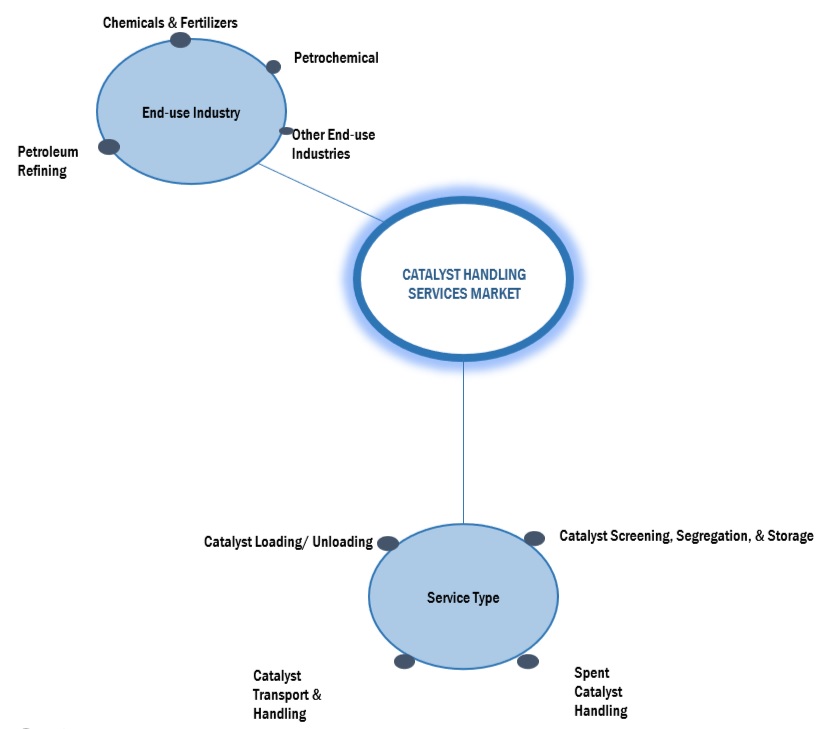

Catalyst Handling Services Market by Service Type (Catalyst loading/Unloading, Catalyst Screening, Segregation, & Storage, Catalyst Transport & Handling, Spent Catalyst Holding), End-use Industry (Petroleum Refining) and Region - Global Forecast to 2028

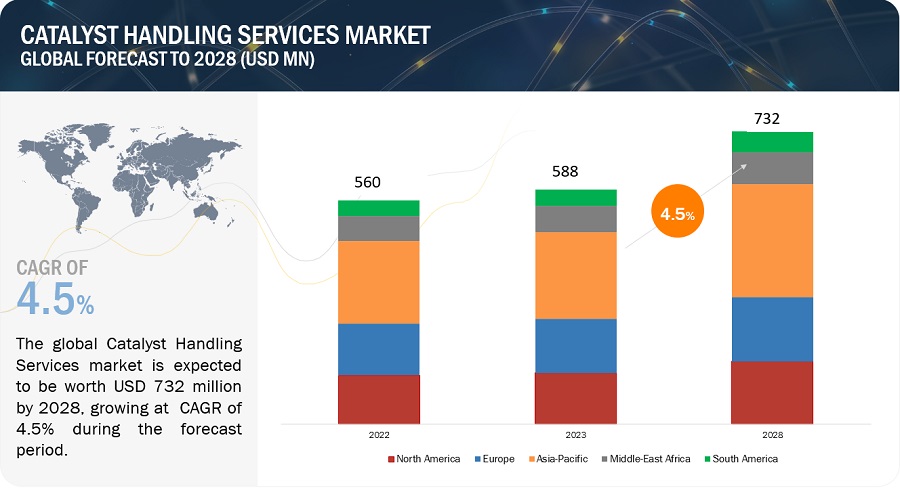

The catalyst handling services market is projected to reach USD 732 million by 2028, at a CAGR of 4.5% from USD 588 million in 2023. The catalyst handling services market encompasses a range of activities such as catalyst loading, unloading, storage, and regeneration. As catalyst-based processes continue to gain prominence in various sectors, the market presents a lucrative avenue for service providers to offer tailored solutions and ensure optimal performance of catalyst systems. The market's growth is further driven by the increasing focus on sustainability and environmental regulations, which require efficient catalyst management and maintenance.

