Data Loss Prevention Market by Offering (Solution, Services), Solution Type (Network DLP, Storage DLP, Endpoint DLP, Cloud DLP), Service (Consulting, Managed Security Service), Applications, Vertical and Regions - Global Forecast to 2028

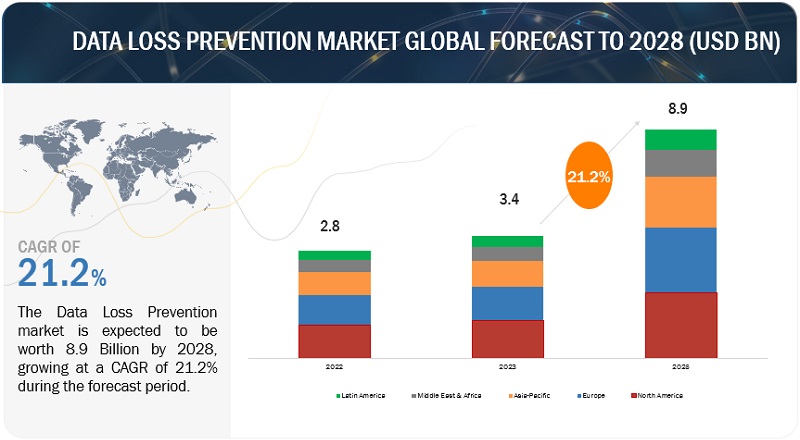

The Data Loss Prevention Market size accounted for USD 3.4 Billion in 2023 and is estimated to achieve a market size of USD 8.9 Billion by 2028 growing at a CAGR of 21.2% from 2023 to 2028. The high rate of Internet penetration and increasing dependency on it for communication has gained the attention of criminals and hackers. Thus, there has been a surge in cases of data breaches. To mitigate these risks, the DLP vendors have started offering DLP as part of a more broadly constituted portfolio of products. The DLP market is thus expected to experience significant growth over the coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Data Loss Prevention Market Growth Dynamics

Driver: Shifting of data to public and private cloud by enterprises.

In this current era, there has been tremendous growth in the number of enterprises shifting their information from on-premises to the cloud, aiming to reduce costs and improve the efficiency of their organization. The enterprise uses public and private cloud opportunities such as Office 365, Box, and Amazon Web Services to enhance operational agility and mobile workforce productivity, lowering costs. This is due to the increase in digital content across the globe, which is creating the need to manage the constantly growing data files. Moreover, the data growth is highly costly in terms of storage capacity due to the high demand for power, management overheads, and cooling capacity in the physical data center. But as the information moves from in-house to cloud, it highlights security, privacy, and compliance concerns.

Restraint: Complex rules and doesn’t guarantee preventio

The proliferation of BYOD and cloud services has made organizations more porous and vulnerable. Sharing data and collaboration has become a must in today’s world of mobility and globalization. The challenge is that some documents must be shared, and some must be confined within the organization’s boundaries. The biggest threat is from insiders, and it has become challenging for any IT professional to define a policy that accurately describes the enterprise requirements without generating an unreasonable amount of “false positives.” Most organizations cannot afford a large team to configure and maintain the complex rules in a typical DLP deployment. Instead, companies fall back to a few basic, intrusive rules (e.g., “block all USB devices” and “no usage of Facebook”). As a result, many DLP deployments fail or never get started seriously.

Opportunity: Increased remote workforce security

As organizations increasingly embrace flexible work arrangements, the DLP market has many opportunities to enhance remote workforce security. Solutions that cater to endpoint security, cloud-based protection, and seamless integration with collaboration tools are in high demand. AI and machine learning-powered DLP systems promise real-time threat detection and policy enforcement. Additionally, focusing on user education, mobile device security, and adherence to zero trust principles is crucial. Compliance and reporting capabilities and managed DLP services provide holistic solutions to address the intricacies of data protection in remote work environments. Customization and flexibility are key considerations, allowing organizations to tailor DLP policies to their needs. Finally, robust incident response and remediation features round out the portfolio of opportunities in this dynamic and ever-evolving market.

Challenge: Deployment challenges

Data breaches are one of the biggest concerns for enterprises nowadays, and at times, data loss is mainly contributed by employees. Hence, enterprises turn toward DLP solutions to prevent data loss, but the enterprises need help with the deployment of DLP solutions. The enterprises first need to identify the data they plan to protect under DLP as the data remains at different levels, i.e., data in motion, data at rest, and data at endpoint, which can pose a significant challenge to the enterprise. Moreover, the enterprises need to formulate internal policies in line with the DLP framework but need more experience and a trained workforce that may be responsible for building the policies. The enterprises must also spend considerable time and money on training, workshops, and seminars to overcome these issues. Other factors, such as underestimated deployment costs and time, ignorance of legal framework, and regulation, may affect the deployment of DLP solutions.

Data Loss Prevention market Ecosystem

Prominent companies in this market include a well-established, financially stable provider of the Data Loss Prevention market. These companies have innovated their offerings and possess a diversified product portfolio, state-of-the-art technologies, and marketing networks. Prominent companies in this market include Broadcom (US), IBM (US), Microsoft (US), Trend Micro (Japan), McAfee (US), Palo Alto Networks (US), GTB Technologies (US), InfoWatch (Russia), Fortra (US), Cisco Systems (US), etc.

