Top Robotics Market Size, Share and Industry Growth Analysis Report by Top Industrial Robotics (Articulated, SCARA, Cartesian, Parallel, Collaborative), Top Service Robotics (Logistics, Domestic, Medical, Defense, Rescue, and Security) End User and Region- Global Growth Driver and Industry Forecast to 2025

Updated on : September 08 , 2023

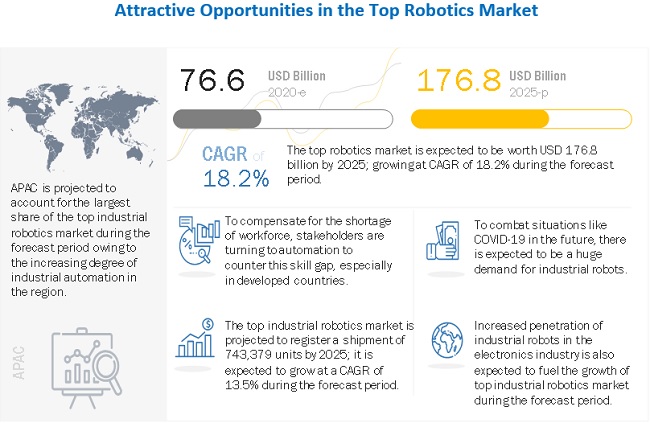

The top robotics market is projected to grow from USD 76.6 billion in 2020 to USD 176.8 billion by 2025; it is expected to grow at a Compound Annual Growth Rate (CAGR) of 18.2% from 2020 to 2025.

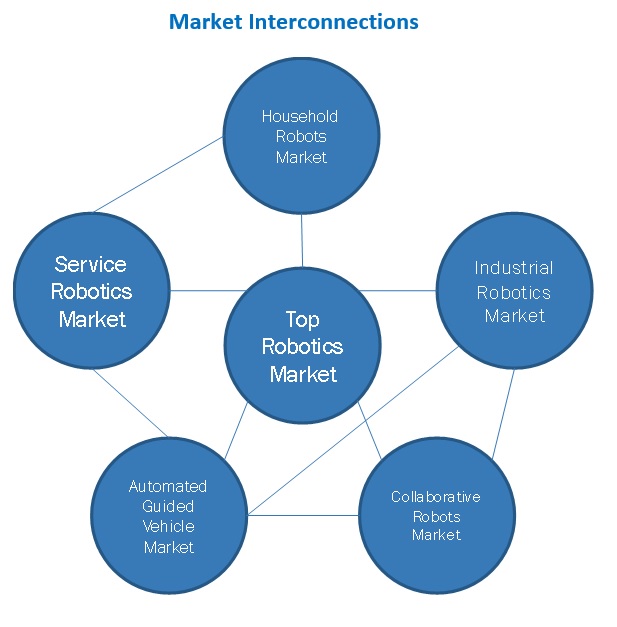

Collaborative robots are becoming more affordable and easier to program for novice users, leading to growing demand for collaborative robots across all industry segments. Service robots are increasingly being adopted for new applications due to various advantages such as increased productivity, streamlined processes, and greater workplace safety. The main advantage of using service robots is the reduction in the cost of operation and high ROI. The objective of the report is to define, describe, and forecast the top robotics market based on type, component, environment, application, industry, and region.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on current top robotics market size and forecast

The emergence of the COVID-19 pandemic, a deadly respiratory disease that originated in China, has now become a worldwide issue and has also affected the top robotics market. Most types of industrial and service robots have been affected by this crisis, which is expected to be a short-term impact. Although the market for service robots are expected to have a short impact, the market for industrial will have a longer impact that is expected to continue till the end of 2020. This is due to the higher growth rate of service robots compared to industrial robots. For instance, FANUC (Japan) has announced that its ROBOT division revenues was down 6.9% compared to the previous year for their financial year ending March 2020. The impact of COVID-19 at the end if the financial year was cited as one of the reasons for the decline. iRobot (US) on the other hand, has already started to recover from the pandemic. The company announced that its Q2 2020 revenue was higher by 8% compared to its previous year.

The COVID-19 pandemic will have a varying impact on different types of industrial and service robots. Traditional industrial robots are expected to be most affected due to a decrease in investments in major industries such as automotive and metals & machinery. However, collaborative robots are not expected to be as affected as it a growing market and is used in a more diverse set of industries. Service robots are expected to be lease affected. With drones, AGVs, disinfectant robots, and telepresence robots are being widely used for applications such as disinfection of premises, monitoring temperature, personal assistance, and for automated delivery, there will be a steady demand for these robots during the pandemic. However, consumer based service robots will be greatly affected due to the fall in disposable income as a result of the pandemic.

Top Robotics Market Dynamics

Driver : Anticipated shortage of skilled labor in manufacturing industries

The manufacturing industries in countries such as the US, Germany, and China have experienced tremendous growth over the past decade; however, these industries are expected to face a workforce shortage within the next few years. The labor shortage is especially prevalent in jobs with many repetitive and ergonomically unfavorable tasks, such as packaging and monitoring in the food industry. In the US, the growth of the manufacturing sector, coupled with retiring workers and reluctance of millennials and Generation Z candidates to enter into manufacturing industries, is expected to create a skill gap in the coming years. To compensate for the shortage of workforce, stakeholders have to find solutions to improve productivity and substitute human labor. Increasing automation to counter the skill gap is one of the solutions adopted by companies, especially in developed countries. ARC Specialties (US), a manufacturing solutions provider, recently developed an AI-based pipe welding solution to perform difficult and complex welds using a Universal Robots (Denmark) UR5 arm. This was developed in response to the shrinking skilled workforce performing difficult and manual tasks such as painting and welding.

Restraint : Concerns over data privacy and regulations

There are ethical issues concerning the ownership of data, especially with the rise of software services for robotics. Similar to other technological domains, a situation can arise where a small number of companies own the majority of customer information. The data captured by ground robots can be completely different from the data captured by drones. With the increase of domestic robots for household chores, education, and entertainment, the private information of individuals is available on the cloud. Third parties can often purchase this data, e.g., marketing agencies, and the privacy of individuals can be infringed upon. For instance, Amazon (US) and Google (US) have enabled voice activation and smart response for various robots such as Lynx (humanoid) and Roomba (vacuum cleaner). The voice from these devices can be infringed upon and misused. Hence, data security must also be considered. Other ethical aspects of robots, such as liability frameworks and the reuse of robot collected data for research or studies, also need to be considered by governments worldwide. The lack of technology standardization also complicates the integration of systems, as most equipment manufacturers use in-house interface protocols for communications. The consequences of a data breach are significant in sectors such as healthcare and military & defense and, therefore, requiring regulations without stifling the technology.

Opportunity : Accelerating spread of COVID-19 pandemic prompting several industries to adopt automation technologies

The pandemic has hit the retail industry very hard; if this pandemic intensifies, the retail companies might need automation technologies, and robotic systems manufacturers might grab this opportunity. For instance, in recent times, retailers have been witnessed placing large orders for kiosk ordering systems. Initially, jobs in the retail sector, such as grocery and delivery, were labor-intensive and involved tasks such as loading trucks and stocking shelves. However, the introduction of retail robots, due to the accelerated spread of the pandemic, is disrupting the retail industry. For example, Simbe Robotics (US) has recently released the inventory tracking robot called Tally. Many retail robots are being launched for the retail sector to conduct tasks such as managing store inventory, addressing worker shortage, helping shoppers find items, and monitoring stock levels for better efficiency. The most significant disruption witnessed during this pandemic is in the supply chains of the robotics ecosystem and the manufacturing sector, wherein there might be an increase in investments to enable automation.

Challenge : Interoperability and integration issues with industrial robots

Interoperability is an important function in any factory or manufacturing unit. A modular framework must exist for both hardware and software to connect and coordinate various automation systems. The focus here is on the software used for programming, diagnosing, and monitoring. It is not uncommon for industries to use robot arms from different manufacturers. Companies may also need to reprogram robots due to a change in production and demand or accommodate different parts, such as vision systems and end effectors. It is the responsibility of the integrator, rather than the manufacturer or end user, to decide on the implementation and set up or programming of the robot. Interoperability issues present a big challenge, especially to SMEs, due to their unique requirements and lack of personnel to set up a complex automation setup.

To know about the assumptions considered for the study, download the pdf brochure

Articulated robots are estimated to hold the largest share of the top industrial robotics market in 2020

Articulated robots are most commonly used in industries worldwide. They have the most number of axes compared to other types of industrial robots. The wrist of the robot can be fitted with a wide variety of end-effectors such as grippers and vacuum cups. These robots have been around for a much longer time than collaborative robots, which have only gained traction in the last decade. Industries such as automotive, electronics, and metal account for the major use of these robots as their production process imperatively needs to be heavily automated. As long as these industries thrive, articulated robots will dominate the market.

Ground service robots are estimated to hold the largest share of the top service robotics market in 2020

The ground environment constitutes of automated guided vehicles (AGVs), cleaning robots, agricultural robots, surgical robots, entertainment robots, inspection robots, humanoid robots, powered exoskeletons, telepresence robots, among others. Ground service robots dominated the market. Ground robots are used for applications such as surgeries, cleaning, and elderly care and communication through telepresence and assistance.

Medical application is estimated to hold the largest share of the top service robotics market in 2020

With the growing aging population that requires more care, robots are being developed to support both patients and medical staff. Medical assistive robots are also used to assist surgery and diagnosis by delivering necessary equipment or carrying instruments and other medical products; rehabilitation robotics help in assisting patients. The advantage of minimally invasive surgery is fueling the growth of medical robots. In 2019, according to the United Nations, there were 703 million people aged over 65 years. The high number of senior citizens and higher disposable income due to urbanization have aided the demand for minimally invasive surgery.

The food & beverages industry in the top industrial robotics market is projected to grow at the highest CAGR from 2020 to 2025

The industrial robotics market for the food and beverage industry is expected to grow at the highest CAGR during the forecast period. Automation in the food & beverage industry is comparatively different from other industries. Components or products are often not uniform in shape, size, weight, and texture. These objects have to be manipulated at a sufficiently fast speed without any damage. With technological advances in end effectors such as soft grippers, applications for traditional industrial robots now involve meat processing, handling of fruit and vegetables, and pick-and-place of processed foods besides packaging and palletizing. Collaborative robots are increasingly being used in the food industry. For instance, Orkla Foods (Sweden) currently uses UR10 robot from Universal Robots (Denmark) for packing ice cream bags in cartons.

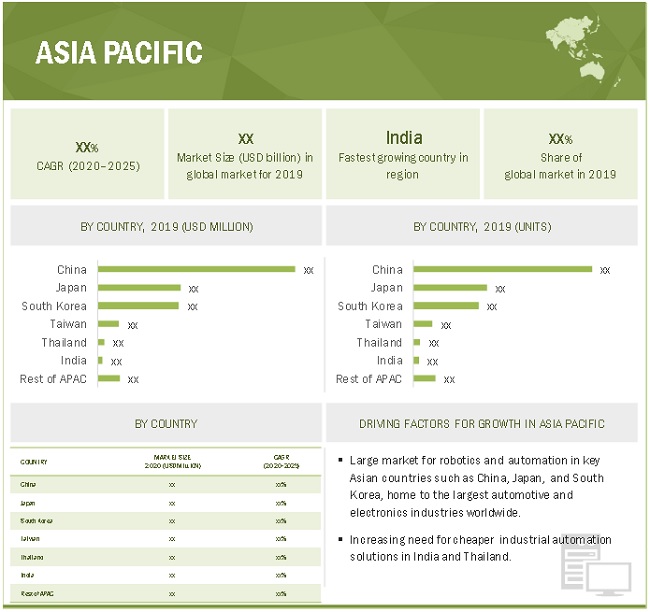

APAC is leading the top industrial robotics market and is projected to grow at the highest CAGR from 2020 to 2025.

