Border Security Market by Domain (Land, Maritime, Airborne), Vertical (Military, Homeland Security), System (Surveillance Systems, Detection Systems, Communication Systems, Command and Control Systems), Installation & Region – Global Forecast to 2029

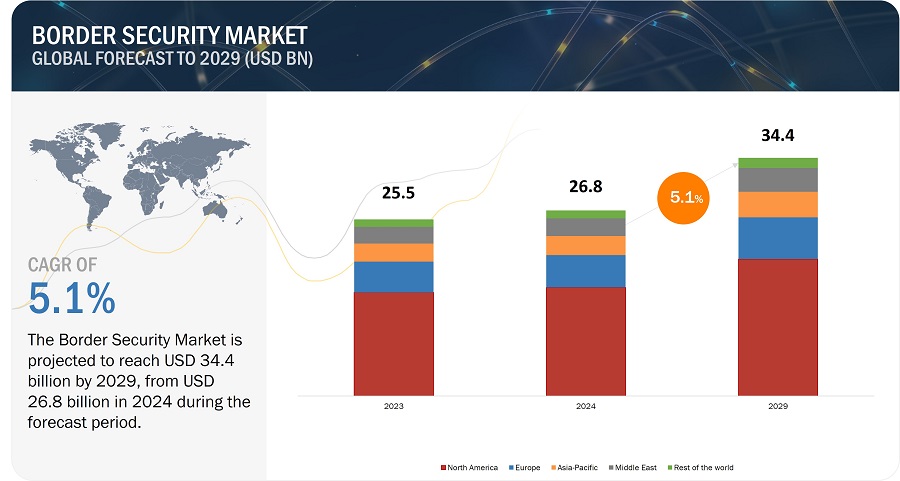

[302 Pages Report] The border security market is projected to reach USD 34.4 billion by 2029, from USD 26.8 billion in 2024, at a CAGR of 5.1% during the forecast period.The market dynamics of the market present a unique and evolving landscape, characterized by rapid technological advancements, and stringent regulatory requirements. The border security market is driven by the increasing terrorist fatalities and rising public safety concerns near border areas. However, the stringent regulations are restraining the market growth. Various opportunities in the market include infrastructure modernization of border security systems, and increase in the defense spending by emerging economies. Challenges such as high cost of R&D and requirement of critical infrastructure for testing border security systems, and integration and interoperability are creating issues for the market.

Technological advancements in border security systems are being undertaken owing to the rising geopolitical tensions and increased threats of attacks across the globe. Governments of various countries are making significant investments in developing advanced border security systems for the enhancement of national security. Technological advancements in the fields of autonomous systems, biometric identification systems, and internet of things have enabled the development of enhanced and highly efficient border security systems.

Border Security Market Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

Border security market Dynamics:

Driver: Public safety concerns near border areas

Public safety concerns near border areas significantly drive the demand for the border security market due to the critical need to prevent illegal activities that threaten the safety and security of a nation's citizens. Border regions are often hotspots for unlawful activities such as drug trafficking, human trafficking, and smuggling of weapons, which pose serious risks to public security. Governments and security agencies are increasingly investing in advanced technologies and strategies to monitor and secure borders effectively, aiming to deter and detect illegal crossings and safeguard against potential threats.

For instance, the US President's FY25 Budget includes a notable USD 1.9 billion increase in the base budget for Customs and Border Protection (CBP), and Immigration and Customs Enforcement (ICE), representing a 7 percent rise. This funding boost is aimed at bolstering the operational capacity of these agencies, enabling them to better manage and secure US borders against a variety of threats. This includes the deployment of advanced surveillance technologies, improved infrastructure, and enhanced personnel training to ensure more effective border control and immigration enforcement.

Restraint: Stringent regulations

Stringent regulations pose significant restraints on the border security market by limiting the flexibility and responsiveness of companies involved in this market. Regulations often impose rigorous standards on the development, testing, and deployment of border security technologies, which can delay the introduction of innovative solutions. For instance, manufacturers of surveillance equipment, such as drones and biometric scanners, must navigate complex approval processes set by agencies like the Federal Aviation Administration (FAA) and the Department of Homeland Security (DHS) in the US. These processes ensure that the technologies meet stringent safety and privacy standards, but they also slow down the ability to respond swiftly to emerging threats.