By service, the Managed Security Service segment is expected to grow with the highest CAGR during the forecast period

The increased complexity of threats and attacks and the emergence of sophisticated cyber criminals force companies to upgrade their security systems consistently. As a result, companies are rapidly outsourcing their network security concerns to specialized service providers known as mobile security service providers. Mobile security service offerings exist in many forms, from pure system management to sophisticated log analysis, from on-premises device monitoring and management services to SaaS and cloud services. The global mobile security service market is highly fragmented and comprises players from diverse backgrounds, ranging from specialized mobile security service providers to telecommunication companies, system integrators, and VARs.

Based on region, Asia Pacific is expected to grow with the highest CAGR during the forecast period

Due to the ever-growing threat landscape, the Asia Pacific region is highly concerned with increasing security spending. This region, which includes emerging economies such as China, India, Australia, Hong Kong, and Japan, has many small and medium-sized businesses (SMBs) providing significant employment opportunities. However, the high cost of cybersecurity projects prevents many SMBs from implementing strong security practices, making them more vulnerable to cyberattacks. Countries such as Japan, China, and Singapore have launched new national cybersecurity policies to address the sophisticated cyber threats. Organizations in the Asia Pacific region are spending significant resources to deal with cybersecurity breaches. Australia and Malaysia are currently better positioned than other countries to face cybersecurity challenges.

Market Players:

The major players in the Data Loss Prevention market are Broadcom (US), IBM (US), Microsoft (US), Trend Micro (Japan), McAfee (US), Palo Alto Networks (US), GTB Technologies (US), InfoWatch (Russia), Fortra (US), Cisco Systems (US), etc. These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches, enhancements, and acquisitions to expand their footprint in the Data Loss Prevention market.

Want to explore hidden markets that can drive new revenue in Data Loss Prevention Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Data Loss Prevention Market?

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

Data Loss Prevention Market by Offering (Solution, Services), Solution Type (Network DLP, Storage DLP, Endpoint DLP, Cloud DLP), Service(Consulting, System Integration and Installation, Managed Security Service, Education and Training, Risk and Threat Assessment) Applications(Encryption, Centralized Management, Policy, Standards, and Procedures, Web and Email Protection, Cloud Storage, Incident Response and Workflow Management, Others), Vertical (IT and Telecommunication, Government, BFSI, Aerospace, Defence and Intelligence, Healthcare, Retail and Logistics, Manufacturing, Energy and Utilities, and Other Verticals) |

|

Region covered |

North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

|

Companies covered |

Broadcom (US), IBM (US), Microsoft (US), Trend Micro (Japan), McAfee (US), Palo Alto Networks (US), GTB Technologies (US), InfoWatch (Russia), Fortra (US), Cisco Systems (US), etc. |

This research report categorizes the Data Loss Prevention Market based on offering, solution type, service, applications, vertical, and regions.

DLP Market Based on Offering:

- Solution

- Services

DLP Market Based on Solution:

- Network DLP

- Storage/Datacenter DLP

- Endpoint DLP

- Cloud DLP

DLP Market Based on Service:

- Consulting

- System Integration and Installation

- Managed Security Service

- Education and Training

- Risk and Threat Assessment

DLP Market Based on Application:

- Encryption

- Centralized Management

- Policy, Standards, and Procedures

- Web and Email Protection

- Cloud Storage

- Incident Response and Workflow management

- Others

DLP Market Based on Vertical:

- IT and Telecommunication

- Government

- BFSI

- Aerospace, Defence and Intelligence

- Healthcare

- Retail and Logistics

- Manufacturing

- Energy and Utilities

- Other Verticals

DLP Market Based on the Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Nordics

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand (ANZ)

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- KSA

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments in Data Loss Prevention (DLP) Market

- In September 2023, McAfee announced the launch of AI-powered Scam Protection to proactively spot and block scams in real-time.

- In September 2023, McAfee announced the launch of its new McAfee Privacy & Identity Guard product to proactively monitor and remove data online to help prevent potential identity theft and fraud.

- In June 2023, McAfee announced McAfee Business Protection, a new comprehensive security solution for small business owners in collaboration with Dell Technologies. McAfee Business Protection helps Dell small business customers avoid cyber threats and vulnerabilities with award-winning security, identity and dark web data monitoring, VPN, web protection for safe browsing, and more.

- In February 2023, Trend Micro announced the signing of a definitive agreement to acquire Anlyz, a leading provider of security operations center (SOC) technology. The acquisition will extend Trend's orchestration, automation, and integration capabilities and enable enterprises and Managed Security Service Providers (MSSPs) to improve operational efficiencies, cost-effectiveness, and security outcomes.

- In May 2022, Broadcom acquired VMware, a leading innovator in enterprise software, under which Broadcom will acquire all of the outstanding shares of VMware in a cash-and-stock transaction.

Frequently Asked Questions (FAQ):

What is Data Loss Prevention (DLP?

