Telepresence Robot Market by Component (Head (Camera, Display, Speaker, and Microphone) and Body (Power Source and Sensor & Control system)), Type, Application (Education, Healthcare, Enterprise, and Homecare), and Geography - Global Forecast to 2023

The overall telepresence robot market was valued at USD 129.8 million in 2017 and is expected to reach USD 312.6 million by 2023, at a CAGR of 16.5% from 2018 to 2023.

Enhanced operational efficiency in enterprises and high demand for telepresence robots for healthcare applications are the major factors driving the growth of the market. For this study, the base year considered is 2017, and the forecast period is from 2018 to 2023.

Market Dynamics

Drivers

- Enhanced operational efficiency in enterprises due to the virtual meeting

- High demand from the healthcare industry

- Low cost due to the availability of supporting devices

Restraints

- Technical complexities leading to operational failures

Opportunities

- Advancement in robotic technology

- Wide-level adoption from education to residential sectors

Challenges

- Lack of secure communication and common protocols

High demand from the healthcare industry to drive the global telepresence robot

The global telepresence robot market size is estimated to reach 312.6 million by 2023 largely due to the growing demand from the healthcare industry. Robotics telepresence is highly adopted in the healthcare industry to socialize with elderly people. In the healthcare sector, telepresence robots can perform several tasks, such as patient monitoring, remote visiting, delivering medicines and food, reminding patients to take medicines on time, as well as other tasks such as connecting to doctors and nurses for medical or any other assistance. Telepresence robots in the healthcare industry facilitate virtual communication among doctors, patients, medical students, and therapists located anywhere across the world. A telepresence robot enables doctors and patients to contact each other through HD audio and video. Patients can consult and share their health issues with doctors in real time. Telepresence robots also provide medical education through HD audiovisual recording and live broadcasting; this could include training for clinical pathology, surgery, and related subjects, as well as other academic communications.

Major study objectives are as follows:

- To define, describe, segment, and forecast the global market, in terms of value, segmented on the basis of component, type, application, and geography

- To forecast the market size, in terms of value and volume, for type and application segments with regard to 4 main regions: the Americas, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contribution to this market

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges pertaining to this market

- To analyze opportunities in the market for stakeholders and details of the competitive landscape for leaders in the market

- To provide a detailed overview of the value chain of the market

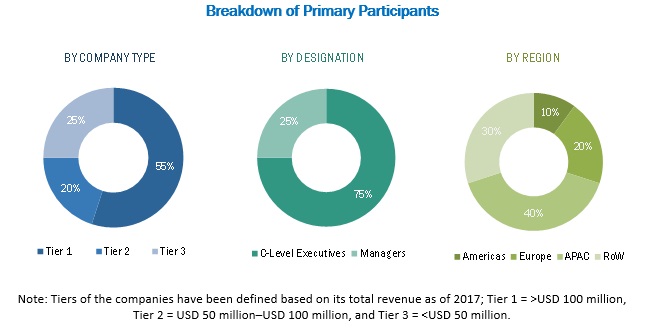

During this research study, major players operating in the telepresence robot market in various regions have been identified, and their offerings, regional presence, and distribution channels have been analyzed through in-depth discussions. Top-down and bottom-up approaches have been used to determine the overall market size. Sizes of the other individual markets have been estimated using the percentage splits obtained through secondary sources such as Hoovers, Bloomberg BusinessWeek, and Factiva, along with primary respondents. The entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews with industry experts such as CEOs, VPs, directors, and marketing executives for key insights (both qualitative and quantitative) pertaining to the market. The figure below shows the breakdown of the primaries based on the company type, designation, and region considered during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Double Robotics (US), Inbot Technology (China), Suitable Technologies (US), Mantaro Networks (US), VGo Communications (UK), InTouch Technologies (US), Qihan Technology (China), Amy Robotics (China), Anybots (US), SuperDroid Robots (US), Ava Robotics (US), Camanio Care (Sweden), Wicron (Russia), Xandex (US), Rbot (Russia), AXYN Robotique (France), OhmniLabs (US), Swivl (US), Xaxxon Technologies (Canada), and Hease Robotics (France) are among the key players in the telepresence market.