Opportunity: Infrastructure modernization of border security systems

The upgradation of existing border security infrastructure presents a significant opportunity within the border security market. With evolving threats and increasing demands for enhanced security measures, governments and agencies worldwide are investing heavily in modernizing their border protection capabilities. Companies operating in the border security market are leveraging these opportunities by developing innovative products and services tailored to the specific needs of border security agencies. This includes advanced surveillance systems, biometric identification tools, automated border control systems, and integrated command and control platforms. As nations prioritize the modernization of their border security frameworks, there is a growing demand for solutions that enhance situational awareness, streamline operations, and improve response times. This demand creates fertile ground for businesses to expand their portfolios and capture a larger market share, while contributing to the overall security and efficiency of border management processes.

Challenge: High Cost of R&D and requirement of critical infrastructure for testing border security systems

The cost incurred for the research and development of the border security system is on the higher side. Significant investments are required at different stages of the value chain of the security system especially in research and development, manufacturing, system integration and assembly stage. Border Security systems need to have attributes such as reliability, accuracy, durability, and energy efficiency among others. In a competitive scenario, to maintain technology leadership position, develop highly functional and efficient security systems, considerable amount of investment is required in the R&D, which includes research scholars, research centers, testing fields and infrastructure, collaboration with universities, research institutes and other companies.

Ecosystem Map for the Border Security Market

Based on domain, the land segment of the border security market is expected to lead the market.

Land segment is estimated to lead the market based on domain. Conflict, economic inequality, and climate change are putting increased pressure on people to migrate, which is forcing countries to strengthen border security at their land borders in order to better control and manage the movement of people. Stronger border security measures are required as a result of the increased risk of illegal activities like drug and people trafficking, human trafficking, and the entrance of terrorist and criminal forces.

Based on verticals, the Homeland Security segment will grow at the highest CAGR during the forecast period.

Homeland Securitys segment is forecasted to grow at highest CAGR. As security concerns and societal difficulties increase, governments are focusing more on immigration control, counterterrorism operations, and stopping drug and people trafficking. More sophisticated and efficient border security measures are needed to address these problems in order to control migration, stop terrorist attacks, and fight organized crime. As governments invest in cutting-edge technologies like surveillance systems, biometric identification, and detecting techniques to improve their security capabilities and protect their citizens, this increased attention is fueling growth in the border security industry.

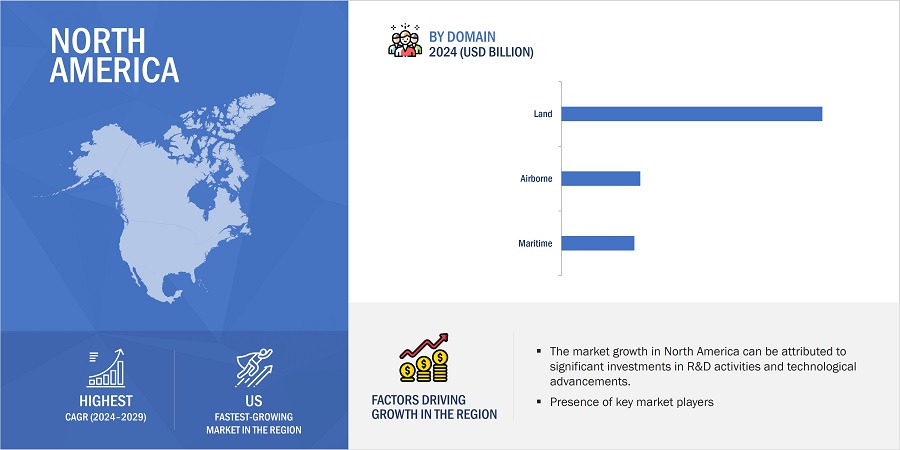

The North America region to have the highest market marketshare in 2024.

North America is estimated to have the highest market share of 58.5% in the border security market. This is due to several key factors, including the geopolitical landscape, economic capacity of North American countries, and presence of various key players in the region.

