Agricultural Packaging Market by Material (Plastic, Metal, Paper & Paperboard, Composites), Product (Pouches & Bags, Drums, Bottles & Cans), Barrier Strength (Low, Medium, High), Application, and Region - Global Forecast to 2023

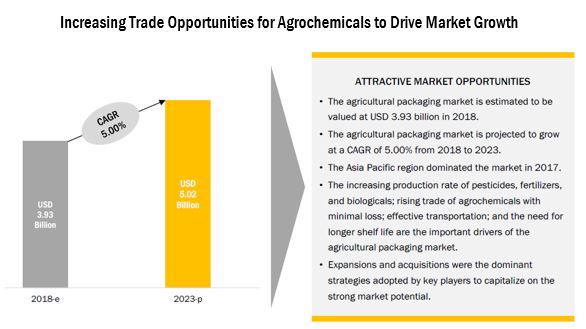

[171 Pages Report] The agricultural packaging market was valued at USD 3.74 Billion in 2017, and is projected to reach USD 5.02 Billion by 2023, at a CAGR of 5.00% during the forecast period.

The years considered for the study are as follows:

- Base year 2017

- Estimated year 2018

- Projected year 2023

- Forecast period 2018 to 2023

For More details on this research, Request Free Sample Report

The objectives of the report

- Determining and projecting the size of the agricultural packaging market, with respect to material, product, application, barrier strength, and regional markets, over a five-year period ranging from 2018 to 2023.

- Identifying attractive opportunities in the market by determining the largest and fastest-growing segments across regions.

- Analyzing the demand-side factors based on the impact of macro and microeconomic factors on the market and shifts in demand patterns across different subsegments and regions.

Research Methodology:

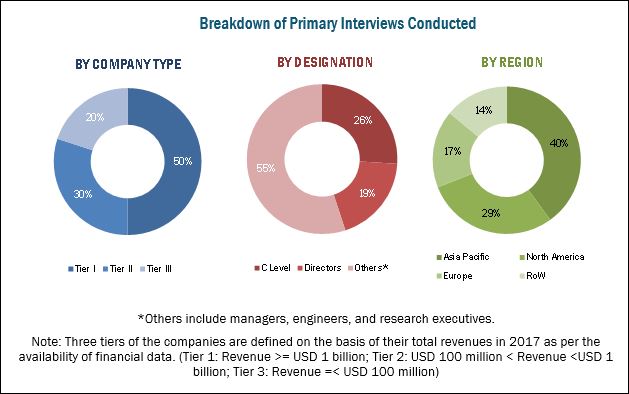

- Major regions were identified, along with countries contributing the maximum share

- Secondary research was conducted to obtain the value of agricultural packaging market for regions such as North America, Europe, Asia Pacific, South America, and RoW

- The key players have been identified through secondary sources such as the Bloomberg, Businessweek, Factiva, agricultural magazines, and companies annual reports while their market share in the respective regions has been determined through both primary and secondary research. The research methodology includes the study of annual and financial reports of top market players, as well as interviews with industry experts (such as CEOs, VPs, directors, and marketing executives) for key insights (both quantitative and qualitative) for the agricultural packaging market.

To know about the assumptions considered for the study, download the pdf brochure

The various contributors involved in the value chain of the agricultural packaging market include raw material suppliers, R&D institutes, agricultural packaging manufacturing companies such as Amcor Limited (Australia), Bemis Company, Inc. (US), Greif, Inc. (US), Sonoco Products Company (US), and Mondi Group (South Africa), agrochemical manufacturers, and government bodies & regulatory associations such as the US Department of Agriculture (USDA) and Food and Agricultural Organization (FAO).

Target Audience

The stakeholders for the report are as follows:

- Key manufacturers of pesticides, fertilizers, and other crop inputs

- Key companies in the agricultural biologicals market

- Traders, distributors, and suppliers in the agricultural pesticides market

- Key packaging manufacturers for the agricultural industry

- Traders and suppliers of raw materials to the packaging industry

- Concerned government authorities, commercial R&D institutions, and other regulatory bodies

Scope of the Report:

This research report categorizes the agricultural packaging market based on material, product, application, barrier strength, and region.

