Impact of COVID-19 on Construction Industry Market by Type (Residential, Non-Residential, and Heavy & Civil Engineering) and Region (North America, Europe, Asia Pacific, Middle East & Africa, South America) - Global Forecast to 2024

COVID-19 Impact on Construction Industry Market

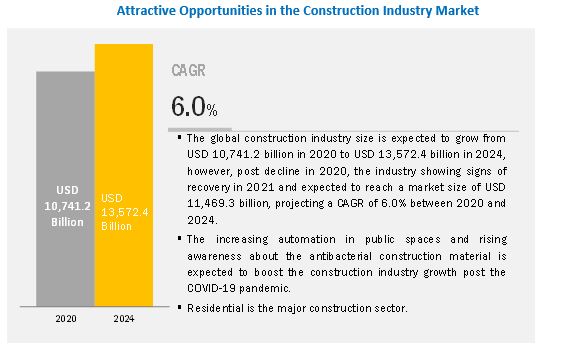

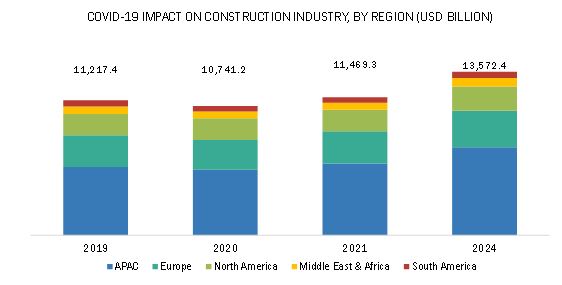

The construction industry market was valued at USD 10,741.2 billion in 2020 and is projected to reach USD 13,572.4 billion in 2024, growing at a cagr 6.0% from 2020 to 2024. The construction industry is expected to grow due to expected economic recovery resulting in increasing awareness about antibacterial construction materials.

To know about the assumptions considered for the study, Request for Free Sample Report

Construction Industry Market Dynamics

Drivers: Increasing automation in public spaces and rising awareness about antibacterial construction materials

The public spaces will move toward more automation to contain the spread of COVID-19. Designers will increasingly prefer antibacterial fabrics and finishes, including those already existing, like copper, and will inevitably be developed. Certain construction elements, which are already standard in health care, may find application in other public spaces, such as reducing the number of flat surfaces where germs can spread and installing ventilation systems that help remove potentially contaminated air from any given area. Health care design, too, will very likely get an upgrade in the near future. While social distancing would seem necessary, it is reasonable to expect that concerns about possible future virus outbreaks might encourage architects to design with an eye on open spaces that enable and encourage people to spread out.

Restraints: Volatility in raw material prices

Raw material and energy used in different types of construction have volatile prices and are set to continue in the forecast period. Sudden increase or price decrease affects the end project cost and profit margin of manufacturers and contractors. The primary raw materials used in the construction industry are cement, aggregates, sand, steel, aluminum, wood, glass, flooring materials, wall materials, and cladding materials. Volatility in the prices of energy and crude oil used for manufacturing and transporting these materials is the leading cause of fluctuations in the prices of these raw materials. These fluctuations, in turn, results in the volatility of prices of finished buildings. The instability of petroleum and crude oil costs may cause the price of raw materials to rise and increase the cost of raw materials used in precast concrete. Hence, the prices of these materials have a direct impact on the cost of precast concrete. Furthermore, with an increase in the cost of raw materials, vendors increase the price of their products or reduce their profit margins, which will have an adverse effect on the market growth

Residential is the major segment of the construction industry.

Globally, construction is more than USD 11 trillion industry, of which residential construction is the largest sector. The occurrence of COVID-19 has caused disruption in the residential construction sector. The main disruption is in the supply chain. The transformation of COVID-19 from a China-centric challenge to a global pandemic has resulted in shifting the impact to the global construction supply chains and markets.

The ongoing pandemic has created a number of challenges not only for the construction industry but also disrupted the global economy. The global crisis, duration of the recession, and path of recovery will largely determine the nature and severity of these challenges. The construction industry, particularly the new residential segment, was performing well and witnessing a surge in activity across many sectors in 2020. Owing to the rising number of cases in across the globe, many ongoing projects that were considered essential by the government authorities were not stopped, but new residential construction permits were suspended.

