AML Market by Offering (Solutions (KYC/CDD & Sanctions Screening, Transaction Monitoring, Case Management & Reporting), Services), Deployment Mode, Organization Size, End User (Banks & Financial Institutes, Insurance) and Region - Global Forecast to 2028

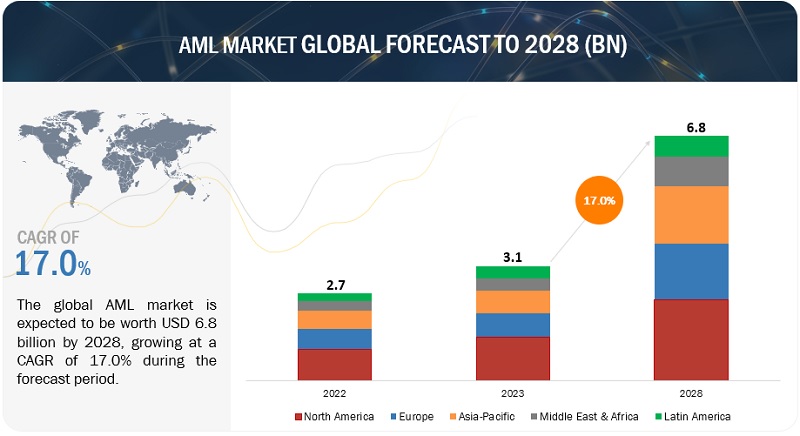

The global AML market size is projected to grow from USD 3.1 billion in 2023 to USD 6.8 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 17.0% during the forecast period. The expansion of the AML market can be attributed to the adoption of cloud-based AML solutions to combat financial crimes.

Moreover, the AML market is experiencing growth due to the introduction of AI/ML-powered solutions and services. These factors contribute to the market’s promising growth potential, providing organizations with enhanced security measures.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

AML Market Dynamics

Driver: Growth in focus toward digital payments and internet banking

Digital payment and online banking services have grown phenomenally over the past ten years. These platforms have fundamentally changed how financial transactions are carried out, driven by technical improvements and shifting customer preferences. The economic environment has changed because of the accessibility and convenience provided by digital payment methods and online banking. The growth of e-commerce has accelerated digital payments as more and more online shoppers choose cashless purchases. User confidence has also increased because of the introduction of contactless payments and security features like biometric authentication. The increased use of digital payments allows fraudsters to commit financial crimes by stealing passwords, committing identity thefts, and impersonating clients’ identities for economic benefits. Therefore, financial institutions are adopting AML solutions on a large scale to counter such threats.

Restraint: Increased technological complexities and sophistication of attacks

Cybercriminals use sophisticated strategies to hide the source of illegal income, including ransomware attacks, identity theft, and cryptocurrency-related scams. Because of the serious risk that these activities represent to the integrity of financial systems, institutions must improve their AML skills to stay one step ahead of criminals. The techniques criminals use to finance illegal operations and launder money also advance with technology. The sophisticated cyber-attacks specifically target financial institutions to compromise their security protocols and get unauthorized access to private client information and transaction logs. By influencing or hiding illegal financial activity, these breaches might jeopardize the integrity of AML procedures and undermine AML efforts.

Opportunity: Increased use of AML in the real estate sector

The real estate sector is an attractive target for money launderers due to the large sums of money involved in property transactions and the perceived anonymity that the sector can offer. As a result, the real estate market is more vulnerable to money laundering, with criminals exploiting it to support terrorism, launder illegal cash, and avoid paying taxes. It can be challenging to track the movement of money and spot suspected money laundering activities when buying and selling real estate in multiple countries.

Governments and regulators worldwide have recently introduced new rules and policies to address the issue of rising anti-money laundering (AML) threats in the real estate industry. Certain governments are considering the establishment of public registers or registries that provide accessible information about property ownership and beneficial ownership. The utilization of real estate for money laundering will be discouraged by this transparency. Government disclosure of beneficial ownership information by real estate entities is a step towards greater transparency. It helps law enforcement identify the funding source and inhibits shell companies' use to hide real property owners.

Challenge: Lack of awareness related to government regulations and deployment of AML solutions

Some businesses might not realize how vulnerable they are to being used as a money laundering target. They may ignore the need for comprehensive AML solutions because they think their business or sector is not exposed to such hazards. They may become exposed due to this misunderstanding to criminal groups looking to take advantage of flaws in their financial systems. The lack of expertise in deploying AML solutions must be addressed in several ways. By offering instructional materials, workshops, and guidelines on the significance of AML compliance, industry groups, regulatory authorities, and governments may play a significant role in raising awareness. To show the practical advantages of efficient AML solutions, collaborative efforts combining financial institutions, technology suppliers, and industry organizations may promote best practices and share success stories.

AML Market Ecosystem

By end user, insurance is expected to grow at the highest CAGR during the forecast period.

The insurance sector encompasses a range of segments, including life insurance, health insurance, travel insurance, corporate insurance, and vehicle insurance. Insurance companies provide customers with adaptable policies as well as investment products and services that permit substantial cash deposits and withdrawals. However, the malleability of these offerings elevates the risk of illicit activities, such as money laundering, within the insurance industry. Vulnerable aspects within life insurance offerings susceptible to money laundering comprise single premium policies, high regular premium services, policy surrenders, ownership transfers, policy loans, and top-ups.