North America, particularly the United States, has extensive land and maritime borders, which necessitates robust security measures. The region's focus on preventing illegal immigration, drug trafficking, and potential terrorist activities has led to substantial investments in advanced border security technologies. Additipnally, the economic capacity of North American countries supports large-scale procurement and deployment of sophisticated security systems. Governments in this region have significant budgets allocated to defense and security, enabling them to invest in cutting-edge technologies like surveillance systems, biometrics, and unmanned aerial vehicles (UAVs).

Furthermore, North America is home to many leading technology companies and defense contractors including Lockheed Martin Corporation (US), General Dynamics Corporation (US), Northrop Grumman (US), who are at the forefront of developing and supplying state-of-the-art security solutions. This local expertise and innovation drive the market forward, ensuring that the region remains ahead in terms of technological advancements.

Border Security Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major players in the border security market are Lockheed Martin Corporation (US), General Dynamics Corporation (US), Northrop Grumman (US), BAE Systems (UK), and Thales (France). These players have adopted various growth strategies expand their presence in the border security companies.

Want to explore hidden markets that can drive new revenue in Border Security Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Border Security Market?

|

Report Metric |

Details |

|

Estimated Market Size |

USD 26.8 billion in 2024 |

| Projected Market Size |

USD 34.4 billion by 2029 |

| Border Security Market Growth Rate (CAGR) |

5.1 % |

|

Market size available for years |

2020-2029 |

|

Base year considered |

2023 |

|

Forecast period |

2024-2029 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

By Domain, Vertical, System, Installation, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, Middle East and Rest of the World. |

|

Companies covered |

Lockheed Martin Corporation (US), General Dynamics Corporation (US), Northrop Grumman (US), BAE Systems (UK), and Thales (France), and many more. |

Border Security Market Highlights

This research report categorizes the border security market based on domain, vertical, system, installation, and region.

|

Segment |

Subsegment |

|

By Domain |

|

|

By Vertical |

|

|

By Systems |

|

|

By Installation |

|

|

By Region |

|

Recent Developments

- In April 2024, Lockheed Martin has received a contract worth up to USD 4.1 billion from the Missile Defense Agency to upgrade the C2BMC system with advanced technology for enhanced response capabilities to emerging threats across domains. Operations will focus on facilities in Huntsville, Alabama, and Colorado Springs, Colorado.

- In March 2024, BAE Systems was awarded a contract by the U.S. Navy worth approximately USD 86 million to support its Mobile Deployable Command, Control, Communications, Computers, Combat Systems, Intelligence, Surveillance, and Reconnaissance (MDC5ISR) programs. The contract, spanning five years, involves providing engineering and technical services for new and existing MDC5ISR systems and platforms.

- In January 2024, General Dynamics Information Technology (GDIT) was awarded a USD 1.8 billion contract by U.S. Customs and Border Protection to modernize and expand border surveillance tower systems. The contract, lasting up to 14 years, includes updating sensor towers and enhancing surveillance technology along the U.S. borders.

- In December 2023, Thales partnered with Trablisa (Spain) to install an Integrated Surveillance System at the Spanish Civil Guard's Melilla Command, featuring high-resolution cameras for enhanced land and maritime border control in Melilla.

- In September 2023, Lockheed Martin was awarded a USD 23.8 million contract by the US Navy to begin developing the Integrated Combat System, aimed at connecting the Navy’s and U.S. Coast Guard’s surface fleets. This contract, including options that could reach USD 1.1 billion by fiscal 2030, also includes updates for P-3 aircraft.

- In September 2023, the Australian government has awarded Northrop Grumman a USD 968.5 million contract to purchase its fourth MQ-4C Triton Unmanned Aerial System (UAS) and upgrade its fleet of P-8A maritime patrol aircraft. This contract enhances Australia's capabilities with integrated command, control, communications, computers, intelligence, surveillance, reconnaissance, search and rescue, and maritime strike capabilities across air and sea operations.

- In February 2023, BAE Systems Digital Intelligence secured USD 46 million contract with the UK's Home Office to develop risk analytics. Over three years, this initiative aims to enhance border security by analyzing data from millions of passenger journeys and freight entries, helping manage and mitigate risks to national security.

