Bottled Water Processing Market Size, Share, Industry Growth, Trends Report by Product Type (Still Water and Sparkling Water), Packaging Material, Technology (Ion Exchange & Demineralization, Disinfection, Filtration, and Packaging), Equipment and Region - Global Forecast to 2028

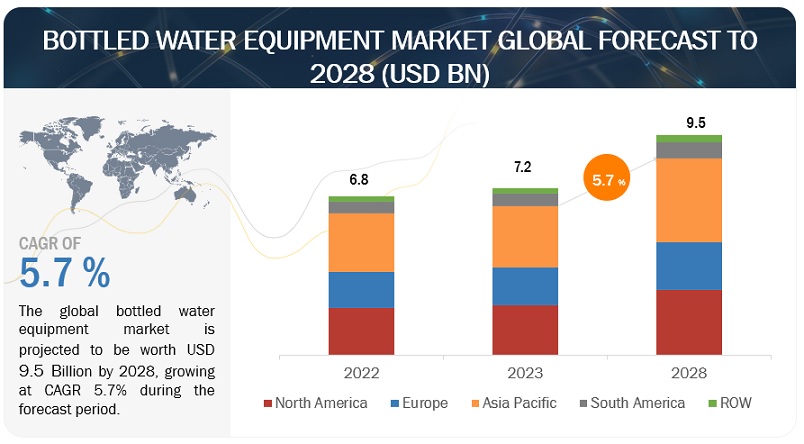

The bottled water processing market comprises the bottled water market and the bottled water equipment market. The bottled water equipment market is estimated at USD 7.2 billion in 2023 and is projected to reach USD 9.5 billion by 2028, at a CAGR of 5.7% from 2023 to 2028.

Whereas the bottled water market is estimated at USD 311.1 billion in 2023 and is projected to reach USD 457.1 billion by 2028, at a CAGR of 8.0% from 2023 to 2028.

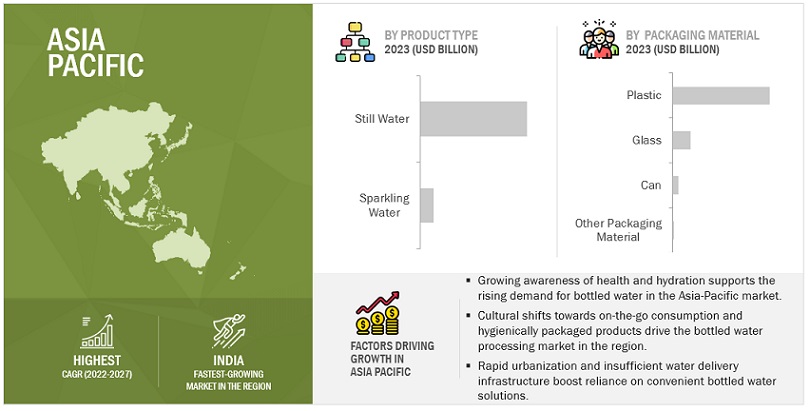

The market in the Asia Pacific region has witnessed substantial growth, particularly in countries with limited access to publicly provided piped water sources. As highlighted by Foster et al. in 2021, reports from the World Health Organization (WHO) and UNICEF, bottled water has become a prevalent choice for self-supply in areas facing challenges in accessing clean and safe drinking water through traditional public water supply systems. Several factors contribute to the rising reliance on bottled water in these regions. First and foremost is the imperative to ensure a consistent and safe supply of drinking water. Government failures in providing quality drinking water through local utilities, coupled with the limitations of water delivery infrastructure in urban centers experiencing rapid urbanization, have created a demand for alternative solutions.

Marketing campaigns orchestrated by the bottled water industry further fuel this shift in consumer behavior. These campaigns strategically discredit tap water while emphasizing the purity and safety associated with bottled water. The influence of such marketing efforts has contributed to shaping consumer perceptions and preferences, making bottled water a trusted option in the absence of reliable public water supply systems. The bottled water processing market in these regions is not only a response to deficiencies in public water supply systems but also a result of strategic industry initiatives and consumer-driven perceptions. As communities seek dependable alternatives in the face of inadequate public water infrastructure, the bottled water processing market continues to thrive, reflecting the dynamic interplay of water accessibility, public policies, and consumer choices.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Drivers: Increase in consumption of bottled water

Water is one of the most vital substances on the planet; it is involved in every bodily function. Bottled water as the healthiest packaged beverage product is in high demand as compared to carbonated drinks. Bottled water is considered an easy way to remain hydrated and helps in maintaining a healthy diet. According to the U.N. University's Institute for Water, Environment and Health, the bottled water market witnessed a remarkable 73% growth from 2010 to 2020, with consumption expected to escalate from approximately 350 billion liters in 2021 to a staggering 460 billion liters by 2030.