APAC held the largest share of top industrial robotics market in 2019. Although APAC lost some of its share compared to other regions in 2018, it still held the largest share of the market in 2019. A decrease in sales of industrial robots in countries such as China due to the fall in demand in the automotive sector and the effects of the US-China trade war are mainly responsible for the slowdown. As a result, major industrial robot manufacturers posted a lower than expected growth and revenue for the year ending 2018. The market growth in APAC is still expected to be the highest, as China recovers itself in the coming years and other countries like Taiwan and Thailand push for further automation. Increasing labor costs in APAC is also forcing manufacturers to automate to maintain their cost advantage. Therefore, strong growth for collaborative robots is expected in APAC.

European and North American industrial robotics market saw a sharp decline in the first and second quarter of 2020 due to COVID-19. Many industrial robot manufacturers announced a regional decline in revenue. This is expected to continue to third quarter as production remains impacted. Due to the faster recovery in APAC countries such as China and Japan, the negative impact of industrial robots is expected to subside over time. Due to a decline of production in regions such as North America and Europe, the APAC region may likely experience more sales as a result of unexpected production demand as a result of the continuing pandemic.

Key Market Players

Major vendors in the top industrial robotics market include ABB (Switzerland), YASKAWA (Japan), FANUC (Japan), KUKA (Germany), Mitsubishi Electric (Japan), Kawasaki Heavy Industries (Japan), DENSO (Japan), NACHI-FUJIKOSHI (Japan), Seiko Epson (Japan), Dürr (Germany), Universal Robots (Denmark), Omron Adept (US), b+m Surface Systems (Germany), Stäubli (Switzerland), Comau (Italy), Yamaha (Japan), IGM (Austria), ST Robotics (US), Franka Emika (Germany), and CMA Robotics (Italy). Major vendors in the top service robotics market include Intuitive Surgical (US), DJI (China), Daifuku (Japan), iRobot (US), DeLaval (Sweden), Kongsberg Maritime (Norway), Northrop Grumman (US), Neato Robotics (US), Swisslog Holding (Switzerland), Stryker (US), Lely (Netherlands), ECA GROUP (France), 3DR (US), SoftBank Robotics Group (Japan), PrecisionHawk (US), UBTECH Robotics (China), Parrot Drones SAS (France), CYBERDYNE (Japan), GE Inspection Robotics (Switzerland), Starship Technologies (US), ecoRobotix (Switzerland), HARVEST CROO (US), and GRAAL (Italy). Apart from these, Hyundai Robotics (South Korea) and Moley Robotics (UK) are among a few emerging companies in the top robotics market.

Top Robotics market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 76.6 Billion |

| Projected Market Size | USD 176.8 Billion |

| Growth Rate | CAGR of 18.2% |

|

Market size available for years |

2017—2025 |

|

Base year |

2019 |

|

Forecast period |

2020—2025 |

|

Units |

Value (USD Billion/Million) |

|

Segments covered |

|

|

Geographic regions covered |

|

|

Companies covered (Top Industrial Robotics) |

FANUC (Japan), ABB (Switzerland), YASKAWA (Japan), KUKA (Germany), Kawasaki Heavy Industries (Japan), Mitsubishi Electric (Japan)< DENSO (Japan), NACHI-FUJIKOSHI (Japan), Universal Robots (Denmark), Omron Adept (Japan), Seiko Epson (Japan), Stäubli (Switzerland), Siasun (China), Techman Robot (Taiwan), Comau (Italy), Yamaha (Japan), b+m Surface Systems (Germany), Delta Electronics (Taiwan), IGM (Austria), Dürr (Germany), Rethink Robotics (US), CMA Robotics (Italy), Precise Automation (US),ST Robotics (US), Franka Emika (Germany), MABI Robotic (Switzerland), Bosch (Germany), TAL Manufacturing Solutions (India), Hyundai Robotics (South Korea), and Kassow Robots (Denmark) |

|

Companies covered (Top Service Robotics) |

Intuitive Surgical (US), Daifuku (Japan), DJI (China), iRobot (US), Kongsberg Maritime (Norway), DeLaval (Sweden), Amazon Robotics (US), Softbank Robotics (Japan), UBTECH Robotics (China), Precision Hawk (US), Hanson Robotics (China), CYBERDYNE (Japan), Parrot (France), GE Inspection Robotics (Switzerland), Stryker (US), KUKA (Germany), Neato Robotics (US), ECA Group (France), 3DR (US), Lely (Netherlands), GRAAL (Italy), Starship Technologies (US), ecoRobotix (Switzerland), HARVEST CROO (US), CMR Surgical (UK), EndoMaster (Singapore), SKYDIO (US), Skyqraft (Sweden), Matternet (US), ROBOTICS PLUS (New Zealand), Diligent Robotics (US), Flirtey (US), Dusty Robotics (US), Built Robotics (US), Moley Robotics (UK), and SPYCE FOOD (US) |

Top Robotics Market, by Robotics Type:

- Top Industrial Robotics

- Top Service Robotics

- Impact of COVID-19 on robotics types

This report categorizes the top industrial robotics market based on type, application, industry, and geography.

Top Industrial Robotics Market, by Type:

- Traditional Industrial Robots (Articulated, Cartesian, SCARA, Parallel, and Collaborative Robots)

- Collaborative Industrial Robots

- Impact of COVID-19 on industrial robot types

Top Industrial Robotics Market, by Application:

- Handling

- Welding & Soldering

- Assembling & Disassembling

- Dispensing

- Processing

- Others (Inspections & Quality Testing and Die Casting & Molding)

- COVID-19 impact on market for various applications

Top Industrial Robotics Market, by Industry:

- Automotive

- Electrical & Electronics

- Metals & Machinery

- Plastics, Rubber, and Chemicals

- Food & Beverages

- Precision Engineering & Optics

- Pharmaceuticals & Cosmetics

- Others (Paper & Printing, Foundry & Forging, Ceramics & Stone, and Wood)

- Impact of COVID-19 on industries

Geographic Analysis of Top Industrial Robotics Market:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- Italy

- Spain

- France

- UK

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- Taiwan

- Thailand

- India

- Rest of APAC

-

RoW

- Middle East & Africa

- South America

- Impact of COVID-19 on industrial robotics market in various regions

This report categorizes the top service robotics market based on type, component, environment, application and geography.

Top Service Robotics Market, by Type:

- Professional

- Personal & Domestic

- Impact of COVID-19 on service robot types

Top Service Robotics Market, by Environment:

- Aerial (Commercial & Consumer Drones)

- Ground (AGVs, Cleaning Robots, Agricultural Robots, Surgical Robots, Entertainment & Leisure Robots, Inspection Robots, Humanoid Robots, Powered Exoskeletons, Telepresence Robots, and Others)

- Marine (ROVs, AUVs, and USVs)

- COVID-19 impact on service robotics market for various environments

Top Service Robotics Market, by Application:

- Logistics

- Field

- Research & Space Exploration

- Medical

- Public Relations

- Inspection & Maintenance

- Construction & Demolition

- Defense, Rescue, and Security

- Marine

- Domestic

- Entertainment, Educational, and Personal

- COVID-19 impact on service robotics market for various applications

Geographic Analysis of Top Service Robotics Market:

-

North America

- US

- Canada

- Mexico

-

Europe

- Germany

- France

- UK

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- India

- Rest of APAC

-

RoW

- Middle East & Africa

- South America

- COVID-19 impact on service robotics market in various regions

Recent Developments

- In September 2019, ABB (Switzerland) announced a partnership with Huawei (China) for the co-development of artificial intelligence (AI). ABB showcased its robots using vision and AI deep learning (based on a Huawei AI Accelerator Module) to perform waste separation.

- In January 2020, iRobot (US) partnered with If This Then That (IFTTT), a leading integration and discovery platform for web services, to enable new, embedded smart home integrations. Through IFTTT, iRobot wants to work toward integrating devices and services, such as smart thermostats and lighting and home security, directly within the iRobot HOME App.

- In February 2020, Intuitive Surgical (US) announced the acquisition of Orpheus Medical (US), a provider of information technology connectivity, with expertise in processing and archiving surgical video for hospitals. It is expected that combining the strength of both companies will provide current and future customers easier and faster access to their data.

Frequently Asked Questions (FAQ):

What will be the dynamics for the adoption of top robotics market based on type?

For traditional industrial robots, articulated robots are expected to continue to have the most widespread adoption across various industries. Collaborative robots on the other hand have a high growth potential and are being adopted at a fast rate. However, the market for collaborative robots is still small compared to traditional industrial robots

How professional and personal & domestic service robots will contribute to the overall top robotics market growth by 2025?

Professional service robots are expected to have the highest share, mainly due to their utility and high costs. However, personal & domestic robots are expected to grow at a higher CAGR due to increasing requirement towards automating domestic tasks such as cleaning, vacuuming, and lawn mowing.

How will technological developments such as integration of AI with robots and 5G technology change the top robotics market landscape in the future?

Service robots will leverage AI natural language processing abilities to interact with customers in a more human way while industrial robots will utilize AI mainly for predictive maintenance. While IIoT is helping with AI tasks such as predictive maintenance, 5G is set to complement AI functionalities. 5G technology is set to make AI even more capable due to its low latency and high speed as well as bandwidth.

Which region is expected to adopt industrial and service systems at a fast rate?

APAC is expected to adopt both industrial and service at the fastest rate. Countries such as Taiwan, Thailand, and India have a high potential for the future growth of the market.

What are the key market dynamics influencing top robotics market growth? How will they turn into strengths or weaknesses of companies operating in the market space?

Growing demand for industrial robots will increase with the growth of major industries such as automotive, electrical & electronics, food & beverages, and pharmaceutical & cosmetics industry. For service robots, the growing aging population and busy lifestyles will contribute towards the growth of service robots. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 42)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 STUDY SCOPE

FIGURE 1 SEGMENTATION OF TOP ROBOTICS MARKET

FIGURE 2 SEGMENTATION OF TOP INDUSTRIAL ROBOTICS MARKET

FIGURE 3 SEGMENTATION OF TOP SERVICE ROBOTICS MARKET

1.3.1 YEARS CONSIDERED

1.4 CURRENCY & PRICING

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 48)

2.1 RESEARCH DATA

FIGURE 4 TOP ROBOTICS MARKET : RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Major secondary sources

2.1.1.2 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primaries

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.1.3.1 Key industry insights

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1—BOTTOM-UP (DEMAND SIDE) – DEMAND FOR DRONES IN THE US

FIGURE 6 TOP ROBOTICS MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—REVENUE GENERATED FROM PRODUCTS IN MARINE ROBOTS MARKET

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)—ILLUSTRATION OF REVENUE ESTIMATION FOR ONE OF THE COMPANIES IN MARINE ROBOTS MARKET

FIGURE 9 TOP ROBOTICS MARKET : TOP-DOWN APPROACH

2.2.3 MARKET PROJECTIONS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 10 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 60)

TABLE 1 SCENARIOS FOR RECOVERY OF GLOBAL ECONOMY

3.1 REALISTIC SCENARIO

3.2 OPTIMISTIC SCENARIO

3.3 PESSIMISTIC SCENARIO

FIGURE 11 TOP ROBOTICS MARKET GROWTH PROJECTION FOR REALISTIC, OPTIMISTIC, AND PESSIMISTIC SCENARIOS

FIGURE 12 IMPACT OF COVID-19 ON TOP ROBOTICS MARKET

FIGURE 13 ARTICULATED ROBOTS TO HOLD LARGEST SHARE OF TOP INDUSTRIAL ROBOTICS MARKET IN 2025

FIGURE 14 HANDLING APPLICATION TO HOLD LARGEST SHARE OF TOP INDUSTRIAL ROBOTICS MARKET IN 2025

FIGURE 15 TOP INDUSTRIAL ROBOTICS MARKET FOR FOOD & BEVERAGES INDUSTRY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 16 APAC TO HOLD LARGEST SHARE OF TOP INDUSTRIAL ROBOTICS MARKET, IN TERMS OF VOLUME, IN 2020

