Agricultural Coatings Market by Category (Seed Coatings, Fertilizer Coatings, and Pesticide Coatings), Seed Coating Types (Polymers, Colorants, and Pellets), Fertilizer Coating Types, Pesticide Coating Applications, and Region - Global Forecast to 2026

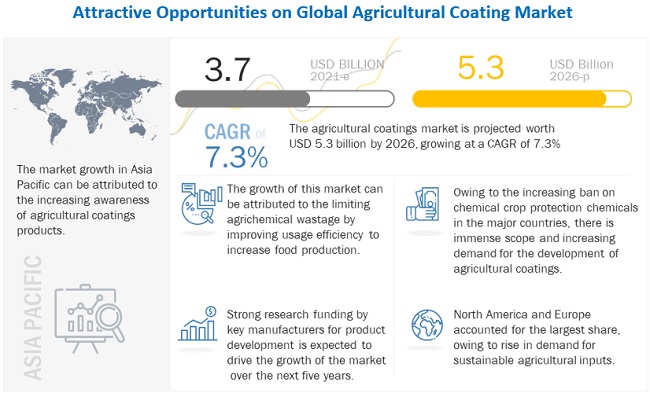

The agricultural coatings market size is expected to expand at a compound annual growth rate (CAGR) of 7.3% between 2021 and 2026, from an estimated $3.7 billion in 2021. It is anticipated that the global market would expand significantly, with a projected value of $5.3 billion by 2026.

The consumption of agricultural coatings is increasing significantly due to the rising demand for agricultural output, protection from pests & diseases, the need for ease of handling and flowability, and increasing the quality consciousness of farmers. The increasing demand for food by the ever-increasing population has put significant pressure on farmers to increase farm yields, which has paved the way for the use of agricultural coatings. Farmers, as well as consumers, are willing to pay more for quality seeds, and fertilizers for enhancing the yield. The advances in farming techniques and applications of commercial seed, fertilizer, and pesticides technology have created a significant demand for agricultural coating in the global market.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact on the Agricultural Coatings Market:

The outbreak of COVID-19 and the measures taken to control the pandemic have a crippling effect on the agriculture sector across the globe. Many countries have adopted several emergency measures to combat the COVID-19 crisis. These measures range from closing borders and public institutions, as well as isolating homes, communities, and the total lockdown of regions and the entire state. These mitigation measures have resulted in various disruptions in the functioning of markets and supply chains for agricultural inputs and products. Seeds are the starting point for agricultural production; therefore, during times of crisis such as the COVID-19 pandemic, seed delivery is among the essential services that must continue to operate to support the current and subsequent production cycles. However, issues related to transportation of seeds either domestically or internationally, due to the reduced number of flights, fewer drivers, and slow process of the necessary documentation, because of fewer staff, is creating specific problems for the seed sector. This, in turn, has affected the seed coatings market, globally. Similarly, other agricultural coatings such as pesticide coatings and fertilizer coatings have also been moderately affected due to COVID-19.

COVID-19 impact on the agriculture and agri-allied sectors remain latent, especially with the inability of small farmers to move their products from their farms to markets, both semi-urban and urban, and to source agricultural quality inputs in some regions across the globe.

Immediate actions are required to facilitate farmers’ access to agricultural inputs and related products; the disruptions caused by COVID-19 may lead to a decrease in agricultural production and acreages due to the unavailability of agricultural inputs across the globe.

Agricultural Coating Market Dynamics:

Driver: Enhancement and benefits derived from seed technologies to encourage the adoption of seed coated products

There are various technological developments in seed technologies, which increasingly benefit sustainable crop production. The increasing demand for agricultural output has encouraged the commercial use of innovative seed technologies. There is an increasing trend of commercial application of seed technologies by specialist applicators or seed companies. High-value seeds require more complex technology, and thus, are used by commercial applicators.

The introduction of advanced low-rate chemistry and genetic traits has changed conventional soil-applied pesticides to seed-delivered solutions. In addition, the development of commercial seeds, such as hybrid corn, rice, and cotton, has encouraged the commercial application of low seed rates, further increasing the cost benefits of commercial seed enhancement technologies. Companies such as BASF SE (Germany), Bayer (Germany), and Croda International Plc (UK) are engaged in developing new and innovative treatment solutions, including seed coating and priming.

The type of seed enhancement technologies used depends on the crop type, soil type, and the economic growth of the region, and the value of seeds. Thus, there is a high growth scope for customization of seeds, encouraging the development of innovative seed technologies. Countries such as the US, India, China, and Brazil are witnessing a trend of adopting on-farm techniques to cultivate specialist seeds. These specialists use various seed enhancement solutions to increase the quality and productivity of seeds, providing high growth opportunities for seed coating material manufacturers. Thus, increasing the application of commercial seed technology is projected to drive the growth of the market for seed coating materials.

Restraint: Uncertainty in climate conditions to impact the seed coating market

Climate changes play an important role in the agricultural industry. It is useful in improving the yield and preventing diseases and insect attacks. Uncertainties in the climatic conditions are projected to impact the crop yield, which results in the loss of crops.

Climate has a significant impact on various agricultural crops, and at times, climatic factors are the natural factors that encourage the production of crops. Weather forecasts are important for agricultural activities to plan agricultural practices, such as sowing, irrigation, management of crop diseases & pests, and harvest planning. For instance, common mustard crops grow naturally in mesic temperate regions; these mustard crops are projected to reduce due to global warming and increased aridity. Increased aridity is predicted to reduce the oil concertation and seed yield of rapeseed crops.

The increased emission of CO2 and other greenhouse gases, such as methane and nitrous oxide, is responsible for the change in global temperature and warming. This change in the climate directly affects the oilseed crops by decreasing the activity of pollinators. For instance, rapeseed is grown globally for cooking, animal feed, and biofuels

Opportunity: Crop-specific nutrient management through precision farming

Precision agriculture is a technology-based approach to grow crops efficiently in a site-specific manner with specialized application equipment, which can help retain water and nutrients in the root zone. The work scheme of precision agriculture can be summarized in three stages:

- Geo-referenced remote area information using certain sensors

- Analysis of data obtained through an appropriate system of information processing

- Adjustment of the amount applied depending on the needs of each location

Precision farming has the potential to improve production and nutrient-use efficiency, ensuring that nutrients do not leach from or accumulate in excessive concentrations in parts of the field. Precision farming has been gaining importance in developed countries for efficient usage of the fertigation method in which controlled-release fertilizers play an important role. The release patterns and coating technology of controlled-release fertilizers can be fed into the information system, which can further provide an accurate analysis of the nutrient requirements for the crops, application rate, and mixing ratio required within the fertigation system.