The bottled water segment in the US beverage industry is considered appealing due to its convenience, health benefits, safety, and high-quality value. Many consumers prefer the taste of bottled water, and it is closely regulated by the Food and Drug Administration (FDA) to ensure a consistently safe product. Manufacturers are capitalizing on this by introducing new flavored options with attractive packaging. This growth in demand, both in quantity and quality, driven by governmental regulations, contributes to the expansion of the bottled water processing market. The Asia Pacific region, particularly countries like India, China, Indonesia, Vietnam, South Korea, Thailand, and Malaysia, is expected to experience significant growth in the bottled water industry, with China's market showing robust development due to premiumization trends, high consumption, and increased disposable income. Factors such as bulk water purchases and changing drinking habits also play a role in driving the bottled water market in these countries.

Restraints: Ultrashort-Chain PFAS Found in Bottled Water Pose Challenges for the Industry

PFAS, a group of chemicals used since the 1950s for various applications such as polymer manufacturing, surface coating, and firefighting foams, has been under increasing scrutiny due to widespread contamination and associated health and environmental risks. While the historically most used PFAS substances, including PFOS and PFOA, have been banned or phased out, the study now draws attention to the presence of ultrashort-chain PFAS, such as trifluoroacetic acid (TFA), perfluoro-propionic acid (PFPrA), and trifluoromethane sulphonic acid (TFMS), in bottled water. Several research articles detected PFAS substances in 39 out of over 100 bottled waters tested, with some cases showing levels deemed concerning by water quality experts. Bottled waters labeled as "purified," commonly filtered through reverse osmosis, contained fewer PFAS overall than "spring" water, which does not undergo this specific filtration method. This finding indicates a potential link between water purification processes and the presence of ultrashort-chain PFAS in bottled water.

The bottled water industry, already facing increased scrutiny over environmental concerns related to plastic waste, is now confronted with potential market restraints due to the presence of ultrashort-chain PFAS. Consumer confidence in bottled water safety could be compromised, leading to a shift in preferences towards alternative beverages or water sources. Additionally, the lack of standardized testing for ultrashort PFAS in source waters for bottled water production may expose companies to reputational and regulatory risks.

Opportunities: Desalination Plants Drives Surge in Bottled Water Processing Equipment Industry

With increasing urbanization, there is a rise in demand for better quality drinking water, which, in turn, increases the need for membrane filtration processing in water and wastewater treatment applications globally. Rising concern regarding wastewater discharge and drinking water quality is also driving the bottled water processing market globally.

In the past decade, the desalination market has seen an unprecedented rise, as the sources of fresh water are becoming limited. However, the use of desalination units and plants is limited to deserts or areas where the sources of water are saline. Saudi Arabia, the United States, the UAE, and Kuwait have the highest desalination capacities in the world. Saudi Arabia has the world's biggest desalination capacity, accounting for about one-fifth of the global desalination capacity. The rise in the desalination market has invariably increased the demand for water purification, which is used in the bottled water industry.

Desalination plants, utilizing advanced processes such as Reverse Osmosis (RO), provide a crucial avenue for diversifying water sources for the bottled water industry. In regions where freshwater is scarce, these facilities offer an alternative, ensuring a consistent supply of high-quality water for bottling operations. The reliability of desalinated water aligns seamlessly with the stringent quality standards demanded by consumers in the bottled water market.

