Antimicrobial Susceptibility Testing Market by Product (Manual, Automated), Type (Antibacterial, Antifungal), Application (Clinical Diagnostics), Method (ETEST, Disk Diffusion, Agar Diffusion, Genotyping), End User & Region - Global Forecast to 2027

Market Growth Outlook Summary

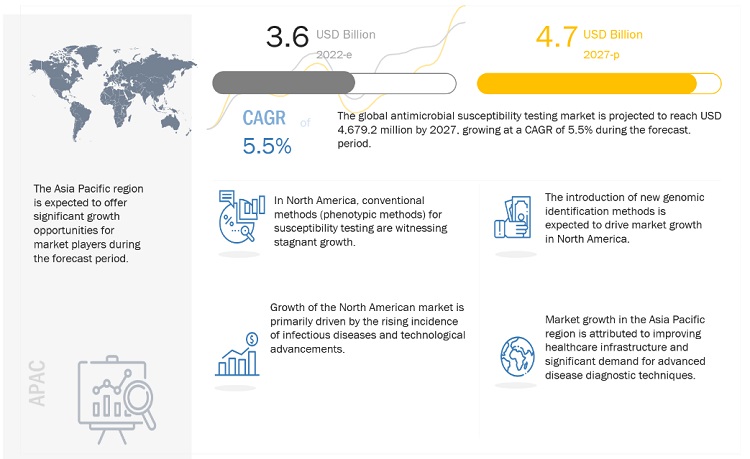

The global antimicrobial susceptibility testing market growth forecasted to transform from USD 3.6 billion in 2022 to USD 4.7 billion by 2027, driven by a CAGR of 5.5%. The high prevalence of infectious diseases, rising government funding and initiatives for antimicrobial susceptibility testing programs, technological developments for the creation of new AST methods, and the emergence of multidrug resistance in microorganisms are the main factors driving the market growth. However, strict government controls are anticipated to limit this market's expansion to some degree. Players in the antimicrobial susceptibility testing market may anticipate having tremendous growth potential as a result of emerging markets and ongoing R&D to provide quick antimicrobial susceptibility testing.

Antimicrobial Susceptibility Testing Market Trends

e- Estimated; p- Projected

To know about the assumptions considered for the study, Request for Free Sample Report

Antimicrobial Susceptibility Testing Market Dynamics

Driver: Emergence of multidrug resistance due to drug abuse

As medication resistance increases internationally, making diseases harder to cure and ultimately to mortality, antibiotics are becoming less and less effective. According to the WHO priority pathogen list, new antibiotics are urgently needed, for instance, to treat carbapenem-resistant gram-negative bacterial infections. Unfortunately, these novel medicines will experience the same destiny as the present antibiotics and become useless if people do not modify the way antibiotics are used currently.

Opportunity: Growth opportunities in emerging market

Emerging countries such as APAC, India, China and Japan present significant opportunities for players operating in the Antimicrobial susceptibility testing market. The demand for Antimicrobial susceptibility testing market in these countries is increasing owing to rapid growth in medical tourism, the growing adult (aged 20 and above) population, increasing drug abuse. These countries are also home to a strong and qualified workforce and have a great knowledge of advance technologies. Furthermore, these countries have lenient policies for imports/exports and are underpenetrated in most aspects, which could help companies in brand development. Increasing developing technicians and the keen to know about new technologies is helping the regions to grow and update their technologies.

Challenge: Complex Regulatory Frameworks

The time gap between defining clinical breakpoints, approving novel antimicrobial drugs, and putting these medicines on the market is one of the biggest problems with antimicrobial susceptibility testing. When pharmaceutical companies submit unapproved new medication applications, the FDA determines certain cutoff criteria. Adoption of antimicrobial susceptibility products is further constrained by the lack of clinical breakpoints for certain medications. For example, there are no clinical cutoffs available to determine antifungal treatment efficacy in invasive non-Aspergillus mold infections.

Restraint: High Cost of automated Laboratory Instruments

Automated antimicrobial laboratory equipment has top-of-the-line features and functions, and it costs a lot of money. The incubation and detection times are shortened by the use of automated AST systems. The high cost of maintenance for these devices, which are well-equipped with cutting-edge software that requires routine upkeep, is another hurdle to this industry.

By product type, the automated laboratory instruments segment accounted for the largest share of the antimicrobial susceptibility testing industry during the forecast period.

In 2022, automated laboratory instruments accounted for the largest share of in the antimicrobial susceptibility testing market. This segment is projected to reach USD 1.5 billion by 2027 from USD 1.7 billion in 2022, at a CAGR of 6.9% during the forecast period.

By End User, Hospitals and diagnostic center segment of antimicrobial susceptibility testing industry is expected to grow at the fastest rate during the forecast period.