By offering, the solution segment is to grow at the highest CAGR during the forecast period.

AML solutions offer a range of benefits, including preventing money laundering and terrorism financing, fortifying the financial system's integrity against illicit activities, enhancing customer due diligence and risk assessment, ensuring regulatory compliance, mitigating the risk of penalties, and bolstering the reputation of financial institutions. Integrating AML solutions is imperative for any financial entity to safeguard its operations and clients from financial crimes. Chosen solutions must be comprehensive, scalable, user-friendly, cost-effective, and tailored to the institution's unique needs, risk level, and transaction volume. Implementing AML solutions empowers financial institutions to uphold the safety and stability of the financial ecosystem.

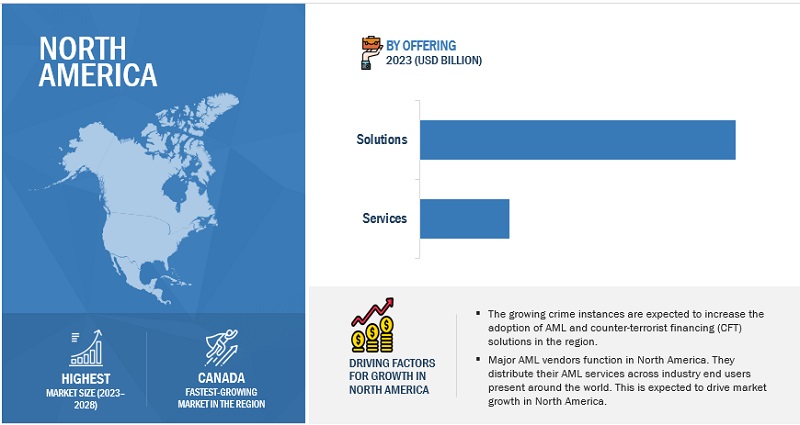

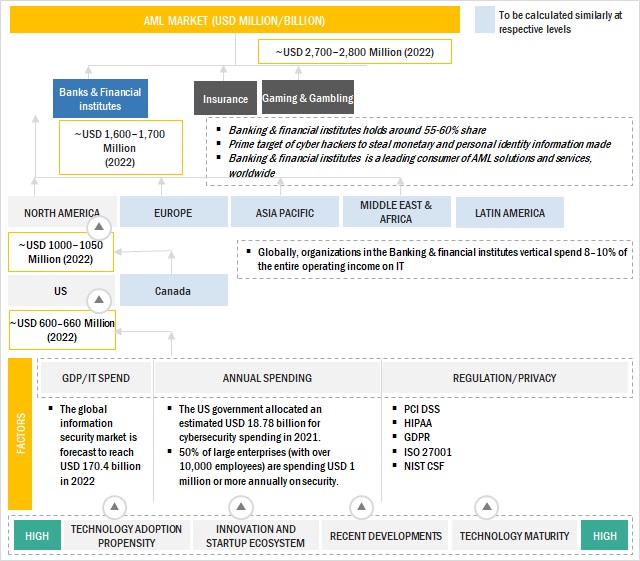

By region, North America accounts for the highest market size during the forecast period.

North America is estimated to be the largest contributor in terms of the market size in the AML market. It is one of the most affected regions in the world by money laundering and terrorist financing crime activities; as a result, it has the highest number of AML solution providers. Money laundering is a significant issue in the United States. The region is an appealing target for money launderers looking to take advantage of vulnerabilities in various businesses and sectors due to its immense size and economic diversity. The sophisticated financial system in North America, along with the anonymity provided by digital transactions and intricate corporate networks, creates an ideal environment for blending criminal funds with the legal economy. The banking system's accessibility is the main source of laundered money. Another form of money laundering used by criminals in the USA is trade-based money laundering.

Key Market Players

The key players in the AML market are LexisNexis (US), Oracle (US), FIS (US), Fiserv (US), Jumio (US), NICE Actimize (US), SAS Institute (US), GB Group (UK), FICO (US), ACI Worldwide (US), Experian (Ireland) and others.

Want to explore hidden markets that can drive new revenue in AML Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in AML Market?

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments Covered |

offering, solution, service, organization size, deployment mode, end users, and regions |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Major vendors in the global AML market include LexisNexis (US), Oracle (US), FIS (US), Fiserv (US), Jumio (US), NICE Actimize (US), SAS Institute (US), GB Group (UK), FICO (US), ACI Worldwide (US), Experian (Ireland), Nelito Systems (India), Wolter Kluwer (Netherlands), Comarch (Poland), Allsec Technologies (india), Dixtior (Portugal), Temenos (Switzerland), TCS (India), ComplyAdvantage (UK), Featurespace (UK), Feedzai (Portugal), Tier1 Financial Solutions (Canada), Finacus Solutions (india), FRISS ( Netherlands), TransUnion (US), SymphonyAI (US), Napier (UK), IDMERIT (US), IMTF (Switzerlands), Innovative Systems (US), Sedicii (Ireland), Trulioo (Canada), NameScan (Australia), DataVisor (US), Gurucul (US) |

The study categorizes the AML market by offering, solution, service, organization size, deployment mode, end users, and regions.

