Zero Trust Architecture Market by Offering (Solutions and Services), Organization Size (SMEs and Large Enterprises), Deployment Mode (Cloud and On-Premises), Vertical (BFSI, IT & ITeS, Healthcare) and Region - Global Forecast to 2028

Updated on : March 21, 2024

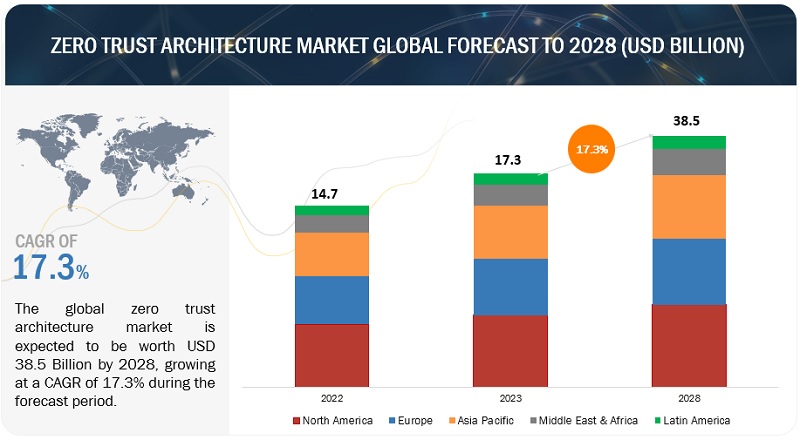

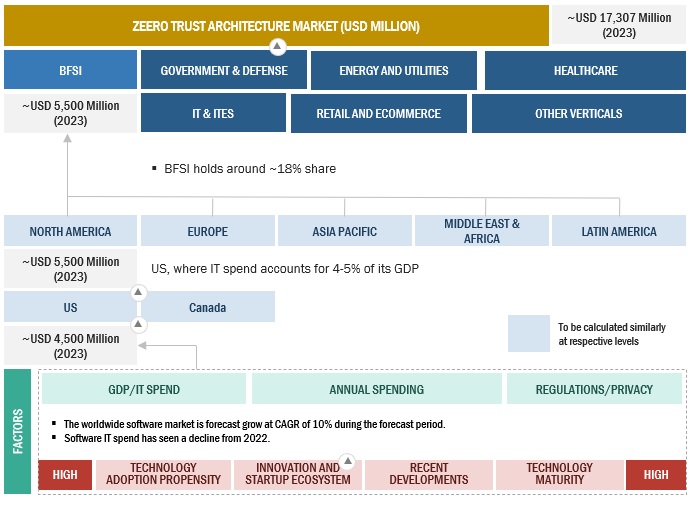

The Zero Trust Architecture Market is anticipated to increase at a Compound Annual Growth Rate (CAGR) of 17.3% over the course of the forecast period, from USD 17.3 billion in 2023 to USD 38.5 billion by 2028. The zero trust architecture market is expanding due to the imperative of meeting regulatory compliance requirements, such as GDPR and HIPAA, highlighting the importance of stringent control over network access. Furthermore, the market is propelled by the evolving cybersecurity landscape characterized by increasingly sophisticated threats like self-propagating malware and ransomware, necessitating advanced security measures. Additionally, the proliferation of digital transformation and cloud adoption has broadened the attack surface, making the “never trust, always verify” zero trust approach a vital component of modern cybersecurity strategies.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Zero Trust Architecture Market Dynamics

Driver: Growing need for zero trust architecture fueled by digital transformation and cloud integration

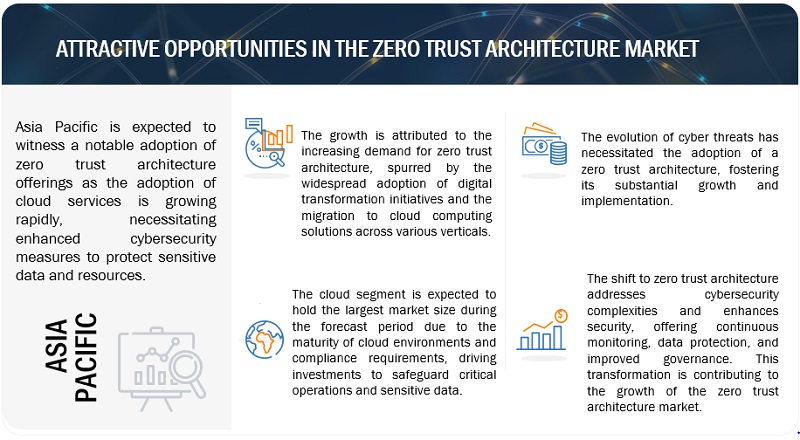

The combination of digital transformation and the widespread use of cloud environments is driving the shift to a zero trust architecture. Digital transformation involves integrating digital technologies into all business operations, creating a highly interconnected IT landscape. This expanded landscape increases the potential attack surface as organizations incorporate IoT devices, cloud apps, and connected systems. Additionally, the growing use of multi-cloud environments highlights the need for a security framework to protect data and apps across various cloud platforms. Zero trust architecture is gaining prominence because it adheres to the principle of “never trust, always verify.” Every user, device, and application request undergoes continuous authentication and authorization, even within the internal network. This approach ensures that only legitimate entities gain access to critical resources and data, reducing the risk of unauthorized access and lateral movement of threats. Consequently, digital transformation and cloud adoption convergence underscore the demand for zero trust architecture as a robust security solution to protect critical data and minimize potential losses in complex, interconnected IT environments.

