Automated Fingerprint Identification System Market by Component (Fingerprint Input Modules, Microprocessors/Microcontrollers, Displays, Matchers), Search Type (Tenprint Search, Latent Search), Application, and Geography - Global Forecast to 2020

The automated fingerprint identification system market size is estimated to reach USD 8.49 Billion by 2020, at an estimated CAGR of 21.0% between 2015 and 2020. The automated fingerprint identification system is the biometric identification technique which obtains, stores, and analyzes the fingerprint data using digital imaging technology. The report aims at estimating the market size and future growth potential of the market across different segments such as components, search types, applications, and regions. The base year considered for the study is 2014, and the market size is estimated for the period 20152020. With the rise in use of identification systems, AFIS is expected to play a key role in fueling the growth of the market in the next five years.

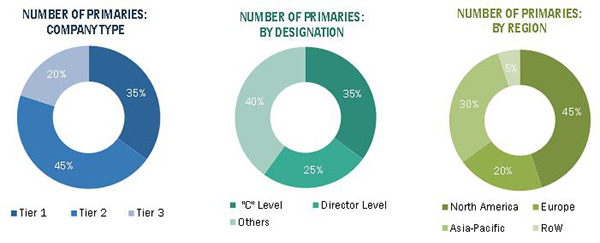

The research methodology used to estimate and forecast the automated fingerprint identification system market begins with capturing data on key vendors revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market from the revenue of the key players in the market. After arriving at the overall market size, the total market was split into several segments and subsegments which are then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. This data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

The automated fingerprint identification system ecosystem comprises stakeholders such as the electronic hardware suppliers, mobile application developers, research organizations, and the technology standards organizations, alliances, forums among others.

Key Target Audience

- Governments, financial institutions, and investment communities

- System integrators

- Analysts and strategic business planners

- Semiconductor foundries

- Biometric product manufacturers

- Software vendors

Want to explore hidden markets that can drive new revenue in Automated Fingerprint Identification System Market?

The research report segments the market to the following submarkets:

By Component:

- Hardware

- Fingerprint Input Modules

- Microprocessors/Microcontrollers

- Displays

- Others

- Software

By Search Type:

- Tenprint to Tenprint Searches

- Latent to Latent Searches

By Application:

- Government

- Healthcare

- Transportation

- Hospitality

- Banking & Finance

- Others

By Region:

- North America

- Europe

- Asia-Pacific

- Rest of the World

- Middle East & Africa

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the MEA automated fingerprint identification system market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

The automated fingerprint identification system (AFIS) market size is expected to grow from USD 3.28 Billion in 2015 to USD 8.49 Billion by 2020, at a CAGR of 21.0% between 2015 and 2020. The increasing implementation of AFIS as the secure identification system is creating a huge demand for automated fingerprint identification system solutions across the world. The major factors driving the market are the transformation and technology evolution from manual process to digital process and the need for secure transaction. Furthermore, due to rise in the demand for integrated automated fingerprint identification system solutions and increasing adoption of mobile payment solutions, the market finds huge opportunity to flourish in the next five years.

In this report, the market is segmented on the basis of component, search type, application, and region. The AFIS market for software is expected to have the largest market share and is likely to dominate the market between 2015 and 2020because of the growing demand for integrated AFIS products. The government and transportation sectors are expected to play a key role in changing the automated fingerprint identification system landscape and would grow at the highest rate during the forecast period.

Automated fingerprint identification systems for tenprint searches are expected to dominate the AFIS market and to hold the largest market share, whereas latent print searches would grow at a steady rate during the forecast period from 2015-2020. The use of tenprint searches in the sectors such as hospitality, healthcare, and transportation is fueling the growth of the tenprint search AFIS market.

The automated fingerprint identification system solutions are being increasingly adopted in other verticals, such as the banking and finance, which have led to the growth of the market across the globe. The AFIS market for the hospitality and government sectors is estimated to witness high growth during the forecast period.

