Africa Centrifugal Pump Market by Type (Overhung Impeller, Between Bearing, Vertically Suspended), Operation Type (Electrical, Hydraulic, Air-driven), Stage (Single, Multi), End User (Industrial, Residential & Commercial) and Country - Forecast to 2030

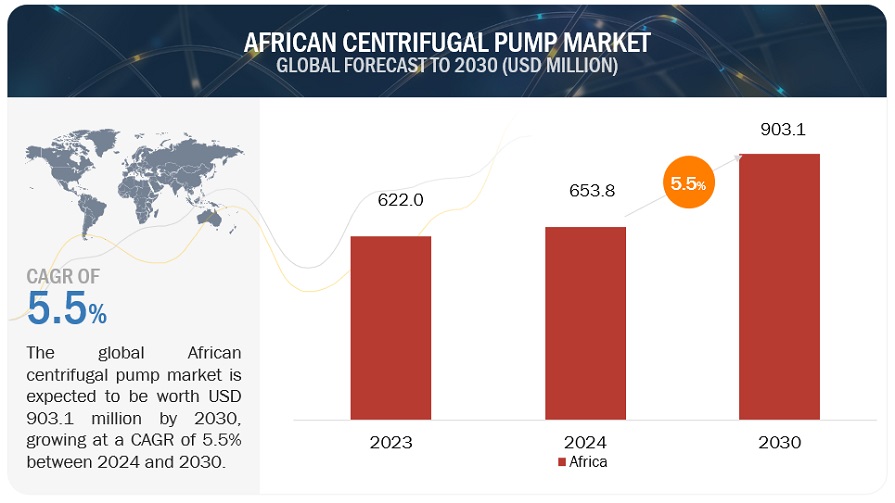

[243 Pages Report] The African centrifugal pump market is expected to exhibit a compound annual growth rate (CAGR) of 5.5% between 2024 and 2030. The market is expected to grow from over USD 653.8 million in 2024 to USD 903.1 million by 2030. The increasing need for centrifugal pumps in end-use industries, such as mining, manufacturing, oil & gas, and chemicals, is the main factor fueling this growth. As these industries grow, the requirement for efficient and reliable pumping solutions has increased in Africa. Furthermore, these pumps are extensively used in wastewater treatment plants for desalination and other applications, driving the market. Other key factors augmenting the demand for centrifugal pumps in Africa include rapid industrialization and urbanization and the growing adoption of pumping systems that run on solar power due to the expansion of the renewable energy sector.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

African Centrifugal Pump Market Dynamics

Driver: Rising emphasis on wastewater treatment

In the oil and gas sector, centrifugal pumps are crucial for moving fluids between different phases, such as transportation, processing, and exploration. The need for centrifugal pumps is further fueled by the growth of the industrial and manufacturing sectors, especially in the wastewater treatment industry. Strict environmental laws and social pressures led to an increased emphasis on wastewater treatment. Additionally, the recognition of wastewater as a valuable resource is increasing, encouraging its reuse and recycling for various applications, such as irrigation and cooling. This inclination toward environmentally friendly water management techniques and the economic benefits of water reuse within industries augment demand for centrifugal pumps.

Restraint: Water scarcity and resource management issues

The problem of water scarcity in Africa is getting worse. By 2025, about 460 million people are expected to live in areas where there is water stress, based on predictions. There are many challenges in this circumstance, particularly in the field of agriculture, which plays a major role in the economic growth of the continent. The need for centrifugal pumps, which are necessary for irrigation, is lower in areas where there is a severe water deficit. For example, in nations, such as KenWater, scarcity is becoming an increasingly serious issue. Forecasts show that by 2025, approximately 460 million people will live in water-stressed areas. This may negatively impact the agriculture sector. Centrifugal pumps are necessary for watering. The agricultural sector is affected by the lack of water, a situation exacerbated by factors, such as population growth, urbanization, and increased industrial and household demands.