Based on Material, the market has been segmented as follows:

- Plastic

- Flexible plastic

- Rigid plastic

- Metal

- Paper & paperboards

- Composite materials

- Others (glass, nanomaterials, and jute)

Based on Product, the market has been segmented as follows:

- Pouches & bags

- Drums

- Bottles & cans

- Others (sacks, tubes, and jars)

Based on Application, the market has been segmented as follows:

- Chemical pesticides

- Chemical fertilizers

- Biologicals

Based on Barrier Strength, the market has been segmented as follows:

- Low

- Medium

- High

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (South Africa, Egypt and other countries in Middle East and Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the companys specific scientific needs.

The following customization options are available for the report:

Product Analysis:

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe market for agricultural packaging into the Netherlands, Ukraine, Poland, and Belgium

- Further breakdown of the Rest of Asia Pacific market for agricultural packaging into Indonesia, Vietnam, and the Philippines

- Further breakdown of the Rest of South America market for agricultural packaging into Colombia, Uruguay, and Peru

- Further breakdown of the Others in RoW market for agricultural packaging into Israel, Turkey, Nigeria, and the UAE

Company Information

- Detailed analyses and profiling of additional market players (up to five)

The agricultural packaging market is estimated at USD 3.93 Billion in 2018, and is projected to reach USD 5.02 Billion by 2023, at a CAGR of 5.00%. The agricultural benefits associated with these packaging solutions are the major factors contributing to the growth of this market, globally.

For More details on this research, Request Free Sample Report

The agricultural packaging market is a relatively small sector of the industrial packaging market; significant evolution has been observed with regard to the packaging of chemical pesticides and fertilizers. Regulatory guidelines and R&D are the major factors that have been fueling the growth of this market. Application of PET and HDPE plastics for the confinement of pesticides revolutionized the agrochemical packaging industry. Increasing need for effective storage and transport of pesticides and fertilizers and rising demand for longer shelf life of these products are the driving factors for the steady growth of this market.

Chemical pesticides and fertilizers are the major applications of agricultural packaging targeted by companies. Owing to the increasing ban on chemical pesticides in major countries, there is immense scope and an increasing need for the development of agricultural packaging for fertilizers. The reduced development cost and time associated with packaging solutions for these agrochemicals, high demand for pest resistance across the globe, and advent of biodegradable packaging solutions in the market are propelling the market growth.

The agricultural packaging market, based on product, has been segmented into pouches & bags, bottles & cans, drums, and others which include sacks, tubes, and jars. The application of pouches & bags in agrochemical packaging has increased in terms of dry/solid formulations of fertilizers and pesticides as these provide higher safety against transportation losses in a sustainable manner. Plastic materials, such as polyethene, are easily available; hence, they are highly preferred on a wide scale by agrochemical manufacturers owing to their low cost. The application of pouches & bags for packaging in agriculture is expected to increase with the rise in the number of solid/dry formulation agrochemical product launches by major players.

Plastics are the mostly widely adopted packaging material for pesticides and fertilizers in either rigid or flexible form. The factors supporting the increasing adoption of plastic in this market are that they are lightweight, strong, and economical to manufacture. It is for these reasons that they are widely used in packaging when compared to paperboard, metal, and glass packaging materials. The market for plastic in agricultural packaging is thus estimated to dominate the global market in 2018.

The agricultural packaging market, in terms of barrier strength, was dominated by the medium-barrier strength materials. These materials are extensively preferred by end-use farmers and the agrochemical manufacturers, as they are a perfect balance between cost-effective packaging solutions and mid-level barrier properties, which are the best blend for the packaging of agrochemicals. Medium-barrier solutions deliver moderate levels of moisture barrier, heat resistance, gas permeability, and oxygen barrier as well as easy handling and molding properties.

