Cryogenic Equipment Market by Equipment (Tanks, Valves, Vaporizers, Pumps), Cryogen (Nitrogen, Argon, Oxygen, LNG, Hydrogen), End-user Industry (Energy & Power, Chemical, Metallurgy, Transportation), System Type, Application & Region - Forecast to 2028

Cryogenic Equipment Market Size, Global Industry Share Forecast

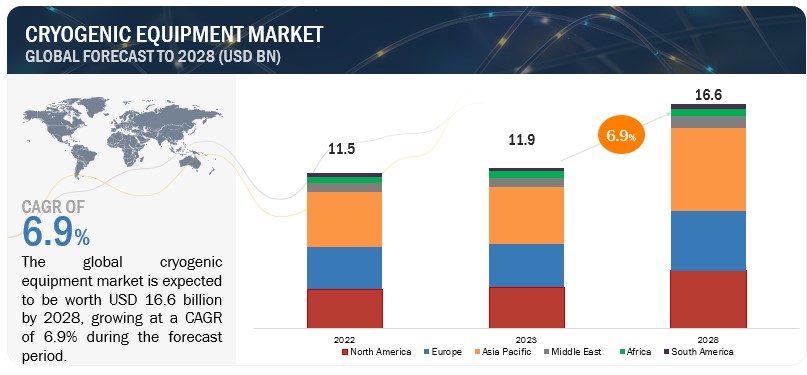

[307 Pages Report] The global Cryogenic Equipment Market size was valued at $11.9 billion in 2023 to reach $16.6 billion by 2028; it is expected to record a CAGR of 6.9% from 2023 to 2028. The rising adoption of liquefied natural gas (LNG) as a clean and efficient energy source, along with the increasing use of industrial gases in metallurgy, oil & gas, and energy & power sectors, is fueling the expansion of the cryogenic equipment market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Cryogenic Equipment Market Dynamics

Driver: Increasing utilization of industrial gases in metallurgy, oil & gas, and energy & power industries

In the metallurgy industry, processes such as metal forming/smelting, fabrication, welding, and combustion require industrial gases such as oxygen, nitrogen, argon, and hydrogen, wherein oxygen and nitrogen are the most used industrial gases. These gases are required in their cryogenic liquid forms to provide precise temperature control and enhanced process efficiency. Different types of cryogenic equipment, such as storage tanks and distribution systems, are indispensable in handling and supplying these gases in their liquid state. The superior performance and cost-effectiveness of cryogenic systems make them the preferred choice in metallurgical applications. Further, steel is expected to witness a significant rise in demand across the world, especially in the developing economies. According to the World Steel Association (WSA), ~73% of global steel production is produced using the oxygen process (Basic Oxygen Process). In steel production and processing, oxygen gas is often used in conjunction with cryogenic equipment to enhance the efficiency and quality of operations. In the steelmaking process, oxygen is injected into the molten iron in blast furnaces to promote combustion and accelerate the removal of impurities, resulting in improved steel quality. Cryogenic equipment is employed to store and supply liquid oxygen, ensuring precise control over the injection process. In addition to the aforementioned factors, researches and innovations associated with the development of high-strength and high-conductivity alloys for non-rare-earth induction motors that can be deployed in EVs, metals with high rigidity and stiffness for use in industrial applications, new composites such as highly conducting carbon nanotubes to enhance the efficiency of electrical energy transport and new corrosion protection systems for marine and offshore applications are also likely to drive the demand for cryogenic equipment from the metallurgy industry. The growth of industry fuels the demand for industrial gases, which consequently drives the demand for cryogenic equipment necessary for handling, storing, and transporting industrial gases.

Restraint: Volatile raw material and metal prices and significant competition from gray market players

Cryogenic equipment is constructed using a variety of materials, including stainless steel, bronze, carbon steel, and specialized alloys. In recent years, there has been a substantial increase in the prices of raw materials like iron ore and other ores, leading to a consistent upward trend in global prices for metals, particularly stainless steel. China, being the largest steel producer and exporter, has experienced fluctuations in processed metal prices, impacting various industries. The production of cryogenic equipment demands top-quality raw materials, and the rising cost of these materials has created intense competition among leading cryogenic equipment manufacturers. The surge in cryogenic equipment prices has also prompted a preference for smaller-scale manufacturers in the informal market, especially in countries like China and India. Consequently, the fluctuating prices of metals have become a significant obstacle for the market. In addition to major raw material suppliers, the presence of numerous local and regional providers who can offer materials meeting international standards at competitive prices provides manufacturers with procurement options. This, in turn, gives rise to the existence of unregulated gray market players, which further impedes the market's growth.

Opportunities: Evolving applications of cryogenic electronics

Cryogenic gases play a pivotal role in semiconductor manufacturing and testing processes. Liquid nitrogen is a widely employed coolant for dissipating heat generated during the manufacturing phase. The use of extremely low temperatures, often approaching absolute zero, can facilitate the creation of electronics with heightened performance, reduced noise, and enhanced efficiency. Furthermore, subjecting electronics to cryogenic treatment can minimize gaps within the metallic components of their structure. This, in turn, enhances the reliability of electronics by improving both thermal and electrical conductivity and reducing operating power requirements. The applications of cryogenic electronics are on the rise. Cryogenic electronics find applications in the development of quantum computers. Quantum bits (qubits) are incredibly sensitive and require temperatures close to absolute zero to minimize environmental interference. Cryogenic electronic systems are used to control and readout qubits, enabling the advancement of quantum computing technology. Similarly, cryogenic electronics are crucial for LNAs in radio astronomy and astrophysics, as well as in medical imaging equipment like magnetic resonance imaging (MRI). Extremely low temperatures reduce electronic noise, improving the sensitivity of these devices and enhancing the quality of data acquisitiont. Power-conversion circuits can be applied at superconducting power generation, management, and distribution applications. Moreover, as investments in the renewable energy sector continue to grow, there will be an increasing demand for cryogenic signal-processing systems and sensors used in instrumentation for wind tunnels. Additionally, the expanding use of cryogenic electronics in various research endeavors, superconducting magnet systems, low-temperature detector systems, and infrared array systems is expected to create opportunities for providers of cryogenic equipment.