By offerings:

- Solutions

- Services

By Solution:

- KYC/CDD and Sanction Screening

- Transaction Monitoring

- Case Management and Reporting

By Services:

- Professional Services

- Managed services

By Deployment mode:

- On-Premises

- Cloud

By Organization size:

- SMEs

- Large Enterprises

By End-user:

- Banks & Financial Institutes

- Insurance

- Gaming & Gambling

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In April 2023, NICE Actimize launched SAM-10 as Part of its Anti-Money Laundering suite of solutions. It is an AI-Based AML Transaction Monitoring Innovation With Multilayered Analytics to Better Detect Suspicious Activity.

- In January 2023, IMTF acquired the Siron anti-money laundering and compliance solutions developed by US-based FICO Corporation, a leading analytical business intelligence software provider. With this acquisition, IMTF has now taken over the management of all Siron anti-financial crime solutions worldwide.

- In December 2022, NICE Actimized Partners with The Knoble. The Knoble's Financial Crimes Working Group will get expertise from NICE Actimize in the areas of technology, research, and other resources to aid in the identification and elimination of fraud in human trafficking-related operations.

- In November 2022, Hoist Finance partnered with SAS anti-money laundering (AML) technology supported by Consortix, a strategic SAS AML partner, to fight against financial crime. Hoist Finance is a Swedish credit management company operating in several European countries.

- In February 2022, GB Group acquired Verifi Identity Services Limited, commonly known as “Cloudcheck,” a provider of electronic identity verification (IDV) and anti-money laundering (AML) solutions in New Zealand.

Frequently Asked Questions (FAQ):

What are the opportunities in the global AML market?

Higher adoption of advanced analytics in AML, Integration of AI, ML, and big data technologies in developing AML solutions, adoption of cloud-based AML solutions to combat financial crimes, and Increased use of AML in the real estate sector are a few factors contributing to the growth and creating new opportunities for the AML market.

What is the definition of the AML market?

MarketsandMarkets defines anti-money laundering as a practice by financial institutes such as banks, insurance, or gaming & gambling enterprises to monitor and prevent illegal activities supporting money laundering and terrorist financing. These banks and financial institutes follow policies and regulations during KYC/CDD, transaction screening, and monitoring and compliance to avoid fraudulent and illegal activities around the financial systems.

Which region is expected to show the highest market share in the AML market?

North America is expected to account for the largest market share during the forecast period.

What are the major market players covered in the report?

Major vendors, namely, include LexisNexis (US), Oracle (US), FIS (US), Fiserv (US), Jumio (US), NICE Actimize (US), SAS Institute (US), GB Group (UK), FICO (US), ACI Worldwide (US), Experian (Ireland).

What is the current size of the global AML market?

The global AML market size is projected to grow from USD 3.1 billion in 2023 to USD 6.8 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 17.0% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increased monetary penalties, regulatory sanctions, and reputational loss due to noncompliance with regulations- Rise in focus toward digital payments and Internet banking- Necessity to create infrastructure with 360-degree view of data in financial landscapeRESTRAINTS- Increased technological complexities and sophistication of attacks- Budgetary issues in developing in-house fraud detection solutionsOPPORTUNITIES- Higher adoption of advanced analytics in AML- Integration of AI, ML, and big data technologies in developing AML solutions- Adoption of cloud-based AML solutions to combat financial crimes- Increased use of AML in real estate sectorCHALLENGES- Lack of skilled AML professionals with in-depth knowledge- Lack of awareness related to government regulations and deployment of AML solutions

-

5.3 USE CASESFICO HELPED 4FINANCE INCREASE EFFICIENCY WHILE MAINTAINING REGULATORY COMPLIANCENICE ACTIMIZE HELPED EUROPEAN BANK IMPROVE INSIGHT INTO GLOBAL OPERATIONSSAS INSTITUTE HELPED BANGKOK BANK STAY AHEAD OF EMERGING RISKS AND CHANGING REGULATIONS

- 5.4 VALUE CHAIN ANALYSIS

-

5.5 MARKET ECOSYSTEM

-

5.6 PORTER’S FIVE FORCES MODEL ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITVE RIVALRY

- 5.7 PRICING ANALYSIS

-

5.8 TECHNOLOGICAL ANALYSISANTI-MONEY LAUNDERING AND AI/MLANTI-MONEY LAUNDERING AND DATA ANALYTICSANTI-MONEY LAUNDERING AND INTERNET OF THINGSANTI-MONEY LAUNDERING AND REAL-TIME AUTHENTICATION

-

5.9 PATENT ANALYSIS

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 5.11 TECHNOLOGY ROADMAP

- 5.12 BUSINESS MODEL

- 5.13 EVOLUTION OF AML

-

5.14 REGULATORY LANDSCAPEFINANCIAL INDUSTRY REGULATORY AUTHORITYFINANCIAL ACTION TASK FORCE (FATF)INTERNATIONAL MONETARY FUNDGENERAL DATA PROTECTION REGULATIONGRAMM—LEACH—BLILEY ACTSARBANES—OXLEY ACTREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.15 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.16 KEY CONFERENCES AND EVENTS

