3D Camera Market Size, Share, Industry Growth, Trends & Analysis by Image Detection Technique (Time of Flight, Structured Light, Stereoscopic Vision), Type (Target Camera, Target-free Camera), End-user Industry and Region (North America, Europe, Asia Pacific, RoW) - Global Forecast to 2028

3D Camera Market Size & Growth

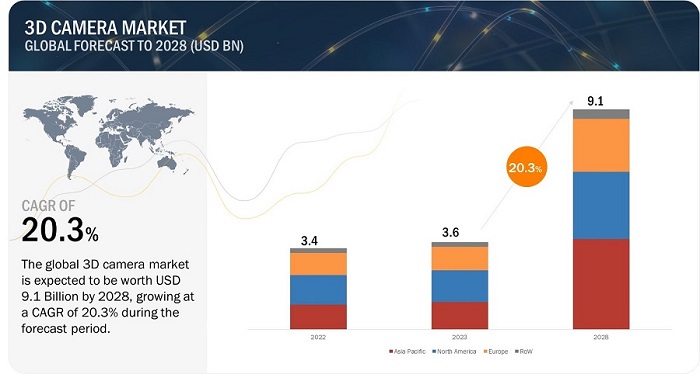

The global 3D camera market Size, Share, Industry Growth, Trends & Analysis in terms of revenue was estimated to be worth USD 3.6 Billion in 2023 and is poised to reach USD 9.1 Billion by 2028, growing at a CAGR of 20.3% from during forcast period (2023-2028).

The new research study consists of an industry trend analysis of the market. The growth of the 3D camera industry is propelled by wide applications of 3D imaging, increasing adoption of industrial robots, and rising demand for 3D cameras in construction. However, the high cost of 3D cameras and technological limitations are restraining factors for the growth of this market. The growth of AR/VR, advancements in 3D printing, and integration of machine learning in 3D cameras are key growth opportunity for players in the market.

3D Camera Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

3D Camera Market Trends: Analyzing the Types - Target Camera and Target-free Camera

- High Precision: Target cameras provide highly accurate and detailed 3D data, making them suitable for applications that require precise measurements.

- Active Illumination: Many target cameras use active illumination techniques, such as projecting structured light patterns, to enhance depth accuracy in various lighting conditions.

- Stereo Vision Technology: Utilizes multiple lenses to capture different angles of the scene, calculating depth through image disparity.

- Time-of-Flight Technology: Measures the time taken by light pulses to travel to the object and return, providing accurate depth information in real-time.

- Laser Scanning: Uses laser beams to scan the environment, capturing detailed 3D data over large areas.

- Single-lens System: Often employs a single lens and sensor system, simplifying the camera design and reducing size.

3D Camera Market Dynamics

Driver: Increasing adoption of industrial robots

The use of 3D cameras in robotics and drones is becoming more common. Using 3D cameras in robotics can significantly improve the performance and efficiency of manufacturing and other industrial applications. For instance, by using 3D cameras to capture detailed information about the environment, robots can be programmed to perform complex tasks with greater precision and accuracy. This can lead to increased efficiency, reduced waste, and improved safety in industrial settings.

As per the IFR (International Federation of Robotics), the 2022 World Robotics report showed an all-time high of 517,385 new industrial robots installed in 2021 in factories worldwide. The stock of operational robots globally hit a new record of about 3.5 million units, while global robot installations were expected to grow by 10% to almost 570,000 units in 2022. The increasing installation of industrial robots in 3D imaging will drive the demand for 3D cameras.

Restraint: Technological limitations

Despite advances in 3D camera technology, there may still be technological limitations that impact the quality of images and videos captured. For example, 3D cameras may struggle to capture accurate depth information in low-light conditions or environments with complex lighting. This can limit their adoption in certain applications, such as professional filmmaking or scientific research. Also, the range and depth perception of 3D cameras can be limited, particularly in low-light or high-contrast environments. This can result in inaccuracies or incomplete 3D models. Using 3D cameras can be more complex than traditional cameras, requiring specialized knowledge and training in areas such as 3D modeling and image processing. This can be a potential restraint for users who may not have the resources or expertise to utilize 3D cameras effectively.

Opportunity: Growth of AR/VR

The growth of 3D cameras has played a vital role in driving innovation and development in augmented reality (AR) and virtual reality (VR). For instance, 3D cameras capture in-depth information, which enables more realistic and immersive AR/VR experiences. This helps users feel more connected to the virtual world. 3D cameras can also track body movements and gestures, which enables more natural and intuitive interaction with virtual objects, allowing users to make hand gestures to manipulate objects in AR/VR environments.

3D cameras have opened up new applications for AR/VR, particularly in areas such as education, training, and remote collaboration. As 3D camera technology continues to improve and becomes more widely available, the cost of using 3D cameras for AR/VR applications may decrease, opening up the field to a broader user base.

Challenge: Competition from established camera manufacturers

Prominent camera manufacturers such as Canon, Sony, and Nikon have well-developed brand recognition and customer loyalty, making it difficult for new players to enter the market. These manufacturers have established distribution channels and marketing networks that can be difficult to compete with. These players have experience in high-volume manufacturing, which allows them to produce cameras at lower costs than newer players. Furthermore, the limited demand for 3D cameras increases the per-unit production costs, making it challenging for new players to compete on price.

