Air Separation Plant Market by Process (Cryogenic, Non-cryogenic), Gas (Nitrogen, Oxygen, Argon, CO2, Helium), End-Use Industry (Iron & Steel, Oil & Gas, Chemical, Healthcare, Electronics, F&B, Glass, Coal Gasification) & Region - Global Forecast to 2028

Updated on : June 17, 2024

Air Separation Plant Market

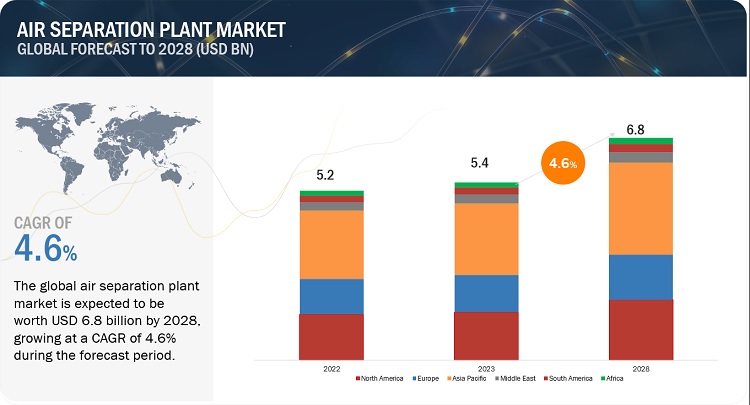

The global air separation plant market was valued at USD 5.4 billion in 2023 and is projected to reach USD 6.8 billion by 2028, growing at 4.6% cagr from 2023 to 2028. The demand for air separation plants is closely linked to the growth of various end-use industries. For instance, the need for air separation plants is very high in the steel industry since steelmaking processes require a lot of oxygen.

Attractive Opportunities in the Air Separation Plant Market

To know about the assumptions considered for the study, Request for Free Sample Report

Air Separation Plant Market Dynamics

Driver: Growing demand for industrial gases from dynamic manufacturing sectors

Air separation plants are in greater demand due to the rising need for industrial gases like oxygen, nitrogen, and argon in several industries. Industrial gases are essential to steel, chemical, and oil & gas production processes. The use of industrial gases in environmental applications has expanded as a result of the growing focus on environmental sustainability and energy efficiency. The need for industrial gases and air separation facilities rises in tandem with the expansion of these sectors.

Restraint: High costs associated with fabrication, component assembly, and operations

Large-scale machinery, including distillation columns, heat exchangers, compressors, and storage tanks, are produced as part of the manufacture and fabrication of air separation plants. These parts frequently require specialized production techniques, which raises the cost. Air separation systems are frequently modified to meet unique application needs and site requirements. The cost of fabrication may go up if the design is customized and site-specific factors are taken into account. Specific materials that can withstand high temperatures and pressures are needed for air separation plants. These materials are frequently more expensive than conventional materials.

Opportunity: Transition to green technologies

As part of broader efforts to minimize carbon emissions and promote sustainability, the industry has placed much importance on converting air separation plants to green technologies. Air separation facilities are looking into integrating renewable energy sources like wind and solar power to meet their energy needs. Installing on-site renewable energy systems or obtaining renewable energy from the grid might be part of this. The carbon footprint connected to the operation of air separation plants can be significantly decreased by employing renewable energy.

Challenge: Hazards associated with cryogenic air separation technology

There are some risks associated with cryogenic air separation technology, which is often used in air separation plants and must be managed appropriately. One of the leading products of air separation facilities is high-purity oxygen. Oxygen enrichment in the atmosphere or small areas can provide a highly combustible atmosphere. Hazards from fire or explosion are now becoming more probable. Stringent safety precautions must be in place to avoid oxygen enrichment and guarantee optimum ventilation.

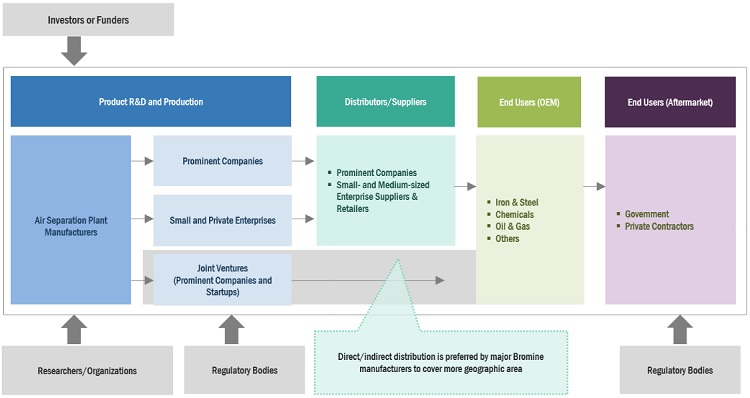

Air Separation Plant Market Ecosystem

Linde Plc (UK), Air Liquide SA (France), Air Products and Chemicals, Inc. (US), Taiyo Nippon Sanso Corporation (Japan), and Messer Group GmbH (Germany) are the prominent companies in the air separation plant market. These companies are well-established, financially stable, and have a global presence in the market.

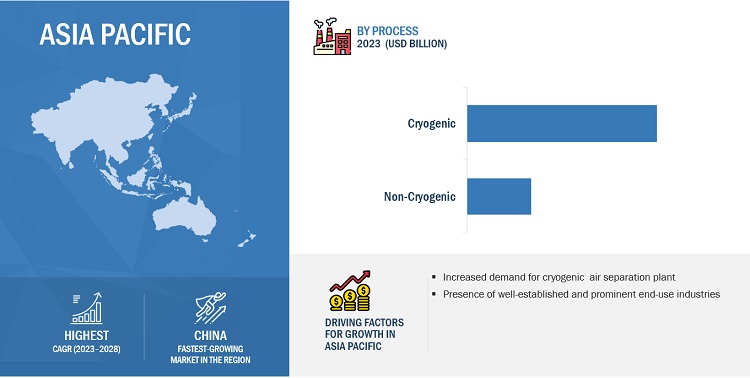

Based on the process, the cryogenic segment is projected to grow at a significant CAGR during the forecast period.