Challenges: Supply chain disruptions due to Russia–Ukraine war

The Russia–Ukraine war has had a significant impact on the global LNG market, leading to soaring prices and disrupting supply chains. Europe, in particular, has been hit hard, as it has traditionally relied heavily on Russian pipeline gas. In response to the war, European countries have scrambled to diversify their gas supplies, with LNG playing a key role. Prior to the war, Europe imported around 40% of its natural gas from Russia. However, in the wake of the invasion, European countries have moved to reduce their reliance on Russian gas, and LNG imports have surged. In 2022, European LNG imports increased by 60% than the previous year. The increase in European LNG demand has had a knock-on effect on global LNG prices, which have soared to record highs. In March 2022, the benchmark European LNG price reached over USD 80 per million British thermal units (MMBtu), more than four times higher than the level at the start of the year. The war also had an impact on Asian LNG demand. As European countries have competed for LNG supplies, Asian buyers have faced higher prices and reduced availability. This has led to some demand destruction in Asia, as buyers have switched to other fuels, such as coal and oil. However, Asian LNG demand is expected to rebound in the coming months, as the region's economies recover from the COVID-19 pandemic. In addition, the war in Ukraine is likely to accelerate the transition to cleaner energy sources in Asia, and LNG is expected to play a key role in meeting this growing demand. The war has also disrupted LNG supply chains. The closure of the Black Sea has made it more difficult and expensive to transport LNG from the region. In addition, there have been concerns about the security of LNG supplies from Russia and other countries in the region. It is likely to have a significant impact on the global LNG market in the medium and long term. The war has accelerated the transition to cleaner energy sources in Europe and other parts of the world, and LNG is expected to play a key role in meeting this growing demand. In addition, the war has highlighted the importance of diversifying energy supplies. European countries are now looking to secure LNG supplies from a wider range of sources, and LNG producers are looking to expand their markets..

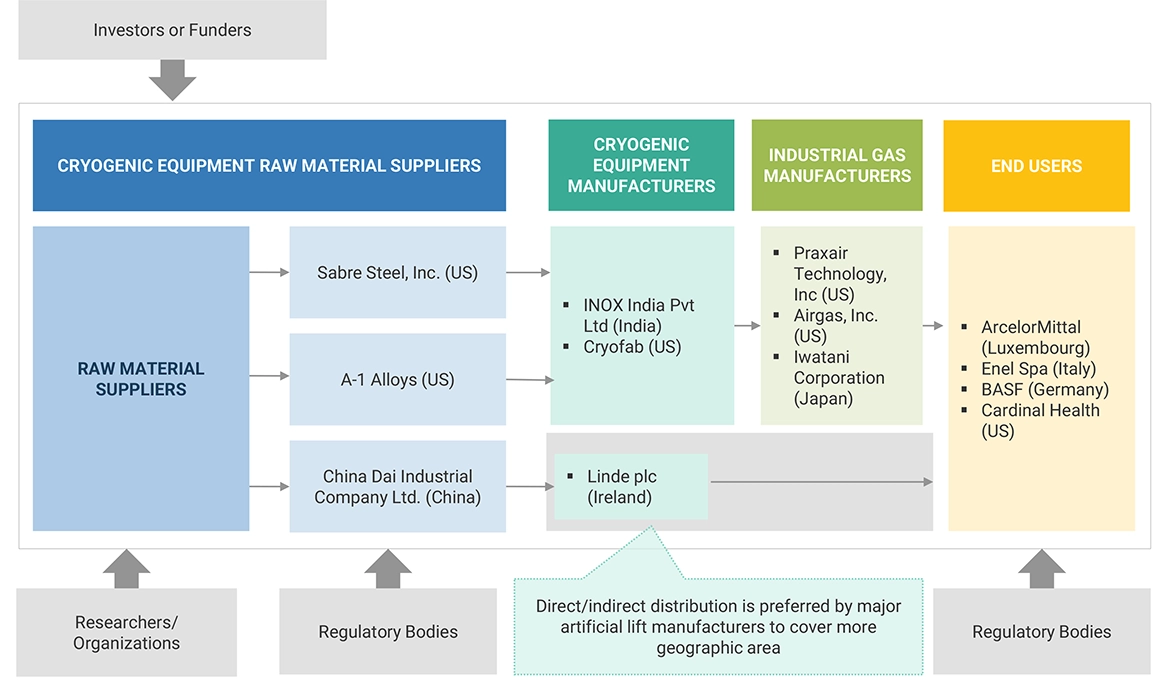

Cryogenic Equipment Market Ecosystem

In this market, prominent companies stand out as well-established and financially stable providers of cryogenic equipment products and services. With years of experience, these companies boast a diverse product portfolio, cutting-edge technologies, and robust global sales and marketing networks. Their proven track record in the industry positions them as reliable and trusted partners for customers seeking cryogenic equipment solutions. These companies have demonstrated their ability to adapt to market dynamics and consistently deliver high-quality products and services, making them leaders in meeting the demands of the oil and gas sector. Prominent companies in this market include as Linde plc (Ireland); Air Liquide (France); Air Products and Chemicals, Inc. (US); Chart Industries (US); Parker Hannifin Corp. (US); Flowserve Corporation (US); Nikkiso Co., Ltd. (Japan); and INOX India Limited (India).

The elctronics segment, by end-user industry, is expected to be the fastest growing market during the forecast period.

This report segments the cryogenic equipment market based on end-user industry into different types: metallurgy, energy & power, chemical, electronics, transportation, and other end-user industries. The electronics segment is expected to grow at the highest CAGR during the forecast period. The use of cryogenic equipment is critical in testing and characterization of electronic components such as fiber optics, flat-panel displays, integrated circuits, LED devices, photovoltaics, printed circuit boards (PCBs), and semiconductors. The market for the electronics industry is expected to grow due to increasing development of superconducting electronics.

By system type, handling system is expected to be second-largest market during the forecast period.

This report segments the cryogenic equipment market based on system type into four segments: storage system, handling system, supply system, and others. The handling system segment is expected to be the second-largest market during the forecast period. Handling systems are used for transferring cryogenic fluids to the desired location. Handling systems facilitate the movement and transfer of cryogenic fluids for specific applications. These systems primarily comprises valves, regulators, and gauges and are used in tandem with other cryogenic systems. Cryogenic handling systems are integral to certain advanced manufacturing processes, such as cryomachining and cryogenic cooling. These processes improve machining precision and extend tool life, resulting in higher-quality products and cost savings.