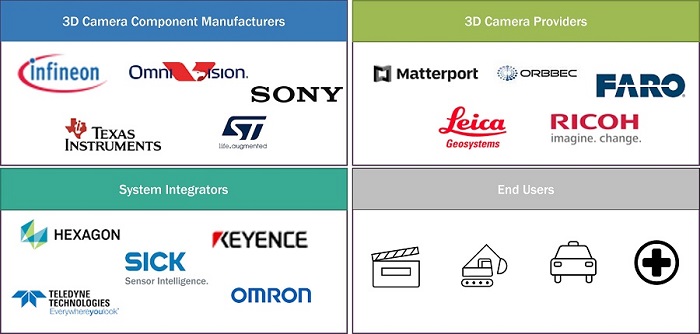

3d Camera Market Ecosystem

The 3D camera market is dominated by established and financially sound manufacturers with extensive experience in the industry. These companies have diversified product portfolios, cutting-edge technologies, and strong global sales and marketing networks. Leading players in the market include FARO (US), Ricoh Co., Ltd. (Japan), Leica Geosystems AG (Switzerland), Panasonic Holdings Corporation (Japan), and others.

Based on image detection technique, the 3D camera market for Time of Flight to hold highest CAGR during the forecast period.

The ToF segment in the 3D camera market is expected to grow at the highest CAGR during the forecast period. This growth can be attributed to the growing adoption of ToF 3D cameras in different verticals such as AR/VR, healthcare, automotive, and industrial. For instance, ToF cameras can be used to help robots navigate their environment by creating a 3D map of the surroundings. This can be useful in applications such as autonomous vehicles, drones, and industrial automation. Additionally, ToF cameras are well-suited for creating immersive AR and VR experiences, as they can accurately track the position and movement of objects in the real world.

Based on camera type, target 3D camera market to hold the highest market share from 2023 to 2028.

Target 3D cameras are used to capture highly accurate 3D models of objects, structures, or environments. This technology is used in various industries, including logistics, architecture, construction, manufacturing, medical and dental imaging, and entertainment. In logistics and supply chains, these cameras can help streamline the process of tracking and managing inventory. They can be used to automate tasks such as counting and sorting packages, which can help reduce errors and save time. For example, as packages are moved throughout warehouses, these cameras can capture 3D images of each package and use software algorithms to identify the package, track its location, and update inventory records in real time. This information can then be used to optimize workflows, reduce shipping errors, and improve the overall efficiency.

Automotive end-user industry to hold highest CAGR during the forecast period.

Automotive segment is expected to register the highest CAGR during the forecast period. The growing use of 3D cameras in automobiles is a recent trend in the automotive industry that is changing the way cars are designed and operated. These cameras use multiple lenses and sensors to capture depth information, which enables them to create a 3D map of the car's surroundings in real-time. One of the most significant benefits of using 3D cameras in cars is their ability to enhance safety features. For example, they can be used to detect obstacles, pedestrians, and other vehicles, which can help to prevent collisions and improve overall driving safety. They can also be used to assist with parking and provide better visibility in low-light conditions. In addition to safety features, 3D cameras can also be used for driver assistance and infotainment purposes. They can be used to monitor driver behaviour, such as eye movements and facial expressions, and provide alerts if the driver appears distracted or drowsy. They can also be used to enhance the user experience by providing interactive 3D maps and navigation systems.

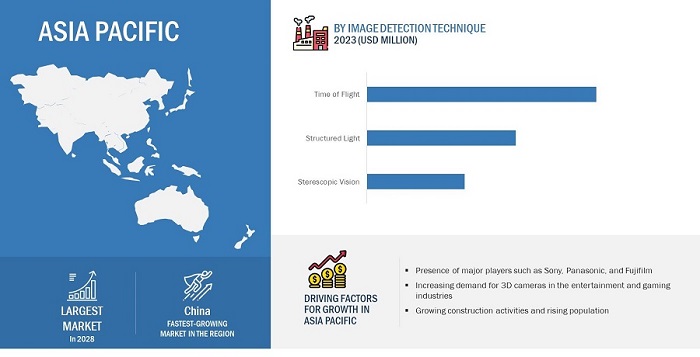

3D camera market in Asia Pacific to hold the highest CAGR during the forecast period

The Asia Pacific region has been experiencing strong growth in the use of 3D cameras in applications such as virtual reality (VR), augmented reality (AR), robotics, and industrial automation. The APAC market is expected to grow at a higher CAGR during the forecast period. This growth is attributed to the growing use of 3D cameras, driven by technological advancements, the increasing demand for advanced imaging solutions, and a growing need for more accurate and detailed spatial data. As a result, the region will likely remain a key market for companies operating in the 3D camera industry, with strong opportunities for growth and innovation in the years ahead.

3D Camera Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Companies 3D Camera Market

The 3D camera Companies are dominated by players such FARO (US), Ricoh Co., Ltd. (Japan), Leica Geosystems AG (Switzerland), Panasonic Holdings Corporation (Japan), Intel Corp. (US), and others.