Restraint: Challenges and costs of transitioning to zero trust architecture

Transitioning to a zero trust architecture is complex and costly, especially for organizations with extensive networks. This security model requires a deep understanding and can lead to vulnerabilities if implemented incorrectly. It involves significant expenses for new hardware and software and IT staff training. Adapting existing IT systems and policies is time-consuming and resource-intensive. Integrating large multinational corporations with legacy systems across multiple locations into a zero trust architecture is a significant investment and a barrier to complete adoption.

Opportunity: Growing prospects in zero trust solutions and services

The increasing need for zero trust architecture presents exciting prospects for creating new products and services that adhere to this security philosophy. Conventional security methods are increasingly seen as inadequate, prompting organizations to seek innovative solutions. This growing demand has led to specialized offerings like Zero Trust Identity and Access Management (IAM) solutions, which enhance identity verification through multi-factor authentication and behavioral analysis. Supporting these efforts, security analytics and monitoring tools are vital for continuously assessing user and network activity, enabling swift detection and response to anomalies and threats. Additionally, there’s a rising demand for zero trust endpoint security solutions, ensuring secure access based on a device’s security status. With the ongoing growth of cloud adoption, there’s an opportunity to develop zero trust cloud architecture solutions that enforce strict access controls and protect data. Alongside product development, service providers can offer implementation, customized solutions, security audits, and educational programs to facilitate the seamless adoption of zero trust architecture measures. Eventually, businesses can play a pivotal role in enhancing cybersecurity postures and addressing evolving security challenges.

Challenge: Declining traditional security model boundaries

The traditional security model relied on trust within organizational perimeters, but evolving factors like cloud computing and remote work blur these boundaries. Zero trust architecture’s fundamental principle is “never trust, always verify,” requiring authentications for all users and devices, regardless of location. To extend zero trust principles to remote employees and personal devices, robust Identity and Access Management (IAM) solutions are crucial. It ensures only authorized individuals access sensitive data, regardless of the physical location, addressing a significant challenge in the zero trust architecture.

Zero Trust Architecture Market Ecosystem

By vertical, the Retail and eCommerce segment will grow at the highest CAGR during the forecast period.

Due to several compelling factors, the retail and eCommerce sector is witnessing a significant surge in adopting Zero Trust Architecture. These include the sector’s management of high-value data and assets, such as sensitive customer information and product data, which are prime targets for cyberattacks. Furthermore, as retail and eCommerce organizations increasingly embrace digital technologies like cloud computing, mobile commerce, and IoT, they face heightened security risks, making it a valuable defense strategy. Additionally, strict compliance requirements, such as PCI DSS and GDPR, compel these organizations to implement comprehensive security measures, with zero trust offering a robust framework. Moreover, there is a growing awareness among retail and eCommerce entities about the benefits of safeguarding the data and systems driving its adoption.

By organization size, the SMEs will grow at the highest CAGR during the forecast period.

SMEs are experiencing explosive growth in the zero trust architecture market, driven by increasing cyber threats targeting them due to their perceived vulnerability compared to larger enterprises. It offers a comprehensive security framework, addressing these concerns by providing enhanced protection. Moreover, there is a growing awareness among SMEs about the benefits, with more businesses recognizing the necessity of a holistic security approach to safeguard the data and systems. The affordability of solutions is on the rise, making this advanced security technology more accessible to smaller enterprises. Additionally, simplified deployment and management of solutions make them increasingly appealing to SMEs with limited IT resources, further fueling the adoption in this market segment.

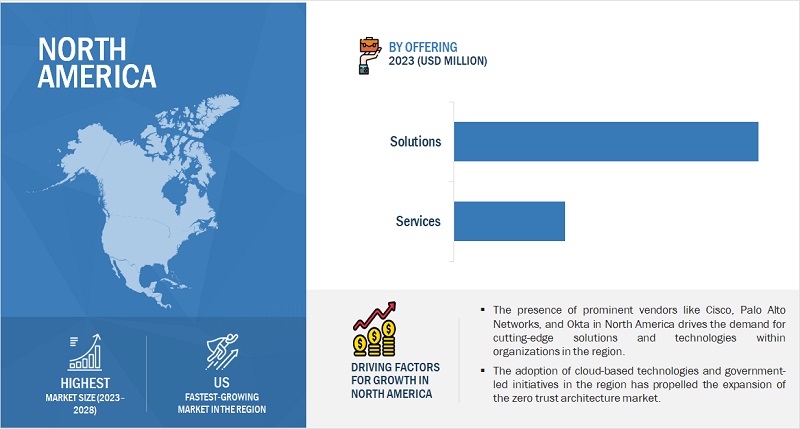

By region, North America accounts for the highest market size during the forecast period.

The zero trust architecture market in North America is thriving due to the presence of major players like Cisco, Palo Alto Networks, and Zscaler. These leading companies provide North American organizations with early access to cutting-edge solutions and technologies. Moreover, North America boasts highly cybersecurity-aware organizations that recognize the importance of comprehensive security strategies like zero trust to safeguard the data and systems from cyber threats. The region also enforces stringent cybersecurity regulations, compelling businesses to implement robust security measures, with zero trust aiding compliance. Additionally, North America’s early embrace of cloud computing presents both opportunities and security challenges, and zero trust plays a crucial role in enabling secure access to and utilization of cloud services.