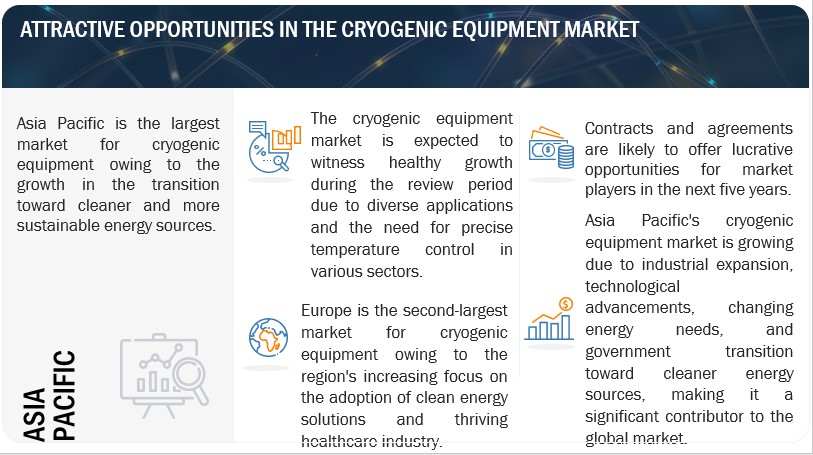

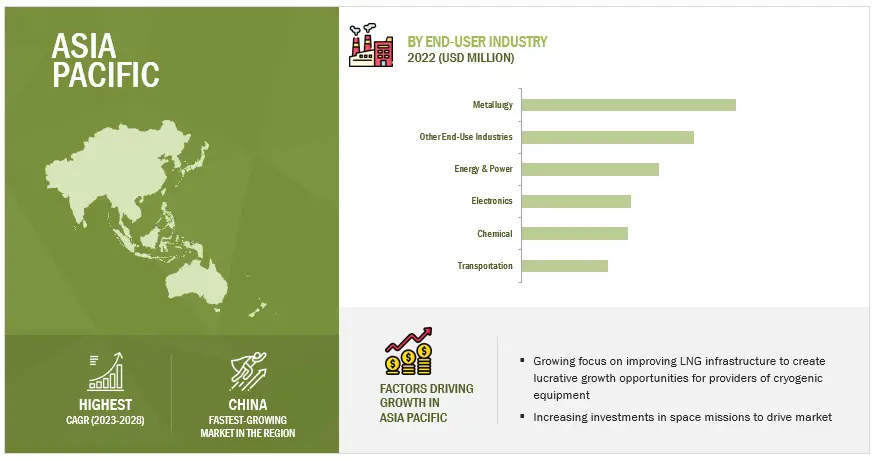

“Asia Pacific: The largest in the cryogenic equipment market.”

Asia Pacific is expected to be the largest region in the cryogenic equipment market between 2023–2028, followed by Europe and North America. Asia Pacific has been leading the cryogenic equipment market. The cryogenic equipment market is experiencing growth due to the presence of leading solution providers like Linde plc (Ireland); Air Liquide (France); Air Products and Chemicals, Inc. (US); Flowserve Corporation (US); Nikkiso Co., Ltd. (Japan); and INOX India Limited (India). Notably, in 2020, INOX India Limited partnered with Shell Energy for developing the market for LNG supply through roadways from Shell’s LNG terminal in Gujarat, catering to expanding market.

Key Market Players

The cryogenic equipment market is dominated by a few major players that have a wide regional presence. The major players in the cryogenic equipment market include as Linde plc (Ireland); Air Liquide (France); Air Products and Chemicals, Inc. (US); Chart Industries (US); and Parker Hannifin Corp. (US). Between 2018 and 2023, Strategies such as contracts, agreements, acquisitions, and expansions are followed by these companies to capture a larger share of the cryogenic equipment market.

Want to explore hidden markets that can drive new revenue in Cryogenic Equipment Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Cryogenic Equipment Market?

|

Report Metric |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Cryogenic Equipment Market by Equipment, Cryogen, End-user Industry, System Type, Application, and Region. |

|

Geographies covered |

Asia Pacific, North America, Europe, South America, Middle East and Africa. |

|

Companies covered |

Linde plc (Ireland); Air Liquide (France); Air Products and Chemicals, Inc. (US); Chart Industries (US); Parker Hannifin Corp. (US); Flowserve Corporation (US); Nikkiso Co., Ltd. (Japan); INOX India Limited (India); SHI Cryogenics Group (Japan); Emerson Electric Co. (US); Sulzer Ltd (Switzerland); Taylor-Wharton (US); Wessington Cryogenics (UK); PHPK Technologies (US); Acme Cryo (US); Five SAS (France); HEROSE GMBH (Germany); Shell-N-Tube (India); CRYOFAB (US); Cryostar (France) |

This research report categorizes the cryogenic equipment market based on type, mechanism, application, well type, and region.

On the basis of equipment:

- Tanks

- Valves

- Vaporizers

- Pumps

- Other Equipments

On the basis of cryogen:

- Nitrogen

- Oxygen

- Argon

- LNG

- Hydrogen

- Other Cryogens

On the basis of end-user industry:

- Metallurgy

- Energy & power

- Chemical

- Electronics

- Transportation

- Other End-user Industries

On the basis of application:

- CASU

- Non-CASU

On the basis of system type:

- Storage System

- Handling System

- Supply System

- Others

On the basis of region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East

- Africa

Recent Developments

- In July 2023, Chart Industries opened a second facility at Alabama. This plant is expected to fabricate the largest shop-built cryogenic tanks ever manufactured globally—70% larger than the previous model—to begin in the first quarter 2024. The tanks manufactured at this site will be used as propellant storage solutions in the aerospace industry, hydrogen and LNG storage solutions in the marine industry and many other processes and technologies adopted in the sciences and decarbonization industries.

- In June 2023, INOX India Limited built an LNG facility in Tamil Nadu, which comprises 2 x 113 KL LNG tanks, regas system with a capacity of 5,000 SCMH @ 22 Bar pressure and associated equipment was supplied by INOXCVA on a turnkey basis in a record time.

- In April 2023, Linde signed an agreement with Evonik, a leading specialty chemicals company, to supply green hydrogen in Singapore. According to the agreement, Linde will build, own, and operate a nine-megawatt alkaline electrolyzer plant on Jurong Island, Singapore. The plant will produce green hydrogen, which Evonik will use to manufacture methionine, an essential component in animal feed.

- In March 2023, Air Products and Chemicals, Inc. and Shaanxi LNG Reserves & Logistics Company signed an agreement to supply its proprietary liquefied natural gas (LNG) process technology and equipment to Technip Energies for the Xi'An LNG Emergency Reserve & Peak Regulation Project with Shaanxi LNG Reserves & Logistics Company Ltd., in ShaanXi Province, China.

Frequently Asked Questions (FAQ):

What is the current size of the cryogenic equipment market?

The current market size of the cryogenic equipment market is USD 11.5 billion in 2022.

What are the major drivers for the cryogenic equipment market?

Increasing utilization of industrial gases in metallurgy, oil & gas, and energy & power industries will be major drivers for the cryogenic equipment market.

Which is the largest region during the forecasted period in the cryogenic equipment market?

Asia Pcific is expected to dominate the cryogenic equipment market between 2023–2028, followed by Europe and North America.

Which is the largest segment, by equipment, during the forecasted period in the cryogenic equipment market?

The tanks segment is expected to be the largest market during the forecast period.

Which is the fastest segment, by application, during the forecasted period in the cryogenic equipment market?

