Waste Heat Recovery System Market by Application (Preheating and Steam & Electricity Generation), End-Use Industry (Petroleum Refining, Metal Production, Cement, Chemicals, Pulp & Paper), and Region - Global Forecast to 2027

Updated on : April 15, 2024

Waste Heat Recovery System Market

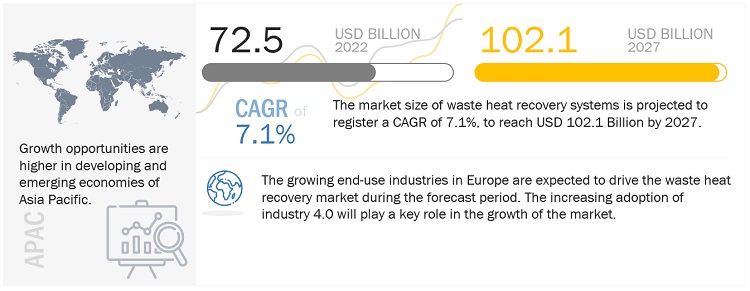

The global waste heat recovery system market was valued at USD 72.5 billion in 2022 and is projected to reach USD 102.1 billion by 2027, growing at 7.1% cagr from 2022 to 2027. The increase in demand for heat recovery systems is due to fast industrialization and growing awareness about attaining sustainable growth through energy efficiency. A significant drawback of waste heat recovery systems industry is their high cost. Additionally, the installation of waste heat recovery systems necessitates significant changes to the current setup, which results in a halt of production and downtime. Waste heat recovery systems are frequently used to preheat combustion air, space heating, furnace loads, and boiler feed water. The cascade system of waste heat recovery is bolstering the product demand which is an opportunity for the market. The industrial processes generating waste heat streams have variations in their temperatures. Many industrial facilities do not have onsite utilization of low-temperature heat. The heat exchanger surface corrodes as a result of low heat recovery is a challenge to the market.

Attractive Opportunities in the Waste Heat Recovery System Market

e- Estimated, p- Projected

To know about the assumptions considered for the study, Request for Free Sample Report

Waste Heat Recovery System Market Dynamics

Driver- Growing environmental concerns

Climate change is the greatest economic, political, developmental, and environmental challenge for countries worldwide. Enhancing energy efficiency is the cheapest and the most reliable method of curbing carbon emissions, thus saving costs. Supplying energy for sustainable economic development is a goal shared by both developed and developing countries. The exhaust manufacturing facilities generate a lot of heat, which raises the carbon footprint and has a negative impact on the environment. Waste heat recovery systems are useful for improving the overall energy efficiency of industrial manufacturing processes, thereby boosting their demand.

Restraint- High capital investment

The major restraints of waste heat recovery systems are their high cost. The waste heat recovery systems industry require complex maintenance, which is expensive. Because of this, installing such a system requires a significant capital investment, which only large industries can afford. Small and medium-sized businesses cannot afford to cover such high costs. In most cases, the recovered heat may not be of sufficient quality to improve the process's energy efficiency. The cost-benefit analysis may be skewed by high costs and little benefit. One of the obstacles to the market's expansion is the high cost of waste heat recovery systems.

Opportunity - Rise in government incentives and emerging waste heat recovery system technologies

The EU promotes best practices and incentivizes Member States to implement waste heat recovery measures. Countries have directly or indirectly supported the recovery and use of waste heat. In Denmark, there are several measures in place that support waste heat recovery systems, including heat planning regulation, taxation, subsidies, heat price regulation, a ban on electrical heating, and a law on district cooling. In Italy, since 2011, with the EEN 9-11, the Italian Energy Management Authority (ARERA) has introduced the eligibility of Waste Heat Recovery in the white certificate scheme, allowing a 5-year benefit. Since 2017, with Decree DM 11 Gennaio 2017, a specific incentive scheme for waste heat recovery with Organic Rankine Cycle systems has been introduced, allowing a 10-year benefit. To remain competitive in the market, key players are favorably inclined to pursue various growth strategies such as capacity expansions, product launches, and product innovations. This is expected to have a significant positive impact on market growth.

Challenge - Issues associated with waste heat recovery systems

The industrial processes generating waste heat streams have variations in their temperatures. Many industrial facilities do not have onsite utilization of low-temperature heat. The heat exchanger surface corrodes as a result of low heat recovery. Some of the cooling water vapor in exhaust gases condenses, depositing corrosive solids and liquids on the heat exchanger surface. It is necessary to build the heat exchanger to withstand contact with these corrosive deposits. Industrial facilities that generate high-temperature waste heat require expensive materials and mechanisms to retain that temperature for use in other applications. The temperature reduces fast when exposed to the outside environment. This temperature reduction may affect the quality of the energy available for recovery. These complexities in recovering the waste heat make waste heat recovery systems unsuitable for use in many applications.

Waste Heat Recovery System Market Ecosystem

By End-use industry, the Cement segment registered the highest CAGR during the forecast period.