FIGURE 17 GROUND-BASED ROBOTS TO HOLD LARGEST SHARE OF TOP SERVICE ROBOTICS MARKET IN 2025

FIGURE 18 PROFESSIONAL ROBOTS TO HOLD LARGER SHARE OF TOP SERVICE ROBOTICS MARKET IN 2025

FIGURE 19 TOP SERVICE ROBOTICS MARKET FOR DOMESTIC APPLICATION TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 20 NORTH AMERICA TO HOLD LARGEST SHARE OF TOP SERVICE ROBOTICS MARKET IN 2020

4 PREMIUM INSIGHTS (Page No. - 70)

4.1 ATTRACTIVE OPPORTUNITIES IN TOP INDUSTRIAL ROBOTICS MARKET

FIGURE 21 ANTICIPATED SHORTAGE OF SKILLED LABOR IN MANUFACTURING INDUSTRIES TO FUEL GROWTH OF TOP INDUSTRIAL ROBOTICS MARKET DURING FORECAST PERIOD

4.2 TOP INDUSTRIAL ROBOTICS MARKET , BY TYPE

FIGURE 22 TOP ROBOTICS MARKET FOR COLLABORATIVE ROBOTS TO GROW AT HIGHEST CAGR DURING 2020–2025

4.3 TOP INDUSTRIAL ROBOTICS MARKET, BY APPLICATION

FIGURE 23 HANDLING APPLICATION TO HOLD LARGEST SHARE OF TOP INDUSTRIAL ROBOTICS MARKET IN 2020

4.4 TOP INDUSTRIAL ROBOTICS MARKET, BY INDUSTRY

FIGURE 24 AUTOMOTIVE INDUSTRY TO HOLD LARGEST SHARE OF TOP INDUSTRIAL ROBOTICS MARKET IN 2020

4.5 TOP INDUSTRIAL ROBOTICS MARKET, BY COUNTRY

FIGURE 25 CHINA TO HOLD LARGEST SHARE OF TOP INDUSTRIAL ROBOTICS MARKET IN 2020

4.6 ATTRACTIVE OPPORTUNITIES IN TOP SERVICE ROBOTICS MARKET

FIGURE 26 GROWING USE OF IOT IN ROBOTS FOR COST-EFFECTIVE PREDICTIVE MAINTENANCE WOULD FUEL GROWTH OF TOP SERVICE ROBOTICS MARKET DURING FORECAST PERIOD

4.7 TOP SERVICE ROBOTICS MARKET, BY TYPE

FIGURE 27 PROFESSIONAL ROBOTS TO HOLD LARGER SHARE OF TOP INDUSTRIAL ROBOTICS MARKET IN 2020

4.8 TOP SERVICE ROBOTICS MARKET, BY ENVIRONMENT

FIGURE 28 GROUND ROBOTS TO HOLD LARGEST SHARE OF TOP SERVICE ROBOTICS MARKET IN 2020

4.9 TOP SERVICE ROBOTICS MARKET, BY APPLICATION

FIGURE 29 DOMESTIC APPLICATION TO HOLD LARGEST SHARE OF TOP SERVICE ROBOTICS MARKET BY 2025

4.10 TOP SERVICE ROBOTICS MARKET, BY COUNTRY

FIGURE 30 US TO HOLD LARGEST SHARE OF TOP SERVICE ROBOTICS MARKET IN 2020

5 TOP ROBOTICS MARKET , BY ROBOTICS TYPE (Page No. - 75)

5.1 INTRODUCTION

FIGURE 31 TOP INDUSTRIAL ROBOTICS MARKET TO HOLD LARGER SHARE COMPARED WITH TOP SERVICE ROBOTICS MARKET IN 2020

TABLE 2 TOP ROBOTICS MARKET , BY ROBOTICS TYPE, 2017–2025 (USD BILLION)

5.1.1 TOP INDUSTRIAL ROBOTICS MARKET

5.1.2 TOP SERVICE ROBOTICS MARKET

5.2 IMPACT OF COVID-19 ON ROBOTICS TYPES

5.2.1 MORE IMPACTED TYPE

FIGURE 32 IMPACT OF COVID-19 ON INDUSTRIAL ROBOTICS MARKET

5.2.2 LESS IMPACTED TYPE

FIGURE 33 IMPACT OF COVID-19 ON SERVICE ROBOTICS MARKET

6 MARKET OVERVIEW OF TOP INDUSTRIAL ROBOTICS MARKET (Page No. - 79)

6.1 INTRODUCTION

6.2 MARKET DYNAMICS

FIGURE 34 IMPACT OF DRIVERS AND OPPORTUNITIES ON TOP INDUSTRIAL ROBOTICS MARKET

FIGURE 35 IMPACT OF RESTRAINTS AND CHALLENGES ON TOP INDUSTRIAL ROBOTICS MARKET

6.2.1 DRIVERS

6.2.1.1 Growing demand for collaborative robots across all industry segments

6.2.1.2 Anticipated shortage of skilled labor in manufacturing industries

6.2.1.3 Initiatives by governments and public–private companies to mitigate COVID-19 impact

6.2.2 RESTRAINTS

6.2.2.1 High cost of deployment, especially for SMEs

6.2.2.2 Reduction of jobs due to automation

6.2.3 OPPORTUNITIES

6.2.3.1 Increasing automation in electronics industry

6.2.4 CHALLENGES

6.2.4.1 Interoperability and integration issues with industrial robots

6.2.4.2 Difficulties faced by startup companies to virtually demonstrate their products

6.3 TARIFFS AND REGULATIONS

6.3.1 POSITIVE IMPACT OF TARIFFS ON INDUSTRIAL ROBOTS

6.3.2 NEGATIVE IMPACT OF TARIFFS ON INDUSTRIAL ROBOTS

6.4 REGULATIONS

6.4.1 NORTH AMERICA

6.4.2 EUROPE

6.4.3 APAC

6.5 CASE STUDIES

6.5.1 ROBOTIC LASER CUTTING AND HEAVY-PART MATERIAL HANDLING HELP UPF REDUCE OPERATING COSTS AND INCREASE PRODUCTION FLEXIBILITY

6.5.2 ROYAL DUTCH SHELL IMPLEMENTED INDUSTRIAL ROBOTS FROM FANUC TO INCREASE PRODUCTIVITY IN MANUFACTURING SOLAR CELLS

6.5.3 HITACHI POWDERED METALS DEPLOYED ROBOTIC AUTOMATION FROM ABB, BOOSTING PRODUCTION BY 400%

6.5.4 WESTHEIMER BREWERY AUTOMATED ITS END-OF-LINE PROCESSING USING ROBOTS FROM KAWASAKI HEAVY INDUSTRIES

6.5.5 ONLINE PHARMACY APOTEA ACHIEVED 30% HIGHER PRODUCTIVITY BY DEPLOYING ABB ROBOTS

6.5.6 FORD DEPLOYS THREE UR10 COLLABORATIVE ROBOTS FROM UNIVERSAL ROBOTS FOR AUTOMATED ENGINE OIL FILLING

6.5.7 BEYERDYNAMIC USED UR3 AND UR5 COLLABORATIVE ROBOTS BY UNIVERSAL ROBOTS TO INCREASE QUALITY AND PRODUCTIVITY

6.5.8 BAUMRUK & BAUMRUK AUTOMATED ITS PROCESS OF LOADING SMALLER PARTS INTO MILLING CENTERS

6.5.9 CASCINA ITALIA IMPROVED FLEXIBILITY AND OPERATIONAL EFFICIENCY OF ITS BUSINESS WITH UR5 ROBOT BY UNIVERSAL ROBOTS

6.5.10 COPENHAGEN UNIVERSITY HOSPITAL USED COLLABORATIVE ROBOTS FOR HANDLING AND SORTING BLOOD SAMPLES FOR ANALYSIS

7 TRENDS, VALUE CHAIN ANALYSIS, AND ECOSYSTEM OF TOP INDUSTRIAL ROBOTICS MARKET (Page No. - 89)

7.1 INTRODUCTION

7.2 VALUE CHAIN ANALYSIS

FIGURE 36 VALUE CHAIN ANALYSIS OF INDUSTRIAL ROBOTS ECOSYSTEM: R&D AND MANUFACTURING PHASES CONTRIBUTE MAXIMUM VALUE

7.3 ECOSYSTEM/MARKET MAP

FIGURE 37 ROBOTICS ECOSYSTEM

7.3.1 ROBOT OEMS

TABLE 3 OEMS OF INDUSTRIAL ROBOTS

7.3.2 SUPPLIERS

7.3.3 ROBOT INTEGRATORS

7.3.4 DISTRIBUTORS

7.4 TECHNOLOGY TRENDS

7.4.1 INTEGRATION OF VISION SYSTEMS WITH INDUSTRIAL ROBOTS

7.4.2 PENETRATION OF IIOT AND AI IN INDUSTRIAL MANUFACTURING

7.4.3 PENETRATION OF 5G IN INDUSTRIAL MANUFACTURING

7.5 PATENT ANALYSIS

TABLE 4 PATENTS FILED FOR VARIOUS TYPES OF INDUSTRIAL ROBOTS

FIGURE 38 INDUSTRIAL ROBOTICS PATENTS PUBLISHED BETWEEN 2015 AND 2019

7.6 TRADE DATA

7.6.1 VEHICLE PRODUCTION DATA

TABLE 5 GLOBAL VEHICLES PRODUCTION, BY REGION, 2018–2025 (MILLION UNITS)

TABLE 6 GLOBAL VEHICLES PRODUCTION, BY TYPE, 2018–2025 (MILLION UNITS)

8 TOP INDUSTRIAL ROBOTICS MARKET, BY TYPE (Page No. - 98)

8.1 INTRODUCTION

FIGURE 39 TOP ROBOTICS MARKET FOR COLLABORATIVE ROBOTS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 7 TOP INDUSTRIAL ROBOTICS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 8 TOP INDUSTRIAL ROBOTICS MARKET, BY TYPE, 2017–2025 (UNITS)

8.2 ARTICULATED ROBOTS

8.2.1 ARTICULATED ROBOTS HELD LARGEST SIZE OF TOP INDUSTRIAL ROBOTICS MARKET IN 2019

8.2.2 AVERAGE SELLING PRICE OF ARTICULATED ROBOTS

FIGURE 40 REPRESENTATION OF 6-AXIS ARTICULATED ROBOTS

TABLE 9 ARTICULATED ROBOTS: APPLICATIONS, ADVANTAGES, AND DISADVANTAGES

TABLE 10 ARTICULATED ROBOTS MARKET, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 11 ARTICULATED ROBOTS MARKET, BY APPLICATION, 2017–2025 (UNITS)

FIGURE 41 ARTICULATED ROBOTS MARKET FOR METALS & MACHINERY INDUSTRY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 12 ARTICULATED ROBOTS MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 13 ARTICULATED ROBOTS MARKET, BY INDUSTRY, 2017–2025 (UNITS)

8.3 SCARA ROBOTS

8.3.1 SCARA ROBOTS WOULD WITNESS HIGHEST GROWTH AMONG TRADITIONAL ROBOTS DURING FORECAST PERIOD

8.3.2 AVERAGE SELLING PRICE OF SCARA ROBOTS

FIGURE 42 REPRESENTATION OF 4-AXIS SCARA ROBOTS

TABLE 14 SCARA ROBOTS: APPLICATIONS, ADVANTAGES, AND DISADVANTAGES

TABLE 15 SCARA ROBOTS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

FIGURE 43 SCARA ROBOTS WILL BE SHIPPED PRIMARILY FOR HANDLING APPLICATIONS DURING FORECAST PERIOD

TABLE 16 SCARA ROBOTS MARKET, BY APPLICATION, 2017–2025 (UNITS)

