equipment market are Suez Water Technologies & Solutions (US), Veolia Water Technologies (France), DuPont (US), LG Chem (Korea), Toray Industries, Inc. (Japan), Sulzer (Switzerland) and Wärtsilä (Finland). Between 2017 and 2021, the companies adopted growth strategies such as contracts & agreements, investments & expansions, partnerships, collaborations, alliances & joint ventures to capture a larger share of the market.

Want to explore hidden markets that can drive new revenue in Water Desalination Equipment Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Water Desalination Equipment Market?

|

Report Attributes |

Details |

|

Market size value in 2021: |

USD 7.1 Billion |

|

Projected to reach in 2026: |

USD 11.2 Billion |

|

CAGR: |

9.5% |

|

Base Year Considered: |

2020 |

|

Forecast Period: |

2021-2026 |

|

Largest Market: |

Middle East & Africa |

|

Region Covered: |

Americas, Europe, Asia Pacific, Middle East & Africa |

|

Segments Covered: |

Technology, Application, Product, Region |

|

Companies Covered: |

Suez Water Technologies & Solutions (US), Toray Industries, Inc. (Japan), Wärtsilä (Finland), Advanced Watertek (UAE), LG Chem (Korea), Torishima Pump Mfg. Co., Ltd. (Japan), Koch Separation Solutions (US), Veolia Water Technologies (France), Alfa Laval (Sweden), Sulzer (Switzerland), TOYOBO CO., LTD. (Japan), DOW (US), TRIWIN WATERTEC CO., LTD. (Taiwan), Aqua-Chem (US), Pure Aqua, Inc. (US), Danfoss (Denmark), Hatenboer (Netherlands), Thomas Desalination (US), DESMI A/S (Denmark), ANDRITZ (Austria), Rite Water (India), Godrej (India), Metito (UAE), Wetico (Saudi Arabia). |

This research report categorizes the water desalination equipment market by technology, application, product, and region.

On the basis of by technology:

- Reverse Osmosis

- Multi-stage flash Distillation

- Multiple-effect distillation

- Others

On the basis of by application:

- Municipal

- Industrial

- Others

On the basis of by product:

- Membranes

- Pumps

- Evaporators

- Others

On the basis of region:

- Americas

- Europe

- Asia Pacific

- Middle East & Africa

Recent Developments

- In July 2021, DuPont was selected by IDE Water Technologies to provide SWRO membrane elements, including dry SWRO membranes, to the Sorek B desalination plant in Israel. DuPont’s membranes had been selected for this project owing to their versatility and ease of installation.

- In July 2021, Veolia Water Technologies entered into an agreement with 24 new partners to market, sell, and deliver specific Veolia Water Technologies products in the APAC region. The partners, with their local distribution expertise, will aid in expanding the global reach of the company’s products. The countries covered include China, Indonesia, Malaysia, Thailand, Vietnam, Bangladesh, Sri Lanka, and New Zealand.

- In June 2021, Advanced Watertek was awarded the contract to refurbish and upgrade an existing seawater reverse osmosis (SWRO) system located in Fujairah, UAE. The company had replaced the older equipment such as pressure switches, conductivity analyzers, pH analyzers, flow transmitters, and motorized actuated valves with new and upgraded equipment to revamp the old control panel and automate the existing plant.

- In April 2021, LG Chem had partnered up with CaribDA to supply LG Chem’s SWRO membranes for disaster relief, for installation at the coastal communities in the Caribbean Island of St. Vincent. LG Chem’s SWRO membranes aided in the process of production of clean water in the disaster-struck region and helped alleviate the shortage of fresh water supplies.

- In February 2021, TOYOBO CO., LTD. partnered with SWPC, a seawater desalination consultant company, and AJMC, a consolidated subsidiary of TOYOBO CO., LTD. to develop an environmentally friendly water treatment system equipped with a hollow fiber forward osmosis (FO) membrane for desalination plants. This partnership is likely to aid TOYOBO CO., LTD. to achieve strategic growth through the development of new products and technologies in the desalination sector.

Frequently Asked Questions (FAQ):

What is the current size of the water desalination equipment market?

The current market size of global market is USD 6.6 billion in 2020.

What are the major drivers?

The factors driving the growth for water desalination equipment are water scarcity and depletion of freshwater sources across the globe and rapid urbanization and industrialization in developing economies.

Which is the fastest-growing region during the forecasted period?