The demand for waste heat recovery systems in the cement industry is driven by the rapid global growth of the construction sector. Increased investment in construction operations in numerous emerging economies and economic growth are driving the market in the cement industry. The industry is expected to be driven by the expansion of construction activities in emerging economies such as China, India, and Indonesia, particularly in social, educational, medical, retail, and residential construction.

By Application, the Preheating segment registers the highest cagr during the forecast period.

Due to its great efficiency and low fuel use, preheating is one of the most popular applications of waste heat in furnaces and kilns. Large boilers, metal-heating furnaces, high-temperature kilns, compact boilers, and compact industrial furnaces benefit from waste heat preheating. waste gases generated after recovery are utilized to preheat the stock in the aluminum and copper industries. This has the added benefit of reducing explosions caused by entrapped water vapor. As a result, the heat rejected by the process is utilized in the preheating application, resulting in increased energy efficiency and lower fuel costs.

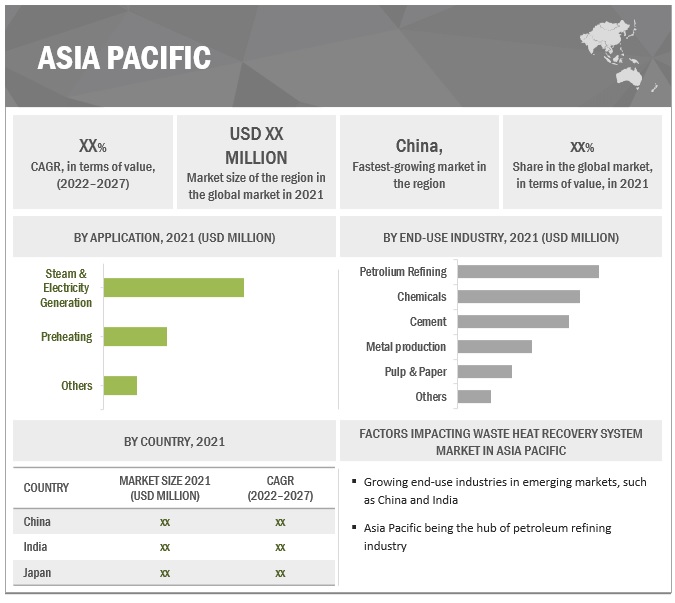

China to register the highest CAGR during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

The key factor driving the installation of waste heat recovery systems in (China) country is its economic and industrial expansion. China is taking steps to boost growth in a variety of industries, including chemicals, food and beverage, and cement. The country's construction sector is developing rapidly, driving up the demand for waste heat recovery systems in the cement industry. Because of the availability of low-cost raw materials and labor, China has developed itself as a manufacturing hub in recent years. This has resulted in significant expenditures in the country's manufacturing sector, increasing the need for waste heat recovery systems.

Waste Heat Recovery System Market Players

Key players, ABB Ltd. (Switzerland), Wood (John Wood Group Plc) (UK), Ormat Technologies Inc. (US), General Electric Co. (US), Mitsubishi Heavy Industries Ltd. (Japan), Echogen Power Systems Inc. (US), Econotherm Ltd. (UK), Thermax Limited (India), Siemens AG (Germany), and Cool Energy Inc. (Colorado) have adopted various growth strategies, such as acquisitions, contracts, agreements, and new projects to increase their market shares and enhance their product portfolios.

Read More: Waste Heat Recovery System Companies

Waste Heat Recovery System Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 72.5 billion |

|

Revenue Forecast in 2027 |

USD 102.1 billion |

|

CAGR |

7.1% |

|

Years Considered |

2020–2027 |

|

Base year |

2021 |

|

Forecast period |

2022–2027 |

|

Unit considered |

Value (USD Million/USD Billion) |

|

Segments |

Application and Region |

|

Regions |

North America, Europe, Asia-Pacific, Middle East and Africa, and South America |

|

Companies |

ABB Ltd. (Switzerland), Wood (John Wood Group Plc) (UK), Ormat Technologies Inc. (U.S.), General Electric Co. (US), Mitsubishi Heavy Industries Ltd. (Japan), Echogen Power Systems Inc. (US), Econotherm Ltd. (UK), Thermax Limited (India), Siemens AG (Germany), Cool Energy Inc. (Colorado) and others are covered in the WHRS market. |

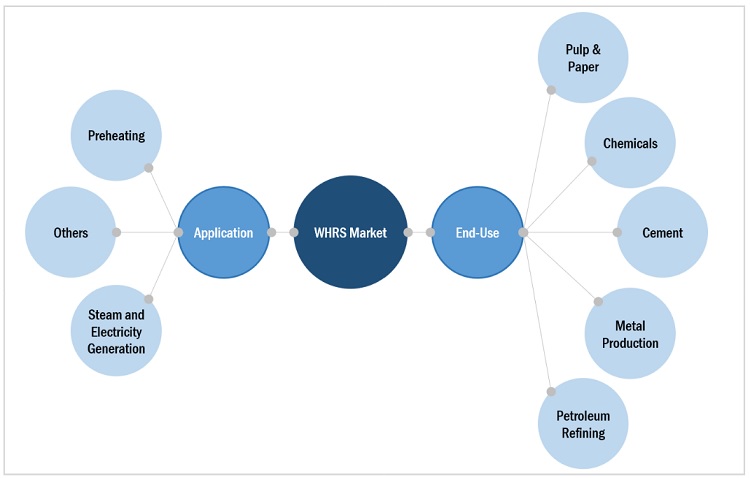

This research report categorizes the global waste heat recovery system market on the basis of Application, End-Use Industry, and Region.