-

6.1 INTRODUCTIONOFFERING: MARKET DRIVERS

-

6.2 SOLUTIONSSURGE IN FINANCIAL TRANSACTIONS AND CONTINUAL INNOVATION OF MONEY LAUNDERING METHODS TO DRIVE MARKETSOLUTIONS: MARKET DRIVERSKNOW YOUR CUSTOMER/CUSTOMER DUE DILIGENCE & SANCTIONS SCREENINGTRANSACTION MONITORINGCASE MANAGEMENT & REPORTING

-

6.3 SERVICESRISE IN NEED TO SAFEGUARD ECONOMIC SYSTEMS AND MITIGATE RISKS TO DRIVE MARKETSERVICES: MARKET DRIVERSPROFESSIONAL SERVICES- Consulting services- Training and education- Integration and maintenanceMANAGED SERVICES

-

7.1 INTRODUCTIONDEPLOYMENT MODE: MARKET DRIVERS

-

7.2 CLOUDRAPID ADOPTION OF CLOUD SOLUTIONS TO BOOST CLOUD DEPLOYMENT GROWTH IN AML MARKET

-

7.3 ON-PREMISESSIGNIFICANCE AND MECHANICS OF ON-PREMISES AML DEPLOYMENT TO BOOST MARKET

-

8.1 INTRODUCTIONORGANIZATION SIZE: MARKET DRIVERS

-

8.2 SMALL- AND MEDIUM-SIZED ENTERPRISESCOST-EFFECTIVENESS AND RESOURCE-SAVING BENEFITS TO DRIVE CLOUD-BASED AML SOLUTIONS MARKET

-

8.3 LARGE ENTERPRISESEARLY ADOPTION OF AML SOLUTIONS BY LARGE ENTERPRISES FOR ROBUST APPLICATION SECURITY

-

9.1 INTRODUCTIONEND USER: MARKET DRIVERS

-

9.2 BANKING & FINANCIAL INSTITUTESSURGE IN FRAUD CASES AND INCREASING PREVALENCE OF TERRORISM TO DRIVE MARKET

-

9.3 INSURANCERISK OF ILLICIT ACTIVITIES IN INSURANCE SECTOR TO DRIVE MARKET

-

9.4 GAMING & GAMBLINGMONEY LAUNDERING RISKS IN GAMING AND GAMBLING TO DRIVE MARKET

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPEUNITED STATES- Rapid integration of technology to drive adoption of advanced AML solutionsCANADA- Canada's geographic location and extensive trade connections to create opportunities for cross-border money laundering

-

10.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPEUK- Use of regulatory technology solutions to enhance efficiency of AML complianceGERMANY- Strict legislations to promote compliance and watchfulness cultureFRANCE- Sizable economy, political stability, and sophisticated financial system to make France appealing venue for money launderersPORTUGAL- Strict AML regulations and advanced AML solutions to combat money laundering activities in PortugalREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPECHINA- Government initiatives to catalyze AML market expansionJAPAN- Promotion of AML education and government initiatives to combat AML activitiesAUSTRALIA AND NEW ZEALAND- Successful implementation of legal, regulatory, and operational measures to combat money laundering and terrorist financingSINGAPORE- Technological innovations to drive AML solutions in SingaporeINDIA- Evolving AML regulations and cost-effective AML solutions to drive marketREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY LANDSCAPEUNITED ARAB EMIRATES- Government initiatives to promote AML and CFT measuresKINGDOM OF SAUDI ARABIA- Proliferation of online banking solutions to drive AML solutions marketSOUTH AFRICA- Growth of digital banking, mobile payments, and internet usage in South Africa to drive adoption of AML solutionsREST OF MIDDLE EAST & AFRICA

-

10.6 LATIN AMERICALATIN AMERICA: MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Rise in money laundering instances to drive need for AML solutions and servicesMEXICO- Rising instances of money laundering by drug cartels to drive cloud-based AML solutionsREST OF LATIN AMERICA

- 11.1 OVERVIEW

- 11.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 RANKING OF KEY PLAYERS IN AML MARKET

-

11.6 COMPANY FOOTPRINTOVERVIEWPRODUCT FOOTPRINT

-

11.7 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.8 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING FOR STARTUPS/SMES

- 11.9 COMPETITIVE SCENARIO AND TRENDS

-

12.1 KEY PLAYERSLEXISNEXIS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORACLE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFIS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFISERV- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJUMIO- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewNICE ACTIMIZE- Business overview- Products/Solutions/Services offered- Recent developmentsSAS INSTITUTE- Business overview- Products/Solutions/Services offered- Recent developmentsGB GROUP PLC- Business overview- Products/Solutions/Services offered- Recent developmentsFICO- Business overview- Products/Solutions/Services offered- Recent developmentsACI WORLDWIDE- Business overview- Products/Solutions/Services offered- Recent developmentsEXPERIAN- Business overview- Products/Solutions/Services offered- Recent developmentsNELITO SYSTEMSWOLTERS KLUWERCOMARCHALLSEC TECHNOLOGIESDIXTIORTEMENOSTCSCOMPLYADVANTAGEFEATURESPACEFEEDZAINAPIERTIER1 FINANCIAL SOLUTIONSFINACUS SOLUTIONSFRISSTRANSUNION