Non-CASU is expected to be the fastest market during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing utilization of industrial gases in metallurgy, oil & gas, and energy & power industries- Growing popularity of liquefied natural gas as source of clean and efficient energy- Rapid transition toward clean energyRESTRAINTS- High CAPEX and OPEX costs associated with cryogenic plants- Volatile raw material and metal prices and significant competition from gray market playersOPPORTUNITIES- Launch of new space and satellite missions- Evolving applications of cryogenic electronics- Development of hydrogen economyCHALLENGES- Hazards and greenhouse gas emissions resulting from leakage of cryogenic fluids- Supply chain disruptions due to Russia–Ukraine war

-

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.4 PRICING ANALYSISINDICATIVE PRICING ANALYSIS, BY EQUIPMENTAVERAGE SELLING PRICE TREND, BY REGION

-

5.5 SUPPLY CHAIN ANALYSISCRYOGENIC EQUIPMENT RAW MATERIAL SUPPLIERSCRYOGENIC EQUIPMENT MANUFACTURERSINDUSTRIAL GAS MANUFACTURERSEND USERS

-

5.6 ECOSYSTEM/MARKET MAP

- 5.7 TECHNOLOGY ANALYSIS

-

5.8 PATENT ANALYSISLIST OF MAJOR PATENTS

-

5.9 TRADE ANALYSISHS CODE 280430- Nitrogen export scenario- Nitrogen import scenarioHS CODE 280421- Argon export scenario- Argon import scenarioHS CODE 280440- Oxygen export scenario- Oxygen import scenarioHS CODE 271111- LNG export scenario- LNG import scenarioHS CODE 280410- Hydrogen export scenario- Hydrogen import scenario

- 5.10 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.11 TARIFFS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSCRYOGENIC EQUIPMENT MARKET: REGULATORY FRAMEWORK

-

5.12 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.13 CASE STUDY ANALYSISPHARMACEUTICAL INGREDIENT MANUFACTURER ADOPTED AFCRYO’S CRYOCUBE PRODUCT TO RECEIVE SECURE SUPPLY OF PHARMACOPOEIA-COMPLIANT LIQUID AND GAS

-

5.14 MAJOR PHARMACEUTICAL COMPANY INTRODUCED COMPREHENSIVE CRYOGENIC SOLUTION TO REVOLUTIONIZE COLD CHAIN MANAGEMENTRESEARCH INSTITUTE DEVELOPED CRYOGENIC SOLUTION FOR SPECIMEN PRESERVATION

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 6.1 INTRODUCTION

-

6.2 TANKSINCREASING LNG PRODUCTION TO FUEL DEMAND FOR CRYOGENIC TANKS

-

6.3 VALVESHIGH DEMAND FOR INDUSTRIAL GASES FROM AEROSPACE AND ELECTRONICS COMPANIES TO DRIVE MARKET

-

6.4 VAPORIZERSGROWING CONSUMPTION OF INDUSTRIAL GASES ACROSS END-USER INDUSTRIES TO BOOST DEMAND FOR CRYOGENIC VAPORIZERS

-

6.5 PUMPSINCREASING USE OF LNG AS BUNKER FUEL TO CREATE REQUIREMENT FOR CRYOGENIC PUMPS

- 6.6 OTHER EQUIPMENT

- 7.1 INTRODUCTION

-

7.2 NITROGENHIGH ADOPTION OF NITROGEN IN ENERGY & POWER SECTOR TO BOOST DEMAND FOR CRYOGENIC EQUIPMENT

-

7.3 ARGONRISING DEMAND FOR ELECTRONICS TO LEAD TO HIGH REQUIREMENT FOR ARGON-HANDLING CRYOGENIC EQUIPMENT

-

7.4 OXYGENINCREASING STEEL AND IRON PRODUCTION TO CREATE HIGH DEMAND FOR OXYGEN-RELATED CRYOGENIC EQUIPMENT

-

7.5 LNGRISING USE OF LNG AS CLEANER ENERGY SOURCE TO ACCELERATE DEMAND FOR CRYOGENIC EQUIPMENT

-

7.6 HYDROGENGROWING IMPLEMENTATION OF HYDROGEN FUEL CELLS IN TRANSPORTATION AND ENERGY APPLICATIONS TO FUEL MARKET GROWTH

- 7.7 OTHER CRYOGENS

- 8.1 INTRODUCTION

-

8.2 METALLURGYADOPTION OF CRYOGENIC EQUIPMENT IN WELDING, FABRICATION, AND COOLING PROCESSES TO BOOST SEGMENTAL GROWTH

-

8.3 ENERGY & POWERNEED TO IMPROVE EFFICIENCY AND CAPACITY OF POWER TRANSMISSION AND DISTRIBUTION SYSTEMS TO ACCELERATE DEMAND FOR CRYOGENIC EQUIPMENT

-

8.4 CHEMICALREQUIREMENT TO STORE VOLATILE AND REACTIVE CHEMICALS FOR EXTENDED PERIOD TO BOOST DEMAND FOR CRYOGENIC EQUIPMENT

-

8.5 ELECTRONICSDEVELOPMENT OF SUPERCONDUCTING ELECTRONICS TO DRIVE MARKET

-

8.6 TRANSPORTATIONDEVELOPMENT OF FUEL CELL-POWERED ELECTRIC VEHICLES TO CREATE LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- 8.7 OTHER END-USER INDUSTRIES

- 9.1 INTRODUCTION

-

9.2 STORAGE SYSTEMGROWING ADOPTION OF CRYOGENIC ENERGY STORAGE SYSTEMS BY AEROSPACE COMPANIES TO PROVIDE LUCRATIVE OPPORTUNITIES

-

9.3 HANDLING SYSTEMINCREASING FOCUS OF MANUFACTURING FIRMS ON EXTENDING LIFESPAN OF TOOLS AND ACHIEVE COST SAVING TO DRIVE SEGMENTAL GROWTH

-

9.4 SUPPLY SYSTEMRISING USE OF SUPPLY SYSTEMS IN HEALTHCARE, AEROSPACE, AND INDUSTRIAL APPLICATIONS TO SUPPORT MARKET GROWTH

- 9.5 OTHERS

- 10.1 INTRODUCTION

-

10.2 CASU (CRYOGENIC AIR SEPARATION UNIT)INSTALLATION OF CASU TO SEPARATE AND PRODUCE HIGH-PURITY GASES AT EXTREMELY LOW TEMPERATURES TO DRIVE MARKET

-

10.3 NON-CASU (NON-CRYOGENIC AIR SEPARATION UNIT)UTILIZATION OF NON-CASU IN INDUSTRIAL APPLICATIONS THAT DO NOT REQUIRE HIGH-PURITY GASES TO FUEL MARKET GROWTHRAIL AND ROAD TRANSPORT INDUSTRYLNG BULK CARRIER SHIPSLNG REGASIFICATION AND LIQUEFACTION TERMINALSOTHER MINOR APPLICATIONS

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICRECESSION IMPACT ON MARKET IN ASIA PACIFICBY EQUIPMENTBY CRYOGENBY END-USER INDUSTRYBY SYSTEM TYPEBY COUNTRY- China- India- Australia- Japan- Malaysia- Rest of Asia Pacific

-

11.3 EUROPERECESSION IMPACT ON MARKET IN EUROPEBY EQUIPMENTBY CRYOGENBY END-USER INDUSTRYBY SYSTEM TYPEBY COUNTRY- Russia- UK- Germany- France- Rest of Europe

-

11.4 NORTH AMERICARECESSION IMPACT ON MARKET IN NORTH AMERICABY EQUIPMENTBY CRYOGENBY END-USER INDUSTRYBY SYSTEM TYPEBY COUNTRY- US- Canada- Mexico