Industries that depend on generating industrial gases are some of the factors driving the demand for cryogenic air separation plants. Regulations, economic conditions, and industrial growth impact the market for cryogenic air separation plants. The production of gases that satisfy certain industry requirements and applications is made possible by cryogenic air separation systems' adaptability. The flexibility provided by the ability to change the gas production ratio for various industrial purposes ensures the availability of the necessary gas compositions. The need for industrial gases produced by cryogenic air separation plants is anticipated to stay high as companies grow and technology progresses.

Based on gas, the nitrogen segment accounts for the largest share of the overall market.

Air separation plants produce nitrogen gas in response to the demand for nitrogen, which is interconnected. Nitrogen is a vital industrial gas with many uses in numerous sectors of the economy. As businesses expand, more nitrogen-based processes are adopted, and many industries need better quality control and safety measures; the demand for nitrogen has been constantly rising. These are a few of the crucial applications for nitrogen in the steel sector. The properties of nitrogen, such as its inertness, cooling prowess, and impacts on surface treatment, make it a significant resource at various stages of steel manufacturing, improving the general quality and performance of steel products.

Based on the end-use industry, the iron & gas segment accounts for the largest share of the overall market

Due to the industry’s heavy reliance on industrial gases, air separation plants are in high demand in the iron and steel sector. Global infrastructure development, construction projects, the automobile industry, and other industries are driving up demand for iron and steel. Air separation plants are extensively used in the metallurgical and steel industry for oxygen and nitrogen supply. The need for industrial gases supplied by air separation plants, particularly oxygen, rises in tandem with the expansion of the iron and steel industry.

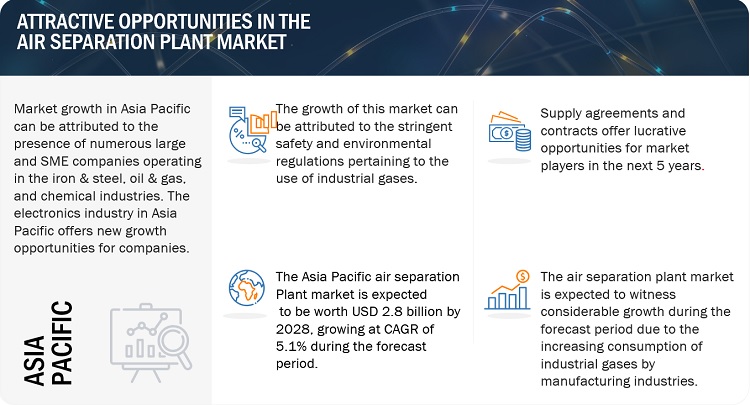

Asia Pacific is expected to account for the largest share of the global market during the forecast period.

Based on the region, Asia Pacific accounts for the largest share. Because of its rapid industrialization, growing economy, and rising need for industrial gases, the Asia Pacific region represents a sizable market for air separation plants. In terms of technological breakthroughs, the Asia Pacific region is in the lead, and this is also applicable to the market for air separation plants. To increase efficiency, dependability, and cost-effectiveness, advanced air separation technologies such as cryogenic distillation, pressure swing adsorption (PSA), and membrane separation are being used in the region.

To know about the assumptions considered for the study, download the pdf brochure

Air Separation Plant Market Players

Linde Plc (UK), Air Liquide SA (France), Air Products and Chemicals, Inc. (US), Taiyo Nippon Sanso Corporation (Japan), Messer Group GmbH (Germany), Daesung Industrial Co., Ltd. (South Korea), Air Water Inc. (Japan), Enerflex Ltd. (Canada), Yingde Gases Group Co., Ltd. (Hong Kong), Inox Air Products Private Limited (India), Hangzhou Hangyang Co., Ltd. (China), Universal Industrial Gases, Inc. (US), Nikkiso Cosmodyne, LLC. (US) and others.

Air Separation Plant Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2016 to 2028 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Process, Gas, End-Use Industry and Region |

|

Geographies Covered |

Asia Pacific, North America, Europe, the Middle East, South America, and Africa |

|

Companies Covered |

The major market players include Linde Plc (UK), Air Liquide SA (France), Air Products and Chemicals, Inc. (US), Taiyo Nippon Sanso Corporation (Japan), Messer Group GmbH (Germany), Daesung Industrial Co., Ltd. (South Korea), Air Water Inc. (Japan), Enerflex Ltd. (Canada), Yingde Gases Group Co., Ltd. (Hong Kong), Inox Air Products Private Limited (India), Hangzhou Hangyang Co., Ltd. (China), Universal Industrial Gases, Inc. (US), Nikkiso Cosmodyne, LLC. (US) and others. |

This research report categorizes the air separation plant market based on process, gas, end-use industry, and region.

Based on the process, the air separation plant market has been segmented as follows:

- Cryogenic

- Non-Cryogenic

Based on gas, the air separation plant market has been segmented as follows:

- Nitrogen

- Oxygen

- Argon

- Others

Based on the end-use industry, the air separation plant market has been segmented as follows:

- Iron & Steel

- Oil & Gas

- Chemical

- Healthcare

- Others

Based on the region, the air separation plant market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- Rest of Asia Pacific (Malaysia, Thailand, and Taiwan)

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (Russia, Ukraine, Poland, and Belgium)

-

Middle East

- Saudi Arabia

- UAE

- Qatar

- Kuwait

- Oman

- Rest of the Middle East (Algeria and Egypt)

-

North America

- US

- Canada

- Mexico

-

Africa

- South Africa

- Rest of Africa

-

South America

- Brazil

- Argentina

- Chile

- Rest of South America (Peru, Colombia, and Venezuela)

Recent Developments

- In January 2023, Linde Plc acquired remaining interests in NexAir, LLC to expand its presence in US.

