Computer Vision in Healthcare Market by Product (Processor, Software, Memory Device, Services), Type (Smart Camera), Application (Imaging, Surgery, Hospital Management (Patient Provider Tracking, Scheduling)), End User & Region - Global Forecast to 2029

Market Growth Outlook Summary

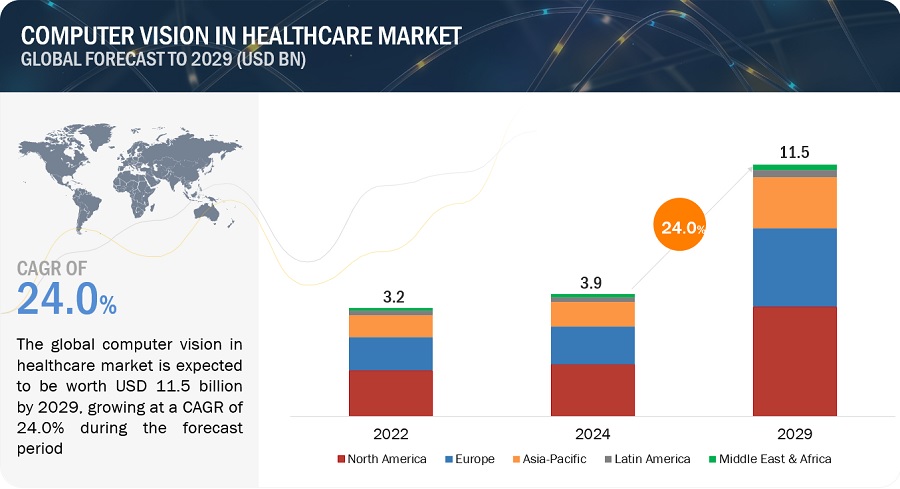

The global computer vision in healthcare market growth forecasted to transform from USD 3.9 billion in 2024 to USD 11.5 billion by 2029, driven by a CAGR of 24.0%. Market growth is propelled by the regulatory initiatives and incentives promote the adoption of computer vision in healthcare. Regulatory agencies, such as the FDA and EMA, provide frameworks for validating and approving medical devices and software applications based on computer vision technologies. Nevertheless, challenges such as the complexity of integrating computer vision systems into existing healthcare infrastructures, shortage of skilled IT professionals and security concerns pose certain obstacles to the growth of the global computer vision in healthcare market. The market for computer vision in healthcare refers to the sector where computer vision technology is applied to various aspects of healthcare services, processes, and systems. This market is characterized by the intersection of advanced computer vision algorithms and applications with the diverse needs of healthcare providers, patients, and other stakeholders.

Computer Vision in Healthcare Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Computer Vision In Healthcare Market Opportunities

Computer Vision in Healthcare Market Dynamics

Driver: The healthcare sector is experiencing a growing need for computer vision systems.

Over time, there has been a notable surge in the demand for AI-powered computer vision solutions within the healthcare sector. These solutions exhibit significant potential across various healthcare realms, ranging from clinical trials and precision medicine to the diagnosis of medical images. The advantages offered by AI-driven CV systems, such as enhanced patient care delivery, expedited and more accurate analysis of diagnostic images, improved medication adherence, and cost reduction, are compelling reasons behind the adoption of these solutions by diverse stakeholders in the healthcare industry.

The growing integration of computer vision technology in healthcare aims to streamline decision-making processes, reduce human errors, and ultimately enhance the efficiency and efficacy of healthcare services. Given the benefits associated with AI-based computer vision in healthcare, an increasing number of academic institutions are opting to implement these solutions. For instance, in April 2024, CAD collaborated with RAD-AID to bolster breast cancer detection using AI technology in underserved regions and low- to middle-income countries (LMICs). Furthermore, in November 2023, ICAD's AI-driven solutions facilitated the expedited detection of breast cancer through a partnership with GE Healthcare. These expanding partnerships are anticipated to drive market growth in the foreseeable future.

Restraint: The resistance of medical practitioners towards adopting AI-based technologies.

The significant expansion of digital health and mobile health technologies has empowered healthcare providers to introduce innovative treatment methods to assist patients. AI technologies provide doctors with valuable tools for diagnosing and treating patients more effectively. However, there exists an apparent reluctance among medical professionals towards embracing new technologies. Some practitioners hold the misconception that AI will gradually replace doctors in the future. Forecasts from the World Economic Forum in January 2016 predicted a loss of 5.1 million jobs across all sectors by 2020 due to AI technologies. However, in the healthcare sector, there is only a 0.42% probability, as indicated by a study from Oxford University published in September 2013, that physicians and surgeons will be replaced by AI by 2020.

Moreover, there is a concern that patients might overly rely on these technologies, potentially leading them to forego necessary in-person treatments, which could strain long-standing doctor-patient relationships.

Presently, many healthcare professionals harbor doubts about the accuracy of AI solutions in diagnosing patient conditions. This skepticism makes it challenging to persuade providers that AI-based solutions are cost-effective, efficient, and safe alternatives that not only provide convenience to doctors but also enhance patient care. Nevertheless, healthcare providers are gradually recognizing the potential benefits of AI-based solutions and the diverse range of applications they offer. Consequently, there is a likelihood that in the forthcoming decade, doctors will increasingly embrace AI-based technologies in healthcare.

Opportunity: Computer vision solutions for healthcare that are hosted in the cloud.

At present, numerous businesses are transitioning to the cloud to capitalize on advantages like simplified deployment, accelerated processing speeds, and user-friendly interfaces. In the context of computer vision solutions, deploying in the cloud enables end-users to access mission-critical data in real-time, presenting a significant advantage. Additionally, cloud-based computer vision solutions offer rapid and straightforward implementation, along with cost savings by eliminating infrastructure and maintenance expenses. Furthermore, they deliver scalability and flexibility to accommodate expanding user bases within organizations. As a result of these advantages, there is a growing demand among end-users for cloud-based computer vision solutions in the healthcare sector.

