Alarm Monitoring Market by Offering (Systems Hardware, Services), Input Signal (Discrete, Protocol), Communication Technology (Wired, Cellular, IP), Application (Building, Equipment, Vehicle Alarm Monitoring), and Geography - Global Forecast to 2023

Updated date -

The overall alarm monitoring market was valued at USD 42.88 Billion in 2017 and is expected to reach USD 59.83 Billion by 2023, at a CAGR of 5.5% during the forecast period. The base year considered for the study is 2017, and the forecast period is between 2018 and 2023.

Alarm Monitoring Market Dynamics

Attractive insurance policy discounts for installing security systems

Several insurance companies offer a discount in the insurance amount for installing and maintaining an alarm system with some form of central monitoring. Insurance companies offer maximum discounts in cases where the alarm system is connected to a central monitoring station. These monitoring stations alert the emergency services in case of an alarm.

It has been observed that several residential customers purchase security systems to benefit from the lower insurance premium rates that are offered to the house owners who have installed security systems. Besides, certain other insurance policies make the installation of security systems at homes mandatory to avail coverage of the policies. Insurance companies offer discounts on the purchase of home security systems, especially to those connected to the fire and local police departments. Insurance companies give discounts in the range between 5% and 20% for different security measures installed in houses on the basis of the home owners’ policy. The discount varies from 15% to 20% for homes that are equipped with burglar and fire alarm systems. These discounts are mainly offered as it is believed that houses equipped with security systems are 60% lesser prone to burglary attacks than the houses without security systems. Hence, this factor boosts the demand for security systems.

False alarmstriggered due to variations in outdoor physical environment

False alarm is a major restraining factor in the adoption of alarm monitoring systems. Alarm systems are influenced by outdoor physical environment, such as variation in temperature and humidity. For instance, in summers, glasses get shattered because of the overwhelming heat, and this results in the triggering of alarm systems—which is a false alarm. The frequent causes of false alarms include prank calls, incorrect key pad codes, lack of training to authorized users. Frequent false alarms increase risks to public safety. For example, in St. Petersburg, Florida, US, the Police Department responds to over 11,000 false alarms each year. In case of an alarm, two law enforcement units are dispatched.

The objectives of this study include:

- To define, describe, segment, and forecast the market, in terms of value, on the basis of offering, communication technology, input signal, end-use application, and geography

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the growth of the market

- To provide a detailed overview of the value chain pertaining to the market

- To strategically profile key players in the alarm monitoring market and analyze competitive developments, such as joint ventures, mergers & acquisitions, product launches and developments, and R&D in the market

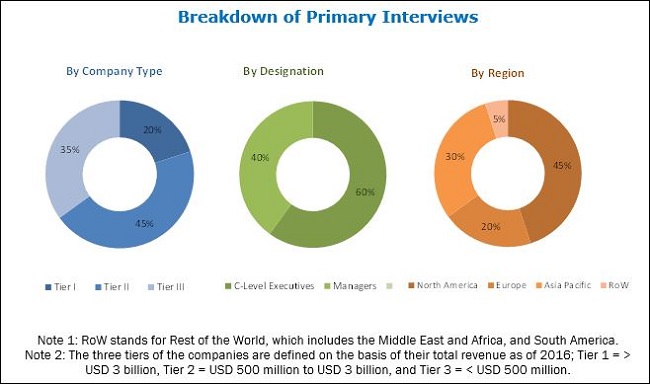

This research study involves the use of extensive secondary sources, directories, and databases (such as annual reports, press releases, journals, company websites, and paid databases) to identify and collect information useful for this study. The entire procedure includes the study of the financial reports of the top market players. After arriving at the overall market size, the total market has been split into several segments and subsegments and confirmed with key industry experts such as CEOs, VPs, directors, and marketing executives. The figure below shows the breakdown of the primaries.

