Centrifuge Market by type (Decanters, High-Speed Separators), Drilling and Excavation Activity (Tunnel Boring, HDD, Exploration Drilling), Application (Solids Control, Mud Cleaning, Dewatering, Fluid Clarification), and Region - Global Forecast to 2028

Updated on : June 14, 2024

Centrifuge Market

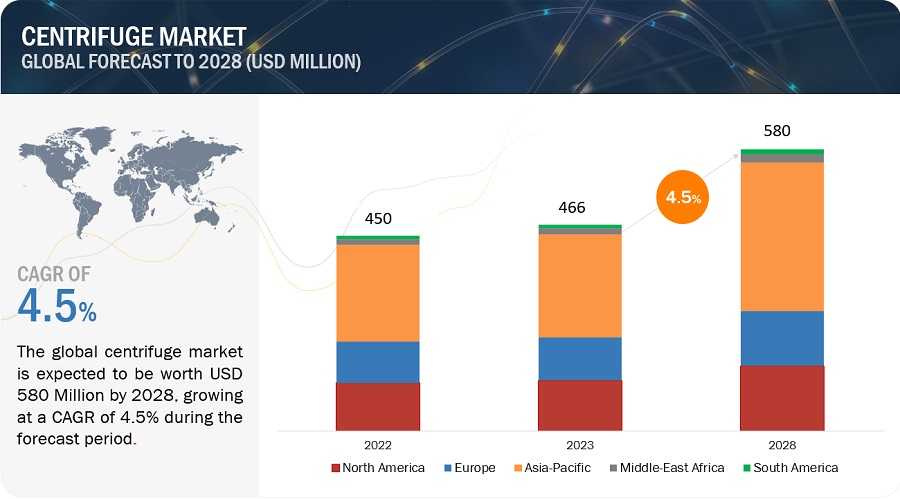

The global centrifuge market was valued at USD 466 million in 2023 and is projected to reach USD 580 million by 2028, growing at 4.5% cagr from 2023 to 2028. The growth of centrifuges is propelled by factors such as increasing industrialization, expanding oil and gas exploration, and a growing emphasis on environmental sustainability. Industries demand efficient liquid-solid separation for resource recovery and waste reduction. Centrifuges play a crucial role in diverse sectors like pharmaceuticals, wastewater treatment, and mining, driving their adoption. Technological advancements, offering higher efficiency and automation, further fuel the demand for these versatile devices across various applications, contributing to their overall market growth.

Attractive Opportunities in the Centrifuge Market

To know about the assumptions considered for the study, Request for Free Sample Report

Centrifuge Market Dynamics

Driver: Growing oil & gas exploration activities

The surge in oil and gas exploration activities serves as a significant driver in propelling the growth of the centrifuge market. As the global demand for energy continues to escalate, industries are increasingly investing in exploration activities to discover new hydrocarbon reserves. Centrifuges play a pivotal role in these operations by efficiently separating drilling mud and cuttings, ensuring the recovery of valuable drilling fluids. This not only enhances the overall efficiency of the drilling process but also contributes to cost savings through the reuse of essential fluids. Moreover, stringent environmental regulations necessitate the adoption of advanced technologies like centrifuges to minimize the environmental impact of exploration activities. The ability of centrifuges to provide sustainable solutions aligns with the industry's commitment to eco-friendly practices.

Furthermore, the growing complexity of drilling environments, including deep-sea exploration and unconventional resources, underscores the need for advanced centrifuge technologies. The versatility of centrifuges makes them indispensable in addressing the challenges posed by diverse drilling conditions. As oil and exploration activities continue to expand globally, the demand for centrifuges is poised to rise, making them a crucial component in optimizing drilling operations and supporting the energy industry's quest for efficient and sustainable resource extraction.

Restraint: Complex operation and maintenance procedure

Complex operation and maintenance procedures represent a notable restraint in the centrifuge market, hindering seamless adoption across various industries. The intricate nature of these devices, often involving precise calibration and configuration, may pose challenges for operators, leading to increased downtime and operational inefficiencies. Centrifuges require skilled personnel for installation, operation, and routine maintenance, adding to the overall operational costs. Moreover, the intricacy of the components and the need for specialized training create a barrier for organizations looking to integrate centrifuges into their processes. As industries strive for streamlined and cost-effective operations, the complexities associated with the use of centrifuges present a significant impediment. Additionally, the intricate maintenance procedures may lead to longer downtimes during scheduled maintenance, impacting overall production timelines. Overcoming these challenges necessitates ongoing investments in training programs and the development of user-friendly designs to simplify operation and maintenance procedures, enabling a broader and more efficient integration of centrifuges in various industrial applications.