- In May 2023, Air Products and Chemicals Inc. signed an investment agreement with the Government of the Republic of Uzbekistan and Uzbekneftegaz JSC to acquire, own, and operate an industrial gas complex.

- In February 2021, Air Liquide and BASF signed a new long-term contract for the supply of oxygen and nitrogen.

Frequently Asked Questions (FAQ):

What is the key driver for the air separation plant market?

Growing demand for industrial gases from dynamic manufacturing sectors

Which region is expected to hold the highest market share in the air separation plant market?

Asia Pacific

What are the end-use industries of air separation plants?

Iron & steel and chemical

Who are the major manufacturers of air separation plants?

Linde Plc (UK), Air Liquide SA (France), Air Products and Chemicals, Inc. (US), Taiyo Nippon Sanso Corporation (Japan), Messer Group GmbH (Germany)

What is the total CAGR expected to record for the air separation plant market during 2023-2028?

CAGR of 4.6% .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing demand for industrial gases from dynamic manufacturing sectors- Increased demand from healthcare and medical applicationsRESTRAINTS- High cost associated with fabrication and operationOPPORTUNITIES- Transition to green technologies- Demand for industrial oxygen in Africa- Emerging applications in glass, gasification, and gas-to-liquid industriesCHALLENGES- Development of affordable and more effective technologies- Hazards associated with cryogenic air separation technology

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.1 PATENT ANALYSISMETHODOLOGYPATENT PUBLICATION TRENDSINSIGHTJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS- Major patents

-

6.2 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.3 KEY CONFERENCES AND EVENTS, 2023

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 VALUE CHAIN ANALYSIS

-

6.6 CASE STUDY ANALYSISINDUSTRIAL- Hangzhou Hangyang Co., Ltd. helps Zhongxin Nenghua Technology Co., Ltd. to design deep cryogenic separation device- Linde plc agrees to supply nitrogen, oxygen, and compressed air to BorsodChem Zrt.- Air Products and Chemicals, Inc. to construct coal-to-methanol production facility in IndonesiaCHEMICAL- Air Liquide to provide gaseous oxygen, nitrogen, and syngas to Eastman Chemical Company- Air Products and Chemicals, Inc. announces buy-back of ASUs from Shanxi Jinmei Huayu Coal Chemical Co., Ltd.FOOD & BEVERAGES- Linde plc supplies nitrogen and oxygen for MEGlobal’s new ethylene glycol plantGLASS & CERAMICS- Messer Group GmbH to construct air separation unit for Saint-Gobain Isover AGELECTRONICS & SEMICONDUCTOR- Linde plc to provide high purity on-site plants in Taiwan- Linde plc sets up high purity nitrogen generator for leading Chinese semiconductor manufacturer- Linde plc provides new air separation unit for Samsung- Air Products and Chemicals, Inc. sets up first cryogenic nitrogen separation plant in MalaysiaHEALTHCARE- Air Liquide China builds ASU to meet increasing demand for medical gases

-

6.7 B2B MARKETING CHANNELS – COMPARATIVE ANALYSISCASE STUDY – LINDE PLC USES MULTIPLE MARKETING CHANNELS TO INCREASE FOOTPRINT

- 6.8 PARTNERSHIPS

-

6.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

6.10 ECOSYSTEM

-

6.11 TECHNOLOGY ANALYSISBASIC AIR SEPARATION PLANT COMPONENTS- Main Air Compressor (MAC)- Pre-purification Unit (PPU)- Cold box- ExpanderCRYOGENIC DISTILLATIONPRESSURE SWING ADSORPTIONMEMBRANE SEPARATION

- 6.12 IMPORT & EXPORT TRADE ANALYSIS

-

6.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 7.1 INTRODUCTION

-

7.2 CRYOGENICINCREASING DEMAND FOR GASES FOR INDUSTRIAL ACTIVITIES TO DRIVE SEGMENT

-

7.3 NON-CRYOGENICCOST-EFFECTIVENESS AND EASY START-UP FEATURES TO FUEL DEMAND- Pressure swing adsorption (PSA)- Vacuum pressure swing adsorption (VPSA)- Membrane separation

- 8.1 INTRODUCTION

-

8.2 NITROGENUSE IN BLANKETING AND INERTING ACROSS MULTIPLE END-USE INDUSTRIES TO BOOST DEMAND

-

8.3 OXYGENRISING NEED FOR MEDICAL OXYGEN TO FUEL SEGMENT GROWTH

-

8.4 ARGONWIDE USAGE IN INDUSTRIAL AND ELECTRONICS APPLICATIONS TO DRIVE DEMAND

- 8.5 OTHERS

- 9.1 INTRODUCTION

-

9.2 IRON & STEELHIGH CONSUMPTION OF GAS IN PRODUCTION PROCESS TO DRIVE MARKET

-

9.3 OIL & GASUSE OF INDUSTRIAL GASES FOR DOWNSTREAM AND UPSTREAM PROCESSES TO BOOST SEGMENT GROWTH- Upstream- Downstream

-

9.4 CHEMICALRESURGENCE IN GLOBAL CHEMICAL INDUSTRY TO DRIVE DEMAND

-

9.5 HEALTHCAREINCREASING CONSUMPTION OF MEDICAL GASES TO DRIVE SEGMENT

- 9.6 OTHERS

- 10.1 INTRODUCTION

-

10.2 ASIA PACIFICASIA PACIFIC: IMPACT OF RECESSIONCHINA- Increasing steel production to spur market growthJAPAN- Demand for industrial gases from manufacturing sector to drive marketINDIA- Growing metal and construction industries to fuel market growthSOUTH KOREA- Increasing use of electronic appliances to drive demandAUSTRALIA & NEW ZEALAND- Demand from iron & steel and healthcare industries to contribute to market growthREST OF ASIA PACIFIC