DLP is a set of technologies that help prevent data breaches of sensitive information that may occur in enterprises across the globe. The DLP solutions mainly focus on the classification and monitoring of data that may be in motion, at rest, or an endpoint, as these solutions provide enterprises with the leverage to stop the numerous leaks of information that occur each day. In other words, the main aim of the DLP solutions is to detect potential data breaches that may occur at different levels. The DLP market is mainly classified based on its applications into network DLP, storage/data center DLP, and endpoint DLP. The applications together constitute the global DLP market.

What is the current Data Loss Prevention(DLP) Market Size?

The Data Loss Prevention Market size is anticipated to grow from $3.4 billion in 2023 to $8.9 billion by 2028, at a CAGR of 21.2% during the forecast period.

What are the major drivers in the Data Loss Prevention market?

The significant drivers of the Data Loss Prevention market are the Shifting of data to public and private clouds by enterprises and the Increase in data thefts across the globe

Which are the key players profiled in the Data Loss Prevention (DLP) Market?

The major players in the Data Loss Prevention market are Broadcom (US), IBM (US), Microsoft (US), Trend Micro (Japan), McAfee (US), Palo Alto Networks (US), GTB Technologies (US), InfoWatch (Russia), Fortra (US), Cisco Systems (US).

What are the opportunities for new market entrants in the Data Loss Prevention market?

Legacy DLP solutions’ higher cost and complexity have made it a luxury that only large enterprises can afford. Large enterprises could only sustain both in terms of money spending and required resources to maintain full-fledged DLP solution deployment. However, with the modern integrated DLP suit solutions, SMBs offer huge market potential to DLP vendors. Also, there is a significant opportunity for delivering various security functionality as a managed or hosted service. These services, in particular, require substantial setup, ongoing monitoring, and tuning, including DLP. Several vendors currently offer DLP as a service and could help increase penetration rates within that underserved market segment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 MARKET OVERVIEW

-

5.2 MARKET DYNAMICSDRIVERS- Shift in data storage to public and private cloud- Global increase in data theft- Regulatory and compliance requirements- Use of AI and machine learningRESTRAINTS- Complex rules and little guarantee for data loss prevention- Lack of awareness- High operational costsOPPORTUNITIES- Growing need for small and medium-sized businesses to increase market penetration- Concerns related to insecure endpoints- Rapid adoption of flexible work modelsCHALLENGES- Issues related to deployment of DLP solutions- Growing need for enterprises to maintain compliance with data localization laws

- 5.3 INDUSTRY TRENDS

- 5.4 BEST PRACTICES IN DATA LOSS PREVENTION MARKET

-

5.5 VALUE CHAIN ANALYSISECOSYSTEM ANALYSISHISTORY OF DATA LOSS PREVENTION MARKET- 2000s–2010s- 2010s–2020s- 2020s–PresentREGULATORY LANDSCAPE- Regulatory bodies, government agencies, and other organizationsKEY CONFERENCES & EVENTS

-

5.6 CASE STUDY ANALYSISF5 HELPED ASIAN PAINTS ENHANCE ITS CUSTOMER EXPERIENCE AND DRIVE SCALABILITYALGOSEC HELPED NCR CORPORATION ACHIEVE ZERO TRUST SECURITYMICRO FOCUS HELPED SWISSCOM AG PROTECT SENSITIVE CUSTOMER DATA IN COMPLEX ENVIRONMENTIMPERVA HELPED DISCOVERY INC. TACKLE DATA COMPLIANCE IN PUBLIC CLOUDQCON ADOPTED VERITAS’ DATA SECURITY FEATURES TO ENSURE DATA SECURITY OF ITS APPLICATIONSCOHESITY HELPED TXT E-SOLUTIONS MINIMIZE DOWNTIME ISSUES RESULTING FROM SEVERAL MERGERS AND ACQUISITIONSPRICING ANALYSIS- Pricing models and trendsPORTER’S FIVE FORCES ANALYSIS- Threat of new entrants- Threat of substitutes- Bargaining power of buyers- Bargaining power of suppliers- Intensity of competitive rivalry

-

5.7 IMPACT OF DATA LOSS PREVENTION MARKET ON ADJACENT TECHNOLOGIESTECHNOLOGY ANALYSIS- Content discovery and classification- Data encryption- Endpoint, cloud, and network DLP- Data masking and redaction- User and Entity Behavior Analytics (UEBA)- Data Activity Monitoring (DAM)- Machine Learning and AIPATENT ANALYSIS- Methodology- Document types- Innovation and patent applicationsDISRUPTIVE TRENDS IMPACTING BUYERS/CUSTOMERSKEY STAKEHOLDERS & BUYING CRITERIA- Key stakeholders in buying process- Buying criteriaFUTURE OF DATA LOSS PREVENTION MARKET

