Access Control Reader Market by Reader Type (Card-based Readers, Biometric Readers, and Multi-technology Readers), Smart Card Technology Type (iCLASS, MIFARE, DESFire, Advant), Vertical, and Geography - Global Forecast to 2024

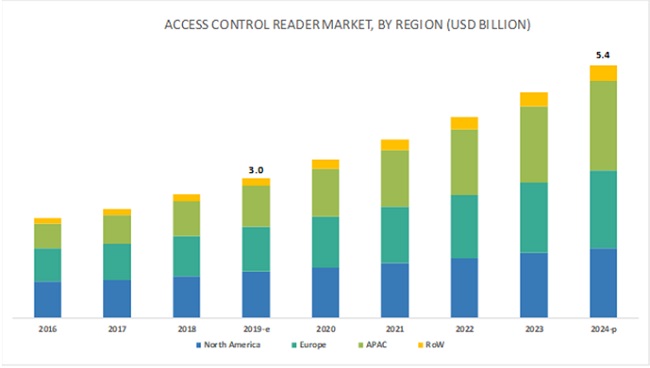

[170 Pages Report] The overall access control reader market is expected to grow from USD 3.0 billion in 2019 to USD 5.4 billion by 2024, at a CAGR of 12.5%. The growth of this market is mainly driven by the high demand for enhanced security; contactless interfaces to boost adoption of smart cards; and increased convenience, enhanced security identity management, and improved human resource management. Increasing urbanization in emerging economics provides major opportunities for the growth of the access control reader market.

“Card-based readers to hold largest share of access control reader market during forecast period”

Card-based readers can be magnetic stripe, proximity, or smart card readers. Card-based readers are proven to be more reliable than biometric readers and electronic locks. The increasing demand for smart and proximity cards to monitor and record employee activities is one of the major drivers for the growth of card-based readers. Smartcards are proven to be more reliable than magnetic stripes and proximity cards. The increasing demand for smart and proximity cards to monitor and record employee activities is one of the drivers for the growth of smart card readers.

“Growing need for security solutions holds largest market share for commercial vertical in access control reader market”

The commercial vertical is the largest adopter of access control readers. In this vertical, commercial premises such as enterprises and data centers, banks and financial centers, hotels, retail stores and malls, and entertainment areas have been considered. These places require access control readers for protecting people and assets by preventing unauthorized access. The demand for access control systems is increasing since they reduce the need for manned security significantly, thereby reducing security expenditure. These factors are encouraging commercial and service organizations to adopt access control readers to protect people and property.

“Market in APAC expected to grow significantly during forecast period”

The access control reader market in APAC is expected to grow at the highest CAGR during the forecast period. Factors driving the growth of the market in this region include large population, heavy investments in digitalization, rapid industrialization, and high demand for security systems. Furthermore, emerging economies are working toward improving their infrastructure, which is expected to impel the growth of the market. Rising adoption of access control readers in small- and medium-sized enterprises, hospitality businesses, airports, ATMs, banks, residential buildings, and religious places is expected to drive the access control reader market in APAC.

Key Market Players

The access control reader market is currently dominated by ASSA ABLOY AB (Sweden), dormakaba Holding AG (Switzerland), Allegion plc (Ireland), Identiv, Inc. (US), IDEMIA Group (France), Nedap N.V. (Netherlands), Suprema HQ Inc. (South Korea), Gemalto N.V. (Netherlands), NAPCO Security Technologies, Inc. (US), and Avigilon Corporation (Canada). A few of the major strategies adopted by these players to compete in the market include product launches and developments, partnerships, and mergers and acquisitions.