In the previous situation, the builders and contractors are struggling to obtain permits for both new and in-process construction projects. At present, both construction companies and workers are resuming their operations. However, new guidelines and regulations issued by the governments have created uncertainty and confusion for the companies as well as the laborers. Homeowners in regions with a high number of COVID-19 cases are limiting contractor access or entrance into homes and are preferring DIY projects as families are staying home.

APAC held the largest share in the construction industry in 2019.

APAC is the major construction market owing to the increasing construction activities in China, India, and Southeast Asian countries. Advancements in technology, regulatory policies, and government norms are some of the major factors driving the construction industry in APAC. However, the COVID-19 pandemic has resulted in a huge decline in the construction market in the region owing to continuous lockdown across various countries in 2020.

Construction Industry Market Players

The key players in the global construction industry are Bechtel Group (US), Balfour Beatty (UK), Grupo ACS (Spain), China State Construction Engineering Corporation Limited (China), L&T Construction (India), PCL Construction Enterprises (Canada), and Skanska Construction (Sweden). These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the construction industry. The study includes an in-depth competitive analysis of these companies in the construction industry, with their company profiles, recent developments, and key market strategies.

Construction Industry Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 10,741.2 billion |

|

Revenue Forecast in 2024 |

USD 13,572.4 billion |

|

CAGR |

6.0% |

|

Years considered for the study |

2019–2024 |

|

Base year |

2020 |

|

Forecast period |

2020–2024 |

|

Units considered |

Value (USD Billion) |

|

Segments |

Type and Region |

|

Regions |

Europe, North America, APAC, Middle East & Africa, and South America |

|

Companies |

Bechtel Group (US), Balfour Beatty (UK), Grupo ACS (Spain), China State Construction Engineering Corporation Limited (China), L&T Construction (India), PCL Construction Enterprises (Canada), and Skanska Construction (Sweden) |

This research report categorizes the composites market based on type and region.

By Type:

- Residential

- Non-Residential

- Heavy & Civil Engineering

By Region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Recent Developments

- In May 2020, Bechtel is take extensive steps to minimize risks of COVID-19 spread. Yet many workers remain reluctant regarding potential exposure to COVID-19 on the job. Even at sites that remain open, the absenteeism rates are high among laborers. As a result of these factors, the company is establishing widespread test and trace capabilities so that the workers/labors can return to work.

- In April 2020, a wide range of preventive measures have been taken by Balfour Beatty, especially at the plant level which has been implemented throughout the crisis, which is helping Balfour Beatty to maintain the supply chain intact. Despite a surge in demand, a shortage of raw material, and logistical challenges, the company has succeeded in fulfilling contractual obligations without outages or long delays. The company’s strategic building merchants are operating at reduced capacity across the UK.

- In February 2020, smid the global pandemic, CSCEC immediately built two hospitals in Wuhan in the span of 10 to 12 days. The 1,000-bed Huoshenshan hospital was completed on February 3, 2020, while the 1,600-bed hospital Leishenshan was completed on February 5, 2020.

- In March 2020, CSCEC has been steadily carrying on the construction of projects in Wuhan as well as others across Hubei province, without compromising the outbreak prevention and control. Its North Fourth Ring Road project in Wuhan was picked up in March 2020.

- In June 2020, PCL Construction Services, Inc. and Silicon Ranch Corporation came together to begin the construction on the 20-megawatt (MWAC) Odom Solar Farm, located near the city of Moultrie in Colquitt County, a rural community in Southwest Georgia. Silicon Ranch Corporation, one of the nation’s largest independent solar power producers, selected PCL’s solar division as the Engineer-Procure-Construct (EPC) contractor for the project.

- In Hune 2020, the renovation work of the University of Delaware’s Worrilow Hall academic building carried out by Skanska was also initially impacted by COVID-19. The company authorities had to rethink on their project plans as materials and workers became scarce. In addition, there was a limit on travel, which made some team members unable to visit the job site. Apart from this, the government and CDC orders mandated new requirements for job site cleanliness. The above-mentioned factors were seriously taken into consideration by the company. Skanska has been following city and state guidelines along with university rules and regulations and working closely and collaboratively with its clients and partners. As a result, the renovation activity of the Worrilow Hall continued during the lockdown, and the Hall is set to reopen in the next few months.