Major Market Developments

- In January 2018, Suitable Technologies (US), a creator of the industry-leading Beam family of telepresence robots, introduced BeamPro 2. The robot offers advanced features that enhance communication within organizations.

- In April 2018, InTouch Technologies (US) entered into a definitive agreement to acquire REACH Health (US), a telemedicine software company. This further solidifies the leading position of InTouch Health as a telehealth partner of choice for hospitals and health systems.

- In February 2016, Amy Robotics partnered with a distributor Damras Group (South Africa) to expand its reach in South Africa.

Target Audience:

- Raw material suppliers

- Original equipment manufacturers (OEMs)

- Technology, service, and solution providers

- Intellectual property (IP) core and licensing providers

- Suppliers and distributors

- Government and other regulatory bodies

- Forums, alliances, and associations

- Technology investors

- Research institutes and organizations

- Analysts and strategic business planners

- Market research and consulting firms

Report Scope

The market segments covered in this report are as follows:

Telepresence Robot Market, by Component

-

Head

- Camera

- Display

- Speaker

- Microphone

-

Body

- Power Source

- Sensors & Control System

- Others

Telepresence Robot Market, by Type

- Stationary

- Mobile

Telepresence Robot Market, by Application

- Education

- Healthcare

- Enterprise

- Homecare

- Others

Telepresence Robot Market, by Geography

- Americas

- Europe

- APAC

- RoW

Critical questions which the report answers

- Most of the suppliers have opted product development and expansions as the key strategies as it could be seen from recent developments. Where will it take the industry in the mid-to-long term?

- Will the study help understand competitors and provide insights to improve positions in the business?

Available Customizations

Detailed analysis and profiling of additional market players by various blocks of the value chain

The telepresence robot market is expected to grow from USD 145.8 million in 2018 to USD 312.6 million by 2023, at a CAGR of 16.5%. This market is mainly driven by the factors such as enhanced operational efficiency in enterprises due to the virtual meeting, high demand from the healthcare industry, and low cost due to the availability of supporting devices.

The telepresence robot market has been segmented on the basis of component into head components, which include camera, display, speaker, and microphone; and body that includes power source, sensor and control system; and other components comprising wheels, body materials, and accessories. The market for the body component is expected to grow at the highest CAGR during the forecast period. As the technological advancement will lead to the complexity in terms of features in telepresence robots, such as artificial intelligence (AI) and autonomous operations, the value of body parts in telepresence robots will increase faster than head components.

The telepresence robot market based on type has been segmented into stationary and mobile robots. The market for mobile telepresence robots is expected to grow at a higher CAGR from 2018 to 2023. The application of stationary telepresence is limited only to particular areas as the stationary robot is used mainly for training purposes in almost every vertical. The mobility is already a major feature of mobile telepresence, and because of its added advantages, these telepresence robots can also find applications in several new verticals, such as defense, surveillance, and security.

The telepresence robot market based on application has been segmented into education, healthcare, enterprise, homecare, and others that include warehouse, surveillance, and defence. The market for healthcare applications is expected to grow at the highest CAGR during 2018–2023. Remotely controlled telepresence robots enable doctors to interact with their patients for consulting and training. Researchers have been developing telepresence robots that can be used for remote surgery to save lives and can be controlled by remote surgeons. These benefits are driving the overall telepresence market in the healthcare sector. The market for education applications is expected to grow at the second-highest CAGR during the forecast period.