Asia Pacific is estimated to account for the largest market share in 2018, followed by North America in the agricultural packaging market over the next five years. The growing trade opportunities of agrochemicals across the globe, especially in countries such as China, India, the US, Canada are the major factors contributing to the high growth opportunities in these regions. Agricultural packaging for fertilizers is expected to boost the growth rate in Europe as the growth in the region has been highly hampered by the growing regulations on chemical pesticide usage and maximum residue limit.

The major factors restraining the growth of the agricultural packaging market are volatility observed in raw material prices and recycling of used and discarded packaging materials. Plastics, for instance, are majorly prepared from petroleum and crude oil. The price fluctuations of oil prices is so high that the industry faces a major challenge in balancing the prices of the packaging products. Recycling of packaging waste has been a challenge across the industrial packaging industry, and more for agrochemical packaging due to the confinement of hazardous chemicals inside them.

The global market for agricultural packaging is dominated by large players such as Amcor Limited (Australia), Bemis Company, Inc. (US), Sonoco Products Company (US), Greif Inc. (US), and Mondi Group (South Africa). Some emerging players in the agricultural packaging market include Packaging Corporation of America (US), NNZ Group (Netherlands), LC Packaging International BV (Netherlands), Silgan Holdings, Inc. (US), Proampac LLC (US), Flex-Pack (US), Purity Flexpack Limited (India), Epac Holdings LLC (US), Kenvos Biotech Co., Ltd. (China), and Parakh Group (India).

Frequently Asked Questions (FAQ):

What is the leading application in the agricultural packaging market?

The chemical pesticides segment was the highest revenue contributor to the market, with USD 1,697.5 million in 2017, and is estimated to reach USD 2,163.9 million by 2023, with a CAGR of 4.2%. The chemical fertilizers segment is estimated to reach USD 2,314.4 million by 2023, at a significant CAGR of 5.9% during the forecast period.

What is the estimated industry size of agricultural packaging?

The global agricultural packaging market was valued at USD 3,747.1 million in 2017, and is projected to reach USD 5,017.2 million by 2023, registering a CAGR of 5.0% from 2018 to 2023.

What is the leading material of agricultural packaging market?

The plastic segment was the highest revenue contributor to the market, with USD 1,954.1 million in 2017, and is estimated to reach USD 2,656.1 million by 2023, with a CAGR of 5.3%. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities in the Agricultural Packaging Market

4.2 Market For Agricultural Packaging, By Application & Region, 2017

4.3 Asia Pacific: Agricultural Packaging Market, By Barrier Strength & Country, 2017

4.4 Market For Agricultural Packaging, By Product & Region, 2017

4.5 Market For Agricultural Packaging Share: Key Countries

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Macroeconomic Indicators

5.2.1 Increased Production and Consumption of Fertilizers

5.2.2 Increase in Consumption of Pesticides

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increased Trade of Agrochemicals