Opportunities: Growing demand for centrifuges in developing countries

The growing demand for centrifuges in developing countries presents a significant opportunity for market expansion and industry development. As these nations experience rapid industrialization and economic growth, there is an increasing need for advanced technologies to optimize industrial processes. Centrifuges, with their versatile applications in sectors such as energy, pharmaceuticals, and wastewater treatment, offer efficient liquid-solid separation solutions. Developing countries, aiming to meet rising energy demands, enhance pharmaceutical production, and address environmental concerns, recognize the value of centrifuges in achieving these objectives. The adoption of centrifuges may lead to improved resource recovery, reduced waste disposal costs, and enhanced overall operational efficiency. Moreover, the opportunity lies in tailoring centrifuge technologies to suit the specific needs and infrastructural capacities of these developing economies. Strategic market penetration and collaborations with local industries may further propel the growth of centrifuges, creating a mutually beneficial scenario where developing countries meet their evolving industrial requirements, and the centrifuge market expands its global footprint.

Challenges: Intense competition among manufacturers

Intense competition among manufacturers poses a formidable challenge in the centrifuge market. With a multitude of companies vying for market share, there is constant pressure to innovate and offer advanced technologies to stay ahead. This competitive landscape may lead to pricing pressures, impacting profit margins, and hindering sustainable growth. Additionally, the race to introduce cutting-edge features and improve efficiency may strain research and development budgets. Differentiating products becomes crucial, and manufacturers must navigate the delicate balance between cost-effectiveness and technological sophistication to meet diverse industry demands. Furthermore, maintaining a strong global presence and customer loyalty amidst fierce competition requires substantial investments in marketing and customer support. The challenge lies in not only keeping pace with technological advancements but also in devising effective strategies to stand out in a crowded marketplace, where differentiation and customer value are paramount for sustained success.

Centrifuge Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of centrifuges. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Alfa Laval (Sweden), GEA Group AG (Germany), Andritz (Austria), FLSmidth (Denmark), and Schlumberger Limited (US).

Based on type, high-speed separators type is projected to account for the second largest share of the centrifuge market.

High-speed separators hold the second largest share in the centrifuge market's type segment due to their pivotal role in achieving rapid and precise liquid-solid separation. These centrifuges operate at elevated speeds, generating powerful centrifugal forces that efficiently separate components based on their densities. Widely utilized in industries such as food and beverage, pharmaceuticals, and chemical processing, high-speed separators excel in handling large volumes with high efficiency. Their versatility in applications requiring fine particle separation, coupled with advancements like automated control systems, positions them as a preferred choice for industries prioritizing speed, accuracy, and operational excellence. This demand for swift and effective separation technologies contributes significantly to the high-speed separators' substantial market share.

Based on drilling and excavation activity, horizontal directional drilling (HDD) activity is projected to account for the second largest share of the centrifuge market.

Horizontal directional drilling (HDD) holds the second largest share in the centrifuge market's drilling and excavation activity segment due to its increasing adoption in infrastructure projects. HDD minimizes surface disruption, making it an ideal method for laying utility lines, pipelines, and cables beneath urban areas and environmentally sensitive regions. As urbanization intensifies, the demand for HDD rises, driving the need for efficient mud and cuttings separation. Centrifuges play a crucial role in HDD operations by ensuring the recovery of valuable drilling fluids, reducing waste, and enhancing the overall efficiency of the drilling process. This, coupled with the ongoing global focus on modernizing infrastructure, positions HDD as a key driver in the centrifuge market's drilling and excavation activity segment.

Based on application, mud cleaning application is projected to account for the second largest share of the centrifuge market.

The mud cleaning application secures the second largest share in the centrifuge market due to its integral role in optimizing drilling operations, especially in the oil and gas industry. Centrifuges are crucial in mud cleaning processes as they effectively separate drilling mud and cuttings, facilitating the recovery of valuable drilling fluids. This not only enhances operational efficiency but also aligns with the industry's commitment to sustainable and cost-effective resource extraction. As the global demand for energy continues to rise, the need for efficient mud cleaning solutions grows proportionally, making it a significant contributor to the centrifuge market's application segment and reflecting its crucial role in enhancing drilling performance and minimizing environmental impact.