APAC region is expected to grow at the highest CAGR during the forecast period, driven by activities in China, India, Japan, and Australia.

Which is the fastest growing segment, by technology during the forecasted period?

The reverse osmosis segment is expected to be the largest segment and the fastest growing segment, owing to its low installation cost, easy processing, ability to treat all types of feed water, and minimal use of chemicals. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 25)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 WATER DESALINATION EQUIPMENT MARKET, BY APPLICATION: INCLUSIONS & EXCLUSIONS

1.2.2 MARKET, BY PRODUCT: INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATION

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 1 WATER DESALINATION EQUIPMENT MARKET: RESEARCH DESIGN

2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION METHODOLOGY

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Breakdown of primaries

FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 IDEAL DEMAND SIDE ANALYSIS

2.4.1 DEMAND SIDE METRICES

FIGURE 6 MAIN METRICS CONSIDERED WHILE ASSESSING DEMAND FOR WATER DESALINATION EQUIPMENT

2.4.2 ASSUMPTIONS FOR DEMAND SIDE ANALYSIS

2.5 SUPPLY SIDE ANALYSIS

FIGURE 7 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF MARKET

FIGURE 8 MARKET: SUPPLY SIDE ANALYSIS

2.5.1 CALCULATIONS FOR SUPPLY SIDE

2.5.2 ASSUMPTIONS FOR SUPPLY SIDE

FIGURE 9 COMPANY MARKET SHARE ANALYSIS, 2020

2.6 FORECAST

3 EXECUTIVE SUMMARY (Page No. - 41)

TABLE 1 MARKET: SNAPSHOT

FIGURE 10 REVERSE OSMOSIS SEGMENT TO DOMINATE MARKET, BY TECHNOLOGY, DURING FORECAST PERIOD

FIGURE 11 MUNICIPAL SEGMENT TO DOMINATE MARKET, BY APPLICATION, DURING FORECAST PERIOD

FIGURE 12 MEMBRANES SEGMENT TO HOLD LARGEST SHARE OF MARKET, BY PRODUCT, DURING FORECAST PERIOD

FIGURE 13 MIDDLE EAST & AFRICA DOMINATED MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 46)

4.1 ATTRACTIVE OPPORTUNITIES IN MARKET

FIGURE 14 INCREASING DEMAND FOR HYBRID DESALINATION PROCESSES TO DRIVE GROWTH OF MARKET

4.2 MARKET, BY REGION

FIGURE 15 ASIA PACIFIC TO WITNESS HIGHEST GROWTH IN MARKET DURING FORECAST PERIOD

4.3 MARKET, BY TECHNOLOGY

FIGURE 16 REVERSE OSMOSIS SEGMENT DOMINATED MARKET, BY TECHNOLOGY, IN 2020

4.4 MARKET, BY APPLICATION

FIGURE 17 MUNICIPAL SEGMENT DOMINATED MARKET, BY APPLICATION, IN 2020

4.5 MARKET, BY PRODUCT

FIGURE 18 MEMBRANES SEGMENT DOMINATED MARKET, BY PRODUCT, IN 2020

4.6 MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION AND COUNTRY

FIGURE 19 MUNICIPAL SEGMENT AND SAUDI ARABIA DOMINATED MIDDLE EAST & AFRICA MARKET IN 2020

5 MARKET OVERVIEW (Page No. - 50)

5.1 INTRODUCTION

5.2 COVID-19 HEALTH ASSESSMENT

FIGURE 20 COVID-19 GLOBAL PROPAGATION

FIGURE 21 COVID-19 PROPAGATION IN SELECTED COUNTRIES

5.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 22 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

