AC Electric Motor Sales in Oil & Gas Market by Type (Induction & Synchronous), Voltage (< 1 KV, 1-6.6 kV, > 6.6 kV), Output Power, HP (< 1 HP, > 1 HP), Output Power, kW (0.12-7.5 kW, 7.5-110 kW, 110-1000 kW, >1000 kW) and Region - Global Forecast to 2023

[158 Pages Report] The global AC electric motor sales in oil & gas market is projected to reach USD 13.2 billion by 2023, at a CAGR of 4.62% from 2018 to 2023. The study involved 4 major activities in estimating the current size for the market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet have been referred to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, trade directories, and databases

Primary Research

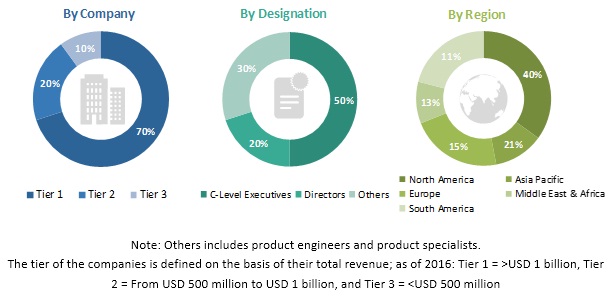

The AC electric motor sales in oil & gas market comprises several stakeholders such as electric motor manufacturers, oil & gas companies, consultants and advisory firms, and rig manufacturers and suppliers in the supply chain. The demand side of this market is characterized by the automation in the oil & gas sector, changing power consumption pattern; thus increasing share of industrial motors in it, and immediate need for efficient electric motors. The supply side is characterized by new product launches and diverse application industries. Various primary sources from both, the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the AC electric motor sales in oil & gas market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industrys supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying the various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, and forecast the global AC electric motor sales in oil & gas market based on type, voltage, output power (HP), output power (kW), and region

- To provide detailed information on the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the AC electric motor sales in oil and gas market with respect to individual growth trends, future expansions, and contributions to the market

- To analyze market opportunities for stakeholders and details of a competitive landscape for market leaders

- To forecast the growth of the AC electric motor sales in oil and gas market with respect to major regions (North America, Europe, Asia Pacific, South America, and the Middle East & Africa)

- To profile key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments such as mergers & acquisitions, expansions, new product developments, and contracts & agreements in the field of AC electric motor sales in oil and gas market

Want to explore hidden markets that can drive new revenue in AC Electric Motor Sales in Oil & Gas Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in AC Electric Motor Sales in Oil & Gas Market?

Report Metric |

Details |

|

Market size available for years |

20162023 |

|

Base year considered |

2017 |

|

Forecast period |

20182023 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Type, Voltage, Output Power (HP), Output Power (kW), and Region |

|

Geographies covered |

North America, Asia Pacific, South America, Europe, Middle East, and Africa |

|

Companies covered |

ABB (Switzerland), WEG (Brazil), GE (US), Siemens (Germany), and Toshiba Corporation (Japan) among others |

This research report categorizes the AC electric motor sales in oil and gas market based on type, output power (HP), output power (kW), and region

On the basis of type, the AC electric motor sales in oil & gas market has been segmented as follows:

- Induction

- Synchronous

On the basis of Voltage, the AC electric motor sales in oil & gas market has been segmented as follows:

- < 1 kV

- 1 kV-6.6 kV

- > 6.6 kV

On the basis of by output power (HP), the AC electric motor sales in oil & gas market has been segmented as follows:

- < 1 HP

- > 1 HP

On the basis of by output power (kW), the AC electric motor sales in oil & gas market has been segmented as follows:

- 0.12-7.5 kW

- 7.5-110 kW

- 110-1000 kW

- > 1000 kW

On the basis of by region, the AC electric motor sales in oil & gas market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East

- South America

- Africa

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Company Information

- Detailed analyses and profiling of additional market players (up to 5)

