Copper Clad Laminates Market by Application (Computers, Communication Systems, Consumer Appliances, Vehicle electronics, Healthcare Devices), Product Type (Rigid, Flexible), Reinforcement Material Type, Resin Type, Region - Global Forecast to 2027

Copper Clad Laminates Market

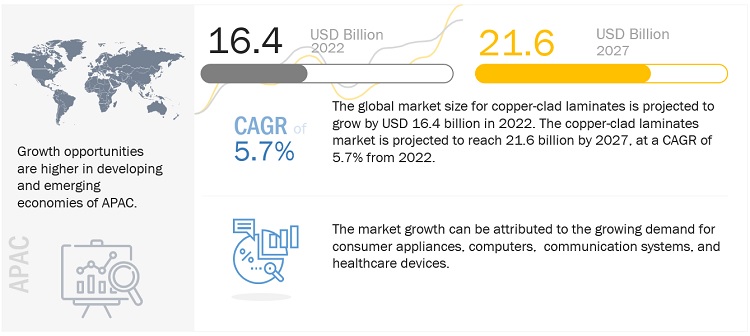

The global copper clad laminates market was valued at USD 16.4 billion in 2022 and is projected to reach USD 21.6 billion by 2027, growing at a cagr 5.7% from 2022 to 2027. The copper clad laminate is widely used in the fabrication of printed circuit boards (PCB). However, copper-clad laminate is a material that soaks in a resin with electronic glass fiber or any other reinforcing material to make the copper clad. Nowadays, in the era of technology, the integration and assembly density of several small and lightweight components on the boards are higher, which results in producing more amount of heat. Hence, to dissipate this amount of heat, there is a requirement for such materials that have a great heat transfer properties. In the market, there are two major types of copper-clad laminates available, i.e., rigid copper-clad laminate and flexible copper laminate. These copper-clad laminates are widely used in various end-use applications such as Computers, communication systems, consumer appliances, vehicle electronics, healthcare devices, and defense technology.

Attractive Opportunities in the Copper-Clad Laminates Market

To know about the assumptions considered for the study, Request for Free Sample Report

Copper Clad Laminates Market Dynamics

Driver: Growth in 5G infrastructure to boost market demand.

In the infrastructure of 5G, copper-clad laminates are used to improve the signal transmission, prevent delamination, manage heat, reduce weight, control moisture, and improve overall cost-effectiveness, which is expected to increase the demand for the product. However, the evolution of the traditional telecom model is expected to require significant changes in the infrastructure. Digital technology offers various advantages, including cost-effective short runs at high-quality resolutions, the capability of customization, and the elimination of costly inventory.

Restraint: Rising prices of raw materials

Due to rising urbanization, changing lifestyles, and rising domestic incomes, the demand for various products, such as computers, printers, mobile phones, and others in which these copper-clad laminates are used, is higher. But to limit the market of copper-clad laminates, there are two factors that play a major role, i.e., rising prices of the raw materials, and their availability. The availability and prices of raw materials, such as copper foils, resins, glass fiber, and others, vary from region to region.

Opportunities: Technological shift in the automotive sector

In the era of technology, various research has taken place in the automotive industry, which includes the digitalization of the sectors, increased automation techniques, and others. Due to varying consumer demands, rapid urbanization, and rapid technological advancements, most of the automotive companies, such as Volvo, Audi, Mercedes, etc., have started developing new models which introduce various technical aspects, such as wide touchscreen panels, airbag controls, Anti-theft systems, and many more.

Challenges: Disruption in the supply chain due to global chip shortage

Shortage of chips across the globe, which has been going on since 2020 and affects more than 150 industries, is a situation when the demand for integrated circuits, often known as semiconductor chips, is higher than the supply. These chips are widely used in video game consoles, cars, home appliances, graphics cards, and other devices that require semiconductor chips. As a result of wide application areas, the prices of semiconductor chips are rising. Due to the COVID-19 pandemic, supply networks, and logistics are hampered very much, which results in the lowering of the production rate of semiconductor chips. As a result of this, various end-use industries such as home appliances, automotive, healthcare, and others are affected.