5.4 MARKET DYNAMICS

FIGURE 23 MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.4.1 DRIVERS

5.4.1.1 Growing water scarcity and depletion of freshwater sources

5.4.1.2 Rapid urbanization and industrialization in developing economies

FIGURE 24 URBAN AND RURAL POPULATION AS PERCENTAGE OF TOTAL POPULATION IN 2020

5.4.2 RESTRAINTS

5.4.2.1 Involvement of high capital and operational expenditures

5.4.2.2 Scaling and fouling issues associated with RO membranes

5.4.3 OPPORTUNITIES

5.4.3.1 Integration of renewable energy sources

FIGURE 25 RENEWABLE ELECTRICITY CAPACITY ADDITIONS, 2007–2021

5.4.3.2 Growing adoption of hybrid desalination technologies

5.4.4 CHALLENGES

5.4.4.1 Environmental issues pertaining to discharge of dense brine

5.5 COVID-19 IMPACT

5.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

5.6.1 REVENUE SHIFT AND NEW REVENUE POCKETS IN MARKET

FIGURE 26 REVENUE SHIFT OF WATER DESALINATION EQUIPMENT PROVIDERS

5.7 PRICING ANALYSIS

TABLE 2 CONSTRUCTION COST OF MEDIUM & LARGE-SCALE SEAWATER REVERSE OSMOSIS PROJECTS

5.8 SUPPLY CHAIN ANALYSIS

FIGURE 27 MARKET: SUPPLY CHAIN ANALYSIS

TABLE 3 MARKET: VALUE CHAIN

5.8.1 RAW MATERIAL SUPPLIERS

5.8.2 WATER DESALINATION EQUIPMENT MANUFACTURERS

5.8.3 ENGINEERING, PROCUREMENT, AND CONSTRUCTION PROVIDERS AND DESALINATION SYSTEM MANUFACTURERS

5.8.4 DISTRIBUTORS

5.8.5 END USERS

5.9 MARKET MAP

FIGURE 28 WATER DESALINATION EQUIPMENT: MARKET MAP

5.10 INNOVATIONS AND PATENT REGISTRATION

5.11 TECHNOLOGY ANALYSIS

5.12 MARKET: REGULATIONS

5.13 PORTER’S FIVE FORCES ANALYSIS

FIGURE 29 MARKET: PORTER’S FIVE FORCES ANALYSIS

TABLE 4 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.13.1 THREAT OF NEW ENTRANTS

5.13.2 BARGAINING POWER OF SUPPLIERS

5.13.3 BARGAINING POWER OF BUYERS

5.13.4 THREAT OF SUBSTITUTES

5.13.5 DEGREE OF COMPETITION

5.14 CASE STUDY ANALYSIS

5.14.1 LG CHEM’S IMPACTFUL SOLUTION TO ADDRESS GROWING WATER DEMAND IN CURAÇAO

6 WATER DESALINATION EQUIPMENT MARKET, BY TECHNOLOGY (Page No. - 68)

6.1 INTRODUCTION

FIGURE 30 MARKET, BY TECHNOLOGY, 2020

TABLE 5 MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

6.2 REVERSE OSMOSIS

6.2.1 LOW INSTALLATION COST AND EASE OF PROCESSING TO DRIVE GROWTH OF REVERSE OSMOSIS TECHNOLOGY SEGMENT

TABLE 6 MARKET FOR REVERSE OSMOSIS, BY REGION, 2019–2026 (USD MILLION)

6.3 MULTI-STAGE FLASH DISTILLATION

6.3.1 INCREASING INVESTMENTS IN WATER TREATMENT SECTOR IN MIDDLE EAST TO BOOST GROWTH OF MULTI-STAGE FLASH DISTILLATION SEGMENT

TABLE 7 MARKET FOR MULTI-STAGE FLASH DISTILLATION, BY REGION, 2019–2026 (USD MILLION)

6.4 MULTIPLE-EFFECT DISTILLATION

6.4.1 HIGH THERMAL EFFICIENCY AND LOW POWER CONSUMPTION TO FUEL DEMAND FOR MULTIPLE-EFFECT DISTILLATION TECHNOLOGY

TABLE 8 MARKET FOR MULTIPLE-EFFECT DISTILLATION, BY REGION, 2019–2026 (USD MILLION)

6.5 OTHERS

TABLE 9 MARKET FOR OTHERS, BY REGION, 2019–2026 (USD MILLION)

7 WATER DESALINATION EQUIPMENT MARKET, BY APPLICATION (Page No. - 73)

7.1 INTRODUCTION

FIGURE 31 MARKET, BY APPLICATION, 2020

TABLE 10 MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

7.2 MUNICIPAL

7.2.1 RAPID URBANIZATION AND DEPLETION OF FRESHWATER RESOURCES TO BOOST GROWTH OF MARKET FOR MUNICIPAL SEGMENT

TABLE 11 MARKET FOR MUNICIPAL, BY REGION, 2019–2026 (USD MILLION)

7.3 INDUSTRIAL

7.3.1 GROWING ADOPTION OF HYBRID DESALINATION TECHNOLOGIES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET

TABLE 12 MARKET FOR INDUSTRIAL, BY REGION, 2019–2026 (USD MILLION)