Challenges: Limited adoption of controlled-release technology

Controlled-release fertilizers have been in use for a long time in countries such as the US and in Western European countries. However, the technology has been relatively nascent for developing countries. Limited awareness of the advantages of CRF with respect to application cost and environmental concerns has been hampering the growth of this market to a large extent. The main reason for the low rate of adoption of this technology is the established conventional fertilizers market since the demand for conventional fertilizers among farmers has been strongly fueled by their belief in high crop returns.

On the other hand, in countries such as India and China, where agriculture is the major source of income for more than half of the country’s population, farmers are not willing to take risks against their crop production. According to the Institute of Management Development and Research (IMDR) in India, small retailers and shopkeepers are unwilling to stock and sell smart fertilizers in the country as they feel their quality is unreliable.

By type, the polymers segment of the agricultural coatings market is projected to grow at the highest CAGR during the forecast period

Seed coating polymers are used in the filmcoating process. The filmcoating process consists of the application of a thin water permeable polymer based coating layer onto the seed, seed coating or pellet. Polymers are available in a range of colours, coverage qualities, opacities and finishes. Polymers provide better shelf life as a result of less settling out of components and requires less water water, resulting in ease of handling and reduced storage losses. It offers improved seedling emergence and vigour which is driving the growth of this segment in the agricultural coatings market.

The market for insecticides segment of pesticides coatings is projected to grow at the highest CAGR during the forecast period

The insecticides segment of the agricultural coating market is projected to grow at the highest CAGR during the forecast period. The increasing research & development expenditures on insecticides by major companies involved in the pesticide coatings market and the rising trend of registration & commercialization of new varieties of microencapsulated insecticides is increasing the adoption of insecticdes for crop protection.

Polymer coatings, a segment of fertilizer coating dominated the fertilizer coatings market during the forecast period

The need for predefined and patterned nutrient release in the case of high-value crops and horticulture triggered the development of polymer coatings in the market as an alternative to sulfur-coated fertilizers. These coatings are either semi-permeable or impermeable membranes with tiny pores, which enable the controlled diffusion of nutrients into the soil. The rate of the release of nutrients can be controlled by the composition and thickness of the polymer coating. The nutrient release is dependent on temperature and the moisture permeability of the polymer coating.

The market for polymer-coated fertilizers has been growing strongly annually, owing to the increasing awareness about the benefits associated with precision in the controlled-release of nutrients using these products. According to TFI, the market for polymer-coated fertilizers has increased to the most significant extent as compared to other controlled-release fertilizers, and this growth is mostly witnessed in the North America and Asia Pacific markets.

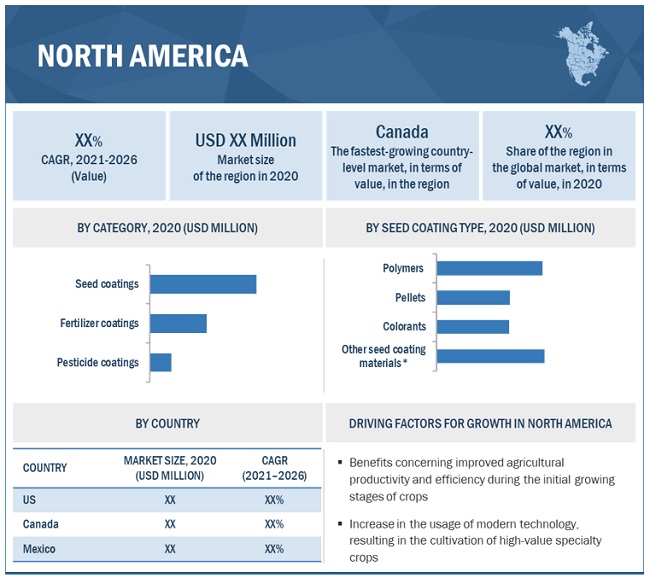

North America accounted for the largest share during the forecast period in the agricultural coatings market

The increase in the demand for high-yielding and disease-resistant crops from both domestic markets as well as export destinations are some of the key drivers of the agricultural coatings market in the region. The North American region mostly cultivates crops such as cereals & grains, fruits, vegetables, oilseeds & pulses, and also plants for clothing and other non-food uses. The region mainly grows cereals & grains, such as wheat, rice, barley, corn, sorghum, and oats, which demand more protection. In North America, agriculture is heavily mechanized with an integrated system of supporting agribusinesses. Especially in the US and Canada, most farmers and ranchers have adopted technology, although few groups continue to use animal power for cultivation purposes. Monoculture is popularly practiced in the North American zones. This results in the nutrient deterioration of nitrogen and phosphates in the soil. And also, there is a high possibility of diseases affecting a single species of plants. This has created awareness among the farmers regarding innovation with respect to the improvement of seed performance.

Scope of the Agricultural Coatings Market Report

| Report Metric | Details |

|---|---|

| Base Year: | 2021 |

| Agricultural Coatings Market Size in 2021: | $3.7 billion |

| Forecast Period: | 2021 to 2026 |

| Forecast Period 2021 to 2026 CAGR: | 7.3% |

| 2026 Value Projection: | USD 5.3 billion |

| No. of Pages: | 272 |

| Tables, & Figures: | 305 Tables, 60 Figures |

| Segments covered: | Fertilizer Coating Types, Pesticide Coating Applications, Region |

| Growth Drivers: |

|

Key Marker Players

Key players in this market include BASF SE (Germany), Bayer AG (Germany), Clariant Technologies (Germany), Croda International Plc (UK), Sensient Technologies (US), Germains Seed Technology (UK), Milliken Chemical (US), Precision Laboratories (US), Pursell Agri-tech (US), Novochem Group (Netherlands), Dorfketal (India), Deltachem (Germany), Israel Chemicals Ltd (Israel), Arkema (France), SQM (Chile), Mosaic (US), Nutrien Ltd (Canada), Aakash Chemicals, Evonik Industries (Germany) and Encapsys LLC (US).

The Agricultural coatings market has been segmented based on category, seed coating types, fertilizer coating types and region.

|

Aspect |

Details |

|

Category |

|

|

Seed Coating Types |

|

|

Region Segmentation |

|

Recent Developments

- In January 2020, Nutrien Ltd entered into an agreement with Agrosema (Brazil), which is an Ag retailer in the southern Brazilian crop input market, to provide new product offerings and solutions to Brazilian agricultural producers.

- In November 2019, Precision Laboratories added a new seed coating polymer to the PRISM line—PrismSCP2020—designed to improve seed uniformity and treatment delivery

- In July 2018, Heritage Colors, a subsidiary of Aakash Chemicals, expanded its production plant in Savannah, GA, which increased production capacities for the company’s existing successful water-based pigment dispersion portfolio.

- In May 2018, Clariant AG company launched a full range of Agrocer seed colorants in China. They were made available in both powder and pigment paste formats, including the six most common colors, and passed the seed safety test.

Frequently Asked Questions (FAQ):

How big is the agricultural coatings market?

