Construction Films Market by Type (LDPE &LLDPE, HDPE, PP, PVC, PVB, PET/BOPET, PA/BOPA, PVC, PVB), Application(Protective & Barrier, Decorative), End-Use Industry (Residential, Commercial, Industrial, Civil Engineering) & Region - Global Forecast to 2026

Updated on : June 17, 2024

Construction Films Market

Construction Films Market was valued at USD 9.9 billion in 2020 and is projected to reach USD 12.9 billion by 2026, growing at a cagr 4.0% from 2021 to 2026. Construction films are used in applications that require vapor barriers, UV resistance, acoustic properties, antiglare, durability, and high strength. Plastic films used in construction are manufactured using different types of polymers. Increasing demand from developing countries (like India and China) and capacity expansion by major construction film manufacturers is expected to drive the growth of the market between 2021 and 2026. However, factory shutdowns, interrupted supply chains, and reduced demand from end-use industries has negatively affected the market.

To know about the assumptions considered for the study, download the pdf brochure

Impact of COVID-19 on global construction films market

The Construction film market is expected to witness slow growth in 2021 due to the novel coronavirus (COVID-19) pandemic. Some construction projects have been delayed and some canceled due to the impact of COVID-19 on the companies and governments that commissioned them. Furthermore, possible supply chain bottlenecks of equipment and materials, such as structural steel and glass from APAC, could cause project delays in current projects or reduced spending on future projects.

Uncertainty surrounding the duration and severity of this crisis makes it difficult to anticipate how a recovery could unfold for the industry. Extending lines of credit, reducing infrastructure costs, short-term funding, lowering the tax burden, and supply chain assistance are measures that the state and central governments are likely to explore globally.

Growth of construction industry in developing countries

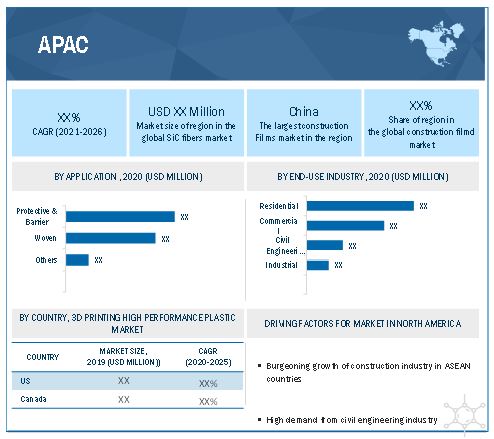

According to ICIS, the volume of global construction industry would grow rapidly by 2030 and would be majorly driven by the US, China, and India. This growth in the construction industry would increase the demand for construction films in various construction applications. APAC is leading the construction market due to increase in the growth of residential, commercial, industrial, and civil engineering projects in countries such as China and India. The construction industry in ASEAN countries are expected to project phenomenal growth as compared to the rest of the world.

Strict environmental and governments norms

Environmental regulations are a challenge for manufacturers, traders, vendors of plastic films. These regulations mandate collection of plastic waste management fee for producers, importers, and vendors selling plastic films for establishing a waste management system. Similarly, these producers and importers need to track records of materials sold and collect waste generated due to plastics and recycle them.

Increase in use of recycle products

The recycling of plastic wastes offers huge potential for film producers. There are many construction film applications where recycled plastic films can be used without compromising on the requirements. China imports most of the global plastic wastes. Considering the growing demand for construction films in APAC, the recycling of plastic wastes into construction films will be an alluring opportunity.

Recycling plastic films

Direct disposal of plastic films raises environmental concerns. Most plastic products do not fit into the recycling system because they have not been designed to be recycled. The Society of the Plastics Industry (SPI) created an industry-wide national system to identify resin types of different plastics with a recycle sign. The major issues faced in recycling plastic films are storage, segregating plastics for recycling, and lack of incentives for manufacturers to promote the use of recycled plastics.

LDPE & LLDPE segment accounted for the largest market share, in terms of value and volume

Based on type, the construction films market has been segmented into LDPE & LLDPE, HDPE, PP/BOPP, PET/BOPET, PA/BOPA, PVB, PVC, and others. The LDPE & LLDPE type segment is expected to lead the construction films market, in terms of volume and volume, during the forecast period. These films have a wide application in construction masking concrete structures, foundation lining, vapor barriers, etc.

Protective & barrier application accounted for the largest market share, in terms of value and volume

Based on application, the barriers & protective segment is estimated to lead the construction films market in terms of value and volume. The growth of this segment can be attributed to the increased demand for moisture and gas barriers. Moreover, construction films are being increasingly preferred as a sound barrier to dissipate highway noise and in stadiums for better acoustics.

Residential end-use industry accounted for the largest share in terms of value and volume

Construction films are used in residential, commercial, industrial, and civil engineering industries. The residential segment accounted for the largest share in the global construction films market owing to increasing in investments and funding in the residential construction. The increase in per capita income and housing projects launched by the governments, globally is expected to drive the construction films market in the residential segment.

APAC held the largest market share in the construction films market

APAC led the construction films market, in terms of value and volume, in 2020, because of its burgeoning construction Industry. China is the major construction market in the APAC construction industry. Increasing disposable income, rapid urbanization, supportive government initiatives and infrastructure investments in countries such as China, India, Indonesia, Malaysia, and Thailand is a major growth driver. India is a potential market in APAC. The growth in the Indian market is backed by the supportive government initiatives and infrastructure investments.

Construction Films Market Players

Some of the key players in the global Construction film market are:

- Mitsubishi Chemical (Japan)

- Du Pont de Nemours (US)

- Polifilm (Germany)

- Berry Global Group (US)

- RKW SE (Germany)

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the Construction film industry. The study includes an in-depth competitive analysis of these key players in the Construction film market, with their company profiles, recent developments, and key market strategies.