Key Market Playes

Palo Alto Networks (US), VMware (US), Zscaler (US), Akamai (US), Microsoft (US), Cisco (US), IBM (US), Citrix (US), Check Point (US), Trellix (US), Forcepoint (US), CrowdStrike (US), Cloudflare (US), Fortinet (US), Google (US), Netskope (US), Perimeter 81 (US), Twingate (US), Appgate (US), Zero Networks (Israel), Versa Networks (US), Axis Security (US), Ivanti (US), NordLayer (US), and GoodAccess (Czech Republic) are the key players and other players in the zero-trust architecture market.

Want to explore hidden markets that can drive new revenue in Zero Trust Architecture Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Zero Trust Architecture Market?

|

Report Metrics |

Details |

|

Market size available for years |

|

|

Base year considered |

|

|

Forecast period |

|

|

Forecast units |

|

|

Segments Covered |

|

|

Geographies covered |

|

|

Companies covered |

|

The study categorizes the zero trust architecture market by segments - offering, organization size, deployment mode, vertical, and region.

By Offering:

- Solution

- Services

By Organization Size:

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

By Deployment Mode:

- Cloud

- On-Premises

Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Government and Defense

- IT & ITeS

- Healthcare

- Retail and ECommerce

- Energy and Utilities

- Other Verticals

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In April 2023, Palo Alto Networks and Accenture joined forces to bolster cyber resilience with integrated Prisma SASE solutions. This partnership streamlines zero trust network access, effectively addressing security concerns for remote workforces.

- In April 2023, Cisco and Microsoft unveiled a collaborative Secure Access Service Edge (SASE) cloud architecture, merging networking and security with a zero-trust approach. This strategic alliance optimizes Microsoft application performance, reinforces security, and bolsters extended detection and response capabilities.

- In May 2023, Zscaler forged a strategic partnership with the Center for Internet Security (CIS) to bolster cybersecurity for state, local, tribal, and territorial governments by leveraging the CIS CyberMarket. Through this partnership, Zscaler’s Zero Trust Exchange brings forth budget-friendly, cutting-edge zero trust solutions to safeguard against the ever-evolving landscape of cyber threats.

- In June 2022, VMware partnered with NIST’s NCCoE to streamline zero trust architecture deployment, offering practical insights and use cases for diverse business needs, ultimately simplifying the design process.

- In May 2022, Fujitsu and Akamai formed a strategic alliance to bolster cybersecurity measures for Australian companies, safeguarding critical infrastructure and digital assets. This partnership aimed to provide cutting-edge defense against ransomware and cyber threats.

Frequently Asked Questions (FAQ):

What are the opportunities in the global zero trust architecture market?

The growing demand for managed security service providers (MSSPs) and the adoption of IoT devices contribute to the growth and create new opportunities for the zero-trust architecture market.

What is the definition of the zero trust architecture market?

Zero Trust Architecture is a cybersecurity framework and approach to network and data security that assumes no implicit trust of any user or system within an organization’s network, even inside the corporate perimeter. It encompasses a set of principles and best practices for securing networks, systems, and data.

It focuses on the overall structure and design of an organization’s IT environment, emphasizing the segmentation of networks, identity and access management, continuous monitoring, and least privilege access.

The architecture is more about strategically planning and designing security measures to build a robust and resilient security posture.

Which region is expected to show the highest market share in the zero trust architecture market?

North America is expected to account for the largest market share during the forecast period.

What are the major market players covered in the report?

Major vendors in the global zero trust architecture market include Palo Alto Networks (US), VMware (US), Zscaler (US), Akamai (US), Microsoft (US), Cisco (US), IBM (US), Citrix (US), Check Point (US), Trellix (US), Forcepoint (US), CrowdStrike (US), Cloudflare (US), Fortinet (US), Google (US), Netskope (US), Perimeter 81 (US), Twingate (US), Appgate (US), Zero Networks (Israel), Versa Networks (US), Axis Security (US), Ivanti (US), NordLayer (US), and GoodAccess (Czech Republic).

What is the current size of the global zero trust architecture market?

The global zero trust architecture market size is projected to grow from USD 17.3 billion in 2023 to USD 38.5 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 17.3% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Evolution of cyber threats spurs growth of robust network segmentation- Digital transformation and cloud adoption drive zero trust architecture demand- Rising emphasis on regulatory compliance driving adoption of zero trust architecture- Shift from perimeter security to embrace zero trust architecture drives marketRESTRAINTS- Legacy systems impact zero trust adoption- Complexity and cost of implementationOPPORTUNITIES- Growth in IoT adoption creates opportunities for zero trust architecture- Expanding opportunities in zero trust architecture and services- MSS demand drives zero trust architecture growth opportunityCHALLENGES- Diminishing strength of conventional security models- Fragmented security operations in zero trust architecture

-

5.3 CASE STUDY ANALYSISDELOITTE’S CUSTOMIZED SOLUTION HELPED A MAJOR INDUSTRIAL ORGANIZATION IN ACHIEVING ZERO TRUST ARCHITECTUREOPTIV EMPOWERED NATIONAL LAW FIRM TO ACHIEVE ZERO TRUST SUCCESSCHILDREN’S HOSPITAL ENHANCED RESILIENCE WITH COLORTOKENS’ ZERO-TRUST SOLUTION