7.4 OTHERS

TABLE 13 MARKET FOR OTHERS, BY REGION, 2019–2026 (USD MILLION)

8 WATER DESALINATION EQUIPMENT MARKET, BY PRODUCT (Page No. - 77)

8.1 INTRODUCTION

FIGURE 32 MARKET, BY PRODUCT, 2020

TABLE 14 MARKET, BY PRODUCT, 2019–2026 (USD MILLION)

8.2 MEMBRANES

8.2.1 GROWTH IN ADOPTION OF REVERSE OSMOSIS TECHNOLOGY TO FUEL GROWTH OF MARKET

TABLE 15 MARKET FOR MEMBRANES, BY REGION, 2019–2026 (USD MILLION)

8.3 PUMPS

8.3.1 INCREASING INVESTMENTS IN WATER AND WASTEWATER MANAGEMENT INFRASTRUCTURE TO FUEL DEMAND FOR WATER DESALINATION EQUIPMENT

TABLE 16 MARKET FOR PUMPS, BY REGION, 2019–2026 (USD MILLION)

8.4 EVAPORATORS

8.4.1 HIGH ENERGY REQUIREMENT TO BE MAJOR CHALLENGE FOR ADOPTION OF THERMAL DESALINATION TECHNOLOGIES

TABLE 17 MARKET FOR EVAPORATORS, BY REGION, 2019–2026 (USD MILLION)

8.5 OTHERS

TABLE 18 MARKET FOR OTHERS, BY REGION, 2019–2026 (USD MILLION)

9 WATER DESALINATION EQUIPMENT MARKET, BY REGION (Page No. - 82)

9.1 INTRODUCTION

FIGURE 33 REGIONAL SNAPSHOT: ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 34 MARKET, BY REGION, 2020

TABLE 19 MARKET, BY REGION, 2019–2026 (USD MILLION)

9.2 MIDDLE EAST & AFRICA

FIGURE 35 MIDDLE EAST & AFRICA: REGIONAL SNAPSHOT

9.2.1 BY TECHNOLOGY

TABLE 20 MARKET IN MIDDLE EAST & AFRICA, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.2.2 BY APPLICATION

TABLE 21 MARKET IN MIDDLE EAST & AFRICA, BY APPLICATION, 2019–2026 (USD MILLION)

9.2.2.1 Application - By Country

TABLE 22 MUNICIPAL: MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 23 INDUSTRIAL: MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 24 OTHER APPLICATION: MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.3 BY PRODUCT

TABLE 25 MARKET IN MIDDLE EAST & AFRICA, BY PRODUCT, 2019–2026 (USD MILLION)

9.2.3.1 Product - By Country

TABLE 26 MEMBRANES: MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 27 PUMPS: MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 28 EVAPORATORS: MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 29 OTHER PRODUCTS: MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.4 BY COUNTRY

TABLE 30 MARKET IN MIDDLE EAST & AFRICA, BY COUNTRY, 2019–2026 (USD MILLION)

9.2.4.1 UAE

9.2.4.1.1 Government initiatives and new project development to drive growth of market in UAE

TABLE 31 MARKET IN UAE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 32 MARKET IN UAE, BY PRODUCT, 2019–2026 (USD MILLION)

9.2.4.2 Saudi Arabia

9.2.4.2.1 High water consumption rate and population growth to drive growth of market in Saudi Arabia

TABLE 33 MARKET IN SAUDI ARABIA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 34 MARKET IN SAUDI ARABIA, BY PRODUCT, 2019–2026 (USD MILLION)

9.2.4.3 Kuwait

9.2.4.3.1 Scarcity of conventional freshwater sources and depletion of aquifers to drive growth of market in Kuwait

TABLE 35 MARKET IN KUWAIT, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 36 MARKET IN KUWAIT, BY PRODUCT, 2019–2026 (USD MILLION)

9.2.4.4 Rest of Middle East & Africa

TABLE 37 MARKET IN REST OF MIDDLE EAST & AFRICA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 38 MARKET IN REST OF MIDDLE EAST & AFRICA, BY PRODUCT, 2019–2026 (USD MILLION)

9.3 ASIA PACIFIC

FIGURE 36 ASIA PACIFIC: REGIONAL SNAPSHOT

9.3.1 BY TECHNOLOGY

TABLE 39 MARKET IN ASIA PACIFIC, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.3.2 BY APPLICATION

TABLE 40 MARKET IN ASIA PACIFIC, BY APPLICATION, 2019–2026 (USD MILLION)