Waste Heat Recovery System Market by Application

- Steam & Electricity generation

- Preheating

Waste Heat Recovery System Market by End-use Industry

- Petroleum Refining

- Metal Production

- Chemical

- Cement

- Paper & Pulp

- Others

Waste Heat Recovery System Market by Region

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa

- South America

The market has been further analyzed for the key countries in each of these regions.

Recent Developments

- In January 2022, The Ormat Technologies Inc. completed the acquisition of a shovel-ready energy storage asset in Upton County, Texas, from Con Edison Development.

- RBC acquired rival Asea Brown Boveri's (ABB) DODGE Mechanical Power Transmission business for USD 2.9 billion in cash in November 2022.

- WSP Global Inc. completed its previously announced acquisition of the environment and infrastructure business (E&I) of John Wood Group PLC through a sale and purchase agreement in September 2022.

- Swiss industrial group ABB Ltd. acquired a minority stake in UK-based climate tech start-up Tallarna Ltd. in a push to expand its portfolio of user-friendly energy management technologies and strengthen the digital portfolio of its Smart Power division in November, 2022.

Frequently Asked Questions (FAQ):

What are your views on the growth prospects of the Waste heat recovery system market?

The industry will grow in coming years as companies are focusing on environment friendly technologies.

Kindly provide the drivers, restraints, opportunities, and challenges of the WHRS market?

Driver: Growing environmental concerns, Restraint: High capital investment, Opportunity: Rise in government incentives and emerging waste heat recovery system technologies, and Challenge: Issues associated with waste heat recovery systems.

What are the emerging technologies/products that are expected to have a significant impact on the market in the future?

Companies are working using traditional methods only. Waste heat recovery system is designed as per the requirement.

Who are the major players in the Waste heat recovery system market?

ABB Ltd, Wood (John Wood Group Plc), Ormat Technologies Inc. (U.S.), Mitsubishi Heavy Industries Ltd. (Japan), Thermax Limited (India), Siemens AG (Germany)

Which is the dominating region in terms of demand for the Waste heat recovery system market?

Europe, followed by APAC .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing need for energy-efficient systems- Growing environmental concernsRESTRAINTS- High capital investmentOPPORTUNITIES- Increasing demand for waste heat recovery systems in preheating segment- Rise in government incentives and emerging waste heat recovery system technologiesCHALLENGES- Issues associated with waste heat recovery systems

-

6.1 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 TRADE ANALYSIS

- 6.4 TECHNOLOGY ANALYSIS

- 6.5 REGULATORY LANDSCAPE

-

6.6 CASE STUDIES

-

6.7 TRENDS/DISRUPTIONS IMPACTING BUYERS/CUSTOMERS

- 6.8 KEY CONFERENCES AND EVENTS, 2022–2023

-

6.9 PRICING ANALYSISCHANGES IN PRICING IN 2021

-

6.10 ECOSYSTEM MAP

-

6.11 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSTOP APPLICANTS

- 7.1 INTRODUCTION

- 7.2 PREHEATING

-

7.3 STEAM & ELECTRICITY GENERATIONSTEAM GENERATIONELECTRICITY GENERATION- Steam Rankine cycle- Organic Rankine cycle (ORC)- Kalina cycle

- 7.4 OTHERS

- 8.1 INTRODUCTION

- 8.2 PETROLEUM REFINING

- 8.3 METAL PRODUCTION

- 8.4 CEMENT

- 8.5 CHEMICALS

- 8.6 PULP & PAPER

- 8.7 OTHERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACTUS- Largest producer and user of energy in worldCANADA- Market characterized by strict emission lawsMEXICO- Fastest-growing market in region

-

9.3 EUROPEEUROPE: RECESSION IMPACTGERMANY- Major exporter of machinery, vehicles, and chemicalsITALY- Third-largest manufacturer of chemicals in EuropeFRANCE- Focused on sustainability and energy efficiency to address environmental concernsUK- Promising market for waste heat recovery systemsBELGIUM- EPC program to encourage installation of waste heat recovery systemsSWEDEN- Committed to undertaking energy-saving initiativesRUSSIA- Focused on energy conservationPOLAND- Aimed at reducing greenhouse gas emissionsSPAIN- Focused on transitioning to low-carbon economyREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACTCHINA- Largest market in Asia PacificINDIA- Promising market for waste heat recovery system technologyJAPAN- Energy Conservation Act mandates major firms to employ energy-saving measuresSOUTH KOREA- Renewable Energy 3020 to boost use of renewable energy sourcesINDONESIA- Renewable Portfolio Standard mandates electricity retailers to source power from renewable sourcesREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: RECESSION IMPACTKINGDOM OF SAUDI ARABIA (KSA)- Energy Efficiency and Renewable Energy Initiative to promote use of energy-efficient technologiesSOUTH AFRICA- Various government initiatives to support development of clean energy technologiesUAE- Dynamic market with significant growth potentialREST OF MIDDLE EAST & AFRICA