The agricultural coatings market is expected to expand at a compound annual growth rate (CAGR) of approximately 7.3% between 2021 and 2026, from an estimated $3.7 billion in 2021. It is anticipated that the worldwide market would expand significantly, with a projected value of $5.3 billion by 2026.

Which players are involved in the manufacturing of the Agricultural coatings market?

BASF SE (Germany), Bayer AG (Germany), Clariant Technologies (Germany), Croda International Plc (UK), Sensient Technologies (US), Germains Seed Technology (UK), Milliken Chemical (US), Precision Laboratories (US), Pursell Agri-tech (US), Novochem Group (Netherlands), Dorfketal (India), Deltachem (Germany), Israel Chemicals Ltd (Israel), Arkema (France), SQM (Chile), Mosaic (US), Nutrien Ltd (Canada), Aakash Chemicals, Evonik Industries (Germany) and Encapsys LLC (US).

Is there Oceania (New Zealand and Australia) specific information (market size, players, growth rate) for the Agricultural coatings market?

On request, We will provide market size, key players, growth rate of this industry in the Oceania region.

What is the future growth potential of the Agricultural coatings market?

The Agricultural coatings market exhibits promising future growth potential driven by various factors. The increasing adoption of precision farming practices, aimed at optimizing crop yields, is likely to boost the demand for advanced agricultural coatings. As environmental concerns continue to rise, there is a growing emphasis on eco-friendly and sustainable solutions, driving the development of environmentally conscious coatings.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 27)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

FIGURE 1 AGRICULTURAL COATINGS MARKET SEGMENTATION

FIGURE 2 REGIONAL SEGMENTATION

1.4 INCLUSIONS & EXCLUSIONS

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2015–2019

1.7 VOLUME UNITS CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 3 AGRICULTURAL COATINGS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key industry insights

2.1.2.2 Breakdown of primary interviews

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

2.2.1 AGRICULTURAL COATINGS MARKET SIZE ESTIMATION – SUPPLY SIDE

2.2.2 AGRICULTURAL COATINGS MARKET SIZE ESTIMATION – DEMAND SIDE

2.2.3 TOP-DOWN APPROACH

FIGURE 5 AGRICULTURAL COATINGS MARKET: TOP-DOWN APPROACH

2.2.4 BOTTOM-UP APPROACH

FIGURE 6 AGRICULTURAL COATINGS MARKET: BOTTOM-UP APPROACH

2.3 GROWTH RATE FORECAST ASSUMPTION

2.4 DATA TRIANGULATION

FIGURE 7 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 RESEARCH LIMITATIONS & ASSOCIATED RISKS

2.7 MARKET SCENARIOS CONSIDERED FOR THE IMPACT OF COVID-19

2.7.1 SCENARIO-BASED MODELLING

2.8 COVID-19 HEALTH ASSESSMENT

FIGURE 8 COVID-19: GLOBAL PROPAGATION

FIGURE 9 COVID-19 PROPAGATION: SELECT COUNTRIES

2.9 COVID-19 ECONOMIC ASSESSMENT

FIGURE 10 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

2.9.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 11 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 12 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 48)

FIGURE 13 AGRICULTURAL COATINGS MARKET SIZE, BY CATEGORY, 2021 VS. 2026 (USD MILLION)

FIGURE 14 SEED COATINGS MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 15 FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 16 PESTICIDE COATINGS MARKET SIZE, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 17 AGRICULTURAL COATINGS MARKET SHARE (VALUE), BY REGION, 2020

3.1 IMPACT OF COVID-19 ON THE AGRICULTURAL COATINGS MARKET SIZE, BY SCENARIO

FIGURE 18 SCENARIO-BASED MODELLING, AGRICULTURAL COATINGS MARKET, 2021–2026 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 53)

4.1 OVERVIEW OF THE AGRICULTURAL COATINGS MARKET

FIGURE 19 INCREASE IN NEED FOR QUALITY AGRICULTURAL INPUTS SUPPORTS THE GROWTH OF THE AGRICULTURAL COATINGS MARKET

4.2 NORTH AMERICA: AGRICULTURAL COATINGS MARKET, BY KEY COUNTRY & CATEGORY

FIGURE 20 NORTH AMERICA: THE US WAS ONE OF THE MAJOR CONSUMERS ACROSS THE GLOBE IN 2020

4.3 PESTICIDE COATINGS MARKET, BY APPLICATION

FIGURE 21 INSECTICIDES WERE THE MOST PREFERRED APPLICATIONS FOR PESTICIDE COATINGS IN 2020

4.4 SEED COATINGS MARKET, BY TYPE

FIGURE 22 POLYMERS DOMINATED THE SEED COATINGS MARKET IN 2020

4.5 FERTILIZER COATINGS MARKET, BY TYPE

FIGURE 23 POLYMER-COATED FERTILIZERS DOMINATED FERTILIZER COATINGS MARKET IN 2020

4.6 AGRICULTURAL COATINGS MARKET: MAJOR REGIONAL SUBMARKETS

FIGURE 24 ASIAN COUNTRIES ARE PROJECTED TO WITNESS HIGH GROWTH DURING THE FORECAST PERIOD

4.7 COVID-19 ECONOMIC IMPACT ON AGRICULTURAL COATINGS MARKET

FIGURE 25 PRE AND POST COVID-19 IMPACT ON AGRICULTURAL COATINGS MARKET DURING THE FORECAST PERIOD (USD MILLION)

5 MARKET OVERVIEW (Page No. - 57)

5.1 INTRODUCTION

5.2 MACROECONOMIC INDICATORS

5.2.1 INTRODUCTION

5.2.1.1 Growth in the usage of commercial seeds

FIGURE 26 MAJOR SEED-PRODUCING COUNTRIES IN THE GLOBAL MARKET, 2015

FIGURE 27 EUROPE: TOP FIVE SEED PRODUCING COUNTRIES, 2013–2016 (‘000 HA)

5.2.1.2 Increase in application rates of fertilizers in developing countries

FIGURE 28 NITROGEN FERTILIZER APPLICATION RATE IN KEY AGRICULTURAL MARKETS, 2014–2018 (KG/HA)

5.2.1.3 Growth in market demand for high-value crops

FIGURE 29 GLOBAL AREA HARVESTED UNDER IMPORTANT HIGH-VALUE CROPS, 2014–2017 (MILLION HA)

5.3 MARKET DYNAMICS

FIGURE 30 AGRICULTURAL COATING MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.3.1 DRIVERS

5.3.1.1 Sustainable approach to mitigate environmental and health risks

5.3.1.2 Need for seed enhancement and protection through seed treatment technologies to compliment seed coatings

TABLE 2 IMPACT OF KEY DRIVERS ON THE SEED COATING MARKET

5.3.1.3 Seed coatings would support agricultural productivity on marginal lands

FIGURE 31 ANNUAL AVAILABILITY OF ARABLE LAND, 1950–2020 (HA/PERSON)