Challenge: Lack of curated data

The availability of comprehensive and well-organized data is essential for training and refining a robust AI system. Traditionally, datasets were predominantly structured and manually inputted. However, the proliferation of digital technologies, including IoT in healthcare, has led to the generation of vast amounts of data from interconnected health monitoring devices, Electronic Health Records (EHRs), and various other remotely connected healthcare equipment. Much of this imaging data lacks a coherent internal structure, making it challenging for developers to derive insights from it effectively. To train machine learning algorithms, developers require high-quality labeled data, often necessitating skilled human annotators. The process of extracting and labeling unstructured data demands a significant workforce and time investment.

Furthermore, patient information is highly sensitive and subject to stringent privacy regulations. Legislation such as HIPAA and the HITECH Act mandates that entities handling sensitive health data implement measures to ensure its privacy and security. These entities are also required to notify patients in case of any breach compromising their information. Consequently, accessing curated data is challenging due to concerns regarding privacy, record identification, and security protocols.

Therefore, structured medical imaging data plays a crucial role in the development of efficient AI-based computer vision systems. Companies are now exploring ways to derive insights from semi-structured data—a combination of structured and unstructured data—that facilitates information extraction through groupings and hierarchies. However, solutions and analytics tools for semi-structured data are still in their early stages of development.

Computer Vision In Healthcare Market Ecosystem Analysis

This section provides an overview of the ecosystem within the computer vision market in healthcare. Network connectivity and hardware providers encompass manufacturers of various components, including graphics processing units (GPUs), central processing units/microprocessing units (CPUs), field-programmable gate arrays (FPGAs), and application-specific integrated circuits (ASICs). Key players in this domain include NVIDIA Corporation and Intel Corporation, with Xilinx being a significant FPGA provider, and other notable hardware providers include Micron, Microsoft, and Intel Corporation. Server provision is dominated by players like Microsoft and Intel Corporation, while cloud service providers include Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and Koninklijke Philips N.V.

Intensifying market competition between established companies and startups is driving the introduction and advancement of hardware products and software platforms tailored for running machine learning algorithms and other AI programs. The ecosystem is characterized by its dynamic nature, where each component contributes significantly to propelling the growth of the computer vision market in healthcare.

The research and product development sector includes in-house research facilities, contract research organizations, and contract development and manufacturing organizations, playing a pivotal role in outsourcing services for product development.

The medical imaging & diagnostics segment registered the highest growth in the computer vision in healthcare industry, by application.

The medical imaging and diagnostics segment in application within the computer vision in healthcare market exhibits the highest growth rate during the forecast period owing to burgeoning demand for medical imaging technologies like MRI, CT scans, and X-rays, driven by the need for accurate and efficient diagnostic tools. Concurrently, the rising prevalence of chronic diseases globally underscores the pivotal role of medical imaging in early detection and ongoing monitoring of conditions such as cancer, cardiovascular disorders, and neurological ailments.

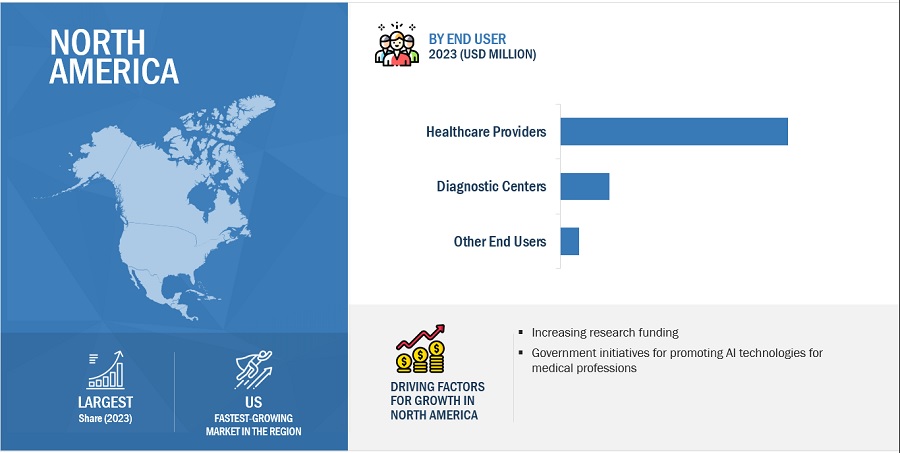

Healthcare providers registered highest growth by the end user of computer vision in healthcare industry during the forecast period

The healthcare providers segment is anticipated to exhibit the highest growth rate in the computer vision in healthcare market. This growth is due to healthcare providers increasingly embracing AI and automation technologies to enhance patient care and streamline operational processes. Within this context, computer vision offers a suite of capabilities, including image analysis and pattern recognition, which are crucial for tasks such as medical imaging interpretation and patient monitoring.

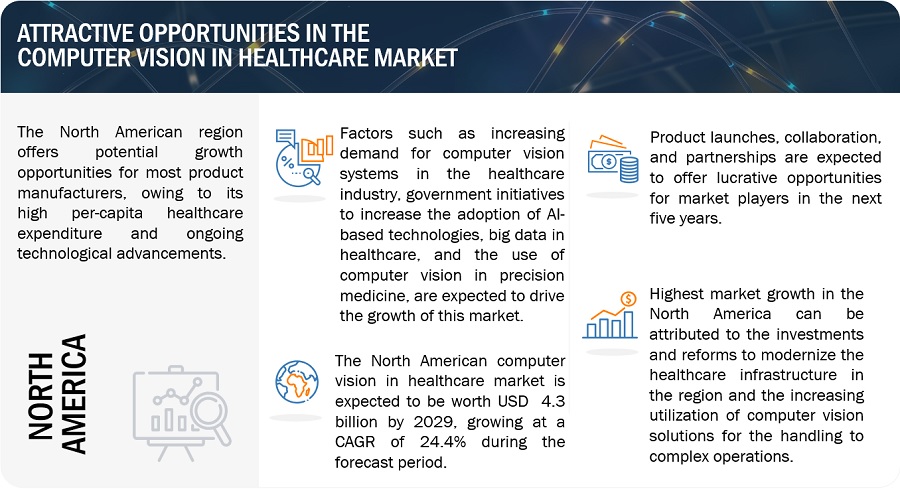

North America accounted for largest share of the computer vision in healthcare industry in 2023.

In 2023, North America commands the largest share of the computer vision in healthcare market. The expansion of the market in North America can be ascribed to various factors, including the region boasts a robust healthcare infrastructure and a strong focus on technological innovation, the region benefits from extensive government support and investment in healthcare IT initiatives and the presence of key market players in the region.