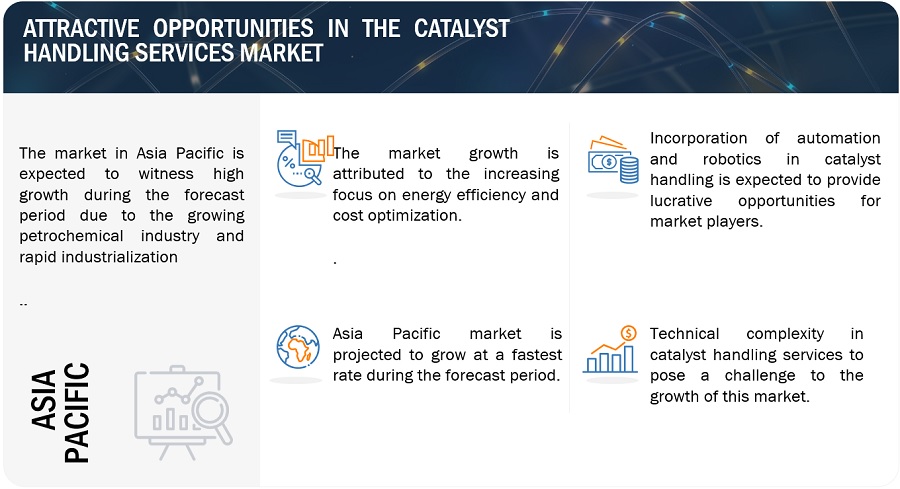

Attractive Opportunities in the Catalyst Handling Services Market

To know about the assumptions considered for the study, Request for Free Sample Report

Catalyst Handling Service Market Dynamics

Driver: Stringent environmental regulations

Stringent environmental regulations act as a significant catalyst for the growth of the catalyst handling service market. Governments and regulatory bodies worldwide are imposing stricter regulations to reduce emissions and promote sustainable practices. These regulations require industries to adopt advanced catalysts and comply with specific emission standards.

For instance, in the oil refining industry, various countries have implemented regulations to reduce sulfur content in transportation fuels. To meet these regulations, refineries must use catalysts in their refining processes to remove sulfur compounds effectively. Catalyst handling services assist refineries in managing and maintaining these catalysts, ensuring optimal performance and adherence to emission standards.

Another example is the chemical industry, where environmental regulations often focus on reducing emissions of volatile organic compounds (VOCs) and hazardous air pollutants (HAPs). Catalysts are employed in chemical processes to facilitate emission control and conversion of harmful substances. Catalyst handling services enable chemical plants to handle and replace catalysts efficiently, ensuring continuous compliance with emission regulations and promoting sustainable practices. By partnering with catalyst handling service providers, industries gain access to specialized knowledge, equipment, and techniques required for proper catalyst management. These services offer expertise in handling hazardous catalyst materials, conducting changeouts in a safe and efficient manner, and implementing emission control strategies.

Restraint: Increasing demand for electric vehicles

The global battery electric vehicle (BEV) market has grown rapidly. Factors such as rising concerns over global warming and air pollution and the federal and state government support to reduce air pollution are increasing the demand for electric vehicles. The usage of these vehicles is growing and is expected to make a sizable part of the overall vehicle production by 2025, accounting for 16% of the total vehicle production. The increasing sales of BEVs are also a result of improved vehicle mileage, reduction in charging time, an increasing number of charging stations, government subsidies on the purchase of BEVs, and exemption from the highway toll tax. The growing demand for BEVs has an impact on the consumption of fuels such as gasoline and diesel. The shift to electric vehicles is supported by advancements in battery technology. Major automakers such as General Motors, Mercedes, BMW, and Ford have decided to venture into commercial electric vehicle production, which will have a negative impact on the catalyst handling services market.

Opportunity: Increasing demand for biofuel

The exponential growth of the global population, coupled with the high standard of living, has resulted in a rapid increase in energy consumption. The threat of climate change is impacting every industry and has become an economic, environmental, and health problem. One of the most effective ways that we can truly tackle climate change is to commit fully to decarbonization. The COVID-19 pandemic has accelerated the decarbonization efforts and provided an opportunity for the vast implementation of this strategy. There are few dominant clean energy technology pathways for effective implementation of the decarbonization strategy such as the following:

- Electrification of end-use sectors

- Green hydrogen

- Use of biofuels in transport applications

Biofuels are an excellent source of energy and widely seen as a potential substitute for fossil fuels. They are prepared from renewable sources such as plants, municipal wastes, crops, and agricultural and forestry by-products. Over the last few decades, biofuels such as biodiesel have gained significant attention as an alternative fuel in the research field because of their sustainable and environment-friendly nature, high combustion efficiency, high flash point, high cetane number, lower CO2 emission, lower sulfur content, and better lubrication. Large global corporations have started changing their strategies accordingly. For instance, the Spanish oil company, Repsol, has recognized biofuels as a near-term option for the maritime and aviation industries. Repsol plans to adapt its current refineries to sites generating renewable energy; the company has invested in its Bilbao refinery. Also, Shell, BP, Total, and Eni have outlined their plans to grow their biofuel production by 2030 while reducing their global oil refining footprints. The production of renewable & biodegradable fuels is expected to change the nature of feedstocks of refineries. These feedstocks will need higher levels of pre-treatment, thereby potentially increasing the frequency of catalyst change-out during processing. Hence, the emergence of biofuel technology presents a growth opportunity for catalyst handling service providers.