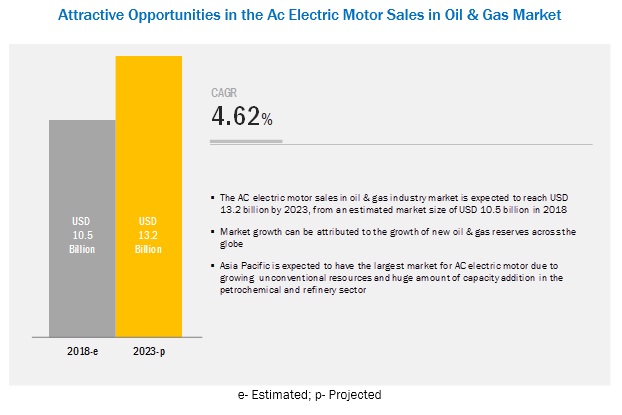

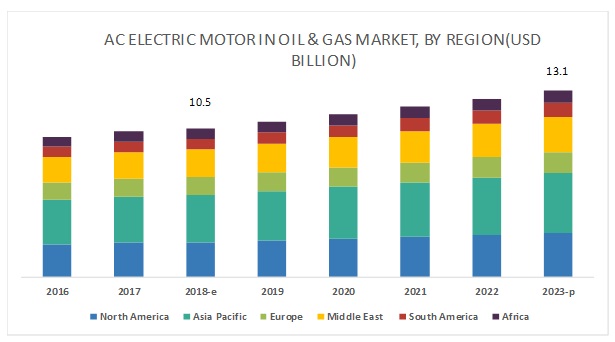

The global AC electric motor sales in oil & gas market is projected to reach a size of USD 13.2 billion by 2023, at a CAGR of 4.62%, from an estimated USD 10.5 billion in 2018. This growth can be attributed to the automation in oil & gas sector, transition to energy efficient motors in oil & gas industry.

By type, the induction motor segment is expected to be the largest contributor in the AC electric motor market during the forecast period

The report segments the AC electric motor segment market, by type, into induction and synchronous motor. The induction motor segment is expected to hold the largest market share by 2023. Due to the simplicity, robustness, and low cost of these motors. They are widely used and are suitable for nearly all types of machinery.

<1 KV accounts the largest market share during the forecast period

The <1 KV ac electric motor market, by voltage, is segmented into <1 KV, 1 KV-6.6 KV and >6.6 KV. The <1 KV is expected to dominate the AC electric motor market by 2023. <1 KV motors are used in the HVAC, petrochemical, steel, pulp & paper, mining & cement, food & beverage, and automobile industries. With rapid industrial development, especially in the oil & gas industry, electric motors find major applications in pumps, machine tools, and power tools in major industries. These factors are expected to drive the AC electric motor market.

By end-user, the industrial segment is expected to grow at the fastest rate during the forecast period

The > 1 HP segment is expected to grow at the fastest rate during the forecast period. Due to wide application of these motors in the oil & gas sector including pumps, auxiliary generators, centrifugal & reciprocating compressors, and cranes. Moreover, Asia Pacific hold the largest market share for oil & gas industry due to rise in urbanization, industrialization, and population growth. Additionally, factors such as the discovery of new reserves in the Great Australian Bight, the Gulf of Thailand, Turkmenistan, and the South China Sea, and the need for EOR (enhanced oil recovery) techniques in countries such as Thailand, Indonesia, India, Australia, and Malaysia, are expected to drive the AC electric motor market in the region

Asia Pacific is expected to account for the largest market size during the forecast period

In this report, the ac electric motor sales in oil & gas market has been analyzed with respect to 6 regions, namely, North America, Europe, South America, Asia Pacific, Africa, and the Middle East. The market in Asia Pacific is estimated to be the largest ac electric motor market from 2018 to 2023. Increasing rapid industrial development, especially in the oil & gas industry are some of the key factors responsible for the growth of the AC electric motor market. Moreover, AC electric motor sales in oil & gas in Asia Pacific is mainly driven by countries such as China, Japan, and India. The global energy consumption in Asia Pacific is expected to rise from 42% in 2016 to 47% by 2035, which would be more than the combined share of North America, Europe, and Eurasia, according to the BP Statistical Review of World Energy 2017.