Computer Vision In Healthcare Market by Region

To know about the assumptions considered for the study, download the pdf brochure

The computer vision in healthcare market key established players include NVIDIA Corporation (US), Intel Corporation (US), Microsoft Corporation (US), Advanced Micro Devices, Inc. (US), Google, Inc. (US) among others.

Computer Vision in Healthcare Market Report Scope

|

Market Overview for Computer Vision in Healthcare |

Details |

|

Projected Market Revenue Size for 2024 |

USD 3.9 billion |

|

Projected Revenue Size by 2029 |

USD 11.5 billion |

|

Industry Growth Rate |

Expected to Grow at a CAGR of 24.0% |

|

Market Driver |

The healthcare sector is witnessing an increasing demand for computer vision systems. |

|

Market Opportunity |

Cloud-hosted computer vision solutions for healthcare. |

The study categorizes computer vision in healthcare market to forecast revenue and analyze trends in each of the following submarkets:

By Products

-

Software

- On Premise Solutions

- Cloud Based Solutions

-

Hardware

-

Processors

- CPUs

- GPUs

- FPGAs

- ASICs

- VPUs

- Memory Devices

- Network

-

Processors

- Services

By Type

- Smart Camera Based Computer Vision Systems

- PC Based Computer Vision Systems

By Application

- Medical Imaging & Diagnostics

- Surgeries

-

Hospital Management

- Patient/Provider Tracking

- Scheduling Optimization

- Inventory Management

- Patient Activity Monitoring/Fall Prevention

- Other Applications

By End User

- Healthcare Providers

- Diagnostic Centers

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- RoE

-

Asia Pacific

- Japan

- China

- India

- RoAPAC

-

Latin America

- Brazil

- Mexico

- RoLATAM

-

Middle East & Africa

- GCC

- RoMEA

Recent Developments in the Computer Vision Healthcare Market

- In April 2024, iCAD partnered with RAD-AID to enhance breast cancer detection utilizing the AI technology in underserved regions and low- and middle-income countries (LMICs).

- In March 2024, Microsoft and NVIDIA have broadened their longstanding collaboration with robust new integrations that harness cutting-edge NVIDIA generative AI and Omniverse technologies across Microsoft Azure, Azure AI services, Microsoft Fabric, and Microsoft 365.

- In February 2022, Advanced Micro Devices acquired Xilinx. This acquisition established the forefront leader in high-performance and adaptive computing, with a significantly expanded scale and the most formidable portfolio of leadership computing, graphics, and adaptive SoC products in the industry.

Frequently Asked Questions (FAQ):

What is the projected growth of the Computer Vision in Healthcare market?

The global computer vision in healthcare market is projected to grow from USD 3.9 billion in 2024 to USD 11.5 billion by 2029, demonstrating a robust CAGR of 24.0%.

What are the key drivers of the Computer Vision in Healthcare market?

Key drivers include regulatory initiatives promoting technology adoption, increasing demand for AI-driven solutions, and advancements in imaging technology.

What challenges does the Computer Vision in Healthcare market face?

The market faces challenges such as data privacy concerns, integration issues with existing healthcare systems, and a shortage of skilled professionals.

How is computer vision technology applied in healthcare?

Applications include medical imaging analysis, remote monitoring, and enhancing diagnostics through AI-powered tools.

What are the benefits of AI-powered computer vision systems in healthcare?

Benefits include faster diagnosis, improved patient care, reduced errors, and enhanced workflow efficiency.

What are recent developments in the Computer Vision in Healthcare market?

Recent developments include new partnerships between tech companies and healthcare providers to innovate imaging solutions and improve patient outcomes.

What is the significance of data in developing AI-based computer vision systems?

High-quality data is essential for training AI models, but challenges like data standardization and privacy regulations persist.

Which regions are driving the Computer Vision in Healthcare market?

North America leads the market due to advanced technology adoption, followed by Europe and Asia Pacific with growing healthcare investments.

How does the aging population impact the Computer Vision in Healthcare market?

The increasing aging population drives demand for enhanced diagnostic tools and remote monitoring solutions to improve care quality.

What advancements in technology are influencing the Computer Vision in Healthcare market?

Advancements include improved imaging technologies, AI algorithms for analysis, and integration of telemedicine capabilities to enhance service delivery.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand for computer vision systems in healthcare industry- Government initiatives to increase adoption of AI-based technologies- Big data in healthcare- Use of computer vision in precision medicine- Advancements in deep learning and neural network technologiesRESTRAINTS- Reluctance of medical practitioners to adopt AI-based technologies- Lack of awareness and technical knowledgeOPPORTUNITIES- Cloud-based healthcare computer vision solutions- Unexplored applicationsCHALLENGES- Rising security concerns related to cloud-based image processing and analytics- Lack of curated data

-

5.3 INDUSTRY TRENDSEARLY DETECTION OF CANCERINTERACTIVE MEDICAL IMAGINGPHYSICIAN TRAINING BY SURGERY SIMULATIONSREAL-TIME SURGICAL ASSISTANCE

-

5.4 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- DEEP LEARNING AND CONVOLUTIONAL NEURAL NETWORKS- ARTIFICIAL INTELLIGENCE- MACHINE LEARNINGCOMPLEMENTARY TECHNOLOGIES- WEARABLE TECHNOLOGY- SMARTPHONE COMPUTER VISION TECHNOLOGYADJACENT TECHNOLOGIES- AUGMENTED REALITY

-

5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

- 5.6 VALUE CHAIN ANALYSIS

-

5.7 ECOSYSTEM MAPPING

-

5.8 PORTER’S FIVE FORCES ANALYSISINTENSITY OF COMPETITIVE RIVALRYBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTES

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 KEY CONFERENCES AND EVENTS

-

5.11 PRICING ANALYSISAVERAGE SELLING PRICE TRENDAVERAGE SELLING PRICE TREND OF PROCESSORS OFFERED BY KEY PLAYERS

-

5.12 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSGOVERNMENT REGULATIONS- US- Europe- China- Japan- India