Want to explore hidden markets that can drive new revenue in 3D Camera Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in 3D Camera Market?

|

Segment |

Subsegment |

| Estimated Value | USD 3.6 Billion in 2023 |

| Projected Value | USD 9.1 Billion by 2028 |

| Growth Rate | CAGR of 20.3% |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Image Detection Technique, Type, and End-user Industry |

|

Geographies covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies covered |

The major market players include ORBBEC (China), FARO (US), Matterport, Inc. (US), Ricoh Co., Ltd. (Japan), Leica Geosystems AG (Switzerland), Panasonic Holdings Corporation (Japan), Giraffe360 (UK), Insta360 (China), NavVis (Germany), GeoSLAM (UK), Intel Corp. (US). (Total 26 players are profiled) |

3D Camera Market Highlights

The study categorizes the 3D camera market based on the following segments:

|

Segment |

Subsegment |

|

3D camera market, by image detection technique |

|

|

3D camera market, by type |

|

|

3D camera market, by end-user industry |

|

|

3D camera market, By region |

|

Recent Developments

- In January 2023, Orbbec launched its latest 3D camera Gemini 2 at the CES 2023 convention in Las Vegas. This newest camera is equipped with ORBBEC’s next-generation depth engine chip, providing a 100° wide field of view along with a no blind zone technology in close range, making it possible for depth measurement from 0 distance to the range of 10m.

- In January 2023, MatterPort announced a collaboration with John Deere. As a part of this collaboration, John Deere will utilize Matterport’s Pro2 and Pro3 cameras to capture spatially accurate, 4k resolution digital twins to optimize facility operations.

- In December 2022, Giraffe360 announced the launch of Giraffe Go Cam. It offers a three times faster operating speed along with a four-inch screen, 500 GB of internal memory, and fast charging ability.

- In December 2022, Faro announced the acquisition of SiteScape, an innovator in LiDAR 3D scanning software solutions for the AEC and O&M markets. SiteScape enables LiDAR equipped mobile devices to easily capture indoor spaces digitally, providing a readily available entry-point to scanning physical spaces for a broad range of applications.

Frequently Asked Questions (FAQ):

What are the major driving factors and opportunities in the 3D camera market?

Some of the major driving factors for the growth of this market include wide applications of 3D imaging, increasing adoption of industrial robots, and rising demand for 3D cameras in construction. Moreover, the growth of AR/VR, advancements in 3D printing, and integration of machine learning in 3D cameras are key growth opportunity for players in the market.

Which region is expected to hold the highest market share?

The market in Asia Pacific will dominate the market share in 2023, showcasing strong demand from 3D camera in the region. The market is driven by the increasing demand for 3D cameras in the entertainment and gaming industries, the growing adoption of 3D technology in the healthcare sector, and the increasing use of 3D cameras in industrial and manufacturing applications.

Who are the leading players in the global 3D camera market?

Companies such as ORBBEC (China), FARO (US), Matterport, Inc. (US), Ricoh Co., Ltd. (Japan), Leica Geosystems AG (Switzerland), Panasonic Holdings Corporation (Japan), Giraffe360 (UK), Insta360 (China), NavVis (Germany), GeoSLAM (UK), and Intel Corp. (US) are the leading players in the market. Moreover, these companies rely on strategies that include new product launches and developments, partnerships and collaborations, and acquisitions. Such advantages give these companies an edge over other companies in the market.

What are some of the technological advancements in the market?

Multi-camera arrays technology is an emerging technology that uses multiple cameras arranged in a specific configuration to capture images from different angles. These images are then combined using computer algorithms to generate a 3D map of the environment. The advantage of multi-camera array technology is that it enables capturing high-quality, high-resolution 3D images suitable for various applications, including virtual reality, augmented reality, and volumetric capture. By capturing images from multiple angles, multi-camera arrays can create a more detailed and accurate 3D map of the environment than other 3D camera technologies. One key application of multi-camera arrays is volumetric capture, the process of capturing a full 3D representation of a person or object.

What is the impact of global recession on the market?

The 3D camera industry is expected to be adversely impacted by the recession and rising inflation in 2023. The growth primarily depends on the production and sales of a broad range of semiconductor devices, including image sensors, optics lens, digital signal processors (DSP), communication interfaces (such as USB, Ethernet, Wi-Fi, Bluetooth), integrated circuits (ICs), and LEDs, which are primary components of 3D camera systems. With the increased inflation, interest rates, and unemployment, demand for 3D camera solutions among consumers and enterprises is bound to be less, which, in turn, will affect production and investments across the globe. Due to the recession, end-user segments, such as consumer electronics, automotive, healthcare, and industrial, which use 3D cameras, would have low CAPEX spending for 3D camera-based solution development.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Wide applications of 3D imaging- Increasing adoption of industrial robots- Rising demand for 3D cameras in constructionRESTRAINTS- High product price due to limited demand- Technological limitations associated with 3D camerasOPPORTUNITIES- Growth of AR/VR- Advancements in 3D printing- Evolution of 3D camera technologyCHALLENGES- Increase in 3D camera production cost due to use of specialized hardware and software- Significant barriers to enter 3D camera market

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 ECOSYSTEM ANALYSIS

-

5.5 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITION RIVALRY

-

5.6 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.7 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.8 AVERAGE SELLING PRICE ANALYSISAVERAGE SELLING PRICE TRENDS

-

5.9 CASE STUDIES

-

5.10 TECHNOLOGY ANALYSISLIGHT DETECTION AND RANGING (LIDAR)MULTI-CAMERA ARRAYSQUANTUM IMAGINGCOMPUTATIONAL PHOTOGRAPHYMETASURFACE LENSES