Challenges: Rising concerns for Transparency and Sustainability for plastic bottles

According to the Guardian post released on November 2023, Consumer rights group Bureau Européen des Unions de Consommateurs (BEUC) argues that the companies' assertions of their plastic water bottles being "100% recycled" or "100% recyclable" are deceptive. The complaint specifically targets the use of green imagery and branding, asserting that such marketing gives a false impression of environmental responsibility. BEUC contends that these bottles are never entirely made from recycled materials, and the actual recycling rates are significantly lower than claimed. The complaint emphasizes that the phrase "100% recyclable" is misleading, as there is no guarantee that a plastic water bottle will undergo recycling. Factors such as collection systems, sorting processes, and technical limitations contribute to lower-than-claimed recycling rates. Additionally, the use of non-recyclable materials in bottle components and lids challenges the assertion of bottles being entirely made from recycled content.

In response to the allegations, Coca-Cola, Nestlé, and Danone have defended their positions. Coca-Cola emphasizes its commitment to reducing plastic packaging and investing in recycling initiatives, asserting that its packaging claims are substantiated. Nestlé highlights its efforts to reduce virgin plastic packaging and communicate transparently with consumers, expressing a goal to achieve one-third less virgin plastic by the end of 2025. Danone underscores its belief in packaging circularity and ongoing investments in recycling infrastructure.

The challenge posed by consumer groups reflects a broader trend in the bottled water processing market, where consumers increasingly seek products with genuine environmental credentials. Greenwashing allegations can tarnish a brand reputation and erode consumer trust. Companies operating in this market must navigate the delicate balance between promoting their products and ensuring transparent communication about environmental impact.

Based on the packaging material, plastic is estimated to account for the largest market share of the bottled water market

Most bottled water is packaged in PET (polyethylene terephthalate) plastic bottles. PET is lightweight, durable, and cost-effective, making it a popular choice for beverage packaging. Other types of plastic, such as HDPE (high-density polyethylene) and PVC (polyvinyl chloride), are also used in some cases. Plastic bottles offer convenience and portability, making them a preferred choice for on-the-go hydration. The lightweight nature of plastic makes it easy for consumers to carry water with them.

Plastic bottled water is widely accessible and available in various sizes and formats. This accessibility makes it easy for consumers to find and purchase bottled water in different locations, from convenience stores to vending machines. Plastic bottles provide a secure and hygienic packaging solution. Sealed plastic bottles help ensure the safety and purity of the water inside, protecting it from contaminants and maintaining its quality.

Based on Product Type, sparkling water is anticipated to have the highest growth rate in the bottled water market

The convenience factor has played a pivotal role in the rise of sparkling water. Packaged in sleek and portable formats, sparkling water has seamlessly integrated into the fast-paced lifestyle of consumers. This shift in packaging has transformed how individuals approach hydration, making sparkling water a favored beverage for everything from gym workouts to casual social gatherings. Beyond being a standalone beverage, sparkling water has found a place in the burgeoning mocktail and cocktail culture. Its effervescence and neutral flavor make it an ideal mixer, further expanding its appeal across various consumption occasions. Packaging innovation has played a pivotal role in enhancing the appeal of sparkling water. Convenient, on-the-go formats have contributed to its popularity, positioning it as a lifestyle beverage. This has led to a transformation in consumer behavior, with sparkling water becoming a go-to option for various occasions, from fitness routines to social gatherings

By Technology, the filtration segment is projected to witness a higher growth rate during the forecast period in the bottled water equipment market.

Growing consumer preference for purified and filtered water, especially in regions with unreliable tap water quality, boosts the demand for advanced filtration systems in bottled water production. Increasing awareness about waterborne diseases and contaminants has driven a demand for high-quality and safe drinking water. Filtration technologies ensure the removal of impurities, pathogens, and pollutants, addressing consumer concerns about water quality.

The Asia Pacific market is projected to contribute the largest share of the global bottled water processing market

One of the driving factors behind the surge in demand for bottled water in the Asia Pacific region is the escalating concerns regarding the quality of tap water in specific areas. As consumers become more conscious of water safety and purity, many are opting for bottled water as a perceived safer and more reliable source of drinking water. The bottled water industry has capitalized on these apprehensions by positioning its products as a trustworthy alternative, meeting stringent quality standards. This heightened awareness about water quality has become a significant driver, influencing consumer choices and contributing to the sustained growth of the bottled water processing market.