-

5.13 PATENT ANALYSISPATENT PUBLICATION TRENDS FOR COMPUTER VISION IN HEALTHCAREJURISDICTION AND TOP APPLICANT ANALYSIS

-

5.14 CASE STUDY ANALYSISTRANSFORMING STROKE CARE WITH AI- Case 1: Punktum collaborated with Mayo Clinic to develop cutting-edge deep learning-based model focused on computer visionAUTOMATING LAB THROUGH AI AND COMPUTER VISION- Case 2: Driving increased effectiveness and optimized labor costsMANAGING FALL ACCIDENTS- Case 3: Detecting Falls - Immediate Notification to Medical Staff

-

5.15 END-USER ANALYSISUNMET NEEDSEND-USER EXPECTATIONS

-

5.16 COMPUTER VISION IN HEALTHCARE SOLUTIONS BUSINESS MODELPLATFORM AS A SERVICESOFTWARE AS A SERVICEPAY-PER-USE OR PAY-PER-TRANSACTIONENTERPRISE LICENSINGHYBRID MODELS

- 5.17 TRADE ANALYSIS

- 5.18 INVESTMENT AND FUNDING SCENARIO

- 6.1 INTRODUCTION

-

6.2 SOFTWAREON-PREMISE SOLUTIONS- Greater control and security to drive adoptionCLOUD-BASED SOLUTIONS- Ease of use, affordability, and reliability to drive growth

-

6.3 HARDWAREPROCESSORS- CPUs- GPUs- FPGAs- ASICs- VPUsMEMORY DEVICES- Specialized, vertically stacked DRAM integrated with processors to increase speed while reducing latency, power, and sizeNETWORKS- AI-enhanced networks provide faster, more accurate ways for customers to explore products

-

6.4 SERVICESRECURRING REQUIREMENT FOR TRAINING, SOFTWARE UPGRADES, AND SOFTWARE MAINTENANCE POST-INSTALLATION TO DRIVE MARKET

- 7.1 INTRODUCTION

-

7.2 PC-BASED COMPUTER VISION SYSTEMSHIGH FLEXIBILITY AND SCALABILITY TO SUPPORT MARKET GROWTH

-

7.3 SMART CAMERA-BASED COMPUTER VISION SYSTEMSABILITY TO PERFORM MULTIPLE FUNCTIONS WITHOUT MANUAL INTERFERENCE TO AID MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 MEDICAL IMAGING & DIAGNOSTICSADVANTAGES SUCH AS INCREASE IN QUALITY, ACCURACY, AND PREDICTABILITY TO SUPPORT MARKET GROWTH

-

8.3 HOSPITAL MANAGEMENTPATIENT ACTIVITY MONITORING/FALL PREVENTION- Contribute significantly to enhancing patient care and safety within hospital management applicationsPATIENT/PROVIDER TRACKING- Real-time monitoring and efficient resource allocation to drive market growthSCHEDULING OPTIMIZATION- Improvement in patient flow management, staff scheduling, and equipment allocation to drive marketINVENTORY MANAGEMENT- AI-enabled inventory management automatically identifies, tracks, and manages inventory levels in real-time

-

8.4 SURGERIESCOMPUTER VISION IMPROVES SURGEONS’ RECOGNITION CAPACITY, HELPING THEM MAKE DECISIONS DURING COMPLICATED SURGERIES

- 8.5 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 HEALTHCARE PROVIDERSLARGEST END USERS OF COMPUTER VISION SOLUTIONS DUE TO HIGHER BUDGETS AND GREATER NEED FOR ADVANCED TECHNOLOGIES

-

9.3 DIAGNOSTIC CENTERSINTRODUCTION OF AI IN COMPUTER VISION SOLUTIONS TO SUPPORT MARKET GROWTH

- 9.4 OTHER END USERS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSISUS- Rising volume of medical imaging data to drive marketCANADA- Increasing government funding for adoption of AI in healthcare sector to drive market

-

10.3 EUROPEEUROPE: RECESSION IMPACT ANALYSISGERMANY- Growing adoption of computer vision systems in healthcare industry to drive marketUK- Rising investments in AI and computer vision technologies to support market growthFRANCE- Growing initiatives to promote adoption of healthcare IT solutions to drive marketITALY- Rising geriatric population and increasing prevalence of chronic diseases to drive adoptionREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSISJAPAN- Well-developed healthcare infrastructure and government initiatives to drive marketCHINA- High prevalence of chronic disorders to support market growthINDIA- Developing IT infrastructure and AI-friendly government initiatives to support market growthREST OF ASIA PACIFIC

-

10.5 LATIN AMERICALATIN AMERICA: RECESSION IMPACT ANALYSISBRAZIL- Rapid adoption of advanced AI technologies to drive marketMEXICO- Awareness of improved patient care to support market growthREST OF LATIN AMERICA

-

10.6 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACT ANALYSISGCC- Rising focus on technological advancements in healthcare sector to drive marketREST OF MIDDLE EAST & AFRICA

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE SHARE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

-

11.5 BRAND/PRODUCT COMPARATIVE ANALYSISNVIDIA CORPORATION (US)INTEL CORPORATION (US)MICROSOFT CORPORATION (US)ADVANCED MICRO DEVICES, INC. (US)GOOGLE (US)

-

11.6 COMPANY EVALUATION AND FINANCIAL METRICS

-

11.7 COMPANY EVALUATION MATRIX: KEY PLAYERSSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSCOMPANY FOOTPRINT

-

11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMESPROGRESSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESCOMPETITIVE BENCHMARKING

-

11.9 COMPETITIVE SCENARIOPRODUCT & SERVICE LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY COMPANIESNVIDIA CORPORATION- Business overview- Products & services offered- Recent developments- MnM viewINTEL CORPORATION- Business overview- Products & services offered- Recent developments- MnM viewMICROSOFT CORPORATION- Business overview- Products & services offered- Recent developments- MnM viewADVANCED MICRO DEVICES, INC.- Business overview- Products & services offered- Recent developmentsGOOGLE- Business overview- Products & services offered- Recent developmentsBASLER AG- Business overview- Products & services offered- Recent developmentsAICURE- Business overview- Products & services offered- Recent developmentsICAD, INC.- Business overview- Products & services offered- Recent developmentsTHERMO FISHER SCIENTIFIC INC.- Business overview- Products & services offeredSENSETIME- Business overview- Products & services offered- Recent developmentsKEYENCE CORPORATION- Business overview- Products & services offered- Recent developmentsASSERT AI- Business overview- Products & services offeredARTISIGHT- Business overview- Products & services offered- Recent developmentsLOOKDEEP INC.- Business overview- Products & services offeredCARE.AI- Business overview- Products & services offered- Recent developmentsCAREVIEW COMMUNICATIONS- Business overview- Products & services offered- Recent developmentsVIRTUSENSE TECHNOLOGIES, INC.- Business overview- Products & services offered- Recent developmentsTETON- Business overview- Products & services offered- Recent developments