-

5.11 PATENT ANALYSIS

-

5.12 TRADE ANALYSIS

- 5.13 TARIFF ANALYSIS

-

5.14 STANDARDS AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSSTANDARDS & REGULATIONS RELATED TO 3D CAMERA MARKET

-

5.15 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 STEREOSCOPIC VISIONSTEREOSCOPIC VISION-BASED 3D CAMERAS IDEAL FOR ROBOT NAVIGATION AND MAPPING IN DIVERSE, UNSTRUCTURED ENVIRONMENTS- Use case: Zillow uses Matterport’s 3D cameras to create high-quality and immersive virtual tours of properties listed on its website

-

6.3 STRUCTURED LIGHTSTRUCTURED LIGHT 3D CAMERAS USED IN VARIOUS MANUFACTURING APPLICATIONS FOR DIMENSIONAL MEASUREMENT, QUALITY CONTROL, AND INSPECTION- Use case: 3D inspection of large heavy machinery components to save material cost

-

6.4 TIME OF FLIGHTTOF 3D CAMERAS USED IN ROBOTICS DUE TO THEIR ABILITY TO PROVIDE FAST, ACCURATE, AND REAL-TIME 3D INFORMATION- Use case: 3D time of flight cameras to aid robotic palletizers

- 7.1 INTRODUCTION

-

7.2 TARGET CAMERAUSES TIME OF FLIGHT TECHNOLOGY- Use case: Cheese factory in Netherlands uses time of flight 3D cameras in self-driving forklifts

-

7.3 TARGET-FREE CAMERAUSES COMBINATION OF TIME OF FLIGHT (TOF), STEREOSCOPIC VISION, AND STRUCTURED LIGHT TECHNOLOGIES- Use case: Amazon Robotics uses 3D camera technology to capture images and track objects at its warehouses

- 8.1 INTRODUCTION

-

8.2 CONSUMER ELECTRONICSGROWING ADOPTION OF 3D CAMERAS IN CONSUMER ELECTRONICS PRODUCTS TO DRIVE MARKET

-

8.3 HEALTHCAREEXTENSIVE APPLICATIONS OF 3D CAMERAS IN MEDICAL IMAGING TO DRIVE MARKET GROWTH- Use case: Researchers at University of Michigan used 3D cameras to create a customized prosthetic socket

-

8.4 INDUSTRIALINCREASING ADOPTION OF 3D CAMERAS ACROSS INDUSTRIAL MANUFACTURING TO SUPPORT MARKET GROWTH- Use case: Manufacturer of autonomous mobile robots selected 3D cameras offered by e-con Systems for warehouse automation

-

8.5 AEROSPACE & DEFENSEDEVELOPMENT OF INSPECTION AND MAINTENANCE TECHNOLOGIES FOR AEROSPACE & DEFENSE TO CREATE DEMAND FOR 3D CAMERAS- Use case: 3D vision inspection of aerospace components

-

8.6 CONSTRUCTIONUSE OF 3D CAMERAS IN CONSTRUCTION MAPPING AND SITE ANALYSIS TO BOOST MARKET- Use case: GreenValley International uses ONE Series 360 cameras to transform LiDAR mapping

-

8.7 AUTOMOTIVEINCREASING ADOPTION OF AUTONOMOUS VEHICLES TO CREATE NEED FOR 3D CAMERAS- Use case: Automated car inspection with 3D cameras in Singapore

-

8.8 MEDIA & ENTERTAINMENTWIDE RANGE OF APPLICATIONS OF 3D CAMERAS IN MEDIA & ENTERTAINMENT TO FOSTER MARKET GROWTH- Use case: Use of 3D cameras to broadcast sporting events

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: IMPACT OF RECESSIONUS- Increasing adoption of 3D cameras across industries to enhance market growth- Case study: Audi uses 3D camera systems from Hella Aglaia to provide a comprehensive view of vehicle’s surroundingsCANADA- Increasing initiatives and investments in healthcare to boost growth- Case study: Johns Hopkins Hospital used 3D camera for spinal surgeryMEXICO- Demand from manufacturing sector to drive market- Case study: Ford redesigned assembly line using 3D cameras

-

9.3 EUROPEEUROPE: IMPACT OF RECESSIONUK- Increasing adoption of AR/VR-based solutions to propel market- Case study: British museum used 3D cameras and VR technology to create virtual tours of its exhibitsGERMANY- Adoption of 3D cameras in autonomous driving to fuel market growth- Case study: General Motors used 3D cameras in Cruise AV autonomous vehiclesFRANCE- Strong focus on R&D in 3D technology to drive market- Case study: Boeing used 3D cameras to inspect aircraft componentsSPAIN- Increasing adoption of 3D cameras in architecture and construction to augment market growth- Case study: Architecture restoration team used 3D cameras to plan and execute repairsREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: IMPACT OF RECESSIONCHINA- Growing investments in AR/VR to drive 3D camera market- Case study: VUZIX used Plessey 3D cameras in its M400 Smart GlassesJAPAN- Growth of application industries to ensure continued demand for 3D cameras- Case study: Amazon Robotics used 3D cameras offered by SICK at its warehousesINDIA- Increasing adoption of 3D cameras in medical imaging to support growth- Case study: Siemens Healthineers used Intel RealSense depth cameras for medical imagingSOUTH KOREA- Increasing investments in industrial automation to boost market- Case study: Bosch used 3D cameras for industrial automationREST OF ASIA PACIFIC