Challenge: Technical complexity in catalyst handling services

The catalyst handling service market faces the challenge of technical complexity due to the intricate nature of catalyst systems and processes. Successfully handling catalysts requires specialized knowledge and skills that may not be readily available to new service providers or industries seeking to manage catalysts in-house.

Catalyst handling involves intricate procedures such as catalyst changeouts, regeneration, and maintenance, which demand a deep understanding of catalyst properties, operating conditions, and safety protocols. The complexity of these operations poses challenges for new service providers attempting to establish themselves in the market. They need to invest in acquiring the necessary expertise, training, and equipment to handle catalysts effectively.

Catalyst Handling Services Market: Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

"Petroleum refining was the largest segment for catalyst handling services market in 2022, in terms of value."

Global crude oil consumption was growing at a steady rate. As per the latest data from the BP Statistical Review of World Energy, global oil consumption has reached approximately 99 million barrels per day (bpd). In terms of specific regions, Asia stands out as the largest consumer of oil, with its oil consumption exceeding 37 million bpd. Within Asia, China remains a key player, consuming more than 14 million bpd, followed by India with a consumption of over 5 million bpd. Other Asian countries, such as Japan, South Korea, and Indonesia, also contribute significantly to the region's oil consumption.

In the refining sector, refineries worldwide processed approximately 82 million bpd of crude oil to meet the increasing demand for refined petroleum products. In Asia alone, refineries processed over 26 million bpd of crude oil. The Middle East holds a substantial refining capacity, with refineries in the Gulf Cooperation Council (GCC) countries playing a significant role in processing crude oil. North America boasts a substantial refining capacity, processing over 20 million bpd of crude oil. The US, in particular, is a major refining player

"Catalyst screening, segregation, & storage was the second largest service type for catalyst handling services market in 2022, in terms of value."

Catalyst screening and segregation involve the meticulous process of evaluating and categorizing catalyst particles based on their size and properties. This critical step ensures the selection of the most efficient catalysts for specific refining or petrochemical processes. Once screened and segregated, the catalysts are stored in controlled environments to preserve their integrity and effectiveness, ensuring optimal performance during their deployment in various industrial applications. This careful handling and storage process enhance the catalysts' longevity and contribute to the overall efficiency and productivity of the refining and petrochemical sectors.

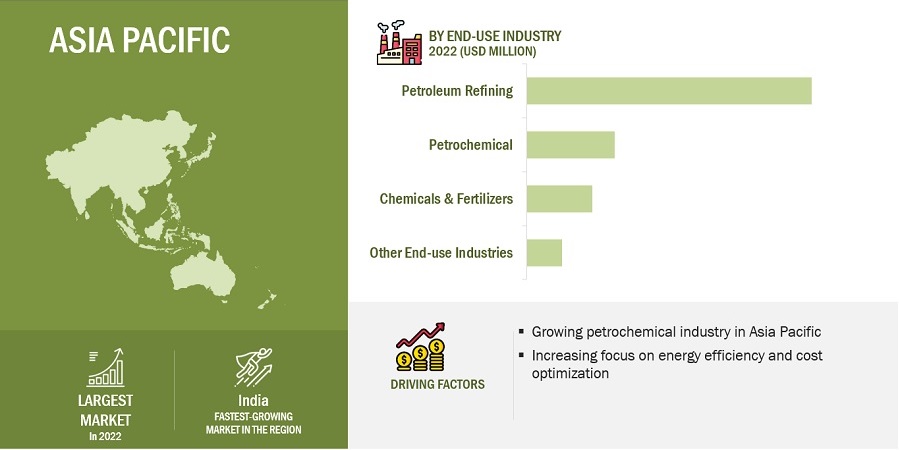

"Asia Pacific was the largest market for catalyst handling services in 2022, in terms of value."

Asia Pacific was the largest market for global catalyst handling services market, in terms of value, in 2022. China is the largest market in Asia Pacific. It is projected to witness the second highest growth during the forecast period considering of increasing focus on energy efficiency and cost optimization.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The key players in this market Anabeeb (Saudi Arabia), Mourik (Netharlands), Cat Tech International (UK), CR 3 (Thailand), Technivac (UK), Catalyst Handling Resources (US), Dickinson Group of Companies (South Africa), Buchen-ICS (Germany), Kanooz Industrial Services (Saudi Arabia), and Group Peeters (Belgium).Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading service providers of catalyst handling services have opted for new technology launches, and partnership to sustain their market position.