-

12.2 OTHER PLAYERSSYMPHONYAIIDMERITIMTFINNOVATIVE SYSTEMSSEDICIITRULIOONAMESCANDATAVISORGURUCUL

- 13.1 INTRODUCTION TO ADJACENT MARKETS

- 13.2 LIMITATIONS

-

13.3 ADJACENT MARKETSFRAUD DETECTION AND PREVENTION MARKETIDENTITY VERIFICATION MARKETEGRC MARKET

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2017–2021

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 AML MARKET SIZE AND GROWTH, 2023–2028 (USD MILLION, Y-O-Y GROWTH)

- TABLE 4 PORTER’S FIVE FORCES IMPACT ANALYSIS

- TABLE 5 PRICING STRUCTURE: NAMESCAN

- TABLE 6 PRICING STRUCTURE: COMPLYCUBE

- TABLE 7 LIST OF PATENTS IN AML MARKET, 2023

- TABLE 8 AML MARKET: TECHNOLOGY ROADMAP

- TABLE 9 AML MARKET: BUSINESS MODEL

- TABLE 10 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- TABLE 12 KEY BUYING CRITERIA FOR TOP THREE END USERS

- TABLE 13 AML MARKET: LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 14 ANTI-MONEY LAUNDERING MARKET, BY COMPONENT, 2017–2022 (USD MILLION)

- TABLE 15 ANTI-MONEY LAUNDERING MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 16 ANTI-MONEY LAUNDERING SOLUTIONS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 17 ANTI-MONEY LAUNDERING SOLUTIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 ANTI-MONEY LAUNDERING SOLUTIONS MARKET, BY TYPE, 2017–2022 (USD MILLION)

- TABLE 19 ANTI-MONEY LAUNDERING SOLUTIONS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 20 KYC/CDD & SANCTIONS SCREENING SOLUTIONS MARKET, BY REGION, 2017–2022(USD MILLION)

- TABLE 21 KYC/CDD & SANCTIONS SCREENING SOLUTIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 TRANSACTION MONITORING SOLUTIONS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 23 TRANSACTION MONITORING SOLUTIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 CASE MANAGEMENT & REPORTING SOLUTIONS MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 25 CASE MANAGEMENT & REPORTING SOLUTIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 ANTI-MONEY LAUNDERING SERVICES MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 27 ANTI-MONEY LAUNDERING SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 29 ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 30 CLOUD-BASED ANTI-MONEY LAUNDERING MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 31 CLOUD-BASED ANTI-MONEY LAUNDERING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 ON-PREMISES ANTI-MONEY LAUNDERING MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 33 ON-PREMISES ANTI-MONEY LAUNDERING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 35 ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 36 SMALL- AND MEDIUM-SIZED ENTERPRISES MARKET, BY REGION, 2017–2022(USD MILLION)

- TABLE 37 SMALL- AND MEDIUM-SIZED ENTERPRISES: ANTI-MONEY LAUNDERING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 LARGE ENTERPRISES MARKET, BY REGION, 2017–2022(USD MILLION)

- TABLE 39 LARGE ENTERPRISES MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022(USD MILLION)

- TABLE 41 ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 42 BANKING & FINANCIAL INSTITUTE END USERS MARKET, BY REGION, 2017–2022(USD MILLION)

- TABLE 43 BANKING & FINANCIAL INSTITUTE END USERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 INSURANCE END USERS MARKET, BY REGION, 2017–2022(USD MILLION)

- TABLE 45 INSURANCE END USERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 GAMING & GAMBLING END USERS MARKET, BY REGION, 2017–2022(USD MILLION)

