Decanters Centrifuges Market by Type (Two-Phase Centrifuge, Three-Phase Centrifuge), Application (Chemical, Oil & Gas, Energy, Petrochemical, Pharmaceutical, Wastewater Treatment, Food & Beverage), Design Type, & Region - Global Forecast 2028

Decanters Centrifuges Market

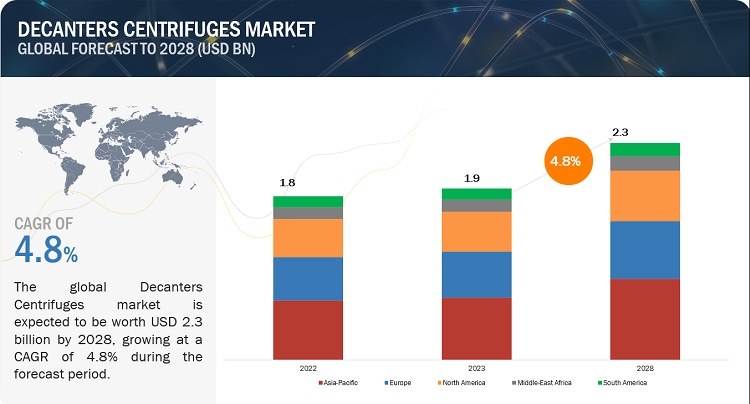

The global decanters centrifuges market is valued at USD 1.9 billion in 2023 and is projected to reach USD 2.3 billion by 2028, growing at 4.8% cagr during the forecast period. The chemical is one of the major applications of the Decanters Centrifuges and offers market growth opportunities. The two-phase Decanters Centrifuges by type segment is experiencing high growth rates in emerging regions such as Asia Pacific and Europe.

Attractive Opportunities in the Decanters Centrifuges Market

To know about the assumptions considered for the study, Request for Free Sample Report

Decanters Centrifuges Market Dynamics

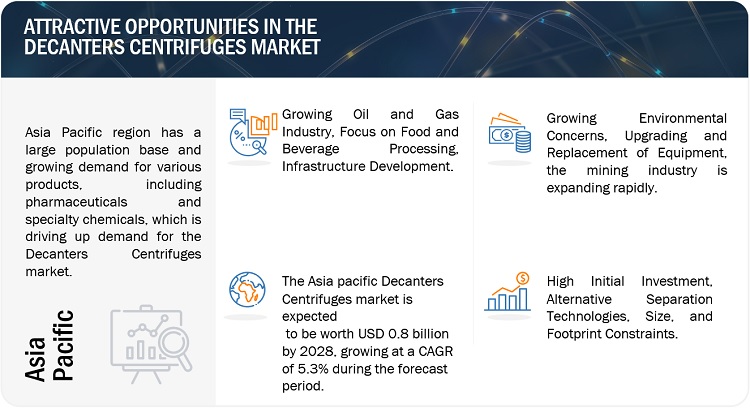

Driver: Increasing demand for solid-liquid separation

The increasing demand for solid-liquid separation is expected to drive the market in the Decanters Centrifuges centrifuge industry. Decanters Centrifuges centrifuges are widely used in various industries, including wastewater treatment, chemical processing, food and beverage, pharmaceuticals, and mining, for the effective separation of solids from liquids. The growing need for efficient separation processes, stringent environmental regulations, and the need to optimize industrial operations are key factors contributing to the rising demand for Decanters Centrifuges centrifuges.

Restraint: High initial investment can restrict the market

The high initial investment required for Decanters Centrifuges centrifuges can act as a restraint on market growth. Decanters Centrifuges centrifuges are sophisticated and complex machines that require substantial capital investment for procurement and installation. The high costs are primarily attributed to factors such as the advanced technology employed in Decanters Centrifuges centrifuges, the quality of materials used in their construction, and the customization required to meet specific industry needs. The significant upfront investment can pose a challenge, particularly for small and medium-sized enterprises (SMEs) with limited financial resources. SMEs may find it difficult to allocate a large portion of their budget toward acquiring Decanters Centrifuges centrifuges, which can hinder their ability to adopt this technology for solid-liquid separation.

Opportunities: Growing demand for water and wastewater treatment

The increasing demand for water and wastewater treatment presents a significant opportunity for the Decanters Centrifuges centrifuge market. As the global population continues to grow and urbanize, the need for effective water and wastewater management becomes paramount. Decanters Centrifuges centrifuges play a crucial role in the separation and dewatering of solids from wastewater, enabling the efficient treatment and disposal of effluent. This demand is further fueled by stringent environmental regulations that require industries to meet strict water quality standards. As governments and industries prioritize water conservation and environmental sustainability, the demand for Decanters Centrifuges centrifuges is expected to continue its upward trajectory, providing ample opportunities for market growth in the coming years.