-

12.2 OTHER PLAYERSVISO.AINANO-X IMAGING LTD.COMOFI MEDTECH PVT. LTD.AIVIDTECHVISIONROBOFLOW, INC.OPTOTUNECUREMETRIX, INC.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 COMPUTER VISION IN HEALTHCARE MARKET: RISK ASSESSMENT

- TABLE 2 GLOBAL INFLATION RATE PROJECTIONS, 2021–2027 (% GROWTH)

- TABLE 3 US HEALTH EXPENDITURE, 2019–2022 (USD MILLION)

- TABLE 4 US HEALTH EXPENDITURE, 2023–2027 (USD MILLION)

- TABLE 5 PORTER’S FIVE FORCES ANALYSIS

- TABLE 6 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS

- TABLE 7 KEY BUYING CRITERIA FOR TOP 3 END USERS

- TABLE 8 COMPUTER VISION IN HEALTHCARE MARKET: LIST OF CONFERENCES AND EVENTS, 2024–2025

- TABLE 9 AVERAGE SELLING PRICE OF PROCESSORS OFFERED BY KEY PLAYERS

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 REST OF THE WORLD: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 UNMET NEEDS IN COMPUTER VISION IN HEALTHCARE MARKET

- TABLE 15 END-USER EXPECTATIONS IN COMPUTER VISION IN HEALTHCARE MARKET

- TABLE 16 COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 17 COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 18 COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 19 COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 20 COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 21 COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 22 ON-PREMISE SOLUTIONS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 23 ON-PREMISE SOLUTIONS MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 24 CLOUD-BASED SOLUTIONS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 25 CLOUD-BASED SOLUTIONS MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 26 COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 27 COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 28 COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 29 COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 30 COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 31 COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 32 COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 33 COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 34 CPUS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 35 CPUS MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 36 GPUS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 37 GPUS MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 38 FPGAS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 39 FPGAS MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 40 ASICS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 41 ASICS MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 42 VPUS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 43 VPUS MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 44 COMPUTER VISION IN HEALTHCARE MEMORY DEVICES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 45 COMPUTER VISION IN HEALTHCARE MEMORY DEVICES MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 46 COMPUTER VISION IN HEALTHCARE NETWORKS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 47 COMPUTER VISION IN HEALTHCARE NETWORKS MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 48 COMPUTER VISION IN HEALTHCARE SERVICES MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 49 COMPUTER VISION IN HEALTHCARE SERVICES MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 50 COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 51 COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 52 PC-BASED COMPUTER VISION SYSTEMS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 53 PC-BASED COMPUTER VISION SYSTEMS MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 54 SMART CAMERA-BASED COMPUTER VISION SYSTEMS MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 55 SMART CAMERA-BASED COMPUTER VISION SYSTEMS MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 56 COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 57 COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 58 COMPUTER VISION IN HEALTHCARE MARKET FOR MEDICAL IMAGING & DIAGNOSTICS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 59 COMPUTER VISION IN HEALTHCARE MARKET FOR MEDICAL IMAGING & DIAGNOSTICS, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 60 COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 61 COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 62 COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 63 COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 64 PATIENT ACTIVITY MONITORING/FALL PREVENTION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 65 PATIENT ACTIVITY MONITORING/FALL PREVENTION MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 66 PATIENT/PROVIDER TRACKING MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 67 PATIENT/PROVIDER TRACKING MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 68 SCHEDULING OPTIMIZATION MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 69 SCHEDULING OPTIMIZATION MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 70 INVENTORY MANAGEMENT MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 71 INVENTORY MANAGEMENT MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 72 COMPUTER VISION IN HEALTHCARE MARKET FOR SURGERIES, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 73 COMPUTER VISION IN HEALTHCARE MARKET FOR SURGERIES, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 74 COMPUTER VISION IN HEALTHCARE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 75 COMPUTER VISION IN HEALTHCARE MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 76 COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 77 COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 78 COMPUTER VISION IN HEALTHCARE MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 79 COMPUTER VISION IN HEALTHCARE MARKET FOR HEALTHCARE PROVIDERS, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 80 COMPUTER VISION IN HEALTHCARE MARKET FOR DIAGNOSTIC CENTERS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 81 COMPUTER VISION IN HEALTHCARE MARKET FOR DIAGNOSTIC CENTERS, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 82 COMPUTER VISION IN HEALTHCARE MARKET FOR OTHER END USERS, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 83 COMPUTER VISION IN HEALTHCARE MARKET FOR OTHER END USERS, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 84 COMPUTER VISION IN HEALTHCARE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 85 COMPUTER VISION IN HEALTHCARE MARKET, BY REGION, 2023–2029 (USD MILLION)

- TABLE 86 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 88 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 90 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 91 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE 2023–2029 (USD MILLION)