-

10.3 EUROPEEUROPE: IMPACT OF RECESSIONGERMANY- Rising demand from manufacturing industry to boost marketFRANCE- Chemical and food & beverage industries to drive demandUK- Demand for medical gases from healthcare industry to drive marketITALY- Increasing demand from chemical industry to boost marketSPAIN- Increasing industrial activities to drive demandREST OF EUROPE

-

10.4 NORTH AMERICANORTH AMERICA: IMPACT OF RECESSIONUS- Increasing consumption of industrial gases to drive marketCANADA- Expansion of oil & gas industry to fuel market growthMEXICO- Rising demand from iron & steel industry to drive market

-

10.5 MIDDLE EASTMIDDLE EAST: IMPACT OF RECESSIONUAE- Growing petrochemical infrastructure to fuel marketSAUDI ARABIA- Growing demand for industrial gases to drive marketQATAR- Demand from manufacturing and healthcare industries to boost marketKUWAIT- Use of air separation plants in refineries and petroleum companies to spur demandOMAN- Demand from oil & gas and chemical industries to fuel marketREST OF MIDDLE EAST

-

10.6 SOUTH AMERICASOUTH AMERICA: IMPACT OF RECESSIONBRAZIL- Increasing industrialization to spur market growthARGENTINA- Growth of oil & gas industry to boost demand for nitrogen and oxygenCHILE- Strong economic landscape to drive demandREST OF SOUTH AMERICA

-

10.7 AFRICAAFRICA: IMPACT OF RECESSIONSOUTH AFRICA- Large customer base to drive marketREST OF AFRICA

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

-

11.3 REVENUE ANALYSISREVENUE ANALYSIS OF TOP PLAYERS IN AIR SEPARATION PLANT MARKET

- 11.4 MARKET SHARE ANALYSIS: AIR SEPARATION PLANT MARKET (2022)

- 11.5 COMPANY FOOTPRINT ANALYSIS

-

11.6 COMPANY EVALUATION QUADRANT, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

11.7 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) MATRIX, 2022PROGRESSIVE COMPANIESDYNAMIC COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKS

- 11.8 COMPETITIVE BENCHMARKING

- 11.9 COMPETITIVE SCENARIO

-

12.1 KEY PLAYERSLINDE PLC- Business overview- Products offered- Deals- Other developments- MnM viewAIR LIQUIDE SA- Business overview- Products offered- Deals- Other developments- MnM viewAIR PRODUCTS AND CHEMICALS, INC.- Business overview- Products offered- Deals- Other developments- MnM viewMESSER GROUP GMBH- Business overview- Products offered- Deals- Other developments- MnM viewTAIYO NIPPON SANSO CORPORATION- Business overview- Products offered- Deals- Other developments- MnM viewDAESUNG INDUSTRIAL CO., LTD.- Business overview- Products offered- Other developmentsAIR WATER INC.- Business overview- Products offered- DealsENERFLEX LTD.- Business overview- Products offered- DealsYINGDE GASES GROUP CO., LTD.- Business overview- Products offered- Deals- Other developmentsINOX AIR PRODUCTS PRIVATE LIMITED- Business overview- Products offered- Deals- Other developmentsHANGZHOU HANGYANG CO., LTD.- Business overview- Products offered- Deals

-

12.2 SME PROFILESSIAD MACCHINE IMPIANTI S.P.A.- Business overview- Products offeredUNIVERSAL INDUSTRIAL GASES, INC.- Business overview- Products offeredNIKKISO COSMODYNE, LLC- Business overview- Products offeredRANCH CRYOGENICS, INC- Business overview- Products offeredTECHNEX LIMITED- Business overview- Products offeredPHOENIX EQUIPMENT CORPORATION- Business overview- Products offeredAMCS CORPORATION- Business overview- Products offeredUNIVERSAL ING. L. & A. BOSCHI PLANTS PRIVATE LIMITED- Business overview- Products offeredCHINA NATIONAL AIR SEPARATION PLANT CORPORATION- Business overview- Products offeredGAS ENGINEERING, LLC- Business overview- Products offeredCRYOTEC ANLAGENBAU GMBH- Business overview- Products offeredNOVAIR SAS- Business overview- Products offeredBDMGASPLANTS- Business overview- Products offeredOXYPLANTS INDIA PVT LTD- Business overview- Products offered

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 AIR SEPARATION PLANT MARKET, BY REGION: INCLUSIONS & EXCLUSIONS

- TABLE 2 AIR SEPARATION PLANT MARKET, BY GAS: INCLUSIONS & EXCLUSIONS

- TABLE 3 AIR SEPARATION PLANT MARKET, BY PROCESS: INCLUSIONS & EXCLUSIONS

- TABLE 4 AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY: INCLUSIONS & EXCLUSIONS

- TABLE 5 AIR SEPARATION PLANT MARKET SNAPSHOT, 2023 & 2028

- TABLE 6 PORTER’S FIVE FORCES ANALYSIS: AIR SEPARATION PLANT MARKET

- TABLE 7 STANDARD DESIGN RECOMMENDATIONS FOR EQUIPMENT USED IN CRYOGENIC PROCESSES

- TABLE 8 AIR SEPARATION PLANT MARKET: KEY CONFERENCES AND EVENTS

- TABLE 9 COMPANIES INVOLVED IN SUPPLY CHAIN OF AIR SEPARATION PLANT MARKET

- TABLE 10 TYPES OF DISTRIBUTION CHANNELS

- TABLE 11 PARTNER COMPANIES OF MAJOR AIR SEPARATION PLANT MANUFACTURERS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE END-USE INDUSTRIES (%)