Challenges: International trade barriers pose substantial challenges

International trade barriers pose substantial challenges for the Decanters Centrifuges centrifuge market. These barriers, including tariffs, quotas, and technical regulations, increase costs, limit market access, disrupt supply chains, create competitive disadvantages, and introduce uncertainty. Higher import costs and complex compliance requirements can impede market growth, hinder manufacturers' expansion into new markets, and disrupt global supply chains. Moreover, domestic manufacturers may face a competitive disadvantage compared to foreign counterparts with fewer trade barriers or government support. The volatile and uncertain business environment resulting from trade barriers further hampers long-term investments and planning.

Decanters Centrifuges Market Ecosystem

Manufacturers of decanters centrifuges who are well-known in the industry and have a secure financial situation. These businesses have a long history in the industry, a wide range of products, and effective international sales and marketing networks.. Prominent companies in this market include GEA (Germany), Flottweg SE (Germany), Pieralisi (Italy), Alfa Laval (Sweden), ANDRITZ (Austria), SLB (US), IHI ROTATING MACHINERY ENGINEERING CO LTD (Japan), Mitsubishi Kakoki Kaisha, Ltd (Japan), Tomoe Engineering Co Ltd (Japan), Flsmidth (Denmark).

The Horizontal segment, by design type, is expected to be the largest market during the forecast period

Based on the design type, With the horizontal type of the market, Decanters Centrifuges centrifuge manufacturers can target a larger customer base across different industries. This expands their market potential and allows them to cater to a broader range of customer needs, horizontal Decanters Centrifuges centrifuges offer flexibility in terms of processing various types of materials, including liquids with high solids content, slurries, and viscous substances. Their horizontal design allows for continuous operation and efficient separation across different applications and industries. This flexibility makes them suitable for a wide range of customer needs and contributes to a larger market size.

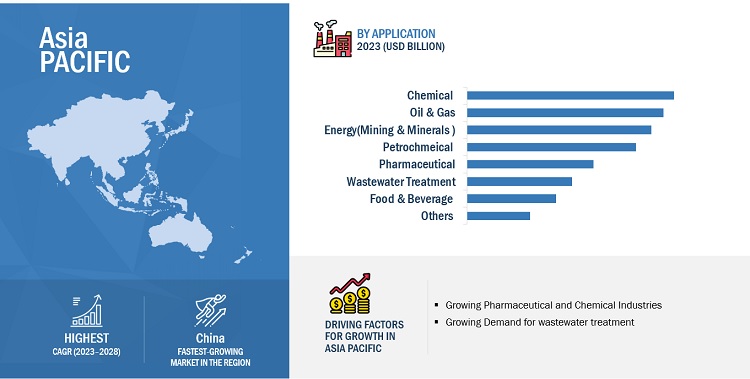

Based on application, the chemical segment accounts for the largest share of the overall market.

Based on application, The chemical industry is one of the largest manufacturing sectors globally, producing a vast array of chemicals used in various industries. The volume and variety of chemical production contribute to a significant demand for Decanters Centrifuges centrifuges. These machines are used in processes such as chemical synthesis, wastewater treatment, pigment and dye production, and the production of specialty chemicals. chemical industry often deals with hazardous or toxic materials that require careful handling and disposal. Decanters Centrifuges centrifuges provide a safe and effective means of separating and removing solid contaminants from chemical waste streams, thereby minimizing environmental impact.

Asia Pacific is expected to account for the largest share of the global market during the forecast period.

Based on the region, the Asia Pacific region is experiencing the largest market share in the Decanters Centrifuges market due to the region has been witnessing significant economic growth and industrial development in countries such as China, India, Japan, South Korea, and Singapore. Asia Pacific region is home to a large number of pharmaceutical, chemical, and petrochemical companies, which are major consumers of Decanters Centrifuges systems.

To know about the assumptions considered for the study, download the pdf brochure

Decanters Centrifuges Market Players

The Decanters Centrifuges market is dominated by a few major players that have a wide regional presence. The key players in the Decanters Centrifuges industry are GEA (Germany), Flottweg SE (Germany), Pieralisi (Italy), Alfa Laval (Sweden), ANDRITZ (Austria), SLB (US), IHI ROTATING MACHINERY ENGINEERING CO LTD (Japan), Mitsubishi Kakoki Kaisha, Ltd (Japan), Tomoe Engineering Co Ltd (Japan), Flsmidth (Denmark). In the last few years, the companies have adopted growth strategies such as acquisitions, new product launches, partnerships, contracts, and agreements to capture a larger share of the Decanters Centrifuges market.