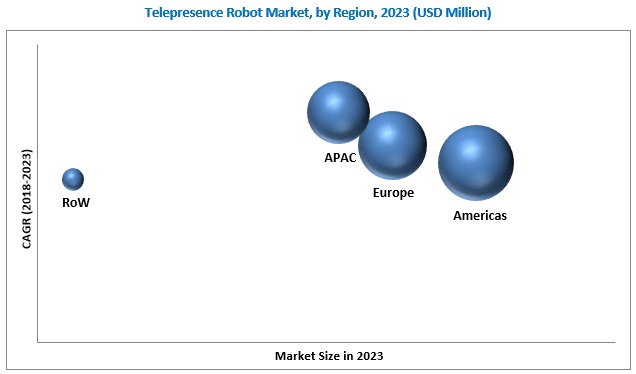

On the basis of geography, the telepresence robot market is broadly classified into the Americas, Europe, APAC, and RoW. The market in APAC is expected to grow at the highest CAGR during the forecast period. Major factors contributing to this growth include the emergence of new technologies in APAC which has created the increased demand for innovative and user-friendly communications.

Technical complexities leading to operational failures of telepresence robot inhibit the market growth. Fully immersive telepresence robots rely on human instructions for motion remotely, which can be controlled by a person. Internet connectivity is required for controlling a telepresence system remotely; also, it has a risk of losing connections due to network failures and the failure in its associate devices. Furthermore, the lack of secure communication and common protocols is a major challenge faced by telepresence robot market players. However, advancements in the robotic technology and wide-level adoption from education and residential sectors can generate significant opportunities for this market.

Double Robotics (US), Inbot Technology (China), Suitable Technologies (US), Mantaro Networks (US), VGo Communications (UK), InTouch Technologies (US), Qihan Technology (China), Amy Robotics (China), Anybots (US), SuperDroid Robots (US), Ava Robotics (US), Camanio Care (Sweden), Wicron (Russia), Xandex (US), Rbot (Russia), AXYN Robotique (France), OhmniLabs (US), Swivl (US), Xaxxon Technologies (Canada), and Hease Robotics (France) are a few key players in the telepresence robot market.

Critical questions the report answers:

- Most of the suppliers have opted product development and expansions as key strategies as it could be seen from the recent developments. Where will it take the industry in the mid-to-long term?

- Will the study help understand competitors and provide insights to improve their positions in the business?

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Geographic Scope

1.3.3 Years Considered for Study

1.4 Currency

1.5 Limitations

1.6 Market Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 List of Major Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Primary Interviews With Experts

2.1.2.2 Key Data From Primary Sources

2.1.2.3 Key Industry Insights

2.1.2.4 Breakdown of Primaries

2.1.3 Secondary and Primary Research

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.1.1 Approach for Capturing the Market Share By Bottom-Up Analysis (Demand Side)

2.2.2 Top-Down Approach

2.2.2.1 Approach for Capturing the Market Share By Top-Down Analysis (Supply Side)

2.3 Market Ranking Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Telepresence Robot Market

4.2 Market, By Component

4.3 Market, By Type

4.4 Market in APAC, By Application and By Country

4.5 Market, By Region

4.6 Country-Wise Analysis of the Telepresence Robot Market

5 Market Overview (Page No. - 34)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Enhanced Operational Efficiency in Enterprises Due to Virtual Meeting

