Telecom Power System Market Size, Share, Statistics and Industry Growth Analysis Report by Grid Type (On-Grid, Off-Grid, Bad-Grid), Component (Rectifiers, Inverters, Controllers, Converters), Power Source, Technology, Power Rating (Below 10 KW, 10-20 KW, Above 20 KW) and Geography - Global Growth Driver and Industry Forecast to 2028

Updated on : Sep 12, 2024

Telecom Power Systems Market Size, Share & Growth

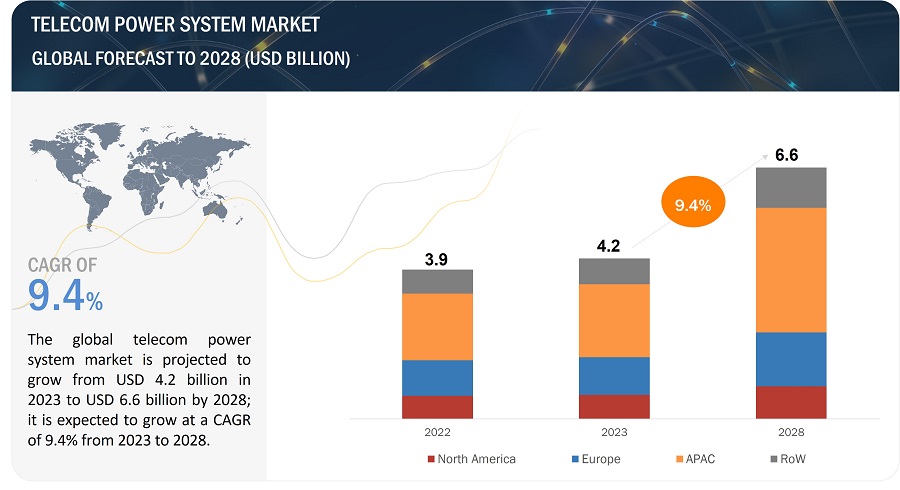

The global telecom power system market share is projected to grow from USD 4.2 billion in 2023 to USD 6.6 billion by 2028; it is expected to grow at a CAGR of 9.4% from 2023 to 2028.

The telecom power systems market is witnessing significant growth due to several key factors. Firstly, the increasing deployment of 5G networks, which require more efficient and reliable power systems, is driving the demand for telecom power systems. Secondly, there is a rising awareness of the carbon footprint associated with the telecom industry, leading to a shift towards more sustainable power systems. Additionally, the expanding telecom infrastructure, driven by the growing demand for connectivity and the rise of remote working, is fueling the need for reliable and efficient power solutions. Government initiatives and investments in telecom infrastructure are also contributing to the market growth. Furthermore, the adoption of smart devices, the growth of cloud computing, and the increasing demand for secure telecom networks are additional driving factors. These factors combined are expected to propel the telecom power systems industry in the coming years.

Telecom Power System Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Telecom Power Systems Market Trends & Dynamics:

Driver: Increasing number of telecom infrastructures in remote areas

The demand for mobile, telephony, and data services has increased in rural areas from developing economies such as India, Africa, and Brazil. The telecom service providers and mobile network operators are expanding their network from the urban and semi-urban regions to rural areas to tap the existing market potential of the rural market in the developing economies. The need for power-efficient networks also rises with the increase in technological advancements in the telecommunications sector. The number of users connected to a network increases due to various services provided by service providers. To provide users with high-speed, large-scale broadband services, and computational activities, service providers install numerous devices/equipment, such as routers, servers, switches, and radio base stations, in locations such as data centers, companies, homes, streets, and public spaces. Also, there is an increased requirement for efficient power management solutions to increase the energy efficiency of these devices, along with power systems, cooling systems, and batteries. With the increase in the number of users and telecom infrastructure in rural areas, the networks’ requirements for telecom power systems will also witness significant growth.

Restraint: Environmental concerns due to usage of diesel

Diesel generators are the preferred source of electrical power for off-grid and standby power applications, such as cellular base stations, because of their durability and reliability. Diesel generators emit harmful pollutants like particulate matter (PM), volatile organic compounds (VOCs), and nitrous oxide (NOx), contributing to the formation of smog and worsening respiratory conditions. These emissions are directly released into the atmosphere, and they deteriorate the environment as well as inhabitants. The emission limits for nitrogen oxides and hydrocarbons have also been reduced for generators between 8 kW and 19 kW power. Thus, environmental concerns coupled with regulations by various regulatory bodies globally regarding the use of diesel generators are expected to hamper the telecom power system market growth during the forecast period.

Opportunity: Increasing technological advancements in cellular networks (5G, LTE services, etc.)

Long-term evolution (LTE), marketed as 4G LTE, is the standard for high-speed data for data terminals and mobile phones. It is one of the fastest wireless technologies in the market, and the rapid global adoption of the technology drives the telecom power system market. The penetration of 4G technology is rapidly increasing in developing countries worldwide. According to the ITU, the 4G penetration in APAC was ~96% in 2022. Also, the countries in Africa witnessed a 4G penetration of ~50% in 2022.

Moreover, the rising penetration of 4G technology has increased demand for high-efficiency telecom power systems, particularly from developing countries such as India. This is expected to drive the market for telecom power systems in developing countries across the world. Also, technological advancements such as the rolling out of 5G services are trending in developed countries such as the US and Japan. According to the GSM Association, global 5G connections are expected to reach 27.14% by 2025. This is further expected to propel the demand for telecom power system industry.

Challenge: Design challenges for telecom power systems

The telecom operators face infrastructure-related challenges in expanding network coverage to rural and remote areas due to higher operational costs and low return on investment. To deploy telecom networks in emerging markets is a technical and major economic challenge due to the absence of power grids, remote locations, harsh climatic conditions, and often the absence of qualified personnel on the ground. The energy required for electricity production should mostly be through renewable energy sources such as diesel-wind, diesel-solar, etc. The challenge is that awareness for the same is difficult to create and the installation costs for renewable energy sources are high, posing it as a challenge for adopting telecom power systems.

Telecom Power Systems Market Ecosystem

Diesel–Battery power source likely to dominate overall telecom power systems market from 2023 to 2028

The high adoption of diesel-battery based combination power sources in telecom power systems can be attributed to several key factors. Firstly, these power systems are highly reliable, making them suitable for remote areas without access to the grid. The diesel generator ensures a constant power supply, while the batteries serve as backup during generator failures, ensuring uninterrupted operations. Secondly, these power systems offer great flexibility, as they can be utilized in both on-grid and off-grid environments and can be scaled to meet the specific requirements of any telecom site. Moreover, despite higher initial investments, diesel-battery power systems are cost-effective in the long run.

Bad grid connected segment likely to hold the largest telecom power system market size during the forecast period.