Construction Films Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2020 |

USD 9.9 billion |

|

Revenue Forecast in 2026 |

USD 12.9 billion |

|

CAGR |

4.0% |

|

Years considered for the study |

2019–2026 |

|

Base year |

2020 |

|

Forecast period |

2021–2026 |

|

Units considered |

Value (USD Million), Volume (million square meter) |

|

Segments |

Type, Application, End-use Industry, and Region |

|

Regions |

APAC, Europe, North America, MEA, and Latin America |

|

Companies |

Saint-Gobain (France) Mitsubishi Chemical (Japan) E.I. du Pont de Nemours (US) Toray (Japan)Berry Global (US) Eastman Chemical (US) Mondi (Great Britain) RKW SE (Germany) Supreme (India) Raven (US) Polyplex (India) Siliconature (Italy) Valeron (USA) Dupont Teijin (USA) SKC (South Korea) Deku (Germany) UPASS (China) |

This research report categorizes the construction film market based on type, application, end-use industry, and region.

By Type:

- LDPE & LLDPE

- HDPE

- Polypropylene (PP)/BOPP

- PET/BOPET

- Polyamide/BOPA

- PVB

- PVC

- Others

By Application:

- Protective & Barrier

- Decoration

- Others

By End-Use Industry:

- Residential

- Commercial

- Industrial

- Civil Engineering

By Region:

- APAC

- Europe

- North America

- MEA

- Latin America

Recent Developments

- In March 2021, Saint-Gobain invests USD 56 million in a new plasterboard plant in Spain to expand its construction solutions business. This expansion is expected to provide growth opportunity for construction films.

- In January 2020, Eastman Chemical Company expanded its operations in Dresden, Germany, to support a new coating and laminating line. This investment will support the strong growth of Eastman’s high-performance window film products used in construction. This expansion is also expected to supplement Eastman’s assets in Martinsville, Virginia,

- In January 2020, Raven Industries expanded its Engineered Films Division fabrication operations by opening of a facility in the east coast of the US in Waynesboro. The strategic location will allow Raven Engineered Films to provide a heightened level of service and faster product delivery to customers of its construction markets.

Frequently Asked Questions (FAQ):

What is Construction Films ?

Construction film is any film used in the construction business, except items intended for use as vapour barrier films, whether or not it is reinforced, laminated, supported, or otherwise mixed with other materials (e.g., tarpaulins, drop sheets, and wind screens);Read More...

What are the factors influencing the growth of the construction films market?

The growing demand for Construction film from civil engineering industries.

Which is the largest country-level market for construction films?

APAC is the largest Construction film market due to the presence major Construction film manufacturers and high demand from industrial and construction industries.

What are the factors contributing to the final price of construction films?

Raw material and technical route adopted for Construction film manufacturers plays a vital role in the costs. The cost of these materials contributes largely to the final pricing of Construction film.

What are the challenges in the construction films market?

Developing Biodegradable films and norms on plastic use are few of the major challenges in the construction film market.

Which type of Construction films holds the largest market share?

LLDPE/LDPE construction film hold the largest share in terms of value

How is the Construction films market aligned?

The market is growing at a moderate pace. It is a potential market and many manufactures are undertaking business strategies to expand their business especially in the developing countries.

Who are the major manufacturers?

RKW SE (Germany), Polifilm (Germany), Mitsubishi Chemical (Japan), E.I. du Pont De Nemours (US), Berry Global (US), are some of the major manufacturers of construction films.

What are the major applications for Construction film?

The major applications for construction films are protection & barrier, decoration, window films, furniture protection, amongst others

What are the major end-use industries for Construction film?

The major end-use industries for construction films are residential, commercial, industrial and civil engineering.

What is the biggest restraint in the construction film market?

Difficulty in recycling is the biggest restraint in the construction films market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 CONSTRUCTION FILMS MARKET SEGMENTATION