In 2022, hospitals and diagnostic centers holds a larger share In the antimicrobial susceptibility testing market with a share of 63.5%. This end-user segment is projected to reach USD 2.9 billion by 2027 from USD 2.2 billion in 2022, at a CAGR of 5.7% during the forecast period. This end-user segment is also expected to grow at the highest CAGR of 5.7% during the forecast period.

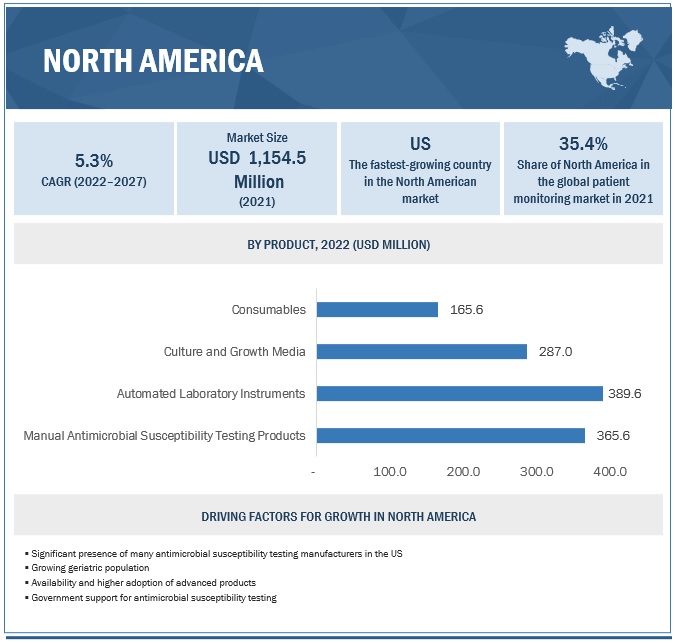

North America is expected to be the largest market of the antimicrobial susceptibility testing industry during the forecast period.

The highest portion of the global antimicrobial susceptibility testing market—35.4%—is accounted for by North America. US and Canada make up North America. The high frequency of illnesses for which pre-tests are required, the growing elderly population, and the appearance of novel bacterial, fungal, and viral strains in North America are the reasons why North America has the biggest proportion. Due to rising drug addiction, misuse, and non-compliance, the APAC area is developing at the highest CAGR of 6.7%.

To know about the assumptions considered for the study, download the pdf brochure

The antimicrobial susceptibility testing market is moderately competitive, with both established companies and upcoming competitors for the same market share. The key players operating in this market include bioMérieux SA (France), Becton, Dickinson, and Company (US), Thermo Fisher Scientific (US), Danaher Corporation (US), Bio-Rad Laboratories, Inc. (US) among others.

Antimicrobial Susceptibility Testing Market Report Scope

|

Report Metric |

Details |

|

Market Revenue Size in 2022 |

$3.6 billion |

|

Projected Revenue Size by 2027 |

$4.7 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 5.5% |

|

Market Driver |

Emergence of multidrug resistance due to drug abuse |

|

Market Opportunity |

Growth opportunities in emerging market |

This report has segmented the Antimicrobial susceptibility testing market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Manual Antimicrobial Susceptibility Testing Product

- Susceptibility Testing Disks

- Mic Strips

- Susceptibility Plates

- Automated Laboratory Instruments

- Culture and Growth Media

- Consumables

By Type

- Antibacterial susceptibility testing

- Antifungal susceptibility testing

- Antiparasitic susceptibility testing

- Other susceptibility testing

By Method

- Etest Method

- Disk Diffusion

- Automated Susceptibility testing instruments

- Agar Diffusion

- Genotyping method

By Application

- Clinical Diagnostics

- Drug Discovery and development

- Epidemiology

- Other applications

By End User

- Hospitals and Diagnostic centers

- Pharmaceutical and Biotechnology Companies

- Research &Academic Institutes

- Clinical Research Organizations

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

Recent Developments of Antimicrobial Susceptibility Testing Market

- In Jan,2023 bioMerieux launched a automated instrument named MAESTRIA

- In Aug,2022 BD India launched the BD MAX MDR-TB panel.

- In May ,2022 Thermofisher scientific introduced automated antimicrobial susceptibility products.

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global antimicrobial susceptibility testing market between 2022 and 2027?

The global antimicrobial susceptibility testing market is projected to grow from USD 3.6 billion in 2022 to USD 4.7 billion by 2027, demonstrating a robust CAGR of 5.5%.

What are the key factors driving the antimicrobial susceptibility testing market?

The main factors driving the antimicrobial susceptibility testing market include the emergence of multidrug resistance due to drug abuse, the high prevalence of infectious diseases, and government initiatives to control the spread of infections.