- TABLE 47 GAMING & GAMBLING END USERS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 ANTI-MONEY LAUNDERING MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 49 ANTI-MONEY LAUNDERING MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 50 NORTH AMERICA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 51 NORTH AMERICA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 52 NORTH AMERICA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 53 NORTH AMERICA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 54 NORTH AMERICA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 55 NORTH AMERICA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 57 NORTH AMERICA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 59 NORTH AMERICA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: ANTI-MONEY LAUNDERING MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 61 NORTH AMERICA: ANTI-MONEY LAUNDERING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 62 US: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 63 US: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 64 US: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 65 US: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 66 US: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 67 US: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 68 US: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 69 US: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 70 US: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 71 US: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 72 CANADA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 73 CANADA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 74 CANADA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 75 CANADA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 76 CANADA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 77 CANADA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 78 CANADA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 79 CANADA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 80 CANADA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 81 CANADA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 82 EUROPE: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 83 EUROPE: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 85 EUROPE: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 87 EUROPE: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 89 EUROPE: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 91 EUROPE: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 92 EUROPE: ANTI-MONEY LAUNDERING MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 93 EUROPE: ANTI-MONEY LAUNDERING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 94 UK: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 95 UK: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 96 UK: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 97 UK: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 98 UK: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 99 UK: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 100 UK: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 101 UK: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 102 UK: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 103 UK: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 104 GERMANY: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 105 GERMANY: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 106 GERMANY: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 107 GERMANY: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 108 GERMANY: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 109 GERMANY: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 110 GERMANY: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 111 GERMANY: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 112 GERMANY: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 113 GERMANY: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 114 FRANCE: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 115 FRANCE: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 116 FRANCE: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 117 FRANCE: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 118 FRANCE: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 119 FRANCE: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 120 FRANCE: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 121 FRANCE: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 122 FRANCE: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 123 FRANCE: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 124 PORTUGAL: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 125 PORTUGAL: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 126 PORTUGAL: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 127 PORTUGAL: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 128 PORTUGAL: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 129 PORTUGAL: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 130 PORTUGAL: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 131 PORTUGAL: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 132 PORTUGAL: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 133 PORTUGAL: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 134 REST OF EUROPE: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 135 REST OF EUROPE: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 136 REST OF EUROPE: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 137 REST OF EUROPE: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 138 REST OF EUROPE: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 139 REST OF EUROPE: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 140 REST OF EUROPE: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 141 REST OF EUROPE: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 142 REST OF EUROPE: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 143 REST OF EUROPE: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 145 ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 148 ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 149 ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 150 ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 151 ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 152 ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 153 ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 154 ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 155 ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 156 CHINA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 157 CHINA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 158 CHINA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 159 CHINA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 160 CHINA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 161 CHINA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 162 CHINA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 163 CHINA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 164 CHINA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 165 CHINA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 166 JAPAN: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 167 JAPAN: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 168 JAPAN: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 169 JAPAN: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 170 JAPAN: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 171 JAPAN: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 172 JAPAN: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 173 JAPAN: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 174 JAPAN: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 175 JAPAN: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 176 AUSTRALIA AND NEW ZEALAND: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 177 AUSTRALIA AND NEW ZEALAND: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 178 AUSTRALIA AND NEW ZEALAND: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 179 AUSTRALIA AND NEW ZEALAND: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 180 AUSTRALIA AND NEW ZEALAND: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 181 AUSTRALIA AND NEW ZEALAND: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 182 AUSTRALIA AND NEW ZEALAND: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 183 AUSTRALIA AND NEW ZEALAND: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 184 AUSTRALIA AND NEW ZEALAND: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 185 AUSTRALIA AND NEW ZEALAND: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 186 SINGAPORE: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 187 SINGAPORE: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 188 SINGAPORE: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 189 SINGAPORE: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 190 SINGAPORE: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 191 SINGAPORE: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 192 SINGAPORE: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 193 SINGAPORE: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 194 SINGAPORE: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 195 SINGAPORE: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 196 INDIA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 197 INDIA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 198 INDIA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 199 INDIA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 200 INDIA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 201 INDIA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 202 INDIA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 203 INDIA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 204 INDIA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 205 INDIA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 206 REST OF ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 207 REST OF ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 208 REST OF ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 209 REST OF ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 210 REST OF ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 211 REST OF ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 212 REST OF ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 213 REST OF ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 214 REST OF ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 215 REST OF ASIA PACIFIC: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 223 MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 224 MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 225 MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 226 MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 227 MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 228 UAE: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 229 UAE: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 230 UAE: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 231 UAE: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 232 UAE: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 233 UAE: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 234 UAE: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 235 UAE: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 236 UAE: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 237 UAE: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 238 KSA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 239 KSA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 240 KSA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 241 KSA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 242 KSA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 243 KSA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 244 KSA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 245 KSA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 246 KSA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 247 KSA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 248 SOUTH AFRICA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 249 SOUTH AFRICA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 250 SOUTH AFRICA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 251 SOUTH AFRICA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 252 SOUTH AFRICA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 253 SOUTH AFRICA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 254 SOUTH AFRICA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 255 SOUTH AFRICA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 256 SOUTH AFRICA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 257 SOUTH AFRICA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 258 REST OF MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 259 REST OF MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 260 REST OF MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 261 REST OF MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 262 REST OF MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 263 REST OF MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 264 REST OF MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 265 REST OF MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 266 REST OF MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 267 REST OF MIDDLE EAST & AFRICA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 268 LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 269 LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 270 LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 271 LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 272 LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 273 LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 274 LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 275 LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 276 LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 277 LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 278 LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 279 LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 280 BRAZIL: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 281 BRAZIL: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 282 BRAZIL: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 283 BRAZIL: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 284 BRAZIL: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 285 BRAZIL: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 286 BRAZIL: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 287 BRAZIL: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 288 BRAZIL: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 289 BRAZIL: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 290 MEXICO: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 291 MEXICO: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 292 MEXICO: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 293 MEXICO: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 294 MEXICO: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 295 MEXICO: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 296 MEXICO: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 297 MEXICO: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 298 MEXICO: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 299 MEXICO: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 300 REST OF LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 301 REST OF LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 302 REST OF LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2017–2022 (USD MILLION)

- TABLE 303 REST OF LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY SOLUTION, 2023–2028 (USD MILLION)

- TABLE 304 REST OF LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 305 REST OF LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 306 REST OF LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 307 REST OF LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 308 REST OF LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2017–2022 (USD MILLION)

- TABLE 309 REST OF LATIN AMERICA: ANTI-MONEY LAUNDERING MARKET, BY END USER, 2023–2028 (USD MILLION)

- TABLE 310 AML MARKET: DEGREE OF COMPETITION

- TABLE 311 AML MARKET: LIST OF STARTUPS/SMES

- TABLE 312 AML MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 313 PRODUCT LAUNCHES, 2020–2023

- TABLE 314 DEALS, 2020–2023

- TABLE 315 LEXISNEXIS: BUSINESS OVERVIEW

- TABLE 316 LEXISNEXIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 317 LEXISNEXIS: PRODUCT LAUNCHES

- TABLE 318 LEXISNEXIS: DEALS

- TABLE 319 ORACLE: BUSINESS OVERVIEW

- TABLE 320 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 321 ORACLE: PRODUCT LAUNCHES