Want to explore hidden markets that can drive new revenue in Catalyst Handling Services Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Catalyst Handling Services Market?

|

Report Metric |

Details |

|

Years considered for the study |

2020-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million/Billion) |

|

Segments |

Service Type, End-use Industry, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Anabeeb (Saudi Arabia), Mourik (Netharlands), Cat Tech International (UK), CR 3 (Thailand), Technivac (UK), Catalyst Handling Resources (US), Dickinson Group of Companies (South Africa), Buchen-ICS (Germany), Kanooz Industrial Services (Saudi Arabia), and Group Peeters (Belgium) |

This report categorizes the global Catalyst handling services market based on services type, end-use industry, and region.

Based on service type, the catalyst handling services market has been segmented as follows:

- Catalyst loading/ unloading

- Catalyst screening, segregation, & storage

- Catalyst transport & handling

- Spent catalyst handling

Based on end-use industry , the catalyst handling services market has been segmented as follows:

- Petroleum refining

- Chemicals & fertilizers

- Petrochemical

- Other End-use Industry

Based on region, the catalyst handling services market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In October 2021, Mourik has launched a new unloading method for free flow single-bed reactors, which minimizes entries and improves safety. This technology is user friendly and easy to handle in operation, due to the lightweight components and simplicity off the equipment.

- In February 2019, Mourik has launched M-Lance technology. This technology helps automate the unloading process, resulting in a safer work environment, and a more efficient, and predictable tubular catalyst change-out.

- In May 2023, CR3 announced a strategic partnership with Petro-Q. This partnership will enable CR3 to deliver innovative solutions to meet the ever-evolving needs of our client base in Qatar.

- In April 2020, CR Asia made a group-wide collaboration agreement with Batrec (part of Veolia) in Switzerland for the disposal of mercury-containing wastes, particularly spent mercury removal adsorbents and mercury-laden sludge.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the catalyst handling services market?

The forecast period for the catalyst handling services market in this study is 2023-2028. The catalyst handling services market is expected to grow at a CAGR of 4.5 %in terms of value, during the forecast period.

Who are the major key players in the catalyst handling services market?

The key global players in the catalyst handling service market include Anabeeb (Saudi Arabia), Mourik (Netharlands), Cat Tech International (UK), CR 3 (Thailand), Technivac (UK), Catalyst Handling Resources (US), Dickinson Group of Companies (South Africa), Buchen-ICS (Germany), Kanooz Industrial Services (Saudi Arabia), and Group Peeters (Belgium)are the key players in the catalyst handling service market

What are some of the strategies adopted by the top market players to penetrate emerging regions?

The major players in the market use technology launch, partnerships, and joint venture, as important growth tactics.

What are the drivers and opportunities for the catalyst handling services market?

Stringent environmental regulations is driving the market during the forecast period. Incorporation of automation and robotics in catalyst handling acts as an opportunity during the forecast period.

Which are the key technology trends prevailing in the catalyst handling services market?

The key technologies prevailing in the catalyst handling services market include automation, and robotics. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Booming petrochemicals industry- Stringent government regulations promoting sustainable environment- Rising demand for catalyst handling services from several industries to ensure energy efficiency- Growing need to achieve environmental sustainability through catalyst regeneration and recyclingRESTRAINTS- Decline in demand for catalyst handling services due to high adoption of EVsOPPORTUNITIES- Increased operational efficiency with integration of automation and robotics into catalyst handling- Increasing demand for biofuel with rising focus on decarbonizationCHALLENGES- Technical complexities associated with catalyst handling services- Limited availability of skilled workforce

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 VALUE CHAIN OF CATALYST HANDLING SERVICESRAW MATERIAL SUPPLIERSCATALYST MANUFACTURERSCATALYST HANDLING EQUIPMENT/TECHNOLOGY PROVIDERSCATALYST HANDLING SERVICE PROVIDERSEND-USE INDUSTRIESCATALYST RECYCLING AND METAL RECLAMATION

-

5.5 TECHNOLOGY ANALYSISAUTOMATIONROBOTICSRENEWABLE FUEL TECHNOLOGYAUGMENTED REALITY (AR) AND VIRTUAL REALITY (VR)

-

5.6 ECOSYSTEM MAPPING

-

5.7 PATENT ANALYSISMETHODOLOGYDOCUMENT TYPEINSIGHTS

-

5.8 CASE STUDY ANALYSISCR 3 PROVIDED INNOVATIVE SOLUTIONS ADDRESSING CHALLENGES FACED BY SOUTHEAST ASIAN PETROCHEMICAL PLANTCR 3 OFFERED EFFECTIVE SOLUTIONS ADDRESSING CHALLENGES FACED BY SOUTHEAST ASIAN REFINERY