5.3.1.4 Increase in the seed replacement rate to drive the adoption of coated commercial seeds

5.3.1.5 Favorable government policies and regulations

5.3.2 RESTRAINTS

5.3.2.1 High costs involved in the agricultural coating process

5.3.2.2 Subsidies on fertilizers provided by the government of developing economies

5.3.3 OPPORTUNITIES

5.3.3.1 Development of biodegradable seed coatings to reduce environmental pollution

5.3.3.2 Crop-specific nutrient management through precision farming

5.3.4 CHALLENGES

5.3.4.1 Unorganized new entrants with a low profit-to-cost ratio

5.3.4.2 Improper management and lack of awareness of controlled-release fertilizers

5.3.5 IMPACT OF THE COVID-19 PANDEMIC ON THE AGRICULTURAL COATINGS INDUSTRY

6 INDUSTRY TRENDS (Page No. - 68)

6.1 REGULATIONS

6.1.1 NORTH AMERICA

6.1.1.1 US

6.1.1.1.1 Product registration for pesticides in the US

6.1.1.1.2 Regulatory framework for fertilizers

6.1.1.2 Canada

6.1.2 EUROPE

6.1.3 ASIA PACIFIC

6.1.3.1 Australia

6.1.3.2 China

6.1.4 ROW

6.1.4.1 Israel

6.2 PATENT ANALYSIS

FIGURE 32 NUMBER OF PATENTS APPROVED FOR AGRICULTURAL COATINGS IN THE MARKET, 2016–2020

FIGURE 33 REGIONAL ANALYSIS OF PATENTS APPROVED IN THE AGRICULTURAL COATINGS MARKET, 2016–2020

TABLE 3 LIST OF KEY PATENTS FOR SEED COATINGS, 2016–2020

6.3 MARKET ECOSYSTEM

TABLE 4 AGRICULTURAL COATINGS MARKET: ROLE IN ECOSYSTEM

FIGURE 34 SUPPLY CHAIN ECOSYSTEM

6.3.1 UPSTREAM

6.3.1.1 Major agricultural coating providers

6.3.2 DOWNSTREAM

6.3.2.1 Regulatory bodies & certification providers

6.4 VALUE CHAIN ANALYSIS

6.4.1 RESEARCH & PRODUCT DEVELOPMENT

6.4.2 AGRICULTURAL COATING MANUFACTURERS

6.4.3 DISTRIBUTORS

6.4.4 RETAILERS

FIGURE 35 VALUE CHAIN ANALYSIS

6.5 YC-YCC SHIFTS IN THE AGRICULTURAL COATINGS MARKET

FIGURE 36 DEMAND FOR HIGH-QUALITY AGRICULTURAL INPUTS SUCH AS MULTI-TRAIT HYBRID SEEDS FOR IMPROVING FOOD QUALITY IS THE NEW HOT BET IN THE MARKET

6.6 TECHNOLOGY ANALYSIS

6.6.1 NEW FERTILIZER COATING TECHNOLOGY

6.7 CASE STUDIES

6.7.1 DEMAND FOR BIOLOGICAL SEED COATING SOLUTIONS

6.7.1.1 Problem statement

6.7.1.2 Solution offered

6.7.1.3 Outcome

6.8 PRICING ANALYSIS

FIGURE 37 AVERAGE PRICE TRENDS OF FERTILIZER COATINGS, 2016–2020 (USD/TON)

6.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 AGRICULTURAL COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

6.9.1 THREAT OF NEW ENTRANTS

6.9.2 THREAT OF SUBSTITUTES

6.9.3 BARGAINING POWER OF SUPPLIERS

6.9.4 BARGAINING POWER OF BUYERS

6.9.5 INTENSITY OF COMPETITIVE RIVALRY

6.10 TRADE ANALYSIS

6.10.1 EXPORT SCENARIO: SEEDS FOR SOWING

FIGURE 38 SOYBEAN SEED EXPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

FIGURE 39 WHEAT SEED EXPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

FIGURE 40 CORN SEED EXPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

FIGURE 41 VEGETABLE SEED EXPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

6.10.2 IMPORT SCENARIO: SEEDS FOR SOWING

FIGURE 42 SOYBEAN SEED IMPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

FIGURE 43 WHEAT SEED IMPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

FIGURE 44 CORN SEED IMPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

FIGURE 45 VEGETABLE SEED IMPORTS, BY KEY COUNTRY, 2012–2019 (USD MILLION)

7 AGRICULTURAL COATINGS MARKET, BY CATEGORY (Page No. - 90)

7.1 INTRODUCTION

TABLE 6 AGRICULTURAL COATINGS MARKET SIZE, BY CATEGORY, 2017–2020 (USD MILLION)

TABLE 7 AGRICULTURAL COATINGS MARKET SIZE, BY CATEGORY, 2021–2026 (USD MILLION)

7.1.1 OPTIMISTIC SCENARIO

TABLE 8 OPTIMISTIC SCENARIO: AGRICULTURAL COATINGS MARKET SIZE, BY CATEGORY, 2018–2021 (USD MILLION)

7.1.2 REALISTIC SCENARIO

TABLE 9 REALISTIC SCENARIO: AGRICULTURAL COATINGS MARKET SIZE, BY CATEGORY, 2018–2021 (USD MILLION)

7.1.3 PESSIMISTIC SCENARIO

TABLE 10 PESSIMISTIC SCENARIO: AGRICULTURAL COATINGS MARKET SIZE, BY CATEGORY, 2018–2021 (USD MILLION)

7.2 FERTILIZER COATINGS

7.2.1 CONTROLLED-RELEASE FERTILIZERS ARE EFFICIENT ALTERNATIVES BECAUSE OF THEIR LOW IMPACT ON THE ENVIRONMENT

TABLE 11 FERTILIZER COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 12 FERTILIZER COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.3 SEED COATINGS

7.3.1 SEED COATING PROTECTS THE SEEDS AND BREAKS DOWN ONLY WHEN THE SOIL TEMPERATURE IS OPTIMAL FOR GERMINATION

TABLE 13 SEED COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 14 SEED COATING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

7.4 PESTICIDE COATINGS

7.4.1 THE SAVINGS FROM REDUCED PESTICIDES WASTAGE AND LABOR COSTS INCREASE THE GROWERS’ RETURNS

TABLE 15 PESTICIDE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 16 PESTICIDE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8 SEEDS COATING MARKET, BY TYPE (Page No. - 96)

8.1 INTRODUCTION

TABLE 17 SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 18 SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

8.2 COVID-19 IMPACT ON THE SEED COATINGS MARKET

8.2.1 OPTIMISTIC SCENARIO

TABLE 19 OPTIMISTIC SCENARIO: SEED COATINGS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

8.2.2 REALISTIC SCENARIO

TABLE 20 REALISTIC SCENARIO: SEED COATINGS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