The primary reasons for the widespread adoption of bad grids (battery-assisted direct current grids) in telecom power systems are the location of telecom power sites in remote areas with unreliable or limited grid power, the cost efficiency of bad grids compared to alternative power systems, their flexibility to meet diverse power requirements, and their lower environmental impact, appealing to telecom companies aiming to reduce their carbon footprint. These factors collectively drive the high deployment of bad grids, especially in developing economies and remote locations.

Generators to hold the largest market share for telecom power systems from 2023 to 2028

Based on components, generators are likely to dominate among all components as it provide reliability and long hours of use in remote locations without compromising performance. The use of generators has been a mainstay in the telecommunications industry. Generators that run on diesel are the most common sources of portable power since diesel fuel is widely available and requires a low initial setup cost. Backup diesel generators are built to last, providing reliability and long hours of use in remote locations without compromising performance.

China to hold the largest share of the telecom power system market in APAC from 2023 to 2028

China is expected to hold a significant share in the telecom power system market in APAC owing to high investments in network infrastructures, along with the presence of telecommunication companies, such as China Telecom and China Mobile, and low-cost communication technology providers, such as ZTE Corporation and Huawei Technologies. It is also a densely populated country worldwide, leading to a rise in demand for mobile and data connectivity infrastructures. The country's dense population is expected to lead to issues regarding the reliability of connectivity, resulting in call drops and network failures. Therefore, the key telecommunication players in China are collaborating to deploy advanced wireless infrastructures to offer enhanced wireless connectivity.

The key telecommunication equipment providers in China, including ZTE Corporation and Huawei Technologies, have signed more than 95 5G commercial deals with the leading global operators. Huawei launched 35 5G commercial networks in December 2020. Huawei Technologies and ZTE Corporation have a complete industrial chain in 5G technology with broader coverage than Nokia and Ericsson. They offer chips, terminals, power systems, and specialized end-to-end 5G solutions.

Telecom Power System Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Telecom Power Systems Companies - Key Market Players

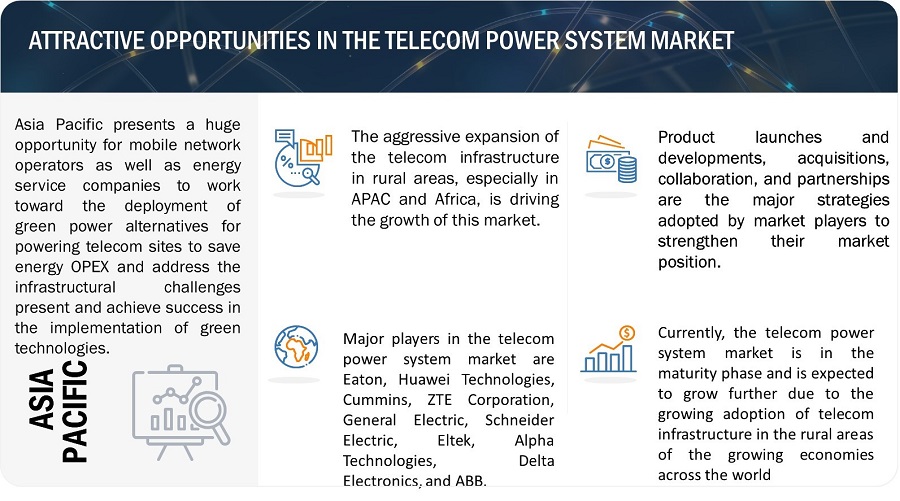

The telecom power system companies is dominated by a few globally established players such as Eaton (US), Huawei Technologies (China), Cummins (US), ZTE Corporation (China), General Electric (US), Delta Electronics, Inc. (Taiwan), and Schneider Electric (France). These companies have adopted both organic and inorganic growth strategies such as product launches and developments, partnerships, contracts, expansions, and acquisitions to strengthen their position in the market.

Want to explore hidden markets that can drive new revenue in Telecom Power System Market?

Scope of the Report

Want to explore hidden markets that can drive new revenue in Telecom Power System Market?

|

Report Metric |

Details |

|

Market Size Available for Years |

2019-2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Unit |

Value (USD Million/Billion) |

|

Segments Covered |

By Region, By Technology, By Grid Type, By Power Source, By Power Rating, By Component |

|

Geographic Regions Covered |

North America, Europe, Asia Pacific, and RoW (includes the Middle East, Africa, and South America) |

|

Companies Covered |

The major players include Eaton (US), Huawei Technologies Co., Ltd. (China), Cummins, Inc. (US), ZTE Corporation (China), General Electric (US), Delta Electronics, Inc. (Taiwan), Alpha Technologies (US), ABB (Switzerland), Staticon Ltd. (Canada), and Schneider Electric (France).(Total 25 companies) |

Telecom Power System Market Highlights

This report categorizes the telecom power system market based on Component, grid type, power source, power rating, technology, and region available at the regional and global levels.

|

Segment |

Subsegment |

|

By Component |

|

|

By Grid Type |

|

|

By Power Rating |

|

|

By Power Source |

|

|

By Technology |

|

|

By Region |

|

Recent Developments

- In June 2023, ZTE Corporation has signed a Memorandum of Understanding (MOU) with TM, Malaysia's prominent converged telco and technology company.

- In April 2023, ABB is driving forward its expansion strategy in the US through an investment of around USD 170 million, aimed at establishing advanced manufacturing, innovation, and distribution facilities.

- In May 2023, ZTE Corporation and the International Project Management Association (IPMA) have officially entered a memorandum of understanding (MOU) to establish a collaborative partnership. This collaboration will encompass various aspects, including research on project management standards, sharing best practices in project management, and conducting professional talent training.

- In March 2023, General Electric revealed its intention to allocate over USD 450 million towards enhancing its current manufacturing facilities in the United States this year.

- In March 2023, ABB entered into a strategic partnership with Direct Energy Partners (DEP), a digital technology start-up focused on expediting the adoption of Direct Current (DC) microgrids.

- In March 2022, Huawei launched and added a brand-new addition to its network solution by launching a 50 Gbps E band solution for ultra-high bandwidth requirements in urban areas, which can provide up to a 50% transmission range when compared to other available solutions in the industry. This helps to save network energy on all bands and to scale up the deployment of 5G networks.

- In February 2022, General Electric revealed a multiyear strategic collaboration agreement with Amazon Web Services, Inc. (AWS) to expedite grid modernization for utilities.

- In January 2022, Eaton introduced the latest addition to Eaton's 5 series UPS line, the Eaton 5PX G2 rackmount, and tower UPS provide the maximum power possible at each power rating. The 5PX G2 UPS has power ratings ranging from 1 to 3 kVA, with low and high voltage options, and offers up to four optional external battery modules for extra runtime. The UPS is primarily used in servers (including VoIP (Voice over Internet Protocol)), storage, networking equipment, switches (including PoE (Power of Ethernet)), and other IT equipment. It provides enhanced connectivity and cybersecurity protection, suitable for universities, medical facilities, IT, etc.