Frequently Asked Questions (FAQ):

Which are the major sectors in the construction industry?

The major sectors of the construction industry are residential, non-residential and civil & engineering.

Which region is the largest and fastest-growing market for the construction industry?

The residential segment has the highest share in the overall construction market. However, the heavy & civil engineering building construction segment is expected to grow at the highest CAGR by 2024.

Which technologies are coming up in the construction industry?

New technologies such as data collection apps, drones, building information, modeling (BIM) software, virtual reality, and wearables, 3d printing and artificial intelligence are the future technologies which will drive the growth of the market.

What are the major strategies adopted by leading market players?

The market leading players in the industry are adopting different strategies such as budget re-planning/restructuring, cost reduction, flexible business model, technology innovation, setting up of crisis management teams for each region, automation to address labor shortages etc.

How is the construction industry going to recover in 2024?

Government initiatives, new construction project plans, vaccination drives, increasing urbanization and the restart of many halted projects are anticipated to drive the growth of the market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 14)

1.1 OBJECTIVES OF THE STUDY

1.2 COVID-19

1.3 CONFIRMED CASES AND DEATHS BY COUNTRY

FIGURE 1 UNPRECEDENTED PROPAGATION OF COVID-19 PANDEMIC

1.4 MARKET SCOPE

1.4.1 MARKET DEFINITION

FIGURE 2 CONSTRUCTION INDUSTRY SEGMENTATION

FIGURE 3 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 LIMITATIONS OF THE STUDY

2 RESEARCH METHODOLOGY (Page No. - 18)

2.1 RESEARCH DATA

FIGURE 4 IMPACT OF COVID-19 ON CONSTRUCTION INDUSTRY: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Breakdown of primary interviews

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

FIGURE 5 IMPACT OF COVID-19 ON GLOBAL CONSTRUCTION INDUSTRY: MARKET SIZE ESTIMATION (METHOD 1)

2.2.2 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 6 IMPACT OF COVID-19 ON GLOBAL CONSTRUCTION INDUSTRY: MARKET SIZE ESTIMATION (METHOD 2)

