Backscatter X-ray Devices Market by Type (Handheld and Non-handheld), Application (Customs and Border Protection, Law Enforcement, Airport/Aviation, Military and Defense) and Geography (2022-2027)

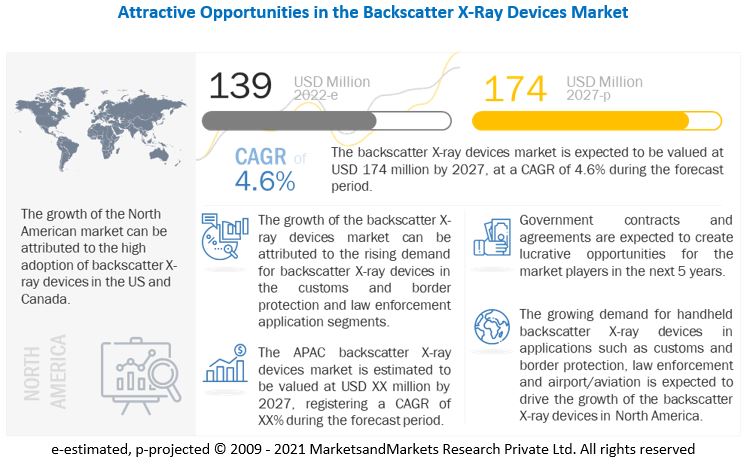

[106 Pages Report] The backscatter X-ray devices market was valued at USD 132 million in 2021 and is projected to reach USD 174 million by 2027; it is expected to grow at a CAGR of 4.6% from 2022 to 2027.

The key factors driving the growth of the backscatter X-ray devices industry include increase in number of terrorist attacks and illegal immigration, increasing deployment of security solutions at public gathering spaces, rise in smuggling of narcotics, and reduction in passenger waiting time.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Global Backscatter X-ray Devices Market

The backscatter X-ray devices market includes major Tier I and II manufacturers and distributors such as Rapiscan Systems (US), Nuctech Company Limited (China), Viken Detection (US), LAURUS Systems, Inc. (US), Scanna MSC Ltd. (UK), Autoclear LLC (US), and Tek8, Inc. (US). These companies have their manufacturing facilities spread across various countries across North America, Europe, APAC, and RoW. COVID-19 has impacted their businesses as well.

Market Dynamics of Backscatter X-ray Devices Market

Driver: Increase in number of terrorist attacks and illegal immigration

The demand for security screening devices such as backscatter X-ray devices has increased in the past few years due to the increased illegal immigration and terrorist attacks worldwide. 9/11 in the US, London bombings in 2007, Mumbai attack in 2008, Sri Lanka Easter bombing in 2019, mass shooting at a mosque in New Zealand in 2019, mass shooting in Vienna in 2020, and suicide bombing and mass shooting attacks at Kabul airport are examples of some of the major terrorist attacks carried out globally. According to the Global Terrorism Database 2020, in 2019, around 8,500 terrorist attacks were witnessed across the globe, which killed more than 20,300 people, including 5,460 perpetrators and 14,840 victims.

The growth in the number of criminal activities and terrorist attacks globally has increased concerns about the safety and security of assets and people. X-ray baggage scanners provide a complete X-ray image of an individual’s belongings, which highlights the presence of any contraband object in the baggage and consequently prevents unlawful activities. Governments worldwide are emphasizing using advanced security screening solutions. All these factors are fueling the demand for backscatter X-ray devices. Their deployment is enhancing safety at sensitive entry areas, especially airports, of countries.

Restraint: Privacy concerns associated with backscatter X-ray body scanners

Most passengers in developed countries (due to high awareness) do not prefer to undergo the scanning process because of health and privacy concerns. The scanning process provides an output of body outlines of the person being scanned, and, thus, airport officials find it difficult to convince passengers to undergo scanning.

Although backscatter X-ray technology has emerged as an alternative to manual searches at airports and other security checkpoints by easily penetrating through clothing, it has raised privacy concerns for the passengers. Most passengers think that viewing the scanned image by the official can violate confidential medical information. For instance, if a passenger uses a colostomy bag, has a missing limb, wears a prosthesis, or is transgender.