- In December 2021, ZTE added a product to its router product series, which focuses on internet core nodes, backbone aggregation nodes, large-scale MAN core egress nodes, and DC-GW (Data Centre Gateway). It is a high-capacity router, which is safe, reliable, and can be expanded to transport integrated services as it is a standalone system and it focuses on building flat networks, facilitating unified transport, and future-oriented network evolution.

- In November 2021, ZTE launched its first-ever pilot network to facilitate and support 5G-SA (5G- Standalone Access) capabilities. It further included the use of advanced 5G network capabilities in medical applications.

Frequently Asked Questions (FAQ):

How big is the global telecom power system market?

The global telecom power system market is projected to grow from USD 4.2 billion in 2023 to USD 6.6 billion by 2028; it is expected to grow at a CAGR of 9.4% from 2023 to 2028.

Who are the winners in the global telecom power system market?

Companies such as Eaton (US), Huawei (China), Cummins (US), ZTE (China), General Electric (US), and Schneider Electric (France) are the winners in the telecom power system market. These companies cater to the requirements of their customers by providing advanced telecom power systems with a presence in multiple countries.

How recession is likely to impact telecom power system suppliers?

The recession has undeniably impacted the telecom power system market in different regions across the globe. The recession has led to a reduction in capital expenditure (Capex) for telecommunication service providers. Financial constraints have compelled these companies to scale back or delay investments in network infrastructure, including power systems. This decrease in Capex spending directly affects global demand for telecom power systems.

What are the opportunities for the existing players and those planning to enter various stages of the telecom power system value chain?

There are various opportunities for the existing players to enter the value chain of the telecom power system industry. Growing telecom infrastructure, increasing adoption of hybrid power systems and increasing demand and adoption of telecom services in remote areas will likely provide significant market opportunities.

Which region is likely to offer lucrative growth in the telecom power system market?

Asia Pacific presents a huge opportunity for mobile network operators and energy service companies to work toward deploying green power alternatives for powering telecom sites to save energy OPEX and address the infrastructural challenges present and achieve success in the implementation of green technologies.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Development of telecom infrastructure in rural areas with growing number of mobile subscribers- Expansion of coverage by telecom companies due to growing demand for telecom services- Adoption of cleaner and more sustainable solutions by telecom companies to reduce environmental footprint- Increasing investments by governments and private firms worldwide in 5G technologyRESTRAINTS- High deployment and operational costs of telecom power systems- Environmental concerns associated with use of diesel generatorsOPPORTUNITY- Growing adoption of hybrid power systems- Increasing technological advancements in cellular networks- Surging requirement for advanced telecom infrastructure with growing popularity of M2M and IoT technologies- Rising use of GaN-based power devices with evolution of 5G technologyCHALLENGES- Lack of skilled workforce and infrastructure-related issues- Designing robust and power-efficient telecom power systems- Need for constant maintenance and monitoring of systems and components

- 5.3 VALUE CHAIN ANALYSIS

-

5.4 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

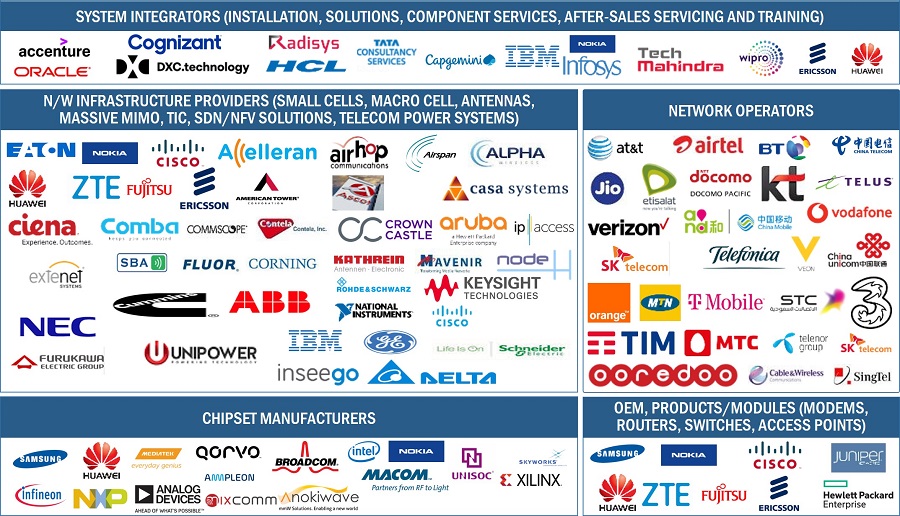

5.5 ECOSYSTEM MAPPINGTELECOM INFRASTRUCTURE PROVIDERS (SMALL CELLS, MACRO CELL, ANTENNAS, MASSIVE MIMO, TIC, SDN/NFV SOLUTIONS, TELECOM POWER SYSTEMS)OEMS, PRODUCT MANUFACTURERS (PRODUCTS/MODULES (MODEMS, ROUTERS, SWITCHES, ACCESS POINTS)SYSTEM INTEGRATORSNETWORK OPERATORS

-

5.6 TECHNOLOGY ANALYSIS5G NETWORKSMART MANUFACTURINGASSET PERFORMANCE MANAGEMENTREMOTE MONITORING AND MANAGEMENT (RMM)

-

5.7 PRICING ANALYSIS: AVERAGE SELLING PRICE TRENDSAVERAGE SELLING PRICE OF TELECOM POWER SYSTEMS OFFERED BY KEY PLAYERS, BY POWER RATING

-

5.8 PORTER’S FIVE FORCE ANALYSISINTENSITY OF COMPETITIVE RIVALRYTHREAT OF SUBSTITUTESBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTS

-

5.9 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.10 CASE STUDY ANALYSISINCORPORATION OF HYBRID GENERATOR TO POWER MULTIPLE LARGE TELECOM LOADS AND SEASONAL AIR CONDITIONING LOADINTEGRATION OF SITEBOSS DEVICE WITH INTERMAPPER SOFTWARE TO ACHIEVE INCREASED VISIBILITY TO SITE OPERATIONS AND MITIGATE RISK OF SITE FAILUREADOPTION OF METKA IPS MODULAR POWER SYSTEM BY NIGERIAN TELECOM OPERATOR TO OFFER DATA AND VOICE SERVICES THROUGH OFF-GRID LTE NETWORKDEPLOYMENT OF METKA IPS MODULAR POWER SYSTEM AT OFF-GRID TELECOM SITES OF AFTEL TO MINIMIZE DIESEL GENERATOR RUNTIMEPARTNERSHIP OF NURI TELECOM WITH MEGACHIPS TO DEVELOP HD-PLC SOLUTION FOR FASTER AND CHEAPER SMART METERING APPLICATIONS