-

9.5 REST OF THE WORLDREST OF THE WORLD: IMPACT OF RECESSIONSOUTH AMERICA- Government support for 3D printing to drive marketMIDDLE EAST AND AFRICA- Increasing adoption of 3D printing to boost market

- 10.1 INTRODUCTION

- 10.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 COMPANY REVENUE ANALYSIS, 2020–2022

- 10.4 MARKET SHARE ANALYSIS, 2022

-

10.5 COMPANY EVALUATION QUADRANT, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 STARTUPS/SMES EVALUATION QUADRANT, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.7 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

10.8 STARTUPS/SMES EVALUATION MATRIXLIST OF STARTUPS/SMES: 3D CAMERA MARKETCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES: 3D CAMERA MARKET

-

10.9 COMPETITIVE SCENARIOS AND TRENDS

-

11.1 KEY PLAYERSORBBEC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFARO TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMATTERPORT INCORPORATED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRICOH CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewLEICA GEOSYSTEMS AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPANASONIC HOLDINGS CORPORATION- Business overview- Products/Solutions/Services offered- Recent developmentsGIRAFFE360- Business overview- Products/Solutions/Services offered- Recent developmentsINSTA360- Business overview- Products/Solutions/Services offered- Recent developmentsNAVVIS- Business overview- Products/Solutions/Services offered- Recent developmentsGEOSLAM- Business overview- Products/Solutions/Services offered- Recent developmentsINTEL CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments

-

11.2 OTHER PLAYERSKANDAOFUJIFILM CORPORATIONMECH-MIND ROBOTICSGOPRO INCORPORATEDEASTMAN KODAK COMPANYCOGNEX CORPORATIONAXIS COMMUNICATIONS ABPICKIT 3DSONY CORPORATION4DAGE CO., LTD.REALSEEPLANITAR INC.TRIMBLE INC.HIKROBOT CO., LTD.IFM ELECTRONIC GMBH

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 RISK FACTOR ANALYSIS

- TABLE 2 ASSUMPTIONS FOR RECESSION ANALYSIS

- TABLE 3 ROLE OF COMPANIES IN ECOSYSTEM/VALUE CHAIN

- TABLE 4 IMPACT OF PORTER’S FIVE FORCES ON 3D CAMERA MARKET

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES (%)

- TABLE 6 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

- TABLE 7 AVERAGE SELLING PRICE OF 3D CAMERAS, BY END-USER INDUSTRY AND COMPANY (USD)

- TABLE 8 USE CASE: AMAZON USED 3D CAMERA FROM INTEL

- TABLE 9 USE CASE: DJI USED HASSELBLAD 3D CAMERA IN ITS MAVIC 2 PRO DRONE

- TABLE 10 USE CASE: HTC USED INTEL 3D CAMERA IN ITS VIVE PRO VR HEADSET

- TABLE 11 USE CASE: APPLE IPHONE X USES 3D CAMERA MODULE MADE BY LUMENTUM

- TABLE 12 USE CASE: HP INTEGRATED 3D CAMERA SYSTEM FROM INTEL IN SPROUT PRO WORKSTATION

- TABLE 13 LIST OF FEW PATENTS IN 3D CAMERA MARKET, 2020–2022

- TABLE 14 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 15 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 16 MFN TARIFFS FOR HS CODE: 852580 EXPORTED BY CHINA

- TABLE 17 MFN TARIFFS FOR HS CODE: 852580 EXPORTED BY US

- TABLE 18 MFN TARIFF FOR HS CODE: 852580 EXPORTED BY GERMANY

- TABLE 19 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 21 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 22 REST OF THE WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 23 3D CAMERA MARKET: DETAILED LIST OF CONFERENCES AND EVENTS, 2023–2024

- TABLE 24 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2019–2022 (USD MILLION)

- TABLE 25 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2023–2028 (USD MILLION)

- TABLE 26 STEREOSCOPIC VISION: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 27 STEREOSCOPIC VISION: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 28 STEREOSCOPIC VISION: 3D CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 29 STEREOSCOPIC VISION: 3D CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 30 STRUCTURED LIGHT: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 31 STRUCTURED LIGHT: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 32 STRUCTURED LIGHT: 3D CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 STRUCTURED LIGHT: 3D CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 TIME OF FLIGHT: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 35 TIME OF FLIGHT: 3D CAMERA MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 36 TIME OF FLIGHT: 3D CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 37 TIME OF FLIGHT: 3D CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 38 3D CAMERA MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 39 3D CAMERA MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 40 3D CAMERA MARKET, BY END-USER INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 41 3D CAMERA MARKET, BY END-USER INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 42 3D CAMERA MARKET, BY END-USER INDUSTRY, 2019–2022 (THOUSAND UNITS)

- TABLE 43 3D CAMERA MARKET, BY END-USER INDUSTRY, 2023–2028 (THOUSAND UNITS)

- TABLE 44 CONSUMER ELECTRONICS: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2019–2022 (USD MILLION)

- TABLE 45 CONSUMER ELECTRONICS: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2023–2028 (USD MILLION)

- TABLE 46 HEALTHCARE: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2019–2022 (USD MILLION)

- TABLE 47 HEALTHCARE: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2023–2028 (USD MILLION)

- TABLE 48 INDUSTRIAL: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2019–2022 (USD MILLION)

- TABLE 49 INDUSTRIAL: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2023–2028 (USD MILLION)