According to IMF data on tourism tracker Asia & Pacific released on March 2023, In 2022, tourist arrivals in Asia & Pacific reached around 31% of 2019 levels. The burgeoning tourism and hospitality industry in the Asia Pacific region has emerged as a substantial driver for the market. As the region experiences increased tourist inflows, hotels, restaurants, and tourist destinations have witnessed a corresponding surge in the demand for bottled water. This growth is fueled by the hospitality sector's recognition of the importance of offering safe and convenient hydration options to guests. The reliance on bottled water in this industry has become integral to meeting the expectations of both domestic and international travelers, further propelling the market forward.

Enhancements in distribution and retail channels have played a pivotal role in fostering the growth of the bottled water processing market in the Asia Pacific region. The increased availability of bottled water in diverse retail outlets such as supermarkets and convenience stores has significantly expanded consumer access. Additionally, the integration of online platforms for purchasing bottled water has provided consumers with convenient and efficient ways to procure their preferred products. This improved accessibility has not only increased market reach but has also contributed to the overall convenience associated with choosing bottled water over other beverages.

Key Market Players

Key players operating in bottled water equipment market include Bottled Water Equipment Market :

DuPont (US), GEA Group Aktiengesellschaft (Germany), Alfa Laval (Sweden), 3M (US), Veolia (France) SPX FLOW, Inc. (US), Pall Corporation (US), Pentair (US), Porvair Filtration Group (UK), TORAY INDUSTRIES, INC. (Japan). Key players in bottled Water Market include Nestlé (Switzerland), The Coca-Cola Company (US), PepsiCo (US), Danone (France), Nongfu Spring (China), Tata Consumer Products Limited (India), National Beverage Corp. (US), Keurig Dr Pepper Inc. (US), Gerolsteiner Brunnen GmbH & Co. KG (Germany), CG Roxane, LLC (US).

Other Players in the ecosystem:

Creative OZ Air (I) Pvt. Ltd., Marlo Incorporated, Lenntech B.V., Accuteck Packaging Equipment Companies, Inc., Evergreen technologies, Tetra Laval S.A, E-Rotek Water Systems Co., ltd., Danaher Corporation, Otsuka Pharmaceutical Co., Ltd., Primo Water Corporation, Fiji Water Company LLC, VOSS Water.

Bottled Water Processing Market Report Scope:

|

Report Metric |

Details |

|||

|

Market size estimation |

2023–2028 |

|||

|

Base year considered |

2022 |

|||

|

Forecast period considered |

2023–2028 |

|||

|

Units considered |

Value (USD Million), Volume (Million Gallon) |

|||

|

Segments Covered |

By Product Type, By Packaging Material, By Technology, By Equipment, and By Region |

|||

|

Regions covered |

North America, South America, Europe, Asia Pacific, and Rest of the World |

|||

|

Companies studied |

|

Bottled Water Processing Market Report Segmentation:

By Product Type

- Still Water

- Sparkling Water

By Packaging Material

- Plastic

- Glass

- Cans

- Other Packaging Materials

By Equipment

- Filters

- fillers & cappers

- molders

- shrink wrappers

- bottle washers

- other equipments

By Technology

- Ion exchange and demineralization

- Disinfection

- Filtration

- Packaging

By Region

- North America

- Europe

- Asia Pacific

- South America

- Rest of the World (RoW)

Recent Developments

- In August 2020, DuPont (US) launched TapTec Plus HF in the Indian market. This product introduction is positioned to address the evolving demands of consumers seeking high-quality water purification solutions in the residential sector.

- In September 2022, GEA Group Aktiengesellschaft (Germany)introduced the intelligent software solution GEA Smart Filtration for membrane filtration plants, which monitors the plant status remotely via an app. This tool is another cornerstone in GEA's software portfolio that leverages the power of cloud connectivity and real-time analytics to increase plant availability and performance.

- In March 2021, DuPont (US) entered a collaborative partnership with Waterise AS, focusing on advancing sustainable subsea desalination technology. This collaboration signifies a joint effort to provide seawater reverse osmosis membranes and expertise for Waterise's subsea desalination plants. The partnership aligns with DuPont's ongoing commitment to innovation and sustainability, addressing global water challenges while contributing to the company's leadership in water purification and separation technologies.

Frequently Asked Questions (FAQ):

What is the bottled water market growth?