-

6.1 INTRODUCTIONOFFERINGS: DATA LOSS PREVENTION MARKET DRIVERS

-

6.2 SOLUTIONSRISING DATA BREACHES TO DRIVE MARKET GROWTH

-

6.3 SERVICESGROWING NEED TO SECURE SENSITIVE INFORMATION TO DRIVE MARKET

-

7.1 INTRODUCTIONSOLUTIONS: DATA LOSS PREVENTION MARKET DRIVERS

-

7.2 NETWORK DLPNEED TO PREVENT DATA LOSS TO LEAD TO ADOPTION OF DLP SOLUTIONS

-

7.3 STORAGE/DATA CENTER DLPINCREASING INSIDER THREATS TO DRIVE ADOPTION OF DLP

-

7.4 ENDPOINT DLPRISING NEED FOR ENDPOINT SECURITY TO DRIVE MARKET GROWTH

-

7.5 CLOUD DLPGROWING NEED TO SECURE SENSITIVE DATA ON CLOUD FROM UNAUTHORIZED ACCESS TO DRIVE MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 ENCRYPTIONGROWING NEED TO ENCRYPT DATA AND PROTECT IT TO DRIVE DLP MARKET

-

8.3 CENTRALIZED MANAGEMENTRISING NEED TO MANAGE AND PROTECT DATA TO DRIVE MARKET

-

8.4 POLICIES, STANDARDS, AND PROCEDURESRISING NEED FOR ENTERPRISES TO ENFORCE POLICIES EFFECTIVELY FOR DATA LOSS PREVENTION TO DRIVE MARKET

-

8.5 WEB AND EMAIL PROTECTIONINCREASING NEED TO PROTECT DATA DIGITALLY TO DRIVE MARKET GROWTH

-

8.6 CLOUD STORAGEINCREASING CLOUD STORAGE APPS AND DATA INVOLVED TO LEAD TO SIGNIFICANT MARKET GROWTH

-

8.7 INCIDENT RESPONSE AND WORKFLOW MANAGEMENTRISING NEED TO PREVENT DATA LEAKAGE TO DRIVE MARKET

- 8.8 OTHER APPLICATIONS

-

9.1 INTRODUCTIONSERVICES: DATA LOSS PREVENTION MARKET DRIVERS

-

9.2 CONSULTINGINCREASING DATA THREATS TO BUSINESSES AND CUSTOMERS TO DRIVE MARKET

-

9.3 SYSTEM INTEGRATION AND INSTALLATIONGROWING CYBER ATTACKS ACROSS INDUSTRIES TO DRIVE MARKET

-

9.4 MANAGED SECURITY SERVICERISING NEED TO SECURE CRITICAL DATA TO DRIVE MARKET GROWTH

-

9.5 EDUCATION AND TRAININGNEED TO IMPLEMENT DATA SECURITY AWARENESS PROGRAMS TO DRIVE DLP MARKET

-

9.6 RISK AND THREAT ASSESSMENTGROWING DATA SECURITY MANAGEMENT TO DRIVE MARKET

-

10.1 INTRODUCTIONVERTICALS: DATA LOSS PREVENTION MARKET DRIVERS

-

10.2 AEROSPACE, DEFENSE, AND INTELLIGENCEINCREASING DATA BREACHES TO SUPPORT MARKET GROWTHCASE STUDY- United Airlines detected and blocked evolving threats

-

10.3 GOVERNMENT (EXCLUDING DEFENSE)INCREASING DATA THREATS AND CYBER ATTACKS TO DRIVE MARKETCASE STUDY- Elche city council improved email security to protect local citizens and businesses

-

10.4 BFSI (BANKING, FINANCIAL SERVICES, AND INSURANCE)TECHNOLOGICAL ADVANCEMENTS TO SUPPORT MARKET GROWTHCASE STUDY- Lake Trust Credit Union chose Cisco SecureX

-

10.5 TELECOMMUNICATION & ITDEVELOPMENT OF INNOVATIVE TECHNOLOGIES TO DRIVE MARKET GROWTHCASE STUDY- Whispir kept internal and customer communications data secure with Proofpoint

-

10.6 HEALTHCAREINCREASING INSTANCES OF MEDICAL RECORD THEFTS TO DRIVE ADOPTION OF DLP SOLUTIONSCASE STUDY- Adventist Health consolidated multivendor firewalls for Cisco

-

10.7 RETAIL & LOGISTICSADVANCEMENTS IN MOBILE TECHNOLOGY TO BOOST DLP MARKETCASE STUDY- Matas achieved secured digital transformation and online sales expansion

-

10.8 MANUFACTURINGAUTOMATION OF MANUFACTURING PROCESSES TO PROPEL ADOPTION OF DLP SOLUTIONS AND SERVICESCASE STUDY- Streamlined security accelerated manufacturing digital transformation

-

10.9 ENERGY & UTILITIESNEED TO PROTECT CUSTOMER DATA TO DRIVE MARKET GROWTHCASE STUDY- Cisco helped Albuquerque Water Authority modernize and protect critical infrastructure

- 10.10 OTHER VERTICALS

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: DATA LOSS PREVENTION MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTUS- Presence of eminent companies offering DLP solutions to drive marketCANADA- Increased adoption of DLP technologies to support market growth