- TABLE 13 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 14 AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 15 AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 16 CRYOGENIC: AIR SEPARATION PLANT MARKET, BY REGION, 2016–2022 (USD MILLION)

- TABLE 17 CRYOGENIC: AIR SEPARATION PLANT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 NON-CRYOGENIC: AIR SEPARATION PLANT MARKET, BY REGION, 2016–2022 (USD MILLION)

- TABLE 19 NON-CRYOGENIC: AIR SEPARATION PLANT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 AIR SEPARATION PLANT MARKET, BY GAS, 2016–2022 (USD MILLION)

- TABLE 21 AIR SEPARATION PLANT MARKET, BY GAS, 2023–2028 (USD MILLION)

- TABLE 22 NITROGEN: AIR SEPARATION PLANT MARKET, BY REGION, 2016–2022 (USD MILLION)

- TABLE 23 NITROGEN: AIR SEPARATION PLANT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 OXYGEN: AIR SEPARATION PLANT MARKET, BY REGION, 2016–2022 (USD MILLION)

- TABLE 25 OXYGEN: AIR SEPARATION PLANT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 ARGON: AIR SEPARATION PLANT MARKET, BY REGION, 2016–2022 (USD MILLION)

- TABLE 27 ARGON: AIR SEPARATION PLANT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 28 OTHERS: AIR SEPARATION PLANT MARKET, BY REGION, 2016–2022 (USD MILLION)

- TABLE 29 OTHERS: AIR SEPARATION PLANT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 31 AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 32 IRON & STEEL: AIR SEPARATION PLANT MARKET, BY REGION, 2016–2022 (USD MILLION)

- TABLE 33 IRON & STEEL: AIR SEPARATION PLANT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 OIL & GAS: AIR SEPARATION PLANT MARKET, BY REGION, 2016–2022 (USD MILLION)

- TABLE 35 OIL & GAS: AIR SEPARATION PLANT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 CHEMICAL: AIR SEPARATION PLANT MARKET, BY REGION, 2016–2022 (USD MILLION)

- TABLE 37 CHEMICAL: AIR SEPARATION PLANT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 HEALTHCARE: AIR SEPARATION PLANT MARKET, BY REGION, 2016–2022 (USD MILLION)

- TABLE 39 HEALTHCARE: AIR SEPARATION PLANT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 OTHER END-USE INDUSTRIES: AIR SEPARATION PLANT MARKET, BY REGION, 2016–2022 (USD MILLION)

- TABLE 41 OTHER END-USE INDUSTRIES: AIR SEPARATION PLANT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 AIR SEPARATION PLANT MARKET, BY REGION, 2016–2022 (USD MILLION)

- TABLE 43 AIR SEPARATION PLANT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 ASIA PACIFIC: AIR SEPARATION PLANT MARKET, BY COUNTRY, 2016–2022 (USD MILLION)

- TABLE 45 ASIA PACIFIC: AIR SEPARATION PLANT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 46 ASIA PACIFIC: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 47 ASIA PACIFIC: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 49 ASIA PACIFIC: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: AIR SEPARATION PLANT MARKET, BY GAS, 2016–2022 (USD MILLION)

- TABLE 51 ASIA PACIFIC: AIR SEPARATION PLANT MARKET, BY GAS, 2023–2028 (USD MILLION)

- TABLE 52 CHINA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 53 CHINA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 54 CHINA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 55 CHINA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 56 JAPAN: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 57 JAPAN: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 58 JAPAN: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 59 JAPAN: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 60 INDIA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 61 INDIA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 62 INDIA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 63 INDIA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 64 SOUTH KOREA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 65 SOUTH KOREA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 66 SOUTH KOREA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 67 SOUTH KOREA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 68 AUSTRALIA & NEW ZEALAND: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 69 AUSTRALIA & NEW ZEALAND: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 70 AUSTRALIA & NEW ZEALAND: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 71 AUSTRALIA & NEW ZEALAND: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 72 REST OF ASIA PACIFIC: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 73 REST OF ASIA PACIFIC: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 74 REST OF ASIA PACIFIC: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 75 REST OF ASIA PACIFIC: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 76 EUROPE: AIR SEPARATION PLANT MARKET, BY COUNTRY, 2016–2022 (USD MILLION)

- TABLE 77 EUROPE: AIR SEPARATION PLANT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 78 EUROPE: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 79 EUROPE: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 80 EUROPE: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 81 EUROPE: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 82 EUROPE: AIR SEPARATION PLANT MARKET, BY GAS, 2016–2022 (USD MILLION)

- TABLE 83 EUROPE: AIR SEPARATION PLANT MARKET, BY GAS, 2023–2028 (USD MILLION)

- TABLE 84 GERMANY: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 85 GERMANY: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 86 GERMANY: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 87 GERMANY: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 88 FRANCE: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 89 FRANCE: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 90 FRANCE: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 91 FRANCE: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 92 UK: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 93 UK: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 94 UK: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 95 UK: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 96 ITALY: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 97 ITALY: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 98 ITALY: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 99 ITALY: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 100 SPAIN: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 101 SPAIN: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 102 SPAIN: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 103 SPAIN: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 104 REST OF EUROPE: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 105 REST OF EUROPE: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 106 REST OF EUROPE: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 107 REST OF EUROPE: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 108 NORTH AMERICA: AIR SEPARATION PLANT MARKET, BY COUNTRY, 2016–2022 (USD MILLION)