What challenges are faced by the antimicrobial susceptibility testing market?

Key challenges include complex regulatory frameworks, delays in clinical breakpoints for new drugs, and the high cost of automated laboratory instruments, which can hinder the adoption of advanced testing solutions.

Which regions are expected to show the most growth in the antimicrobial susceptibility testing market?

Emerging economies like China, India, and Japan are expected to experience significant growth due to increasing healthcare investments, medical tourism, and the rising prevalence of drug-resistant infections.

What are the key products used in antimicrobial susceptibility testing?

Key products include automated laboratory instruments, manual antimicrobial susceptibility testing products such as susceptibility testing disks, MIC strips, susceptibility plates, and various consumables like culture and growth media.

How does the emergence of multidrug resistance impact the antimicrobial susceptibility testing market?

The rise of multidrug resistance due to antibiotic abuse is a major driver for antimicrobial susceptibility testing, as it has become essential for diagnosing and treating drug-resistant infections, including those caused by bacteria like E. coli and P. aeruginosa.

What are the recent developments in the antimicrobial susceptibility testing market?

Recent developments include bioMérieux's launch of the MAESTRIA automated instrument in 2023, BD India's introduction of the BD MAX MDR-TB panel in 2022, and Thermo Fisher Scientific's release of new automated antimicrobial susceptibility testing products in 2022.

Which end-user segment is expected to grow the fastest in the antimicrobial susceptibility testing market?

Hospitals and diagnostic centers are expected to grow at the fastest rate during the forecast period, driven by the increasing need for antimicrobial testing to combat drug-resistant infections in clinical settings.

What role does the high cost of automated laboratory instruments play in the antimicrobial susceptibility testing market?

The high cost of automated laboratory instruments, along with the need for regular maintenance, poses a restraint on market growth, limiting the adoption of these advanced systems in certain regions or facilities.

What advancements in technology are influencing the antimicrobial susceptibility testing market?

Technological advancements, such as the development of automated susceptibility testing systems and molecular diagnostic tools, are improving the speed, accuracy, and efficiency of antimicrobial susceptibility testing, driving market innovation.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Rising incidence of infectious diseases coupled with epidemic and pandemic events- Increasing funding, research grants, and public-private investments- Technological advancements- Growing government initiatives to detect and control antimicrobial-resistant species- Emergence of multidrug resistance due to drug abuseRESTRAINTS- High cost of automated ID/AST systemsOPPORTUNITIES- Growth opportunities in emerging marketsCHALLENGES- Complex regulatory frameworks

-

5.3 PORTER’S FIVE FORCES ANALYSISOVERVIEWTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 REGULATORY ANALYSISNORTH AMERICA- US- CanadaEUROPEASIA PACIFIC- Japan- China- India

-

5.5 ECOSYSTEM ANALYSIS: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET

-

5.6 VALUE CHAIN ANALYSISRESEARCH & DEVELOPMENTMANUFACTURING AND ASSEMBLYDISTRIBUTION, MARKETING AND SALES, AND POST-SALES SERVICES

-

5.7 SUPPLY CHAIN ANALYSISPROMINENT COMPANIESSMALL AND MEDIUM-SIZED ENTERPRISES

- 5.8 KEY CONFERENCES AND EVENTS IN 2023–2024

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 PATENT ANALYSIS

- 6.1 INTRODUCTION

-

6.2 MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTSMANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPEMANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY APPLICATIONMANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY METHODMANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY END USERSUSCEPTIBILITY TESTING DISKS- Significant adoption of disk diffusion tests in emerging countries to support segment growth- Susceptibility testing disks market, by type- Susceptibility testing disks market, by application- Susceptibility testing disks market, by method- Susceptibility testing disks market, by end userMIC STRIPS- Growing adoption of broad-spectrum MIC strips to support market growth- MIC strips market, by type- MIC strips market, by application- MIC strips market, by method- MIC strips market, by end userSUSCEPTIBILITY TESTING PLATES- Increasing adoption of automated/rapid AST systems hampering growth- Susceptibility testing plates market, by type- Susceptibility testing plates market, by application- Susceptibility testing plates market, by method- Susceptibility testing plates market, by end user

-

6.3 AUTOMATED LABORATORY INSTRUMENTSONGOING TREND OF LABORATORY AUTOMATION AMONG CLINICAL LABORATORIES TO FUEL GROWTHAUTOMATED LABORATORY INSTRUMENTS MARKET, BY TYPEAUTOMATED LABORATORY INSTRUMENTS MARKET, BY APPLICATIONAUTOMATED LABORATORY INSTRUMENTS MARKET, BY METHODAUTOMATED LABORATORY INSTRUMENTS MARKET, BY END USER