The bottled water market is projected to reach USD 457.1 billion by 2028, at a CAGR of 8.0% from 2023 to 2028.

How big is the bottled water equipment market?

The bottled water equipment market is estimated at USD 6.8 billion in 2022 and USD 7.2 billion in 2023 and is projected to reach USD 9.5 billion by 2028, at a CAGR of 5.7% from 2023 to 2028.

Which region is projected to account for the largest share of the bottled water equipment market?

The Asia Pacific region accounted for the largest share in terms of value at USD 2.7 Billion in 2023 and is expected to grow at a CAGR of 6.5% during the forecast period.

Which are the major key players in the bottled water equipment market?

DuPont (US), GEA Group Aktiengesellschaft (Germany), Alfa Laval (Sweden), 3M (US), Veolia (France), SPX FLOW, Inc. (US), Pall Corporation (US), Pentair (US), Porvair Filtration Group (UK) and TORAY INDUSTRIES, INC (Japan).

What are the factors driving the bottled water processing market?

Health Consciousness: Rising awareness of health benefits drives the preference for bottled water.

Limited Public Water Access: Bottled water meets the demand in regions lacking clean public water infrastructure.

Urbanization and Convenience: On-the-go lifestyles fuel the demand for portable bottled water.

Environmental Sustainability: Shift towards eco-friendly packaging addresses environmental concerns.

Marketing Influence: Strategic campaigns shape perceptions, emphasizing purity and quality.

Population Growth: Increasing global population amplifies the need for clean and safe water sources.

Which segment by product type accounted for the largest bottled water market share?

By product type, the still water segment dominated the market for bottled water and was valued the largest at USD 276.2 billion in 2023. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