- TABLE 109 NORTH AMERICA: AIR SEPARATION PLANT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 110 NORTH AMERICA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 111 NORTH AMERICA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 112 NORTH AMERICA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 113 NORTH AMERICA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 114 NORTH AMERICA: AIR SEPARATION PLANT MARKET, BY GAS, 2016–2022 (USD MILLION)

- TABLE 115 NORTH AMERICA: AIR SEPARATION PLANT MARKET, BY GAS, 2023–2028 (USD MILLION)

- TABLE 116 US: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 117 US: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 118 US: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 119 US: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 120 CANADA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 121 CANADA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 122 CANADA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 123 CANADA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 124 MEXICO: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 125 MEXICO: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 126 MEXICO: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 127 MEXICO: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 128 MIDDLE EAST: AIR SEPARATION PLANT MARKET, BY COUNTRY, 2016–2022 (USD MILLION)

- TABLE 129 MIDDLE EAST: AIR SEPARATION PLANT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 130 MIDDLE EAST: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 131 MIDDLE EAST: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 132 MIDDLE EAST: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 133 MIDDLE EAST: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 134 MIDDLE EAST: AIR SEPARATION PLANT MARKET, BY GAS, 2016–2022 (USD MILLION)

- TABLE 135 MIDDLE EAST: AIR SEPARATION PLANT MARKET, BY GAS, 2023–2028 (USD MILLION)

- TABLE 136 UAE: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 137 UAE: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 138 UAE: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 139 UAE: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 140 SAUDI ARABIA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 141 SAUDI ARABIA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 142 SAUDI ARABIA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 143 SAUDI ARABIA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 144 QATAR: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 145 QATAR: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 146 QATAR: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 147 QATAR: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 148 KUWAIT: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 149 KUWAIT: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 150 KUWAIT: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 151 KUWAIT: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 152 OMAN: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 153 OMAN: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 154 OMAN: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 155 OMAN: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 156 REST OF MIDDLE EAST: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 157 REST OF MIDDLE EAST: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 158 REST OF MIDDLE EAST: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 159 REST OF MIDDLE EAST: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 160 SOUTH AMERICA: AIR SEPARATION PLANT MARKET, BY COUNTRY, 2016–2022 (USD MILLION)

- TABLE 161 SOUTH AMERICA: AIR SEPARATION PLANT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 162 SOUTH AMERICA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 163 SOUTH AMERICA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 164 SOUTH AMERICA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 165 SOUTH AMERICA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 166 SOUTH AMERICA: AIR SEPARATION PLANT MARKET, BY GAS, 2016–2022 (USD MILLION)

- TABLE 167 SOUTH AMERICA: AIR SEPARATION PLANT MARKET, BY GAS, 2023–2028 (USD MILLION)

- TABLE 168 BRAZIL: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 169 BRAZIL: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 170 BRAZIL: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 171 BRAZIL: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 172 ARGENTINA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 173 ARGENTINA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 174 ARGENTINA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 175 ARGENTINA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 176 CHILE: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 177 CHILE: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 178 CHILE: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 179 CHILE: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 180 REST OF SOUTH AMERICA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 181 REST OF SOUTH AMERICA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 182 REST OF SOUTH AMERICA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 183 REST OF SOUTH AMERICA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 184 AFRICA: AIR SEPARATION PLANT MARKET, BY COUNTRY, 2016–2022 (USD MILLION)

- TABLE 185 AFRICA: AIR SEPARATION PLANT MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 186 AFRICA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 187 AFRICA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 188 AFRICA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 189 AFRICA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 190 AFRICA: AIR SEPARATION PLANT MARKET, BY GAS, 2016–2022 (USD MILLION)

- TABLE 191 AFRICA: AIR SEPARATION PLANT MARKET, BY GAS, 2023–2028 (USD MILLION)

- TABLE 192 SOUTH AFRICA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 193 SOUTH AFRICA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 194 SOUTH AFRICA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 195 SOUTH AFRICA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 196 REST OF AFRICA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2016–2022 (USD MILLION)

- TABLE 197 REST OF AFRICA: AIR SEPARATION PLANT MARKET, BY PROCESS, 2023–2028 (USD MILLION)

- TABLE 198 REST OF AFRICA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2016–2022 (USD MILLION)

- TABLE 199 REST OF AFRICA: AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 200 AIR SEPARATION PLANT MANUFACTURERS PURSUE AGREEMENT AND JOINT VENTURE STRATEGIES

- TABLE 201 AIR SEPARATION PLANT MARKET: DEGREE OF COMPETITION

- TABLE 202 COMPANY INDUSTRY FOOTPRINT

- TABLE 203 COMPANY PROCESS FOOTPRINT

- TABLE 204 COMPANY REGION FOOTPRINT

- TABLE 205 AIR SEPARATION PLANT MARKET: KEY STARTUPS/SMES

- TABLE 206 AIR SEPARATION PLANT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 207 AIR SEPARATION PLANT MARKET: DEALS, 2018-2023