9.3.2.1 Application - By Country

TABLE 41 MUNICIPAL: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 42 INDUSTRIAL: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 43 OTHER APPLICATION: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.3 BY PRODUCT

TABLE 44 MARKET IN ASIA PACIFIC, BY PRODUCT, 2019–2026 (USD MILLION)

9.3.3.1 Product - By Country

TABLE 45 MEMBRANES: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 46 PUMPS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 47 EVAPORATORS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 48 OTHER PRODUCTS: MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.4 BY COUNTRY

TABLE 49 MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2026 (USD MILLION)

9.3.4.1 China

9.3.4.1.1 Long-term industrial growth and increasing investments in water and wastewater management sector to drive growth of market in China

TABLE 50 MARKET IN CHINA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 51 MARKET IN CHINA, BY PRODUCT, 2019–2026 (USD MILLION)

9.3.4.2 India

9.3.4.2.1 Shrinking water bodies and government initiatives to drive growth of Indian market

TABLE 52 MARKET IN INDIA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 53 MARKET IN INDIA, BY PRODUCT, 2019–2026 (USD MILLION)

9.3.4.3 Japan

9.3.4.3.1 Increasing number of overseas projects to drive growth of market in Japan

TABLE 54 MARKET IN JAPAN, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 55 MARKET IN JAPAN, BY PRODUCT, 2019–2026 (USD MILLION)

9.3.4.4 Australia

9.3.4.4.1 Green energy projects to create lucrative opportunities for market in Australia

TABLE 56 MARKET IN AUSTRALIA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 57 MARKET IN AUSTRALIA, BY PRODUCT, 2019–2026 (USD MILLION)

9.3.4.5 Rest of Asia Pacific

TABLE 58 MARKET IN REST OF ASIA PACIFIC, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 59 MARKET IN REST OF ASIA PACIFIC, BY PRODUCT, 2019–2026 (USD MILLION)

9.4 AMERICAS

9.4.1 BY TECHNOLOGY

TABLE 60 MARKET IN AMERICAS, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.4.2 BY APPLICATION

TABLE 61 MARKET IN AMERICAS, BY APPLICATION, 2019–2026 (USD MILLION)

9.4.2.1 Application - By Country

TABLE 62 MUNICIPAL: MARKET IN AMERICAS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 63 INDUSTRIAL: MARKET IN AMERICAS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 64 OTHER APPLICATION: MARKET IN AMERICAS, BY COUNTRY, 2019–2026 (USD MILLION)

9.4.3 BY PRODUCT

TABLE 65 MARKET IN AMERICAS, BY PRODUCT, 2019–2026 (USD MILLION)

9.4.3.1 Product - By Country

TABLE 66 MEMBRANES: MARKET IN AMERICAS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 67 PUMPS: MARKET IN AMERICAS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 68 EVAPORATORS: MARKET IN AMERICAS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 69 OTHER PRODUCTS: MARKET IN AMERICAS, BY COUNTRY, 2019–2026 (USD MILLION)

9.4.4 BY COUNTRY

TABLE 70 MARKET IN AMERICAS, BY COUNTRY, 2019–2026 (USD MILLION)

9.4.4.1 US

9.4.4.1.1 Growing water scarcity in some parts of US to drive market growth

TABLE 71 MARKET IN US, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 72 MARKET IN US, BY PRODUCT, 2019–2026 (USD MILLION)

9.4.4.2 Canada

9.4.4.2.1 Degrading water sources to drive demand for water desalination equipment in Canada

TABLE 73 MARKET IN CANADA, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 74 MARKET IN CANADA, BY PRODUCT, 2019–2026 (USD MILLION)

9.4.4.3 Brazil

9.4.4.3.1 Concerns related to water crisis to drive growth of Brazil market

TABLE 75 MARKET IN BRAZIL, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 76 MARKET IN BRAZIL, BY PRODUCT, 2019–2026 (USD MILLION)

9.4.4.4 Rest of Americas

TABLE 77 MARKET IN REST OF AMERICAS, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 78 MARKET IN REST OF AMERICAS, BY PRODUCT, 2019–2026 (USD MILLION)

9.5 EUROPE

9.5.1 BY TECHNOLOGY

TABLE 79 MARKET IN EUROPE, BY TECHNOLOGY, 2019–2026 (USD MILLION)

9.5.2 BY APPLICATION

TABLE 80 MARKET IN EUROPE, BY APPLICATION, 2019–2026 (USD MILLION)