The major players in the global AC electric motor sales in oil & gas market, are ABB (Switzerland), Siemens (Germany), Schneider Electric (France), Rockwell (US), WEG (Brazil), Toshiba Corporation (Japan), General Electric (US).

Recent Developments

- In September 2018, Siemens offered Simotics XP Chemstar, a customized solution for the chemical and petrochemical as well as oil & gas industries. These motors offer a high level of reliability even under extreme conditions and in potentially explosive atmospheres while providing precisely tailored compliance with industry-specific requirements.

- In February 2018, ABB integrated the Baldor Electric Company name into its global ABB brand as a part of its next level strategy, which includes harmonizing different ABB-owned brands under the global ABB master brand.

- In July 2017, ABB acquired B&R (Bernecker + Rainer Industrie-Elektronik GmbH), the largest independent provider focused on product- and software-based, open-architecture solutions for machine and factory automation worldwide.

Key Questions addressed by the report

- The report identifies and addresses key markets for AC electric motor market, which would help manufacturers review the growth in demand.

- The report helps system providers understand the pulse of the market and provides insights into drivers, restraints, opportunities, and challenges.

- The report will help key players understand the strategies of their competitors better and make better strategic decisions.

- The report addresses the market share analysis of key players in AC electric motor sales market, and with the help of this companies can enhance their revenues in respective market.

- The report provides insights about emerging geographies for AC electric motor sales, and the entire market ecosystem can gain competitive advantage from such insights.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Definition

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regional Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 23)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions

2.4.1 Assumptions

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 35)

4.1 Attractive Opportunities in the Ac Electric Motor Sales in Oil & Gas Market During the Forecast Period

4.2 Ac Electric Motor Sales in Oil & Gas, By Country

4.3 Asia Pacific Ac Electric Motor Sales in Oil & Gas, By Output Power (HP) & Country

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Automation in Oil & Gas Sector

5.2.1.2 Transition to Energy-Efficient Motors in Oil & Gas Industry

5.2.2 Restraints

5.2.2.1 Stagnant Growth in Oil & Gas Industry

5.2.2.2 Growing Renewable Energy Sector

5.2.3 Opportunities

5.2.3.1 New Discoveries of Oil & Gas Reserves in the African Region

5.2.3.2 Increasing Use of Rovs and Auvs Will Provide Opportunities for Ac Electric Motors

5.2.4 Challenges

5.2.4.1 Strict Government Regulations

6 Ac Electric Motor Sales in Oil & Gas Market, By Type (Page No. - 42)

6.1 Introduction

6.2 Induction Motor

6.2.1 Asia Pacific is Projected to Be the Largest Market for Induction Motor

6.3 Synchronous Motor

6.3.1 Asia Pacific is Projected to Be the Largest Market for Synchronous Motor

7 Ac Electric Motor Sales in Oil & Gas Market, By Voltage (Page No. - 46)

7.1 Introduction

7.2 <1 kV Motor

7.2.1 Increasing Need for Low Maintenance and Highly Efficient Motors is Expected to Drive the Market for Motors With Voltage <1 kV

7.3 16.6 kV Motor

7.3.1 North America is Projected to Be the Second Largest Market for Ac Electric Motors With 16.6 kV Voltage Range

7.4 >6.6 kV Motor

7.4.1 Asia Pacific is Projected to Be the Largest Market for Ac Electric Motors With >6.6 kV Voltage Range

8 Ac Electric Motor Sales in Oil & Gas Market, By Output Power (HP) (Page No. - 51)

8.1 Introduction

8.2 <1 HP Motor

8.2.1 Asia Pacific is Projected to Be the Largest Market for Ac Electric Motors With < 1 HP Range

8.3 >1 HP Motor

8.3.1 Asia Pacific is Projected to Be the Largest Market for Ac Electric Motors With > 1 HP Range

9 Ac Electric Motor Sales in Oil & Gas Market, By Output Power (kW) (Page No. - 55)

9.1 Introduction

9.2 0.127.5 kW

9.2.1 Increasing Use of Ac Electric Motors With 0.127.5 kW Range in Oil & Gas Applications is Expected to Drive the Market for This Segment