-

5.9 REGULATORY LANDSCAPEREGULATIONS- North America- Asia Pacific- Europe, Middle East & Africa, and South America

-

5.10 MACROECONOMIC INDICATORSGLOBAL GDP TRENDSREFINERY THROUGHPUT TRENDSMINING TRENDS

-

5.11 CATALYST MANUFACTURERSCATALYST MANUFACTURERS AND THEIR PLANTS

- 6.1 INTRODUCTION

-

6.2 CATALYST LOADING/UNLOADINGADOPTION OF CATALYST LOADING/UNLOADING TO MINIMIZE DOWNTIME AND ENSURE CONTINUOUS PLANT OPERATIONS

-

6.3 CATALYST SCREENING, SEGREGATION & STORAGEUTILIZATION OF CATALYST SCREENING TECHNIQUE TO PREVENT CROSS-CONTAMINATION

-

6.4 CATALYST TRANSPORT & HANDLINGRISING NEED FOR QUALITY CATALYST TRANSPORT TO ENSURE SECURE TRANSIT OPERATIONS

-

6.5 SPENT CATALYST HANDLINGHIGH GROWTH TRENDS ACROSS END-USE INDUSTRIES TO BOOST CONSUMPTION

- 6.6 OTHERS

- 7.1 INTRODUCTION

-

7.2 PETROLEUM REFININGRISING CRUDE OIL CONSUMPTION TO DRIVE DEMAND IN ASIA PACIFIC AND MIDDLE EAST & AFRICA

-

7.3 CHEMICALS AND FERTILIZERSHUGE INVESTMENTS BY DOMESTIC AND FOREIGN PLAYERS TO DRIVE GLOBAL CHEMICAL AND FERTILIZER MARKET

-

7.4 PETROCHEMICALSINTEGRATION OF DOWNSTREAM OPERATIONS TO DRIVE DEMAND FOR PETROCHEMICALS

- 7.5 OTHERS

- 8.1 INTRODUCTION

-

8.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Rising investments in end-use industries to drive marketCANADA- Increasing investment in chemical & fertilizer industry to boost marketMEXICO- Government-led initiatives to drive demand for catalyst handling services

-

8.3 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Increasing capacity expansion to support market growthJAPAN- Rising investment in oil & gas and chemical sector to boost demandSOUTH KOREA- Growing investments in several end-use industries to drive marketINDIA- Persistent growth of several end-use industries to boost demandAUSTRALIA- Government subsidies in refineries to drive demandTHAILAND- Government-led promotion in biofuel sector to boost market growthINDONESIA- Rising economic contribution by state-owned refining companies to drive marketREST OF ASIA PACIFIC

-

8.4 EUROPEEUROPE: RECESSION IMPACTGERMANY- Rolling investment in chemical industry to fuel market growthITALY- Increased innovations in downstream sector to support market growthSPAIN- Strong focus on research and innovation to boost demandRUSSIA- Abundant natural resources and government initiatives to fuel growthNETHERLANDS- Abundance of accessible ecosystem to support growthREST OF EUROPE

-

8.5 SOUTH AMERICABRAZIL- Strong domestic demand to accelerate market growthARGENTINA- Rising investment in expansion projects to boost demandCOLOMBIA- Government initiatives to foster innovation and sustainability to drive demandREST OF SOUTH AMERICA

-

8.6 MIDDLE EAST & AFRICASAUDI ARABIA- Government support in developing businesses to accelerate market growthUAE- Rapid growth of chemical and petrochemicals sector to increase demandIRAN- Government initiatives in petroleum refining sector to boost marketKUWAIT- High export growth to propel marketSOUTH AFRICA- Developments in chemicals and petrochemicals sectors to drive market growthREST OF MIDDLE EAST & AFRICA

- 9.1 OVERVIEW

- 9.2 RANKING ANALYSIS OF TOP 5 MARKET PLAYERS, 2022

- 9.3 MARKET SHARE ANALYSIS, 2022

-

9.4 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

9.5 STARTUPS/SMALL AND MEDIUM-SIZED ENTERPRISES (SMES) EVALUATION MATRIXRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIES