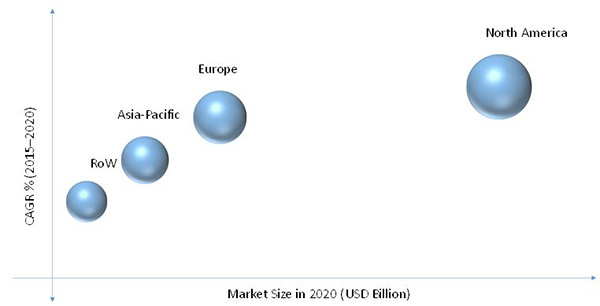

North America is expected to hold the largest market share and dominate the automated fingerprint identification system market between 2015 and 2020because of the presence of large number of biometric vendors. APAC offers potential growth opportunities as there is rise in adoption among enterprises and law enforcement agencies that are turning towards automated fingerprint identification system solutions to secure against potential threats.

The market, however, is restrained to grow as the devices are not compatible with each other. The data sharing and algorithmic performances have been a major drawback for the market to pick up. These technical challenges of interoperability need to be addressed to ensure the continual growth of the AFIS market. The major vendors in the automated fingerprint identification system market include 3M Cogent Inc. (U.S.), Morpho SA (France), NEC Corporation (Japan), Fujitsu Ltd. (Japan), Crossmatch Technologies Ltd. (U.S.), HID Global Corporation (U.S.), M2SYS Technology (U.S.), East Shore Technologies (U.S.), AFIX Technologies Inc. (U.S., Papillon Systems (Russia), Sonda Technologies Ltd. (Russia), Dermalog Identification Systems GmbH (Germany), and Suprema Incorporation (South Korea). These players adopted various strategies such as new product developments, collaborations, partnerships, and expansions to cater to the needs of the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Market, 20152020 (USD Billion)

4.2 Market Major Search Type

4.3 Market in APAC

4.4 U.S. Along With U.K., Expected to Emerge as the Fastest-Growing Region Between 2015 and 2020

4.5 Market: Market Share of Two Major Applications in 2014

4.6 Market: Developed vs Developing Market

4.7 Market: Government and Transportation Sectors (2020)

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.2.1 Automated Fingerprint Identification System Market, By Component

5.2.2 Automated Fingerprint Identification System Market, By Search Type

5.2.3 Automated Fingerprint Identification System Market, By Application

5.2.4 Automatic Fingerprint Identification System Market, By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Transformation and Technology Evolution From A Manual Process to A Digital Process