9.3 7.5110 kW

9.3.1 Asia Pacific is Projected to Be the Largest Market for Ac Electric Motors With 7.5110 kW Range

9.4 1101,000 kW

9.4.1 Asia Pacific is Projected to Be the Largest Market for Ac Electric Motors With 1101,000 kW Range

9.5 >1,000 kW

9.5.1 North America is Projected to Be the Second Largest Market for Ac Electric Motors With 7.5110 kW Range

10 Ac Electric Motor Sales in Oil & Gas Market, By Region (Page No. - 60)

10.1 Introduction

10.2 Asia Pacific

10.2.1 By Type

10.2.2 By Voltage

10.2.3 By Output Power (HP)

10.2.4 By Output Power (kW)

10.2.5 By Country

10.2.5.1 China

10.2.5.1.1 Increasing Oil Fields are Expected to Drive the Demand for Ac Electric Motors in the Country

10.2.5.2 Japan

10.2.5.2.1 Increasing Consumption of Oil and Gas to Drive the Demand for Ac Electric Motors in the Country

10.2.5.3 India

10.2.5.3.1 India is Emerging as A Refinery Hub to Drive the Demand for Ac Electric Motors in the Country

10.2.5.4 South Korea

10.2.5.4.1 Induction Motor Segment is Projected to Be the Largest Market in South Korea

10.2.5.5 Australia

10.2.5.5.1 Increasing Exploration and Drilling Activities Will Drive the Ac Electric Motor Sales in the Country

10.2.5.6 Vietnam

10.2.5.6.1 Increasing Investment By the Government in Offshore Oil & Gas Exploration Will Drive the Ac Electric Motor Sales in the Country

10.2.5.7 Rest of Asia Pacific

10.3 North America

10.3.1 By Type

10.3.2 By Voltage

10.3.3 By Power Output (HP)

10.3.4 By Output Power (kW)

10.3.5 By Country

10.3.5.1 US

10.3.5.1.1 Technological Advances in Onshore Horizontal Drilling Will Drive the Ac Electric Motor Sales in the Country

10.3.5.2 Canada

10.3.5.2.1 Increasing E&P Activities Will Drive the Ac Electric Motor Sales in the Country

10.3.5.3 Mexico

10.3.5.3.1 Induction Motor Segment Will Account for the Largest Share in the Country

10.4 Europe

10.4.1 By Type

10.4.2 By Voltage

10.4.3 By Output Power (HP)

10.4.4 By Output Power (kW)

10.4.5 By Country

10.4.5.1 Denmark

10.4.5.1.1 Implementation of Technology in Oil & Gas Exploration Activities Will Drive the Market for Ac Electric Motor Sales in the Country

10.4.5.2 France

10.4.5.2.1 Induction Motor Segment Will Account for the Largest Share in the Country

10.4.5.3 Germany

10.4.5.3.1 Germany Being the Largest Refiners in the World, Will Drive the Market for Ac Electric Motor Sales in the Country