TABLE 17 SCARA ROBOTS MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 18 SCARA ROBOTS MARKET, BY INDUSTRY, 2017–2025 (UNITS)

8.4 PARALLEL ROBOTS

8.4.1 PARALLEL ROBOTS ARE IDEAL FOR MOVING SMALL PAYLOADS AT VERY HIGH SPEEDS

8.4.2 AVERAGE SELLING PRICE OF PARALLEL ROBOTS

FIGURE 44 REPRESENTATION OF PARALLEL ROBOTS

TABLE 19 PARALLEL ROBOTS: APPLICATIONS, ADVANTAGES, AND DISADVANTAGES

TABLE 20 PARALLEL ROBOTS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

TABLE 21 PARALLEL ROBOTS MARKET, BY APPLICATION, 2017–2025 (UNITS)

FIGURE 45 PARALLEL ROBOTS MARKET FOR FOOD & BEVERAGES INDUSTRY TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 22 PARALLEL ROBOTS MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 23 PARALLEL ROBOTS MARKET, BY INDUSTRY, 2017–2025 (UNITS)

8.5 CARTESIAN ROBOTS

8.5.1 CARTESIAN ROBOTS HAVE SIMPLE MOVEMENTS AND ARE EASY TO PROGRAM

8.5.2 AVERAGE SELLING PRICE OF CARTESIAN ROBOTS

FIGURE 46 REPRESENTATION OF CARTESIAN ROBOTS

TABLE 24 CARTESIAN ROBOTS: APPLICATIONS, ADVANTAGES, AND DISADVANTAGES

TABLE 25 CARTESIAN ROBOTS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

FIGURE 47 PROCESSING APPLICATION TO WITNESS HIGHEST CAGR IN CARTESIAN ROBOTS MARKET DURING FORECAST PERIOD

TABLE 26 CARTESIAN ROBOTS MARKET, BY APPLICATION, 2017–2025 (UNITS)

TABLE 27 CARTESIAN ROBOTS MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 28 CARTESIAN ROBOTS MARKET, BY INDUSTRY, 2017–2025 (UNITS)

8.6 COLLABORATIVE ROBOTS

8.6.1 COLLABORATIVE ROBOTS HAVE HUGE POTENTIAL IN INDUSTRIES AS THEY CAN OPERATE SAFELY ALONGSIDE HUMANS

8.6.2 AVERAGE SELLING PRICE OF COLLABORATIVE ROBOTS

TABLE 29 COLLABORATIVE ROBOTS: APPLICATIONS, ADVANTAGES, AND DISADVANTAGES

TABLE 30 COLLABORATIVE ROBOTS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

FIGURE 48 ASSEMBLING & DISASSEMBLING APPLICATION TO WITNESS HIGHEST CAGR IN COLLABORATIVE ROBOT MARKET DURING FORECAST PERIOD

TABLE 31 COLLABORATIVE ROBOTS MARKET, BY APPLICATION, 2017–2025 (UNITS)

TABLE 32 COLLABORATIVE ROBOTS MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 33 COLLABORATIVE ROBOTS MARKET, BY INDUSTRY, 2017–2025 (UNITS)

8.7 IMPACT OF COVID-19 ON INDUSTRIAL ROBOT TYPES

8.7.1 MORE IMPACTED TYPE

FIGURE 49 IMPACT OF COVID-19 ON ARTICULATED ROBOTS MARKET

8.7.2 LESS IMPACTED TYPE

FIGURE 50 IMPACT OF COVID-19 ON COLLABORATIVE ROBOT MARKET

9 TOP INDUSTRIAL ROBOTICS MARKET, BY APPLICATION (Page No. - 121)

9.1 INTRODUCTION

FIGURE 51 HANDLING APPLICATION TO HOLD LARGEST SHARE OF TOP INDUSTRIAL ROBOTICS MARKET IN 2020

TABLE 34 TOP INDUSTRIAL ROBOTICS MARKET, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 35 TOP INDUSTRIAL ROBOTICS MARKET, BY APPLICATION, 2017–2025 (THOUSAND UNITS)

9.2 HANDLING

9.2.1 HANDLING APPLICATION TO DOMINATE TOP INDUSTRIAL ROBOTICS MARKET IN 2020

TABLE 36 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR HANDLING APPLICATION

TABLE 37 TOP INDUSTRIAL ROBOTICS MARKET FOR HANDLING APPLICATION, BY TYPE, 2017–2025 (USD MILLION)

9.3 ASSEMBLING & DISASSEMBLING

9.3.1 ASSEMBLY REQUIRES ROBOTS THAT CAN DELIVER SPEED AND PRECISION

TABLE 38 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR ASSEMBLING APPLICATION

TABLE 39 TOP INDUSTRIAL ROBOTICS MARKET FOR ASSEMBLING & DISASSEMBLING APPLICATION, BY TYPE, 2017–2025 (USD MILLION)

9.4 WELDING & SOLDERING

9.4.1 ROBOTS WITH HOLLOW WRIST DESIGNS ARE USED FOR WELDING

TABLE 40 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR WELDING & SOLDERING APPLICATION

TABLE 41 TOP INDUSTRIAL ROBOTICS MARKET FOR WELDING & SOLDERING APPLICATION, BY TYPE, 2017–2025 (USD MILLION)

9.5 DISPENSING

TABLE 42 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR DISPENSING APPLICATION

9.5.1 GLUING

9.5.1.1 Automotive and electronics industries require highly precise adhesive dispensers

9.5.2 PAINTING

9.5.2.1 Robots used for painting must be explosion- and contamination-proof

9.5.3 FOOD DISPENSING

9.5.3.1 Dispensing robots used in food industry must be certified by agencies such as FDA and EFSA

TABLE 43 TOP INDUSTRIAL ROBOTICS MARKET FOR DISPENSING APPLICATION, BY TYPE, 2017–2025 (USD MILLION)

9.6 PROCESSING

TABLE 44 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR PROCESSING APPLICATION

9.6.1 GRINDING AND POLISHING

9.6.1.1 Automated grinding and polishing improve consistency of finish of workpieces

9.6.2 MILLING

9.6.2.1 Robotic milling is ideal for large workpieces

9.6.3 CUTTING

9.6.3.1 Robotic cutting is employed in various industries

TABLE 45 TOP INDUSTRIAL ROBOTICS MARKET FOR PROCESSING APPLICATION, BY TYPE, 2017–2025 (USD MILLION)

9.7 OTHERS

TABLE 46 COMPANIES OFFERING INDUSTRIAL ROBOTS FOR OTHER APPLICATIONS

9.7.1 INSPECTION AND QUALITY TESTING

9.7.1.1 Automated inspection enhances repeatability of inspection procedures

9.7.2 DIE CASTING AND MOLDING

9.7.2.1 Foundry and forging robots are used in die casting and molding applications

TABLE 47 TOP INDUSTRIAL ROBOTICS MARKET FOR OTHER APPLICATIONS, BY TYPE, 2017–2025 (USD MILLION)

9.8 COVID-19 IMPACT ON MARKET FOR VARIOUS APPLICATIONS

9.8.1 MOST IMPACTED APPLICATION

FIGURE 52 IMPACT OF COVID-19 ON TOP INDUSTRIAL ROBOTICS MARKET FOR HANDLING APPLICATION

9.8.2 LEAST IMPACTED APPLICATION

FIGURE 53 IMPACT OF COVID-19 ON TOP INDUSTRIAL ROBOTICS MARKET FOR DISPENSING APPLICATION

10 TOP INDUSTRIAL ROBOTICS MARKET, BY INDUSTRY (Page No. - 134)

10.1 INTRODUCTION

FIGURE 54 AUTOMOTIVE INDUSTRY TO HOLD LARGEST SIZE OF TOP INDUSTRIAL ROBOTICS MARKET DURING FORECAST PERIOD

TABLE 48 TOP INDUSTRIAL ROBOTICS MARKET, BY INDUSTRY, 2017–2025 (USD MILLION)

TABLE 49 TOP INDUSTRIAL ROBOTICS MARKET, BY INDUSTRY, 2017–2025 (UNITS)

10.2 AUTOMOTIVE

10.2.1 AUTOMOTIVE INDUSTRY ACCOUNTED FOR LARGEST SIZE OF TOP INDUSTRIAL ROBOTICS MARKET IN 2019

FIGURE 55 APAC TO HOLD LARGEST SHARE OF TOP INDUSTRIAL ROBOTICS MARKET FOR AUTOMOTIVE INDUSTRY THROUGHOUT FORECAST PERIOD

TABLE 50 TOP INDUSTRIAL ROBOTICS MARKET FOR AUTOMOTIVE INDUSTRY, BY REGION, 2017–2025 (UNITS)

10.3 ELECTRICAL & ELECTRONICS

10.3.1 SCARA ROBOTS ARE EXTENSIVELY USED IN ELECTRICAL & ELECTRONICS INDUSTRY FOR HANDLING APPLICATIONS

FIGURE 56 INDUSTRIAL ROBOTICS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY TO GROW AT HIGHEST CAGR IN APAC DURING FORECAST PERIOD

TABLE 51 TOP INDUSTRIAL ROBOTICS MARKET FOR ELECTRICAL & ELECTRONICS INDUSTRY, BY REGION, 2017–2025 (UNITS)

10.4 METALS & MACHINERY

10.4.1 METALS & MACHINERY INDUSTRY CAN ACHIEVE COST-EFFECTIVE PRODUCTION THROUGH AUTOMATION

FIGURE 57 INDUSTRIAL ROBOTICS MARKET FOR METALS & MACHINERY INDUSTRY TO GROW AT HIGHEST CAGR IN APAC DURING FORECAST PERIOD

TABLE 52 TOP INDUSTRIAL ROBOTICS MARKET FOR METALS & MACHINERY INDUSTRY, BY REGION, 2017–2025 (UNITS)

10.5 PLASTICS, RUBBER, AND CHEMICALS

10.5.1 ROBOTIC MOLDING AND HANDLING IS OFTEN USED IN PLASTICS, RUBBER, AND CHEMICALS INDUSTRIES

FIGURE 58 APAC TO HOLD LARGEST SHARE OF INDUSTRIAL ROBOTICS MARKET FOR PLASTICS, RUBBER, AND CHEMICALS INDUSTRY THROUGHOUT FORECAST PERIOD

TABLE 53 TOP INDUSTRIAL ROBOTICS MARKET FOR PLASTICS, RUBBER, AND CHEMICALS INDUSTRY, BY REGION, 2017–2025 (UNITS)

10.6 FOOD & BEVERAGES

10.6.1 FOOD-GRADE AND IP67-CERTIFIED ROBOTS ARE OFTEN USED IN FOOD & BEVERAGES INDUSTRY

FIGURE 59 APAC TO BE FASTEST-GROWING MARKET FOR INDUSTRIAL ROBOTS FOR FOOD & BEVERAGES INDUSTRY DURING FORECAST PERIOD

TABLE 54 TOP INDUSTRIAL ROBOTICS MARKET FOR FOOD & BEVERAGES INDUSTRY, BY REGION, 2017–2025 (UNITS)

10.7 PRECISION ENGINEERING & OPTICS

10.7.1 BUFFING AND POLISHING ARE A FEW TASKS PERFORMED USING ROBOTS IN PRECISION ENGINEERING AND OPTICS INDUSTRY

FIGURE 60 INDUSTRIAL ROBOTICS MARKET FOR PRECISION ENGINEERING & OPTICS INDUSTRY TO GROW AT HIGHEST CAGR IN EUROPE DURING FORECAST PERIOD

TABLE 55 TOP INDUSTRIAL ROBOTICS MARKET FOR PRECISION ENGINEERING & OPTICS INDUSTRY, BY REGION, 2017–2025 (UNITS)

10.8 PHARMACEUTICALS & COSMETICS

10.8.1 ROBOTS ARE INCREASINGLY BEING USED IN HOSPITALS AND RESEARCH LABORATORIES FOR HANDLING AND DISPENSING APPLICATIONS