To know about the assumptions considered for the study, download the pdf brochure

The key players operating in the alarm monitoring market include ADT (US), Moni (US), Honeywell (US), Securitas (Sweden), UTC (US), Schneider (France), Johnson Controls (US), Vivint (US), Vector Security (US), Bosch (Germany).

Target Audience:

- Semiconductor and electronic component providers

- Connectivity providers

- Monitoring service providers

- Platform providers

- Research organizations

- Technology investors

- Technology standard organizations, alliances, and associations

The alarm monitoring market has been segmented on the basis of:

Application

- Equipment monitoring

- Vehicle alarm monitoring

- Building alarm monitoring

- Environment monitoring

Offering

- Systems and hardware

- Software, services, and solutions

Communication Technology

- Wired telecommunication network

- Cellular wireless network

- Wireless radio network

- IP network

By Input Signal

- Discrete

- Analog

- Protocol

By Geography

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- UK

- France

- Rest of Europe

-

Asia Pacific (APAC)

- China

- Japan

- South Korea

- India

- Rest of APAC

-

Rest of the World (RoW)

- South America

- Middle East and Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players on the basis of various blocks of the value chain

The overall alarm monitoring market is expected to be valued at USD 45.70 Billion in 2018 and is likely to reach USD 59.83 Billion by 2023, at a CAGR 5.5% between 2018 and 2023. The major factors driving the growth of the market include attractive insurance policy discounts for installing security systems and increasing popularity of smart homes and home automation systems.

Software, services, and solutions held a major share of the overall alarm monitoring market in 2017. The software, services, and solutions segment dominates the market as most players in this market generate revenues through monitoring and installation fees, which they obtain as monthly recurring charges. Many players in this market offer free equipment and installation to expand their customer base.

Among all communication technologies, wired telecommunication network held the largest share of the overall alarm monitoring market in 2017. Wired telecommunication is the most commonly used communication technology in the existing alarm monitoring systems; its reliability is a major reason of its dominating presence.

Among all end-use applications, building alarm monitoring held the largest share of the overall alarm monitoring market in 2017. Alarm monitoring systems installed in buildings are designed to detect emergency situations such as fire, smoke, intrusion, and flood. Residential buildings form a major segment of the market for building alarm monitoring; a major part of the overall revenue in this segment is generated through monthly recurring charges, which alarm monitoring companies obtain in lieu of monitoring services. Most companies catering to residential customers do not charge for the equipment or installation costs; however; they charge a monthly fee for monitoring.

Protocol inputs are electrical signals, which are formatted into a formal code that represents more complex information than that in case of discrete or analog signals. There are different types of protocols for transmitting telecom alarm data. With growing cybersecurity concerns, protocol signals are preferred over analog and discrete signals as these signals provide more security due to encryption.