Other players operating in the access control reader market are Peter Hengstler Gmbh+Co. (Germany), Paxtron Access Ltd. (UK), Castles Technology (Taiwan), DUALi Inc. (South Korea), Salto Systems (Spain), Axis Communications (Sweden), AMAG Technology (US), Pax Technology Ltd. (China), Advanced Card Systems Ltd. (China), Gallagher Group (New Zealand), Vanderbilt Industries (US), and Brivo, Inc. (US). These players have adopted strategies such as product developments and launches, mergers and acquisitions, and partnerships and collaborations to grow in the access control reader market.

Want to explore hidden markets that can drive new revenue in Access Control Reader Market?

Scope of the Report:

Want to explore hidden markets that can drive new revenue in Access Control Reader Market?

|

Report Metric |

Details |

|

Market size available for years |

2016–2024 |

|

Base year |

2018 |

|

Forecast period |

2019–2024 |

|

Units |

Value (USD Million/Billion), Shipment (Thousand/ Million) |

|

Segments covered |

Reader Type, Smartcard Technology Type, Vertical, and Region |

|

Geographic regions covered |

Americas, APAC, Europe, and RoW |

|

Companies covered |

ASSA ABLOY AB (Sweden), dormakaba Holding AG (Switzerland), Allegion plc (Ireland), Identiv, Inc. (US), Nedap N.V. (Netherlands), Suprema HQ Inc. (South Korea), Napco Security Technologies (US), Gemalto N.V. (Netherlands), Avigilon Corporation (Canda), IDEMIA (France), Peter Hengstler Gmbh+Co. (Germany), Paxtron Access Ltd. (UK), Castles Technology (Taiwan), DUALi Inc. (South Korea), Salto Systems (Spain), Axis Communications (Sweden), AMAG Technology (US), Pax Technology Ltd. (China), Advanced Card Systems Ltd. (China), Gallagher Group (New Zealand), Vanderbilt Industries (US), and Brivo, Inc. (US) |

This report categorizes the access control reader market based on reader type, smart card technology, vertical, and region.

By Reader:

- Card-based Readers

- Magnetic Stripe Readers

- Proximity Card Readers (125 kHz)

- Smart Card Readers (13.6 MHz)

- Biometric Readers

- Fingerprint Recognition

- Palm Recognition

- Iris Recognition

- Face Recognition

- Vein Recognition

- Voice Recognition

- Multi-technology Readers

By Smart Card Technology Type:

- iCLASS

- MIFARE

- DESFire

- LEGIC Advant

- Others (Seos and Wiegand technologies)

By Vertical:

- Commercial

- Government

- Residential

By Geography

- Americas

- US

- Canada

- Mexico

- South America

- Europe

- Scandinavia (Sweden, Norway, Finland, and Denmark)

- DACH (Germany, Austria, and Switzerland)

- Benelux (Belgium, Netherlands, and Luxembourg)

- UK & Ireland

- France

- Italy

- Iberia (Portugal and Spain)

- Asia Pacific (APAC)

- China

- Japan

- India

- South Korea

- Australia & New Zealand

- Rest of APAC (Philippines, Singapore, Hong Kong, Indonesia, and Taiwan)

- Rest of the World (RoW)

- Middle East

- Africa

Major market developments

- In March 2018, Identiv, Inc. (US) launched the iAuthenticate 2.0 OtterBox smart card reader. This reader was designed for the OtterBox uniVERSE Case System and Apple iPhone and iPad.

- In September 2018, ASSA ABLOY AB (Sweden) acquired Crossmatch (US), one of the leading providers of biometric identity management and secure authentication solutions. This acquisition will enhance ASSA´s position as the world’s one of the leading biometric companies.

- In September 2017, Identiv, Inc. (US) partnered with Zwipe AS (Norway), a biometric technology company, for access control card formatting services. Identiv’s card service bureau is programming the radio frequency identification (RFID) chips in Zwipe’s biometric credential line, providing all physical access control system (PACS) formats from Identiv’s portfolio.

Key questions addressed by the report

- Where will all these developments take the industry in the mid-to-long term?

- What are the upcoming trends in the market?

- What are the opportunities for existing market players and those who are planning to enter the market?