-

9.6 COMPETITIVE SCENARIOTECHNOLOGY LAUNCHESDEALS

-

10.1 KEY PLAYERSANABEEB- Business overview- Services offered- MnM viewMOURIK- Business overview- Services offered- Recent developments- MnM viewCAT TECH INTERNATIONAL- Business overview- Services offered- MnM viewCR3- Business overview- Services offered- Recent developments- MnM viewTECHNIVAC- Business overview- Services offered- MnM viewCATALYST HANDLING RESOURCES- Business overview- Services offered- MnM viewDICKINSON GROUP OF COMPANIES- Business overview- Services offered- MnM viewBUCHEN-ICS- Business overview- Services offered- MnM viewKANOOZ INDUSTRIAL SERVICES- Business overview- Services offered- MnM viewGROUP PEETERS- Business overview- Services offered- MnM view

-

10.2 OTHER PLAYERSTUBEMASTERPOLMANPLANT-TECH SERVICESDRILLDROPVEOLIA ANZAJAKS S.A.INTEGRITY CIS LLCMAVIROUSA DEBUSKCELVACARTIS INDUSTRIALHCIPRIOR INDUSTRIAL SERVICESTURN 2 SPECIALITY COMPANIESSPECIALTY WELDING AND TURNAROUNDS

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 CATALYST HANDLING SERVICES MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 PATENTS BY VOLVO TRUCK CORPORATION

- TABLE 3 PATENTS BY MOBIL OIL CORP.

- TABLE 4 TOP 10 PATENT OWNERS IN LAST 10 YEARS

- TABLE 5 PROJECTED REAL GROSS DOMESTIC PRODUCT GROWTH (ANNUAL PERCENT CHANGE) OF KEY COUNTRIES, 2018–2025

- TABLE 6 REFINERY THROUGHPUT IN KEY COUNTRIES, 2018-2020 (THOUSAND BARRELS PER DAY)

- TABLE 7 TOTAL MINERAL PRODUCTION OF KEY COUNTRIES, 2021

- TABLE 8 CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 9 CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 10 CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 11 CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 12 CATALYST HANDLING SERVICES MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 13 CATALYST HANDLING SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 14 NORTH AMERICA: CATALYST HANDLING SERVICES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 15 NORTH AMERICA: CATALYST HANDLING SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 16 NORTH AMERICA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 17 NORTH AMERICA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 18 NORTH AMERICA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 19 NORTH AMERICA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 20 US: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 21 US: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 22 US: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 23 US: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 24 CANADA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 25 CANADA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 26 CANADA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 27 CANADA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 28 MEXICO: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 29 MEXICO: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 30 MEXICO: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 31 MEXICO: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 32 ASIA PACIFIC: CATALYST HANDLING SERVICES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 33 ASIA PACIFIC: CATALYST HANDLING SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 34 ASIA PACIFIC: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 35 ASIA PACIFIC: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 36 ASIA PACIFIC: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 37 ASIA PACIFIC: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 38 CHINA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 39 CHINA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 40 CHINA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 41 CHINA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 42 JAPAN: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 43 JAPAN: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 44 JAPAN: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 45 JAPAN: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 46 SOUTH KOREA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 47 SOUTH KOREA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 48 SOUTH KOREA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 49 SOUTH KOREA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 50 INDIA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 51 INDIA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 52 INDIA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 53 INDIA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 54 AUSTRALIA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 55 AUSTRALIA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 56 AUSTRALIA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 57 AUSTRALIA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 58 THAILAND: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 59 THAILAND: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 60 THAILAND: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 61 THAILAND: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 62 INDONESIA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 63 INDONESIA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 64 INDONESIA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 65 INDONESIA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 66 REST OF ASIA PACIFIC: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 67 REST OF ASIA PACIFIC: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 68 REST OF ASIA PACIFIC: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 69 REST OF ASIA PACIFIC: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 70 EUROPE: CATALYST HANDLING SERVICES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 71 EUROPE: CATALYST HANDLING SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 72 EUROPE: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 73 EUROPE: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 74 EUROPE: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 75 EUROPE: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 76 GERMANY: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 77 GERMANY: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 78 GERMANY: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 79 GERMANY: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 80 ITALY: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 81 ITALY: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 82 ITALY: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 83 ITALY: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 84 SPAIN: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 85 SPAIN: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 86 SPAIN: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 87 SPAIN: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 88 RUSSIA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 89 RUSSIA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 90 RUSSIA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 91 RUSSIA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 92 NETHERLANDS: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 93 NETHERLANDS: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 94 NETHERLANDS: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 95 NETHERLANDS: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 96 REST OF EUROPE: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 97 REST OF EUROPE: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 98 REST OF EUROPE: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 99 REST OF EUROPE: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 100 SOUTH AMERICA: CATALYST HANDLING SERVICES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 101 SOUTH AMERICA: CATALYST HANDLING SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 102 SOUTH AMERICA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 103 SOUTH AMERICA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 104 SOUTH AMERICA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 105 SOUTH AMERICA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 106 BRAZIL: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 107 BRAZIL: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 108 BRAZIL: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 109 BRAZIL: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 110 ARGENTINA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 111 ARGENTINA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 112 ARGENTINA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 113 ARGENTINA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 114 COLOMBIA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 115 COLOMBIA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 116 COLOMBIA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 117 COLOMBIA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 118 REST OF SOUTH AMERICA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 119 REST OF SOUTH AMERICA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 120 REST OF SOUTH AMERICA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 121 REST OF SOUTH AMERICA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: CATALYST HANDLING SERVICES MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: CATALYST HANDLING SERVICES MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 128 SAUDI ARABIA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 129 SAUDI ARABIA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 130 SAUDI ARABIA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 131 SAUDI ARABIA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 132 UAE: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 133 UAE: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 134 UAE: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 135 UAE: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 136 IRAN: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 137 IRAN: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 138 IRAN: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 139 IRAN: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 140 KUWAIT: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 141 KUWAIT: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 142 KUWAIT: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 143 KUWAIT: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 144 SOUTH AFRICA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 145 SOUTH AFRICA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 146 SOUTH AFRICA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 147 SOUTH AFRICA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 148 REST OF MIDDLE EAST & AFRICA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2020–2022 (USD MILLION)