Read More: Decanters Centrifuges Companies

Decanters Centrifuges Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 1.9 billion |

|

Revenue Forecast in 2028 |

USD 2.3 billion |

|

CAGR |

4.8% |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million/Billion) |

|

Segments |

Type, Design type, Application, and Region. |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

GEA (Germany), Flottweg SE (Germany), Pieralisi (Italy), Alfa Laval (Sweden), ANDRITZ (Austria), SLB (US), IHI ROTATING MACHINERY ENGINEERING CO LTD (Japan), Mitsubishi Kakoki Kaisha, Ltd (Japan), Tomoe Engineering Co Ltd (Japan), Flsmidth (Denmark). |

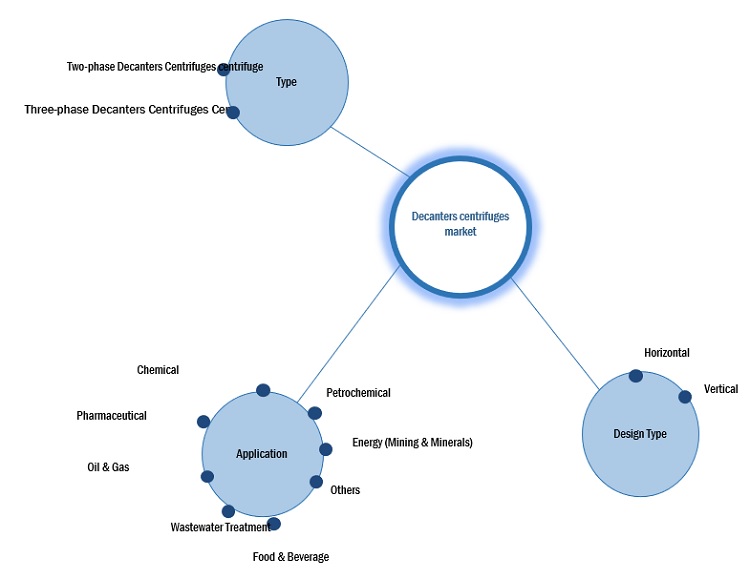

This report categorizes the global decanters centrifuges market based on type, design type, application, and region.

Based on By Type, the decanters centrifuges market has been segmented as follows:

- Two-phase centrifuge

- Three-phase centrifuge

Based on By Design type, the decanters centrifuges market industry has been segmented as follows:

- Horizontal

- Vertical

Based on Application, the decanters centrifuges market has been segmented as follows:

- Chemical

- Oil & Gas

- Energy (Mining & Minerals)

- Petrochemical

- Pharmaceutical

- Wastewater Treatment

- Food & Beverage

- Others

Based on the Region, the decanters centrifuges market has been segmented as follows:

- North America

- Asia Pacific

- Europe

- Middle East & Africa

- South America

Recent Developments

- Oct 2021 DealITC Paperboards and Specialty Papers Division in Bhadrachalam, India, receives two GEA CF 8000 Decanters Centrifuges. The GEA Decanters Centrifuges will aid in the modernization and expansion of ITC.

- Oct 2021 Deal MEGGLE has received two new Flottweg Decanters Centrifuges centrifuges for casein production from Flottweg. MEGGLE has already used Flottweg separation technology for a variety of uses, including lactose extraction.

- August 2022 Partnership SPX FLOW, Inc., a leading provider of process solutions for the industrial, nutrition, and healthcare markets, has announced a new collaboration with Flottweg. Collaboration between SPX FLOW and Flottweg Decanters Centrifuges brings together expertise and innovation.

- Nov 2022 Deal Wien Energie is one of the main regional energy suppliers in Austria. Flottweg supplied Wien Energie with 12 Xelletor Decanters Centrifuges centrifuges for dewatering sewage sludge from the adjacent main sewage treatment plant.

- September 2022 Deal To dewater sludge, Flottweg Peru has a high-performance Z92 Decanters Centrifuges installed in Mining company Andalucita.

- April 2023 Partnership Flottweg, is a German company, is widely regarded as a world leader in separation technology. Rhames Ltd will be the UK's agent for all Flottweg's industry-leading equipment, comprising new machines and spare parts.

Frequently Asked Questions (FAQ):

What is the current size of the Decanters Centrifuges market?

The current market size of the global Decanters Centrifuges market is 1.9 Billion in 2023.