- How inorganic growth strategies implemented by key players impact the growth of the market, and who would have the undue advantage?

- What are the current investment trends in the access control reader market?

Frequently Asked Questions (FAQ):

What are the trends prevalent in the market?

Contactless technologies has boosted the adoption of smart cards in conventional applications across healthcare, payments, and physical access control. Contactless payment technologies such as NFC, HCE, and RFID ensure faster transactions using touch-and-go payments, which accelerates customer throughput in busy periods and helps shorten customer queues. Increased throughput results in higher revenues for retailers.

Which are the major companies in the market? What are their major strategies to strengthen their market presence?

ASSA ABLOY AB, Allegion plc , Identiv, Inc., IDEMIA Group , Nedap N.V. , Gemalto N.V. , NAPCO Security Technologies, Inc. , and Avigilon Corporation are some of the major companies providing access control readers. Product launches is one of the key strategies adopted by these players. Apart from launches, these players extend their focus on inorganic stretgies such as acquisitions, contracts, partnerships, and agreements.

Which region is expected to witness significant demand for access control readers in the coming years?

APAC is the fastest-growing region in the world currently. The rising adoption of access control readers in small- and medium-sized enterprises, hospitality businesses, airports, ATMs, banks, residential buildings, and religious places is expected to drive the access control reader market in APAC. The demand for access control readers in APAC is also fueled by the rising adoption of security measures by the commercial, military & defense, government, and industrial verticals.

Which are the major verticals of this market?

The commercial vertical is the largest adopter of access control readers. In this vertical, commercial premises such as enterprises and data centers, banks and financial centers, hotels, and retail stores and malls are considered. These places require access control readers to prevent unauthorized access into restricted areas. These buildings integrate access control readers that meet compliance standards and upgrade them as required.

Which are the major opportunities in the access control readers market?

Emerging economies such as China and India, are witnessing rapid urbanization with the development of smart cities. The concentration of industrial development in cities has led to a growing demand for infrastructure. This will ultimately lead to the development of educational & healthcare institutions, public administration offices, shopping malls, stores, and warehouses. This, in turn, will boost the demand for advanced biometric solutions and smartcard, particularly in technologically advancing countries such as India, China, and Brazil. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Study Objectives

1.2 Definition

1.3 Markets Covered

1.3.1 Geographic Scope

1.3.2 Years Considered

1.4 Currency

1.5 Package Size

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Major Secondary Sources

2.1.1.2 Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.1.2.4 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing Market Size By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing Market Size By Top-Down Analysis (Supply Side)

2.3 Market Breakdown and Data Triangulation

2.4 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Key Driving Factors Pertaining to Access Control Reader Market

4.2 Smart Card Reader Market, By Technology

4.3 Market in Europe, Card-Based Reader Type and Country

4.4 Market, By Country

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 High Demand for Enhanced Security

5.2.1.2 Contactless Interfaces to Boost Adoption of Smart Cards

5.2.1.3 Increased Convenience, Enhanced Secure Identity Management, and Improved Human Resource Management

5.2.2 Restraints

5.2.2.1 Limited Awareness About Advanced Security Solutions Among Users

5.2.3 Opportunities

5.2.3.1 Increasing Urbanization in Emerging Economies

5.2.4 Challenges

5.2.4.1 Security Concerns Related to Unauthorized Access and Data Breach

5.3 Value Chain Analysis

6 Access Control Reader Market, By Reader Type (Page No. - 40)

6.1 Introduction

6.2 Card-Based Readers

6.2.1 Magnetic Stripe Readers

6.2.1.1 Magnetic Stripe Readers Accounted for Smallest Share of Card-Based Reader Market, in Terms of Value and Volume, in 2018

6.2.2 Proximity Card Readers (125 Khz)

6.2.2.1 Proximity Card Readers are Expected to Hold Significant Size of Card-Based Reader Market, in Terms of Value and Volume, During Forecast Period