Opportunities: Burgeoning demand for renewable energy

The centrifugal pumps market is expanding at an unprecedented rate due to the expansion of Africa’s renewable energy industry, especially with the increased consumption of solar-powered devices. Energy-conserving centrifugal pumps are turning into more and more common as solar energy investments increase, particularly in places where access is limited to conventional power networks. Off-grid solar photovoltaic (SPV) pumping systems are growing in popularity as a dependable, fossil fuel-free source of water for irrigating crops in remote areas with limited access to electricity. For instance, in Kenya, efforts to use solar irrigation have greatly increased the food security and productivity of small-scale farmers. Solar water pumps have the potential to optimize crop yields in Sub-Saharan Africa, where approximately 95% of the agricultural production relies on rain-fed farming. Solar-powered pumps are projected to significantly impact rural development and agricultural productivity as they gain popularity. This integration aligns with the renewable energy aspirations of multiple African nations.

Challenges: Presence of gray market players

Due to the presence of local manufacturers and gray market players, the unorganized sector poses moderate challenges to the African centrifugal pump market. Providing pumps at much lower prices is one of the main challenges the unorganized sector faces. It is common for regional producers to lower the costs of products from organized, foreign producers by using insufficient components and looser standards for quality. Customers in developing nations who are economical and may value cost-effectiveness over long-term dependability and effectiveness will find this cost advantage especially appealing. They are competitors in areas with significant logistical difficulties due to their adaptability, enabling them to quickly respond to market demand. Although challenges are associated with the unorganized sector, the threat to global manufacturers is moderate. International brands face obstacles due to local players’ extensive distribution and competitive pricing. However, these challenges also allow multinational corporations to innovate and differentiate themselves from the competition. Global manufacturers can gradually penetrate regions where the unorganized sector is predominant and carve out niche markets by concentrating on cutting-edge technologies, superior quality, and marketing strategies. The presence of local players thus presents both a challenge and an opportunity, fostering a dynamic market environment that can spur innovation and growth.

African Centrifugal Pump Ecosystem

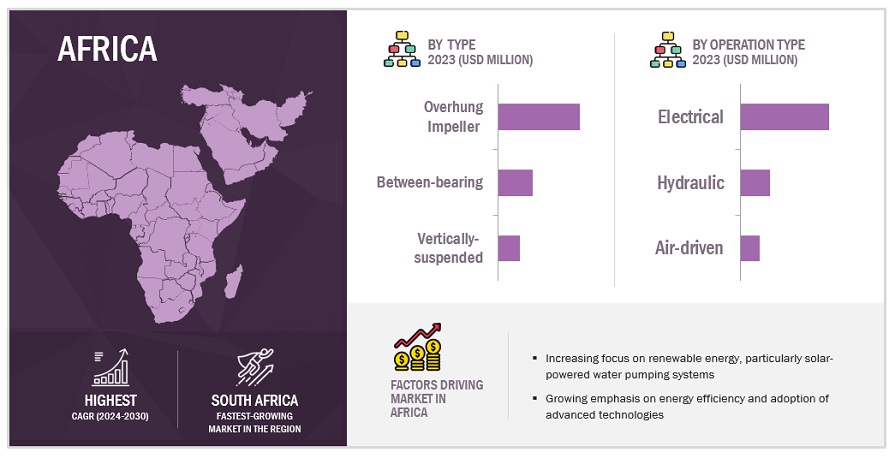

Overhung impeller segment held largest market share in 2023

Based on type segment, the overhung impeller segment is expected to dominate the African centrifugal pump market. Major applications for overhung impeller centrifugal pumps include commercial and industrial sectors. The expansion of the centrifugal pump market in Africa for the overhung impeller segment is attributed to the increased investments in water and wastewater treatment facilities due to its variable arrangements. Furthermore, the small-size layout of the centrifugal pumps eliminates the need for a larger space, augmenting the segmental growth.

Electrical segment captured largest market share in 2023

Based on operation type, the African centrifugal pump market for the electrical segment is projected to be the largest market from 2020 to 2030, depending on the type of operation. Fluids are pumped from the wells using electrical centrifugal pumps, which require less energy and save significant energy. Additionally, higher efficiency and dependability attributes have contributed to adopting electrical centrifugal pumps across various industries, such as oil & gas and water & wastewater treatment.