-

11.5 MIDDLE EASTRECESSION IMPACT ON MARKET IN MIDDLE EASTBY EQUIPMENTBY CRYOGENBY END-USER INDUSTRYBY SYSTEM TYPEBY COUNTRY- Saudi Arabia- UAE- QATAR- Rest of Middle East

-

11.6 AFRICARECESSION IMPACT ON MARKET IN AFRICABY EQUIPMENTBY CRYOGENBY END-USER INDUSTRYBY SYSTEM TYPEBY COUNTRY- South Africa- Nigeria- Algeria- Rest of Africa

-

11.7 SOUTH AMERICARECESSION IMPACT ON MARKET IN SOUTH AMERICABY EQUIPMENTBY CRYOGENBY END-USER INDUSTRYBY SYSTEM TYPEBY COUNTRY- Brazil- Argentina- Venezuela- Rest of South America

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2022

- 12.3 MARKET EVALUATION FRAMEWORK, 2018–2023

- 12.4 SEGMENTAL REVENUE ANALYSIS, 2018–2022

-

12.5 COMPETITIVE SCENARIOS AND TRENDSDEALSOTHERS

-

12.6 COMPANY EVALUATION MATRIX (KEY PLAYERS), 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT (KEY PLAYERS)

-

12.7 COMPANY EVALUATION MATRIX (OTHER PLAYERS), 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT (OTHER PLAYERS)

-

13.1 KEY PLAYERSLINDE PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAIR LIQUIDE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAIR PRODUCTS AND CHEMICALS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHART INDUSTRIES- Business overview- Products/solutions/services offered- Recent developments- MnM viewPARKER HANNIFIN CORP- Business overview- Products/Solutions/Services offered- MnM viewFLOWSERVE CORPORATION- Business overview- Products/Solutions/Services offeredNIKKISO CO., LTD.- Business overview- Products/Solutions/Services offeredINOX INDIA LIMITED- Business overview- Products/Services/Solutions offered- Recent developmentsTAYLOR-WHARTON- Business overview- Products/Solutions/Services offered- Recent developmentsEMERSON ELECTRIC CO.- Business overview- Products/Solutions/Services offered- Recent developmentsWESSINGTON CRYOGENICS- Business overview- Products/Solutions/Services offeredSULZER LTD- Business overview- Products/Solutions/Services offeredPHPK TECHNOLOGIES- Business overview- Products/Solutions/Services offeredACME CRYO.- Business overview- Products/Solutions/Services offered- Recent developmentsSHI CRYOGENICS GROUP- Business overview- Products/Solutions/Services offered- Recent developments

-

13.2 OTHER PLAYERSFIVES SASCRYOFABHEROSE GMBHCRYOSTARSHELL-N-TUBE

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 CRYOGENIC EQUIPMENT MARKET SNAPSHOT

- TABLE 2 GLOBAL OIL DEMAND (OECD VS. NON-OECD), 2021–2028

- TABLE 3 CRYOGENIC EQUIPMENT: INDICATIVE PRICING ANALYSIS, 2022

- TABLE 4 CRYOGENIC EQUIPMENT: AVERAGE SELLING PRICE TREND, 2022

- TABLE 5 ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 6 EXPORT DATA FOR HS CODE 280430, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 7 IMPORT SCENARIO FOR HS CODE 280430, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 8 EXPORT DATA FOR HS CODE 280421, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 9 IMPORT SCENARIO FOR HS CODE 280421, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 10 EXPORT DATA FOR HS CODE 280440, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 11 IMPORT SCENARIO FOR HS CODE 280440, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 12 EXPORT DATA FOR HS CODE 271111, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 13 IMPORT SCENARIO FOR HS CODE 271111, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 14 EXPORT DATA FOR HS CODE 280410, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 15 IMPORT SCENARIO FOR HS CODE 280410, BY COUNTRY, 2020–2022 (USD THOUSAND)

- TABLE 16 CRYOGENIC EQUIPMENT MARKET: LIST OF CONFERENCES AND EVENTS

- TABLE 17 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 CRYOGENIC EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USER INDUSTRIES (%)

- TABLE 22 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

- TABLE 23 CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018–2022 (USD MILLION)

- TABLE 24 CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 25 CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018–2022 (THOUSAND UNITS)

- TABLE 26 CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023–2028 (THOUSAND UNITS)

- TABLE 27 TANKS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 28 TANKS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 VALVES: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 30 VALVES: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 VAPORIZERS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 32 VAPORIZERS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 33 PUMPS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 34 PUMPS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 OTHER EQUIPMENT: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 36 OTHER EQUIPMENT: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018–2022 (USD MILLION)

- TABLE 38 CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023–2028 (USD MILLION)

- TABLE 39 NITROGEN: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 40 NITROGEN: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 ARGON: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 42 ARGON: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 OXYGEN: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 44 OXYGEN: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 LNG: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 46 LNG: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 HYDROGEN: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 48 HYDROGEN: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 OTHER CRYOGENS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 50 OTHER CRYOGENS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 52 CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 53 METALLURGY: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 54 METALLURGY: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 METALLURGY: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018–2022 (USD MILLION)

- TABLE 56 METALLURGY: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023–2028 (USD MILLION)

- TABLE 57 ENERGY & POWER: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 58 ENERGY & POWER: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 59 ENERGY & POWER: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018–2022 (USD MILLION)

- TABLE 60 ENERGY & POWER: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023–2028 (USD MILLION)

- TABLE 61 CHEMICAL: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 62 CHEMICAL: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 63 CHEMICAL: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018–2022 (USD MILLION)

- TABLE 64 CHEMICAL: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023–2028 (USD MILLION)

- TABLE 65 ELECTRONICS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 66 ELECTRONICS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 67 ELECTRONICS: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018–2022 (USD MILLION)

- TABLE 68 ELECTRONICS: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023–2028 (USD MILLION)

- TABLE 69 TRANSPORTATION: CRYOGENIC EQUIPMENT MARKET, BY TRANSPORT TYPE, 2018–2022 (USD MILLION)

- TABLE 70 TRANSPORTATION: CRYOGENIC EQUIPMENT MARKET, BY TRANSPORT TYPE, 2023–2028 (USD MILLION)

- TABLE 71 TRANSPORTATION: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 72 TRANSPORTATION: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 73 TRANSPORTATION: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018–2022 (USD MILLION)

- TABLE 74 TRANSPORTATION: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023–2028 (USD MILLION)

- TABLE 75 OTHER END-USER INDUSTRIES: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 76 OTHER END-USER INDUSTRIES: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 OTHER END-USER INDUSTRIES: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018–2022 (USD MILLION)

- TABLE 78 OTHER END-USER INDUSTRIES: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023–2028 (USD MILLION)

- TABLE 79 CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2018–2022 (USD MILLION)

- TABLE 80 CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2023–2028 (USD MILLION)