1.3.1 REGIONS COVERED

1.3.2 YEARS CONSIDERED IN THE REPORT

1.4 CURRENCY

1.5 UNIT CONSIDERED

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 BASE NUMBER CALCULATION

2.1.1 SUPPLY-SIDE APPROACH

2.1.2 DEMAND-SIDE APPROACH

2.2 FORECAST NUMBER CALCULATION

2.2.1 SUPPLY SIDE

2.2.2 DEMAND SIDE

2.3 RESEARCH DATA

2.3.1 SECONDARY DATA

2.3.2 PRIMARY DATA

2.3.2.1 Primary interviews – Top construction films manufacturers

2.3.2.2 Breakdown of primary interviews

2.3.2.3 Key industry insights

2.4 MARKET SIZE ESTIMATION

2.4.1 BOTTOM-UP APPROACH

FIGURE 2 CONSTRUCTION FILMS MARKET: BOTTOM-UP APPROACH

2.4.2 TOP-DOWN APPROACH

FIGURE 3 MARKET: TOP-DOWN APPROACH

2.5 DATA TRIANGULATION

FIGURE 4 MARKET: DATA TRIANGULATION

2.6 FACTOR ANALYSIS

2.7 ASSUMPTIONS

2.8 LIMITATIONS & RISKS ASSOCIATED WITH CONSTRUCTION FILMS MARKET

3 EXECUTIVE SUMMARY (Page No. - 39)

FIGURE 5 LDPE/LLDPE FILM SEGMENT TO DRIVE CONSTRUCTION FILMS MARKET DURING THE FORECAST PERIOD

FIGURE 6 PROTECTIVE & BARRIER APPLICATION ACCOUNTED FOR LARGEST SHARE IN OVERALL CONSTRUCTION FILMS MARKET

FIGURE 7 RESIDENTIAL END-USE SEGMENT TO ACCOUNT FOR THE LARGEST SHARE

FIGURE 8 CHINA PROJECTED TO WITNESS THE HIGHEST CAGR BETWEEN 2021 AND 2026

FIGURE 9 APAC TO REGISTER HIGHEST CAGR BETWEEN 2021 AND 2026

4 PREMIUM INSIGHTS (Page No. - 43)

4.1 ATTRACTIVE OPPORTUNITIES IN THE MARKET

FIGURE 10 PROTECTIVE & BARRIER APPLICATION TO OFFER LUCRATIVE OPPORTUNITIES TO MARKET PLAYERS

4.2 MARKET SIZE, BY FILM TYPE

FIGURE 11 LDPE/LLDPE TO LEAD CONSTRUCTION FILMS MARKET DURING THE FORECAST PERIOD

4.3 CONSTRUCTION FILMS MARKET SIZE, BY APPLICATION

FIGURE 12 PROTECTIVE & BARRIER FILMS TO REGISTER HIGHEST GROWTH BETWEEN 2021 AND 2026

4.4 CONSTRUCTION FILMS MARKET, BY REGION AND END-USE INDUSTRY

FIGURE 13 RESIDENTIAL SEGMENT ACCOUNTED FOR LARGEST SHARE IN OVERALL CONSTRUCTION FILMS MARKET

4.5 MARKET, BY COUNTRY

FIGURE 14 CHINA TO BE FASTEST-GROWING MARKET BETWEEN 2021 AND 2026

5 MARKET OVERVIEW (Page No. - 46)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN THE CONSTRUCTION FILMS MARKET

5.2.1 DRIVERS

5.2.1.1 Growth in global construction industry

TABLE 1 CONTRIBUTION TO GROWTH IN GLOBAL CONSTRUCTION OUTPUT, BY COUNTRY (2019-2030)

5.2.1.2 Increasing demand for water barrier and protective films

5.2.1.3 Stimulus packages by US government for construction industry to recover from COVID-19

5.2.2 RESTRAINTS

5.2.2.1 Saturated European market

5.2.2.2 Stringent environmental norms

5.2.2.3 Disruption in supply chain and lower production capacity utilization due to COVID-19 pandemic

5.2.3 OPPORTUNITIES

5.2.3.1 Quick recovery of construction industry from pandemic in China and other countries

TABLE 2 EXPECTED RECOVERY IN CONSTRUCTION OUTPUT, 2021

5.2.3.2 Increasing use of recyclable plastic products

5.2.4 CHALLENGES

5.2.4.1 Recycling of plastics films

5.2.4.2 Maintain uninterrupted supply chain and operate at full production capacity

5.2.4.3 Liquidity crunch

5.3 SUPPLY CHAIN ANALYSIS

TABLE 3 CONSTRUCTION FILMS MARKET: SUPPLY CHAIN

6 INDUSTRY TRENDS (Page No. - 51)

6.1 INTRODUCTION

6.2 PORTER’S FIVE FORCES ANALYSIS

FIGURE 16 MARKET: PORTER’S FIVE FORCES ANALYSIS

6.2.1 THREAT OF NEW ENTRANTS

6.2.2 THREAT OF SUBSTITUTES

6.2.3 BARGAINING POWER OF SUPPLIERS

6.2.4 BARGAINING POWER OF BUYERS

6.2.5 INTENSITY OF COMPETITIVE RIVALRY

TABLE 4 CONSTRUCTION FILM MARKET: PORTER’S FIVE FORCES ANALYSIS

6.3 ECOSYSTEM: CONSTRUCTION FILMS MARKET

6.4 VALUE CHAIN ANALYSIS

FIGURE 17 MARKET: VALUE CHAIN ANALYSIS

6.5 IMPACT OF COVID-19 ON END-USE INDUSTRIES

6.5.1 RESIDENTIAL BUILDING CONSTRUCTION

6.5.2 NON-RESIDENTIAL BUILDING CONSTRUCTION

6.5.3 HEAVY & CIVIL ENGINEERING CONSTRUCTION

6.6 IMPACT OF COVID-19 ON CONSTRUCTION INDUSTRY & MEASURES TAKEN

6.6.1 FINANCING

6.6.2 DESIGN/ARCHITECTS

6.6.3 CONSTRUCTION MATERIAL SUPPLIERS

6.6.4 LOGISTICS/EQUIPMENT SUPPLIERS

6.6.5 CONSTRUCTION CONTRACTORS/CONSULTANTS

6.6.6 MAINTENANCE/USERS/SERVICE PROVIDERS

6.7 TECHNOLOGY ANALYSIS

6.8 PRICING ANALYSIS

6.9 AVERAGE SELLING PRICE

TABLE 5 CONSTRUCTION FILMS: AVERAGE SELLING PRICE, BY REGION

6.10 KEY MARKET FOR IMPORT/EXPORT

6.10.1 CHINA

6.10.2 US

6.10.3 GERMANY

6.10.4 SOUTH KOREA

6.10.5 UK

6.10.6 INDIA

6.11 TARIFF AND REGULATIONS

6.12 CASE STUDY ANALYSIS

6.13 CONSTRUCTION FILMS: YC AND YCC SHIFT

6.14 PATENT ANALYSIS

6.14.1 METHODOLOGY

FIGURE 18 PATENT PUBLICATION TRENDS, 2012–2020

6.14.2 INSIGHTS

6.14.3 JURISDICTION ANALYSIS FOR CONSTRUCTION FILMS

FIGURE 19 PATENT JURISDICTION ANALYSIS FOR CONSTRUCTION FILMS (2012–2020)

7 CONSTRUCTION FILMS MARKET, BY FILM TYPE (Page No. - 63)

7.1 INTRODUCTION

7.2 CONSTRUCTION FILMS MARKET, BY FILM TYPE

TABLE 6 MARKET SIZE, BY FILM TYPE, 2017–2020 (USD MILLION)