10.4.5.4 Italy

10.4.5.4.1 Increasing National Oil & Gas Production in the Country Will Drive the Market for Ac Electric Motor Sales

10.4.5.5 Norway

10.4.5.5.1 Increasing E&P Activities in the Country are Expected to Drive the Ac Electric Motor Sales

10.4.5.6 Portugal

10.4.5.6.1 Increasing E&P Contracts in the Country are Expected to Drive the Ac Electric Motor Sales

10.4.5.7 Russia

10.4.5.7.1 Expansion of Natural Gas Pipelines in the Country is Expected to Drive the Ac Electric Motor Sales

10.4.5.8 Spain

10.4.5.8.1 Induction Motor Segment is Estimated to Contribute the Largest Market Share in the Spanish Market

10.4.5.9 Sweden

10.4.5.9.1 Induction Motor Segment is Estimated to Contribute the Largest Market Share in the Swedish Market

10.4.5.10 UK

10.4.5.10.1 Induction Motor Segment is Estimated to Contribute the Largest Market Share in the UK Market

10.4.5.11 Rest of Europe

10.5 Middle East

10.5.1 By Type

10.5.2 By Voltage

10.5.3 By Output Power (HP)

10.5.4 By Output Power (kW)

10.5.5 By Country

10.5.5.1 Kuwait

10.5.5.1.1 Increasing Government Spending in Oil & Gas Industry is Expected to Drive the Ac Electric Motor Sales in the Country

10.5.5.2 Saudi Arabia

10.5.5.2.1 Increasing Government Spending in Oil & Gas Industry is Expected to Drive the Ac Electric Motor Sales in the Country

10.5.5.3 UAE

10.5.5.3.1 Abundant Oil Reserves in the Country are Expected to Drive the Ac Electric Motor Sales in the UAE

10.5.5.4 Rest of Middle East

10.6 South America

10.6.1 By Type

10.6.2 By Voltage

10.6.3 By Output Power (HP)

10.6.4 By Output Power (kW)

10.6.5 By Country

10.6.5.1 Brazil

10.6.5.1.1 Huge Investments By Oil & Gas Companies From Across the Globe are Expected to Drive the Ac Electric Motor Sales in Brazil

10.6.5.2 Argentina

10.6.5.2.1 Induction Motor Segment is Expected to Hold the Largest Share in Ac Electric Motor Sales in the Country

10.6.5.3 Venezuela

10.6.5.3.1 Induction Motor Segment is Expected to Hold the Largest Share in Ac Electric Motor Sales in the Country

10.6.5.4 Chile

10.6.5.4.1 Increasing Petroleum Production is Expected to Drive the Ac Electric Motor Sales in the Country

10.6.5.5 Colombia

10.6.5.5.1 Strong Network of Oil & Gas Pipelines is Expected to Drive the Ac Electric Motor Sales in the Country

10.6.5.6 Rest of South America

10.7 Africa

10.7.1 By Type

10.7.2 By Voltage

10.7.3 By Output Power (HP)

10.7.4 By Output Power (kW)

10.7.5 By Country

10.7.5.1 Algeria

10.7.5.1.1 Increasing Investment in Upstream Activities is Expected to Drive the Ac Electric Motor Sales in the Country

10.7.5.2 Egypt

10.7.5.2.1 Increasing Investment in Oil & Gas Sector is Expected to Drive the Ac Electric Motor Sales in the Country

10.7.5.3 Libya

10.7.5.3.1 Induction Motor Segment is Expected to Account for the Largest Share in Ac Electric Motor Sales in Oil & Gas Industry in the Country

10.7.5.4 Rest of North Africa

10.7.5.5 Nigeria

10.7.5.5.1 Induction Motor Segment is Expected to Be the Fastest Growing Segment in Ac Electric Motor Sales in Oil & Gas Industry in the Country

10.7.5.6 Kenya

10.7.5.6.1 Induction Motor Segment is Expected to Be the Fastest Growing Segment in Ac Electric Motor Sales in Oil & Gas Industry in the Country

10.7.5.7 South Africa

10.7.5.7.1 Initiatives From the Government for the Growth of Mining Sector are Expected to Drive the Ac Electric Motor Sales in the Country