-

5.11 TRADE DATA ANALYSISIMPORT DATAEXPORT DATA

-

5.12 PATENT ANALYSIS

- 5.13 KEY CONFERENCES AND EVENTS, 2023–2024

-

5.14 TARIFF AND REGULATORY LANDSCAPETARIFFSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific- RoWREGULATIONS- North America- Europe- Asia PacificSTANDARDS

- 6.1 INTRODUCTION

-

6.2 RECTIFIERSUSE OF RECTIFIERS TO PROTECT TELECOM POWER SYSTEMS AGAINST AC OVERVOLTAGE TO BOOST SEGMENTAL GROWTH

-

6.3 INVERTERSDEPLOYMENT OF INVERTER AS EFFECTIVE AC POWER BACKUP SOLUTION TO BOOST SEGMENTAL GROWTH

-

6.4 CONVERTERSADOPTION OF CONVERTERS TO OPTIMIZE ENERGY USAGE AND REDUCE WASTAGE TO SUPPORT MARKET GROWTH

-

6.5 CONTROLLERSDEPLOYMENT OF CONTROLLERS IN TELECOM POWER SYSTEMS TO MONITOR OPERATIONAL PARAMETERS AND SAVE OPERATIONAL COSTS TO ACCELERATE MARKET GROWTH

-

6.6 HEAT MANAGEMENT SYSTEMSIMPLEMENTATION OF HEAT MANAGEMENT SYSTEMS FOR HEAT EXCHANGE, DIRECT VENTILATION, AND THERMOELECTRIC COOLING TO DRIVE SEGMENTAL GROWTH

-

6.7 GENERATORSEMPLOYMENT OF GENERATORS TO PREVENT SERVICE INTERRUPTIONS DURING EXTENDED POWER OUTAGES TO BOOST SEGMENTAL GROWTH

-

6.8 OTHERSPOWER DISTRIBUTION UNITSBATTERIESSOLAR OR PV CELLSWIND TURBINESSURGE PROTECTION DEVICESCIRCUIT BREAKERS

- 7.1 INTRODUCTION

-

7.2 ON-GRIDUSE OF ON-GRID TELECOM POWER SYSTEMS TO REDUCE ENVIRONMENTAL IMPACT TO SUPPORT MARKET GROWTH

-

7.3 OFF-GRIDDEPLOYMENT OF OFF-GRID TELECOM POWER SYSTEMS TO PROVIDE ELECTRICITY TO AREAS FAR FROM T&D INFRASTRUCTURE TO BOOST SEGMENTAL GROWTH

-

7.4 BAD GRIDCONCENTRATION OF BAD GRID-CONNECTED TELECOM POWER SYSTEMS IN DEVELOPING COUNTRIES SUCH AS INDIA AND BRAZIL TO SUPPORT SEGMENTAL GROWTH

- 8.1 INTRODUCTION

-

8.2 BELOW 10 KWADOPTION OF LOW-OUTPUT TELECOM POWER SYSTEMS IN CELL TOWERS, BTS, AND BASE STATIONS TO BOOST SEGMENTAL GROWTH

-

8.3 10–20 KWUSE OF MEDIUM-OUTPUT POWER SYSTEMS IN 5G TOWERS AND RECTIFIER MODULES TO SUPPORT SEGMENTAL GROWTH

-

8.4 ABOVE 20 KWDEPLOYMENT OF HIGH-OUTPUT POWER SYSTEMS IN ACCESS NETWORKS, DATA CENTERS, AND FTTH NETWORKS TO CONTRIBUTE TO SEGMENTAL GROWTH

- 9.1 INTRODUCTION

-

9.2 DIESEL–BATTERY POWER SOURCEUSE OF DIESEL-BATTERY HYBRID SOLUTIONS IN OFF-GRID AND BAD GRID APPLICATIONS TO DRIVE MARKET

-

9.3 DIESEL–SOLAR POWER SOURCEIMPLEMENTATION OF DIESEL–SOLAR POWER SOURCE IN REMOTE CELLULAR BASE STATIONS TO SUPPORT MARKET GROWTH

-

9.4 DIESEL–WIND POWER SOURCESUITABILITY OF DIESEL–WIND POWER SYSTEMS IN BAD-GRID AND OFF-GRID AREAS TO STIMULATE MARKET GROWTH

-

9.5 MULTIPLE POWER SOURCES (DIESEL/SOLAR/WIND/BATTERY/BIOMASS)COST-EFFECTIVE GENERATION OF ELECTRICITY TO BOOST DEMAND FOR MULTIPLE POWER SOURCES

- 10.1 INTRODUCTION

-

10.2 AC POWER SYSTEMSRISING USE OF AC POWER SYSTEMS TO PROVIDE STABLE AND REGULATED ELECTRICAL POWER SUPPLY TO DRIVE MARKET

-

10.3 DC POWER SYSTEMSGROWING ADOPTION OF DC POWER SYSTEMS BY TELECOM OPERATORS TO ENSURE CONTINUOUS OPERATIONS AND PROTECT CRITICAL EQUIPMENT TO DRIVE MARKET

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICARECESSION IMPACT ON MARKET IN NORTH AMERICAUS- Rapid development of 5G wireless network infrastructure to drive marketCANADA- Development of telecom infrastructure in rural areas to boost demand for telecom power systemsMEXICO- Rising demand for advanced wireless infrastructure to support market growth

-

11.3 EUROPERECESSION IMPACT ON MARKET IN EUROPEUK- Implementation of smarty city projects to drive marketGERMANY- Increasing investments in commercial launch of 5G services to boost demand for telecom power systemsFRANCE- Rising need for advanced networking solutions owing to adoption of IoT technology to boost demand for telecom power systemsSPAIN- Innovations in IoT and SCADA technologies to create opportunities for telecom power system providersREST OF EUROPE

-

11.4 ASIA PACIFICRECESSION IMPACT ON MARKET IN ASIA PACIFICCHINA- Collaboration of telecom companies with providers of advanced wireless infrastructure to contribute to market growthJAPAN- 5G base station deployment plan by telecom operators to present opportunities for telecom power system providersSOUTH KOREA- Investments in 5G-enabled base stations to create opportunities for telecom power system providersINDIA- 5G network testing and rollout plans in rural areas of India to boost demand for telecom power systemsAUSTRALIA & NEW ZEALAND- Telecom infrastructure developments to contribute to high demand for telecom power systemsREST OF ASIA PACIFIC

-

11.5 ROWRECESSION IMPACT ON MARKET IN ROWMIDDLE EAST & AFRICA- Deployment of cleaner power systems at telecommunication sites to drive marketSOUTH AMERICA- Transition of consumers from 4G to 5G plan to fuel market growth