TABLE 7 MARKET SIZE, BY FILM TYPE, 2017–2020 (MILLION SQUARE METER)

TABLE 8 MARKET SIZE, BY FILM TYPE, 2021–2026 (USD MILLION)

TABLE 9 MARKET SIZE, BY FILM TYPE, 2021–2026 (MILLION SQUARE METER)

7.3 LDPE & LLDPE

FIGURE 20 APAC TO LEAD LLDPE CONSTRUCTION FILMS MARKET, 2021–2026

TABLE 10 LLDPE & LDPE MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 11 LLDPE & LDPE MARKET SIZE, BY REGION, 2017–2020 (MILLION SQUARE METER)

TABLE 12 LLDPE & LDPE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 13 LLDPE & LDPE MARKET SIZE, BY REGION, 2021–2026 (MILLION SQUARE METER)

7.4 HDPE

TABLE 14 HDPE CONSTRUCTION FILMS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 15 HDPE MARKET SIZE, BY REGION, 2017–2020 (MILLION SQUARE METER)

TABLE 16 HDPE MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 17 HDPE MARKET SIZE, BY REGION, 2021–2026 (MILLION SQUARE METER)

7.5 PP/BOPP

TABLE 18 PP/BOPP CONSTRUCTION FILMS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 19 PP/BOPP MARKET SIZE, BY REGION, 2017–2020 (MILLION SQUARE METER)

TABLE 20 PP/BOPP MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 21 PP/BOPP MARKET SIZE, BY REGION, 2021–2026 (MILLION SQUARE METER)

7.6 PET/BOPET

TABLE 22 PET/BOPET CONSTRUCTION FILMS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 PET/BOPET MARKET SIZE, BY REGION, 2017–2020 (MILLION SQUARE METER)

TABLE 24 PET/BOPET MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 25 PET/BOPET MARKET SIZE, BY REGION, 2021–2026 (MILLION SQUARE METER)

7.7 POLYAMIDE/BOPA

TABLE 26 POLYAMIDE/BOPA CONSTRUCTION FILMS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 POLYAMIDE/BOPA MARKET SIZE, BY REGION, 2017–2020 (MILLION SQUARE METER)

TABLE 28 POLYAMIDE/BOPA MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 29 POLYAMIDE/BOPA MARKET SIZE, BY REGION, 2021–2026 (MILLION SQUARE METER)

7.8 PVB

TABLE 30 PVB CONSTRUCTION FILMS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 31 PVB MARKET SIZE, BY REGION, 2017–2020 (MILLION SQUARE METER)

TABLE 32 PVB MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 33 PVB MARKET SIZE, BY REGION, 2021–2026 (MILLION SQUARE METER)

7.9 PVC

TABLE 34 PVC CONSTRUCTION FILMS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 35 PVC MARKET SIZE, BY REGION, 2017–2020 (MILLION SQUARE METER)

TABLE 36 PVC MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 37 PVC MARKET SIZE, BY REGION, 2021–2026 (MILLION SQUARE METER)

7.10 OTHERS

TABLE 38 OTHER CONSTRUCTION FILMS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 39 OTHER MARKET SIZE, BY REGION, 2017–2020 (MILLION SQUARE METER)

TABLE 40 OTHERS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 41 OTHERS MARKET SIZE, BY REGION, 2021–2026 (MILLION SQUARE METER)

7.11 CROSS-LAMINATED FILMS MARKET

TABLE 42 CROSS-LAMINATED CONSTRUCTION FILMS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION AND MILLION SQUARE METER)

TABLE 43 CROSS-LAMINATED MARKET SIZE, BY REGION, 2021–2026 (USD MILLION AND MILLION SQUARE METER)

8 CONSTRUCTION FILMS MARKET, BY APPLICATION (Page No. - 82)

8.1 INTRODUCTION

FIGURE 21 PROTECTIVE & BARRIER APPLICATION TO LEAD OVERALL CONSTRUCTION FILMS MARKET BETWEEN 2021 AND 2026

TABLE 44 CONSTRUCTION FILMS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 45 MARKET SIZE, BY APPLICATION, 2017–2020 (MILLION SQUARE METER)

TABLE 46 MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 47 MARKET SIZE, BY APPLICATION, 2021–2026 (MILLION SQUARE METER)

8.2 PROTECTIVE & BARRIER

FIGURE 22 APAC TO BE FASTEST-GROWING MARKET IN PROTECTIVE & BARRIER APPLICATION BETWEEN 2021 AND 2026

TABLE 48 CONSTRUCTION FILMS MARKET SIZE IN PROTECTIVE & BARRIER APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 MARKET SIZE IN PROTECTIVE & BARRIER APPLICATION, BY REGION, 2017–2020 (MILLION SQUARE METER)

TABLE 50 MARKET SIZE IN PROTECTIVE & BARRIER APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 51 MARKET SIZE IN PROTECTIVE & BARRIER APPLICATION, BY REGION, 2021–2026 (MILLION SQUARE METER)

8.2.1 PROTECTIVE & BARRIER MARKET, BY TYPE

8.2.1.1 Vapor/moisture barrier

8.2.1.2 Gas barrier

8.2.1.3 Others

TABLE 52 PROTECTIVE & BARRIER: CONSTRUCTION FILMS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 53 PROTECTIVE & BARRIER: MARKET SIZE, BY TYPE, 2017–2020 (MILLION SQUARE METER)

TABLE 54 PROTECTIVE & BARRIER: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 55 PROTECTIVE & BARRIER: MARKET SIZE, BY TYPE, 2021–2026 (MILLION SQUARE METER)