Several complaints have been filed by Human Rights Association and individuals about naked pictures that body scanners generate. The American Civil Liberties Union (ACLU) (US) and the Electronic Privacy Information Center (EPIC) (US) have opposed the use of this technology. According to ACLU, the backscatter X-ray devices are “virtual strip search” systems.

According to a trial conducted by TSA, 79% of the passengers opted to try backscatter X-ray technology over the traditional pat-down in secondary screening. Backscatter X-raying can generate photo-quality images of naked bodies. Thus, different software have been designed to distort the visuals of private areas. However, some journalists expressed concern that blurring may allow people to carry contraband products by attaching them to their genitals. The Guardian, a British newspaper, has revealed concern among British officials that the use of such scanners to scan children may be illegal under the Protection of Children Act 1978, which prohibits the creation and distribution of indecent images of children. To date, no concrete solution in terms of technology has been developed to resolve the issue of privacy concerns.

Opportunity: Technological advancements in X-ray

The advancements in X-ray screening systems could facilitate the deployment of security screening solutions at several places. Different types of technologies, such as standard X-ray, dual-energy, backscatter, and CT, are used in X-ray imaging systems. Earlier, 2D X-ray systems were used to screen baggage at airports. However, X-ray systems providing a 3D view of luggage have been launched recently. These systems provide better and more intuitive information about the bag contents by allowing viewers/operators to zoom in and rotate the bag for a 360° view. In the single-view X-ray transmission mode, the X-ray beam is transmitted through objects and detectors positioned opposite to the beam. Dual-view X-rays use 2 X-ray beams peaking at different energies (high and low) and pass them through an object. This technique generates material-specific images by comparing two different energies. Material discrimination helps operators locate suspicious objects and identify potential threats.

Challenge: Inclusion of artificial intelligence for digital transformation of security applications

Backscatter and CT X-ray screening technologies are largely used at various critical places worldwide for security. The major drawback associated with these X-ray technologies is the requirement of high time for screening baggage and cargo. Integration of advanced technologies such as AI and IoT can reduce not only the screening time but also ensure accurate detection of contraband items in baggage and cargo. Governments from various countries have been investing in developing new AI-based security systems. The UK government has invested USD 2.37 million (GBP 1.8 million) to develop AI-based systems for its airports. The US TSA has deployed new CT scanners equipped with AI at the Los Angeles International Airport and John F. Kennedy and Phoenix airports to detect target threats at high accuracy. In the aviation industry, AI technology is expected to be used in self-check-in robots for facial recognition.

Non-handheld segment to account for the largest share of backscatter X-ray devices market during the forecast period

On the basis of type, the backscatter X-ray devices market has been segmented into handheld and non-handheld. The handheld segment of the backscatter X-ray devices market is projected to witness a higher growth rate than the non-handheld segment owing to the increasing acceptance of handheld devices globally due to low price and portability.

Customs and border protection application to account for the largest share of backscatter X-ray devices market during the forecast period

On the basis of application, the backscatter X-ray devices market has been segmented into customs & border protection, law enforcement, airport/aviation, military & defense, and others. The customs & border protection segment is projected to account for the largest size of the backscatter X-ray devices market from 2022 to 2027. The fast and effective features of backscatter X-ray devices in scanning people, baggage, and vehicles are fueling their demand in the customs and border protection application segment.

APAC to account for the largest growth of backscatter X-ray devices market during the forecast period

Among all regions, APAC is expected to register the highest growth in the backscatter X-ray devices market during the forecast period. The market in APAC has been classified into China, Japan, South Korea, and the Rest of APAC. The market in APAC is mainly dominated by China and Japan as the majority of players have their presence in these countries. In the recent times, several countries in APAC have experienced terrorist attacks, such as India, Pakistan, Sri Lanka, Australia, and others, which has compelled the governments in these countries to upgrade their security measures by investing a significant amount in developing and installing advance and multi-technology security systems. Thus, the backscatter X-ray devices market is expected to grow at the highest rate in APAC region. There is a huge threat of terrorist attacks, and civil unrest/community riots in countries such as India, Bangladesh, Indonesia, and the Philippines. To curb terrorism, governments in various nations have laid down multiple policies and have adopted advanced security measures for homeland security, and at airports and seaports. Moreover, many public events and gatherings that are likely to take place in APAC countries will boost the demand for backscatter X-ray devices market in APAC.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The backscatter X-ray devices companies such as include Rapiscan Systems (US), Nuctech Company Limited (China), Viken Detection (US), LAURUS Systems, Inc. (US), Scanna MSC Ltd. (UK), Autoclear LLC (US), and Tek8, Inc. (US).