Copper Clad Laminates Market Ecosystem

By Application, Vehicle Electronics accounted for the highest CAGR during the forecast period

Copper-clad Laminates are widely used in various electronic components of the vehicles, such as touchscreen panels, anti-theft systems, air-bag controllers, audio systems, ignition timing systems, and many more. There is an increasing need for advanced automotive & transportation safety and driver assistance systems, such as collision avoidance and emergency braking, blind spot recognition, and lane departure warning, and others which helps to boost the demand for copper-clad laminates in the forecast period.

By Resin, the Epoxy resin segment accounted for the highest CAGR during the forecast period

Epoxy can be used to make epoxy phenolic glass cloth laminated sheet that is alkali-free E-glass fabric that has been heated and pressed while being impregnated with both epoxy and phenolic resins. This product, which has excellent heat and humidity resistance, mechanical strength, and dielectric qualities, can be used in insulating parts for different electrical machines, motors, generators, electrical appliances, and humid environments. Rapid, urbanization, growing consumer needs, and rapid changes in the consumer’s lifestyles are the factor that fueled the demand for various home appliances, and this enhanced the demand for copper-clad laminates in the forecast period.

By Reinforcement Material, the Fibreglass segment accounted for the highest CAGR during the forecast period

Fibreglass is the reinforcement material that is used to manufacture the bonding sheet. The fabric, like glass sheets, is produced by weaving the glass yarn fibers. These sheets are then impregnated with a resin such as epoxy resin to form the core (cured resin) and prepreg (uncured resin) materials of different densities and thicknesses. These fiberglass sheets provide several benefits, such as excellent electrical properties, good moisture resistance, heat resistance, high strength, and others. Because of such benefits, these are widely used in making several electronic products that provide excellent energy-saving benefits.

By Type, the Flexible segment accounted for the highest CAGR during the forecast period

Flexible copper-clad laminates come in either single-layer or double-layer, which are made of PI film or polyester film as substrate material. This type of copper-clad laminate is an insulating and thin copper foil conductor with flexibility on the surface. Flexible copper-clad laminates provide several mechanical and electrical properties, along with good moisture resistance and low melting point. These flexible copper clad laminates provides low weight, thinness, and flexibility which make them an appropriate material to use in several electronic products, including cell phone, digital camera, automotive GPS, and laptop.

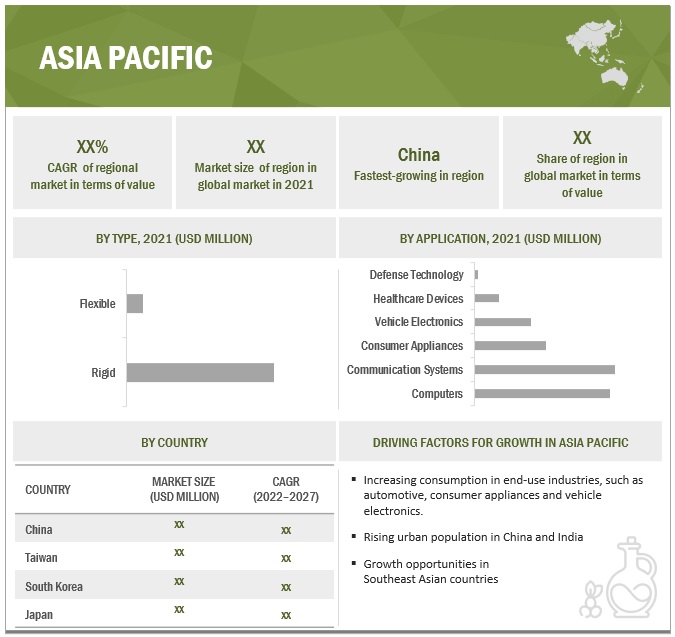

Asia Pacific is projected to account for the highest CAGR in the copper clad laminates market during the forecast period

Asia Pacific region is the hub of the electronic market. Due to the, rapidly growing electronics and automotive industries, competitive manufacturing costs, abundant availability of raw materials at lower costs, high economic growth rate, and lower labor & transportation costs are fueling the PCBs market in the region, which automatically boost the market of copper clad laminates.

To know about the assumptions considered for the study, download the pdf brochure

Copper Clad Laminates Market Players

Copper Clad Laminates comprises major manufacturers such as Kingboard Laminates Holdings Ltd. (China), Shengyi Technology Co. Ltd.(Sytech) (China), Nan Ya Plastics Corporation (Taiwan), Panasonic Holdings Corporation (Japan), and Taiwan Union Technology Corporation (Taiwan) were the leading players in the copper-clad laminates market. Expansions, acquisitions, joint ventures, and new product developments are some of the major strategies adopted by these key players to enhance their positions in the copper-clad laminates market.