- 12.1 OVERVIEW

-

12.2 STRATEGIES ADOPTED BY KEY PLAYERSPRODUCT PORTFOLIOREGIONAL FOCUSMANUFACTURING FOOTPRINTORGANIC/INORGANIC GROWTH STRATEGIES

- 12.3 MARKET SHARE ANALYSIS: TELECOM POWER SYSTEM MARKET, 2022

- 12.4 FIVE-YEAR COMPANY REVENUE ANALYSIS

-

12.5 EVALUATION MATRIX FOR KEY PLAYERSSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 12.6 COMPANY FOOTPRINT

-

12.7 EVALUATION MATRIX FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

- 12.8 COMPETITIVE BENCHMARKING

-

12.9 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHESDEALS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSEATON- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHUAWEI TECHNOLOGIES CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCUMMINS INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewZTE CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGENERAL ELECTRIC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSCHNEIDER ELECTRIC- Business overview- Products/Solutions/Services offered- Recent developmentsALPHA TECHNOLOGIES- Business overview- Products/Solutions/Services offeredDELTA ELECTRONICS, INC.- Business overview- Products/Solutions/Services offered- Recent developmentsABB- Business overview- Products/Solutions/Services offered- Recent developmentsSTATICON LTD.- Business overview- Products/Solutions/Services offered

-

13.3 OTHER PLAYERSASCOT INDUSTRIAL S.R.L.UNIPOWERDYNAMIC POWER GROUPEFOREHANGZHOU ZHONHENG POWER ENERGYMYERS POWER PRODUCTS, INC.ELTEKVERTIV GROUPVOLTSERVER INC.JMA WIRELESSCORNING INCORPORATEDEMERSON ELECTRIC CO.POWERONEUPSEXICOM TELE-SYSTEMSSTATIC POWER

- 14.1 INSIGHTS FROM INDUSTRY EXPERTS

- 14.2 DISCUSSION GUIDE

- 14.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.4 CUSTOMIZATION OPTIONS

- 14.5 RELATED REPORTS

- 14.6 AUTHOR DETAILS

- TABLE 1 ASSUMPTIONS FOR RESEARCH STUDY

- TABLE 2 4G TECHNOLOGY PENETRATION IN URBAN AREAS VS. RURAL AREAS, 2022 (%)

- TABLE 3 INTERNET USERS, BY GEOGRAPHY, 2022 (%)

- TABLE 4 4G TECHNOLOGY PENETRATION RATE, 2022 (%)

- TABLE 5 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 6 IMPACT ANALYSIS OF PORTER’S FIVE FORCES ON TELECOM POWER SYSTEM MARKET

- TABLE 7 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 POWER SOURCES (%)

- TABLE 8 KEY BUYING CRITERIA FOR TOP 3 POWER SOURCES

- TABLE 9 IMPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 10 EXPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD BILLION)

- TABLE 11 NOTABLE PATENTS PERTAINING TO TELECOM POWER SYSTEMS

- TABLE 12 NUMBER OF PATENTS REGISTERED IN LAST 10 YEARS

- TABLE 13 LIST OF MAJOR CONFERENCES AND EVENTS RELATED TO TELECOM POWER SYSTEMS

- TABLE 14 TELECOM POWER SYSTEM MARKET, BY COMPONENT, 2019–2022 (USD MILLION)

- TABLE 15 TELECOM POWER SYSTEM MARKET, BY COMPONENT, 2023–2028 (USD MILLION)

- TABLE 16 TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2019–2022 (USD MILLION)

- TABLE 17 TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2023–2028 (USD MILLION)

- TABLE 18 ON-GRID: TELECOM POWER SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 19 ON-GRID: TELECOM POWER SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 OFF-GRID: TELECOM POWER SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 21 OFF-GRID: TELECOM POWER SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 BAD GRID: TELECOM POWER SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 23 BAD GRID: TELECOM POWER SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 TELECOM POWER SYSTEM MARKET, BY POWER RATING, 2019–2022 (USD MILLION)

- TABLE 25 TELECOM POWER SYSTEM MARKET, BY POWER RATING, 2023–2028 (USD MILLION)

- TABLE 26 TELECOM POWER SYSTEM MARKET, BY POWER RATING, 2019–2022 (THOUSAND UNITS)

- TABLE 27 TELECOM POWER SYSTEM MARKET, BY POWER RATING, 2023–2028 (THOUSAND UNITS)

- TABLE 28 TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 29 TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 30 ADVANTAGES OF DIESEL–BATTERY POWER SOURCE

- TABLE 31 DISADVANTAGES OF DIESEL–BATTERY POWER SOURCE

- TABLE 32 DIESEL–BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 33 DIESEL–BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 34 DIESEL–BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 35 DIESEL–BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 36 DIESEL–BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 37 DIESEL–BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 38 DIESEL–BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 39 DIESEL–BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 40 DIESEL–BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 41 DIESEL–BATTERY POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 42 ADVANTAGES OF DIESEL–SOLAR POWER SOURCE

- TABLE 43 DISADVANTAGES OF DIESEL–SOLAR POWER SOURCE

- TABLE 44 DIESEL–SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 45 DIESEL–SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 46 DIESEL–SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 47 DIESEL–SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 48 DIESEL–SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 49 DIESEL–SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 50 DIESEL–SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 51 DIESEL–SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 52 DIESEL–SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 53 DIESEL–SOLAR POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 ADVANTAGES OF DIESEL–WIND POWER SOURCE

- TABLE 55 DISADVANTAGES OF DIESEL–WIND POWER SOURCE

- TABLE 56 DIESEL–WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 57 DIESEL–WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 DIESEL–WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 59 DIESEL–WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 60 DIESEL–WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 61 DIESEL–WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 62 DIESEL–WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 63 DIESEL–WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 64 DIESEL–WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 65 DIESEL–WIND POWER SOURCE: TELECOM POWER SYSTEM MARKET IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 ADVANTAGES OF DIESEL–BIOMASS POWER SOURCE

- TABLE 67 DISADVANTAGES OF DIESEL–BIOMASS POWER SOURCE

- TABLE 68 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 69 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 70 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 71 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET IN NORTH AMERICA, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 72 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET IN EUROPE, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 73 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET IN EUROPE, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 74 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 75 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 76 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET IN ROW, BY REGION, 2019–2022 (USD MILLION)

- TABLE 77 MULTIPLE POWER SOURCES: TELECOM POWER SYSTEM MARKET IN ROW, BY REGION, 2023–2028 (USD MILLION)

- TABLE 78 TELECOM POWER SYSTEM MARKET, BY TECHNOLOGY, 2019–2022 (USD MILLION)

- TABLE 79 TELECOM POWER SYSTEM MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

- TABLE 80 TELECOM POWER SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 81 TELECOM POWER SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 82 TELECOM POWER SYSTEM MARKET, BY REGION, 2019–2022 (THOUSAND UNITS)