FIGURE 7 DIFFERENT SCENARIOS FOR construction industry market

2.3 DATA TRIANGULATION

FIGURE 8 CONSTRUCTION INDUSTRY: DATA TRIANGULATION

3 MACROECONOMIC INDICATORS (Page No. - 24)

FIGURE 9 IMPACT OF COVID-19 IN 2020 ON DIFFERENT COUNTRIES

FIGURE 10 THREE SCENARIO-BASED ANALYSES OF IMPACT OF COVID-19 ON OVERALL BUSINESS

4 CUSTOMER ANALYSIS (Page No. - 28)

4.1 SHIFT IN INSTITUTIONAL/INDUSTRIAL CUSTOMERS

4.1.1 DISRUPTION IN INDUSTRIAL/COMMERCIAL SECTORS

4.1.2 IMPACT ON CUSTOMERS' OUTPUT & STRATEGIES TO RESUME/IMPROVE PRODUCTION

4.1.2.1 Impact on customers' revenues

4.1.2.2 Impact on construction of new facilities

4.1.2.3 Short-term strategies to manage cost structure and supply chains

4.1.2.4 Long-term strategies to manage cost structure and supply chains

4.1.3 NEW construction industry market OPPORTUNITIES/GROWTH OPPORTUNITIES

4.1.3.1 Measures taken by customers in 2020

4.1.3.2 Customers' perspective on growth outlook

4.2 SHIFT IN RESIDENTIAL CUSTOMER SEGMENTS

4.2.1 DISRUPTION IN CONSTRUCTION INDUSTRY

4.2.2 IMPACT ON CUSTOMER SPENDING PATTERNS

4.2.2.1 Changing income levels

4.2.2.2 Customers' perspective on growth outlook/new construction

5 COVID-19 IMPACT: CONSTRUCTION ECOSYSTEM (Page No. - 33)

5.1 VALUE CHAIN ANALYSIS

FIGURE 11 VALUE CHAIN OF CONSTRUCTION INDUSTRY

5.1.1 RESIDENTIAL BUILDING CONSTRUCTION

5.1.2 NON-RESIDENTIAL BUILDING CONSTRUCTION

5.1.3 HEAVY & CIVIL ENGINEERING CONSTRUCTION

5.2 IMPACT ON VALUE CHAIN & MEASURES TAKEN

5.2.1 FINANCING

5.2.2 DESIGN/ARCHITECTS

5.2.3 CONSTRUCTION MATERIAL SUPPLIERS

5.2.4 LOGISTICS/EQUIPMENT SUPPLIERS

5.2.5 CONSTRUCTION CONTRACTORS/CONSULTANTS

5.2.6 MAINTENANCE/USERS/SERVICE PROVIDERS

FIGURE 12 IMPACT OF VALUE CHAIN OF CONSTRUCTION INDUSTRY

5.3 MARKET DYNAMICS

FIGURE 13 IMPACT OF COVID-19 ON construction industry market : DRIVERS AND RESTRAINTS

5.3.1 DRIVERS

5.3.1.1 Increasing automation in public spaces and rising awareness about antibacterial construction materials

5.3.1.2 Population growth and rapid urbanization

TABLE 1 APAC URBANIZATION TREND, 1990–2050

5.3.1.3 Increasing demand for energy-efficient buildings

5.3.2 RESTRAINTS

5.3.2.1 Shutdown of manufacturing facilities

5.3.2.2 Non-availability of raw materials

5.3.2.3 Impact on supply chain and logistics

5.3.2.4 Volatility in raw material prices

FIGURE 14 CRUDE OIL PRICE TREND

5.3.2.5 Global housing crisis

6 IMPACT OF COVID-19 ON CONSTRUCTION COMPANIES (Page No. - 42)

6.1 TOP-PERFORMING SECTORS

6.1.1 RESIDENTIAL

6.2 MAJORLY HAMPERED, SECTORS

6.2.1 NON-RESIDENTIAL

6.2.2 HEAVY & CIVIL ENGINEERING

6.3 TOP PERFORMER BY CONSTRUCTION TECHNOLOGIES

6.3.1 PREFABRICATED TECHNOLOGY

6.3.2 AUTOMATED CONSTRUCTION TECHNOLOGY

6.3.3 COMPUTER INTEGRATED/SMART CONSTRUCTION TECHNIQUES

6.3.4 WORKFORCE SOURCING

6.4 COVID-19 IMPACT ON TOP COMPANIES

6.4.1 BECHTEL GROUP

6.4.2 BALFOUR BEATTY

6.4.3 ACS GROUP

6.4.4 CHINA STATE CONSTRUCTION ENGINEERING CORPORATION LIMITED

6.4.5 L&T CONSTRUCTION

6.4.6 PCL CONSTRUCTION ENTERPRISES

6.4.7 SKANSKA AB

7 WINNING STRATEGIES OF CONSTRUCTION COMPANIES (Page No. - 51)

7.1 WINNING STRATEGIES TO GAIN MARKET SHARE

7.1.1 SHORT-TERM STRATEGIES (TILL Q12021)

7.1.2 MIDTERM STRATEGIES (2021–2022)

7.1.3 LONG-TERM STRATEGIES (2024 ONWARDS)

7.2 COVID-19-RELATED DEVELOPMENTS/STRATEGIES OF STAKEHOLDERS IN CONSTRUCTION VALUE CHAIN

8 IMPACT OF COVID-19 ON CONSTRUCTION INDUSTRY (Page No. - 56)

8.1 SCENARIO-BASED FORECASTING, BY TYPE

8.1.1 PESSIMISTIC SCENARIO

TABLE 2 GLOBAL PESSIMISTIC SCENARIO: COVID-19 IMPACT ON construction industry market SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.1.2 REALISTIC SCENARIO

TABLE 3 GLOBAL REALISTIC SCENARIO: COVID-19 IMPACT ON CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.1.3 OPTIMISTIC SCENARIO