-

9.6 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACTBRAZIL- Market in early stage of developmentARGENTINA- Major producer of oil and natural gas in regionREST OF SOUTH AMERICA

- 10.1 INTRODUCTION

-

10.2 STRATEGIES ADOPTED BY KEY PLAYERSMARKET SHARE ANALYSIS OF KEY PLAYERS, 2021

- 10.3 STRATEGIES ADOPTED BY KEY PLAYERS

-

10.4 COMPANY EVALUATION QUADRANTSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

10.5 START-UP/SMALL AND MEDIUM-SIZED ENTERPRISE (SME) EVALUATION QUADRANTRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIES

- 10.6 REVENUE ANALYSIS OF TOP PLAYERS

- 10.7 COMPETITIVE BENCHMARKING

-

10.8 COMPETITIVE SITUATION AND TRENDSDEALSOTHER DEVELOPMENTS

-

11.1 KEY PLAYERSABB LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWOOD (JOHN WOOD GROUP PLC)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewORMAT TECHNOLOGIES INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGENERAL ELECTRIC CO.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMITSUBISHI HEAVY INDUSTRIES, LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSIEMENS AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTHERMAX LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewECHOGEN POWER SYSTEMS, LLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewECONOTHERM LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCOOL ENERGY, INC.- Business overview- Products/Solutions/Services offered- MnM view

-

11.2 OTHER PLAYERSTRANSPARENT ENERGY SYSTEMS PVT. LTD.JP STEEL PLANTECH CO. (STEEL PLANTECH)TMEICCLYDE BERGEMANN POWER GROUPKILBURN ENGINEERING LIMITEDSIGMA THERMALPENTA ENGINEERING CORPORATIONUNIDYNETHERMAL SYSTEMS (HYDERABAD) PVT. LTD.ESTEEM POWER EQUIPMENT INDIA PVT. LTD.HRS PROCESS SYSTEMS LIMITED (HRS PSL)CENTPROE.L.I., INC.OXFORD NANOSYSTEMSBOWMAN POWER GROUP LTD.

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 END-USE INDUSTRIES CONSIDERED IN REPORT

- TABLE 2 IMPACT OF PORTER’S FIVE FORCES ON WASTE HEAT RECOVERY SYSTEM MARKET

- TABLE 3 BOILER, STEAM, OR OTHER VAPOR GENERATING (OTHER THAN CENTRAL HEATING HOT WATER BOILERS, ALSO CAPABLE OF PRODUCING LOW PRESSURE STEAM) SUPERHEATED WATER BOILER (8402) IMPORTS, BY COUNTRY, 2021

- TABLE 4 BOILER, STEAM, OR OTHER VAPOR GENERATING (OTHER THAN CENTRAL HEATING HOT WATER BOILERS, ALSO CAPABLE OF PRODUCING LOW PRESSURE STEAM) SUPERHEATED WATER BOILER (8402) EXPORTS, BY COUNTRY 2021

- TABLE 5 HEAT EXCHANGE UNIT (NOT USED FOR DOMESTIC PURPOSES) (841950) IMPORTS, BY COUNTRY, 2021

- TABLE 6 HEAT EXCHANGE UNIT (NOT USED FOR DOMESTIC PURPOSES) (841950) EXPORTS, BY COUNTRY, 2021

- TABLE 7 TURBINE, STEAM, AND OTHER VAPOR TURBINE (8406) IMPORTS, BY COUNTRY, 2021

- TABLE 8 TURBINE, STEAM, AND OTHER VAPOR TURBINE (8406) EXPORTS, BY COUNTRY, 2021

- TABLE 9 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 MULTI-STAGE HEAT RECOVERY SYSTEMS FOR ENHANCED SAVINGS

- TABLE 11 WASTE HEAT RECOVERY IN SINTER PLANTS FOR ENERGY EFFICIENCY

- TABLE 12 WASTE HEAT RECOVERY SYSTEM MARKET: KEY CONFERENCES AND EVENTS, 2022–2023

- TABLE 13 LIST OF PATENTS

- TABLE 14 WASTE HEAT SOURCES AND RELATED RECOVERY OPPORTUNITIES AT LOW TEMPERATURES (<230°C/446°F)

- TABLE 15 WASTE HEAT SOURCES AND RELATED RECOVERY OPPORTUNITIES AT MEDIUM TEMPERATURES (230°C–650°C/446-1,202°F)

- TABLE 16 WASTE HEAT SOURCES AND RELATED RECOVERY OPPORTUNITIES AT HIGH TEMPERATURES (>650°C/1,202°F)

- TABLE 17 WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 18 WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 19 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN PREHEATING APPLICATION, BY REGION, 2017–2020 (USD MILLION)

- TABLE 20 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN PREHEATING APPLICATION, BY REGION, 2021–2027 (USD MILLION)

- TABLE 21 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN STEAM & ELECTRICITY GENERATION APPLICATION, BY REGION, 2017–2020 (USD MILLION)