Want to explore hidden markets that can drive new revenue in Backscatter X-ray Devices Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Backscatter X-ray Devices Market?

|

Report Metric |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Type, Application, and Region |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Rapiscan Systems (US), Nuctech Company Limited (China), Viken Detection (US), LAURUS Systems, Inc. (US), Scanna MSC Ltd. (UK), Autoclear LLC (US), and Tek8, Inc. (US). |

In this research report, the backscatter X-ray devices market has been segmented on the basis of type, application, and geography.

Backscatter X-ray Devices Market, by Type

- Handheld

- Non-handheld

Backscatter X-ray Devices Market, by Application

- Customs and Border Protection

- Law Enforcement

- Airport/Aviation

- Military and Defense

- Others

Geographic Analysis

- North America

- Europe

- APAC

- RoW

Recent Developments

- In October 2021, OSI Systems announced that its Security division received an indefinite-delivery, indefinite-quantity (IDIQ) contract by the US Customs and Border Protection (CBP) for deploying the low-energy portal (LEP) X-ray systems. The multiple vendor IDIQ contracts are valued at ~USD 390 million and include a 5-year ordering period for systems and associated services.

- In November 2021, Nuctech was awarded a contract by the Dubai Expo Security Committee to provide efficient security screening solutions to scan visitors at the entrance, baggage scanners for checking complex items, and a new security check system at the entrance for cargo inspection at the Dubai Expo 2020 venue.

- In July 2021, Viken Detection launched FOXHOUND-HNA, a tri-mode functionality and design, handheld narcotics analyzer optimized for drug interdiction and tailored for use in law enforcement operations.

Frequently Asked Questions (FAQ):

What is the current size of the global backscatter X-ray devices market?

The backscatter X-ray devices market was valued at USD 132 million in 2021 and is projected to reach USD 174 million by 2027; it is expected to grow at a CAGR of 4.6% from 2022 to 2027.

Who are the winners in the global backscatter X-ray devices market?

Some of the key companies operating in the backscatter X-ray devices market are Rapiscan Systems (US), Nuctech Company Limited (China), Viken Detection (US), LAURUS Systems, Inc. (US), Scanna MSC Ltd. (UK), Autoclear LLC (US), and Tek8, Inc. (US). These players have adopted various growth strategies such as product launches/developments, partnerships/contracts/ collaborations/acquisitions to expand their global presence and increase their share in the global backscatter X-ray devices market.

What are the major drivers for the backscatter X-ray devices market?

The key factors driving the growth of the backscatter X-ray devices market include increase in number of terrorist attacks and illegal immigration, increasing deployment of security solutions at public gathering spaces, rise in smuggling of narcotics, and reduction in passenger waiting time.

What are the growing application verticals in the backscatter X-ray devices market?

The backscatter X-ray devices market is led by customs & border protection segment is projected to account for the largest size of the backscatter X-ray devices market from 2022 to 2027. The fast and effective features of backscatter X-ray devices in scanning people, baggage, and vehicles are fueling their demand in the customs and border protection application segment.

What are the impact of COVID-19 on the global backscatter X-ray devices market?

Due to COVID-19, the manufacturing units of major players are highly hampered due to worldwide lockdown and limited availability of labor and raw material. A number of scheduled product launches and related developments have been postponed due to the pandemic. However, the impact of COVID-19 is expected to reduce during the forecast period. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 12)

1.1 STUDY OBJECTIVES

1.2 DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 BACKSCATTER X-RAY DEVICES MARKET: SEGMENTATION

1.3.2 GEOGRAPHIC SCOPE

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 PACKAGE SIZE

1.6 MARKET STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 15)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.1.2 List of key secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Primary interviews with experts