- TABLE 50 AEROSPACE & DEFENSE: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2019–2022 (USD MILLION)

- TABLE 51 AEROSPACE & DEFENSE: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2023–2028 (USD MILLION)

- TABLE 52 CONSTRUCTION: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2019–2022 (USD MILLION)

- TABLE 53 CONSTRUCTION: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2023–2028 (USD MILLION)

- TABLE 54 AUTOMOTIVE: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2019–2022 (USD MILLION)

- TABLE 55 AUTOMOTIVE: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2023–2028 (USD MILLION)

- TABLE 56 MEDIA & ENTERTAINMENT: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2019–2022 (USD MILLION)

- TABLE 57 MEDIA & ENTERTAINMENT: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2023–2028 (USD MILLION)

- TABLE 58 3D CAMERA MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 59 3D CAMERA MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2019–2022 (USD MILLION)

- TABLE 61 NORTH AMERICA: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2023–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: 3D CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: 3D CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 64 EUROPE: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2019–2022 (USD MILLION)

- TABLE 65 EUROPE: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2023–2028 (USD MILLION)

- TABLE 66 EUROPE: 3D CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 67 EUROPE: 3D CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 68 ASIA PACIFIC: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2019–2022 (USD MILLION)

- TABLE 69 ASIA PACIFIC: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2023–2028 (USD MILLION)

- TABLE 70 ASIA PACIFIC: 3D CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 71 ASIA PACIFIC: 3D CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 72 REST OF THE WORLD: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2019–2022 (USD MILLION)

- TABLE 73 REST OF THE WORLD: 3D CAMERA MARKET, BY IMAGE DETECTION TECHNIQUE, 2023–2028 (USD MILLION)

- TABLE 74 REST OF THE WORLD: 3D CAMERA MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 75 REST OF THE WORLD: 3D CAMERA MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 76 OVERVIEW OF STRATEGIES ADOPTED BY COMPANIES IN 3D CAMERA MARKET

- TABLE 77 3D CAMERA MARKET: DEGREE OF COMPETITION

- TABLE 78 OVERALL COMPANY FOOTPRINT

- TABLE 79 COMPANY IMAGE DETECTION TECHNIQUE FOOTPRINT

- TABLE 80 COMPANY TYPE FOOTPRINT

- TABLE 81 COMPANY END-USER INDUSTRY FOOTPRINT

- TABLE 82 COMPANY REGION FOOTPRINT

- TABLE 83 DETAILED LIST OF KEY STARTUPS/SMES: 3D CAMERA MARKET

- TABLE 84 OVERALL STARTUPS FOOTPRINT

- TABLE 85 STARTUPS IMAGE DETECTION TECHNIQUE FOOTPRINT

- TABLE 86 STARTUPS TYPE FOOTPRINT

- TABLE 87 STARTUPS END-USER INDUSTRY FOOTPRINT

- TABLE 88 STARTUPS REGION FOOTPRINT

- TABLE 89 3D CAMERA MARKET: TOP PRODUCT LAUNCHES AND DEVELOPMENTS, JANUARY 2022 TO JANUARY 2023

- TABLE 90 3D CAMERA MARKET: TOP DEALS AND OTHER DEVELOPMENTS, FEBRUARY 2022 TO JANUARY 2023

- TABLE 91 ORBBEC: BUSINESS OVERVIEW

- TABLE 92 ORBBEC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 93 ORBBEC: PRODUCT LAUNCHES

- TABLE 94 ORBBEC: DEALS

- TABLE 95 FARO TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 96 FARO TECHNOLOGIES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 97 FARO TECHNOLOGIES: PRODUCT LAUNCHES

- TABLE 98 FARO TECHNOLOGIES: DEALS

- TABLE 99 MATTERPORT INCORPORATED: BUSINESS OVERVIEW

- TABLE 100 MATTERPORT INCORPORATED: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 101 MATTERPORT INCORPORATION: PRODUCT LAUNCHES

- TABLE 102 MATTERPORT INCORPORATED: DEALS

- TABLE 103 RICOH: BUSINESS OVERVIEW

- TABLE 104 RICOH: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 105 RICOH: PRODUCT LAUNCHES

- TABLE 106 LEICA GEOSYSTEMS AG: BUSINESS OVERVIEW

- TABLE 107 LEICA GEOSYSTEMS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 108 LEICA GEOSYSTEMS AG: PRODUCT LAUNCHES

- TABLE 109 PANASONIC HOLDINGS CORPORATION: BUSINESS OVERVIEW

- TABLE 110 PANASONIC HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/ SERVICES OFFERED

- TABLE 111 PANASONIC HOLDINGS CORPORATION: DEALS

- TABLE 112 GIRAFFE360: BUSINESS OVERVIEW

- TABLE 113 GIRAFFE360: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 114 GIRAFFE360: PRODUCT LAUNCHES

- TABLE 115 INSTA360: BUSINESS OVERVIEW

- TABLE 116 INSTA360: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 117 INSTA360: DEALS

- TABLE 118 NAVVIS: BUSINESS OVERVIEW

- TABLE 119 NAVVIS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 120 NAVVIS: PRODUCT LAUNCHES

- TABLE 121 NAVVIS: DEALS

- TABLE 122 GEOSLAM: BUSINESS OVERVIEW

- TABLE 123 GEOSLAM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 GEOSLAM: DEALS