What are the major drivers for the Decanters Centrifuges market?

Increasing Demand for Solid-Liquid Separation, Expansion of Water Treatment Facilities.

Which is the fastest-growing region during the forecasted period in the Decanters Centrifuges market?

Europe is expected to be the fastest-growing region for the global Decanters Centrifuges market between 2023–2028. Europe also has a well-established regulatory framework that supports innovation and the adoption of new technologies in the pharmaceutical and chemical industries.

Which is the fastest-growing segment, by type during the forecasted period in the Decanters Centrifuges market?

By type, the Decanters Centrifuges market has been segmented into the two-phase Decanters Centrifuges centrifuge segment and is anticipated to be the fastest-growing Decanters Centrifuges market segment by type during the forecast period.

Which is the fastest growing segment by design type method during the forecasted period in the Decanters Centrifuges market?

By design type, the Horizontal segment is anticipated to be the fastest growing in the Decanters Centrifuges market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the market size of the Decanters Centrifuges market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The Decanters Centrifuges market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the Decanters Centrifuges industry have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the Decanters Centrifuges industry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to Decanters Centrifuges by type, design type, applications, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Decanters Centrifuges and future outlook of their business which will affect the overall market.

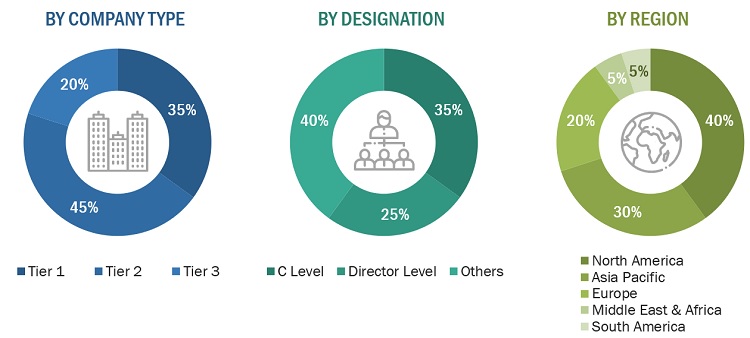

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

GEA (Germany) |

Regional Head |

|

Flottweg SE (Germany) |

Sales Manager |

|

Pieralisi (Italy) |

Director |

|

Alfa Laval (Sweden) |

Marketing Manager |

|

ANDRITZ (Austria), |

R&D Manager |

Market Size Estimation

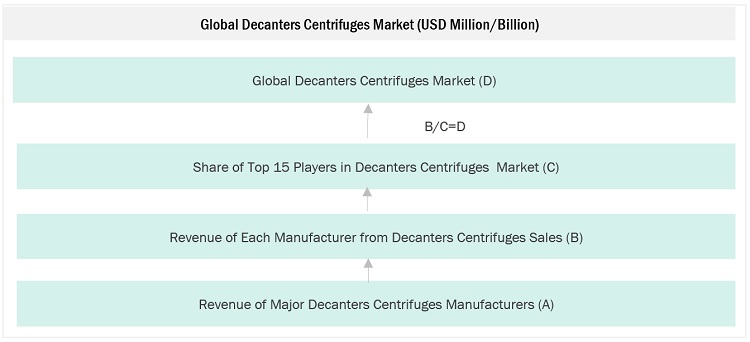

The top-down and bottom-up approaches have been used to estimate and validate the size of the Decanters Centrifuges market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Decanters Centrifuges Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Decanters Centrifuges Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The Decanters Centrifuges market refers to the global industry that encompasses the manufacturing, distribution, and sale of Decanters Centrifuges centrifuge equipment used for the efficient separation of solid particles from liquid streams in various industries such as wastewater treatment, chemical processing, food and beverage, pharmaceuticals, mining, and oil and gas. It is segmented into by type, design type, application, and region.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define and describe the Decanters Centrifuges market based on type, design type, and application, in terms of value.

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To estimate the market size in terms of value.

- To strategically analyze micromarkets1 with respect to individual growth trends, future expansions, and their contributions to the overall Decanters Centrifuges market.

- To provide post-pandemic estimation for the Decanters Centrifuges market and analyze the impact of the pandemic on market growth.

- To analyze market opportunities for stakeholders and the competitive landscape for market leaders.

- To forecast the growth of the Decanters Centrifuges market with respect to five key regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their key countries.

- To strategically profile the key players and comprehensively analyze their core competencies2.

- To analyze competitive developments, such as investments & expansions, mergers & acquisitions, product launches, contracts & agreements, and joint ventures & collaborations in the Decanters Centrifuges market

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Decanters Centrifuges Market