- TABLE 81 STORAGE SYSTEM: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 82 STORAGE SYSTEM: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 HANDLING SYSTEM: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 84 HANDLING SYSTEM: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 85 SUPPLY SYSTEM: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 86 SUPPLY SYSTEM: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 87 OTHERS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 88 OTHERS: CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 89 CRYOGENIC EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 90 CRYOGENIC EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 91 NON-CASU: CRYOGENIC EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 92 NON-CASU: CRYOGENIC EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 93 CRYOGENIC EQUIPMENT MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 94 CRYOGENIC EQUIPMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 95 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018–2022 (USD MILLION)

- TABLE 96 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 97 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018–2022 (USD MILLION)

- TABLE 98 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023–2028 (USD MILLION)

- TABLE 99 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 100 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 101 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2018–2022 (USD MILLION)

- TABLE 102 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2023–2028 (USD MILLION)

- TABLE 103 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 104 ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 105 CHINA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 106 CHINA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 107 INDIA: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018–2022 (USD MILLION)

- TABLE 108 INDIA: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 109 INDIA: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018–2022 (USD MILLION)

- TABLE 110 INDIA: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023–2028 (USD MILLION)

- TABLE 111 INDIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 112 INDIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 113 INDIA: CRYOGENIC EQUIPMENT MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 114 INDIA: CRYOGENIC EQUIPMENT MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 115 INDIA: CRYOGENIC EQUIPMENT MARKET, BY NON-CASU APPLICATION, 2018–2022 (USD MILLION)

- TABLE 116 INDIA: CRYOGENIC EQUIPMENT MARKET, BY NON-CASU APPLICATION, 2023–2028 (USD MILLION)

- TABLE 117 AUSTRALIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 118 AUSTRALIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 119 JAPAN: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 120 JAPAN: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 121 MALAYSIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 122 MALAYSIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 123 REST OF ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 124 REST OF ASIA PACIFIC: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 125 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018–2022 (USD MILLION)

- TABLE 126 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 127 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018–2022 (USD MILLION)

- TABLE 128 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023–2028 (USD MILLION)

- TABLE 129 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 130 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 131 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2018–2022 (USD MILLION)

- TABLE 132 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2023–2028 (USD MILLION)

- TABLE 133 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 134 EUROPE: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 135 RUSSIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 136 RUSSIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 137 UK: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 138 UK: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 139 GERMANY: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 140 GERMANY: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 141 FRANCE: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 142 FRANCE: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 143 REST OF EUROPE: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 144 REST OF EUROPE: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 145 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018–2022 (USD MILLION)

- TABLE 146 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 147 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018–2022 (USD MILLION)

- TABLE 148 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023–2028 (USD MILLION)

- TABLE 149 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 150 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 151 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2018–2022 (USD MILLION)

- TABLE 152 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2023–2028 (USD MILLION)

- TABLE 153 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 154 NORTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 155 US: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 156 US: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 157 CANADA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 158 CANADA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 159 MEXICO: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 160 MEXICO: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 161 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018–2022 (USD MILLION)

- TABLE 162 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 163 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018–2022 (USD MILLION)

- TABLE 164 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023–2028 (USD MILLION)

- TABLE 165 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 166 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 167 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2018–2022 (USD MILLION)

- TABLE 168 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2023–2028 (USD MILLION)

- TABLE 169 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 170 MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 171 SAUDI ARABIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 172 SAUDI ARABIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 173 UAE: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 174 UAE: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 175 QATAR: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 176 QATAR: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 177 REST OF MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 178 REST OF MIDDLE EAST: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 179 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018–2022 (USD MILLION)

- TABLE 180 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 181 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018–2022 (USD MILLION)

- TABLE 182 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023–2028 (USD MILLION)

- TABLE 183 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 184 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 185 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2018–2022 (USD MILLION)

- TABLE 186 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2023–2028 (USD MILLION)

- TABLE 187 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 188 AFRICA: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 189 SOUTH AFRICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 190 SOUTH AFRICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 191 NIGERIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 192 NIGERIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 193 ALGERIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 194 ALGERIA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 195 REST OF AFRICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 196 REST OF AFRICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 197 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2018–2022 (USD MILLION)

- TABLE 198 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY EQUIPMENT, 2023–2028 (USD MILLION)

- TABLE 199 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2018–2022 (USD MILLION)

- TABLE 200 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN, 2023–2028 (USD MILLION)

- TABLE 201 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 202 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 203 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2018–2022 (USD MILLION)

- TABLE 204 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY SYSTEM TYPE, 2023–2028 (USD MILLION)

- TABLE 205 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 206 SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 207 BRAZIL: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 208 BRAZIL: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 209 ARGENTINA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 210 ARGENTINA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 211 VENEZUELA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 212 VENEZUELA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 213 REST OF SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2018–2022 (USD MILLION)

- TABLE 214 REST OF SOUTH AMERICA: CRYOGENIC EQUIPMENT MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 215 STRATEGIES ADOPTED BY KEY PLAYERS

- TABLE 216 CRYOGENIC EQUIPMENT MARKET: DEGREE OF COMPETITION

- TABLE 217 MARKET EVALUATION FRAMEWORK, 2018–2022

- TABLE 218 CRYOGENIC EQUIPMENT MARKET: DEALS, 2018–2023

- TABLE 219 CRYOGENIC EQUIPMENT MARKET: OTHERS, 2018–2023

- TABLE 220 EQUIPMENT: COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 221 CRYOGEN: COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 222 END-USER INDUSTRY: COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 223 SYSTEM TYPE: COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 224 REGION: COMPANY FOOTPRINT (KEY PLAYERS)

- TABLE 225 EQUIPMENT: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 226 CRYOGEN: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 227 END-USER INDUSTRY: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 228 SYSTEM TYPE: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 229 REGION: COMPANY FOOTPRINT (OTHER PLAYERS)

- TABLE 230 LINDE PLC: COMPANY OVERVIEW

- TABLE 231 LINDE PLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 232 LINDE PLC: DEALS

- TABLE 233 LINDE PLC: OTHERS

- TABLE 234 AIR LIQUIDE: COMPANY OVERVIEW

- TABLE 235 AIR LIQUIDE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 236 AIR LIQUIDE: DEALS

- TABLE 237 AIR LIQUIDE: OTHERS

- TABLE 238 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY OVERVIEW

- TABLE 239 AIR PRODUCTS AND CHEMICALS, INC.: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 240 AIR PRODUCTS AND CHEMICALS, INC.: DEALS

- TABLE 241 AIR PRODUCTS AND CHEMICALS, INC.: OTHERS

- TABLE 242 CHART INDUSTRIES: COMPANY OVERVIEW

- TABLE 243 CHART INDUSTRIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 CHART INDUSTRIES: DEALS

- TABLE 245 CHART INDUSTRIES: OTHERS

- TABLE 246 PARKER HANNIFIN CORP.: COMPANY OVERVIEW

- TABLE 247 PARKER HANNIFIN CORP.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 248 FLOWSERVE CORPORATION: COMPANY OVERVIEW