Single-stage segment accounted for largest market share in 2023

Based on stage, the single-stage segment accounted for the largest market share in 2023. Single-stage centrifugal pumps use single impellers and volutes in series to achieve pumping pressure. The pumped fluids are discharged from impellers and volutes. These centrifugal pumps are used to increase fluid pressure in commercial and residential buildings. Moreover, they are highly preferred over multi-stage pumps, majorly in the industrial sector. These centrifugal pumps are ideal for booster systems and high pressure pumping applications. They provide many advantages as they can function in various flow/head situations.

Industrial segment held largest share of African centrifugal pump market in 2023

Based on this, the industrial segment held the largest share in 2023 of the African centrifugal pump market during the forecast period. Centrifugal pumps are widely used in industries, including oil & gas. The development of artificial lifts for unconventional onshore oil & gas wells contributed to the development of centrifugal pumps.

South Africa to account for largest market share in 2023

South Africa is the largest market for centrifugal pumps in the region. South Africa is the most developed nation in Sub-Saharan Africa and the continent with the biggest economy. The nation’s development can be attributed to rapid industrialization and infrastructure development. This is a major factor propelling the centrifugal pump market since it draws more foreign investors to establish manufacturing facilities. Moreover, one of the main factors bolstering the expansion of the centrifugal pump market in Africa is the escalating adoption of these pumps in the mining and construction industries.

Key Players

Some of the key players operating in the African centrifugal pump market include Grundfos (Denmark), Xylem Inc. (US), Sulzer (Switzerland), KSB (Germany), Flowserve Corporation (US), Wilo (Germany), NOV (US), Ruhrpumpen Group (US), EBARA Corporation (Japan), Tapflo Group (Germany), SPP Pumps (US). Startups operating in the market include Tsurumi Pumps (Japan), Zheijang Doyin Technology Co. Ltd. (China), Donnlee Pumps (South Africa), and PSG (US).

Want to explore hidden markets that can drive new revenue in Africa Centrifugal Pump Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Africa Centrifugal Pump Market?

|

Report Metrics |

Details |

|

Market size available for years |

2020–2030 |

|

Base year considered |

2023 |

|

Forecast period |

2024–2030 |

|

Forecast units |

Value (USD Million) and Volume (Thousand Units) |

|

Segments covered |

By Type, By Operation Type, By Stage, and By Vertical |

|

Geographies covered |

Africa |

|

Companies covered |

Grundfos Holding A/S (Denmark), Xylem Inc. (US), Sulzer (Switzerland), KSB (Germany), Wilo (Germany), Weir (UK), Ruhrpumpen Group (US), EBARA Corporation (Japan), Tapflo Group (Germany), SPP Pumps (US), Vikas Pumps (India), SAM Engineering (South Africa), SPP Pumps (UK), Lewa GmbH (Germany), Flowserve (USA), ITT Rheinhütte Pumpen GmbH (Germany), NOV (USA), Rapid Allweiler (Germany), Curo Pumps (India), SPX Flow (USA) |

This research report categorizes the Africa centrifugal pump market based on type, operation type, stage, end-user, and country.

Based on type, the Africa centrifugal pump market has been segmented as follows:

- Overhung Impeller

- Between Bearing

- Vertically Suspended

Based on operation type, the Africa centrifugal pump market has been segmented as follows:

- Electrical

- Hydraulic

- Air-driven

Based on stage, the Africa centrifugal pump market has been segmented as follows:

- Single Stage

- Multi Stage

Based on the end-user, the Africa centrifugal pump market has been segmented as follows:

-

Industrial

- Oil and Gas

- Water and Wastewater

- Mining and Metal

- Chemicals

- Power Generation

- Food and Beverages

- Pharmaceuticals

- Pulp and Paper

- Agriculture

- Automotive

- Textile

- Residential & Commercial

Based on the country, the Africa centrifugal pump market has been segmented as follows:

- Egypt

- Morocco

- Libya

- Algeria

- Tunisia

- Senegal

- Kenya

- Nigeria

- Rwanda

- South Africa

- Rest of Africa

Recent Developments

- In January 2022, Russia introduced the Special Investment Contract (SpIC 2.0), which targeted water supply and wastewater treatment projects. This initiative allowed Grundfos to invest more than 21.25 million USD in new manufacturing technologies and create new job opportunities.