-

11.3 EUROPEEUROPE: DATA LOSS PREVENTION MARKET DRIVERSEUROPE: RECESSION IMPACTUK- Increase in cybercrimes and thefts to propel market growthGERMANY- Increasing investments in DLP landscape to propel adoption of solutions and servicesFRANCE- Increasing government initiatives to strengthen adoption of DLP solutionsSPAIN- Growing need to secure data to boost marketITALY- Thriving telecom sector to create opportunities for DLP solutionsNORDICS- Increasing awareness of data security and privacy regulations to fuel market growthREST OF EUROPE

-

11.4 ASIA PACIFICASIA PACIFIC: DATA LOSS PREVENTION MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTCHINA- Intensive usage of internet to strengthen adoption of DLP solutionsINDIA- Rise in adoption of DLP solutions for securing confidential dataJAPAN- Increased cyber-attacks and need to secure data to accelerate market growthAUSTRALIA & NEW ZEALAND- Need to protect sensitive data and ensure compliance to drive marketREST OF ASIA PACIFIC

-

11.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: DATA LOSS PREVENTION MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTUAE- Increasing digitalization to boost adoption of DLP solutionsKINGDOM OF SAUDI ARABIA- Growing businesses and need to gain customer trust to propel market growthREST OF MIDDLE EAST & AFRICA

-

11.6 LATIN AMERICALATIN AMERICA: DATA LOSS PREVENTION MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTBRAZIL- Increasing penetration of mobiles and internet to drive marketMEXICO- Rising incidences of data crimes to propel marketREST OF LATIN AMERICA

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 12.3 HISTORICAL REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

-

12.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

12.6 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

12.7 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALS

-

13.1 KEY PLAYERSBROADCOM INC.- Business overview- Products/Solutions/Services offered- Recent developments- MNM viewTREND MICRO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMCAFEE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCISCO- Business overview- Products/Solutions/Services offered- Recent developments- MNM ViewIBM- Business overview- Products/Solutions/Services offered- Recent developments- MNM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developmentsFORTRA- Business overview- Products/Solutions/Services offered- Recent developmentsGTB TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developmentsINFOWATCH- Business overview- Products/Solutions/Services offeredPALO ALTO NETWORKS- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 MAJOR PLAYERSZSCALERNETSKOPECROWDSTRIKEZECURIONSOPHOSPROOFPOINT

-

13.3 OTHER PLAYERS/STARTUPSSPIRIONCOSOSYS (ENDPOINT PROTECTOR)CHECK POINT SOFTWARE TECHNOLOGIES LTD.SECURETRUSTPERIMETER 81MIMECASTTESSIANDOCONTROLSAFETICACYBERHAVENTERAMIND

- 14.1 INTRODUCTION TO ADJACENT MARKETS

- 14.2 LIMITATIONS

- 14.3 CYBERSECURITY MARKET

- 14.4 FRAUD DETECTION AND PREVENTION MARKET

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2020–2022

- TABLE 2 ROLE OF PLAYERS IN MARKET ECOSYSTEM

- TABLE 3 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 LIST OF CONFERENCES & EVENTS, 2023–2024