6.2.3 Smart Card Readers (13.56 Mhz)

6.2.3.1 Smartcard Readers Expected to Witness Highest CAGR in Card-Based Reader Market During Forecast Period

6.2.3.1.1 Contact-Based

6.2.3.1.2 Contactless

6.3 Biometric Readers

6.3.1 Fingerprint

6.3.1.1 Fingerprint Held Largest Size of Biometric Reader Market, in Terms of Value and Volume, in 2018

6.3.2 Palm Recognition

6.3.2.1 Palm Recognition Readers are Used in Access Control Systems for Security Purpose

6.3.3 IRIS Recognition

6.3.3.1 IRIS Recognition Readers Provide High Accuracy for Authentication

6.3.4 Face Recognition

6.3.4.1 Face Recognition Readers to Exhibit Highest CAGR in Biometric Reader Market During Forecast Period

6.3.5 Vein Recognition

6.3.5.1 Vein Recognition Readers Gaining Visibility in Upcoming Years for Biometric Readers

6.3.6 Voice Recognition

6.3.6.1 Voice Recognition Readers' Usability for Restricting Unauthorized Access

6.4 Multi-Technology Readers

6.4.1 Multi-Technology Readers to Account for Significant Size of Access Control Reader Market During Forecast Period

7 Smart Card Reader Market, By Technology Type (Page No. - 54)

7.1 Introduction

7.2 iCLASS

7.2.1 iCLASS Technology to have Significant Demand for Smartcard Readers

7.3 MIFARE

7.3.1 MIFARE Technology Expected to Witness at Highest Growth Rate During Forecast Period

7.4 DESFire

7.4.1 DESFire Technology—Advanced Version of MIFARE Family

7.5 LEGIC Advant

7.5.1 Small Market Share of Advant Due to Limited Access

7.6 Others

8 Access Control Reader Market, By Vertical (Page No. - 60)

8.1 Introduction

8.2 Commercial

8.2.1 Access Control Readers Witness High Adoption in Enterprises and Data Centers for Security Purposes

8.2.1.1 Enterprises and Data Centers

8.2.1.2 Banks and Financial Centers

8.2.1.3 Hotels, Stadiums, and Amusement Parks

8.2.1.4 Retail Stores and Malls

8.3 Government

8.3.1 Government Vertical Expected to Grow at Significant Rate of During Forecast Period

8.4 Residential

8.4.1 Residential Vertical Expected to Grow at Highest CAGR During Forecast Period

9 Geographic Analysis (Page No. - 66)

9.1 Introduction

9.2 Americas

9.2.1 US

9.2.1.1 US Expected to Continue to Account for Largest Share of Access Control Reader Market in the Americas During 2019–2024

9.2.2 Canada

9.2.2.1 Adoption of High-Security Solutions in Canada Resulted in A Significant Share of Market in Country

9.2.3 Mexico

9.2.3.1 Growth Opportunities for Home Automation and Security Applications to Make Access Control Reader Market Lucrative in Mexico

9.2.4 South America

9.2.4.1 Growing Security Concerns and Increasing Use of Identification Solutions Would Lead the Market in South America

9.3 Europe

9.3.1 UK and Ireland

9.3.1.1 Market in the UK Expected to Grow at A Significant Rate During Forecast Period

9.3.2 Dach Countries

9.3.2.1 Dach Countries Likely to Continue to Account for Largest Size of Market During 2019–2024

9.3.3 France

9.3.3.1 Growing Number of Terrorist Attacks Drive French Market

9.3.4 Italy

9.3.4.1 Italy Expected to Deploy Security Solutions to Overcome Challenges Such as Increased Crime Rate, Homeland Security Breaches, and Illegal Immigration

9.3.5 Scandinavia

9.3.5.1 Scandinavia Expected to Witness Highest CAGR in Access Control Market During Forecast Period

9.3.6 Benelux

9.3.6.1 Growing Need for Identification and Security Solutions Would Boost Demand for Access Control Readers in These Countries