- In October 2021, Xylem finalized the acquisition of Anadolu Flygt, the leading pump and water treatment system provider in Turkey, including installation and after-sales services. This acquisition broadened Xylem’s smart water portfolio into the Turkish market, solidifying its position as a leader in intelligent technology solutions for the water industry.

- In January 2021, Sakhumnotho Pumps acquired a 25.1% stake in Sulzer Pumps South Africa. Sulzer Pumps Limited, the South African subsidiary of the Swiss multinational engineering firm Sulzer, specializes in manufacturing industrial pumps.

Frequently Asked Questions (FAQ):

What is the current size of the African centrifugal pump market?

The global African centrifugal pump market is projected to reach USD 653.8 million in 2024.

What are the major drivers for the African centrifugal pump market?

Centrifugal pumps are becoming a crucial solution for farmers to address their irrigation needs. Along with rapid industrialization and urbanization, this factor drives the African centrifugal pump market.

Which country contributes to a major share of the African centrifugal pump market?

South Africa is expected to hold the largest market share in 2024. Key industries, including mining, oil & gas, water & wastewater treatment, power generation, and construction, deploy centrifugal pumps. The numerous industrial applications and requirements for effective water management solutions contribute to the substantial demand for centrifugal pumps. Given the absence of freshwater resources, there has also been a rising emphasis on wastewater treatment as a vital source of non-potable water.

Which is the fastest-growing segment, by type, in the African centrifugal pump market?

Among all centrifugal pump types, the overhung impeller segment is expected to grow at the highest CAGR between 2024 and 2030. Its compact design and adaptable configurations allow it to be used in various industrial applications. Due to its simple design, it is easy to install and maintain, which is especially useful in spaces that need frequent servicing. These pumps are rapidly adopted due to their cost-effectiveness and ability to adapt to different operational needs. They are well-positioned to meet industry demands for space-saving and more efficient solutions.

Name the new technologies expected to impact the growth of the all-terrain vehicle market.

The African centrifugal pump market for the electrical segment is anticipated to grow at the fastest rate during the forecast period. The continent is becoming more electrified, and the public and commercial sectors are making significant investments to connect rural and urban areas to the electrical grid, driving the market. Electrical centrifugal pumps are also preferred for applications, including home water supply and industrial processes due to their dependability, efficiency, and simplicity of integration into current systems. The need for electrical pumps will increase as Africa’s cities and industries grow, especially in industries, such as manufacturing, agriculture, and water management, where steady and reliable power is essential. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

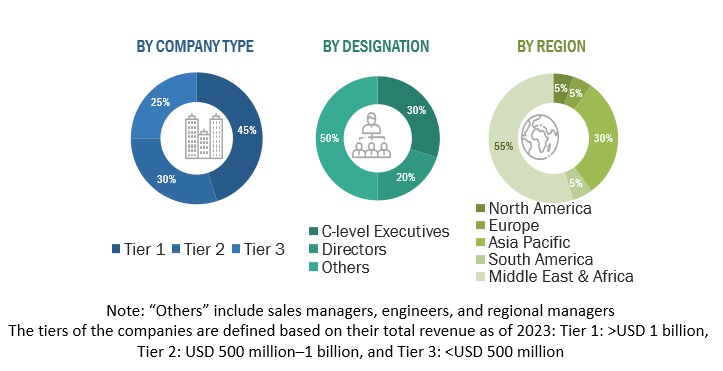

The present size of the centrifugal pump market in Africa was estimated by this study using a number of important procedures. To acquire information about the market, related markets, and the larger parent market, a significant amount of secondary research was done. The conclusions, suppositions, and market size were then confirmed by primary research involving professionals from the industry at every stage of the value chain. Next, a country-by-country analysis was used to estimate the size of the overall market. Ultimately, to ascertain the size of distinct market segments and sub-segments, market segmentation and data triangulation were executed.

Secondary Research

The secondary research process collected data relevant to a technical, market-oriented, and commercial analysis of the Africa centrifugal pump market by consulting a variety of sources, including directories and databases like Hoover's, Bloomberg BusinessWeek, Factiva, and OneSource. White papers, certified publications, articles by renowned experts, trade directories, manufacturers, associations, investor presentations, press releases and presentations from the companies themselves were some additional secondary sources.