- TABLE 5 AVERAGE SELLING PRICE OF DATA LOSS PREVENTION MARKET SOLUTIONS

- TABLE 6 IMPACT OF PORTER’S FIVE FORCES ON DATA LOSS PREVENTION MARKET

- TABLE 7 PATENTS FILED, 2020–2023

- TABLE 8 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 9 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 10 DATA LOSS PREVENTION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 11 DATA LOSS PREVENTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 12 SOLUTIONS: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 13 SOLUTIONS: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 14 SERVICES: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 15 SERVICES: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 16 DATA LOSS PREVENTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 17 DATA LOSS PREVENTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 18 NETWORK DLP: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 19 NETWORK DLP: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 STORAGE/DATA CENTER DLP: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 STORAGE/DATA CENTER DLP: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 ENDPOINT DLP: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 23 ENDPOINT DLP: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 CLOUD DLP: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 CLOUD DLP: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 DATA LOSS PREVENTION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 27 DATA LOSS PREVENTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 28 ENCRYPTION: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 29 ENCRYPTION: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 CENTRALIZED MANAGEMENT: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 CENTRALIZED MANAGEMENT: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 POLICIES, STANDARDS, AND PROCEDURES: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 33 POLICIES, STANDARDS, AND PROCEDURES: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 WEB AND EMAIL PROTECTION: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 35 WEB AND EMAIL PROTECTION: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 CLOUD STORAGE: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 37 CLOUD STORAGE: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 INCIDENT RESPONSE AND WORKFLOW MANAGEMENT: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 INCIDENT RESPONSE AND WORKFLOW MANAGEMENT: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 OTHER APPLICATIONS: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 41 OTHER APPLICATIONS: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 DATA LOSS PREVENTION MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 43 DATA LOSS PREVENTION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 44 CONSULTING: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 45 CONSULTING: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 SYSTEM INTEGRATION AND INSTALLATION: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 SYSTEM INTEGRATION AND INSTALLATION: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 MANAGED SECURITY SERVICE: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 49 MANAGED SECURITY SERVICE: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 EDUCATION AND TRAINING: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 51 EDUCATION AND TRAINING: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 52 RISK AND THREAT ASSESSMENT: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 RISK AND THREAT ASSESSMENT: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 DATA LOSS PREVENTION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 55 DATA LOSS PREVENTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 56 AEROSPACE, DEFENSE, AND INTELLIGENCE: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 57 AEROSPACE, DEFENSE, AND INTELLIGENCE: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 GOVERNMENT: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 59 GOVERNMENT: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 BFSI: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 BFSI: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 TELECOMMUNICATION & IT: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 63 TELECOMMUNICATION & IT: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 64 HEALTHCARE: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 65 HEALTHCARE: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 RETAIL & LOGISTICS: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 67 RETAIL & LOGISTICS: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 68 MANUFACTURING: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 69 MANUFACTURING: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 ENERGY & UTILITIES: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 71 ENERGY & UTILITIES: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 72 OTHER VERTICALS: DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 73 OTHER VERTICALS: DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 74 DATA LOSS PREVENTION MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 75 DATA LOSS PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 76 NORTH AMERICA: DATA LOSS PREVENTION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 77 NORTH AMERICA: DATA LOSS PREVENTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 78 NORTH AMERICA: DATA LOSS PREVENTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 79 NORTH AMERICA: DATA LOSS PREVENTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 80 NORTH AMERICA: DATA LOSS PREVENTION MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 81 NORTH AMERICA: DATA LOSS PREVENTION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 82 NORTH AMERICA: DATA LOSS PREVENTION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: DATA LOSS PREVENTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: DATA LOSS PREVENTION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: DATA LOSS PREVENTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: DATA LOSS PREVENTION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: DATA LOSS PREVENTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: DATA LOSS PREVENTION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 89 EUROPE: DATA LOSS PREVENTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: DATA LOSS PREVENTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 91 EUROPE: DATA LOSS PREVENTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: DATA LOSS PREVENTION MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 93 EUROPE: DATA LOSS PREVENTION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: DATA LOSS PREVENTION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 95 EUROPE: DATA LOSS PREVENTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: DATA LOSS PREVENTION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 97 EUROPE: DATA LOSS PREVENTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: DATA LOSS PREVENTION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 99 EUROPE: DATA LOSS PREVENTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 100 ASIA PACIFIC: DATA LOSS PREVENTION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 101 ASIA PACIFIC: DATA LOSS PREVENTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 102 ASIA PACIFIC: DATA LOSS PREVENTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 103 ASIA PACIFIC: DATA LOSS PREVENTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 104 ASIA PACIFIC: DATA LOSS PREVENTION MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 105 ASIA PACIFIC: DATA LOSS PREVENTION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 106 ASIA PACIFIC: DATA LOSS PREVENTION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 107 ASIA PACIFIC: DATA LOSS PREVENTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 108 ASIA PACIFIC: DATA LOSS PREVENTION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 109 ASIA PACIFIC: DATA LOSS PREVENTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 110 ASIA PACIFIC: DATA LOSS PREVENTION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 111 ASIA PACIFIC: DATA LOSS PREVENTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: DATA LOSS PREVENTION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: DATA LOSS PREVENTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: DATA LOSS PREVENTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: DATA LOSS PREVENTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: DATA LOSS PREVENTION MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 117 MIDDLE EAST & AFRICA: DATA LOSS PREVENTION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 118 MIDDLE EAST & AFRICA: DATA LOSS PREVENTION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 119 MIDDLE EAST & AFRICA: DATA LOSS PREVENTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 120 MIDDLE EAST & AFRICA: DATA LOSS PREVENTION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: DATA LOSS PREVENTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: DATA LOSS PREVENTION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: DATA LOSS PREVENTION MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 124 LATIN AMERICA: DATA LOSS PREVENTION MARKET, BY OFFERING, 2018–2022 (USD MILLION)

- TABLE 125 LATIN AMERICA: DATA LOSS PREVENTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 126 LATIN AMERICA: DATA LOSS PREVENTION MARKET, BY SOLUTION, 2018–2022 (USD MILLION)

- TABLE 127 LATIN AMERICA: DATA LOSS PREVENTION MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 128 LATIN AMERICA: DATA LOSS PREVENTION MARKET, BY SERVICE, 2018–2022 (USD MILLION)

- TABLE 129 LATIN AMERICA: DATA LOSS PREVENTION MARKET, BY SERVICE, 2023–2028 (USD MILLION)

- TABLE 130 LATIN AMERICA: DATA LOSS PREVENTION MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 131 LATIN AMERICA: DATA LOSS PREVENTION MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 132 LATIN AMERICA: DATA LOSS PREVENTION MARKET, BY VERTICAL, 2018–2022 (USD MILLION)

- TABLE 133 LATIN AMERICA: DATA LOSS PREVENTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 134 LATIN AMERICA: DATA LOSS PREVENTION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 135 LATIN AMERICA: DATA LOSS PREVENTION MARKET, BY COUNTRY 2023–2028 (USD MILLION)

- TABLE 136 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 137 DATA LOSS PREVENTION MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 138 COMPANY FOOTPRINT

- TABLE 139 DETAILED LIST OF STARTUPS/SMES

- TABLE 140 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 141 DATA LOSS PREVENTION MARKET: PRODUCT LAUNCHES, FEBRUARY 2021–SEPTEMBER 2023