- TABLE 208 AIR SEPARATION PLANT MARKET: PRODUCT LAUNCHES, 2018-2023

- TABLE 209 AIR SEPARATION PLANT MARKET: OTHER DEVELOPMENTS, 2018-2023

- TABLE 210 LINDE PLC: COMPANY SNAPSHOT

- TABLE 211 AIR LIQUIDE SA: COMPANY SNAPSHOT

- TABLE 212 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT

- TABLE 213 MESSER GROUP GMBH: COMPANY SNAPSHOT

- TABLE 214 TAIYO NIPPON SANSO CORPORATION: COMPANY SNAPSHOT

- TABLE 215 DAESUNG INDUSTRIAL CO., LTD.: COMPANY SNAPSHOT

- TABLE 216 AIR WATER, INC.: COMPANY SNAPSHOT

- TABLE 217 ENERFLEX LTD.: COMPANY SNAPSHOT

- TABLE 218 YINGDE GASES GROUP CO., LTD.: COMPANY SNAPSHOT

- TABLE 219 INOX AIR PRODUCTS PRIVATE LIMITED: COMPANY SNAPSHOT

- TABLE 220 HANGZHOU HANGYANG CO., LTD.: COMPANY SNAPSHOT

- TABLE 221 SIAD MACCHINE IMPIANTI S.P.A.: COMPANY SNAPSHOT

- TABLE 222 UNIVERSAL INDUSTRIAL GASES, INC.: COMPANY SNAPSHOT

- TABLE 223 NIKKISO COSMODYNE, LLC: COMPANY SNAPSHOT

- TABLE 224 RANCH CRYOGENICS, INC: COMPANY SNAPSHOT

- TABLE 225 TECHNEX LIMITED: COMPANY SNAPSHOT

- TABLE 226 PHOENIX EQUIPMENT CORPORATION: COMPANY SNAPSHOT

- TABLE 227 AMCS CORPORATION: COMPANY SNAPSHOT

- TABLE 228 UNIVERSAL ING. L. & A. BOSCHI PLANTS PRIVATE LIMITED: COMPANY SNAPSHOT

- TABLE 229 CHINA NATIONAL AIR SEPARATION PLANT CORPORATION: COMPANY SNAPSHOT

- TABLE 230 GAS ENGINEERING, LLC: COMPANY SNAPSHOT

- TABLE 231 CRYOTEC ANLAGENBAU GMBH: COMPANY SNAPSHOT

- TABLE 232 NOVAIR SAS: COMPANY SNAPSHOT

- TABLE 233 BDMGASPLANTS: COMPANY SNAPSHOT

- TABLE 234 OXYPLANTS INDIA PVT LTD: COMPANY SNAPSHOT

- FIGURE 1 AIR SEPARATION PLANT MARKET: SEGMENTATION

- FIGURE 2 AIR SEPARATION PLANT MARKET: RESEARCH DESIGN

- FIGURE 3 DATA TRIANGULATION METHOD

- FIGURE 4 CRYOGENIC SEGMENT ACCOUNTED FOR LARGEST SHARE OF AIR SEPARATION PLANT MARKET IN 2022

- FIGURE 5 NITROGEN SEGMENT DOMINATED AIR SEPARATION PLANT MARKET IN 2022

- FIGURE 6 IRON & STEEL END-USE INDUSTRY COMMANDED MAJOR SHARE OF AIR SEPARATION PLANT MARKET IN 2022

- FIGURE 7 ASIA PACIFIC TO RECORD HIGHEST GROWTH IN AIR SEPARATION PLANT MARKET FROM 2023 TO 2028

- FIGURE 8 NEED FOR INDUSTRIAL GASES AND MEDICAL OXYGEN TO DRIVE MARKET GROWTH

- FIGURE 9 CHINA ESTIMATED TO BE LARGEST AIR SEPARATION PLANT MARKET IN 2022

- FIGURE 10 ASIA PACIFIC TO OFFER LUCRATIVE GROWTH OPPORTUNITIES DURING FORECAST PERIOD

- FIGURE 11 GAS SUPPLY MODES

- FIGURE 12 AIR SEPARATION PLANT MARKET DYNAMICS

- FIGURE 13 GLOBAL STEEL PRODUCTION, 2016–2021

- FIGURE 14 GLOBAL USERS OF CONSUMER ELECTRONIC PRODUCTS, 2016–2021

- FIGURE 15 PORTER’S FIVE FORCES ANALYSIS: AIR SEPARATION PLANT MARKET

- FIGURE 16 NUMBER OF PATENTS YEAR-WISE (2014–2022)

- FIGURE 17 CHINA ACCOUNTED FOR HIGHEST PATENT COUNT DURING 2014-2022

- FIGURE 18 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 19 SUPPLY CHAIN ANALYSIS OF AIR SEPARATION PLANT MARKET

- FIGURE 20 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDED DURING MANUFACTURING PROCESS

- FIGURE 21 MARKETING CHANNELS USED BY COMPANIES IN AIR SEPARATION PLANT MARKET

- FIGURE 22 GLOBAL PARTNER PRESENCE IN AIR SEPARATION PLANT MARKET

- FIGURE 23 REVENUE SHIFT & NEW REVENUE POCKETS FOR AIR SEPARATION PLANT MANUFACTURERS

- FIGURE 24 ECOSYSTEM MAP FOR AIR SEPARATION PLANT MARKET

- FIGURE 25 GLOBAL TRADE ROUTES FOR AIR SEPARATION PLANTS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF TOP THREE END-USE INDUSTRIES

- FIGURE 27 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 28 AIR SEPARATION PLANT MARKET, BY PROCESS, 2023 & 2028 (USD MILLION)

- FIGURE 29 AIR SEPARATION PLANT MARKET, BY GAS, 2023 & 2028 (USD MILLION)

- FIGURE 30 AIR SEPARATION PLANT MARKET, BY END-USE INDUSTRY, 2023 & 2028 (USD MILLION)

- FIGURE 31 GEOGRAPHIC SNAPSHOT: MARKET IN CHINA PROJECTED TO RECORD HIGHEST CAGR (2023–2028)

- FIGURE 32 ASIA PACIFIC: AIR SEPARATION PLANT MARKET SNAPSHOT

- FIGURE 33 EUROPE: AIR SEPARATION PLANT MARKET SNAPSHOT

- FIGURE 34 NORTH AMERICA: AIR SEPARATION PLANT MARKET SNAPSHOT

- FIGURE 35 TOP PLAYERS – REVENUE ANALYSIS (2018-2022)