2.1.2.3 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): CALCULATION OF MARKET SIZE THROUGH REVENUES OF MARKET PLAYERS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2 (DEMAND SIZE): CALCULATION OF MARKET SIZE THROUGH DEMAND FOR DEVICE TYPES

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.1.1 Estimating market size using bottom-up analysis (demand side)

2.2.2 TOP-DOWN APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.2.2.1 Estimating market size using top-down approach (supply side)

2.3 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

2.5 RISK ASSESSMENT

TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

3 EXECUTIVE SUMMARY (Page No. - 26)

3.1 COVID-19 IMPACT ANALYSIS

FIGURE 7 BACKSCATTER X-RAY DEVICES MARKET TO WITNESS SWOOSH SHAPED RECOVERY FROM 2021

FIGURE 8 BACKSCATTER X-RAY DEVICES MARKET IN APAC TO GROW AT FASTEST RATE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 28)

4.1 OPPORTUNITIES IN BACKSCATTER X-RAY DEVICES MARKET

FIGURE 9 RISING DEMAND FOR BACKSCATTER X-RAY DEVICES IN CUSTOMS AND BORDER PROTECTION SEGMENT TO DRIVE MARKET GROWTH

4.2 BACKSCATTER X-RAY DEVICES MARKET, BY TYPE

FIGURE 10 BACKSCATTER X-RAY DEVICES MARKET FOR HANDHELD DEVICES TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

4.3 BACKSCATTER X-RAY DEVICES MARKET IN NORTH AMERICA, BY APPLICATION AND COUNTRY

FIGURE 11 CUSTOMS AND BORDER PROTECTION AND US HELD LARGEST SHARES OF NORTH AMERICAN BACKSCATTER X-RAY DEVICES MARKET IN 2021

4.4 BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY

FIGURE 12 US DOMINATED BACKSCATTER X-RAY DEVICES MARKET IN 2021

4.5 BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION

FIGURE 13 CUSTOMS AND BORDER PROTECTION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 31)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS FOR BACKSCATTER X-RAY DEVICES MARKET

FIGURE 14 INCREASE IN NUMBER OF TERRORIST ATTACKS AND ILLEGAL IMMIGRATION TO DRIVE GROWTH OF BACKSCATTER X-RAY DEVICES MARKET DURING FORECAST PERIOD

5.2.1 DRIVERS

5.2.1.1 Increase in number of terrorist attacks and illegal immigration

FIGURE 15 TOP COUNTRIES WITH HIGHEST DEATHS FROM TERRORISM, BY PERCENTAGE OF TOTAL DEATHS, 2019

5.2.1.2 Increasing deployment of security solutions at public gathering spaces

5.2.1.3 Rise in smuggling of narcotics

5.2.1.4 Reduction in passenger waiting time

5.2.2 RESTRAINTS

5.2.2.1 Privacy concerns associated with backscatter X-ray body scanners

5.2.2.2 Health concerns related to use of backscatter X-ray devices

5.2.2.3 High installation and maintenance costs

5.2.3 OPPORTUNITIES

5.2.3.1 Technological advancements in X-ray screening systems

5.2.3.2 Development of low-cost products

5.2.4 CHALLENGES

5.2.4.1 Inclusion of artificial intelligence for digital transformation of security applications

5.2.4.2 Improving effectiveness of existing scanners

5.3 VALUE CHAIN ANALYSIS

FIGURE 16 VALUE CHAIN ANALYSIS (2022): MAJOR VALUE IS ADDED BY MANUFACTURING AND ASSEMBLY STAGES

5.4 TARIFF AND REGULATORY LANDSCAPE

5.4.1 AMERICAN NATIONAL STANDARD FOR PERFORMANCE OF CHECKPOINT CABINET X-RAY IMAGING SECURITY SYSTEMS

5.4.2 STANDARD PRACTICE FOR EVALUATING IMAGING PERFORMANCE OF SECURITY X-RAY SYSTEMS

5.4.3 SAFETY REQUIREMENTS FOR ELECTRICAL EQUIPMENT FOR MEASUREMENT, CONTROL, AND LABORATORY USE - PART 2-091: PARTICULAR REQUIREMENT FOR CABINET X-RAY SYSTEMS