- TABLE 142 DATA LOSS PREVENTION MARKET: DEALS, APRIL 2021–SEPTEMBER 2023

- TABLE 143 BROADCOM INC.: COMPANY OVERVIEW

- TABLE 144 BROADCOM INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 145 BROADCOM INC.: DEALS

- TABLE 146 TREND MICRO: COMPANY OVERVIEW

- TABLE 147 TREND MICRO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 148 TREND MICRO: DEALS

- TABLE 149 MCAFEE: COMPANY OVERVIEW

- TABLE 150 MCAFEE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 151 MCAFEE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 152 MCAFEE: DEALS

- TABLE 153 CISCO: BUSINESS OVERVIEW

- TABLE 154 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 155 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 156 CISCO: DEALS

- TABLE 157 IBM: COMPANY OVERVIEW

- TABLE 158 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 159 IBM: PRODUCT LAUNCHES

- TABLE 160 IBM: DEALS

- TABLE 161 MICROSOFT: COMPANY OVERVIEW

- TABLE 162 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 163 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 164 MICROSOFT: DEALS

- TABLE 165 FORTRA: COMPANY OVERVIEW

- TABLE 166 FORTRA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 167 FORTRA: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 168 FORTRA: DEALS

- TABLE 169 GTB TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 170 GTB TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 171 GTB TECHNOLOGIES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 172 GTB TECHNOLOGIES: DEALS

- TABLE 173 INFOWATCH: COMPANY OVERVIEW

- TABLE 174 INFOWATCH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 175 PALO ALTO NETWORKS: COMPANY OVERVIEW

- TABLE 176 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 177 PALO ALTO NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 178 PALO ALTO NETWORKS: DEALS

- TABLE 179 ADJACENT MARKETS AND FORECASTS

- TABLE 180 CYBERSECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 181 CYBERSECURITY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 182 CYBERSECURITY MARKET, BY SOFTWARE, 2016–2021 (USD MILLION)

- TABLE 183 CYBERSECURITY MARKET, BY SOFTWARE, 2022–2027 (USD MILLION)

- TABLE 184 CYBERSECURITY MARKET, BY SERVICE, 2016–2021 (USD MILLION)

- TABLE 185 CYBERSECURITY MARKET, BY SERVICE, 2022–2027 (USD MILLION)

- TABLE 186 CYBERSECURITY MARKET, BY SECURITY TYPE, 2016–2021 (USD MILLION)

- TABLE 187 CYBERSECURITY MARKET, BY SECURITY TYPE, 2022–2027 (USD MILLION)

- TABLE 188 CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

- TABLE 189 CYBERSECURITY MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

- TABLE 190 CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

- TABLE 191 CYBERSECURITY MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

- TABLE 192 CYBERSECURITY MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 193 CYBERSECURITY MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 194 CYBERSECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 195 CYBERSECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 196 FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 197 FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 198 FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 199 FRAUD DETECTION AND PREVENTION MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 200 FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 201 FRAUD DETECTION AND PREVENTION MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 202 FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 203 FRAUD DETECTION AND PREVENTION MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 204 FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 205 FRAUD DETECTION AND PREVENTION MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 206 FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 207 FRAUD DETECTION AND PREVENTION MARKET, BY REGION, 2023–2028 (USD MILLION)

- FIGURE 1 RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA LOSS PREVENTION MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY-SIDE): REVENUE FROM DATA LOSS PREVENTION SERVICE VENDORS

- FIGURE 5 DATA LOSS PREVENTION MARKET, 2021–2028 (USD MILLION)

- FIGURE 6 DATA LOSS PREVENTION MARKET: REGIONAL SHARE, 2023

- FIGURE 7 ASIA PACIFIC TO BE BEST MARKET FOR INVESTMENTS DURING FORECAST PERIOD

- FIGURE 8 RISING GOVERNMENT INITIATIVES FOR DIGITAL PAYMENTS TO ACT AS OPPORTUNITY IN DATA LOSS PREVENTION MARKET

- FIGURE 9 ENDPOINT AND AEROSPACE, DEFENSE, AND INTELLIGENCE TO ACCOUNT FOR LARGER SHARES IN NORTH AMERICA

- FIGURE 10 AEROSPACE, DEFENSE, AND INTELLIGENCE AND CHINA TO ACCOUNT FOR LARGER SHARES IN ASIA PACIFIC

- FIGURE 11 SERVICES SEGMENT TO RECORD HIGHER CAGR

- FIGURE 12 SYSTEM INTEGRATION AND INSTALLATION TO HOLD LARGEST SHARE IN 2023

- FIGURE 13 ENCRYPTION SEGMENT TO HOLD LARGEST SHARE IN 2023

- FIGURE 14 DATA LOSS PREVENTION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 15 VALUE CHAIN FOR DATA LOSS PREVENTION WITH RESPECT TO SMALL & MEDIUM-SIZED BUSINESSES AND CONSUMERS