-

6.4 CULTURE AND GROWTH MEDIAHIGH UTILIZATION OF DISK DIFFUSION AND BROTH DILUTION METHODS TO DRIVE GROWTHCULTURE AND GROWTH MEDIA MARKET, BY TYPECULTURE AND GROWTH MEDIA MARKET, BY APPLICATIONCULTURE AND GROWTH MEDIA MARKET, BY METHODCULTURE AND GROWTH MEDIA MARKET, BY END USER

-

6.5 CONSUMABLESINCREASING NUMBER OF SUSCEPTIBILITY TESTS PERFORMED AT HOSPITALS TO SUPPORT GROWTHCONSUMABLES MARKET, BY TYPECONSUMABLES MARKET, BY APPLICATIONCONSUMABLES MARKET, BY METHODCONSUMABLES MARKET, BY END USER

- 7.1 INTRODUCTION

-

7.2 ANTIBACTERIAL SUSCEPTIBILITY TESTINGEMERGENCE OF MULTIDRUG-RESISTANCE TO INCREASE ADOPTION OF ANTIBACTERIAL SUSCEPTIBILITY TESTING PRODUCTS

-

7.3 ANTIFUNGAL SUSCEPTIBILITY TESTINGINCREASING INFECTIONS OF CANDIDA AND ASPERGILLUS SPECIES TO DRIVE GROWTH

-

7.4 ANTIPARASITIC SUSCEPTIBILITY TESTINGRISING INITIATIVES TO CREATE AWARENESS ABOUT PARASITIC INFECTIONS TO DRIVE GROWTH

- 7.5 OTHER SUSCEPTIBILITY TESTING

- 8.1 INTRODUCTION

-

8.2 CLINICAL DIAGNOSTICSTECHNOLOGICAL ADVANCEMENTS AND INCREASING NUMBER OF SUSCEPTIBILITY TESTS PERFORMED TO DRIVE GROWTH

-

8.3 DRUG DISCOVERY AND DEVELOPMENTRISING ADOPTION OF RAPID AST SOLUTIONS BY BIOPHARMACEUTICAL COMPANIES TO DRIVE SEGMENT GROWTH

-

8.4 EPIDEMIOLOGYOUTBREAK OF PANDEMICS AND EPIDEMICS TO DRIVE DEMAND FOR AST PRODUCTS

- 8.5 OTHER APPLICATIONS

- 9.1 INTRODUCTION

-

9.2 AUTOMATED ANTIMICROBIAL SUSCEPTIBILITY TESTINGTECHNOLOGICAL ADVANCEMENTS AND FAVORABLE PRODUCT PIPELINE TO DRIVE GROWTH

-

9.3 DISK DIFFUSIONRISING INCIDENCE OF URINARY TRACT INFECTIONS TO DRIVE GROWTH

-

9.4 AGAR DILUTIONAGAR DILUTION HELPS EXPLORE DRUG COMBINATIONS FOR COMBINED ANTIBIOTIC THERAPY

-

9.5 ETESTUNCERTAINTIES IN RESULT INTERPRETATION AFFECTING MARKET GROWTH

-

9.6 GENOTYPIC METHODSONGOING CLINICAL TRIALS AND UPCOMING PRODUCT LAUNCHES SUPPORT GROWTH

- 10.1 INTRODUCTION

-

10.2 HOSPITALS AND DIAGNOSTIC CENTERSHIGH PREVALENCE OF INFECTIOUS DISEASES AND RISING ADOPTION OF RAPID AST SOLUTIONS TO DRIVE GROWTH

-

10.3 PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIESINCREASING NUMBER OF BIOPHARMACEUTICAL COMPANIES TO SUPPORT SEGMENT GROWTH

-

10.4 RESEARCH AND ACADEMIC INSTITUTESGROWING RESEARCH GRANTS AND FUNDING TO ACCELERATE MARKET GROWTH

-

10.5 CONTRACT RESEARCH ORGANIZATIONSCLINICAL TRIAL GLOBALIZATION AND GROWING NUMBER OF CROS IN EMERGING ECONOMIES TO DRIVE GROWTH

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICAUS- US to dominate North American market during forecast periodCANADA- Favorable government initiatives to drive growth during forecast period

-

11.3 EUROPEGERMANY- Germany to dominate European market during forecast periodFRANCE- Supportive government policies and easy access to healthcare services to fuel growthUK- Significant prevalence of infectious diseases coupled with increasing awareness of AST products to drive market growthITALY- Increasing R&D investments by pharmaceutical companies to propel demand for AST productsSPAIN- Rising geriatric population to drive market growthREST OF EUROPE