-

5.4 VALUE CHAIN ANALYSISCOMPONENTPLANNING AND DESIGNINGINTEGRATION & DEPLOYMENTCOMPLIANCE AND AUDITINGEND USERS

-

5.5 ECOSYSTEM

-

5.6 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

-

5.7 PRICING ANALYSISAVERAGE SELLING PRICE TREND OF KEY PLAYER, BY OFFERINGINDICATIVE PRICING ANALYSIS, BY OFFERING

-

5.8 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCE (AI) AND MACHINE LEARNING (ML)IAMCLOUD-NATIVE ZERO TRUSTNETWORK SEGMENTATION

-

5.9 PATENT ANALYSIS

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- 5.11 BUSINESS MODEL

-

5.12 REGULATORY LANDSCAPEPAYMENT CARD INDUSTRY DATA SECURITY STANDARD (PCI-DSS)GENERAL DATA PROTECTION REGULATION (GDPR)CALIFORNIA CONSUMER PRIVACY ACT (CCPA)GRAMM-LEACH-BLILEY ACT OF 1999 (GLBA)PERSONAL INFORMATION PROTECTION AND ELECTRONIC DOCUMENTS ACT (PIPEDA)HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT (HIPAA)THE INTERNATIONAL ORGANIZATION FOR STANDARDIZATION (ISO) STANDARD 27001REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.13 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2023–2024

-

6.1 INTRODUCTIONOFFERING: ZERO TRUST ARCHITECTURE MARKET DRIVERS

-

6.2 SOLUTIONSFOCUS ON OPTIMIZING OPERATIONAL EFFICIENCY WITH ZERO TRUST ARCHITECTURE MODEL TO DRIVE MARKETIDENTITY AND ACCESS MANAGEMENT (IAM)MICRO-SEGMENTATIONZERO TRUST NETWORK ACCESS (ZTNA)CONTINUOUS MONITORINGLEAST PRIVILEGE ACCESS

-

6.3 SERVICESCOMPREHENSIVE SERVICES TO EMPOWER ZERO TRUST ARCHITECTURE IMPLEMENTATION

-

7.1 INTRODUCTIONORGANIZATION SIZE: ZERO TRUST ARCHITECTURE MARKET DRIVERS

-

7.2 SMALL- AND MEDIUM-SIZED ENTERPRISESSMES’ DIGITAL TRANSFORMATION TO SPUR ZERO TRUST ARCHITECTURE ADOPTION

-

7.3 LARGE ENTERPRISESTRANSFORMATIVE ADOPTION OF ZERO TRUST ARCHITECTURE IN LARGE ENTERPRISES TO CONTRIBUTE TO GROWTH

-

8.1 INTRODUCTIONDEPLOYMENT MODE: ZERO TRUST ARCHITECTURE MARKET DRIVERS

-

8.2 ON-PREMISESCONTROL AND COMPLIANCE EASILY ACHIEVED THROUGH ON-PREMISES ZERO TRUST DEPLOYMENT

-

8.3 CLOUDEMBRACING CLOUD DEPLOYMENT FOR ZERO TRUST DUE TO ADVANTAGES SUCH AS SECURITY AND SCALABILITY

-

9.1 INTRODUCTIONVERTICAL: ZERO TRUST ARCHITECTURE MARKET DRIVERS

-

9.2 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)INCREASING DEMAND TO ADOPT ADVANCED SOLUTIONS AMID RISING CYBER THREATS TO DRIVE DEMAND FOR ZTA SOLUTIONS

-

9.3 GOVERNMENT & DEFENSEZERO TRUST ARCHITECTURE TO ENHANCE CYBERSECURITY RESILIENCE IN GOVERNMENT & DEFENSE VERTICAL

-

9.4 IT & ITESRISING COMPLEXITIES IN CYBERSECURITY TO PROPEL MARKET

-

9.5 HEALTHCAREINCREASING CYBER THREATS TO BOOST POPULARITY OF ZERO TRUST FRAMEWORK

-

9.6 RETAIL & ECOMMERCEZERO TRUST ARCHITECTURE TO SECURE RETAIL AND ECOMMERCE IN DIGITAL TRANSFORMATION

-

9.7 ENERGY & UTILITIESDEMAND FOR HEIGHTENED CRITICAL INFRASTRUCTURE SECURITY TO FUEL ADOPTION OF ZERO TRUST ARCHITECTURE SOLUTIONS

- 9.8 OTHER VERTICALS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICANORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET DRIVERSNORTH AMERICA: RECESSION IMPACTNORTH AMERICA: REGULATORY LANDSCAPEUS- Rising cybersecurity concerns to prompt US government’s zero trust initiativesCANADA- Initiatives taken by government to drive adoption of zero trust architecture

-

10.3 EUROPEEUROPE: ZERO TRUST ARCHITECTURE MARKET DRIVERSEUROPE: RECESSION IMPACTEUROPE: REGULATORY LANDSCAPEUK- UK enterprises to embrace zero trust for enhanced cybersecurityGERMANY- Germany to accelerate adoption of zero trust amid digital growthFRANCE- Need for robust cybersecurity to drive zero trust adoption in FranceITALY- Zero trust architecture adoption in Italy to soar amid cloud security focusREST OF EUROPE