5.2.1.2 Growing Demand From the Healthcare Industry

5.2.1.3 Low Cost Due to Availability of Supporting Devices

5.2.2 Restraints

5.2.2.1 Technical Complexities Leading to Operational Failures

5.2.3 Opportunities

5.2.3.1 Advancement in the Robotic Technology

5.2.3.2 Wide Level Adoption From Education and Residential Sectors

5.2.4 Challenges

5.2.4.1 Lack of Secure Communication and Common Protocols

5.3 Value Chain Analysis

6 Market, By Component (Page No. - 41)

6.1 Introduction

6.2 Head

6.2.1 Camera

6.2.1.1 Independent Camera Base Widely Used in Telepresence Robots

6.2.2 Display

6.2.2.1 High Quality Inbuilt Display to Boost Demand

6.2.3 Speaker

6.2.3.1 Amplified Speakers Preferred in Telepresence Robots

6.2.4 Microphone

6.2.4.1 Directional Microphone Preference to Drive Microphone Demand

6.3 Body

6.3.1 Power Source

6.3.1.1 Power Source to Hold Highest Share of Body Component Market

6.3.2 Sensors and Control System

6.3.2.1 Sensors and Control Systems Core Component of Telepresence Robots

6.3.3 Others

7 Market, By Type (Page No. - 46)

7.1 Introduction

7.2 Stationary

7.2.1 Stationary Telepresence Robots Widely Used for Enterprise Application

7.3 Mobile

7.3.1 Mobile Telepresence Robot to Dominate Market

8 Market, By Application (Page No. - 52)

8.1 Introduction

8.2 Education

8.2.1 Student Engagement With Telepresence Robot to Drive Market Growth

8.3 Healthcare

8.3.1 Healthcare Application to Grow at Highest CAGR

8.4 Enterprise

8.4.1 Enterprise Application to Account for Largest Share of Telepresence Market

8.5 Homecare

8.5.1 Telepresence as Advanced Video Telephony Highly Used in Homecare Application

8.6 Others

9 Market, By Region (Page No. - 63)

9.1 Introduction

9.2 Americas

9.2.1 US

9.2.1.1 US to Account for Largest Share of Market in the Americas

9.2.2 Canada

9.2.2.1 Canada Likely to Witness Second-Highest Growth Rate in Market in the Americas

9.2.3 Mexico

9.2.3.1 High Adoption of Telepresence Robots in Medical Facilities to Drive Market

9.2.4 South America

9.2.4.1 Inclination Toward Adoption of Robotics Technologies to Boost Market

9.3 Europe

9.3.1 Germany

9.3.1.1 Growing Robotics System Applicability to Increase Demand

9.3.2 UK

9.3.2.1 Elderly Care and Personal Assistance to Generate Demand for Telepresence

9.3.3 France

9.3.3.1 French Telepresence Market Dominated By Huge Presence of Robotics Players

9.3.4 Rest of Europe

9.4 Asia Pacific

9.4.1 China

9.4.1.1 China Holds Largest Share of APAC Market

9.4.2 Japan

9.4.2.1 Well-Established Robotics Industry Augments Market Growth and Demand

9.4.3 India

9.4.3.1 Indian Market Likely to Grow at Highest Rate

9.4.4 South Korea

9.4.4.1 Advanced Robot Technologies to Offer Significant Growth Opportunities

9.4.5 Rest of APAC

9.5 Rest of the World

9.5.1 Middle East

9.5.1.1 Professional and Personal Service Robotics Driving Demand for Telepresence Robots

9.5.2 Africa

9.5.2.1 Telepresence Robot Adoption for Video Conferencing Driving Market

10 Competitive Landscape (Page No. - 84)

10.1 Overview

10.2 Market Ranking Analysis

10.3 Competitive Scenario

10.3.1 Product Launches and Expansions

10.3.2 Acquisitions and Partnerships

11 Company Profiles (Page No. - 88)

11.1 Introduction

11.2 Key Players

(Business Overview, Products Offered, SWOT Analysis, and MnM View)*

11.2.1 Double Robotics

11.2.2 Inbot Technology

11.2.3 Suitable Technologies

11.2.4 Mantaro Networks

11.2.5 VGO Communications

11.2.6 Intouch Technologies

11.2.7 Qihan Technology

11.2.8 Amy Robotics

11.2.9 Anybots

11.2.10 Superdroid Robots

11.3 Other Key Players

11.3.1 Ava Robotics

11.3.2 Camanio Care

11.3.3 Wicron

11.3.4 Xandex

11.3.5 Rbot

11.4 Key Innovators

11.4.1 Axyn Robotique

11.4.2 Ohmnilabs

11.4.3 Swivl

11.4.4 Xaxxon Technologies

11.4.5 Hease Robotics

*Details on Business Overview, Products Offered, SWOT Analysis, and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 108)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Available Customizations