5.4.4 PERFORMANCE STANDARDS FOR IONIZING RADIATION-EMITTING PRODUCTS, SECTION 1020.40— CABINET X-RAY SYSTEMS

5.4.5 OCCUPATIONAL SAFETY AND HEALTH STANDARDS, SECTION 1910.1096 – IONIZING RADIATION

5.4.6 EUROPEAN CIVIL AVIATION CONFERENCE (ECAC) STANDARDS

5.4.7 US DEPARTMENT OF HOMELAND SECURITY (DHS), TRANSPORTATION SECURITY ADMINISTRATION (TSA)

5.4.8 US DEPARTMENT OF HEALTH AND HUMAN SERVICES (HHS), US FOOD AND DRUG ADMINISTRATION (FDA)

5.4.9 HEALTH PHYSICS SOCIETY (HPS)

5.5 ECOSYSTEM ANALYSIS

TABLE 2 BACKSCATTER X-RAY DEVICES MARKET: ECOSYSTEM

5.6 PORTER’S FIVE FORCES ANALYSIS

FIGURE 17 PORTER’S FIVE FORCES ANALYSIS: BACKSCATTER X-RAY DEVICES MARKET, 2021

TABLE 3 BACKSCATTER X-RAY DEVICES MARKET: PORTER’S FIVE FORCES ANALYSIS, 2021

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

5.7 TECHNOLOGY ANALYSIS

5.7.1 MULTI-ENERGY BACKSCATTER X-RAY TECHNOLOGY

5.8 CASE STUDY ANALYSIS

5.8.1 VIKEN DETECTION HELPED US CUSTOMS AND BORDER PROTECTION (CBP) AGENCY IN SECURING SOUTHERN BORDER

5.9 TRENDS AND DISRUPTIONS IMPACTING BUSINESSES OF CUSTOMERS

FIGURE 18 REVENUE SHIFT IN BACKSCATTER X-RAY DEVICES MARKET

5.10 PRICING ANALYSIS

TABLE 4 PRICES OF DIFFERENT TYPES OF BACKSCATTER X-RAY DEVICES, 2021

5.11 PATENT ANALYSIS

TABLE 5 MAJOR INNOVATIONS AND PATENT REGISTRATIONS, 1993-2021

5.12 TRADE DATA

TABLE 6 IMPORT DATA FOR KEY COUNTRIES FOR HS CODE 85437012, 2016–2020 (USD THOUSAND)

TABLE 7 EXPORT DATA FOR KEY COUNTRIES FOR HS CODE 85437012, 2016–2020 (USD THOUSAND)

TABLE 8 IMPORT DATA FOR KEY COUNTRIES FOR HS CODE 902229, 2016–2020 (USD THOUSAND)

TABLE 9 EXPORT DATA FOR KEY COUNTRIES FOR HS CODE 902229, 2016–2020 (USD THOUSAND)

6 BACKSCATTER X-RAY DEVICES MARKET, BY TYPE (Page No. - 48)

6.1 INTRODUCTION

FIGURE 19 MARKET FOR HANDHELD BACKSCATTER X-RAY DEVICES TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 10 BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2018–2021 (USD MILLION)

TABLE 11 BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 12 BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2018–2021 (UNITS)

TABLE 13 BACKSCATTER X-RAY DEVICES MARKET, BY TYPE, 2022–2027 (UNITS)

6.2 HANDHELD

6.2.1 PORTABILITY AND FLEXIBILITY FEATURES OF HANDHELD BACKSCATTER X-RAY DEVICES TO FUEL THEIR DEMAND

6.3 NON-HANDHELD

6.3.1 ABILITY OF NON-HANDHELD BACKSCATTER X-RAY DEVICES TO IDENTIFY CONTRABAND ITEMS WITHOUT MAKING PHYSICAL CONTACT TO INCREASE THEIR DEMAND

7 BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION (Page No. - 52)

7.1 INTRODUCTION

FIGURE 20 CUSTOMS AND BORDER PROTECTION APPLICATION SEGMENT TO HOLD LARGEST SHARE OF BACKSCATTER X-RAY DEVICES MARKET DURING FORECAST PERIOD

TABLE 14 BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 15 BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