9.5.2.1 Application - By Country

TABLE 81 MUNICIPAL: MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 82 INDUSTRIAL: MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 83 OTHER APPLICATION: MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

9.5.3 BY PRODUCT

TABLE 84 MARKET IN EUROPE, BY PRODUCT, 2019–2026 (USD MILLION)

9.5.3.1 Product - By Country

TABLE 85 MEMBRANES: MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 86 PUMPS: MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 87 EVAPORATORS: MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 88 OTHER PRODUCTS: MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

9.5.4 BY COUNTRY

TABLE 89 MARKET IN EUROPE, BY COUNTRY, 2019–2026 (USD MILLION)

9.5.4.1 France

9.5.4.1.1 Domestic and overseas contracts of key market players to drive growth of market in France

TABLE 90 MARKET IN FRANCE, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 91 MARKET IN FRANCE, BY PRODUCT, 2019–2026 (USD MILLION)

9.5.4.2 Germany

9.5.4.2.1 Increasing demand for water in industrial sector to drive growth of market in Germany

TABLE 92 MARKET IN GERMANY, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 93 MARKET IN GERMANY, BY PRODUCT, 2019–2026 (USD MILLION)

9.5.4.3 UK

9.5.4.3.1 Integration of renewable energy sources to create lucrative opportunities for market in UK

TABLE 94 MARKET IN UK, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 95 MARKET IN UK, BY PRODUCT, 2019–2026 (USD MILLION)

9.5.4.4 Spain

9.5.4.4.1 Government initiatives to drive growth of market in Spain

TABLE 96 MARKET IN SPAIN, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 97 MARKET IN SPAIN, BY PRODUCT, 2019–2026 (USD MILLION)

9.5.4.5 Italy

9.5.4.5.1 Increased investments in water infrastructure to drive growth of market in Italy

TABLE 98 MARKET IN ITALY, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 99 MARKET IN ITALY, BY PRODUCT,2019–2026 (USD MILLION)

9.5.4.6 Rest of Europe

TABLE 100 MARKET IN REST OF EUROPE,BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 101 MARKET IN REST OF EUROPE,BY PRODUCT, 2019–2026 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 126)