8.2.3 PESSIMISTIC SCENARIO

TABLE 21 PESSIMISTIC SCENARIO: SEED COATINGS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

8.3 POLYMERS

8.3.1 POLYMERS ARE WIDELY USED IN SEED COATINGS AS THEY OFFER MULTIPLE BENEFITS

TABLE 22 POLYMER: SEED COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 23 POLYMER: SEED COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.4 COLORANTS

8.4.1 COLORANTS ENHANCE THE APPEARANCE OF SEEDS

TABLE 24 SEED COLORANTS: COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 25 SEED COLORANTS: COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.5 PELLETS

8.5.1 PELLETING INCREASES THE WEIGHT OF THE SEED, THEREBY IMPROVING THE PLANTABILITY

TABLE 26 PELLETS: SEED COATING MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 27 PELLETS: SEED COATING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

8.6 OTHER SEED COATING MATERIALS

8.6.1 ADDITIVES IMPROVE CROP VIABILITY AND YIELD

TABLE 28 OTHER SEED COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 29 OTHER SEED COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

9 FERTILIZER COATINGS MARKET, BY TYPE (Page No. - 104)

9.1 INTRODUCTION

TABLE 30 FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 31 FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 32 FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 33 FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (KT)

9.2 COVID-19 IMPACT ON THE FERTILIZER COATINGS MARKET

9.2.1 OPTIMISTIC SCENARIO

TABLE 34 OPTIMISTIC SCENARIO: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 35 OPTIMISTIC SCENARIO: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2018–2021 (KT)

9.2.2 REALISTIC SCENARIO

TABLE 36 REALISTIC SCENARIO: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 37 REALISTIC SCENARIO: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2018–2021 (KT)

9.2.3 PESSIMISTIC SCENARIO

TABLE 38 PESSIMISTIC SCENARIO: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2018–2021 (USD MILLION)

TABLE 39 PESSIMISTIC SCENARIO: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2018–2021 (KT)

9.3 POLYMER COATINGS

9.3.1 THE NEED FOR CULTIVATING HIGH-VALUE CROPS HAS LED TO A SURGE IN DEMAND FOR POLYMER-COATED FERTILIZERS

TABLE 40 POLYMERS: FERTILIZER COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 41 POLYMERS: FERTILIZER COATING MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 42 POLYMERS: FERTILIZER COATINGS MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 43 POLYMERS: FERTILIZER COATINGS MARKET SIZE, BY REGION, 2021–2026 (KT)

9.4 COLORANTS

9.4.1 INCREASED USE OF FERTILIZERS IS PROJECTED TO DRIVE THE USE OF FERTILIZER COLORANTS

TABLE 44 COLORANTS: FERTILIZER COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 45 COLORANTS: FERTILIZER COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 46 COLORANTS: FERTILIZER COATINGS MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 47 COLORANTS: FERTILIZER COATINGS MARKET SIZE, BY REGION, 2021–2026 (KT)

9.5 OTHER FERTILIZER COATINGS

TABLE 48 OTHER FERTILIZER COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 49 OTHER FERTILIZER COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

TABLE 50 OTHER FERTILIZER COATINGS MARKET SIZE, BY REGION, 2017–2020 (KT)

TABLE 51 OTHER FERTILIZER COATINGS MARKET SIZE, BY REGION, 2021–2026 (KT)

10 PESTICIDE COATINGS MARKET, BY APPLICATION (Page No. - 115)

10.1 INTRODUCTION

TABLE 52 PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 53 PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

10.2 COVID-19 IMPACT ON THE PESTICIDE COATINGS MARKET

10.2.1 OPTIMISTIC SCENARIO

TABLE 54 OPTIMISTIC SCENARIO: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

10.2.2 REALISTIC SCENARIO

TABLE 55 REALISTIC SCENARIO: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

10.2.3 PESSIMISTIC SCENARIO

TABLE 56 PESSIMISTIC SCENARIO: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2018–2021 (USD MILLION)

10.3 INSECTICIDES

10.3.1 THE INSECTICIDE FORMULATIONS ARE ENCLOSED IN A POLYMERIC WALL, PROTECTING THE ACTIVE INGREDIENT

TABLE 57 INSECTICIDE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 58 INSECTICIDE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.4 HERBICIDES

10.4.1 MICROENCAPSULATED HERBICIDES IN EXTREMELY SMALL CAPSULES CAN BE SUSPENDED IN A LIQUID CARRIER AND APPLIED WITH CONVENTIONAL EQUIPMENT

TABLE 59 HERBICIDE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 60 HERBICIDE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.5 FUNGICIDES

10.5.1 THE ENCAPSULATION TECHNOLOGY ENABLES THE FUNGICIDE TO WORK FAST AND EFFECTIVELY

TABLE 61 FUNGICIDE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 62 FUNGICIDE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.6 RODENTICIDES

10.6.1 MICROENCAPSULATION PLAYS A VITAL ROLE IN TIME-RELEASE RODENTICIDE, GIVING IT A LONGER ACTION OR DELAYED TIME

TABLE 63 RODENTICIDES COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 64 RODENTICIDES COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

10.7 OTHER PESTICIDE COATINGS

TABLE 65 OTHER PESTICIDE COATINGS MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

TABLE 66 OTHER PESTICIDE COATINGS MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

11 AGRICULTURAL COATINGS MARKET, BY REGION (Page No. - 124)

11.1 INTRODUCTION

FIGURE 46 US AND CHINA PROJECTED TO ACCOUNT FOR LARGE SHARES IN THE AGRICULTURAL COATINGS MARKET DURING THE FORECAST PERIOD

11.2 NORTH AMERICA

FIGURE 47 NORTH AMERICA: REGIONAL SNAPSHOT

TABLE 67 NORTH AMERICA: AGRICULTURAL COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 68 NORTH AMERICA: AGRICULTURAL COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: AGRICULTURAL COATINGS MARKET SIZE, BY CATEGORY, 2017–2020 (USD MILLION)

TABLE 70 NORTH AMERICA: AGRICULTURAL COATINGS MARKET SIZE, BY CATEGORY, 2021–2026 (USD MILLION)

TABLE 71 NORTH AMERICA: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 72 NORTH AMERICA: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 74 NORTH AMERICA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 75 NORTH AMERICA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 76 NORTH AMERICA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 77 NORTH AMERICA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 78 NORTH AMERICA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.2.1 US

11.2.1.1 The use of neonicotinoid seed coatings provides protection and enhances plant growth

TABLE 79 US: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 80 US: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 81 US: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 82 US: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 83 US: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 84 US: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.2.2 CANADA

11.2.2.1 Due to the cold temperature in the country, delayed harvest can be enabled using the seed coating technique

TABLE 85 CANADA: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 86 CANADA: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 87 CANADA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 88 CANADA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 89 CANADA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 90 CANADA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.2.3 MEXICO