12.4 Related Reports

12.5 Author Details

List of Tables (63 Tables)

Table 1 Telepresence Robot Market, By Component, 2015–2023 (USD Million)

Table 2 Market, By Head Component, 2015–2023 (USD Million)

Table 3 Market, By Body Component, 2015–2023 (USD Million)

Table 4 Market, By Type, 2015–2023 (USD Million)

Table 5 Market, By Type, 2015–2023 (Units)

Table 6 Stationary Telepresence Robot Market, By Application, 2015–2023 (USD Million)

Table 7 Stationary Telepresence Robot Market, By Application, 2015–2023 (Units)

Table 8 Stationary Telepresence Robot Market, By Region, 2015–2023 (USD Million)

Table 9 Stationary Telepresence Robot Market, By Region, 2015–2023 (Units)

Table 10 Mobile Telepresence Robot Market, By Application, 2015–2023 (USD Million)

Table 11 Mobile Telepresence Robot Market, By Application, 2015–2023 (Units)

Table 12 Mobile Telepresence Robot Market, By Region, 2015–2023 (USD Million)

Table 13 Mobile Telepresence Robot Market, By Region, 2015–2023 (Units)

Table 14 Market, By Application, 2015–2023 (USD Million)

Table 15 Market, By Application, 2015–2023 (Units)

Table 16 Market for Education, By Type, 2015–2023 (USD Million)

Table 17 Market for Education, By Type, 2015–2023 (Units)

Table 18 Market for Education, By Region, 2015–2023 (USD Million)

Table 19 Market for Education, By Region, 2015–2023 (Units)

Table 20 Market for Healthcare, By Type, 2015–2023 (USD Million)

Table 21 Market for Healthcare, By Type, 2015–2023 (Units)

Table 22 Market for Healthcare, By Region, 2015–2023 (USD Million)

Table 23 Market for Healthcare, By Region, 2015–2023 (Units)

Table 24 Market for Enterprise, By Type, 2015–2023 (USD Million)

Table 25 Market for Enterprise, By Type, 2015–2023 (Units)

Table 26 Market for Enterprise, By Region, 2015–2023 (USD Million)

Table 27 Market for Enterprise, By Region, 2015–2023 (Units)

Table 28 Market for Homecare, By Type, 2015–2023 (USD Million)

Table 29 Market for Homecare, By Type, 2015–2023 (Units)

Table 30 Market for Homecare, By Region, 2015–2023 (USD Million)

Table 31 Market for Homecare, By Region, 2015–2023 (Units)

Table 32 Market for Other Applications, By Type, 2015–2023 (USD Million)

Table 33 Market for Other Applications, By Type, 2015–2023 (Units)

Table 34 Market for Other Applications, By Region, 2015–2023 (USD Million)

Table 35 Market for Other Applications, By Region, 2015–2023 (Units)

Table 36 Market, By Region, 2015–2023 (USD Million)

Table 37 Market, By Region, 2015–2023 (Units)

Table 38 Market in the Americas, By Type, 2015–2023 (USD Million)

Table 39 Market in the Americas, By Type, 2015–2023 (Units)

Table 40 Market in the Americas, By Application, 2015–2023 (USD Million)

Table 41 Market in the Americas, By Application, 2015–2023 (Units)

Table 42 Market in the Americas, By Country, 2015–2023 (USD Million)

Table 43 Market in the Americas, By Country, 2015–2023 (Units)

Table 44 Market in Europe, By Type, 2015–2023 (USD Million)

Table 45 Market in Europe, By Type, 2015–2023 (Units)

Table 46 Market in Europe, By Application, 2015–2023 (USD Million)