9.3.7 Iberia

9.3.7.1 Market in Iberia Expected to Grow at Moderate Rate

9.4 APAC

9.4.1 China

9.4.1.1 China Likely to Continue to Hold Largest Share of Access Control Reader Market in APAC During Forecast Period

9.4.2 Japan

9.4.2.1 With the Growing Economy and Rising Demand for Advance Security Solutions, Japan is Likely to Continue to Be Second-Largest Market in APAC for Access Control Readers in Next Few Years

9.4.3 India

9.4.3.1 Growing Security Threat and Increasing Urbanization Boost Indian Market Growth

9.4.4 South Korea

9.4.4.1 Increasing Need to Improve Security for Small- and Medium-Sized Businesses Compels South Korean Companies to Adopt Access Control Solutions

9.4.5 Australia and New Zealand

9.4.5.1 Need to Manage Visitor Movements and Behavior Boosts Demand for Access Control Readers in Australia and New Zealand

9.4.6 Rest of APAC

9.5 RoW

9.5.1 Middle East

9.5.1.1 Growing Security Initiatives By Governments Drive the Middle Eastern Access Control Reader Market

9.5.2 Africa

9.5.2.1 Growing Industrialization in Africa Expected to Increase Demand for Access Control Readers

10 Competitive Landscape (Page No. - 99)

10.1 Introduction

10.2 Market Player Ranking Analysis

10.3 Competitive Leadership Mapping

10.3.1 Visionary Leaders

10.3.2 Dynamic Differentiators

10.3.3 Innovators

10.3.4 Emerging Companies

10.4 Competitive Benchmarking

10.4.1 Strength of Product Portfolio (25 Companies)

10.4.2 Business Strategy Excellence (25 Companies)

10.5 Competitive Scenario

10.6 Competitive Situations & Trends

10.6.1 Product Launches/Developments

10.6.2 Acquisitions

10.6.3 Collaborations/Contracts/Agreements/Partnerships

10.6.4 Expansions

11 Company Profiles (Page No. - 118)

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view)*

11.1 Introduction

11.2 Key Players

11.2.1 ASSA ABLOY AB

11.2.2 Dormakaba Holding AG

11.2.3 Allegion PLC

11.2.4 Identiv, Inc.

11.2.5 IDEMIA

11.2.6 Nedap N.V.

11.2.7 Suprema Hq Inc.

11.2.8 Gemalto N.V. (Thales Group)

11.2.9 NAPCO Security Technologies, Inc.

11.2.10 Avigilon Corporation (MotoRoLA Solutions, Inc.)

11.3 Other Companies

11.3.1 Peter Hengstler GmbH+Co. (PHG)

11.3.2 Paxton Access Ltd.

11.3.3 Castles Technology

11.3.4 DUALi Inc.

11.3.5 AMAG Technology, Inc.

11.3.6 AXIS Communications AB

11.3.7 PAX Technology Limited

11.3.8 Advanced Card Systems Limited

11.3.9 Gallagher Group Limited

11.3.10 Brivo, Inc.

11.3.11 Salto Systems S.L.

11.3.12 Vanderbilt Industries

11.3.13 Watchdata

11.3.14 Arabit Systems Inc.

11.3.15 Idteck Co., Ltd.

11.3.16 Union Community Co., Ltd.

11.3.17 Nortech Control Systems Limited

11.3.18 Stanley Convergent Security Solutions, Inc.

(Business overview, Products offered, Recent Developments, SWOT analysis, MNM view *Details on might not be captured in case of unlisted companies.)*

12 Appendix (Page No. - 163)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Author Details

List of Tables (69 Tables)

Table 1 Top 10 Countries With Highest Number of Terror Attacks and Fatalities, 2016