- TABLE 125 INTEL CORPORATION: BUSINESS OVERVIEW

- TABLE 126 INTEL CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 127 INTEL CORPORATION: PRODUCT LAUNCHES

- TABLE 128 INTEL CORPORATION: DEALS

- FIGURE 1 3D CAMERA MARKET SEGMENTATION

- FIGURE 2 GDP GROWTH PROJECTION UNTIL 2023 FOR MAJOR ECONOMIES

- FIGURE 3 3D CAMERA MARKET: RESEARCH DESIGN

- FIGURE 4 RESEARCH FLOW OF MARKET SIZE ESTIMATION

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE): REVENUE FROM SALES OF 3D CAMERA PRODUCTS AND SOLUTIONS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 7 TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 TARGET-FREE CAMERA SEGMENT TO CAPTURE HIGHER CAGR IN 3D CAMERA MARKET DURING FORECAST PERIOD

- FIGURE 10 TIME OF FLIGHT SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 11 AUTOMOTIVE SEGMENT TO AMASS LARGEST SHARE OF 3D CAMERA MARKET IN 2028

- FIGURE 12 3D CAMERA MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 13 INCREASING USE OF 3D CAMERAS IN CONSTRUCTION AND ARCHITECTURE INDUSTRIES TO DRIVE MARKET

- FIGURE 14 US AND TIME OF FLIGHT TECHNOLOGY EXPECTED TO HOLD LARGEST SHARE OF NORTH AMERICAN 3D CAMERA MARKET IN 2023

- FIGURE 15 CHINA TO ACCOUNT FOR LARGEST SHARE OF 3D CAMERA MARKET IN ASIA PACIFIC DURING FORECAST PERIOD

- FIGURE 16 3D CAMERA MARKET IN CHINA TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 17 3D CAMERA MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 3D CAMERA MARKET: IMPACT ANALYSIS OF DRIVERS

- FIGURE 19 3D CAMERA MARKET: IMPACT ANALYSIS OF RESTRAINTS

- FIGURE 20 3D CAMERA MARKET: IMPACT ANALYSIS OF OPPORTUNITIES

- FIGURE 21 3D CAMERA MARKET: IMPACT ANALYSIS OF CHALLENGES

- FIGURE 22 VALUE CHAIN ANALYSIS: 3D CAMERA

- FIGURE 23 KEY PLAYERS IN 3D CAMERA MARKET

- FIGURE 24 PORTER’S FIVE FORCES ANALYSIS: 3D CAMERA MARKET

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE END-USER INDUSTRIES

- FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE END-USER INDUSTRIES

- FIGURE 27 REVENUE SHIFTS FOR PLAYERS IN 3D CAMERA MARKET

- FIGURE 28 AVERAGE SELLING PRICES OF 3D CAMERAS, BY END-USER INDUSTRY AND COMPANY

- FIGURE 29 AVERAGE SELLING PRICE ANALYSIS, BY END-USER INDUSTRY

- FIGURE 30 NUMBER OF PATENTS GRANTED IN 3D CAMERA MARKET, 2012–2022

- FIGURE 31 IMPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 32 EXPORT DATA, BY COUNTRY, 2018–2022 (USD MILLION)

- FIGURE 33 TIME OF FLIGHT SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 TARGET-FREE CAMERA SEGMENT TO GROW AT HIGHER CAGR IN 3D CAMERA MARKET DURING FORECAST PERIOD

- FIGURE 35 INDUSTRIAL SEGMENT TO REGISTER HIGHEST CAGR IN 3D CAMERA MARKET DURING FORECAST PERIOD

- FIGURE 36 3D CAMERA MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR FROM 2023 TO 2028

- FIGURE 37 NORTH AMERICA: 3D CAMERA MARKET SNAPSHOT

- FIGURE 38 EUROPE: 3D CAMERA MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: 3D CAMERA MARKET SNAPSHOT

- FIGURE 40 THREE-YEAR REVENUE ANALYSIS OF TOP FIVE PLAYERS IN 3D CAMERA MARKET

- FIGURE 41 MARKET SHARES OF LEADING PLAYERS IN 3D CAMERA MARKET, 2022

- FIGURE 42 3D CAMERA MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2022

- FIGURE 43 3D CAMERA MARKET: STARTUPS/SMES EVALUATION QUADRANT, 2022

- FIGURE 44 FARO TECHNOLOGIES: COMPANY SNAPSHOT

- FIGURE 45 MATTERPORT INCORPORATED: COMPANY SNAPSHOT

- FIGURE 46 RICOH: COMPANY SNAPSHOT

- FIGURE 47 PANASONIC HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 48 INTEL CORPORATION: COMPANY SNAPSHOT

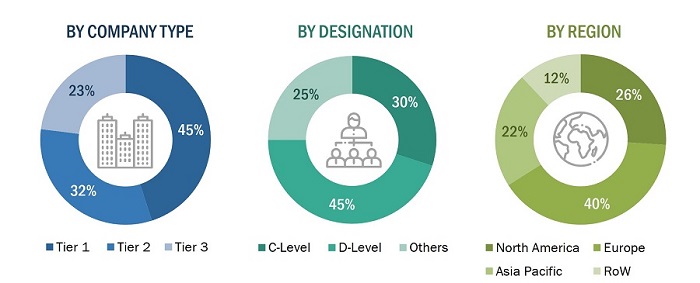

The study involved four major activities in estimating the current size of the 3D camera market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources for this research study included corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers; certified publications; articles by recognized authors; directories; and databases. The secondary data was collected and analyzed to determine the overall market size, further validated through primary research.