Copper Clad Laminates Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 16.4 billion |

|

Revenue Forecast in 2027 |

USD 21.6 billion |

|

CAGR |

5.7% |

|

Years Considered |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Unit considered |

Value (USD Billion) |

|

Segments |

Type, Reinforcement material, Resin type, Application, and Region |

|

Regions |

Asia-Pacific, North America, Europe, Rest of the World |

|

Companies |

The major players are Kingboard Laminates Holdings Ltd. (China), Shengyi Technology Co., Ltd (China), Nan Ya Plastics Corporation (Taiwan), Panasonic Holdings Corporation (Japan), Taiwan Union Technology Corporation (Taiwan) and others are covered in the Copper clad laminate market. |

This research report categorizes the global copper clad laminate market on the basis of Type, Reinforcement material, Resin type, Application, and Region.

Copper Clad Laminate Market, By Type

- Rigid copper clad laminates

- Flexible copper clad laminates

Copper Clad Laminate Market, By Reinforcement Material

- Glass Fiber

- Paper Base

- Compound Materials

Copper Clad Laminate Market, By Resin Type

- Epoxy

- Phenolic

- Polyimide

- Others

Copper Clad Laminate Market, By Application

- Computers

- Communication Systems

- Consumer Appliances

- Vehicle Electronics

- Healthcare Devices

- Defense Technology

Copper Clad Laminate Market, By Region

- Asia Pacific (APAC)

- North America

- Europe

- Rest Of the World

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In October 2022, Taiwan Union Technology Corporation (TUC) launched RF/mmWave products- PegaClad series to meet the needs of 5G applications. These can be applied to low-orbit satellites and mmWave automotive radars

- In March 2022, Taiwan Union Technology Corporation (TUC) collaborated with IEC to provide the best quality to the PCB sector.

- In October 2021, TUC launched new advanced materials for high-speed and high-frequency applications to meet the needs of 5G.

- In October 2021, TUC launched PegaClad series materials for sub6GHz/mmWave antenna/radar applications.

- In January 2022, Panasonic corporation's industry company has developed the MEGTRON 8 multi-layer circuit board materials featuring low transmission loss specifically for high-speed networking devices.

- In February, Panasonic Corporation revealed that its Industrial solutions company began selling R-5410, a halogen-free multi-layer circuit board material with extremely low transmission loss appropriate for millimeter-wave antennas. March 2021 marked the beginning of mass production. This will help achieve enhanced Mobile BroadBand (eMBB), massive Machine Type Communications (mMTC), and Ultra-Reliable and Low Latency Communications (https://www.marketsandmarkets.com/Market-Reports/copper-clad-laminates-market-100748480.htmlLC) in 5G (5th generation mobile communication systems).

- March 2022, ITEQ Corporation created a joint venture firm in Taiwan with the Japanese electronic and chemical materials manufacturer, Mitsubishi Gas Chemical Company, Inc. with the aim of producing and marketing products for laminated material for printed wiring boards.

- In February 2021, AGC Inc., and NTT DOCOMO and a global group entered into a fundamental agreement to form a consortium to offer 5G technologies, initially in Thailand and then potentially in other Asia Pacific nations with the addition of new partners. ACTIVIO Inc., AGC Inc., Advanced Wireless Network Co., Ltd., etc. AGC Inc. is expected to be involved in the provision of innovative proprietary thin, small-footprint, antenna components and the enhancement of indoor coverage technologies, primarily for mm-Wave.

- In 2022, AGC Ceramics created a joint venture in China for the BRIGHTORBTM 3D printer business.

- In October 2022, Rogers Corporation announced a second multi-million Euro investment in its site in Eschenbach, Germany. By making this extra investment, Rogers will be able to meet the rising demand in the automotive, renewable energy, and industrial industry segments and expand the capacity of curamik AMB (Active Metal Brazed) and DBC (Direct Bonded Copper) substrates. The expansion's first phase was expected to be finished in the second half of 2022, while subsequent phases are expected to start in 2023.