- TABLE 83 TELECOM POWER SYSTEM MARKET, BY REGION, 2023–2028 (THOUSAND UNITS)

- TABLE 84 NORTH AMERICA: TELECOM POWER SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 85 NORTH AMERICA: TELECOM POWER SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2019–2022 (USD MILLION)

- TABLE 89 NORTH AMERICA: TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2023–2028 (USD MILLION)

- TABLE 90 US: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 91 US: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 92 CANADA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 93 CANADA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 94 MEXICO: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 95 MEXICO: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 96 EUROPE: TELECOM POWER SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 97 EUROPE: TELECOM POWER SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 98 EUROPE: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 99 EUROPE: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 100 EUROPE: TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2019–2022 (USD MILLION)

- TABLE 101 EUROPE: TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2023–2028 (USD MILLION)

- TABLE 102 UK: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 103 UK: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 104 GERMANY: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 105 GERMANY: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 106 FRANCE: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 107 FRANCE: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 108 SPAIN: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 109 SPAIN: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 110 REST OF EUROPE: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 111 REST OF EUROPE: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 112 ASIA PACIFIC: TELECOM POWER SYSTEM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 113 ASIA PACIFIC: TELECOM POWER SYSTEM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 114 ASIA PACIFIC: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 115 ASIA PACIFIC: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 116 ASIA PACIFIC: TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2019–2022 (USD MILLION)

- TABLE 117 ASIA PACIFIC: TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2023–2028 (USD MILLION)

- TABLE 118 CHINA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 119 CHINA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 120 JAPAN: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 121 JAPAN: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 122 SOUTH KOREA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 123 SOUTH KOREA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 124 INDIA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 125 INDIA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 126 AUSTRALIA & NEW ZEALAND: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 127 AUSTRALIA & NEW ZEALAND: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 128 REST OF ASIA PACIFIC: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 129 REST OF ASIA PACIFIC: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 130 ROW: TELECOM POWER SYSTEM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 131 ROW: TELECOM POWER SYSTEM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 132 ROW: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 133 ROW: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 134 ROW: TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2019–2022 (USD MILLION)

- TABLE 135 ROW: TELECOM POWER SYSTEM MARKET, BY GRID TYPE, 2023–2028 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 137 MIDDLE EAST & AFRICA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 138 SOUTH AMERICA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2019–2022 (USD MILLION)

- TABLE 139 SOUTH AMERICA: TELECOM POWER SYSTEM MARKET, BY POWER SOURCE, 2023–2028 (USD MILLION)

- TABLE 140 OVERVIEW OF STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- TABLE 141 TELECOM POWER SYSTEM MARKET: DEGREE OF COMPETITION, 2022

- TABLE 142 OVERALL COMPANY FOOTPRINT

- TABLE 143 FOOTPRINT OF DIFFERENT COMPANIES BASED ON POWER SOURCES

- TABLE 144 FOOTPRINT OF DIFFERENT COMPANIES FOR VARIOUS COMPONENTS

- TABLE 145 FOOTPRINT OF DIFFERENT COMPANIES BASED ON REGIONS

- TABLE 146 LIST OF STARTUPS IN TELECOM POWER SYSTEM MARKET

- TABLE 147 PRODUCT LAUNCHES, 2020–2023

- TABLE 148 DEALS, 2020–2023

- TABLE 149 EATON: COMPANY OVERVIEW

- TABLE 150 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- TABLE 151 CUMMINS: COMPANY SNAPSHOT

- TABLE 152 ZTE CORPORATION: COMPANY SNAPSHOT

- TABLE 153 GENERAL ELECTRIC: COMPANY SNAPSHOT

- TABLE 154 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- TABLE 155 ALPHA TECHNOLOGIES: COMPANY SNAPSHOT

- TABLE 156 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

- TABLE 157 ABB: COMPANY SNAPSHOT

- TABLE 158 STATICON LTD.: COMPANY SNAPSHOT

- TABLE 159 ASCOT INDUSTRIAL S.R.L.: COMPANY SNAPSHOT

- TABLE 160 UNIPOWER: COMPANY SNAPSHOT

- TABLE 161 DYNAMIC POWER GROUP: COMPANY SNAPSHOT

- TABLE 162 EFORE: COMPANY SNAPSHOT

- TABLE 163 HANGZHOU ZHONHENG POWER ENERGY: COMPANY SNAPSHOT

- TABLE 164 MYERS POWER PRODUCTS, INC.: COMPANY SNAPSHOT

- TABLE 165 ELTEK: COMPANY SNAPSHOT

- TABLE 166 VERTIV GROUP: COMPANY SNAPSHOT

- TABLE 167 VOLTSERVER: COMPANY SNAPSHOT

- TABLE 168 JMA WIRELESS: COMPANY SNAPSHOT

- TABLE 169 CORNING INCORPORATED: COMPANY SNAPSHOT

- TABLE 170 EMERSON ELECTRIC CO.: COMPANY SNAPSHOT

- TABLE 171 POWERONEUPS: COMPANY SNAPSHOT

- TABLE 172 EXICOM TELE-SYSTEMS: COMPANY SNAPSHOT

- TABLE 173 STATIC POWER: COMPANY SNAPSHOT

- FIGURE 1 TELECOM POWER SYSTEM MARKET SEGMENTATION

- FIGURE 2 TELECOM POWER SYSTEM MARKET: RESEARCH DESIGN

- FIGURE 3 TELECOM POWER SYSTEM MARKET: PROCESS FLOW OF MARKET SIZE ESTIMATION

- FIGURE 4 TOP-DOWN APPROACH: MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 - SUPPLY SIDE

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 - SUPPLY SIDE

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND SIDE

- FIGURE 7 DATA TRIANGULATION

- FIGURE 8 TELECOM POWER SYSTEM MARKET, 2019–2028 (USD MILLION)

- FIGURE 9 BAD-GRID TELECOM POWER SYSTEMS TO ACCOUNT FOR LARGEST MARKET SHARE IN 2028

- FIGURE 10 INVERTERS TO REGISTER HIGHEST CAGR IN TELECOM POWER SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 11 DIESEL-BATTERY POWER SOURCE HELD LARGEST SHARE OF TELECOM POWER SYSTEM MARKET IN 2022

- FIGURE 12 DC POWER SYSTEMS TO DOMINATE MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 13 TELECOM POWER SYSTEMS BELOW 10 KW TO COMMAND MARKET BETWEEN 2023 AND 2028

- FIGURE 14 ASIA PACIFIC TO EXHIBIT HIGHEST CAGR IN GLOBAL TELECOM POWER SYSTEM MARKET DURING FORECAST PERIOD

- FIGURE 15 DEVELOPMENT OF TELECOMMUNICATION IN RURAL AREAS TO CREATE GROWTH OPPORTUNITIES FOR PLAYERS IN TELECOM POWER SYSTEM PROVIDERS