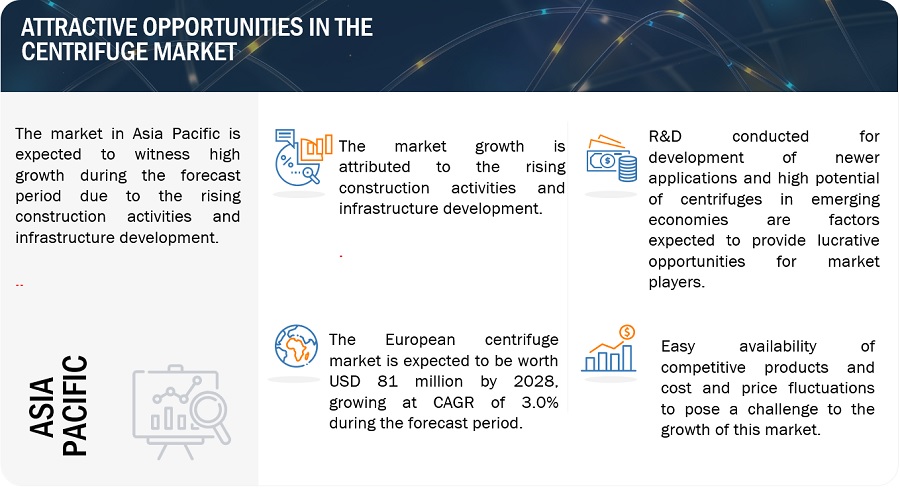

Asia Pacific is expected to be the fastest-growing market during the forecast period.

Asia Pacific is poised to be the fastest-growing market for centrifuges during the forecast period due to a confluence of dynamic factors propelling industrial growth. Rapid urbanization, increasing population, and robust economic development contribute to heightened demand across sectors such as oil and gas, pharmaceuticals, and wastewater treatment. With a burgeoning emphasis on environmental sustainability and stringent regulatory frameworks, industries are adopting centrifuges for efficient liquid-solid separation. Additionally, escalating investments in research and development activities contribute to technological advancements, further fuelling the region's centrifuge market growth. The Asia Pacific's strategic positioning at the forefront of key industries, coupled with a burgeoning need for advanced separation technologies, solidifies its status as the fastest-growing centrifuge market, presenting lucrative opportunities for manufacturers and stakeholders in the evolving industrial landscape.

To know about the assumptions considered for the study, download the pdf brochure

Centrifuge Market Players

The centrifuge market is dominated by a few major players that have a wide regional presence. The key players in the centrifuge market are Alfa Laval (Sweden), GEA Group AG (Germany), Andritz (Austria), FLSmidth (Denmark), Schlumberger Limited (US), Flottweg SE (Germany), SPX Flow, Inc. (US), Mitsubishi Kakoki Kaisha, Ltd. (Japan), Ferrum Ltd. (Switzerland), and Siebtechnik Tema GmbH (Germany). In the last few years, the companies have adopted growth strategies such as Product launches, Investments, Acquisitions, and expansions to capture a larger share of the centrifuge market.

Read More: Centrifuge Companies

Centrifuge Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 450 Million |

|

Revenue Forecast in 2028 |

USD 580 Million |

|

CAGR |

4.5% |

|

Years considered for the study |

2020-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million) |

|

Segments |

Type, Drilling and Excavation Activity, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Alfa Laval (Sweden), GEA Group AG (Germany), Andritz (Austria), FLSmidth (Denmark), Schlumberger Limited (US), Flottweg SE (Germany), SPX Flow, Inc. (US), Mitsubishi Kakoki Kaisha, Ltd. (Japan), Ferrum Ltd. (Switzerland), and, Siebtechnik Tema GmbH (Germany) |

This report categorizes the global centrifuge market based on type, drilling and excavation activity, application, and region.

On the basis of type, the centrifuge market has been segmented as follows:

- Decanters

- High-Speed Separators

-

Others

- Peeler Centrifuges

- Pusher Centrifuges

- Others

On the basis of drilling and excavation activity, the centrifuge market has been segmented as follows:

-

Tunnel Boring

- Transportation Infrastructure

- Utility Infrastructure

- Mining

- Others

-

Horizontal Directional Drilling (HDD)

- Pipeline Installation

- Fiber Optic and Telecommunication Cable Installation

- Underground Power and Electrical Lines

- Others

-

Exploration Drilling

- Mining

- Oil & Gas

- Geothermal Energy

- Others

- Others

On the basis of application, the centrifuge market has been segmented as follows:

- Solids Control

- Mud Cleaning

- Dewatering

- Fluid Clarification

-

Others

- Cuttings Management

- Others

On the basis of region, the centrifuge market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments in Centrifuge Market

- In January 2023, Alfa Laval developed new biofuel-ready separators for the marine industry to effectively clean biofuels like HVO (hydrotreated vegetable oil) and FAME (fatty acid methyl ester) and prevent performance issues and expensive engine wear.