7.2 CUSTOMS AND BORDER PROTECTION

7.2.1 GROWING ADOPTION OF HANDHELD BACKSCATTER X-RAY DEVICES BY CUSTOMS AND BORDER PROTECTION AGENCIES

TABLE 16 BACKSCATTER X-RAY DEVICES MARKET FOR CUSTOMS AND BORDER PROTECTION, BY REGION, 2018–2021 (USD MILLION)

TABLE 17 BACKSCATTER X-RAY DEVICES MARKET FOR CUSTOMS AND BORDER PROTECTION, BY REGION, 2022–2027 (USD MILLION)

7.3 LAW ENFORCEMENT

7.3.1 INCREASED ADOPTION OF BACKSCATTER X-RAY DEVICES BY LAW ENFORCEMENT OFFICERS DURING COVID-19 PERIOD

TABLE 18 BACKSCATTER X-RAY DEVICES MARKET FOR LAW ENFORCEMENT, BY REGION, 2018–2021 (USD MILLION)

TABLE 19 BACKSCATTER X-RAY DEVICES MARKET FOR LAW ENFORCEMENT, BY REGION, 2022–2027 (USD MILLION)

7.4 AIRPORT/AVIATION

7.4.1 INCREASED DEPLOYMENT OF BACKSCATTER DEVICES AT AIRPORTS AND AVIATION CENTERS

TABLE 20 BACKSCATTER X-RAY DEVICES MARKET FOR AIRPORT/AVIATION, BY REGION, 2018–2021 (USD MILLION)

TABLE 21 BACKSCATTER X-RAY DEVICES MARKET FOR AIRPORT/AVIATION, BY REGION, 2022–2027 (USD MILLION)

7.5 MILITARY AND DEFENSE

7.5.1 GROWING USE OF BACKSCATTER X-RAY DEVICES FOR HIGH-RISK SECURITY OR EXPLOSIVE DETECTION

TABLE 22 BACKSCATTER X-RAY DEVICES MARKET FOR MILITARY AND DEFENSE, BY REGION, 2018–2021 (USD MILLION)

TABLE 23 BACKSCATTER X-RAY DEVICES MARKET FOR MILITARY AND DEFENSE, BY REGION, 2022–2027 (USD MILLION)

7.6 OTHERS

7.6.1 INDUSTRIAL

7.6.2 MINING

7.6.3 PORTS

7.6.4 EVENT SECURITY

TABLE 24 BACKSCATTER X-RAY DEVICES MARKET FOR OTHERS, BY REGION, 2018–2021 (USD MILLION)

TABLE 25 BACKSCATTER X-RAY DEVICES MARKET FOR OTHERS, BY REGION, 2022–2027 (USD MILLION)

8 GEOGRAPHIC ANALYSIS (Page No. - 60)

8.1 INTRODUCTION

FIGURE 21 BACKSCATTER X-RAY DEVICES MARKET: BY REGION

FIGURE 22 NORTH AMERICA TO HOLD LARGEST SHARE OF BACKSCATTER X-RAY DEVICES MARKET DURING FORECAST PERIOD

TABLE 26 BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 27 BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 28 HANDHELD BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 HANDHELD BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

TABLE 30 NON-HANDHELD BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 31 NON-HANDHELD BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 23 BACKSCATTER X-RAY DEVICES MARKET: BY COUNTRY

FIGURE 24 SNAPSHOT OF BACKSCATTER X-RAY DEVICES MARKET IN NORTH AMERICA

TABLE 32 NORTH AMERICA BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 33 NORTH AMERICA BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 34 NORTH AMERICA BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 35 NORTH AMERICA BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

8.2.1 IMPACT OF COVID-19 ON NORTH AMERICAN BACKSCATTER X-RAY DEVICES MARKET

8.2.2 US

8.2.2.1 High adoption of X-ray screening solutions to drive US market growth

8.2.3 CANADA

8.2.3.1 Stringent government regulations to drive growth of backscatter X-ray devices in Canada

8.2.4 MEXICO

8.2.4.1 Increasing illicit activities in Mexico to fuel deployment of backscatter X-ray devices

8.3 EUROPE

FIGURE 25 EUROPEAN BACKSCATTER X-RAY DEVICES MARKET: BY COUNTRY

FIGURE 26 SNAPSHOT OF BACKSCATTER X-RAY DEVICES MARKET IN EUROPE

TABLE 36 EUROPE BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 37 EUROPE BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 38 EUROPE BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 39 EUROPE BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