- FIGURE 16 DIESEL–BATTERY POWER SOURCE SEGMENT TO HOLD LARGEST SHARE OF TELECOM POWER SYSTEM MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 17 BAD GRID SEGMENT TO ACCOUNT FOR LARGEST SHARE OF TELECOM POWER SYSTEM MARKET IN 2028

- FIGURE 18 GENERATORS TO HOLD SIGNIFICANT SHARE OF TELECOM POWER SYSTEM MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 19 TELECOM POWER SYSTEMS BELOW 10 KW TO DOMINATE MARKET IN 2028

- FIGURE 20 DC POWER SYSTEMS TO DOMINATE MARKET FROM 2023 TO 2028

- FIGURE 21 TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 23 TELECOM POWER SYSTEM MARKET DRIVERS AND THEIR IMPACT

- FIGURE 24 MOBILE DATA TRAFFIC, 2018–2022 (EXABYTE/MONTH)

- FIGURE 25 TELECOM POWER SYSTEM MARKET RESTRAINTS AND THEIR IMPACT

- FIGURE 26 TELECOM POWER SYSTEM MARKET OPPORTUNITIES AND THEIR IMPACT

- FIGURE 27 GROWING TREND OF CELLULAR IOT CONNECTIONS, 2019 VS. 2025

- FIGURE 28 TELECOM POWER SYSTEM MARKET CHALLENGES AND THEIR IMPACT

- FIGURE 29 VALUE CHAIN: TELECOM POWER SYSTEM MARKET

- FIGURE 30 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PLAYERS IN TELECOM POWER SYSTEM MARKET

- FIGURE 31 KEY PLAYERS IN ECOSYSTEM

- FIGURE 32 AVERAGE SELLING PRICE (ASP) OF POWER SYSTEMS WITH DIFFERENT POWER RATINGS (KW), 2019–2028

- FIGURE 33 AVERAGE SELLING PRICE OF TELECOM POWER SYSTEMS PROVIDED BY MAJOR PLAYERS, BY POWER RATING

- FIGURE 34 IMPACT ANALYSIS OF PORTER’S FIVE FORCES ON TELECOM POWER SYSTEM MARKET

- FIGURE 35 TELECOM POWER SYSTEM MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 36 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 POWER SOURCES

- FIGURE 37 KEY BUYING CRITERIA FOR TOP 3 POWER SOURCES

- FIGURE 38 IMPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD BILLION)

- FIGURE 39 EXPORT DATA FOR HS CODE 8504-COMPLIANT PRODUCTS, BY COUNTRY, 2018–2022 (USD BILLION)

- FIGURE 40 TOP 10 COMPANIES WITH HIGHEST PERCENTAGE OF PATENT APPLICATIONS IN LAST 10 YEARS

- FIGURE 41 NUMBER OF PATENTS GRANTED PER YEAR, 2013–2022

- FIGURE 42 INVERTERS TO REGISTER HIGHEST CAGR IN TELECOM POWER SYSTEM MARKET FROM 2023 TO 2028

- FIGURE 43 OFF-GRID TELECOM POWER SYSTEMS TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 TELECOM POWER SYSTEMS BELOW 10 KW TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 45 DIESEL–SOLAR POWER SOURCE SEGMENT TO EXHIBIT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 46 DC POWER SYSTEMS TO COMMAND TELECOM POWER SYSTEM MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 47 ASIA PACIFIC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 48 SNAPSHOT OF TELECOM POWER SYSTEM MARKET IN NORTH AMERICA

- FIGURE 49 IMPACT OF RECESSION ON MARKET IN NORTH AMERICA

- FIGURE 50 SNAPSHOT OF TELECOM POWER SYSTEM MARKET IN EUROPE

- FIGURE 51 IMPACT OF RECESSION ON MARKET IN EUROPE

- FIGURE 52 SNAPSHOT OF TELECOM POWER SYSTEM MARKET IN ASIA PACIFIC

- FIGURE 53 IMPACT OF RECESSION ON MARKET IN ASIA PACIFIC

- FIGURE 54 IMPACT OF RECESSION ON MARKET IN ROW

- FIGURE 55 FIVE-YEAR REVENUE ANALYSIS OF TOP 5 PLAYERS IN TELECOM POWER SYSTEM MARKET

- FIGURE 56 TELECOM POWER SYSTEM COMPANY EVALUATION MATRIX, 2022

- FIGURE 57 TELECOM POWER SYSTEM STARTUPS/SMES EVALUATION MATRIX, 2022

- FIGURE 58 EATON: COMPANY SNAPSHOT

- FIGURE 59 HUAWEI TECHNOLOGIES CO., LTD.: COMPANY SNAPSHOT

- FIGURE 60 CUMMINS INC.: COMPANY SNAPSHOT

- FIGURE 61 ZTE CORPORATION: COMPANY SNAPSHOT

- FIGURE 62 GENERAL ELECTRIC: COMPANY SNAPSHOT

- FIGURE 63 SCHNEIDER ELECTRIC: COMPANY SNAPSHOT

- FIGURE 64 DELTA ELECTRONICS, INC.: COMPANY SNAPSHOT

- FIGURE 65 ABB: COMPANY SNAPSHOT

The study involved four major activities for estimating the telecom power system market size. Exhaustive secondary research has been conducted to collect information relevant to the market, its peer markets, and its parent market. Primary research has been undertaken to validate key findings, assumptions, and sizing with industry experts across the value chain of the telecom power system market. Both top-down and bottom-up approaches have been employed to estimate the complete market size. It has been followed by the market breakdown and data triangulation methods to estimate the size of different segments and subsegments of the market.

Secondary Research

The research methodology used to estimate and forecast the size of the telecom power system market began with the acquisition of data related to the revenues of key vendors in the market through secondary research. The secondary research referred to for this research study involves telecom power and telecom network magazines, and journals. Moreover, the study involved extensive use of secondary sources, directories, and databases, such as Hoovers, Bloomberg Businessweek, Factiva, and OneSource, to identify and collect valuable information for a technical, market-oriented, and commercial study of the telecom power system market. Vendor offerings have been taken into consideration to determine market segmentation. The entire research methodology included the study of annual reports, press releases, and investor presentations of companies; white papers; and certified publications and articles by recognized authors; directories; and databases.