-

10.4 ASIA PACIFICASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET DRIVERSASIA PACIFIC: RECESSION IMPACTASIA PACIFIC: REGULATORY LANDSCAPECHINA- Enhancing mobile security and networking with zero trust to drive market growthJAPAN- Increasing cyberattack threats to drive demand for zero trustINDIA- Increasing economic growth and digital advancement to drive adoption of zero trust in IndiaREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET DRIVERSMIDDLE EAST & AFRICA: RECESSION IMPACTMIDDLE EAST & AFRICA: REGULATORY LANDSCAPEMIDDLE EAST- Rise in cloud-first strategy to drive adoption of zero trustGCC- Evolving digital landscape in GCC to contribute to market growthREST OF MIDDLE EASTAFRICA- Zero trust architecture to gain momentum in African industries

-

10.6 LATIN AMERICALATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET DRIVERSLATIN AMERICA: RECESSION IMPACTLATIN AMERICA: REGULATORY LANDSCAPEBRAZIL- Zero trust adoption to soar in Brazil amid surge in pandemic-driven cyberattacksMEXICO- Mexico to embrace zero trust and XDR for cybersecurity advancementREST OF LATIN AMERICA

- 11.1 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2 REVENUE ANALYSIS

- 11.3 MARKET SHARE ANALYSIS

-

11.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

11.5 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

11.6 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHES & ENHANCEMENTSDEALS

-

12.1 KEY PLAYERSPALO ALTO NETWORKS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewVMWARE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewZSCALER- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewAKAMAI- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCISCO- Business overview- Products/Solutions/Services offered- Recent developmentsIBM- Business overview- Products/Solutions/Services offered- Recent developmentsCITRIX- Business overview- Products/Solutions/Services offered- Recent developmentsCHECK POINT- Business overview- Products/Solutions/Services offered- Recent developmentsTRELLIX- Business overview- Products/Solutions/Services offered- Recent developmentsFORCEPOINT- Business overview- Products/Solutions/Services offered- Recent developmentsCROWDSTRIKE- Business overview- Products/Solutions/Services offered- Recent developmentsCLOUDFLARE- Business overview- Products/Solutions/Services offered- Recent developmentsFORTINET- Business overview- Products/Solutions/Services offered- Recent developmentsGOOGLE- Business overview- Products/Solutions/Services offered- Recent developments

-

12.2 OTHER KEY PLAYERSNETSKOPEPERIMETER 81TWINGATEAPPGATEZERO NETWORKSVERSAAXIS SECURITYIVANTINORDLAYERGOODACCESS

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

-

13.3 ZERO TRUST ARCHITECTURE ECOSYSTEM AND ADJACENT MARKETS

-

13.4 IDENTITY AND ACCESS MANAGEMENT (IAM) MARKETIDENTITY AND ACCESS MANAGEMENT (IAM) MARKET, BY OFFERING

-

13.5 CYBER SECURITY MARKETCYBER SECURITY MARKET, BY COMPONENT

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 ZERO TRUST ARCHITECTURE VS. ZERO TRUST SECURITY

- TABLE 2 USD EXCHANGE RATES, 2018–2022

- TABLE 3 FACTOR ANALYSIS

- TABLE 4 ZERO TRUST ARCHITECTURE MARKET GROWTH, 2017–2022 (USD MILLION)

- TABLE 5 ZERO TRUST ARCHITECTURE MARKET GROWTH, 2023–2028 (USD MILLION)

- TABLE 6 ECOSYSTEM ANALYSIS: ZERO TRUST ARCHITECTURE MARKET

- TABLE 7 PORTER’S FIVE FORCES MODEL: IMPACT ANALYSIS

- TABLE 8 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING

- TABLE 9 CLOUDFLARE: INDICATIVE PRICING ANALYSIS

- TABLE 10 INSTASAFE: INDICATIVE PRICING ANALYSIS

- TABLE 11 LIST OF FEW PATENTS IN ZERO TRUST ARCHITECTURE, 2022–23

- TABLE 12 BUSINESS MODEL

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- TABLE 17 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- TABLE 18 CONFERENCES AND EVENTS, 2023–2024