- TABLE 92 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 93 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 94 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 95 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 96 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 97 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 98 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 99 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 100 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 101 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 102 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 103 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 104 US: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 105 US: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 106 US: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 107 US: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 108 US: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 109 US: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 110 US: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 111 US: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 112 US: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 113 US: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 114 US: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 115 US: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 116 US: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 117 US: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 118 US: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 119 US: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 120 CANADA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 121 CANADA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 122 CANADA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 123 CANADA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 124 CANADA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 125 CANADA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 126 CANADA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 127 CANADA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 128 CANADA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 129 CANADA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 130 CANADA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 131 CANADA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 132 CANADA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 133 CANADA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 134 CANADA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 135 CANADA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 136 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 137 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 138 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 139 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 140 EUROPE: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 141 EUROPE: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 142 EUROPE: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 143 EUROPE: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 144 EUROPE: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 145 EUROPE: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 146 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 147 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 148 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 149 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 150 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 151 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 152 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 153 EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 154 GERMANY: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 155 GERMANY: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 156 GERMANY: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 157 GERMANY: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 158 GERMANY: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 159 GERMANY: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 160 GERMANY COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 161 GERMANY: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 162 GERMANY: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 163 GERMANY: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 164 GERMANY: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 165 GERMANY: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 166 GERMANY: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 167 GERMANY: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 168 GERMANY: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 169 GERMANY: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 170 UK: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 171 UK: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 172 UK: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 173 UK: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 174 UK: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 175 UK: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 176 UK: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 177 UK: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 178 UK: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 179 UK: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 180 UK: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 181 UK: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 182 UK: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 183 UK: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 184 UK: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 185 UK: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 186 FRANCE: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 187 FRANCE: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 188 FRANCE: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 189 FRANCE: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 190 FRANCE: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 191 FRANCE: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 192 FRANCE: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 193 FRANCE: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 194 FRANCE: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 195 FRANCE: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 196 FRANCE: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 197 FRANCE: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 198 FRANCE: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 199 FRANCE: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 200 FRANCE: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 201 FRANCE: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 202 ITALY: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 203 ITALY: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 204 ITALY: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 205 ITALY: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 206 ITALY: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 207 ITALY: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 208 ITALY: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 209 ITALY: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 210 ITALY: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 211 ITALY: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 212 ITALY: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 213 ITALY: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 214 ITALY: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 215 ITALY: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 216 ITALY: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 217 ITALY: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 218 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 219 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 220 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 221 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 222 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 223 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 224 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 225 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 226 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 227 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 228 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 229 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 230 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 231 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 232 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 233 REST OF EUROPE: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 234 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 235 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 236 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 237 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 238 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 239 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 240 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 241 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 242 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 243 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 244 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 245 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 246 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 247 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 248 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 249 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 250 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 251 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 252 JAPAN: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 253 JAPAN: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 254 JAPAN: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 255 JAPAN: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 256 JAPAN: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 257 JAPAN: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 258 JAPAN: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 259 JAPAN: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 260 JAPAN: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 261 JAPAN: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 262 JAPAN: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 263 JAPAN: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 264 JAPAN: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 265 JAPAN: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 266 JAPAN: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 267 JAPAN: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 268 CHINA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 269 CHINA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 270 CHINA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 271 CHINA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 272 CHINA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 273 CHINA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 274 CHINA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 275 CHINA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 276 CHINA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 277 CHINA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 278 CHINA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 279 CHINA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 280 CHINA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 281 CHINA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 282 CHINA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 283 CHINA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 284 INDIA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 285 INDIA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 286 INDIA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 287 INDIA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 288 INDIA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 289 INDIA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 290 INDIA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 291 INDIA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 292 INDIA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 293 INDIA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 294 INDIA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 295 INDIA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 296 INDIA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 297 INDIA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 298 INDIA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 299 INDIA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 300 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 301 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 302 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 303 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 304 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 305 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 306 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 307 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 308 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 309 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 310 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 311 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 312 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 313 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 314 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 315 REST OF ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 316 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 317 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY COUNTRY, 2023–2029 (USD MILLION)

- TABLE 318 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 319 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 320 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 321 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 322 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 323 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 324 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 325 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 326 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 327 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 328 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 329 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 330 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 331 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 332 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 333 LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 334 BRAZIL: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 335 BRAZIL: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 336 BRAZIL: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 337 BRAZIL: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 338 BRAZIL: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 339 BRAZIL: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 340 BRAZIL: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 341 BRAZIL: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 342 BRAZIL: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 343 BRAZIL: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 344 BRAZIL: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 345 BRAZIL: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 346 BRAZIL: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 347 BRAZIL: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 348 BRAZIL: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 349 BRAZIL: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 350 MEXICO: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 351 MEXICO: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 352 MEXICO: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 353 MEXICO: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 354 MEXICO: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 355 MEXICO: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 356 MEXICO: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 357 MEXICO: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 358 MEXICO: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 359 MEXICO: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 360 MEXICO: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 361 MEXICO: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 362 MEXICO: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 363 MEXICO: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 364 MEXICO: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 365 MEXICO: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 366 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 367 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 368 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 369 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 370 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 371 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 372 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 373 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 374 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 375 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 376 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 377 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 378 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 379 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 380 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 381 REST OF LATIN AMERICA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 382 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 383 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY REGION, 2023–2029 (USD MILLION)

- TABLE 384 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 385 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 386 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 387 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 388 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 389 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 390 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 391 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 392 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 393 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 394 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 395 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 396 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 397 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 398 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 399 MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 400 GCC: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 401 GCC: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 402 GCC: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 403 GCC: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 404 GCC: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 405 GCC: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 406 GCC: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 407 GCC: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 408 GCC: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 409 GCC: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 410 GCC: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 411 GCC: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 412 GCC: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 413 GCC: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 414 GCC: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 415 GCC: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2 023–2029 (USD MILLION)

- TABLE 416 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2018–2022 (USD MILLION)

- TABLE 417 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2023–2029 (USD MILLION)

- TABLE 418 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 419 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE SOFTWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 420 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 421 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE HARDWARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 422 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 423 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE PROCESSORS MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 424 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 425 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 426 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 427 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2023–2029 (USD MILLION)

- TABLE 428 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 429 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET FOR HOSPITAL MANAGEMENT, BY TYPE, 2023–2029 (USD MILLION)

- TABLE 430 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2018–2022 (USD MILLION)

- TABLE 431 REST OF MIDDLE EAST & AFRICA: COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2023–2029 (USD MILLION)

- TABLE 432 COMPUTER VISION IN HEALTHCARE MARKET: DEGREE OF COMPETITION

- TABLE 433 COMPANY FOOTPRINT

- TABLE 434 PRODUCT & SERVICE FOOTPRINT

- TABLE 435 APPLICATION FOOTPRINT

- TABLE 436 END-USER FOOTPRINT

- TABLE 437 REGIONAL FOOTPRINT

- TABLE 438 COMPUTER VISION IN HEALTHCARE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 439 COMPUTER VISION IN HEALTHCARE MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS (STARTUPS/SMES)