8.3 DECORATIVE

TABLE 56 CONSTRUCTION FILMS MARKET SIZE IN DECORATIVE APPLICATION, BY REGION, 2017–2020 (USD MILLION)

TABLE 57 MARKET SIZE IN DECORATIVE APPLICATION, BY REGION, 2017–2020 (MILLION SQUARE METER)

TABLE 58 MARKET SIZE IN BARRIERS & DECORATIVE APPLICATION, BY REGION, 2021–2026 (USD MILLION)

TABLE 59 MARKET SIZE IN DECORATIVE APPLICATION, BY REGION, 2021–2026 (MILLION SQUARE METER)

8.4 OTHER APPLICATIONS

TABLE 60 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 61 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (MILLION SQUARE METER)

TABLE 62 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 63 MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2026 (MILLION SQUARE METER)

9 CONSTRUCTION FILMS MARKET, BY END-USE INDUSTRY (Page No. - 92)

9.1 INTRODUCTION

TABLE 64 CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 65 MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 66 MARKET SIZE, BY END USE-INDUSTRY, 2021–2026 (USD MILLION)

TABLE 67 MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

9.2 RESIDENTIAL

FIGURE 23 APAC TO BE FASTEST-GROWING MARKET IN RESIDENTIAL INDUSTRY BETWEEN 2021 AND 2026

TABLE 68 CONSTRUCTION FILMS MARKET SIZE IN RESIDENTIAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 69 MARKET SIZE IN RESIDENTIAL, BY REGION, 2017–2020 (MILLION SQUARE METER)

TABLE 70 MARKET SIZE IN RESIDENTIAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 71 MARKET SIZE IN RESIDENTIAL, BY REGION, 2021–2026 (MILLION SQUARE METER)

9.2.1 RESIDENTIAL CONSTRUCTION FILMS MARKET, BY APPLICATION

9.2.1.1 Wall Cladding

9.2.1.2 Roofing

9.2.1.3 Doors & Windows

9.2.1.4 Others

TABLE 72 RESIDENTIAL: CONSTRUCTION FILMS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 73 RESIDENTIAL: MARKET SIZE, BY APPLICATION, 2017–2020 (MILLION SQUARE METER)

TABLE 74 RESIDENTIAL: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 75 RESIDENTIAL: MARKET SIZE, BY APPLICATION, 2021–2026 (MILLION SQUARE METER)

9.3 COMMERCIAL

TABLE 76 CONSTRUCTION FILMS MARKET SIZE IN COMMERCIAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 77 MARKET SIZE IN COMMERCIAL, BY REGION, 2017–2020 (MILLION SQUARE METER)

TABLE 78 MARKET SIZE IN COMMERCIAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 79 MARKET SIZE IN COMMERCIAL, BY REGION, 2021–2026 (MILLION SQUARE METER)

9.3.1 COMMERCIAL CONSTRUCTION FILMS MARKET, BY APPLICATION

9.3.1.1 Wall Cladding

9.3.1.2 Roofing

9.3.1.3 Doors & Windows

9.3.1.4 Others

TABLE 80 COMMERCIAL: CONSTRUCTION FILMS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 81 COMMERCIAL: MARKET SIZE, BY APPLICATION, 2017–2020 (MILLION SQUARE METER)

TABLE 82 COMMERCIAL: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 83 COMMERCIAL: MARKET SIZE, BY APPLICATION, 2021–2026 (MILLION SQUARE METER)

9.4 INDUSTRIAL

TABLE 84 CONSTRUCTION FILMS MARKET SIZE IN INDUSTRIAL, BY REGION, 2017–2020 (USD MILLION)

TABLE 85 MARKET SIZE IN INDUSTRIAL, BY REGION, 2017–2020 (MILLION SQUARE METER)

TABLE 86 MARKET SIZE IN INDUSTRIAL, BY REGION, 2021–2026 (USD MILLION)

TABLE 87 MARKET SIZE IN INDUSTRIAL, BY REGION, 2021–2026 (MILLION SQUARE METER)

9.5 CIVIL ENGINEERING

FIGURE 24 APAC TO BE FASTEST-GROWING MARKET IN CIVIL ENGINEERING INDUSTRY BETWEEN 2021 AND 2026

TABLE 88 MARKET SIZE IN CIVIL ENGINEERING, BY REGION, 2017–2020 (USD MILLION)

TABLE 89 MARKET SIZE IN CIVIL ENGINEERING, BY REGION, 2017–2020 (MILLION SQUARE METER)

TABLE 90 MARKET SIZE IN CIVIL ENGINEERING, BY REGION, 2021–2026 (USD MILLION)

TABLE 91 MARKET SIZE IN CIVIL ENGINEERING, BY REGION, 2021–2026 (MILLION SQUARE METER)

10 CONSTRUCTION FILMS MARKET, BY REGION (Page No. - 106)

10.1 INTRODUCTION

FIGURE 25 CHINA TO DRIVE CONSTRUCTION FILMS MARKET BETWEEN 2021 AND 2026

TABLE 92 MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 93 MARKET SIZE, BY REGION, 2017–2020 (MILLION SQUARE METER)

TABLE 94 MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 95 MARKET SIZE, BY REGION, 2021–2026 (MILLION SQUARE METER)

10.2 APAC

FIGURE 26 APAC: CONSTRUCTION FILMS MARKET SNAPSHOT

10.2.1 MARKET IN APAC, BY FILM TYPE

TABLE 96 APAC: MARKET SIZE, BY FILM TYPE, 2017–2020 (USD MILLION)

TABLE 97 APAC: MARKET SIZE, BY FILM TYPE, 2017–2020 (MILLION SQUARE METER)

TABLE 98 APAC: MARKET SIZE, BY FILM TYPE, 2021–2026 (USD MILLION)