- TABLE 19 ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 20 ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 21 SOLUTIONS: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 22 SOLUTIONS: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 23 SERVICES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 24 SERVICES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 25 ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 26 ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 27 SMES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 28 SMES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 29 LARGE ENTERPRISES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 30 LARGE ENTERPRISES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 31 ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 32 ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 33 ON-PREMISES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 34 ON-PREMISES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 35 CLOUD: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 36 CLOUD: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 38 ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 39 BFSI: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 40 BFSI: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 41 GOVERNMENT & DEFENSE: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 42 GOVERNMENT & DEFENSE: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 43 IT & ITES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 44 IT & ITES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 45 HEALTHCARE: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 46 HEALTHCARE: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 47 RETAIL & ECOMMERCE: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 48 RETAIL & ECOMMERCE: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 49 ENERGY & UTILITIES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 50 ENERGY & UTILITIES: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 51 OTHER VERTICALS: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 52 OTHER VERTICALS: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 53 ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 54 ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 55 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 56 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 58 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 59 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 60 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 61 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 62 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 63 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 64 NORTH AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 65 US: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 66 US: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 67 US: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 68 US: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 69 US: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 70 US: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 71 US: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 72 US: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 73 CANADA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 74 CANADA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 75 CANADA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 76 CANADA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 77 CANADA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 78 CANADA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 79 CANADA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 80 CANADA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 81 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 82 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 83 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 84 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 85 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 86 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 87 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 88 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 89 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 90 EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 91 UK: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 92 UK: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 93 UK: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 94 UK: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 95 UK: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 96 UK: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 97 UK: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 98 UK: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 99 GERMANY: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 100 GERMANY: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 101 GERMANY: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 102 GERMANY: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 103 GERMANY: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 104 GERMANY: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 105 GERMANY: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 106 GERMANY: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 107 FRANCE: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 108 FRANCE: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 109 FRANCE: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 110 FRANCE: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 111 FRANCE: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 112 FRANCE: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 113 FRANCE: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 114 FRANCE: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 115 ITALY: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 116 ITALY: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 117 ITALY: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 118 ITALY: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 119 ITALY: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 120 ITALY: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 121 ITALY: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 122 ITALY: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 123 REST OF EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 124 REST OF EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 125 REST OF EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 126 REST OF EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 127 REST OF EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 128 REST OF EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 129 REST OF EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 130 REST OF EUROPE: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 131 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 132 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 133 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 134 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 135 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 136 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 137 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 138 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 139 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 140 ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 141 CHINA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 142 CHINA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 143 CHINA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 144 CHINA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 145 CHINA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 146 CHINA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 147 CHINA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 148 CHINA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 149 JAPAN: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 150 JAPAN: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 151 JAPAN: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 152 JAPAN: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 153 JAPAN: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 154 JAPAN: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 155 JAPAN: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 156 JAPAN: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 157 INDIA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 158 INDIA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 159 INDIA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 160 INDIA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 161 INDIA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 162 INDIA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 163 INDIA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 164 INDIA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 165 REST OF ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 166 REST OF ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 167 REST OF ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 168 REST OF ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 169 REST OF ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 170 REST OF ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 171 REST OF ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 173 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 174 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 175 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 176 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 177 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 178 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 179 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 180 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 181 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 182 MIDDLE EAST & AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 183 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 184 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 185 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 186 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 187 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 188 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 189 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 190 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 191 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 192 MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 193 GCC: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 194 GCC: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 195 GCC: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 196 GCC: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 197 GCC: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 198 GCC: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 199 GCC: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 200 GCC: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 201 REST OF MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 202 REST OF MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 203 REST OF MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 204 REST OF MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 205 REST OF MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 206 REST OF MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 207 REST OF MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 208 REST OF MIDDLE EAST: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 209 AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 210 AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 211 AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 212 AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 213 AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 214 AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 215 AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 216 AFRICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 217 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 218 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 219 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 220 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 221 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 222 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 223 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 224 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 225 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2017–2022 (USD MILLION)

- TABLE 226 LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 227 BRAZIL: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 228 BRAZIL: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 229 BRAZIL: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 230 BRAZIL: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 231 BRAZIL: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 232 BRAZIL: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 233 BRAZIL: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 234 BRAZIL: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 235 MEXICO: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 236 MEXICO: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 237 MEXICO: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 238 MEXICO: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 239 MEXICO: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 240 MEXICO: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 241 MEXICO: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 242 MEXICO: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 243 REST OF LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 244 REST OF LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 245 REST OF LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2017–2022 (USD MILLION)

- TABLE 246 REST OF LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY ORGANIZATION SIZE, 2023–2028 (USD MILLION)

- TABLE 247 REST OF LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2017–2022 (USD MILLION)

- TABLE 248 REST OF LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY DEPLOYMENT MODE, 2023–2028 (USD MILLION)

- TABLE 249 REST OF LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2017–2022 (USD MILLION)

- TABLE 250 REST OF LATIN AMERICA: ZERO TRUST ARCHITECTURE MARKET, BY VERTICAL, 2023–2028 (USD MILLION)

- TABLE 251 ZERO TRUST ARCHITECTURE MARKET: DEGREE OF COMPETITION

- TABLE 252 VERTICAL FOOTPRINT

- TABLE 253 REGION FOOTPRINT

- TABLE 254 COMPANY FOOTPRINT

- TABLE 255 ZERO TRUST ARCHITECTURE MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 256 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES: VERTICAL FOOTPRINT

- TABLE 257 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES: REGION FOOTPRINT

- TABLE 258 ZERO TRUST ARCHITECTURE MARKET: PRODUCT LAUNCHES & ENHANCEMENTS, 2021–2023

- TABLE 259 ZERO TRUST ARCHITECTURE MARKET: DEALS, 2021–2023

- TABLE 260 PALO ALTO NETWORKS: BUSINESS OVERVIEW

- TABLE 261 PALO ALTO NETWORKS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 262 PALO ALTO NETWORKS: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 263 PALO ALTO NETWORKS: DEALS

- TABLE 264 VMWARE: BUSINESS OVERVIEW

- TABLE 265 VMWARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 266 VMWARE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 267 VMWARE: DEALS

- TABLE 268 ZSCALER: BUSINESS OVERVIEW

- TABLE 269 ZSCALER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 270 ZSCALER: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 271 ZSCALER: DEALS

- TABLE 272 AKAMAI: BUSINESS OVERVIEW

- TABLE 273 AKAMAI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 274 AKAMAI: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 275 AKAMAI: DEALS

- TABLE 276 MICROSOFT: BUSINESS OVERVIEW

- TABLE 277 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 278 MICROSOFT: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 279 MICROSOFT: DEALS

- TABLE 280 CISCO: BUSINESS OVERVIEW

- TABLE 281 CISCO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 282 CISCO: DEALS

- TABLE 283 IBM: BUSINESS OVERVIEW

- TABLE 284 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 IBM: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 286 IBM: DEALS