- TABLE 249 FLOWSERVE CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 250 NIKKISO CO., LTD.: COMPANY OVERVIEW

- TABLE 251 NIKKISO CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 252 INOX INDIA LIMITED: COMPANY OVERVIEW

- TABLE 253 INOX INDIA LIMITED: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 254 INOX INDIA LIMITED: DEALS

- TABLE 255 INOX INDIA LIMITED: OTHERS

- TABLE 256 TAYLOR-WHARTON: COMPANY OVERVIEW

- TABLE 257 TAYLOR-WHARTON: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 258 TAYLOR-WHARTON: DEALS

- TABLE 259 EMERSON ELECTRIC CO.: COMPANY OVERVIEW

- TABLE 260 EMERSON ELECTRIC CO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 261 EMERSON ELECTRIC CO.: DEALS

- TABLE 262 WESSINGTON CRYOGENICS: COMPANY OVERVIEW

- TABLE 263 WESSINGTON CRYOGENICS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 264 SULZER LTD: COMPANY OVERVIEW

- TABLE 265 SULZER LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 PHPK TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 267 PHPK TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 268 ACME CRYO.: COMPANY OVERVIEW

- TABLE 269 ACME CRYO.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 ACME CRYO.: DEALS

- TABLE 271 SHI CRYOGENICS GROUP: COMPANY OVERVIEW

- TABLE 272 SHI CRYOGENICS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 273 SHI CRYOGENICS GROUP: DEALS

- FIGURE 1 CRYOGENIC EQUIPMENT MARKET: RESEARCH DESIGN

- FIGURE 2 DATA TRIANGULATION METHODOLOGY

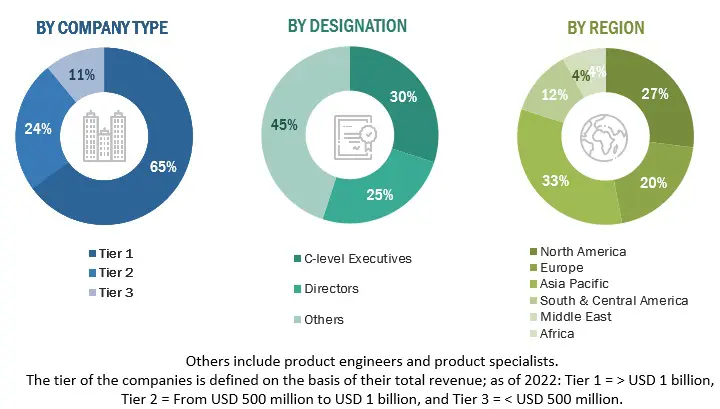

- FIGURE 3 BREAKDOWN OF PRIMARIES: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 CRYOGENIC EQUIPMENT MARKET: BOTTOM-UP APPROACH

- FIGURE 5 CRYOGENIC EQUIPMENT MARKET: TOP-DOWN APPROACH

- FIGURE 6 METRICS CONSIDERED FOR ANALYZING AND ASSESSING DEMAND FOR CRYOGENIC EQUIPMENT

- FIGURE 7 KEY METRICS CONSIDERED FOR ASSESSING SUPPLY OF CRYOGENIC EQUIPMENT

- FIGURE 8 CRYOGENIC EQUIPMENT MARKET: SUPPLY-SIDE ANALYSIS

- FIGURE 9 TANKS TO DOMINATE CRYOGENIC EQUIPMENT MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 10 NITROGEN TO ACCOUNT FOR LARGEST SHARE OF CRYOGENIC EQUIPMENT MARKET IN 2028

- FIGURE 11 ELECTRONICS INDUSTRY TO HOLD MAJORITY OF MARKET SHARE IN 2028

- FIGURE 12 CASU APPLICATIONS TO HOLD LARGER SHARE OF CRYOGENIC EQUIPMENT MARKET IN 2028

- FIGURE 13 STORAGE SYSTEMS TO LEAD CRYOGENIC EQUIPMENT MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 14 ASIA PACIFIC DOMINATED CRYOGENIC EQUIPMENT MARKET IN 2022

- FIGURE 15 UTILIZATION OF INDUSTRIAL GASES IN METALLURGY AND ENERGY & POWER INDUSTRIES TO DRIVE MARKET

- FIGURE 16 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN CRYOGENIC EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 17 NITROGEN AND CHINA HELD LARGEST SHARE OF ASIA PACIFIC CRYOGENIC EQUIPMENT MARKET, BY CRYOGEN AND COUNTRY, RESPECTIVELY, IN 2022

- FIGURE 18 TANKS HELD LARGEST SHARE OF GLOBAL CRYOGENIC EQUIPMENT MARKET IN 2022

- FIGURE 19 NITROGEN SEGMENT CAPTURED MAJORITY OF MARKET SHARE IN 2022

- FIGURE 20 METALLURGY INDUSTRY ACCOUNTED FOR LARGEST SHARE OF CRYOGENIC EQUIPMENT MARKET IN 2022

- FIGURE 21 CASU APPLICATIONS DOMINATED CRYOGENIC EQUIPMENT MARKET IN 2022

- FIGURE 22 STORAGE SYSTEMS DOMINATED CRYOGENIC EQUIPMENT MARKET IN 2022

- FIGURE 23 CRYOGENIC EQUIPMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 24 GLOBAL OIL DEMAND, 2019–2028

- FIGURE 25 GLOBAL CLEAN ENERGY INVESTMENTS, 2015–2023

- FIGURE 26 IRON ORE PRICING TREND, 2016–2023

- FIGURE 27 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 CRYOGENIC EQUIPMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 29 INNOVATIONS AND PATENT REGISTRATIONS PERTAINING TO CRYOGENIC EQUIPMENT, 2018–2022

- FIGURE 30 NITROGEN EXPORT DATA FOR TOP 5 COUNTRIES, 2020–2022 (USD THOUSAND)

- FIGURE 31 NITROGEN IMPORT DATA FOR TOP 5 COUNTRIES, 2020–2022 (USD THOUSAND)

- FIGURE 32 ARGON EXPORT DATA FOR TOP 5 COUNTRIES, 2020–2022 (USD THOUSAND)

- FIGURE 33 ARGON IMPORT DATA FOR TOP 5 COUNTRIES, 2020–2022 (USD THOUSAND)

- FIGURE 34 OXYGEN EXPORT DATA FOR TOP 5 COUNTRIES, 2020–2022 (USD THOUSAND)

- FIGURE 35 OXYGEN IMPORT DATA FOR TOP 5 COUNTRIES, 2020–2022 (USD THOUSAND)

- FIGURE 36 LNG EXPORT DATA FOR TOP 5 COUNTRIES, 2020–2022 (USD THOUSAND)

- FIGURE 37 LNG IMPORT DATA FOR TOP 5 COUNTRIES, 2020–2022 (USD THOUSAND)