5.3.1.2 Increased Shelf Life of Agrochemicals and Biologicals

5.3.2 Restraints

5.3.2.1 Volatility in Raw Material Prices for Plastic Packaging

5.3.3 Opportunities

5.3.3.1 Increased Focus on Developing Efficient and Environment-Friendly Packaging

5.3.3.2 Stringent Environmental Regulations Promoting the Development of Sustainable Packaging Solutions

5.3.4 Challenges

5.3.4.1 Recycling and Environmental Concerns

6 Agricultural Packaging Market, By Material (Page No. - 49)

6.1 Introduction

6.2 Plastic

6.2.1 Rigid

6.2.2 Flexible

6.3 Metal

6.4 Paper & Paperboard

6.5 Composites

6.6 Other Materials

7 Agricultural Packaging Market, By Barrier Strength (Page No. - 57)

7.1 Introduction

7.2 Medium

7.3 High

7.4 Low

8 Agricultural Packaging Market, By Application (Page No. - 63)

8.1 Introduction

8.2 Chemical Pesticides

8.3 Chemical Fertilizers

8.4 Biologicals

9 Agricultural Packaging Market, By Product (Page No. - 69)

9.1 Introduction

9.2 Pouches & Bags

9.3 Drums

9.4 Bottles & Cans

9.5 Others

10 Agricultural Packaging Market, By Region (Page No. - 76)

10.1 Introduction

10.2 North America

10.2.1 US

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 France

10.3.3 UK

10.3.4 Italy

10.3.5 Spain

10.3.6 Rest of Europe

10.4 Asia Pacific

10.4.1 China

10.4.2 India

10.4.3 Australia

10.4.4 Japan

10.4.5 Rest of Asia Pacific

10.5 South America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South America

10.6 Rest of the World

10.6.1 South Africa

10.6.2 Egypt

10.6.3 Others in RoW

11 Competitive Landscape (Page No. - 122)

11.1 Overview

11.2 Company Rankings

11.3 Competitive Scenario

11.3.1 Mergers & Acquisitions

11.3.2 Expansions & Agreements

11.3.3 New Product Launches

12 Company Profiles (Page No. - 129)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Amcor Limited

12.2 Bemis Company, Inc.

12.3 Sonoco Products Company

12.4 Mondi Group

12.5 Packaging Corporation of America

12.6 Greif, Inc.

12.7 NNZ Group

12.8 LC Packaging International Bv

12.9 Silgan Holdings, Inc.

12.10 Proampac LLC

12.11 Flex-Pack

12.12 Purity Flexpack Ltd.

12.13 Epac Holdings, LLC.

12.14 Kenvos Biotech Co., Ltd

12.15 Parakh Group

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 162)

13.1 Discussion Guide

13.2 Knowledge Store: Marketsandmarkets Subscription Portal

13.3 Introducing RT: Real-Time Market Intelligence

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (92 Tables)

Table 1 USD Exchange Rate, 20142017

Table 2 Agricultural Packaging Market Size, By Material, 20162023 (USD Million)

Table 3 Plastic: Market Size For Agricultural Packaging, By Region, 20162023 (USD Million)

Table 4 Rigid Plastic: Market Size For Agricultural Packaging, By Region, 20162023 (USD Million)

Table 5 Flexible Plastic: Market Size For Agricultural Packaging, By Region, 20162023 (USD Million)

Table 6 Metal: Market Size For Agricultural Packaging, By Region, 20162023 (USD Million)

Table 7 Paper & Paperboard: Agricultural Packaging Market Size, By Region, 20162023 (USD Million)

Table 8 Composites: Market Size For Agricultural Packaging, By Region, 20162023 (USD Million)

Table 9 Others: Agricultural Packaging Materials Market Size, By Region, 20162023 (USD Million)

Table 10 Agricultural Packaging Market Size, By Barrier Strength, 20162023 (USD Million)

Table 11 Medium-Barrier: Agricultural Packaging Market Size, By Region, 20162023 (USD Million)

Table 12 High-Barrier: Market Size For Agricultural Packaging, By Region, 20162023 (USD Million)

Table 13 Low-Barrier: Market Size For Agricultural Packaging, By Region, 20162023 (USD Million)

Table 14 Agricultural Packaging Market Size, By Application, 20162023 (USD Million)

Table 15 Chemical Pesticides: Market Size For Agricultural Packaging, By Region, 20162023 (USD Million)

Table 16 Chemical Fertilizers: Market Size For Agricultural Packaging, By Region, 20162023 (USD Million)

Table 17 Biologicals: Market Size For Agricultural Packaging, By Region, 20162023 (USD Million)

Table 18 Agricultural Packaging Market Size, By Product, 20162023 (USD Million)

Table 19 Pouches & Bags: Market Size For Agricultural Packaging, By Region, 20162023 (USD Million)

Table 20 Drums: Market Size For Agricultural Packaging, By Region, 20162023 (USD Million)

Table 21 Bottle & Cans:Market Size For Agricultural Packaging, By Region, 20162023 (USD Million)

Table 22 Other Products: Market Size For Agricultural Packaging, By Region, 20162023 (USD Million)

Table 23 Agricultural Packaging Market Size, By Region, 20162023 (USD Million)

Table 24 North America: Agricultural Packaging Market Size, By Country, 20162023 (USD Million)

Table 25 North America: Market Size For Agricultural Packaging, By Material, 20162023 (USD Million)