Table 2 Access Control Reader Market, By Reader Type, 2016–2024 (USD Million)

Table 3 Market for Card-Based Readers, By Type, 2016–2024 (USD Million)

Table 4 Market for Card-Based Readers, By Type, 2016–2024 (Thousand Units)

Table 5 Market for Card-Based Readers, By Region, 2016–2024 (USD Million)

Table 6 Access Control Reader Market for Proximity Card Readers, By Region, 2016–2024 (USD Million)

Table 7 Market for Smartcard Readers, By Region, 2016–2024 (USD Million)

Table 8 Market for Smart Card Readers, By Type, 2016–2024 (USD Million)

Table 9 Market for Biometric Readers, By Type, 2016–2024 (USD Million)

Table 10 Market for Biometric Readers, By Type, 2016–2024 (Thousand Units)

Table 11 Market for Biometric Readers, By Region, 2016–2024 (USD Million)

Table 12 Market for Fingerprint Readers, By Region, 2016–2024 (USD Million)

Table 13 Market for PLAM Readers, By Region, 2016–2024 (USD Million)

Table 14 Market for IRIS Readers, By Region, 2016–2024 (USD Million)

Table 15 Market for Face Recognition Readers, By Region, 2016–2024 (USD Million)

Table 16 Market for Vein Recognition Readers, By Region, 2016–2024 (USD Million)

Table 17 Market for Voice Recognition Readers, By Region, 2016–2024 (USD Thousand)

Table 18 Access Control Reader Market for Multi-Technology Readers, By Region, 2016–2024 (USD Million)

Table 19 Smart Card Reader Market, By Technology Type, 2016–2024 (USD Million)

Table 20 Market for iCLASS Based Readers, By Region, 2016–2024 (USD Million)

Table 21 Market for MIFARE-Based Readers, By Region, 2016–2024 (USD Million)

Table 22 Market for DESFire-Based Readers, By Region, 2016–2024 (USD Million)

Table 23 Market for Advant Based Readers, By Region, 2016–2024 (USD Thousand)

Table 24 Market for Other Technology-Based Readers, By Region, 2016–2024 (USD Million)

Table 25 Market, By Vertical, 2016–2024 (USD Million)

Table 26 Market for Commercial Vertical, By Region, 2016–2024 (USD Million)

Table 27 Market for Government Vertical, By Region, 2016–2024 (USD Million)

Table 28 Market for Residential Vertical, By Region, 2016–2024 (USD Million)

Table 29 Access Control Reader Market, By Region, 2016–2024 (USD Million)

Table 30 Market in Americas, By Reader Type, 2016–2024 (USD Million)

Table 31 Market in Americas for Card-Based Readers, By Type, 2016–2024 (USD Million)

Table 32 Market in Americas for Card-Based Readers, By Type, 2016–2024 (Thousand Units)

Table 33 Market in Americas for Smartcard Readers, By Type, 2016–2024 (USD Million)

Table 34 Market in Americas for Biometric Readers, By Type, 2016–2024 (USD Million)

Table 35 Market in Americas for Biometric Readers, By Type, 2016–2024 (Thousand Units)

Table 36 Smart Card Reader Market in Americas, By Technology, 2016–2024 (USD Million)

Table 37 Market in Americas, By Vertical, 2016–2024 (USD Million)

Table 38 Market in Americas, By Geography, 2016–2024 (USD Million)

Table 39 Access Control Reader Market in Europe, By Reader Type, 2016–2024 (USD Million)

Table 40 Market in Europe for Card-Based Readers, By Type, 2016–2024 (USD Million)

Table 41 Market in Europe for Card-Based Readers, By Type, 2016–2024 (Thousand Units)

Table 42 Market in Europe for Smartcard Readers, By Type, 2016–2024 (USD Million)

Table 43 Market in Europe for Biometric Readers, By Type, 2016–2024 (USD Million)

Table 44 Market in Europe for Biometric Readers, By Type, 2016–2024 (Thousand Units)