- In December 2022, Alfa Laval signed an agreement with a subsidiary of CVR Energy, Inc., a US-based renewable fuels and petroleum refining company, to supply pre-treatment systems consisting of various equipment such as , heat exchangers, pumps, separators and agitators intended to reduce contaminants in the feedstocks before conversion into biofuels.

- In May 2023, GEA Group AG will invest around EUR 50 million in the modernization of its German centrifuge production facilities in Niederahr (Rhineland-Palatinate) and Oelde (North Rhine-Westphalia) by the end of 2024. By investing in sustainable production, digitalization and automation, GEA is targeting further growth in its key markets, including food, beverage, and pharmaceutical industries.

- In April 2022, Andritz introduced screen scroll centrifuge HX, which increases uptime and product quality. These new ANDRITZ screen scroll centrifuge HX can process bulk chemicals, minerals, agrochemicals, and food, even under difficult feeding conditions.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the centrifuge market?

The growth of this market can be attributed to the rapid Industrialization, oil and gas exploration, environmental sustainability, technological advancements, and global energy demand.

Which are the key applications driving the centrifuge market?

The key applications driving the demand for centrifuge are solids control, mud cleaning, dewatering, fluid clarification, and others.

Who are the major manufacturers?

Major manufacturers include Alfa Laval (Sweden), GEA Group AG (Germany), Andritz (Austria), FLSmidth (Denmark), and Schlumberger Limited (US).

What will be the growth prospects of the centrifuge market?

Rise in technological advancements and rising demand from process industries are some of the driving factors.

What will be the growth prospects of the centrifuge market in terms of CAGR in next five years?

The CAGR of the market will be in between 4-5% in next five years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the market size of the centrifuge market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key centrifuge, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

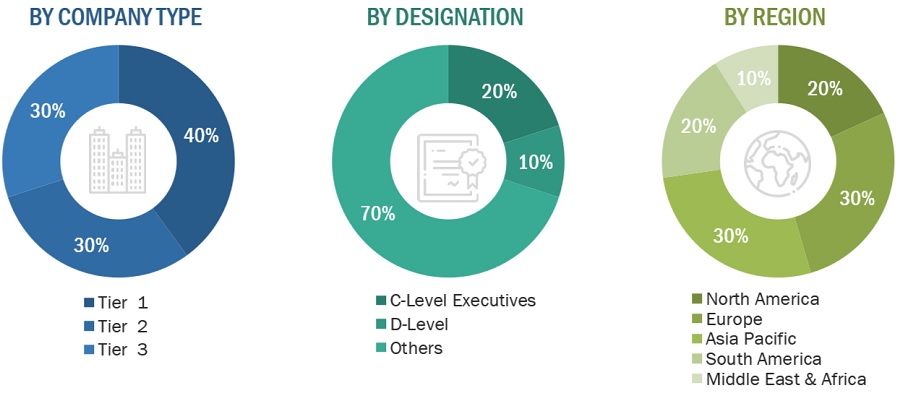

The centrifuge market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the centrifuge market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the centrifuge industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, drilling and excavation activity, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of centrifuge and future outlook of their business which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for centrifuge for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on type, drilling and excavation activity, application, and country were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Centrifuge Market: Bottum-Up Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Centrifuge Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the total market size from the estimation process centrifuge above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

A centrifuge is a crucial industrial apparatus designed for efficient separation of liquids and solids based on their density differences. Employed across diverse sectors such as oil and gas, pharmaceuticals, and wastewater treatment, centrifuges utilize high-speed rotation to generate centrifugal force, compelling heavier particles to move outward, while lighter components remain closer to the axis. This results in the effective separation of substances like drilling mud and cuttings, facilitating the recovery of valuable liquids and minimizing waste disposal costs. Centrifuges play a pivotal role in enhancing operational efficiency, meeting stringent environmental regulations, and ensuring resource recovery. With continuous advancements in technology, modern centrifuges offer features like automation and increased throughput, further contributing to their indispensable role in optimizing industrial processes.

Key Stakeholders

- Centrifuge Manufacturers

- Centrifuge Traders, Distributors, and Suppliers

- Raw Type Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the centrifuge market, in terms of value.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on type, drilling and excavation activity, application, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and impact on centrifuge market

Growth opportunities and latent adjacency in Centrifuge Market