Table 26 North America: Market Size For Agricultural Packaging, By Barrier Strength, 20162023 (USD Million)

Table 27 North America: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 28 North America: Agricultural Packaging Market Size, By Product, 20162023 (USD Million)

Table 29 US: Agricultural Packaging Market Size, By Material, 20162023 (USD Million)

Table 30 US: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 31 Canada: Market Size For Agricultural Packaging, By Material, 20162023 (USD Million)

Table 32 Canada: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 33 Mexico: Agricultural Packaging Market Size, By Material, 20162023 (USD Million)

Table 34 Mexico: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 35 Europe: Agricultural Packaging Market Size, By Country, 20162023 (USD Million)

Table 36 Europe: Market Size For Agricultural Packaging, By Material, 20162023 (USD Million)

Table 37 Europe: Market Size For Agricultural Packaging, By Barrier Strength, 20162023 (USD Million)

Table 38 Europe: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 39 Europe: Agricultural Packaging Market Size, By Product, 20162023 (USD Million)

Table 40 Germany: Market Size For Agricultural Packaging, By Material, 20162023 (USD Million)

Table 41 Germany: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 42 France: Market Size For Agricultural Packaging, By Material, 20162023 (USD Million)

Table 43 France: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 44 UK: Agricultural Packaging Market Size, By Material, 20162023 (USD Million)

Table 45 UK: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 46 Italy: Market Size For Agricultural Packaging, By Material, 20162023 (USD Million)

Table 47 Italy: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 48 Spain: Agricultural Packaging Market Size, By Material, 20162023 (USD Million)

Table 49 Spain: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 50 Rest of Europe: Market Size For Agricultural Packaging, By Material, 20162023 (USD Million)

Table 51 Rest of Europe: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 52 Asia Pacific: Agricultural Packaging Market Size, By Country, 20162023 (USD Million)

Table 53 Asia Pacific: Market Size For Agricultural Packaging, By Material, 20162023 (USD Million)

Table 54 Asia Pacific: Market Size For Agricultural Packaging, By Barrier Strength, 20162023 (USD Million)

Table 55 Asia Pacific: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 56 Asia Pacific: Agricultural Packaging Market Size, By Product, 20162023 (USD Million)

Table 57 China: Market Size For Agricultural Packaging, By Material, 20162023 (USD Million)

Table 58 China: Agricultural Packaging Market Size, By Application, 20162023 (USD Million)

Table 59 India: Market Size For Agricultural Packaging, By Material, 20162023 (USD Million)

Table 60 India: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 61 Australia: Agricultural Packaging Market Size, By Material, 20162023 (USD Million)

Table 62 Australia: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 63 Japan: Market Size For Agricultural Packaging, By Material, 20162023 (USD Million)

Table 64 Japan: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 65 Rest of Asia Pacific: Agricultural Packaging Market Size, By Material, 20162023 (USD Million)

Table 66 Rest of Asia Pacific: Agricultural Packaging Market Size, By Application, 20162023 (USD Million)

Table 67 South America: Market Size For Agricultural Packaging, By Country, 20162023 (USD Million)

Table 68 South America: Market Size For Agricultural Packaging, By Material, 20162023 (USD Million)

Table 69 South America: Market Size For Agricultural Packaging, By Barrier Strength, 20162023 (USD Million)

Table 70 South America: Agricultural Packaging Market Size, By Application, 20162023 (USD Million)

Table 71 South America: Market Size For Agricultural Packaging, By Product, 20162023 (USD Million)

Table 72 Brazil: Market Size For Agricultural Packaging, By Material, 20162023 (USD Million)

Table 73 Brazil: Agricultural Packaging Market Size, By Application, 20162023 (USD Million)

Table 74 Argentina: Market Size For Agricultural Packaging, By Material, 20162023 (USD Million)

Table 75 Argentina: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 76 Rest of South America: Agricultural Packaging Market Size, By Material, 20162023 (USD Million)

Table 77 Rest of South America: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 78 RoW: Agricultural Packaging Market Size, By Country, 20162023 (USD Million)