TABLE 99 APAC: MARKET SIZE, BY FILM TYPE, 2021–2026 (MILLION SQUARE METER)

10.2.2 MARKET IN APAC, BY APPLICATION

TABLE 100 APAC: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 101 APAC: MARKET SIZE, BY APPLICATION, 2017–2020 (MILLION SQUARE METER)

TABLE 102 APAC: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 103 APAC: MARKET SIZE, BY APPLICATION, 2021–2026 (MILLION SQUARE METER)

10.2.3 MARKET IN APAC, BY END-USE INDUSTRY

TABLE 104 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 105 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 106 APAC: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 107 APAC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.2.4 MARKET IN APAC, BY COUNTRY

TABLE 108 APAC: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 109 APAC: MARKET SIZE, BY COUNTRY, 2017–2020 (MILLION SQUARE METER)

10.2.5 MARKET IN APAC, BY COUNTRY

TABLE 110 APAC: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 111 APAC: MARKET SIZE, BY COUNTRY, 2021–2026 (MILLION SQUARE METER)

10.2.5.1 China

TABLE 112 CHINA: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 113 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 114 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 115 CHINA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.2.5.2 Japan

TABLE 116 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 117 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 118 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 119 JAPAN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.2.5.3 India

TABLE 120 INDIA: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 121 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 122 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 123 INDIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.2.5.4 South Korea

TABLE 124 SOUTH KOREA: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 125 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 126 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 127 SOUTH KOREA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.2.5.5 Rest of APAC

TABLE 128 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 129 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 130 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 131 REST OF APAC: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.3 EUROPE

FIGURE 27 EUROPE: CONSTRUCTION FILMS MARKET SNAPSHOT

10.3.1 MARKET IN EUROPE, BY FILM TYPE

TABLE 132 EUROPE: MARKET SIZE, BY FILM TYPE, 2017–2020 (USD MILLION)

TABLE 133 EUROPE: MARKET SIZE, BY FILM TYPE, 2017–2020 (MILLION SQUARE METER)

TABLE 134 EUROPE: MARKET SIZE, BY FILM TYPE, 2021–2026 (USD MILLION)

TABLE 135 EUROPE: MARKET SIZE, BY FILM TYPE, 2021–2026 (MILLION SQUARE METER)

10.3.2 MARKET IN EUROPE, BY APPLICATION

TABLE 136 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 137 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2020 (MILLION SQUARE METER)

TABLE 138 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 139 EUROPE: MARKET SIZE, BY APPLICATION, 2021–2026 (MILLION SQUARE METER)

10.3.3 MARKET IN EUROPE, BY END-USE INDUSTRY

TABLE 140 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 141 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 142 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 143 EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.3.4 MARKET IN EUROPE, BY COUNTRY

TABLE 144 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 145 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2020 (MILLION SQUARE METER)

10.3.5 MARKET IN EUROPE, BY COUNTRY

TABLE 146 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 147 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2026 (MILLION SQUARE METER)

10.3.5.1 Germany

TABLE 148 GERMANY: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 149 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 150 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 151 GERMANY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.3.5.2 UK

TABLE 152 UK: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 153 UK: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 154 UK: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 155 UK: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.3.5.3 France

TABLE 156 FRANCE: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 157 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 158 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 159 FRANCE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.3.5.4 Italy

TABLE 160 ITALY: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 161 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 162 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 163 ITALY: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.3.5.5 Spain

TABLE 164 SPAIN: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 165 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 166 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 167 SPAIN: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.3.5.6 Rest of Europe

TABLE 168 REST OF EUROPE: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 169 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 170 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 171 REST OF EUROPE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.4 NORTH AMERICA

FIGURE 28 NORTH AMERICA: CONSTRUCTION FILMS MARKET SNAPSHOT

10.4.1 MARKET IN NORTH AMERICA, BY FILM TYPE

TABLE 172 NORTH AMERICA: MARKET SIZE, BY FILM TYPE, 2017–2020 (USD MILLION)

TABLE 173 NORTH AMERICA: MARKET SIZE, BY FILM TYPE, 2017–2020 (MILLION SQUARE METER)

TABLE 174 NORTH AMERICA: MARKET SIZE, BY FILM TYPE, 2021–2026 (USD MILLION)

TABLE 175 NORTH AMERICA: MARKET SIZE, BY FILM TYPE, 2021–2026 (MILLION SQUARE METER)

10.4.2 MARKET IN NORTH AMERICA, BY APPLICATION

TABLE 176 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 177 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (MILLION SQUARE METER)

TABLE 178 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 179 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (MILLION SQUARE METER)

10.4.3 MARKET IN NORTH AMERICA, BY END-USE INDUSTRY

TABLE 180 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 181 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 182 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 183 NORTH AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.4.4 MARKET IN NORTH AMERICA, BY COUNTRY

TABLE 184 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 185 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 186 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 187 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (MILLION SQUARE METER)

10.4.4.1 US

TABLE 188 US: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 189 US: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 190 US: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 191 US: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.4.4.2 Canada

TABLE 192 CANADA: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 193 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 194 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 195 CANADA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.5 MEA

10.5.1 CONSTRUCTION FILMS MARKET IN MEA, BY FILM TYPE

TABLE 196 MEA: MARKET SIZE, BY FILM TYPE, 2017–2020 (USD MILLION)

TABLE 197 MEA: MARKET SIZE, BY FILM TYPE, 2017–2020 (MILLION SQUARE METER)

TABLE 198 MEA: MARKET SIZE, BY FILM TYPE, 2021–2026 (USD MILLION)

TABLE 199 MEA: MARKET SIZE, BY FILM TYPE, 2021–2026 (MILLION SQUARE METER)

10.5.2 MARKET IN MEA, BY APPLICATION

TABLE 200 MEA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 201 MEA: MARKET SIZE, BY APPLICATION, 2017–2020 (MILLION SQUARE METER)