-

11.4 ASIA PACIFICJAPAN- Growing geriatric population to drive marketCHINA- Favorable government regulations and heavy burden of infectious diseases to drive market growthINDIA- Growing initiatives for clinical diagnosis by government and major players to drive market growthAUSTRALIA- Increasing government funding for research activities to drive market growthSOUTH KOREA- Requirement of rapid AMR detection to drive growthREST OF ASIA PACIFIC

-

11.5 LATIN AMERICABRAZIL- Established presence of major AST product manufacturers to drive growthMEXICO- Growing economic development to drive market growthREST OF LATIN AMERICA

-

11.6 MIDDLE EAST & AFRICAGROWING INCIDENCE OF INFECTIOUS DISEASES AND LARGE PATIENT POOL TO DRIVE MARKET GROWTH

- 12.1 INTRODUCTION

- 12.2 STRATEGIES OF KEY PLAYERS/RIGHT TO WIN

- 12.3 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 12.4 MARKET SHARE ANALYSIS (2021)

-

12.5 COMPANY EVALUATION MATRIX FOR 25 MAJOR PLAYERS (2021)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

12.6 COMPANY EVALUATION MATRIX FOR START-UPS/SMES (2021)PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 12.7 COMPETITIVE BENCHMARKING

-

12.8 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALS

-

13.1 KEY PLAYERSBIOMÉRIEUX SA- Business overview- Products offered- Recent developments- MnM viewBECTON, DICKINSON AND COMPANY- Business overview- Products offered- Recent developments- MnM viewTHERMO FISHER SCIENTIFIC- Business overview- Products offered- Recent developments- MnM viewDANAHER CORPORATION- Business overview- Products offered- Recent developments- MnM viewBIO-RAD LABORATORIES, INC.- Business overview- Products offered- Recent developments- MnM viewBRUKER- Business overview- Products offered- Recent developments- MnM viewROCHE DIAGNOSTICS- Business overview- Products offered- Recent developments- MnM viewMERCK KGAA- Business overview- Products offered- Recent developments- MnM viewACCELERATE DIAGNOSTICS, INC.- Business overview- Products offered- Recent developments- MnM viewHIMEDIA LABORATORIES- Business overview- Products offered- Recent developments- MnM viewLIOFILCHEM S.R.L.- Business overview- Products offered- Recent developmentsALIFAX S.R.L.- Business overview- Products offered- Recent developmentsCREATIVE DIAGNOSTICS- Business overview- Products offeredSYNBIOSIS- Business overview- Products offeredBIOANALYSE- Business overview- Products offered

-

13.2 OTHER COMPANIESZHUHAI DL BIOTECH CO., LTD.ELITECH GROUPMAST GROUP LTD.CONDALABGENEFLUIDICS, INC.BIOTRON LTD.INVIVOGENMP BIOMEDICALSQUANTAMATRIX INC.PML MICROBIOLOGICALS

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 LIMITATIONS AND ASSOCIATED RISKS

- TABLE 2 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 US FDA: MEDICAL DEVICE CLASSIFICATION

- TABLE 4 US: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 5 CANADA: MEDICAL DEVICE REGULATORY APPROVAL PROCESS

- TABLE 6 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PHARMACEUTICALS AND MEDICAL DEVICES AGENCY

- TABLE 7 CHINA: CLASSIFICATION OF MEDICAL DEVICES

- TABLE 8 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET: DETAILED LIST OF MAJOR CONFERENCES AND EVENTS

- TABLE 9 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS

- TABLE 10 KEY BUYING CRITERIA FOR ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS

- TABLE 11 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 12 MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 13 MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 14 MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 15 MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 16 MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 17 MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 18 SUSCEPTIBILITY TESTING DISKS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 19 SUSCEPTIBILITY TESTING DISKS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 20 SUSCEPTIBILITY TESTING DISKS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 21 SUSCEPTIBILITY TESTING DISKS MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 22 SUSCEPTIBILITY TESTING DISKS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 23 MIC STRIPS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 24 MIC STRIPS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 25 MIC STRIPS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 26 MIC STRIPS MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 27 MIC STRIPS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 28 SUSCEPTIBILITY TESTING PLATES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 29 SUSCEPTIBILITY TESTING PLATES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 30 SUSCEPTIBILITY TESTING PLATES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 31 SUSCEPTIBILITY TESTING PLATES MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 32 SUSCEPTIBILITY TESTING PLATES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 33 AUTOMATED LABORATORY INSTRUMENTS MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 34 AUTOMATED LABORATORY INSTRUMENTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 35 AUTOMATED LABORATORY INSTRUMENTS MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 36 AUTOMATED LABORATORY INSTRUMENTS MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 37 AUTOMATED LABORATORY INSTRUMENTS MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 38 CULTURE AND GROWTH MEDIA MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 39 CULTURE AND GROWTH MEDIA MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 40 CULTURE AND GROWTH MEDIA MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 41 CULTURE AND GROWTH MEDIA MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 42 CULTURE AND GROWTH MEDIA MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 43 CONSUMABLES MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 44 CONSUMABLES MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 45 CONSUMABLES MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 46 CONSUMABLES MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 47 CONSUMABLES MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 48 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 49 ANTIBACTERIAL SUSCEPTIBILITY TESTING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 50 NUMBER OF HOSPITALIZATIONS AND DIRECT MEDICAL COSTS ASSOCIATED WITH FUNGAL DISEASES IN US FOR FY 2019