10.7.5.8 Rest of Africa

11 Competitive Landscape (Page No. - 106)

11.1 Ranking of Players and Industry Concentration, 2017

11.2 Competitive Scenario

11.2.1 Contracts & Agreements

11.2.2 New Product Developments

11.2.3 Investments & Expansions

11.2.4 Mergers & Acquisitions

12 Company Profile (Page No. - 112)

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

12.1 Benchmarking

12.2 Siemens

12.3 GE

12.4 ABB

12.5 WEG SE

12.6 Yaskawa

12.7 RockWell

12.8 Allied Motion

12.9 Nidec Corporation

12.10 Regal Beloit

12.11 Johnson Electric

12.12 Hitachi

12.13 ARC System

12.14 Schneider Electric

12.15 Toshiba Corporation

12.16 TMEIC

12.17 ATB

12.18 Hoyer

*Details on Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 150)

13.1 Insights of Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (87 Tables)

Table 1 AC Electric Motor Sales in Oil & Gas Market Snapshot

Table 2 Market Size, By Type, 20162023 (USD Million)

Table 3 Induction Motor: Market Size, By Region, 20162023 (USD Million)

Table 4 Synchronous Motor: Market Size, By Region, 20162023 (USD Million)

Table 5 AC Electric Motor Sale in Oil and Gas Market Size, By Voltage ( kV), 20162023 (USD Million)

Table 6 <1 kV: AC Electric Motor Sale in Oil and Gas Market Size, By Region, 20162023 (USD Million)

Table 7 16.6 kV Motor: AC Motor Sales in Oil and Gas Market Size, By Region, 20162023 (USD Million)

Table 8 >6.6 kV Motor: AC Electric Motor Sale in Oil and Gas Market Size, By Region, 20162023 (USD Million)

Table 9 AC Electric Motor Sale in Oil and Gas Market Size, By Output Power (HP), 20162023 (USD Million)

Table 10 <1 HP: AC Electric Motor Sale in Oil and Gas Market Size, By Region, 20162023 (USD Million)

Table 11 >1 HP Motor: AC Electric Motor Sale in Oil and Gas Market Size, By Region, 20162023 (USD Million)

Table 12 AC Electric Motor Sale in Oil and Gas Market Size, By Output Power (kW), 20162023 (USD Million)

Table 13 0.127.5 kW: AC Electric Motor Sale in Oil and Gas Market Size, By Region, 20162023 (USD Million)

Table 14 7.5110 kW: AC Electric Motor Sale in Oil and Gas Market Size, By Region, 20162023 (USD Million)

Table 15 1101,000 kW: AC Electric Motor Sale in Oil and Gas Market Size, By Region, 20162023 (USD Million)

Table 16 >1,000 kW: AC Electric Motor Sale in Oil and Gas Market Size, By Region, 20162023 (USD Million)

Table 17 AC Electric Motor Sales in Oil & Gas Market Size, By Region, 20162023 (USD Million)

Table 18 Asia Pacific: AC Electric Motor Sales in Oil & Gas Market Size, By Type, 20162023 (USD Million)

Table 19 Asia Pacific: Market Size, By Voltage, 20162023 (USD Million)

Table 20 Asia Pacific: Market Size, By Output Power (HP), 20162023 (USD Million)

Table 21 Asia Pacific: Market Size, By Output Power (kW), 20162023 (USD Million)

Table 22 Asia Pacific: Market Size, By Country, 20162023 (USD Million)

Table 23 China: Market Size, By Type, 20162023 (USD Million)

Table 24 Japan: AC Electric Motor Sales in Oil & Gas Market Size, By Type, 20162023 (USD Million)

Table 25 India: Market Size, By Type, 20162023 (USD Million)

Table 26 South Korea: Market Size, By Type, 20162023 (USD Million)

Table 27 Australia: Market Size, By Type, 20162023 (USD Million)

Table 28 Vietnam: Market Size, By Type, 20162023 (USD Million)

Table 29 Rest of Asia Pacific: Market Size, By Type, 20162023 (USD Million)

Table 30 North America: AC Electric Motor Sales in Oil & Gas Market Size, By Type, 20162023 (USD Million)