11.2.3.1 Increase in demand for export quality vegetables would drive the agricultural coatings market

TABLE 91 MEXICO: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 92 MEXICO: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 93 MEXICO: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 94 MEXICO: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 95 MEXICO: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 96 MEXICO: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.3 EUROPE

TABLE 97 EUROPE: AGRICULTURAL COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 98 EUROPE: AGRICULTURAL COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 99 EUROPE: AGRICULTURAL COATINGS MARKET SIZE, BY CATEGORY, 2017–2020 (USD MILLION)

TABLE 100 EUROPE: AGRICULTURAL COATINGS MARKET SIZE, BY CATEGORY, 2021–2026 (USD MILLION)

TABLE 101 EUROPE: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 102 EUROPE: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 103 EUROPE: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 104 EUROPE: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 105 EUROPE: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 106 EUROPE: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 107 EUROPE: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 108 EUROPE: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.1 SPAIN

11.3.1.1 Increase in the cultivation of GM crops to drive the growth of the advanced pesticide coatings as an beneficial investment

TABLE 109 SPAIN: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 110 SPAIN: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 111 SPAIN: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 112 SPAIN: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 113 SPAIN: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 114 SPAIN: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.2 ITALY

11.3.2.1 Italy, being a significant producer of high quality fruits & vegetables, would adopt highly efficient coated pesticide and fertilizer formulations

TABLE 115 ITALY: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 116 ITALY: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 117 ITALY: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 118 ITALY: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 119 ITALY: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 120 ITALY: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.3 GERMANY

11.3.3.1 Regulations in Europe have led to an increase in the usage of sustainable fertilizer and seed enhancement coatings to curb environmental pollution in Germany

TABLE 121 GERMANY: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 122 GERMANY: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 123 GERMANY: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 124 GERMANY: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 125 GERMANY: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 126 GERMANY: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.4 FRANCE

11.3.4.1 Increase in sustainable farming practices has led to a surge in demand for biodegradable seed enhancement methods

TABLE 127 FRANCE: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 128 FRANCE: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 129 FRANCE: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 130 FRANCE: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 131 FRANCE: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 132 FRANCE: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.5 NETHERLANDS

11.3.5.1 With the adoption of new coating technologies for various agri-inputs, the Netherlands has witnessed enhanced production efficiency for crop yields

TABLE 133 NETHERLANDS: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 134 NETHERLANDS: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 135 NETHERLANDS: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 136 NETHERLANDS: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 137 NETHERLANDS: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 138 NETHERLANDS: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.3.6 REST OF EUROPE

TABLE 139 REST OF EUROPE: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 140 REST OF EUROPE: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 141 REST OF EUROPE: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 142 REST OF EUROPE: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 143 REST OF EUROPE: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 144 REST OF EUROPE: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.4 ASIA PACIFIC

FIGURE 48 ASIA PACIFIC: REGIONAL SNAPSHOT

TABLE 145 ASIA PACIFIC: AGRICULTURAL COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 146 ASIA PACIFIC: AGRICULTURAL COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 147 ASIA PACIFIC: AGRICULTURAL COATINGS MARKET SIZE, BY CATEGORY, 2017–2020 (USD MILLION)

TABLE 148 ASIA PACIFIC: AGRICULTURAL COATINGS MARKET SIZE, BY CATEGORY, 2021–2026 (USD MILLION)

TABLE 149 ASIA PACIFIC: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 150 ASIA PACIFIC: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 151 ASIA PACIFIC: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 152 ASIA PACIFIC: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 153 ASIA PACIFIC: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 154 ASIA PACIFIC: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 155 ASIA PACIFIC: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 156 ASIA PACIFIC: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 Unstable economic conditions and declining ecological conditions to drive the growth of the agricultural coatings market

TABLE 157 CHINA: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 158 CHINA: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 159 CHINA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 160 CHINA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 161 CHINA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 162 CHINA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.2 AUSTRALIA

11.4.2.1 Policy reforms emphasize the increased production and high-quality agricultural inputs

TABLE 163 AUSTRALIA: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 164 AUSTRALIA: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 165 AUSTRALIA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 166 AUSTRALIA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 167 AUSTRALIA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 168 AUSTRALIA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.3 INDIA

11.4.3.1 India expected to provide growth opportunities to advanced sustainable technology businesses through favorable agricultural policies

TABLE 169 INDIA: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 170 INDIA: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 171 INDIA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 172 INDIA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 173 INDIA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 174 INDIA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.4 JAPAN

11.4.4.1 Increase in agricultural outputs through limited resources of the country to encourage the market growth of agrochemical coatings

TABLE 175 JAPAN: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 176 JAPAN: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 177 JAPAN: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 178 JAPAN: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 179 JAPAN: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 180 JAPAN: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.5 THAILAND

11.4.5.1 Rise in demand for hybrid cereal crops and export of vegetable seeds drive the market for seed coatings

TABLE 181 THAILAND: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 182 THAILAND: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 183 THAILAND: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 184 THAILAND: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 185 THAILAND: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 186 THAILAND: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.4.6 REST OF ASIA PACIFIC

TABLE 187 REST OF ASIA PACIFIC: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 188 REST OF ASIA PACIFIC: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 189 REST OF ASIA PACIFIC: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 190 REST OF ASIA PACIFIC: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 191 REST OF ASIA PACIFIC: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 192 REST OF ASIA PACIFIC: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.5 SOUTH AMERICA

TABLE 193 SOUTH AMERICA: AGRICULTURAL COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 194 SOUTH AMERICA: AGRICULTURAL COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 195 SOUTH AMERICA: AGRICULTURAL COATINGS MARKET SIZE, BY CATEGORY, 2017–2020 (USD MILLION)

TABLE 196 SOUTH AMERICA: AGRICULTURAL COATINGS MARKET SIZE, BY CATEGORY, 2021–2026 (USD MILLION)

TABLE 197 SOUTH AMERICA: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 198 SOUTH AMERICA: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 199 SOUTH AMERICA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 200 SOUTH AMERICA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 201 SOUTH AMERICA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 202 SOUTH AMERICA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 203 SOUTH AMERICA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 204 SOUTH AMERICA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.1 BRAZIL

11.5.1.1 Increased emphasis on R&D, supportive policies, and integrated approach is expected to establish the market for agricultural coatings

TABLE 205 BRAZIL: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 206 BRAZIL: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 207 BRAZIL: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 208 BRAZIL: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 209 BRAZIL: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 210 BRAZIL: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.2 ARGENTINA

11.5.2.1 Higher demand early seed protection is expected to drive the market growth of seed treatment solutions and consequently, the seed coatings market

TABLE 211 ARGENTINA: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 212 ARGENTINA: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 213 ARGENTINA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 214 ARGENTINA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 215 ARGENTINA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 216 ARGENTINA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.3 CHILE