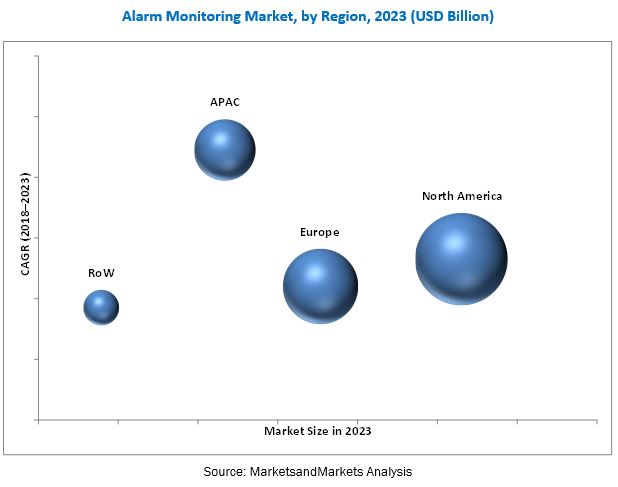

North America is in the forefront in the evolution and development of alarm monitoring technology as this region is home to some of the largest multinational corporations in the world. Most leading players operating in the global alarm monitoring market are based in this region. Increased R&D in the field of remote monitoring, home automation systems, and Internet of Things, in terms of new and improved technologies, is a major factor driving market growth in North America. The emerging R&D activities at the academic and industry levels are broadening the application areas of alarm monitoring to include equipment monitoring, building alarm monitoring, environment monitoring, and medical equipment monitoring in North America. The market in APAC is expected to grow at the highest rate between 2018 and 2023 as the region is highly concerned about the increase in security spending owing to the ever-growing threat landscape in the region. In the recent years, APAC has undergone tremendous economic growth, political transformations, and social changes.

Some of the major players operating in the alarm monitoring market are ADT (US), Moni (US), Honeywell US), Securitas (Sweden), UTC (US), Schneider (France), Johnson Controls (US), Vivint (US), Vector Security (US), and Bosch (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst of Alarm Monitoring Market

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 29)

4.1 Attractive Opportunities for the Market in Alarm Monitoring

4.2 Market, By Communication Technology

4.3 Market, By Application

4.4 Market for Building Alarm Monitoring, By Building Type

4.5 Market for Equipment Monitoring, By Equipment Type

4.6 Market in North America, By Application and Country

4.7 Market, By Geography

5 Market Overview (Page No. - 33)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Attractive Insurance Policy Discounts for Installing Security Systems

5.2.1.2 Growing Popularity of Smart Homes and Home Automation Systems

5.2.2 Restraints

5.2.2.1 False Alarms

5.2.3 Opportunities

5.2.3.1 Diy Home Security Systems

5.2.3.2 Smartphone-And Handheld Device-Based Security Systems

5.2.4 Challenges

5.2.4.1 Telecom and Cable Companies Entering the Alarm Monitoring Space

5.3 Value Chain Analysis

5.3.1 Research and Product Development

5.3.2 Alarm Monitoring Original Equipment Manufacturers (OEMS)

5.3.3 Key Technology Providers/System Integrators

5.3.4 Alarm Monitoring Service Providers

5.3.5 Applications

5.4 Key Industry Trends

6 By Offering (Page No. - 38)

6.1 Introduction

6.2 Systems & Hardware

6.2.1 Remote Terminal Units (RTUS)

6.2.2 Alarms Sensors

6.2.2.1 Motion Detector Sensors

6.2.2.2 Door/Window Sensors

6.2.2.3 Fire/Smoke Detecting Sensors

6.2.3 Communication Networks & Gateways

6.2.4 Central Monitoring Receivers

6.2.5 Others

6.3 Software, Services, & Solutions

6.3.1 Monitoring Services

6.3.2 Installation Services

6.3.3 Software

7 By Input Signal (Page No. - 44)

7.1 Introduction

7.2 Analog

7.3 Discrete

7.4 Protocol

8 By Communication Technology (Page No. - 50)

8.1 Introduction

8.2 Wired Telecommunication Network

8.3 Cellular Wireless Network

8.4 Wireless Radio Network

8.4.1 IP Network

9 By Application (Page No. - 62)

9.1 Introduction

9.2 Building Alarm Monitoring

9.3 Equipment Monitoring

9.3.1 Telecom Equipment

9.3.2 Industrial Equipment Monitoring

9.3.3 Medical Equipment Monitoring

9.3.4 Others

9.4 Vehicle Alarm Monitoring

9.5 Environmental Monitoring

10 Geographic Analysis (Page No. - 73)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 UK

10.3.2 Germany

10.3.3 France

10.3.4 Rest of Europe (RoE)

10.4 APAC

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 Rest of APAC

10.5 RoW

10.5.1 Middle East & Africa

10.5.2 South America

11 Competitive Landscape (Page No. - 89)

11.1 Overview

11.2 Market Ranking Analysis

11.3 Competitive Scenario

11.3.1 Product Launches and Developments

11.3.2 Partnerships, Acquisitions, and Collaborations

12 Company Profiles (Page No. - 93)

(Business Overview, Products and Services, Recent Developments, SWOT Analysis, and MnM View)*