Table 31 North America: Market Size, By Voltage, 20162023 (USD Million)

Table 32 North America: Market Size, By Output Power (HP), 20162023 (USD Million)

Table 33 North America: Market Size, By Output Power (kW), 20162023 (USD Million)

Table 34 North America: Market Size, By Country, 20162023 (USD Million)

Table 35 US: AC Electric Motor Sales in Oil & Gas Market Size, By Type, 20162023 (USD Million)

Table 36 Canada: Market Size, By Type, 20162023 (USD Million)

Table 37 Mexico: Market Size, By Type, 20162023 (USD Million)

Table 38 Europe: AC Electric Motor Sales in Oil & Gas Market Size, By Type, 20162023 (USD Million)

Table 39 Europe: Market Size, By Voltage, 20162023 (USD Million)

Table 40 Europe: Market Size, By Output Power (HP), 20162023 (USD Million)

Table 41 Europe: Market Size, By Output Power (kW), 20162023 (USD Million)

Table 42 Europe: Market Size, By Country, 20162023 (USD Million)

Table 43 Denmark: Market Size, By Type, 20162023 (USD Million)

Table 44 France: AC Electric Motor Sales in Oil & Gas Market Size, By Type, 20162023 (USD Million)

Table 45 Germany: Market Size, By Type, 20162023 (USD Million)

Table 46 Italy: Market Size, By Type, 20162023 (USD Million)

Table 47 Norway: Market Size, By Type, 20162023 (USD Million)

Table 48 Portugal: Market Size, By Type, 20162023 (USD Million)

Table 49 Russia: Market Size, By Type, 20162023 (USD Million)

Table 50 Spain: Market Size, By Type, 20162023 (USD Million)

Table 51 Sweden: Market Size, By Type, 20162023 (USD Million)

Table 52 UK: AC Electric Motor Sales in Oil and Gas Market Size, By Type, 20162023 (USD Million)

Table 53 Rest of Europe: Market Size, By Type, 20162023 (USD Million)

Table 54 Middle East: AC Electric Motor Sales in Oil & Gas Market Size, By Type, 20162023 (USD Million)

Table 55 Middle East: Market Size, By Voltage, 20162023 (USD Million)

Table 56 Middle East: Market Size, By Output Power (HP), 20162023 (USD Million)

Table 57 Middle East: Market Size, By Output Power (kW), 20162023 (USD Million)

Table 58 Middle East: Market Size, By Country, 20162023 (USD Million)

Table 59 Kuwait: Market Size, By Type, 20162023 (USD Million)

Table 60 Saudi Arabia: AC Electric Motor Sales in Oil & Gas Market Size, By Type, 20162023 (USD Million)

Table 61 UAE: Market Size, By Type, 20162023 (USD Million)

Table 62 Rest of Middle East: Market Size, By Type, 20162023 (USD Million)

Table 63 South America: AC Electric Motor Sales in Oil & Gas Market Size, By Type, 20162023 (USD Million)

Table 64 South America: AC Electric Motor Sales in Oil and Gas Market Size, By Voltage, 20162023 (USD Million)

Table 65 South America: Market Size, By Output Power (HP), 20162023 (USD Million)

Table 66 South America: Market Size, By Output Power (kW), 20162023 (USD Million)

Table 67 South America: Market Size, By Country, 20162023 (USD Million)

Table 68 Brazil: AC Electric Motor Sales in Oil & Gas Market Size, By Type, 20162023 (USD Million)

Table 69 Argentina: AC Electric Motor Sales in Oil and Gas Market Size, By Type, 20162023 (USD Million)

Table 70 Venezuela: Market Size, By Type, 20162023 (USD Million)

Table 71 Chile: Market Size, By Type, 20162023 (USD Million)

Table 72 Colombia: Market Size, By Type, 20162023 (USD Million)

Table 73 Rest of South America: Market Size, By Type, 20162023 (USD Million)

Table 74 Africa: AC Electric Motor Sales in Oil & Gas Market Size, By Type, 20162023 (USD Million)