- In December 2022, Thales launched a new multimodal biometric pod for border and travel management, integrating iris and face recognition to streamline ID enrollment and verification processes. It reduces processing times and enhances efficiency at entry and exit points, focusing on security and privacy in data handling.

- In June 2022, Thales Digital Identity and Security signed a contract with Spain to deploy over 1,500 biometric border terminals. Selected by Spain's Ministry of Interior, Thales and Zelenza will cover land, sea, and air border points, enhancing Spain's biometric entry and exit system for non-European citizens across the Schengen area.

- In February 2022, Echodyne and Northrop Grumman expanded their partnership with a strategic agreement and minority investment. They are integrating Echodyne's radar technology into Northrop Grumman's advanced defense and security solutions, starting with counter-UAS capabilities. The collaboration aims to explore additional applications for Echodyne's radar technology.

- In December 2020, Lockheed Martin and Rafael Advanced Defense Systems partnered to develop, test, and manufacture High Energy Laser Weapon Systems (HELWS) in the U.S. and Israel. The collaboration builds on assets developed independently under Israel's IRON BEAM project, aiming to adapt the system for the American market and other potential markets.

Frequently Asked Questions (FAQs):

What is the current size of the border security market?

The border security market is projected to reach USD 34.4 billion by 2029, from USD 26.8 billion in 2024, at a CAGR of 5.1% during the forecast period.

Who are the winners in the border security market?

Lockheed Martin Corporation (US), General Dynamics Corporation (US), Northrop Grumman (US), BAE Systems (UK), and Thales (France).

What are some of the technological advancements in the market?

- Autonomous systems: Autonomous systems are advanced technological solutions capable of performing tasks and making decisions without human intervention. These systems use a combination of artificial intelligence (AI), machine learning, robotics, and sensor technologies to understand and interact with their environment. These systems are increasingly transforming border security operations by integrating advanced technologies such as artificial intelligence, machine learning, and robotics. It enhances surveillance, detection, and response capabilities, enabling border security forces to efficiently manage large and often challenging geographical areas.

- Biometric identification systems: Biometric identification systems, such as facial recognition software, fingerprint readers, and iris scanners, have become integral to border security. These systems provide a sophisticated means of identifying individuals based on unique physical characteristics, ensuring a higher level of accuracy and security.

- Internet of Things: The Internet of Things (IoT) refers to the network of interconnected physical devices, vehicles, appliances, and other objects embedded with sensors, software, and connectivity capabilities that enable them to collect and exchange data. These devices are often equipped with unique identifiers and can communicate with each other over the internet, without requiring human-to-human or human-to-computer interaction.

What are the factors driving the growth of the market?

- Rising geopolitical instability

- Public safety concerns near border areas

- Growing adoption of new technologies for border security

- Increasing terrorist fatalities necessitates border security systems

Which region is expected to hold highest market share in the border security market?

Border security market in the North America region is estimated to hold the largest market share of 58.5% of the total market in 2024.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

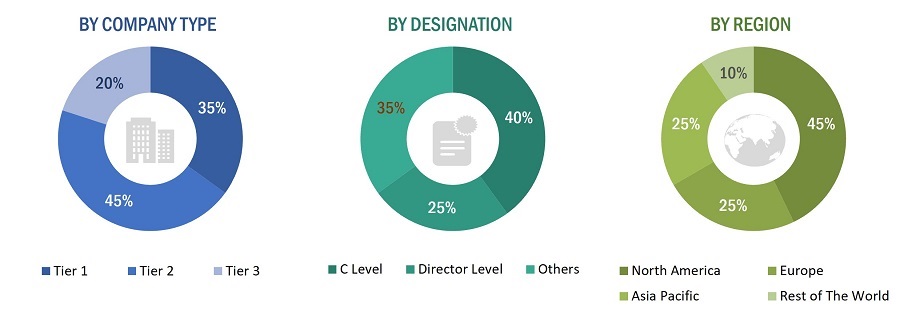

This research study involved the substantial use of secondary sources, directories, and databases, such as D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect information on the border security market. Primary sources included experts from core and related industries, suppliers, manufacturers, solution providers, technology developers, alliances, and organizations related to all segments of the industry’s value chain. All primary sources were interviewed to obtain and verify critical qualitative and quantitative information as well as assess prospects for the growth of the market during the forecast period.