TABLE 4 GLOBAL OPTIMISTIC SCENARIO: COVID-19 IMPACT ON CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.2 BY TYPE, REALISTIC SCENARIO

8.2.1 RESIDENTIAL CONSTRUCTION

TABLE 5 COVID-19 IMPACT ON RESIDENTIAL CONSTRUCTION MARKET SIZE, BY REGION, 2019–2024 (USD BILLION)

8.2.2 NON-RESIDENTIAL CONSTRUCTION

TABLE 6 COVID-19 IMPACT ON NON-RESIDENTIAL CONSTRUCTION industry MARKET SIZE, BY REGION, 2019–2024 (USD BILLION)

8.2.3 HEAVY & CIVIL ENGINEERING CONSTRUCTION

TABLE 7 COVID-19 IMPACT ON HEAVY & CIVIL ENGINEERING CONSTRUCTION MARKET SIZE, BY REGION, 2019–2024 (USD BILLION)

8.3 BY REGION, REALISTIC SCENARIO

TABLE 8 POST-COVID-19: CONSTRUCTION MARKET SIZE, BY REGION, 2019–2024 (USD BILLION)

TABLE 9 POST-COVID-19: CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.1 APAC

TABLE 10 POST-COVID-19: APAC CONSTRUCTION MARKET SIZE, BY COUNTRY, 2019–2024 (USD BILLION)

TABLE 11 POST-COVID-19: APAC CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.1.1 China

8.3.1.1.1 Construction industry heavily dependent on rural migrant workers

TABLE 12 POST-COVID-19: CHINA CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.1.2 Japan

8.3.1.2.1 Economic situation in country under control

TABLE 13 POST-COVID-19: JAPAN CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.1.3 India

8.3.1.3.1 Rapid growth of construction industry

TABLE 14 POST-COVID-19: INDIA CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.1.4 Australia

8.3.1.4.1 Construction industry to significantly contribute to GDP

TABLE 15 POST-COVID-19: AUSTRALIA CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.1.5 Indonesia

8.3.1.5.1 Construction industry supporting country's economic growth

TABLE 16 POST-COVID-19: INDONESIA CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.1.6 South Korea

8.3.1.6.1 Government's high economic interest in residential, commercial, and infrastructure projects

TABLE 17 POST-COVID-19: SOUTH KOREA CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.1.7 Rest of APAC

TABLE 18 POST-COVID-19: REST OF APAC CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.2 EUROPE

TABLE 19 POST-COVID-19: EUROPE CONSTRUCTION industry MARKET SIZE, BY COUNTRY, 2019–2024 (USD BILLION)

TABLE 20 POST-COVID-19: EUROPE CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.2.1 UK

8.3.2.1.1 Lockdown restrictions and other measures to have a negative impact on construction activities

TABLE 21 POST-COVID-19: UK CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.2.2 Germany

8.3.2.2.1 German construction industry in relatively good position

TABLE 22 POST-COVID-19: GERMANY CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.2.3 France

8.3.2.3.1 Revival of construction market expected by end of 2021

TABLE 23 POST-COVID-19: FRANCE CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.2.4 Italy

8.3.2.4.1 Construction market to witness growth in near future

TABLE 24 POST-COVID-19: ITALY CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.2.5 Russia

8.3.2.5.1 Demand for construction material remained high

TABLE 25 POST-COVID-19: RUSSIA CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.2.6 Spain

8.3.2.6.1 Country to witness strong and balanced growth in 2021

TABLE 26 POST-COVID-19: SPAIN CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.2.7 Rest of Europe

TABLE 27 POST-COVID-19: REST OF EUROPE CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.3 NORTH AMERICA

TABLE 28 POST-COVID-19: NORTH AMERICA CONSTRUCTION industry MARKET SIZE, BY COUNTRY, 2019–2024 (USD BILLION)

TABLE 29 POST-COVID-19: NORTH AMERICA CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.3.1 US

8.3.3.1.1 Contractors facing difficulties with material supply chain

TABLE 30 POST-COVID-19: US CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.3.2 Canada