Table 75 Africa: AC Electric Motor Sales in Oil and Gas Market Size, By Voltage, 20162023 (USD Million)

Table 76 Africa: Market Size, By Output Power (HP), 20162023 (USD Million)

Table 77 Africa: Market Size, By Output Power (kW), 20162023 (USD Million)

Table 78 Africa: Market Size, By Country, 20162023 (USD Million)

Table 79 Algeria: Market Size, By Type, 20162023 (USD Million)

Table 80 Egypt: Market Size, By Type, 20162023 (USD Million)

Table 81 Libya: Market Size, By Type, 20162023 (USD Million)

Table 82 Rest of North Africa: Market Size, By Type, 20162023 (USD Million)

Table 83 Nigeria: Market Size, By Type, 20162023 (USD Million)

Table 84 Kenya: Market Size, By Type, 20162023 (USD Million)

Table 85 South Africa: AC Electric Motor Sales in Oil and Gas Market Size, By Type, 20162023 (USD Million)

Table 86 Rest of Africa: Market Size, By Type, 20162023 (USD Million)

Table 87 Siemens AG Was the Most Active Player in the Market Between 2015 & 2018

List of Figures (38 Figures)

Figure 1 Ac Electric Motor Sales in Oil & Gas Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Asia Pacific is Expected to Dominate the Ac Electric Motor Sales in Oil and Gas Market in 2018

Figure 7 Induction Motor Segment is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 8 <1 kV Segment is Expected to Lead the Ac Electric Motor Sales in Oil and Gas Market During the Forecast Period

Figure 9 1101,000 kW Output Power Segment is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 10 >1 HP Output Power Segment is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 11 Increasing Automation in Oil & Gas Industry is Expected to Drive the Ac Electric Motor Sales in Oil & Gas Market From 20182023

Figure 12 The Saudi Arabia Market is Expected to Grow at the Highest Cagr During The Forecast Period

Figure 13 >1 HP Segment and China Dominated The Ac Electric Motor Sales in Oil and Gas Market in Asia Pacific

Figure 14 Ac Electric Motor Sales in Oil & Gas Market: Drivers, Restraints, Opportunities, and Challenges

Figure 15 West Texas Intermediate (WTI) Crude Oil Price, 20132017

Figure 16 Induction Motor Segment is Expected to Dominate the Market With the Maximum Market Share During the Forecast Period

Figure 17 <1 kV Segment is Expected to Dominate the Market With the Maximum Market Share During the Forecast Period

Figure 18 >1 HP Segment is Expected to Dominate the Market With the Maximum Market Share During the Forecast Period

Figure 19 1101,000 kW Segment is Expected to Dominate the Market With the Maximum Market Share During the Forecast Period

Figure 20 Middle East is Expected to Grow at the Highest Cagr During the Forecast Period

Figure 21 Ac Electric Motor Sales in Oil and Gas Market in 2017

Figure 22 Asia Pacific: Market Snapshot

Figure 23 North America: Market Snapshot

Figure 24 Key Developments in the Ac Electric Motor Market, 20152018

Figure 25 ABB Ltd Led the Ac Electric Motor Market in 2017

Figure 26 Siemens: Company Snapshot

Figure 27 Ge: Company Snapshot

Figure 28 ABB: Company Snapshot

Figure 29 WEG SE: Company Snapshot

Figure 30 Yaskawa: Company Snapshot

Figure 31 Rockwell: Company Snapshot

Figure 32 Allied Motion: Company Snapshot

Figure 33 Nidec Corporation: Company Snapshot

Figure 34 Regal Beloit: Company Snapshot

Figure 35 Johnson Electric: Company Snapshot

Figure 36 Hitachi: Company Snapshot

Figure 37 Schneider: Company Snapshot

Figure 38 Toshiba Corporation: Company Snapshot

Growth opportunities and latent adjacency in AC Electric Motor Sales in Oil & Gas Market