- TABLE 149 REST OF MIDDLE EAST & AFRICA: CATALYST HANDLING SERVICES MARKET, BY SERVICE TYPE, 2023–2028 (USD MILLION)

- TABLE 150 REST OF MIDDLE EAST & AFRICA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2020–2022 (USD MILLION)

- TABLE 151 REST OF MIDDLE EAST & AFRICA: CATALYST HANDLING SERVICES MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 152 CATALYST HANDLING SERVICES MARKET: DEGREE OF COMPETITION

- TABLE 153 CATALYST HANDLING SERVICES MARKET: TECHNOLOGY LAUNCHES, 2018–2022

- TABLE 154 CATALYST HANDLING SERVICES MARKET: DEALS, 2018–2023

- TABLE 155 ANABEEB: COMPANY OVERVIEW

- TABLE 156 MOURIK: COMPANY OVERVIEW

- TABLE 157 MOURIK TECHNOLOGY LAUNCHES

- TABLE 158 CAT TECH INTERNATIONAL: COMPANY OVERVIEW

- TABLE 159 CR3: COMPANY OVERVIEW

- TABLE 160 CR 3.: TECHNOLOGY LAUNCHES

- TABLE 161 CR3: DEALS

- TABLE 162 TECHNIVAC: COMPANY OVERVIEW

- TABLE 163 CATALYST HANDLING RESOURCES: COMPANY OVERVIEW

- TABLE 164 DICKINSON GROUP OF COMPANIES.: COMPANY OVERVIEW

- TABLE 165 BUCHEN-ICS: COMPANY OVERVIEW

- TABLE 166 KANOOZ INDUSTRIAL SERVICES: COMPANY OVERVIEW

- TABLE 167 GROUP PEETERS: COMPANY OVERVIEW

- FIGURE 1 CATALYST HANDLING SERVICES MARKET: RESEARCH DESIGN

- FIGURE 2 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 3 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 4 CATALYST HANDLING SERVICES MARKET: DATA TRIANGULATION

- FIGURE 5 SPENT CATALYST HANDLING SEGMENT TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 6 PETROLEUM REFINING SEGMENT TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 7 CATALYST HANDLING SERVICES WITNESSED LARGEST MARKET IN ASIA PACIFIC IN 2022

- FIGURE 8 HIGH GROWTH TRENDS ACROSS DOWNSTREAM SECTOR DRIVE CATALYST HANDLING SERVICES MARKET

- FIGURE 9 CHINA AND PETROLEUM REFINING SEGMENT ACCOUNTED FOR LARGEST SHARES

- FIGURE 10 CATALYST LOADING/UNLOADING SEGMENT TO CAPTURE LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 11 PETROLEUM REFINING SEGMENT TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 12 INDIA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN CATALYST HANDLING SERVICES MARKET