- TABLE 287 CITRIX: BUSINESS OVERVIEW

- TABLE 288 CITRIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 289 CITRIX: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 290 CITRIX: DEALS

- TABLE 291 CHECK POINT: BUSINESS OVERVIEW

- TABLE 292 CHECK POINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 293 CHECK POINT: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 294 CHECK POINT: DEALS

- TABLE 295 TRELLIX: BUSINESS OVERVIEW

- TABLE 296 TRELLIX: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 TRELLIX: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 298 FORCEPOINT: BUSINESS OVERVIEW

- TABLE 299 FORCEPOINT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 FORCEPOINT: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 301 FORCEPOINT: DEALS

- TABLE 302 CROWDSTRIKE: BUSINESS OVERVIEW

- TABLE 303 CROWDSTRIKE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 304 CROWDSTRIKE: DEALS

- TABLE 305 CLOUDFLARE: BUSINESS OVERVIEW

- TABLE 306 CLOUDFLARE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 307 CLOUDFLARE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 308 CLOUDFLARE: DEALS

- TABLE 309 FORTINET: BUSINESS OVERVIEW

- TABLE 310 FORTINET: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 311 FORTINET: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 312 FORTINET: DEALS

- TABLE 313 GOOGLE: BUSINESS OVERVIEW

- TABLE 314 GOOGLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 315 GOOGLE: PRODUCT LAUNCHES & ENHANCEMENTS

- TABLE 316 GOOGLE: DEALS

- TABLE 317 ADJACENT MARKETS AND FORECASTS

- TABLE 318 IDENTITY AND ACCESS MANAGEMENT MARKET, BY OFFERING, 2017–2022 (USD MILLION)

- TABLE 319 IDENTITY AND ACCESS MANAGEMENT MARKET, BY OFFERING, 2023–2028 (USD MILLION)

- TABLE 320 SOLUTIONS: IDENTITY AND ACCESS MANAGEMENT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 321 SOLUTIONS: IDENTITY AND ACCESS MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 322 SERVICES: IDENTITY AND ACCESS MANAGEMENT MARKET, BY REGION, 2017–2022 (USD MILLION)

- TABLE 323 SERVICES: IDENTITY AND ACCESS MANAGEMENT MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 324 CYBER SECURITY MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

- TABLE 325 CYBER SECURITY MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

- TABLE 326 HARDWARE: CYBER SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 327 HARDWARE: CYBER SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 328 SOFTWARE: CYBER SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 329 SOFTWARE: CYBER SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- TABLE 330 SERVICES: CYBER SECURITY MARKET, BY REGION, 2016–2021 (USD MILLION)

- TABLE 331 SERVICES: CYBER SECURITY MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 ZERO TRUST ARCHITECTURE MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 ZERO TRUST ARCHITECTURE MARKET ESTIMATION: RESEARCH FLOW

- FIGURE 4 APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOFTWARE/SERVICES OF ZERO TRUST ARCHITECTURE VENDORS

- FIGURE 5 APPROACH 1 (SUPPLY-SIDE ANALYSIS)

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY (APPROACH 2): BOTTOM-UP (DEMAND SIDE) — PRODUCTS/SOLUTIONS/SERVICES

- FIGURE 7 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET IN 2023

- FIGURE 8 INCREASING INSTANCES OF SOPHISTICATED CYBERATTACKS AND NEED FOR ADHERENCE TO REGULATORY COMPLIANCE TO DRIVE MARKET GROWTH

- FIGURE 9 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 10 LARGE ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 11 CLOUD TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 12 IT & ITES SEGMENT AND NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET DURING FORECAST PERIOD

- FIGURE 13 ASIA PACIFIC TO EMERGE AS LUCRATIVE MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: ZERO TRUST ARCHITECTURE MARKET

- FIGURE 15 VALUE CHAIN: ZERO TRUST ARCHITECTURE MARKET

- FIGURE 16 ECOSYSTEM: ZERO TRUST ARCHITECTURE MARKET

- FIGURE 17 PORTER’S FIVE FORCES ANALYSIS: ZERO TRUST ARCHITECTURE MARKET

- FIGURE 18 AVERAGE SELLING PRICE TREND OF KEY PLAYERS: TOP 3 OFFERINGS

- FIGURE 19 ZERO TRUST ARCHITECTURE MARKET: PATENT ANALYSIS

- FIGURE 20 REGIONAL ANALYSIS OF PATENTS FOR ZERO TRUST ARCHITECTURE MARKET, 2022

- FIGURE 21 ZERO TRUST ARCHITECTURE MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

- FIGURE 22 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

- FIGURE 23 KEY BUYING CRITERIA FOR TOP 3 APPLICATIONS

- FIGURE 24 SOLUTIONS SEGMENT TO ACCOUNT FOR LARGER MARKET DURING FORECAST PERIOD

- FIGURE 25 LARGE ENTERPRISES TO DOMINATE DURING FORECAST PERIOD

- FIGURE 26 CLOUD TO DOMINATE DURING FORECAST PERIOD

- FIGURE 27 RETAIL & ECOMMERCE SEGMENT TO ACHIEVE HIGHEST GROWTH RATE DURING FORECAST PERIOD

- FIGURE 28 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 29 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 30 ASIA PACIFIC: MARKET SNAPSHOT