12.1 Key Players

12.1.1 ADT

12.1.2 Moni

12.1.3 Honeywell

12.1.4 Securitas

12.1.5 UTC (Chubb)

12.1.6 Schneider

12.1.7 Johnson Controls

12.1.8 Vivint

12.1.9 Vector Security

12.1.10 Bosch

12.2 Other Key Players

12.2.1 Comcast

12.2.2 Slomin's

12.2.3 G4s

12.2.4 Sector Alarm

12.2.5 Prosegur

12.2.6 ABB

12.2.7 Engineered Protection Systems

12.2.8 Stanley Security

12.2.9 Trigion

12.2.10 AT&T

*Details on Business Overview, Products and Services, Recent Developments, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 124)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (64 Tables)

Table 1 Greater Vertical Integration is A Leading Trend Among Key Market Players

Table 2 Market for Software, Services, & Solutions, 2015–2023(USD Million)

Table 3 Alarm Monitoring Market, By Offering, 2015–2023(USD Million)

Table 4 Market for Alarm Monitoring-Related Systems & Hardware, By Component, 2015–2023 (USD Billion)

Table 5 Market, By Input Signal, 2015–2023 (USD Billion)

Table 6 Market for Analog Input Signals for Alarm Monitoring, By Application, 2015–2023 (USD Billion)

Table 7 Market for Analog Input Signals for Alarm Monitoring, By Communication Technology, 2015–2023 (USD Billion)

Table 8 Market for Discrete Input Signals for Alarm Monitoring, By Application, 2015–2023 (USD Billion)

Table 9 Market for Discrete Input Signals for Alarm Monitoring, By Communication Technology, 2015–2023 (USD Billion)

Table 10 Market for Protocol Input Signals for Alarm Monitoring, By Application, 2015–2023 (USD Billion)

Table 11 Market for Protocol Input Signals for Alarm Monitoring, By Communication Technology, 2015–2023 (USD Billion)

Table 12 Market, By Communication Technology, 2015–2023 (USD Million)

Table 13 Market for Wired Telecommunication Network-Based Alarm Monitoring, By Region, 2015–2023 (USD Billion)

Table 14 Market for Wired Telecommunication Network-Based Alarm Monitoring, By Input Signal, 2015–2023 (USD Billion)

Table 15 Market for Wired Telecommunication Network-Based Alarm Monitoring, By Application, 2015–2023 (USD Billion)

Table 16 Market for Wired Telecommunication Network-Based Alarm Monitoring, By Building Type, 2015–2023 (USD Billion)

Table 17 Market for Wired Telecommunication Network-Based Alarm Monitoring, By Equipment Type, 2015–2023 (USD Billion)

Table 18 Market for Cellular Wireless Network-Based Alarm Monitoring, By Region, 2015–2023 (USD Billion)

Table 19 Market for Cellular Wireless Network-Based Alarm Monitoring, By Input Signal, 2015–2023 (USD Billion)

Table 20 Market for Cellular Wireless Network-Based Alarm Monitoring, By Application, 2015–2023 (USD Billion)

Table 21 Market for Cellular Wireless Network-Based Alarm Monitoring, By Building Type, 2015–2023 (USD Billion)

Table 22 Market for Cellular Wireless Network-Based Alarm Monitoring, By Equipment Type, 2015–2023 (USD Billion)

Table 23 Market for Wireless Radio Network-Based Alarm Monitoring, By Region, 2015–2023 (USD Billion)

Table 24 Market for Wireless Radio Network-Based Alarm Monitoring, By Input Signal, 2015–2023 (USD Billion)

Table 25 Market for Wireless Radio Network-Based Alarm Monitoring, By Application, 2015–2023 (USD Billion)