TABLE 202 MEA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 203 MEA: MARKET SIZE, BY APPLICATION, 2021–2026 (MILLION SQUARE METER)

10.5.3 MARKET IN MEA, BY END-USE INDUSTRY

TABLE 204 MEA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 205 MEA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 206 MEA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 207 MEA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.5.4 MARKET IN MEA, BY COUNTRY

TABLE 208 MEA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 209 MEA: MARKET SIZE, BY COUNTRY, 2017–2020 (MILLION SQUARE METER)

10.5.5 MARKET IN MEA, BY COUNTRY

TABLE 210 MEA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 211 MEA: MARKET SIZE, BY COUNTRY, 2021–2026 (MILLION SQUARE METER)

10.5.5.1 Saudi Arabia

TABLE 212 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 213 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 214 SAUDI ARABIA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 215 SAUDI ARABIA: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.5.5.2 UAE

TABLE 216 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 217 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 218 UAE: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 219 UAE: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.5.5.3 Rest of MEA

TABLE 220 REST OF MEA: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 221 REST OF MEA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 222 REST OF MEA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 223 REST OF MEA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.6 LATIN AMERICA

10.6.1 CONSTRUCTION FILMS MARKET IN LATIN AMERICA, BY FILM TYPE

TABLE 224 LATIN AMERICA: MARKET SIZE, BY FILM TYPE, 2017–2020 (USD MILLION)

TABLE 225 LATIN AMERICA: MARKET SIZE, BY FILM TYPE, 2017–2020 (MILLION SQUARE METER)

TABLE 226 LATIN AMERICA: MARKET SIZE, BY FILM TYPE, 2021–2026 (USD MILLION)

TABLE 227 LATIN AMERICA: MARKET SIZE, BY FILM TYPE, 2021–2026 (MILLION SQUARE METER)

10.6.2 CONSTRUCTION FILMS MARKET IN LATIN AMERICA, BY APPLICATION

TABLE 228 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 229 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2017–2020 (MILLION SQUARE METER)

TABLE 230 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

TABLE 231 LATIN AMERICA: MARKET SIZE, BY APPLICATION, 2021–2026 (MILLION SQUARE METER)

10.6.3 CONSTRUCTION FILMS MARKET IN LATIN AMERICA, BY END-USE INDUSTRY

TABLE 232 LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 233 LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 234 LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 235 LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.6.4 MARKET IN LATIN AMERICA, BY COUNTRY

TABLE 236 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 237 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 238 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 239 LATIN AMERICA: CONSTRUCTION FILMS MARKET SIZE, BY COUNTRY, 2021–2026 (MILLION SQUARE METER)

10.6.4.1 Mexico

TABLE 240 MEXICO: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 241 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 242 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 243 MEXICO: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.6.4.2 Brazil

TABLE 244 BRAZIL: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 245 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 246 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 247 BRAZIL: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

10.6.4.3 Rest of Latin America

TABLE 248 REST OF LATIN AMERICA: CONSTRUCTION FILMS MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

TABLE 249 REST OF LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (MILLION SQUARE METER)

TABLE 250 REST OF LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (USD MILLION)

TABLE 251 REST OF LATIN AMERICA: MARKET SIZE, BY END-USE INDUSTRY, 2021–2026 (MILLION SQUARE METER)

11 COMPETITIVE LANDSCAPE (Page No. - 171)

11.1 INTRODUCTION

FIGURE 29 CAPACITY EXPANSION IS KEY GROWTH STRATEGY ADOPTED BETWEEN 2015 AND 2020

11.2 MARKET SHARE ANALYSIS

FIGURE 30 DUPONT DE NEMOURS, INC. LED THE CONSTRUCTION FILM MARKET IN 2020

TABLE 252 DEGREE OF COMPETITION: COMPETITIVE

11.3 MARKET RANKING

FIGURE 31 MARKET RANKING OF KEY PLAYERS

11.4 MARKET EVALUATION FRAMEWORK

TABLE 253 CONSTRUCTION FILMS MARKET: NEW PRODUCT LAUNCH/DEVELOPMENT, 2015-2020

TABLE 254 MARKET: DEALS, 2015-2020

11.5 REVENUE ANALYSIS OF TOP MARKET PLAYERS

TABLE 255 REVENUE ANALYSIS OF TOP MARKET PLAYERS, 2020 (USD MILLION)

11.6 COMPANY EVALUATION MATRIX

TABLE 256 COMPANY PRODUCT FOOTPRINT

TABLE 257 COMPANY APPLICATION FOOTPRINT

TABLE 258 COMPANY REGION FOOTPRINT

11.6.1 STAR

11.6.2 PERVASIVE

11.6.3 PARTICIPANTS

11.6.4 EMERGING LEADERS

FIGURE 32 CONSTRUCTION FILMS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2020

11.7 START-UP/ SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIX

11.7.1 PROGRESSIVE COMPANIES

11.7.2 RESPONSIVE COMPANIES

11.7.3 DYNAMIC COMPANIES

11.7.4 STARTING BLOCKS

FIGURE 33 CONSTRUCTION FILMS MARKET (START-UPS/SMES): COMPETITIVE LEADERSHIP MAPPING

11.8 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 34 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

11.9 BUSINESS STRATEGY EXCELLENCE

FIGURE 35 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN CONSTRUCTION FILMS MARKET

12 COMPANY PROFILES (Page No. - 187)

(Business overview, Products offered, Other developments, Winning Imperatives, Development and Growth Strategies, Threat from Competition & Right to Win)*