- FIGURE 38 HYDROGEN EXPORT DATA FOR TOP 5 COUNTRIES, 2020–2022 (USD THOUSAND)

- FIGURE 39 HYDROGEN IMPORT DATA FOR TOP 5 COUNTRIES, 2020–2022 (USD THOUSAND)

- FIGURE 40 CRYOGENIC EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 41 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END-USER INDUSTRIES

- FIGURE 42 KEY BUYING CRITERIA FOR TOP 3 END-USER INDUSTRIES

- FIGURE 43 CRYOGENIC EQUIPMENT MARKET SHARE, BY EQUIPMENT, 2022

- FIGURE 44 CRYOGENIC EQUIPMENT MARKET SHARE, BY CRYOGEN, 2022

- FIGURE 45 CRYOGENIC EQUIPMENT MARKET SHARE, BY END-USER INDUSTRY, 2022

- FIGURE 46 CRYOGENIC EQUIPMENT MARKET SHARE, BY SYSTEM TYPE, 2022

- FIGURE 47 CRYOGENIC EQUIPMENT MARKET SHARE, BY APPLICATION, 2022

- FIGURE 48 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN CRYOGENIC EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 49 CRYOGENIC EQUIPMENT MARKET SHARE, IN TERMS OF VALUE, BY REGION, 2022

- FIGURE 50 SNAPSHOT: CRYOGENIC EQUIPMENT MARKET IN ASIA PACIFIC

- FIGURE 51 SNAPSHOT: CRYOGENIC EQUIPMENT MARKET IN EUROPE

- FIGURE 52 MARKET SHARE ANALYSIS, 2022

- FIGURE 53 SEGMENTAL REVENUE ANALYSIS, 2018–2022

- FIGURE 54 CRYOGENIC EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2022

- FIGURE 55 CRYOGENIC EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (OTHER PLAYERS), 2022

- FIGURE 56 LINDE PLC: COMPANY SNAPSHOT

- FIGURE 57 AIR LIQUIDE: COMPANY SNAPSHOT

- FIGURE 58 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT

- FIGURE 59 CHART INDUSTRIES: COMPANY SNAPSHOT

- FIGURE 60 PARKER HANNIFIN CORP.: COMPANY SNAPSHOT

- FIGURE 61 FLOWSERVE CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 NIKKISO CO., LTD.: COMPANY SNAPSHOT

- FIGURE 63 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- FIGURE 64 SULZER LTD: COMPANY SNAPSHOT

The study involved major activities in estimating the current size of the cryogenic equipment market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the cryogenic equipment market involved the use of extensive secondary sources, directories, and databases, such as Hoover’s, Bloomberg, Factiva, IRENA, International Energy Agency, and Statista Industry Journal, to collect and identify information useful for a technical, market-oriented, and commercial study of the cryogenic equipment market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The cryogenic equipment market comprises several stakeholders, such as cryogenic equipment manufacturers, technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for types of cryogenic equipments such as rod lift systems, electric submersible pumps, progressive cavity pumps, and gas lift systems. The supply side is characterized by rising demand for contracts from the industrial sector and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the cryogenic equipment market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share has been determined through primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through both primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

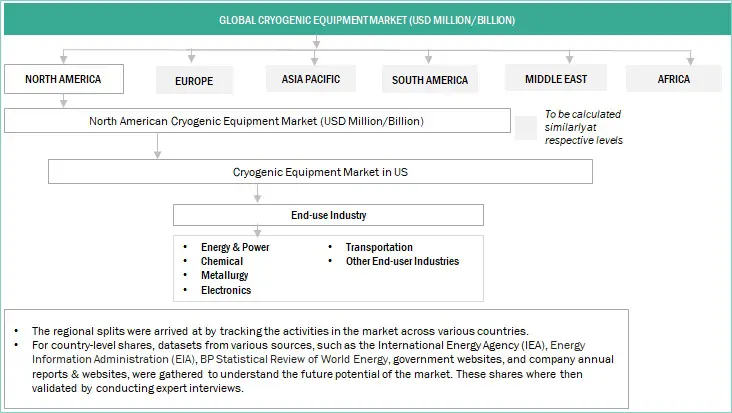

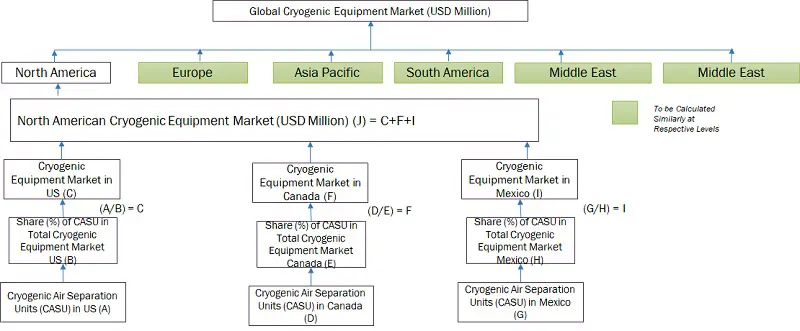

Cryogenic Equipment Market Size: Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Cryogenic Equipment Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size from the above estimation process, the total market has been split into several segments and subsegments. Data triangulation and market breakdown processes have been employed to complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

Cryogenic equipment comprises specialized machinery designed for use at extremely low temperatures, typically below -150 degrees Celsius. It enables the storage, transport, and handling of materials like gases and biological samples at these ultra-low temperatures. This technology finds application in various fields, from healthcare to aerospace, supporting scientific research and industrial processes.

The market for cryogenic equipment is the sum of revenues generated by global companies through the sales of cryogenic equipment.

Key Stakeholders

- Cryogenic equipment manufacturers and providers

- Industrial gas supplying companies

- Manufacturing industries

- R&D laboratories

- Consulting companies from energy & power sector

- Distributors of cryogenic equipment

- Government and research organizations

- State and national regulatory authorities

Objectives of the Study

- To define, describe, segment, and forecast the cryogenic equipment market by equipment, cryogen, end-user industry, system type, application, and region, in terms of value

- To describe and forecast the market for six key regions: North America, Europe, Asia Pacific, South America, the Middle East, and Africa, along with their country-level market sizes, in terms of value

- To provide detailed information regarding key drivers, restraints, opportunities, and challenges influencing market growth

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market size

- To provide supply chain analysis, trends/disruptions impacting customer business, ecosystem/market map, pricing analysis, Porter’s five forces analysis, case study analysis, and regulatory standards pertaining to cryogenic equipment

- To analyze opportunities for stakeholders in the cryogenic equipment and draw a competitive landscape of the market

- To strategically analyze the ecosystem, tariffs and regulations, patents, and trading scenarios pertaining to cryogenic equipment

- To compare key market players based on product specifications and applications

- To strategically profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as contracts and agreements, investments and expansions, mergers and acquisitions, partnerships, joint ventures and collaborations, in the cryogenic equipment.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cryogenic Equipment Market