Table 26 Market for Wireless Radio Network-Based Alarm Monitoring, By Building Type, 2015–2023 (USD Billion)

Table 27 Market for Wireless Radio Network-Based Alarm Monitoring, By Equipment Type, 2015–2023 (USD Billion)

Table 28 Alarm Monitoring Market for IP Network-Based Alarm Monitoring, By Region, 2015–2023 (USD Billion)

Table 29 Market for IP Network-Based Alarm Monitoring, By Input Signal, 2015–2023 (USD Billion)

Table 30 Market for IP Network-Based Alarm Monitoring, By Application, 2015–2023 (USD Billion)

Table 31 Market for IP Network-Based Alarm Monitoring, By Building Type, 2015–2023 (USD Billion)

Table 32 Market for IP Network-Based Alarm Monitoring, By Equipment Type, 2015–2023 (USD Billion)

Table 33 Alarm Monitoring Market, By Application, 2015–2023 (USD Billion)

Table 34 Market for Building Alarm Monitoring, By Building Type, 2015–2023 (USD Billion)

Table 35 Market for Building Alarm Monitoring, By Communication Technology, 2015–2023 (USD Billion)

Table 36 Market for Building Alarm Monitoring, By Region, 2015–2023 (USD Billion)

Table 37 Market for Building Alarm Monitoring, By Input Signal, 2015–2023 (USD Billion)

Table 38 Market for Equipment Monitoring, By Equipment Type, 2015–2023 (USD Billion)

Table 39 Market for Equipment Monitoring, By Communication Technology, 2015–2023 (USD Billion)

Table 40 Market for Equipment Monitoring, By Region, 2015–2023 (USD Billion)

Table 41 Market for Equipment Monitoring, By Input Signal, 2015–2023 (USD Billion)

Table 42 Market for Vehicle Alarm Monitoring, By Communication Technology, 2015–2023 (USD Billion)

Table 43 Market for Vehicle Monitoring, By Region, 2015–2023 (USD Billion)

Table 44 Market for Vehicle Monitoring, By Input Signal, 2015–2023 (USD Billion)

Table 45 Market for Environmental Monitoring, By Communication Technology, 2015–2023 (USD Billion)

Table 46 Market for Environmental Monitoring, By Region, 2015–2023 (USD Billion)

Table 47 Market for Environmental Monitoring, By Input Signal Type, 2015–2023 (USD Billion)

Table 48 Market, By Region, 2015–2023 (USD Billion)

Table 49 Market for Systems & Hardware, By Region, 2015–2023 (USD Billion)

Table 50 Market in North America, By Country, 2015–2023 (USD Billion)

Table 51 Market in North America, By Application, 2015–2023 (USD Billion)

Table 52 Market in North America, By Communication Technology, 2015–2023 (USD Billion)

Table 53 Market in Europe, By Country/Region, 2015–2023 (USD Billion)

Table 54 Market in Europe, By Application, 2015–2023 (USD Billion)

Table 55 Market in Europe, By Communication Technology, 2015–2023 (USD Billion)

Table 56 Market in APAC, By Country/Region, 2015–2023 (USD Billion)

Table 57 Market in APAC, By Application, 2015–2023 (USD Billion)

Table 58 Market in APAC, By Communication Technology, 2015–2023 (USD Billion)

Table 59 Market in RoW, By Region, 2015–2023 (USD Billion)

Table 60 Market in RoW, By Application, 2015–2023 (USD Billion)

Table 61 Market in RoW, By Communication Technology, 2015–2023 (USD Billion)

Table 62 Top Players in the Alarm Monitoring Market

Table 63 10 Most Recent Product Launches in the Alarm Monitoring Market

Table 64 Top 5 Partnerships, Acquisitions, and Collaborations in the Alarm Monitoring Market

List of Figures (47 Figures)

Figure 1 Segmentation of the Alarm Monitoring Market

Figure 2 Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown & Data Triangulation