- TABLE 440 COMPUTER VISION IN HEALTHCARE MARKET: PRODUCT & SERVICE LAUNCHES, JANUARY 2020–APRIL 2024

- TABLE 441 COMPUTER VISION IN HEALTHCARE MARKET: DEALS, JANUARY 2020–APRIL 2024

- TABLE 442 COMPUTER VISION IN HEALTHCARE MARKET: OTHER DEVELOPMENTS, JANUARY 2020–APRIL 2024

- TABLE 443 NVIDIA CORPORATION: BUSINESS OVERVIEW

- TABLE 444 NVIDIA CORPORATION: PRODUCTS & SERVICES OFFERED

- TABLE 445 NVIDIA CORPORATION: PRODUCT & SERVICE LAUNCHES

- TABLE 446 NVIDIA CORPORATION: DEALS

- TABLE 447 INTEL CORPORATION: BUSINESS OVERVIEW

- TABLE 448 INTEL CORPORATION: PRODUCTS & SERVICES OFFERED

- TABLE 449 INTEL CORPORATION: PRODUCT & SERVICE LAUNCHES

- TABLE 450 MICROSOFT CORPORATION: BUSINESS OVERVIEW

- TABLE 451 MICROSOFT CORPORATION: PRODUCTS & SERVICES OFFERED

- TABLE 452 MICROSOFT CORPORATION: DEALS

- TABLE 453 ADVANCED MICRO DEVICES, INC.: BUSINESS OVERVIEW

- TABLE 454 ADVANCED MICRO DEVICES, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 455 ADVANCED MICRO DEVICES, INC.: DEALS

- TABLE 456 GOOGLE: COMPANY OVERVIEW

- TABLE 457 GOOGLE: PRODUCTS & SERVICES OFFERED

- TABLE 458 GOOGLE: DEALS

- TABLE 459 BASLER AG: BUSINESS OVERVIEW

- TABLE 460 BASLER AG: PRODUCTS & SERVICES OFFERED

- TABLE 461 BASLER AG: PRODUCT & SERVICE LAUNCHES

- TABLE 462 AICURE: BUSINESS OVERVIEW

- TABLE 463 AICURE: PRODUCTS & SERVICES OFFERED

- TABLE 464 AICURE: DEALS

- TABLE 465 ICAD, INC.: BUSINESS OVERVIEW

- TABLE 466 ICAD, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 467 ICAD, INC.: PRODUCT & SERVICE LAUNCHES

- TABLE 468 ICAD, INC.: DEALS

- TABLE 469 ICAD, INC.: OTHER DEVELOPMENTS

- TABLE 470 THERMO FISHER SCIENTIFIC INC.: BUSINESS OVERVIEW

- TABLE 471 THERMO FISHER SCIENTIFIC INC.: PRODUCTS & SERVICES OFFERED

- TABLE 472 SENSETIME: BUSINESS OVERVIEW

- TABLE 473 SENSETIME: PRODUCTS & SERVICES OFFERED

- TABLE 474 SENSETIME: PRODUCT & SERVICE LAUNCHES

- TABLE 475 KEYENCE CORPORATION: BUSINESS OVERVIEW

- TABLE 476 KEYENCE CORPORATION: PRODUCTS & SERVICES OFFERED

- TABLE 477 KEYENCE CORPORATION: PRODUCT & SERVICE LAUNCHES

- TABLE 478 ASSERT AI: BUSINESS OVERVIEW

- TABLE 479 ASSERT AI: PRODUCTS & SERVICES OFFERED

- TABLE 480 ARTISIGHT: BUSINESS OVERVIEW

- TABLE 481 ARTISIGHT: PRODUCTS & SERVICES OFFERED

- TABLE 482 ARTISIGHT: DEALS

- TABLE 483 LOOKDEEP INC.: BUSINESS OVERVIEW

- TABLE 484 LOOKDEEP INC.: PRODUCTS & SERVICES OFFERED

- TABLE 485 CARE.AI: BUSINESS OVERVIEW

- TABLE 486 CARE.AI: PRODUCTS & SERVICES OFFERED

- TABLE 487 CARE.AI: DEALS

- TABLE 488 CARE.AI: OTHER DEVELOPMENTS

- TABLE 489 CAREVIEW COMMUNICATIONS: BUSINESS OVERVIEW

- TABLE 490 CAREVIEW COMMUNICATIONS: PRODUCTS & SERVICES OFFERED

- TABLE 491 CAREVIEW COMMUNICATIONS: PRODUCT & SERVICE LAUNCHES

- TABLE 492 CAREVIEW COMMUNICATIONS: DEALS

- TABLE 493 VIRTUSENSE TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 494 VIRTUSENSE TECHNOLOGIES, INC.: PRODUCTS & SERVICES OFFERED