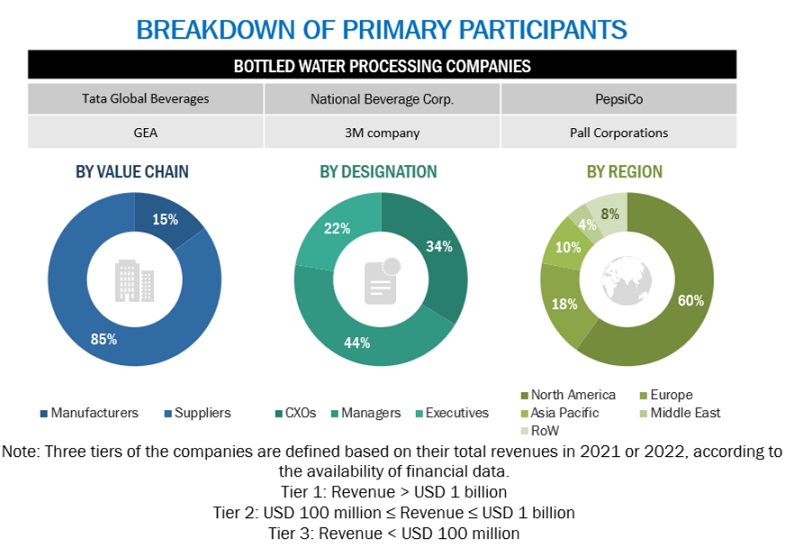

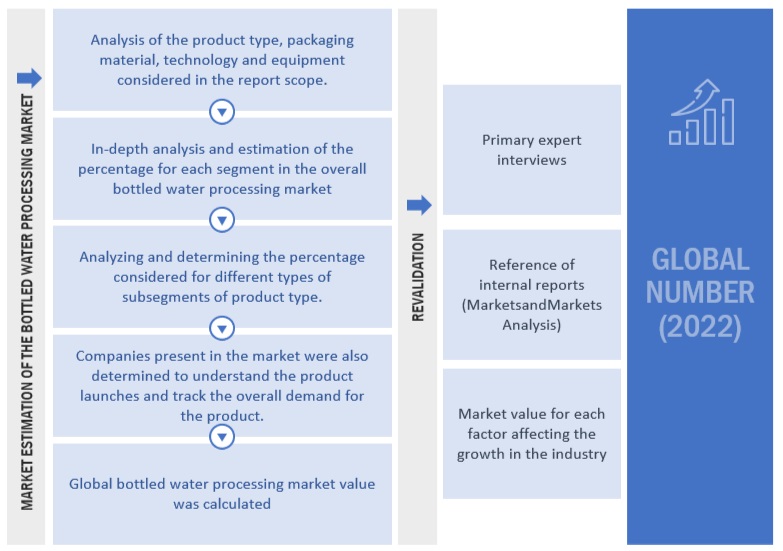

The research study involved extensive secondary sources, directories, and databases such as Bloomberg Businessweek and Factiva to identify and collect information useful for a technical, market-oriented, and commercial study of the bottled water processing market. In-depth interviews were conducted with various primary respondents—such as key industry participants, subject matter experts (SMEs), C-level executives of key market players, and industry consultants—to obtain and verify critical qualitative and quantitative information and assess prospects.

Secondary Research

In the secondary research process, various secondary sources were referred to, so as to identify and collect information. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, reports by the International Bottled Water Association (IBWA) and regulatory bodies, news articles, trade directories, and databases. They were used to identify and collect information. The secondary research was used mainly to obtain key information about the industry’s supply chain, distribution channels, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, regional markets and key developments from both market- and technology-oriented perspectives.

Primary Research

The bottled water processing market comprises several stakeholders, such as raw material suppliers, processors, machine and component manufacturers, and regulatory organizations, in the supply chain. The supply side of the bottled water processing market is characterized by the presence of key machine/equipment manufacturers or assembly manufacturers. The demand side is characterized by the presence of bottled water processors, manufacturers, retailers, and key technology providers for the manufacturing of bottled water. Various key opinion leaders (KOLs) from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, CEOs, managers from public and private organizations, and food & beverage stakeholders. The primary sources from the supply side include the research institutions involved in R&D to introduce technologies for updating equipment, key opinion leaders, distributors, and food equipment manufacturers.

To know about the assumptions considered for the study, download the pdf brochure