Figure 6 Assumptions of the Research Study

Figure 7 Snapshot of the Alarm Monitoring Market (2015–2023)

Figure 8 Market for Cellular Wireless Network-Based Alarm Monitoring Systems to Grow at the Highest CAGR Between 2018 and 2023

Figure 9 Market for Building Alarm Monitoring to Grow at the Highest CAGR During the Forecast Period

Figure 10 Medical Equipment Monitoring Held the Largest Size of the Market for Equipment Monitoring, By Equipment Type, in 2017

Figure 11 Residential Buildings to Hold A Larger Size of the Market for Building Alarm Monitoring, By Building Type, Throughout the Forecast Period

Figure 12 North America Held the Largest Share of the Market in 2017

Figure 13 Increasing Building Alarm Monitoring Applications to Drive the Growth of the Market During the Forecast Period

Figure 14 Wired Telecommunication Network to Hold the Largest Size of the Market By 2023

Figure 15 Building Alarm Monitoring to Hold the Largest Size of the Market in 2018

Figure 16 Residential Buildings to Hold A Larger Size of the Market for Building Alarm Monitoring Throughout the Forecast Period

Figure 17 Medical Equipment Monitoring Held the Largest Size of the Market for Equipment Monitoring in 2017

Figure 18 Building Alarm Monitoring Held the Largest Share of the Market in North America in 2018

Figure 19 Market in APAC to Grow at the Highest CAGR Between 2018 and 2023

Figure 20 Drivers, Restraints, Opportunities, & Challenges in the Alarm Monitoring Market

Figure 21 Alarm Monitoring: Value Chain Analysis

Figure 22 Alarm Monitoring, By Offering

Figure 23 Market for Alarm Monitoring-Related Software, Services, & Solutions to Grow at A Higher CAGR During the Forecast Period

Figure 24 Alarm Monitoring, By Input Signal

Figure 25 Market for Analog Input Signals for Cellular Wireless Network-Based Alarm Monitoring to Grow at the Highest Rate Between 2018 and 2023

Figure 26 Alarm Monitoring Market, By Communication Technology

Figure 27 Market for Cellular Wireless Network-Based Alarm Monitoring to Grow at the Highest CAGR During the Forecast Period

Figure 28 Alarm Monitoring, By Application

Figure 29 Market for Building Alarm Monitoring, By Building Type

Figure 30 Residential Buildings to Hold A Larger Share of the Market for Building Alarm Monitoring in 2018

Figure 31 Market for Equipment Monitoring, By Equipment Type

Figure 32 Medical Equipment Monitoring to Lead the Market for Equipment Monitoring in 2018

Figure 33 Alarm Monitoring, By Geography

Figure 34 Geographic Snapshot of the Alarm Monitoring Market

Figure 35 Snapshot of the Market in North America

Figure 36 Snapshot of the Market in Europe

Figure 37 Snapshot of the Market in APAC

Figure 38 Snapshot of the Market in RoW

Figure 39 Product Launches Emerged as the Key Growth Strategy Adopted By Key Market Players Between January 2015 and January 2018

Figure 40 Evaluation Framework: Alarm Monitoring Market

Figure 41 Honeywell: Company Snapshot

Figure 42 Securitas: Company Snapshot

Figure 43 UTC (Chubb): Company Snapshot

Figure 44 Schneider: Company Snapshot

Figure 45 Johnson Controls: Company Snapshot

Figure 46 Vivint: Company Snapshot

Figure 47 Bosch: Company Snapshot

Growth opportunities and latent adjacency in Alarm Monitoring Market

What are the major applications and the future trends in the market for alarm monitoring? Have you considered IoT or smart alarms in the scope of the report?

Do you have market shares for all companies listed in the report for the market? Who holds the top notch in the alarm monitoring market? What are the trends in the market?

Hi, would it be possible to access market valuation figures and growth predictions for the alarm monitoring sector in the UK specifically?