Table 79 RoW: Market Size For Agricultural Packaging, By Material, 20162023 (USD Million)

Table 80 RoW: Market Size For Agricultural Packaging, By Barrier Strength, 20162023 (USD Million)

Table 81 RoW: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 82 RoW: Agricultural Packaging Market Size, By Product, 20162023 (USD Million)

Table 83 South Africa: Market Size For Agricultural Packaging, By Material, 20162023 (USD Million)

Table 84 South Africa: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 85 Egypt: Market Size For Agricultural Packaging, By Material, 20162023 (USD Million)

Table 86 Egypt: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 87 Others in RoW: Agricultural Packaging Market Size, By Material, 20162023 (USD Million)

Table 88 Others in RoW: Market Size For Agricultural Packaging, By Application, 20162023 (USD Million)

Table 89 Agricultural Packaging Market, Company Ranking, 2017

Table 90 Mergers & Acquisitions, 2013 - 2018

Table 91 Expansions & Agreements, 2014 - 2016

Table 92 New Product Launches, 2015 - 2017

List of Figures (42 Figures)

Figure 1 Agricultural Packaging Market Segmentation

Figure 2 Regional Segmentation

Figure 3 Agricultural Packaging: Research Design

Figure 4 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Market Size Estimation Methodology: Top-Down Approach

Figure 7 Data Triangulation Methodology

Figure 8 Agricultural Packaging Market Size, By Material, 2018 vs 2023

Figure 9 Market For Agricultural Packaging, By Application, 2018 vs 2023

Figure 10 Agricultural Packaging Market Size, By Product, 2018 vs 2023

Figure 11 Market For Agricultural Packaging: Regional Snapshot

Figure 12 Increasing Trade Opportunities for Agrochemicals to Drive Market Growth

Figure 13 Packaging of Chemical Pesticides and Chemical Fertilizers Dominated the Market, 2017

Figure 14 Strong Demand for Products With Medium Barrier Strength, 2017

Figure 15 Asia Pacific Dominated the Pouches & Bags Segment in 2017

Figure 16 China and US: Important Markets for Agricultural Packaging, 2017

Figure 17 Global Consumption of Nitrogen Fertilizer Nutrients, 20052015 (MMT)

Figure 18 Agricultural Packaging Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Insecticide Exports, Key Markets, 20112016 (USD Billion)

Figure 20 Insecticide Imports, Key Markets, 20112016 (USD Billion)

Figure 21 Nitrogenous Fertilizer Exports, Key Markets, 20112016 (USD Billion)

Figure 22 Nitrogenous Fertilizer Imports, Key Markets, 20112016 (USD Billion)

Figure 23 Average Oil Prices Per Barrel, 20102018 (USD)

Figure 24 Plastic Material Segment is Projected to Dominate the Market Through 2023

Figure 25 Medium-Barrier Segment is Projected to Dominate the Market Through 2023

Figure 26 Pouches & Bags Segment is Projected to Dominate the Market Through 2023

Figure 27 Geographical Snapshot (20182023): Rapidly Growing Markets are Emerging as New Hotspots

Figure 28 North America: Snapshot of Market For Agricultural Packaging

Figure 29 Asia Pacific: Snapshot of Market For Agricultural Packaging

Figure 30 Key Developments By Leading Players in the Agricultural Packaging Market, 20122018

Figure 31 Amcor Limited: Company Snapshot

Figure 32 Amcor Limited: SWOT Analysis

Figure 33 Bemis Company, Inc.: Company Snapshot

Figure 34 Bemis Company, Inc.: SWOT Analysis

Figure 35 Sonoco Products Company: Company Snapshot

Figure 36 Sonoco Products Company: SWOT Analysis

Figure 37 Mondi Group: Company Snapshot

Figure 38 Mondi Group: SWOT Analysis

Figure 39 Packaging Corporation of America: Company Snapshot

Figure 40 Packaging Corporation of America: SWOT Analysis

Figure 41 Greif, Inc.: Company Snapshot

Figure 42 Silgan Holdings Inc.: Company Snapshot

Growth opportunities and latent adjacency in Agricultural Packaging Market