8.3.1 IMPACT OF COVID-19 ON EUROPEAN BACKSCATTER X-RAY DEVICES MARKET

8.3.2 GERMANY

8.3.2.1 Presence of multiple international airports has increased demand for backscatter X-ray devices in Germany

8.3.3 UK

8.3.3.1 Surge in terrorist attacks and criminal activities has increased adoption of X-ray screening systems in UK

8.3.4 FRANCE

8.3.4.1 Increasing terrorism and unlawful activities have fueled demand for backscatter X-ray devices in France

8.3.5 REST OF EUROPE

8.4 APAC

FIGURE 27 APAC BACKSCATTER X-RAY DEVICES MARKET: BY COUNTRY

FIGURE 28 SNAPSHOT OF BACKSCATTER X-RAY DEVICES MARKET IN APAC

TABLE 40 APAC BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 41 APAC BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 42 APAC BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 43 APAC BACKSCATTER X-RAY DEVICES MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

8.4.1 IMPACT OF COVID-19 ON APAC BACKSCATTER X-RAY DEVICES MARKET

8.4.2 CHINA

8.4.2.1 Stringent government rules pertaining to security screening have provided momentum to backscatter X-ray devices market in China

8.4.3 JAPAN

8.4.3.1 Increasing investments in development of public transportation to create growth opportunities for Japan market

8.4.4 SOUTH KOREA

8.4.4.1 Technological advancements and presence of large seaports in South Korea to fuel demand for backscatter X-ray devices

8.4.5 REST OF APAC

8.5 ROW

FIGURE 29 ROW BACKSCATTER X-RAY DEVICES MARKET: BY COUNTRY

TABLE 44 ROW BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2018–2021 (USD MILLION)

TABLE 45 ROW BACKSCATTER X-RAY DEVICES MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 46 ROW BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 47 ROW BACKSCATTER X-RAY DEVICES MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5.1 MIDDLE EAST & AFRICA

8.5.1.1 Expanding mining industry to boost demand for backscatter X-ray devices

8.5.2 SOUTH AMERICA

8.5.2.1 Increasing global trade through ports to boost demand for backscatter X-ray devices in South America

9 COMPETITIVE LANDSCAPE (Page No. - 79)

9.1 OVERVIEW

9.1.1 INTRODUCTION

9.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

9.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN BACKSCATTER X-RAY DEVICES MARKET

9.3 MARKET SHARE ANALYSIS OF KEY PLAYERS IN BACKSCATTER X-RAY DEVICES MARKET IN 2021

FIGURE 30 BACKSCATTER X-RAY DEVICES MARKET: MARKET SHARE ANALYSIS, 2021

TABLE 48 BACKSCATTER X-RAY DEVICES MARKET: DEGREE OF COMPETITION

TABLE 49 BACKSCATTER X-RAY DEVICES MARKET RANKING ANALYSIS: NORTH AMERICA

TABLE 50 BACKSCATTER X-RAY DEVICES MARKET RANKING ANALYSIS: EUROPE

TABLE 51 BACKSCATTER X-RAY DEVICES MARKET RANKING ANALYSIS: APAC

9.4 BACKSCATTER X-RAY DEVICES MARKET: COMPANY FOOTPRINT

TABLE 52 COMPANY FOOTPRINT: BY TYPE (5 COMPANIES)

TABLE 53 COMPANY FOOTPRINT: BY APPLICATION (5 COMPANIES)

TABLE 54 COMPANY FOOTPRINT: BY REGION (5 COMPANIES)

TABLE 55 BACKSCATTER X-RAY DEVICES MARKET: COMPANY FOOTPRINT

9.5 COMPETITIVE SCENARIO AND TRENDS

9.5.1 PRODUCT LAUNCHES

TABLE 56 BACKSCATTER X-RAY DEVICES MARKET: PRODUCT LAUNCHES, 2020–2021

9.5.2 DEALS

TABLE 57 BACKSCATTER X-RAY DEVICES MARKET: DEALS, 2020–2021

10 COMPANY PROFILES (Page No. - 86)

10.1 INTRODUCTION

10.2 KEY PLAYERS

(Business overview, Products/solutions/services offered, Recent Developments, MNM view)*