11.5.3.1 Key players in the seed industry focus on investing in the expansion of businesses towards seed treatment and coating solutions in Chile

TABLE 217 CHILE: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 218 CHILE: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 219 CHILE: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 220 CHILE: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 221 CHILE: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 222 CHILE: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.5.4 REST OF SOUTH AMERICA

TABLE 223 REST OF SOUTH AMERICA: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 224 REST OF SOUTH AMERICA: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 225 REST OF SOUTH AMERICA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 226 REST OF SOUTH AMERICA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 227 REST OF SOUTH AMERICA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 228 REST OF SOUTH AMERICA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.6 REST OF THE WORLD

TABLE 229 ROW: AGRICULTURAL COATINGS MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 230 ROW: AGRICULTURAL COATINGS MARKET SIZE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 231 ROW: AGRICULTURAL COATINGS MARKET SIZE, BY CATEGORY, 2017–2020 (USD MILLION)

TABLE 232 ROW: AGRICULTURAL COATINGS MARKET SIZE, BY CATEGORY, 2021–2026 (USD MILLION)

TABLE 233 ROW: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 234 ROW: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 235 ROW: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 236 ROW: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 237 ROW: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (KT)

TABLE 238 ROW: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (KT)

TABLE 239 ROW: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 240 ROW: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.6.1 SOUTH AFRICA

11.6.1.1 The country is slowly adopting innovative and precise techniques to support early seed development stages

TABLE 241 SOUTH AFRICA: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 242 SOUTH AFRICA: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 243 SOUTH AFRICA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 244 SOUTH AFRICA: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 245 SOUTH AFRICA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 246 SOUTH AFRICA: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

11.6.2 OTHERS IN ROW

TABLE 247 OTHERS IN ROW: SEED COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 248 OTHERS IN ROW: SEED COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 249 OTHERS IN ROW: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2017–2020 (USD MILLION)

TABLE 250 OTHERS IN ROW: FERTILIZER COATINGS MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

TABLE 251 OTHERS IN ROW: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

TABLE 252 OTHERS IN ROW: PESTICIDE COATINGS MARKET SIZE, BY APPLICATION, 2021–2026 (USD MILLION)

12 COMPETITIVE LANDSCAPE (Page No. - 207)

12.1 OVERVIEW

12.2 MARKET RANKING ANALYSIS, 2019

TABLE 253 AGRICULTURAL COATINGS MARKET: TOP 5 COMPANY RANKING ANALYSIS

12.3 COMPANY REVENUE ANALYSIS

FIGURE 49 REVENUE ANALYSIS OF THE KEY PLAYERS IN THE AGRICULTURAL COATINGS MARKET, 2015–2019 (USD MILLION)

12.4 COVID-19-SPECIFIC COMPANY RESPONSE

12.4.1 BASF SE

12.4.2 BAYER AG

12.5 COMPANY EVALUATION QUADRANT

12.5.1 STARS

12.5.2 EMERGING LEADERS

12.5.3 PERVASIVE PLAYERS

12.5.4 PARTICIPANTS

FIGURE 50 AGRICULTURAL COATINGS MARKET, COMPANY EVALUATION QUADRANT, 2020 (OVERALL MARKET)