- TABLE 322 ORACLE: DEALS

- TABLE 323 FIS: BUSINESS OVERVIEW

- TABLE 324 FIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 325 FIS: PRODUCT LAUNCHES

- TABLE 326 FIS: DEALS

- TABLE 327 FISERV: BUSINESS OVERVIEW

- TABLE 328 FISERV: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 329 FISERV: PRODUCT LAUNCHES

- TABLE 330 FISERV: DEALS

- TABLE 331 JUMIO: BUSINESS OVERVIEW

- TABLE 332 JUMIO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 333 JUMIO: PRODUCT LAUNCHES

- TABLE 334 JUMIO: DEALS

- TABLE 335 NICE ACTIMIZE: BUSINESS OVERVIEW

- TABLE 336 NICE ACTIMIZE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 337 NICE ACTIMIZE: PRODUCT LAUNCHES

- TABLE 338 NICE ACTIMIZE: DEALS

- TABLE 339 SAS INSTITUTE: BUSINESS OVERVIEW

- TABLE 340 SAS INSTITUTE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 341 SAS INSTITUTE: DEALS

- TABLE 342 GB GROUP: BUSINESS OVERVIEW

- TABLE 343 GB GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 344 GB GROUP: PRODUCT LAUNCHES

- TABLE 345 GB GROUP: DEALS

- TABLE 346 FICO: BUSINESS OVERVIEW

- TABLE 347 FICO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 348 FICO: DEALS

- TABLE 349 ACI WORLDWIDE: BUSINESS OVERVIEW

- TABLE 350 ACI WORLDWIDE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 351 ACI WORLDWIDE: PRODUCT LAUNCHES

- TABLE 352 ACI WORLDWIDE: DEALS

- TABLE 353 EXPERIAN: BUSINESS OVERVIEW

- TABLE 354 EXPERIAN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 355 EXPERIAN: PRODUCT LAUNCHES

- TABLE 356 EXPERIAN: DEALS

- TABLE 357 ADJACENT MARKETS AND FORECASTS

- TABLE 358 FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2017–2022 (USD MILLION)

- TABLE 359 FRAUD DETECTION AND PREVENTION MARKET, BY FRAUD TYPE, 2023–2028 (USD MILLION)

- TABLE 360 IDENTITY VERIFICATION MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 361 IDENTITY VERIFICATION MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 362 IDENTITY VERIFICATION MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

- TABLE 363 IDENTITY VERIFICATION MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

- TABLE 364 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

- TABLE 365 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

- TABLE 366 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET, BY BUSINESS FUNCTION, 2016–2021 (USD MILLION)

- TABLE 367 ENTERPRISE GOVERNANCE, RISK, AND COMPLIANCE MARKET, BY BUSINESS FUNCTION, 2022–2027 (USD MILLION)

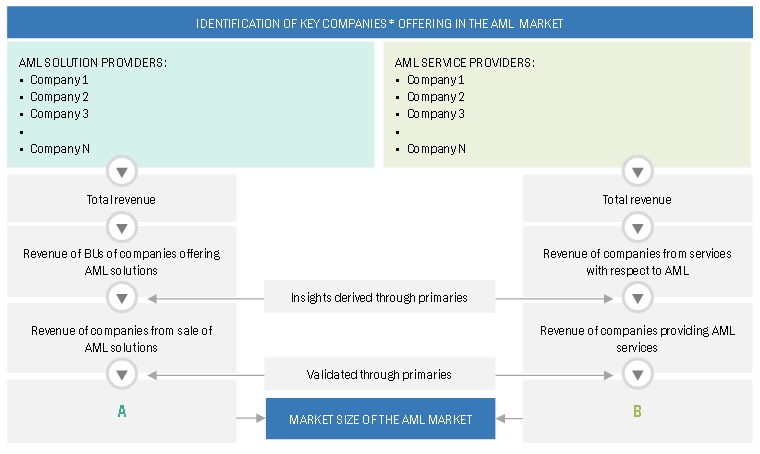

- FIGURE 1 ANTI-MONEY LAUNDERING MARKET: RESEARCH DESIGN

- FIGURE 2 ANTI-MONEY LAUNDERING MARKET: MARKET BREAKUP AND DATA TRIANGULATION

- FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE OF SOLUTIONS AND SERVICES IN ANTI-MONEY LAUNDERING MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1: SUPPLY-SIDE ANALYSIS

- FIGURE 5 ANTI-MONEY LAUNDERING MARKET—MARKET ESTIMATION APPROACH: RESEARCH FLOW

- FIGURE 6 ANTI-MONEY LAUNDERING MARKET—MARKET ESTIMATION APPROACH: SUPPLY-SIDE ANALYSIS (COMPANY REVENUE ESTIMATION)

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY APPROACH 2—BOTTOM-UP (DEMAND SIDE): PRODUCTS/SOLUTIONS/SERVICES

- FIGURE 8 GLOBAL AML MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

- FIGURE 9 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

- FIGURE 10 AML MARKET: FASTEST-GROWING SEGMENTS

- FIGURE 11 INCREASED MONETARY PENALTIES AND REGULATORY SANCTIONS EXPECTED TO DRIVE GROWTH OF ANTI-MONEY LAUNDERING MARKET