- FIGURE 14 PORTER’S FIVE FORCES ANALYSIS OF CATALYST HANDLING SERVICES MARKET

- FIGURE 15 OVERVIEW OF CATALYST HANDLING SERVICES VALUE CHAIN

- FIGURE 16 CATALYST HANDLING SERVICES ECOSYSTEM

- FIGURE 17 GRANTED PATENTS

- FIGURE 18 PUBLICATION TRENDS - LAST 10 YEARS

- FIGURE 19 JURISDICTION ANALYSIS

- FIGURE 20 TOP 10 COMPANIES/APPLICANTS

- FIGURE 21 PETROLEUM REFINING SEGMENT TO BE LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 22 PETROLEUM REFINING TO BE LARGEST END-USE INDUSTRY OF CATALYST HANDLING SERVICES

- FIGURE 23 CATALYST HANDLING SERVICES MARKET IN INDIA TO REGISTER HIGHEST CAGR DURING 2023–2028

- FIGURE 24 NORTH AMERICA: CATALYST HANDLING SERVICES MARKET SNAPSHOT

- FIGURE 25 ASIA PACIFIC: CATALYST HANDLING SERVICES MARKET SNAPSHOT

- FIGURE 26 COMPANIES ADOPTED TECHNOLOGY LAUNCHES AS KEY GROWTH STRATEGY BETWEEN 2018 AND 2022

- FIGURE 27 RANKING OF TOP FIVE PLAYERS IN CATALYST HANDLING SERVICES MARKET, 2022

- FIGURE 28 CATALYST HANDLING SERVICES MARKET, BY COMPANY, 2022

- FIGURE 29 CATALYST HANDLING SERVICES MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 30 CATALYST HANDLING SERVICES MARKET: STARTUPS AND SMES MATRIX, 2022

The study involved four major activities in estimating the market size of the catalyst handling service market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The catalyst handling service market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, service providers and end users. Various primary sources from the supply and demand sides of the catalyst handling service market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include service providers,manufacturers, associations, and institutions involved in the catalyst handling services industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, raw material, end-use industries, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and outlook of their business which will affect the overall market.

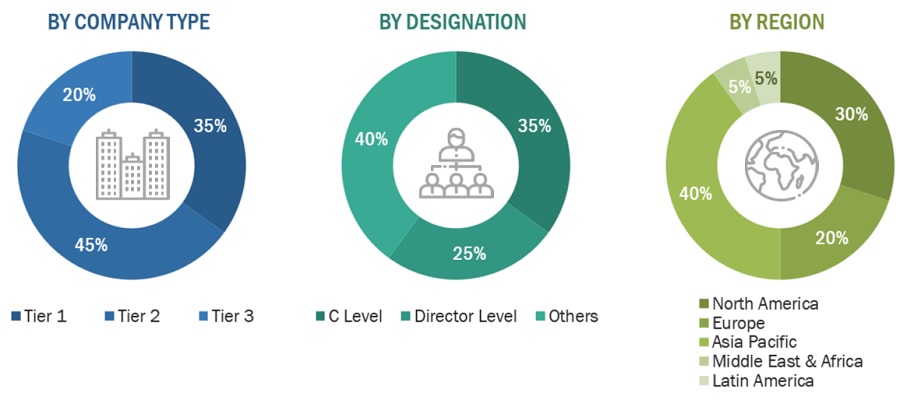

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

Anabeeb |

Individual Industry Expert |

|

Mourik |

Sales Manager |

|

Cat Tech International |

Director |

|

CR 3 |

Marketing Manager |

|

Technivac |

R&D Manager |

|

|

|

Market Size Estimation

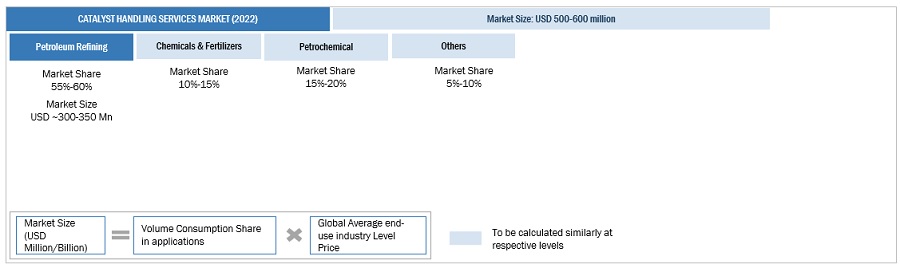

The top-down and bottom-up approaches have been used to estimate and validate the size of the catalyst handling service market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Catalyst Handling Service Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Catalyst Handling Service Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Catalyst handling services encompass the crucial steps of unloading spent catalysts from reactors, conducting screening and cleaning processes, and reloading the necessary catalysts back into the reactor. Additionally, these services cover catalyst transportation, storage, and the proper handling of spent catalysts. The primary industries benefiting from these services include oil and gas refineries, petrochemicals, and chemicals.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the size of the catalyst handling service market, in terms of value

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on service type, end-use industry, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Catalyst Handling Services Market