Primary Research

A wide range of supply chain participants are involved in the Africa centrifugal pump market, including distributors, end users, manufacturers of components, raw material suppliers, and producers and assemblers of centrifugal pumps. End users are the main force behind the demand side, especially in the expanding industrial sector. The market is impacted by mergers and acquisitions among major players as well as the growing demand for contracts from the industrial sector on the supply side. Primary sources from the supply and demand sides of the market were interviewed in order to obtain qualitative and quantitative insights. Below is a breakdown of these primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

- The bottom-up approach has been used to estimate and validate the size of the Africa centrifugal pump market.

- This method considers the amount of centrifugal pumps used in different African industries, as well as the associated revenue and market statistics for centrifugal pumps in Africa.

- Extensive secondary and primary research has been carried out to obtain an understanding of the global market environment for various centrifugal pump types in Africa.

- Extensive primary interviews have been carried out with influential figures in Africa's centrifugal pump system development, such as top original equipment manufacturers and first-rate suppliers.

- h2>Qualitative aspects including market drivers, constraints, opportunities, and challenges have been carefully taken into account when estimating and projecting the market size.

Global Africa Centrifugal Pump Market Size: Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Africa Centrifugal Pump Market Size: Top-down Approach

Data Triangulation

The market is divided into numerous segments and subsegments as part of a thorough estimation process that determines the total market size. In order to obtain accurate statistics for every segment and subsegment, a thorough market engineering methodology is utilized. When necessary, techniques for breaking down the market and triangulating data are used. By examining numerous variables and patterns from the supply and demand sides of the Africa centrifugal pump market ecosystem, data triangulation is carried out. By using this method, the market estimates are guaranteed to be precise and to reflect the dynamics and trends of the present market.

Market Definition

Typically derived from a motor, a centrifugal pump is a mechanical device that transfers fluids by transforming rotational energy into hydrodynamic energy within the fluid flow. It works by introducing velocity into the fluid through a rotating impeller, which is subsequently transformed into pressure energy as the fluid leaves through a discharge pipe. Centrifugal pumps are used in a broad variety of industries, including mining, chemicals, oil and gas, power generation, water and wastewater treatment, and industrial processes. This market is distinguished by its segmentation according to variables like end-user applications (e.g., residential, commercial, industrial), operation type (e.g., electrical, hydraulic), stage (e.g., single-stage, multi-stage), and pump type (e.g., overhung impeller, between bearing, vertically suspended). Centrifugal pumps are in high demand. Driven by the need for efficient fluid transfer solutions, technological advancements in pump design, and increasing industrialization and urbanization, which necessitate reliable and effective pumping systems for a range of critical operations.

Key Stakeholders

- Government Utility Providers

- Independent Power Producers

- Pump manufacturers

- Power equipment and garden tool manufacturers

- Consulting companies in the energy & power sector

- Distribution utilities

- Government and research organizations

- Organizations, forums, and associations

- Raw material suppliers

- State and national regulatory authorities

- Pump manufacturers, distributors, and suppliers

- Pump original equipment manufacturers (OEMs)

Objectives of the Study

- To determine the value of the Africa centrifugal pump market by type, operation type, stage, end user, and countries

- To estimate market size for Africa's major countries while taking the effects of the recession into account

- To offer a thorough understanding of the factors influencing market growth, including the drivers, restraints, opportunities, and industry-specific challenges

- To strategically assess each subsegment in terms of its growth trends, potential, and impact on the overall market size

- To identify market opportunities for stakeholders and provide insights into the competitive landscape for key market leaders

- To strategically profile the leading players in the market and thoroughly analyze their market shares and core competencies

- To monitor and evaluate competitive developments, including agreements, sales contracts, partnerships, new product launches, acquisitions, contracts, expansions, and investments within the Africa centrifugal pump market

- The value of the Africa centrifugal pump market is covered in this report

Available Customization

Based on the available market data, MarketsandMarkets provides tailored customizations to meet specific company requirements. The report can be customized with the following options:

PRODUCT ANALYSIS

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

COMPANY INFORMATION

- Detailed analyses and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Africa Centrifugal Pump Market