Table 45 Smart Card Reader Market in Europe, By Technology, 2016–2024 (USD Million)

Table 46 Market in Europe, By Vertical, 2016–2024 (USD Million)

Table 47 Market in Europe, By Geography, 2016–2024 (USD Million)

Table 48 Access Control Reader Market in APAC, By Reader Type, 2016–2024 (USD Million)

Table 49 Market in APAC for Card-Based Readers, By Type, 2016–2024 (USD Million)

Table 50 Market in APAC for Card-Based Readers, By Type, 2016–2024 (Thousand Units)

Table 51 Market in APAC for Smartcard Readers, By Type, 2016–2024 (USD Million)

Table 52 Market in APAC for Biometric Readers, By Type, 2016–2024 (USD Million)

Table 53 Market in APAC for Biometric Readers, By Type, 2016–2024 (Thousand Units)

Table 54 Smart Card Reader Market in APAC, By Technology, 2016–2024 (USD Million)

Table 55 Market in APAC, By Vertical, 2016–2024 (USD Million)

Table 56 Market in APAC, By Country, 2016–2024 (USD Million)

Table 57 Access Control Reader Market in RoW, By Reader Type, 2016–2024 (USD Million)

Table 58 Market in RoW for Card-Based Readers, By Type, 2016–2024 (USD Million)

Table 59 Market in RoW for Card-Based Readers, By Type, 2016–2024 (Thousand Units)

Table 60 Market in RoW for Smartcard Readers, By Type, 2016–2024 (USD Million)

Table 61 Market in RoW for Biometric Readers, By Type, 2016–2024 (USD Million)

Table 62 Market in RoW for Biometric Readers, By Type, 2016–2024 (Thousand Units)

Table 63 Smart Card Reader Market in RoW, By Technology, 2016–2024 (USD Million)

Table 64 Market in RoW, By Vertical, 2016–2024 (USD Million)

Table 65 Access Control Reader Market in RoW, By Region, 2016–2024 (USD Million)

Table 66 Product Launches/Developments (2016–2019)

Table 67 Mergers and Acquisitions (2016–2019)

Table 68 Collaborations/Contracts/Agreements/Partnerships (2016–2019)

Table 69 Expansions (2016–2019)

List of Figures (41 Figures)

Figure 1 Access Control Reader Market: Segmentation

Figure 2 Smart Card Reader Market Segmentation

Figure 3 Market: Research Design

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Assumptions for Research Study

Figure 8 Access Control Reader Market, 2016–2024 (USD Billion)

Figure 9 Market, By Reader Type (2019 vs 2024)

Figure 10 Smart Card Readers Held Largest Share of Card-Based Market in 2018

Figure 11 Access Control Reader Market for Residential Vertical Expected to Grow at Highest CAGR From 2019 to 2024

Figure 12 APAC to Exhibit Highest CAGR in Market During Forecast Period

Figure 13 Growing Worldwide Demand for Security Solutions to Boost Market During Forecast Period

Figure 14 MIFARE Technology-Based Smart Card Leaders Expected to Account for Largest Market Size By 2024

Figure 15 Fingerprint Readers to Lead Smart Card Reader Market During 2019–2024

Figure 16 Smartcard Readers and Dach Countries Accounted for Largest Share of Market in Europe in 2018

Figure 17 India to Witness Highest CAGR in Global Market From 2019 to 2024

Figure 18 High Adoption of Access Control Solutions Owing to Enhanced Security Drives Growth of Market

Figure 19 Major Value Added By Original Equipment Manufacturers and Security and Management Software Providers

Figure 20 Card-Based Readers Expected to Dominate Market During 2019–2024

Figure 21 APAC is Expected to Lead Biometric Reader Market During Forecast Period

Figure 22 MIFARE Technology-Based Smart Cards Expected to Account for Largest Market Share By 2024