FIGURE 61 APAC TO HOLD LARGEST SHARE OF INDUSTRIAL ROBOTICS MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY THROUGHOUT FORECAST PERIOD

TABLE 56 TOP INDUSTRIAL ROBOTICS MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY, BY REGION, 2017–2025 (UNITS)

10.9 OTHERS

10.9.1 INDUSTRIAL ROBOTS ARE BEING USED IN SMALL AND EMERGING INDUSTRIES SUCH AS FURNITURE AND SCULPTING

FIGURE 62 APAC TO HOLD LARGEST SHARE OF INDUSTRIAL ROBOTICS MARKET FOR OTHER INDUSTRIES THROUGHOUT FORECAST PERIOD

TABLE 57 TOP INDUSTRIAL ROBOTICS MARKET FOR OTHER INDUSTRIES, BY REGION, 2017–2025 (UNITS)

10.10 IMPACT OF COVID-19 ON INDUSTRIES

10.10.1 MOST IMPACTED INDUSTRY

FIGURE 63 IMPACT OF COVID-19 ON INDUSTRIAL ROBOTICS MARKET FOR AUTOMOTIVE INDUSTRY

10.10.2 LEAST IMPACTED INDUSTRY

FIGURE 64 IMPACT OF COVID-19 ON INDUSTRIAL ROBOTICS MARKET FOR PHARMACEUTICALS & COSMETICS INDUSTRY

11 GEOGRAPHIC ANALYSIS OF TOP INDUSTRIAL ROBOTICS MARKET (Page No. - 151)

11.1 INTRODUCTION

FIGURE 65 TOP INDUSTRIAL ROBOTICS MARKET TO GROW AT HIGHEST CAGR IN INDIA DURING FORECAST PERIOD

TABLE 58 TOP INDUSTRIAL ROBOTICS MARKET, BY REGION, 2017–2025 (USD BILLION)

TABLE 59 TOP INDUSTRIAL ROBOTICS MARKET, BY REGION, 2017–2025 (UNITS)

11.2 NORTH AMERICA

FIGURE 66 NORTH AMERICA: SNAPSHOT OF TOP INDUSTRIAL ROBOTICS MARKET

TABLE 60 TOP INDUSTRIAL ROBOTICS MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 61 TOP INDUSTRIAL ROBOTICS MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (UNITS)

11.2.1 US

11.2.1.1 Automotive industry contributed a significant share to top industrial robotics market

11.2.2 CANADA

11.2.2.1 Canada has witnessed steady upswing in foreign investments in robotics sector

11.2.3 MEXICO

11.2.3.1 Proximity to US and government’s measures to augment manufacturing activities have fueled growth of industrial robotics market in Mexico

11.3 EUROPE

FIGURE 67 EUROPE: SNAPSHOT OF TOP INDUSTRIAL ROBOTICS MARKET

TABLE 62 TOP INDUSTRIAL ROBOTICS MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 63 TOP INDUSTRIAL ROBOTICS MARKET IN EUROPE, BY COUNTRY, 2017–2025 (UNITS)

11.3.1 GERMANY

11.3.1.1 High productivity rate and steady wage level make Germany an attractive investment location

11.3.2 ITALY

11.3.2.1 Presence of small and medium-sized players makes Italy an attractive market for industrial robots

11.3.3 SPAIN

11.3.3.1 Pharmaceuticals and automobiles sectors are expected to create huge demand for robots in Spain

11.3.4 FRANCE

11.3.4.1 Government funding is expected to boost automation and presence of robots in France

11.3.5 UK

11.3.5.1 Strong manufacturing industry is expected to increase demand for industrial robots in UK

11.3.6 REST OF EUROPE

11.3.6.1 High labor costs are expected to propel industrial robotics market

11.4 APAC

FIGURE 68 APAC: SNAPSHOT OF TOP INDUSTRIAL ROBOTICS MARKET

TABLE 64 TOP INDUSTRIAL ROBOTICS MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 65 TOP INDUSTRIAL ROBOTICS MARKET IN APAC, BY COUNTRY, 2017–2025 (UNITS)

11.4.1 CHINA

11.4.1.1 China is moving from labor-intensive simple industries toward manufacturing high-tech goods

11.4.2 SOUTH KOREA

11.4.2.1 South Korea’s electronics industry ranked third in terms of production globally in 2018

11.4.3 JAPAN

11.4.3.1 Japan’s aging population makes labor costly and increases demand for industrial robots

11.4.4 TAIWAN

11.4.4.1 Taiwan is home to TSMC, world’s largest independent semiconductor foundry

11.4.5 THAILAND

11.4.5.1 Declining prices of robots are lowering cost barriers for SMEs

11.4.6 INDIA

11.4.6.1 India is attracting various global companies, which would eventually build demand for industrial robots

11.4.7 REST OF APAC

11.4.7.1 Singapore is attracting several companies, which would boost industrial robotics market

11.5 ROW

FIGURE 69 MIDDLE EAST & AFRICA TO HOLD LARGER SHARE DURING FORECAST PERIOD

TABLE 66 TOP INDUSTRIAL ROBOTICS MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 67 TOP INDUSTRIAL ROBOTICS MARKET IN ROW, BY REGION, 2017–2025 (UNITS)

11.5.1 MIDDLE EAST & AFRICA

11.5.1.1 Chemicals industry is one of the main industries in Middle East adopting robots

11.5.2 SOUTH AMERICA

11.5.2.1 Brazil and Argentina are increasing use of robotics in electronics and food & beverages industries

11.6 COVID-19 IMPACT ON INDUSTRIAL ROBOTICS MARKET IN VARIOUS REGIONS

11.6.1 MOST IMPACTED REGION

FIGURE 70 IMPACT OF COVID-19 ON INDUSTRIAL ROBOTICS MARKET IN NORTH AMERICA

11.6.2 LEAST IMPACTED REGION

FIGURE 71 IMPACT OF COVID-19 ON INDUSTRIAL ROBOTICS MARKET IN APAC

12 COMPETITIVE LANDSCAPE OF TOP INDUSTRIAL ROBOTICS MARKET (Page No. - 168)

12.1 OVERVIEW

FIGURE 72 PLAYERS IN INDUSTRIAL ROBOTICS MARKET ADOPTED ORGANIC GROWTH AS THEIR KEY STRATEGY FOR BUSINESS EXPANSION FROM 2017 TO 2019

12.2 MARKET SHARE ANALYSIS: TOP INDUSTRIAL ROBOTICS MARKET, 2019

12.2.1 TRADITIONAL INDUSTRIAL ROBOTICS MARKET SHARE ANALYSIS, 2019

FIGURE 73 TRADITIONAL INDUSTRIAL ROBOTICS MARKET SHARE ANALYSIS, 2019

12.2.2 COLLABORATIVE ROBOT MARKET SHARE ANALYSIS, 2019

FIGURE 74 COLLABORATIVE ROBOT MARKET SHARE ANALYSIS, 2019

12.3 5-YEAR COMPANY REVENUE ANALYSIS

FIGURE 75 5-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN TOP INDUSTRIAL ROBOTICS MARKET

12.4 COMPETITIVE LEADERSHIP MAPPING

12.4.1 STAR

12.4.2 EMERGING LEADER

12.4.3 PERVASIVE

12.4.4 PARTICIPANT

FIGURE 76 INDUSTRIAL ROBOTICS MARKET (GLOBAL) COMPETITIVE LEADERSHIP MAPPING, 2019

12.5 STRENGTH OF PRODUCT PORTFOLIO (25 PLAYERS)

FIGURE 77 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN TOP ROBOTICS MARKET

12.6 BUSINESS STRATEGY EXCELLENCE (25 PLAYERS)

FIGURE 78 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN TOP ROBOTICS MARKET

12.7 STARTUP/SME EVALUATION MATRIX

TABLE 68 STARTUPS/SMES IN INDUSTRIAL ROBOTICS MARKET

12.7.1 PROGRESSIVE COMPANIES

12.7.2 RESPONSIVE COMPANIES

12.7.3 DYNAMIC COMPANIES

12.7.4 STARTING BLOCKS

FIGURE 79 TOP INDUSTRIAL ROBOTICS MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX, 2019

12.8 COMPETITIVE SITUATIONS AND TRENDS

FIGURE 80 PRODUCT LAUNCHES ACCOUNTED FOR MAJORITY SHARE OF TOTAL DEVELOPMENTS IN INDUSTRIAL ROBOTICS MARKET FROM 2017 TO 2019

12.8.1 PRODUCT LAUNCHES

TABLE 69 TOP INDUSTRIAL ROBOTICS MARKET, PRODUCT LAUNCHES, 2017–2019

12.8.2 PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES

TABLE 70 TOP INDUSTRIAL ROBOTICS MARKET, PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES, 2017–2019

12.8.3 EXPANSIONS

TABLE 71 TOP INDUSTRIAL ROBOTICS MARKET, EXPANSIONS, 2017–2019

12.8.4 ACQUISITIONS

TABLE 72 TOP INDUSTRIAL ROBOTICS MARKET, ACQUISITIONS, 2017-2019

12.8.5 CONTRACTS AND AGREEMENTS

TABLE 73 TOP INDUSTRIAL ROBOTICS MARKET, CONTRACTS AND AGREEMENTS, 2017–2019

13 MARKET OVERVIEW OF TOP SERVICE ROBOTICS MARKET (Page No. - 181)

13.1 INTRODUCTION

13.2 MARKET EVOLUTION

FIGURE 81 EVOLUTION OF SERVICE ROBOTS

13.3 MARKET DYNAMICS

FIGURE 82 IMPACT OF DRIVERS AND OPPORTUNITIES ON TOP SERVICE ROBOTICS MARKET

FIGURE 83 IMPACT OF RESTRAINTS AND CHALLENGES ON TOP SERVICE ROBOTICS MARKET

13.3.1 DRIVERS

13.3.1.1 High ROI using robotic systems

13.3.1.2 Rising use of IoT in robots for cost-effective predictive maintenance

FIGURE 84 INTERNET OF ROBOTIC THINGS MARKET, 2016–2022

13.3.1.3 Increasing funding for research on robots

13.3.1.4 Rising insurance coverage for medical exoskeletons and robotic surgeries

FIGURE 85 CAGR OF POWERED EXOSKELETONS MARKET DURING 2020–2025

13.3.2 RESTRAINTS

13.3.2.1 Concerns over data privacy and regulations

13.3.2.2 Decreased consumer spending affecting robot manufacturers as a result of COVID-19

13.3.3 OPPORTUNITIES

13.3.3.1 Increase in application of robots for companionship, handicap assistance, and assistance for geriatric population

FIGURE 86 PROJECTION OF POPULATION ABOVE 65 YEARS OF AGE

13.3.3.2 Focus on improving endurance and range of operation capability of robots

13.3.3.3 Adoption of swarm intelligence technology enabling robots to perform various complex tasks with ease

FIGURE 87 SWARM INTELLIGENCE MARKET, 2020 & 2030

13.3.3.4 Accelerating spread of COVID-19 prompting several industries to adopt automation technologies

13.3.4 CHALLENGES

13.3.4.1 Inaccurate results impeding use in critical operations

13.4 TARIFFS AND REGULATIONS

13.4.1 NEGATIVE IMPACT OF TARIFFS ON SERVICE ROBOTS

13.4.2 POSITIVE IMPACT OF TARIFFS ON SERVICE ROBOTS

13.5 REGULATIONS

13.5.1 NORTH AMERICA

13.5.2 EUROPE

13.5.3 APAC

13.6 CASE STUDIES

13.6.1 DFDS IS COMBINING DRONES AND AI TO STREAMLINE TERMINAL OPERATIONS

13.6.2 JIUZHOU AERIAL SPRAYING TEAM USES DRONES FROM DJI FOR AGRICULTURAL SPRAYING

13.6.3 KUKA IMPLEMENTED AN AUTONOMOUS TRANSPORTATION SOLUTION IN ITS PRODUCTION LINE

13.6.4 SOFTBANK ROBOTICS DEPLOYED ITS COMMERCIAL ROBOTIC VACUUM IN CINCINNATI/NORTHERN KENTUCKY INTERNATIONAL AIRPORT (CVG)