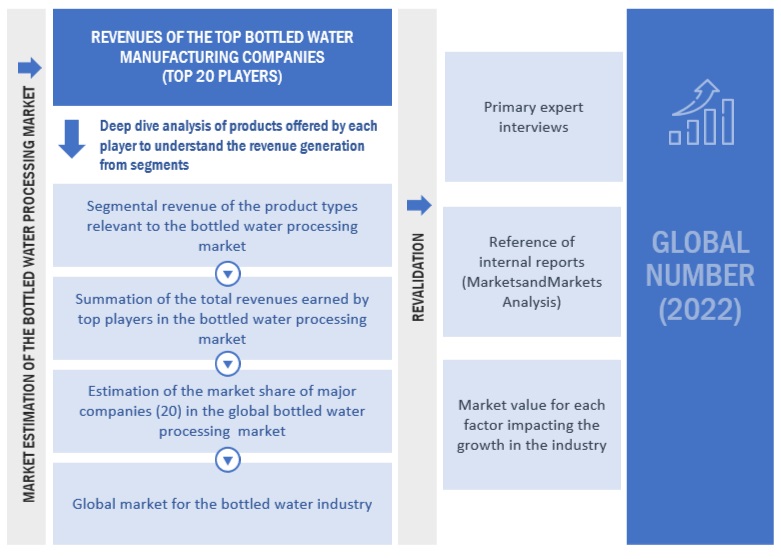

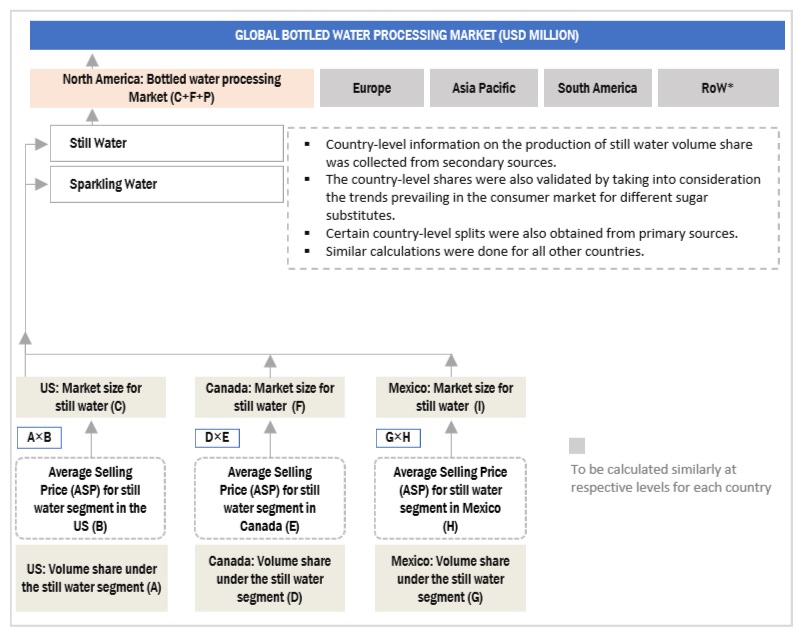

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the market. These approaches were also used extensively to estimate the market size of various dependent submarkets in the overall bottled water processing market. The research methodology used to estimate the market size includes the following details:

- The key players were identified through extensive secondary and primary research.

- The industry’s value chain and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary research and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary sources, and analyzed to obtain the final quantitative and qualitative data.

Market size estimation: Top-Down approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market size estimation methodology: Bottom-up approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition, the market size was validated using both the top-down and bottom-up approaches; it was then verified through primary interviews. Thus, there are three approaches: the first is the top-down approach, the second is the bottom-up approach, and the third is the learning and verification approach through expert interviews. Only when the values arrived at from the three points match, is the data assumed to be correct.

Market Definition

Bottled water processing technology & equipment is defined (for this study) as: “any process, method, and protocol by which the machineries and equipment are used in the manufacturing, handling, packaging, and storing of these.” The global demand and revenue generated by the sales and marketing of these equipment and technology lead to the sizing of the global sales value market.

“Bottled water is an optimal choice for hydration and refreshment, offering consistent safety, quality, good taste, and convenience. The United States Food and Drug Administration (FDA) comprehensively regulates bottled water, treating it as a packaged food product. Bottled water must adhere to the FDA's stringent requirements regarding food safety, labeling, and inspections. It is also subject to state regulations, and members of the International Bottled Water Association (IBWA) are obligated to follow the IBWA Model Code.

The classification of water as "bottled water" or "drinking water" is contingent upon meeting all applicable federal and state standards, being sealed in a sanitary container, and being intended for human consumption. Importantly, FDA standards for bottled water are legally mandated to be at least as rigorous and health-protective as the standards set by the U.S. Environmental Protection Agency (EPA) for public water systems.”

Key Stakeholders

-

Manufacturers/Suppliers

- Bottled water manufacturers and processors.

- Polymer industry

- Bottled water retailers, wholesalers, and distributors.

- Bottled water equipment manufacturers and providers.

- Research & development laboratories

-

Regulatory bodies and institutions, and government agencies

- Organizations such as the Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Food Safety Agency (EFSA), EUROPA, Codex Alimentarius, and Food Safety Australia and New Zealand (FSANZ)

- Associations such as International Bottled Water Association (IBWA), International Council of Bottled Water Associations, Canadian Bottled Water Association (CBWA), European Federation of Bottled Waters (EFBW), China Beverage Industry Association (CBIA), Asia and Middle East Bottled Water Association (ABWA), Australasian Bottled Water Institute (ABWI) (Australia and New Zealand), European Bottled Watercooler Association (EBWA), Latin American Bottled Water Association (LABWA)

- Intermediary suppliers

- Bottled water logistics service providers and transporters.

Report Objectives

Market Intelligence

- Determining and projecting the size of the bottled water processing market with respect to equipment, technology, product type, packaging material, and region, over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the market by determining the largest and fastest-growing segments across regions

- Providing detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- Analyzing the micro-markets with respect to individual growth trends, prospects, and their contribution to the total market

Competitive Intelligence

- Identifying and profiling the key market players in the bottled water processing market.

-

Providing a comparative analysis of the market leaders on the basis of the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key regions.

- Providing insights on key product innovations and investments in the bottled water processing market.

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

- Further breakdown of the Rest of European bottled water processing market, by key country

- Further breakdown of the Rest of the South American bottled water processing market, by key country

- Further breakdown of the Rest of Asia Pacific bottled water processing market, by key country

Company Information

- Detailed analyses and profiling of additional market players

Growth opportunities and latent adjacency in Bottled Water Processing Market