- FIGURE 16 ECOSYSTEM MAP

- FIGURE 17 HISTORY OF DATA LOSS PREVENTION MARKET

- FIGURE 18 NUMBER OF PATENTS GRANTED ANNUALLY, 2020–2023

- FIGURE 19 TOP TEN PATENT APPLICANTS WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2020–2023

- FIGURE 20 DISRUPTIVE TRENDS IMPACTING BUYERS/CUSTOMERS

- FIGURE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 22 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 23 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 24 ENDPOINT DLP TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 25 CLOUD STORAGE TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 26 SYSTEM INTEGRATION AND INSTALLATION SERVICE TO ACCOUNT FOR LARGEST MARKET SIZE IN 2028

- FIGURE 27 DATA LOSS PREVENTION TO WITNESS HIGH ADOPTION RATE FROM AEROSPACE, DEFENSE, AND INTELLIGENCE SECTOR IN NEXT 5 YEARS

- FIGURE 28 DATA LOSS PREVENTION MARKET: REGIONAL SNAPSHOT, 2023

- FIGURE 29 DATA LOSS PREVENTION MARKET, BY REGION, 2023 VS. 2028 (USD MILLION)

- FIGURE 30 NORTH AMERICA: DATA LOSS PREVENTION MARKET SNAPSHOT

- FIGURE 31 ASIA PACIFIC: DATA LOSS PREVENTION MARKET SNAPSHOT

- FIGURE 32 HISTORICAL REVENUE ANALYSIS OF KEY PLAYERS, 2020–2022 (USD MILLION)

- FIGURE 33 DATA LOSS PREVENTION MARKET: COMPANY EVALUATION MATRIX, 2023

- FIGURE 34 DATA LOSS PREVENTION MARKET: STARTUP/SME EVALUATION MATRIX, 2023

- FIGURE 35 BROADCOM INC.: COMPANY SNAPSHOT

- FIGURE 36 TREND MICRO: COMPANY SNAPSHOT

- FIGURE 37 CISCO: COMPANY SNAPSHOT

- FIGURE 38 IBM: COMPANY SNAPSHOT

- FIGURE 39 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 40 PALO ALTO NETWORKS: COMPANY SNAPSHOT

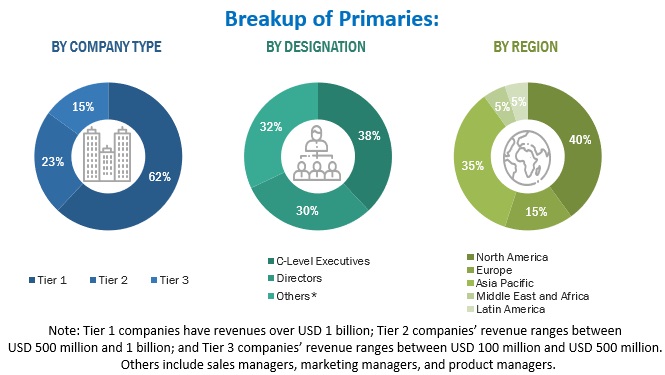

The study involved four major activities in estimating the current size of the global Data Loss Prevention market. In the first step, exhaustive secondary research collected information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total Data Loss Prevention market size. After that, the market breakup and data triangulation techniques were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as Bloomberg and BusinessWeek, have been referred to identify and collect information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, such as Linux Journal and Container Journal, and articles from recognized authors, directories, and databases.

Primary Research

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Marketing Officers (CMO), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the Data Loss Prevention market along with the associated service providers, and system integrators working in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. Following is the breakup of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and forecast the Data Loss Prevention market and other dependent submarkets. The bottom-up procedure was used to arrive at the overall market size of the global market using key companies’ revenue and their offerings in the market. The research methodology used to estimate the market size includes the following:

- The key players in the Data Loss Prevention market have been identified through extensive secondary research.

- Regarding value, the market size has been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Loss Prevention Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Loss Prevention Market Size: Top-Down Approach

Data Triangulation

With data triangulation and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

DLP is a set of technologies that help prevent data breaches of sensitive information that may occur in enterprises across the globe. The DLP solutions mainly focus on the classification and monitoring of data that may be in motion, at rest, or an endpoint, as these solutions provide enterprises with the leverage to stop the numerous leaks of information that occur each day. In other words, the main aim of the DLP solutions is to detect potential data breaches that may occur at different levels. The DLP market is mainly classified based on its applications into network DLP, storage/data center DLP, and endpoint DLP. The applications together constitute the global DLP market.

Key Stakeholders

- DLP vendors

- Solution providers

- System integrators

- Value-Added Resellers (VARs)

- Service providers and distributors

- Government agencies

- Large enterprises

Report Objectives

- To determine, segment, and forecast the global Data Loss Prevention market by offering solution types, services, applications, verticals, and regions in terms of value.

- To forecast the size of the market segments to five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape.

- To strategically analyze the macro and micro markets to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market.

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the Data Loss Prevention market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies.

- Track and analyze competitive developments, such as mergers and acquisitions, product launches and developments, partnerships, agreements, collaborations, business expansions, and Research & Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of an additional two market players

Growth opportunities and latent adjacency in Data Loss Prevention Market