- TABLE 51 ANTIFUNGAL SUSCEPTIBILITY TESTING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 52 ANTIPARASITIC SUSCEPTIBILITY TESTING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 53 OTHER SUSCEPTIBILITY TESTING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 54 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 55 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR CLINICAL DIAGNOSTICS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 56 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR DRUG DISCOVERY AND DEVELOPMENT, BY REGION, 2020–2027 (USD MILLION)

- TABLE 57 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR EPIDEMIOLOGY, BY REGION, 2020–2027 (USD MILLION)

- TABLE 58 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 59 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 60 AUTOMATED ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 61 DISK DIFFUSION-BASED ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 62 AGAR DILUTION-BASED ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 63 ETEST-BASED ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 64 GENOTYPIC METHODS-BASED ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 65 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 66 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR HOSPITALS AND DIAGNOSTIC CENTERS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 67 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR PHARMACEUTICAL AND BIOTECHNOLOGY COMPANIES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 68 FUNDING BY DEPARTMENT OF HEALTH AND SOCIAL CARE (UK) FOR ANTIMICROBIAL RESISTANCE STUDIES, 2020

- TABLE 69 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR RESEARCH AND ACADEMIC INSTITUTES, BY REGION, 2020–2027 (USD MILLION)

- TABLE 70 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET FOR CONTRACT RESEARCH ORGANIZATIONS, BY REGION, 2020–2027 (USD MILLION)

- TABLE 71 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY REGION, 2020–2027 (USD MILLION)

- TABLE 72 NORTH AMERICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 73 NORTH AMERICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 74 NORTH AMERICA: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 75 NORTH AMERICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 76 NORTH AMERICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 77 NORTH AMERICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 78 NORTH AMERICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 79 US: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 80 US: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 81 CANADA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 82 CANADA: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 83 EUROPE: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 84 EUROPE: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 85 EUROPE: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 86 EUROPE: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 87 EUROPE: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 88 EUROPE: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 89 EUROPE: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 90 GERMANY: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 91 GERMANY: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 92 FRANCE: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 93 FRANCE: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 94 UK: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 95 UK: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 96 ITALY: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 97 ITALY: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 98 SPAIN: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 99 SPAIN: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 100 REST OF EUROPE: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 101 REST OF EUROPE: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 102 ASIA PACIFIC: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 103 ASIA PACIFIC: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 104 ASIA PACIFIC: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 105 ASIA PACIFIC: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 106 ASIA PACIFIC: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 107 ASIA PACIFIC: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 108 ASIA PACIFIC: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 109 JAPAN: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 110 JAPAN: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 111 INCIDENCE OF INFECTIOUS DISEASES IN CHINA, 2020

- TABLE 112 CHINA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 113 CHINA: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 114 INDIA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 115 INDIA: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 116 AUSTRALIA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 117 AUSTRALIA: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 118 SOUTH KOREA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 119 SOUTH KOREA: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 120 REST OF ASIA PACIFIC: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 121 REST OF ASIA PACIFIC: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 122 LATIN AMERICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

- TABLE 123 LATIN AMERICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 124 LATIN AMERICA: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 125 LATIN AMERICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 126 LATIN AMERICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 127 LATIN AMERICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 128 LATIN AMERICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 129 BRAZIL: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 130 BRAZIL: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 131 MEXICO: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 132 MEXICO: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 133 REST OF LATIN AMERICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 134 REST OF LATIN AMERICA: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY TYPE, 2020–2027 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD, 2020–2027 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY END USER, 2020–2027 (USD MILLION)

- TABLE 141 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET

- TABLE 142 PRODUCT FOOTPRINT ANALYSIS OF TOP PLAYERS IN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET

- TABLE 143 APPLICATION FOOTPRINT ANALYSIS OF TOP PLAYERS IN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET

- TABLE 144 REGIONAL FOOTPRINT ANALYSIS OF TOP PLAYERS IN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET

- TABLE 145 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET: PRODUCT LAUNCHES, JANUARY 2020–JANUARY 2023

- TABLE 146 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET: DEALS, JANUARY 2020–JANUARY 2023

- TABLE 147 COMPANY OVERVIEW: BIOMÉRIEUX SA

- TABLE 148 COMPANY OVERVIEW: BECTON, DICKINSON AND COMPANY

- TABLE 149 COMPANY OVERVIEW: THERMO FISHER SCIENTIFIC

- TABLE 150 COMPANY OVERVIEW: DANAHER CORPORATION

- TABLE 151 COMPANY OVERVIEW: BIO-RAD LABORATORIES, INC.