- In July 2022, Rogers Corporation through the POWERDRIVE project: power electronics optimization for next-generation electric car components, the company announced its participation in the European Union's Horizon Europe research initiative. The integrated busbar solution from Rogers, called ROLINX Power Interconnect, will be available. It offers outstanding performance in power distribution with a wide variety of laminated and powder-coated busbars. The ROLINX team will collaborate with important stakeholders to speed system-level optimization by leveraging its design expertise and process engineering capacity.

Frequently Asked Questions (FAQ):

What are the major drivers driving the growth of the copper-clad laminates market?

The major drivers influencing the growth of the copper-clad laminates market are growth in 5G infrastructure, rising usage of PCBs in various applications such as LEDs, consumer electronics, industrial equipment, automotive components, aerospace components, safety and security equipment, telecom equipment, and others.

What are the major challenges in the copper-clad laminates market?

The major challenge in the copper-clad laminates market is a disruption in the supply chain network, which affects the availability of raw materials.

What are the restraining factors in the copper-clad laminates market?

The major restraining factor faced by the copper-clad laminates market is the rising prices of raw materials such as copper foils, glass fibers, resins, and others.

What is the key opportunity in the copper-clad laminates Market?

The growing demand for modern automotive vehicles, which are equipped with several modern equipment such as anti-theft systems, smart audio & video systems, and many more, has a new opportunity for the copper-clad laminates market.

What are the end-use industries where copper-clad laminates are used?

The copper-clad laminates are majorly used in various end-use industries such as automotive, electronics, communication systems, and others. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

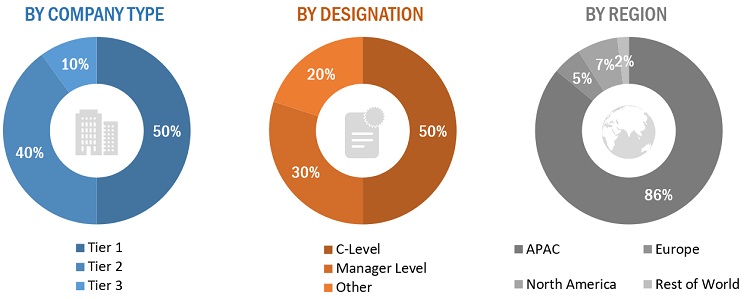

This research involved the use of extensive secondary sources and databases, such as Factiva and Bloomberg, to identify and collect information useful for a technical and market-oriented study of the copper clad laminate market. Primary sources included industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with various primary respondents, such as key industry participants, subject matter experts (SMEs), executives of key companies, and industry consultants, to obtain and verify critical qualitative and quantitative information as well as to assess growth prospects.

Secondary Research

In the secondary research process, various sources such as annual reports, press releases, and investor presentations of companies; white papers; and publications from recognized websites and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the industry's supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives.

Primary Research

The Copper clad laminate market comprises several stakeholders in the supply chain, which include suppliers, processors, and end-product manufacturers. Various primary sources from the supply and demand sides of the markets have been interviewed to obtain qualitative and quantitative information. The primary participants from the demand side include key opinion leaders, executives, vice presidents, and CEOs of companies in the copper clad laminate market. Primary sources from the supply side include associations and institutions involved in the copper clad laminate industry, key opinion leaders, and processing players.

Following is the breakdown of primary respondents—

Notes: Others include sales, marketing, engineers, and product managers.

Tier 1= USD 1 Billion; Tier 2 = below USD 1 Billion to USD 500 Million; and Tier 3 = Below USD 500 Million.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the global Copper clad laminate market. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Bottom-Up Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market was split into several segments and subsegments. To complete the overall market size estimation process and arrive at the exact statistics for all segments and subsegments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data have been triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size has been validated by using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global copper clad laminate market in terms of value.

- To provide insights regarding the significant factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze and forecast the market based on type, reinforcement material, resin type, region, and end-use application.

- To forecast the market size, in terms of value, with respect to four main regions: North America, Europe, Asia Pacific and Rest of the World.

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape.

- To strategically profile key players in the market.

- To analyze competitive developments in the market, such as new product launches, capacity expansions, and mergers & acquisitions.

- To strategically profile the leading players and comprehensively analyze their key developments in the market.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest of the APAC Copper clad laminate market

- Further breakdown of the Rest of Europe’s Copper clad laminate market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Copper Clad Laminates Market