5.3.1.2 Growing Investments in Government and Enterprise Sectors to Support E-Governance Applications

5.3.1.3 Increasing Online Transactions

5.3.1.4 Increasing National and Network Security Threats

5.3.2 Restraints

5.3.2.1 Inconvenience and Fear of Privacy and Intrusion

5.3.2.2 Availability of Substitutes Such as Iris and Face Recognition Technologies

5.3.3 Opportunities

5.3.3.1 High Demand for Access Control Systems in the Government and Civil Sectors

5.3.3.2 Increasing Demand for Biometric Systems as A Service

5.3.3.3 Growth in the Mobile Solutions Market

5.3.4 Challenges

5.3.4.1 Data Security and Rapid Processing

5.3.4.2 Pricing and Entry Barriers in the Large-Sized Markets

6 Supply-Side Analysis (Page No. - 45)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Technology Roadmap

6.4 Porters Five Forces Model

6.4.1 Intensity of Competitive Rivalry

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Buyers

6.4.4 Bargaining Power of Suppliers

6.4.5 Threat of New Entrants

7 Automated Fingerprint Identification System Market, By Component (Page No. - 53)

7.1 Introduction

7.2 Hardware

7.2.1 Fingerprint Input Modules

7.2.1.1 Sensors

7.2.1.1.1 Optical Sensors

7.2.1.1.2 Capacitive Sensors

7.2.1.1.3 Ultrasound Sensors

7.2.1.1.4 Thermal Sensors

7.2.2 Microprocessors/Microcontrollers

7.2.3 Displays

7.2.4 Others

7.3 Software

7.3.1 Matchers

7.3.1.1 Miniature-Based Matching

7.3.1.2 Pattern Matching

7.3.2 Database Fingerprints

8 Automated Fingerprint Identification System Market, By Search Type (Page No. - 60)

8.1 Introduction

8.1.1 Tenprint to Tenprint Search

8.1.2 Latent Print to Latent Print Search

8.1.3 Others

9 Automated Fingerprint Identification System Market, By Application (Page No. - 64)

9.1 Introduction

9.2 Banking & Finance

9.3 Government

9.4 Hospitality

9.5 Healthcare

9.6 Transportation

9.7 Others

10 Automated Fingerprint Identification System Market, By Geography (Page No. - 86)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Rest of North America (Canada & Mexico)

10.3 Europe

10.3.1 U.K.

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe

10.4 Asia-Pacific (APAC)

10.4.1 China

10.4.2 India

10.4.3 South Korea

10.4.4 Japan

10.4.5 Rest of APAC

10.5 Rest of the World (RoW)

10.5.1 Middle East & Africa

10.5.2 Latin America

11 Competitive Landscape (Page No. - 111)

11.1 Overview

11.2 Market Ranking for Automated Fingerprint Identification System (AFIS) Market

11.3 Competitive Scenario

11.4 New Product Launches and Developments

11.5 Contracts/Agreements

11.6 Partnerships/Collaborations/Acquisitions

11.7 Expansions

12 Company Profiles (Page No. - 118)

(Overview, Products and Services, Financials, Strategy & Development)*

12.1 Introduction

12.2 3M Cogent Inc.

12.3 Morpho SA

12.4 NEC Corporation

12.5 Fujitsu Limited

12.6 Suprema Incorporation

12.7 Crossmatch Technologies Inc.

12.8 HID Global Corporation

12.9 Sonda Technologies Ltd.

12.10 Dermalog Identification Systems Gmbh

12.11 M2sys Technology

12.12 Papillon Systems

12.13 East Shore Technologies

12.14 Afix Technologies Incorporation

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies

13 Appendix (Page No. - 145)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

List of Tables (75 Tables)

Table 1 Technology Evolution and E-Governance Applications are Propelling the Growth of the AFIS Market

Table 2 Fear of Privacy and New Substitutes Act as Restraints for the AFIS Market

Table 3 High Demand for Access Control in the Government and Civil Sectors is A Huge Opportunity for the AFIS Market

Table 4 Security of Data and Faster Processing Systems Would Be the Biggest Challenge

Table 5 Key Industry Trends in the Market

Table 6 Porters Five Forces Analysis: Bargaining Power of Suppliers Likely to Have A High Impact on the Overall Market

Table 7 Global Automated Fingerprint Identification System Market, By Component, 20132020 (USD Billion)

Table 8 Market, By Hardware Component, 20132020 (USD Billion)

Table 9 Market, By Search Type, 20132020 (USD Billion)

Table 10 Global AFIS Market for Tenprint to Tenprint Search, By Application, 20132020 (USD Billion)

Table 11 Global AFIS Market for Latent to Latent Print Search, By Application, 20132020 (USD Billion)

Table 12 Automated Fingerprint Identification System Market, By Application, 20132020 (USD Billion)

Table 13 Global Banking & Finance AFIS Market, By Search Type, 20132020 (USD Billion)

Table 14 Automated Fingerprint Identification System Market for Banking & Finance, By Region, 20132020 (USD Billion)

Table 15 North America: AFIS Market for Banking & Finance Sector, By Country, 20132020 (USD Billion)

Table 16 Europe: Automated Fingerprint Identification System Market for Banking & Finance Sector, By Country, 20132020 (USD Million)

Table 17 APAC: AFIS Market for Banking & Finance Sector, By Country, 20132020 (USD Million)

Table 18 RoW: AFIS Market for Banking & Finance Sector, By Country, 20132020 (USD Million)

Table 19 Global AFIS Market for Government Sector, By Search Type, 20132020 (USD Billion)

Table 20 Market for Government Sector, By Region, 20132020 (USD Billion)

Table 21 North America: AFIS Market for Government Sector, By Country, 20132020 (USD Billion)