List of major secondary sources

|

SOURCE |

WEB LINK |

|

NIST (National Institute of Standards and Technology) |

https://nvlpubs.nist.gov/nistpubs/Legacy/TN/nbstechnicalnote1682.pdf |

|

Semiconductor Industry Association |

|

|

European Machine Vision Association |

|

|

National Stereoscopic Association |

|

|

Automated Imaging Association |

Primary Research

Extensive primary research was conducted after gaining knowledge about the current scenario of the 3D camera market through secondary research. Several primary interviews were conducted with experts from both demand and supply sides across four major regions—North America, Europe, Asia Pacific, and RoW. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the 3D camera market and its various dependent submarkets. The key players in the market were identified through secondary research, and their market share in the respective regions was determined through primary and secondary research. This entire procedure involved the study of annual and financial reports of top players and extensive interviews with industry leaders such as chief executive officers (CEOs), vice presidents (VPs), directors, and marketing executives. All percentage shares and breakdowns were determined using secondary sources and verified through primary sources. All the possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was consolidated and supplemented with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Bottom-Up Approach

The bottom-up approach was used to arrive at the overall size of the 3D camera market from the revenues of the key players and their shares in the market. The overall market size was calculated based on the revenues of the key players identified in the market.

- Identifying various end-user industries using or expected to implement 3D cameras

- Analyzing each end-user industry and application, along with the major related companies and 3D camera hardware providers

- Estimating the 3D camera market for end-user industries

- Understanding the demand generated by companies operating across different end-use applications

- Tracking the ongoing and upcoming implementation of projects based on 3D camera technology by end-user industries and forecasting the market based on these developments and other critical parameters

- Carrying out multiple discussions with the key opinion leaders to understand the type of 3D camera-based products designed and developed by end-user industries. This information would help analyze the breakdown of the scope of work carried out by each major company in the 3D camera market

- Arriving at the market estimates by analyzing 3D camera companies as per their countries and subsequently combining this information to arrive at the market estimates by region

- Verifying and cross-checking the estimates at every level through discussions with the key opinion leaders, including CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

- Studying various paid and unpaid sources of information, such as annual reports, press releases, white papers, and databases

Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research.

To calculate the market size of specific segments, the most appropriate immediate parent market size has been used to implement the top-down approach. The top-down approach was implemented for the data extracted from the secondary research to validate the market size obtained.

The market share of each company was estimated to verify the revenue shares used earlier in the top-down approach. The overall parent market size and individual market sizes were determined and confirmed in this study by the data triangulation method and the validation of data through primaries. The data triangulation method used in this study is explained in the next section.

- Focusing on top-line investments and expenditures being made in the ecosystems of various end-user industries. Additionally, listing key developments, analyzing updated technology in the marketplace, as well as evaluating the market by further splitting it into various image detection techniques

- Building and developing the information related to the market revenue generated by key 3D camera manufacturers

- Conducting multiple on-field discussions with the key opinion leaders involved in the development of 3D camera products in various end-user industries

- Estimating geographic splits using secondary sources based on various factors, such as the number of players in a specific country and region, the type of 3D camera, and the level of solutions offered in end-user industries

- The impact of the recession on the steps mentioned above has also been considered

Data Triangulation

After arriving at the overall size of the 3D camera market from the market size estimation process explained above, the total market was split into several segments and subsegments. Data triangulation procedures were employed wherever applicable to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from both, demand, and supply sides. In addition to this, the market size was validated using top-down and bottom-up approaches.

Market Definition

A 3D camera is capable of capturing three-dimensional images or videos, which can be viewed from different angles to provide a sense of depth and spatial information. These cameras use various technologies such as stereoscopic imaging, depth mapping, and structured light scanning to capture 3D images. They are commonly used in industries such as entertainment, gaming, virtual reality, and medical imaging to create 3D models and maps in various fields like engineering, architecture, and surveying. In the consumer electronics industry, 3D cameras are often used to capture 3D photos and videos to share on social media or to view on 3D-capable televisions and monitors.

In addition to their applications in various industries, 3D cameras have become increasingly popular in recent years in the consumer market. They are used by hobbyists, enthusiasts, and professionals alike to capture 3D photos and videos of landscapes, people, animals, and more.

Key Stakeholders

- Government and financial institutions and investment communities

- Analysts and strategic business planners

- 3D camera product designers and fabricators

- 3D camera hardware providers

- 3D camera providers

- 3D camera integrated solution providers

- Business providers

- Professional service/solution providers

- Research organizations

- Technology standard organizations, forums, alliances, and associations

- Technology investors

Report Objectives

- To define, describe, and forecast the 3D camera market size, by image detection technique, type, end-use industry, and region in terms of value

- To forecast the 3D camera market size, by end-use industry, in terms of volume

- To forecast the size of the market segments for four major regions—North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To study the complete value chain and allied industry segments and perform a value chain analysis of the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market

- To analyze competitive developments such as joint ventures, collaborations, agreements, contracts, partnerships, mergers & acquisitions, product developments, and research & development (R&D) in the market

- To analyze the impact of the recession on the 3D camera market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of the 3D camera market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the 3D camera market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in 3D Camera Market