- FIGURE 31 TOP 5 PLAYERS HAVE DOMINATED THE MARKET IN LAST 5 YEARS

- FIGURE 32 SHARE OF LEADING COMPANIES IN ZERO TRUST ARCHITECTURE MARKET

- FIGURE 33 ZERO TRUST ARCHITECTURE MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 34 PRODUCT FOOTPRINT

- FIGURE 35 ZERO TRUST ARCHITECTURE MARKET: START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 36 PALO ALTO NETWORKS: COMPANY SNAPSHOT

- FIGURE 37 VMWARE: COMPANY SNAPSHOT

- FIGURE 38 ZSCALER: COMPANY SNAPSHOT

- FIGURE 39 AKAMAI: COMPANY SNAPSHOT

- FIGURE 40 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 41 CISCO: COMPANY SNAPSHOT

- FIGURE 42 IBM: COMPANY SNAPSHOT

- FIGURE 43 CHECK POINT: COMPANY SNAPSHOT

- FIGURE 44 CROWDSTRIKE: COMPANY SNAPSHOT

- FIGURE 45 CLOUDFLARE: COMPANY SNAPSHOT

- FIGURE 46 FORTINET: COMPANY SNAPSHOT

- FIGURE 47 GOOGLE: COMPANY SNAPSHOT

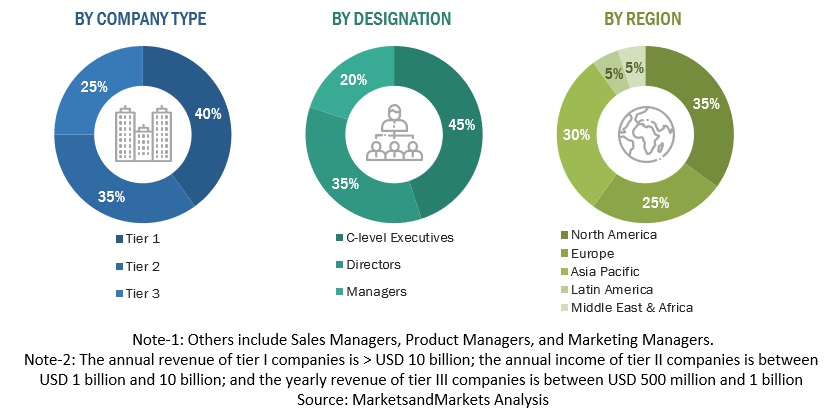

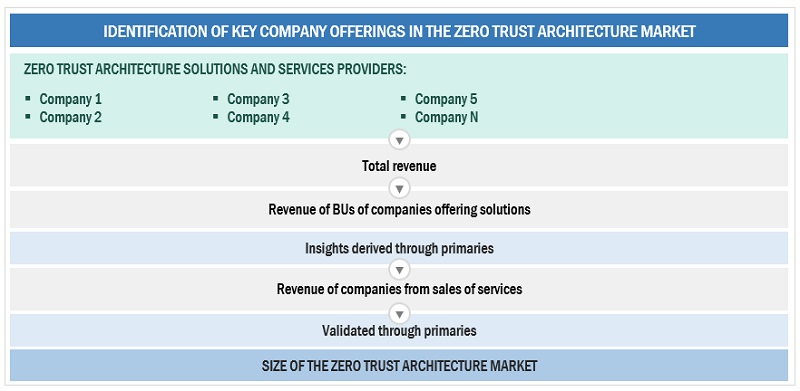

The study involved significant estimating of the current zero trust architecture market size. Exhaustive secondary research was done to collect information on the zero trust architecture industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the zero trust architecture market.

Secondary Research

The market for the companies offering zero trust architecture and services is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of zero trust architecture vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various supply and demand sources were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the Zero trust architecture market.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify the segmentation types, industry trends, competitive landscape of Zero trust architecture solutions offered by various market players, and fundamental market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches and several data triangulation methods were extensively used to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global zero trust architecture market and the size of various dependent sub-segments in the overall Zero trust architecture market. The research methodology used to estimate the market size includes the following details: critical players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives.

All percentage splits and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Infographic Depicting Bottom-Up and Top-Down Approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

The market was split into several segments and subsegments after arriving at the overall market size using the market size estimation processes explained above. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

- Zero Trust Architecture is a cybersecurity framework and approach to network and data security that assumes no implicit trust of any user or system within an organization’s network, even inside the corporate perimeter. It encompasses a set of principles and best practices for securing networks, systems, and data.

- It focuses on the overall structure and design of an organization’s IT environment, emphasizing the segmentation of networks, identity and access management, continuous monitoring, and least privilege access.

- The architecture is more about strategically planning and designing security measures to build a robust and resilient security posture.

Key Stakeholders

- Government agencies

- Zero trust security solution vendors

- System integrators

- Value-Added Resellers (VARs)

- Information Technology (IT) security agencies

- Research organizations

- Distribution partners

- Privacy specialists

Report Objectives

- To define, describe, and forecast the zero trust architecture market based on - offering, organization size, deployment mode, vertical, and region.

- To define, describe, and forecast the zero trust architecture market by – offering, organization size, deployment mode, vertical, and region.

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to the primary factors (drivers, restraints, opportunities, and challenges) influencing the growth of the zero trust architecture market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the zero trust architecture market

- To profile the key players of the zero trust architecture market and comprehensively analyze their market size and core competencies in the market

- Track and analyze competitive developments, such as new product launches, mergers and acquisitions, partnerships, agreements, and collaborations in the global zero trust architecture market.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Zero Trust Architecture Market