10.1 OVERVIEW

FIGURE 37 KEY DEVELOPMENTS IN MARKET,2017 TO 2021

10.2 SHARE ANALYSIS OF KEY PLAYERS, 2020

TABLE 102 MARKET: DEGREE OF COMPETITION

FIGURE 38 SHARE ANALYSIS OF TOP PLAYERS IN MARKET, 2020

10.3 MARKET EVALUATION FRAMEWORK

TABLE 103 MARKET EVALUATION FRAMEWORK, 2017–2021

10.4 REVENUE ANALYSIS OF TOP 7 MARKET PLAYERS

FIGURE 39 TOP PLAYERS DOMINATED MARKET IN LAST 5 YEARS

10.5 RECENT DEVELOPMENTS

10.5.1 DEALS

10.5.1.1 Market: Deals,January 2021– July 2021

10.5.2 OTHERS

10.5.2.1 Market: Others,November 2019– July 2021

10.6 COMPETITIVE LEADERSHIP MAPPING

10.6.1 STAR

10.6.2 EMERGING LEADER

10.6.3 PERVASIVE

10.6.4 PARTICIPANT

FIGURE 40 MARKET: COMPETITIVE LEADERSHIP MAPPING, 2020

TABLE 104 COMPANY TECHNOLOGY FOOTPRINT

TABLE 105 COMPANY REGION FOOTPRINT

11 COMPANY PROFILES (Page No. - 138)

11.1 KEY COMPANIES

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

11.1.1 SUEZ WATER TECHNOLOGIES & SOLUTIONS

TABLE 106 SUEZ WATER TECHNOLOGIES & SOLUTIONS: BUSINESS OVERVIEW

FIGURE 41 SUEZ WATER TECHNOLOGIES & SOLUTIONS: COMPANY SNAPSHOT

TABLE 107 SUEZ WATER TECHNOLOGIES & SOLUTIONS: DEALS

11.1.2 DUPONT

TABLE 108 DUPONT: BUSINESS OVERVIEW

FIGURE 42 DUPONT: COMPANY SNAPSHOT

TABLE 109 DUPONT: DEALS

TABLE 110 DUPONT: OTHERS

11.1.3 LG CHEM

TABLE 111 LG CHEM: BUSINESS OVERVIEW

FIGURE 43 LG CHEM: COMPANY SNAPSHOT

TABLE 112 LG CHEM: DEALS

11.1.4 TORAY INDUSTRIES, INC.

TABLE 113 TORAY INDUSTRIES, INC.: BUSINESS OVERVIEW

FIGURE 44 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

TABLE 114 TORAY INDUSTRIES, INC.: DEALS

TABLE 115 TORAY INDUSTRIES, INC.: OTHERS

11.1.5 WÄRTSILÄ COMPANY

TABLE 116 WÄRTSILÄ: BUSINESS OVERVIEW

FIGURE 45 WÄRTSILÄ: COMPANY SNAPSHOT

TABLE 117 WÄRTSILÄ: DEALS

TABLE 118 WÄRTSILÄ: OTHERS

11.1.6 ALFA LAVAL

TABLE 119 ALFA LAVAL: BUSINESS OVERVIEW

FIGURE 46 ALFA LAVAL: COMPANY SNAPSHOT

TABLE 120 ALFA LAVAL: OTHERS

11.1.7 ANDRITZ

TABLE 121 ANDRITZ: BUSINESS OVERVIEW

FIGURE 47 ANDRITZ: COMPANY SNAPSHOT

11.1.8 TOYOBO CO., LTD.

TABLE 122 TOYOBO CO., LTD.: BUSINESS OVERVIEW

FIGURE 48 TOYOBO CO., LTD.: COMPANY SNAPSHOT

TABLE 123 TOYOBO CO., LTD.: DEALS

11.1.9 ADVANCED WATERTEK

TABLE 124 ADVANCED WATERTEK: BUSINESS OVERVIEW

TABLE 125 ADVANCED WATERTEK: DEALS

TABLE 126 ADVANCED WATERTEK: OTHERS

11.1.10 DANFOSS

TABLE 127 DANFOSS: BUSINESS OVERVIEW

11.1.11 SULZER

TABLE 128 SULZER: BUSINESS OVERVIEW

FIGURE 49 SULZER: COMPANY SNAPSHOT

TABLE 129 SULZER: DEALS

11.1.12 TRIWIN WATERTEC CO., LTD.

TABLE 130 TRIWIN WATERTEC CO., LTD. BUSINESS OVERVIEW

11.1.13 VEOLIA WATER TECHNOLOGIES

TABLE 131 VEOLIA WATER TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 50 VEOLIA WATER TECHNOLOGIES: COMPANY SNAPSHOT

TABLE 132 VEOLIA WATER TECHNOLOGIES: DEALS

TABLE 133 VEOLIA WATER TECHNOLOGIES: OTHERS

11.1.14 KOCH SEPARATION SOLUTIONS

TABLE 134 KOCH SEPARATION SOLUTIONS: BUSINESS OVERVIEW

TABLE 135 KOCH SEPARATION SOLUTIONS: OTHERS

11.1.15 DOW

TABLE 136 DOW: BUSINESS OVERVIEW

FIGURE 51 DOW: COMPANY SNAPSHOT

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

11.2 OTHER PLAYERS

11.2.1 TORISHIMA PUMP MFG. CO., LTD.

11.2.2 GODREJ

11.2.3 HATENBOER

11.2.4 DESMI A/S

11.2.5 PURE AQUA, INC.

12 APPENDIX (Page No. - 182)

12.1 INSIGHTS OF INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the water desalination equipment market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and market sizing with industry experts across the value chain through rigorous primary research. Both top-down and bottom-up approaches were used to estimate the total market size. The market breakdown and data triangulation techniques were employed to estimate the market size of the segments and the corresponding subsegments.

Secondary Research

This research study involved the use of extensive secondary sources, directories, and databases such as water and wastewater management data, industry publications, several newspaper articles, Statista Industry Journal, Factiva, and water & environment journal to identify and collect information useful for a technical, market-oriented, and commercial study of the water desalination equipment market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The water desalination equipment market comprises several stakeholders such as companies related to the industry, consulting companies in the water & wastewater management sector, water & wastewater management companies, government & research organizations, organizations, forums, alliances & associations, water desalination equipment providers, state & national energy authorities, dealers & suppliers, and vendors. The demand side of the market is characterized by increased investment in the water & wastewater management sector. The supply side is characterized by investments & expansion and partnerships & collaborations among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is given below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the global water desalination equipment market and its dependent submarkets. These methods were also extensively used to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market shares in the respective regions have been determined through both primary and secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Global Water desalination equipment Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the water desalination equipment market.