13.6.5 TWELVE BELROBOTICS ROBOT MOWERS ARE IN USE OVER FIVE SPORTS COMPLEXES IN ZEVENAAR COMMUNITY

13.6.6 COMESTAR HOLSTEIN INVESTS IN ROBOTIC MILKING FROM DELAVAL (SWEDEN)

13.6.7 CANCER TREATMENT CENTERS OF AMERICA (CTCA) USES SURGICAL ROBOTS FROM INTUITIVE SURGICAL

13.6.8 GENERAL ELECTRIC SIGNED AN AGREEMENT TO DEPLOY ADVANCED ROBOTS FOR INSPECTION OF ALINTA ENERGY’S GAS-FIRED POWER PLANTS

13.6.9 FORD MAKES EKSOVEST EXOSKELETONS AVAILABLE TO EMPLOYEES WORLDWIDE AFTER SUCCESSFUL US TRIALS

13.6.10 OCEAN INFINITY ORDERED 5 HUGIN AUTONOMOUS UNDERWATER VEHICLES FROM KONGSBERG MARITIME

14 TRENDS, VALUE CHAIN ANALYSIS, AND ECOSYSTEM OF TOP SERVICE ROBOTICS MARKET (Page No. - 195)

14.1 INTRODUCTION

14.2 VALUE CHAIN ANALYSIS

FIGURE 88 VALUE CHAIN ANALYSIS OF TOP SERVICE ROBOTICS ECOSYSTEM: R&D AND MANUFACTURING PHASES CONTRIBUTE MAXIMUM VALUE

14.3 ECOSYSTEM/MARKET MAP

14.3.1 ROBOT OEMS

TABLE 74 ROBOT OEMS OF VARIOUS TYPES OF SERVICE ROBOTS

14.3.2 SUPPLIERS

14.3.3 IT/BIG DATA COMPANIES

14.3.4 SOFTWARE SOLUTIONS PROVIDERS

14.3.5 RESEARCH CENTERS

14.4 TECHNOLOGY TRENDS

14.4.1 GROWTH OF TELEPRESENCE AND HUMANOID ROBOTS

14.4.2 INTEGRATION OF AI WITH ROBOTS

14.4.3 RESEARCH ON STANDARD OS FOR ROBOTS

14.4.4 GROWTH OF ROBOT AS A SERVICE BUSINESS MODEL

14.5 PATENT ANALYSIS

TABLE 75 PATENTS FILED FOR VARIOUS TYPES OF SERVICE ROBOTS

FIGURE 89 SERVICE ROBOTICS PATENS PUBLISHED BETWEEN 2015 AND 2019

15 TOP SERVICE ROBOTICS MARKET, BY TYPE (Page No. - 202)

15.1 INTRODUCTION

FIGURE 90 TOP SERVICE ROBOTICS MARKET FOR PERSONAL & DOMESTIC ROBOTS IS EXPECTED TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 76 TOP SERVICE ROBOTICS MARKET, BY TYPE, 2017–2025 (USD BILLION)

15.2 PROFESSIONAL

15.2.1 PROFESSIONAL ROBOTS HELD A LARGER MARKET SHARE THAN PERSONAL AND DOMESTIC ROBOTS IN 2019

TABLE 77 PROFESSIONAL ROBOTS MARKET, BY ENVIRONMENT, 2017–2025 (USD BILLION)

TABLE 78 PROFESSIONAL GROUND ROBOTS MARKET, BY ROBOT TYPE, 2017–2025 (USD MILLION)

TABLE 79 PROFESSIONAL GROUND ROBOTS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

15.3 PERSONAL & DOMESTIC

15.3.1 PERSONAL & DOMESTIC ROBOTS ARE USED FOR CLEANING, ENTERTAINMENT, ASSISTANCE, AND COMPANIONSHIP

TABLE 80 PERSONAL & DOMESTIC ROBOTS MARKET, BY ENVIRONMENT, 2017–2025 (USD MILLION)

FIGURE 91 MARKET FOR HUMANOID ROBOTS TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 81 PERSONAL & DOMESTIC GROUND ROBOTS MARKET, BY ROBOT TYPE, 2017–2025 (USD MILLION)

TABLE 82 PERSONAL & DOMESTIC GROUND ROBOTS MARKET, BY APPLICATION, 2017–2025 (USD BILLION)

TABLE 83 PERSONAL & DOMESTIC GROUND ROBOTS MARKET, BY DOMESTIC APPLICATION, 2017–2025 (USD MILLION)

TABLE 84 PERSONAL & DOMESTIC GROUND ROBOTS MARKET, BY ENTERTAINMENT, EDUCATION, AND PERSONAL APPLICATION, 2017–2025 (USD MILLION)

15.4 IMPACT OF COVID-19 ON SERVICE ROBOT TYPES

15.4.1 MORE IMPACTED TYPE

FIGURE 92 IMPACT OF COVID-19 ON SERVICE ROBOTICS MARKET FOR PERSONAL AND DOMESTIC ROBOTS

15.4.2 LESS IMPACTED TYPE

FIGURE 93 IMPACT OF COVID-19 ON SERVICE ROBOTICS MARKET FOR PROFESSIONAL ROBOTS

16 TOP SERVICE ROBOTICS MARKET, BY ENVIRONMENT (Page No. - 211)

16.1 INTRODUCTION

FIGURE 94 MARKET FOR GROUND ROBOTS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 85 TOP SERVICE ROBOTICS MARKET, BY ENVIRONMENT, 2017–2025 (USD BILLION)

16.2 AERIAL

TABLE 86 PRODUCT OFFERINGS OF VARIOUS DRONE MANUFACTURERS

TABLE 87 AERIAL ROBOTS MARKET, BY TYPE, 2017–2025 (USD BILLION)

16.2.1 COMMERCIAL DRONES

16.2.1.1 Commercial drones dominate service robotics market for aerial environment

16.2.2 CONSUMER DRONES

16.2.2.1 Consumer drones are mainly adopted by individuals for personal and hobby purposes

16.2.3 AVERAGE SELLING PRICES OF DRONES

16.3 GROUND

TABLE 88 GROUND ROBOTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

FIGURE 95 MARKET FOR POWERED EXOSKELETONS EXPECTED TO GROW AT HIGHEST CAGR AMONG ALL GROUND ROBOTS DURING FORECAST PERIOD

TABLE 89 GROUND ROBOTS MARKET, BY ROBOT TYPE, 2017–2025 (USD MILLION)

16.3.1 AUTOMATED GUIDED VEHICLES (AGVS)

TABLE 90 PRODUCT OFFERINGS OF VARIOUS AGV MANUFACTURERS

TABLE 91 AGVS MARKET, BY VEHICLE TYPE, 2017–2025 (USD MILLION)

16.3.1.1 Tow vehicles

16.3.1.1.1 Tow vehicles can move more load with multiple trailers than a single fork truck

16.3.1.2 Unit load carriers

16.3.1.2.1 Unit load carriers are used to move unit loads such as standard pallets, drums, carts, racks, rolls, and custom containers

16.3.1.3 Pallet trucks

16.3.1.3.1 Pallet trucks have a capacity of up to 6,000 lbs. and can handle more than one pallet

16.3.1.4 Forklift trucks

16.3.1.4.1 Forklift trucks offer easy tracking of goods, just-in-time picking, less damage, and fewer operator hours

16.3.1.5 Assembly line vehicles

16.3.1.5.1 Implementation of assembly line AGVs at production plants results in up to 50% increase in efficiency

16.3.1.6 Other

16.3.2 CLEANING ROBOTS

FIGURE 96 MARKET FOR LAWN MOWERS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 92 CLEANING ROBOTS MARKET, BY ROBOT TYPE, 2017–2025 (USD MILLION)

16.3.2.1 Vacuuming robots

16.3.2.1.1 Vacuuming robots offer features such as adjustable suction power, scheduling mechanism, voice recognition, and smart navigation system

TABLE 93 PRODUCT OFFERINGS OF VARIOUS VACUUMING ROBOT MANUFACTURERS

16.3.2.2 Lawn mowers

16.3.2.2.1 Manufacturers are integrating robotic lawn mowers with voice command, AI, and onboard GPS systems to make them more user-friendly

TABLE 94 PRODUCT OFFERINGS OF VARIOUS ROBOTIC LAWN MOWER MANUFACTURERS

16.3.2.3 Pool cleaning robots

16.3.2.3.1 Pool cleaning robots reduce operation costs as they are not required to be connected to a pump

TABLE 95 PRODUCT OFFERINGS OF VARIOUS POOL CLEANING ROBOT MANUFACTURERS

16.3.2.4 Window and gutter cleaning robots

16.3.2.4.1 Window cleaning robots are expected to generate more demand in developed countries with high-rise buildings

TABLE 96 PRODUCT OFFERINGS OF VARIOUS WINDOW AND GUTTER CLEANING ROBOT MANUFACTURERS

16.3.3 AGRICULTURAL ROBOTS

TABLE 97 PRODUCT OFFERINGS OF VARIOUS AGRICULTURAL ROBOT MANUFACTURERS

TABLE 98 AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2017–2025 (USD MILLION)

FIGURE 97 MARKET FOR AUTONOMOUS HARVESTING SYSTEMS EXPECTED TO GROW AT HIGHER CAGR THAN MILKING ROBOTS DURING FORECAST PERIOD

TABLE 99 AGRICULTURAL ROBOTS MARKET, BY ROBOT TYPE, 2017–2025 (UNITS)

16.3.3.1 Milking robots

16.3.3.1.1 Milking robots are also known as voluntary milking systems

16.3.3.2 Automated harvesting systems

16.3.3.2.1 Automated harvesting systems use a combination of cameras, sensors, and machine vision to harvest

16.3.4 SURGICAL ROBOTS

TABLE 100 PRODUCT OFFERINGS OF VARIOUS SURGICAL ROBOT MANUFACTURERS

16.3.4.1 Laparoscopy robotic systems

16.3.4.1.1 Robotic laparoscopy devices offer better stability than the human hand, reduced number of incisions, and better visual magnification

16.3.4.2 Orthopedic robotic systems

16.3.4.2.1 Orthopedic surgeries are expected to increase due to rise in obesity and aging demographic

16.3.4.3 Neurosurgical robotic systems

16.3.4.3.1 Robotic neurosurgery is witnessing slow development as it is more complicated than other robotic surgeries

16.3.5 ENTERTAINMENT & LEISURE ROBOTS

TABLE 101 PRODUCT OFFERINGS OF VARIOUS ENTERTAINMENT & LEISURE ROBOT MANUFACTURERS

FIGURE 98 MARKET FOR HOBBY SYSTEMS EXPECTED TO GROW AT HIGHER CAGR THAN TOY ROBOTS DURING FORECAST PERIOD

TABLE 102 ENTERTAINMENT & LEISURE ROBOTS MARKET, BY ROBOT TYPE, 2017–2025 (USD MILLION)

TABLE 103 ENTERTAINMENT & LEISURE ROBOTS MARKET, BY ROBOT TYPE, 2017–2025 (THOUSAND UNITS)