- FIGURE 36 RANKING OF TOP 5 PLAYERS IN AIR SEPARATION PLANT MARKET

- FIGURE 37 LINDE PLC HELD LARGEST MARKET SHARE IN 2022

- FIGURE 38 AIR SEPARATION PLANT MARKET: COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 39 AIR SEPARATION PLANT MARKET: SME COMPETITIVE LEADERSHIP MAPPING, 2022

- FIGURE 40 LINDE PLC: COMPANY SNAPSHOT

- FIGURE 41 AIR LIQUIDE SA: COMPANY SNAPSHOT

- FIGURE 42 AIR PRODUCTS AND CHEMICALS, INC.: COMPANY SNAPSHOT

- FIGURE 43 MESSER GROUP GMBH: COMPANY SNAPSHOT

- FIGURE 44 TAIYO NIPPON SANSO CORPORATION: COMPANY SNAPSHOT

- FIGURE 45 DAESUNG INDUSTRIAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 46 AIR WATER INC.: COMPANY SNAPSHOT

- FIGURE 47 ENERFLEX LTD.: COMPANY SNAPSHOT

The study involved four major activities in estimating the current market size of air separation plants. Exhaustive secondary research was done to collect information on the market, peer, and parent markets. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of air separation plants through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on the revenues of critical vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

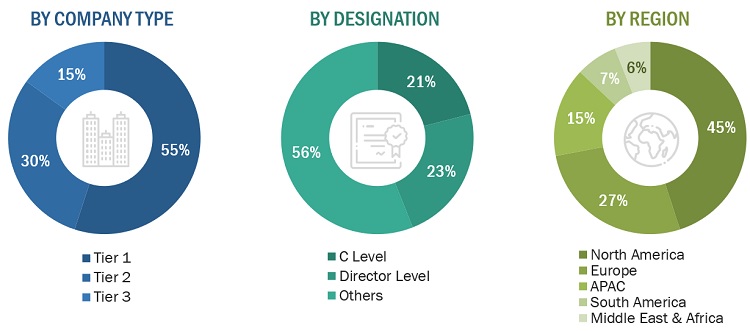

The air separation plant market comprises several stakeholders, such as manufacturers, suppliers, associations, and regulatory organizations, in the supply chain. The demand side of this market is characterized by the development of various end-use industries such as iron & steel, oil & gas, chemical, and healthcare, among others. Advancements in technology illustrate the supply side. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

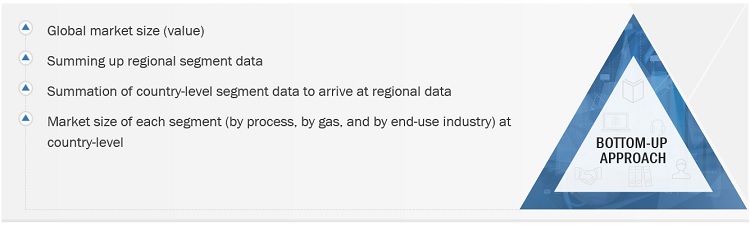

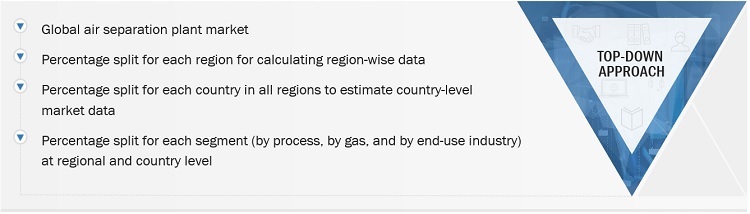

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the air separation plant market. These methods were also used extensively to determine the extent of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players in the industry and market were identified through extensive secondary research.

- The supply chain of the industry and the market size in terms of value were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes studying the key market players’ reports, reviews, newsletters, and extensive interviews for opinions from leaders, such as directors and marketing executives.

Global Air separation plant Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Air separation plant Market Size: Top-Down Approach

Data Triangulation

The market was split into several segments and sub-segments after arriving at the overall market size using the market size estimation processes as explained above. Data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides. It was then verified through primary interviews.

Market Definition

According to the Compressed Gas Association (CGA), air separation plants, or air separation units (ASUs), are industrial equipment/ facilities that produce one or both the most common atmospheric industrial gases, namely, nitrogen and oxygen, and can co-produce liquid products. Some air separation plants also have compressed dry air, argon, ultra-high purity (UHP) oxygen, or, occasionally, rare gases such as neon, krypton, and xenon. Air separation plant products are delivered to customers as gases through local pipelines or regional networks. They are also offered as liquids in bulk liquid trailers or compressed gases in high-pressure cylinders.

Key Stakeholder

- Carbon Steel, Aluminium, and Copper Suppliers

- Instrumentation Suppliers

- Industrial Gas Suppliers

- Air Separation Plant Component Suppliers

- European Industrial Gas Association (EIGA), Compressed Gas Association (CGA), Asia Industrial Gas Association (AIGA), American Gas Association (AGA), and Gas Industries Association (GIA)

- Market Research and Consulting Firms

- NGOs, Governments, Investment Banks, Venture Capitalists, and Private Equity Firms

Report Objectives:

- To define, describe, and forecast the air separation plant market based on the process, gas, end-use industry, and region.

- To provide detailed information regarding the key factors influencing the market growth, such as drivers, restraints, opportunities, and industry-specific challenges

- To strategically analyze the market concerning individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and draw a competitive landscape of the market.

- To forecast the market size in terms of value for central regions (along with countries), namely, Asia Pacific, North America, Europe, the Middle East & Africa, and South America

- To strategically profile critical companies and comprehensively evaluate their market share and core competencies.

- To analyze competitive developments, such as acquisitions, agreements, contracts, divestments, expansions, investments, joint ventures, mergers, and new product launches, in the market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the air separation plant market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Air Separation Plant Market