- TABLE 22 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN STEAM & ELECTRICITY GENERATION APPLICATION, BY REGION, 2021–2027 (USD MILLION)

- TABLE 23 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2017–2020 (USD MILLION)

- TABLE 24 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN OTHER APPLICATIONS, BY REGION, 2021–2027 (USD MILLION)

- TABLE 25 WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 26 WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 27 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN PETROLEUM REFINING END-USE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

- TABLE 28 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN PETROLEUM REFINING END-USE INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

- TABLE 29 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN METAL PRODUCTION END-USE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

- TABLE 30 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN METAL PRODUCTION END-USE INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

- TABLE 31 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN CEMENT END-USE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

- TABLE 32 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN CEMENT END-USE INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

- TABLE 33 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN CHEMICALS END-USE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

- TABLE 34 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN CHEMICALS END-USE INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

- TABLE 35 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN PULP & PAPER END-USE INDUSTRY, BY REGION, 2017–2020 (USD MILLION)

- TABLE 36 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN PULP & PAPER END-USE INDUSTRY, BY REGION, 2021–2027 (USD MILLION)

- TABLE 37 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2017–2020 (USD MILLION)

- TABLE 38 WASTE HEAT RECOVERY SYSTEM MARKET SIZE IN OTHER END-USE INDUSTRIES, BY REGION, 2021–2027 (USD MILLION)

- TABLE 39 WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY REGION, 2017–2020 (USD MILLION)

- TABLE 40 WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

- TABLE 41 NORTH AMERICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 42 NORTH AMERICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 43 NORTH AMERICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 44 NORTH AMERICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 45 NORTH AMERICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 46 NORTH AMERICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 47 US: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 48 US: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 49 US: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 50 US: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 51 CANADA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 52 CANADA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 53 CANADA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 54 CANADA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 55 MEXICO: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 56 MEXICO: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 57 MEXICO: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 58 MEXICO: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 59 EUROPE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 60 EUROPE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 61 EUROPE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 62 EUROPE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 63 EUROPE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 64 EUROPE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 65 GERMANY: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 66 GERMANY: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 67 GERMANY: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 68 GERMANY: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 69 ITALY: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 70 ITALY: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 71 ITALY: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 72 ITALY: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 73 FRANCE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 74 FRANCE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 75 FRANCE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 76 FRANCE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 77 UK: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 78 UK: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 79 UK: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 80 UK: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 81 BELGIUM: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 82 BELGIUM: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 83 BELGIUM: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 84 BELGIUM: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 85 SWEDEN: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 86 SWEDEN: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 87 SWEDEN: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 88 SWEDEN: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 89 RUSSIA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 90 RUSSIA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 91 RUSSIA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 92 RUSSIA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 93 POLAND: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 94 POLAND: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 95 POLAND: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 96 POLAND: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 97 SPAIN: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 98 SPAIN: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 99 SPAIN: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 100 SPAIN: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 101 REST OF EUROPE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 102 REST OF EUROPE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 103 REST OF EUROPE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 104 REST OF EUROPE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 105 ASIA PACIFIC: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 106 ASIA PACIFIC: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 107 ASIA PACIFIC: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 108 ASIA PACIFIC: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 109 ASIA PACIFIC: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 110 ASIA PACIFIC: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 111 CHINA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 112 CHINA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 113 CHINA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 114 CHINA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 115 INDIA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 116 INDIA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 117 INDIA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 118 INDIA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 119 JAPAN: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 120 JAPAN: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 121 JAPAN: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 122 JAPAN: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 123 SOUTH KOREA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 124 SOUTH KOREA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 125 SOUTH KOREA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 126 SOUTH KOREA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 127 INDONESIA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 128 INDONESIA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 129 INDONESIA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 130 INDONESIA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 131 REST OF ASIA PACIFIC: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 132 REST OF ASIA PACIFIC: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 133 REST OF ASIA PACIFIC: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 138 MIDDLE EAST & AFRICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 141 KINGDOM OF SAUDI ARABIA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 142 KINGDOM OF SAUDI ARABIA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 143 KINGDOM OF SAUDI ARABIA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 144 KINGDOM OF SAUDI ARABIA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 145 SOUTH AFRICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 146 SOUTH AFRICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 147 SOUTH AFRICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 148 SOUTH AFRICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 149 UAE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 150 UAE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 151 UAE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 152 UAE: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 153 REST OF MIDDLE EAST & AFRICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 154 REST OF MIDDLE EAST & AFRICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 155 REST OF MIDDLE EAST & AFRICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 156 REST OF MIDDLE EAST & AFRICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 157 SOUTH AMERICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY COUNTRY, 2017–2020 (USD MILLION)

- TABLE 158 SOUTH AMERICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

- TABLE 159 SOUTH AMERICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 160 SOUTH AMERICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 161 SOUTH AMERICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 162 SOUTH AMERICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 163 BRAZIL: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 164 BRAZIL: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 165 BRAZIL: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 166 BRAZIL: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 167 ARGENTINA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 168 ARGENTINA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 169 ARGENTINA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 170 ARGENTINA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 171 REST OF SOUTH AMERICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2017–2020 (USD MILLION)