Table 22 Europe: Market for Government Sector, By Country, 20132020 (USD Million)

Table 23 APAC: AFIS Market for Government Sector, By Country, 20132020 (USD Million)

Table 24 RoW: AFIS Market for Government Sector, By Country, 20132020 (USD Million)

Table 25 Global AFIS Market for Hospitality Sector, By Search Type, 20132020 (USD Million)

Table 26 Global AFIS Market for Hospitality Sector, By Region, 20132020 (USD Million)

Table 27 North America: AFIS Market for Hospitality Sector, By Country, 20132020 (USD Million)

Table 28 Europe: AFIS Market for Hospitality Sector, By Country, 20132020 (USD Million)

Table 29 APAC: AFIS Market for Hospitality Sector, By Country, 20132020 (USD Million)

Table 30 RoW: AFIS Market for Hospitality Sector, By Country, 20132020 (USD Million)

Table 31 Global AFIS Market for Healthcare Sector, By Search Type, 20132020 (USD Million)

Table 32 Global AFIS Market for Healthcare Sector, By Region, 20132020 (USD Million)

Table 33 North America: AFIS Market for Healthcare Sector, By Country, 20132020 (USD Million)

Table 34 Europe: AFIS Market for Healthcare Sector, By Country, 20132020 (USD Million)

Table 35 APAC: AFIS Market for Healthcare Sector, By Country, 20132020 (USD Million)

Table 36 RoW: AFIS Market for Healthcare Sector, By Country, 20132020 (USD Million)

Table 37 Global AFIS Market for Transportation Sector, By Search Type, 20132020 (USD Million)

Table 38 Global AFIS Market for Transportation Sector, By Region, 20132020 (USD Million)

Table 39 North America: AFIS Market for Transportation Sector, By Country, 20132020 (USD Million)

Table 40 Europe: AFIS Market for Transportation Sector, By Country, 20132020 (USD Million)

Table 41 APAC: AFIS Market for Transportation Sector, By Country, 20132020 (USD Million)

Table 42 RoW: AFIS Market for Transportation Sector, By Country, 20132020 (USD Million)

Table 43 Global AFIS Market for Other Sectors, By Search Type, 20132020 (USD Million)

Table 44 Global AFIS Market for Other Sectors, By Region, 20132020 (USD Million)

Table 45 North America: AFIS Market for Other Sectors, By Country, 20132020 (USD Million)

Table 46 Europe: AFIS Market for Other Sector, By Country, 20132020 (USD Million)

Table 47 APAC: AFIS Market for Other Sectors, By Country, 20132020 (USD Million)

Table 48 RoW: AFIS Market for Other Sector, By Country, 20132020 (USD Million)

Table 49 Automated Fingerprint Identification System Market, By Region, 20132020 (USD Billion)

Table 50 North America: Market, By Application, 20132020 (USD Billion)

Table 51 North America: Market, By Country, 20132020 (USD Billion)

Table 52 U.S.: Market, By Application, 20132020 (USD Million)

Table 53 Rest of North America (Canada & Mexico): Market, By Application, 20132020 (USD Million)

Table 54 Europe: Market, By Application, 20132020 (USD Million)

Table 55 Europe: Market, By Country, 20132020 (USD Million)

Table 56 U.K.: Market, By Application, 20132020 (USD Million)

Table 57 Germany: Market, By Application, 20132020 (USD Million)

Table 58 France: Market, By Application, 20132020 (USD Million)

Table 59 Rest of Europe: Market, By Application, 20132020 (USD Million)

Table 60 Asia-Pacific: Market, By Application, 20132020 (USD Million)

Table 61 APAC: Market, By Country, 20132020 (USD Million)

Table 62 China: Market, By Application, 20132020 (USD Million)

Table 63 India: Market, By Application, 20132020 (USD Million)

Table 64 South Korea: Market, By Application, 20132020 (USD Million)

Table 65 Japan: Market, By Application, 20132020 (USD Million)

Table 66 Rest of APAC: Market, By Application, 20132020 (USD Million)