- TABLE 152 COMPANY OVERVIEW: BRUKER

- TABLE 153 COMPANY OVERVIEW: ROCHE DIAGNOSTICS

- TABLE 154 COMPANY OVERVIEW: MERCK KGAA

- TABLE 155 COMPANY OVERVIEW: ACCELERATE DIAGNOSTICS, INC.

- TABLE 156 COMPANY OVERVIEW: HIMEDIA LABORATORIES

- TABLE 157 COMPANY OVERVIEW: LIOFILCHEM S.R.L.

- TABLE 158 COMPANY OVERVIEW: ALIFAX S.R.L.

- TABLE 159 COMPANY OVERVIEW: CREATIVE DIAGNOSTICS

- TABLE 160 COMPANY OVERVIEW: SYNBIOSIS

- TABLE 161 COMPANY OVERVIEW: BIOANALYSE

- FIGURE 1 RESEARCH DESIGN: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET

- FIGURE 2 PRIMARY SOURCES

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 MARKET SIZE ESTIMATION: SUPPLY-SIDE ANALYSIS

- FIGURE 7 DATA TRIANGULATION METHODOLOGY

- FIGURE 8 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

- FIGURE 9 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET SHARE, BY TYPE, 2022 VS. 2027

- FIGURE 10 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

- FIGURE 11 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET, BY METHOD, 2022 VS. 2027 (USD MILLION)

- FIGURE 12 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET SHARE, BY END USER, 2022 VS. 2027

- FIGURE 13 GEOGRAPHICAL SNAPSHOT OF ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET

- FIGURE 14 TECHNOLOGICAL ADVANCEMENTS AND RISING INCIDENCE OF INFECTIOUS DISEASES TO DRIVE MARKET GROWTH

- FIGURE 15 SUSCEPTIBILITY TESTING DISKS SEGMENT TO DOMINATE MANUAL ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS MARKET

- FIGURE 16 ANTIBACTERIAL SUSCEPTIBILITY TESTING SEGMENT TO DOMINATE NORTH AMERICAN MARKET

- FIGURE 17 CHINA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 ECOSYSTEM COVERAGE

- FIGURE 20 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 SUPPLY CHAIN ANALYSIS

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS

- FIGURE 23 KEY BUYING CRITERIA FOR ANTIMICROBIAL SUSCEPTIBILITY TESTING PRODUCTS

- FIGURE 24 TOP 10 PATENT APPLICANTS

- FIGURE 25 TOP 10 PATENT OWNERS

- FIGURE 26 NORTH AMERICA: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET SNAPSHOT

- FIGURE 27 ASIA PACIFIC: ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET SNAPSHOT

- FIGURE 28 REVENUE SHARE ANALYSIS OF TOP PLAYERS IN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET

- FIGURE 29 BIOMÉRIEUX SA HELD LEADING POSITION IN ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET IN 2021

- FIGURE 30 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET: COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2021