Secondary Research

The market size of companies offering border security systems was arrived at based on the secondary data available through paid and unpaid sources, as well as by analyzing the product portfolios of major companies and rating them based on their performance and quality.

In the secondary research process, various secondary sources were referred to identify and collect information for this study. These included government sources; corporate filings such as annual reports, press releases, and investor presentations; white papers, journals, and certified publications; and articles by recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s value and supply chain and identify the key players by various products, market classifications, and segmentation according to their offerings and industry trends related to domain, vertical, system, installation, and region, and key developments from both the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. Primary sources from the supply side included various industry experts, such as vice presidents (VPs), directors from business development, marketing, product development/innovation teams, and related key executives from components vendors, border security systems manufacturers, integrators, distributors, and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from products, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped me understand the various trends related to border security systems. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of customers/end users of border security systems, were interviewed to understand the buyer’s perspective on suppliers, products, component providers, their current usage of border security systems, and the outlook of their businesses.

To know about the assumptions considered for the study, download the pdf brochure

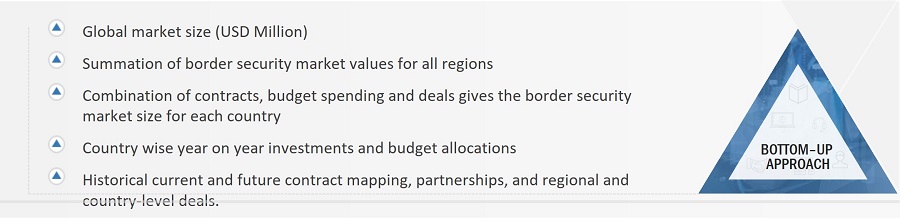

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the border security market. The research methodology used to estimate the size of the market includes the following details.

Key players in the border security market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews with leaders such as directors, engineers, marketing executives, and other stakeholders of leading companies operating in the border security market.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data on the border security market. This data was consolidated, enhanced with detailed inputs, analyzed by MarketsandMarkets, and presented in this report.

Market size estimation methodology: Bottom-up Approach

Market size estimation methodology: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the estimated market numbers for border security systems segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. The market size was also validated using both top-down and bottom-up approaches.

Market Definition

Border Security systems are complete and fully integrated border management solutions as well as specific systems and products for surveillance and control of different environments such as land, airborne, and coastal border surveillance. Border security systems include buried cable/buried sensors, Radar systems, CCTV and thermal imaging IR detection camera systems, perimeter intrusion detection systems/ intelligent fencing systems, unmanned vehicles, wide-band wireless communication systems, command and control (C2) systems, biometric systems, and others (RF jammers, microwave intrusion detection system).

Report Objectives

- To define, describe, segment, and forecast the size of the border security market based on domain, vertical, system, installation, and region

- To forecast the size of market segments with respect to five regions, namely North America, Europe, Asia Pacific, the Middle East, and the Rest of the World, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the market growth

- To analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders by identifying key market trends

- To profile key market players and comprehensively analyze their market shares and core competencies2

- To identify detailed financial positions, key products, and unique selling points of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis, market ranking analysis, and revenue analysis of key players

- To analyze the degree of competition in the market by identifying key growth strategies adopted by leading market players

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Border Security Market

Hi, I'm looking for custom-made market research on Long-range and medium range Land-based Electro-Optics/Infrared observation Systems. The systems on the research have to be stationary (not handheld or vehicle mounted or mobile). The main focus areas of interest are Border security and coastal security, critical Infrastructure protection (CIP) such as Gas and oil, Army bases, Airports etc. And also Land based Automatic Target Detection and Tracking systems manufacturers.

I am specifically looking for a report that focuses on the ground environment and radars and cameras only. Does the scope of the Border Security System Market cover it all?

Hello I would be pleased to receive some information regarding Border Security System Market. May I have an overview with the brochure to see if I wish to buy the all study?

Free sample request for Border Security System Market by Environment (Ground, Aerial, Naval), System (Laser, Radar, Camera, Wide Band Wireless Communication, Perimeter Intrusion, Unmanned Vehicles, C2C, Biometric Systems), and Geography - Global Forecast to 2022