12.1 RAVEN

TABLE 259 RAVEN: BUSINESS OVERVIEW

FIGURE 36 RAVEN: COMPANY SNAPSHOT

12.2 SAINT-GOBAIN

TABLE 260 SAINT-GOBAIN: BUSINESS OVERVIEW

FIGURE 37 SAINT-GOBAIN: COMPANY SNAPSHOT

12.3 BERRY GLOBAL GROUP

TABLE 261 BERRY GLOBAL: BUSINESS OVERVIEW

FIGURE 38 BERRY GLOBAL: COMPANY SNAPSHOT

12.4 TORAY INDUSTRIES

TABLE 262 TORAY INDUSTRIES: BUSINESS OVERVIEW

FIGURE 39 TORAY INDUSTRIES: COMPANY SNAPSHOT

12.5 EASTMAN CHEMICAL COMPANY

TABLE 263 EASTMAN CHEMICAL COMPANY: BUSINESS OVERVIEW

FIGURE 40 EASTMAN CHEMICAL COMPANY: COMPANY SNAPSHOT

12.6 RKW SE

TABLE 264 RKW SE: BUSINESS OVERVIEW

12.7 MITSUBISHI CHEMICAL

TABLE 265 MITSUBISHI CHEMICAL: BUSINESS OVERVIEW

12.8 DUPONT TEIJIN FILMS

TABLE 266 DUPONT TEIJIN FILMS: BUSINESS OVERVIEW

12.9 E. I. DU PONT DE NEMOURS AND COMPANY

TABLE 267 DUPONT DE NEMOURS, INC. AND COMPANY: BUSINESS OVERVIEW

FIGURE 41 DUPONT DE NEMOURS, INC. AND COMPANY: COMPANY SNAPSHOT

12.10 SKC

TABLE 268 SKC : BUSINESS OVERVIEW

12.11 SILICONATURE SPA

TABLE 269 SILICONATURE S.P.A: BUSINESS OVERVIEW

12.12 DEKU

TABLE 270 DEKU: BUSINESS OVERVIEW

12.13 MONDI

TABLE 271 MONDI: BUSINESS OVERVIEW

FIGURE 42 MONDI: COMPANY SNAPSHOT

12.14 MTI POLYEXE INC.

TABLE 272 MTI POLYEXE INC.: BUSINESS OVERVIEW

12.15 POLYPLEX

TABLE 273 POLYPLEX: BUSINESS OVERVIEW

FIGURE 43 POLYPLEX: COMPANY SNAPSHOT

12.16 UPASS

TABLE 274 UPASS: BUSINESS OVERVIEW

12.17 SUPREME

TABLE 275 SUPREME: BUSINESS OVERVIEW

FIGURE 44 SUPREME: COMPANY SNAPSHOT

12.18 VALERON STRENGTH FILMS

TABLE 276 VALERON STRENGTH FILMS: BUSINESS OVERVIEW

*Details on Business overview, Products offered, Other developments, Winning Imperatives, Development and Growth Strategies, Threat from Competition & Right to Win might not be captured in case of unlisted companies.

12.19 OTHER COMPANIES

12.19.1 POLIFILM

12.19.2 DUNMORE CORPORATION

12.19.3 TRIOPLAST NYBORG A/S

12.19.4 CLIMAX SYNTHETIC

12.19.5 SPARTECH

12.19.6 ISOSPORT

12.19.7 OPTIMUM PLASTICS

12.19.8 INTEPLAST GROUP

12.19.9 SOLVAY

12.19.10 TECH FOLIEN LTD.

12.19.11 PLASTIKA KRITIS

12.19.12 INDUSTRIAL DEVELOPMENT COMPANY (INDEVCO) SAL

12.19.13 SABIC

12.19.14 QINGDAO KF PLASTICS

12.19.15 BMP PACKAGING KFT.

13 APPENDIX (Page No. - 229)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

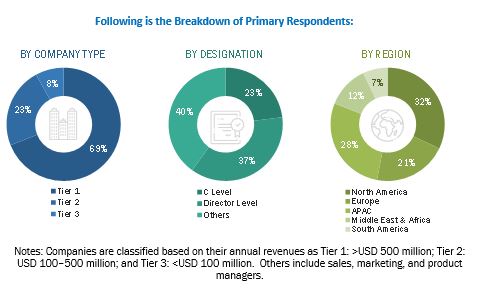

The study involved two major activities in estimating the current size of the construction film market. Exhaustive secondary research was performed to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation procedures were used to determine the extent of market segments and sub-segments.

Secondary Research

In the secondary research process, information was sourced from annual reports, press releases & investor presentations of companies; white papers; certified publications; trade directories; articles from recognized authors; gold standard and silver standard websites; and databases. Secondary research was used to obtain critical information about the value chain of the industry, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about key developments from a market-oriented perspective.

Primary Research

The construction films market comprises several stakeholders in the value chain, including raw material suppliers, processors, end-product manufacturers, and end users. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the demand side include key opinion leaders from various end-use industries of construction films. The primary sources from the supply side include experts from companies manufacturing construction films.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the Construction film market. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall Construction film market size, using the market size estimation processes explained above, the market was split into several segments and sub-segments. To complete the whole market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the size of the Construction film market, in terms of value and volume

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the market based on film type, application, end-use industry, and region

- To analyze and project the market based on five regions, namely, Europe, North America, Asia Pacific (APAC), the Middle East & Africa (MEA), and Latin America

- To strategically analyze the micromarkets concerning individual growth trends, prospects, and their contribution to the overall market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations

MarketsandMarkets offers customizations according to the specific needs of the companies with the given market data.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of Rest of APAC Construction film market

- Further breakdown of Rest of Europe Construction film market

- Further breakdown of Rest of MEA Construction film market

- Further breakdown of Rest of Latin American Construction film market

Company Information

- Detailed analysis and profiling of additional market players (up to 10)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Construction Films Market