- TABLE 495 VIRTUSENSE TECHNOLOGIES, INC.: DEALS

- TABLE 496 TETON: BUSINESS OVERVIEW

- TABLE 497 TETON: PRODUCTS & SERVICES OFFERED

- TABLE 498 TETON: OTHER DEVELOPMENTS

- TABLE 499 VISO.AI: COMPANY OVERVIEW

- TABLE 500 NANO-X IMAGING LTD.: COMPANY OVERVIEW

- TABLE 501 COMOFI MEDTECH PVT. LTD.: COMPANY OVERVIEW

- TABLE 502 AIVIDTECHVISION: COMPANY OVERVIEW

- TABLE 503 ROBOFLOW, INC.: COMPANY OVERVIEW

- TABLE 504 OPTOTUNE: COMPANY OVERVIEW

- TABLE 505 CUREMETRIX, INC.: COMPANY OVERVIEW

- FIGURE 1 COMPUTER VISION IN HEALTHCARE: MARKET SEGMENTATION

- FIGURE 2 COMPUTER VISION IN HEALTHCARE: REGIONAL SEGMENTATION

- FIGURE 3 RESEARCH DESIGN

- FIGURE 4 PRIMARY SOURCES

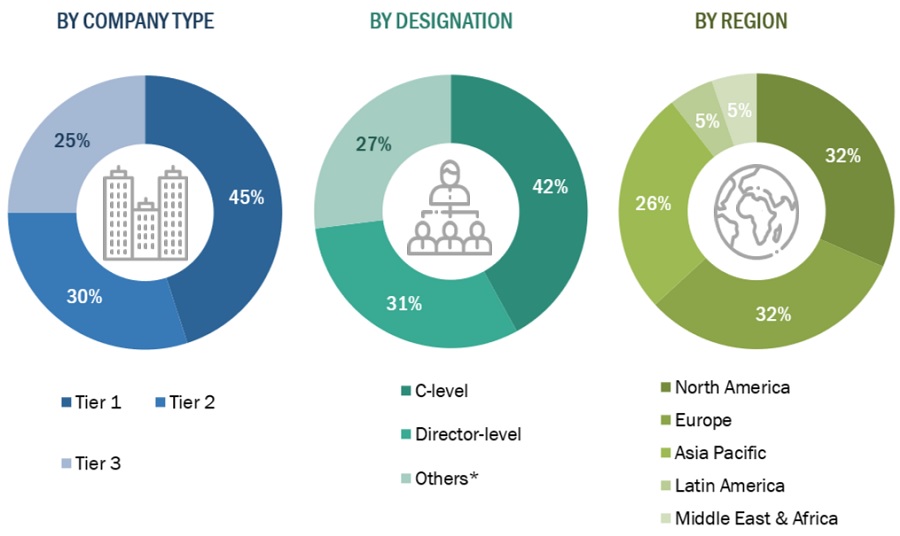

- FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS (DEMAND SIDE): BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 6 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 CAGR PROJECTIONS FROM ANALYSIS OF MARKET DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2024–2029)

- FIGURE 9 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

- FIGURE 10 DATA TRIANGULATION METHODOLOGY

- FIGURE 11 STUDY ASSUMPTIONS

- FIGURE 12 COMPUTER VISION IN HEALTHCARE MARKET, BY PRODUCT & SERVICE, 2024 VS. 2029 (USD MILLION)

- FIGURE 13 COMPUTER VISION IN HEALTHCARE MARKET, BY TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 14 COMPUTER VISION IN HEALTHCARE MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 15 COMPUTER VISION IN HEALTHCARE MARKET, BY END USER, 2024 VS. 2029 (USD MILLION)

- FIGURE 16 GEOGRAPHICAL SNAPSHOT OF COMPUTER VISION IN HEALTHCARE MARKET

- FIGURE 17 INCREASING DEMAND FOR COMPUTER VISION SYSTEMS IN HEALTHCARE INDUSTRY TO DRIVE MARKET

- FIGURE 18 SOFTWARE SEGMENT ACCOUNTED FOR LARGEST SHARE OF ASIA PACIFIC MARKET IN 2023

- FIGURE 19 CHINA TO REGISTER HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 20 NORTH AMERICA TO DOMINATE COMPUTER VISION IN HEALTHCARE MARKET DURING FORECAST PERIOD

- FIGURE 21 EMERGING MARKETS TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

- FIGURE 22 COMPUTER VISION IN HEALTHCARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 REVENUE SHIFT IN COMPUTER VISION IN HEALTHCARE MARKET

- FIGURE 24 COMPUTER VISION IN HEALTHCARE MARKET: VALUE CHAIN ANALYSIS

- FIGURE 25 COMPUTER VISION IN HEALTHCARE MARKET: ECOSYSTEM MAPPING

- FIGURE 26 COMPUTER VISION IN HEALTHCARE MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 END USERS

- FIGURE 28 KEY BUYING CRITERIA FOR TOP 3 END USERS

- FIGURE 29 AVERAGE SELLING PRICE OF PROCESSORS OFFERED BY KEY PLAYERS

- FIGURE 30 PATENT PUBLICATION TRENDS IN COMPUTER VISION IN HEALTHCARE MARKET, 2015–2024

- FIGURE 31 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTES) FOR COMPUTER VISION IN HEALTHCARE (JANUARY 2015 TO MARCH 2024)

- FIGURE 32 IMPORT DATA FOR HS CODE 854231, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 33 EXPORT DATA FOR HS CODE 854231, BY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 34 RECENT FUNDING OF PLAYERS IN COMPUTER VISION IN HEALTHCARE MARKET

- FIGURE 35 NORTH AMERICA: COMPUTER VISION IN HEALTHCARE MARKET SNAPSHOT

- FIGURE 36 ASIA PACIFIC: COMPUTER VISION IN HEALTHCARE MARKET SNAPSHOT

- FIGURE 37 KEY DEVELOPMENTS OF MAJOR PLAYERS IN COMPUTER VISION IN HEALTHCARE MARKET, JANUARY 2020–APRIL 2024

- FIGURE 38 REVENUE ANALYSIS OF KEY PLAYERS IN COMPUTER VISION IN HEALTHCARE MARKET, 2019–2023 (USD MILLION)

- FIGURE 39 COMPUTER VISION IN HEALTHCARE MARKET SHARE ANALYSIS (2023)

- FIGURE 40 COMPUTER VISION IN HEALTHCARE: TOP TRENDING BRANDS/PRODUCTS

- FIGURE 41 EV/EBITDA OF KEY VENDORS

- FIGURE 42 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF COMPUTER VISION SOLUTION VENDORS

- FIGURE 43 COMPUTER VISION IN HEALTHCARE MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 44 COMPUTER VISION IN HEALTHCARE MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 45 NVIDIA CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 46 INTEL CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 47 MICROSOFT CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 48 ADVANCED MICRO DEVICES, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 49 ALPHABET INC. (GOOGLE): COMPANY SNAPSHOT (2023)

- FIGURE 50 BASLER AG: COMPANY SNAPSHOT (2023)

- FIGURE 51 ICAD, INC.: COMPANY SNAPSHOT (2023)

- FIGURE 52 THERMO FISHER SCIENTIFIC INC.: COMPANY SNAPSHOT (2023)

- FIGURE 53 SENSETIME: COMPANY SNAPSHOT (2023)

- FIGURE 54 KEYENCE CORPORATION: COMPANY SNAPSHOT (2023)

- FIGURE 55 CAREVIEW COMMUNICATIONS: COMPANY SNAPSHOT (2022)