16.3.5.1 Toy robots

16.3.5.1.1 Humanoids, pets, retro robots, and remote-controlled robots are a few types of toy robots

16.3.5.2 Hobby systems

16.3.5.2.1 Hobby systems are more associated with leisure or sports

16.3.6 INSPECTION ROBOTS

16.3.6.1 Inspection robots are generally used in conditions that are hazardous for humans

TABLE 104 PRODUCT OFFERINGS OF VARIOUS INSPECTION ROBOT MANUFACTURERS

16.3.7 HUMANOID ROBOTS

16.3.7.1 Humanoids are being used mainly for public relation application worldwide

TABLE 105 PRODUCT OFFERINGS OF VARIOUS HUMANOID ROBOT MANUFACTURERS

TABLE 106 HUMANOID ROBOTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

16.3.8 POWERED EXOSKELETONS

16.3.8.1 Powered exoskeletons find applications in industrial, medical, military, and construction verticals

TABLE 107 PRODUCT OFFERINGS OF VARIOUS POWERED EXOSKELETON MANUFACTURERS

16.3.9 TELEPRESENCE ROBOTS

16.3.9.1 Telepresence robots are used in healthcare, corporate, and personal applications

TABLE 108 PRODUCT OFFERINGS OF VARIOUS TELEPRESENCE ROBOT MANUFACTURERS

FIGURE 99 MARKET FOR PERSONAL & DOMESTIC TELEPRESENCE ROBOTS IS EXPECTED TO GROW AT A HIGHER CAGR THAN PROFESSIONAL ROBOTS DURING FORECAST PERIOD

TABLE 109 TELEPRESENCE ROBOTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

16.3.10 OTHERS

16.4 MARINE

TABLE 110 MARINE ROBOTS MARKET, BY TYPE, 2017–2025 (USD MILLION)

TABLE 111 MARINE ROBOTS MARKET, BY ROBOT TYPE, 2017–2025 (USD MILLION)

16.4.1 UNMANNED SURFACE VEHICLES (USVS)

16.4.1.1 USVs are used for applications such as defense, oceanography, surveillance, and search and rescue operations

TABLE 112 PRODUCT OFFERINGS OF VARIOUS USV MANUFACTURERS

TABLE 113 USVS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

16.4.2 AUTONOMOUS UNDERWATER VEHICLES (AUVS)

16.4.2.1 AUVs are programmed to collect data such as oceanographic and geologic information

TABLE 114 PRODUCT OFFERINGS OF VARIOUS AUV MANUFACTURERS

TABLE 115 AUVS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

16.4.3 REMOTELY OPERATED VEHICLES (ROVS)

16.4.3.1 ROVs have an endurance of about 8 hours

TABLE 116 PRODUCT OFFERINGS OF VARIOUS ROV MANUFACTURERS

FIGURE 100 ROVS MARKET FOR COMMERCIAL APPLICATION EXPECTED TO GROW AT A HIGHER CAGR THAN DEFENSE, RESCUE, AND SECURITY DURING FORECAST PERIOD

TABLE 117 ROVS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

16.5 COVID-19 IMPACT ON SERVICE ROBOTICS MARKET FOR VARIOUS ENVIRONMENTS

16.5.1 ENVIRONMENT IN WHICH SERVICE ROBOTS MIGHT BE HIGHLY IMPACTED

FIGURE 101 IMPACT OF COVID-19 ON SERVICE ROBOTICS MARKET FOR GROUND ROBOTS

16.5.2 ENVIRONMENT IN WHICH SERVICE ROBOTS MIGHT BE LEAST IMPACTED

FIGURE 102 IMPACT OF COVID-19 ON SERVICE ROBOTICS MARKET FOR AERIAL ENVIRONMENT

17 TOP SERVICE ROBOTICS MARKET, BY APPLICATION (Page No. - 243)

17.1 INTRODUCTION

FIGURE 103 TOP SERVICE ROBOTICS MARKET FOR DOMESTIC APPLICATION IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 118 TOP SERVICE ROBOTICS MARKET, BY APPLICATION, 2017–2025 (USD MILLION)

17.2 DOMESTIC

TABLE 119 TOP SERVICE ROBOTICS MARKET FOR DOMESTIC APPLICATION, BY ROBOT TYPE, 2017–2025 (USD MILLION)

TABLE 120 TOP SERVICE ROBOTICS MARKET, BY DOMESTIC APPLICATION TYPE, 2017–2025 (USD MILLION)

17.2.1 FLOOR CLEANING

17.2.1.1 Newer models of floor cleaning robots are equipped with Wi-Fi connectivity, HEPA filter, real-time floor mapping, and automated recharging and waste disposal

17.2.2 LAWN MOWING

17.2.2.1 Newer models of lawn mowing robots are equipped with rain sensors, self-docking capability, and proximity sensors

17.2.3 POOL CLEANING

17.2.3.1 Pool cleaning robots use laser sensors to detect walls and obstacles

17.2.4 OTHERS

17.3 MEDICAL

FIGURE 104 MARKET FOR POWERED EXOSKELETONS IN MEDICAL APPLICATIONS IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 121 TOP SERVICE ROBOTICS MARKET FOR MEDICAL APPLICATION, BY ROBOT TYPE, 2017–2025 (USD MILLION)

TABLE 122 TOP SERVICE ROBOTICS MARKET, BY MEDICAL APPLICATION TYPE, 2017–2025 (USD MILLION)

17.3.1 SURGERY ASSISTANCE

17.3.1.1 Surgical robots are penetrating the market at a high rate as they offer minimally invasive surgery

17.3.2 HANDICAP ASSISTANCE

17.3.2.1 Inclusion in various insurance policies is a key factor driving demand for handicap assistive robots

17.3.3 UV DISINFECTION

17.3.3.1 UV disinfection robots are a niche category of robots

17.3.4 OTHERS

17.4 FIELD

TABLE 123 TOP SERVICE ROBOTICS MARKET FOR FIELD APPLICATION, BY ROBOT TYPE, 2017–2025 (USD MILLION)

TABLE 124 TOP SERVICE ROBOTICS MARKET, BY FIELD APPLICATION TYPE, 2017–2025 (USD MILLION)

17.4.1 HARVEST MANAGEMENT

17.4.1.1 Due to shortage of labor, high production costs, and environmental factors, the need for harvest management robots is increasing

17.4.2 FIELD FARMING

17.4.2.1 Crop monitoring

17.4.2.1.1 Crop monitoring is generally performed aerially by agricultural drones

17.4.2.2 Plant scouting

17.4.2.2.1 Plant scouting robots are generally used for indoor farming applications in greenhouses or vertical farms

17.4.2.3 Crop scouting

17.4.2.3.1 Crop scouting robots measure traits and readings of individual plants in plantations using a combination of cameras and sensors

17.4.3 DAIRY & LIVESTOCK MANAGEMENT

17.4.3.1 Drones and milking robots are dominant robots for dairy and livestock management applications

17.4.4 OTHERS

17.5 DEFENSE, RESCUE, AND SECURITY

FIGURE 105 MARKET FOR POWERED EXOSKELETONS IN DEFENSE, RESCUE, AND SECURITY APPLICATION IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 125 TOP SERVICE ROBOTICS MARKET FOR DEFENSE, RESCUE, AND SECURITY APPLICATION, BY ROBOT TYPE, 2017–2025 (USD MILLION)

17.5.1 DEMINING

17.5.1.1 Demining robots can work efficiently and flexibly, and improve personnel safety

17.5.2 FIRE AND BOMB FIGHTING

17.5.2.1 Firefighting robots are more precise due to their capability to handle fire from a closer distance

17.5.3 BORDER SECURITY & SURVEILLANCE

17.5.3.1 Border security and surveillance robots are used to curb illegal immigration and imports, implanting of explosive devices, and terrorist activities

17.5.4 OTHERS

17.6 ENTERTAINMENT, EDUCATION, AND PERSONAL

TABLE 126 TOP SERVICE ROBOTICS MARKET FOR ENTERTAINMENT, EDUCATION, AND PERSONAL APPLICATION, BY ROBOT TYPE, 2017–2025 (USD MILLION)

TABLE 127 TOP SERVICE ROBOTICS MARKET, BY ENTERTAINMENT, EDUCATION, AND PERSONAL APPLICATION TYPE, 2017–2025 (USD MILLION)

17.6.1 ENTERTAINMENT

17.6.1.1 Entertainment robots can be used at residences for kids, guests, and elderly people

17.6.2 EDUCATION

17.6.2.1 Robotics enhance educational pursuits and help achieve individual learner requirements

17.6.3 COMPANIONSHIP AND ELDERLY ASSISTANCE

17.6.3.1 Increasing geriatric population worldwide is driving assistance robots market

17.7 PUBLIC RELATIONS

17.7.1 PUBLIC RELATION ROBOTS ARE BEING USED FOR ROOM SERVICES IN HOTELS AND RESTAURANTS, SECURITY AND LAW ENFORCEMENT, AND PROVIDING GUIDANCE TO CUSTOMERS IN RETAIL STORES

FIGURE 106 HUMANOID ROBOTS MARKET FOR PUBLIC RELATION APPLICATION IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 128 TOP SERVICE ROBOTICS MARKET FOR PUBLIC RELATION APPLICATION, BY ROBOT TYPE, 2017–2025 (USD MILLION)

17.8 INSPECTION & MAINTENANCE

TABLE 129 TOP SERVICE ROBOTICS MARKET FOR INSPECTION & MAINTENANCE APPLICATION, BY ROBOT TYPE, 2017–2025 (USD MILLION)

17.8.1 PIPE/PIPELINE INSPECTION

17.8.1.1 Pipeline inspection robots are used for measuring thickness and diameter of pipes and for welding pipes during maintenance

17.8.2 POWER PLANT INSPECTION

17.8.2.1 Robots are used for detection and reduction of power leakage from turbines, generators, pressure lines, and boilers

17.8.3 INSPECTION OF ENERGIZED TRANSMISSION LINES

17.8.3.1 Robots can safely inspect and repair transmission lines remotely

17.8.4 OTHERS

17.9 LOGISTICS

TABLE 130 TOP SERVICE ROBOTICS MARKET FOR LOGISTICS APPLICATION, BY ROBOT TYPE, 2017–2025 (USD MILLION)

TABLE 131 TOP SERVICE ROBOTICS MARKET, BY LOGISTICS APPLICATION TYPE, 2017–2025 (USD MILLION)

17.9.1 WAREHOUSE AUTOMATION

17.9.1.1 AGVs are used in warehouses for just-in-time delivery of raw materials, computerized control of received assembled parts, and tracking of shipped articles

17.9.2 LAST-MILE DELIVERY

17.9.2.1 Adoption of robots for last-mile delivery to be mainly driven by less time and costs taken than manual delivery

17.10 CONSTRUCTION & DEMOLITION

17.10.1 CONSTRUCTION AND DEMOLITION ROBOTS REDUCE LABOR COST AND INCREASE RETURNS ON INVESTMENT

FIGURE 107 MARKET FOR POWERED EXOSKELETONS IN CONSTRUCTION & DEMOLITION APPLICATIONS IS EXPECTED TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 132 TOP SERVICE ROBOTICS MARKET FOR CONSTRUCTION & DEMOLITION APPLICATION, BY ROBOT TYPE, 2017–2025 (USD MILLION)

17.11 MARINE

17.11.1 OCEANOGRAPHY

17.11.1.1 AUVs provide data on time and spatial scales that were previously inaccessible to researchers

17.11.2 ENVIRONMENTAL PROTECTION AND MONITORING

17.11.2.1 Robots are used for wastewater purification and studying remote volcanoes

17.11.3 ARCHAEOLOGICAL EXPLORATION

17.11.3.1 Robots are required in archaeological exploration when sites are dangerous for humans

17.11.4 OTHERS

17.12 RESEARCH & SPACE EXPLORATION

17.12.1 SPACE EXPLORATION ROBOTS TO WITNESS GROWING ADOPTION IN COMING YEARS

TABLE 133 TOP SERVICE ROBOTICS MARKET FOR RESEARCH & SPACE EXPLORATION APPLICATION, BY ROBOT TYPE, 2017–2025 (USD MILLION)