Table 67 RoW: Market, By Application, 20132020 (USD Million)

Table 68 RoW: Market, By Country, 20132020 (USD Million)

Table 69 Middle East & Africa: Market, By Application, 20132020 (USD Million)

Table 70 Latin America: Market, By Application, 20132020 (USD Million)

Table 71 Market Ranking of Top 5 Players in the Automated Fingerprint Identification System (AFIS) Market

Table 72 New Product Launches and Developments, 20122015

Table 73 Contracts/Agreements, 20122015

Table 74 Partnerships/Collaborations/Acquisitions, 20122015

Table 75 Expansions, 20122015

List of Figures (45 Figures)

Figure 1 Global Automated Fingerprint Identification System Market: Research Design

Figure 2 Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Market, 20132020 (USD Billion)

Figure 6 Software Components Expected to Lead the Global AFIS Market During the Forecast Period

Figure 7 Hardware AFIS Market Would Be Dominated By the Fingerprint Modules

Figure 8 AFIS Market Based on Search Type Would Be Led By the Tenprint to Tenprint Search During the Forecast Period

Figure 9 Government Sector Expected to Witness the Highest Growth Rate Between 2015 and 2020

Figure 10 North America Held the Largest Market Share in 2014

Figure 11 Attractive Market Opportunities for Automated Fingerprint Identification Systems

Figure 12 Tenprint to Tenprint Search Segment Accounted for the Largest Market Share in 2014

Figure 13 Government Sector Accounted for the Largest Market Share in APAC in 2014

Figure 14 U.S. Followed By U.K., Estimated to Emerge as Fastest-Growing Countries

Figure 15 Transportation Sector Held the Largest Share of the North American Market, 2014

Figure 16 U.S. Market Expected to Grow at A Higher Rate Than Other Countries in the Next Five Years

Figure 17 Government Sector is Expected to Have A Promising Future in North America During the Forecast Period

Figure 18 Market Segmentation: By Geography

Figure 19 Transformation and Technology Evolution is the Driving Force for the AFIS Market

Figure 20 Growth in the Mobile Solutions Market Would Drive the AFIS Market

Figure 21 Value Chain Analysis (2015): Major Value is Added During Manufacturing and System Integration Stages

Figure 22 Porters Five Forces Analysis (2014)

Figure 23 Market: Porters Five Forces Analysis

Figure 24 AFIS Market: Impact Analysis of Intensity of Competitive Rivalry

Figure 25 AFIS Market: Impact Analysis of Threat of Substitutes

Figure 26 AFIS Market: Impact Analysis of Bargaining Power of Buyers

Figure 27 AFIS Market: Impact Analysis of Bargaining Power of Suppliers

Figure 28 AFIS Market: Impact Analysis of Threat of New Entrants

Figure 29 Market: Hardware Components vs Software Components (2014 vs 2020)

Figure 30 Geographic Snapshot: North America Expected to Register the Highest Growth Rate During the Forecast Period

Figure 31 U.S. Estimated to Lead the AFIS Market With the Largest Market Size Between 2015 and 2020

Figure 32 North America: Market Overview

Figure 33 Europe: Market Overview (2014)

Figure 34 APAC: Market Overview (2014)

Figure 35 Companies Adopted Product Launches as the Key Growth Strategy Over the Last Three Years

Figure 36 Market Evaluation Framework - New Product Launches & Developments Fueled the Growth During 2014 & 2015

Figure 37 Battle for Market Share: New Product Launches Was the Key Strategy

Figure 38 3M Cogent Inc.: SWOT Analysis

Figure 39 Morpho SA: SWOT Analysis

Figure 40 NEC Corporation: Company Snapshot

Figure 41 NEC Corporation: SWOT Analysis

Figure 42 Fujitsu Limited: Company Snapshot

Figure 43 Fujitsu Limited: SWOT Analysis

Figure 44 Suprema Inc.: Company Snapshot

Figure 45 Suprema Inc.: SWOT Analysis

Growth opportunities and latent adjacency in Automated Fingerprint Identification System Market