12.6 PRODUCT FOOTPRINT

TABLE 254 COMPANY CATEGORY FOOTPRINT

TABLE 255 COMPANY REGION FOOTPRINT

TABLE 256 COMPANY PRODUCT FOOTPRINT

12.7 COMPETITIVE SCENARIO & TRENDS

12.7.1 NEW PRODUCT LAUNCHES

TABLE 257 AGRICULTURAL COATINGS MARKET: NEW PRODUCT LAUNCHES, MAY 2018–NOVEMBER 2019

12.7.2 DEALS

TABLE 258 AGRICULTURAL COATINGS MARKET: DEALS, JANUARY 2018– JANUARY 2020

12.7.3 OTHERS

TABLE 259 AGRICULTURAL COATINGS: OTHERS, APRIL 2018–JUNE 2019

13 COMPANY PROFILES (Page No. - 218)

(Business overview, Products offered, Recent developments & MnM View)*

13.1 KEY PLAYERS

13.1.1 BASF SE

TABLE 260 BASF SE: BUSINESS OVERVIEW

FIGURE 51 BASF SE: COMPANY SNAPSHOT

TABLE 261 BASF SE: DEALS

13.1.2 SENSIENT TECHNOLOGIES CORPORATION

TABLE 262 SENSIENT TECHNOLOGIES CORPORATION: BUSINESS OVERVIEW

FIGURE 52 SENSIENT TECHNOLOGIES CORPORATION: COMPANY SNAPSHOT

TABLE 263 SENSIENT TECHNOLOGIES CORPORATION: DEALS

13.1.3 BAYER AG

TABLE 264 BAYER AG: BUSINESS OVERVIEW

FIGURE 53 BAYER AG: COMPANY SNAPSHOT

TABLE 265 BAYER AG: NEW PRODUCT LAUNCHES

TABLE 266 BAYER AG: DEALS

13.1.4 CLARIANT AG

TABLE 267 CLARIANT AG: BUSINESS OVERVIEW

FIGURE 54 CLARIANT AG: COMPANY SNAPSHOT

TABLE 268 CLARIANT AG: NEW PRODUCT LAUNCHES

TABLE 269 CLARIANT AG: DEALS

13.1.5 CRODA INTERNATIONAL PLC

TABLE 270 CRODA INTERNATIONAL PLC: BUSINESS OVERVIEW

FIGURE 55 CRODA INTERNATIONAL PLC: COMPANY SNAPSHOT

TABLE 271 CRODA INTERNATIONAL PLC: NEW PRODUCT LAUNCHES

TABLE 272 CRODA INTERNATIONAL PLC: DEALS

TABLE 273 CRODA INTERNATIONAL PLC: OTHERS

13.1.6 MICHELMAN INCORPORATED

TABLE 274 MICHELMAN INCORPORATED: BUSINESS OVERVIEW

13.1.7 GERMAINS SEED TECHNOLOGY

TABLE 275 GERMAINS SEED TECHNOLOGY: BUSINESS OVERVIEW

TABLE 276 GERMAINS SEED TECHNOLOGY: NEW PRODUCT LAUNCHES

13.1.8 MILLIKEN CHEMICALS

TABLE 277 MILLIKEN CHEMICALS: BUSINESS OVERVIEW

TABLE 278 MILLIKEN CHEMICALS: DEALS

13.2 OTHER PLAYERS

13.2.1 PRECISION LABORATORIES

TABLE 279 PRECISION LABORATORIES: BUSINESS OVERVIEW

TABLE 280 PRECISION LABORATORIES: NEW PRODUCT LAUNCHES

13.2.2 PURSELL AGRI-TECH

TABLE 281 PURSELL AGRI-TECH: BUSINESS OVERVIEW

TABLE 282 PURSELL AGRI-TECH: DEALS

TABLE 283 PURSELL AGRI-TECH: NEW PRODUCT LAUNCHES

13.2.3 DORFKETAL

TABLE 284 DORFKETAL: BUSINESS OVERVIEW

13.2.4 ARKEMA

TABLE 285 ARKEMA: BUSINESS OVERVIEW

FIGURE 56 ARKEMA: COMPANY SNAPSHOT

TABLE 286 ARKEMA: DEALS

13.2.5 NOVOCHEM GROUP

TABLE 287 NOVOCHEM GROUP: BUSINESS OVERVIEW

13.2.6 DELTACHEM

TABLE 288 DELTACHEM: BUSINESS OVERVIEW

13.2.7 ICL

TABLE 289 ICL: BUSINESS OVERVIEW

FIGURE 57 ICL: COMPANY SNAPSHOT

TABLE 290 ICL: DEALS

TABLE 291 ICL: OTHERS

13.2.8 SQM

TABLE 292 SQM: BUSINESS OVERVIEW

FIGURE 58 SQM: COMPANY SNAPSHOT

TABLE 293 SQM: OTHERS

13.2.9 MOSAIC COMPANY

TABLE 294 MOSAIC COMPANY: BUSINESS OVERVIEW

FIGURE 59 MOSAIC COMPANY: COMPANY SNAPSHOT

TABLE 295 MOSAIC COMPANY: OTHERS

TABLE 296 MOSAIC COMPANY: DEALS

13.2.10 NUTRIEN LTD.

TABLE 297 NUTRIEN LTD: BUSINESS OVERVIEW

FIGURE 60 NUTRIEN LTD.: COMPANY SNAPSHOT

TABLE 298 NUTRIEN LTD: DEALS

13.2.11 AAKASH CHEMICALS

TABLE 299 AAKASH CHEMICALS: BUSINESS OVERVIEW

TABLE 300 AAKASH CHEMICALS: OTHERS

13.2.12 EVONIK INDUSTRIES AG

TABLE 301 EVONIK INDUSTRIES AG: BUSINESS OVERVIEW

TABLE 302 EVONIK INDUSTRIES AG: OTHERS

13.2.13 NOURYON

TABLE 303 NOURYON: BUSINESS OVERVIEW

TABLE 304 NOURYON: DEALS

TABLE 305 NOURYON: OTHERS

*Details on Business overview, Products offered, Recent developments & MnM View might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 266)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

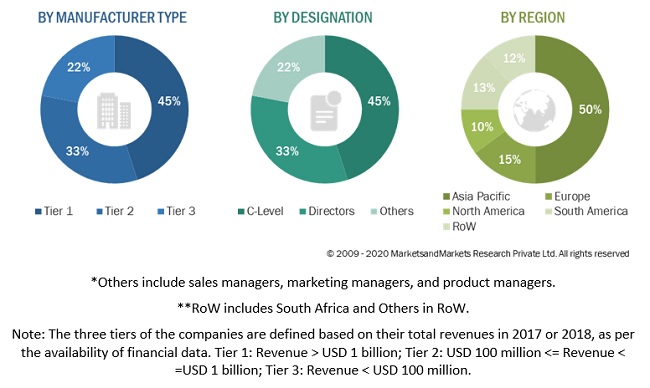

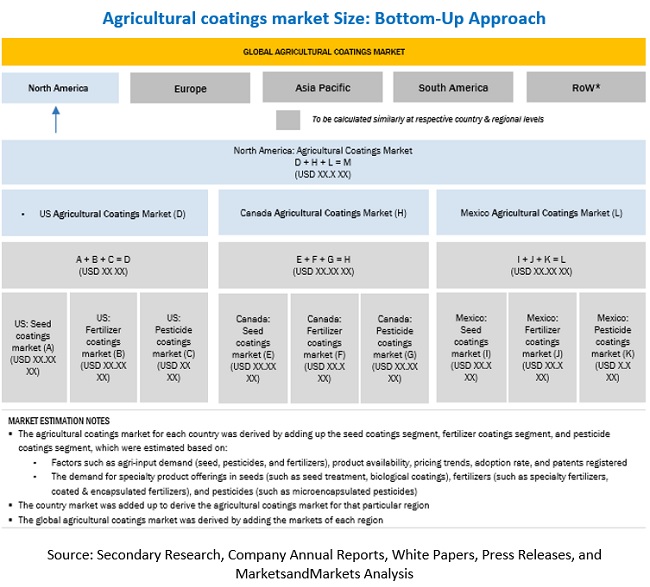

The study involves four major activities to estimate the current market size of the agricultural coatings market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. These findings, assumptions, and market sizes were validated with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation approaches were used to estimate the market size of various segments and subsegments.

Agricultural Coatings Market Secondary Research

In the secondary research process, various secondary sources such as the Food and Drug Administration (FDA), United States Department of Agriculture (USDA), European Commission, Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, food safety organizations, regulatory bodies, and trade directories.

Agricultural Coatings Market Primary Research

The agricultural coatings market comprises several stakeholders, such as raw material suppliers, processors, end-product manufacturers, and regulatory organizations, in the supply chain. The interviews were conducted with market experts from the demand-side (commercial research institutions, agencies, and laboratories) and supply-side (manufacturers of agricultural coatings categories such as fertilizer coatings, pesticides coatings, and seed coatings), across countries in the studied regions. This primary data was collected through questionnaires, e-mails, and telephonic interviews.

Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side included key opinion leaders, executives, vice presidents, and CEOs of agricultural coatings producers and end-use industries.

The primary sources from the supply side included executives from research institutions involved in R&D to introduce technology, key opinion leaders, distributors, and agricultural coatings product manufacturers.

Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the agricultural coatings market. These approaches were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following details:

- The key players in the industry and the markets were identified through extensive secondary research.

- The agricultural coatings market was determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All macroeconomic and microeconomic factors affecting the growth of the agricultural coatings market were considered while estimating the market size.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed. The data was triangulated by studying various factors and trends from both the demand and supply sides in the agricultural coatings market.

Report Objectives

- To define, segment, and estimate the size of the agricultural coatings market with respect to its category, seed coating type, fertilizer coating type, pesticide coating application, and region

- To provide detailed information about the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the complete supply and value chain to understand the influence of all key stakeholders, such as manufacturers, suppliers, and end users

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To profile the key players and comprehensively analyze their core competencies1

- To analyze the competitive developments, such as new product launches, acquisitions, investments, expansions, partnerships, agreements, joint ventures, and product approvals, in the agricultural coatings market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe agricultural coatings market into Poland, Ukraine, and the UK

- Further breakdown of the Rest of the Asia-Pacific agricultural coatings market into Indonesia, Thailand, Vietnam, and South Korea

- Further breakdown of the RoW agricultural coatings market into South Africa and Others in RoW

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Agricultural Coatings Market