10.2.1 RAPISCAN SYSTEMS

TABLE 58 RAPISCAN SYSTEMS: BUSINESS OVERVIEW

TABLE 59 RAPISCAN SYSTEMS: PRODUCT LAUNCHES

TABLE 60 RAPISCAN SYSTEMS: DEALS

10.2.2 NUCTECH COMPANY LIMITED

TABLE 61 NUCTECH COMPANY LIMITED: BUSINESS OVERVIEW

TABLE 62 NUCTECH COMPANY LIMITED: DEALS

10.2.3 VIKEN DETECTION

TABLE 63 VIKEN DETECTION: BUSINESS OVERVIEW

TABLE 64 VIKEN DETECTION: PRODUCT LAUNCHES

TABLE 65 VIKEN DETECTION: DEALS

10.2.4 LAURUS SYSTEMS INC.

TABLE 66 LAURUS SYSTEMS INC.: BUSINESS OVERVIEW

10.2.5 SCANNA MSC LTD.

TABLE 67 SCANNA MSC LTD.: BUSINESS OVERVIEW

10.2.6 AUTOCLEAR LLC

TABLE 68 AUTOCLEAR LLC: BUSINESS OVERVIEW

10.2.7 TEK84, INC.

TABLE 69 TEK84, INC.: BUSINESS OVERVIEW

TABLE 70 TEK84, INC.: DEALS

*Details on Business overview, Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies

11 APPENDIX (Page No. - 101)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

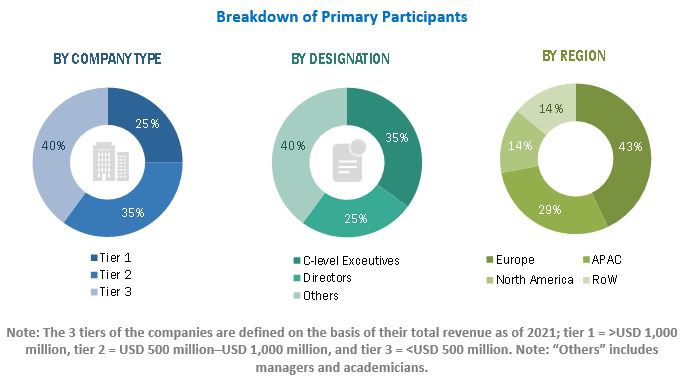

The study involved four major activities in estimating the size of the backscatter X-ray devices market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market’s size. After that, market breakdown and data triangulation were used to determine the market sizes of segments and sub-segments.

Secondary Research

The secondary sources referred to for this research study include organizations such as Transport Security Administration, European Civil Aviation Conference, International Air Transport Association, and so on; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, and business. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the backscatter X-ray devices market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (customs & border protection, law enforcement, airport/aviation, military & defense, industrial, mining, ports and event security) and supply-side (Integrators and security solution providers) players across four major regions, namely, North America, Europe, APAC, and Rest of the World (South America, Africa, Middle East). Approximately 75% and 25% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the backscatter X-ray devices market. These methods were also extensively used to estimate the sizes of various market sub-segments. The research methodology used to estimate the market sizes includes the following:

- The key players in the market were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research.

All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources. Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size.

Global Backscatter X-ray Devices Market Size: Bottom-Up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes explained above-the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives:

- To define, describe, segment, and forecast the backscatter X-ray devices market in terms of value based on type, and application

- To describe and forecast the size of the market for four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value

- To provide qualitative information about different backscatter X-ray devices

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information regarding the key factors such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To provide a detailed value chain for the backscatter X-ray devices market

- To analyze opportunities in the market for stakeholders, along with a detailed competitive landscape of the backscatter X-ray devices market

- To strategically profile the key players and comprehensively analyze their market share and core competencies2, along with the competitive leadership mapping chart

- To analyze the competitive developments such as product launches/developments, contracts/collaborations/agreements/acquisitions in the backscatter X-ray devices market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 2)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Backscatter X-ray Devices Market