Primary Research

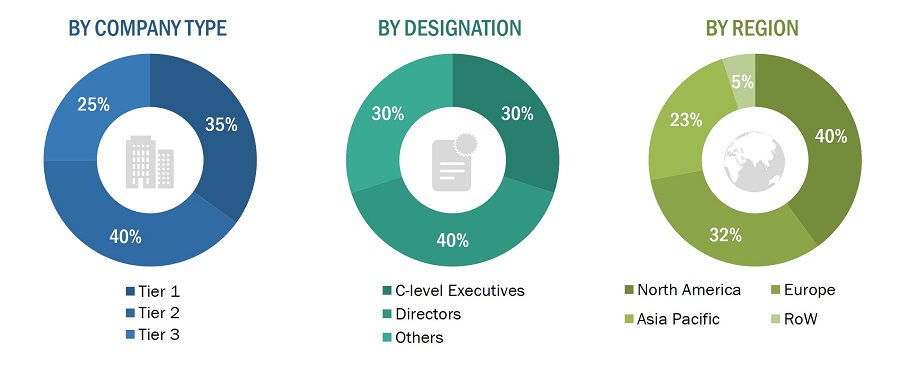

Extensive primary research has been conducted after understanding the telecom power system market scenario through secondary research. Several primary interviews have been conducted with market experts from the demand and supply-side players across key regions: North America, Europe, Asia Pacific, Middle East, Africa, and South America. Various primary sources from both the supply and demand sides of the market have been interviewed to obtain qualitative and quantitative information. Following is the breakdown of the primary respondents.

Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report. After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This and the in-house subject matter experts’ opinions have led us to the findings described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

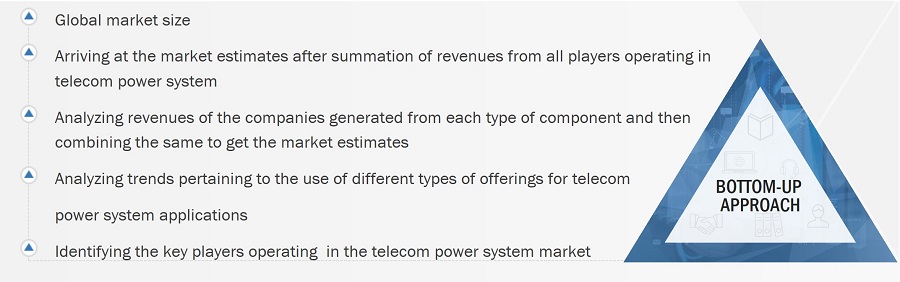

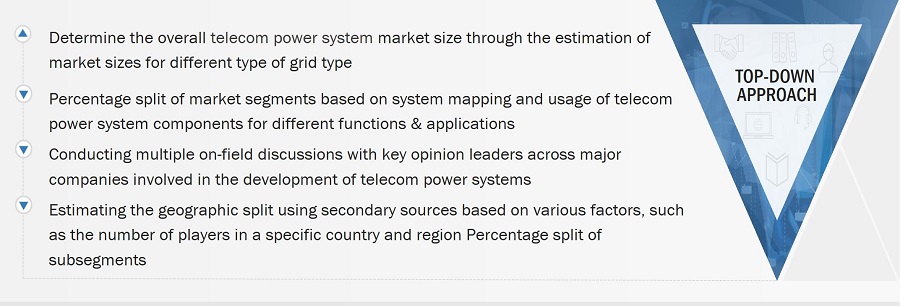

Both top-down and bottom-up approaches have been used to estimate and validate the size of the telecom power system market and its segments. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the supply chain and the size of the telecom power system market have been determined through primary and secondary research processes.

- Several primary interviews have been conducted with key opinion leaders related to the telecom power system market, including key OEMs, IDMs, and Tier I suppliers.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges have been taken into consideration while calculating and forecasting the market size

Global Telecom Power System Market Size: Bottom-up Approach

Global Telecom Power System Market Size: Top-down Approach

Data Triangulation

The market has been split into several segments and subsegments after arriving at the overall market size—using the market size estimation process explained above. Data triangulation and market breakdown procedures have been employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for each segment and subsegment of the market. The data has been triangulated by studying various factors and trends from both the demand and supply sides of the telecom power system market.

Market Definition

Telecom power systems secure telecommunication services in case of grid power interruptions and fluctuations. These systems are essential for running telecommunication networks efficiently. These systems comprise a combination of smaller systems such as converters, distributors, controllers, and batteries, along with conventional AC/DC diesel generators, an electrical distribution system, and distributed AC/DC loads. Power systems offer direct current (DC) and alternating current (AC) backup for various indoor and outdoor applications, thus saving essential operating costs for telecom operators. They ensure safe business continuity and operation.

In direct current (DC) power systems, a rectifier converts alternating current (AC) to DC and provides the power necessary to charge the batteries. In AC power systems, an inverter converts DC into uninterruptible AC. A power system controller monitors and controls the entire system, maximizes battery life, supports energy and cost savings, and informs the operator of maintenance needs. The power system can be integrated with renewable energy sources, which enables major energy and operation cost savings. Additional AC line conditioning elements can be integrated into the system for optimal operation in regions with highly unstable AC main conditions.

Key Stakeholders

- Telecom power system component providers

- Telecom power system integrators and installers

- Telecom power system solution providers

- Consulting companies

- Product manufacturers

- Telecom power system-related associations, organizations, forums, and alliances

- Government and corporate bodies

- Research institutes and organizations

- Venture capitalists, private equity firms, and start-ups

- Distributors and traders

- OEMs

- End users

- Research institutes and organizations

- Market research and consulting firms

- Telecom power system buyers

- Telecom power system technology providers

Report Objectives

- To describe and forecast the telecom power system market in terms of value, based on Component, grid type, power rating, power source, technology, and region.

- To forecast the telecom power system market in terms of volume.

- To forecast the market size, in terms of value, for various segments, with respect to four main regions—North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW).

- To provide detailed information regarding the major factors influencing the growth of the telecom power system market (drivers, restraints, opportunities, and challenges).

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market.

- To analyze opportunities for the market stakeholders by identifying high-growth segments of the telecom power system market.

- To benchmark players within the market using the proprietary “Company Evaluation Matrix” framework, which analyzes market players on various parameters within the broad categories of market rank and product offering.

- To strategically profile the key players, comprehensively analyze their market shares and core competencies2, and provide a detailed competitive landscape for market leaders.

- To track and analyze competitive developments, such as partnerships, collaborations, agreements, and joint ventures; mergers and acquisitions; expansions; and product launches in the telecom power system market.

- To map competitive intelligence based on company profiles, strategies of key players, and game-changing developments such as product launches, partnerships, collaborations, and agreements undertaken in the telecom power system market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

- Additional country-level analysis of telecom power system market

- Estimation of the market size of the segments of the telecom power system market based on different subsegments

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Telecom Power System Market

Hi team, I have interest in your report and would like to have the report brochure or sample for reviewing it. After sharing the brochure, we can discuss about the proceedings.

we are listing different telecom power solutions for different grid types from batteries to fuel cells to generators and renewables and hybrid systems.

I am looking for data on number of Off-Grid and Bad-Grid telecom sites in Asia, Africa, and South America by country. Please let me know the price for this data set.