8.3.3.2.1 Construction sector relatively less impacted by COVID-19

TABLE 31 POST-COVID-19: CANADA CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.3.3 Mexico

8.3.3.3.1 Beginning of recovery expected by 2021

TABLE 32 POST-COVID-19: MEXICO CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.4 SOUTH AMERICA

TABLE 33 POST-COVID-19: SOUTH AMERICA CONSTRUCTION industry MARKET SIZE, BY COUNTRY, 2019–2024 (USD BILLION)

TABLE 34 POST-COVID-19: SOUTH AMERICA CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.4.1 Brazil

8.3.4.1.1 Has potential to become an important market for construction

TABLE 35 POST-COVID-19: BRAZIL CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.4.2 Argentina

8.3.4.2.1 High government investment for road, housing, and sanitation infrastructure

TABLE 36 POST-COVID-19: ARGENTINA CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.4.3 Rest of South America

TABLE 37 POST-COVID-19: REST OF SOUTH AMERICA CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.5 MIDDLE EAST & AFRICA

TABLE 38 POST-COVID-19: MIDDLE EAST & AFRICA CONSTRUCTION industry MARKET SIZE, BY COUNTRY, 2019–2024 (USD BILLION)

TABLE 39 POST-COVID-19: MIDDLE EAST & AFRICA CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.5.1 Saudi Arabia

8.3.5.1.1 Healthcare sector to witness an increase in projects

TABLE 40 POST-COVID-19: SAUDI ARABIA CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.5.2 UAE

8.3.5.2.1 Construction companies approaching material suppliers in India, Singapore, Thailand, and the US

TABLE 41 POST-COVID-19: UAE CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.5.3 Nigeria

8.3.5.3.1 COVID-19 pandemic negatively impacting economic recovery

TABLE 42 POST-COVID-19: NIGERIA CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

8.3.5.4 Rest of the Middle East & Africa

TABLE 43 POST-COVID-19: REST OF MIDDLE EAST & AFRICA CONSTRUCTION industry MARKET SIZE, BY TYPE, 2019–2024 (USD BILLION)

9 APPENDIX (Page No. - 81)

9.1 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

9.2 AVAILABLE CUSTOMIZATIONS

9.3 RELATED REPORTS

9.4 AUTHOR DETAILS

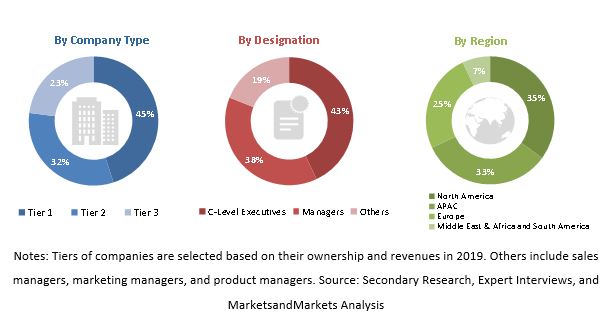

The study involves two major activities in estimating the market size of the construction industry. Exhaustive secondary research is done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, and Factiva, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, regional and country level government data, regional associations data, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The construction industry comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market is characterized by the development of mainly the residential, non-residential, and heavy & civil engineering sectors. Advancements in technology in various sectors describe the supply side. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total construction industry. These methods were also used extensively to determine the size of various sub-segments in the industry. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall construction industry size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, mainly from the residential, non-residential, and heavy & civil engineering sectors.

Report Objectives

- To analyze the impact of the COVID- 19 pandemic on the construction industry, by type and region

- To provide detailed information about the key factors influencing the growth of the industry

- To analyze vendors in the construction industry with capabilities to address emerging technology or construction material during the global lockdown due to the pandemic

- To profile key vendors in each of the key segments of the market and provide insights on their products and service offerings to help organizations during the global lockdown

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the construction industry in Rest of APAC

- Further breakdown of the construction industry in the Rest of Europe

- Further breakdown of the construction industry in Rest of the Middle East & Africa

- Further breakdown of the construction industry in the Rest of South America

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Impact of COVID-19 on Construction Industry Market

Want to know details of companies which have started integrating remote mode of operation in few construction processes. Is such data available?