- FIGURE 31 ANTIMICROBIAL SUSCEPTIBILITY TESTING MARKET: COMPANY EVALUATION MATRIX FOR SMES/START-UPS, 2021

- FIGURE 32 BIOMÉRIEUX SA: COMPANY SNAPSHOT

- FIGURE 33 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT

- FIGURE 34 THERMO FISHER SCIENTIFIC: COMPANY SNAPSHOT

- FIGURE 35 DANAHER CORPORATION: COMPANY SNAPSHOT

- FIGURE 36 BIO-RAD LABORATORIES, INC.: COMPANY SNAPSHOT

- FIGURE 37 BRUKER: COMPANY SNAPSHOT

- FIGURE 38 ROCHE DIAGNOSTICS: COMPANY SNAPSHOT

- FIGURE 39 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 40 ACCELERATE DIAGNOSTICS, INC.: COMPANY SNAPSHOT

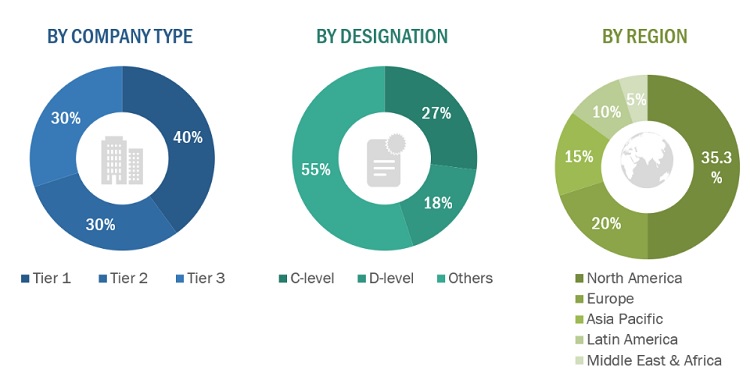

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

The secondary research process involves the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the microcatheter market. It was also used to obtain important information about the key players and market classification & segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations in the medical aesthetic market. The primary sources from the demand side include medical OEMs, Oncologists, CDMOs and service providers, among others. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends & key market dynamics.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

Note: Companies are classified into tiers based on their total revenue. As of 2021, Tier 1 = >USD 1,000 million, Tier 2 = USD 500–1,000 million, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

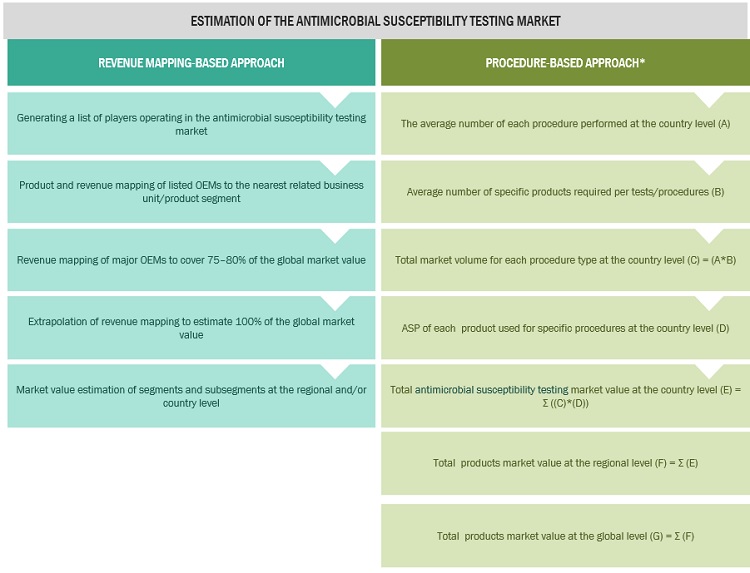

Market Estimation Methodology

In this report, the antimicrobial susceptibility testing market size was arrived at by using the revenue share analysis of leading players. For this purpose, key players in the market were identified, and their revenues from the medical aesthetic business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key marketing executives.

To calculate the global market value, segmental revenues were calculated based on the revenue mapping of major solution/service providers. This process involved the following steps:

- Generating a list of major global players operating in the microcatheter market.

- Mapping annual revenues generated by major global players from the product segment (or nearest reported business unit/product category)

- Revenue mapping of major players to cover major share of the global market share, as of 2021

- Extrapolating the global value of the automated antimicrobial susceptibility testing market

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the Antimicrobial susceptibility testing marketwas split into segments and subsegments. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides. Additionally, the antimicrobial susceptibility testing market was validated using both top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, and forecast the Antimicrobial susceptibility testing market on the basis of product, type, method, applications ,end user, and region .

- To provide detailed information regarding the major factors influencing the growth potential of the Antimicrobial susceptibility testing market(drivers, restraints, opportunities, challenges, and trends)

- To analyze the micromarkets with respect to individual growth trends, future prospects, and contributions to the Antimicrobial susceptibility testing market

- To analyze key growth opportunities in the Antimicrobial susceptibility testing market for key stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of market segments and/or subsegments with respect to five major regions, namely, North America (US and Canada), Europe (Germany, France, the UK, Italy, Spain, and the RoE), Asia Pacific (Japan, China, India, Thailand, Indonesia and the RoAPAC), Latin America (Brazil, Mexico, and RoLATAM), and the Middle East & Africa

- To profile the key players in the Antimicrobial susceptibility testing marketand comprehensively analyze their market shares and core competencies

- To track and analyze the competitive developments undertaken in the automated antimicrobial susceptibility testing market, such as product launches; agreements; expansions; and mergers & acquisitions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the present global microcatheter report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the Rest of Europe Antimicrobial susceptibility testing market into Russia, Belgium, the Netherlands, Switzerland, Austria, Finland, Sweden, Poland, and Portugal among other

- Further breakdown of the Rest of the Asia Pacific Antimicrobial susceptibility testing market into Singapore, Taiwan, New Zealand, Philippines, Malaysia, and other APAC countries

- Further breakdown of the Latin American Antimicrobial susceptibility testing market into Colombia, Chile, Argentina, and Peru, among other

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Antimicrobial Susceptibility Testing Market