Figure 23 Access Control Reader Market for Residential Vertical Expected to Grow at the Highest CAGR From 2019 to 2024

Figure 24 Market for Residential Vertical in APAC to Grow at Highest CAGR From 2019 to 2024

Figure 25 APAC to Dominate Access Control Reader Market During Forecast Period

Figure 26 Snapshot of Market in Americas

Figure 27 Snapshot of Market in Europe

Figure 28 Snapshot of Market in APAC

Figure 29 Companies Adopted Product Launches/Developments as Key Growth Strategies During 2016–2019

Figure 30 ASSA ABLOY AB (Sweden) Led Market in 2018

Figure 31 Market (Global) Competitive Leadership Mapping, 2018

Figure 32 Evaluation Framework: Access Control Reader Market

Figure 33 ASSA ABLOY AB: Company Snapshot

Figure 34 Dormakaba Holding AG: Company Snapshot

Figure 35 Allegion PLC: Company Snapshot

Figure 36 Identiv, Inc.: Company Snapshot

Figure 37 Nedap N.V.: Company Snapshot

Figure 38 Suprema Hq Inc.: Company Snapshot

Figure 39 Gemalto N.V.: Company Snapshot

Figure 40 NAPCO Security Technologies, Inc.: Company Snapshot

Figure 41 Avigilon Corporation: Company Snapshot

The study involved 4 major activities in estimating the current size of the access control reader market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. The next step has been to validate these findings, assumptions, and sizing with industry experts from across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the complete market size. After that, market breakdown and data triangulation methods have been used to estimate the market sizes of segments and subsegments.

Secondary Research

The research methodology used to estimate and forecast the access control reader market begins with capturing data on revenues of key vendors in the market through secondary research. This study involves the use of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource to identify and collect information useful for the technical, market-oriented, and commercial study of the market. Vendor offerings have also been taken into consideration to determine the market segmentation. This entire research methodology includes studying annual and financial reports of top players, presentations, press releases, journals, paid databases, trade directories, regulatory bodies, and safety standard organizations.

Primary Research

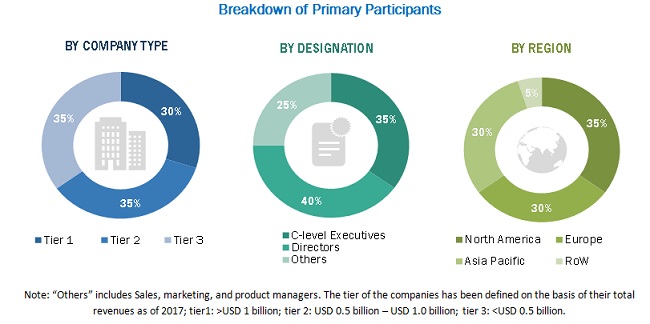

The access control reader market’s supply chain comprises several stakeholders, such as suppliers of standard components, original equipment manufacturers (OEMs), software providers, solutions providers, and system integrators. The supply side is characterized by advancements in access control reader types and their applications in diverse verticals. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. The breakdown of primary respondents is as follows.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the access control reader market and various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Key players in major applications and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the estimation processes as explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides of card-based readers, biometric readers, and multi-technology readers.

Research Objective

- To describe and forecast the access control reader market by reader type, vertical, and geography, in terms of value

- To describe and forecast the market by reader type, in terms of volume

- To describe and forecast the smart card market, by technology

- To describe and forecast the market size for various segments with regard to the Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To provide a detailed overview of the value chain of the market

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall market

- To profile key players and comprehensively analyze their market rankings and core competencies2 and detail the competitive landscape for market leaders

- To analyze growth strategies such as contracts, mergers and acquisitions, product launches and developments, and R&D in the overall market

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Critical Questions

- What will be the new verticals in which access control readers be used?

- Who are the key players in the market and how intense is the competition?

Growth opportunities and latent adjacency in Access Control Reader Market