- TABLE 172 REST OF SOUTH AMERICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY APPLICATION, 2021–2027 (USD MILLION)

- TABLE 173 REST OF SOUTH AMERICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2017–2020 (USD MILLION)

- TABLE 174 REST OF SOUTH AMERICA: WASTE HEAT RECOVERY SYSTEM MARKET SIZE, BY END-USE INDUSTRY, 2021–2027 (USD MILLION)

- TABLE 175 OVERVIEW OF STRATEGIES ADOPTED BY WASTE HEAT RECOVERY SYSTEM MANUFACTURERS

- TABLE 176 WASTE HEAT RECOVERY SYSTEM MARKET: SHARE OF KEY PLAYERS

- TABLE 177 WASTE HEAT RECOVERY SYSTEM MARKET: STRATEGIC POSITIONING OF KEY PLAYERS

- TABLE 178 WASTE HEAT RECOVERY SYSTEM MARKET: DETAILED LIST OF KEY PLAYERS

- TABLE 179 WASTE HEAT RECOVERY SYSTEM MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

- TABLE 180 WASTE HEAT RECOVERY SYSTEM MARKET: DEALS, 2019–2022

- TABLE 181 WASTE HEAT RECOVERY SYSTEM MARKET: OTHER DEVELOPMENTS, 2019–2022

- TABLE 182 ABB LTD.: COMPANY OVERVIEW

- TABLE 183 ABB LTD.: DEALS

- TABLE 184 ABB LTD.: OTHERS

- TABLE 185 WOOD (JOHN WOOD GROUP PLC): COMPANY OVERVIEW

- TABLE 186 WOOD (JOHN WOOD GROUP PLC): DEALS

- TABLE 187 WOOD (JOHN WOOD GROUP PLC): OTHERS

- TABLE 188 ORMAT TECHNOLOGIES INC: COMPANY OVERVIEW

- TABLE 189 ORMAT TECHNOLOGIES INC.: DEALS

- TABLE 190 ORMAT TECHNOLOGIES INC.: OTHERS

- TABLE 191 GENERAL ELECTRIC COMPANY: COMPANY OVERVIEW

- TABLE 192 GENERAL ELECTRIC COMPANY: DEALS

- TABLE 193 GENERAL ELECTRIC COMPANY: OTHERS

- TABLE 194 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY OVERVIEW

- TABLE 195 MITSUBISHI HEAVY INDUSTRIES, LTD.: DEALS

- TABLE 196 MITSUBISHI HEAVY INDUSTRIES, LTD.: OTHERS

- TABLE 197 SIEMENS AG: COMPANY OVERVIEW

- TABLE 198 SIEMENS AG: DEALS

- TABLE 199 THERMAX LIMITED: COMPANY OVERVIEW

- TABLE 200 THERMAX LIMITED: DEALS

- TABLE 201 THERMAX LIMITED: OTHERS

- TABLE 202 ECHOGEN POWER SYSTEMS, LLC: COMPANY OVERVIEW

- TABLE 203 ECHOGEN POWER SYSTEMS, LLC: DEALS

- TABLE 204 ECHOGEN POWER SYSTEMS, LLC: OTHERS

- TABLE 205 ECONOTHERM LTD.: COMPANY OVERVIEW

- TABLE 206 ECONOTHERM LTD.: DEALS

- TABLE 207 ECONOTHERM LTD.: OTHERS

- TABLE 208 COOL ENERGY, INC.: COMPANY OVERVIEW

- FIGURE 1 WASTE HEAT RECOVERY SYSTEM MARKET SEGMENTATION

- FIGURE 2 WASTE HEAT RECOVERY SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 WASTE HEAT RECOVERY SYSTEM MARKET: DATA TRIANGULATION

- FIGURE 7 STEAM & ELECTRICITY GENERATION APPLICATION DOMINATED WASTE HEAT RECOVERY SYSTEM MARKET IN 2021

- FIGURE 8 PETROLEUM REFINING WAS LARGEST END-USE INDUSTRY OF WASTE HEAT RECOVERY SYSTEMS IN 2021

- FIGURE 9 EUROPE WAS LARGEST WASTE HEAT RECOVERY SYSTEM MARKET IN 2021

- FIGURE 10 INCREASING DEMAND FROM END-USE INDUSTRIES TO DRIVE MARKET

- FIGURE 11 GERMANY AND STEAM & ELECTRICITY GENERATION SEGMENT ACCOUNTED FOR LARGEST SHARES

- FIGURE 12 PETROLEUM REFINING SEGMENT TO REGISTER FASTEST GROWTH BETWEEN 2022 AND 2027

- FIGURE 13 PREHEATING TO REGISTER HIGHEST CAGR BETWEEN 2022 AND 2027

- FIGURE 14 CHINA TO BE FASTEST-GROWING MARKET

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN WASTE HEAT RECOVERY SYSTEM MARKET