Objectives of the Study

- To define and describe the water desalination equipment market based on technology, application, product, and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To strategically analyze each segment/subsegment of the market with respect to individual growth trends, future expansions, and their contributions to the market

- To analyze growth opportunities for stakeholders and the competitive landscape for market leaders

- To forecast the growth of the market with respect to five main regions—the Americas, Europe, Asia Pacific, and the Middle East & Africa.

- To strategically profile key players and comprehensively analyze their respective market shares and core competencies1

- To analyze competitive developments such as investments & expansions, mergers & acquisitions, product launches, contracts & agreements, and joint ventures & collaborations in the water desalination equipment market

Multi-effect evaporators & Its impact on Water Desalination Equipment Market

Multi-effect evaporators play an important role in the water desalination equipment market. The process of removing salt and other minerals from seawater or brackish water to make it suitable for human consumption or industrial use is known as desalination. Thermal desalination, one of the two main types of desalination processes, employs multi-effect evaporators.

Seawater is heated to produce steam, which is then condensed to produce fresh water in the thermal desalination process. Multi-effect evaporators are used to heat seawater and evaporate it, concentrating the salt and other minerals. The concentrated saltwater is then routed to the next evaporator in the series, where it is heated and evaporated again, and so on. This process is repeated several times in a series of evaporators, with the steam produced in each stage used to heat the seawater in the following stage.

Multi-effect evaporators have several advantages in the desalination process, including high energy efficiency, low operational costs, and the ability to produce large amounts of fresh water. As a result, there is an increasing demand for multi-effect evaporators in the water desalination equipment market, particularly in countries where water scarcity is a major issue.

By extending the reach of multi-effect evaporators services, companies are also creating new business opportunities. Companies are using these services to create new products and services and to drive their bottom line.

- Improved Energy Efficiency: Multi-effect evaporators offer higher energy efficiency compared to other desalination processes.

- Increased Production Capacity: Multi-effect evaporators are capable of producing a large volume of fresh water from seawater or brackish water.

- Lower Capital Costs: While the initial capital cost of multi-effect evaporators can be higher compared to other desalination technologies, the lower operating costs over the long term can offset the higher initial capital investment.

- Favourable Environmental Impact: The use of multi-effect evaporators in the desalination process has a favourable environmental impact.

The top players in the multi-effect evaporators market GEA Group AG, Veolia Environnement S.A., Suez SA, Alfa Laval AB, SPX Flow, Inc., IDE Technologies.

Some of the key industries that are going to get impacted because of the growth of multi-effect evaporators are,

1. Chemical Industry: Multi-effect evaporators can be used for concentrating and purifying chemicals in the chemical industry.

2. Pharmaceutical Industry: Multi-effect evaporators can be used for the concentration and purification of pharmaceutical products, such as antibiotics and vaccines.

3. Food and Beverage Industry: Multi-effect evaporators can be used for the concentration and evaporation of food and beverage products, such as milk, fruit juices, and coffee extracts.

4. Pulp and Paper Industry: Multi-effect evaporators can be used for the concentration of black liquor in the pulp and paper industry.

5. Textile Industry: Multi-effect evaporators can be used for the concentration and recovery of dyes and other chemicals in the textile industry.

To speak to our analyst today to know more about, multi-effect evaporators market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to your specific needs. The following customization options are available for the report:

Company Information

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Water Desalination Equipment Market

Report coverage is primarily a demand-based study, which has a combination of qualitative and quantitative statistics that will assist in understanding the historic, current, and future market size for Water Desalination Equipment at the regional and country level, which is further broken down by, 1) Technology (Reverse Osmosis, Multi-stage Flash Distillation, Multiple-effect Distillation) 2) Application (Municipal, Industrial) 3) Product (Membranes, Pumps, Evaporators) 4) Regions (Americas, Europe, Asia Pacific, Middle East & Africa [with market size for their key countries]). There are few more points that may help to understand further market scenario: A) Market Estimates, CAGRs and Forecasts. B) Rising demand in the Emerging Markets. C) Opportunity analysis in the market for key stakeholders by identification of high growth segments. D) Trend analysis and study of drivers and restraints that will affect the global landscape. E) Key playing fields and burning issues in the sector. F) Market share, contracts & developments, strategies, and product innovations of key companies/players. G) Competition mapping

Interested in finding out the available customizations by company information of water desalination equipment market for the next five year.