Table 47 Market in Europe, By Application, 2015–2023 (Units)

Table 48 Market in Europe, By Country, 2015–2023 (USD Million)

Table 49 Market in Europe, By Country, 2015–2023 (Units)

Table 50 Market in APAC, By Type, 2015–2023 (USD Million)

Table 51 Market in APAC, By Type, 2015–2023 (Units)

Table 52 Market in APAC, By Application, 2015–2023 (USD Million)

Table 53 Market in APAC, By Application, 2015–2023 (Units)

Table 54 Market in APAC, By Country, 2015–2023 (USD Million)

Table 55 Market in APAC, By Country, 2015–2023 (Units)

Table 56 Market in RoW, By Type, 2015–2023 (USD Million)

Table 57 Market in RoW, By Type, 2015–2023 (Units)

Table 58 Market in RoW, By Application, 2015–2023 (USD Million)

Table 59 Market in RoW, By Application, 2015–2023 (Units)

Table 60 Market in RoW, By Country, 2015–2023 (USD Million)

Table 61 Market in RoW, By Country, 2015–2023 (Units)

Table 62 Most Recent Product Launches and Expansions in Telepresence Robot Market

Table 63 Most Recent Acquisitions and Partnerships in the Telepresence Robot Market

List of Figures (28 Figures)

Figure 1 Telepresence Robot Market: Research Design

Figure 2 Process Flow

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Breakdown and Data Triangulation

Figure 6 Body Component of Telepresence Robot Expected to Hold the Major Share Throughout the Forecast Period

Figure 7 The Mobile Telepresence Robot Market is Expected to Grow Faster During the Forecast Period

Figure 8 Market for Healthcare Application to Grow at Highest CAGR During Forecast Period

Figure 9 APAC Likely to Be Fastest-Growing Region During the Forecast Period

Figure 10 Wide Level Adoption From Education and Residential Sectors Holds Huge Opportunities for this Market

Figure 11 Power Source to Hold the Largest Share of the Market During the Forecast Period

Figure 12 Mobile Telepresence Robot Expected to Hold A Larger Market Share During the Forecast Period

Figure 13 Homecare Application Market and China Expected to Account for the Largest Shares in APAC in 2018

Figure 14 Market in APAC Expected to Grow at the Highest CAGR During the Forecast Period

Figure 15 US Expected to Account for the Largest Share of the Market for Telepresence Robot in 2018

Figure 16 Enhanced Operational Efficiency in Enterprises Due to Virtual Meeting is Driving the Market for Telepresence Robot

Figure 17 Value Chain Analysis: Major Value Added During the Original Equipment Manufacturing Phase

Figure 18 Market for Body Component to Grow at A Higher CAGR During the Forecast Period

Figure 19 Market for Mobile Telepresence Robots to Grow at A Higher CAGR During the Forecast Period

Figure 20 Market for Healthcare Application is Expected to Grow at the Highest CAGR During 2018–2023

Figure 21 Market: Geographic Snapshot

Figure 22 Americas: Telepresence Robot Snapshot

Figure 23 Europe: Telepresence Robot Snapshot

Figure 24 APAC: Telepresence Robot Snapshot

Figure 25 RoW: Telepresence Robot Snapshot

Figure 26 In this Market, Companies Adopted Both Organic and Inorganic Growth Strategies Between January 2016 and June 2018

Figure 27 Top 5 Players in this Market, 2017

Figure 28 Telepresence Robot Evaluation Framework

Growth opportunities and latent adjacency in Telepresence Robot Market

I read your introduction on "telepresence" market. I am interested in learning more and seeing the analysis that you have made regarding the market.

I am in a study on telepresence systems oriented to the education sector. I am measuring the impact of developing immersive video projects for a big Spanish telecommunications company, interested in betting on R & D projects in this area. Could you provide us with the developments in Spain and the major competitors for us in this market?