- FIGURE 12 SOLUTIONS SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 13 TRANSACTION MONITORING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 ON-PREMISES SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2023

- FIGURE 15 LARGE ENTERPRISES TO ACCOUNT FOR LARGER SHARE IN 2023

- FIGURE 16 BANKING & FINANCIAL INSTITUTES AND NORTH AMERICA REGION TO ACCOUNT FOR LARGEST SHARES IN 2023

- FIGURE 17 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: AML MARKET

- FIGURE 19 AML REGULATORY PROCESS FOR FINANCIAL INSTITUTIONS

- FIGURE 20 ANTI-MONEY LAUNDERING MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 ECOSYSTEM: AML MARKET

- FIGURE 22 PORTER’S FIVE FORCES ANALYSIS: ANTI-MONEY LAUNDERING MARKET

- FIGURE 23 ANTI-MONEY LAUNDERING TECHNOLOGICAL ANALYSIS

- FIGURE 24 LIST OF MAJOR PATENTS FOR AML MARKET

- FIGURE 25 AML MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER’S BUSINESSES

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END USERS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE END USERS

- FIGURE 28 SOLUTIONS EXPECTED TO HAVE HIGHER MARKET VALUE DURING FORECAST PERIOD

- FIGURE 29 TRANSACTION MONITORING SOLUTIONS PROJECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 30 ON-PREMISES DEPLOYMENT EXPECTED TO HAVE HIGHER MARKET VALUE DURING FORECAST PERIOD

- FIGURE 31 LARGE ENTERPRISES EXPECTED TO HAVE HIGHER MARKET VALUE DURING FORECAST PERIOD

- FIGURE 32 INSURANCE TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 36 FIVE-YEAR REVENUE ANALYSIS OF KEY AML VENDORS, 2017–2022 (USD MILLION)

- FIGURE 37 AML MARKET SHARE, 2023

- FIGURE 38 KEY PLAYERS’ RANKING, 2023

- FIGURE 39 PRODUCT FOOTPRINT OF KEY COMPANIES

- FIGURE 40 AML MARKET: COMPANY EVALUATION QUADRANT, 2022

- FIGURE 41 AML MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 42 ORACLE: COMPANY SNAPSHOT

- FIGURE 43 FIS: COMPANY SNAPSHOT

- FIGURE 44 FISERV: COMPANY SNAPSHOT

- FIGURE 45 NICE ACTIMIZE: COMPANY SNAPSHOT

- FIGURE 46 GB GROUP: COMPANY SNAPSHOT

- FIGURE 47 FICO: COMPANY SNAPSHOT

- FIGURE 48 ACI WORLDWIDE: COMPANY SNAPSHOT

- FIGURE 49 EXPERIAN: COMPANY SNAPSHOT

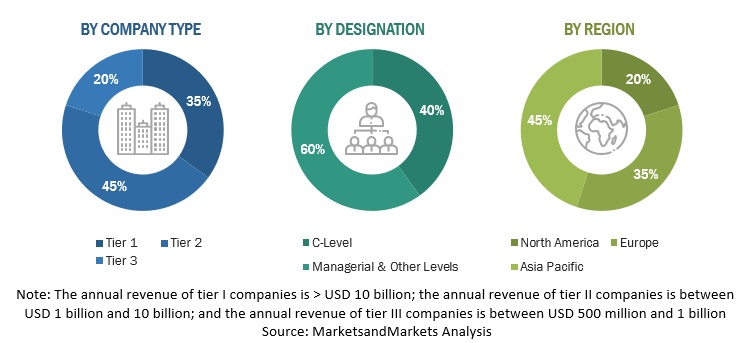

The study involved major activities in estimating the current market size for the AML market. Exhaustive secondary research was done to collect information on the AML industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the AML market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information regarding the study. The secondary sources included annual reports, press releases, investor presentations of AML solution and service vendors, forums, certified publications, and whitepapers. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both markets- and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the AML market.

In the market engineering process, top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global AML market and estimate the size of various other dependent sub-segments in the overall AML market. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research. The entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Bottom-Up approach:

To know about the assumptions considered for the study, Request for Free Sample Report

Top-Down approach:

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

MarketsandMarkets defines anti-money laundering as a practice by financial institutes such as banks, insurance, or gaming & gambling enterprises to monitor and prevent illegal activities supporting money laundering and terrorist financing. These banks and financial institutes follow a set of policies and regulations during KYC/CDD, transaction screening, and monitoring and compliance to avoid fraudulent and illegal activities around the financial systems.

Key Stakeholders

- Chief technology and data officers

- Anti-money laundering service professionals

- Business analysts

- Information technology (IT) professionals

- Government agencies

- Investors and venture capitalists

- Small and medium-sized enterprises (SMEs) and large enterprises

- Third-party providers

- Consultants/consultancies/advisory firms

- Managed and professional service providers

Report Objectives

- To describe and forecast the global anti-money laundering (AML) market by offering, deployment mode, organization size, end user, and region.

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America.

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market.

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape details of major players.

- To profile the key players of the AML market and comprehensively analyze their market shares and core competencies.

- To track and analyze competitive developments, such as mergers & acquisitions (M&A), new product developments, and partnerships & collaborations, in the market.

- To track and analyze the recession impact on the AML market

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in AML Market