- FIGURE 16 PORTER’S FIVE FORCES ANALYSIS OF WASTE HEAT RECOVERY SYSTEM MARKET

- FIGURE 17 SHIFT FROM TRADITIONAL RAW MATERIALS TO SUSTAINABLE ONES

- FIGURE 18 ECOSYSTEM MAP

- FIGURE 19 DOCUMENT TYPE, 2018–2022

- FIGURE 20 PUBLICATION TRENDS, 2018–2022

- FIGURE 21 JURISDICTION ANALYSIS, 2018–2022

- FIGURE 22 TOP APPLICANTS, BY NUMBER OF PATENTS, 2018–2022

- FIGURE 23 WASTE HEAT RECOVERY SYSTEM MARKET, BY APPLICATION

- FIGURE 24 STEAM & ELECTRICITY GENERATION TO BE LARGEST APPLICATION SEGMENT

- FIGURE 25 PETROLEUM REFINING END-USE INDUSTRY TO LEAD MARKET BETWEEN 2022 AND 2027

- FIGURE 26 CHINA TO BE FASTEST-GROWING MARKET

- FIGURE 27 EUROPE: WASTE HEAT RECOVERY SYSTEM MARKET SNAPSHOT

- FIGURE 28 ASIA PACIFIC: WASTE HEAT RECOVERY SYSTEM MARKET SNAPSHOT

- FIGURE 29 WASTE HEAT RECOVERY SYSTEM: MARKET SHARE ANALYSIS

- FIGURE 30 WASTE HEAT RECOVERY SYSTEM MARKET: COMPANY EVALUATION QUADRANT, 2021

- FIGURE 31 START-UP AND SMALL AND MEDIUM-SIZED ENTERPRISE (SMES) EVALUATION MATRIX, 2021

- FIGURE 32 ABB LTD.: COMPANY SNAPSHOT

- FIGURE 33 WOOD (JOHN WOOD GROUP PLC): COMPANY SNAPSHOT

- FIGURE 34 ORMAT TECHNOLOGIES INC.: COMPANY SNAPSHOT

- FIGURE 35 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

- FIGURE 36 MITSUBISHI HEAVY INDUSTRIES, LTD.: COMPANY SNAPSHOT

- FIGURE 37 SIEMENS AG: COMPANY SNAPSHOT

- FIGURE 38 THERMAX LIMITED: COMPANY SNAPSHOT

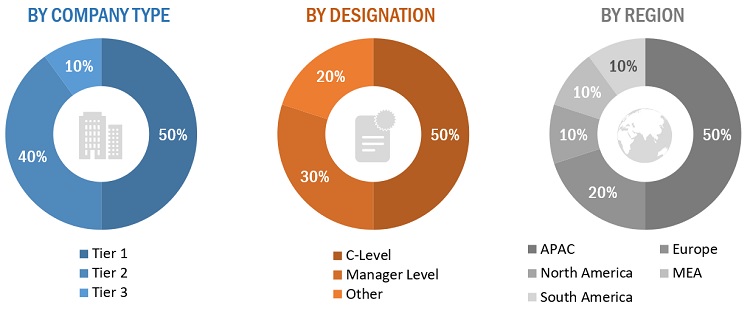

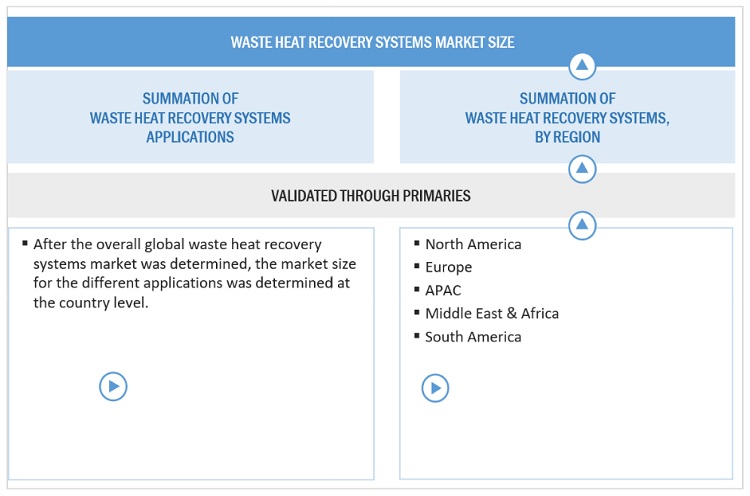

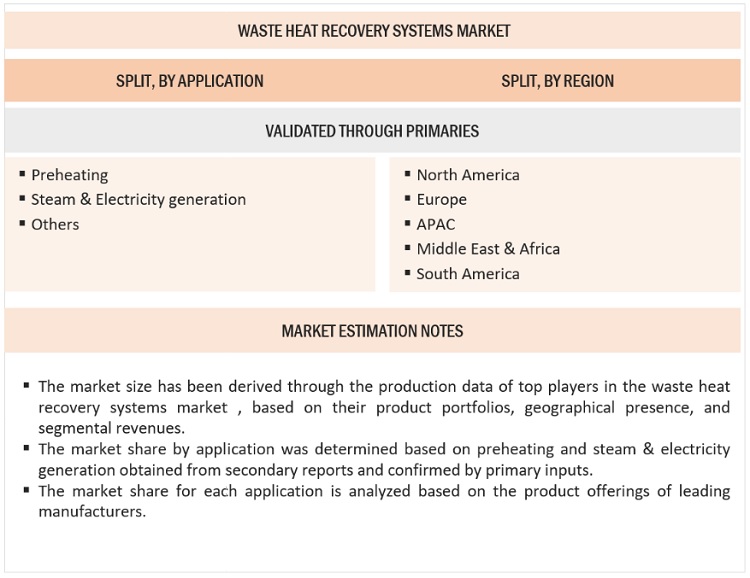

This research study involves the use of extensive secondary sources, directories, and databases, such as Hoovers, ICIS articles, Factiva, and Bloomberg Businessweek, to identify and gather information for a technical, market-oriented, and commercial study of the WHRS market. The primary sources include industry experts from core and related industries and preferred suppliers, regulatory bodies, and organizations related to all segments of the value chain of this industry. In-depth interviews have been conducted with different primary respondents, such as key industry participants, subject matter experts (SMEs), C-Level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as to assess growth prospects.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, investor presentations of companies; white papers; publications from recognized websites; and databases have been referred to for identifying and collecting information. Secondary research has been used to obtain key information about the supply chain of the industry, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both the market- and technology-oriented perspectives.

Primary Research

After the complete market estimation process (which includes calculations for market statistics, market breakdown, market size estimations, market forecast, and data triangulation), extensive primary research has been conducted to gather information and to verify and validate the critical numbers arrived at. Primary research has also been conducted to identify the segmentation, industry trends, key players, competitive landscape, industry trends, strategies of key players, and key market dynamics such as drivers, restraints, opportunities, and challenges.

In the primary research process, different primary sources from the supply and demand sides have been interviewed to obtain qualitative and quantitative information. The primary sources include industry experts such as CEOs, vice presidents, marketing directors, technology & innovation directors, and related key executives from various companies and organizations operating in the WHRS market.

Following is the breakdown of primary respondents—

Note 1: Others include sales, marketing, and product managers.

Note 2: Tier 1, Tier 2, and Tier 3 companies are classified based on their market share, product portfolio, and regional & global presence.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market size estimation process, both the top-down and bottom-up approaches have been used, along with several data triangulation methods to carry out estimations and projections for the overall market and its sub-segments listed in this report. Extensive qualitative and quantitative analyses have been carried out on the complete process to list key information/insights throughout the report. The research methodology used to estimate the market size includes the following:

- The key players in the industry were identified through extensive secondary research.

- The supply chain of the industry and market size, in terms of value, were determined through primary and secondary research.

- All percentage shares split, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of key industry players along with extensive interviews with key officials, such as directors and marketing executives.

Market Size Estimation: Supply side estimation

Note: Bottom-Up Approach

Note: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the process explained above, the total market has been split into several segments and sub-segments. To complete the overall market size estimation process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides. In addition, the market size has been validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the WHRS market in terms of value and volume.

- To provide detailed information regarding the key factors influencing the growth of the market, such as drivers, restraints, opportunities, and challenges.

- To analyze and forecast the market size based on form, and application.

- To analyze and forecast the market size in terms of value, with respect to four main regions: North America, Europe, Asia-Pacific, Middle East and Africa, and South America.

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and contribution to the total market.

- To analyze the opportunities in the market for stakeholders and draw a competitive landscape for market leaders.

- To analyze competitive developments, such as products & services offered, and expansion, in the market.

- To strategically profile key players and comprehensively analyze their core competencies.

Available Customizations:

Along with the given market data, MarketsandMarkets offers customizations as per the specific needs of the companies. The following customization options are available for the report:

Product Analysis:

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Regional Analysis:

- Further breakdown of the Rest North America WHRS market

- Further breakdown of the Rest of APAC WHRS market

- Further breakdown of Rest of Europe WHRS market

- Further breakdown of the Rest of Middle East & Africa WHRS market

- Further breakdown of Rest of South America WHRS market

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Waste Heat Recovery System Market

Detailed insights heat recovery system market with focus on government regulations and incentives with regard to ORC technology.Information on the expected share of ORC in power generation application and by industry (e.g. refining, metals, etc.). and waste heat potentials with regard to volume, temperature, megawatts

General information required on Waste heat recovery market

Number of Organic Rankine Cycle ORC systems (units shipped in addition to revenue) sold / deployed by year, by application, by geography , by system provider, worldwide

Interested in adsorption cooling for thermal energy storage and waste heat based systems.

General information required on Waste heat recovery market in Africa

General information on Waste Heat Recovery System Market, growing segment and competitive landscape

Specific information on electricity generation during Waste Heat Recovery System process

Biofuels market with activated carbon process

General information of environmental impact of climate change

Intrested in general information on waste heat recovery market

Information on Waste Heat Recovery System Market by Application

General information on Waste Heat Recovery System market

General information on Waste Heat Recovery System Market

Technical report on Asia-Pacific Waste Heat Recovery Market

Deeper insight in the waste heat market.

Market intelligence on Temperature control solutions in the data centre market to enhance value add offerings in the product and service portfolio.