17.13 COVID-19 IMPACT ON SERVICE ROBOTICS MARKET FOR VARIOUS APPLICATIONS

17.13.1 MOST IMPACTED APPLICATION

FIGURE 108 IMPACT OF COVID-19 ON SERVICE ROBOTICS MARKET FOR MEDICAL APPLICATION

17.13.2 LEAST IMPACTED APPLICATION

FIGURE 109 IMPACT OF COVID-19 ON SERVICE ROBOTICS MARKET FOR DEFENSE, RESCUE, AND SECURITY APPLICATION

18 GEOGRAPHIC ANALYSIS OF TOP SERVICE ROBOTICS MARKET (Page No. - 270)

18.1 INTRODUCTION

FIGURE 110 TOP SERVICE ROBOTICS MARKET IN APAC COUNTRIES TO GROW AT SIGNIFICANT RATE DURING FORECAST PERIOD

FIGURE 111 NORTH AMERICA TO HOLD LARGEST SHARE OF TOP SERVICE ROBOTICS MARKET IN 2020

TABLE 134 TOP SERVICE ROBOTICS MARKET, BY REGION, 2017–2025 (USD MILLION)

18.2 NORTH AMERICA

FIGURE 112 SNAPSHOT OF TOP SERVICE ROBOTICS MARKET IN NORTH AMERICA

TABLE 135 TOP SERVICE ROBOTICS MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 136 TOP SERVICE ROBOTICS MARKET IN NORTH AMERICA, BY ENVIRONMENT, 2017–2025 (USD MILLION)

18.2.1 US

18.2.1.1 Demand for service robots for education to witness high growth

18.2.2 CANADA

18.2.2.1 Market in Canada is driven by aging population, growing demand for elderly care robots, increasing venture capital investments, and integration of mobile technologies in robots

18.2.3 MEXICO

18.2.3.1 Demand for service robots for delivery in e-commerce industry is expected to rise in Mexico

18.3 EUROPE

FIGURE 113 SNAPSHOT OF TOP SERVICE ROBOTICS MARKET IN EUROPE

TABLE 137 TOP SERVICE ROBOTICS MARKET IN EUROPE, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 138 TOP SERVICE ROBOTICS MARKET IN EUROPE, BY ENVIRONMENT, 2017–2025 (USD MILLION)

18.3.1 GERMANY

18.3.1.1 Robots are being used in Germany for fighting COVID-19, disinfecting hospitals, and entertaining people under quarantine

18.3.2 FRANCE

18.3.2.1 Huge growth opportunity for service robots in France owing to high wages

18.3.3 UK

18.3.3.1 Aging population and universities offer opportunities for surgical and educational robots

18.3.4 REST OF EUROPE

18.3.4.1 European Commission has launched AI-ROBOTICS vs. COVID-19 initiative for gathering ideas about deployable artificial intelligence (AI) and robotics solutions

18.4 APAC

FIGURE 114 SNAPSHOT OF TOP SERVICE ROBOTICS MARKET IN APAC

TABLE 139 TOP SERVICE ROBOTICS MARKET IN APAC, BY COUNTRY, 2017–2025 (USD MILLION)

TABLE 140 TOP SERVICE ROBOTICS MARKET IN APAC, BY ENVIRONMENT, 2017–2025 (USD MILLION)

18.4.1 CHINA

18.4.1.1 Demand for delivery robots is expected to grow at a high rate in China

18.4.2 SOUTH KOREA

18.4.2.1 Demand for assistive service robots is expected to increase in South Korea

18.4.3 JAPAN

18.4.3.1 Japan has a strong hold in service robots in terms of safety technologies and speech recognition

18.4.4 INDIA

18.4.4.1 Indian Space Research Organisation (ISRO) has developed India’s first humanoid, Vyommitra, for space

18.4.5 REST OF APAC

18.4.5.1 Developing countries such as Singapore and Thailand have high GDP growth and are expected to generate significant demand for service robots in near future

18.5 ROW

FIGURE 115 MIDDLE EAST & AFRICA TO DOMINATE MARKET IN ROW THROUGHOUT FORECAST PERIOD

TABLE 141 TOP SERVICE ROBOTICS MARKET IN ROW, BY REGION, 2017–2025 (USD MILLION)

TABLE 142 TOP SERVICE ROBOTICS MARKET IN ROW, BY ENVIRONMENT, 2017–2025 (USD MILLION)

18.5.1 MIDDLE EAST & AFRICA

18.5.1.1 Abundance of labor can restrain the demand for service robots in Middle East

18.5.2 SOUTH AMERICA

18.5.2.1 Investments in public and specialized education are expected to improve standards of living and increase demand for service robots

18.6 COVID-19 IMPACT ON SERVICE ROBOTICS MARKET IN VARIOUS REGIONS

18.6.1 REGION IN WHICH SERVICE ROBOTICS MARKET MIGHT BE HIGHLY IMPACTED

FIGURE 116 IMPACT OF COVID-19 ON SERVICE ROBOTICS MARKET IN EUROPE

18.6.2 REGION IN WHICH SERVICE ROBOTS MIGHT BE LEAST IMPACTED

FIGURE 117 IMPACT OF COVID-19 ON SERVICE ROBOTICS MARKET IN ROW

19 COMPETITIVE LANDSCAPE OF TOP SERVICE ROBOTICS MARKET (Page No. - 288)

19.1 OVERVIEW

FIGURE 118 PLAYERS IN SERVICE ROBOTICS MARKET ADOPTED PRODUCT LAUNCHES AS THEIR KEY STRATEGY FOR BUSINESS EXPANSION FROM 2017 TO 2019

19.2 MARKET SHARE ANALYSIS

FIGURE 119 INTUITIVE SURGICAL LED TOP SERVICE ROBOTICS MARKET IN 2019

TABLE 143 RANKING OF TOP 5 PLAYERS IN SERVICE ROBOTICS MARKET, 2019

19.3 COMPETITIVE LEADERSHIP MAPPING

19.3.1 STAR

19.3.2 EMERGING

19.3.3 PERVASIVE

19.3.4 PARTICIPANT

FIGURE 120 SERVICE ROBOTICS MARKET (GLOBAL): COMPETITIVE LEADERSHIP MAPPING, 2019

19.4 STRENGTH OF PRODUCT PORTFOLIO (25 PLAYERS)

FIGURE 121 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN TOP ROBOTICS MARKET

19.5 BUSINESS STRATEGY EXCELLENCE (25 PLAYERS)

FIGURE 122 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN TOP ROBOTICS MARKET

19.6 STARTUP/SME EVALUATION MATRIX

TABLE 144 STARTUPS/SMES IN SERVICE ROBOTICS MARKET

19.6.1 PROGRESSIVE COMPANIES

19.6.2 RESPONSIVE COMPANIES

19.6.3 DYNAMIC COMPANIES

19.6.4 STARTING BLOCKS

FIGURE 123 TOP SERVICE ROBOTICS MARKET (GLOBAL): STARTUP/SME EVALUATION MATRIX, 2020

19.7 COMPETITIVE SITUATIONS AND TRENDS

FIGURE 124 SERVICE ROBOTICS MARKET WITNESSED SIGNIFICANT GROWTH FROM 2017 TO 2019

19.7.1 PRODUCT LAUNCHES

TABLE 145 TOP SERVICE ROBOTICS MARKET, PRODUCT LAUNCHES, 2017–2019

19.7.2 PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES

TABLE 146 TOP SERVICE ROBOTICS MARKET, PARTNERSHIPS AND COLLABORATIONS, 2017–2019

19.7.3 EXPANSIONS

TABLE 147 TOP SERVICE ROBOTICS MARKET, EXPANSIONS, 2017–2019

19.7.4 ACQUISITIONS

TABLE 148 TOP SERVICE ROBOTICS MARKET, ACQUISITIONS, 2017–2019

20 COMPANY PROFILES (Page No. - 299)

20.1 INTRODUCTION

20.2 KEY PLAYERS

(Business overview, Products offered, Recent developments, COVID-19-related developments, SWOT analysis, and MnM view)*

20.2.1 ABB

FIGURE 125 ABB: COMPANY SNAPSHOT

20.2.2 YASKAWA

FIGURE 126 YASKAWA: COMPANY SNAPSHOT

20.2.3 FANUC

FIGURE 127 FANUC: COMPANY SNAPSHOT

20.2.4 KUKA

FIGURE 128 KUKA: COMPANY SNAPSHOT

20.2.5 MITSUBISHI ELECTRIC

FIGURE 129 MITSUBISHI ELECTRIC: COMPANY SNAPSHOT

20.2.6 IROBOT

FIGURE 130 IROBOT: COMPANY SNAPSHOT

20.2.7 SOFTBANK ROBOTICS GROUP

20.2.8 INTUITIVE SURGICAL

FIGURE 131 INTUITIVE SURGICAL: COMPANY SNAPSHOT

20.2.9 DELAVAL

FIGURE 132 DELAVAL: COMPANY SNAPSHOT

20.2.10 DAIFUKU

FIGURE 133 DAIFUKU: COMPANY SNAPSHOT

*Details on Business overview, Products offered, Recent developments, COVID-19-related developments, SWOT analysis, and MnM view might not be captured in case of unlisted companies.

20.3 RIGHT TO WIN

20.3.1 ABB

20.3.2 FANUC

20.3.3 IROBOT

20.3.4 SOFTBANK ROBOTICS GROUP

20.3.5 INTUITIVE SURGICAL

20.4 OTHER KEY PLAYERS

20.4.1 KAWASAKI HEAVY INDUSTRIES

20.4.2 DENSO

20.4.3 NACHI-FUJIKOSHI

20.4.4 SEIKO EPSON

20.4.5 UNIVERSAL ROBOTS

20.4.6 CYBERDYNE

20.4.7 DJI

20.4.8 KONGSBERG

20.4.9 NORTHROP GRUMMAN

20.4.10 NEATO ROBOTICS

21 APPENDIX (Page No. - 341)

21.1 DISCUSSION GUIDE

21.1.1 TOP INDUSTRIAL ROBOTICS MARKET

21.1.2 TOP SERVICE ROBOTICS MARKET

21.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

21.3 AVAILABLE CUSTOMIZATIONS

21.4 RELATED REPORTS (TOP ROBOTICS MARKET)

21.5 AUTHOR DETAILS

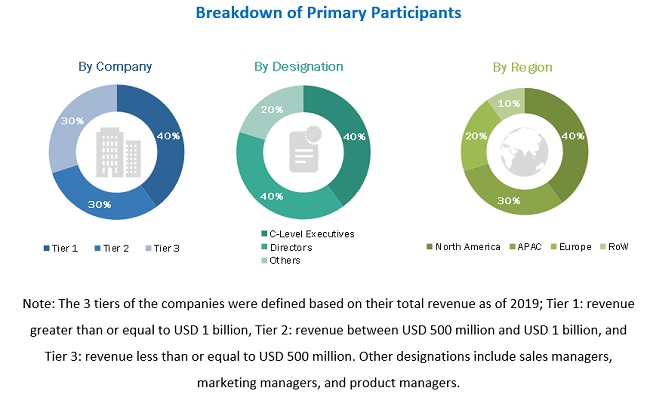

The study involved four major activities in estimating the size for top robotics market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information pertinent to this study. Secondary sources include annual reports; press releases; investor presentations; white papers; journals and certified publications; and articles from recognized authors, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, market’s value chain, total pool of key players, market segmentation according to the industry trends (to the bottommost level), geographic markets, and key developments from both market- and technology-oriented perspectives.

After the complete market engineering (which includes calculations for market statistics, market breakdown, data triangulation, market size estimations, and market forecasting), extensive primary research has been carried out to gather information, as well as to verify and validate the critical numbers arrived at.

Primary research has also been conducted to identify the segmentation types; key players; competitive landscape; and key market dynamics such as drivers, restraints, opportunities, challenges, and industry trends, along with the key strategies adopted by the market players. Extensive qualitative and quantitative analyses have been performed on the complete market engineering process to list the key information and insights throughout the report.

Secondary sources used for this research study include government sources, corporate filings (such as annual reports, investor presentations, and financial statements), and trade, business, and professional associations. The secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Primary Research